|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

United States

Securities And Exchange Commission

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For The Fiscal Year Ended December 31, 2010

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 1-14514

CONSOLIDATED EDISON, INC.

Exact name of registrant as specified in its charter

| New York | 13-3965100 | |

| (State of Incorporation) |

(I.R.S. Employer ID. Number) |

4 Irving Place,

New York, New York 10003

(principal office address)

(212) 460-4600

(telephone number)

Commission File Number 1-1217

CONSOLIDATED EDISON COMPANY OF NEW YORK, INC.

Exact name of registrant as specified in its charter

| New York | 13-5009340 | |

| (State of Incorporation) |

(I.R.S. Employer ID. Number) |

4 Irving Place,

New York, New York 10003

(principal office address)

(212) 460-4600

(telephone number)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

| Consolidated Edison, Inc., | ||

| Common Shares ($.10 par value) | New York Stock Exchange | |

| Consolidated Edison Company of New York, Inc., | ||

| $5 Cumulative Preferred Stock, without par value | New York Stock Exchange | |

| Cumulative Preferred Stock, 4.65% Series C ($100 par value) | New York Stock Exchange | |

Securities Registered Pursuant to Section 12(g) of the Act:

|

Title of each class |

||

| Consolidated Edison Company of New York, Inc. | ||

| Cumulative Preferred Stock, 4.65% Series D ($100 par value) |

Table of Contents

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Con Edison, Inc. (Con Edison) | Yes x | No ¨ | ||||||

| Consolidated Edison Company of New York, Inc. (CECONY) | Yes x | No ¨ | ||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Con Edison | Yes ¨ | No x | ||||||

| CECONY | Yes ¨ | No x | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Con Edison | Yes x | No ¨ | ||||||

| CECONY | Yes x | No ¨ | ||||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Con Edison | Yes x | No ¨ | ||||||

| CECONY | Yes x | No ¨ | ||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Con Edison | ||||||||||||

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||||||||

| CECONY | ||||||||||||

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

| Con Edison | Yes ¨ | No x | ||||||

| CECONY | Yes ¨ | No x | ||||||

The aggregate market value of the common equity of Con Edison held by non-affiliates of Con Edison, as of June 30, 2010, was approximately $12.2 billion.

As of January 31, 2011, Con Edison had outstanding 291,968,911 Common Shares ($.10 par value).

All of the outstanding common equity of CECONY is held by Con Edison.

Documents Incorporated By Reference

Portions of Con Edison’s definitive proxy statement and CECONY’s definitive information statement, for their respective Annual Meetings of Stockholders to be held on May 16, 2011, to be filed with the Commission pursuant to Regulation 14A and Regulation 14C, respectively, not later than 120 days after December 31, 2010, are incorporated in Part III of this report.

Filing Format

This Annual Report on Form 10-K is a combined report being filed separately by two different registrants: Consolidated Edison, Inc. (Con Edison) and Consolidated Edison Company of New York, Inc. (CECONY). CECONY is a subsidiary of Con Edison and, as such, the information in this report about CECONY also applies to Con Edison. As used in this report, the term the “Companies” refers to Con Edison and CECONY. However, CECONY makes no representation as to the information contained in this report relating to Con Edison or the subsidiaries of Con Edison other than itself.

Table of Contents

|

Glossary of Terms |

The following is a glossary of frequently used abbreviations or acronyms that are used in the Companies’ SEC reports:

| Con Edison Companies | ||

| Con Edison | Consolidated Edison, Inc. | |

| CECONY | Consolidated Edison Company of New York, Inc. | |

| Con Edison Development | Consolidated Edison Development, Inc. | |

| Con Edison Energy | Consolidated Edison Energy, Inc. | |

| Con Edison Solutions | Consolidated Edison Solutions, Inc. | |

| O&R | Orange and Rockland Utilities, Inc. | |

| Pike | Pike County Light & Power Company | |

| RECO | Rockland Electric Company | |

| The Companies | Con Edison and CECONY | |

| The Utilities | CECONY and O&R | |

| Regulatory Agencies, Government Agencies, and Quasi-governmental Not-for-Profits | ||

| EPA | U.S. Environmental Protection Agency | |

| FERC | Federal Energy Regulatory Commission | |

| IRS | Internal Revenue Service | |

| ISO-NE | ISO New England Inc. | |

| NJBPU | New Jersey Board of Public Utilities | |

| NJDEP | New Jersey Department of Environmental Protection | |

| NYAG | New York State Attorney General | |

| NYISO | New York Independent System Operator | |

| NYPA | New York Power Authority | |

| NYSDEC | New York State Department of Environmental Conservation | |

| NYSERDA | New York State Energy Research and Development Authority | |

| NYSPSC | New York State Public Service Commission | |

| NYSRC | New York State Reliability Council, LLC | |

| PAPUC | Pennsylvania Public Utility Commission | |

| PJM | PJM Interconnection LLC | |

| SEC | U.S. Securities and Exchange Commission | |

| Accounting | ||

| ABO | Accumulated Benefit Obligation | |

| ASU | Accounting Standards Update | |

| FASB | Financial Accounting Standards Board | |

| LILO | Lease In/Lease Out | |

| OCI | Other Comprehensive Income | |

| SFAS | Statement of Financial Accounting Standards | |

| SSCM | Simplified service cost method | |

| VIE | Variable interest entity | |

| Environmental | ||

| CO 2 | Carbon dioxide | |

| GHG | Greenhouse gases | |

| MGP Sites | Manufactured gas plant sites | |

| PCBs | Polychlorinated biphenyls | |

| PRP | Potentially responsible party | |

| SO 2 | Sulfur dioxide | |

| Superfund | Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 and similar state statutes | |

| 3 |

Table of Contents

|

Glossary of Terms continued |

| Units of Measure | ||

| dths | Dekatherms | |

| kV | Kilovolts | |

| kWh | Kilowatt-hour | |

| mdths | Thousand dekatherms | |

| MMlbs | Million pounds | |

| MVA | Megavolt amperes | |

| MW | Megawatts or thousand kilowatts | |

| MWH | Megawatt hour | |

| Other | ||

| AFDC | Allowance for funds used during construction | |

| COSO | Committee of Sponsoring Organizations of the Treadway Commission | |

| EMF | Electric and magnetic fields | |

| ERRP | East River Repowering Project | |

| Fitch | Fitch Ratings | |

| LTIP | Long Term Incentive Plan | |

| Moody’s | Moody’s Investors Service | |

| S&P | Standard & Poor’s Rating Services | |

| VaR | Value-at-Risk |

| 4 |

Table of Contents

| PAGE | ||||||

| Introduction | 6 | |||||

| 7 | ||||||

| 8 | ||||||

| Part I | ||||||

| Item 1: | 11 | |||||

| Item 1A: | 34 | |||||

| Item 1B: | 37 | |||||

| Item 2: | 37 | |||||

| Item 3: | 37 | |||||

| Item 4: | 38 | |||||

| 39 | ||||||

| Part II | ||||||

| Item 5: | 41 | |||||

| Item 6: | 43 | |||||

| Item 7: |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 | ||||

| Item 7A: | 71 | |||||

| Item 8: | 72 | |||||

| Item 9: |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

154 | ||||

| Item 9A: | 154 | |||||

| Item 9B: | 154 | |||||

| Part III | ||||||

| Item 10: | 155 | |||||

| Item 11: | 155 | |||||

| Item 12: |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

155 | ||||

| Item 13: |

Certain Relationships and Related Transactions, and Director Independence |

155 | ||||

| Item 14: | 155 | |||||

| Part IV | ||||||

| Item 15: | 157 | |||||

| 162 | ||||||

| 5 |

Table of Contents

This introduction contains certain information about Con Edison and its subsidiaries, including, CECONY, and is qualified in its entirety by reference to the more detailed information appearing elsewhere or incorporated by reference in this report.

Con Edison’s mission is to provide energy services to our customers safely, reliably, efficiently, and in an environmentally sound manner; to provide a workplace that allows employees to realize their full potential; to provide a fair return to our investors; and to improve the quality of life in the communities we serve.

Con Edison is a holding company that owns:

| • |

CECONY, which delivers electricity, natural gas and steam to customers in New York City and Westchester County; |

| • |

O&R (together with CECONY referred to as the Utilities), which delivers electricity and natural gas to customers primarily located in southeastern New York, and northern New Jersey and northeastern Pennsylvania; and |

| • |

Competitive energy businesses, which provide retail and wholesale electricity supply and energy services. |

Con Edison anticipates that the Utilities, which are subject to extensive regulation, will continue to provide substantially all of its earnings over the next few years. The Utilities have approved rate plans that are generally designed to cover each company’s cost of service, including the capital and other costs of the company’s energy delivery systems. The Utilities recover from their full-service customers (generally, on a current basis) the cost the Utilities pay for the energy and charge all of their customers the cost of delivery service.

Selected Financial Data

Con Edison

| For the Year Ended December 31, | ||||||||||||||||||||

| (millions of dollars, except per share amounts) | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||

|

Operating revenues |

$ | 11,962 | $ | 13,120 | $ | 13,583 | $ | 13,032 | $ | 13,325 | ||||||||||

|

Energy costs |

6,611 | 7,225 | 7,584 | 6,242 | 5,732 | |||||||||||||||

|

Operating income |

1,628 | 1,847 | 1,920 | 1,899 | 2,120 | |||||||||||||||

|

Income from continuing operations |

751 | 936 | 933 | 879 | 1,003 | |||||||||||||||

|

Total assets |

26,699 | 28,262 | 33,498 | (a) | 33,844 | (a) | 36,146 | (b) | ||||||||||||

|

Long-term debt |

8,298 | 7,611 | 9,232 | 9,854 | 10,671 | |||||||||||||||

|

Shareholders’ equity |

8,217 | 9,289 | 9,911 | 10,462 | 11,274 | |||||||||||||||

|

Basic earnings per share |

||||||||||||||||||||

|

Continuing operations |

$ | 2.97 | $ | 3.48 | $ | 3.37 | $ | 3.16 | $ | 3.49 | ||||||||||

|

Diluted earnings per share |

||||||||||||||||||||

|

Continuing operations |

$ | 2.96 | $ | 3.46 | $ | 3.36 | $ | 3.14 | $ | 3.47 | ||||||||||

|

Cash dividends per common share |

$ | 2.30 | $ | 2.32 | $ | 2.34 | $ | 2.36 | $ | 2.38 | ||||||||||

|

Book value per share |

$ | 31.11 | $ | 33.39 | $ | 35.43 | $ | 36.82 | $ | 37.95 | ||||||||||

|

Average common shares outstanding (millions) |

249 | 266 | 273 | 275 | 284 | |||||||||||||||

|

Stock price low |

$ | 41.17 | $ | 43.10 | $ | 34.11 | $ | 32.56 | $ | 41.52 | ||||||||||

|

Stock price high |

$ | 49.28 | $ | 52.90 | $ | 49.30 | $ | 46.35 | $ | 51.03 | ||||||||||

| (a) | Reflects a $1,130 million decrease in 2009 and a $3,519 million increase in 2008 in regulatory assets for unrecognized pension and other retirement costs. See Notes E and F to the financial statements in Item 8. |

| (b) | Reflects a $1,399 million increase in net plant, a $303 million increase in regulatory assets – environmental remediation costs and a $210 million increase in prepayments. See “Liquidity and Capital Resources – Other Changes in Assets and Liabilities” in Item 7. |

| 6 |

Table of Contents

CECONY

| For the Year Ended December 31, | ||||||||||||||||||||

| (millions of dollars) | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||

|

Operating revenues |

$ | 9,288 | $ | 9,885 | $ | 10,424 | $ | 10,036 | $ | 10,573 | ||||||||||

|

Energy costs |

4,479 | 4,580 | 4,844 | 3,904 | 3,693 | |||||||||||||||

|

Operating income |

1,465 | 1,669 | 1,667 | 1,716 | 1,922 | |||||||||||||||

|

Net income for common stock |

686 | 844 | 783 | 781 | 893 | |||||||||||||||

|

Total assets |

22,816 | 24,504 | 30,415 | (a) | 30,461 | (a) | 32,435 | (b) | ||||||||||||

|

Long-term debt |

6,925 | 7,172 | 8,494 | 9,038 | 9,743 | |||||||||||||||

|

Shareholder’s equity |

7,345 | 8,299 | 9,204 | 9,560 | 10,136 | |||||||||||||||

| (a) | Reflects a $1,076 million decrease in 2009 and a $3,392 million increase in 2008 in regulatory assets for unrecognized pension and other retirement costs. See Notes E and F to the financial statements in Item 8. |

| (b) | Reflects a $1,257 million increase in net plant, a $241 million increase in regulatory assets – environmental remediation costs and a $125 million increase in accounts receivable from affiliated companies. See “Liquidity and Capital Resources – Other Changes in Assets and Liabilities” in Item 7. |

Significant 2010 Developments

| • |

CECONY delivered 58,693 millions of kWhs of electricity (3.6 percent increase from prior year), 123,972 mdths of gas (0.7 percent decrease from prior year) and 23,030 MMlbs of steam to its customers (0.1 percent increase from prior year). The company’s electric and gas rate plans include revenue decoupling mechanisms pursuant to which delivery revenues are not generally affected by changes in delivery volumes from levels assumed in the rate plans. See “Results of Operations” in Item 7. |

| • |

CECONY invested $1,866 million to upgrade and reinforce its energy delivery systems. O&R invested $135 million in its energy delivery systems. See “Capital Requirements and Resources” in Item 1. |

| • |

CECONY’s electric, gas and steam rates increased (on an annual basis) $420.4 million (April 2010), $47.1 million (October 2010) and $49.5 million (October 2010), respectively. O&R’s electric and gas rates increased (on an annual basis) $15.6 million and $9.0 million, respectively (July and November 2010). See Note B to the financial statements in Item 8. |

| • |

Con Edison issued $305 million of common stock, in addition to stock issued under its dividend reinvestment and employee stock plans. CECONY issued $925 million of debentures. O&R issued $170 million of debentures. See “Liquidity and Capital Resources – Cash Flows from Financing Activities” in Item 7. |

Con Edison and CECONY file annual, quarterly and current reports, proxy or information statements and other information with the Securities and Exchange Commission (SEC). The public may read and copy any materials that the Companies file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580 Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers (including Con Edison and CECONY) that file electronically with the SEC. The address of that site is http://www.sec.gov .

This information the Companies file with the SEC is also available free of charge on or through the Investor Information section of their websites as soon as reasonably practicable after the reports are electronically filed with, or furnished to, the SEC. Con Edison’s internet website is at: http://www.conedison.com ; and CECONY’s is at: http://www.coned.com .

The Investor Information section of Con Edison’s website also includes the company’s code of ethics (and amendments or waivers of the code for executive officers or directors), corporate governance guidelines and the

| 7 |

Table of Contents

charters of the following committees of the company’s Board of Directors: Audit Committee, Management Development and Compensation Committee, and Corporate Governance and Nominating Committee. This information is available in print to any shareholder who requests it. Requests should be directed to: Corporate Secretary, Consolidated Edison, Inc., 4 Irving Place, New York, NY 10003.

Information on the Companies’ websites is not incorporated herein.

This report includes forward-looking statements intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectation and not facts. Words such as “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will” and similar expressions identify forward-looking statements. Forward-looking statements are based on information available at the time the statements are made, and accordingly speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various factors including, but not limited to, those discussed under “Risk Factors,” in Item 1A.

| 8 |

Table of Contents

| Contents of Item 1 | Page | |||

| Overview | 11 | |||

|

CECONY |

11 | |||

|

Electric |

11 | |||

|

Gas |

11 | |||

|

Steam |

11 | |||

|

O&R |

||||

|

Electric |

11 | |||

|

Gas |

12 | |||

|

Competitive Energy Businesses |

12 | |||

| Utility Regulation | ||||

|

State Utility Regulation |

12 | |||

|

Regulators |

12 | |||

|

Utility Industry Restructuring in New York |

12 | |||

|

Rate Plans |

12 | |||

|

Liability for Service Interruptions and Other Non-rate Conditions of Service |

14 | |||

|

Generic Proceedings |

15 | |||

|

Federal Utility Regulation |

15 | |||

|

New York Independent System Operator (NYISO) |

15 | |||

| Competition | 15 | |||

| The Utilities | ||||

|

CECONY |

16 | |||

|

Electric Operations |

16 | |||

|

Electric Facilities |

16 | |||

|

Electric Sales and Deliveries |

16 | |||

|

Electric Peak Demand |

17 | |||

|

Electric Supply |

17 | |||

|

Gas Operations |

19 | |||

|

Gas Facilities |

19 | |||

|

Gas Sales and Deliveries |

19 | |||

|

Gas Peak Demand |

20 | |||

|

Gas Supply |

20 | |||

|

Steam Operations |

21 | |||

|

Steam Facilities |

21 | |||

|

Steam Sales and Deliveries |

21 | |||

|

Steam Peak Demand and Capacity |

21 | |||

|

Steam Supply |

21 | |||

|

O&R |

21 | |||

|

Electric Operations |

21 | |||

|

Electric Facilities |

21 | |||

|

Electric Sales and Deliveries |

22 | |||

|

Electric Peak Demand |

22 | |||

|

Electric Supply |

22 | |||

|

Gas Operations |

23 | |||

|

Gas Facilities |

23 | |||

|

Gas Sales and Deliveries |

23 | |||

|

Gas Peak Demand |

23 | |||

|

Gas Supply |

24 | |||

| 9 |

Table of Contents

| Contents of Item 1 | Page | |||

| Competitive Energy Businesses | 24 | |||

|

Con Edison Solutions |

24 | |||

|

Con Edison Energy |

25 | |||

|

Con Edison Development |

25 | |||

| Capital Requirements and Resources | 25 | |||

| Environmental Matters | ||||

|

Climate Change |

28 | |||

|

Environmental Sustainability |

29 | |||

|

CECONY |

29 | |||

|

O&R |

32 | |||

|

Other Federal, State and Local Environmental Provisions |

33 | |||

| State Anti-Takeover Law | 33 | |||

| Employees | 34 | |||

Incorporation By Reference

Information in any item of this report as to which reference is made in this Item 1 is hereby incorporated by reference in this Item 1. The use of terms such as “see” or “refer to” shall be deemed to incorporate into Item 1 at the place such term is used the information to which such reference is made.

| 10 |

Table of Contents

Overview

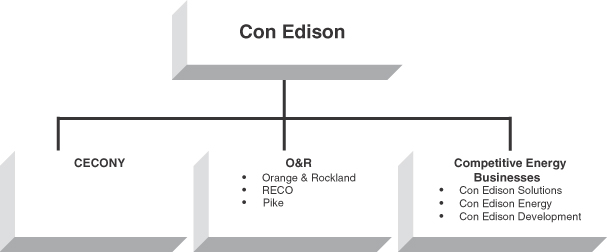

Consolidated Edison, Inc. (Con Edison), incorporated in New York State in 1997, is a holding company which owns all of the outstanding common stock of Consolidated Edison Company of New York, Inc. (CECONY), Orange and Rockland Utilities, Inc. (O&R) and the competitive energy businesses. As used in this report, the term the “Companies” refers to Con Edison and CECONY.

CECONY’s principal business operations are its regulated electric, gas and steam delivery businesses. O&R’s principal business operations are its regulated electric and gas delivery businesses. The competitive energy businesses sell electricity to wholesale and retail customers, provide certain energy-related services, and participate in energy infrastructure projects. Con Edison is evaluating additional opportunities to invest in electric and gas-related businesses.

Con Edison’s strategy is to provide reliable energy services, maintain public and employee safety, promote energy efficiency, and develop cost-effective ways of performing its business. Con Edison seeks to be a responsible steward of the environment and enhance its relationships with customers, regulators and members of the communities it serves.

CECONY

Electric

CECONY provides electric service to approximately 3.3 million customers in all of New York City (except part of Queens) and most of Westchester County, an approximately 660 square mile service area with a population of more than nine million.

Gas

CECONY delivers gas to approximately 1.1 million customers in Manhattan, the Bronx and parts of Queens and Westchester County.

Steam

CECONY operates the largest steam distribution system in the United States by producing and delivering more than 23,000 MMlbs of steam annually to approximately 1,760 customers in parts of Manhattan.

O&R

Electric

O&R and its utility subsidiaries, Rockland Electric Company (RECO) and Pike County Power & Light Company (Pike) (together referred to herein as O&R) provide electric service to approximately 0.3 million customers in southeastern New York and in adjacent areas of northern New Jersey and northeastern Pennsylvania, an approximately 1,350 square mile service area.

| 11 |

Table of Contents

Gas

O&R delivers gas to over 0.1 million customers in southeastern New York and adjacent areas of northeastern Pennsylvania.

Competitive Energy Businesses

Con Edison pursues competitive energy opportunities through three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy and Con Edison Development. These businesses include the sales and related hedging of electricity to wholesale and retail customers, sales of certain energy-related products and services, and participation in energy infrastructure projects. At December 31, 2010, Con Edison’s equity investment in its competitive energy businesses was $337 million and their assets amounted to $807 million.

In 2008, Con Edison Development and its subsidiary, CED/SCS Newington, LLC, completed the sale of their ownership interests in electricity generating plants with an aggregate capacity of approximately 1,706 MW. See Note U to the financial statements in Item 8.

Utility Regulation

State Utility Regulation

Regulators

The Utilities are subject to regulation by the New York State Public Service Commission (NYSPSC), which under the New York Public Service Law, is authorized to set the terms of service and the rates the Utilities charge for providing service in New York. It also approves the issuance of the Utilities’ securities. It exercises jurisdiction over the siting of the Utilities’ electric transmission lines and approves mergers or other business combinations involving New York utilities. O&R’s New Jersey subsidiary, RECO, is subject to similar regulation by the New Jersey Board of Public Utilities (NJBPU). O&R’s Pennsylvania subsidiary, Pike, is subject to similar regulation by the Pennsylvania Public Utility Commission (PAPUC). The NYSPSC, together with the NJBPU and the PAPUC, are referred to herein as state utility regulators.

Utility Industry Restructuring In New York

In the 1990s, the NYSPSC restructured the electric utility industry in the state. In accordance with NYSPSC orders, the Utilities sold all of their electric generating facilities other than those that also produce steam for CECONY’s steam business (see Electric Operations – Electric Facilities below) and provided all of their customers the choice to buy electricity or gas from the Utilities or other suppliers (see Electric Operations – Electric Sales and Deliveries and Gas Operations – Gas Sales and Deliveries below).

Following adoption of NYSPSC industry restructuring, there were several utility mergers as a result of which substantially all of the electric and gas delivery service in New York State is now provided by one of three investor-owned utility companies – Con Edison, National Grid plc and Iberdrola, S.A. – or one of two state authorities – New York Power Authority (NYPA) or Long Island Power Authority.

Rate Plans

Investor-owned utilities in the United States provide service to customers according to the terms of tariffs approved by the appropriate state utility regulator. The tariffs include schedules of rates for service that are designed to permit the utilities to recover from their customers the approved anticipated costs, including capital costs, of providing service to customers as defined by the tariff. The tariffs implement rate plans, that result from rate orders, settlements, or joint proposals developed during rate proceedings. The utilities’ earnings depend on the rate levels authorized in the rate plans and their ability to operate their businesses in a manner consistent with their rate plans.

The utilities’ rate plans each cover specified periods, but rates determined pursuant to a plan generally continue in effect until a new rate plan is approved by the state utility regulator. In New York, either the utility or the NYSPSC can commence a proceeding for a new rate plan, and a new rate plan filed by the utility will take effect automatically in 11 months unless prior to such time the NYSPSC approves a rate plan.

In each rate proceeding, rates are determined by the state utility regulator following the submission by the utility of testimony and supporting information, which are subject to review by the staff of the regulator. Other parties with an interest in the proceeding can

| 12 |

Table of Contents

also review the utility’s proposal and become involved in the rate case. The review process is overseen by an Administrative Law Judge. After an Administrative Law Judge issues a decision, that generally considers the interests of the utility, the regulatory staff, other parties, and legal requisites, the regulator will issue a rate order. The utility and the regulator’s staff and interested parties may enter into a settlement agreement or joint proposal prior to the completion of this administrative process, in which case the agreement would be subject to approval of the regulator.

For each rate plan, the revenues needed to provide the utility a return on invested capital is determined by multiplying the utilities’ forecasted rate base by the utility’s pre-tax weighted average cost of capital. In general, rate base is the amount of the utility’s net plant, deferred taxes and working capital. The NYSPSC uses a forecast of rate base for the rate year. The weighted average cost of capital is determined based on the forecasted amounts and costs of long-term debt and preferred equity, the forecasted amount of common equity and an allowed return on common equity determined by the state utility regulator. The NYSPSC’s current methodology for determining the allowed return on common equity assigns a one-third weight to an estimate determined from a capital asset pricing model applied to a peer group of utility companies and a two-thirds weight to an estimate determined from a dividend discount model using stock prices and dividend forecasts for a peer group of utility companies.

Pursuant to the Utilities’ rate plans, there generally can be no change to the charges to customers during the respective terms of the rate plans other than for recovery of the costs incurred for energy supply and specified adjustments provided for in the rate plans.

Common provisions of the Utilities’ rate plans may include:

“Recoverable energy cost clauses” that allow the Utilities to recover on a current basis the costs for the energy they supply with no mark-up to their full-service customers.

“Other cost reconciliations” that reconcile pension and other postretirement costs, environmental remediation costs, and certain other costs to amounts reflected in delivery rates for such costs. Utilities generally retain the right to petition for recovery or accounting deferral of extraordinary and material cost increases and provision is sometimes made for the utility to retain a share of cost reductions, for example, property tax refunds.

“Revenue decoupling mechanisms” under which actual energy delivery revenues will be compared, on a periodic basis, with the authorized delivery revenues. The difference is accrued with interest for refund to, or recovery from customers, as applicable.

“Earnings sharing provisions” require the Utilities to defer for customer benefit earnings over specified rates of return on common equity. There is no symmetric mechanism for earnings below specified rates of return on common equity.

“Negative earnings adjustments” for failure to meet certain performance standards relating to service reliability, safety and other matters.

| 13 |

Table of Contents

The following table should be read in conjunction with, and is subject to, the more detailed discussion of the Utilities’ rate plans in Note B to the financial statements in Item 8 (which information is incorporated by reference herein).

| Effective Period |

Rate Increases |

Rate Base |

Amortization

To Income of Net Regulatory (Assets) and Liabilities |

Authorized

Return on Equity (ROE) |

ROE Sharing Threshold

(Shareholders/

|

|||||||||||||||

| (millions of dollars, except percentages) | ||||||||||||||||||||

|

CECONY – Electric(b) |

||||||||||||||||||||

|

April 2010 – March 2013 |

|

Yr. 1 – $420.4

Yr. 2 – $420.4 Yr. 3 – $286.9 |

(c) |

|

Yr. 1 – $14,887

Yr. 2 – $15,987 Yr. 3 – $16,826 |

|

|

$(75)

over 3 yrs. |

|

10.15 | % |

|

Yr. 1 –11.15% -

12.149%: 50/50

12.15% - 13.149%:

> 13.149%: 10/90(d) |

|

||||||

|

CECONY – Gas(b) |

||||||||||||||||||||

|

October 2010 – September 2013 |

|

Yr. 1 – $47.1

Yr. 2 – $47.9 Yr. 3 – $46.7 |

|

|

Yr. 1 – $3,027

Yr. 2 – $3,245 Yr. 3 – $3,434 |

|

|

$(53)

over 3 yrs. |

|

9.6 | % |

|

Yr. 1 – 10.35% -

11.59%: 40/60

11.6% - 12.59%:

> 12.59%: 10/90(e) |

|

||||||

|

CECONY – Steam(b) |

||||||||||||||||||||

|

October 2010 – September 2013 |

|

Yr. 1 – $49.5

Yr. 2 – $49.5 Yr. 3 – $17.8 |

(f) |

|

Yr. 1 – $1,589

Yr. 2 – $1,603 Yr. 3 – $1,613 |

|

|

$(20)

over 3 yrs. |

|

9.6 | % |

|

Yr. 1 – 10.35% -

11.59%: 40/60

11.6% - 12.59%:

>12.59%:10/90(e) |

|

||||||

|

O&R – Electric (NY) |

||||||||||||||||||||

|

July 2008 – June 2011 |

|

Yr. 1 – $15.6

Yr. 2 – $15.6 Yr. 3 – $ 5.7 |

(g) |

|

Yr. 1 – $504

Yr. 2 – $567 Yr. 3 – $597 |

|

|

$(34)

over 3 yrs. |

|

9.4 | % |

|

10.2% - 11.2% -

50/50 >11.2% - 25/75 |

|

||||||

|

O&R – Gas (NY) |

||||||||||||||||||||

|

November 2009 – October 2012 |

|

Yr. 1 – $9.0

Yr. 2 – $9.0 Yr. 3 – $4.6 |

(h) |

|

Yr. 1 – $280

Yr. 2 – $296 Yr. 3 – $309 |

|

|

$(2)

over 3 yrs. |

|

10.4 | % |

|

11.4% - 12.4% -

50/50 12.4% - 14% - 35/65 >14% - 10/90 |

|

||||||

| (a) | Subject to limitation for cost reconciliations described in Note B to the financial statements in Item 8. |

| (b) | Pursuant to NYSPSC orders, a portion of the company’s revenues is being collected subject to refund. See “Other Regulatory Matters” in Note B to the financial statements in Item 8. |

| (c) | The rate plan provides for a one-time surcharge of $133.5 million in Year 3. |

| (d) | In Yr. 2 and Yr. 3, 10.65% – 12.149%: 40/60, 12.15% – 13.149%: 25/75, and > 13.15%: 10/90. |

| (e) | In Yr. 2 and Yr. 3, 10.10% – 11.59%: 40/60, 11.60% – 12.59%: 25/75, and >12.6%: 10/90. |

| (f) | The rate plan provides for a one-time surcharge of $31.7 million in Year 3. |

| (g) | The rate plan provides for a one-time surcharge of $9.9 million in Year 3. |

| (h) | The rate plan provides for a one-time surcharge of $4.3 million in Year 3. |

Liability for Service Interruptions and Other Non-rate Conditions of Service

The tariff provisions under which CECONY provides electric, gas and steam service limit the company’s liability to pay for damages resulting from service interruptions to circumstances resulting from its gross negligence or willful misconduct.

CECONY’s tariff for electric service provides for reimbursement to electric customers for spoilage losses resulting from service interruptions in certain circumstances. In general, the company is obligated to reimburse affected residential and commercial customers for food spoilage of up to $450 and $9,000, respectively, and reimburse affected residential customers for prescription medicine spoilage losses without limitation on amount per claim. The company’s maximum aggregate liability for such reimbursement for an incident is $15 million. The company is not required to provide reimbursement to electric customers for outages attributable to generation or transmission system facilities or events beyond its control, such as storms, provided the company makes reasonable efforts to restore service as soon as practicable.

| 14 |

Table of Contents

Generic Proceedings

The NYSPSC from time to time conducts “generic” proceedings to consider issues relating to all electric and gas utilities operating in New York State. Pending proceedings have included those relating to utilities exiting the service of selling electric energy and gas at retail (including an examination of utilities’ provider of last resort responsibility, the utilities’ vision for the ‘smart grid’, the implementation of energy efficiency and renewable energy programs and consumer protections) and addressing any rate disincentives to the promotion of energy efficiency and distributed generation. The Utilities are typically active participants in such proceedings. The Utilities do not expect that these pending generic proceedings will have a material adverse effect on their financial positions, results of operation or liquidity. In February 2011, the NYSPSC initiated a proceeding to examine the existing mechanisms pursuant to which utilities recover site investigation and remediation costs and possible alternatives. See “Environmental Matters – CECONY” and “Environmental Matters – O&R,” below, and Note G to the financial statements in Item 8.

Federal Utility Regulation

The Federal Energy Regulatory Commission (FERC), among other things, regulates the transmission and wholesale sales of electricity in interstate commerce and the transmission and sale of natural gas for resale in interstate commerce. In addition, the FERC has the authority to impose penalties, which could be substantial, including penalties for the violation of reliability rules. Certain activities of the Utilities and the competitive energy businesses are subject to the jurisdiction of FERC. The Utilities are subject to regulation by the FERC with respect to electric transmission rates and to regulation by the NYSPSC with respect to electric and gas retail commodity sales and local delivery service. As a matter of practice, the NYSPSC has approved delivery service rates that include both distribution and transmission costs.

New York Independent System Operator (NYISO)

The NYISO is a not-for-profit organization that controls and operates most of the electric transmission facilities in New York State, including those of the Utilities, as an integrated system and administers wholesale markets for electricity in New York State. In addition to operating the state’s high voltage grid, the NYISO administers the energy, ancillary services and capacity markets. The New York State Reliability Council (NYSRC) promulgates reliability standards subject to FERC oversight. Pursuant to a requirement that is set annually by the NYSRC, the NYISO requires that entities supplying electricity to customers in New York State have generating capacity (either owned or contracted for) in an amount equal to the peak demand of their customers plus the applicable reserve margin. In addition, the NYISO has determined that entities that serve customers in New York City must have enough capacity that is electrically located in New York City to cover a substantial percentage (currently 80 percent; 81 percent effective May 2011) of the peak demands of their New York City customers. These requirements apply both to regulated utilities such as CECONY and O&R for the customers they supply under regulated tariffs and to companies such as Con Edison Solutions that supply customers on market terms. RECO, O&R’s New Jersey subsidiary, provides electric service in an area that has a different independent system operator – PJM Interconnection LLC (PJM).

Competition

Competition from suppliers of oil and other sources of energy, including distributed generation (such as solar, fuel cells and micro-turbines), may provide alternatives for the Utilities’ delivery customers. See “Rate Agreements” in Note B and “Recoverable Energy Costs” in Note A to the financial statements in Item 8.

The Utilities do not consider it reasonably likely that another company would be authorized to provide utility delivery service of electricity, natural gas or steam where the company already provides service. Any such other company would need to obtain NYSPSC consent, satisfy applicable local requirements, install facilities to provide the service, meet applicable services standards, and charge customers comparable taxes and other fees and costs imposed on the service.

| 15 |

Table of Contents

A new delivery company would also be subject to extensive ongoing regulation by the NYSPSC.

The competitive energy businesses participate in competitive energy supply and services businesses that are subject to different risks than those found in the businesses of the Utilities.

The Utilities

CECONY

CECONY, incorporated in New York State in 1884, is a subsidiary of Con Edison and has no significant subsidiaries of its own. Its principal business segments are its regulated electric, gas and steam businesses.

For a discussion of the company’s operating revenues and operating income for each segment, see “Results of Operations” in Item 7. For additional information about the segments, see Note N to the financial statements in Item 8.

Electric Operations

Electric Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation, for distribution facilities were $12,549 million and $11,824 million at December 31, 2010 and 2009, respectively. For its transmission facilities, the costs for utility plant, net of accumulated depreciation, were $2,150 million and $1,953 million at December 31, 2010 and 2009, respectively, and for its generation facilities, the costs for utility plant, net of accumulated depreciation, were $396 million and $392 million, at December 31, 2010 and 2009, respectively.

Distribution Facilities. CECONY owns 62 area distribution substations and various distribution facilities located throughout New York City and Westchester County. At December 31, 2010, the company’s distribution system had a transformer capacity of 28,997 MVA, with 36,781 miles of overhead distribution lines and 96,324 miles of underground distribution lines. The underground distribution lines represent the single longest underground electric delivery system in the United States. To continue its commitment to upgrade and reinforce its energy delivery infrastructure so that it can continue to safely and reliably meet electric demand, the company added one new substation, Newtown, in Queens in 2010.

Transmission Facilities. The company’s transmission facilities are located in New York City and Westchester, Orange, Rockland, Putnam and Dutchess counties in New York State. At December 31, 2010, CECONY owned or jointly owned 438 miles of overhead circuits operating at 138, 230, 345 and 500 kV and 740 miles of underground circuits operating at 69, 138 and 345 kV. The company’s 38 transmission substations and 62 area stations are supplied by circuits operated at 69 kV and above. In 2011, the company expects to complete a 9 1 / 2 mile transmission line connecting its Sprainbrook substation in Westchester County with the new Academy substation being constructed in upper Manhattan.

CECONY’s transmission facilities interconnect with those of National Grid, Central Hudson Gas & Electric Corporation, O&R, Iberdrola USA, Connecticut Light and Power Company, Long Island Power Authority, NYPA and Public Service Electric and Gas Company.

Generating Facilities. CECONY’s electric generating facilities consist of plants located in Manhattan with an aggregate capacity of 698 MW. The company expects to have sufficient amounts of gas and fuel oil available in 2011 for use in these facilities.

Electric Sales and Deliveries

CECONY delivers electricity to its full service customers who purchase electricity from the company. The company also delivers electricity to its customers who purchase electricity from other suppliers through the company’s retail access plan. In addition, the company delivers electricity to state and municipal customers of NYPA and economic development customers of municipal electric agencies.

| 16 |

Table of Contents

The company charges all customers in its service area for the delivery of electricity. The company generally recovers, on a current basis, the cost of the electricity that it buys and then sells to its full-service customers. It does not make any margin or profit on the electricity it sells. Effective April 2008, CECONY’s electric revenues became subject to a revenue decoupling mechanism. As a result, its electric delivery revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. CECONY’s electric sales and deliveries, excluding off-system sales, for the last five years were:

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Electric Energy Delivered (millions of kWhs) |

||||||||||||||||||||

|

CECONY full service customers |

26,101 | 25,314 | 24,640 | 23,483 | 24,142 | |||||||||||||||

|

Delivery service for retail access customers |

19,256 | 21,532 | 22,047 | 21,859 | 23,098 | |||||||||||||||

|

Delivery service to NYPA customers and others |

10,227 | 10,692 | 10,918 | 10,650 | 10,834 | |||||||||||||||

|

Delivery service for municipal agencies |

724 | 723 | 718 | 675 | 619 | |||||||||||||||

|

Total Deliveries in Franchise Area |

56,308 | 58,261 | 58,323 | 56,667 | 58,693 | |||||||||||||||

|

Electric Energy Delivered ($ in millions) |

||||||||||||||||||||

|

CECONY full service customers |

$ | 5,108 | $ | 5,158 | $ | 5,569 | $ | 5,040 | $ | 5,546 | ||||||||||

|

Delivery service for retail access customers |

1,040 | 1,334 | 1,507 | 1,855 | 2,123 | |||||||||||||||

|

Delivery service to NYPA customers and others |

276 | 309 | 378 | 423 | 516 | |||||||||||||||

|

Delivery service for municipal agencies |

17 | 17 | 20 | 21 | 22 | |||||||||||||||

|

Other operating revenues |

611 | 622 | 404 | 335 | 169 | |||||||||||||||

|

Total Deliveries in Franchise Area |

$ | 7,052 | $ | 7,440 | $ | 7,878 | $ | 7,674 | $ | 8,376 | ||||||||||

|

Average Revenue per kWh Sold (Cents)(a) |

||||||||||||||||||||

|

Residential |

20.9 | 21.6 | 24.2 | 23.6 | 25.8 | |||||||||||||||

|

Commercial and Industrial |

18.3 | 19.2 | 21.2 | 19.6 | 20.4 | |||||||||||||||

| (a) | Includes Municipal Agency sales. |

For further discussion of the company’s electric operating revenues and its electric results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Electric Peak Demand

The electric peak demand in CECONY’s service area occurs during the summer air conditioning season. The 2010 service area peak demand, which occurred on July 6, 2010, was 12,963 MW. The 2010 peak demand included an estimated 5,815 MW for CECONY’s full-service customers, 5,125 MW for customers participating in its electric retail access program and 2,023 MW for NYPA’s customers and municipal electric agency customers. The NYISO invoked demand reduction programs on July 6, 2010, as it had on peak demand days in some previous years (most recently 2006). “Design weather” for the electric system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. Since the majority of demand reduction programs are invoked only in specific circumstances, design conditions do not include these programs’ potential impact. However, the CECONY forecasted peak demand at design conditions does include the impact of permanent demand reduction programs. The company estimates that, under design weather conditions, the 2011 service area peak demand will be 13,275 MW, including an estimated 5,735 MW for its full-service customers, 5,450 MW for its electric retail access customers and 2,090 MW for NYPA’s customers and municipal electric agency customers. The company forecasts average annual growth of the peak electric demand in the company’s service area over the next five years at design conditions to be approximately 0.7 percent per year. The company continues to monitor the potential impact on customer demand from the current economic conditions.

Electric Supply

Most of the electricity sold by CECONY to its customers in 2010 was purchased under firm power contracts or through the wholesale electricity market

| 17 |

Table of Contents

administered by the NYISO. Con Edison expects that these resources will again be adequate to meet the requirements of its customers in 2011. The company plans to meet its continuing obligation to supply electricity to its customers through a combination of electricity purchased under contracts, purchased through the NYISO’s wholesale electricity market, or generated from its electricity generating facilities. For information about the company’s contracts for approximately 3,320 MW of electric generating capacity, see Notes I and O to the financial statements in Item 8. To reduce the volatility of its customers’ electric energy costs, the company has contracts to purchase electric energy and enters into derivative transactions to hedge the costs of a portion of its expected purchases under these contracts and through the NYISO’s wholesale electricity market.

CECONY owns generating stations in New York City associated primarily with its steam system. As of December 31, 2010, the generating stations had a combined electric capacity of approximately 698 MW, based on 2010 summer test ratings. For information about electric generating capacity owned by the company, see “Electric Operations – Electric Facilities – Generating Facilities”, above.

In general, the Utilities recover their purchased power costs, including the cost of hedging purchase prices, pursuant to rate provisions approved by the state public utility regulatory authority having jurisdiction. See “Financial and Commodity Market Risks – Commodity Price Risk,” in Item 7 and “Recoverable Energy Costs” in Note A to the financial statements in Item 8. From time to time, certain parties have petitioned the NYSPSC to review these provisions, the elimination of which could have a material adverse effect on the Companies’ financial position, results of operations or liquidity.

In a July 1998 order, the NYSPSC indicated that it “agree(s) generally that CECONY need not plan on constructing new generation as the competitive market develops,” but considers “overly broad” and did not adopt CECONY’s request for a declaration that, solely with respect to providing generating capacity, it will no longer be required to engage in long-range planning to meet potential demand and, in particular, that it will no longer have the obligation to construct new generating facilities, regardless of the market price of capacity. CECONY monitors the adequacy of the electric capacity resources and related developments in its service area, and works with other parties on long-term resource adequacy issues within the framework of the NYISO. In addition, the NYISO has adopted reliability rules that include obligations on transmission owners (such as CECONY) to construct facilities that may be needed for system reliability if the market does not solve a reliability need identified by the NYISO.

In 2009, the then Governor of New York announced a new goal of meeting 45 percent of the State’s electricity needs with energy efficiency or renewable resources by 2015. The goal is to be achieved by reducing electricity consumption by 15 percent, and having 30 percent of the electricity used in New York provided by renewable resources. Establishment of the renewable resources target began in September 2004, when the NYSPSC issued an order establishing a renewable portfolio standard (RPS) which provides that by 2013, 24 percent of the State’s energy needs would come from large renewable facilities (such as wind, hydro, and biomass) and smaller customer-sited renewable generation (limited to solar, fuel cells, and wind farm less than 300 kW in size), and 1 percent would come from green marketing efforts. The NYSPSC agreed with the Utilities that the responsibility for procuring the new renewable resources would rest with the New York State Energy Research and Development Authority (NYSERDA), and not the Utilities. In implementing the RPS for large renewable resources, NYSERDA enters into long-term agreements with developers, and pays the developers renewable premiums based on the facilities’ energy output. For customer-sited resources, NYSERDA provides rebates when customers install eligible renewable technologies. The renewable premiums, rebates, and NYSERDA’s administrative fee are financed through a volumetric charge imposed on the delivery customers of each of the state’s investor-owned utilities. Pursuant to the 2004 NYSPSC order, CECONY billed customers RPS surcharges of $33 million and $32 million in 2010 and 2009, respectively.

| 18 |

Table of Contents

These surcharges will increase as NYSERDA increases its renewables energy purchases. The NYSPSC issued an order in January 2010 formally increasing the RPS target to 30 percent by 2015 and requiring NYSPSC staff to develop a program to address the geographic balance of the RPS, setting-aside up to $30 million per year to be spent in the downstate region (including in the Utilities’ service territories) until 2015 for this purpose. Large renewable resources are grid-connected and sell their energy output in the wholesale energy market administered by the NYISO. As a result of the Utilities participation in the NYISO wholesale markets, a portion of the Utilities’ NYISO energy purchases are sourced from renewable resources. The energy produced by customer-sited renewables offsets the energy which the Utilities would otherwise have procured, thereby reducing the overall level of non-renewable energy consumed. In 2008, the NYSPSC issued an order authorizing the Utilities to begin implementing energy efficiency programs. Costs of the programs will be recovered primarily through a separate non-bypassable charge.

Gas Operations

Gas Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation, for gas facilities, which are primarily distribution facilities, were $3,153 million and $2,892 million at December 31, 2010 and 2009, respectively.

Natural gas is delivered by pipeline to CECONY at various points in its service territory and is distributed to customers by the company through an estimated 4,340 miles of mains and 385,396 service lines. The company owns a natural gas liquefaction facility and storage tank at its Astoria property in Queens, New York. The plant can store approximately 1,000 mdths of which a maximum of about 250 mdths can be withdrawn per day. The company has about 1,226 mdths of additional natural gas storage capacity at a field in upstate New York, owned and operated by Honeoye Storage Corporation, a corporation 28.8 percent owned by CECONY and 71.2 percent owned by Con Edison Development.

Gas Sales and Deliveries

The company generally recovers the cost of the gas that it buys and then sells to its firm sales customers. It does not make any margin or profit on the gas it sells. CECONY’s gas revenues are subject to a weather normalization clause and, effective October 2007, a revenue decoupling mechanism. As a result, its gas delivery revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved.

CECONY’s gas sales and deliveries for the last five years were:

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Gas Delivered (mdth) |

||||||||||||||||||||

|

Firm Sales |

||||||||||||||||||||

|

Full service |

71,858 | 73,734 | 68,943 | 67,994 | 63,592 | |||||||||||||||

|

Firm transportation |

23,688 | 39,017 | 43,245 | 48,671 | 51,859 | |||||||||||||||

|

Total Firm Sales and Transportation |

95,546 | 112,751 | 112,188 | 116,665 | 115,451 | |||||||||||||||

|

Interruptible Sales(a) |

11,995 | 10,577 | 11,220 | 8,225 | 8,521 | |||||||||||||||

|

Total Gas Sold to CECONY Customers |

107,541 | 123,328 | 123,408 | 124,890 | 123,972 | |||||||||||||||

|

Transportation of customer-owned gas |

||||||||||||||||||||

|

NYPA |

41,057 | 42,085 | 44,694 | 37,764 | 24,890 | |||||||||||||||

|

Other (mainly generating plants) |

83,688 | 95,260 | 94,086 | 86,454 | 99,666 | |||||||||||||||

|

Off-System Sales |

691 | 2,325 | 154 | 1 | 7 | |||||||||||||||

|

Total Sales and Transportation |

232,977 | 262,998 | 262,342 | 249,109 | 248,535 | |||||||||||||||

| (a) | Includes 3,385, 2,851, 2,955, 2,043 and 462 mdths for 2010, 2009, 2008, 2007 and 2006 respectively, which are also reflected in firm transportation and other. |

| 19 |

Table of Contents

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Gas Delivered ($ in millions) |

||||||||||||||||||||

|

Firm Sales |

||||||||||||||||||||

|

Full service |

$ | 1,252 | $ | 1,341 | $ | 1,332 | $ | 1,229 | $ | 1,099 | ||||||||||

|

Firm transportation |

105 | 168 | 202 | 266 | 347 | |||||||||||||||

|

Total Firm Sales and Transportation |

1,357 | 1,509 | 1,534 | 1,495 | 1,446 | |||||||||||||||

|

Interruptible Sales |

121 | 88 | 138 | 75 | 60 | |||||||||||||||

|

Total Gas Sold to CECONY Customers |

1,478 | 1,597 | 1,672 | 1,570 | 1,506 | |||||||||||||||

|

Transportation of customer-owned gas |

||||||||||||||||||||

|

NYPA |

4 | 4 | 4 | 4 | 2 | |||||||||||||||

|

Other (mainly generating plants) |

76 | 76 | 85 | 73 | 87 | |||||||||||||||

|

Off-System Sales |

5 | 17 | 1 | — | — | |||||||||||||||

|

Other operating revenues (mainly regulatory amortizations) |

50 | 65 | 77 | 54 | (54 | ) | ||||||||||||||

|

Total Sales and Transportation |

$ | 1,613 | $ | 1,759 | $ | 1,839 | $ | 1,701 | $ | 1,541 | ||||||||||

|

Average Revenue per dth Sold |

||||||||||||||||||||

|

Residential |

$ | 19.24 | $ | 19.78 | $ | 21.15 | $ | 20.33 | $ | 19.31 | ||||||||||

|

General |

$ | 15.07 | $ | 16.01 | $ | 16.77 | $ | 14.91 | $ | 14.28 | ||||||||||

For further discussion of the company’s gas operating revenues and its gas results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Gas Peak Demand

The gas peak demand for firm service customers in CECONY’s service area occurs during the winter heating season. The daily peak day demand during the winter 2010/2011 (through January 25, 2011) occurred on January 23, 2011 when the demand reached 891 mdths. The 2010/2011 winter demand included an estimated 587 mdths for CECONY’s full-service customers and 304 mdths for customers participating in its gas retail access program. “Design weather” for the gas system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. The company estimates that under design weather conditions the 2011/2012 service area peak demand will be 1,151 mdths, including an estimated 675 mdths for its full-service customers and 475 mdths for its retail access customers. The company forecasts average annual growth of the peak gas demand over the next five years at design conditions to be approximately 1.1 percent in its service area. The forecasted peak demand at design conditions does not include gas used by interruptible gas customers or in generating stations (electricity and steam). The company continues to monitor the potential impact on customer demand from the current economic conditions.

Gas Supply

CECONY and O&R have combined their gas requirements, and contracts to meet those requirements, into a single portfolio. The combined portfolio is administered by, and related management services are provided by, CECONY (for itself and as agent for O&R) and costs are allocated between the Utilities in accordance with provisions approved by the NYSPSC. See Note S to the financial statements in Item 8.

Charges from suppliers for the firm purchase of gas, which are based on formulas or indexes or are subject to negotiation, are generally designed to approximate market prices. The gas supply contracts are for various terms extending to 2014. The Utilities have contracts with interstate pipeline companies for the purchase of firm transportation from upstream points where gas has been purchased to the Utilities’ distribution systems, and for upstream storage services. Charges under these transportation and storage contracts are approved by the FERC. Such contracts are for various terms extending to 2023. The Utilities are required to pay certain fixed charges under the supply, transportation and storage contracts whether or not the contracted capacity is actually used. These fixed charges amounted to approximately $246 million in 2010, including $205 million for CECONY. See “Contractual Obligations” below. In addition, the Utilities purchase gas on the spot market and contract for interruptible gas transportation. See “Recoverable Energy Costs” in Note A to the financial statements in Item 8.

| 20 |

Table of Contents

Steam Operations

Steam Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation for steam facilities were $1,617 million and $1,555 million at December 31, 2010 and 2009, respectively.

CECONY generates steam at one steam-electric generating station and five steam-only generating stations and distributes steam to its customers through approximately 106 miles of transmission, distribution, and service piping.

Steam Sales and Deliveries

CECONY’s steam sales and deliveries for the last five years were:

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Steam Sold (MMlbs) |

||||||||||||||||||||

|

General |

515 | 589 | 785 | 786 | 257 | |||||||||||||||

|

Apartment house |

6,774 | 7,519 | 6,614 | 5,962 | 5,870 | |||||||||||||||

|

Annual power |

15,961 | 17,696 | 16,577 | 16,269 | 16,903 | |||||||||||||||

|

Total Steam Delivered to CECONY Customers |

23,250 | 25,804 | 23,976 | 23,017 | 23,030 | |||||||||||||||

|

Steam Sold ($ in millions) |

||||||||||||||||||||

|

General |

$ | 21 | $ | 23 | $ | 23 | $ | 28 | $ | 21 | ||||||||||

|

Apartment house |

174 | 188 | 186 | 165 | 160 | |||||||||||||||

|

Annual power |

405 | 443 | 468 | 446 | 459 | |||||||||||||||

|

Other operating revenues |

23 | 32 | 30 | 22 | 16 | |||||||||||||||

|

Total Steam Delivered to CECONY Customers |

$ | 623 | $ | 686 | $ | 707 | $ | 661 | $ | 656 | ||||||||||

|

Average Revenue per Mlb Sold |

$ | 25.81 | $ | 25.34 | $ | 28.24 | $ | 27.76 | $ | 27.79 | ||||||||||

For further discussion of the company’s steam operating revenues and its steam results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Steam Peak Demand and Capacity

Demand for steam in CECONY’s service area peaks during the winter heating season. The one-hour peak demand during the winter of 2010/2011 (through January 25, 2011) occurred on January 24, 2011 when the demand reached 8,924 MMlbs per hour. The company’s estimate for the winter of 2011/2012 peak demand of its steam customers is 9,780 MMlbs per hour under design criteria, which assumes severe weather.

On December 31, 2010, the steam system had the capability of delivering approximately 13.3 MMlbs of steam per hour, and CECONY estimates that the system will have the capability to deliver 11.8 MMlbs of steam per hour in the 2011/2012 winter.

Steam Supply

Forty-four percent of the steam produced by CECONY in 2010 was supplied by the company’s steam-only generating assets; 41 percent was produced by the company’s steam-electric generating assets, where steam and electricity are primarily cogenerated; and 15 percent was purchased under an agreement with Brooklyn Navy Yard Cogeneration Partners L.P.

O&R

Electric Operations

Electric Facilities

O&R’s capitalized costs for utility plant, net of accumulated depreciation, for distribution facilities were $642 million and $618 million at December 31, 2010 and 2009, respectively. For its transmission facilities, the costs for utility plant, net of accumulated depreciation, were $134 million and $137 million at December 31, 2010 and 2009, respectively.

O&R, RECO and Pike, own, in whole or in part, transmission and distribution facilities which include 554 circuit miles of transmission lines, 13 transmission substations, 61 distribution substations, 84,809 in-service line transformers, 3,774 pole miles of overhead distribution lines and 1,727 miles of underground distribution lines. O&R’s transmission

| 21 |

Table of Contents

system is part of the NYISO system except that portions of RECO’s system are located within the transmission area controlled by the PJM.

Electric Sales and Deliveries

O&R generally recovers, on a current basis, the cost of the electricity that it buys and then sells to its full-service customers. It does not make any margin or profit on the electricity it sells. Effective July 2008, O&R’s New York electric revenues (which accounted for 66.7 percent of O&R’s electric revenues in 2010) became subject to a revenue decoupling mechanism. As a result, O&R’s New York electric delivery revenues are generally not affected by charges in delivery volumes from levels assumed when rates were approved. O&R’s electric sales in New Jersey and Pennsylvania are not subject to a decoupling mechanism. O&R’s electric sales and deliveries, excluding off-system sales for the last five years were:

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Electric Energy Delivered (millions of kWhs) |

||||||||||||||||||||

|

Total deliveries to O&R full service customers |

4,010 | 4,224 | 4,093 | 3,673 | 3,498 | |||||||||||||||

|

Delivery service for retail access customers |

1,766 | 1,688 | 1,814 | 1,901 | 2,330 | |||||||||||||||

|

Total Deliveries In Franchise Area |

5,776 | 5,912 | 5,907 | 5,574 | 5,828 | |||||||||||||||

|

Electric Energy Delivered ($ in millions) |

||||||||||||||||||||

|

Total deliveries to O&R full service customers |

$ | 503 | $ | 596 | $ | 650 | $ | 551 | $ | 570 | ||||||||||

|

Delivery service for retail access customers |

76 | 73 | 80 | 95 | 132 | |||||||||||||||

|

Other operating revenues |

3 | 2 | 3 | 2 | (10 | ) | ||||||||||||||

|

Total Deliveries In Franchise Area |

$ | 582 | $ | 671 | $ | 733 | $ | 648 | $ | 692 | ||||||||||

|

Average Revenue Per kWh Sold (Cents) |

||||||||||||||||||||

|

Residential |

14.0 | 15.6 | 17.4 | 17.2 | 18.3 | |||||||||||||||

|

Commercial and Industrial |

11.3 | 12.9 | 14.6 | 13.3 | 14.1 | |||||||||||||||

For further discussion of the company’s electric operating revenues and its electric results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Electric Peak Demand

The electric peak demand in O&R’s service area occurs during the summer air conditioning season. The 2010 service area peak demand, which occurred on July 6, 2010, was 1,572 MW. The 2010 peak demand included an estimated 1,034 MW for O&R’s full-service customers and 538 MW for customers participating in its electric retail access program. The NYISO did not invoke demand reduction programs. “Design weather” for the electric system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. Since the majority of demand reduction programs are invoked only in specific circumstances, design conditions do not include these programs’ potential impact. However, the O&R forecasted peak demand at design conditions does include the impact of permanent demand reduction programs. The company estimates that, under design weather conditions, the 2011 service area peak demand will be 1,600 MW, including an estimated 1,046 MW for its full-service customers and 554 MW for its electric retail access customers. The company forecasts average annual growth of the peak electric demand in the company’s service area over the next five years at design conditions to be approximately 1.7 percent per year. The company continues to monitor the potential impact on customer demand from the current economic conditions.

Electric Supply

The electricity O&R sold to its customers in 2010 was purchased under firm power contracts or through the wholesale electricity markets administered by the NYISO and PJM. The company expects that these resources will again be adequate to meet the requirements of its customers in 2011. O&R does not own any electric generating capacity.

| 22 |

Table of Contents

Gas Operations

Gas Facilities

O&R’s capitalized costs for utility plant, net of accumulated depreciation for gas facilities, which are primarily distribution facilities, were $382 million and $334 million at December 31, 2010 and 2009, respectively. O&R and Pike own their gas distribution systems, which include 1,744 miles of mains. In addition, O&R owns a gas transmission system, which includes 81 miles of mains.

Gas Sales and Deliveries

O&R generally recovers the cost of the gas that it buys and then sells to its firm sales customers. It does not make any margin or profit on the gas it sells. O&R’s gas revenues are subject to a weather normalization clause. Effective November 2009, O&R’s New York gas revenues (which accounted for substantially all of O&R’s gas revenues in 2009) became subject to a revenue decoupling mechanism. As a result, its gas delivery revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. O&R’s gas deliveries and sales for the last five years were:

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

|

Gas delivered (mdth) |

||||||||||||||||||||

|

Firm Sales |

||||||||||||||||||||

|

Full service |

9,650 | 10,835 | 9,884 | 9,561 | 8,772 | |||||||||||||||

|

Firm transportation |

9,058 | 10,248 | 10,471 | 10,905 | 10,692 | |||||||||||||||

|

Total Firm Sales and Transportation |

18,708 | 21,083 | 20,355 | 20,466 | 19,464 | |||||||||||||||

|

Interruptible Sales |

2,600 | 2,652 | 2,567 | 2,390 | 675 | |||||||||||||||

|

Total Gas Sold To O&R Customers |

21,308 | 23,735 | 22,922 | 22,856 | 20,139 | |||||||||||||||

|

Transportation of customer-owned gas |

||||||||||||||||||||

|

Interruptible transportation |

3,256 | 3,331 | 2,842 | 2,112 | 3,822 | |||||||||||||||

|

Sales for resale |

939 | 1,044 | 1,007 | 953 | 840 | |||||||||||||||

|

Sales to electric generating stations |

3,036 | 4,552 | 2,327 | 1,346 | 691 | |||||||||||||||

|

Off-System Sales |

372 | 455 | 249 | 624 | 1 | |||||||||||||||

|

Total Sales and Transportation |

28,911 | 33,117 | 29,347 | 27,891 | 25,493 | |||||||||||||||

|

Gas delivered ($ in millions) |

||||||||||||||||||||

|

Firm Sales |

||||||||||||||||||||

|

Full service |

$ | 166 | $ | 186 | $ | 172 | $ | 159 | $ | 131 | ||||||||||

|

Firm transportation |

32 | 39 | 45 | 51 | 65 | |||||||||||||||

|

Total Firm Sales and Transportation |

198 | 225 | 217 | 210 | 196 | |||||||||||||||

|

Interruptible Sales |

28 | 25 | 27 | 21 | 9 | |||||||||||||||

|

Total Gas Sold To O&R Customers |

226 | 250 | 244 | 231 | 205 | |||||||||||||||

|

Transportation of customer-owned gas |

||||||||||||||||||||

|

Sales to electric generating stations |

3 | 3 | 4 | 2 | — | |||||||||||||||

|

Other operating revenues |

7 | 12 | 10 | 9 | 13 | |||||||||||||||

|

Total Sales and Transportation |

$ | 236 | $ | 265 | $ | 258 | $ | 242 | $ | 218 | ||||||||||

|

Average Revenue Per dth Sold |

||||||||||||||||||||

|

Residential |

$ | 17.38 | $ | 17.31 | $ | 17.64 | $ | 16.86 | $ | 15.20 | ||||||||||

|

General |

$ | 16.44 | $ | 16.36 | $ | 16.55 | $ | 15.58 | $ | 13.64 | ||||||||||

For further discussion of the company’s gas operating revenues and its gas results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Gas Peak Demand

The gas peak demand for firm service customers in O&R’s service area occurs during the winter heating season. The daily peak day demand during the winter 2010/2011 (through January 31, 2011) occurred on January 23, 2011 when the demand reached 176 mdths. The 2010/2011 winter demand included an estimated 87 mdths for O&R’s full-service customers and 89 mdths for customers participating in its gas retail access program. “Design weather” for the gas system is a standard to which the actual peak demand is adjusted

| 23 |

Table of Contents

for evaluation and planning purposes. The company estimates that under design weather conditions the 2011/2012 service area peak demand will be 224 mdths, including an estimated 110 mdths for its full-service customers and 114 mdths for its retail access customers. The company forecasts average annual growth of the peak gas demand over the next five years at design conditions to be approximately 1.6 percent in the company’s service area. The forecasted peak demand at design conditions does not include gas used by interruptible gas customers or in generating stations. The company continues to monitor the potential impact on customer demand from the current economic conditions.

Gas Supply

O&R and CECONY have combined their gas requirements and purchase contracts to meet those requirements into a single portfolio. See “CECONY – Gas Operations – Gas Supply” above.

Competitive Energy Businesses

Con Edison pursues competitive energy opportunities through three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy and Con Edison Development. These businesses include the sales and related hedging of electricity to wholesale and retail customers, sales of certain energy-related products and services, and participation in energy infrastructure projects. At December 31, 2010, Con Edison’s equity investment in its competitive energy businesses was $337 million and their assets amounted to $807 million.

The competitive energy businesses are pursuing opportunities to invest in renewable generation and energy-related infrastructure projects.

Con Edison Solutions

Con Edison Solutions primarily sells electricity to industrial, commercial and governmental customers in the northeastern United States and Texas. It also sells electricity to residential and small commercial customers in the northeastern United States. Con Edison Solutions does not sell electricity to the Utilities. Con Edison Solutions sells electricity to customers who are provided delivery service by the Utilities. It also provides energy efficiency services, procurement and management services to companies and governmental entities throughout most of the United States.