|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-12252 (Equity Residential)

Commission File Number: 0-24920 (ERP Operating Limited Partnership)

EQUITY RESIDENTIAL

ERP OPERATING LIMITED PARTNERSHIP

( Exact name of registrant as specified in its charter)

|

Maryland (Equity Residential) |

|

13-3675988 (Equity Residential) |

|

Illinois (ERP Operating Limited Partnership) |

|

36-3894853 (ERP Operating Limited Partnership) |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

Two North Riverside Plaza, Chicago, Illinois 60606 |

|

(312) 474-1300 |

|

(Address of principal executive offices) (Zip Code) |

|

(Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Equity Residential Yes ☒ No ☐ |

ERP Operating Limited Partnership Yes ☒ No ☐ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Equity Residential Yes ☒ No ☐ |

ERP Operating Limited Partnership Yes ☒ No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Equity Residential:

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

ERP Operating Limited Partnership:

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Equity Residential ☐ |

ERP Operating Limited Partnership ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Equity Residential Yes ☐ No ☒ |

ERP Operating Limited Partnership Yes ☐ No ☒ |

The number of EQR Common Shares of Beneficial Interest, $0.01 par value, outstanding on July 28, 2017 was 367,313,257.

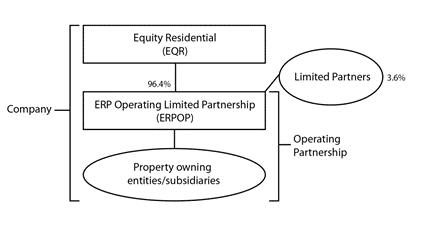

This report combines the reports on Form 10-Q for the quarterly period ended June 30, 2017 of Equity Residential and ERP Operating Limited Partnership. Unless stated otherwise or the context otherwise requires, references to “EQR” mean Equity Residential, a Maryland real estate investment trust (“REIT”), and references to “ERPOP” mean ERP Operating Limited Partnership, an Illinois limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively EQR, ERPOP and those entities/subsidiaries owned or controlled by EQR and/or ERPOP. References to the “Operating Partnership” mean collectively ERPOP and those entities/subsidiaries owned or controlled by ERPOP. The following chart illustrates the Company's and the Operating Partnership's corporate structure:

EQR is the general partner of, and as of June 30, 2017 owned an approximate 96.4% ownership interest in, ERPOP. The remaining 3.6% interest is owned by limited partners. As the sole general partner of ERPOP, EQR has exclusive control of ERPOP's day-to-day management. Management operates the Company and the Operating Partnership as one business. The management of EQR consists of the same members as the management of ERPOP.

The Company is structured as an umbrella partnership REIT (“UPREIT”) and EQR contributes all net proceeds from its various equity offerings to ERPOP. In return for those contributions, EQR receives a number of OP Units (see definition below) in ERPOP equal to the number of Common Shares it has issued in the equity offering. The Company may acquire properties in transactions that include the issuance of OP Units as consideration for the acquired properties. Such transactions may, in certain circumstances, enable the sellers to defer in whole or in part, the recognition of taxable income or gain that might otherwise result from the sales. This is one of the reasons why the Company is structured in the manner shown above. Based on the terms of ERPOP's partnership agreement, OP Units can be exchanged with Common Shares on a one-for-one basis because the Company maintains a one-for-one relationship between the OP Units of ERPOP issued to EQR and the outstanding Common Shares.

The Company believes that combining the reports on Form 10-Q of EQR and ERPOP into this single report provides the following benefits:

|

|

• |

enhances investors' understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

|

|

• |

eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

|

|

• |

creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

The Company believes it is important to understand the few differences between EQR and ERPOP in the context of how EQR and ERPOP operate as a consolidated company. All of the Company's property ownership, development and related business operations are conducted through the Operating Partnership and EQR has no material assets or liabilities other than its investment in ERPOP. EQR's primary function is acting as the general partner of ERPOP. EQR also issues equity from time to time, the net proceeds of which it is obligated to contribute to ERPOP, and guarantees certain debt of ERPOP, as disclosed in this report. EQR does not have any indebtedness as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company's ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from

equity offerings by EQR, which are co ntributed to the capital of ERPOP in exchange for additional partnership interests in ERPOP (“OP Units”) (on a one-for-one Common Share per OP Unit basis) or additional preference units in ERPOP (on a one-for-one preferred share per preference unit basis), the Operating Partnership generates all remaining capital required by the Company's business. These sources include the Operating Partnership's working capital, net cash provided by operating activities, borrowings under its revolving credit facility and /or commercial paper program, the issuance of secured and unsecured debt and equity securities and proceeds received from disposition of certain properties and joint venture interests.

Shareholders' equity, partners' capital and noncontrolling interests are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The limited partners of the Operating Partnership are accounted for as partners' capital in the Operating Partnership's financial statements and as noncontrolling interests in the Company's financial statements. The noncontrolling interests in the Operating Partnership's financial statements include the interests of unaffiliated partners in various consolidated partnerships. The noncontrolling interests in the Company's financial statements include the same noncontrolling interests at the Operating Partnership level and limited partner OP Unit holders of the Operating Partnership. The differences between shareholders' equity and partners' capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership; a single set of consolidated notes to such financial statements that includes separate discussions of each entity's debt, noncontrolling interests and shareholders' equity or partners' capital, as applicable; and a combined Management's Discussion and Analysis of Financial Condition and Results of Operations section that includes discrete information related to each entity.

This report also includes separate Part I, Item 4. Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company is one business and the Company operates that business through the Operating Partnership.

As general partner with control of ERPOP, EQR consolidates ERPOP for financial reporting purposes, and EQR essentially has no assets or liabilities other than its investment in ERPOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

(Amounts in thousands except for share amounts)

(Unaudited)

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

Investment in real estate |

|

|

|

|

|

|

|

|

|

Land |

|

$ |

5,927,949 |

|

|

$ |

5,899,862 |

|

|

Depreciable property |

|

|

19,123,571 |

|

|

|

18,730,579 |

|

|

Projects under development |

|

|

325,823 |

|

|

|

637,168 |

|

|

Land held for development |

|

|

112,474 |

|

|

|

118,816 |

|

|

Investment in real estate |

|

|

25,489,817 |

|

|

|

25,386,425 |

|

|

Accumulated depreciation |

|

|

(5,671,510 |

) |

|

|

(5,360,389 |

) |

|

Investment in real estate, net |

|

|

19,818,307 |

|

|

|

20,026,036 |

|

|

Cash and cash equivalents |

|

|

37,719 |

|

|

|

77,207 |

|

|

Investments in unconsolidated entities |

|

|

59,246 |

|

|

|

60,141 |

|

|

Deposits – restricted |

|

|

254,378 |

|

|

|

76,946 |

|

|

Escrow deposits – mortgage |

|

|

21,016 |

|

|

|

64,935 |

|

|

Other assets |

|

|

445,909 |

|

|

|

398,883 |

|

|

Total assets |

|

$ |

20,636,575 |

|

|

$ |

20,704,148 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Mortgage notes payable, net |

|

$ |

3,743,363 |

|

|

$ |

4,119,181 |

|

|

Notes, net |

|

|

4,456,365 |

|

|

|

4,848,079 |

|

|

Line of credit and commercial paper |

|

|

764,361 |

|

|

|

19,998 |

|

|

Accounts payable and accrued expenses |

|

|

137,920 |

|

|

|

147,482 |

|

|

Accrued interest payable |

|

|

48,823 |

|

|

|

60,946 |

|

|

Other liabilities |

|

|

324,002 |

|

|

|

350,466 |

|

|

Security deposits |

|

|

63,648 |

|

|

|

62,624 |

|

|

Distributions payable |

|

|

191,717 |

|

|

|

192,296 |

|

|

Total liabilities |

|

|

9,730,199 |

|

|

|

9,801,072 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable Noncontrolling Interests – Operating Partnership |

|

|

380,519 |

|

|

|

442,092 |

|

|

Equity: |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred Shares of beneficial interest, $0.01 par value; 100,000,000 shares authorized; 745,600 shares issued and outstanding as of June 30, 2017 and December 31, 2016 |

|

|

37,280 |

|

|

|

37,280 |

|

|

Common Shares of beneficial interest, $0.01 par value; 1,000,000,000 shares authorized; 367,298,765 shares issued and outstanding as of June 30, 2017 and 365,870,924 shares issued and outstanding as of December 31, 2016 |

|

|

3,673 |

|

|

|

3,659 |

|

|

Paid in capital |

|

|

8,838,804 |

|

|

|

8,758,422 |

|

|

Retained earnings |

|

|

1,511,899 |

|

|

|

1,543,626 |

|

|

Accumulated other comprehensive (loss) |

|

|

(101,151 |

) |

|

|

(113,909 |

) |

|

Total shareholders’ equity |

|

|

10,290,505 |

|

|

|

10,229,078 |

|

|

Noncontrolling Interests: |

|

|

|

|

|

|

|

|

|

Operating Partnership |

|

|

229,049 |

|

|

|

221,297 |

|

|

Partially Owned Properties |

|

|

6,303 |

|

|

|

10,609 |

|

|

Total Noncontrolling Interests |

|

|

235,352 |

|

|

|

231,906 |

|

|

Total equity |

|

|

10,525,857 |

|

|

|

10,460,984 |

|

|

Total liabilities and equity |

|

$ |

20,636,575 |

|

|

$ |

20,704,148 |

|

See accompanying notes

2

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Amounts in thousands except per share data)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|

Quarter Ended June 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

1,216,219 |

|

|

$ |

1,211,104 |

|

|

$ |

612,299 |

|

|

$ |

594,939 |

|

|

Fee and asset management |

|

|

361 |

|

|

|

3,133 |

|

|

|

181 |

|

|

|

215 |

|

|

Total revenues |

|

|

1,216,580 |

|

|

|

1,214,237 |

|

|

|

612,480 |

|

|

|

595,154 |

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and maintenance |

|

|

201,924 |

|

|

|

205,472 |

|

|

|

99,316 |

|

|

|

96,307 |

|

|

Real estate taxes and insurance |

|

|

169,231 |

|

|

|

157,611 |

|

|

|

87,503 |

|

|

|

77,415 |

|

|

Property management |

|

|

43,841 |

|

|

|

44,486 |

|

|

|

21,589 |

|

|

|

20,991 |

|

|

General and administrative |

|

|

27,799 |

|

|

|

35,013 |

|

|

|

13,626 |

|

|

|

18,296 |

|

|

Depreciation |

|

|

358,864 |

|

|

|

349,012 |

|

|

|

179,896 |

|

|

|

176,127 |

|

|

Total expenses |

|

|

801,659 |

|

|

|

791,594 |

|

|

|

401,930 |

|

|

|

389,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

414,921 |

|

|

|

422,643 |

|

|

|

210,550 |

|

|

|

206,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

|

1,763 |

|

|

|

59,583 |

|

|

|

1,162 |

|

|

|

56,525 |

|

|

Other expenses |

|

|

(2,132 |

) |

|

|

(4,060 |

) |

|

|

(1,042 |

) |

|

|

(1,504 |

) |

|

Interest: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expense incurred, net |

|

|

(197,434 |

) |

|

|

(299,964 |

) |

|

|

(91,224 |

) |

|

|

(86,472 |

) |

|

Amortization of deferred financing costs |

|

|

(4,383 |

) |

|

|

(7,739 |

) |

|

|

(2,087 |

) |

|

|

(2,345 |

) |

|

Income before income and other taxes, (loss) from investments in unconsolidated entities, net gain (loss) on sales of real estate properties and land parcels and discontinued operations |

|

|

212,735 |

|

|

|

170,463 |

|

|

|

117,359 |

|

|

|

172,222 |

|

|

Income and other tax (expense) benefit |

|

|

(482 |

) |

|

|

(763 |

) |

|

|

(220 |

) |

|

|

(413 |

) |

|

(Loss) from investments in unconsolidated entities |

|

|

(1,755 |

) |

|

|

(1,904 |

) |

|

|

(682 |

) |

|

|

(800 |

) |

|

Net gain on sales of real estate properties |

|

|

124,433 |

|

|

|

3,780,835 |

|

|

|

87,726 |

|

|

|

57,356 |

|

|

Net gain (loss) on sales of land parcels |

|

|

19,170 |

|

|

|

11,722 |

|

|

|

(23 |

) |

|

|

— |

|

|

Income from continuing operations |

|

|

354,101 |

|

|

|

3,960,353 |

|

|

|

204,160 |

|

|

|

228,365 |

|

|

Discontinued operations, net |

|

|

— |

|

|

|

(122 |

) |

|

|

— |

|

|

|

35 |

|

|

Net income |

|

|

354,101 |

|

|

|

3,960,231 |

|

|

|

204,160 |

|

|

|

228,400 |

|

|

Net (income) attributable to Noncontrolling Interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Partnership |

|

|

(12,765 |

) |

|

|

(152,089 |

) |

|

|

(7,354 |

) |

|

|

(8,780 |

) |

|

Partially Owned Properties |

|

|

(1,553 |

) |

|

|

(1,545 |

) |

|

|

(765 |

) |

|

|

(781 |

) |

|

Net income attributable to controlling interests |

|

|

339,783 |

|

|

|

3,806,597 |

|

|

|

196,041 |

|

|

|

218,839 |

|

|

Preferred distributions |

|

|

(1,546 |

) |

|

|

(1,545 |

) |

|

|

(773 |

) |

|

|

(772 |

) |

|

Net income available to Common Shares |

|

$ |

338,237 |

|

|

$ |

3,805,052 |

|

|

$ |

195,268 |

|

|

$ |

218,067 |

|

|

Earnings per share – basic: |

|

|

|

|

|

|

|

|

|

|||||||

|

Income from continuing operations available to Common Shares |

|

$ |

0.92 |

|

|

$ |

10.43 |

|

|

$ |

0.53 |

|

|

$ |

0.60 |

|

|

Net income available to Common Shares |

|

$ |

0.92 |

|

|

$ |

10.43 |

|

|

$ |

0.53 |

|

|

$ |

0.60 |

|

|

Weighted average Common Shares outstanding |

|

|

366,713 |

|

|

|

364,820 |

|

|

|

366,820 |

|

|

|

365,047 |

|

|

Earnings per share – diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations available to Common Shares |

|

$ |

0.92 |

|

|

$ |

10.36 |

|

|

$ |

0.53 |

|

|

$ |

0.59 |

|

|

Net income available to Common Shares |

|

$ |

0.92 |

|

|

$ |

10.36 |

|

|

$ |

0.53 |

|

|

$ |

0.59 |

|

|

Weighted average Common Shares outstanding |

|

|

382,505 |

|

|

|

382,012 |

|

|

|

382,692 |

|

|

|

382,065 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared per Common Share outstanding |

|

$ |

1.0075 |

|

|

$ |

9.0075 |

|

|

$ |

0.50375 |

|

|

$ |

0.50375 |

|

See accompanying notes

3

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Continued)

(Amounts in thousands except per share data)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|

Quarter Ended June 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

354,101 |

|

|

$ |

3,960,231 |

|

|

$ |

204,160 |

|

|

$ |

228,400 |

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) – derivative instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gains (losses) arising during the period |

|

|

3,507 |

|

|

|

(4,467 |

) |

|

|

3,507 |

|

|

|

(1,561 |

) |

|

Losses reclassified into earnings from other comprehensive income |

|

|

9,251 |

|

|

|

32,922 |

|

|

|

4,668 |

|

|

|

4,268 |

|

|

Other comprehensive income (loss) – foreign currency: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustments arising during the period |

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

(25 |

) |

|

Other comprehensive income |

|

|

12,758 |

|

|

|

28,505 |

|

|

|

8,175 |

|

|

|

2,682 |

|

|

Comprehensive income |

|

|

366,859 |

|

|

|

3,988,736 |

|

|

|

212,335 |

|

|

|

231,082 |

|

|

Comprehensive (income) attributable to Noncontrolling Interests |

|

|

(14,782 |

) |

|

|

(154,734 |

) |

|

|

(8,416 |

) |

|

|

(9,664 |

) |

|

Comprehensive income attributable to controlling interests |

|

$ |

352,077 |

|

|

$ |

3,834,002 |

|

|

$ |

203,919 |

|

|

$ |

221,418 |

|

See accompanying notes

4

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

354,101 |

|

|

$ |

3,960,231 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

358,864 |

|

|

|

349,012 |

|

|

Amortization of deferred financing costs |

|

|

4,383 |

|

|

|

7,739 |

|

|

Amortization of above/below market leases |

|

|

1,717 |

|

|

|

1,708 |

|

|

Amortization of discounts and premiums on debt |

|

|

3,359 |

|

|

|

(19,010 |

) |

|

Amortization of deferred settlements on derivative instruments |

|

|

9,246 |

|

|

|

32,850 |

|

|

Write-off of pursuit costs |

|

|

1,546 |

|

|

|

2,563 |

|

|

Loss from investments in unconsolidated entities |

|

|

1,755 |

|

|

|

1,904 |

|

|

Distributions from unconsolidated entities – return on capital |

|

|

1,345 |

|

|

|

1,482 |

|

|

Net (gain) on sales of investment securities and other investments |

|

|

— |

|

|

|

(55,156 |

) |

|

Net (gain) on sales of real estate properties |

|

|

(124,433 |

) |

|

|

(3,780,835 |

) |

|

Net (gain) on sales of land parcels |

|

|

(19,170 |

) |

|

|

(11,722 |

) |

|

Net (gain) on sales of discontinued operations |

|

|

— |

|

|

|

(15 |

) |

|

Compensation paid with Company Common Shares |

|

|

15,027 |

|

|

|

20,729 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Decrease in deposits – restricted |

|

|

310 |

|

|

|

9,121 |

|

|

Decrease (increase) in mortgage deposits |

|

|

900 |

|

|

|

(840 |

) |

|

(Increase) decrease in other assets |

|

|

(39,845 |

) |

|

|

29,944 |

|

|

Increase in accounts payable and accrued expenses |

|

|

24,503 |

|

|

|

7,837 |

|

|

(Decrease) in accrued interest payable |

|

|

(12,123 |

) |

|

|

(27,046 |

) |

|

(Decrease) in other liabilities |

|

|

(32,476 |

) |

|

|

(42,080 |

) |

|

Increase (decrease) in security deposits |

|

|

1,024 |

|

|

|

(13,340 |

) |

|

Net cash provided by operating activities |

|

|

550,033 |

|

|

|

475,076 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Investment in real estate – acquisitions |

|

|

(57,066 |

) |

|

|

(160,680 |

) |

|

Investment in real estate – development/other |

|

|

(175,887 |

) |

|

|

(312,853 |

) |

|

Capital expenditures to real estate |

|

|

(89,297 |

) |

|

|

(74,450 |

) |

|

Non-real estate capital additions |

|

|

(654 |

) |

|

|

(3,259 |

) |

|

Interest capitalized for real estate under development |

|

|

(16,626 |

) |

|

|

(28,386 |

) |

|

Proceeds from disposition of real estate, net |

|

|

297,298 |

|

|

|

6,415,181 |

|

|

Investments in unconsolidated entities |

|

|

(2,488 |

) |

|

|

(1,829 |

) |

|

Distributions from unconsolidated entities – return of capital |

|

|

113 |

|

|

|

524 |

|

|

Proceeds from sale of investment securities and other investments |

|

|

— |

|

|

|

68,528 |

|

|

(Increase) in deposits on real estate acquisitions and investments, net |

|

|

(177,742 |

) |

|

|

(30,815 |

) |

|

(Increase) decrease in mortgage deposits |

|

|

(4,108 |

) |

|

|

46 |

|

|

Net cash (used for) provided by investing activities |

|

|

(226,457 |

) |

|

|

5,872,007 |

|

See accompanying notes

5

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Debt financing costs |

|

$ |

(2 |

) |

|

$ |

(437 |

) |

|

Mortgage deposits |

|

|

47,127 |

|

|

|

(3,971 |

) |

|

Mortgage notes payable, net: |

|

|

|

|

|

|

|

|

|

Lump sum payoffs |

|

|

(370,420 |

) |

|

|

(556,499 |

) |

|

Scheduled principal repayments |

|

|

(6,971 |

) |

|

|

(4,740 |

) |

|

Notes, net: |

|

|

|

|

|

|

|

|

|

Lump sum payoffs |

|

|

(394,077 |

) |

|

|

(1,500,000 |

) |

|

Line of credit and commercial paper: |

|

|

|

|

|

|

|

|

|

Line of credit proceeds |

|

|

890,000 |

|

|

|

246,000 |

|

|

Line of credit repayments |

|

|

(625,000 |

) |

|

|

(246,000 |

) |

|

Commercial paper proceeds |

|

|

2,608,895 |

|

|

|

1,324,784 |

|

|

Commercial paper repayments |

|

|

(2,131,500 |

) |

|

|

(1,712,472 |

) |

|

Proceeds from Employee Share Purchase Plan (ESPP) |

|

|

2,111 |

|

|

|

2,023 |

|

|

Proceeds from exercise of options |

|

|

8,143 |

|

|

|

26,141 |

|

|

Payment of offering costs |

|

|

(36 |

) |

|

— |

|

|

|

Other financing activities, net |

|

|

(40 |

) |

|

|

(33 |

) |

|

Contributions – Noncontrolling Interests – Partially Owned Properties |

|

|

125 |

|

|

— |

|

|

|

Contributions – Noncontrolling Interests – Operating Partnership |

|

|

— |

|

|

|

1 |

|

|

Distributions: |

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

(369,244 |

) |

|

|

(3,306,704 |

) |

|

Preferred Shares |

|

|

(2,318 |

) |

|

|

(1,545 |

) |

|

Noncontrolling Interests – Operating Partnership |

|

|

(13,913 |

) |

|

|

(130,383 |

) |

|

Noncontrolling Interests – Partially Owned Properties |

|

|

(5,944 |

) |

|

|

(27,681 |

) |

|

Net cash (used for) financing activities |

|

|

(363,064 |

) |

|

|

(5,891,516 |

) |

|

Net (decrease) increase in cash and cash equivalents |

|

|

(39,488 |

) |

|

|

455,567 |

|

|

Cash and cash equivalents, beginning of period |

|

|

77,207 |

|

|

|

42,276 |

|

|

Cash and cash equivalents, end of period |

|

$ |

37,719 |

|

|

$ |

497,843 |

|

See accompanying notes

6

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

SUPPLEMENTAL INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid for interest, net of amounts capitalized |

|

$ |

197,336 |

|

|

$ |

313,480 |

|

|

Net cash paid for income and other taxes |

|

$ |

624 |

|

|

$ |

1,166 |

|

|

Real estate acquisitions/dispositions/other: |

|

|

|

|

|

|

|

|

|

Mortgage loans assumed |

|

$ |

— |

|

|

$ |

43,400 |

|

|

Amortization of deferred financing costs: |

|

|

|

|

|

|

|

|

|

Other assets |

|

$ |

1,206 |

|

|

$ |

1,527 |

|

|

Mortgage notes payable, net |

|

$ |

1,378 |

|

|

$ |

2,617 |

|

|

Notes, net |

|

$ |

1,799 |

|

|

$ |

3,595 |

|

|

Amortization of discounts and premiums on debt: |

|

|

|

|

|

|

|

|

|

Mortgage notes payable, net |

|

$ |

195 |

|

|

$ |

(21,476 |

) |

|

Notes, net |

|

$ |

1,196 |

|

|

$ |

2,054 |

|

|

Line of credit and commercial paper |

|

$ |

1,968 |

|

|

$ |

412 |

|

|

Amortization of deferred settlements on derivative instruments: |

|

|

|

|

|

|

|

|

|

Other liabilities |

|

$ |

(5 |

) |

|

$ |

(72 |

) |

|

Accumulated other comprehensive income |

|

$ |

9,251 |

|

|

$ |

32,922 |

|

|

Write-off of pursuit costs: |

|

|

|

|

|

|

|

|

|

Investment in real estate, net |

|

$ |

1,505 |

|

|

$ |

2,072 |

|

|

Other assets |

|

$ |

21 |

|

|

$ |

390 |

|

|

Accounts payable and accrued expenses |

|

$ |

20 |

|

|

$ |

101 |

|

|

Loss from investments in unconsolidated entities: |

|

|

|

|

|

|

|

|

|

Investments in unconsolidated entities |

|

$ |

1,025 |

|

|

$ |

1,122 |

|

|

Other liabilities |

|

$ |

730 |

|

|

$ |

782 |

|

|

Realized/unrealized (gain) loss on derivative instruments: |

|

|

|

|

|

|

|

|

|

Other assets |

|

$ |

(2,877 |

) |

|

$ |

(8,390 |

) |

|

Notes, net |

|

$ |

(630 |

) |

|

$ |

8,390 |

|

|

Other liabilities |

|

$ |

— |

|

|

$ |

4,467 |

|

|

Accumulated other comprehensive income |

|

$ |

3,507 |

|

|

$ |

(4,467 |

) |

|

Investments in unconsolidated entities: |

|

|

|

|

|

|

|

|

|

Investments in unconsolidated entities |

|

$ |

(1,588 |

) |

|

$ |

(929 |

) |

|

Other liabilities |

|

$ |

(900 |

) |

|

$ |

(900 |

) |

|

Debt financing costs: |

|

|

|

|

|

|

|

|

|

Mortgage notes payable, net |

|

$ |

— |

|

|

$ |

(437 |

) |

|

Notes, net |

|

$ |

(2 |

) |

|

$ |

— |

|

|

Other: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

$ |

— |

|

|

$ |

(50 |

) |

See accompanying notes

7

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended |

|

|

|

|

|

June 30, 2017 |

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

PREFERRED SHARES |

|

|

|

|

|

Balance, beginning of year |

|

$ |

37,280 |

|

|

Balance, end of period |

|

$ |

37,280 |

|

|

COMMON SHARES, $0.01 PAR VALUE |

|

|

|

|

|

Balance, beginning of year |

|

$ |

3,659 |

|

|

Conversion of OP Units into Common Shares |

|

|

11 |

|

|

Exercise of share options |

|

|

2 |

|

|

Share-based employee compensation expense: |

|

|

|

|

|

Restricted shares |

|

|

1 |

|

|

Balance, end of period |

|

$ |

3,673 |

|

|

PAID IN CAPITAL |

|

|

|

|

|

Balance, beginning of year |

|

$ |

8,758,422 |

|

|

Common Share Issuance: |

|

|

|

|

|

Conversion of OP Units into Common Shares |

|

|

14,611 |

|

|

Exercise of share options |

|

|

8,141 |

|

|

Employee Share Purchase Plan (ESPP) |

|

|

2,111 |

|

|

Share-based employee compensation expense: |

|

|

|

|

|

Restricted shares |

|

|

5,381 |

|

|

Share options |

|

|

5,979 |

|

|

ESPP discount |

|

|

414 |

|

|

Offering costs |

|

|

(36 |

) |

|

Supplemental Executive Retirement Plan (SERP) |

|

|

(666 |

) |

|

Change in market value of Redeemable Noncontrolling Interests – Operating Partnership |

|

|

30,351 |

|

|

Adjustment for Noncontrolling Interests ownership in Operating Partnership |

|

|

14,096 |

|

|

Balance, end of period |

|

$ |

8,838,804 |

|

|

RETAINED EARNINGS |

|

|

|

|

|

Balance, beginning of year |

|

$ |

1,543,626 |

|

|

Net income attributable to controlling interests |

|

|

339,783 |

|

|

Common Share distributions |

|

|

(369,964 |

) |

|

Preferred Share distributions |

|

|

(1,546 |

) |

|

Balance, end of period |

|

$ |

1,511,899 |

|

|

ACCUMULATED OTHER COMPREHENSIVE (LOSS) |

|

|

|

|

|

Balance, beginning of year |

|

$ |

(113,909 |

) |

|

Accumulated other comprehensive income – derivative instruments: |

|

|

|

|

|

Unrealized holding gains arising during the period |

|

|

3,507 |

|

|

Losses reclassified into earnings from other comprehensive income |

|

|

9,251 |

|

|

Balance, end of period |

|

$ |

(101,151 |

) |

See accompanying notes

8

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (Continued)

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended |

|

|

|

|

|

June 30, 2017 |

|

|

|

NONCONTROLLING INTERESTS |

|

|

|

|

|

OPERATING PARTNERSHIP |

|

|

|

|

|

Balance, beginning of year |

|

$ |

221,297 |

|

|

Conversion of OP Units held by Noncontrolling Interests into OP Units held by General Partner |

|

|

(14,622 |

) |

|

Equity compensation associated with Noncontrolling Interests |

|

|

5,869 |

|

|

Net income attributable to Noncontrolling Interests |

|

|

12,765 |

|

|

Distributions to Noncontrolling Interests |

|

|

(13,386 |

) |

|

Change in carrying value of Redeemable Noncontrolling Interests – Operating Partnership |

|

|

31,222 |

|

|

Adjustment for Noncontrolling Interests ownership in Operating Partnership |

|

|

(14,096 |

) |

|

Balance, end of period |

|

$ |

229,049 |

|

|

PARTIALLY OWNED PROPERTIES |

|

|

|

|

|

Balance, beginning of year |

|

$ |

10,609 |

|

|

Net income attributable to Noncontrolling Interests |

|

|

1,553 |

|

|

Contributions by Noncontrolling Interests |

|

|

125 |

|

|

Distributions to Noncontrolling Interests |

|

|

(5,984 |

) |

|

Balance, end of period |

|

$ |

6,303 |

|

See accompanying notes

9

ERP OPERATING LI MITED PARTNERSHIP

(Amounts in thousands)

(Unaudited)

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

Investment in real estate |

|

|

|

|

|

|

|

|

|

Land |

|

$ |

5,927,949 |

|

|

$ |

5,899,862 |

|

|

Depreciable property |

|

|

19,123,571 |

|

|

|

18,730,579 |

|

|

Projects under development |

|

|

325,823 |

|

|

|

637,168 |

|

|

Land held for development |

|

|

112,474 |

|

|

|

118,816 |

|

|

Investment in real estate |

|

|

25,489,817 |

|

|

|

25,386,425 |

|

|

Accumulated depreciation |

|

|

(5,671,510 |

) |

|

|

(5,360,389 |

) |

|

Investment in real estate, net |

|

|

19,818,307 |

|

|

|

20,026,036 |

|

|

Cash and cash equivalents |

|

|

37,719 |

|

|

|

77,207 |

|

|

Investments in unconsolidated entities |

|

|

59,246 |

|

|

|

60,141 |

|

|

Deposits – restricted |

|

|

254,378 |

|

|

|

76,946 |

|

|

Escrow deposits – mortgage |

|

|

21,016 |

|

|

|

64,935 |

|

|

Other assets |

|

|

445,909 |

|

|

|

398,883 |

|

|

Total assets |

|

$ |

20,636,575 |

|

|

$ |

20,704,148 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND CAPITAL |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|||||||

|

Mortgage notes payable, net |

|

$ |

3,743,363 |

|

|

$ |

4,119,181 |

|

|

Notes, net |

|

|

4,456,365 |

|

|

|

4,848,079 |

|

|

Line of credit and commercial paper |

|

|

764,361 |

|

|

|

19,998 |

|

|

Accounts payable and accrued expenses |

|

|

137,920 |

|

|

|

147,482 |

|

|

Accrued interest payable |

|

|

48,823 |

|

|

|

60,946 |

|

|

Other liabilities |

|

|

324,002 |

|

|

|

350,466 |

|

|

Security deposits |

|

|

63,648 |

|

|

|

62,624 |

|

|

Distributions payable |

|

|

191,717 |

|

|

|

192,296 |

|

|

Total liabilities |

|

|

9,730,199 |

|

|

|

9,801,072 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable Limited Partners |

|

|

380,519 |

|

|

|

442,092 |

|

|

Capital: |

|

|

|

|

|

|

|

|

|

Partners' Capital: |

|

|

|

|

|

|

|

|

|

Preference Units |

|

|

37,280 |

|

|

|

37,280 |

|

|

General Partner |

|

|

10,354,376 |

|

|

|

10,305,707 |

|

|

Limited Partners |

|

|

229,049 |

|

|

|

221,297 |

|

|

Accumulated other comprehensive (loss) |

|

|

(101,151 |

) |

|

|

(113,909 |

) |

|

Total partners' capital |

|

|

10,519,554 |

|

|

|

10,450,375 |

|

|

Noncontrolling Interests – Partially Owned Properties |

|

|

6,303 |

|

|

|

10,609 |

|

|

Total capital |

|

|

10,525,857 |

|

|

|

10,460,984 |

|

|

Total liabilities and capital |

|

$ |

20,636,575 |

|

|

$ |

20,704,148 |

|

See accompanying notes

10

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Amounts in thousands except per Unit data)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|

Quarter Ended June 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

1,216,219 |

|

|

$ |

1,211,104 |

|

|

$ |

612,299 |

|

|

$ |

594,939 |

|

|

Fee and asset management |

|

|

361 |

|

|

|

3,133 |

|

|

|

181 |

|

|

|

215 |

|

|

Total revenues |

|

|

1,216,580 |

|

|

|

1,214,237 |

|

|

|

612,480 |

|

|

|

595,154 |

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and maintenance |

|

|

201,924 |

|

|

|

205,472 |

|

|

|

99,316 |

|

|

|

96,307 |

|

|

Real estate taxes and insurance |

|

|

169,231 |

|

|

|

157,611 |

|

|

|

87,503 |

|

|

|

77,415 |

|

|

Property management |

|

|

43,841 |

|

|

|

44,486 |

|

|

|

21,589 |

|

|

|

20,991 |

|

|

General and administrative |

|

|

27,799 |

|

|

|

35,013 |

|

|

|

13,626 |

|

|

|

18,296 |

|

|

Depreciation |

|

|

358,864 |

|

|

|

349,012 |

|

|

|

179,896 |

|

|

|

176,127 |

|

|

Total expenses |

|

|

801,659 |

|

|

|

791,594 |

|

|

|

401,930 |

|

|

|

389,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

414,921 |

|

|

|

422,643 |

|

|

|

210,550 |

|

|

|

206,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

|

1,763 |

|

|

|

59,583 |

|

|

|

1,162 |

|

|

|

56,525 |

|

|

Other expenses |

|

|

(2,132 |

) |

|

|

(4,060 |

) |

|

|

(1,042 |

) |

|

|

(1,504 |

) |

|

Interest: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expense incurred, net |

|

|

(197,434 |

) |

|

|

(299,964 |

) |

|

|

(91,224 |

) |

|

|

(86,472 |

) |

|

Amortization of deferred financing costs |

|

|

(4,383 |

) |

|

|

(7,739 |

) |

|

|

(2,087 |

) |

|

|

(2,345 |

) |

|

Income before income and other taxes, (loss) from investments in unconsolidated entities, net gain (loss) on sales of real estate properties and land parcels and discontinued operations |

|

|

212,735 |

|

|

|

170,463 |

|

|

|

117,359 |

|

|

|

172,222 |

|

|

Income and other tax (expense) benefit |

|

|

(482 |

) |

|

|

(763 |

) |

|

|

(220 |

) |

|

|

(413 |

) |

|

(Loss) from investments in unconsolidated entities |

|

|

(1,755 |

) |

|

|

(1,904 |

) |

|

|

(682 |

) |

|

|

(800 |

) |

|

Net gain on sales of real estate properties |

|

|

124,433 |

|

|

|

3,780,835 |

|

|

|

87,726 |

|

|

|

57,356 |

|

|

Net gain (loss) on sales of land parcels |

|

|

19,170 |

|

|

|

11,722 |

|

|

|

(23 |

) |

|

|

— |

|

|

Income from continuing operations |

|

|

354,101 |

|

|

|

3,960,353 |

|

|

|

204,160 |

|

|

|

228,365 |

|

|

Discontinued operations, net |

|

|

— |

|

|

|

(122 |

) |

|

|

— |

|

|

|

35 |

|

|

Net income |

|

|

354,101 |

|

|

|

3,960,231 |

|

|

|

204,160 |

|

|

|

228,400 |

|

|

Net (income) attributable to Noncontrolling Interests – Partially Owned Properties |

|

|

(1,553 |

) |

|

|

(1,545 |

) |

|

|

(765 |

) |

|

|

(781 |

) |

|

Net income attributable to controlling interests |

|

$ |

352,548 |

|

|

$ |

3,958,686 |

|

|

$ |

203,395 |

|

|

$ |

227,619 |

|

|

ALLOCATION OF NET INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preference Units |

|

$ |

1,546 |

|

|

$ |

1,545 |

|

|

$ |

773 |

|

|

$ |

772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Partner |

|

$ |

338,237 |

|

|

$ |

3,805,052 |

|

|

$ |

195,268 |

|

|

$ |

218,067 |

|

|

Limited Partners |

|

|

12,765 |

|

|

|

152,089 |

|

|

|

7,354 |

|

|

|

8,780 |

|

|

Net income available to Units |

|

$ |

351,002 |

|

|

$ |

3,957,141 |

|

|

$ |

202,622 |

|

|

$ |

226,847 |

|

|

Earnings per Unit – basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations available to Units |

|

$ |

0.92 |

|

|

$ |

10.43 |

|

|

$ |

0.53 |

|

|

$ |

0.60 |

|

|

Net income available to Units |

|

$ |

0.92 |

|

|

$ |

10.43 |

|

|

$ |

0.53 |

|

|

$ |

0.60 |

|

|

Weighted average Units outstanding |

|

|

379,619 |

|

|

|

378,612 |

|

|

|

379,733 |

|

|

|

378,934 |

|

|

Earnings per Unit – diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations available to Units |

|

$ |

0.92 |

|

|

$ |

10.36 |

|

|

$ |

0.53 |

|

|

$ |

0.59 |

|

|

Net income available to Units |

|

$ |

0.92 |

|

|

$ |

10.36 |

|

|

$ |

0.53 |

|

|

$ |

0.59 |

|

|

Weighted average Units outstanding |

|

|

382,505 |

|

|

|

382,012 |

|

|

|

382,692 |

|

|

|

382,065 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared per Unit outstanding |

|

$ |

1.0075 |

|

|

$ |

9.0075 |

|

|

$ |

0.50375 |

|

|

$ |

0.50375 |

|

See accompanying notes

11

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Continued)

(Amounts in thousands except per Unit data)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|

Quarter Ended June 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

354,101 |

|

|

$ |

3,960,231 |

|

|

$ |

204,160 |

|

|

$ |

228,400 |

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) – derivative instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gains (losses) arising during the period |

|

|

3,507 |

|

|

|

(4,467 |

) |

|

|

3,507 |

|

|

|

(1,561 |

) |

|

Losses reclassified into earnings from other comprehensive income |

|

|

9,251 |

|

|

|

32,922 |

|

|

|

4,668 |

|

|

|

4,268 |

|

|

Other comprehensive income (loss) – foreign currency: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustments arising during the period |

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

(25 |

) |

|

Other comprehensive income |

|

|

12,758 |

|

|

|

28,505 |

|

|

|

8,175 |

|

|

|

2,682 |

|

|

Comprehensive income |

|

|

366,859 |

|

|

|

3,988,736 |

|

|

|

212,335 |

|

|

|

231,082 |

|

|

Comprehensive (income) attributable to Noncontrolling Interests – Partially Owned Properties |

|

|

(1,553 |

) |

|

|

(1,545 |

) |

|

|

(765 |

) |

|

|

(781 |

) |

|

Comprehensive income attributable to controlling interests |

|

$ |

365,306 |

|

|

$ |

3,987,191 |

|

|

$ |

211,570 |

|

|

$ |

230,301 |

|

See accompanying notes

12

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

354,101 |

|

|

$ |

3,960,231 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

358,864 |

|

|

|

349,012 |

|

|

Amortization of deferred financing costs |

|

|

4,383 |

|

|

|

7,739 |

|

|

Amortization of above/below market leases |

|

|

1,717 |

|

|

|

1,708 |

|

|

Amortization of discounts and premiums on debt |

|

|

3,359 |

|

|

|

(19,010 |

) |

|

Amortization of deferred settlements on derivative instruments |

|

|

9,246 |

|

|

|

32,850 |

|

|

Write-off of pursuit costs |

|

|

1,546 |

|

|

|

2,563 |

|

|

Loss from investments in unconsolidated entities |

|

|

1,755 |

|

|

|

1,904 |

|

|

Distributions from unconsolidated entities – return on capital |

|

|

1,345 |

|

|

|

1,482 |

|

|

Net (gain) on sales of investment securities and other investments |

|

|

— |

|

|

|

(55,156 |

) |

|

Net (gain) on sales of real estate properties |

|

|

(124,433 |

) |

|

|

(3,780,835 |

) |

|

Net (gain) on sales of land parcels |

|

|

(19,170 |

) |

|

|

(11,722 |

) |

|

Net (gain) on sales of discontinued operations |

|

|

— |

|

|

|

(15 |

) |

|

Compensation paid with Company Common Shares |

|

|

15,027 |

|

|

|

20,729 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Decrease in deposits – restricted |

|

|

310 |

|

|

|

9,121 |

|

|

Decrease (increase) in mortgage deposits |

|

|

900 |

|

|

|

(840 |

) |

|

(Increase) decrease in other assets |

|

|

(39,845 |

) |

|

|

29,944 |

|

|

Increase in accounts payable and accrued expenses |

|

|

24,503 |

|

|

|

7,837 |

|

|

(Decrease) in accrued interest payable |

|

|

(12,123 |

) |

|

|

(27,046 |

) |

|

(Decrease) in other liabilities |

|

|

(32,476 |

) |

|

|

(42,080 |

) |

|

Increase (decrease) in security deposits |

|

|

1,024 |

|

|

|

(13,340 |

) |

|

Net cash provided by operating activities |

|

|

550,033 |

|

|

|

475,076 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Investment in real estate – acquisitions |

|

|

(57,066 |

) |

|

|

(160,680 |

) |

|

Investment in real estate – development/other |

|

|

(175,887 |

) |

|

|

(312,853 |

) |

|

Capital expenditures to real estate |

|

|

(89,297 |

) |

|

|

(74,450 |

) |

|

Non-real estate capital additions |

|

|

(654 |

) |

|

|

(3,259 |

) |

|

Interest capitalized for real estate under development |

|

|

(16,626 |

) |

|

|

(28,386 |

) |

|

Proceeds from disposition of real estate, net |

|

|

297,298 |

|

|

|

6,415,181 |

|

|

Investments in unconsolidated entities |

|

|

(2,488 |

) |

|

|

(1,829 |

) |

|

Distributions from unconsolidated entities – return of capital |

|

|

113 |

|

|

|

524 |

|

|

Proceeds from sale of investment securities and other investments |

|

|

— |

|

|

|

68,528 |

|

|

(Increase) in deposits on real estate acquisitions and investments, net |

|

|

(177,742 |

) |

|

|

(30,815 |

) |

|

(Increase) decrease in mortgage deposits |

|

|

(4,108 |

) |

|

|

46 |

|

|

Net cash (used for) provided by investing activities |

|

|

(226,457 |

) |

|

|

5,872,007 |

|

See accompanying notes

13

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Debt financing costs |

|

$ |

(2 |

) |

|

$ |

(437 |

) |

|

Mortgage deposits |

|

|

47,127 |

|

|

|

(3,971 |

) |

|

Mortgage notes payable, net: |

|

|

|

|

|

|

|

|

|

Lump sum payoffs |

|

|

(370,420 |

) |

|

|

(556,499 |

) |

|

Scheduled principal repayments |

|

|

(6,971 |

) |

|

|

(4,740 |

) |

|

Notes, net: |

|

|

|

|

|

|

|

|

|

Lump sum payoffs |

|

|

(394,077 |

) |

|

|

(1,500,000 |

) |

|

Line of credit and commercial paper: |

|

|

|

|

|

|

|

|

|

Line of credit proceeds |

|

|

890,000 |

|

|

|

246,000 |

|

|

Line of credit repayments |

|

|

(625,000 |

) |

|

|

(246,000 |

) |

|

Commercial paper proceeds |

|

|

2,608,895 |

|

|

|

1,324,784 |

|

|

Commercial paper repayments |

|

|

(2,131,500 |

) |

|

|

(1,712,472 |

) |

|

Proceeds from EQR's Employee Share Purchase Plan (ESPP) |

|

|

2,111 |

|

|

|

2,023 |

|

|

Proceeds from exercise of EQR options |

|

|

8,143 |

|

|

|

26,141 |

|

|

Payment of offering costs |

|

|

(36 |

) |

|

— |

|

|

|

Other financing activities, net |

|

|

(40 |

) |

|

|

(33 |

) |

|

Contributions – Noncontrolling Interests – Partially Owned Properties |

|

|

125 |

|

|

— |

|

|

|

Contributions – Limited Partners |

|

|

— |

|

|

|

1 |

|

|

Distributions: |

|