|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the fiscal year ended December 31, 2015,

|

|

|

o

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the transition period from

to

|

|

|

Minnesota

|

41-0948415

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

2001 Theurer Boulevard

Winona, Minnesota

|

55987-0978

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $.01 per share

|

The NASDAQ Stock Market

|

|

Large Accelerated Filer

|

x

|

Accelerated Filer

|

o

|

|

Non-accelerated Filer

|

o

(Do not check if a smaller reporting company)

|

Smaller Reporting Company

|

o

|

|

Page

|

|||

|

Item 1.

|

|||

|

Item 1A.

|

|||

|

Item 1B.

|

|||

|

Item 2.

|

|||

|

Item 3.

|

|||

|

Item 4.

|

|||

|

Item X.

|

|||

|

Item 5.

|

|||

|

Item 6.

|

|||

|

Item 7.

|

|||

|

Item 7A.

|

|||

|

Item 8.

|

|||

|

Item 9.

|

|||

|

Item 9A.

|

|||

|

Item 9B.

|

|||

|

Item 10.

|

|||

|

Item 11.

|

|||

|

Item 12.

|

|||

|

Item 13.

|

|||

|

Item 14.

|

|||

|

Item 15.

|

|||

|

ITEM 1.

|

BUSINESS

|

|

2015

|

2014

|

|||

|

Store and Onsite

|

13,961

|

|

12,293

|

|

|

Non-store selling

|

1,566

|

|

1,349

|

|

|

Selling subtotal

|

15,527

|

|

13,642

|

|

|

Distribution

|

3,459

|

|

3,120

|

|

|

Manufacturing

|

662

|

|

630

|

|

|

Administrative

|

1,098

|

|

1,025

|

|

|

Non-selling subtotal

|

5,219

|

|

4,775

|

|

|

Total

|

20,746

|

|

18,417

|

|

|

2015

|

2014

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||

|

Net sales (in millions)

|

$3,869.2

|

3,733.5

|

3,326.1

|

3,133.6

|

2,766.9

|

2,269.5

|

1,930.3

|

2,340.4

|

2,061.8

|

1,809.3

|

|||||||||

|

Number of stores

|

2,622

|

2,637

|

2,687

|

2,652

|

2,585

|

2,490

|

2,369

|

2,311

|

2,160

|

2,000

|

|||||||||

|

2015

|

2014

|

||||||

|

North America

|

United States

|

2,320

|

|

2,336

|

|

||

|

Puerto Rico and Dominican Republic

|

8

|

|

8

|

|

|||

|

Canada

|

200

|

|

202

|

|

|||

|

Mexico

|

47

|

|

44

|

|

|||

|

Subtotal

|

2,575

|

|

2,590

|

|

|||

|

Central & South America

|

Panama, Brazil, Colombia, and Chile

|

9

|

|

9

|

|

||

|

Asia

|

China and India

|

10

|

|

10

|

|

||

|

Southeast Asia

|

Singapore, Malaysia, and Thailand

|

7

|

|

7

|

|

||

|

Europe

|

The Netherlands, Hungary, United Kingdom, Germany, Czech Republic, Italy, Romania, Poland, and Sweden

|

20

|

|

20

|

|

||

|

Africa

|

South Africa

|

1

|

|

1

|

|

||

|

Total

|

2,622

|

|

2,637

|

|

|||

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||

|

North America

|

United States

|

32

|

|

10

|

|

30

|

|

58

|

|

101

|

|

||||

|

Puerto Rico and Dominican Republic

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Canada

|

4

|

|

4

|

|

10

|

|

13

|

|

11

|

|

|||||

|

Mexico

|

3

|

|

3

|

|

5

|

|

2

|

|

1

|

|

|||||

|

Subtotal

|

39

|

|

17

|

|

45

|

|

73

|

|

113

|

|

|||||

|

Central & South America

|

Panama, Brazil, Colombia, and Chile

|

1

|

|

1

|

|

4

|

|

1

|

|

1

|

|

||||

|

Asia

|

China and India

|

1

|

|

2

|

|

—

|

|

—

|

|

3

|

|

||||

|

Southeast Asia

|

Singapore, Malaysia, and Thailand

|

—

|

|

—

|

|

—

|

|

2

|

|

—

|

|

||||

|

Europe

|

The Netherlands, Hungary, United Kingdom, Germany, Czech Republic, Italy, Romania, Poland, and Sweden

|

—

|

|

3

|

|

4

|

|

4

|

|

5

|

|

||||

|

Africa

|

South Africa

|

—

|

|

1

|

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

41

|

|

24

|

|

53

|

|

80

|

|

122

|

|

|||||

|

Age of Stores on

December 31, 2015

|

Year

Opened

|

Number of

Stores in Group

on December

31, 2015

|

Closed Stores

(1)

|

Converted Stores

(2)

|

Average

Monthly

Sales

2015

(3)

|

Average

Monthly

Sales

2014

(3)

|

Percent

Change

|

||||||||||||

|

0-1 year old

|

2015

|

41

|

0/0

|

0/0

|

$

|

18

|

|

(4)

|

N/A

|

—

|

|

||||||||

|

1-2 years old

|

2014

|

22

|

2/0

|

0/0

|

106

|

|

37

|

|

(4)

|

186.5

|

%

|

||||||||

|

2-3 years old

|

2013

|

48

|

3/0

|

-2/0

|

100

|

|

90

|

|

11.1

|

%

|

|||||||||

|

3-4 years old

|

2012

|

70

|

5/3

|

0/0

|

93

|

|

88

|

|

5.7

|

%

|

|||||||||

|

4-5 years old

|

2011

|

109

|

4/8

|

0/-1

|

94

|

|

96

|

|

-2.1

|

%

|

|||||||||

|

5-6 years old

|

2010

|

108

|

7/7

|

-1/0

|

104

|

|

96

|

|

8.3

|

%

|

|||||||||

|

6-7 years old

|

2009

|

57

|

4/4

|

-1/0

|

149

|

|

146

|

|

2.1

|

%

|

|||||||||

|

7-8 years old

|

2008

|

132

|

6/9

|

-2/0

|

92

|

|

93

|

|

-1.1

|

%

|

|||||||||

|

8-9 years old

|

2007

|

141

|

3/8

|

0/0

|

104

|

|

104

|

|

0.0

|

%

|

|||||||||

|

9-10 years old

|

2006

|

217

|

2/12

|

0/0

|

105

|

|

102

|

|

2.9

|

%

|

|||||||||

|

10-11 years old

|

2005

|

202

|

3/6

|

0/0

|

97

|

|

95

|

|

2.1

|

%

|

|||||||||

|

11-12 years old

|

2004

|

205

|

3/4

|

0/0

|

110

|

|

109

|

|

0.9

|

%

|

|||||||||

|

12-16 years old

|

2000-2003

|

483

|

2/6

|

0/-1

|

119

|

|

115

|

|

3.5

|

%

|

|||||||||

|

16+ years old

|

1967-1999

|

787

|

6/6

|

0/1

|

163

|

|

158

|

|

3.2

|

%

|

|||||||||

|

(3)

|

Included in the average monthly sales amounts are sales from our non-store selling locations, such as our Holo-Krome

®

business (included in the 2009 group, the year it was acquired).

|

|

ITEM 1A.

|

RISK FACTORS

|

|

•

|

general business conditions,

|

|

•

|

business conditions in our principal markets,

|

|

•

|

interest rates,

|

|

•

|

inflation,

|

|

•

|

liquidity in credit markets,

|

|

•

|

taxation,

|

|

•

|

government regulations,

|

|

•

|

energy and fuel prices and electrical power rates,

|

|

•

|

unemployment trends,

|

|

•

|

terrorist attacks and acts of war,

|

|

•

|

weather conditions, and

|

|

•

|

other matters that influence customer confidence and spending.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

Purpose

|

Tote Locations (ASRS)

(1)

|

Approximate

Square Feet

|

||||

|

Distribution center and home office

|

253,000

|

|

259,000

|

|

||

|

Manufacturing facility

|

100,000

|

|

||||

|

Computer support center

|

13,000

|

|

||||

|

Winona store

|

15,000

|

|

||||

|

Winona product support facility

|

55,000

|

|

||||

|

Rack and shelving storage

|

42,000

|

|

||||

|

Multi-building complex which houses certain operations of the distribution group, the support services group, and the home office support group

|

30,000

|

|

||||

|

Supplemental warehouse, office, and potential store space, which is subject to a pre-existing retail lease

|

100,000

|

|

||||

|

Purpose

|

Location

|

Tote Locations (ASRS)

(1)

|

Approximate

Square Feet

|

|||

|

Distribution center

|

Indianapolis, Indiana

|

539,000

|

|

(2)

|

1,039,000

|

|

|

Manufacturing facility

|

Indianapolis, Indiana

|

220,000

|

|

|||

|

Distribution center

|

Atlanta, Georgia

|

78,000

|

|

198,000

|

|

|

|

Distribution center

|

Dallas, Texas

|

41,000

|

|

(3)

|

176,000

|

|

|

Distribution center

|

Scranton, Pennsylvania

|

87,000

|

|

189,000

|

|

|

|

Distribution center

|

Akron, Ohio

|

74,000

|

|

152,000

|

|

|

|

Distribution center

|

Kansas City, Kansas

|

—

|

|

300,000

|

|

|

|

Distribution center

|

Kitchener, Ontario, Canada

|

105,000

|

|

142,000

|

|

|

|

Distribution center

|

High Point, North Carolina

|

—

|

|

(4)

|

256,000

|

|

|

Distribution center and manufacturing facility

|

Modesto, California

|

83,000

|

|

328,000

|

|

|

|

Manufacturing facility

|

Rockford, Illinois

|

100,000

|

|

|||

|

Local re-distribution center and manufacturing facility

|

Johor, Malaysia

|

27,000

|

|

|||

|

Manufacturing facility

|

Wallingford, Connecticut

|

187,000

|

|

|||

|

(4)

|

This facility is currently under construction to add an ASRS with capacity of approximately 112,000 tote locations for small parts.

|

|

Purpose

|

Location

|

Approximate

Square Feet

|

Lease Expiration

Date

|

Remaining

Lease

Renewal

Options

|

||||

|

Distribution center

|

Seattle, Washington

|

100,000

|

|

April 2017

|

Two

|

|||

|

Distribution center

|

Salt Lake City, Utah

|

74,000

|

|

July 2017

|

Two

|

|||

|

Distribution center and packaging facility

|

Salt Lake City, Utah

|

26,000

|

|

July 2017

|

One

|

|||

|

Distribution center

|

Apodaca, Nuevo Leon, Mexico

|

46,000

|

|

March 2020

|

None

|

|||

|

Distribution center and manufacturing facility

|

Edmonton, Alberta, Canada

|

45,000

|

|

July 2020

|

One

|

|||

|

Manufacturing facility

|

Houston, Texas

|

21,000

|

|

July 2019

|

None

|

|||

|

Local re-distribution center and manufacturing facility

|

Modrice, Czech Republic

|

15,000

|

|

July 2021

|

None

|

|||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM X.

|

EXECUTIVE OFFICERS OF THE REGISTRANT

|

|

Name

|

Employee of

Fastenal

Since

|

Age

|

Position

|

||

|

Daniel L. Florness

|

1996

|

52

|

President, Chief Executive Officer, and Director

|

||

|

Leland J. Hein

|

1985

|

55

|

Senior Executive Vice President – Sales and Director

|

||

|

James C. Jansen

|

1992

|

45

|

Executive Vice President – Manufacturing

|

||

|

Sheryl A. Lisowski

|

1994

|

48

|

Interim Chief Financial Officer, Controller, and Chief Accounting Officer

|

||

|

Nicholas J. Lundquist

|

1979

|

58

|

Executive Vice President – Operations

|

||

|

Charles S. Miller

|

1999

|

41

|

Executive Vice President – Sales

|

||

|

Terry M. Owen

|

1999

|

47

|

Senior Executive Vice President – Sales Operations

|

||

|

Gary A. Polipnick

|

1983

|

53

|

Executive Vice President – FAST Solutions

®

|

||

|

Ashok Singh

|

2001

|

53

|

Executive Vice President – Information Technology

|

||

|

John L. Soderberg

|

1993

|

44

|

Executive Vice President – Sales Operations and Support

|

||

|

Reyne K. Wisecup

|

1988

|

52

|

Executive Vice President – Human Resources and Director

|

||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2015

|

High

|

Low

|

2014

|

High

|

Low

|

||||||||||||

|

First quarter

|

$

|

47.40

|

|

$

|

39.82

|

|

First quarter

|

$

|

50.43

|

|

$

|

42.70

|

|

||||

|

Second quarter

|

43.41

|

|

40.01

|

|

Second quarter

|

51.20

|

|

47.80

|

|

||||||||

|

Third quarter

|

42.82

|

|

36.13

|

|

Third quarter

|

50.08

|

|

43.74

|

|

||||||||

|

Fourth quarter

|

41.64

|

|

35.50

|

|

Fourth quarter

|

48.21

|

|

40.78

|

|

||||||||

|

2015

|

2014

|

||||||

|

First quarter

|

$

|

0.28

|

|

$

|

0.25

|

|

|

|

Second quarter

|

0.28

|

|

0.25

|

|

|||

|

Third quarter

|

0.28

|

|

0.25

|

|

|||

|

Fourth quarter

|

0.28

|

|

0.25

|

|

|||

|

Total

|

$

|

1.12

|

|

$

|

1.00

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

|||||

|

Period

|

Total Number of Shares

Purchased

|

Average Price

Paid per Share

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs (1)

|

Maximum Number (or

Approximate Dollar

Value) of Shares that May Yet Be Purchased Under the Plans or Programs (1)

|

||||

|

October 1-31, 2015

|

200,000

|

$38.55

|

200,000

|

3,200,000

|

||||

|

November 1-30, 2015

|

200,000

|

$38.77

|

200,000

|

3,000,000

|

||||

|

December 1-31, 2015

|

100,000

|

$39.97

|

100,000

|

2,900,000

|

||||

|

Total

|

500,000

|

$38.92

|

500,000

|

2,900,000

|

||||

|

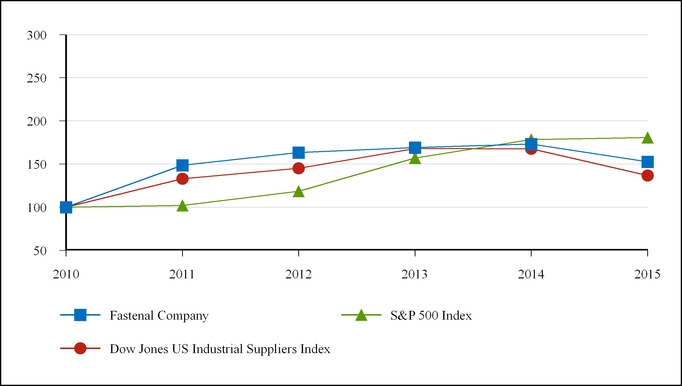

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

|||||||

|

Fastenal Company

|

$

|

100.00

|

148.43

|

163.37

|

169.18

|

173.16

|

152.71

|

|||||

|

S&P 500 Index

|

100.00

|

102.11

|

118.45

|

156.82

|

178.28

|

180.75

|

||||||

|

Dow Jones US Industrial Suppliers Index

|

100.00

|

132.98

|

145.02

|

167.88

|

167.78

|

136.77

|

||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

Q4

2014 |

Q4

2015 |

Twelve-month

% Change |

||||||

|

End of period total store employee count

|

12,293

|

|

13,961

|

|

13.6

|

%

|

||

|

Change in total store employee count

|

|

1,668

|

|

|||||

|

End of period total employee count

|

18,417

|

|

20,746

|

|

12.6

|

%

|

||

|

Change in total employee count

|

|

2,329

|

|

|||||

|

Industrial vending machines (installed device count)

|

46,855

|

|

55,510

|

|

18.5

|

%

|

||

|

Number of store locations

|

2,637

|

|

2,622

|

|

-0.6

|

%

|

||

|

(1)

|

During 2015, we added 1,668 people into our stores. We stated in January 2015 we would add people in an aggressive fashion during 2015. This is the result.

|

|

(2)

|

After several years of holding back on store openings and even contracting our total store base, we plan to expand our pace of store openings in 2016 with a goal of opening 60 to 75 new stores (an increase of approximately 2% to 3% over our number of stores as of December 31, 2015). We opened 41 and 24 stores in 2015 and 2014, respectively, and we closed or consolidated 50 and 73 stores in 2015 and 2014, respectively.

|

|

(3)

|

We are seeing a very strong pace of national account signings. During 2015, we signed more new contracts (defined as new customer accounts with a multi-site contract) with national account customers than in 2014. This increase reversed the declining trend in the previous year. Similar to the third quarter of 2015, the business with our top 100 national account customers (representing approximately 25% of sales) experienced poor sales results in the fourth quarter of 2015, with net sales contraction of approximately 4.3%, while sales to our remaining national account customers (representing approximately 22% of sales) grew approximately 8.1%.

|

|

(4)

|

We have also seen an expansion of our Onsite business (defined as dedicated sales and service provided from within the customer's facility) during 2015. During the year we signed 82 new Onsite customer locations.

|

|

(5)

|

We converted approximately 800 stores to the CSP 16 (Customer Service Project 2016) format in the fourth quarter of 2015. This merchandising footprint, disclosed at our November 2015 Investor Day, involves expanded inventory placement at our store locations to enhance same-day capabilities.

|

|

(1)

|

2015 was hit hard by a slowdown in our business with customers connected to the oil and gas industry. Those customers include direct industry participants as well as other customers serving those participants.

|

|

(2)

|

2015 was negatively affected by a strong U.S. dollar, relative to other currencies, which hurts our U.S. customer base (which accounts for approximately 89% of sales).

|

|

(3)

|

The net sales of our Canadian business, which grew about 4% in 'local currency' during the fourth quarter of 2015, slowed from 6% growth in the third quarter of 2015.

|

|

(4)

|

During the fourth quarter of 2015 we decided to terminate our manufacturing joint venture in Brazil and settled several unrelated disputes. These items resulted in approximately $4 million of additional expense in the quarter. We listed these as negative due to the immediate financial impact, but consider these to be positive developments allowing us to focus on growth.

|

|

(5)

|

In late November 2015, and even more so in late December 2015, we experienced a greater number and longer duration of customer plant shutdowns related to the holiday season.

|

|

1.

|

Sales and sales trends

– a recap of our recent sales trends and some insight into the activities with different end markets.

|

|

2.

|

Growth drivers of our business

– a recap of how we grow our business.

|

|

3.

|

Profit drivers of our business

– a recap of how we increase our profits.

|

|

4.

|

|

|

5.

|

Cash flow impact items

– a recap of the operational working capital utilized in our business, and the related cash flow.

|

|

Q4

2014 |

Q4

2015 |

Twelve-month

% Change |

||||||

|

Average full-time equivalent store employee count

|

10,376

|

|

11,436

|

|

10.2

|

%

|

||

|

Average full-time equivalent employee count

|

15,512

|

|

16,901

|

|

9.0

|

%

|

||

|

Note – Full-time equivalent is based on 40 hours per week.

|

||||||||

|

2015

|

2014

|

2013

|

|||||||

|

Net sales

|

$

|

3,869,187

|

|

3,733,507

|

|

3,326,106

|

|

||

|

Percentage change

|

3.6

|

%

|

12.2

|

%

|

6.1

|

%

|

|||

|

Business days

|

254

|

|

253

|

|

254

|

|

|||

|

Daily sales

|

$

|

15,233

|

|

14,757

|

|

13,095

|

|

||

|

Percentage change

|

3.2

|

%

|

12.7

|

%

|

6.1

|

%

|

|||

|

Impact of currency fluctuations (primarily Canada)

|

-1.2

|

%

|

-0.5

|

%

|

-0.2

|

%

|

|||

|

Store Age

|

2015

|

2014

|

2013

|

||

|

Opened greater than 10 years

|

2.7%

|

10.5%

|

2.1%

|

||

|

Opened greater than 5 years

|

2.5%

|

10.9%

|

3.6%

|

||

|

Opened greater than 2 years

|

2.5%

|

11.5%

|

4.4%

|

||

|

2015

|

2014

|

2013

|

|||

|

Fastener product line

|

38%

|

40%

|

42%

|

||

|

Other product lines

|

62%

|

60%

|

58%

|

||

|

|

Jan.

|

Feb.

|

Mar.

|

Apr.

|

May

|

June

|

July

|

Aug.

|

Sept.

|

Oct.

|

Nov.

|

Dec.

|

|||||||||||||||||||||||

|

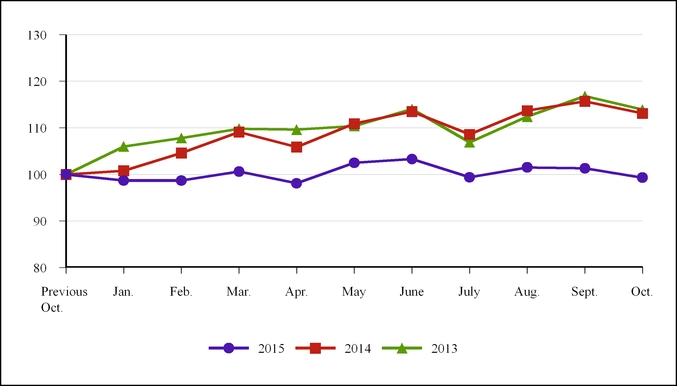

2015

|

12.0

|

%

|

8.6

|

%

|

5.6

|

%

|

6.1

|

%

|

5.3

|

%

|

3.7

|

%

|

3.2

|

%

|

1.6

|

%

|

-0.3

|

%

|

-0.8

|

%

|

-1.1

|

%

|

-3.8

|

%

|

|||||||||||

|

2014

|

6.7

|

%

|

7.7

|

%

|

11.6

|

%

|

10.0

|

%

|

13.5

|

%

|

12.7

|

%

|

14.7

|

%

|

15.0

|

%

|

12.9

|

%

|

14.6

|

%

|

15.3

|

%

|

17.4

|

%

|

|||||||||||

|

2013

|

6.7

|

%

|

8.2

|

%

|

5.1

|

%

|

4.8

|

%

|

5.3

|

%

|

6.0

|

%

|

2.9

|

%

|

7.2

|

%

|

5.7

|

%

|

7.7

|

%

|

8.2

|

%

|

6.7

|

%

|

|||||||||||

|

|

Jan.

|

Feb.

|

Mar.

|

Apr.

|

May

|

June

|

July

|

Aug.

|

Sept.

|

Oct.

|

Nov.

|

Dec.

|

|||||||||||||||||||||||

|

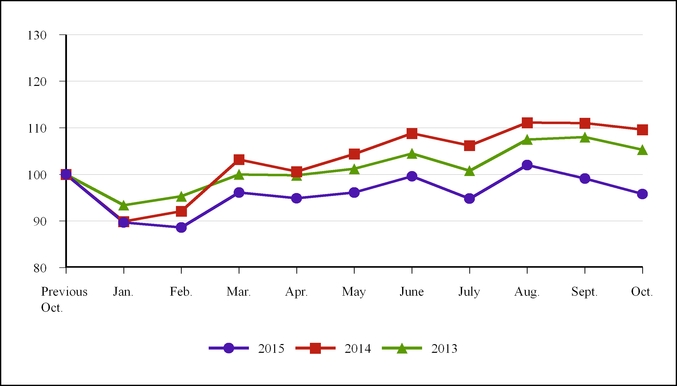

2015

|

11.2

|

%

|

7.8

|

%

|

4.8

|

%

|

5.4

|

%

|

4.6

|

%

|

3.2

|

%

|

2.6

|

%

|

1.0

|

%

|

-0.9

|

%

|

-1.1

|

%

|

-2.1

|

%

|

-5.0

|

%

|

|||||||||||

|

2014

|

5.5

|

%

|

6.5

|

%

|

10.2

|

%

|

8.4

|

%

|

12.1

|

%

|

11.4

|

%

|

13.4

|

%

|

14.0

|

%

|

11.8

|

%

|

13.5

|

%

|

14.0

|

%

|

16.5

|

%

|

|||||||||||

|

2013

|

5.0

|

%

|

6.5

|

%

|

3.4

|

%

|

3.1

|

%

|

3.5

|

%

|

4.3

|

%

|

1.4

|

%

|

5.5

|

%

|

4.2

|

%

|

6.1

|

%

|

6.2

|

%

|

4.9

|

%

|

|||||||||||

|

|

Jan.

|

Feb.

|

Mar.

|

Apr.

|

May

|

June

|

July

|

Aug.

|

Sept.

|

Oct.

|

Nov.

|

Dec.

|

|||||||||||||||||||||||

|

2015

|

10.8

|

%

|

7.2

|

%

|

4.8

|

%

|

5.6

|

%

|

4.6

|

%

|

3.1

|

%

|

3.1

|

%

|

1.3

|

%

|

-1.1

|

%

|

-1.0

|

%

|

-1.8

|

%

|

-5.3

|

%

|

|||||||||||

|

2014

|

4.6

|

%

|

5.4

|

%

|

9.5

|

%

|

7.7

|

%

|

11.5

|

%

|

10.8

|

%

|

12.9

|

%

|

13.4

|

%

|

11.7

|

%

|

13.3

|

%

|

13.6

|

%

|

16.2

|

%

|

|||||||||||

|

2013

|

3.2

|

%

|

5.6

|

%

|

2.3

|

%

|

2.0

|

%

|

2.7

|

%

|

3.4

|

%

|

0.6

|

%

|

4.7

|

%

|

3.2

|

%

|

5.3

|

%

|

6.1

|

%

|

4.8

|

%

|

|||||||||||

|

|

Jan.

(1)

|

Feb.

|

Mar.

|

Apr.

|

May

|

June

|

July

|

Aug.

|

Sept.

|

Oct.

|

Cumulative Change from Jan. to Oct.

|

||||||||||||||||||||

|

Benchmark

|

0.8

|

%

|

2.2

|

%

|

3.8

|

%

|

0.4

|

%

|

3.1

|

%

|

2.7

|

%

|

-2.1

|

%

|

2.5

|

%

|

3.7

|

%

|

-1.2

|

%

|

15.9%

|

||||||||||

|

2015

|

-3.6

|

%

|

-0.1

|

%

|

4.2

|

%

|

-2.1

|

%

|

3.4

|

%

|

0.9

|

%

|

-4.3

|

%

|

4.1

|

%

|

-0.9

|

%

|

-2.0

|

%

|

2.9%

|

||||||||||

|

15Delta

|

-4.4

|

%

|

-2.3

|

%

|

0.4

|

%

|

-2.5

|

%

|

0.3

|

%

|

-1.8

|

%

|

-2.2

|

%

|

1.6

|

%

|

-4.6

|

%

|

-0.8

|

%

|

-13.0%

|

||||||||||

|

2014

|

-1.4

|

%

|

3.0

|

%

|

7.1

|

%

|

-2.6

|

%

|

4.2

|

%

|

2.5

|

%

|

-3.8

|

%

|

5.8

|

%

|

1.0

|

%

|

-1.5

|

%

|

16.2%

|

||||||||||

|

14Delta

|

-2.2

|

%

|

0.8

|

%

|

3.3

|

%

|

-3.0

|

%

|

1.1

|

%

|

-0.2

|

%

|

-1.7

|

%

|

3.3

|

%

|

-2.7

|

%

|

-0.3

|

%

|

0.3%

|

||||||||||

|

2013

|

-0.4

|

%

|

2.0

|

%

|

3.4

|

%

|

-1.1

|

%

|

1.0

|

%

|

3.2

|

%

|

-5.5

|

%

|

5.5

|

%

|

2.9

|

%

|

-2.9

|

%

|

8.2%

|

||||||||||

|

13Delta

|

-1.2

|

%

|

-0.2

|

%

|

-0.4

|

%

|

-1.5

|

%

|

-2.1

|

%

|

0.5

|

%

|

-3.4

|

%

|

3.0

|

%

|

-0.8

|

%

|

-1.7

|

%

|

-7.7%

|

||||||||||

|

|

Q1

|

Q2

|

Q3

|

Q4

|

Annual

|

|||||||||

|

2015

|

6.9

|

%

|

3.8

|

%

|

1.1

|

%

|

-2.2

|

%

|

2.3

|

%

|

||||

|

2014

|

9.0

|

%

|

11.2

|

%

|

13.7

|

%

|

13.8

|

%

|

12.0

|

%

|

||||

|

2013

|

7.0

|

%

|

5.9

|

%

|

4.7

|

%

|

7.2

|

%

|

6.3

|

%

|

||||

|

Q1

|

Q2

|

Q3

|

Q4

|

Annual

|

||||||||||

|

2015

|

5.5

|

%

|

0.0

|

%

|

-4.4

|

%

|

-6.2

|

%

|

-1.4

|

%

|

||||

|

2014

|

1.6

|

%

|

5.5

|

%

|

9.9

|

%

|

11.4

|

%

|

6.9

|

%

|

||||

|

2013

|

1.7

|

%

|

1.9

|

%

|

1.0

|

%

|

1.9

|

%

|

1.6

|

%

|

||||

|

Q1

|

Q2

|

Q3

|

Q4

|

Annual

|

||||||||||

|

2015

|

11.7

|

%

|

9.0

|

%

|

5.9

|

%

|

1.2

|

%

|

6.8

|

%

|

||||

|

2014

|

14.2

|

%

|

17.1

|

%

|

17.6

|

%

|

19.0

|

%

|

17.2

|

%

|

||||

|

2013

|

10.8

|

%

|

8.5

|

%

|

8.9

|

%

|

12.0

|

%

|

10.1

|

%

|

||||

|

|

Q1

|

Q2

|

Q3

|

Q4

|

Annual

|

|||||||||

|

2015

|

6.2

|

%

|

1.6

|

%

|

-1.7

|

%

|

-6.1

|

%

|

-0.2

|

%

|

||||

|

2014

|

2.9

|

%

|

7.5

|

%

|

9.3

|

%

|

12.6

|

%

|

7.8

|

%

|

||||

|

2013

|

2.9

|

%

|

0.7

|

%

|

3.9

|

%

|

2.8

|

%

|

2.5

|

%

|

||||

|

Q1

|

Q2

|

Q3

|

Q4

|

Annual

|

||||||||||||

|

Device count

signed

during the period

|

2015

|

3,962

|

|

5,144

|

|

4,689

|

|

4,016

|

|

17,811

|

|

|||||

|

2014

|

4,025

|

|

4,137

|

|

4,072

|

|

4,108

|

|

16,342

|

|

||||||

|

2013

|

6,568

|

|

6,084

|

|

4,836

|

|

4,226

|

|

21,714

|

|

||||||

|

'Machine equivalent' count

signed

during the period

|

2015

|

2,916

|

|

3,931

|

|

3,769

|

|

3,319

|

|

13,935

|

|

|||||

|

2014

|

2,974

|

|

3,179

|

|

3,189

|

|

3,243

|

|

12,585

|

|

||||||

|

2013

|

4,825

|

|

4,505

|

|

3,656

|

|

3,244

|

|

16,230

|

|

||||||

|

Q1

|

Q2

|

Q3

|

Q4

|

||||||||||||

|

Device count

installed

at the end of the period

|

2015

|

48,545

|

|

50,620

|

|

53,547

|

|

55,510

|

|

||||||

|

2014

|

42,153

|

|

43,761

|

|

45,596

|

|

46,855

|

|

|||||||

|

2013

|

32,007

|

|

36,452

|

|

39,180

|

|

40,775

|

|

|||||||

|

'Machine equivalent' count

installed

at the end of the

|

2015

|

35,997

|

|

37,714

|

|

40,067

|

|

41,905

|

|

||||||

|

period

|

2014

|

30,326

|

|

31,713

|

|

33,296

|

|

34,529

|

|

||||||

|

2013

|

22,020

|

|

25,512

|

|

27,818

|

|

29,262

|

|

|||||||

|

Q1

|

Q2

|

Q3

|

Q4

|

||||||||||||

|

Percent of total net sales to customers with

|

2015

|

40.5

|

%

|

40.9

|

%

|

42.1

|

%

|

43.9

|

%

|

||||||

|

industrial vending

(1)

|

2014

|

37.8

|

%

|

37.0

|

%

|

37.8

|

%

|

39.3

|

%

|

||||||

|

2013

|

27.5

|

%

|

30.0

|

%

|

33.3

|

%

|

36.6

|

%

|

|||||||

|

Daily sales growth to customers with

|

2015

|

12.3

|

%

|

8.6

|

%

|

4.8

|

%

|

0.7

|

%

|

||||||

|

industrial vending

(2)

|

2014

|

19.7

|

%

|

20.9

|

%

|

21.9

|

%

|

20.0

|

%

|

||||||

|

2013

|

23.9

|

%

|

18.9

|

%

|

15.2

|

%

|

18.7

|

%

|

|||||||

|

STATEMENT OF EARNINGS INFORMATION

(percentage of net sales)

for the periods ended December 31:

|

|||||||||

|

|

Twelve-month Period

|

||||||||

|

|

2015

|

2014

|

2013

|

||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Gross profit

|

50.4

|

%

|

50.8

|

%

|

51.7

|

%

|

|||

|

Operating and administrative expenses

|

29.0

|

%

|

29.8

|

%

|

30.3

|

%

|

|||

|

Gain on sale of property and equipment

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

|||

|

Operating income

|

21.4

|

%

|

21.1

|

%

|

21.4

|

%

|

|||

|

Net interest income (expense)

|

-0.1

|

%

|

0.0

|

%

|

0.0

|

%

|

|||

|

Earnings before income taxes

|

21.3

|

%

|

21.1

|

%

|

21.5

|

%

|

|||

|

Note – Amounts may not foot due to rounding difference.

|

|||||||||

|

|

Q1

|

Q2

|

Q3

|

Q4

|

||||||||

|

2015

|

50.8

|

%

|

50.3

|

%

|

50.5

|

%

|

49.9

|

%

|

||||

|

2014

|

51.2

|

%

|

50.8

|

%

|

50.8

|

%

|

50.5

|

%

|

||||

|

2013

|

52.3

|

%

|

52.2

|

%

|

51.7

|

%

|

50.6

|

%

|

||||

|

Twelve-month Period

|

||||||||

|

|

2015

|

2014

|

2013

|

|||||

|

Employee related expenses

|

0.7

|

%

|

11.7

|

%

|

4.6

|

%

|

||

|

Occupancy related expenses

|

7.4

|

%

|

6.9

|

%

|

11.2

|

%

|

||

|

Selling transportation costs

|

-13.1

|

%

|

10.1

|

%

|

0.8

|

%

|

||

|

Twelve-month Period

|

||||||||

|

2015

|

2014

|

2013

|

||||||

|

Store based

|

6.2

|

%

|

12.5

|

%

|

2.3

|

%

|

||

|

Total selling (includes store)

|

6.1

|

%

|

12.3

|

%

|

3.3

|

%

|

||

|

Distribution

|

6.1

|

%

|

11.5

|

%

|

4.3

|

%

|

||

|

Manufacturing

|

0.1

|

%

|

10.7

|

%

|

6.0

|

%

|

||

|

Administrative

|

6.7

|

%

|

8.9

|

%

|

7.1

|

%

|

||

|

Total average FTE headcount

|

5.9

|

%

|

11.9

|

%

|

3.8

|

%

|

||

|

Dollar Amounts

|

2015

|

2014

|

2013

|

||||||

|

Net earnings

|

$

|

516,361

|

|

494,150

|

|

448,636

|

|

||

|

Basic EPS

|

1.77

|

|

1.67

|

|

1.51

|

|

|||

|

Diluted EPS

|

1.77

|

|

1.66

|

|

1.51

|

|

|||

|

Percentage Change

|

2015

|

2014

|

2013

|

||||||

|

Net earnings

|

4.5

|

%

|

10.1

|

%

|

6.7

|

%

|

|||

|

Basic EPS

|

6.0

|

%

|

10.6

|

%

|

6.3

|

%

|

|||

|

Diluted EPS

|

6.6

|

%

|

9.9

|

%

|

6.3

|

%

|

|||

|

Dollar change

|

2015

|

2014

|

||||

|

Accounts receivable, net

|

$

|

6,298

|

|

47,746

|

|

|

|

Inventories

|

44,039

|

|

85,156

|

|

||

|

Operational working capital

|

$

|

50,337

|

|

132,902

|

|

|

|

Annual percentage change

|

2015

|

2014

|

||||

|

Accounts receivable, net

|

1.4

|

%

|

11.5

|

%

|

||

|

Inventories

|

5.1

|

%

|

10.9

|

%

|

||

|

Operational working capital

|

3.8

|

%

|

11.1

|

%

|

||

|

2015

|

2014

|

2013

|

||||||

|

Store

|

61

|

%

|

56

|

%

|

58

|

%

|

||

|

Distribution center

|

39

|

%

|

44

|

%

|

42

|

%

|

||

|

Total

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

2015

|

2014

|

2013

|

|||||||

|

Net cash provided

|

$

|

546,940

|

|

499,392

|

|

416,120

|

|

||

|

% of net earnings

|

105.9

|

%

|

101.1

|

%

|

92.8

|

%

|

|||

|

2015

|

2014

|

2013

|

|||||||

|

Net cash used

|

$

|

180,627

|

|

188,781

|

|

201,792

|

|

||

|

% of net earnings

|

35.0

|

%

|

38.2

|

%

|

45.0

|

%

|

|||

|

2015

|

2014

|

2013

|

|||||||

|

Net capital expenditures

|

$

|

145,227

|

|

183,655

|

|

201,550

|

|

||

|

% of net earnings

|

28.1

|

%

|

37.2

|

%

|

44.9

|

%

|

|||

|

2016

|

2015

|

2014

|

2013

|

|||||||||

|

Net Capital Expenditures

|

(Estimate)

|

(Actual)

|

(Actual)

|

(Actual)

|

||||||||

|

Manufacturing, warehouse and packaging equipment, industrial vending equipment, and facilities

|

$

|

66,000

|

|

112,460

|

|

144,649

|

|

164,940

|

|

|||

|

Shelving and related supplies for store openings and for product expansion at existing stores

|

22,000

|

|

8,958

|

|

6,712

|

|

6,354

|

|

||||

|

Data processing software and equipment

|

24,000

|

|

19,653

|

|

23,978

|

|

12,652

|

|

||||

|

Real estate and improvements to store locations

|

5,000

|

|

4,247

|

|

4,091

|

|

9,603

|

|

||||

|

Vehicles

|

18,000

|

|

9,850

|

|

10,044

|

|

12,991

|

|

||||

|

Proceeds from sale of property and equipment

|

(7,000

|

)

|

(9,941

|

)

|

(5,819

|

)

|

(4,990

|

)

|

||||

|

$

|

128,000

|

|

145,227

|

|

183,655

|

|

201,550

|

|

||||

|

Peak borrowings

|

2015

|

2014

|

|||

|

First quarter

|

185,000

|

|

85,000

|

|

|

|

Second quarter

|

400,000

|

|

115,000

|

|

|

|

Third quarter

|

395,000

|

|

160,000

|

|

|

|

Fourth quarter

|

390,000

|

|

155,000

|

|

|

|

Total

|

2016

|

2017 and

2018 |

2019 and

2020 |

After

2020 |

|||||||||||

|

Facilities and equipment

|

$

|

247,128

|

|

95,789

|

|

113,782

|

|

35,978

|

|

1,579

|

|

||||

|

Vehicles

|

54,581

|

|

27,599

|

|

25,540

|

|

1,442

|

|

—

|

|

|||||

|

Total

|

$

|

301,709

|

|

123,388

|

|

139,322

|

|

37,420

|

|

1,579

|

|

||||

|

2015

|

2014

|

2013

|

|||||||

|

Net cash used

|

$

|

337,563

|

|

249,732

|

|

234,443

|

|

||

|

% of net earnings

|

65.4

|

%

|

50.5

|

%

|

52.3

|

%

|

|||

|

2015

|

2014

|

2013

|

|||||||

|

Dividends paid

|

$

|

327,101

|

|

296,581

|

|

237,456

|

|

||

|

% of net earnings

|

63.3

|

%

|

60.0

|

%

|

52.9

|

%

|

|||

|

Common stock purchases

|

292,951

|

|

52,942

|

|

9,080

|

|

|||

|

% of net earnings

|

56.7

|

%

|

10.7

|

%

|

2.0

|

%

|

|||

|

Total returned to shareholders

|

$

|

620,052

|

|

349,523

|

|

246,536

|

|

||

|

% of net earnings

|

120.1

|

%

|

70.7

|

%

|

54.9

|

%

|

|||

|

Proceeds from the exercise of stock options and

the related excess tax benefits from stock-based compensation

|

$

|

(22,489

|

)

|

(9,791

|

)

|

(12,093

|

)

|

||

|

% of net earnings

|

-4.4

|

%

|

-2.0

|

%

|

-2.6

|

%

|

|||

|

Cash borrowings, net

|

$

|

(260,000

|

)

|

(90,000

|

)

|

—

|

|

||

|

% of net earnings

|

-50.4

|

%

|

-18.2

|

%

|

—

|

%

|

|||

|

Net cash used

|

$

|

337,563

|

|

249,732

|

|

234,443

|

|

||

|

% of net earnings

|

65.4

|

%

|

50.5

|

%

|

52.3

|

%

|

|||

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

|

December 31

|

|||||

|

|

2015

|

2014

|

||||

|

Assets

|

||||||

|

Current assets:

|

||||||

|

Cash and cash equivalents

|

$

|

129,019

|

|

114,496

|

|

|

|

Trade accounts receivable, net of allowance for doubtful accounts of $11,729 and $12,619, respectively

|

468,375

|

|

462,077

|

|

||

|

Inventories

|

913,263

|

|

869,224

|

|

||

|

Deferred income tax assets

|

—

|

|

21,765

|

|

||

|

Prepaid income taxes

|

22,558

|

|

—

|

|

||

|

Other current assets

|

131,561

|

|

115,703

|

|

||

|

Total current assets

|

1,664,776

|

|

1,583,265

|

|

||

|

Property and equipment, net

|

818,889

|

|

763,889

|

|

||

|

Other assets, net

|

48,797

|

|

11,948

|

|

||

|

Total assets

|

$

|

2,532,462

|

|

2,359,102

|

|

|

|

Liabilities and Stockholders' Equity

|

||||||

|

Current liabilities:

|

||||||

|

Current portion of debt

|

$

|

62,050

|

|

90,000

|

|

|

|

Accounts payable

|

125,973

|

|

103,909

|

|

||

|

Accrued expenses

|

185,143

|

|

174,002

|

|

||

|

Income taxes payable

|

—

|

|

7,442

|

|

||

|

Total current liabilities

|

373,166

|

|

375,353

|

|

||

|

Long-term debt

|

302,950

|

|

—

|

|

||

|

Deferred income tax liabilities

|

55,057

|

|

68,532

|

|

||

|

Commitments and contingencies (Notes 4, 8, and 9)

|

|

|

||||

|

Stockholders’ equity:

|

||||||

|

Preferred stock, 5,000,000 shares authorized

|

—

|

|

—

|

|

||

|

Common stock, 400,000,000 shares authorized, 289,581,682 and 295,867,844 shares issued and outstanding, respectively

|

2,896

|

|

2,959

|

|

||

|

Additional paid-in capital

|

2,024

|

|

33,744

|

|

||

|

Retained earnings

|

1,842,772

|

|

1,886,350

|

|

||

|

Accumulated other comprehensive (loss) income

|

(46,403

|

)

|

(7,836

|

)

|

||

|

Total stockholders’ equity

|

1,801,289

|

|

1,915,217

|

|

||

|

Total liabilities and stockholders’ equity

|

$

|

2,532,462

|

|

2,359,102

|

|

|

|

2015

|

2014

|

2013

|

|||||||

|

Net sales

|

$

|

3,869,187

|

|

3,733,507

|

|

3,326,106

|

|

||

|

Cost of sales

|

1,920,253

|

|

1,836,105

|

|

1,606,661

|

|

|||

|

Gross profit

|

1,948,934

|

|

1,897,402

|

|

1,719,445

|

|

|||

|

Operating and administrative expenses

|

1,121,590

|

|

1,110,776

|

|

1,007,431

|

|

|||

|

Gain on sale of property and equipment

|

(1,411

|

)

|

(964

|

)

|

(643

|

)

|

|||

|

Operating income

|

828,755

|

|

787,590

|

|

712,657

|

|

|||

|

Interest income

|

373

|

|

759

|

|

924

|

|

|||

|

Interest expense

|

(3,108

|

)

|

(915

|

)

|

(113

|

)

|

|||

|

Earnings before income taxes

|

826,020

|

|

787,434

|

|

713,468

|

|

|||

|

Income tax expense

|

309,659

|

|

293,284

|

|

264,832

|

|

|||

|

Net earnings

|

$

|

516,361

|

|

494,150

|

|

448,636

|

|

||

|

Basic net earnings per share

|

$

|

1.77

|

|

1.67

|

|

1.51

|

|

||

|

Diluted net earnings per share

|

$

|

1.77

|

|

1.66

|

|

1.51

|

|

||

|

Basic weighted average shares outstanding

|

291,453

|

|

296,490

|

|

296,754

|

|

|||

|

Diluted weighted average shares outstanding

|

292,045

|

|

297,313

|

|

297,684

|

|

|||

|

2015

|

2014

|

2013

|

|||||||

|

Net earnings

|

$

|

516,361

|

|

494,150

|

|

448,636

|

|

||

|

Other comprehensive (loss) income, net of tax:

|

|||||||||

|

Foreign currency translation adjustments (net of tax of $0 in 2015, 2014, and 2013)

|

(38,567

|

)

|

(18,683

|

)

|

(7,354

|

)

|

|||

|

Change in marketable securities (net of tax of $0 in 2015, 2014, and 2013)

|

—

|

|

(254

|

)

|

98

|

|

|||

|

Comprehensive income

|

$

|

477,794

|

|

475,213

|

|

441,380

|

|

||

|

|

Common Stock

|

|

|

|

|

|||||||||||||

|

|

Shares

|

Amount

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Total

Stockholders’

Equity

|

||||||||||||

|

Balance as of December 31, 2012

|

296,564

|

|

$

|

2,966

|

|

61,436

|

|

1,477,601

|

|

18,357

|

|

1,560,360

|

|

|||||

|

Dividends paid in cash

|

—

|

|

—

|

|

—

|

|

(237,456

|

)

|

—

|

|

(237,456

|

)

|

||||||

|

Purchases of common stock

|

(200

|

)

|

(2

|

)

|

(9,078

|

)

|

—

|

|

—

|

|

(9,080

|

)

|

||||||

|

Stock options exercised

|

389

|

|

4

|

|

9,302

|

|

—

|

|

—

|

|

9,306

|

|

||||||

|

Stock-based compensation

|

—

|

|

—

|

|

5,400

|

|

—

|

|

—

|

|

5,400

|

|

||||||

|

Excess tax benefits from stock-based compensation

|

—

|

|

—

|

|

2,787

|

|

—

|

|

—

|

|

2,787

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

—

|

|

448,636

|

|

—

|

|

448,636

|

|

||||||

|

Other comprehensive income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

(7,256

|

)

|

(7,256

|

)

|

||||||

|

Balance as of December 31, 2013

|

296,753

|

|

$

|

2,968

|

|

69,847

|

|

1,688,781

|

|

11,101

|

|

1,772,697

|

|

|||||

|

Dividends paid in cash

|

—

|

|

—

|

|

—

|

|

(296,581

|

)

|

—

|

|

(296,581

|

)

|

||||||

|

Purchases of common stock

|

(1,200

|

)

|

(12

|

)

|

(52,930

|

)

|

—

|

|

—

|

|

(52,942

|

)

|

||||||

|

Stock options exercised

|

315

|

|

3

|

|

7,694

|

|

—

|

|

—

|

|

7,697

|

|

||||||

|

Stock-based compensation

|

—

|

|

—

|

|

7,039

|

|

—

|

|

—

|

|

7,039

|

|

||||||

|

Excess tax benefits from stock-based compensation

|

—

|

|

—

|

|

2,094

|

|

—

|

|

—

|

|

2,094

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

—

|

|

494,150

|

|

—

|

|

494,150

|

|

||||||

|

Other comprehensive income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

(18,937

|

)

|

(18,937

|

)

|

||||||

|

Balance as of December 31, 2014

|

295,868

|

|

$

|

2,959

|

|

33,744

|

|

1,886,350

|

|

(7,836

|

)

|

1,915,217

|

|

|||||

|

Dividends paid in cash

|

—

|

|

—

|

|

—

|

|

(327,101

|

)

|

—

|

|

(327,101

|

)

|

||||||

|

Purchases of common stock

|

(7,100

|

)

|

(71

|

)

|

(60,042

|

)

|

(232,838

|

)

|

—

|

|

(292,951

|

)

|

||||||

|

Stock options exercised

|

814

|

|

8

|

|

19,091

|

|

—

|

|

—

|

|

19,099

|

|

||||||

|

Stock-based compensation

|

—

|

|

—

|

|

5,841

|

|

—

|

|

—

|

|

5,841

|

|

||||||

|

Excess tax benefits from stock-based compensation

|

—

|

|

—

|

|

3,390

|

|

—

|

|

—

|

|

3,390

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

—

|

|

516,361

|

|

—

|

|

516,361

|

|

||||||

|

Other comprehensive income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

(38,567

|

)

|

(38,567

|

)

|

||||||

|

Balance as of December 31, 2015

|

289,582

|

|

$

|

2,896

|

|

2,024

|

|

1,842,772

|

|

(46,403

|

)

|

1,801,289

|

|

|||||

|

2015

|

2014

|

2013

|

|||||||

|

Cash flows from operating activities:

|

|||||||||

|

Net earnings

|

$

|

516,361

|

|

494,150

|

|

448,636

|

|

||

|

Adjustments to reconcile net earnings to net cash provided by operating activities, net of acquisitions:

|

|||||||||

|

Depreciation of property and equipment

|

86,071

|

|

72,145

|

|

63,770

|

|

|||

|

Gain on sale of property and equipment

|

(1,411

|

)

|

(964

|

)

|

(643

|

)

|

|||

|

Bad debt expense

|

8,769

|

|

11,480

|

|

9,421

|

|

|||

|

Deferred income taxes

|

8,290

|

|

1,760

|

|

8,129

|

|

|||

|

Stock-based compensation

|

5,841

|

|

7,039

|

|

5,400

|

|

|||

|

Excess tax benefits from stock-based compensation

|

(3,390

|

)

|

(2,094

|

)

|

(2,787

|

)

|

|||

|

Amortization of non-compete agreements

|

527

|

|

527

|

|

421

|

|

|||

|

Changes in operating assets and liabilities, net of acquisitions:

|

|||||||||

|

Trade accounts receivable

|

(20,608

|

)

|

(63,418

|

)

|

(51,593

|

)

|

|||

|

Inventories

|

(47,830

|

)

|

(87,622

|

)

|

(68,685

|

)

|

|||

|

Other current assets

|

(15,778

|

)

|

(7,510

|

)

|

(10,627

|

)

|

|||

|

Accounts payable

|

20,617

|

|

12,501

|

|

13,234

|

|

|||

|

Accrued expenses

|

11,141

|

|

25,263

|

|

22,424

|

|

|||

|

Income taxes

|

(26,610

|

)

|

34,405

|

|

(14,714

|

)

|

|||

|

Other

|

4,950

|

|

1,730

|

|

(6,266

|

)

|

|||

|

Net cash provided by operating activities

|

546,940

|

|

499,392

|

|

416,120

|

|

|||

|

Cash flows from investing activities:

|

|||||||||

|

Purchases of property and equipment

|

(155,168

|

)

|

(189,474

|

)

|

(206,540

|

)

|

|||

|

Cash paid for acquisitions

|

(23,493

|

)

|

(5,575

|

)

|

—

|

|

|||

|

Proceeds from sale of property and equipment

|

9,941

|

|

5,819

|

|

4,990

|

|

|||