|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

63-0860407

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

3660 Grandview Parkway, Suite 200

Birmingham, Alabama

|

35243

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

New York Stock Exchange

|

|

|

|

Page

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

each of the factors discussed in Item 1A,

Risk Factors

; as well as uncertainties and factors discussed elsewhere in this Form 10-K, in our other filings from time to time with the SEC, or in materials incorporated therein by reference;

|

|

•

|

changes in the rules and regulations of the healthcare industry at either or both of the federal and state levels, including those contemplated now and in the future as part of national healthcare reform and deficit reduction such as the reinstatement of the “75% Rule” or the introduction of site neutral payments with skilled nursing facilities for certain conditions, and related increases in the costs of complying with such changes;

|

|

•

|

reductions or delays in, or suspension of, reimbursement for our services by governmental or private payors, including our ability to obtain and retain favorable arrangements with third-party payors;

|

|

•

|

increased costs of regulatory compliance and compliance monitoring in the healthcare industry, including the costs of investigating and defending asserted claims, whether meritorious or not;

|

|

•

|

our ability to attract and retain nurses, therapists, and other healthcare professionals in a highly competitive environment with often severe staffing shortages and the impact on our labor expenses from potential union activity and staffing recruitment and retention;

|

|

•

|

competitive pressures in the healthcare industry and our response to those pressures;

|

|

•

|

our ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures consistent with our growth strategy, including realization of anticipated revenues, cost savings, and productivity improvements arising from the related operations;

|

|

•

|

any adverse outcome of various lawsuits, claims, and legal or regulatory proceedings, including the ongoing investigations initiated by the U.S. Department of Health and Human Services, Office of the Inspector General;

|

|

•

|

increased costs of defending and insuring against alleged professional liability and other claims and the ability to predict the costs related to such claims;

|

|

•

|

potential incidents affecting the proper operation, availability, or security of our information systems;

|

|

•

|

the price of our common or preferred stock as it affects our willingness and ability to repurchase shares and the financial and accounting effects of any repurchases;

|

|

•

|

our ability and willingness to continue to declare and pay dividends on our common stock;

|

|

•

|

our ability to attract and retain key management personnel; and

|

|

•

|

general conditions in the economy and capital markets, including any instability or uncertainty related to governmental impasse over approval of the United States federal budget or an increase to the debt ceiling.

|

|

Item 1.

|

Business

|

|

For the Year Ended December 31,

|

||||||||||||

|

2013

|

2012

|

2011

|

||||||||||

|

(Actual Amounts)

|

||||||||||||

|

Consolidated data:

|

||||||||||||

|

Number of inpatient rehabilitation hospitals

(1)

|

103

|

|

100

|

|

99

|

|

||||||

|

Number of outpatient rehabilitation satellite clinics

|

20

|

|

24

|

|

26

|

|

||||||

|

Number of hospital-based home health agencies

|

25

|

|

25

|

|

25

|

|

||||||

|

Number of inpatient rehabilitation units managed by us through management contracts

|

3

|

|

3

|

|

3

|

|

||||||

|

Discharges

|

129,988

|

|

123,854

|

|

118,354

|

|

||||||

|

Outpatient visits

|

806,631

|

|

880,182

|

|

943,439

|

|

||||||

|

Number of licensed beds

(2)

|

6,825

|

|

6,656

|

|

6,461

|

|

||||||

|

(In Millions)

|

||||||||||||

|

Net operating revenues:

|

||||||||||||

|

Net patient revenue - inpatient

|

$

|

2,130.8

|

|

$

|

2,012.6

|

|

$

|

1,866.4

|

|

|||

|

Net patient revenue - outpatient and other

|

142.4

|

|

149.3

|

|

160.5

|

|

||||||

|

Net operating revenues

|

$

|

2,273.2

|

|

$

|

2,161.9

|

|

$

|

2,026.9

|

|

|||

|

(1)

|

Including

2

,

2

, and

3

hospitals as of December 31,

2013

,

2012

, and

2011

, respectively, that operate as joint ventures which we account for using the equity method of accounting.

|

|

(2)

|

Excluding

151

,

151

, and

234

licensed beds as of December 31,

2013

,

2012

, and

2011

, respectively, of hospitals that operate as joint ventures which we account for using the equity method of accounting.

|

|

•

|

People

. We believe our

23,600

employees, in particular our highly skilled clinical staff, share a steadfast commitment to providing outstanding rehabilitative care to our patients. We also undertake significant efforts to ensure our clinical and support staff receives the education and training necessary to provide the highest quality rehabilitative care in the most cost-effective manner.

|

|

•

|

Quality

. Our hospitals provide a broad base of clinical experience from which we have developed best practices and protocols. We believe these clinical best practices and protocols help ensure the delivery of consistently high-quality rehabilitative healthcare services across all of our hospitals. We have developed a program called “TeamWorks,” which is a series of operations-focused initiatives using identified best practices to reduce inefficiencies and improve performance across a wide spectrum of operational areas. We believe these initiatives have enhanced, and will continue to enhance, patient-employee interactions and coordination of care and communication among the patient, the patient’s family, the hospital’s treatment team, and payors, which, in turn, improves outcomes and patient satisfaction.

|

|

•

|

Efficiency and Cost Effectiveness

. Our size helps us provide inpatient rehabilitative healthcare services on a cost-effective basis. Specifically, because of our large number of inpatient hospitals, we can utilize proven staffing models and take advantage of certain supply chain efficiencies. In addition, our proprietary management reporting system aggregates data from each of our key business systems into a comprehensive reporting package used by the management teams in our hospitals as well as executive management. This system allows users to analyze data and trends and create custom reports on a timely basis.

|

|

•

|

Strong Cash Flow Generation and Balance Sheet

. We have a proven track record, even in the challenging regulatory and economic environment of the last several years, of generating strong cash flows from operations that have allowed us to successfully reduce our financial leverage, implement our growth strategy, and make significant shareholder value-enhancing distributions. As of December 31, 2013, we have a flexible balance sheet with relatively low financial leverage, no significant debt maturities prior to 2018, and ample availability under our revolving credit facility, which along with the cash flows generated from operations should, we believe, provide excellent support for our business strategy.

|

|

•

|

Technology

. As a market leader in inpatient rehabilitation, we have devoted substantial effort and expertise to leveraging technology to improve patient care and operating efficiencies. Specific rehabilitative technology, such as our internally-developed therapeutic device called the “AutoAmbulator,” utilized in our facilities allows us to effectively treat patients with a wide variety of significant physical disabilities or injuries. Our commitment to technology also includes information technology, such as our rehabilitation-specific electronic clinical information system (“CIS”) and our internally-developed management reporting system described above. To date, we have installed the CIS in

36

hospitals with another

20

installations scheduled for

2014

. We expect to complete installation in our existing hospitals by the end of

2017

. We believe the CIS will improve patient care and safety and enhance operational efficiency. Given the increased emphasis on coordination across the patient care spectrum, we also believe the CIS sets the stage for connectivity with referral sources and health information exchanges. Ultimately, we believe the CIS can be a key competitive differentiator and impact patient choice.

|

|

•

|

continuing to provide high-quality, cost-effective care to patients in our existing markets;

|

|

•

|

achieving organic growth at our existing hospitals;

|

|

•

|

continuing to expand our services to more patients who require inpatient rehabilitative services by constructing and opportunistically acquiring new hospitals in new markets; and

|

|

•

|

considering additional shareholder value-enhancing strategies such as repurchases of our common and preferred stock and common stock dividends, recognizing that some of these actions may increase our leverage ratio.

|

|

•

|

acquired Walton Rehabilitation Hospital, a 58-bed inpatient rehabilitation hospital in Augusta, Georgia, in April 2013;

|

|

•

|

began accepting patients at our newly built, 40-bed inpatient rehabilitation hospital in Littleton, Colorado, in May 2013;

|

|

•

|

began accepting patients at our newly built, 34-bed inpatient rehabilitation hospital in Stuart, Florida in June 2013. This hospital is a joint venture with Martin Health System;

|

|

•

|

completed the relocation of patients to our new 53-bed HealthSouth Rehabilitation Hospital of Western Massachusetts in Ludlow, Massachusetts in December 2013, which replaced a leased facility; and

|

|

•

|

continued development of the following de novo hospitals:

|

|

Location

|

# of Beds

|

Actual / Expected Construction Start Date

|

Expected Operational Date

|

|

Altamonte Springs, Florida

|

50

|

Q4 2013

|

Q4 2014

|

|

Newnan, Georgia

|

50

|

Q4 2013

|

Q4 2014

|

|

Middletown, Delaware

|

34

|

Q4 2013

|

Q4 2014

|

|

Modesto, California

|

50

|

Second Half - 2014

|

Q4 2015

|

|

Franklin, Tennessee

*

|

40

|

TBD

|

TBD

|

|

•

|

completed a tender offer for our common stock in March 2013 in which we repurchased approximately 9.1 million shares at a price of $25.50 per share;

|

|

•

|

initiated a quarterly cash dividend on our common stock of $0.18 per share. The first quarterly dividend was paid in October 2013; and

|

|

•

|

received authorization from our board of directors in October 2013 for the repurchase of up to an additional $200 million of our common stock.

|

|

•

|

entered into closing agreements with the IRS in April 2013 which settled various matters for tax years through December 31, 2008 and resulted in an increase to our deferred tax assets, including an approximate $283 million increase to our federal net operating loss carryforward on a gross basis, and a net income tax benefit of approximately $115 million;

|

|

•

|

amended our credit agreement in June 2013 to, among other things, permit unlimited restricted payments so long as the senior secured leverage ratio remains less than or equal to 1.5x and extend the revolver maturity from August 2017 to June 2018;

|

|

•

|

purchased the real estate previously subject to leases associated with four of our hospitals in the third quarter of 2013;

|

|

•

|

redeemed $30.2 million and $27.9 million of the outstanding principal amount of our existing 7.25% Senior Notes due 2018 and our existing 7.75% Senior Notes due 2022, respectively, in November 2013; and

|

|

•

|

exchanged $320 million in aggregate principal amount of newly issued 2.00% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of our outstanding 6.50% Series A Convertible Perpetual Preferred Stock in November 2013.

|

|

|

For the Year Ended December 31,

|

|||||||

|

|

2013

|

2012

|

2011

|

|||||

|

Medicare

|

74.5

|

%

|

73.4

|

%

|

72.0

|

%

|

||

|

Medicaid

|

1.2

|

%

|

1.2

|

%

|

1.6

|

%

|

||

|

Workers' compensation

|

1.2

|

%

|

1.5

|

%

|

1.6

|

%

|

||

|

Managed care and other discount plans, including Medicare Advantage

|

18.5

|

%

|

19.3

|

%

|

19.8

|

%

|

||

|

Other third-party payors

|

1.8

|

%

|

1.8

|

%

|

2.0

|

%

|

||

|

Patients

|

1.1

|

%

|

1.3

|

%

|

1.2

|

%

|

||

|

Other income

|

1.7

|

%

|

1.5

|

%

|

1.8

|

%

|

||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Market basket update

|

2.6%

|

|

Healthcare reform reduction

|

30 basis points

|

|

Productivity adjustment reduction

|

50 basis points

|

|

Item 1A.

|

Risk Factors

|

|

2014

|

2015-16

|

2017-19

|

|

0.3%

|

0.2%

|

0.75%

|

|

•

|

licensure, certification, and accreditation;

|

|

•

|

policies, either at the national or local level, delineating what conditions must be met to qualify for reimbursement under Medicare (also referred to as coverage requirements);

|

|

•

|

coding and billing for services;

|

|

•

|

requirements of the 60% compliance threshold under the 2007 Medicare Act;

|

|

•

|

relationships with physicians and other referral sources, including physician self-referral and anti-kickback laws;

|

|

•

|

quality of medical care;

|

|

•

|

use and maintenance of medical supplies and equipment;

|

|

•

|

maintenance and security of patient information and medical records;

|

|

•

|

acquisition and dispensing of pharmaceuticals and controlled substances; and

|

|

•

|

disposal of medical and hazardous waste.

|

|

•

|

limitations, including state CONs as well as CMS and other regulatory approval requirements, on our ability to complete such acquisitions, particularly those involving not-for-profit providers, on terms, timetables, and valuations reasonable to us;

|

|

•

|

limitations in obtaining financing for acquisitions at a cost reasonable to us;

|

|

•

|

difficulties integrating acquired operations, personnel, and information systems, and in realizing projected revenues, efficiencies and cost savings, or returns on invested capital;

|

|

•

|

entry into markets, businesses or services in which we may have little or no experience;

|

|

•

|

diversion of business resources or management’s attention from ongoing business operations; and

|

|

•

|

exposure to undisclosed or unforeseen liabilities of acquired operations, including liabilities for failure to comply with healthcare laws and anti-trust considerations in specific markets.

|

|

•

|

limiting our ability to borrow additional amounts to fund working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy and other general corporate purposes;

|

|

•

|

making us more vulnerable to adverse changes in general economic, industry and competitive conditions, in government regulation and in our business by limiting our flexibility in planning for, and making it more difficult for us to react quickly to, changing conditions;

|

|

•

|

placing us at a competitive disadvantage compared with competing providers that have less debt; and

|

|

•

|

exposing us to risks inherent in interest rate fluctuations for outstanding amounts under our credit facility, which could result in higher interest expense in the event of increases in interest rates.

|

|

•

|

incur or guarantee indebtedness;

|

|

•

|

pay dividends on, or redeem or repurchase, our capital stock; or repay, redeem or repurchase our subordinated obligations;

|

|

•

|

issue or sell certain types of preferred stock;

|

|

•

|

make investments;

|

|

•

|

incur obligations that restrict the ability of our subsidiaries to make dividends or other payments to us;

|

|

•

|

sell assets;

|

|

•

|

engage in transactions with affiliates;

|

|

•

|

create certain liens;

|

|

•

|

enter into sale/leaseback transactions; and

|

|

•

|

merge, consolidate, or transfer all or substantially all of our assets.

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 2.

|

Properties

|

|

|

|

Number of Hospitals

|

|||||||||||||

|

State

|

Licensed Beds

|

Building and Land Owned

|

Building Owned and Land Leased

|

Building and Land Leased

|

Total

|

||||||||||

|

Alabama *

|

383

|

|

1

|

|

3

|

|

2

|

|

6

|

|

|||||

|

Arizona

|

335

|

|

1

|

|

1

|

|

3

|

|

5

|

|

|||||

|

Arkansas

|

267

|

|

2

|

|

1

|

|

1

|

|

4

|

|

|||||

|

California

|

114

|

|

1

|

|

—

|

|

1

|

|

2

|

|

|||||

|

Colorado

|

104

|

|

1

|

|

—

|

|

1

|

|

2

|

|

|||||

|

Florida *

|

827

|

|

8

|

|

1

|

|

2

|

|

11

|

|

|||||

|

Georgia*

|

58

|

|

1

|

|

(1)

|

—

|

|

—

|

|

1

|

|

||||

|

Illinois *

|

55

|

|

—

|

|

1

|

|

—

|

|

1

|

|

|||||

|

Indiana

|

85

|

|

—

|

|

—

|

|

1

|

|

1

|

|

|||||

|

Kansas

|

242

|

|

1

|

|

—

|

|

2

|

|

3

|

|

|||||

|

Kentucky *

|

80

|

|

1

|

|

1

|

|

—

|

|

2

|

|

|||||

|

Louisiana

|

47

|

|

1

|

|

—

|

|

—

|

|

1

|

|

|||||

|

Maine *

|

100

|

|

—

|

|

—

|

|

1

|

|

1

|

|

|||||

|

Maryland *

|

54

|

|

1

|

|

—

|

|

—

|

|

1

|

|

|||||

|

Massachusetts *

|

53

|

|

1

|

|

—

|

|

—

|

|

1

|

|

|||||

|

Missouri*

|

156

|

|

—

|

|

2

|

|

—

|

|

2

|

|

|||||

|

Nevada

|

219

|

|

2

|

|

—

|

|

1

|

|

3

|

|

|||||

|

New Hampshire *

|

50

|

|

—

|

|

1

|

|

—

|

|

1

|

|

|||||

|

New Jersey *

|

199

|

|

1

|

|

1

|

|

1

|

|

3

|

|

|||||

|

New Mexico

|

87

|

|

1

|

|

—

|

|

—

|

|

1

|

|

|||||

|

Ohio

|

60

|

|

—

|

|

—

|

|

1

|

|

1

|

|

|||||

|

Pennsylvania

|

774

|

|

5

|

|

—

|

|

4

|

|

9

|

|

|||||

|

Puerto Rico*

|

72

|

|

—

|

|

—

|

|

2

|

|

2

|

|

|||||

|

South Carolina *

|

338

|

|

1

|

|

4

|

|

—

|

|

5

|

|

|||||

|

Tennessee *

|

380

|

|

3

|

|

3

|

|

—

|

|

6

|

|

|||||

|

Texas

|

1,063

|

|

11

|

|

2

|

|

2

|

|

15

|

|

|||||

|

Utah

|

84

|

|

1

|

|

—

|

|

—

|

|

1

|

|

|||||

|

Virginia *

|

271

|

|

2

|

|

1

|

|

3

|

|

6

|

|

|||||

|

West Virginia *

|

268

|

|

1

|

|

3

|

|

—

|

|

4

|

|

|||||

|

|

6,825

|

|

48

|

|

25

|

|

28

|

|

101

|

|

|||||

|

(1)

|

Walton Rehabilitation Hospital, a 58-bed inpatient rehabilitation hospital in Augusta, Georgia, is a party to an industrial development bond financing that reduces

ad valorem

taxes payable by the hospital. In connection with this financing, title to the real property is held by the Development Authority of Richmond County. We lease the hospital property and hold the bonds issued by the Authority, the payment on which equals the amount payable under the lease. We may terminate the bond financing and the associated lease at any time at our option without penalty, and fee title to the hospital property will return to us.

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

High

|

Low

|

|||||

|

2012

|

|

|

|||||

|

First Quarter

|

$

|

21.53

|

|

$

|

16.55

|

|

|

|

Second Quarter

|

23.35

|

|

18.44

|

|

|||

|

Third Quarter

|

24.99

|

|

20.99

|

|

|||

|

Fourth Quarter

|

24.39

|

|

19.85

|

|

|||

|

2013

|

|

|

|

|

|||

|

First Quarter

|

$

|

26.40

|

|

$

|

21.53

|

|

|

|

Second Quarter

|

30.95

|

|

25.07

|

|

|||

|

Third Quarter

|

36.52

|

|

28.70

|

|

|||

|

Fourth Quarter

|

37.01

|

|

32.97

|

|

|||

|

Period

|

Total Number of Shares (or Units) Purchased

|

Average Price Paid per Share (or Unit) ($)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Number (or Approximate Dollar Value) of Shares That May Yet Be Purchased Under the Plans or Programs

(1)

|

||||||||||

|

October 1 through October 31, 2013

|

1,842

|

|

(2)

|

$

|

35.51

|

|

—

|

|

$

|

200,000,000

|

|

|||

|

November 1 through November 30, 2013

|

—

|

|

—

|

|

—

|

|

200,000,000

|

|

||||||

|

December 1 through December 31, 2013

|

—

|

|

—

|

|

—

|

|

200,000,000

|

|

||||||

|

Total

|

1,842

|

|

35.51

|

|

—

|

|

||||||||

|

(1)

|

On October 28, 2013, we announced our board of directors authorized the repurchase of up to $200 million of our common stock. On February 14, 2014, our board of directors approved an increase in this common stock repurchase authorization from $200 million to $250 million. The repurchase authorization does not require the repurchase of a specific number of shares, has an indefinite term, and is subject to termination at any time by our board of directors. Subject to certain terms and conditions, including a maximum price per share and compliance with federal and state securities and other laws, the repurchases may be made from time to time in open market transactions, privately negotiated transactions, or other transactions, including trades under a plan established in accordance with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended.

|

|

(2)

|

These shares were purchased pursuant to previous elections by one or more members of our board of directors to participate in our Directors’ Deferred Stock Investment Plan. This plan is a nonqualified deferral plan allowing nonemployee directors to make advance elections to defer a fixed percentage of their director fees. The plan administrator acquires the shares in the open market which are then held in a rabbi trust. The plan provides that dividends paid on the shares held for the accounts of the directors will be reinvested in shares of our common stock which will also be held in the trust. The directors’ rights to all shares in the trust are nonforfeitable, but the shares are only released to the directors after departure from our board.

|

|

|

For the Year Ended December 31,

|

|||||||||||||||||

|

|

Base Period

|

Cumulative Total Return

|

||||||||||||||||

|

Company/Index Name

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

||||||||||||

|

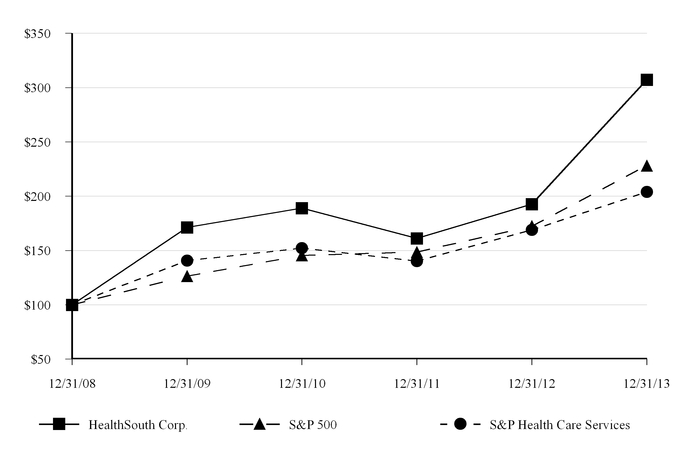

HealthSouth

|

100.00

|

|

171.26

|

|

188.96

|

|

161.22

|

|

192.61

|

|

307.27

|

|

||||||

|

Standard & Poor’s 500 Index

|

100.00

|

|

126.46

|

|

145.51

|

|

148.59

|

|

172.37

|

|

228.19

|

|

||||||

|

S&P Health Care Services Select Industry Index

|

100.00

|

|

140.72

|

|

152.17

|

|

140.36

|

|

168.96

|

|

203.95

|

|

||||||

|

Item 6.

|

Selected Financial Data

|

|

|

For the Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

(In Millions, Except per Share Data)

|

||||||||||||||||||

|

Statement of Operations Data:

|

|

|

|

|

|

||||||||||||||

|

Net operating revenues

|

$

|

2,273.2

|

|

$

|

2,161.9

|

|

$

|

2,026.9

|

|

$

|

1,877.6

|

|

$

|

1,784.9

|

|

||||

|

Operating earnings

(1)

|

435.7

|

|

378.7

|

|

351.4

|

|

295.9

|

|

228.7

|

|

|||||||||

|

Provision for income tax expense (benefit)

(2)

|

12.7

|

|

108.6

|

|

37.1

|

|

(740.8

|

)

|

(2.9

|

)

|

|||||||||

|

Income from continuing operations

|

382.5

|

|

231.4

|

|

205.8

|

|

930.7

|

|

110.4

|

|

|||||||||

|

(Loss) income from discontinued operations, net of tax

(3)

|

(1.1

|

)

|

4.5

|

|

48.8

|

|

9.1

|

|

18.4

|

|

|||||||||

|

Net income

|

381.4

|

|

235.9

|

|

254.6

|

|

939.8

|

|

128.8

|

|

|||||||||

|

Less: Net income attributable to noncontrolling interests

|

(57.8

|

)

|

(50.9

|

)

|

(45.9

|

)

|

(40.8

|

)

|

(34.0

|

)

|

|||||||||

|

Net income attributable to HealthSouth

|

323.6

|

|

185.0

|

|

208.7

|

|

899.0

|

|

94.8

|

|

|||||||||

|

Less: Convertible perpetual preferred stock dividends

|

(21.0

|

)

|

(23.9

|

)

|

(26.0

|

)

|

(26.0

|

)

|

(26.0

|

)

|

|||||||||

|

Less: Repurchase of convertible perpetual preferred stock

(4)

|

(71.6

|

)

|

(0.8

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net income attributable to HealthSouth common shareholders

|

$

|

231.0

|

|

$

|

160.3

|

|

$

|

182.7

|

|

$

|

873.0

|

|

$

|

68.8

|

|

||||

|

Weighted average common shares outstanding:

(5)

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic

|

88.1

|

|

94.6

|

|

93.3

|

|

92.8

|

|

88.8

|

|

|||||||||

|

Diluted

|

102.1

|

|

108.1

|

|

109.2

|

|

108.5

|

|

103.3

|

|

|||||||||

|

Earnings per common share:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic earnings per share attributable to HealthSouth common shareholders:

(6)

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Continuing operations

|

$

|

2.59

|

|

$

|

1.62

|

|

$

|

1.39

|

|

$

|

9.20

|

|

$

|

0.57

|

|

||||

|

Discontinued operations

|

(0.01

|

)

|

0.05

|

|

0.52

|

|

0.10

|

|

0.20

|

|

|||||||||

|

Net income

|

$

|

2.58

|

|

$

|

1.67

|

|

$

|

1.91

|

|

$

|

9.30

|

|

$

|

0.77

|

|

||||

|

Diluted earnings per share attributable to HealthSouth common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Continuing operations

|

$

|

2.59

|

|

$

|

1.62

|

|

$

|

1.39

|

|

$

|

8.20

|

|

$

|

0.57

|

|

||||

|

Discontinued operations

|

(0.01

|

)

|

0.05

|

|

0.52

|

|

0.08

|

|

0.20

|

|

|||||||||

|

Net income

|

$

|

2.58

|

|

$

|

1.67

|

|

$

|

1.91

|

|

$

|

8.28

|

|

$

|

0.77

|

|

||||

|

Cash dividends per common share

(7)

|

$

|

0.36

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Amounts attributable to HealthSouth:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Income from continuing operations

|

$

|

324.7

|

|

$

|

180.5

|

|

$

|

158.8

|

|

$

|

889.8

|

|

$

|

77.1

|

|

||||

|

(Loss) income from discontinued operations, net of tax

|

(1.1

|

)

|

4.5

|

|

49.9

|

|

9.2

|

|

17.7

|

|

|||||||||

|

Net income attributable to HealthSouth

|

$

|

323.6

|

|

$

|

185.0

|

|

$

|

208.7

|

|

$

|

899.0

|

|

$

|

94.8

|

|

||||

|

|

As of December 31,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

(In Millions)

|

||||||||||||||||||

|

Balance Sheet Data:

|

|

|

|

|

|

||||||||||||||

|

Working capital

|

$

|

268.8

|

|

$

|

335.9

|

|

$

|

178.4

|

|

$

|

111.0

|

|

$

|

34.8

|

|

||||

|

Total assets

|

2,534.4

|

|

2,424.2

|

|

2,271.6

|

|

2,372.5

|

|

1,681.5

|

|

|||||||||

|

Long-term debt, including current portion

(4)

|

1,517.5

|

|

1,253.5

|

|

1,254.7

|

|

1,511.3

|

|

1,662.5

|

|

|||||||||

|

Convertible perpetual preferred stock

(4)

|

93.2

|

|

342.2

|

|

387.4

|

|

387.4

|

|

387.4

|

|

|||||||||

|

HealthSouth shareholders’ equity (deficit)

|

344.6

|

|

291.0

|

|

116.4

|

|

(85.8

|

)

|

(972.9

|

)

|

|||||||||

|

(1)

|

We define operating earnings as income from continuing operations attributable to HealthSouth before (1) loss on early extinguishment of debt; (2) interest expense and amortization of debt discounts and fees; (3) other income; (4) loss on interest rate swaps; and (5) income tax expense or benefit.

|

|

(2)

|

For information related to our

Provision for income tax expense (benefit),

see Item 7,

Management’s Discussion and Analysis of Financial Condition and Results of Operations

, and

Note 16,

Income Taxes

, to the accompanying consolidated financial statements. During the second quarter of 2013, we entered into closing agreements with the IRS that settled federal income tax matters related to the previous restatement of our 2000 and 2001 financial statements, as well as certain other tax matters, through December 31, 2008 and recorded a net income tax benefit of approximately $115 million. During the fourth quarter of 2010, we determined it is more likely than not a substantial portion of our deferred tax assets will be realized in the future and decreased our valuation allowance by $825.4 million through our

Provision for income tax benefit

in our consolidated statement of operations.

|

|

(3)

|

Income from discontinued operations, net of tax

in 2011 included post-tax gains from the sale of five of our long-term acute care hospitals and a settlement related to a previously disclosed audit of unclaimed property. See

Note 15,

Assets and Liabilities in and Results of Discontinued Operations

, to the accompanying consolidated financial statements.

|

|

(4)

|

During the fourth quarter of 2013, we exchanged $320 million in aggregate principal amount of newly issued 2.00% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of our outstanding 6.50% Series A Convertible Perpetual Preferred Stock. See

Note 8,

Long-term Debt

and

Note 10,

Convertible Perpetual Preferred Stock

, to the accompanying consolidated financial statements.

|

|

(5)

|

In the first quarter of 2013, we completed a tender offer for our common stock whereby we repurchased approximately 9.1 million shares. See

Note 17,

Earnings per Common Share

, to the accompanying consolidated financial statements.

|

|

(6)

|

Previously, we reported basic earnings per share of $9.41 and $0.77 for the years ended 2010 and 2009, respectively. In conjunction with the initiation of quarterly cash dividends in the third quarter of 2013, we revised our calculation to present earnings per share using the two-class method. See

Note 17,

Earnings per Common Share

, to the accompanying consolidated financial statements.

|

|

(7)

|

During the third quarter of 2013, our board of directors approved the initiation of a quarterly cash dividend on our common stock of $0.18 per share. See

Note 17,

Earnings per Common Share

, to the accompanying consolidated financial statements.

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

•

|

continuing to provide high-quality, cost-effective care to patients in our existing markets;

|

|

•

|

achieving organic growth at our existing hospitals;

|

|

•

|

continuing to expand our services to more patients who require inpatient rehabilitative services by constructing and opportunistically acquiring new hospitals in new markets; and

|

|

•

|

considering additional shareholder value-enhancing strategies such as repurchases of our common and preferred stock and common stock dividends, recognizing that some of these actions may increase our leverage ratio.

|

|

•

|

acquired Walton Rehabilitation Hospital, a 58-bed inpatient rehabilitation hospital in Augusta, Georgia, in April 2013;

|

|

•

|

began accepting patients at our newly built, 40-bed inpatient rehabilitation hospital in Littleton, Colorado in May 2013;

|

|

•

|

began accepting patients at our newly built, 34-bed inpatient rehabilitation hospital in Stuart, Florida in June 2013. This hospital is a joint venture with Martin Health System;

|

|

•

|

completed the relocation of HealthSouth Rehabilitation Hospital of Western Massachusetts in Ludlow, Massachusetts to a newly built, 53-bed inpatient rehabilitation hospital, which replaced a leased facility;

|

|

•

|

added

68

beds to existing hospitals; and

|

|

Location

|

# of Beds

|

Actual / Expected Construction Start Date

|

Expected Operational Date

|

|

Altamonte Springs, Florida

|

50

|

Q4 2013

|

Q4 2014

|

|

Newnan, Georgia

|

50

|

Q4 2013

|

Q4 2014

|

|

Middletown, Delaware

|

34

|

Q4 2013

|

Q4 2014

|

|

Modesto, California

|

50

|

Second Half - 2014

|

Q4 2015

|

|

Franklin, Tennessee*

|

40

|

TBD

|

TBD

|

|

•

|

completed a tender offer for our common stock in March 2013. As a result of the tender offer, we repurchased approximately 9.1 million shares at a price of $25.50 per share for a total cost of $234.1 million, including fees and expenses relating to the tender offer;

|

|

•

|

initiated a quarterly cash dividend of $0.18 per share on our common stock. The first quarterly dividend was declared in July 2013 and paid in October 2013; and

|

|

•

|

received authorization from our board of directors in October 2013 for the repurchase of up to an additional $200 million of our common stock.

|

|

•

|

entered into closing agreements with the IRS that settled federal income tax matters related to the previous restatement of our 2000 and 2001 financial statements, as well as certain other tax matters, through December 31, 2008. As a result of these closing agreements, we increased our deferred tax assets, primarily our federal net operating loss carryforward (“NOL”), and recorded a net income tax benefit of approximately $115 million in the second quarter of 2013. This income tax benefit primarily resulted from an approximate $283 million increase to our federal NOL on a gross basis;

|

|

•

|

amended our credit agreement during the second quarter of 2013 to, among other things, permit unlimited restricted payments so long as the senior secured leverage ratio remains less than or equal to 1.5x and extend the revolver maturity from August 2017 to June 2018;

|

|

•

|

purchased the real estate previously subject to leases associated with four of our hospitals for approximately $70 million during the third quarter of 2013;

|

|

•

|

redeemed $30.2 million and $27.9 million of the outstanding principal amount of our existing 7.25% Senior Notes due 2018 and 7.75% Senior Notes due 2022, respectively, in November 2013; and

|

|

•

|

exchanged $320 million in aggregate principal amount of newly issued 2.00% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of our outstanding 6.50% Series A Convertible Perpetual Preferred Stock, leaving 96,245 shares of the preferred stock outstanding, in November 2013.

|

|

•

|

Operating in a Highly Regulated Industry

. We are required to comply with extensive and complex laws and regulations at the federal, state, and local government levels. These rules and regulations have affected, or could in the future affect, our business activities by having an impact on the reimbursement we receive for services provided or the costs of compliance, mandating new documentation standards, requiring licensure or certification of our hospitals, regulating our relationships with physicians and other referral sources, regulating the use of our properties, and limiting our ability to enter new markets or add new beds to existing hospitals. Ensuring continuous compliance with these laws and regulations is an operating requirement for all healthcare providers.

|

|

Market basket update

|

2.6%

|

|

Healthcare reform reduction

|

30 basis points

|

|

Productivity adjustment reduction

|

50 basis points

|

|

•

|

31 of our hospitals already operate as joint ventures with acute care hospitals, and we continue to pursue joint ventures as one of our growth initiatives. These joint ventures create an immediate link to an acute care system and position us to quickly and efficiently integrate our services in a coordinated care model.

|

|

•

|

Our electronic clinical information system is capable of interfaces with all major acute care electronic medical record systems and health information exchanges making communication easier across the continuum of healthcare providers.

|

|

•

|

We own the real estate associated with approximately 73% of our hospitals, and all but one of our hospitals are free standing. This combined with our strong balance sheet and consistent strong free cash flows enhances our flexibility to collaborate and partner with other providers.

|

|

•

|

We have a proven track record of being a high-quality, cost-effective provider. Our FIM

®

Gains consistently exceed industry results, and we have the scale and operating leverage to contribute to a low cost per discharge.

|

|

•

|

We have agreed to participate in a few bundling projects as a post-acute rehabilitation provider, and we have expressed interest in participating in several ACOs. As of December 31, 2013, we have executed one ACO participation agreement.

|

|

•

|

Maintaining Strong Volume Growth

. Various factors may impact our ability to maintain our recent volume growth rates, including competition and increasing regulatory and administrative burdens. In any particular market, we may encounter competition from local or national entities with longer operating histories or other competitive advantages, such as acute care hospitals with their own rehabilitation units and other post-acute providers with relationships with referring acute care hospitals or physicians. Overly aggressive payment review practices by Medicare contractors, excessively strict enforcement of regulatory policies by government agencies, and increasingly restrictive or burdensome rules, regulations or statutes governing admissions practices may lead us to not accept patients who would be appropriate for and would benefit from the services we provide. In addition, from time to time, we must get regulatory approval to add beds to our existing hospitals in states with certificate of need laws. This approval may be withheld or take longer than expected. In the case of new store volume growth, the addition of hospitals to our portfolio, whether de novo construction or the product of acquisitions or joint ventures, also may be difficult and take longer than expected.

|

|

•

|

Recruiting and Retaining High-Quality Personnel

. See Item 1A,

Risk Factors

, for a discussion of competition for staffing, shortages of qualified personnel, and other factors that may increase our labor costs. Recruiting and retaining qualified personnel for our hospitals remain a high priority for us. We attempt to maintain a comprehensive compensation and benefits package that allows us to remain competitive in this challenging staffing environment while remaining consistent with our goal of being a high-quality, cost-effective provider of inpatient rehabilitative services.

|

|

|

For the Year Ended December 31,

|

|||||||

|

|

2013

|

2012

|

2011

|

|||||

|

Medicare

|

74.5

|

%

|

73.4

|

%

|

72.0

|

%

|

||

|

Medicaid

|

1.2

|

%

|

1.2

|

%

|

1.6

|

%

|

||

|

Workers' compensation

|

1.2

|

%

|

1.5

|

%

|

1.6

|

%

|

||

|

Managed care and other discount plans, including Medicare Advantage

|

18.5

|

%

|

19.3

|

%

|

19.8

|

%

|

||

|

Other third-party payors

|

1.8

|

%

|

1.8

|

%

|

2.0

|

%

|

||

|

Patients

|

1.1

|

%

|

1.3

|

%

|

1.2

|

%

|

||

|

Other income

|

1.7

|

%

|

1.5

|

%

|

1.8

|

%

|

||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

|

For the Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2013

|

2012

|

2011

|

2013 v. 2012

|

2012 v. 2011

|

||||||||||||

|

|

(In Millions)

|

|

|

||||||||||||||

|

Net operating revenues

|

$

|

2,273.2

|

|

$

|

2,161.9

|

|

$

|

2,026.9

|

|

5.1

|

%

|

6.7

|

%

|

||||

|

Less: Provision for doubtful accounts

|

(26.0

|

)

|

(27.0

|

)

|

(21.0

|

)

|

(3.7

|

)%

|

28.6

|

%

|

|||||||

|

Net operating revenues less provision for doubtful accounts

|

2,247.2

|

|

2,134.9

|

|

2,005.9

|

|

5.3

|

%

|

6.4

|

%

|

|||||||

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Salaries and benefits

|

1,089.7

|

|

1,050.2

|

|

982.0

|

|

3.8

|

%

|

6.9

|

%

|

|||||||

|

Hospital-related expenses:

|

|||||||||||||||||

|

Other operating expenses

|

323.0

|

|

303.8

|

|

288.3

|

|

6.3

|

%

|

5.4

|

%

|

|||||||

|

Occupancy costs

|

47.0

|

|

48.6

|

|

48.4

|

|

(3.3

|

)%

|

0.4

|

%

|

|||||||

|

Supplies

|

105.4

|

|

102.4

|

|

102.8

|

|

2.9

|

%

|

(0.4

|

)%

|

|||||||

|

General and administrative expenses

|

119.1

|

|

117.9

|

|

110.5

|

|

1.0

|

%

|

6.7

|

%

|

|||||||

|

Depreciation and amortization

|

94.7

|

|

82.5

|

|

78.8

|

|

14.8

|

%

|

4.7

|

%

|

|||||||

|

Government, class action, and related settlements

|

(23.5

|

)

|

(3.5

|

)

|

(12.3

|

)

|

571.4

|

%

|

(71.5

|

)%

|

|||||||

|

Professional fees—accounting, tax, and legal

|

9.5

|

|

16.1

|

|

21.0

|

|

(41.0

|

)%

|

(23.3

|

)%

|

|||||||

|

Total operating expenses

|

1,764.9

|

|

1,718.0

|

|

1,619.5

|

|

2.7

|

%

|

6.1

|

%

|

|||||||

|

Loss on early extinguishment of debt

|

2.4

|

|

4.0

|

|

38.8

|

|

(40.0

|

)%

|

(89.7

|

)%

|

|||||||

|

Interest expense and amortization of debt discounts and fees

|

100.4

|

|

94.1

|

|

119.4

|

|

6.7

|

%

|

(21.2

|

)%

|

|||||||

|

Other income

|

(4.5

|

)

|

(8.5

|

)

|

(2.7

|

)

|

(47.1

|

)%

|

214.8

|

%

|

|||||||

|

Equity in net income of nonconsolidated affiliates

|

(11.2

|

)

|

(12.7

|

)

|

(12.0

|

)

|

(11.8

|

)%

|

5.8

|

%

|

|||||||

|

Income from continuing operations before income tax expense

|

395.2

|

|

340.0

|

|

242.9

|

|

16.2

|

%

|

40.0

|

%

|

|||||||

|

Provision for income tax expense

|

12.7

|

|

108.6

|

|

37.1

|

|

(88.3

|

)%

|

192.7

|

%

|

|||||||

|

Income from continuing operations

|

382.5

|

|

231.4

|

|

205.8

|

|

65.3

|

%

|

12.4

|

%

|

|||||||

|

(Loss) income from discontinued operations, net of tax

|

(1.1

|

)

|

4.5

|

|

48.8

|

|

(124.4

|

)%

|

(90.8

|

)%

|

|||||||

|

Net income

|

381.4

|

|

235.9

|

|

254.6

|

|

61.7

|

%

|

(7.3

|

)%

|

|||||||

|

Less: Net income attributable to noncontrolling interests

|

(57.8

|

)

|

(50.9

|

)

|

(45.9

|

)

|

13.6

|

%

|

10.9

|

%

|

|||||||

|

Net income attributable to HealthSouth

|

$

|

323.6

|

|

$

|

185.0

|

|

$

|

208.7

|

|

74.9

|

%

|

(11.4

|

)%

|

||||

|

|

For the Year Ended December 31,

|

|||||||

|

|

2013

|

2012

|

2011

|

|||||

|

Provision for doubtful accounts

|

1.1

|

%

|

1.2

|

%

|

1.0

|

%

|

||

|

Operating expenses:

|

||||||||

|

Salaries and benefits

|

47.9

|

%

|

48.6

|

%

|

48.4

|

%

|

||

|

Hospital-related expenses:

|

||||||||

|

Other operating expenses

|

14.2

|

%

|

14.1

|

%

|

14.2

|

%

|

||

|

Occupancy costs

|

2.1

|

%

|

2.2

|

%

|

2.4

|

%

|

||

|

Supplies

|

4.6

|

%

|

4.7

|

%

|

5.1

|

%

|

||

|

General and administrative expenses

|

5.2

|

%

|

5.5

|

%

|

5.5

|

%

|

||

|

Depreciation and amortization

|

4.2

|

%

|

3.8

|

%

|

3.9

|

%

|

||

|

Government, class action, and related settlements

|

(1.0

|

)%

|

(0.2

|

)%

|

(0.6

|

)%

|

||

|

Professional fees—accounting, tax, and legal

|

0.4

|

%

|

0.7

|

%

|

1.0

|

%

|

||

|

Total operating expenses

|

77.6

|

%

|

79.5

|

%

|

79.9

|

%

|

||

|

|

For the Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2013

|

2012

|

2011

|

2013 v. 2012

|

2012 v. 2011

|

||||||||||||

|

|

(In Millions)

|

||||||||||||||||

|

Net patient revenue - inpatient

|

$

|

2,130.8

|

|

$

|

2,012.6

|

|

$

|

1,866.4

|

|

5.9

|

%

|

7.8

|

%

|

||||

|

Net patient revenue - outpatient & other

|

142.4

|

|

149.3

|

|

160.5

|

|

(4.6

|

)%

|

(7.0

|

)%

|

|||||||

|

Net operating revenues

|

$

|

2,273.2

|

|

$

|

2,161.9

|

|

$

|

2,026.9

|

|

5.1

|

%

|

6.7

|

%

|

||||

|

|

(Actual Amounts)

|

|

|||||||||||||||

|

Discharges

|

129,988

|

|

123,854

|

|

118,354

|

|

5.0

|

%

|

4.6

|

%

|

|||||||

|

Net patient revenue per discharge

|

$

|

16,392

|

|

$

|

16,250

|

|

$

|

15,770

|

|

0.9

|

%

|

3.0

|

%

|

||||

|

Outpatient visits

|

806,631

|

|

880,182

|

|

943,439

|

|

(8.4

|

)%

|

(6.7

|

)%

|

|||||||

|

Average length of stay (days)

|

13.3

|

|

13.4

|

|

13.5

|

|

(0.7

|

)%

|

(0.7

|

)%

|

|||||||

|

Occupancy %

|

69.3

|

%

|

68.2

|

%

|

67.7

|

%

|

1.6

|

%

|

0.7

|

%

|

|||||||

|

# of licensed beds

|

6,825

|

|

6,656

|

|

6,461

|

|

2.5

|

%

|

3.0

|

%

|

|||||||

|

Full-time equivalents*

|

16,093

|

|

15,453

|

|

15,089

|

|

4.1

|

%

|

2.4

|

%

|

|||||||

|

Employees per occupied bed

|

3.42

|

|

3.42

|

|

3.47

|

|

—

|

%

|

(1.4

|

)%

|

|||||||

|

*

|

Excludes approximately 400 full-time equivalents in each year who are considered part of corporate overhead with their salaries and benefits included in

General and administrative expenses

in our consolidated statements of operations. Full-time equivalents included in the above table represent HealthSouth employees who participate in or support the operations of our hospitals and exclude an estimate of full-time equivalents related to contract labor.

|

|

|

For the Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net operating revenues

|

$

|

0.2

|

|

$

|

1.0

|

|

$

|

95.7

|

|

||

|

Less: Provision for doubtful accounts

|

0.3

|

|

—

|

|

(1.5

|

)

|

|||||

|

Net operating revenues less provision for doubtful accounts

|

0.5

|

|

1.0

|

|

94.2

|

|

|||||

|

Costs and expenses

|

0.2

|

|

0.2

|

|

66.3

|

|

|||||

|

Impairments

|

1.1

|

|

—

|

|

6.8

|

|

|||||

|

(Loss) income from discontinued operations

|

(0.8

|

)

|

0.8

|

|

21.1

|

|

|||||

|

(Loss) gain on disposal of assets/sale of investments of discontinued operations

|

(0.4

|

)

|

5.0

|

|

65.6

|

|

|||||

|

Income tax benefit (expense)

|

0.1

|

|

(1.3

|

)

|

(37.9

|

)

|

|||||

|

(Loss) income from discontinued operations, net of tax

|

$

|

(1.1

|

)

|

$

|

4.5

|

|

$

|

48.8

|

|

||

|

|

For the Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net cash provided by operating activities

|

$

|

470.3

|

|

$

|

411.5

|

|

$

|

342.7

|

|

||

|

Net cash used in investing activities

|

(226.2

|

)

|

(178.8

|

)

|

(24.6

|

)

|

|||||

|

Net cash used in financing activities

|

(312.4

|

)

|

(130.0

|

)

|

(336.3

|

)

|

|||||

|

(Decrease) increase in cash and cash equivalents

|

$

|

(68.3

|

)

|

$

|

102.7

|

|

$

|

(18.2

|

)

|

||

|

|

Total

|

2014

|

2015-2016

|

2017-2018

|

2019 and thereafter

|

||||||||||||||

|

Long-term debt obligations:

|

|

|

|

|

|

|

|

||||||||||||

|

Long-term debt, excluding revolving credit facility and capital lease obligations

(a)

|

$

|

1,383.6

|

|

$

|

6.3

|

|

$

|

4.9

|

|

$

|

274.6

|

|

$

|

1,097.8

|

|

||||

|

Revolving credit facility

|

45.0

|

|

—

|

|

—

|

|

45.0

|

|

—

|

|

|||||||||

|

Interest on long-term debt

(b)

|

682.3

|

|

89.3

|

|

177.8

|

|

172.1

|

|

243.1

|

|

|||||||||

|

Capital lease obligations

(c)

|

175.5

|

|

12.3

|

|

27.1

|

|

26.9

|

|

109.2

|

|

|||||||||

|

Operating lease obligations

(d)(e)

|

253.9

|

|

37.9

|

|

67.0

|

|

48.3

|

|

100.7

|

|

|||||||||

|

Purchase obligations

(e)(f)

|

121.4

|

|

26.3

|

|

48.4

|

|

20.9

|

|

25.8

|

|

|||||||||

|

Other long-term liabilities

(g)(h)

|

3.8

|

|

0.2

|

|

0.4

|

|

0.4

|

|

2.8

|

|

|||||||||

|

Total

|

$

|

2,665.5

|

|

$

|

172.3

|

|

$

|

325.6

|

|

$

|

588.2

|

|

$

|

1,579.4

|

|

||||

|

(a)

|

Included in long-term debt are amounts owed on our bonds payable and other notes payable. These borrowings are further explained in

Note 8,

Long-term Debt

,

to the accompanying consolidated financial statements.

|

|

(b)

|

Interest on our fixed rate debt is presented using the stated interest rate. Interest expense on our variable rate debt is estimated using the rate in effect as of December 31,

2013

. Interest related to capital lease obligations is excluded from this line. Future minimum payments, which are accounted for as interest, related to sale/leaseback transactions involving real estate accounted for as financings are included in this line (see

Note 5,

Property and Equipment

, and

Note 8,

Long-term Debt

, to the accompanying consolidated financial statements). Amounts exclude amortization of debt discounts, amortization of loan fees, or fees for lines of credit that would be included in interest expense in our consolidated statements of operations.

|

|

(c)

|

Amounts include interest portion of future minimum capital lease payments.

|

|

(d)

|

We lease approximately 27% of our hospitals as well as other property and equipment under operating leases in the normal course of business. Some of our hospital leases contain escalation clauses based on changes in the Consumer Price Index while others have fixed escalation terms. The minimum lease payments do not include contingent rental expense. Some lease agreements provide us with the option to renew the lease or purchase the leased property. Our future operating lease obligations would change if we exercised these renewal options and if we entered into additional operating lease agreements. For more information, see

Note 5,

Property and Equipment

,

to the accompanying consolidated financial statements.

|

|

(e)

|

Future operating lease obligations and purchase obligations are not recognized in our consolidated balance sheet.

|

|

(f)

|

Purchase obligations include agreements to purchase goods or services that are enforceable and legally binding on HealthSouth and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum, or variable price provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty. Our purchase obligations primarily relate to software licensing and support.

|

|

(g)

|

Because their future cash outflows are uncertain, the following noncurrent liabilities are excluded from the table above: general liability, professional liability, and workers’ compensation risks, noncurrent amounts related to third-party billing audits, and deferred income taxes. Also, as of December 31,

2013

, we had

$1.1 million

of total gross unrecognized tax benefits. For more information, see

Note 9,

Self-Insured Risks

,

Note 16,

Income Taxes

,

and

Note 18,

Contingencies and Other Commitments

,

to the accompanying consolidated financial statements. See also the discussion below of our purchases of the real estate associated with leased properties.

|

|

(h)

|

The table above does not include

Redeemable noncontrolling interests

of

$13.5 million

because of the uncertainty surrounding the timing and amounts of any related cash outflows.

|

|

|

For the Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net income

|

$

|

381.4

|

|

$

|

235.9

|

|

$

|

254.6

|

|

||

|

Loss (income) from discontinued operations, net of tax, attributable to HealthSouth

|

1.1

|

|

(4.5

|

)

|

(49.9

|

)

|

|||||

|

Provision for income tax expense

|

12.7

|

|

108.6

|

|

37.1

|

|

|||||

|

Interest expense and amortization of debt discounts and fees

|

100.4

|

|

94.1

|

|

119.4

|

|

|||||

|

Loss on early extinguishment of debt

|

2.4

|

|

4.0

|

|

38.8

|

|

|||||

|

Professional fees—accounting, tax, and legal

|

9.5

|

|

16.1

|

|

21.0

|

|

|||||

|

Government, class action, and related settlements

|

(23.5