UNITED STATES

|

Large accelerated filer

x

|

Accelerated filer

o

|

Non-accelerated filer

o

|

|

U.S. GAAP

x

|

International Financial Reporting

o

Standards as issued by the International

Accounting Standards Board

|

Other

o

|

|

Page

|

|||

| 2 | |||

| 2 | |||

|

Item 1.

|

3 | ||

|

Item 2.

|

3 | ||

|

Item 3.

|

3 | ||

|

Item 4.

|

12 | ||

|

Item 4A.

|

39 | ||

|

Item 5.

|

40 | ||

|

Item 6.

|

60 | ||

|

Item 7.

|

72 | ||

|

Item 8.

|

74 | ||

|

Item 9.

|

76 | ||

|

Item 10.

|

77 | ||

|

Item 11.

|

92 | ||

|

Item 12.

|

94 | ||

|

Item 13.

|

94 | ||

|

Item 14.

|

94 | ||

|

Item 15.

|

95 | ||

|

Item 16A.

|

95 | ||

|

Item 16B.

|

95 | ||

|

Item 16C.

|

96 | ||

|

Item 16D.

|

96 | ||

|

Item 16E.

|

96 | ||

|

Item 16F.

|

96 | ||

|

Item 16G.

|

96 | ||

|

Item 17.

|

96 | ||

|

Item 18.

|

96 | ||

|

Item 19.

|

97 | ||

|

|

•

|

the scope and length of customer contracts;

|

|

|

•

|

governmental regulations and approvals;

|

|

|

•

|

changes in governmental budgeting priorities;

|

|

|

•

|

general market, political and economic conditions in the countries in which we operate or sell, including Israel and the United States among others;

|

|

|

•

|

differences in anticipated and actual program performance, including the ability to perform under long-term fixed-price contracts;

|

|

|

•

|

the impact on our backlog from export restrictions by the Government of Israel;

|

|

|

•

|

inventory write-downs and possible liabilities to customers from program cancellations due to political relations between Israel and countries where our customers may be located; and

|

|

|

•

|

the outcome of legal and/or regulatory proceedings.

|

|

Identity of Direc

to

rs, Senior Management and Advisers.

|

|

Item 3.

|

Key Information.

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||

| (U.S. dollars in millions except for share and per share amounts) | |||||||||||||||||||

|

Income Statement Data:

|

|||||||||||||||||||

|

Revenues

|

$

|

1,981.8

|

$

|

2,638.3

|

$

|

2,832.4

|

$

|

2,670.1

|

$

|

2,817.5

|

|||||||||

|

Cost of revenues

|

1,454.9

|

1,870.9

|

1,982.9

|

1,872.2

|

2,085.5

|

||||||||||||||

|

Restructuring expenses

|

10.5

|

–

|

–

|

–

|

–

|

||||||||||||||

|

Gross profit

|

516.4

|

767.4

|

849.5

|

797.9

|

732.0

|

||||||||||||||

|

Research and development expenses, net

|

127.0

|

185.0

|

216.8

|

234.1

|

241.1

|

||||||||||||||

|

Marketing and selling

expenses

|

157.4

|

198.2

|

250.9

|

230.0

|

235.9

|

||||||||||||||

|

General and administrative expenses

|

107.4

|

134.2

|

119.3

|

131.2

|

139.3

|

||||||||||||||

|

Acquired in-process research and development (IPR&D) and other expenses (income)

|

16.6

|

1.0

|

–

|

(4.7

|

)

|

–

|

|||||||||||||

|

Total operating expenses

|

408.4

|

518.4

|

587.0

|

590.6

|

616.3

|

||||||||||||||

|

Operating income

|

108.0

|

249.0

|

262.5

|

207.3

|

115.7

|

||||||||||||||

|

Finance expense, net

|

19.4

|

36.8

|

15.6

|

21.3

|

13.6

|

||||||||||||||

|

Other income/(expense), net

|

0.4

|

94.3

|

0.4

|

13.3

|

1.9

|

||||||||||||||

|

Income before taxes on

income

|

89.0

|

306.5

|

247.3

|

199.3

|

104.0

|

||||||||||||||

|

Taxes on income

|

13.8

|

54.3

|

38.1

|

24.0

|

13.6

|

||||||||||||||

|

Equity in net losses/earnings of affiliated companies

|

14.5

|

14.4

|

19.3

|

18.8

|

15.4

|

||||||||||||||

|

Net income from

continuing operations, net

|

89.7

|

266.6

|

228.5

|

194.1

|

105.8

|

||||||||||||||

|

Income (loss) from

discontinued operations, net

|

–

|

–

|

–

|

0.9

|

(16.0)

|

||||||||||||||

|

Net income

|

89.7

|

266.6

|

228.5

|

195.0

|

89.8

|

||||||||||||||

|

Less: net income (loss) attributed to non-controlling interests

|

13.0

|

62.4

|

13.6

|

11.1

|

(0.5)

|

||||||||||||||

|

Income attributed to Elbit Systems’ shareholders

|

76.7

|

204.2

|

*

|

214.9

|

183.5

|

90.3

|

|||||||||||||

|

Earnings per share:

|

|||||||||||||||||||

|

Basic net earnings (loss) per share

|

|||||||||||||||||||

|

Continuing operations

|

$

|

1.82

|

4.85

|

*

|

5.08

|

4.29

|

2.33

|

||||||||||||

|

Discontinued operations

|

--

|

--

|

--

|

0.01

|

(0.22)

|

||||||||||||||

|

Total

|

$

|

1.82

|

4.85

|

*

|

5.08

|

4.30

|

2.11

|

||||||||||||

|

Diluted net earnings (loss) per share

|

|||||||||||||||||||

|

Continuing operations

|

1.81

|

4.78

|

*

|

5.00

|

4.24

|

2.31

|

|||||||||||||

|

Discontinued operations

|

--

|

--

|

--

|

0.01

|

(0.22)

|

||||||||||||||

|

Total

|

$

|

1.81

|

4.78

|

*

|

5.00

|

4.25

|

2.09

|

||||||||||||

|

December 31,

|

||||||||||||||||||||

|

2007

|

2008

|

2009

|

2010

|

2011

|

||||||||||||||||

|

(U.S. dollars in millions except for share and per share amounts)

|

||||||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash, cash equivalents and short-term investments

|

$ | 376 | $ | 278 | $ | 280 | $ | 215 | $ | 224 | ||||||||||

|

Working capital

|

177 | 290 | 392 | 382 | 236 | |||||||||||||||

|

Long-term deposits and marketable securities

|

42 | 41 | 44 | 52 | 12 | |||||||||||||||

|

Long-term trade receivables

|

– | – | 17 | 90 | 163 | |||||||||||||||

|

Property, plant and equipment,

net

|

353 | 384 | 405 | 504 | 518 | |||||||||||||||

|

Total assets

|

2,789 | 2,940 | 3,054 | 3,616 | 3,721 | |||||||||||||||

|

Long-term debt

|

431 | 270 | 389 | 292 | 302 | |||||||||||||||

|

Series A Notes, net of current maturities

|

– | – | – | 273 | 235 | |||||||||||||||

|

Capital stock

|

307 | 300 | 284 | 294 | 245 | |||||||||||||||

|

Elbit Systems shareholders’

equity

|

536 | 724 | 833 | 967 | 898 | |||||||||||||||

|

Non-controlling interests

|

20 | 76 | 24 | 39 | 29 | |||||||||||||||

|

Total equity

|

556 | 800 | 857 | 1,005 | 928 | |||||||||||||||

|

Number of outstanding ordinary shares of NIS 1 par value (in thousands)

|

42,060 | 42,079 | 42,531 | 42,693 | 42,608 | |||||||||||||||

|

Dividends paid per ordinary share with respect to the applicable year

|

$ | 0.67 | $ | 1.42 | $ | 1.82 | $ | 1.44 | $ | 1.44 | ||||||||||

|

|

•

|

unexpected changes in regulatory requirements;

|

|

|

•

|

termination or non-renewal of export licenses;

|

|

|

•

|

changes in governmental defense budgets and national priorities;

|

|

|

•

|

imposition of tariffs and other barriers and restrictions;

|

|

|

•

|

burdens of complying with a variety of foreign laws;

|

|

|

•

|

political and economic instability; and

|

|

|

•

|

changes in diplomatic and trade relationships.

|

|

|

•

|

identify emerging technological trends in our current and future markets;

|

|

|

•

|

identify additional uses for our existing technology to address customer needs in our current or future markets;

|

|

|

•

|

develop and maintain competitive products and services for our current and future markets;

|

|

|

•

|

enhance our offerings by adding innovative features that differentiate our offerings from those of our competitors;

|

|

|

•

|

develop, manufacture and bring solutions to the market quickly at cost-effective prices;

|

|

|

•

|

develop working prototypes as a condition to receiving contract awards; or

|

|

|

•

|

effectively structure our business, through the use of joint ventures, teaming agreements and other forms of alliances, to reflect the competitive environment.

|

|

|

•

|

some foreign countries may not protect proprietary rights as comprehensively as the laws of the United States and Israel;

|

|

|

•

|

detecting infringements and enforcing proprietary rights may be time consuming and costly, diverting management’s attention and company resources;

|

|

|

•

|

measures such as non-disclosure agreements afford only limited protection;

|

|

|

•

|

unauthorized parties may copy aspects of our products or technologies to develop similar products or technologies or obtain and use information that we regard as proprietary;

|

|

|

•

|

our patents may expire, thus providing competitors access to the applicable technology;

|

|

|

•

|

competitors may independently develop products that are substantially equivalent or superior to our products or circumvent our intellectual property rights; and

|

|

|

•

|

competitors may register patents in technologies relevant to our business areas.

|

|

|

•

|

the difficulty in integrating newly-acquired businesses and operations in an efficient and cost-effective manner and the risk that we encounter significant unanticipated costs or other problems associated with integration;

|

|

|

•

|

failure to meet the challenges of achieving strategic objectives, cost savings and other benefits expected from acquisitions could lead to impairment of intangible assets related to the acquired companies;

|

|

|

•

|

the risk that our markets do not evolve as anticipated and that the technologies acquired do not prove to be those needed to be successful in those markets;

|

|

|

•

|

the risk that we assume significant liabilities that exceed the enforceability or other limitations of applicable indemnification provisions, if any, or the financial resources of any indemnifying parties, including indemnity for regulatory compliance issues that may result in our incurring successor liability;

|

|

|

•

|

the potential loss of key employees of the acquired businesses;

|

|

|

•

|

the risk of diverting the attention of senior management from our existing operations; and

|

|

|

•

|

the risk that certain of our newly acquired operating subsidiaries in various countries could be subject to more restrictive regulations by the local authorities after our acquisition.

|

|

Information on the C

om

pany.

|

|

|

•

|

military aircraft and helicopter systems;

|

|

|

•

|

helmet mounted systems;

|

|

|

•

|

commercial aviation systems and aerostructures;

|

|

|

•

|

unmanned aircraft systems;

|

|

|

•

|

land vehicle systems;

|

|

|

•

|

command, control, communications, computer and intelligence (C4I) systems;

|

|

|

•

|

electro-optic and countermeasures systems;

|

|

|

•

|

homeland security systems;

|

|

|

•

|

EW and signal intelligence systems; and

|

|

|

•

|

various commercial activities.

|

|

2009

|

2010

|

2011

|

||||||||||

|

(U.S. dollars in millions)

|

||||||||||||

|

Airborne systems:

|

$ | 693 | $ | 791 | $ | 970 | ||||||

|

Land systems:

|

450 | 363 | 405 | |||||||||

|

C4ISR systems:

|

1,169 | 1,019 | 996 | |||||||||

|

Electro-optic systems:

|

406 | 369 | 300 | |||||||||

|

Other (mainly non-defense engineering and production services):

|

114 | 128 | 146 | |||||||||

|

Total:

|

$ | 2,832 | $ | 2,670 | $ | 2,817 | ||||||

|

2009

|

2010

|

2011

|

||||||||||

|

Israel

|

22% | 24% | 25% | |||||||||

|

United States

|

29% | 32% | 32% | |||||||||

|

Europe

|

26% | 20% | 19% | |||||||||

|

Others

|

23% | 24% | 24% | |||||||||

U.S. Subsidiaries

|

|

|

Israel

(1)

|

|

U.S.

(2)

|

|

Other Countries

(3)

|

|

Owned

|

2,193,000 square feet

|

713,000 square feet

|

1,063,000 square feet

|

|||

|

Leased

|

2,024,000 square feet

|

618,000 square feet

|

300,000 square feet

|

|

(1)

|

Includes offices, development and engineering facilities, manufacturing facilities, maintenance facilities, hangar facilities and a landing strip in various locations in Israel used by Elbit Systems and our various majority-owned Israeli subsidiaries.

|

|

(2)

|

Includes offices, development and engineering facilities, manufacturing facilities and maintenance facilities of Elbit Systems of America primarily in Texas, New Hampshire, Florida, Alabama and Virginia. Elbit Systems of America’s facilities in Texas, New Hampshire and Alabama are located on a total of approximately153 acres of land owned by Elbit Systems of America. This does not include properties not held by Elbit Systems of America, including approximately 6,000 square feet leased by our wholly-owned subsidiary Elmec Inc. in Massachusetts.

|

|

(3)

|

Includes offices, design and engineering facilities and manufacturing facilities in Europe, Brazil, Australia and Asia.

|

|

2009

|

2010

|

2011

|

||||||||||

|

(U.S. dollars in millions)

|

||||||||||||

|

Total Investment

|

$ | 245.8 | $ | 268.6 | $ | 288.7 | ||||||

|

Less Participation*

|

29.0 | 34.5 | 47.6 | |||||||||

|

Net Investment

|

$ | 216.8 | $ | 234.1 | $ | 241.1 | ||||||

|

*

|

See above – “Government Rights in Data” and see below – “Conditions in Israel – Chief Scientist (OCS) and Investment Center Funding.”

|

|

|

•

|

adequate service of process has been made and the defendant has had a reasonable opportunity to be heard;

|

|

|

•

|

the judgment and its enforcement are not contrary to the law, public policy, security or sovereignty of the State of Israel;

|

|

|

•

|

the judgment was not obtained by fraud and does not conflict with any other valid judgment in the same matter between the same parties;

|

|

|

•

|

an action between the same parties in the same matter is not pending in any Israeli court at the time the lawsuit is instituted in the foreign court; and

|

|

|

•

|

the judgment is no longer subject to a right of appeal.

|

|

Unresolved

Staf

f Comments.

|

|

Item 5.

|

Operating and

Financial Review

and Prospects.

|

|

|

•

|

Revenue Recognition.

|

|

|

•

|

Business Combinations and Purchase Price Allocation.

|

|

|

•

|

Impairment of Long-Lived Assets and Goodwill.

|

|

|

•

|

Other-Than-Temporary Decline in Value of Investments in Investee.

|

|

|

•

|

Useful Lives of Long-Lived Assets.

|

|

|

•

|

Taxes on Income.

|

|

|

•

|

Stock-Based Compensation Expense.

|

| Year ended December 31, | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

| (in thousands of U.S. dollars except per share data) | ||||||||||||||||||||||||

|

Total revenues

|

$ | 2,817,465 | 100.0 | $ | 2,670,133 | 100.0 | $ | 2,832,437 | 100.0 | |||||||||||||||

|

Cost of revenues

|

2,085,451 | 74.0 | 1,872,263 | 70.1 | 1,982,954 | 70.0 | ||||||||||||||||||

|

Gross profit

|

732,014 | 26.0 | 797,870 | 29.9 | 849,483 | 30.0 | ||||||||||||||||||

|

Research and development (R&D) expenses

|

288,668 | 10.2 | 268,578 | 10.0 | 245,812 | 8.7 | ||||||||||||||||||

|

Less – participation

|

(47,576 | ) | (1.6 | ) | (34,447 | ) | (1.29 | ) | (29,060 | ) | (1.0 | ) | ||||||||||||

|

R&D expenses, net

|

241,092 | 8.6 | 234,131 | 8.8 | 216,752 | 7.7 | ||||||||||||||||||

|

Marketing and selling expenses

|

235,909 | 8.4 | 229,942 | 8.6 | 250,963 | 8.9 | ||||||||||||||||||

|

General and administrative expenses

|

139,349 | 4.9 | 131,200 | 4.9 | 119,311 | 4.2 | ||||||||||||||||||

|

Acquired IPR&D and other expenses

|

– | – | (4,756 | ) | (0.2 | ) | – | – | ||||||||||||||||

| 616,350 | 21.9 | 590,517 | 22.1 | 587,026 | 20.7 | |||||||||||||||||||

|

Operating income

|

115,664 | 4.1 | 207,353 | 7.8 | 262,457 | 9.3 | ||||||||||||||||||

|

Financial expenses, net

|

(13,569 | ) | (0.5 | ) | (21,251 | ) | (0.8 | ) | (15,585 | ) | (0.6 | ) | ||||||||||||

|

Other income, net

|

1,909 | 0.1 | 13,259 | 0.5 | 458 | – | ||||||||||||||||||

|

Income before taxes on income

|

104,004 | 3.7 | 199,361 | 7.5 | 247,330 | 8.7 | ||||||||||||||||||

|

Taxes on income

|

13,624 | 0.5 | 24,037 | 0.9 | 38,109 | 1.3 | ||||||||||||||||||

| 90,380 | 3.2 | 175,324 | 6.6 | 209,221 | 7.4 | |||||||||||||||||||

|

Equity in net earnings of affiliated companies and partnership

|

15,377 | 0.6 | 18,796 | 0.7 | 19,292 | 0.7 | ||||||||||||||||||

|

Income from continuing operations

|

$ | 105,757 | 3.8 | $ | 194,120 | 7.3 | $ | 228,513 | 8.1 | |||||||||||||||

|

Income (loss) from discontinued operations, net

|

(15,977 | ) | (0.6 | ) | 921 | – | – | |||||||||||||||||

|

Net income

|

89,780 | 3.2 | 195,041 | 7.3 | 228,513 | 8.1 | ||||||||||||||||||

|

Less – net loss (income) attributable to non-controlling interests

|

$ | 508 | $ | (11,543 | ) | (0.4 | ) | $ | (13,566 | ) | (0.5 | ) | ||||||||||||

|

Net income attributable to the Company’s shareholders

|

$ | 90,288 | 3.2 | $ | 183,498 | 6.9 | $ | 214,947 | 7.6 | |||||||||||||||

|

Diluted net earnings (loss) per share:

Continuing operations

|

$ | 2.48 | $ | 4.24 | $ | 5.00 | ||||||||||||||||||

|

Discontinued operations

|

(0.37 | ) | 0.01 | – | ||||||||||||||||||||

|

Total

|

$ | 2.11 | $ | 4.25 | $ | 5.00 | ||||||||||||||||||

|

Year ended

|

||||||||||||||||

|

December 31, 2011

|

December 31, 2010

|

|||||||||||||||

|

$ millions

|

%

|

$ millions

|

%

|

|||||||||||||

|

Airborne systems

|

969.4 | 34.4 | 791.1 | 29.6 | ||||||||||||

|

Land systems

|

405.3 | 14.4 | 363.2 | 13.6 | ||||||||||||

|

C4ISR systems

|

996.4 | 35.4 | 1,019.1 | 38.2 | ||||||||||||

|

Electro-optic systems

|

300.2 | 10.6 | 368.8 | 13.8 | ||||||||||||

|

Other (mainly non-defense engineering and production services)

|

146.2 | 5.2 | 127.9 | 4.8 | ||||||||||||

|

Total

|

2,817.5 | 100.0 | 2,670.1 | 100.0 | ||||||||||||

|

Year ended

|

||||||||||||||||

|

December 31, 2011

|

December 31, 2010

|

|||||||||||||||

|

$ millions

|

%

|

$ millions

|

%

|

|||||||||||||

|

Israel

|

697.8 | 24.8 | 651.0 | 24.4 | ||||||||||||

|

United States

|

890.4 | 31.6 | 844.0 | 31.6 | ||||||||||||

|

Europe

|

545.5 | 19.4 | 541.7 | 20.3 | ||||||||||||

|

Other countries

|

683.8 | 24.2 | 633.4 | 23.7 | ||||||||||||

|

Total

|

2,817.5 | 100.0 | 2,670.1 | 100.0 | ||||||||||||

|

Year ended

|

||||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

$ millions

|

%

|

$ millions

|

%

|

|||||||||||||

|

Airborne systems

|

791.1 | 29.6 | 693.2 | 24.5 | ||||||||||||

|

Land systems

|

363.2 | 13.6 | 449.7 | 15.9 | ||||||||||||

|

C4ISR systems

|

1,019.1 | 38.2 | 1,168.8 | 41.3 | ||||||||||||

|

Electro-optic systems

|

368.8 | 13.8 | 406.4 | 14.3 | ||||||||||||

|

Other (mainly non-defense engineering and production services)

|

127.9 | 4.8 | 114.3 | 4.0 | ||||||||||||

|

Total

|

2,670.1 | 100.0 | 2,832.4 | 100.0 | ||||||||||||

|

Year ended

|

||||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

$ millions

|

%

|

$ millions

|

%

|

|||||||||||||

|

Israel

|

651.0 | 24.4 | 627.3 | 22.1 | ||||||||||||

|

United States

|

844.0 | 31.6 | 813.4 | 28.7 | ||||||||||||

|

Europe

|

541.7 | 20.3 | 728.2 | 25.7 | ||||||||||||

|

Other countries

|

633.4 | 23.7 | 663.5 | 23.5 | ||||||||||||

|

Total

|

2,670.1 | 100.0 | 2,832.4 | 100.0 | ||||||||||||

|

Forward

|

Notional

Amount*

|

Unrealized

Gain (Loss)

|

||||||

|

Buy US$ and Sell:

|

||||||||

|

Euro

|

154,251 | 7.8 | ||||||

|

GBP

|

45,095 | 2.4 | ||||||

|

NIS

|

- | - | ||||||

|

Other various currencies

|

34,122 | 0.2 | ||||||

|

Forward

|

Notional

Amount*

|

Unrealized

Gain (Loss)

|

||||||

|

Sell US$ and Buy:

|

||||||||

|

Euro

|

57,022 | (2.7 | ) | |||||

|

GBP

|

30,868 | (0.7 | ) | |||||

|

NIS

|

654,106 | (19.2 | ) | |||||

|

Other various currencies

|

14,073 | (1.6 | ) | |||||

|

Options

|

Notional

Amount*

|

Unrealized

Gain (Loss)

|

||||||

|

Buy US$ and Sell:

|

||||||||

| NIS | 12,000 | (0.7 | ) | |||||

|

Sell US$ and Buy:

|

||||||||

|

NIS

|

12,000 | 0 | ||||||

|

*

|

Notional amount information is based on the foreign exchange rate at year end.

|

|

Less than

1 year

|

2-3 years

|

4-5 years

|

More than

5 years

|

|||||||||||||

|

(U.S. dollars in millions)

|

||||||||||||||||

|

1. Long-Term Debt Obligations

|

98 | 292 | 10 | – | ||||||||||||

|

2. Series A Notes

|

30 | 60 | 60 | 110 | ||||||||||||

|

3. Operating Lease Obligations*

|

37 | 45 | 20 | 15 | ||||||||||||

|

4. Purchase Obligations*

|

810 | 173 | 38 | 5 | ||||||||||||

|

5. Other Long-Term Liabilities Reflected on the Company’s Balance Sheet under U.S.

GAAP**

|

- | - | - | - | ||||||||||||

|

6. Other Long-Term Liabilities***

|

- | - | - | - | ||||||||||||

|

Total

|

975 | 570 | 128 | 130 | ||||||||||||

|

*

|

For further description of the Purchase Obligations see above “Long-Term Arrangements and Commitments – Purchase Commitments” and See Item 18. Financial Statements – Note 20(H).

|

|

**

|

The obligation amount does not include an amount of $394 million of pension and employee termination liabilities. See Item 18. Financial Statements – Notes 2(R) and 17. The obligation amount also does not include an amount of $51 million of tax reserve related to uncertain tax positions. See Item 18. Financial Statements – Note 18.

|

|

***

|

See below “Off-Balance Sheet Transactions.”

|

|

2011

|

2010

|

2009

|

||||||||||

|

GAAP gross profit

|

732.0 | 797.9 | 849.5 | |||||||||

|

Adjustments:

|

||||||||||||

|

Amortization of intangible assets

|

30.9 | 25.0 | 22.2 | |||||||||

|

Cessation of program

(1)

|

72.8 | – | – | |||||||||

|

Reorganization, restructuring and other related expenses

(2)

|

– | 12.8 | – | |||||||||

|

Non-GAAP gross profit

|

835.7 | 835.7 | 871.7 | |||||||||

|

Percent of revenues

|

29.7 | 31.3 | % | 30.8 | % | |||||||

|

GAAP operating income

|

115.7 | 207.4 | 262.5 | |||||||||

|

Adjustments:

|

||||||||||||

|

Amortization of intangible assets

|

57.3 | 47.7 | 44.0 | |||||||||

|

Cessation of program

(1)

|

72.8 | – | – | |||||||||

|

Reorganization, restructuring and other related expenses

(2)

|

– | 16.4 | – | |||||||||

|

Impairment of investments

(3)

|

– | 1.3 | 1.4 | |||||||||

|

Gain from changes in holdings

(4)

|

– | (4.8 | ) | – | ||||||||

|

Non-GAAP operating income

|

245.8 | 268.0 | 307.9 | |||||||||

|

Percent of revenues

|

8.7 | % | 10.0 | % | 10.9 | % | ||||||

|

GAAP net income attributable to Elbit Systems’ shareholders

|

90.3 | 183.5 | 214.9 | |||||||||

|

Adjustments:

|

||||||||||||

|

Amortization of intangible assets

|

57.3 | 47.7 | 44.0 | |||||||||

|

Cessation of program

(1)

|

72.8 | – | – | |||||||||

|

Reorganization, restructuring and other related expenses

(2)

|

– | 16.4 | – | |||||||||

|

Impairment of investments

(3)

|

0.5 | 1.3 | 1.4 | |||||||||

|

Gain from changes in holdings

(4)

|

– | ) | (17.6 | ) | (1.0 | ) | ||||||

|

Adjustment of loss (gain) from discontinued operations, net

(5)

|

9.4 | (0.5 | ) | – | ||||||||

|

Related tax benefits

|

(23.7 | ) | (8.9 | ) | (9.0 | ) | ||||||

|

Non-GAAP net income attributable to Elbit Systems’ shareholders

|

206.6 | 221.9 | 250.3 | |||||||||

|

Percent of revenues

|

7.3 | % | 8.3 | % | 8.8 | % | ||||||

|

Non-GAAP diluted net EPS

|

4.8 | 5.1 | 5.8 | |||||||||

|

|

(1)

|

Adjustment of expenses related to cessation of program, which resulted in write-off of inventories and other related costs.

|

|

|

(2)

|

Adjustment of reorganization, restructuring and other related expenses in 2010 were mainly due to write-off of inventories in the amount of approximately $13 million related to the acquisitions of Soltam and ITL.

|

|

|

(3)

|

Impairment of investments in 2011 was due to a

djustment of impairment in

available-for-sale

marketable securities

, and in 2010 and 2009 were due to the impairment of

intangible assets.

|

|

|

(4)

|

Adjustment of gain from changes in holdings includes the income from the sale of Mediguide shares ($1 million in 2009 and $12.6 million in 2010) and a gain of $4.8 million from a r

evaluation of a previously held investment due to accounting treatment as a business combination achieved in stages

in 2010.

|

|

|

(5)

|

Adjustment of loss from discontinued operations, net of tax and minority interest, related to impairment of held-for-sale investment acquired during 2010, as part of the acquisition of the Mikal group of companies.

|

|

Directors, Senior

Management and

Employees.

|

|

Name

|

Age

|

Director

Since

|

|||||

|

Michael Federmann (Chairman)

|

68

|

2000

|

|||||

|

Moshe Arad

|

77

|

2005

|

|||||

|

Avraham Asheri

|

74

|

2000

|

|||||

|

Rina Baum

|

66

|

2001

|

|||||

|

David Federmann

|

37

|

2007

|

|||||

|

Yigal Ne’eman

|

70

|

2004

|

|||||

|

Yehoshua Gleitman (External Director)

|

62

|

2010

|

|||||

|

Dov Ninveh

|

64

|

2000

|

|||||

|

Dalia Rabin (External Director)

|

61

|

2010

|

|

Name

|

Age

|

Position

|

||

|

Joseph Ackerman

|

62

|

President and Chief Executive Officer

|

||

|

Elad Aharonson

|

38

|

Executive Vice President and General Manager – UAS Division

|

||

|

Jonathan Ariel

|

55

|

Executive Vice President and Chief Legal Officer

|

||

|

David Block Temin

|

56

|

Executive Vice President, Chief Compliance Officer and Senior Counsel

|

||

|

Adi Dar

|

40

|

Executive Vice President and General Manager – Electro-Optics Elop Division

|

||

|

Itzhak Dvir

|

64

|

Executive Vice President and Chief Operating Officer

|

||

|

Jacob Gadot

|

64

|

Executive Vice President – International Marketing and Business Development

|

||

|

Joseph Gaspar

|

63

|

Executive Vice President and Chief Financial Officer

|

||

|

Itzhak Gat

|

64

|

Executive Vice President and General Manager – Elisra Division

|

||

|

Zeev Gofer

|

59

|

Executive Vice President – Strategic and Business Development - North America

|

||

|

Dalia Gonen

|

60

|

Executive Vice President – Human Resources

|

||

|

Ran Hellerstein

|

61

|

Executive Vice President and Co-General Manager – Aerospace Division

|

||

|

Raanan Horowitz

|

51

|

President and Chief Executive Officer – Elbit Systems of America

|

||

|

Bezhalel Machlis

|

48

|

Executive Vice President and General Manager – Land and C4I Division

|

||

|

Ilan Pacholder

|

57

|

Executive Vice President – Mergers and Acquisitions, Offset and Financing

|

||

|

Marco Rosenthal

|

64

|

Executive Vice President - Corporate Shared Services – Technologies and Operations Division

|

||

|

Haim Rousso

|

65

|

Executive Vice President – Engineering and Technology Excellence

|

||

|

Gideon Sheffer

|

63

|

Executive Vice President – Strategic Planning and Business Development – Israel

|

||

|

Yoram Shmuely

|

51

|

Executive Vice President and Co-General Manager – Aerospace Division

|

||

|

Udi Vered

|

53

|

Executive Vice President – Service Solutions

|

|

Salaries, Directors’ Fees

Commissions and Bonuses

|

Pension, Retirement

and Similar Benefits

|

|||||||

|

(U.S. dollars in thousands)

|

||||||||

|

All directors (consisting of 9 persons)

|

$

|

349*

|

*

|

$

|

–

|

|||

|

All officers (consisting of 21 persons)

|

$

|

10,799**

|

**

|

$

|

1,323

|

|||

|

*

|

Elbit Systems’ shareholders at the annual general shareholders meeting held in 2004 approved payment to directors thereafter in accordance with maximum regulatory rates payable to External Directors under Israeli law for companies similarly classified based on their shareholding equity. These rates were linked to the Israeli consumer price index and were so updated and paid by Elbit Systems through March 2008. At an extraordinary general shareholders meeting held in March 2008, our shareholders approved increasing compensation, effective April 1, 2008 (and thereafter so long as such approval has not been replaced or revoked by the shareholders) to our External Directors and to other directors meeting the director independence criteria of Nasdaq, each of whom has additional duties under applicable non-Israeli law. The increased compensation was consistent with amendments to Israeli law regarding compensation to External Directors who serve on the boards of “dual listed” companies, such as Elbit Systems, and are subject to corresponding additional duties. As a result, External Directors and other such “independent” directors are and will be entitled, so long as the above-mentioned resolution adopted in March 2008 is in effect, to an annual fee of NIS 113,143 (equal to approximately $31,587) and a per meeting fee of 2,489 NIS (equal to approximately $695), which reflect the fees levels previously approved at the 2008 Shareholders’ Extraordinary General Meeting and linked to the Israeli consumer price index. The other directors are paid the following compensation: an annual fee of NIS 56,386 (equal to approximately $15,741) and a per meeting fee of NIS 2,127 (equal to approximately $594), which reflect the fees levels previously approved at the 2004 annual general shareholders meeting and linked to the Israeli consumer price index. In compliance with recent amendments to the Companies Law, our Audit Committee and the Board approved, in meetings held on October 23, 2011 and October 24, 2011, respectively, in accordance with the Israeli Companies Regulations (Relief from Related Parties’ Transactions), 5760-2000 (the “Regulations”), payment of director’s compensation to Michael Federmann and to David Federmann in amounts equal to the compensation paid by the Company to other directors of the Company who are not “independent” directors, as specified above. We currently intend to maintain such compensation rates to such directors. Compensation payments to directors are made either directly to the director or to his or her employing company.

|

|

**

|

We recorded an amount of approximately $2 million in 2011 as compensation costs related to stock options granted to our Executive Officers under our 2007 Employee Stock Option Plan. (See below “Share Ownership – Elbit Systems’ Stock Option Plans.”)

|

|

(A)

|

if that person is not a relative of the controlling shareholder of that company, or if that person (and each of that person’s relatives, partners and employers, or any person to whom he or she directly or indirectly reports), or any entity controlled by that person, did not have, at any time during the two years preceding that person’s appointment as an External Director, any affiliation with any of: (1) the applicable company, (2) the controlling shareholder of the applicable company or any of his or her relatives, (3) the entities controlling the company, (4) the entities controlled by the company or (5) the entities controlled by the company’s controlling shareholders;

|

|

|

(B)

|

if and so long as: (1) no conflict of interest exists or may exist between his or her responsibilities as a member of the board of directors of the respective company and his or her other positions or business activities or (2) such position or business activities would not impair his or her ability to serve as a director; and

|

|

|

(C)

|

if and so long as: (1) that person (and each of that person’s relatives, partners and employers, or any person to whom he or she directly or indirectly reports or any entity controlled by that person) has no business or professional relationships with any of the persons or entities mentioned in (A) above and (2) no other consideration except as permitted under the Companies Law is paid to that person in connection with that person's position as a director in the relevant company.

|

|

Audit Committee

:

|

Financial Statements

Review Committee

:

|

Corporate Governance and

Nominating Committee

:

|

Compensation

Committee

:

|

|||

|

Yehoshua Gleitman

(Chair)

|

Yehoshua Gleitman

(Chair)

|

Avraham Asheri

(Chair)

|

Dalia Rabin

(Chair)

|

|||

|

Moshe Arad

|

Moshe Arad

|

Yehoshua Gleitman

|

Moshe Arad

|

|||

|

Avraham Asheri

|

Avraham Asheri

|

Yigal Ne’eman

|

Avraham Asheri

|

|||

|

Yigal Ne’eman

|

Yigal Ne’eman

|

Dalia Rabin

|

||||

|

Dalia Rabin

|

Dalia Rabin

|

|

Total

Employees

|

U.S.

Employees

|

|||

|

2011

|

12,545

|

1,980

|

||

|

2010

|

12,317

|

1,963

|

||

|

2009

|

11,238

|

1,806

|

|

|

(1)

|

50% of the options will be vested and exercisable from the second anniversary of the Commencement Date;

|

|

|

(2)

|

An additional 25% of the options will be vested and exercisable from the third anniversary of the Commencement Date; and

|

|

|

(3)

|

The remaining 25% of the options will be vested and exercisable from the fourth anniversary of the Commencement Date.

|

|

Item 7.

|

Major Shareholders and

Related

Party Transactions.

|

|

|

•

|

beneficial ownership of more than 5% of our outstanding ordinary shares; and

|

|

|

•

|

the number of ordinary shares beneficially owned by all of our officers and directors as a group.

|

|

Name of Beneficial Owner

|

Amount Owned

|

Percent of Ordinary Shares

|

||||

|

Federmann Enterprises Ltd.

99 Hayarkon Street

Tel-Aviv, Israel

(2)

|

||||||

|

19,503,380

|

45.97 % | |||||

|

Heris Aktiengesellschaft

c/o 99 Hayarkon Street

Tel-Aviv, Israel

|

||||||

| 3,836,458 (3) | 9.04 % | |||||

|

Migdal Insurance & Financial

Holdings Ltd.

4 Efal Street

Petach Tikva, Israel

|

||||||

|

2,450,272

|

5.77 % | |||||

|

All officers and directors as

a group (29 persons)

|

||||||

| 187,911 (4) | 0.44 % | |||||

|

|

(1)

|

The total number of ordinary shares excludes 23,021 ordinary shares held by one of our subsidiaries and 822,800 ordinary shares held by us as treasury shares.

|

|

|

(2)

|

Federmann Enterprises Ltd. (FEL) owns our ordinary shares directly and indirectly through Heris Aktiengesellschaft (Heris) which is controlled by FEL. FEL is controlled by Beit Federmann Ltd. (BFL). BFL is controlled by Beit Bella Ltd. (BBL) and Beit Yekutiel Ltd. (BYL). Michael Federmann is the controlling shareholder of BBL and BYL. He is also the chairman of Elbit Systems’ Board and the chairman of the Board and the chief executive officer of FEL. Therefore, Mr. Federmann controls, directly and indirectly, the vote of ordinary shares owned by Heris and FEL.

|

|

|

(3)

|

The amount of ordinary shares owned by Heris is included in the amount of shares held by FEL as set forth in footnote (2) above.

|

|

|

(4)

|

This amount does not include (i) any ordinary shares that may be deemed to be beneficially owned by Michael Federmann as described in footnote (2) above and (ii) 28.800 ordinary shares underlying options that are currently exercisable or that will become exercisable within 60 days of February 29, 2012. A portion of the underlying options are “phantom options” or “cashless” options that have been calculated based on our February 29, 2012 closing share price on the TASE of $36.82.

|

|

February 29, 2012

|

February 28, 2011

|

May 31, 2010

|

May 31, 2009

|

||||||||||||||||||||||||||

|

Shares Owned

|

% of Shares Owned

|

Shares Owned

|

% of Shares Owned

|

Shares Owned

|

% of Shares Owned

|

Shares Owned

|

% of Shares Owned

|

||||||||||||||||||||||

|

FEL

|

|

|

19,503,380

|

(1)

|

45.97 |

%

|

|

19,457,566

|

(2)

|

|

|

45.50

|

%

|

|

|

19,342,625

|

|

|

45.49

|

%

|

|

|

19,342,625

|

(3)

|

|

|

45.91

|

%

|

|

|

(1)

|

Reflects incidental purchases by FEL of shares in open market transactions during May 2011 – February 2012.

|

|

(2)

|

Reflects incidental purchases by FEL of shares in open market transactions during May 2010 – February 2011.

|

|

(3)

|

Reflects incidental purchases by FEL of shares in open market transactions during May 2008 – February 2009.

|

|

Finan

c

ial Information.

|

|

2009

|

$ |

1.82 per share

|

||

|

2010

|

$ |

1.44 per share

|

||

| 2011 | $ |

1.44 per share

|

||

|

The

Offer

and Listing.

|

|

Nasdaq

|

TASE

(1)

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

2007

|

$ | 59.56 | $ | 32.32 | $ | 59.93 | $ | 32.47 | ||||||||

|

2008

|

$ | 63.40 | $ | 36.25 | $ | 62.64 | $ | 36.06 | ||||||||

|

2009

|

$ | 70.50 | $ | 40.50 | $ | 69.78 | $ | 40.27 | ||||||||

|

2010

|

$ | 66.65 | $ | 46.80 | $ | 65.69 | $ | 46.70 | ||||||||

|

2011

|

$ | 56.75 | $ | 35.35 | $ | 55.36 | $ | 34.29 | ||||||||

|

Nasdaq

|

TASE

(1)

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

2010

|

||||||||||||||||

|

First Quarter

|

$ | 66.65 | $ | 59.27 | $ | 65.69 | $ | 58.67 | ||||||||

|

Second Quarter

|

$ | 65.35 | $ | 48.50 | $ | 64.97 | $ | 48.77 | ||||||||

|

Third Quarter

|

$ | 55.31 | $ | 49.35 | $ | 54.83 | $ | 48.33 | ||||||||

|

Fourth Quarter

|

$ | 55.71 | $ | 46.80 | $ | 55.13 | $ | 46.70 | ||||||||

|

2011

|

||||||||||||||||

|

First Quarter

|

$ | 55.95 | $ | 48.78 | $ | 52.58 | $ | 47.95 | ||||||||

|

Second Quarter

|

$ | 56.75 | $ | 46.62 | $ | 55.36 | $ | 44.11 | ||||||||

|

Third Quarter

|

$ | 49.94 | $ | 35.35 | $ | 49.20 | $ | 34.29 | ||||||||

|

Fourth Quarter

|

$ | 45.63 | $ | 39.50 | $ | 44.00 | $ | 40.74 | ||||||||

|

2012

|

||||||||||||||||

|

First Quarter (through February 29, 2012)

|

$ | 42.09 | $ | 35.30 | $ | 41.65 | $ | 35.37 | ||||||||

|

Nasdaq

|

TASE

(1)

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

September 2011

|

$ | 40.68 | $ | 35.35 | $ | 39.89 | $ | 34.29 | ||||||||

|

October 2011

|

$ | 45.63 | $ | 39.23 | $ | 44.25 | $ | 39.96 | ||||||||

|

November 2011

|

$ | 43.98 | $ | 39.50 | $ | 43.79 | $ | 39.32 | ||||||||

|

December 2011

|

$ | 43.65 | $ | 40.30 | $ | 44.00 | $ | 41.70 | ||||||||

|

January 2012

|

$ | 42.02 | $ | 40.30 | $ | 41.65 | $ | 40.05 | ||||||||

|

February 2012

|

$ | 42.09 | $ | 35.30 | $ | 41.15 | $ | 35.37 | ||||||||

|

(1)

|

The closing prices of our ordinary shares on the TASE have been translated into U.S. dollars using the daily representative rate of exchange of the NIS to the U.S. dollar as published by the Bank of Israel for the applicable day of the high/low amount in the specified period.

|

|

Additional Infor

m

ation.

|

|

|

(1)

|

extraordinary transactions with an Office Holder or in which an Office Holder has a Personal Interest;

|

|

|

(2)

|

all arrangements regarding terms of service including relevant compensation, between a company and an Office Holder including the grant of an exemption, insurance, undertaking to indemnify or indemnification under a permit to indemnify;

|

|

|

(3)

|

material actions or arrangements that may otherwise be considered a breach of fiduciary duty of an Office Holder; or

|

|

|

(4)

|

except for certain specific exemptions under the Companies Law, extraordinary transactions of a public company with its controlling shareholder or with another person in which the controlling shareholder has a Personal Interest, including a private offering in which the controlling shareholder has a Personal Interest, as well as an agreement of a public company with its controlling shareholder or his or her relatives, directly or indirectly, including through a company controlled by him or her, regarding the grant of services to the applicable company or regarding the terms of service and/or employment of the controlling shareholder or his or her relatives, as the case may be.

|

Exemption, Insurance and Indemnification of Directors and Officers

|

|

(1)

|

a breach of fiduciary duty, except indemnification or insurance that provides coverage for a breach of a fiduciary duty to the company while acting in good faith and having reasonable cause to assume that such act would not prejudice the interests of the company;

|

|

|

(2)

|

a willful breach of the duty of care or reckless disregard for the circumstances or to the consequences of a breach of the duty of care other than mere negligence;

|

|

|

(3)

|

an act done with the intent to unlawfully realize a personal gain;

|

|

|

(4)

|

a fine or monetary penalty imposed upon such Office Holder; or

|

|

|

(5)

|

certain monetary liabilities that are set forth in the Securities Law.

|

|

|

Insurance and Indemnification of Directors and Officers under the Articles of Association

|

|

|

(1)

|

a breach of his or her duty of care to Elbit Systems or to another person;

|

|

|

(2)

|

a breach of his or her fiduciary duty to Elbit Systems, provided that the director or officer acted in good faith and had reasonable cause to assume that his or her act would not harm the interests of Elbit Systems; or

|

|

(3)

|

a financial obligation imposed on him or her in favor of another person;

|

|

|

(4)

|

a payment that he or she are obligated to pay to an injured party as set forth in the relevant sections of the Securities Law;

|

|

|

(5)

|

expenses incurred by him or her in connection with certain administrative proceedings specified in the Securities Law, including reasonable litigation expenses (including also lawyers' fees); or

|

|

|

(6)

|

any other event for which insurance of a director or officer is or may be permitted.

|

|

|

(1)

|

a monetary liability imposed on the director or officer or paid by him or her in favor of a third party under a judgment, including a judgment by way of compromise or a judgment of an arbitrator approved by a court; provided however, that in case such undertaking is granted in advance it will be limited to events which, in the Board’s opinion, are foreseeable in light of the Elbit Systems’ actual activities at the time of granting the obligation to indemnify, and to a sum or criteria as the Board deems reasonable under the circumstances, and the undertaking to indemnify will specify the aforementioned events and sum or criteria;

|

|

(2)

|

a payment imposed on him or her in favor of an injured party in the circumstances specified in the Securities Law;

|

|

|

(3)

|

reasonable litigation expenses (including lawyer’s fees), incurred by a director or officer as a result of an investigation or proceeding conducted against him by an authority authorized to conduct such investigation or procedure, conducted against him or her by an authority authorized to conduct such investigation or procedure, provided that such investigation or procedure, (i) concludes without the filing of an indictment against the director or officer and without imposition of monetary payment in lieu of criminal proceedings, or (ii) concludes with imposing on the director or officer monetary payment in lieu of criminal proceedings, provided that the alleged criminal offense in question does not require proof of criminal intent or was incurred by the director or officer in connection with a monetary sanction imposed by the Companies Law or the Securities Law;

|

|

|

(4)

|

expenses incurred by a director or a officer in connection with certain administrative proceedings set forth in the Securities Law, including reasonable litigation expenses (including lawyers' fees);

|

|

|

(5)

|

reasonable litigation expenses (including lawyers fees), expended by the director or officer or imposed on him or her by the court for:

|

|

|

(a)

|

proceedings issued against him or her by or on Elbit Systems’ behalf or by a third party;

|

|

|

(b)

|

criminal proceedings from which the director or officer was acquitted; or

|

|

|

(c)

|

criminal proceedings in which he or she was convicted of an offense that does not require proof of criminal intent; or

|

|

|

(6)

|

any other liability or expense for which it is or may be permissible to indemnify a director or an officer.

|

|

|

•

|

such majority includes a majority of the total votes of shareholders who have no Personal Interest in the approval of the transaction and who participate in the voting, in person, by proxy or by written ballot, at the meeting (abstentions not taken into account); or

|

|

|

•

|

the total number of votes of shareholders mentioned above that are voted against the transaction do not represent more than 1% of the total voting rights in the company.

|

|

|

(1)

|

Exemption from corporate tax for periods ranging between two – ten years depending on specific conditions; and

|

|

|

(2)

|

Reduced corporate tax rates for several years thereafter depending on certain conditions.

|

|

|

•

|

a citizen or individual resident of the United States for U.S. federal income tax purposes;

|

|

|

•

|

a corporation (or an entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any political subdivision thereof (including the District of Columbia);

|

|

|

•

|

an estate whose income is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

a trust if (A) a U.S. court is able to exercise primary supervision over the trust’s administration and (B) one or more U.S. persons have the authority to control all of the trust’s substantial decisions.

|

|

Item 11.

|

Quantitative and Qualitative

Di

sclosures About Market Risk.

|

|

Maturity Date - Notional Amount

|

||||||||||||||||||||||||||||

|

2012

|

2013

|

2014

|

2015

|

2016 onwards

|

Total

|

Fair Value at 31.12.11

|

||||||||||||||||||||||

| ( US dollars in millions) | ||||||||||||||||||||||||||||

|

Sell US$ and buy:

|

||||||||||||||||||||||||||||

|

EUR

|

27.3 | 16.7 | 10.2 | 2.5 | 0.3 | 57.0 | (2.7 | ) | ||||||||||||||||||||

|

GBP

|

9.6 | 21.2 | - | - | - | 30.9 | (0.7 | ) | ||||||||||||||||||||

|

NIS

|

654.1 | - | - | - | - | 654.1 | (19.9 | ) | ||||||||||||||||||||

|

Other currencies

|

9.6 | 3.6 | 0.4 | 0.3 | 0.2 | 14.1 | 1.6 | |||||||||||||||||||||

|

Total

|

700.6 | 41.5 | 10.6 | 2.8 | 0.5 | 756.0 | (21.7 | ) | ||||||||||||||||||||

|

Maturity Date - Notional Amount

|

||||||||||||||||||||||||||||

|

2012

|

2013

|

2014

|

2015

|

2016 onwards

|

Total

|

Fair Value at 31.12.11

|

||||||||||||||||||||||

| ( US dollars in millions) | ||||||||||||||||||||||||||||

|

Buy US$ and sell:

|

||||||||||||||||||||||||||||

|

EUR

|

92.6 | 23.8 | 28.8 | 7.0 | 2.1 | 154.3 | 7.8 | |||||||||||||||||||||

|

GBP

|

44.6 | 0.5 | - | - | - | 45.1 | 2.4 | |||||||||||||||||||||

|

Other currencies

|

19.7 | 9.9 | 3.2 | 0.4 | 0.9 | 34.1 | 0.2 | |||||||||||||||||||||

|

Total

|

156.9 | 34.2 | 32.0 | 7.4 | 3.0 | 233.5 | 10.4 | |||||||||||||||||||||

Interest Rate Risk Management

|

Description of Se

curit

ies Other than Equity Securities.

|

|

|

|

Item 15.

|

Controls and Procedures.

|

|

Item 16A.

|

Audit

Committee

Financial Expert.

|

|

Year Ended December 31

|

||||||||

|

2011

|

2010

|

|||||||

|

(U.S. dollars in thousands)

|

||||||||

|

Audit Fees

|

$ | 2,961 | $ | 3,072 | ||||

|

Tax Fees

|

$ | 444 | $ | 424 | ||||

|

Other Fees

|

$ | 413 | 80 | |||||

|

Total

|

$ | 3,818 | $ | 3,576 | ||||

|

Exemptions from the Listing S

tan

dards for Audit Committees.

|

|

Period

|

Total Number of Shares Purchased by the Company

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of the Plan

|

Maximum Number of Shares that May Yet Be Purchased Under the Plan

|

||||||||||||

|

October 1 – October 31, 2011

|

36,234 | $ | 42.96 | 36,234 | 963,766 | |||||||||||

|

November 1 – November 30, 2011

|

86,142 | $ | 41.90 | 86,142 | 877,624 | |||||||||||

|

December 1 – December 31, 2011

|

117,992 | $ | 41.98 | 117,992 | 759,632 | |||||||||||

|

Changes in Registran

t’s

Certifying Accountant.

|

|

Financial

State

ments.

|

|

Exhib

it

s.

|

|

|

(a)

|

Index to Financial Statements

|

|

Page

|

||

|

Report of Independent Registered Public Accounting Firm

|

F-2

|

|

|

Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting

|

F-3

|

|

|

Consolidated Balance Sheets at December 31, 2011 and 2010

|

F-4

|

|

|

Consolidated Statements of Income

|

F-6

|

|

|

Consolidated Statements of Changes in Shareholders’ Equity

|

F-7

|

|

|

Consolidated Statements of Cash Flows

|

F-9

|

|

|

Notes to Consolidated Financial Statements

|

F-11

|

|

|

Schedule II – Valuation and Qualifying Accounts

|

S-1

|

|

|

(b)

|

Exhibits

|

|

1.1

|

Elbit Systems’ Memorandum of Association

(1)

|

|

1.2

|

Elbit Systems’ Restated Articles of Association

(2)

|

|

4.1

|

Elbit Systems 2007 Stock Option Plan, as amended

(3)

|

|

4.2

|

Elbit Systems’ Post Merger Stock Option Plan (Summary in English)

(1)

|

|

8

|

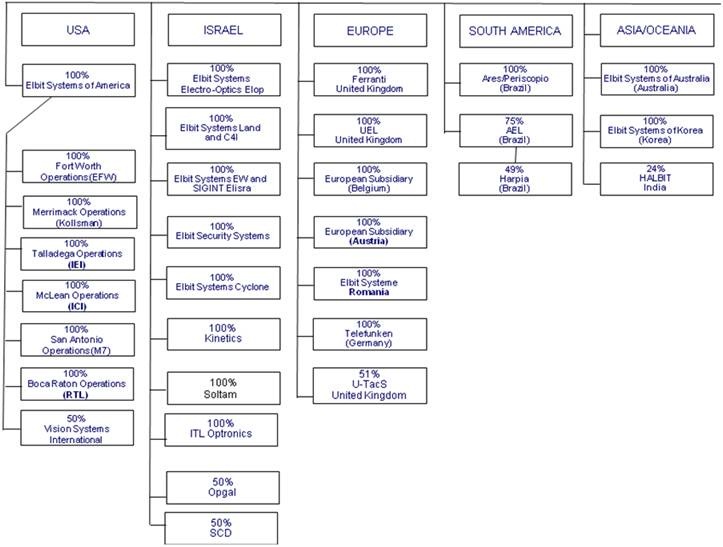

Primary Operating Subsidiaries of Elbit Systems

|

|

12.1

|

Certification of Chief Executive Officer of the Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

12.2

|

Certification of Chief Financial Officer of the Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

13.1

|

Certification of Chief Executive Officer of the Registrant pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

13.2

|

Certification of Chief Financial Officer of the Registrant pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

15.1

|

Consent of Kost Forer Gabbay & Kasierer

|

|

(1)

|

Filed as an exhibit to Elbit Systems’ Annual Report on Form 20-F (File No. 0-28998) for the year ended December 31, 2000, which was filed with the Securities and Exchange Commission on April 5, 2001, and incorporated herein by reference.

|

|

(2)

|

Filed as an exhibit to Elbit Systems’ Report on Form 6-K for March 2008, which was filed by Elbit Systems with the Securities and Exchange Commission on March 26, 2008, and incorporated herein by reference.

|

|

(3)

|

Filed as exhibit 4.3 to Elbit Systems’ post-effective amendment No. 1 to registration statement on Form S-8 (File No. 333-139512), which was filed by Elbit Systems with the Securities and Exchange Commission on December 1, 2011, and incorporated herein by reference.

|

|

ELBIT SYSTEMS LTD.

|

|||

|

By:

|

/s/ JOSEPH ACKERMAN

|

||

| Name: |

Joseph Ackerman

|

||

| Title: |

President and Chief Executive Officer

|

||

|

(Principal Executive Officer)

|

|||

| ELBIT SYSTEMS LTD. AND SUBSIDIARIES |

| ELBIT SYSTEMS LTD. AND SUBSIDIARIES |

|

Page

|

|

|

F - 2 - F - 3

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS:

|

|

|

F - 4 - F - 5

|

|

|

F - 6

|

|

|

F - 7 - F - 8

|

|

|

F - 9 - F - 10

|

|

|

F - 11 - F - 62

|

|

Kost Forer Gabbay & Kasierer

3 Aminadav St.

Tel-Aviv 67067, Israel

Tel:

972 (3)6232525

Fax: 972 (3)5622555

www.ey.com

|

|

Tel Aviv, Israel

|

|

March 13, 2012

|

|

Kost Forer Gabbay & Kasierer

3 Aminadav St.

Tel-Aviv 67067, Israel

Tel:

972 (3)6232525

Fax: 972 (3)5622555

www.ey.com

|

|

Tel Aviv, Israel

|

|

March 13, 2012

|

|

|

|

U.S. dollars (In thousands)

|

|

December 31,

|

||||||||||||

|

Note

|

2011

|

2010

|

||||||||||

|

CURRENT ASSETS:

|

||||||||||||

|

Cash and cash equivalents

|

$ | 202,577 | $ | 151,059 | ||||||||

|

Short-term bank deposits and marketable securities

|

21,693 | 63,486 | ||||||||||

|

Trade and unbilled receivables, net

|

(3) | 669,524 | 702,364 | |||||||||

|

Other receivables and prepaid expenses

|

(4) | 180,024 | 166,124 | |||||||||

|

Inventories, net of customer advances

|

(5) | 761,269 | 665,270 | |||||||||

|

Total current assets

|

1,835,087 | 1,748,303 | ||||||||||

|

LONG-TERM INVESTMENTS AND RECEIVABLES:

|

||||||||||||

|

Investments in affiliated companies, partnership

and other companies

|

(6) | 110,159 | 89,814 | |||||||||

|

Available-for-sale marketable securities

|

(9) | - | 7,179 | |||||||||

|

Long-term trade and unbilled receivables

|

(7) | 162,762 | 90,343 | |||||||||

|

Long-term bank deposits and other receivables

|

(8) | 12,215 | 44,401 | |||||||||

|

Deferred income taxes, net

|

(18F) | 36,130 | 29,892 | |||||||||

|

Severance pay fund

|

(2R) | 283,477 | 302,351 | |||||||||

| 604,743 | 563,980 | |||||||||||

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

(10) | 517,608 | 503,851 | |||||||||

|

GOODWILL

|

(11) | 499,326 | 486,046 | |||||||||

|

OTHER INTANGIBLE ASSETS, NET

|

(11) | 263,746 | 313,593 | |||||||||

| $ | 3,720,510 | $ | 3,615,773 | |||||||||

|

CONSOLIDATED BALANCE SHEETS

|

|

U.S. dollars (In thousands, except share data)

|

|

December 31,

|

||||||||||||

|

Note

|

2011

|

2010

|

||||||||||

|

CURRENT LIABILITIES:

|

||||||||||||

|

Short-term bank credit and loans

|

(12) | $ | 2,998 | $ | 15,115 | |||||||

|

Current maturities of long-term loans and Series A Notes

|

(15) | 127,627 | 43,093 | |||||||||

|

Trade payables

|

316,264 | 360,736 | ||||||||||

|

Other payables and accrued expenses

|

(13) | 743,866 | 648,121 | |||||||||

|

Customer advances in excess of costs incurred on contracts

in progress

|

(14) | 407,222 | 302,691 | |||||||||

|

Total current liabilities

|

1,597,977 | 1,369,756 | ||||||||||

|

LONG-TERM LIABILITIES:

|

||||||||||||

|

Long-term loans, net of current maturities

|

(15) | 302,255 | 292,039 | |||||||||

|

Series A Notes, net of current maturities

|

(16) | 235,319 | 273,357 | |||||||||

|

Employee benefit liabilities

|

394,115 | 395,303 | ||||||||||

|

Deferred income taxes and tax liabilities, net

|

(18F) | 48,467 | 55,936 | |||||||||

|

Customer advances in excess of costs incurred on contracts

in progress

|

(14) | 154,696 | 177,191 | |||||||||

|

Other long-term liabilities

|

59,961 | 46,740 | ||||||||||

| 1,194,813 | 1,240,566 | |||||||||||

|

COMMITMENTS AND CONTINGENT LIABILITIES

|

(20) | |||||||||||

|

EQUITY:

|

(21) | |||||||||||

|

Elbit Systems Ltd. equity:

|

||||||||||||

|

Share capital:

|

||||||||||||

|

Ordinary shares of New Israeli Shekels ("NIS") 1 par value each;

Authorized – 80,000,000 shares as of

December 31, 2011 and 2010;

Issued 43,257,077 and 43,102,261shares as

of December 31, 2011 and 2010, respectively;

Outstanding 42,607,788 and 42,693,340 shares

as of December 31, 2011 and 2010, respectively

|

12,093 | 12,050 | ||||||||||

|

Additional paid-in capital

|

232,407 | 281,594 | ||||||||||

|

Treasury shares – 649,289 and 408,921 shares as of December 31, 2011 and 2010, respectively

|

(14,422 | ) | (4,321 | ) | ||||||||

|

Accumulated other comprehensive loss

|

(56,226 | ) | (18,460 | ) | ||||||||

|

Retained earnings

|

724,485 | 695,830 | ||||||||||

|

Total Elbit Systems Ltd. equity

|

898,337 | 966,693 | ||||||||||

|

Non-controlling interests

|

29,383 | 38,758 | ||||||||||

| 927,720 | 1,005,451 | |||||||||||

|

Total liabilities and equity

|

$ | 3,720,510 | $ | 3,615,773 | ||||||||

|

|

|

U.S. dollars (In thousands, except share data)

|

|

Year ended December 31,

|

||||||||||||||||

|

Note

|

2011

|

2010

|

2009

|

|||||||||||||

|

Revenues

|

(22) | $ | 2,817,465 | $ | 2,670,133 | $ | 2,832,437 | |||||||||

|

Cost of revenues

|

2,085,451 | 1,872,263 | 1,982,954 | |||||||||||||

|

Gross profit

|

732,014 | 797,870 | 849,483 | |||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Research and development, net

|

(23) | 241,092 | 234,131 | 216,752 | ||||||||||||

|

Marketing and selling

|

235,909 | 229,942 | 250,963 | |||||||||||||

|

General and administrative

|

139,349 | 131,200 | 119,311 | |||||||||||||

|

Other operating income, net

|

(1E(1)) | - | (4,756 | ) | - | |||||||||||

|

Total operating expenses

|

616,350 | 590,517 | 587,026 | |||||||||||||

|

Operating income

|

115,664 | 207,353 | 262,457 | |||||||||||||

|

Financial expenses, net

|

(24) | (13,569 | ) | (21,251 | ) | (15,585 | ) | |||||||||

|

Other income, net

|

(25) | 1,909 | 13,259 | 458 | ||||||||||||

|

Income

before income taxes

|

104,004 | 199,361 | 247,330 | |||||||||||||

|

Income taxes

|

(18D) | 13,624 | 24,037 | 38,109 | ||||||||||||

| 90,380 | 175,324 | 209,221 | ||||||||||||||

|

Equity in net earnings of affiliated companies and partnership

|

(6B) | 15,377 | 18,796 | 19,292 | ||||||||||||

|

Income from continuing operations

|

105,757 | 194,120 | 228,513 | |||||||||||||

|

Income (loss) from discontinued operations and impairment, net

|

(1G) | (15,977 | ) | 921 | - | |||||||||||

|

Net income

|

$ | 89,780 | $ | 195,041 | $ | 228,513 | ||||||||||

|

Less: net loss (income) attributable to non-controlling interests

|

508 | (11,543 | ) | (13,566 | ) | |||||||||||

|

Net income attributable to Elbit Systems Ltd.'s shareholders

|

$ | 90,288 | $ | 183,498 | $ | 214,947 | ||||||||||

|

Earnings per share attributable to Elbit Systems Ltd.'s

ordinary shareholders:

|

(21) | |||||||||||||||

|

Basic net earnings (losses) per share:

|

||||||||||||||||

|

Continuing operations

|

2.33 | 4.29 | 5.08 | |||||||||||||

|

Discontinued operations

|

(0.22 | ) | 0.01 | - | ||||||||||||

|

Total

|

$ | 2.11 | $ | 4.30 | $ | 5.08 | ||||||||||

|

Diluted net earnings (losses) per share:

|

||||||||||||||||

|

Continuing operations

|

2.31 | 4.24 | 5.00 | |||||||||||||

|

Discontinued operations

|

(0.22 | ) | 0.01 | - | ||||||||||||

|

Total

|

$ | 2.09 | $ | 4.25 | $ | 5.00 | ||||||||||

|

Weighted average number of shares used in computation

of basic earnings per share

|

42,764 | 42,645 | 42,305 | |||||||||||||

|

Weighted average number of shares used in computation

of diluted earnings per share

|

43,131 | 43,217 | 42,983 | |||||||||||||

|

Amounts attributable to Elbit Systems Ltd.'s common shareholders

|

||||||||||||||||

|

Income from continuing operations, net of income taxes

|

$ | 99,778 | $ | 182,951 | $ | 214,947 | ||||||||||

|

Discontinued operations, net of income taxes

|

(9,490 | ) | 547 | - | ||||||||||||

|

Net income attributable to Elbit Systems Ltd.'s shareholders

|

$ | 90,288 | $ | 183,498 | $ | 214,947 | ||||||||||

|

STATEMENTS OF CHANGES

IN

EQUITY

|

|

U.S. dollars (In thousands, except share data)

|

|

Number of

outstanding

shares

|

Share

capital

|

Additional

paid-in

capital

|

Accumulated

other

comprehensive

income (loss)

|

Retained

earnings

|

Treasury

shares

|

Non-

controlling

interest

|

Total

equity

|

Total

comprehensive

income

|

||||||||||||||||||||||||||||

|

Balance as of January 1, 2009

|

42,079,452 | $ | 11,892 | $ | 300,227 | $ | (13,573 | ) | $ | 429,608 | $ | (4,321 | ) | $ | 76,475 | $ | 800,308 | |||||||||||||||||||

|

Exercise of options

|

451,443 | 114 | 9,757 | - | - | - | - | 9,871 | ||||||||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 5,134 | - | - | - | - | 5,134 | ||||||||||||||||||||||||||||

|

Dividends paid

|

- | - | - | - | (76,172 | ) | - | - | (76,172 | ) | ||||||||||||||||||||||||||

|

Purchase of subsidiary shares from non-

controlling interest

|

- | - | (42,991 | ) | - | - | - | (67,259 | ) | (110,250 | ) | |||||||||||||||||||||||||

|

Other comprehensive income, net of tax:

|

||||||||||||||||||||||||||||||||||||

|

Unrealized loss on derivative instruments,

net of $749 tax income

|

- | - | - | (11,381 | ) | - | - | (97 | ) | (11,478 | ) | $ | (11,478 | ) | ||||||||||||||||||||||

|

Foreign currency translation differences

|