|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

77-0369576

|

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S.

Employer Identification Number)

|

|

Title of each class

|

Name of each exchange on which

registered

|

|

|

Common

Stock, $.0001 par value

|

New

York Stock Exchange

|

|

Large

accelerated filer

T

|

Accelerated

filer

o

|

Non-accelerated

filer

o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

o

|

|

Part

I.

|

|

Page

|

||

|

Item

1.

|

1

|

|||

|

Item

1A.

|

5

|

|||

|

Item

1B.

|

15

|

|||

|

Item

2.

|

15

|

|||

|

Item

3.

|

21

|

|||

|

Item

4.

|

21

|

|||

|

Part

II.

|

|

|

||

|

Item

5.

|

22

|

|||

|

Item

6.

|

26

|

|||

|

Item

7.

|

28

|

|||

|

Item

7A.

|

39

|

|||

|

Item

8.

|

41

|

|||

|

Item

9.

|

41

|

|||

|

Item

9A.

|

41

|

|||

|

Item

9B.

|

41

|

|||

|

Part

III.

|

|

|

||

|

Item

10.

|

41

|

|||

|

Item

11.

|

41

|

|||

|

Item

12.

|

41

|

|||

|

Item

13.

|

41

|

|||

|

Item

14.

|

41

|

|||

|

Part

IV.

|

||||

|

Item

15.

|

42

|

|||

|

F-1

|

||||

|

|

·

|

Markets

in major metropolitan areas that have regional population primarily in

excess of one million;

|

|

|

·

|

Constraints

on new supply driven by: (i) low availability of developable land sites

where competing housing could be built; (ii) political growth barriers,

such as protected land, urban growth boundaries, and potential lengthy and

expensive development permit processes; and (iii) natural limitations to

development, such as mountains or

waterways;

|

|

|

·

|

Rental

demand is enhanced by affordability of rents compared to expensive

for-sale housing; and

|

|

|

·

|

Housing

demand that is based on proximity to jobs, high quality of life and

related commuting factors, as well as potential job

growth.

|

|

|

·

|

Property Management

–

The Chief

Operating Officer, Senior Vice President of Operations, Divisional

Managers, Regional Portfolio Managers and Area Managers are accountable

for the performance and maintenance of the communities. They supervise,

provide training for the on-site managers, review actual performance

against budget, monitor market trends and prepare operating and capital

budgets.

|

|

|

·

|

Capital Preservation –

The Capital and Maintenance department is responsible for the planning,

budgeting and completion of major capital improvement projects at our

communities.

|

|

|

·

|

Business Planning and Control

–

Comprehensive business plans are implemented in conjunction with

every investment decision. These plans include benchmarks for

future financial performance, based on collaborative discussions between

on-site managers and senior

management.

|

|

|

·

|

Development and Redevelopment

–

We focus on acquiring and developing apartment communities in

supply constrained markets, and redeveloping our existing communities to

improve the financial and physical aspects of our

communities.

|

|

|

·

|

In

December, the Company acquired Axis 2300 (formerly known as “DuPont

Lofts”), a 115-unit condominium development project in Irvine, California

for $27.0 million. The project is 85 percent complete and will

require an additional six months of construction and estimated remaining

costs of development are $9.1 million, consisting primarily of unit

interior finishes. Following construction, the Company intends

to operate the asset as an apartment community. All units

feature 11-foot ceilings, custom finishes, a washer and dryer and a

fireplace.

|

|

|

·

|

Also

during December, the Company acquired Regency at Encino, a 75-unit

community located in Encino, California for $16.0 million. The community

features upgraded appliances and finishes in 51 of the

units. The Company intends to renovate the additional 24 units

upon normal resident turnover. All units feature 9-foot

ceilings and a washer and dryer.

|

|

As

of 12/31/09 ($ in millions)

|

|||||||||||||||||

|

Incurred

|

Estimated

|

Estimated

|

|||||||||||||||

|

Development

Pipeline

|

Location

|

Units

|

Project

Cost

|

Remaining

Cost

|

Project

Cost

(1)

|

||||||||||||

|

Development Projects

|

|||||||||||||||||

|

Fourth

& U

|

Berkeley,

CA

|

171 | $ | 49.5 | $ | 13.8 | $ | 63.3 | |||||||||

|

Joule

Brodway

|

Seattle,

WA

|

295 | 68.1 | 26.7 | 94.8 | ||||||||||||

|

Tasman

Retail Pad and Garage

|

Sunnyvale,

CA

|

- | 5.4 | 16.3 | 21.7 | ||||||||||||

|

Axis

2300

|

Irvine,

CA

|

115 | 27.2 | 9.1 | 36.3 | ||||||||||||

| 581 | 150.2 | 65.9 | 216.1 | ||||||||||||||

|

Predevelopment

projects

|

various

|

332 | 53.7 | 89.3 | 143.0 | ||||||||||||

|

Land

held for future development or sale

|

various

|

1,329 | 71.1 | - | 71.1 | ||||||||||||

|

Development

Pipeline

|

2,242 | $ | 275.0 | $ | 155.2 | $ | 430.2 | ||||||||||

|

|

·

|

cash

flow may not be sufficient to meet required payments of principal and

interest;

|

|

|

·

|

inability

to refinance maturing indebtedness on encumbered apartment

communities;

|

|

|

·

|

inability

to comply with debt covenants could cause an acceleration of the maturity

date; and

|

|

|

·

|

repaying

debt before the scheduled maturity date could result in prepayment

penalties.

|

|

|

·

|

the

general economic climate;

|

|

|

·

|

local

economic conditions in which the communities are located, such as

oversupply of housing or a reduction in demand for rental

housing;

|

|

|

·

|

the

attractiveness of the communities to

tenants;

|

|

|

·

|

competition

from other available housing; and

|

|

|

·

|

the

Company’s ability to provide for adequate maintenance and

insurance.

|

|

|

·

|

funds

may be expended and management's time devoted to projects that may not be

completed;

|

|

|

·

|

construction

costs of a project may exceed original estimates possibly making the

project economically unfeasible;

|

|

|

·

|

projects

may be delayed due to, without limitation, adverse weather

conditions;

|

|

|

·

|

occupancy

rates and rents at a completed project may be less than anticipated;

and

|

|

|

·

|

expenses

at completed development projects may be higher than

anticipated.

|

|

|

·

|

national

and global economic conditions;

|

|

|

·

|

actual

or anticipated variations in our quarterly operating results or

dividends;

|

|

|

·

|

changes

in our funds from operations or earnings

estimates;

|

|

|

·

|

issuances

of common stock, preferred stock or convertible debt

securities;

|

|

|

·

|

publication

of research reports about us or the real estate

industry;

|

|

|

·

|

the

general reputation of real estate investment trusts and the attractiveness

of their equity securities in comparison to other equity securities

(including securities issued by other real estate based

companies);

|

|

|

·

|

general

stock and bond market conditions, including changes in interest rates on

fixed income securities, that may lead prospective purchasers of our stock

to demand a higher annual yield from

dividends;

|

|

|

·

|

availability

to credit markets and cost of

credit;

|

|

|

·

|

a

change in analyst ratings or our credit ratings;

and

|

|

|

·

|

terrorist

activity may adversely affect the markets in which our securities trade,

possibly increasing market volatility and causing erosion of business and

consumer confidence and spending.

|

|

|

·

|

authorize

or create any class or series of stock that ranks senior to such preferred

stock with respect to the payment of dividends, rights upon liquidation,

dissolution or winding-up of our

business;

|

|

|

·

|

amend,

alter or repeal the provisions of the Company’s Charter or Bylaws,

including by merger or consolidation, that would materially and adversely

affect the rights of such series of preferred stock;

or

|

|

|

·

|

in

the case of the preferred stock into which our preferred units are

exchangeable, merge or consolidate with another entity or transfer

substantially all of its assets to another entity, except if such

preferred stock remains outstanding with the surviving entity and has the

same terms and in certain other

circumstances.

|

|

|

·

|

the

Company completes a “going private” transaction and its common stock is no

longer registered under the Securities Exchange Act of 1934, as

amended;

|

|

|

·

|

the

Company completes a consolidation or merger or sale of substantially all

of its assets and the surviving entity’s debt securities do not possess an

investment grade rating;

|

|

|

·

|

the

Company fails to qualify as a REIT.

|

|

|

·

|

80%

of the votes entitled to be cast by holders of outstanding voting shares;

and

|

|

|

·

|

Two-thirds

of the votes entitled to be cast by holders of outstanding voting shares

other than shares held by the interested stockholder with whom the

business combination is to be

effected.

|

|

|

·

|

the

Company’s directors have terms of office of three years and the board of

directors is divided into three classes with staggered terms; as a result,

less than a majority of directors are up for re-election to the board in

any one year;

|

|

|

·

|

directors

may be removed, without cause, only upon a two-thirds vote of

stockholders, and with cause, only upon a majority vote of

stockholders;

|

|

|

·

|

the

Company’s board can fix the number of directors and fill vacant

directorships upon the vote of a majority of the

directors;

|

|

|

·

|

stockholders

must give advance notice to nominate directors or propose business for

consideration at a stockholders’ meeting;

and

|

|

|

·

|

for

stockholders to call a special meeting, the meeting must be requested by

not less than a majority of all the votes entitled to be cast at the

meeting.

|

|

|

·

|

the

Company’s partners in Fund II might remove the Company as the general

partner of Fund II;

|

|

|

·

|

the

Company’s partners in Fund II might have economic or business

interests or goals that are inconsistent with our business interests or

goals; or

|

|

|

·

|

the

Company’s partners in Fund II might fail to approve decisions regarding

Fund II that are in the Company’s best

interest.

|

|

|

·

|

that

the value of mortgaged property may be less than the amounts owed, causing

realized or unrealized losses;

|

|

|

·

|

the

borrower may not pay indebtedness under the mortgage when due, requiring

us to foreclose, and the amount recovered in connection with the

foreclosure may be less than the amount

owed;

|

|

|

·

|

that

interest rates payable on the mortgages may be lower than our cost of

funds; and

|

|

|

·

|

in

the case of junior mortgages, that foreclosure of a senior mortgage could

eliminate the junior mortgage.

|

|

|

·

|

located

near employment centers;

|

|

|

·

|

attractive

communities that are well maintained;

and

|

|

|

·

|

proactive

customer service approach.

|

|

Rentable

|

||||||||||||

|

Square

|

Year

|

Year

|

||||||||||

|

Apartment

Communities

(1)

|

Location

|

Units

|

Footage

|

Built

|

Acquired

|

Occupancy

(2)

|

||||||

|

Southern

California

|

||||||||||||

|

Alpine

Country

|

Alpine,

CA

|

108

|

81,900

|

1986

|

2002

|

98%

|

||||||

|

Alpine

Village

|

Alpine,

CA

|

306

|

254,400

|

1971

|

2002

|

98%

|

||||||

|

Barkley,

The(3)(4)

|

Anaheim,

CA

|

161

|

139,800

|

1984

|

2000

|

98%

|

||||||

|

Bonita

Cedars

|

Bonita,

CA

|

120

|

120,800

|

1983

|

2002

|

97%

|

||||||

|

Camarillo

Oaks

|

Camarillo,

CA

|

564

|

459,000

|

1985

|

1996

|

95%

|

||||||

|

Camino

Ruiz Square

|

Camarillo,

CA

|

160

|

105,448

|

1990

|

2006

|

99%

|

||||||

|

Cielo

(5)

|

Chatsworth,

CA

|

119

|

125,400

|

2009

|

2009

|

90%

|

||||||

|

Cambridge

|

Chula

Vista, CA

|

40

|

22,100

|

1965

|

2002

|

95%

|

||||||

|

Woodlawn

Colonial

|

Chula

Vista, CA

|

159

|

104,500

|

1974

|

2002

|

95%

|

||||||

|

Mesa

Village

|

Clairemont,

CA

|

133

|

43,600

|

1963

|

2002

|

96%

|

||||||

|

Parcwood(5)

|

Corona,

CA

|

312

|

270,000

|

1989

|

2004

|

96%

|

||||||

|

Tierra

del Sol/Norte

|

El

Cajon, CA

|

156

|

117,000

|

1969

|

2002

|

98%

|

||||||

|

Regency

at Encino

|

Encino,

CA

|

75

|

78,487

|

1989

|

2009

|

100%

|

||||||

|

Valley

Park(6)

|

Fountain

Valley, CA

|

160

|

169,700

|

1969

|

2001

|

96%

|

||||||

|

Capri

at Sunny Hills(6)

|

Fullerton,

CA

|

100

|

128,100

|

1961

|

2001

|

97%

|

||||||

|

Wilshire

Promenade

|

Fullerton,

CA

|

149

|

128,000

|

1992(7)

|

1997

|

98%

|

||||||

|

Montejo(6)

|

Garden

Grove, CA

|

124

|

103,200

|

1974

|

2001

|

97%

|

||||||

|

CBC

Apartments

|

Goleta,

CA

|

148

|

91,538

|

1962

|

2006

|

97%

|

||||||

|

Chimney

Sweep Apartments

|

Goleta,

CA

|

91

|

88,370

|

1967

|

2006

|

91%

|

||||||

|

Hampton

Court

|

Glendale,

CA

|

83

|

71,500

|

1974(8)

|

1999

|

97%

|

||||||

|

Hampton

Place

|

Glendale,

CA

|

132

|

141,500

|

1970(9)

|

1999

|

97%

|

||||||

|

Devonshire

|

Hemet,

CA

|

276

|

207,200

|

1988

|

2002

|

94%

|

||||||

|

Huntington

Breakers

|

Huntington

Beach, CA

|

342

|

241,700

|

1984

|

1997

|

98%

|

||||||

|

Hillsborough

Park

|

La

Habra, CA

|

235

|

215,500

|

1999

|

1999

|

98%

|

||||||

|

Trabuco

Villas

|

Lake

Forest, CA

|

132

|

131,000

|

1985

|

1997

|

98%

|

||||||

|

Marbrisa

|

Long

Beach, CA

|

202

|

122,800

|

1987

|

2002

|

98%

|

||||||

|

Pathways

|

Long

Beach, CA

|

296

|

197,700

|

1975(10)

|

1991

|

96%

|

||||||

|

Belmont

Station

|

Los

Angeles, CA

|

275

|

225,000

|

2008

|

2008

|

99%

|

||||||

|

Bunker

Hill

|

Los

Angeles, CA

|

456

|

346,600

|

1968

|

1998

|

97%

|

||||||

|

Cochran

Apartments

|

Los

Angeles, CA

|

58

|

51,400

|

1989

|

1998

|

95%

|

||||||

|

Kings

Road

|

Los

Angeles, CA

|

196

|

132,100

|

1979(11)

|

1997

|

97%

|

||||||

|

Marbella,

The

|

Los

Angeles, CA

|

60

|

50,108

|

1991

|

2005

|

95%

|

||||||

|

Park

Place

|

Los

Angeles, CA

|

60

|

48,000

|

1988

|

1997

|

95%

|

||||||

|

Renaissance,

The(5)

|

|

Los

Angeles, CA

|

168

|

154,268

|

1990(12)

|

2006

|

97%

|

|||||

|

Windsor

Court

|

Los

Angeles, CA

|

58

|

46,600

|

1988

|

1997

|

95%

|

||||||

|

Marina

City Club(13)

|

|

Marina

Del Rey, CA

|

101

|

127,200

|

1971

|

2004

|

96%

|

|||||

|

Mirabella

|

|

Marina

Del Rey, CA

|

188

|

176,800

|

2000

|

2000

|

95%

|

|||||

|

Mira

Monte

|

Mira

Mesa, CA

|

355

|

262,600

|

1982(14)

|

2002

|

97%

|

||||||

|

Hillcrest

Park

|

Newbury

Park, CA

|

608

|

521,900

|

1973(15)

|

1998

|

97%

|

||||||

|

Fairways(16)

|

Newport

Beach, CA

|

74

|

107,100

|

1972

|

1999

|

94%

|

||||||

|

Country

Villas

|

Oceanside,

CA

|

180

|

179,700

|

1976

|

2002

|

97%

|

||||||

|

Mission

Hills

|

Oceanside,

CA

|

282

|

244,000

|

1984

|

2005

|

97%

|

||||||

|

Mariners

Place

|

Oxnard,

CA

|

105

|

77,200

|

1987

|

2000

|

97%

|

||||||

|

Monterey

Villas

|

Oxnard,

CA

|

122

|

122,100

|

1974(17)

|

1997

|

98%

|

||||||

|

Tierra

Vista

|

Oxnard,

CA

|

404

|

387,100

|

2001

|

2001

|

97%

|

||||||

|

Monterra

del Mar

|

Pasadena,

CA

|

123

|

74,400

|

1972(18)

|

1997

|

99%

|

||||||

|

Monterra

del Rey

|

Pasadena,

CA

|

84

|

73,100

|

1972(19)

|

1999

|

98%

|

||||||

|

Monterra

del Sol

|

Pasadena,

CA

|

85

|

69,200

|

1972(20)

|

1999

|

97%

|

||||||

|

Villa

Angelina(6)

|

Placentia,

CA

|

256

|

217,600

|

1970

|

2001

|

97%

|

||||||

|

(continued)

|

||||||||||||

|

Rentable

|

||||||||||||

|

Square

|

Year

|

Year

|

||||||||||

|

Apartment

Communities

(1)

|

Location

|

Units

|

Footage

|

Built

|

Acquired

|

Occupancy

(2)

|

||||||

|

Southern

California (continued)

|

||||||||||||

|

Fountain

Park

|

|

Playa

Vista, CA

|

705

|

608,900

|

2002

|

2004

|

95%

|

|||||

|

Highridge(6)

|

Rancho

Palos Verdes, CA

|

255

|

290,200

|

1972(21)

|

1997

|

95%

|

||||||

|

Bluffs

II, The(22)

|

San

Diego, CA

|

224

|

126,700

|

1974

|

1997

|

98%

|

||||||

|

Summit

Park

|

San

Diego, CA

|

300

|

229,400

|

1972

|

2002

|

97%

|

||||||

|

Vista

Capri - North

|

San

Diego, CA

|

106

|

51,800

|

1975

|

2002

|

95%

|

||||||

|

Brentwood(6)

|

Santa

Ana, CA

|

140

|

154,800

|

1970

|

2001

|

95%

|

||||||

|

Treehouse(6)

|

Santa

Ana, CA

|

164

|

135,700

|

1970

|

2001

|

96%

|

||||||

|

Hope

Ranch Collection

|

Santa

Barbara, CA

|

108

|

126,700

|

1965&73

|

2007

|

98%

|

||||||

|

Hidden

Valley(23)

|

|

Simi

Valley, CA

|

324

|

310,900

|

2004

|

2004

|

97%

|

|||||

|

Meadowood

|

Simi

Valley, CA

|

320

|

264,500

|

1986

|

1996

|

96%

|

||||||

|

Shadow

Point

|

Spring

Valley, CA

|

172

|

131,200

|

1983

|

2002

|

98%

|

||||||

|

Coldwater

Canyon

|

Studio

City, CA

|

39

|

34,125

|

1979

|

2007

|

97%

|

||||||

|

Studio

40-41 (5)

|

Studio

City, CA

|

149

|

127,238

|

2009

|

2009

|

95%

|

||||||

|

Lofts

at Pinehurst, The

|

Ventura,

CA

|

118

|

71,100

|

1971(24)

|

1997

|

97%

|

||||||

|

Pinehurst(25)

|

|

Ventura,

CA

|

28

|

21,200

|

1973

|

2004

|

99%

|

|||||

|

Woodside

Village

|

|

Ventura,

CA

|

145

|

136,500

|

1987

|

2004

|

98%

|

|||||

|

Walnut

Heights

|

Walnut,

CA

|

163

|

146,700

|

1964

|

2003

|

96%

|

||||||

|

Avondale

at Warner Center

|

Woodland

Hills, CA

|

446

|

331,000

|

1970(26)

|

1997

|

97%

|

||||||

|

13,087

|

10,952,982

|

97%

|

||||||||||

|

Northern

California

|

||||||||||||

|

Belmont

Terrace

|

Belmont,

CA

|

71

|

72,951

|

1974

|

2006

|

98%

|

||||||

|

Carlmont

Woods(5)

|

Belmont,

CA

|

195

|

107,200

|

1971

|

2004

|

98%

|

||||||

|

Davey

Glen(5)

|

Belmont,

CA

|

69

|

65,974

|

1962

|

2006

|

97%

|

||||||

|

Pointe

at Cupertino, The

|

Cupertino,

CA

|

116

|

135,200

|

1963(27)

|

1998

|

98%

|

||||||

|

Harbor

Cove(5)

|

Foster

City, CA

|

400

|

306,600

|

1971

|

2004

|

98%

|

||||||

|

Stevenson

Place

|

Fremont,

CA

|

200

|

146,200

|

1971(28)

|

1983

|

97%

|

||||||

|

Boulevard

|

Fremont,

CA

|

172

|

131,200

|

1978(29)

|

1996

|

98%

|

||||||

|

City

View

|

Hayward,

CA

|

560

|

462,400

|

1975(30)

|

1998

|

98%

|

||||||

|

Alderwood

Park(5)

|

Newark,

CA

|

96

|

74,624

|

1987

|

2006

|

97%

|

||||||

|

Bridgeport

|

Newark,

CA

|

184

|

139,000

|

1987(31)

|

1987

|

98%

|

||||||

|

The

Grand

|

Oakland,

CA

|

238

|

205,026

|

2009

|

2009

|

98%

|

||||||

|

Regency

Towers(5)

|

Oakland,

CA

|

178

|

140,900

|

1975(32)

|

2005

|

96%

|

||||||

|

San

Marcos

|

Richmond,

CA

|

432

|

407,600

|

2003

|

2003

|

98%

|

||||||

|

Mt

Sutro

|

San

Francisco, CA

|

99

|

64,000

|

1973

|

2001

|

98%

|

||||||

|

Carlyle,

The

|

San

Jose, CA

|

132

|

129,200

|

2000

|

2000

|

97%

|

||||||

|

Enclave,

The(5)

|

San

Jose, CA

|

637

|

525,463

|

1998

|

2005

|

98%

|

||||||

|

Esplanade

|

San

Jose, CA

|

278

|

279,000

|

2002

|

2004

|

98%

|

||||||

|

Waterford,

The

|

San

Jose, CA

|

238

|

219,600

|

2000

|

2000

|

99%

|

||||||

|

Hillsdale

Garden(33)

|

San

Mateo, CA

|

697

|

611,505

|

1948

|

2006

|

97%

|

||||||

|

Bel

Air

|

San

Ramon, CA

|

462

|

391,000

|

1988/2000(34)

|

1997

|

97%

|

||||||

|

Canyon

Oaks

|

San

Ramon, CA

|

250

|

237,894

|

2005

|

2007

|

98%

|

||||||

|

Foothill

Gardens

|

San

Ramon, CA

|

132

|

155,100

|

1985

|

1997

|

98%

|

||||||

|

Mill

Creek at Windermere

|

San

Ramon, CA

|

400

|

381,060

|

2005

|

2007

|

97%

|

||||||

|

Twin

Creeks

|

San

Ramon, CA

|

44

|

51,700

|

1985

|

1997

|

98%

|

||||||

|

Le

Parc Luxury Apartments

|

Santa

Clara, CA

|

140

|

113,200

|

1975(35)

|

1994

|

98%

|

||||||

|

Marina

Cove(36)

|

Santa

Clara, CA

|

292

|

250,200

|

1974(37)

|

1994

|

98%

|

||||||

|

Chestnut

Street

|

Santa

Cruz, CA

|

96

|

87,640

|

2002

|

2008

|

98%

|

||||||

|

Harvest

Park

|

Santa

Rosa, CA

|

104

|

116,628

|

2004

|

2007

|

97%

|

||||||

|

Bristol

Commons

|

Sunnyvale,

CA

|

188

|

142,600

|

1989

|

1997

|

99%

|

||||||

|

Brookside

Oaks(6)

|

Sunnyvale,

CA

|

170

|

119,900

|

1973

|

2000

|

98%

|

||||||

|

Magnolia

Lane(38)

|

Sunnyvale,

CA

|

32

|

31,541

|

2001

|

2007

|

99%

|

||||||

|

Montclaire,

The

|

Sunnyvale,

CA

|

390

|

294,100

|

1973(39)

|

1988

|

98%

|

||||||

|

Summerhill

Park

|

Sunnyvale,

CA

|

100

|

78,500

|

1988

|

1988

|

99%

|

||||||

|

Thomas

Jefferson(6)

|

Sunnyvale,

CA

|

156

|

110,824

|

1969

|

2007

|

99%

|

||||||

|

Windsor

Ridge

|

Sunnyvale,

CA

|

216

|

161,800

|

1989

|

1989

|

98%

|

||||||

|

Vista

Belvedere

|

Tiburon,

CA

|

76

|

78,300

|

1963

|

2004

|

97%

|

||||||

|

Tuscana

|

Tracy,

CA

|

30

|

29,088

|

2007

|

2007

|

97%

|

||||||

|

8,270

|

7,054,718

|

98%

|

||||||||||

|

(continued)

|

||||||||||||

|

Rentable

|

||||||||||||

|

Square

|

Year

|

Year

|

||||||||||

|

Apartment

Communities

(1)

|

Location

|

Units

|

Footage

|

Built

|

Acquired

|

Occupancy

(2)

|

||||||

|

Seattle,

Washington Metropolitan Area

|

||||||||||||

|

Cedar

Terrace

|

Bellevue,

WA

|

180

|

174,200

|

1984

|

2005

|

96%

|

||||||

|

Emerald

Ridge-North

|

Bellevue,

WA

|

180

|

144,000

|

1987

|

1994

|

97%

|

||||||

|

Foothill

Commons

|

Bellevue,

WA

|

388

|

288,300

|

1978(40)

|

1990

|

95%

|

||||||

|

Palisades,

The

|

Bellevue,

WA

|

192

|

159,700

|

1977(41)

|

1990

|

99%

|

||||||

|

Sammamish

View

|

Bellevue,

WA

|

153

|

133,500

|

1986(42)

|

1994

|

99%

|

||||||

|

Woodland

Commons

|

Bellevue,

WA

|

236

|

172,300

|

1978(43)

|

1990

|

97%

|

||||||

|

Canyon

Pointe

|

Bothell,

WA

|

250

|

210,400

|

1990

|

2003

|

97%

|

||||||

|

Inglenook

Court

|

Bothell,

WA

|

224

|

183,600

|

1985

|

1994

|

96%

|

||||||

|

Salmon

Run at Perry Creek

|

Bothell,

WA

|

132

|

117,100

|

2000

|

2000

|

98%

|

||||||

|

Stonehedge

Village

|

Bothell,

WA

|

196

|

214,800

|

1986

|

1997

|

97%

|

||||||

|

Highlands

at Wynhaven

|

Issaquah,

WA

|

333

|

424,674

|

2000

|

2008

|

96%

|

||||||

|

Park

Hill at Issaquah

|

Issaquah,

WA

|

245

|

277,700

|

1999

|

1999

|

97%

|

||||||

|

Wandering

Creek

|

Kent,

WA

|

156

|

124,300

|

1986

|

1995

|

98%

|

||||||

|

Bridle

Trails

|

Kirkland,

WA

|

108

|

99,700

|

1986(44)

|

1997

|

97%

|

||||||

|

Evergreen

Heights

|

Kirkland,

WA

|

200

|

188,300

|

1990

|

1997

|

97%

|

||||||

|

Laurels

at Mill Creek, The

|

Mill

Creek, WA

|

164

|

134,300

|

1981

|

1996

|

97%

|

||||||

|

Morning

Run(5)

|

Monroe,

WA

|

222

|

221,786

|

1991

|

2005

|

97%

|

||||||

|

Anchor

Village(6)

|

Mukilteo,

WA

|

301

|

245,900

|

1981

|

1997

|

97%

|

||||||

|

Castle

Creek

|

Newcastle,

WA

|

216

|

191,900

|

1997

|

1997

|

98%

|

||||||

|

Brighton

Ridge

|

Renton,

WA

|

264

|

201,300

|

1986

|

1996

|

97%

|

||||||

|

Fairwood

Pond

|

Renton,

WA

|

194

|

189,200

|

1997

|

2004

|

97%

|

||||||

|

Forest

View

|

Renton,

WA

|

192

|

182,500

|

1998

|

2003

|

97%

|

||||||

|

Cairns,

The

|

Seattle,

WA

|

100

|

70,806

|

2006

|

2007

|

95%

|

||||||

|

Eastlake

2851(5)

|

Seattle,

WA

|

127

|

234,086

|

2008

|

2008

|

97%

|

||||||

|

Fountain

Court

|

Seattle,

WA

|

320

|

207,000

|

2000

|

2000

|

98%

|

||||||

|

Linden

Square

|

Seattle,

WA

|

183

|

142,200

|

1994

|

2000

|

97%

|

||||||

|

Tower

@ 801(5)

|

Seattle,

WA

|

173

|

118,500

|

1970

|

2005

|

98%

|

||||||

|

Wharfside

Pointe

|

Seattle,

WA

|

142

|

119,200

|

1990

|

1994

|

97%

|

||||||

|

Echo

Ridge(5)

|

Snoqualmie,

WA

|

120

|

124,359

|

2000

|

2005

|

98%

|

||||||

|

5,891

|

5,295,611

|

98%

|

||||||||||

|

Total/Weighted

Average

|

27,248

|

23,303,311

|

97%

|

|

Rentable

|

||||||||||||

|

Square

|

Year

|

Year

|

||||||||||

|

Other

real estate assets

(1)

|

Location

|

Tenants

|

Footage

|

Built

|

Acquired

|

Occupancy

(2)

|

||||||

|

Office

Buildings

|

||||||||||||

|

925

/ 935 East Meadow Drive(45)

|

Palo

Alto, CA

|

1

|

31,900

|

1988

/ 1962

|

1997

/ 2007

|

100%

|

||||||

|

6230

Sunset Blvd(46)

|

Los

Angeles, CA

|

1

|

35,000

|

1938

|

2006

|

100%

|

||||||

|

17461

Derian Ave(47)

|

Irvine,

CA

|

8

|

110,000

|

1983

|

2000

|

100%

|

||||||

|

22110-22120

Clarendon Street(48)

|

Woodland

Hills, CA

|

9

|

38,940

|

1982

|

2001

|

87%

|

||||||

|

Total

Office Buildings

|

19

|

215,840

|

98%

|

|

|

(1)

|

Unless

otherwise specified, the Company has a 100% ownership interest in each

community.

|

|

|

(2)

|

For

apartment communities, occupancy rates are based on financial occupancy

for the year ended December 31, 2009; for the office buildings or

properties which have not yet stabilized, or have insufficient operating

history, occupancy rates are based on physical occupancy as of December

31, 2009. For an explanation of how financial occupancy and

physical occupancy are calculated, see “Properties-Occupancy Rates” in

this Item 2.

|

|

|

(3)

|

The

Company has a 30% special limited partnership interest in the entity that

owns this apartment community. This investment was made under arrangements

whereby Essex Management Corporation (“EMC”) became the general partner

and the existing partners were granted the right to require the applicable

partnership to redeem their interest for cash. Subject to

certain conditions, the Company may, however, elect to deliver an

equivalent number of shares of the Company’s common stock in satisfaction

of the applicable partnership's cash redemption

obligation.

|

|

|

(4)

|

The

community is subject to a ground lease, which, unless extended, will

expire in 2082.

|

|

|

(5)

|

This

community is owned by Fund II. The Company has a 28.2% interest in Fund II

which is accounted for using the equity method of

accounting.

|

|

|

(6)

|

The

Company holds a 1% special limited partner interest in the partnerships

which own these apartment communities. These investments were made under

arrangements whereby EMC became the 1% sole general partner and the other

limited partners were granted the right to require the applicable

partnership to redeem their interest for cash. Subject to certain

conditions, the Company may, however, elect to deliver an equivalent

number of shares of the Company’s common stock in satisfaction of the

applicable partnership’s cash redemption

obligation.

|

|

|

(7)

|

In

2002 the Company purchased an additional 21 units adjacent to this

apartment community for $3 million. This property was built in

1992.

|

|

|

(8)

|

The

Company completed a $1.6 million redevelopment in

2000.

|

|

|

(9)

|

The

Company completed a $2.3 million redevelopment in

2000.

|

|

|

(10)

|

The

Company is in the process of performing a $10.8 million

redevelopment.

|

|

|

(11)

|

The

Company completed a $6.2 million redevelopment in

2007.

|

|

|

(12)

|

Fund

II completed a $5.3 million redevelopment in

2008.

|

|

|

(13)

|

This

community is subject to a ground lease, which, unless extended, will

expire in 2067.

|

|

|

(14)

|

The

Company completed a $6.1 million redevelopment in

2007.

|

|

|

(15)

|

The

Company completed an $11.0 million redevelopment in 2001 and an additional

$3.6 million redevelopment in 2005.

|

|

|

(16)

|

This

community is subject to a ground lease, which, unless extended, will

expire in 2027.

|

|

|

(17)

|

The

Company completed a $3.2 million redevelopment in

2002.

|

|

|

(18)

|

The

Company completed a $1.9 million redevelopment in

2000.

|

|

|

(19)

|

The

Company completed a $1.9 million redevelopment in

2001.

|

|

|

(20)

|

The

Company completed a $1.7 million redevelopment in

2001.

|

|

|

(21)

|

The

Company is in the process of performing a $16.6 million

redevelopment.

|

|

|

(22)

|

The

Company had an 85% controlling limited partnership interest as of December

31, 2006, and during January 2007 the Company acquired the remaining 15%

partnership interest.

|

|

|

(23)

|

The

Company and EMC have a 74.0% and a 1% member interest,

respectively.

|

|

|

(24)

|

The

Company completed a $3.5 million redevelopment in

2002.

|

|

|

(25)

|

The

community is subject to a ground lease, which, unless extended, will

expire in 2028.

|

|

|

(26)

|

The

Company is in the process of performing a $14.1 million

redevelopment.

|

|

|

(27)

|

The

Company completed a $2.7 million redevelopment in

2001.

|

|

|

(28)

|

The

Company completed a $4.5 million redevelopment in

1998.

|

|

|

(29)

|

The

Company completed an $8.9 million redevelopment in

2008.

|

|

|

(30)

|

The

Company completed a $9.4 million redevelopment in

2009.

|

|

|

(31)

|

The

Company is in the process of performing a $4.6 million

redevelopment.

|

|

|

(32)

|

Fund

II completed a $4.5 million redevelopment in

2008.

|

|

|

(33)

|

In

the second quarter of 2007, the Company entered into a joint venture

partnership with a third-party, and the Company contributed the

improvements for an 81.5% interest and the joint venture partner

contributed the title to the land for an 18.5% interest in the

partnership.

|

|

|

(34)

|

The

Company completed construction of 114 units of the 462 total units in

2000.

|

|

|

(35)

|

The

Company completed a $3.4 million redevelopment in

2002.

|

|

|

(36)

|

A

portion of this community on which 84 units are presently located is

subject to a ground lease, which, unless extended, will expire in

2028.

|

|

|

(37)

|

The

Company is in the process of performing a $9.9 million

redevelopment.

|

|

|

(38)

|

The

community is subject to a ground lease, which, unless extended, will

expire in 2070.

|

|

|

(39)

|

The

Company is in the process of performing a $15.1 million

redevelopment.

|

|

|

(40)

|

The

Company is in the process of performing a $36.3 million redevelopment,

including the construction of 28 in-fill

units.

|

|

|

(41)

|

The

Company completed a $7.0 million redevelopment in

2007.

|

|

|

(42)

|

The

Company completed a $3.9 million redevelopment in

2007.

|

|

|

(43)

|

The

Company is in the process of performing an $11.8 million

redevelopment.

|

|

|

(44)

|

The

Company completed a $5.1 million redevelopment and completed construction

of 16 units of the community’s 108 units in

2006.

|

|

|

(45)

|

The

Company occupies 100% of this

property.

|

|

|

(46)

|

The

property is leased through July 2012 to a single tenant and was

reclassified out of the Company’s predevelopment pipeline in December

2008.

|

|

|

(47)

|

The

Company has a mortgage receivable, and consolidates this property in

accordance with GAAP. The Company occupies 4.6% of this

property.

|

|

|

(48)

|

The

Company occupies 30% of this

property.

|

|

Quarter Ended

|

High

|

Low

|

Close

|

|||||||||

| December 31, 2009 | $ | 88.35 | $ | 73.28 | $ | 83.65 | ||||||

| September 30, 2009 | $ | 86.49 | $ | 55.96 | $ | 79.58 | ||||||

| June 30, 2009 | $ | 71.84 | $ | 55.42 | $ | 62.23 | ||||||

| March 31, 2009 | $ | 77.77 | $ | 49.19 | $ | 57.34 | ||||||

| December 31, 2008 | $ | 117.77 | $ | 60.77 | $ | 76.75 | ||||||

| September 30, 2008 | $ | 129.57 | $ | 100.63 | $ | 118.33 | ||||||

| June 30, 2008 | $ | 124.33 | $ | 105.12 | $ | 106.50 | ||||||

|

March

31, 2008

|

$ | 117.51 | $ | 84.59 | $ | 113.98 | ||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Ordinary

income

|

79.82 | % | 98.95 | % | 75.65 | % | ||||||

|

Capital

gain

|

15.76 | % | 1.05 | % | 24.35 | % | ||||||

|

Unrecaptured

section 1250 capital gain

|

4.42 | % | 0.00 | % | 0.00 | % | ||||||

|

Return

of capital

|

0.00 | % | 0.00 | % | 0.00 | % | ||||||

| 100.00 | % | 100.00 | % | 100.00 | % | |||||||

|

Year

Ended

|

Annual

Dividend

|

Quarter

Ended

|

2009

|

2008

|

2007

|

||||||||||||

|

1994

|

$ | 0.915 |

March

31,

|

$ | 1.030 | $ | 1.020 | $ | 0.930 | ||||||||

|

1995

|

$ | 1.685 |

June

30,

|

1.030 | 1.020 | 0.930 | |||||||||||

|

1996

|

$ | 1.720 |

September

30,

|

1.030 | 1.020 | 0.930 | |||||||||||

|

1997

|

$ | 1.770 |

December

31,

|

1.030 | 1.020 | 0.930 | |||||||||||

|

1998

|

$ | 1.950 |

Annual

Dividend

|

$ | 4.120 | $ | 4.080 | $ | 3.720 | ||||||||

|

1999

|

$ | 2.150 | |||||||||||||||

|

2000

|

$ | 2.380 | |||||||||||||||

|

2001

|

$ | 2.800 | |||||||||||||||

|

2002

|

$ | 3.080 | |||||||||||||||

|

2003

|

$ | 3.120 | |||||||||||||||

|

2004

|

$ | 3.160 | |||||||||||||||

|

2005

|

$ | 3.240 | |||||||||||||||

|

2006

|

$ | 3.360 | |||||||||||||||

|

Security

Type

|

Period

|

Total

Number of Shares Purchased

|

Average

Price Paid per Share

|

Total

Number of Shares Purchased as Part of Publicly Announced Plans or

Programs

|

Total

Amount that May Yet be Purchased Under the Plans or

Programs

|

|||||||||||||||

|

Series

G

|

11/9/09

|

60,000 | $ | 18.13 | 60,000 | $ | 41,785,740 | |||||||||||||

|

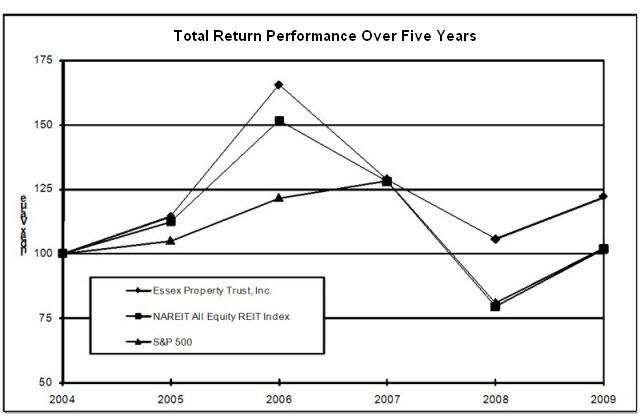

Period

Ending

|

||||||||||||||||||||||||

|

Index

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

||||||||||||||||||

|

Essex

Property Trust, Inc.

|

100.00 | 114.43 | 165.12 | 128.64 | 105.47 | 121.92 | ||||||||||||||||||

|

NAREIT

All Equity REIT Index

|

100.00 | 112.16 | 151.49 | 127.72 | 79.53 | 101.79 | ||||||||||||||||||

|

S&P

500

|

100.00 | 104.91 | 121.48 | 128.16 | 80.74 | 102.11 | ||||||||||||||||||

|

Years

Ended December 31,

|

||||||||||||||||||||

|

2009

|

2008

(1)

|

2007

(1)

|

2006

(1)

|

2005

(1)

|

||||||||||||||||

|

($

in thousands, except per share amounts)

|

||||||||||||||||||||

|

OPERATING

DATA:

|

||||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||

|

Rental

and other property

|

$ | 407,064 | $ | 403,268 | $ | 369,659 | $ | 324,934 | $ | 293,828 | ||||||||||

|

Management

and other fees from affiliates

|

4,325 | 5,166 | 5,090 | 5,030 | 10,951 | |||||||||||||||

| 411,389 | 408,434 | 374,749 | 329,964 | 304,779 | ||||||||||||||||

|

EXPENSES

|

||||||||||||||||||||

|

Property

operating expenses

|

139,711 | 132,417 | 121,475 | 109,120 | 99,235 | |||||||||||||||

|

Depreciation

and amortization

|

118,027 | 109,701 | 96,598 | 76,109 | 72,891 | |||||||||||||||

|

Interest

|

86,016 | 85,063 | 85,896 | 78,705 | 72,696 | |||||||||||||||

|

General

and administrative

|

23,704 | 26,984 | 26,673 | 22,759 | 21,686 | |||||||||||||||

|

Impairment

and other charges

|

17,442 | 1,350 | 800 | 1,770 | 5,827 | |||||||||||||||

| 384,900 | 355,515 | 331,442 | 288,463 | 272,335 | ||||||||||||||||

|

Earnings

from operations

|

26,489 | 52,919 | 43,307 | 41,501 | 32,444 | |||||||||||||||

|

Interest

and other income

|

13,040 | 11,337 | 10,310 | 6,176 | 8,524 | |||||||||||||||

|

Gain

on early retirement of debt

|

4,750 | 3,997 | - | - | - | |||||||||||||||

|

Equity

income (loss) in co-investments

|

670 | 7,820 | 3,120 | (1,503 | ) | 18,553 | ||||||||||||||

|

Gain

on the sales of real estate

|

103 | 4,578 | - | - | 6,391 | |||||||||||||||

|

Income

before discontinued operations

|

45,052 | 80,651 | 56,737 | 46,174 | 65,912 | |||||||||||||||

|

Income

from discontinued operations

|

8,687 | 3,744 | 146,324 | 34,399 | 36,644 | |||||||||||||||

|

Net

income

|

53,739 | 84,395 | 203,061 | 80,573 | 102,556 | |||||||||||||||

|

Net

income attributable to noncontrolling interest

|

(16,631 | ) | (22,255 | ) | (90,961 | ) | (21,168 | ) | (23,384 | ) | ||||||||||

|

Net

income attributable to controlling interest

|

37,108 | 62,140 | 112,100 | 59,405 | 79,172 | |||||||||||||||

|

Dividends

to preferred stockholders

|

(4,860 | ) | (9,241 | ) | (9,174 | ) | (5,145 | ) | (1,953 | ) | ||||||||||

|

Excess

of the carrying amount of preferred stock redeemed over the cash paid to

redeem preferred stock

|

49,952 | - | - | - | - | |||||||||||||||

|

Net

income available to common stockholders

|

$ | 82,200 | $ | 52,899 | $ | 102,926 | $ | 54,260 | $ | 77,219 | ||||||||||

|

Per

share data:

|

||||||||||||||||||||

|

Basic:

|

||||||||||||||||||||

|

Income

before discontinued operations available to common

stockholders

|

$ | 2.72 | $ | 1.96 | $ | 1.14 | $ | 0.98 | $ | 1.88 | ||||||||||

|

Net

income available to common stockholders

|

$ | 3.01 | $ | 2.10 | $ | 4.19 | $ | 2.35 | $ | 3.35 | ||||||||||

|

Weighted

average common stock outstanding

|

27,270 | 25,205 | 24,548 | 23,082 | 23,039 | |||||||||||||||

|

Diluted:

|

||||||||||||||||||||

|

Income

before discontinued operations available to common

stockholders

|

$ | 2.61 | $ | 1.95 | $ | 1.11 | $ | 0.96 | $ | 1.85 | ||||||||||

|

Net

income available to common stockholders

|

$ | 2.91 | $ | 2.09 | $ | 4.10 | $ | 2.30 | $ | 3.30 | ||||||||||

|

Weighted

average common stock outstanding

|

29,747 | 25,347 | 25,101 | 23,551 | 23,389 | |||||||||||||||

|

Cash

dividend per common share

|

$ | 4.12 | $ | 4.08 | $ | 3.72 | $ | 3.36 | $ | 3.24 | ||||||||||

|

As

of December 31,

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

($

in thousands)

|

||||||||||||||||||||

|

BALANCE

SHEET DATA:

|

||||||||||||||||||||

|

Investment

in rental properties (before accumulated Depreciation)

|

$ | 3,412,930 | $ | 3,279,788 | $ | 3,117,759 | $ | 2,669,187 | $ | 2,431,629 | ||||||||||

|

Net

investment in rental properties

|

2,663,466 | 2,639,762 | 2,575,772 | 2,204,172 | 2,042,589 | |||||||||||||||

|

Real

estate under development

|

274,965 | 272,273 | 233,445 | 107,620 | 54,416 | |||||||||||||||

|

Total

assets

|

3,254,637 | 3,164,823 | 2,980,323 | 2,485,840 | 2,239,290 | |||||||||||||||

|

Total

secured indebtedness

|

1,832,549 | 1,588,931 | 1,362,873 | 1,186,554 | 1,129,918 | |||||||||||||||

|

Total

unsecured indebtedness

|

14,893 | 165,457 | 282,486 | 208,765 | 205,077 | |||||||||||||||

|

Cumulative

convertible preferred stock

|

4,349 | 145,912 | 145,912 | 145,912 | - | |||||||||||||||

|

Cumulative

redeemable preferred stock

|

25,000 | 25,000 | 25,000 | 25,000 | 25,000 | |||||||||||||||

|

Stockholders'

equity

|

1,053,096 | 852,227 | 803,417 | 628,846 | 600,946 | |||||||||||||||

|

As

of and for the years ended December 31,

|

||||||||||||||||||||

|

2009

|

2008

(1)

|

2007

(1)

|

2006

(1)

|

2005

(1)

|

||||||||||||||||

|

OTHER

DATA:

|

||||||||||||||||||||

|

Net

income

|

$ | 53,739 | $ | 84,395 | $ | 203,061 | $ | 80,573 | $ | 102,556 | ||||||||||

|

Interest

expense

|

86,016 | 85,063 | 85,896 | 78,705 | 72,696 | |||||||||||||||

|

Tax

expense

|

- | - | 396 | 525 | 2,538 | |||||||||||||||

|

Depreciation

and amortization

|

118,422 | 113,294 | 102,250 | 83,034 | 80,149 | |||||||||||||||

|

EBITDA

(2)

|

258,177 | 282,752 | 391,603 | 242,837 | 257,939 | |||||||||||||||

|

Same-property

gross operating margin

(3)(4)

|

66 | % | 67 | % | 67 | % | 67 | % | 66 | % | ||||||||||

|

Average

same-property monthly rental rate per apartment unit

(4)(5)

|

$ | 1,349 | $ | 1,401 | $ | 1,314 | $ | 1,225 | $ | 1,149 | ||||||||||

|

Average

same-property monthly operating expenses per apartment unit

(4)(6)

|

$ | 470 | $ | 456 | $ | 437 | $ | 421 | $ | 395 | ||||||||||

|

Total

apartment units (at end of period)

|

27,248 | 26,992 | 27,489 | 27,553 | 26,587 | |||||||||||||||

|

Same-property

occupancy rate

(7)

|

97 | % | 96 | % | 96 | % | 96 | % | 97 | % | ||||||||||

|

Total

communities (at end of period)

|

133 | 134 | 134 | 130 | 126 | |||||||||||||||

|

|

(1)

|

The

results of operations for 2008, 2007, 2006 and 2005 have been revised to

reflect discontinued operations for properties sold subsequent to December

31, 2008 along with the retrospective adoption of accounting standards

adopted on January 1, 2009 for noncontrolling interests and exchangeable

bonds.

|

|

|

(2)

|

EBITDA

is defined as net income before interest expense, income taxes,

depreciation and amortization. EBITDA, as defined by the

Company, is not a recognized measurement under U.S. generally accepted

accounting principles, or GAAP. This measurement should not be

considered in isolation or as a substitute for net income, cash flows from

operating activities and other income or cash flow statement data prepared

in accordance with GAAP, or as a measure of profitability or

liquidity. The Company’s definition may not be comparable to

that of other companies.

|

|

(3)

|

Gross

operating margin represents rental revenues and other property income less

property operating expenses, exclusive of depreciation and amortization,

divided by rental revenues and other property

income.

|

|

(4)

|

A

stabilized apartment community, or “Same-Property” apartment units (as

defined in Item 7), are those units in communities that the Company has

consolidated for the entire two years as of the end of the period set

forth. The number of apartment units in such properties may

vary at each year-end. Percentage changes in averages per unit

do not correspond to total Same-Property revenues and expense percentage

changes which are discussed in Item 7—Management’s Discussion and Analysis

of Financial Condition and Results of

Operations.

|

|

(5)

|

Average

Same-Property monthly rental rate per apartment unit represents total

scheduled rent for the same property apartment units for the period

(actual rental rates on occupied apartment units plus market rental rates

on vacant apartment units) divided by the number of such apartment units

and further divided by the number of months in the

period.

|

|

|

(6)

|

Average

Same-Property monthly expenses per apartment unit represents total monthly

operating expenses, exclusive of depreciation and amortization, for the

same property apartment units for the period divided by the total number

of such apartment units and further divided by the number of months in the

period.

|

|

|

(7)

|

Occupancy

rates are based on financial occupancy. For an explanation of

how financial occupancy is calculated, see Item 7 – Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

|

As

of December 31, 2009

|

As

of December 31, 2008

|

|||||||||||||||

|

Apartment

Units

|

%

|

Apartment

Units

|

%

|

|||||||||||||

|

Southern

California

|

12,339 | 51 | % | 12,500 | 51 | % | ||||||||||

|

Northern

California

|

6,695 | 28 | % | 6,457 | 27 | % | ||||||||||

|

Seattle

Metro

|

5,249 | 21 | % | 5,338 | 22 | % | ||||||||||

|

Total

|

24,283 | 100 | % | 24,295 | 100 | % | ||||||||||

|

Years

ended

|

||||||||

|

December

31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Southern

California

|

96.6 | % | 95.6 | % | ||||

|

Northern

California

|

97.7 | % | 97.4 | % | ||||

|

Seattle

Metro

|

97.2 | % | 96.7 | % | ||||

|

Years

Ended

|

||||||||||||||||||||

|

Number

of

|

December

31,

|

Dollar

|

Percentage

|

|||||||||||||||||

|

Properties

|

2009

|

2008

|

Change

|

Change

|

||||||||||||||||

|

Property

Revenues

($

in thousands)

|

||||||||||||||||||||

|

2009/2008

Same-Properties:

|

||||||||||||||||||||

|

Southern

California

|

55 | $ | 183,246 | $ | 188,807 | $ | (5,561 | ) | (2.9 | ) % | ||||||||||

|

Northern

California

|

24 | 104,316 | 106,301 | (1,985 | ) | (1.9 | ) | |||||||||||||

|

Seattle

Metro

|

22 | 58,041 | 60,430 | (2,389 | ) | (4.0 | ) | |||||||||||||

|

Total

2009/2008 Same-Property revenues

|

101 | 345,603 | 355,538 | (9,935 | ) | (2.8 | ) | |||||||||||||

|

2009/2008

Non-Same Property Revenues (1)

|

61,461 | 47,730 | 13,731 | 28.8 | ||||||||||||||||

|

Total

property revenues

|

$ | 407,064 | $ | 403,268 | $ | 3,796 | 0.9 | % | ||||||||||||

|

Years

ended

|

||||||||

|

December

31,

|

||||||||

|

2008

|

2007

|

|||||||

|

Southern

California

|

95.5 | % | 95.5 | % | ||||

|

Northern

California

|

97.5 | % | 96.5 | % | ||||

|

Seattle

Metro

|

96.9 | % | 96.1 | % | ||||

|

Years

Ended

|

||||||||||||||||||||

|

Number

of

|

December

31,

|

Dollar

|

Percentage

|

|||||||||||||||||

|

Properties

|

2008

|

2007

|

Change

|

Change

|

||||||||||||||||

|

Property

Revenues

($

in thousands)

|

||||||||||||||||||||

|

2008/2007

Same-Properties:

|

||||||||||||||||||||

|

Southern

California

|

53 | $ | 184,222 | $ | 181,417 | $ | 2,805 | 1.5 | % | |||||||||||

|

Northern

California

|

18 | 79,389 | 72,611 | 6,778 | 9.3 | |||||||||||||||

|

Seattle

Metro

|

21 | 61,007 | 56,616 | 4,391 | 7.8 | |||||||||||||||

|

Total

2008/2007 Same-Property revenues

|

92 | 324,618 | 310,644 | 13,974 | 4.5 | |||||||||||||||

|

2008/2007

Non-Same Property Revenues (1)

|

78,650 | 59,015 | 19,635 | 33.3 | ||||||||||||||||

|

Total

property revenues

|

$ | 403,268 | $ | 369,659 | $ | 33,609 | 9.1 | % | ||||||||||||

|

2011

and

|

2013

and

|

|||||||||||||||||||

|

($

in thousands)

|

2010

|

2012

|

2014

|

Thereafter

|

Total

|

|||||||||||||||

|

Mortgage

notes payable

|

$ | 155,869 | $ | 205,411 | $ | 251,154 | $ | 991,116 | $ | 1,603,549 | ||||||||||

|

Exchangeable

bonds

|

4,893 | - | - | - | 4,893 | |||||||||||||||

|

Lines

of credit

|

10,000 | - | 229,000 | - | 239,000 | |||||||||||||||

|

Interest

on indebtedness (1)

|

87,213 | 136,461 | 101,822 | 206,319 | 531,815 | |||||||||||||||

|

Development

commitments

|

65,900 | - | - | - | 65,900 | |||||||||||||||

|

Redevelopment

commitments

|

36,198 | - | - | - | 36,198 | |||||||||||||||

| $ | 360,073 | $ | 341,872 | $ | 581,976 | $ | 1,197,435 | $ | 2,481,355 | |||||||||||

|

|

(a)

|

historical

cost accounting for real estate assets in accordance with GAAP assumes,

through depreciation charges, that the value of real estate assets

diminishes predictably over time. NAREIT stated in its White Paper on

Funds from Operations “since real estate asset values have historically

risen or fallen with market conditions, many industry investors have

considered presentations of operating results for real estate companies

that use historical cost accounting to be insufficient by themselves.”

Consequently, NAREIT’s definition of FFO reflects the fact that real

estate, as an asset class, generally appreciates over time and

depreciation charges required by GAAP do not reflect the underlying

economic realities.

|

|

(b)

|

REITs

were created as a legal form of organization in order to encourage public

ownership of real estate as an asset class through investment in firms

that were in the business of long-term ownership and management of real

estate. The exclusion, in NAREIT’s definition of FFO, of gains

from the sales of previously depreciated operating real estate assets

allows investors and analysts to readily identify the operating results of

the long-term assets that form the core of a REIT’s activity and assists

in comparing those operating results between

periods.

|

|

For

the year

|

||||||||||||||||||||

|

ended

|

For

the quarter ended

|

|||||||||||||||||||

|

12/31/09

|

12/31/09

|

9/30/09

|

6/30/09

|

3/31/09

|

||||||||||||||||

|

Net

income available to common stockholders

|

$ | 82,200,000 | $ | 6,781,000 | $ | 21,739,000 | $ | 11,415,000 | $ | 42,265,000 | ||||||||||

|

Adjustments:

|

||||||||||||||||||||

|

Depreciation

and amortization

|

118,522,000 | 30,349,000 | 29,895,000 | 29,073,000 | 29,204,000 | |||||||||||||||

|

Gains

not included in FFO, net of internal disposition cost

|

(7,943,000 | ) | (2,852,000 | ) | (2,237,000 | ) | (626,000 | ) | (2,225,000 | ) | ||||||||||

|

Noncontrolling

interests and co-investments

(1)

|

7,607,000 | 1,510,000 | 1,394,000 | 2,141,000 | 2,563,000 | |||||||||||||||

|

Funds

from operations

|

$ | 200,386,000 | $ | 35,788,000 | $ | 50,791,000 | $ | 42,003,000 | $ | 71,807,000 | ||||||||||

|

Weighted

average number of shares outstanding diluted

(2)

|

29,746,614 | 30,893,169 | 30,070,076 | 29,303,695 | 28,692,959 | |||||||||||||||

|

For

the year

|

||||||||||||||||||||

|

ended

|

For

the quarter ended

|

|||||||||||||||||||

|

12/31/08

|

12/31/08

|

9/30/08

|

6/30/08

|

3/31/08

|

||||||||||||||||

|

Net

income available to common stockholders

|

$ | 52,899,000 | $ | 17,954,000 | $ | 11,421,000 | $ | 8,744,000 | $ | 14,780,000 | ||||||||||

|

Adjustments:

|

||||||||||||||||||||

|

Depreciation

and amortization

|

113,293,000 | 28,296,000 | 28,581,000 | 28,682,000 | 27,734,000 | |||||||||||||||

|

Gains

not included in FFO

|

(7,849,000 | ) | (5,356,000 | ) | (2,493,000 | ) | - | - | ||||||||||||

|

Noncontrolling

interests and co-investments

(1)

|

9,181,000 | 2,733,000 | 2,134,000 | 1,808,000 | 2,312,000 | |||||||||||||||

|

Funds

from operations

|

$ | 167,524,000 | $ | 43,627,000 | $ | 39,643,000 | $ | 39,234,000 | $ | 44,826,000 | ||||||||||

|

Weighted

average number of shares outstanding diluted

(2)

|

27,807,946 | 28,663,993 | 27,910,297 | 27,623,939 | 27,398,605 | |||||||||||||||

|

For

the year

|

||||||||||||||||||||

|

ended

|