|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

|

36-3857664

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Two North Riverside Plaza,

Suite 800, Chicago, Illinois

|

|

60606

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Common Stock, $0.01 Par Value

|

|

New York Stock Exchange

|

|

(Title of Class)

|

|

(Name of exchange on which registered)

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

Smaller reporting company

|

o

|

Emerging Growth Company

|

o

|

|

Non-accelerated filer

|

o

|

(Do not check if a smaller reporting company)

|

|||||

|

|

|

Page

|

|

|

PART I.

|

|||

|

Item 1.

|

Business

|

||

|

Item 1A.

|

Risk Factors

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

||

|

Item 2.

|

Properties

|

||

|

Item 3.

|

Legal Proceedings

|

||

|

Item 4.

|

Mine Safety Disclosure

|

||

|

PART II.

|

|||

|

Item 5.

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

||

|

Item 6.

|

Selected Financial Data

|

||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

||

|

Forward-Looking Statements

|

|||

|

Item 8.

|

Financial Statements and Supplementary Data

|

||

|

Item 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

||

|

Item 9A.

|

Controls and Procedures

|

||

|

Item 9B.

|

Other Information

|

||

|

PART III.

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

||

|

Item 11.

|

Executive Compensation

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

||

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

||

|

Item 14.

|

Principal Accountant Fees and Services

|

||

|

PART IV.

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

||

|

Item 16.

|

Form 10-K Summary

|

||

|

•

|

Consistently providing high levels of services and amenities in attractive surroundings to foster a strong sense of community and pride of home ownership;

|

|

•

|

Efficiently managing the Properties to increase operating margins by increasing occupancy, maintaining competitive market rents and controlling expenses;

|

|

•

|

Increasing income and property values by strategic expansion and, where appropriate, renovation of the Properties;

|

|

•

|

Utilizing technology to evaluate potential acquisitions, identify and track competing properties and monitor existing and prospective customer satisfaction;

|

|

•

|

Selectively acquiring properties that have potential for long-term cash flow growth and creating property concentrations in and around retirement or vacation destinations and major metropolitan areas to capitalize on operating synergies and incremental efficiencies;

|

|

•

|

Selecting joint venture partners that share business objectives, growth initiatives, and risk profiles similar to ours;

|

|

•

|

Managing our debt balances in order to maintain financial flexibility, minimize exposure to interest rate fluctuations and maintain an appropriate degree of leverage to maximize return on capital; and

|

|

•

|

Developing and maintaining relationships with various capital providers.

|

|

•

|

Current and projected cash flow of the property and the potential for increased cash flow;

|

|

•

|

Geographic area and the type of property;

|

|

•

|

Replacement cost of the property, including land values, entitlements and zoning;

|

|

•

|

Location, construction quality, condition and design of the property;

|

|

•

|

Potential for capital appreciation of the property;

|

|

•

|

Terms of tenant leases or usage rights, including the potential for rent increases;

|

|

•

|

Potential for economic growth and the tax and regulatory environment of the community in which the property is located;

|

|

•

|

Potential for expansion, including increasing the number of Sites;

|

|

•

|

Occupancy and demand by customers for properties of a similar type in the vicinity and the customers' profiles;

|

|

•

|

Prospects for liquidity through sale, financing or refinancing of the property;

|

|

•

|

Competition from existing properties and the potential for the construction of new properties in the area; and

|

|

•

|

Working capital demands.

|

|

•

|

Whether the Property meets our current investment criteria;

|

|

•

|

Our desire to exit certain non-core markets and recycle the capital into core markets; and

|

|

•

|

Our ability to sell the Property at a price that we believe will provide an appropriate return for our stockholders.

|

|

•

|

Barriers to Entry:

We believe that the supply of new properties in locations we target will be constrained by barriers to entry. The most significant barrier has been the difficulty of securing zoning permits from local authorities. This has been the result of (i) the public's perception of manufactured housing, and (ii) the fact that MH communities and RV resorts generate less tax revenue than conventional housing properties because the homes are treated as personal property (a benefit to the homeowner) rather than real property. Further, the length of time between investment in a property's development and the attainment of stabilized occupancy and the generation of revenues is significant. The initial development of the infrastructure may take up to two or three years and once a property is ready for occupancy, it may be difficult to attract customers to an empty property.

|

|

•

|

Customer Base

: We believe that properties tend to achieve and maintain a stable rate of occupancy due to the following factors: (i) customers typically own their own homes, (ii) properties tend to foster a sense of community as a result of amenities, such as clubhouses and recreational and social activities, (iii) customers often sell their homes in-place (similar to site-built residential housing) with no interruption of rental payments to us, and (iv) moving a Site Set home from one property to another involves substantial cost and effort.

|

|

•

|

Lifestyle Choice

: According to the Recreational Vehicle Industry Association ("RVIA"), in a survey conducted by the University of Michigan in 2011, approximately 8.9 million or 8.5% of U.S. vehicle-owning households owned an RV. The 77 million people born in the United States from 1946 to 1964, or "baby boomers", make up the fastest growing segment of this market. According to Pew Research Center, every day 10,000 Americans turn 65 years old. We believe that this population segment, seeking an active lifestyle, will provide opportunities for our future cash flow growth. As RV owners age and move beyond the more active RV lifestyle, they will often seek more permanent retirement or vacation establishments. Site Set housing has become an increasingly popular housing alternative for retirement, second-home, and "empty-nest" living. According to 2014 U.S. Census Bureau National Population Projections figures, the population of people ages 55 and older is expected to grow 22% within the next 15 years.

|

|

•

|

Construction Quality:

The Department of Housing and Urban Development's ("HUD") standards for Site Set housing construction quality are the only federal standards governing housing quality of any type in the United States. Site Set homes produced since 1976 have received a "red and silver" government seal certifying that they were built in compliance with the federal code. The code regulates Site Set home design and construction, strength and durability, fire resistance and energy efficiency, and the installation and performance of heating, plumbing, air conditioning, thermal and electrical systems. In newer homes, top grade lumber and dry wall materials are common. Also, manufacturers are required to follow the same fire codes as builders of site-built structures. Although resort cottages, which are generally smaller homes, do not come under the same regulations, the resort cottages are built and certified in accordance with NFPA 1192-15 and ANSI A119.5-09 consensus standards for park model recreational vehicles and have many of the same quality features.

|

|

•

|

Comparability to Site-Built Homes:

Since inception, the Site Set housing industry has experienced a trend toward multi-section homes. The average current Site Set homes are approximately 1,446 square feet. Many such homes have nine-foot ceilings or vaulted ceilings, fireplaces and as many as four bedrooms, and closely resemble single-family ranch-style site-built homes. At our Properties, there is an active resale or rental market for these larger homes. According to the 2016 U.S. Census American Community Survey, manufactured homes represent 9.2% of single-family housing units.

|

|

•

|

Second Home and Vacation Home Demographics

: According to 2017 National Association of Realtors ("NAR") reports, sales of second homes in 2016 accounted for 31.0% of residential transactions, or 1.9 million second-home sales in 2016 and a typical vacation-home buyer earned $89,900 in 2016. According to 2014 NAR reports, there were approximately 8.0 million vacation homes in 2013 and a typical vacation-home buyer was 43 years old. According to the 2017 NAR reports, approximately 43.0% of vacation homes were purchased in the south; 24.0% were purchased in the west; 17.0% were purchased in the midwest; and 16.0% were purchased in the northeast. Looking ahead, we expect continued strong demand from baby boomers. It is currently estimated that approximately 10,000 baby boomers will turn 65 daily through 2030. Additionally the population of people age 55 and older is expected to grow 22% from 2018 to 2032. We believe these individuals will continue to drive the market for second home sales as vacation properties, investment opportunities, or retirement retreats. We believe it is likely that over the next decade we will continue to see high levels of second home sales and that resort homes and cottages in our Properties will continue to provide a viable second-home alternative to site-built homes.

|

|

•

|

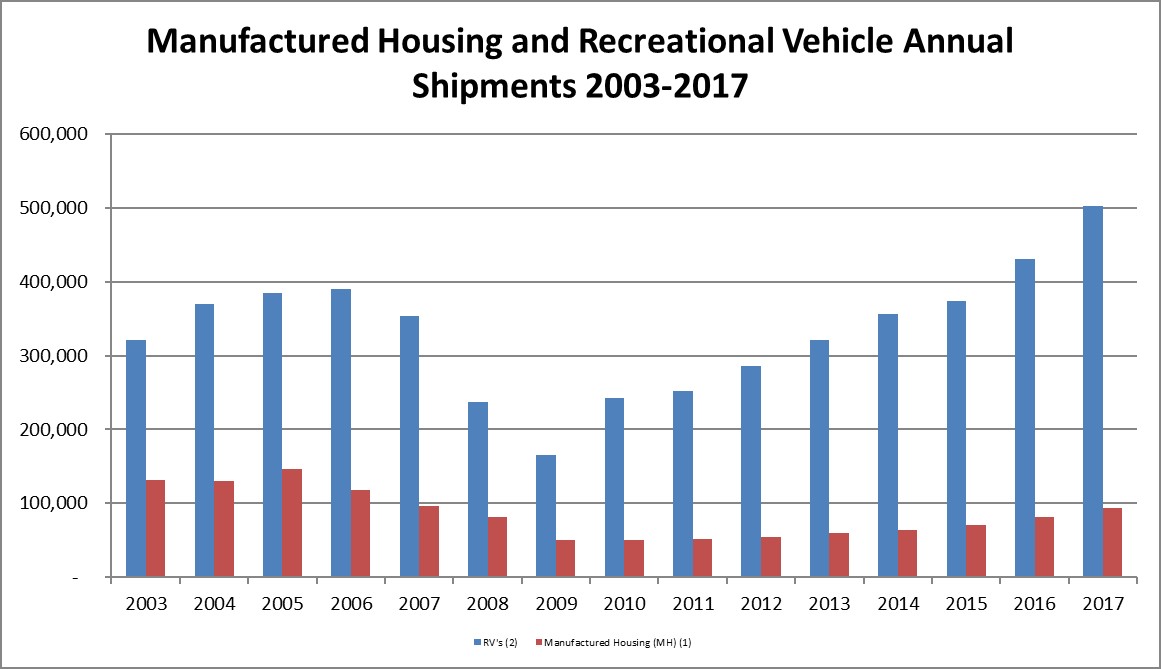

Shipments:

According to statistics compiled by the U.S. Census Bureau, manufactured home shipments have increased each year since 2010 and are on pace for a ninth straight year of growth. Although new manufactured home shipments continue to be below historical levels, shipments in

2017

increased about

14.5%

to

92,900

units as compared to shipments in

2016

of

81,100

units. According to the RVIA, wholesale shipments of RVs increased

16.6%

in

2017

to approximately

502,300

units as compared to

2016

, which continued a positive trend in RV shipments that started in late 2009. Certain industry experts have predicted that

2018

RV shipments will increase by about 3.7% as compared to

2017

.

|

———————————————————————————————————————————

———————————————————————————————————————————

|

1.

|

U.S. Census: Manufactured Homes Survey

|

|

2.

|

Source: RVIA

|

|

•

|

Sales:

Retail sales of RVs totaled approximately

412,200

in

2017

, a

11.4%

increase from

2016

RV sales of

369,900

and a

27.1%

increase from

2015

RV sales of

324,400

. We believe that consumers remain concerned about the current economy, and the potential for stagnant economic conditions in the future. However, the enduring appeal of the RV lifestyle has

|

|

•

|

Availability of financing:

Since 2008 only a few sources of financing have been available for manufactured home and RV manufacturers. Although RV financing is more readily available, the economic and legislative environment has generally made it difficult for purchasers of both manufactured homes and RVs to obtain financing. Legislation enacted in 2010 known as the SAFE Act (Safe Mortgage Licensing Act) requires community owners interested in providing financing for customer purchases of manufactured homes to register as a mortgage loan originator in states where they engage in such financing. In comparison to financing available to purchasers of site-built homes, the few third party financing sources available to purchasers of manufactured homes offer financing with higher down payments, higher rates and shorter maturities, and loan approval is subject to more stringent underwriting criteria. In 2013, we entered into a joint venture, ECHO Financing, LLC, to buy and sell homes and purchase loans made by an unaffiliated lender to residents at our Properties. Please see our risk factors in Item 1A - Risk Factors and consolidated financial statements and related notes beginning on page F-1 of this Form 10-K for more detailed information.

|

|

•

|

changes in the national, regional and/or local economic climate;

|

|

•

|

the attractiveness of our Properties to customers, competition from manufactured home communities and other lifestyle-oriented properties and alternative forms of housing (such as apartment buildings and site-built single family homes);

|

|

•

|

the ability of manufactured home and RV manufacturers to adapt to changes in the economic climate and the availability of units from these manufacturers;

|

|

•

|

the ability of our potential customers to sell or lease their existing site-built residences in order to purchase resort homes or cottages at our Properties, and heightened price sensitivity for seasonal and second homebuyers;

|

|

•

|

the possible reduced ability of our potential customers to obtain financing on the purchase of resort homes, resort cottages or RVs;

|

|

•

|

the ability of our potential customers to obtain affordable chattel financing from manufactured home lenders;

|

|

•

|

our ability to collect rent, annual payments and principal and interest from customers and pay or control maintenance, insurance and other operating costs (including real estate taxes), which could increase over time;

|

|

•

|

unfavorable weather conditions, especially on holiday weekends in the spring and summer months, could reduce the economic performance at our resort Properties;

|

|

•

|

change in climate and the occurrence of natural disasters or catastrophic events;

|

|

•

|

the failure of our assets to generate income sufficient to pay our expenses, service our debt and maintain our Properties, which may adversely affect our ability to make expected distributions to our stockholders or may result in claims including, but not limited to, foreclosure by a lender in the event of our inability to service our debt;

|

|

•

|

fluctuation in the exchange rate of the U.S. dollar to other currencies and its impact on foreign customers of our northern and southern Properties;

|

|

•

|

changes in U.S. social, political, economic conditions, laws, governmental regulations (including rent control laws and regulations governing usage, zoning and taxes and chattel financing), and policies governing health care systems and drug prices, U.S. tax laws, foreign trade, manufacturing, and development and investment;

|

|

•

|

changes in laws and governmental regulations related to proposed minimum wage increases; and

|

|

•

|

our ability to attract customers to enter new or upgraded right-to-use contracts and to retain customers who have previously entered right-to-use contracts.

|

|

•

|

integration may prove costly or time-consuming and may divert senior management's attention from the management of daily operations;

|

|

•

|

difficulties or an inability to access capital or increases in financing costs;

|

|

•

|

we may incur costs and expenses associated with any undisclosed or potential liabilities;

|

|

•

|

development and expansion projects may require long-term planning and involve complex and costly activities;

|

|

•

|

unforeseen difficulties may arise in integrating an acquisition into our portfolio;

|

|

•

|

expected synergies may not materialize; and

|

|

•

|

we may acquire properties in new markets where we face risks associated with lack of market knowledge such as: understanding of the local economy, the local governmental and/or local permit procedures.

|

|

•

|

downturns in economic conditions disrupting the single family housing market;

|

|

•

|

local conditions, such as an oversupply of lifestyle-oriented properties or a reduction in demand for lifestyle-oriented properties;

|

|

•

|

increased costs to acquire homes;

|

|

•

|

the ability of customers to obtain affordable financing; and

|

|

•

|

demographics, such as the retirement of the "baby boomers", and their demand for access to our lifestyle-oriented Properties.

|

|

•

|

o

ur joint venture partners might experience financial distress, become bankrupt or fail to fund their share of required capital contributions, which may delay construction or development of a property or increase our financial commitment to the joint venture;

|

|

•

|

our joint venture partners may have business interests or goals with respect to a property that conflict with our business interests and goals, which could increase the likelihood of disputes regarding the ownership, management or disposition of the property; and

|

|

•

|

we may be unable to take actions that are opposed by our joint venture partners under arrangements that require us to share decision-making authority over major decisions affecting the ownership or operation of the joint venture and any property owned by the joint venture, such as the sale or financing of the property or the making of additional capital contributions for the benefit of the venture.

|

|

•

|

our cash flow could be insufficient to pay distributions at expected levels and meet required payments of principal and interest;

|

|

•

|

we might be required to use a substantial portion of our cash flow from operations to pay our indebtedness, thereby reducing the availability of our cash flow to fund the implementation of our business strategy, acquisitions, capital expenditures and other general corporate purposes;

|

|

•

|

our debt service obligations could limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

•

|

we may not be able to refinance existing indebtedness (which requires substantial principal payments at maturity) and, if we can, the terms of such refinancing might not be as favorable as the terms of existing indebtedness;

|

|

•

|

if principal payments due at maturity cannot be refinanced, extended or paid with proceeds of other capital transactions, such as new equity capital, our cash flow may not be sufficient in all years to repay all maturing debt;

|

|

•

|

prevailing interest rates or other factors at the time of refinancing (such as the possible reluctance of lenders to make commercial real estate loans) result in higher interest rates, increased interest expense would adversely affect net income, cash flow and our ability to service debt and make distributions to stockholders;

|

|

•

|

to the extent that any Property is cross-collateralized with any other Properties, any default under the mortgage note relating to one Property will result in a default under the financing arrangements relating to other Properties that also provide security for that mortgage note or are cross-collateralized with such mortgage note; and

|

|

•

|

recent increases in the U.S. federal reserve funds rate will likely result in an increase in market interest rates, which may increase the costs of refinancing existing indebtedness or obtaining new debt.

|

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Florida

|

||||||||||||||||||

|

East Coast:

|

||||||||||||||||||

|

Cheron Village

|

Davie

|

FL

|

MH

|

30

|

202

|

202

|

99.5

|

%

|

||||||||||

|

Carriage Cove

|

Daytona Beach

|

FL

|

MH

|

59

|

418

|

418

|

90.9

|

%

|

||||||||||

|

Coquina Crossing

|

Elkton

|

FL

|

MH

|

316

|

26

|

597

|

597

|

92.1

|

%

|

|||||||||

|

Bulow Plantation

|

Flagler Beach

|

FL

|

MH

|

323

|

181

|

276

|

276

|

100.0

|

%

|

|||||||||

|

Bulow RV

|

Flagler Beach

|

FL

|

RV

|

(e)

|

352

|

103

|

100.0

|

%

|

||||||||||

|

Carefree Cove

|

Ft Lauderdale

|

FL

|

MH

|

20

|

164

|

164

|

93.9

|

%

|

||||||||||

|

Park City West

|

Ft Lauderdale

|

FL

|

MH

|

60

|

363

|

363

|

98.6

|

%

|

||||||||||

|

Sunshine Holiday MH

|

Ft Lauderdale

|

FL

|

MH

|

32

|

245

|

245

|

98.0

|

%

|

||||||||||

|

Sunshine Holiday RV

|

Ft Lauderdale

|

FL

|

RV

|

(e)

|

130

|

49

|

100.0

|

%

|

||||||||||

|

Lake Worth Village

|

Lake Worth

|

FL

|

MH

|

117

|

823

|

823

|

89.1

|

%

|

||||||||||

|

Maralago Cay

|

Lantana

|

FL

|

MH

|

102

|

5

|

602

|

602

|

100.0

|

%

|

|||||||||

|

Coral Cay Plantation

|

Margate

|

FL

|

MH

|

121

|

818

|

818

|

99.4

|

%

|

||||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Lakewood Village

|

Melbourne

|

FL

|

MH

|

68

|

349

|

349

|

87.1

|

%

|

||||||||||

|

Miami Everglades

|

Miami

|

FL

|

RV

|

34

|

303

|

102

|

100.0

|

%

|

||||||||||

|

Encore Super Park(Sunshine Holiday)

|

Ormond Beach

|

FL

|

RV

|

69

|

349

|

142

|

100.0

|

%

|

||||||||||

|

Holiday Village

|

Ormond Beach

|

FL

|

MH

|

43

|

301

|

301

|

86.7

|

%

|

||||||||||

|

The Meadows, FL

|

Palm Beach Gardens

|

FL

|

MH

|

55

|

378

|

378

|

97.1

|

%

|

||||||||||

|

Breezy Hill RV

|

Pompano Beach

|

FL

|

RV

|

52

|

762

|

396

|

100.0

|

%

|

||||||||||

|

Highland Wood RV

|

Pompano Beach

|

FL

|

RV

|

15

|

148

|

17

|

100.0

|

%

|

||||||||||

|

Rose Bay

|

Port Orange

|

FL

|

RV

|

21

|

303

|

204

|

100.0

|

%

|

||||||||||

|

Lighthouse Pointe

|

Port Orange

|

FL

|

MH

|

64

|

433

|

433

|

84.1

|

%

|

||||||||||

|

Pickwick

|

Port Orange

|

FL

|

MH

|

84

|

4

|

432

|

432

|

99.3

|

%

|

|||||||||

|

Space Coast

|

Rockledge

|

FL

|

RV

|

24

|

270

|

136

|

100.0

|

%

|

||||||||||

|

Indian Oaks

|

Rockledge

|

FL

|

MH

|

38

|

208

|

208

|

100.0

|

%

|

||||||||||

|

Encore RV Park(Sunshine Travel)

|

Vero Beach

|

FL

|

RV

|

30

|

6

|

300

|

130

|

100.0

|

%

|

|||||||||

|

Village Green

|

Vero Beach

|

FL

|

MH

|

174

|

782

|

782

|

87.7

|

%

|

||||||||||

|

Heron Cay

|

Vero Beach

|

FL

|

MH

|

130

|

589

|

589

|

87.6

|

%

|

||||||||||

|

Vero Palm

|

Vero Beach

|

FL

|

MH

|

64

|

285

|

285

|

82.8

|

%

|

||||||||||

|

Heritage Plantation

|

Vero Beach

|

FL

|

MH

|

64

|

437

|

437

|

84.4

|

%

|

||||||||||

|

Countryside at Vero Beach

|

Vero Beach

|

FL

|

MH

|

125

|

644

|

644

|

92.1

|

%

|

||||||||||

|

Holiday Village, FL

|

Vero Beach

|

FL

|

MH

|

20

|

128

|

128

|

—

|

%

|

||||||||||

|

Palm Beach Colony

|

West Palm Beach

|

FL

|

MH

|

48

|

284

|

284

|

100.0

|

%

|

||||||||||

|

Central:

|

||||||||||||||||||

|

Clover Leaf Farms

|

Brooksville

|

FL

|

MH

|

227

|

18

|

777

|

777

|

98.3

|

%

|

|||||||||

|

Clover Leaf Forest

|

Brooksville

|

FL

|

RV

|

30

|

277

|

150

|

100.0

|

%

|

||||||||||

|

Encore Super Park(Lake Magic)

|

Clermont

|

FL

|

RV

|

69

|

471

|

149

|

100.0

|

%

|

||||||||||

|

Clerbrook Golf & RV Resort

|

Clermont

|

FL

|

RV

|

288

|

1,255

|

451

|

100.0

|

%

|

||||||||||

|

Orlando

|

Clermont

|

FL

|

RV

|

270

|

30

|

850

|

141

|

100.0

|

%

|

|||||||||

|

Orange Lake

|

Clermont

|

FL

|

MH

|

38

|

242

|

242

|

99.2

|

%

|

||||||||||

|

Haselton Village

|

Eustis

|

FL

|

MH

|

52

|

291

|

291

|

98.3

|

%

|

||||||||||

|

Southern Palms

|

Eustis

|

FL

|

RV

|

120

|

950

|

345

|

100.0

|

%

|

||||||||||

|

Lakeside Terrace

|

Fruitland Park

|

FL

|

MH

|

39

|

241

|

241

|

99.2

|

%

|

||||||||||

|

Grand Island

|

Grand Island

|

FL

|

MH

|

35

|

362

|

362

|

70.7

|

%

|

||||||||||

|

Tropical Palms

|

Kissimmee

|

FL

|

RV

|

59

|

566

|

115

|

100.0

|

%

|

||||||||||

|

Sherwood Forest RV Park

|

Kissimmee

|

FL

|

RV

|

107

|

43

|

513

|

143

|

100.0

|

%

|

|||||||||

|

Sherwood Forest

|

Kissimmee

|

FL

|

MH

|

124

|

769

|

769

|

97.4

|

%

|

||||||||||

|

Lakeland Harbor

|

Lakeland

|

FL

|

MH

|

65

|

504

|

504

|

99.8

|

%

|

||||||||||

|

Lakeland Junction

|

Lakeland

|

FL

|

MH

|

23

|

193

|

193

|

100.0

|

%

|

||||||||||

|

Beacon Hill Colony

|

Lakeland

|

FL

|

MH

|

31

|

201

|

201

|

100.0

|

%

|

||||||||||

|

Beacon Terrace

|

Lakeland

|

FL

|

MH

|

55

|

297

|

297

|

100.0

|

%

|

||||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Kings & Queens

|

Lakeland

|

FL

|

MH

|

18

|

107

|

107

|

94.4

|

%

|

||||||||||

|

Coachwood Colony

|

Leesburg

|

FL

|

MH

|

29

|

201

|

201

|

91.0

|

%

|

||||||||||

|

Mid-Florida Lakes

|

Leesburg

|

FL

|

MH

|

290

|

1,225

|

1,225

|

86.5

|

%

|

||||||||||

|

Southernaire

|

Mt. Dora

|

FL

|

MH

|

14

|

114

|

114

|

87.7

|

%

|

||||||||||

|

Foxwood

|

Ocala

|

FL

|

MH

|

56

|

365

|

365

|

85.8

|

%

|

||||||||||

|

Oak Bend

|

Ocala

|

FL

|

MH

|

62

|

3

|

262

|

262

|

88.9

|

%

|

|||||||||

|

Villas at Spanish Oaks

|

Ocala

|

FL

|

MH

|

69

|

455

|

455

|

87.3

|

%

|

||||||||||

|

Audubon

|

Orlando

|

FL

|

MH

|

40

|

280

|

280

|

98.6

|

%

|

||||||||||

|

Hidden Valley

|

Orlando

|

FL

|

MH

|

50

|

303

|

303

|

99.0

|

%

|

||||||||||

|

Starlight Ranch

|

Orlando

|

FL

|

MH

|

130

|

783

|

783

|

89.7

|

%

|

||||||||||

|

Covington Estates

|

Saint Cloud

|

FL

|

MH

|

59

|

241

|

241

|

100.0

|

%

|

||||||||||

|

Three Flags RV Resort

|

Wildwood

|

FL

|

RV

|

23

|

221

|

40

|

100.0

|

%

|

||||||||||

|

Parkwood Communities

|

Wildwood

|

FL

|

MH

|

121

|

694

|

694

|

97.8

|

%

|

||||||||||

|

Winter Garden

|

Winter Garden

|

FL

|

RV

|

27

|

350

|

146

|

100.0

|

%

|

||||||||||

|

Gulf Coast (Tampa/Naples):

|

||||||||||||||||||

|

Riverside RV

|

Arcadia

|

FL

|

RV

|

196

|

499

|

10

|

100.0

|

%

|

||||||||||

|

Toby's RV

|

Arcadia

|

FL

|

RV

|

44

|

379

|

270

|

100.0

|

%

|

||||||||||

|

Sunshine Key RV Resort (g)

|

Big Pine Key

|

FL

|

RV

|

54

|

409

|

—

|

—

|

%

|

||||||||||

|

Encore RV Park(Manatee)

|

Bradenton

|

FL

|

RV

|

42

|

415

|

244

|

100.0

|

%

|

||||||||||

|

Windmill Manor

|

Bradenton

|

FL

|

MH

|

49

|

292

|

292

|

96.6

|

%

|

||||||||||

|

Shady Lane Oaks

|

Clearwater

|

FL

|

MH

|

31

|

249

|

249

|

97.6

|

%

|

||||||||||

|

Shady Lane Village

|

Clearwater

|

FL

|

MH

|

19

|

156

|

156

|

95.5

|

%

|

||||||||||

|

Hillcrest

|

Clearwater

|

FL

|

MH

|

25

|

278

|

278

|

96.4

|

%

|

||||||||||

|

Holiday Ranch

|

Clearwater

|

FL

|

MH

|

12

|

150

|

150

|

97.3

|

%

|

||||||||||

|

Silk Oak

|

Clearwater

|

FL

|

MH

|

19

|

181

|

181

|

95.6

|

%

|

||||||||||

|

Glen Ellen

|

Clearwater

|

FL

|

MH

|

12

|

106

|

106

|

91.5

|

%

|

||||||||||

|

Encore Super Park(Crystal Isles)

|

Crystal River

|

FL

|

RV

|

38

|

260

|

83

|

100.0

|

%

|

||||||||||

|

Lake Haven

|

Dunedin

|

FL

|

MH

|

48

|

379

|

379

|

97.9

|

%

|

||||||||||

|

Colony Cove

|

Ellenton

|

FL

|

MH

|

538

|

36

|

2,206

|

2,206

|

98.0

|

%

|

|||||||||

|

Ridgewood Estates

|

Ellenton

|

FL

|

MH

|

77

|

380

|

380

|

100.0

|

%

|

||||||||||

|

Fort Myers Beach Resort

|

Fort Myers

|

FL

|

RV

|

31

|

306

|

116

|

100.0

|

%

|

||||||||||

|

Sunburst RV Park(Gulf Air Travel)

|

Fort Myers Beach

|

FL

|

RV

|

25

|

246

|

157

|

100.0

|

%

|

||||||||||

|

Sunburst RV Park(Barrington Hills)

|

Hudson

|

FL

|

RV

|

28

|

392

|

244

|

100.0

|

%

|

||||||||||

|

Sunburst RV Park(Vacation Village)

|

Largo

|

FL

|

RV

|

29

|

293

|

179

|

100.0

|

%

|

||||||||||

|

Eldorado Village

|

Largo

|

FL

|

MH

|

25

|

227

|

227

|

99.1

|

%

|

||||||||||

|

Whispering Pines - Largo

|

Largo

|

FL

|

MH

|

55

|

393

|

393

|

91.1

|

%

|

||||||||||

|

Paradise Park - Largo (c)

|

Largo

|

FL

|

MH

|

15

|

108

|

108

|

99.1

|

%

|

||||||||||

|

East Bay Oaks

|

Largo

|

FL

|

MH

|

40

|

328

|

328

|

99.4

|

%

|

||||||||||

|

Down Yonder

|

Largo

|

FL

|

MH

|

50

|

361

|

361

|

99.7

|

%

|

||||||||||

|

Shangri La

|

Largo

|

FL

|

MH

|

14

|

160

|

160

|

93.8

|

%

|

||||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Fiesta Key (g)

|

Long Key

|

FL

|

RV

|

28

|

324

|

13

|

100.0

|

%

|

||||||||||

|

Encore RV Park(Pasco)

|

Lutz

|

FL

|

RV

|

27

|

255

|

210

|

100.0

|

%

|

||||||||||

|

Sunburst RV Park(Pioneer Village)

|

N. Ft. Myers

|

FL

|

RV

|

90

|

733

|

381

|

100.0

|

%

|

||||||||||

|

Island Vista MHC

|

N. Ft. Myers

|

FL

|

MH

|

121

|

616

|

616

|

76.8

|

%

|

||||||||||

|

Windmill Village - Ft. Myers

|

N. Ft. Myers

|

FL

|

MH

|

69

|

491

|

491

|

93.1

|

%

|

||||||||||

|

The Heritage

|

N. Ft. Myers

|

FL

|

MH

|

214

|

22

|

453

|

453

|

99.1

|

%

|

|||||||||

|

Pine Lakes

|

N. Ft. Myers

|

FL

|

MH

|

314

|

584

|

584

|

100.0

|

%

|

||||||||||

|

Lake Fairways

|

N. Ft. Myers

|

FL

|

MH

|

259

|

896

|

896

|

100.0

|

%

|

||||||||||

|

Buccaneer

|

N. Ft. Myers

|

FL

|

MH

|

223

|

39

|

971

|

971

|

99.8

|

%

|

|||||||||

|

Country Place

|

New Port Richey

|

FL

|

MH

|

82

|

515

|

515

|

100.0

|

%

|

||||||||||

|

Hacienda Village

|

New Port Richey

|

FL

|

MH

|

66

|

505

|

505

|

99.8

|

%

|

||||||||||

|

Harbor View

|

New Port Richey

|

FL

|

MH

|

69

|

471

|

471

|

97.7

|

%

|

||||||||||

|

Encore Super Park(Royal Coachman-Sarasota South)

|

Nokomis

|

FL

|

RV

|

111

|

546

|

452

|

100.0

|

%

|

||||||||||

|

Lake Village

|

Nokomis

|

FL

|

MH

|

65

|

391

|

391

|

99.7

|

%

|

||||||||||

|

Bay Lake Estates

|

Nokomis

|

FL

|

MH

|

34

|

228

|

228

|

96.9

|

%

|

||||||||||

|

Silver Dollar Resort

|

Odessa

|

FL

|

RV

|

412

|

459

|

383

|

100.0

|

%

|

||||||||||

|

Terra Ceia

|

Palmetto

|

FL

|

RV

|

18

|

203

|

157

|

100.0

|

%

|

||||||||||

|

The Meadows at Countrywood

|

Plant City

|

FL

|

MH

|

140

|

13

|

737

|

737

|

96.4

|

%

|

|||||||||

|

The Arbors at Countrywood

|

Plant City

|

FL

|

MH

|

(e)

|

62

|

62

|

—

|

%

|

||||||||||

|

The Oaks at Countrywood

|

Plant City

|

FL

|

MH

|

44

|

168

|

168

|

83.9

|

%

|

||||||||||

|

The Lakes at Countrywood

|

Plant City

|

FL

|

MH

|

122

|

424

|

424

|

94.8

|

%

|

||||||||||

|

Encore Super Park(Harbor Lakes)

|

Port Charlotte

|

FL

|

RV

|

80

|

528

|

338

|

100.0

|

%

|

||||||||||

|

Encore RV Park(Gulf View)

|

Punta Gorda

|

FL

|

RV

|

78

|

206

|

79

|

100.0

|

%

|

||||||||||

|

Tropical Palms MHC

|

Punta Gorda

|

FL

|

MH

|

50

|

294

|

294

|

90.8

|

%

|

||||||||||

|

Emerald Lake

|

Punta Gorda

|

FL

|

MH

|

28

|

201

|

201

|

100.0

|

%

|

||||||||||

|

Winds of St Armands North

|

Sarasota

|

FL

|

MH

|

74

|

471

|

471

|

99.8

|

%

|

||||||||||

|

Winds of St Armands South

|

Sarasota

|

FL

|

MH

|

61

|

306

|

306

|

99.7

|

%

|

||||||||||

|

Topics RV

|

Spring Hill

|

FL

|

RV

|

35

|

230

|

174

|

100.0

|

%

|

||||||||||

|

Pine Island RV Resort

|

St. James City

|

FL

|

RV

|

31

|

363

|

96

|

100.0

|

%

|

||||||||||

|

Carefree Village

|

Tampa

|

FL

|

MH

|

58

|

397

|

397

|

98.2

|

%

|

||||||||||

|

Tarpon Glen

|

Tarpon Springs

|

FL

|

MH

|

24

|

169

|

169

|

91.1

|

%

|

||||||||||

|

Featherock

|

Valrico

|

FL

|

MH

|

84

|

521

|

521

|

100.0

|

%

|

||||||||||

|

Ramblers Rest

|

Venice

|

FL

|

RV

|

117

|

647

|

395

|

100.0

|

%

|

||||||||||

|

Bay Indies

|

Venice

|

FL

|

MH

|

210

|

1,309

|

1,309

|

99.8

|

%

|

||||||||||

|

Peace River

|

Wauchula

|

FL

|

RV

|

72

|

38

|

454

|

41

|

100.0

|

%

|

|||||||||

|

Crystal Lakes-Zephyrhills

|

Zephyrhills

|

FL

|

MH

|

147

|

52

|

315

|

315

|

100.0

|

%

|

|||||||||

|

Forest Lake Estates

|

Zephyrhills

|

FL

|

MH

|

164

|

894

|

894

|

99.8

|

%

|

||||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Forest Lake Estates RV

|

Zephyrhills

|

FL

|

RV

|

42

|

12

|

274

|

185

|

100.0

|

%

|

|||||||||

|

Sixth Avenue

|

Zephyrhills

|

FL

|

MH

|

14

|

140

|

140

|

79.3

|

%

|

||||||||||

|

Total Florida Market

|

10,415

|

528

|

53,939

|

44,314

|

95.6

|

%

|

||||||||||||

|

California

|

||||||||||||||||||

|

Northern California:

|

||||||||||||||||||

|

Monte del Lago

|

Castroville

|

CA

|

MH

|

54

|

310

|

310

|

99.4

|

%

|

||||||||||

|

Colony Park

|

Ceres

|

CA

|

MH

|

20

|

186

|

186

|

97.8

|

%

|

||||||||||

|

Russian River Campground

|

Cloverdale

|

CA

|

RV

|

41

|

135

|

3

|

100.0

|

%

|

||||||||||

|

Snowflower (f)

|

Emigrant Gap

|

CA

|

RV

|

612

|

200

|

268

|

—

|

—

|

%

|

|||||||||

|

Four Seasons

|

Fresno

|

CA

|

MH

|

40

|

242

|

242

|

88.0

|

%

|

||||||||||

|

Yosemite Lakes

|

Groveland

|

CA

|

RV

|

403

|

30

|

299

|

3

|

100.0

|

%

|

|||||||||

|

Tahoe Valley (d) (f)

|

Lake Tahoe

|

CA

|

RV

|

86

|

20

|

413

|

—

|

—

|

%

|

|||||||||

|

Sea Oaks

|

Los Osos

|

CA

|

MH

|

18

|

1

|

125

|

125

|

100.0

|

%

|

|||||||||

|

Ponderosa (d)

|

Lotus

|

CA

|

RV

|

22

|

170

|

14

|

100.0

|

%

|

||||||||||

|

Turtle Beach (g)

|

Manteca

|

CA

|

RV

|

39

|

79

|

—

|

—

|

%

|

||||||||||

|

Coralwood (d)

|

Modesto

|

CA

|

MH

|

22

|

194

|

194

|

98.5

|

%

|

||||||||||

|

Lake Minden

|

Nicolaus

|

CA

|

RV

|

165

|

82

|

323

|

9

|

100.0

|

%

|

|||||||||

|

Lake of the Springs

|

Oregon House

|

CA

|

RV

|

954

|

507

|

541

|

73

|

100.0

|

%

|

|||||||||

|

Concord Cascade

|

Pacheco

|

CA

|

MH

|

31

|

283

|

283

|

100.0

|

%

|

||||||||||

|

San Francisco RV (f)

|

Pacifica

|

CA

|

RV

|

12

|

122

|

—

|

—

|

%

|

||||||||||

|

Quail Meadows

|

Riverbank

|

CA

|

MH

|

20

|

146

|

146

|

99.3

|

%

|

||||||||||

|

California Hawaiian

|

San Jose

|

CA

|

MH

|

50

|

418

|

418

|

100.0

|

%

|

||||||||||

|

Westwinds (4 Properties) (d)

|

San Jose

|

CA

|

MH

|

88

|

723

|

723

|

100.0

|

%

|

||||||||||

|

Sunshadow (d)

|

San Jose

|

CA

|

MH

|

30

|

121

|

121

|

100.0

|

%

|

||||||||||

|

Village of the Four Seasons

|

San Jose

|

CA

|

MH

|

30

|

271

|

271

|

100.0

|

%

|

||||||||||

|

Laguna Lake

|

San Luis Obispo

|

CA

|

MH

|

100

|

300

|

300

|

100.0

|

%

|

||||||||||

|

Contempo Marin

|

San Rafael

|

CA

|

MH

|

63

|

396

|

396

|

99.7

|

%

|

||||||||||

|

De Anza Santa Cruz

|

Santa Cruz

|

CA

|

MH

|

30

|

198

|

198

|

98.5

|

%

|

||||||||||

|

Santa Cruz Ranch RV Resort (f)

|

Scotts Valley

|

CA

|

RV

|

7

|

106

|

—

|

—

|

%

|

||||||||||

|

Royal Oaks

|

Visalia

|

CA

|

MH

|

20

|

149

|

149

|

81.2

|

%

|

||||||||||

|

Southern California:

|

||||||||||||||||||

|

Soledad Canyon

|

Acton

|

CA

|

RV

|

273

|

1,251

|

30

|

100.0

|

%

|

||||||||||

|

Los Ranchos

|

Apple Valley

|

CA

|

MH

|

30

|

389

|

389

|

97.9

|

%

|

||||||||||

|

Date Palm Country Club (d)

|

Cathedral City

|

CA

|

MH

|

232

|

3

|

538

|

538

|

98.7

|

%

|

|||||||||

|

Date Palm RV

|

Cathedral City

|

CA

|

RV

|

(e)

|

140

|

14

|

100.0

|

%

|

||||||||||

|

Oakzanita

|

Descanso

|

CA

|

RV

|

145

|

5

|

146

|

25

|

100.0

|

%

|

|||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Rancho Mesa

|

El Cajon

|

CA

|

MH

|

20

|

158

|

158

|

98.7

|

%

|

||||||||||

|

Rancho Valley

|

El Cajon

|

CA

|

MH

|

19

|

140

|

140

|

100.0

|

%

|

||||||||||

|

Royal Holiday

|

Hemet

|

CA

|

MH

|

22

|

198

|

198

|

63.1

|

%

|

||||||||||

|

Idyllwild

|

Idyllwild

|

CA

|

RV

|

191

|

287

|

53

|

100.0

|

%

|

||||||||||

|

Pio Pico

|

Jamul

|

CA

|

RV

|

176

|

10

|

512

|

90

|

100.0

|

%

|

|||||||||

|

Wilderness Lakes Campground

|

Menifee

|

CA

|

RV

|

73

|

529

|

53

|

100.0

|

%

|

||||||||||

|

Morgan Hill Campground

|

Morgan Hill

|

CA

|

RV

|

62

|

339

|

11

|

100.0

|

%

|

||||||||||

|

Pacific Dunes Ranch (f)

|

Oceana

|

CA

|

RV

|

48

|

215

|

—

|

—

|

%

|

||||||||||

|

San Benito Campground

|

Paicines

|

CA

|

RV

|

199

|

23

|

523

|

57

|

100.0

|

%

|

|||||||||

|

Palm Springs

|

Palm Desert

|

CA

|

RV

|

35

|

401

|

18

|

100.0

|

%

|

||||||||||

|

Las Palmas

|

Rialto

|

CA

|

MH

|

18

|

136

|

136

|

100.0

|

%

|

||||||||||

|

Parque La Quinta

|

Rialto

|

CA

|

MH

|

19

|

166

|

166

|

100.0

|

%

|

||||||||||

|

Rancho Oso

|

Santa Barbara

|

CA

|

RV

|

310

|

40

|

187

|

21

|

100.0

|

%

|

|||||||||

|

Meadowbrook

|

Santee

|

CA

|

MH

|

43

|

338

|

338

|

100.0

|

%

|

||||||||||

|

Lamplighter

|

Spring Valley

|

CA

|

MH

|

32

|

270

|

270

|

98.5

|

%

|

||||||||||

|

Santiago Estates

|

Sylmar

|

CA

|

MH

|

113

|

9

|

300

|

300

|

100.0

|

%

|

|||||||||

|

Total California Market:

|

5,017

|

930

|

13,681

|

7,169

|

97.7

|

%

|

||||||||||||

|

Arizona:

|

||||||||||||||||||

|

Apache East

|

Apache Junction

|

AZ

|

MH

|

17

|

123

|

123

|

100.0

|

%

|

||||||||||

|

Countryside RV

|

Apache Junction

|

AZ

|

RV

|

53

|

560

|

283

|

100.0

|

%

|

||||||||||

|

Denali Park

|

Apache Junction

|

AZ

|

MH

|

33

|

163

|

163

|

99.4

|

%

|

||||||||||

|

Golden Sun RV

|

Apache Junction

|

AZ

|

RV

|

33

|

329

|

197

|

100.0

|

%

|

||||||||||

|

Valley Vista

|

Benson

|

AZ

|

RV

|

6

|

145

|

6

|

100.0

|

%

|

||||||||||

|

Casita Verde RV Resort

|

Casa Grande

|

AZ

|

RV

|

14

|

192

|

93

|

100.0

|

%

|

||||||||||

|

Fiesta Grande RV Resort

|

Casa Grande

|

AZ

|

RV

|

77

|

767

|

519

|

100.0

|

%

|

||||||||||

|

Foothills West RV Resort

|

Casa Grande

|

AZ

|

RV

|

16

|

188

|

124

|

100.0

|

%

|

||||||||||

|

Sunshine Valley

|

Chandler

|

AZ

|

MH

|

55

|

381

|

381

|

95.8

|

%

|

||||||||||

|

Verde Valley Campground

|

Cottonwood

|

AZ

|

RV

|

273

|

129

|

352

|

92

|

100.0

|

%

|

|||||||||

|

Casa del Sol East II

|

Glendale

|

AZ

|

MH

|

29

|

239

|

239

|

96.7

|

%

|

||||||||||

|

Casa del Sol East III

|

Glendale

|

AZ

|

MH

|

28

|

236

|

236

|

97.0

|

%

|

||||||||||

|

Palm Shadows

|

Glendale

|

AZ

|

MH

|

33

|

293

|

293

|

93.5

|

%

|

||||||||||

|

Hacienda De Valencia

|

Mesa

|

AZ

|

MH

|

51

|

364

|

364

|

98.9

|

%

|

||||||||||

|

The Highlands at Brentwood

|

Mesa

|

AZ

|

MH

|

45

|

268

|

268

|

98.9

|

%

|

||||||||||

|

Mesa Spirit

|

Mesa

|

AZ

|

RV

|

90

|

1,600

|

713

|

100.0

|

%

|

||||||||||

|

Monte Vista

|

Mesa

|

AZ

|

RV

|

142

|

38

|

947

|

753

|

100.0

|

%

|

|||||||||

|

Seyenna Vistas (The Mark)

|

Mesa

|

AZ

|

MH

|

60

|

4

|

407

|

407

|

99.8

|

%

|

|||||||||

|

Viewpoint

|

Mesa

|

AZ

|

RV

|

332

|

15

|

2,188

|

1,706

|

100.0

|

%

|

|||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Apollo Village

|

Peoria

|

AZ

|

MH

|

29

|

3

|

238

|

238

|

96.6

|

%

|

|||||||||

|

Casa del Sol West I

|

Peoria

|

AZ

|

MH

|

31

|

245

|

245

|

100.0

|

%

|

||||||||||

|

Carefree Manor

|

Phoenix

|

AZ

|

MH

|

16

|

130

|

130

|

99.2

|

%

|

||||||||||

|

Central Park

|

Phoenix

|

AZ

|

MH

|

37

|

293

|

293

|

97.6

|

%

|

||||||||||

|

Desert Skies

|

Phoenix

|

AZ

|

MH

|

24

|

166

|

166

|

99.4

|

%

|

||||||||||

|

Sunrise Heights

|

Phoenix

|

AZ

|

MH

|

28

|

199

|

199

|

97.0

|

%

|

||||||||||

|

Whispering Palms

|

Phoenix

|

AZ

|

MH

|

15

|

116

|

116

|

96.6

|

%

|

||||||||||

|

Desert Vista (f)

|

Salome

|

AZ

|

RV

|

10

|

125

|

—

|

—

|

%

|

||||||||||

|

Sedona Shadows

|

Sedona

|

AZ

|

MH

|

48

|

6

|

198

|

198

|

99.0

|

%

|

|||||||||

|

Venture In RV Resort

|

Show Low

|

AZ

|

RV

|

26

|

389

|

271

|

100.0

|

%

|

||||||||||

|

Paradise

|

Sun City

|

AZ

|

RV

|

80

|

950

|

737

|

100.0

|

%

|

||||||||||

|

The Meadows

|

Tempe

|

AZ

|

MH

|

60

|

390

|

390

|

98.7

|

%

|

||||||||||

|

Fairview Manor

|

Tucson

|

AZ

|

MH

|

28

|

235

|

235

|

100.0

|

%

|

||||||||||

|

Westpark

|

Wickenburg

|

AZ

|

MH

|

48

|

7

|

231

|

231

|

97.4

|

%

|

|||||||||

|

Araby

|

Yuma

|

AZ

|

RV

|

25

|

337

|

294

|

100.0

|

%

|

||||||||||

|

Cactus Gardens

|

Yuma

|

AZ

|

RV

|

43

|

430

|

256

|

100.0

|

%

|

||||||||||

|

Capri RV Park

|

Yuma

|

AZ

|

RV

|

20

|

303

|

209

|

100.0

|

%

|

||||||||||

|

Desert Paradise

|

Yuma

|

AZ

|

RV

|

26

|

260

|

110

|

100.0

|

%

|

||||||||||

|

Foothill

|

Yuma

|

AZ

|

RV

|

18

|

180

|

63

|

100.0

|

%

|

||||||||||

|

Mesa Verde

|

Yuma

|

AZ

|

RV

|

28

|

345

|

284

|

100.0

|

%

|

||||||||||

|

Suni Sands

|

Yuma

|

AZ

|

RV

|

34

|

336

|

174

|

100.0

|

%

|

||||||||||

|

Total Arizona Market:

|

2,061

|

202

|

15,838

|

11,799

|

99.2

|

%

|

||||||||||||

|

Colorado:

|

||||||||||||||||||

|

Hillcrest Village

|

Aurora

|

CO

|

MH

|

72

|

602

|

602

|

99.2

|

%

|

||||||||||

|

Cimarron Village

|

Broomfield

|

CO

|

MH

|

50

|

327

|

327

|

99.7

|

%

|

||||||||||

|

Holiday Village CO

|

Co. Springs

|

CO

|

MH

|

38

|

240

|

240

|

94.6

|

%

|

||||||||||

|

Holiday Hills

|

Denver

|

CO

|

MH

|

99

|

736

|

736

|

94.7

|

%

|

||||||||||

|

Golden Terrace

|

Golden

|

CO

|

MH

|

32

|

263

|

263

|

99.6

|

%

|

||||||||||

|

Golden Terrace West

|

Golden

|

CO

|

MH

|

39

|

7

|

311

|

311

|

98.4

|

%

|

|||||||||

|

Golden Terrace South

|

Golden

|

CO

|

MH

|

15

|

80

|

80

|

96.3

|

%

|

||||||||||

|

Golden Terrace South RV (f)

|

Golden

|

CO

|

RV

|

(e)

|

80

|

—

|

—

|

%

|

||||||||||

|

Pueblo Grande

|

Pueblo

|

CO

|

MH

|

33

|

252

|

252

|

60.3

|

%

|

||||||||||

|

Bear Creek

|

Sheridan

|

CO

|

MH

|

12

|

121

|

121

|

95.9

|

%

|

||||||||||

|

Woodland Hills

|

Thornton

|

CO

|

MH

|

55

|

434

|

434

|

99.3

|

%

|

||||||||||

|

Total Colorado Market

|

445

|

7

|

3,446

|

3,366

|

94.8

|

%

|

||||||||||||

|

|

||||||||||||||||||

|

Property

|

City

|

State

|

MH/RV

|

Acres

(a)

|

Developable

Acres (b) |

Total Number of Sites as of 12/31/17

|

Total Number of Annual Sites as of 12/31/17

|

Annual Site Occupancy as of 12/31/17

|

||||||||||

|

Northeast:

|

||||||||||||||||||

|

Stonegate Manor

|

North Windham

|

CT

|

MH

|

114

|

372

|

372

|

94.6

|

%

|

||||||||||

|

Waterford Estates

|

Bear

|

DE

|

MH

|

159

|

731

|

731

|

96.9

|

%

|

||||||||||

|

McNicol

|

Lewes

|

DE

|

MH

|

25

|

93

|

93

|

100.0

|

%

|

||||||||||

|

Whispering Pines

|

Lewes

|

DE

|

MH

|

67

|

2

|

393

|

393

|

93.6

|

%

|

|||||||||

|

Mariners Cove

|

Millsboro

|

DE

|

MH

|

101

|

374

|

374

|

94.4

|

%

|

||||||||||

|

Sweetbriar

|

Millsboro

|

DE

|

MH

|

38

|

146

|

146

|

92.5

|

%

|

||||||||||

|

Aspen Meadows

|

Rehoboth Beach

|

DE

|

MH

|

46

|

200

|

200

|

100.0

|

%

|

||||||||||

|

Camelot Meadows

|