|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

36-4316614

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

One Edwards Way, Irvine, California

|

|

92614

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(949) 250-2500

(Registrant's telephone number, including area code)

|

||

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated

filer

o

|

|

Smaller reporting company

o

|

Emerging growth company

o

|

|

|

|

|

Page

Number

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

September 30,

2018 |

December 31,

2017 |

|||||

|

ASSETS

|

|

|

|

|

|||

|

Current assets

|

|

|

|

|

|||

|

Cash and cash equivalents

|

$

|

1,261.3

|

|

$

|

818.3

|

|

|

|

Short-term investments (Note 5)

|

334.4

|

|

519.2

|

|

|||

|

Accounts receivable, net of allowances of $8.3 and $8.5, respectively

|

423.8

|

|

438.7

|

|

|||

|

Other receivables

|

106.3

|

|

40.6

|

|

|||

|

Inventories (Note 2)

|

583.8

|

|

554.9

|

|

|||

|

Prepaid expenses

|

52.6

|

|

60.6

|

|

|||

|

Other current assets

|

150.4

|

|

116.9

|

|

|||

|

Total current assets

|

2,912.6

|

|

2,549.2

|

|

|||

|

Long-term investments (Note 5)

|

479.0

|

|

567.0

|

|

|||

|

Property, plant, and equipment, net

|

826.1

|

|

679.7

|

|

|||

|

Goodwill

|

1,122.3

|

|

1,126.5

|

|

|||

|

Other intangible assets, net

|

467.9

|

|

468.0

|

|

|||

|

Deferred income taxes

|

115.1

|

|

167.1

|

|

|||

|

Other assets

|

35.2

|

|

108.9

|

|

|||

|

Total assets

|

$

|

5,958.2

|

|

$

|

5,666.4

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|||

|

Current liabilities

|

|

|

|

|

|||

|

Accounts payable and accrued liabilities (Note 2)

|

$

|

661.2

|

|

$

|

770.3

|

|

|

|

Short-term debt (Note 6)

|

599.9

|

|

598.0

|

|

|||

|

Contingent consideration liabilities (Note 7)

|

—

|

|

51.7

|

|

|||

|

Total current liabilities

|

1,261.1

|

|

1,420.0

|

|

|||

|

Long-term debt (Note 6)

|

593.6

|

|

438.4

|

|

|||

|

Contingent consideration liabilities (Note 7)

|

192.6

|

|

192.6

|

|

|||

|

Taxes payable

|

264.5

|

|

347.5

|

|

|||

|

Other long-term liabilities

|

285.1

|

|

311.7

|

|

|||

|

Commitments and contingencies (Note 11)

|

|

|

|

|

|||

|

Stockholders' equity

|

|

|

|

|

|||

|

Preferred stock, $.01 par value, authorized 50.0 shares, no shares outstanding

|

—

|

|

—

|

|

|||

|

Common stock, $1.00 par value, 350.0 shares authorized, 214.8 and 212.0 shares issued, and 209.1 and 209.7 shares outstanding, respectively

|

214.8

|

|

212.0

|

|

|||

|

Additional paid-in capital

|

1,341.2

|

|

1,166.9

|

|

|||

|

Retained earnings

|

2,687.7

|

|

1,962.1

|

|

|||

|

Accumulated other comprehensive loss

|

(139.0

|

)

|

(132.7

|

)

|

|||

|

Treasury stock, at cost, 5.7 and 2.3 shares, respectively

|

(743.4

|

)

|

(252.1

|

)

|

|||

|

Total stockholders' equity

|

3,361.3

|

|

2,956.2

|

|

|||

|

Total liabilities and stockholders' equity

|

$

|

5,958.2

|

|

$

|

5,666.4

|

|

|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Net sales

|

$

|

906.6

|

|

$

|

821.5

|

|

$

|

2,745.1

|

|

$

|

2,546.8

|

|

|||

|

Cost of sales

|

224.9

|

|

213.3

|

|

704.7

|

|

640.0

|

|

|||||||

|

Gross profit

|

681.7

|

|

608.2

|

|

2,040.4

|

|

1,906.8

|

|

|||||||

|

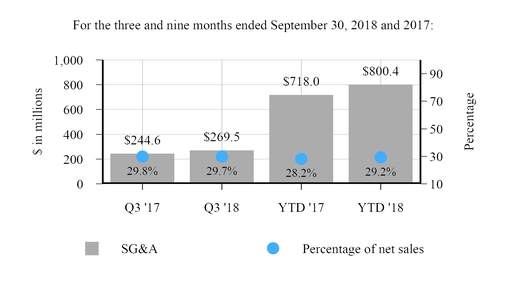

Selling, general, and administrative expenses

|

269.5

|

|

244.6

|

|

800.4

|

|

718.0

|

|

|||||||

|

Research and development expenses

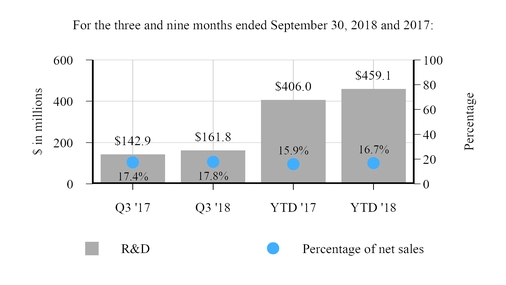

|

161.8

|

|

142.9

|

|

459.1

|

|

406.0

|

|

|||||||

|

Intellectual property litigation expenses

|

7.9

|

|

13.7

|

|

19.1

|

|

31.6

|

|

|||||||

|

Change in fair value of contingent consideration liabilities, net (Note 7)

|

(6.4

|

)

|

(16.7

|

)

|

8.3

|

|

(12.5

|

)

|

|||||||

|

Special charges (Note 4)

|

—

|

|

9.7

|

|

—

|

|

9.7

|

|

|||||||

|

Other operating expenses, net

|

—

|

|

—

|

|

—

|

|

0.7

|

|

|||||||

|

Operating income

|

248.9

|

|

214.0

|

|

753.5

|

|

753.3

|

|

|||||||

|

Interest expense (income), net

|

0.5

|

|

0.1

|

|

(0.3

|

)

|

3.9

|

|

|||||||

|

Special charges (gains) (Note 4)

|

—

|

|

0.5

|

|

(7.1

|

)

|

31.7

|

|

|||||||

|

Other (income) expense, net

|

(0.3

|

)

|

1.6

|

|

(2.3

|

)

|

6.7

|

|

|||||||

|

Income before provision for income taxes

|

248.7

|

|

211.8

|

|

763.2

|

|

711.0

|

|

|||||||

|

Provision for income taxes

|

22.8

|

|

41.7

|

|

48.0

|

|

124.6

|

|

|||||||

|

Net income

|

$

|

225.9

|

|

$

|

170.1

|

|

$

|

715.2

|

|

$

|

586.4

|

|

|||

|

Share information

(Note 13)

|

|

|

|

|

|

|

|

|

|||||||

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|||||||

|

Basic

|

$

|

1.08

|

|

$

|

0.81

|

|

$

|

3.41

|

|

$

|

2.78

|

|

|||

|

Diluted

|

$

|

1.06

|

|

$

|

0.79

|

|

$

|

3.34

|

|

$

|

2.71

|

|

|||

|

Weighted-average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|||||||

|

Basic

|

209.0

|

|

211.3

|

|

209.5

|

|

211.0

|

|

|||||||

|

Diluted

|

213.2

|

|

216.2

|

|

214.1

|

|

216.1

|

|

|||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Net income

|

$

|

225.9

|

|

$

|

170.1

|

|

$

|

715.2

|

|

$

|

586.4

|

|

|||

|

Other comprehensive income (loss), net of tax (Note 12):

|

|||||||||||||||

|

Foreign currency translation adjustments

|

(2.0

|

)

|

26.2

|

|

(39.8

|

)

|

87.1

|

|

|||||||

|

Unrealized gain (loss) on cash flow hedges

|

13.1

|

|

(10.6

|

)

|

34.0

|

|

(29.2

|

)

|

|||||||

|

Defined benefit pension plans

|

(0.2

|

)

|

0.5

|

|

0.3

|

|

0.6

|

|

|||||||

|

Unrealized gain (loss) on available-for-sale investments

|

0.3

|

|

(2.1

|

)

|

(3.7

|

)

|

(4.7

|

)

|

|||||||

|

Reclassification of net realized investment loss to earnings

|

0.6

|

|

1.1

|

|

2.9

|

|

1.9

|

|

|||||||

|

Other comprehensive income (loss)

|

11.8

|

|

15.1

|

|

(6.3

|

)

|

55.7

|

|

|||||||

|

Comprehensive income

|

$

|

237.7

|

|

$

|

185.2

|

|

$

|

708.9

|

|

$

|

642.1

|

|

|||

|

|

Nine Months Ended

September 30, |

||||||

|

|

2018

|

2017

|

|||||

|

Cash flows from operating activities

|

|

|

|

|

|||

|

Net income

|

$

|

715.2

|

|

$

|

586.4

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|||

|

Depreciation and amortization

|

57.5

|

|

60.7

|

|

|||

|

Stock-based compensation (Note 9)

|

55.0

|

|

46.3

|

|

|||

|

Impairment charge (Note 4)

|

—

|

|

31.0

|

|

|||

|

Change in fair value of contingent consideration liabilities, net (Note 7)

|

8.3

|

|

(12.5

|

)

|

|||

|

Deferred income taxes

|

29.8

|

|

44.1

|

|

|||

|

Other

|

3.0

|

|

4.5

|

|

|||

|

Changes in operating assets and liabilities:

|

|

|

|

|

|||

|

Accounts and other receivables, net

|

(0.3

|

)

|

(20.7

|

)

|

|||

|

Inventories

|

(43.5

|

)

|

(109.8

|

)

|

|||

|

Accounts payable and accrued liabilities

|

4.0

|

|

54.9

|

|

|||

|

Income taxes

|

(208.6

|

)

|

(55.0

|

)

|

|||

|

Other

|

13.4

|

|

6.9

|

|

|||

|

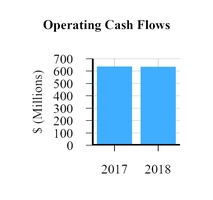

Net cash provided by operating activities

|

633.8

|

|

636.8

|

|

|||

|

Cash flows from investing activities

|

|

|

|

|

|||

|

Capital expenditures

|

(181.1

|

)

|

(116.2

|

)

|

|||

|

Purchases of held-to-maturity investments (Note 5)

|

(190.0

|

)

|

(716.9

|

)

|

|||

|

Proceeds from held-to-maturity investments (Note 5)

|

388.1

|

|

333.0

|

|

|||

|

Purchases of available-for sale investments (Note 5)

|

(115.3

|

)

|

(477.8

|

)

|

|||

|

Proceeds from available-for-sale investments (Note 5)

|

193.1

|

|

381.0

|

|

|||

|

Payment of contingent consideration

|

(10.0

|

)

|

—

|

|

|||

|

Acquisition of business, net of cash acquired

|

—

|

|

(84.9

|

)

|

|||

|

Other

|

(13.8

|

)

|

(14.7

|

)

|

|||

|

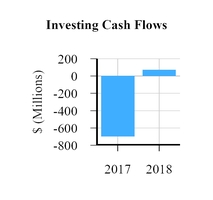

Net cash provided by (used in) investing activities

|

71.0

|

|

(696.5

|

)

|

|||

|

Cash flows from financing activities

|

|

|

|

|

|||

|

Proceeds from issuance of debt, net (Note 6)

|

686.4

|

|

989.3

|

|

|||

|

Payments on debt and capital lease obligations (Note 6)

|

(524.1

|

)

|

(812.8

|

)

|

|||

|

Purchases of treasury stock

|

(523.5

|

)

|

(512.0

|

)

|

|||

|

Proceeds from stock plans

|

119.3

|

|

91.3

|

|

|||

|

Payment of contingent consideration

|

(15.1

|

)

|

—

|

|

|||

|

Other

|

0.5

|

|

—

|

|

|||

|

Net cash used in financing activities

|

(256.5

|

)

|

(244.2

|

)

|

|||

|

Effect of currency exchange rate changes on cash and cash equivalents

|

(5.3

|

)

|

4.1

|

|

|||

|

Net increase (decrease) in cash and cash equivalents

|

443.0

|

|

(299.8

|

)

|

|||

|

Cash and cash equivalents at beginning of period

|

818.3

|

|

930.1

|

|

|||

|

Cash and cash equivalents at end of period

|

$

|

1,261.3

|

|

$

|

630.3

|

|

|

|

September 30, 2018

|

December 31, 2017

|

||||||

|

Inventories

|

|||||||

|

Raw materials

|

$

|

117.3

|

|

$

|

101.4

|

|

|

|

Work in process

|

141.6

|

|

121.1

|

|

|||

|

Finished products

|

324.9

|

|

332.4

|

|

|||

|

$

|

583.8

|

|

$

|

554.9

|

|

||

|

September 30, 2018

|

December 31, 2017

|

||||||

|

Accounts payable and accrued liabilities

|

|

|

|

|

|||

|

Accounts payable

|

$

|

134.0

|

|

$

|

116.6

|

|

|

|

Employee compensation and withholdings

|

212.2

|

|

249.4

|

|

|||

|

Taxes payable (Note 14)

|

11.7

|

|

97.8

|

|

|||

|

Property, payroll, and other taxes

|

44.2

|

|

41.9

|

|

|||

|

Research and development accruals

|

49.6

|

|

39.2

|

|

|||

|

Accrued rebates

|

77.3

|

|

71.0

|

|

|||

|

Fair value of derivatives

|

3.3

|

|

24.8

|

|

|||

|

Accrued marketing expenses

|

21.0

|

|

14.9

|

|

|||

|

Litigation and insurance reserves

|

17.5

|

|

15.0

|

|

|||

|

Accrued relocation costs

|

12.4

|

|

8.7

|

|

|||

|

Accrued professional services

|

9.3

|

|

8.5

|

|

|||

|

Accrued realignment reserves

|

0.3

|

|

8.2

|

|

|||

|

Other accrued liabilities

|

68.4

|

|

74.3

|

|

|||

|

$

|

661.2

|

|

$

|

770.3

|

|

||

|

Nine Months Ended

September 30, |

|||||||

|

2018

|

2017

|

||||||

|

Cash paid during the year for:

|

|||||||

|

Income taxes

|

$

|

227.3

|

|

$

|

122.4

|

|

|

|

Non-cash investing and financing transactions:

|

|

|

|

|

|||

|

Fair value of shares issued in payment for contingent consideration liabilities

|

$

|

34.3

|

|

$

|

—

|

|

|

|

Fair value of shares issued in connection with business combinations

|

$

|

—

|

|

$

|

266.5

|

|

|

|

Retirement of treasury stock

|

$

|

—

|

|

$

|

2,746.2

|

|

|

|

Capital expenditures accruals

|

$

|

23.7

|

|

$

|

19.1

|

|

|

|

|

September 30, 2018

|

December 31, 2017

|

|||||||||||||||||||||||||||||

|

Held-to-maturity

|

Cost

|

Gross Unrealized Gains

|

Gross Unrealized Losses

|

Fair Value

|

Cost

|

Gross Unrealized Gains

|

Gross Unrealized Losses

|

Fair Value

|

|||||||||||||||||||||||

|

Bank time deposits

|

$

|

190.0

|

|

$

|

—

|

|

$

|

—

|

|

$

|

190.0

|

|

$

|

382.9

|

|

$

|

—

|

|

$

|

—

|

|

$

|

382.9

|

|

|||||||

|

Commercial paper

|

—

|

|

—

|

|

—

|

|

—

|

|

1.4

|

|

—

|

|

—

|

|

1.4

|

|

|||||||||||||||

|

U.S. government and agency securities

|

—

|

|

—

|

|

—

|

|

—

|

|

3.9

|

|

—

|

|

—

|

|

3.9

|

|

|||||||||||||||

|

Total

|

$

|

190.0

|

|

$

|

—

|

|

$

|

—

|

|

$

|

190.0

|

|

$

|

388.2

|

|

$

|

—

|

|

$

|

—

|

|

$

|

388.2

|

|

|||||||

|

Available-for-sale

|

|||||||||||||||||||||||||||||||

|

Bank time deposits

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

0.5

|

|

$

|

—

|

|

$

|

—

|

|

$

|

0.5

|

|

|||||||

|

Commercial paper

|

21.2

|

|

—

|

|

—

|

|

21.2

|

|

40.3

|

|

—

|

|

—

|

|

40.3

|

|

|||||||||||||||

|

U.S. government and agency securities

|

82.2

|

|

—

|

|

(0.9

|

)

|

81.3

|

|

69.4

|

|

—

|

|

(0.7

|

)

|

68.7

|

|

|||||||||||||||

|

Foreign government bonds

|

1.7

|

|

—

|

|

—

|

|

1.7

|

|

3.0

|

|

—

|

|

—

|

|

3.0

|

|

|||||||||||||||

|

Asset-backed securities

|

94.1

|

|

—

|

|

(0.7

|

)

|

93.4

|

|

121.2

|

|

—

|

|

(0.4

|

)

|

120.8

|

|

|||||||||||||||

|

Corporate debt securities

|

403.8

|

|

0.9

|

|

(3.9

|

)

|

400.8

|

|

446.5

|

|

0.8

|

|

(1.8

|

)

|

445.5

|

|

|||||||||||||||

|

Municipal securities

|

2.8

|

|

—

|

|

—

|

|

2.8

|

|

4.4

|

|

—

|

|

—

|

|

4.4

|

|

|||||||||||||||

|

Total

|

$

|

605.8

|

|

$

|

0.9

|

|

$

|

(5.5

|

)

|

$

|

601.2

|

|

$

|

685.3

|

|

$

|

0.8

|

|

$

|

(2.9

|

)

|

$

|

683.2

|

|

|||||||

|

Held-to-Maturity

|

Available-for-Sale

|

||||||||||||||

|

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

|||||||||||

|

|

(in millions)

|

||||||||||||||

|

Due in 1 year or less

|

$

|

190.0

|

|

$

|

190.0

|

|

$

|

145.2

|

|

$

|

144.4

|

|

|||

|

Due after 1 year through 5 years

|

—

|

|

—

|

|

372.0

|

|

368.9

|

|

|||||||

|

Due after 5 years through 10 years

|

—

|

|

—

|

|

1.0

|

|

1.0

|

|

|||||||

|

Instruments not due at a single maturity date

|

—

|

|

—

|

|

87.6

|

|

86.9

|

|

|||||||

|

$

|

190.0

|

|

$

|

190.0

|

|

$

|

605.8

|

|

$

|

601.2

|

|

||||

|

September 30, 2018

|

|||||||||||||||||||||||

|

Less than 12 Months

|

12 Months or Greater

|

Total

|

|||||||||||||||||||||

|

Fair Value

|

Gross Unrealized Losses

|

Fair Value

|

Gross Unrealized Losses

|

Fair Value

|

Gross Unrealized Losses

|

||||||||||||||||||

|

Commercial paper

|

$

|

7.5

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7.5

|

|

$

|

—

|

|

|||||

|

U.S. government and agency securities

|

122.0

|

|

(0.3

|

)

|

41.3

|

|

(0.6

|

)

|

163.3

|

|

(0.9

|

)

|

|||||||||||

|

Foreign government bonds

|

1.7

|

|

—

|

|

—

|

|

—

|

|

1.7

|

|

—

|

|

|||||||||||

|

Asset-backed securities

|

39.0

|

|

(0.2

|

)

|

43.1

|

|

(0.5

|

)

|

82.1

|

|

(0.7

|

)

|

|||||||||||

|

Corporate debt securities

|

158.8

|

|

(2.0

|

)

|

98.6

|

|

(1.9

|

)

|

257.4

|

|

(3.9

|

)

|

|||||||||||

|

Municipal securities

|

2.8

|

|

—

|

|

—

|

|

—

|

|

2.8

|

|

—

|

|

|||||||||||

|

$

|

331.8

|

|

$

|

(2.5

|

)

|

$

|

183.0

|

|

$

|

(3.0

|

)

|

$

|

514.8

|

|

$

|

(5.5

|

)

|

||||||

|

December 31, 2017

|

|||||||||||||||||||||||

|

Less than 12 Months

|

12 Months or Greater

|

Total

|

|||||||||||||||||||||

|

Fair Value

|

Gross Unrealized Losses

|

Fair Value

|

Gross Unrealized Losses

|

Fair Value

|

Gross Unrealized Losses

|

||||||||||||||||||

|

Commercial paper

|

$

|

2.4

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2.4

|

|

$

|

—

|

|

|||||

|

U.S. government and agency securities

|

31.5

|

|

(0.2

|

)

|

37.1

|

|

(0.5

|

)

|

68.6

|

|

(0.7

|

)

|

|||||||||||

|

Foreign government bonds

|

3.0

|

|

—

|

|

—

|

|

—

|

|

3.0

|

|

—

|

|

|||||||||||

|

Asset-backed securities

|

90.8

|

|

(0.3

|

)

|

23.2

|

|

(0.1

|

)

|

114.0

|

|

(0.4

|

)

|

|||||||||||

|

Corporate debt securities

|

253.3

|

|

(1.2

|

)

|

59.2

|

|

(0.6

|

)

|

312.5

|

|

(1.8

|

)

|

|||||||||||

|

Municipal securities

|

4.3

|

|

—

|

|

—

|

|

—

|

|

4.3

|

|

—

|

|

|||||||||||

|

$

|

385.3

|

|

$

|

(1.7

|

)

|

$

|

119.5

|

|

$

|

(1.2

|

)

|

$

|

504.8

|

|

$

|

(2.9

|

)

|

||||||

|

|

September 30,

2018 |

December 31,

2017 |

|||||

|

|

(in millions)

|

||||||

|

Equity method investments

|

|

|

|

|

|||

|

Cost

|

$

|

9.5

|

|

$

|

9.2

|

|

|

|

Equity in losses

|

(5.1

|

)

|

(5.1

|

)

|

|||

|

Carrying value of equity method investments

|

4.4

|

|

4.1

|

|

|||

|

Equity securities

|

|

|

|

|

|||

|

Carrying value of non-marketable equity securities

|

17.8

|

|

10.7

|

|

|||

|

Total investments in unconsolidated affiliates

|

$

|

22.2

|

|

$

|

14.8

|

|

|

|

|

September 30, 2018

|

|

December 31, 2017

|

||||||||||

|

|

Amount

|

Effective

Interest Rate |

|

Amount

|

Effective

Interest Rate |

||||||||

|

(in millions)

|

(in millions)

|

||||||||||||

|

Fixed-rate 4.300% 2018 Notes

|

$

|

600.0

|

|

4.329

|

%

|

$

|

—

|

|

—

|

%

|

|||

|

Fixed-rate 2.875% 2013 Notes

|

600.0

|

|

2.983

|

%

|

600.0

|

|

2.983

|

%

|

|||||

|

Total senior notes

|

1,200.0

|

|

600.0

|

|

|||||||||

|

Unamortized discount

|

(1.4

|

)

|

|

|

|

(0.5

|

)

|

|

|

||||

|

Unamortized debt issuance costs

|

(5.1

|

)

|

(0.8

|

)

|

|||||||||

|

Hedge accounting fair value adjustments (see Note 8)

|

—

|

|

|

|

|

(0.7

|

)

|

|

|

||||

|

Total carrying amount

|

$

|

1,193.5

|

|

|

|

|

$

|

598.0

|

|

|

|

||

|

September 30, 2018

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||

|

Assets

|

|

|

|

|

|

|

|

|

|||||||

|

Cash equivalents

|

$

|

22.2

|

|

$

|

114.1

|

|

$

|

—

|

|

$

|

136.3

|

|

|||

|

Available-for-sale investments:

|

|

|

|||||||||||||

|

Corporate debt securities

|

—

|

|

400.8

|

|

—

|

|

400.8

|

|

|||||||

|

Asset-backed securities

|

—

|

|

93.4

|

|

—

|

|

93.4

|

|

|||||||

|

U.S. government and agency securities

|

21.3

|

|

60.0

|

|

—

|

|

81.3

|

|

|||||||

|

Foreign government bonds

|

—

|

|

1.7

|

|

—

|

|

1.7

|

|

|||||||

|

Commercial paper

|

—

|

|

21.2

|

|

—

|

|

21.2

|

|

|||||||

|

Municipal securities

|

—

|

|

2.8

|

|

—

|

|

2.8

|

|

|||||||

|

Investments held for deferred compensation plans

|

72.7

|

|

—

|

|

—

|

|

72.7

|

|

|||||||

|

Derivatives

|

—

|

|

28.2

|

|

—

|

|

28.2

|

|

|||||||

|

$

|

116.2

|

|

$

|

722.2

|

|

$

|

—

|

|

$

|

838.4

|

|

||||

|

Liabilities

|

|

|

|

|

|

|

|

|

|||||||

|

Derivatives

|

$

|

—

|

|

$

|

13.8

|

|

$

|

—

|

|

$

|

13.8

|

|

|||

|

Deferred compensation plans

|

73.4

|

|

—

|

|

—

|

|

73.4

|

|

|||||||

|

Contingent consideration liabilities

|

—

|

|

—

|

|

192.6

|

|

192.6

|

|

|||||||

|

$

|

73.4

|

|

$

|

13.8

|

|

$

|

192.6

|

|

$

|

279.8

|

|

||||

|

December 31, 2017

|

|

|

|

|

|

|

|

|

|||||||

|

Assets

|

|

|

|

|

|

||||||||||

|

Cash equivalents

|

$

|

52.2

|

|

$

|

22.8

|

|

$

|

—

|

|

$

|

75.0

|

|

|||

|

Available-for-sale investments:

|

|||||||||||||||

|

Bank time deposits

|

—

|

|

0.5

|

|

—

|

|

0.5

|

|

|||||||

|

Corporate debt securities

|

—

|

|

445.5

|

|

—

|

|

445.5

|

|

|||||||

|

Asset-backed securities

|

—

|

|

120.8

|

|

—

|

|

120.8

|

|

|||||||

|

U.S. government and agency securities

|

20.6

|

|

48.1

|

|

—

|

|

68.7

|

|

|||||||

|

Foreign government bonds

|

—

|

|

3.0

|

|

—

|

|

3.0

|

|

|||||||

|

Commercial paper

|

—

|

|

40.3

|

|

—

|

|

40.3

|

|

|||||||

|

Municipal securities

|

—

|

|

4.4

|

|

—

|

|

4.4

|

|

|||||||

|

Investments held for deferred compensation plans

|

63.7

|

|

—

|

|

—

|

|

63.7

|

|

|||||||

|

Derivatives

|

—

|

|

4.9

|

|

—

|

|

4.9

|

|

|||||||

|

$

|

136.5

|

|

$

|

690.3

|

|

$

|

—

|

|

$

|

826.8

|

|

||||

|

Liabilities

|

|

|

|

|

|

|

|

|

|||||||

|

Derivatives

|

$

|

—

|

|

$

|

24.8

|

|

$

|

—

|

|

$

|

24.8

|

|

|||

|

Deferred compensation plans

|

64.1

|

|

—

|

|

—

|

|

64.1

|

|

|||||||

|

Contingent consideration liabilities

|

|

|

—

|

|

244.3

|

|

244.3

|

|

|||||||

|

$

|

64.1

|

|

$

|

24.8

|

|

$

|

244.3

|

|

$

|

333.2

|

|

||||

|

Balance at December 31, 2017

|

$

|

244.3

|

|

|

|

Payments

|

(60.0

|

)

|

||

|

Changes in fair value

|

8.3

|

|

||

|

Balance at September 30, 2018

|

$

|

192.6

|

|

|

|

|

Notional Amount

|

||||||

|

|

September 30, 2018

|

December 31, 2017

|

|||||

|

|

(in millions)

|

||||||

|

Foreign currency forward exchange contracts

|

$

|

1,268.1

|

|

$

|

979.8

|

|

|

|

Cross currency swap contracts

|

300.0

|

|

—

|

|

|||

|

|

|

Fair Value

|

||||||||

|

Derivatives designated as hedging instruments

|

Balance Sheet

Location

|

September 30, 2018

|

December 31, 2017

|

|||||||

|

Assets

|

|

|

|

|

|

|||||

|

Foreign currency contracts

|

Other current assets

|

$

|

28.2

|

|

$

|

4.9

|

|

|||

|

Liabilities

|

|

|

|

|

|

|||||

|

Cross currency swap contracts

|

Other long-term liabilities

|

$

|

10.5

|

|

$

|

—

|

|

|||

|

Foreign currency contracts

|

Accrued and other liabilities

|

$

|

3.3

|

|

$

|

24.8

|

|

|||

|

|

|

|

|

Gross Amounts

Not Offset in

the Consolidated

Balance Sheet

|

|

||||||||||||||||||

|

|

|

Gross Amounts

Offset in the

Consolidated

Balance Sheet

|

|

||||||||||||||||||||

|

|

|

Net Amounts

Presented in the

Consolidated

Balance Sheet

|

|||||||||||||||||||||

|

September 30, 2018

|

Gross

Amounts

|

Financial

Instruments

|

Cash

Collateral

Received

|

Net

Amount

|

|||||||||||||||||||

|

Derivative assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Foreign currency contracts

|

$

|

28.2

|

|

$

|

—

|

|

$

|

28.2

|

|

$

|

(3.3

|

)

|

$

|

—

|

|

$

|

24.9

|

|

|||||

|

Derivative liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Foreign currency contracts

|

$

|

3.3

|

|

$

|

—

|

|

$

|

3.3

|

|

$

|

(3.3

|

)

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Cross currency swap contracts

|

$

|

10.5

|

|

$

|

—

|

|

$

|

10.5

|

|

$

|

—

|

|

$

|

—

|

|

$

|

10.5

|

|

|||||

|

December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Derivative assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Foreign currency contracts

|

$

|

4.9

|

|

$

|

—

|

|

$

|

4.9

|

|

$

|

(3.7

|

)

|

$

|

—

|

|

$

|

1.2

|

|

|||||

|

Derivative liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Foreign currency contracts

|

$

|

24.8

|

|

$

|

—

|

|

$

|

24.8

|

|

$

|

(3.7

|

)

|

$

|

—

|

|

$

|

21.1

|

|

|||||

|

|

Amount of Gain or (Loss)

Recognized in OCI

on Derivative

|

|

Amount of Gain or (Loss)

Reclassified from

Accumulated OCI

into Income

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Location of Gain or

(Loss) Reclassified from

Accumulated OCI

into Income

|

Three Months Ended

September 30, |

|||||||||||||||

|

|

||||||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||

|

Cash flow hedges

|

||||||||||||||||||

|

Foreign currency contracts

|

$

|

12.1

|

|

$

|

(13.6

|

)

|

Cost of sales

|

$

|

(4.6

|

)

|

$

|

3.1

|

|

|||||

|

Selling, general, and administrative expenses

|

$

|

(0.4

|

)

|

$

|

(0.4

|

)

|

||||||||||||

|

|

Amount of Gain or (Loss)

Recognized in OCI

on Derivative

|

|

Amount of Gain or (Loss)

Reclassified from

Accumulated OCI

into Income

|

|||||||||||||||

|

|

Nine Months Ended

September 30, |

Location of Gain or

(Loss) Reclassified from

Accumulated OCI

into Income

|

Nine Months Ended

September 30, |

|||||||||||||||

|

|

||||||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||

|

Cash flow hedges

|

||||||||||||||||||

|

Foreign currency contracts

|

$

|

28.2

|

|

$

|

(39.7

|

)

|

Cost of sales

|

$

|

(18.8

|

)

|

$

|

7.8

|

|

|||||

|

Selling, general, and administrative expenses

|

$

|

(2.5

|

)

|

$

|

(0.2

|

)

|

||||||||||||

|

|

Amount of Gain or (Loss)

Recognized in OCI

on Derivative

|

|

Amount of Gain or (Loss)

Recognized in Income on Derivative (Amount Excluded from

Effectiveness Testing)

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Location of Gain or

(Loss) Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing)

|

Three Months Ended

September 30, |

|||||||||||||||

|

|

||||||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||

|

Net investment hedges

|

||||||||||||||||||

|

Cross currency swap contracts

|

$

|

(0.5

|

)

|

$

|

—

|

|

Interest expense (income), net

|

$

|

1.6

|

|

$

|

—

|

|

|||||

|

Foreign currency denominated debt

|

$

|

—

|

|

$

|

(16.9

|

)

|

||||||||||||

|

|

Amount of Gain or (Loss)

Recognized in OCI

on Derivative

(Effective Portion)

|

|

Amount of Gain or (Loss)

Recognized in Income on Derivative (Amount Excluded from

Effectiveness Testing)

|

|||||||||||||||

|

|

Nine Months Ended

September 30, |

Location of Gain or

(Loss) Reclassified from

Accumulated OCI

into Income

|

Nine Months Ended

September 30, |

|||||||||||||||

|

|

||||||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||

|

Net investment hedges

|

||||||||||||||||||

|

Cross currency swap contracts

|

$

|

(10.5

|

)

|

$

|

—

|

|

Interest expense (income), net

|

$

|

1.8

|

|

$

|

—

|

|

|||||

|

Foreign currency denominated debt

|

$

|

6.8

|

|

$

|

(32.5

|

)

|

||||||||||||

|

|

|

Amount of Gain or (Loss)

Recognized in Income on

Derivative

|

||||||||

|

|

|

Three Months Ended

September 30, |

||||||||

|

|

Location of Gain or (Loss)

Recognized in Income on

Derivative

|

|||||||||

|

Fair value hedges

|

2018

|

2017

|

||||||||

|

Interest rate swap agreements

|

Interest expense (income), net

|

$

|

—

|

|

$

|

(0.1

|

)

|

|||

|

|

|

Amount of Gain or (Loss)

Recognized in Income on

Derivative

|

||||||||

|

|

|

Nine Months Ended

September 30, |

||||||||

|

|

Location of Gain or (Loss)

Recognized in Income on

Derivative

|

|||||||||

|

Fair value hedges

|

2018

|

2017

|

||||||||

|

Interest rate swap agreements

|

Interest expense (income), net

|

$

|

—

|

|

$

|

0.1

|

|

|||

|

|

|

Amount of Gain or (Loss)

Recognized in Income on

Derivative

|

||||||||

|

|

|

Three Months Ended

September 30, |

||||||||

|

|

Location of Gain or (Loss)

Recognized in Income on

Derivative

|

|||||||||

|

Derivatives not designated as hedging instruments

|

2018

|

2017

|

||||||||

|

Foreign currency contracts

|

Other (income) expense, net

|

$

|

5.9

|

|

$

|

(6.2

|

)

|

|||

|

|

|

Amount of Gain or (Loss)

Recognized in Income on

Derivative

|

||||||||

|

|

|

Nine Months Ended

September 30, |

||||||||

|

|

Location of Gain or (Loss)

Recognized in Income on

Derivative

|

|||||||||

|

Derivatives not designated as hedging instruments

|

2018

|

2017

|

||||||||

|

Foreign currency contracts

|

Other (income) expense, net

|

$

|

7.3

|

|

$

|

(12.8

|

)

|

|||

|

|

Location and Amount of Gain or (Loss) Recognized in Income on Cash Flow Hedging Relationships

|

||||||||||||||||||||||

|

|

Three Months Ended September 30, 2018

|

Nine Months Ended September 30, 2018

|

|||||||||||||||||||||

|

|

Cost of sales

|

Selling, general, and administrative expenses

|

Interest expense (income), net

|

Cost of sales

|

Selling, general, and administrative expenses

|

Interest expense (income), net

|

|||||||||||||||||

|

Total amounts of income and expense line items presented in the consolidated condensed statements of operations in which the effects of cash flow hedges are recorded

|

$

|

(224.9

|

)

|

$

|

(269.5

|

)

|

$

|

(0.5

|

)

|

$

|

(704.7

|

)

|

$

|

(800.4

|

)

|

$

|

0.3

|

|

|||||

|

The effects of cash flow hedging:

|

|||||||||||||||||||||||

|

Gain (loss) on cash flow hedging relationships:

|

|

|

|

|

|||||||||||||||||||

|

Foreign currency contracts:

|

|

|

|

|

|||||||||||||||||||

|

Amount of gain (loss) reclassified from accumulated OCI into income

|

$

|

(4.6

|

)

|

$

|

(0.4

|

)

|

$

|

—

|

|

$

|

(18.8

|

)

|

$

|

(2.5

|

)

|

$

|

—

|

|

|||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Cost of sales

|

$

|

2.7

|

|

$

|

2.4

|

|

$

|

8.5

|

|

$

|

7.0

|

|

|||

|

Selling, general, and administrative expenses

|

11.9

|

|

10.3

|

|

36.4

|

|

30.5

|

|

|||||||

|

Research and development expenses

|

2.8

|

|

3.1

|

|

10.1

|

|

8.8

|

|

|||||||

|

Total stock-based compensation expense

|

$

|

17.4

|

|

$

|

15.8

|

|

$

|

55.0

|

|

$

|

46.3

|

|

|||

|

Option Awards

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Average risk-free interest rate

|

2.8

|

%

|

1.8

|

%

|

2.9

|

%

|

1.8

|

%

|

|||||||

|

Expected dividend yield

|

None

|

|

None

|

|

None

|

|

None

|

|

|||||||

|

Expected volatility

|

29.2

|

%

|

33.2

|

%

|

29.1

|

%

|

33.0

|

%

|

|||||||

|

Expected term (years)

|

5.2

|

|

4.7

|

|

5.0

|

|

4.6

|

|

|||||||

|

Fair value, per option

|

$

|

46.37

|

|

$

|

36.26

|

|

$

|

42.44

|

|

$

|

33.74

|

|

|||

|

ESPP

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Average risk-free interest rate

|

1.2

|

%

|

0.7

|

%

|

0.9

|

%

|

0.5

|

%

|

|||||||

|

Expected dividend yield

|

None

|

|

None

|

|

None

|

|

None

|

|

|||||||

|

Expected volatility

|

34.3

|

%

|

34.3

|

%

|

32.8

|

%

|

33.1

|

%

|

|||||||

|

Expected term (years)

|

0.7

|

|

0.7

|

|

0.6

|

|

0.6

|

|

|||||||

|

Fair value, per share

|

$

|

46.58

|

|

$

|

29.15

|

|

$

|

36.53

|

|

$

|

25.69

|

|

|||

|

|

Foreign

Currency

Translation

Adjustments

|

Unrealized (Loss) Gain on Cash Flow Hedges

|

Unrealized Loss on Available-for-sale Investments

|

Unrealized

Pension

Costs

|

Total

Accumulated

Other

Comprehensive

Loss

|

||||||||||||||

|

December 31, 2017

|

$

|

(100.1

|

)

|

$

|

(13.9

|

)

|

$

|

(4.6

|

)

|

$

|

(14.1

|

)

|

$

|

(132.7

|

)

|

||||

|

Other comprehensive (loss) gain before reclassifications

|

(35.8

|

)

|

28.2

|

|

(3.5

|

)

|

(0.2

|

)

|

(11.3

|

)

|

|||||||||

|

Amounts reclassified from accumulated other comprehensive loss

|

—

|

|

21.3

|

|

2.9

|

|

0.6

|

|

24.8

|

|

|||||||||

|

Deferred income tax benefit

|

(4.0

|

)

|

(15.5

|

)

|

(0.2

|

)

|

(0.1

|

)

|

(19.8

|

)

|

|||||||||

|

September 30, 2018

|

$

|

(139.9

|

)

|

$

|

20.1

|

|

$

|

(5.4

|

)

|

$

|

(13.8

|

)

|

$

|

(139.0

|

)

|

||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|

||||||||||||||

|

|

Affected Line on Consolidated Condensed

Statements of Operations

|

||||||||||||||||

|

Details about Accumulated Other

Comprehensive Loss Components

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

(Loss) gain on cash flow hedges

|

$

|

(4.6

|

)

|

$

|

3.1

|

|

$

|

(18.8

|

)

|

$

|

7.8

|

|

Cost of sales

|

||||

|

(0.4

|

)

|

(0.4

|

)

|

(2.5

|

)

|

(0.2

|

)

|

Selling, general, and administrative expenses

|

|||||||||

|

(5.0

|

)

|

2.7

|

|

(21.3

|

)

|

7.6

|

|

Total before tax

|

|||||||||

|

1.1

|

|

(1.2

|

)

|

5.1

|

|

(3.0

|

)

|

Provision for income taxes

|

|||||||||

|

$

|

(3.9

|

)

|

$

|

1.5

|

|

$

|

(16.2

|

)

|

$

|

4.6

|

|

Net of tax

|

|||||

|

Loss on available-for-sale investments

|

$

|

(0.6

|

)

|

$

|

(1.1

|

)

|

$

|

(2.9

|

)

|

$

|

(1.9

|

)

|

Other (income) expense, net

|

||||

|

—

|

|

0.1

|

|

0.2

|

|

0.1

|

|

Provision for income taxes

|

|||||||||

|

$

|

(0.6

|

)

|

$

|

(1.0

|

)

|

$

|

(2.7

|

)

|

$

|

(1.8

|

)

|

Net of tax

|

|||||

|

Unrealized pension costs

|

$

|

—

|

|

$

|

—

|

|

$

|

(0.6

|

)

|

$

|

—

|

|

Other (income) expense, net

|

||||

|

—

|

|

—

|

|

0.1

|

|

—

|

|

Provision for income taxes

|

|||||||||

|

$

|

—

|

|

$

|

—

|

|

$

|

(0.5

|

)

|

$

|

—

|

|

||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Basic:

|

|

|

|

|

|

|

|

|

|||||||

|

Net income

|

$

|

225.9

|

|

$

|

170.1

|

|

$

|

715.2

|

|

$

|

586.4

|

|

|||

|

Weighted-average shares outstanding

|

209.0

|

|

211.3

|

|

209.5

|

|

211.0

|

|

|||||||

|

Basic earnings per share

|

$

|

1.08

|

|

$

|

0.81

|

|

$

|

3.41

|

|

$

|

2.78

|

|

|||

|

Diluted:

|

|

|

|

|

|

|

|

|

|||||||

|

Net income

|

$

|

225.9

|

|

$

|

170.1

|

|

$

|

715.2

|

|

$

|

586.4

|

|

|||

|

Weighted-average shares outstanding

|

209.0

|

|

211.3

|

|

209.5

|

|

211.0

|

|

|||||||

|

Dilutive effect of stock plans

|

4.2

|

|

4.9

|

|

4.6

|

|

5.1

|

|

|||||||

|

Dilutive weighted-average shares outstanding

|

213.2

|

|

216.2

|

|

214.1

|

|

216.1

|

|

|||||||

|

Diluted earnings per share

|

$

|

1.06

|

|

$

|

0.79

|

|

$

|

3.34

|

|

$

|

2.71

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Segment Net Sales

|

|

|

|

|

|

|

|

|

|||||||

|

United States

|

$

|

518.5

|

|

$

|

470.4

|

|

$

|

1,510.2

|

|

$

|

1,413.9

|

|

|||

|

Europe

|

191.6

|

|

167.8

|

|

608.1

|

|

614.3

|

|

|||||||

|

Japan

|

95.4

|

|

84.0

|

|

288.4

|

|

257.1

|

|

|||||||

|

Rest of World

|

96.8

|

|

87.1

|

|

290.2

|

|

261.4

|

|

|||||||

|

Total segment net sales

|

$

|

902.3

|

|

$

|

809.3

|

|

$

|

2,696.9

|

|

$

|

2,546.7

|

|

|||

|

Segment Operating Income

|

|

|

|

|

|

|

|

|

|||||||

|

United States

|

$

|

353.0

|

|

$

|

303.2

|

|

$

|

1,010.5

|

|

$

|

921.4

|

|

|||

|

Europe

|

90.9

|

|

75.3

|

|

295.6

|

|

306.9

|

|

|||||||

|

Japan

|

55.0

|

|

46.4

|

|

171.8

|

|

145.2

|

|

|||||||

|

Rest of World

|

28.3

|

|

24.7

|

|

89.6

|

|

77.4

|

|

|||||||

|

Total segment operating income

|

$

|

527.2

|

|

$

|

449.6

|

|

$

|

1,567.5

|

|

$

|

1,450.9

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Net Sales Reconciliation

|

|

|

|

|

|

|

|

|

|||||||

|

Segment net sales

|

$

|

902.3

|

|

$

|

809.3

|

|

$

|

2,696.9

|

|

$

|

2,546.7

|

|

|||

|

Foreign currency

|

4.3

|

|

12.2

|

|

48.2

|

|

0.1

|

|

|||||||

|

Consolidated net sales

|

$

|

906.6

|

|

$

|

821.5

|

|

$

|

2,745.1

|

|

$

|

2,546.8

|

|

|||

|

Pre-tax Income Reconciliation

|

|

|

|

|

|

|

|

|

|||||||

|

Segment operating income

|

$

|

527.2

|

|

$

|

449.6

|

|

$

|

1,567.5

|

|

$

|

1,450.9

|

|

|||

|

Unallocated amounts:

|

|

|

|

|

|

|

|

|

|||||||

|

Corporate items

|

(274.6

|

)

|

(216.6

|

)

|

(800.3

|

)

|

(658.8

|

)

|

|||||||

|

Special charges (Note 4)

|

—

|

|

(9.7

|

)

|

—

|

|

(9.7

|

)

|

|||||||

|

Intellectual property litigation expenses

|

(7.9

|

)

|

(13.7

|

)

|

(19.1

|

)

|

(31.6

|

)

|

|||||||

|

Foreign currency

|

4.2

|

|

4.4

|

|

5.4

|

|

2.5

|

|

|||||||

|

Consolidated operating income

|

248.9

|

|

214.0

|

|

753.5

|

|

753.3

|

|

|||||||

|

Non-operating (expense) income

|

(0.2

|

)

|

(2.2

|

)

|

9.7

|

|

(42.3

|

)

|

|||||||

|

Consolidated pre-tax income

|

$

|

248.7

|

|

$

|

211.8

|

|

$

|

763.2

|

|

$

|

711.0

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

|

(in millions)

|

||||||||||||||

|

Net Sales by Geographic Area

|

|

|

|

|

|

|

|

|

|||||||

|

United States

|

$

|

518.7

|

|

$

|

470.4

|

|

$

|

1,510.3

|

|

$

|

1,413.9

|

|

|||

|

Europe

|

201.3

|

|

182.3

|

|

659.3

|

|

627.0

|

|

|||||||

|

Japan

|

94.2

|

|

83.2

|

|

289.5

|

|

253.0

|

|

|||||||

|

Rest of World

|

92.4

|

|

85.6

|

|

286.0

|

|

252.9

|

|

|||||||

|

$

|

906.6

|

|

$

|

821.5

|

|

$

|

2,745.1

|

|

$

|

2,546.8

|

|

||||

|

Net Sales by Major Product and Service Area

|

|

|

|

|

|

|

|

|

|||||||

|

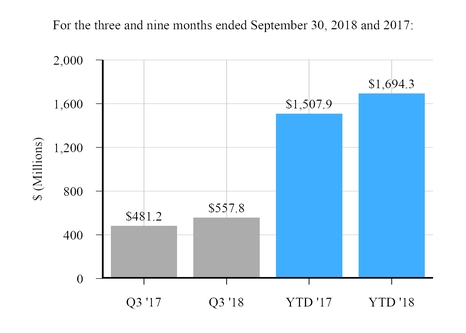

Transcatheter Heart Valve Therapy

|

$

|

557.8

|

|

$

|

481.2

|

|

$

|

1,694.3

|

|

$

|

1,507.9

|

|

|||

|

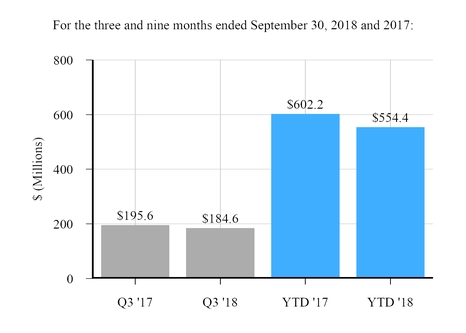

Surgical Heart Valve Therapy

|

184.6

|

|

195.6

|

|

554.4

|

|

602.2

|

|

|||||||

|

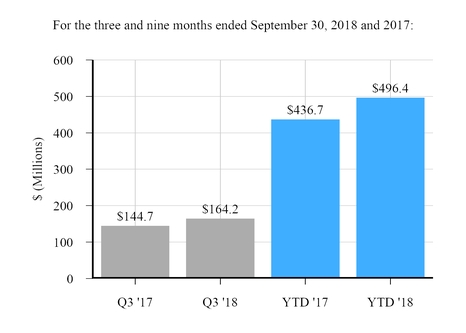

Critical Care

|

164.2

|

|

144.7

|

|

496.4

|

|

436.7

|

|

|||||||

|

$

|

906.6

|

|

$

|

821.5

|

|

$

|

2,745.1

|

|

$

|

2,546.8

|

|

||||

|

|

September 30, 2018

|

December 31, 2017

|

|||||

|

|

(in millions)

|

||||||

|

Long-lived Tangible Assets by Geographic Area

|

|

|

|

|

|||

|

United States

|

$

|

617.6

|

|

$

|

608.7

|

|

|

|

Europe

|

33.2

|

|

28.4

|

|

|||

|

Japan

|

6.9

|

|

7.6

|

|

|||

|

Rest of World

|

198.9

|

|

139.7

|

|

|||

|

$

|

856.6

|

|

$

|

784.4

|

|

||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||||||||

|

|

Percent Change

|

Percent Change

|

|||||||||||||||||||||||||||

|

|

2018

|

2017

|

Change

|

2018

|

2017

|

Change

|

|||||||||||||||||||||||

|

United States

|

$

|

518.7

|

|

$

|

470.4

|

|

$

|

48.3

|

|

10.2

|

%

|

$

|

1,510.3

|

|

$

|

1,413.9

|

|

$

|

96.4

|

|

6.8

|

%

|

|||||||

|

Europe

|

201.3

|

|

182.3

|

|

19.0

|

|

10.5

|

%

|

659.3

|

|

627.0

|

|

32.3

|

|

5.2

|

%

|

|||||||||||||

|

Japan

|

94.2

|

|

83.2

|

|

11.0

|

|

13.3

|

%

|

289.5

|

|

253.0

|

|

36.5

|

|

14.5

|

%

|

|||||||||||||

|

Rest of World

|

92.4

|

|

85.6

|

|

6.8

|

|

8.0

|

%

|

286.0

|

|

252.9

|

|

33.1

|

|

13.1

|

%

|

|||||||||||||

|

International

|

387.9

|

|

351.1

|

|

36.8

|

|

10.5

|

%

|

1,234.8

|

|

1,132.9

|

|

101.9

|

|

9.0

|

%

|

|||||||||||||

|

Total net sales

|

$

|

906.6

|

|

$

|

821.5

|

|

$

|

85.1

|

|

10.4

|

%

|

$

|

2,745.1

|

|

$

|

2,546.8

|

|

$

|

198.3

|

|

7.8

|

%

|

|||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||||||||