|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended: December 31, 2018

|

|

|

OR

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

DELAWARE

|

74-2806888

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

3500 COLLEGE BOULEVARD

LEAWOOD, KANSAS

|

66211

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.02 par value

|

The Nasdaq Stock Market, LLC

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

Non-accelerated filer

o

|

|

|

Smaller reporting company

o

|

Emerging growth company

o

|

||

|

|

|||

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|||

|

Item Number

|

Item Description

|

Page

|

|

Item 1.

|

||

|

Item IA.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

(in millions)

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

EFT Processing transactions per year

|

1,262

|

1,523

|

1,885

|

2,352

|

2,721

|

|

•

|

Cash withdrawals;

|

|

•

|

Cash deposits;

|

|

•

|

Balance inquiries;

|

|

•

|

Transactions not completed because the relevant card issuer does not give authorization;

|

|

•

|

Dynamic currency conversion; and

|

|

•

|

Prepaid telecommunication recharges and other electronic content.

|

|

•

|

Directly online from the content provider using an online payment method; or

|

|

•

|

Through physical retail stores, online retailers or other electronic channels, including payment wallets, online banking, mobile applications and other sources.

|

|

•

|

Through “postpaid” accounts, where usage is billed at the end of each billing period; or

|

|

•

|

Through “prepaid” accounts, where customers pay in advance by crediting their accounts prior to usage.

|

|

(in millions)

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

epay processing transactions per year

|

1,244

|

1,335

|

1,294

|

1,186

|

1,149

|

|

(in millions)

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

Money transfer transactions per year

|

48.5

|

68.7

|

82.3

|

92.2

|

107.6

|

|

Name

|

Age

|

Served Since

|

Position Held

|

|

Michael J. Brown

|

62

|

July 1994

|

Chairman, Chief Executive Officer and President

|

|

Rick L. Weller

|

61

|

November 2002

|

Executive Vice President - Chief Financial Officer

|

|

Jeffrey B. Newman

|

64

|

December 1996

|

Executive Vice President - General Counsel

|

|

Kevin J. Caponecchi

|

52

|

July 2007

|

Executive Vice President - Chief Executive Officer, epay, Software and EFT Asia Pacific Division

|

|

Juan C. Bianchi

|

48

|

April 2007

|

Executive Vice President - Chief Executive Officer, Money Transfer Segment

|

|

Nikos Fountas

|

55

|

September 2009

|

Executive Vice President - Chief Executive Officer, EFT Europe, Middle East and Africa Division

|

|

Martin L. Bruckner

|

43

|

January 2014

|

Senior Vice President - Chief Technology Officer

|

|

•

|

The integration plans for our acquisitions are based on benefits that involve assumptions as to future events, including our ability to successfully achieve anticipated synergies, leveraging our existing relationships, as well as general business and industry conditions, many of which are beyond our control and may not materialize. Unforeseen factors may offset components of our integration plans in whole or in part. As a result, our actual results may vary considerably, or be considerably delayed, compared to our estimates;

|

|

•

|

The integration process could disrupt the activities of the businesses that are being combined. The combination of companies requires, among other things, coordination of administrative and other functions. In addition, the loss of key employees, customers or vendors of acquired businesses could materially and adversely impact the integration of the acquired businesses;

|

|

•

|

The execution of our integration plans may divert the attention of our management from other key responsibilities;

|

|

•

|

We may assume unanticipated liabilities and contingencies; or

|

|

•

|

Our acquisition targets could fail to perform in accordance with our expectations at the time of purchase.

|

|

•

|

our ability to obtain any necessary financing in the future for working capital, capital expenditures, debt service requirements or other purposes may be limited or financing may be unavailable;

|

|

•

|

a portion of our cash flows must be dedicated to the payment of principal and interest on our indebtedness and other obligations and will not be available for use in our business;

|

|

•

|

our level of indebtedness could limit our flexibility in planning for, or reacting to, changes in our business and the markets in which we operate;

|

|

•

|

our level of indebtedness will make us more vulnerable to changes in general economic conditions and/or a downturn in our business, thereby making it more difficult for us to satisfy our obligations; and

|

|

•

|

because a portion of our debt bears interest at a variable rate of interest, our actual debt service obligations could increase as a result of adverse changes in interest rates.

|

|

•

|

preferred stock that could be issued by our board of directors to make it more difficult for a third party to acquire, or to discourage a third party from acquiring, a majority of our outstanding voting stock;

|

|

•

|

classification of our directors into three classes with respect to the time for which they hold office;

|

|

•

|

supermajority voting requirements to amend the provision in our certificate of incorporation providing for the classification of our directors into three such classes;

|

|

•

|

non-cumulative voting for directors;

|

|

•

|

control by our board of directors of the size of our board of directors;

|

|

•

|

limitations on the ability of stockholders to call special meetings of stockholders; and

|

|

•

|

advance notice requirements for nominations of candidates for election to our board of directors or for proposing matters that can be acted upon by our stockholders at stockholder meetings.

|

|

•

|

the acceptance of our ATM processing and management services in our target markets;

|

|

•

|

the maintenance of the level of transaction fees we receive;

|

|

•

|

the continued use of our ATMs by credit and debit cardholders; and

|

|

•

|

our ability to generate revenues from interchange fees and from other value added services, including dynamic currency conversion.

|

|

(a)

|

(b)

|

(c)

|

||||||||

|

Plan category

|

Number of Securities to be

Issued Upon Exercise of Outstanding

Options and Rights

|

Weighted Average

Exercise Price of

Outstanding Options and Rights (1)

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation

Plans (Excluding Securities Reflected in Column (a))(2)

|

|||||||

|

Equity compensation plans approved by security holders:

|

3,391,373

|

|

||||||||

|

Stock option awards

|

2,562,570

|

|

$

|

57.10

|

|

|||||

|

Restricted stock unit awards

|

371,841

|

|

—

|

|

||||||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

2,934,411

|

|

$

|

57.10

|

|

3,391,373

|

|

|||

|

(1)

|

The weighted average exercise price in this column does not take into account the restricted stock unit awards.

|

|

(2)

|

Included in this column is

0.3 million

shares remaining under our employee stock purchase plan. During 2018, Euronet issued

21,872

shares to employees under the employee stock purchase plan.

|

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Dollar Value of Shares that May Yet Be Purchased Under the Programs (in thousands) (1)

|

||||||||||

|

October 1 - October 31, 2018

|

—

|

|

$

|

—

|

|

—

|

|

$

|

200,000

|

|

||||

|

November 1 - November 30, 2018

|

—

|

|

—

|

|

—

|

|

200,000

|

|

||||||

|

December 1 - December 31, 2018

|

—

|

|

—

|

|

—

|

|

200,000

|

|

||||||

|

Total

|

—

|

|

$

|

—

|

|

—

|

|

|||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(dollar amounts in thousands, except per share amounts)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Income statement data:

|

||||||||||||||||||||

|

Revenues

|

$

|

2,536,629

|

|

$

|

2,252,422

|

|

$

|

1,958,615

|

|

$

|

1,772,262

|

|

$

|

1,664,150

|

|

|||||

|

Operating expenses (1)

|

|

2,072,694

|

|

1,891,395

|

|

1,628,313

|

|

1,497,396

|

|

1,433,964

|

|

|||||||||

|

Depreciation and amortization

|

106,021

|

|

95,030

|

|

80,529

|

|

70,025

|

|

71,455

|

|

||||||||||

|

Operating income (1)

|

357,914

|

|

265,997

|

|

249,773

|

|

204,841

|

|

158,731

|

|

||||||||||

|

Other expenses, net

|

(62,998

|

)

|

(9,662

|

)

|

(16,880

|

)

|

(63,747

|

)

|

(17,228

|

)

|

||||||||||

|

Income from continuing operations before income taxes

|

294,916

|

|

256,335

|

|

232,893

|

|

141,094

|

|

141,503

|

|

||||||||||

|

Income tax expense

|

(62,785

|

)

|

(99,395

|

)

|

(58,795

|

)

|

(42,602

|

)

|

(40,015

|

)

|

||||||||||

|

Income from continuing operations

|

$

|

232,131

|

|

$

|

156,940

|

|

$

|

174,098

|

|

$

|

98,492

|

|

$

|

101,488

|

|

|||||

|

Earnings per share from continuing operations:

|

||||||||||||||||||||

|

Basic

|

$

|

4.52

|

|

$

|

2.99

|

|

$

|

3.34

|

|

$

|

1.89

|

|

$

|

1.96

|

|

|||||

|

Diluted

|

$

|

4.26

|

|

$

|

2.85

|

|

$

|

3.23

|

|

$

|

1.83

|

|

$

|

1.89

|

|

|||||

|

Balance sheet data

(at period end)

:

|

||||||||||||||||||||

|

Assets

|

$

|

3,321,155

|

|

$

|

3,140,029

|

|

$

|

2,712,872

|

|

$

|

2,192,714

|

|

$

|

2,038,447

|

|

|||||

|

Debt obligations, long-term portion

|

589,782

|

|

404,012

|

|

561,663

|

|

405,472

|

|

397,256

|

|

||||||||||

|

Capital lease obligations, long-term portion

|

8,199

|

|

9,753

|

|

6,969

|

|

4,147

|

|

2,148

|

|

||||||||||

|

Summary network data

|

||||||||||||||||||||

|

Number of operational ATMs at end of period

|

40,354

|

|

37,133

|

|

33,973

|

|

21,360

|

|

20,364

|

|

||||||||||

|

EFT processing transactions during the period (millions)

|

2,721

|

|

2,352

|

|

1,885

|

|

1,523

|

|

1,262

|

|

||||||||||

|

Number of operational prepaid processing POS terminals at end of period (rounded)

|

719,000

|

|

683,000

|

|

661,000

|

|

674,000

|

|

681,000

|

|

||||||||||

|

Prepaid processing transactions during the period (millions)

|

1,149

|

|

1,186

|

|

1,294

|

|

1,335

|

|

1,244

|

|

||||||||||

|

Money transfer transactions during the period (millions)

|

107.6

|

|

92.2

|

|

82.3

|

|

68.7

|

|

48.5

|

|

||||||||||

|

(1)

|

The results of 2018 and 2017 include non-cash charges related to impairment of goodwill and acquired intangible assets of $7.0 million and $34.1 million, respectively.

|

|

•

|

The EFT Processing Segment, which processes transactions for a network of

40,354

ATMs and approximately

293,000

POS terminals across Europe, the Middle East, Asia Pacific, and the United States. We provide comprehensive electronic payment solutions consisting of ATM cash withdrawal and deposit services, ATM network participation, outsourced ATM and POS management solutions, credit and debit card outsourcing, DCC, and other value added services. Through this segment, we also offer a suite of integrated electronic financial transaction software solutions for electronic payment and transaction delivery systems.

|

|

•

|

The epay Segment, which provides distribution, processing and collection services for prepaid mobile airtime and other electronic content. We operate a network of approximately

719,000

POS terminals providing electronic processing of prepaid mobile airtime top-up services and other electronic content in Europe, the Middle East, Asia Pacific, the United States and South America. We also provide vouchers and physical gift fulfillment services in Europe.

|

|

•

|

The Money Transfer Segment, which provides global consumer-to-consumer money transfer services, primarily under the brand names Ria, IME and xe and global account-to-account money transfer services under the brand names xe and HiFX. We offer services under the brand names Ria and IME through a network of sending agents, Company-owned stores (primarily in North America, Europe and Malaysia) and our websites (riamoneytransfer.com and online.imeremit.com), disbursing money transfers through a worldwide correspondent network that includes approximately

369,000

locations. xe is a provider of foreign currency exchange information and offers money transfer services on its currency data websites (xe.com and x-rates.com). We offer services under the brand name xe through our websites (www.xe.com and https://transfer.xe.com) and through our xe and HiFX customer service representatives. In addition to money transfers, we also offer customers bill payment services (primarily in the U.S.), payment alternatives such as money orders and prepaid debit cards, comprehensive check cashing services for a wide variety of issued checks, along with competitive foreign currency exchange services and prepaid mobile top-up. Through our HiFM brand, we offer cash management solutions and foreign currency risk management services to small-to-medium sized businesses.

|

|

•

|

increasing the number of ATMs and cash deposit terminals in our independent ATM networks;

|

|

•

|

increasing transactions processed on our network of owned and operated ATMs and POS devices;

|

|

•

|

signing new outsourced ATM and POS terminal management contracts;

|

|

•

|

expanding value added services and other products offered by our EFT Processing Segment, including the sale of DCC, acquiring and other prepaid card services to banks and retailers;

|

|

•

|

expanding our epay processing network and portfolio of digital content;

|

|

•

|

expanding our money transfer services, cross-currency payments products and bill payment network;

|

|

•

|

expanding our cash management solutions and foreign currency risk management services; and

|

|

•

|

developing our credit and debit card outsourcing business.

|

|

•

|

the impact of competition by banks and other ATM operators and service providers in our current target markets;

|

|

•

|

the demand for our ATM outsourcing services in our current target markets;

|

|

•

|

our ability to develop products or services, including value added services, to drive increases in transactions and revenues;

|

|

•

|

the expansion of our various business lines in markets where we operate and in new markets;

|

|

•

|

our entry into additional card acceptance and ATM management agreements with banks;

|

|

•

|

our ability to obtain required licenses in markets we intend to enter or expand services;

|

|

•

|

our ability to enter into and renew ATM network cash supply agreements with financial institutions;

|

|

•

|

the availability of financing for expansion;

|

|

•

|

our ability to efficiently install ATMs contracted under newly awarded outsourcing agreements;

|

|

•

|

our ability to renew existing contracts at profitable rates;

|

|

•

|

our ability to maintain pricing at current levels or mitigate price reductions in certain markets;

|

|

•

|

the impact of changes in rules imposed by international card organizations such as Visa and Mastercard on card transactions on ATMs, including reductions in ATM interchange fees, restrictions on the ability to apply direct access fees, the ability to offer DCC transactions on ATMs, and increases in fees charged on DCC transactions;

|

|

•

|

the impact of changes in laws and regulations affecting the profitability of our services, including regulation of DCC transactions by the E.U.;

|

|

•

|

our ability to expand and sign additional customers for the cross-border merchant processing and acquiring business; and

|

|

•

|

the continued development and implementation of our software products and their ability to interact with other leading products.

|

|

•

|

our ability to maintain and renew existing agreements, and to negotiate new agreements in additional markets with mobile operators, digital content providers, agent financial institutions and retailers;

|

|

•

|

our ability to use existing expertise and relationships with mobile operators, digital content providers and retailers to our advantage;

|

|

•

|

the continued use of third-party providers such as ourselves to supply electronic processing solutions for existing and additional digital content;

|

|

•

|

the development of mobile phone networks in the markets in which we do business and the increase in the number of mobile phone users;

|

|

•

|

the overall pace of growth in the prepaid mobile phone and digital content market, including consumer shifts between prepaid and postpaid services;

|

|

•

|

our market share of the retail distribution capacity;

|

|

•

|

the development of new technologies that may compete with POS distribution of prepaid mobile airtime and other products;

|

|

•

|

the level of commission that is paid to the various intermediaries in the electronic payment distribution chain;

|

|

•

|

our ability to fully recover monies collected by retailers;

|

|

•

|

our ability to add new and differentiated products in addition to those offered by mobile operators;

|

|

•

|

our ability to develop and effectively market additional value added services;

|

|

•

|

our ability to take advantage of cross-selling opportunities with our EFT Processing and Money Transfer Segments, including providing money transfer services through our distribution network; and

|

|

•

|

the availability of financing for further expansion.

|

|

•

|

the continued growth in worker migration and employment opportunities;

|

|

•

|

the mitigation of economic and political factors that have had an adverse impact on money transfer volumes, such as changes in the economic sectors in which immigrants work and the developments in immigration policies in the countries in which we operate;

|

|

•

|

the continuation of the trend of increased use of electronic money transfer and bill payment services among high-income individuals, immigrant workers and the unbanked population in our markets;

|

|

•

|

our ability to maintain our agent and correspondent networks;

|

|

•

|

our ability to offer our products and services or develop new products and services at competitive prices to drive increases in transactions;

|

|

•

|

the development of new technologies that may compete with our money transfer network, and our ability to acquire, develop and implement new technologies;

|

|

•

|

the expansion of our services in markets where we operate and in new markets;

|

|

•

|

our ability to strengthen our brands;

|

|

•

|

our ability to fund working capital requirements;

|

|

•

|

our ability to recover from agents funds collected from customers and our ability to recover advances made to correspondents;

|

|

•

|

our ability to maintain compliance with the regulatory requirements of the jurisdictions in which we operate or plan to operate;

|

|

•

|

our ability to take advantage of cross-selling opportunities with our epay Segment, including providing prepaid services through our stores and agents worldwide;

|

|

•

|

our ability to leverage our banking and merchant/retailer relationships to expand money transfer corridors to Europe, Asia and Africa, including high growth corridors to Central and Eastern European countries;

|

|

•

|

the availability of financing for further expansion;

|

|

•

|

the ability to maintain banking relationships necessary for us to service our customers;

|

|

•

|

our ability to successfully expand our agent network in Europe using our payment institution licenses under the Second Payment Services Directive ("PSD2") and using our various licenses in the United States;

|

|

•

|

our ability to provide additional value-added products under the xe brand; and,

|

|

•

|

the considerations regarding the use of our various trade names within the money transfer business.

|

|

|

Revenues

|

Operating Income (Expense)

|

||||||||||||||||||||||

|

(in thousands)

|

2018

|

2017

|

2016

|

2018

|

2017

|

2016

|

||||||||||||||||||

|

EFT Processing

|

$

|

753,651

|

|

$

|

634,559

|

|

$

|

464,254

|

|

$

|

197,245

|

|

$

|

162,897

|

|

$

|

117,156

|

|

||||||

|

epay

|

743,784

|

|

733,998

|

|

693,986

|

|

78,997

|

|

38,101

|

|

68,242

|

|

||||||||||||

|

Money Transfer

|

1,042,962

|

|

886,858

|

|

801,919

|

|

122,526

|

|

104,545

|

|

101,526

|

|

||||||||||||

|

Total

|

2,540,397

|

|

2,255,415

|

|

1,960,159

|

|

398,768

|

|

305,543

|

|

286,924

|

|

||||||||||||

|

Corporate services, eliminations and other

|

(3,768

|

)

|

(2,993

|

)

|

(1,544

|

)

|

(40,854

|

)

|

(39,546

|

)

|

(37,151

|

)

|

||||||||||||

|

Total

|

$

|

2,536,629

|

|

$

|

2,252,422

|

|

$

|

1,958,615

|

|

$

|

357,914

|

|

$

|

265,997

|

|

$

|

249,773

|

|

||||||

|

|

Average Translation Rate

Year Ended December 31,

|

2018 Increase (Decrease) Percent

|

2017 Increase (Decrease) Percent

|

|||||||||||||||

|

Currency

|

2018

|

2017

|

2016

|

|||||||||||||||

|

Australian dollar

|

$

|

0.7476

|

|

$

|

0.7668

|

|

$

|

0.7435

|

|

(3

|

)%

|

3

|

%

|

|||||

|

British pound

|

$

|

1.3352

|

|

$

|

1.2886

|

|

$

|

1.3555

|

|

4

|

%

|

(5

|

)%

|

|||||

|

euro

|

$

|

1.1809

|

|

$

|

1.1297

|

|

$

|

1.1067

|

|

5

|

%

|

2

|

%

|

|||||

|

Hungarian forint

|

$

|

0.0037

|

|

$

|

0.0037

|

|

$

|

0.0036

|

|

—

|

%

|

3

|

%

|

|||||

|

Indian rupee

|

$

|

0.0147

|

|

$

|

0.0154

|

|

$

|

0.0149

|

|

(5

|

)%

|

3

|

%

|

|||||

|

Malaysian ringgit

|

$

|

0.2482

|

|

$

|

0.2328

|

|

$

|

0.2418

|

|

7

|

%

|

(4

|

)%

|

|||||

|

New Zealand dollar

|

$

|

0.6924

|

|

$

|

0.7108

|

|

$

|

0.6968

|

|

(3

|

)%

|

2

|

%

|

|||||

|

Polish zloty

|

$

|

0.2774

|

|

$

|

0.2656

|

|

$

|

0.2538

|

|

4

|

%

|

5

|

%

|

|||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

Increase (Decrease) Amount

|

Increase Percent

|

|||||||||||

|

Total revenues

|

$

|

753,651

|

|

$

|

634,559

|

|

$

|

119,092

|

|

19

|

%

|

||||

|

Operating expenses:

|

|

|

|

|

|||||||||||

|

Direct operating costs

|

366,977

|

|

318,875

|

|

48,102

|

|

15

|

%

|

|||||||

|

Salaries and benefits

|

75,791

|

|

61,683

|

|

14,108

|

|

23

|

%

|

|||||||

|

Selling, general and administrative

|

46,925

|

|

33,158

|

|

13,767

|

|

42

|

%

|

|||||||

|

Acquired intangible assets impairment

|

—

|

|

2,286

|

|

(2,286

|

)

|

n/m

|

|

|||||||

|

Depreciation and amortization

|

66,713

|

|

55,660

|

|

11,053

|

|

20

|

%

|

|||||||

|

Total operating expenses

|

556,406

|

|

471,662

|

|

84,744

|

|

18

|

%

|

|||||||

|

Operating income

|

$

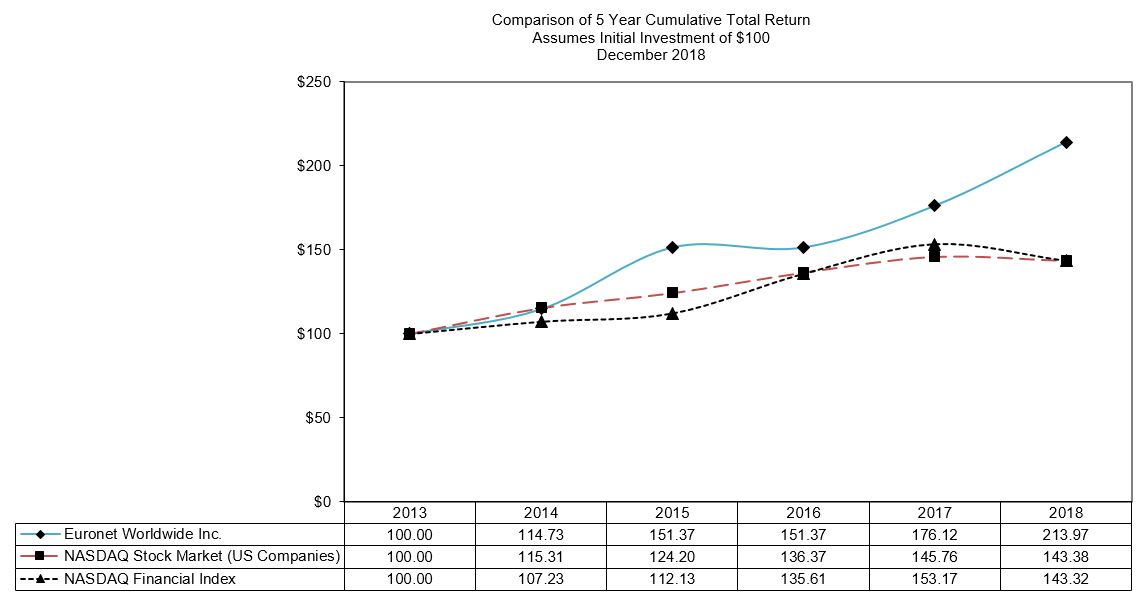

|

197,245

|

|

$

|

162,897

|

|

$

|

34,348

|

|

21

|

%

|

||||

|

Transactions processed (millions)

|

2,721

|

|

2,352

|

|

369

|

|

16

|

%

|

|||||||

|

ATMs as of December 31

|

40,354

|

|

37,133

|

|

3,221

|

|

9

|

%

|

|||||||

|

Average ATMs

|

40,094

|

|

36,658

|

|

3,436

|

|

9

|

%

|

|||||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

||||||||||||||

|

(dollar amounts in thousands)

|

2017

|

2016

|

Increase Amount

|

Increase

Percent

|

||||||||||||

|

Total revenues

|

$

|

634,559

|

|

$

|

464,254

|

|

$

|

170,305

|

|

37

|

%

|

|||||

|

Operating expenses:

|

|

|

|

|

||||||||||||

|

Direct operating costs

|

318,875

|

|

224,793

|

|

94,082

|

|

42

|

%

|

||||||||

|

Salaries and benefits

|

61,683

|

|

51,822

|

|

9,861

|

|

19

|

%

|

||||||||

|

Selling, general and administrative

|

33,158

|

|

30,399

|

|

2,759

|

|

9

|

%

|

||||||||

|

Acquired intangible assets impairment

|

2,286

|

|

—

|

|

2,286

|

|

n/m

|

|

||||||||

|

Depreciation and amortization

|

55,660

|

|

40,084

|

|

15,576

|

|

39

|

%

|

||||||||

|

Total operating expenses

|

471,662

|

|

347,098

|

|

124,564

|

|

36

|

%

|

||||||||

|

Operating income

|

$

|

162,897

|

|

$

|

117,156

|

|

$

|

45,741

|

|

39

|

%

|

|||||

|

Transactions processed (millions)

|

2,352

|

|

1,885

|

|

467

|

|

25

|

%

|

||||||||

|

ATMs as of December 31

|

37,133

|

|

33,973

|

|

3,160

|

|

9

|

%

|

||||||||

|

Average ATMs

|

36,658

|

|

27,795

|

|

8,863

|

|

32

|

%

|

||||||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||

|

Increase

(Decrease) Amount

|

Increase

(Decrease) Percent

|

||||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

|||||||||||||

|

Total revenues

|

$

|

743,784

|

|

$

|

733,998

|

|

$

|

9,786

|

|

1

|

%

|

||||

|

Operating expenses:

|

|

|

|

|

|||||||||||

|

Direct operating costs

|

564,252

|

|

564,032

|

|

220

|

|

—

|

%

|

|||||||

|

Salaries and benefits

|

57,748

|

|

54,459

|

|

3,289

|

|

6

|

%

|

|||||||

|

Selling, general and administrative

|

35,749

|

|

36,014

|

|

(265

|

)

|

(1

|

)%

|

|||||||

|

Goodwill impairment

|

—

|

|

31,770

|

|

(31,770

|

)

|

n/m

|

|

|||||||

|

Depreciation and amortization

|

7,038

|

|

9,622

|

|

(2,584

|

)

|

(27

|

)%

|

|||||||

|

Total operating expenses

|

664,787

|

|

695,897

|

|

(31,110

|

)

|

(4

|

)%

|

|||||||

|

Operating income

|

$

|

78,997

|

|

$

|

38,101

|

|

$

|

40,896

|

|

107

|

%

|

||||

|

Transactions processed (millions)

|

1,149

|

|

1,186

|

|

(37

|

)

|

(3

|

)%

|

|||||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||

|

(dollar amounts in thousands)

|

2017

|

2016

|

Increase

(Decrease) Amount

|

Increase (Decrease) Percent

|

|||||||||||

|

Total revenues

|

$

|

733,998

|

|

$

|

693,986

|

|

$

|

40,012

|

|

6

|

%

|

||||

|

Operating expenses:

|

|

|

|

|

|||||||||||

|

Direct operating costs

|

564,032

|

|

528,774

|

|

35,258

|

|

7

|

%

|

|||||||

|

Salaries and benefits

|

54,459

|

|

51,378

|

|

3,081

|

|

6

|

%

|

|||||||

|

Selling, general and administrative

|

36,014

|

|

34,517

|

|

1,497

|

|

4

|

%

|

|||||||

|

Goodwill impairment

|

31,770

|

|

—

|

|

31,770

|

|

n/m

|

|

|||||||

|

Depreciation and amortization

|

9,622

|

|

11,075

|

|

(1,453

|

)

|

(13

|

)%

|

|||||||

|

Total operating expenses

|

695,897

|

|

625,744

|

|

70,153

|

|

11

|

%

|

|||||||

|

Operating income

|

$

|

38,101

|

|

$

|

68,242

|

|

$

|

(30,141

|

)

|

(44

|

)%

|

||||

|

Transactions processed (millions)

|

1,186

|

|

1,294

|

|

(108

|

)

|

(8

|

)%

|

|||||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

Increase Amount

|

Increase Percent

|

|||||||||||

|

Total revenues

|

$

|

1,042,962

|

|

$

|

886,858

|

|

$

|

156,104

|

|

18

|

%

|

||||

|

Operating expenses:

|

|

|

|

|

|||||||||||

|

Direct operating costs

|

560,930

|

|

476,322

|

|

84,608

|

|

18

|

%

|

|||||||

|

Salaries and benefits

|

194,808

|

|

168,371

|

|

26,437

|

|

16

|

%

|

|||||||

|

Selling, general and administrative

|

125,647

|

|

108,022

|

|

17,625

|

|

16

|

%

|

|||||||

|

Acquired intangible assets impairment

|

7,049

|

|

—

|

|

7,049

|

|

n/m

|

|

|||||||

|

Depreciation and amortization

|

32,002

|

|

29,598

|

|

2,404

|

|

8

|

%

|

|||||||

|

Total operating expenses

|

920,436

|

|

782,313

|

|

138,123

|

|

18

|

%

|

|||||||

|

Operating income

|

$

|

122,526

|

|

$

|

104,545

|

|

$

|

17,981

|

|

17

|

%

|

||||

|

Transactions processed (millions)

|

107.6

|

|

92.2

|

|

15.4

|

|

17

|

%

|

|||||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||

|

(dollar amounts in thousands)

|

2017

|

2016

|

Increase Amount

|

Increase Percent

|

|||||||||||

|

Total revenues

|

$

|

886,858

|

|

$

|

801,919

|

|

$

|

84,939

|

|

11

|

%

|

||||

|

Operating expenses:

|

|

|

|

|

|||||||||||

|

Direct operating costs

|

476,322

|

|

422,508

|

|

53,814

|

|

13

|

%

|

|||||||

|

Salaries and benefits

|

168,371

|

|

155,471

|

|

12,900

|

|

8

|

%

|

|||||||

|

Selling, general and administrative

|

108,022

|

|

93,219

|

|

14,803

|

|

16

|

%

|

|||||||

|

Depreciation and amortization

|

29,598

|

|

29,195

|

|

403

|

|

1

|

%

|

|||||||

|

Total operating expenses

|

782,313

|

|

700,393

|

|

81,920

|

|

12

|

%

|

|||||||

|

Operating income

|

$

|

104,545

|

|

$

|

101,526

|

|

$

|

3,019

|

|

3

|

%

|

||||

|

Transactions processed (millions)

|

92.2

|

|

82.3

|

|

9.9

|

|

12

|

%

|

|||||||

|

Year Ended December 31,

|

Year-over-Year Change

|

|||||||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

2016

|

2018 Increase (Decrease) Percent

|

2017 (Decrease) Increase Percent

|

|||||||||||||

|

Salaries and benefits

|

$

|

32,085

|

|

$

|

26,274

|

|

$

|

29,749

|

|

22

|

%

|

(12

|

)%

|

|||||

|

Selling, general and administrative

|

8,501

|

|

13,122

|

|

7,227

|

|

(35

|

)%

|

82

|

%

|

||||||||

|

Depreciation and amortization

|

268

|

|

150

|

|

175

|

|

79

|

%

|

(14

|

)%

|

||||||||

|

Total operating expenses

|

$

|

40,854

|

|

$

|

39,546

|

|

$

|

37,151

|

|

3

|

%

|

6

|

%

|

|||||

|

|

Year Ended December 31,

|

Year-over-Year Change

|

||||||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

2016

|

2018

(Decrease)

Increase

Percent

|

2017

Increase (Decrease)

Percent

|

|||||||||||||

|

Interest income

|

$

|

1,320

|

|

$

|

2,443

|

|

$

|

1,696

|

|

(46

|

)%

|

44

|

%

|

|||||

|

Interest expense

|

(37,573

|

)

|

(32,571

|

)

|

(28,332

|

)

|

15

|

%

|

15

|

%

|

||||||||

|

(Loss) Income from unconsolidated affiliates

|

(117

|

)

|

48

|

|

—

|

|

n/m

|

|

n/m

|

|

||||||||

|

Other gains, net

|

27

|

|

118

|

|

19,956

|

|

n/m

|

|

n/m

|

|

||||||||

|

Foreign currency exchange (loss) gain, net

|

(26,655

|

)

|

20,300

|

|

(10,200

|

)

|

n/m

|

|

n/m

|

|

||||||||

|

Other expense, net

|

$

|

(62,998

|

)

|

$

|

(9,662

|

)

|

$

|

(16,880

|

)

|

n/m

|

|

(43

|

)%

|

|||||

|

Year Ended December 31,

|

||||||||||||

|

(dollar amounts in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Income before income taxes

|

$

|

294,916

|

|

$

|

256,335

|

|

$

|

232,893

|

|

|||

|

Income tax expense

|

(62,785

|

)

|

(99,395

|

)

|

(58,795

|

)

|

||||||

|

Net income

|

$

|

232,131

|

|

$

|

156,940

|

|

$

|

174,098

|

|

|||

|

Effective income tax rate

|

21.3

|

%

|

38.8

|

%

|

25.2

|

%

|

||||||

|

Income before income taxes

|

$

|

294,916

|

|

$

|

256,335

|

|

$

|

232,893

|

|

|||

|

Adjust: Goodwill and acquired intangible assets impairment

|

(7,049

|

)

|

(34,056

|

)

|

—

|

|

||||||

|

Adjust: Other gains, net

|

27

|

|

118

|

|

19,956

|

|

||||||

|

Adjust: Foreign currency exchange (loss) gain, net

|

(26,655

|

)

|

20,300

|

|

(10,200

|

)

|

||||||

|

Income before income taxes, as adjusted

|

$

|

328,593

|

|

$

|

269,973

|

|

$

|

223,137

|

|

|||

|

Income tax expense

|

$

|

(62,785

|

)

|

$

|

(99,395

|

)

|

$

|

(58,795

|

)

|

|||

|

Adjust: Income tax benefit (expense) attributable to 2017 U.S. tax reform

|

12,262

|

|

(41,597

|

)

|

—

|

|

||||||

|

Adjust: Income tax benefit attributable to acquired intangible assets impairment

|

1,506

|

|

3,411

|

|

—

|

|

||||||

|

Adjust: Income tax (expense) attributable to other gains, net

|

—

|

|

—

|

|

(3,903

|

)

|

||||||

|

Adjust: Income tax benefit (expense) attributable to foreign currency exchange (loss) gain, net

|

8,743

|

|

(2,750

|

)

|

789

|

|

||||||

|

Income tax expense, as adjusted

|

$

|

(85,296

|

)

|

$

|

(58,459

|

)

|

$

|

(55,681

|

)

|

|||

|

Effective income tax rate, as adjusted

|

26.0

|

%

|

21.7

|

%

|

25.0

|

%

|

||||||

|

Subsidiary

|

Percent

Owned

|

Segment - Country

|

||

|

Movilcarga

|

95%

|

epay - Spain

|

||

|

Euronet China

|

85%

|

EFT - China

|

||

|

Euronet Pakistan

|

70%

|

EFT - Pakistan

|

||

|

Euronet Infinitium Solutions

|

65%

|

EFT - India

|

||

|

Year Ended December 31,

|

||||||||||||

|

Liquidity

|

2018

|

2017

|

2016

|

|||||||||

|

Cash and cash equivalents and restricted cash provided by (used in):

|

||||||||||||

|

Operating activities

|

$

|

397,233

|

|

$

|

286,276

|

|

$

|

391,524

|

|

|||

|

Investing activities

|

(132,283

|

)

|

(101,858

|

)

|

(136,313

|

)

|

||||||

|

Financing activities

|

2,024

|

|

(161,149

|

)

|

79,510

|

|

||||||

|

Effect of foreign currency exchange rate changes on cash and cash equivalents and restricted cash

|

(36,540

|

)

|

65,161

|

|

(25,463

|

)

|

||||||

|

Increase in cash and cash equivalents and restricted cash

|

$

|

230,434

|

|

$

|

88,430

|

|

$

|

309,258

|

|

|||

|

Payments due by period

|

||||||||||||||||||||

|

(in thousands)

|

Total

|

Less than

1 year

|

1-3 years

|

3-5 years

|

More than

5 years

|

|||||||||||||||

|

Long-term debt obligations, including interest

|

$

|

636,573

|

|

$

|

6,023

|

|

$

|

630,550

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Obligations under operating leases

|

311,651

|

|

80,803

|

|

114,642

|

|

68,015

|

|

48,191

|

|

||||||||||

|

Obligations under capital leases

|

14,977

|

|

6,150

|

|

7,823

|

|

1,004

|

|

—

|

|

||||||||||

|

Purchase obligations

|

25,033

|

|

16,520

|

|

4,475

|

|

2,110

|

|

1,928

|

|

||||||||||

|

Total

|

$

|

988,234

|

|

$

|

109,496

|

|

$

|

757,490

|

|

$

|

71,129

|

|

$

|

50,119

|

|

|||||

|

•

|

our business plans and financing plans and requirements;

|

|

•

|

trends affecting our business plans and financing plans and requirements;

|

|

•

|

trends affecting our business;

|

|

•

|

the adequacy of capital to meet our capital requirements and expansion plans;

|

|

•

|

the assumptions underlying our business plans;

|

|

•

|

our ability to repay indebtedness;

|

|

•

|

our estimated capital expenditures;

|

|

•

|

the potential outcome of loss contingencies;

|

|

•

|

our expectations regarding the closing of any pending acquisitions;

|

|

•

|

business strategy;

|

|

•

|

government regulatory action;

|

|

•

|

the expected effects of changes in laws or accounting standards;

|

|

•

|

technological advances; and

|

|

•

|

projected costs and revenues.

|

|

Index to Consolidated Financial Statements

|

Page

|

|

|

As of December 31,

|

||||||

|

2018

|

2017

|

||||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

1,054,357

|

|

$

|

819,144

|

|

|

|

Restricted cash

|

76,595

|

|

81,374

|

|

|||

|

Trade accounts receivable, net of allowances for doubtful accounts of $24,287 at December 31, 2018 and $20,958 at December 31, 2017

|

693,616

|

|

744,879

|

|

|||

|

Prepaid expenses and other current assets

|

263,019

|

|

244,789

|

|

|||

|

Total current assets

|

2,087,587

|

|

1,890,186

|

|

|||

|

Property and equipment, net of accumulated depreciation of $373,180 at December 31, 2018 and $340,128 at December 31, 2017

|

291,869

|

|

268,303

|

|

|||

|

Goodwill

|

704,197

|

|

717,386

|

|

|||

|

Acquired intangible assets, net of accumulated amortization of $190,920 at December 31, 2018 and $179,142 at December 31, 2017

|

114,485

|

|

150,543

|

|

|||

|

Other assets, net of accumulated amortization of $50,821 at December 31, 2018 and $44,469 at December 31, 2017

|

123,017

|

|

113,611

|

|

|||

|

Total assets

|

$

|

3,321,155

|

|

$

|

3,140,029

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Trade accounts payable

|

$

|

528,913

|

|

$

|

494,841

|

|

|

|

Accrued expenses and other current liabilities

|

706,554

|

|

759,789

|

|

|||

|

Current portion of capital lease obligations

|

5,458

|

|

5,369

|

|

|||

|

Short-term debt obligations and current maturities of long-term debt obligations

|

38,017

|

|

41,288

|

|

|||

|

Income taxes payable

|

40,159

|

|

54,437

|

|

|||

|

Deferred revenue

|

59,293

|

|

51,996

|

|

|||

|

Total current liabilities

|

1,378,394

|

|

1,407,720

|

|

|||

|

Debt obligations, net of current portion

|

589,782

|

|

404,012

|

|

|||

|

Capital lease obligations, net of current portion

|

8,199

|

|

9,753

|

|

|||

|

Deferred income taxes

|

57,145

|

|

54,969

|

|

|||

|

Other long-term liabilities

|

54,793

|

|

64,097

|

|

|||

|

Total liabilities

|

2,088,313

|

|

1,940,551

|

|

|||

|

Equity:

|

|

|

|||||

|

Euronet Worldwide, Inc. stockholders’ equity:

|

|

|

|||||

|

Preferred Stock, $0.02 par value. 10,000,000 shares authorized; none issued

|

—

|

|

—

|

|

|||

|

Common Stock, $0.02 par value. 90,000,000 shares authorized; 59,897,309 issued at December 31, 2018 and 58,892,744 issued at December 31, 2017

|

1,198

|

|

1,178

|

|

|||

|

Additional paid-in capital

|

1,104,264

|

|

1,072,005

|

|

|||

|

Treasury stock, at cost, 8,077,311 shares at December 31, 2018 and 6,084,586 shares at December 31, 2017

|

(391,551

|

)

|

(217,161

|

)

|

|||

|

Retained earnings

|

669,805

|

|

436,954

|

|

|||

|

Accumulated other comprehensive loss

|

(151,043

|

)

|

(94,458

|

)

|

|||

|

Total Euronet Worldwide, Inc. stockholders’ equity

|

1,232,673

|

|

1,198,518

|

|

|||

|

Noncontrolling interests

|

169

|

|

960

|

|

|||

|

Total equity

|

1,232,842

|

|

1,199,478

|

|

|||

|

Total liabilities and equity

|

$

|

3,321,155

|

|

$

|

3,140,029

|

|

|

|

Year Ended December 31,

|

||||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Revenues

|

$

|

2,536,629

|

|

$

|

2,252,422

|

|

$

|

1,958,615

|

|

|||

|

Operating expenses:

|

||||||||||||

|

Direct operating costs

|

1,488,406

|

|

1,356,250

|

|

1,174,545

|

|

||||||

|

Salaries and benefits

|

360,432

|

|

310,787

|

|

288,420

|

|

||||||

|

Selling, general and administrative

|

216,807

|

|

190,302

|

|

165,348

|

|

||||||

|

Goodwill and acquired intangible assets impairment

|

7,049

|

|

34,056

|

|

—

|

|

||||||

|

Depreciation and amortization

|

106,021

|

|

95,030

|

|

80,529

|

|

||||||

|

Total operating expenses

|

2,178,715

|

|

1,986,425

|

|

1,708,842

|

|

||||||

|

Operating income

|

357,914

|

|

265,997

|

|

249,773

|

|

||||||

|

Other income (expense):

|

||||||||||||

|

Interest income

|

1,320

|

|

2,443

|

|

1,696

|

|

||||||

|

Interest expense

|

(37,573

|

)

|

(32,571

|

)

|

(28,332

|

)

|

||||||

|

(Loss) Income from unconsolidated affiliates

|

(117

|

)

|

48

|

|

—

|

|

||||||

|

Foreign currency exchange (loss) gain, net

|

(26,655

|

)

|

20,300

|

|

(10,200

|

)

|

||||||

|

Other gains, net

|

27

|

|

118

|

|

19,956

|

|

||||||

|

Other expense, net

|

(62,998

|

)

|

(9,662

|

)

|

(16,880

|

)

|

||||||

|

Income before income taxes

|

294,916

|

|

256,335

|

|

232,893

|

|

||||||

|

Income tax expense

|

(62,785

|

)

|

(99,395

|

)

|

(58,795

|

)

|

||||||

|

Net income

|

232,131

|

|

156,940

|

|

174,098

|

|

||||||

|

Less: Net loss (income) attributable to noncontrolling interests

|

720

|

|

(95

|

)

|

317

|

|

||||||

|

Net income attributable to Euronet Worldwide, Inc.

|

$

|

232,851

|

|

$

|

156,845

|

|

$

|

174,415

|

|

|||

|

Earnings per share attributable to Euronet Worldwide, Inc. stockholders:

|

||||||||||||

|

Basic

|

$

|

4.52

|

|

$

|

2.99

|

|

$

|

3.34

|

|

|||

|

Diluted

|

$

|

4.26

|

|

$

|

2.85

|

|

$

|

3.23

|

|

|||

|

Weighted average shares outstanding:

|

||||||||||||

|

Basic

|

51,487,557

|

|

52,523,272

|

|

52,276,951

|

|

||||||

|

Diluted

|

54,627,747

|

|

55,116,327

|

|

54,001,079

|

|

||||||

|

Year Ended December 31,

|

||||||||||||

|

|

2018

|

2017

|

2016

|

|||||||||

|

Net income

|

$

|

232,131

|

|

$

|

156,940

|

|

$

|

174,098

|

|

|||

|

Other comprehensive income (loss), net of tax:

|

||||||||||||

|

Translation adjustment

|

(56,656

|

)

|

116,401

|

|

(45,175

|

)

|

||||||

|

Comprehensive income

|

175,475

|

|

273,341

|

|

128,923

|

|

||||||

|

Comprehensive (income) loss attributable to noncontrolling interests

|

791

|

|

(292

|

)

|

358

|

|

||||||

|

Comprehensive income attributable to Euronet Worldwide, Inc.

|

$

|

176,266

|

|

$

|

273,049

|

|

$

|

129,281

|

|

|||

|

Number of

Shares

Outstanding

|

Common

Stock

|

Additional

Paid-in

Capital

|

Treasury

Stock

|

||||||||||||

|

Balance as of December 31, 2015

|

53,031,802

|

|

$

|

1,159

|

|

$

|

1,023,254

|

|

$

|

(138,750

|

)

|

||||

|

Net income (loss)

|

|

|

|

|

|

|

|

|

|||||||

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|||||||

|

Stock issued under employee stock plans

|

421,170

|

|

9

|

|

7,426

|

|

(1,143

|

)

|

|||||||

|

Share-based compensation

|

|

|

|

|

14,983

|

|

|

|

|||||||

|

Repurchase of shares

|

(1,149,571

|

)

|

(75,569

|

)

|

|||||||||||

|

Balance as of December 31, 2016

|

52,303,401

|

|

1,168

|

|

1,045,663

|

|

(215,462

|

)

|

|||||||

|

Net income

|

|

|

|

|

|

|

|

|

|||||||

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|||||||

|

Stock issued under employee stock plans

|

504,757

|

|

10

|

|

10,104

|

|

(1,699

|

)

|

|||||||

|

Share-based compensation

|

|

|

|

|

15,618

|

|

|

|

|||||||

|

Other

|

|

|

620

|

|

|

|

|||||||||

|

Balance as of December 31, 2017

|

52,808,158

|

|

1,178

|

|

1,072,005

|

|

(217,161

|

)

|

|||||||

|

Net income (loss)

|

|

|

|

|

|

|

|

|

|||||||

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|||||||

|

Stock issued under employee stock plans

|

1,039,480

|

|

20

|

|

15,634

|

|

610

|

|

|||||||

|

Share-based compensation

|

|

|

|

|

16,764

|

|

|

|

|||||||

|

Repurchase of shares

|

(2,032,599

|

)

|

(175,000

|

)

|

|||||||||||

|

Other

|

4,959

|

|

(139

|

)

|

|||||||||||

|

Balance as of December 31, 2018

|

51,819,998

|

|

$

|

1,198

|

|

$

|

1,104,264

|

|

$

|

(391,551

|

)

|

||||

|

Retained Earnings

|

Accumulated Other

Comprehensive Loss

|

Noncontrolling

Interests

|

Total

|

|||||||||||||

|

Balance as of December 31, 2015

|

$

|

104,427

|

|

$

|

(165,528

|

)

|

$

|

1,366

|

|

$

|

825,928

|

|

||||

|

Net income (loss)

|

174,415

|

|

|

|

(317

|

)

|

174,098

|

|

||||||||

|

Other comprehensive loss

|

(45,134

|

)

|

(41

|

)

|

(45,175

|

)

|

||||||||||

|

Stock issued under employee stock plans

|

|

|

|

|

6,292

|

|

||||||||||

|

Share-based compensation

|

|

|

|

|

14,983

|

|

||||||||||

|

Repurchase of shares

|

|

|

|

|

(75,569

|

)

|

||||||||||

|

Balance as of December 31, 2016

|

278,842

|

|

(210,662

|

)

|

1,008

|

|

900,557

|

|

||||||||

|

Net income

|

156,845

|

|

|

|

95

|

|

156,940

|

|

||||||||

|

Other comprehensive income

|

116,204

|

|

197

|

|

116,401

|

|

||||||||||

|

Stock issued under employee stock plans

|

|

|

|

|

8,415

|

|

||||||||||

|

Share-based compensation

|

|

|

|

|

15,618

|

|

||||||||||

|

Other

|

1,267

|

|

|

|

(340

|

)

|

1,547

|

|

||||||||

|

Balance as of December 31, 2017

|

436,954

|

|

(94,458

|

)

|

960

|

|

1,199,478

|

|

||||||||

|

Net income (loss)

|

232,851

|

|

|

|

(720

|

)

|

232,131

|

|

||||||||

|

Other comprehensive loss

|

(56,585

|

)

|

(71

|

)

|

(56,656

|

)

|

||||||||||

|

Stock issued under employee stock plans

|

|

|

16,264

|

|

||||||||||||

|

Share-based compensation

|

|

|

|

|

16,764

|

|

||||||||||

|

Repurchase of shares

|

(175,000

|

)

|

||||||||||||||

|

Other

|

|

|

|

|

|

(139

|

)

|

|||||||||

|

Balance as of December 31, 2018

|

$

|

669,805

|

|

$

|

(151,043

|

)

|

$

|

169

|

|

$

|

1,232,842

|

|

||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Net income

|

$

|

232,131

|

|

$

|

156,940

|

|

$

|

174,098

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|||||||||

|

Depreciation and amortization

|

106,021

|

|

95,030

|

|

80,529

|

|

|||||

|

Share-based compensation

|

16,764

|

|

15,618

|

|

14,983

|

|

|||||

|

Unrealized foreign exchange loss (gain), net

|

26,655

|

|

(20,300

|

)

|

10,200

|

|

|||||

|

Non-cash impairment of goodwill and acquired intangible assets

|

7,049

|

|

34,056

|

|

—

|

|

|||||

|

Other gains

|

—

|

|

—

|

|

(19,449

|

)

|

|||||

|

Deferred income taxes

|

2,425

|

|