|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

46-1406086

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

9 West 57th Street, Suite #4920

New York, New York

|

10019

|

|

|

(Address of Principal Executive Office)

|

(Zip Code)

|

|

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

x

|

Smaller reporting company

o

|

|

Emerging growth filer

o

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|

|

Page

|

|

|

PART I

|

|

|

PART II

|

|

|

June 30, 2017

|

December 31, 2016

|

||||||

|

ASSETS

|

(Unaudited)

|

||||||

|

Cash and cash equivalents

|

$

|

133,258

|

|

$

|

118,048

|

|

|

|

Restricted cash

|

5,544

|

|

5,021

|

|

|||

|

Commercial mortgage loans, held for investment, net of allowance of $2,600 and $2,181

|

1,248,333

|

|

1,046,556

|

|

|||

|

Commercial mortgage loans, held-for-sale, measured at fair value

|

9,388

|

|

21,179

|

|

|||

|

Real estate securities, available-for-sale, at fair value

|

15,294

|

|

49,049

|

|

|||

|

Receivable for loan repayment

|

—

|

|

401

|

|

|||

|

Accrued interest receivable

|

6,230

|

|

5,955

|

|

|||

|

Prepaid expenses and other assets

|

3,783

|

|

1,916

|

|

|||

|

Total assets

|

$

|

1,421,830

|

|

$

|

1,248,125

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|||||||

|

Collateralized loan obligations

|

$

|

530,833

|

|

$

|

278,450

|

|

|

|

Repurchase agreements - commercial mortgage loans

|

177,494

|

|

257,664

|

|

|||

|

Other financing - commercial mortgage loans

|

35,609

|

|

—

|

|

|||

|

Repurchase agreements - real estate securities

|

49,071

|

|

66,639

|

|

|||

|

Interest payable

|

987

|

|

897

|

|

|||

|

Distributions payable

|

5,432

|

|

5,591

|

|

|||

|

Accounts payable and accrued expenses

|

2,105

|

|

1,170

|

|

|||

|

Due to affiliates

|

3,861

|

|

4,064

|

|

|||

|

Total liabilities

|

$

|

805,392

|

|

$

|

614,475

|

|

|

|

Commitment and Contingencies (See Note 8)

|

|

|

|

|

|||

|

Preferred stock, $0.01 par value, 50,000,000 authorized, none issued and outstanding as of June 30, 2017 and December 31, 2016

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value, 949,999,000 shares authorized, 31,957,913 and 31,884,631 shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively

|

319

|

|

319

|

|

|||

|

Additional paid-in capital

|

706,459

|

|

704,500

|

|

|||

|

Accumulated other comprehensive income (loss)

|

448

|

|

(500

|

)

|

|||

|

Accumulated deficit

|

(90,788

|

)

|

(70,669

|

)

|

|||

|

Total stockholders' equity

|

616,438

|

|

633,650

|

|

|||

|

Total liabilities and stockholders' equity

|

$

|

1,421,830

|

|

$

|

1,248,125

|

|

|

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

||||||||||||

|

Interest income:

|

|||||||||||||||

|

Interest income

|

$

|

20,843

|

|

$

|

20,222

|

|

$

|

39,722

|

|

$

|

40,513

|

|

|||

|

Less: Interest expense

|

7,717

|

|

5,393

|

|

13,145

|

|

10,161

|

|

|||||||

|

Net interest income

|

13,126

|

|

14,829

|

|

26,577

|

|

30,352

|

|

|||||||

|

Operating expenses:

|

|||||||||||||||

|

Asset management and subordinated performance fee

|

2,341

|

|

3,015

|

|

4,653

|

|

6,025

|

|

|||||||

|

Acquisition fees

and acquisition expenses

|

1,866

|

|

223

|

|

2,490

|

|

380

|

|

|||||||

|

Administrative services expenses

|

950

|

|

539

|

|

1,805

|

|

1,355

|

|

|||||||

|

Professional fees

|

1,205

|

|

811

|

|

1,972

|

|

2,072

|

|

|||||||

|

Other expenses

|

756

|

|

712

|

|

1,362

|

|

1,406

|

|

|||||||

|

Total Operating Expenses

|

7,118

|

|

5,300

|

|

12,282

|

|

11,238

|

|

|||||||

|

Loan loss provision

|

(193

|

)

|

669

|

|

419

|

|

834

|

|

|||||||

|

Realized loss on loans sold

|

1,718

|

|

—

|

|

1,965

|

|

—

|

|

|||||||

|

Realized (gain) loss on sale of real estate securities

|

(201

|

)

|

—

|

|

(172

|

)

|

—

|

|

|||||||

|

Unrealized (Gain) Loss on loans held-for-sale

|

(1,597

|

)

|

—

|

|

(247

|

)

|

—

|

|

|||||||

|

Net income

|

$

|

6,281

|

|

$

|

8,860

|

|

$

|

12,330

|

|

$

|

18,280

|

|

|||

|

Basic net income per share

|

$

|

0.20

|

|

$

|

0.28

|

|

$

|

0.39

|

|

$

|

0.58

|

|

|||

|

Diluted net income per share

|

$

|

0.20

|

|

$

|

0.28

|

|

$

|

0.39

|

|

$

|

0.58

|

|

|||

|

Basic weighted average shares outstanding

|

31,850,897

|

|

31,802,261

|

|

31,796,504

|

|

31,676,513

|

|

|||||||

|

Diluted weighted average shares outstanding

|

31,860,444

|

|

31,807,927

|

|

31,806,170

|

|

31,682,402

|

|

|||||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

|||||||||||||

|

Net income

|

$

|

6,281

|

|

$

|

8,860

|

|

$

|

12,330

|

|

$

|

18,280

|

|

||||

|

Unrealized gain/(loss) on available-for-sale securities

|

(440

|

)

|

2,391

|

|

948

|

|

(2,573

|

)

|

||||||||

|

Comprehensive income attributable to Benefit Street Partners Realty Trust, Inc.

|

$

|

5,841

|

|

$

|

11,251

|

|

$

|

13,278

|

|

$

|

15,707

|

|

||||

|

Common Stock

|

|||||||||||||||||||||||

|

Number of Shares

|

Par Value

|

Additional Paid-In Capital

|

Accumulated Other Comprehensive Income

|

Accumulated Deficit

|

Total Stockholders' Equity

|

||||||||||||||||||

|

Balance, December 31, 2016

|

31,884,631

|

|

$

|

319

|

|

$

|

704,500

|

|

$

|

(500

|

)

|

$

|

(70,669

|

)

|

$

|

633,650

|

|

||||||

|

Common stock repurchases

|

(497,005

|

)

|

(5

|

)

|

(9,444

|

)

|

—

|

|

—

|

|

(9,449

|

)

|

|||||||||||

|

Common stock issued through distribution reinvestment plan

|

570,287

|

|

5

|

|

11,388

|

|

—

|

|

—

|

|

11,393

|

|

|||||||||||

|

Share-based compensation

|

—

|

|

—

|

|

15

|

|

—

|

|

—

|

|

15

|

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

12,330

|

|

12,330

|

|

|||||||||||

|

Distributions declared

|

—

|

|

—

|

|

—

|

|

—

|

|

(32,449

|

)

|

(32,449

|

)

|

|||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

948

|

|

—

|

|

948

|

|

|||||||||||

|

Balance, June 30, 2017

|

31,957,913

|

|

$

|

319

|

|

$

|

706,459

|

|

$

|

448

|

|

$

|

(90,788

|

)

|

$

|

616,438

|

|

||||||

|

Six Months Ended June 30,

|

|||||||

|

2017

|

2016

|

||||||

|

Cash flows from operating activities:

|

|||||||

|

Net income

|

$

|

12,330

|

|

$

|

18,280

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||

|

Premium amortization and (discount accretion), net

|

(1,159

|

)

|

(1,143

|

)

|

|||

|

Accretion of deferred commitment fees

|

(1,124

|

)

|

(765

|

)

|

|||

|

Amortization of deferred financing costs

|

2,366

|

|

1,333

|

|

|||

|

Share-based compensation

|

15

|

|

18

|

|

|||

|

Change in unrealized losses on loans held for sale

|

(247

|

)

|

—

|

|

|||

|

Change in unrealized losses on real estate securities

|

—

|

|

—

|

|

|||

|

Loan loss provision

|

419

|

|

834

|

|

|||

|

Changes in assets and liabilities:

|

|||||||

|

Accrued interest receivable

|

849

|

|

877

|

|

|||

|

Prepaid expenses and other assets

|

1,799

|

|

(20

|

)

|

|||

|

Accounts payable and accrued expenses

|

935

|

|

52

|

|

|||

|

Due to affiliates

|

(203

|

)

|

(278

|

)

|

|||

|

Interest payable

|

90

|

|

16

|

|

|||

|

Net cash provided by operating activities

|

$

|

16,070

|

|

$

|

19,204

|

|

|

|

Cash flows from investing activities:

|

|||||||

|

Origination and purchase of commercial mortgage loans

|

$

|

(395,929

|

)

|

$

|

(25,194

|

)

|

|

|

Proceeds from sale of real estate securities

|

34,888

|

|

—

|

|

|||

|

Proceeds from sale of commercial mortgage loans

|

67,586

|

|

—

|

|

|||

|

Principal repayments received on commercial mortgage loans

|

137,767

|

|

22,401

|

|

|||

|

Principal repayments received on real estate securities

|

—

|

|

2,213

|

|

|||

|

Net cash provided by investing activities

|

$

|

(155,688

|

)

|

$

|

(580

|

)

|

|

|

Cash flows from financing activities:

|

|||||||

|

Common stock repurchases

|

$

|

(9,449

|

)

|

$

|

(6,013

|

)

|

|

|

Borrowings under collateralized loan obligations

|

339,500

|

|

—

|

|

|||

|

Repayments of collateralized loan obligations

|

(81,270

|

)

|

—

|

|

|||

|

Borrowings on repurchase agreements - commercial mortgage loans

|

266,579

|

|

104,626

|

|

|||

|

Repayments of repurchase agreements - commercial mortgage loans

|

(346,748

|

)

|

(48,809

|

)

|

|||

|

Borrowings on repurchase agreements - real estate securities

|

245,532

|

|

715,666

|

|

|||

|

Repayments of repurchase agreements - real estate securities

|

(263,100

|

)

|

(713,597

|

)

|

|||

|

Other financing - commercial mortgage loans

|

36,200

|

|

—

|

|

|||

|

Increase in restricted cash related to financing activities

|

(523

|

)

|

(1,132

|

)

|

|||

|

Payments of deferred financing costs

|

(10,678

|

)

|

(816

|

)

|

|||

|

Distributions paid

|

(21,215

|

)

|

(19,703

|

)

|

|||

|

Net cash (used in) provided by financing activities

|

$

|

154,828

|

|

$

|

30,222

|

|

|

|

Net change in cash and cash equivalents

|

$

|

15,210

|

|

$

|

48,846

|

|

|

|

Cash and cash equivalents, beginning of period

|

118,048

|

|

14,807

|

|

|||

|

Cash and cash equivalents, end of period

|

$

|

133,258

|

|

$

|

63,653

|

|

|

|

Six Months Ended June 30,

|

|||||||

|

2017

|

2016

|

||||||

|

Supplemental disclosures of cash flow information:

|

|||||||

|

Interest paid

|

$

|

12,258

|

|

$

|

8,811

|

|

|

|

Supplemental disclosures of non-cash flow information:

|

|||||||

|

Distributions payable

|

$

|

5,432

|

|

$

|

5,392

|

|

|

|

Common stock issued through distribution reinvestment plan

|

11,393

|

|

12,950

|

|

|||

|

Loans transferred to commercial real estate loans, held-for-sale, transferred

at fair value |

57,513

|

|

—

|

|

|||

|

•

|

The real estate debt business which is focused on originating, acquiring and asset managing commercial real estate debt investments, including first mortgage loans, subordinate mortgages, mezzanine loans and participations in such loans.

|

|

•

|

The real estate securities business which is focused on investing in and asset managing commercial real estate securities primarily consisting of CMBS and may include unsecured REIT debt, CDO notes and other securities.

|

|

June 30, 2017

|

December 31, 2016

|

||||||

|

Senior loans

|

$

|

1,179,548

|

|

$

|

901,907

|

|

|

|

Mezzanine loans

|

71,385

|

|

136,830

|

|

|||

|

Subordinated loans

|

—

|

|

10,000

|

|

|||

|

Total gross carrying value of loans

|

1,250,933

|

|

1,048,737

|

|

|||

|

Less: Allowance for loan losses

|

2,600

|

|

2,181

|

|

|||

|

Total commercial mortgage loans, held for investment, net

|

$

|

1,248,333

|

|

$

|

1,046,556

|

|

|

|

Six Months Ended June 30, 2017

|

Six Months Ended June 30, 2016

|

||||||

|

Beginning of period

|

$

|

2,181

|

|

$

|

888

|

|

|

|

Provision for loan losses

|

419

|

|

834

|

|

|||

|

Charge-offs

|

—

|

|

—

|

|

|||

|

Recoveries

|

—

|

|

—

|

|

|||

|

Ending allowance for loan losses

|

$

|

2,600

|

|

$

|

1,722

|

|

|

|

June 30, 2017

|

December 31, 2016

|

|||||||||||||

|

Loan Type

|

Par Value

|

Percentage

|

Par Value

|

Percentage

|

||||||||||

|

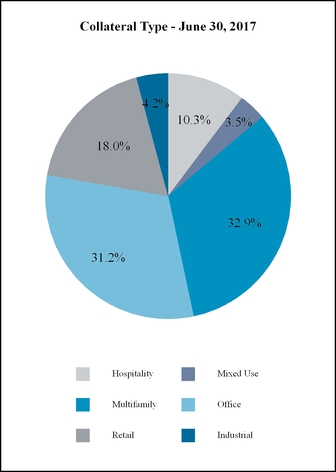

Office

|

$

|

399,402

|

|

31.6

|

%

|

$

|

340,944

|

|

31.6

|

%

|

||||

|

Multifamily

|

420,891

|

|

33.2

|

%

|

329,203

|

|

30.6

|

%

|

||||||

|

Hospitality

|

117,135

|

|

9.3

|

%

|

143,582

|

|

13.3

|

%

|

||||||

|

Retail

|

229,980

|

|

18.2

|

%

|

154,684

|

|

14.4

|

%

|

||||||

|

Mixed Use

|

45,235

|

|

3.6

|

%

|

56,136

|

|

5.2

|

%

|

||||||

|

Industrial

|

53,208

|

|

4.2

|

%

|

52,688

|

|

4.9

|

%

|

||||||

|

$

|

1,265,851

|

|

100.0

|

%

|

$

|

1,077,237

|

|

100.0

|

%

|

|||||

|

Investment Rating

|

Summary Description

|

|

|

1

|

Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable.

|

|

|

2

|

Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable.

|

|

|

3

|

Performing investments requiring closer monitoring. Trends and risk factors show some deterioration.

|

|

|

4

|

Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative.

|

|

|

5

|

Underperforming investment with expected loss of interest and some principal.

|

|

|

Six Months Ended June 30, 2017

|

Six Months Ended June 30, 2016

|

||||||

|

Balance at Beginning of Year

|

$

|

1,046,556

|

|

$

|

1,124,201

|

|

|

|

Acquisitions and originations

|

396,920

|

|

25,194

|

|

|||

|

Principal repayments

|

(137,366

|

)

|

(22,690

|

)

|

|||

|

Discount accretion and premium amortization*

|

1,146

|

|

1,124

|

|

|||

|

Loans transferred to commercial real estate loans, held-for-sale, at fair value

|

(57,513

|

)

|

—

|

|

|||

|

Fees capitalized into carrying value of loans

|

(991

|

)

|

—

|

|

|||

|

Provision for loan losses

|

(419

|

)

|

(834

|

)

|

|||

|

Balance at End of Period

|

$

|

1,248,333

|

|

$

|

1,126,995

|

|

|

|

Weighted Average

|

||||||||||||||||

|

Number of Investments

|

Interest Rate

|

Maturity

|

Par Value

|

Fair Value

|

||||||||||||

|

June 30, 2017

|

1

|

|

8.1

|

%

|

May 2032

|

$

|

15,000

|

|

$

|

15,294

|

|

|||||

|

December 31, 2016

|

6

|

|

5.8

|

%

|

February 2020

|

50,000

|

|

49,049

|

|

|||||||

|

Amortized Cost

|

Unrealized Gains

|

Unrealized Losses

|

Fair Value

|

|||||||||||||

|

June 30, 2017

|

$

|

14,846

|

|

$

|

448

|

|

$

|

—

|

|

$

|

15,294

|

|

||||

|

December 31, 2016

|

49,548

|

|

—

|

|

(499

|

)

|

49,049

|

|

||||||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

||||||||||||

|

Unrealized gains (losses) available-for-sale securities

|

$

|

(570

|

)

|

$

|

2,391

|

|

$

|

467

|

|

$

|

(2,573

|

)

|

|||

|

Reclassification adjustment for net (gains) losses on available-for-sale included in net income (loss)

|

130

|

|

—

|

|

481

|

|

—

|

|

|||||||

|

Net Reclass

|

$

|

(440

|

)

|

$

|

2,391

|

|

$

|

948

|

|

$

|

(2,573

|

)

|

|||

|

The amounts reclassified for net (gain) loss on available-for-sale securities are included in the realized (gain) loss on sale of real estate securities in the Company's consolidated statements of operations.

|

|||||||||||||||

|

Weighted Average

|

|||||||||||||||||

|

Counterparty

|

Amount Outstanding

|

Accrued Interest

|

Collateral Pledged (*)

|

Interest Rate

|

Days to Maturity

|

||||||||||||

|

As of June 30, 2017

|

|||||||||||||||||

|

J.P. Morgan Securities LLC

|

$

|

49,071

|

|

$

|

96

|

|

$

|

71,058

|

|

3.09

|

%

|

39

|

|||||

|

Total/Weighted Average

|

$

|

49,071

|

|

$

|

96

|

|

$

|

71,058

|

|

3.09

|

%

|

39

|

|||||

|

As of December 31, 2016

|

|||||||||||||||||

|

J.P. Morgan Securities LLC

|

$

|

59,122

|

|

$

|

96

|

|

$

|

92,658

|

|

2.55

|

%

|

6

|

|||||

|

Citigroup Global Markets, Inc.

|

3,879

|

|

1

|

|

4,850

|

|

2.11

|

%

|

26

|

||||||||

|

Wells Fargo Securities, LLC

|

3,638

|

|

4

|

|

4,850

|

|

2.05

|

%

|

13

|

||||||||

|

Total/Weighted Average

|

$

|

66,639

|

|

$

|

101

|

|

$

|

102,358

|

|

2.50

|

%

|

8

|

|||||

|

2015 Facility ($000s)

|

Par Value Issued

|

Par Value Outstanding

(*)

|

Interest Rate

|

Maturity Date

|

||||||||

|

As of June 30, 2017

|

||||||||||||

|

Tranche A

|

$

|

231,345

|

|

$

|

140,890

|

|

1M LIBOR + 175

|

8/1/2030

|

||||

|

Tranche B

|

42,841

|

|

42,841

|

|

1M LIBOR + 388

|

8/1/2030

|

||||||

|

Tranche C

|

76,044

|

|

20,000

|

|

1M LIBOR + 525

|

8/1/2030

|

||||||

|

$

|

350,230

|

|

$

|

203,731

|

|

|||||||

|

As of December 31, 2016

|

||||||||||||

|

Tranche A

|

$

|

231,345

|

|

$

|

222,195

|

|

1M LIBOR + 175

|

8/1/2030

|

||||

|

Tranche B

|

42,841

|

|

42,841

|

|

1M LIBOR + 388

|

8/1/2030

|

||||||

|

Tranche C

|

76,044

|

|

20,000

|

|

1M LIBOR + 525

|

8/1/2030

|

||||||

|

$

|

350,230

|

|

$

|

285,036

|

|

|||||||

|

2017 Facility ($000s)

|

Par Value Issued

|

Par Value Outstanding

|

Interest Rate

|

Maturity Date

|

||||||||

|

As of June 30, 2017

|

||||||||||||

|

Tranche A

|

$

|

223,600

|

|

$

|

223,600

|

|

1M LIBOR + 135

|

7/1/2027

|

||||

|

Tranche B

|

48,000

|

|

48,000

|

|

1M LIBOR + 240

|

7/1/2027

|

||||||

|

Tranche C

|

67,900

|

|

67,900

|

|

1M LIBOR + 425

|

7/1/2027

|

||||||

|

$

|

339,500

|

|

$

|

339,500

|

|

|||||||

|

Assets ($000s)

|

June 30, 2017

|

December 31, 2016

|

||||||

|

Cash

|

$

|

160

|

|

$

|

5

|

|

||

|

Commercial mortgage loans, held for investment, net of allowance of $2,406 and $1,017

(1)

|

752,277

|

|

417,057

|

|

||||

|

Accrued interest receivable

|

2,036

|

|

1,101

|

|

||||

|

Total assets

|

$

|

754,473

|

|

$

|

418,163

|

|

||

|

Liabilities

|

||||||||

|

Notes payable

(2)(3)

|

$

|

586,635

|

|

$

|

334,246

|

|

||

|

Interest payable

|

557

|

|

564

|

|

||||

|

Total liabilities

|

$

|

587,192

|

|

$

|

334,810

|

|

||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

||||||||||||

|

Net income (in thousands)

|

$

|

6,281

|

|

$

|

8,860

|

|

$

|

12,330

|

|

$

|

18,280

|

|

|||

|

Basic weighted average shares outstanding

|

31,850,897

|

|

31,802,261

|

|

31,796,504

|

|

31,676,513

|

|

|||||||

|

Unvested restricted shares

|

9,547

|

|

5,666

|

|

9,666

|

|

5,889

|

|

|||||||

|

Diluted weighted average shares outstanding

|

31,860,444

|

|

31,807,927

|

|

31,806,170

|

|

31,682,402

|

|

|||||||

|

Basic net income per share

|

$

|

0.20

|

|

$

|

0.28

|

|

$

|

0.39

|

|

$

|

0.58

|

|

|||

|

Diluted net income per share

|

$

|

0.20

|

|

$

|

0.28

|

|

$

|

0.39

|

|

$

|

0.58

|

|

|||

|

Number of Requests

|

Number of Shares Repurchased

|

Average Price per Share

|

||||||||

|

Cumulative as of December 31, 2016

|

985

|

|

918,683

|

|

$

|

23.94

|

|

|||

|

January 1 - March 31, 2017

|

502

|

|

496,678

|

|

19.04

|

|

||||

|

April 1 - June 30, 2017

|

2

|

|

327

|

|

20.08

|

|

||||

|

Cumulative as of June 30, 2017

|

1,489

|

|

1,415,688

|

|

$

|

22.22

|

|

|||

|

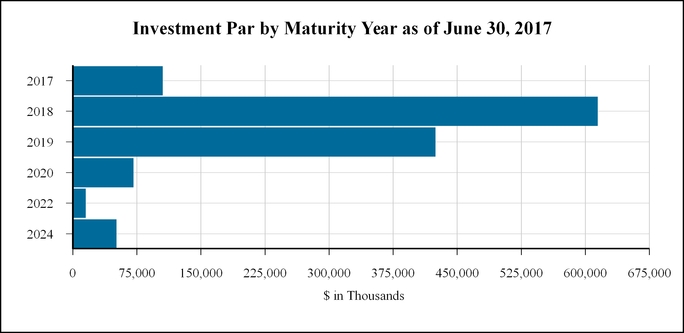

Funding Expiration

|

June 30, 2017

|

December 31, 2016

|

||||||

|

2016

|

$

|

—

|

|

$

|

—

|

|

||

|

2017

|

7,367

|

|

7,794

|

|

||||

|

2018

|

52,023

|

|

62,368

|

|

||||

|

2019

|

25,521

|

|

9,072

|

|

||||

|

2020

|

17,356

|

|

—

|

|

||||

|

Total

|

$

|

102,267

|

|

$

|

79,234

|

|

||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

Payable as of

|

|||||||||||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

June 30, 2017

|

December 31, 2016

|

||||||||||||||||||||

|

Total compensation and reimbursement for services provided by the Former Advisor, its affiliates, entities under common control with the Former Advisor and the Former Dealer Manager

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

480

|

|

$

|

480

|

|

|||||||

|

Acquisition fees and expenses

|

$

|

4,542

|

|

$

|

223

|

|

5,954

|

|

380

|

|

—

|

|

—

|

|

|||||||||||

|

Administrative services expenses

|

950

|

|

—

|

|

539

|

|

1,805

|

|

1,355

|

|

950

|

|

1,000

|

|

|||||||||||

|

Advisory and investment banking fee

|

—

|

|

—

|

|

—

|

|

6

|

|

—

|

|

—

|

|

|||||||||||||

|

Asset management and subordinated performance fee

|

2,341

|

|

3,015

|

|

4,653

|

|

6,025

|

|

2,341

|

|

2,439

|

|

|||||||||||||

|

Other related party expenses

|

48

|

|

24

|

|

96

|

|

50

|

|

90

|

|

145

|

|

|||||||||||||

|

Total related party fees and reimbursements

|

$

|

7,881

|

|

$

|

3,801

|

|

$

|

12,508

|

|

$

|

7,816

|

|

$

|

3,861

|

|

$

|

4,064

|

|

|||||||

|

•

|

Level I - Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

|

|

•

|

Level II - Inputs (other than quoted prices included in Level I) are either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

|

|

•

|

Level III - Unobservable inputs that reflect the entity’s own assumptions about the assumptions that market participants would use in the pricing of the asset or liability and are consequently not based on market activity, but rather through particular valuation techniques.

|

|

Total

|

Level I

|

Level II

|

Level III

|

||||||||||||

|

June 30, 2017

|

|||||||||||||||

|

Real estate securities

|

$

|

15,294

|

|

$

|

—

|

|

$

|

—

|

|

$

|

15,294

|

|

|||

|

December 31, 2016

|

|

||||||||||||||

|

Real estate securities

|

49,049

|

|

—

|

|

—

|

|

49,049

|

|

|||||||

|

June 30, 2017

|

December 31, 2016

|

|||||||

|

Beginning balance

|

$

|

49,049

|

|

$

|

—

|

|

||

|

Transfers into Level III

|

—

|

|

57,639

|

|

||||

|

Total realized and unrealized gains (losses)

|

||||||||

|

included in earnings:

|

||||||||

|

Realized gain (loss) on sale of real estate securities

|

172

|

|

(874

|

)

|

||||

|

Impairment losses on real estate securities

|

—

|

|

(310

|

)

|

||||

|

Net accretion

|

13

|

|

—

|

|

||||

|

Unrealized gains (losses) included in OCI

(1)

|

948

|

|

1,719

|

|

||||

|

Purchases

|

—

|

|

—

|

|

||||

|

Sales

|

(34,888

|

)

|

(9,125

|

)

|

||||

|

Cash repayments/receipts

|

—

|

|

—

|

|

||||

|

Transfers out of Level III

|

—

|

|

—

|

|

||||

|

Ending balance

|

$

|

15,294

|

|

$

|

49,049

|

|

||

|

Total

|

Level I

|

Level II

|

Level III

|

||||||||||||

|

June 30, 2017

(*)

|

|||||||||||||||

|

Commercial mortgage loans, held-for-sale, measured at fair value

|

$

|

9,388

|

|

$

|

—

|

|

$

|

—

|

|

$

|

9,388

|

|

|||

|

December 31, 2016

(*)

|

|||||||||||||||

|

Commercial mortgage loans, held-for-sale, measured at fair value

|

21,179

|

|

—

|

|

—

|

|

21,179

|

|

|||||||

|

Level

|

Carrying Amount

|

Fair Value

|

|||||||||

|

June 30, 2017

|

|||||||||||

|

Commercial mortgage loans

(1)

|

Asset

|

III

|

$

|

1,250,933

|

|

$

|

1,248,569

|

|

|||

|

Collateralized loan obligation

|

Liability

|

II

|

530,833

|

|

543,131

|

|

|||||

|

December 31, 2016

|

|||||||||||

|

Commercial mortgage loans

(1)

|

Asset

|

III

|

1,048,737

|

|

1,029,756

|

|

|||||

|

Collateralized loan obligation

|

Liability

|

II

|

278,450

|

|

282,001

|

|

|||||

|

Gross Amounts Not Offset on the Balance Sheet

|

||||||||||||||||||||||||

|

Repurchase Agreements

|

Gross Amounts of Recognized Liabilities

|

Gross Amounts Offset on the Balance Sheet

|

Net Amount of Liabilities Presented on the Balance Sheet

|

Financial Instruments as Collateral Pledged

(*)

|

Cash Collateral Pledged

|

Net Amount

|

||||||||||||||||||

|

June 30, 2017

|

||||||||||||||||||||||||

|

Commercial mortgage loans

|

$

|

177,494

|

|

$

|

—

|

|

$

|

177,494

|

|

$

|

761,968

|

|

$

|

5,005

|

|

$

|

—

|

|

||||||

|

Real estate securities

|

49,071

|

|

—

|

|

49,071

|

|

71,058

|

|

389

|

|

—

|

|

||||||||||||

|

December 31, 2016

|

||||||||||||||||||||||||

|

Commercial mortgage loans

|

257,664

|

|

—

|

|

257,664

|

|

399,914

|

|

5,000

|

|

—

|

|

||||||||||||

|

Real estate securities

|

66,639

|

|

—

|

|

66,639

|

|

102,358

|

|

21

|

|

—

|

|

||||||||||||

|

•

|

The real estate debt business focuses on originating, acquiring and asset managing commercial real estate debt investments, including first mortgage loans, subordinate mortgages, mezzanine loans and participations in such loans.

|

|

•

|

The real estate securities business focuses on investing in and asset managing commercial real estate securities primarily consisting of CMBS and may include unsecured REIT debt, CDO notes and other securities.

|

|

Three Months Ended June 30, 2017

|

Total

|

Real Estate Debt

|

Real Estate Securities

|

|||||||||

|

Interest income

|

$

|

20,843

|

|

$

|

20,432

|

|

$

|

411

|

|

|||

|

Interest expense

|

7,717

|

|

7,307

|

|

410

|

|

||||||

|

Net income

|

6,281

|

|

6,090

|

|

191

|

|

||||||

|

Three Months Ended June 30, 2016

|

||||||||||||

|

Interest income

|

20,222

|

|

18,615

|

|

1,607

|

|

||||||

|

Interest expense

|

5,393

|

|

4,710

|

|

683

|

|

||||||

|

Net income

|

8,860

|

|

8,451

|

|

409

|

|

||||||

|

Six Months Ended June 30, 2017

|

Total

|

Real Estate Debt

|

Real Estate Securities

|

|||||||||

|

Interest income

|

$

|

39,722

|

|

$

|

38,640

|

|

$

|

1,082

|

|

|||

|

Interest expense

|

13,145

|

|

12,300

|

|

845

|

|

||||||

|

Net income

|

12,330

|

|

12,039

|

|

291

|

|

||||||

|

Six Months Ended June 30, 2016

|

||||||||||||

|

Interest income

|

40,513

|

|

37,291

|

|

3,222

|

|

||||||

|

Interest expense

|

10,161

|

|

8,801

|

|

1,360

|

|

||||||

|

Net income

|

18,280

|

|

17,510

|

|

770

|

|

||||||

|

As of June 30, 2017

|

Total

|

Real Estate Debt

|

Real Estate Securities

|

|||||||||

|

Total Assets

|

$

|

1,421,830

|

|

$

|

1,406,049

|

|

$

|

15,781

|

|

|||

|

As of December 31, 2016

|

||||||||||||

|

Total Assets

|

1,248,125

|

|

1,198,806

|

|

49,319

|

|

||||||

|

•

|

our business and investment strategy;

|

|

•

|

our ability to make investments in a timely manner or on acceptable terms;

|

|

•

|

current credit market conditions and our ability to obtain long-term financing for our investments in a timely manner and on terms that are consistent with what we project when we invest;

|

|

•

|

the effect of general market, real estate market, economic and political conditions, including the recent economic slowdown and dislocation in the global credit markets;

|

|

•

|

our ability to make scheduled payments on our debt obligations;

|

|

•

|

our ability to generate sufficient cash flows to make distributions to our stockholders;

|

|

•

|

our ability to generate sufficient debt and equity capital to fund additional investments;

|

|

•

|

our ability to refinance our existing financing arrangements;

|

|

•

|

the degree and nature of our competition;

|

|

•

|

the availability of qualified personnel;

|

|

•

|

our ability to maintain our qualification as a real estate investment trust ("REIT"); and

|

|

•

|

other factors set forth under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2016.

|

|

Loan Type

|

Property Type

|

Par Value

|

Interest Rate

(1)

|

Effective Yield

|

Loan to Value

(2)

|

|

Senior 1

|

Office

|

$6,290

|

1M LIBOR + 4.90%

|

6.1%

|

80.0%

|

|

Senior 2

|

Office

|

31,250

|

1M LIBOR + 4.50%

|

5.9%

|

75.0%

|

|

Senior 3

|

Retail

|

9,450

|

1M LIBOR + 4.90%

|

6.2%

|

69.2%

|

|

Senior 4

|

Hospitality

|

7,660

|

1M LIBOR + 5.50%

|

7.1%

|

55.3%

|

|

Senior 5

|

Retail

|

7,460

|

1M LIBOR + 4.75%

|

6.1%

|

78.0%

|

|

Senior 6

|

Retail

|

11,800

|

1M LIBOR + 4.75%

|

6.1%

|

79.4%

|

|

Senior 7

|

Office

|

33,734

|

1M LIBOR + 4.65%

|

6.1%

|

80.0%

|

|

Senior 8

|

Office

|

41,201

|

1M LIBOR + 5.25%

|

6.6%

|

75.0%

|

|

Senior 9

|

Office

|

13,440

|

1M LIBOR + 5.00%

|

6.4%

|

75.0%

|

|

Senior 10

|

Office

|

29,806

|

1M LIBOR + 4.60%

|

5.9%

|

65.0%

|

|

Senior 11

|

Retail

|

11,684

|

1M LIBOR + 4.50%

|

5.8%

|

74.8%

|

|

Senior 12

|

Multifamily

|

14,546

|

1M LIBOR + 5.00%

|

6.4%

|

76.7%

|

|

Senior 13

|

Retail

|

9,950

|

1M LIBOR + 5.25%

|

6.6%

|

80.0%

|

|

Senior 14

|

Multifamily

|

10,922

|

1M LIBOR + 4.75%

|

6.0%

|

75.0%

|

|

Senior 15

|

Hospitality

|

16,800

|

1M LIBOR + 4.90%

|

6.2%

|

74.0%

|

|

Senior 16

|

Multifamily

|

26,410

|

1M LIBOR + 4.25%

|

5.6%

|

79.7%

|

|

Senior 17

|

Multifamily

|

14,852

|

1M LIBOR + 4.50%

|

5.9%

|

76.0%

|

|

Senior 18

|

Retail

|

14,600

|

1M LIBOR + 4.25%

|

5.6%

|

65.0%

|

|

Senior 19

|

Retail

|

27,249

|

1M LIBOR + 4.75%

|

6.0%

|

67.4%

|

|

Senior 20

|

Office

|

8,784

|

1M LIBOR + 4.65%

|

6.1%

|

70.8%

|

|

Senior 21

|

Industrial

|

19,553

|

1M LIBOR + 4.25%

|

5.6%

|

68.0%

|

|

Senior 22

|

Multifamily

|

18,941

|

1M LIBOR + 4.20%

|

5.5%

|

76.4%

|

|

Senior 23

|

Hospitality

|

10,350

|

1M LIBOR + 5.50%

|

6.9%

|

69.9%

|

|

Senior 24

|

Hospitality

|

15,375

|

1M LIBOR + 5.30%

|

6.6%

|

73.5%

|

|

Senior 25

|

Mixed Use

|

45,235

|

1M LIBOR + 5.50%

|

6.9%

|

72.6%

|

|

Senior 26

|

Retail

|

7,500

|

1M LIBOR + 5.00%

|

6.5%

|

59.0%

|

|

Senior 27

|

Retail

|

4,725

|

1M LIBOR + 5.50%

|

7.0%

|

72.0%

|

|

Senior 28

|

Multifamily

|

44,595

|

1M LIBOR + 4.25%

|

5.7%

|

77.0%

|

|

Senior 29

|

Multifamily

|

18,075

|

1M LIBOR + 4.50%

|

5.8%

|

75.0%

|

|

Loan Type

|

Property Type

|

Par Value

|

Interest Rate

(1)

|

Effective Yield

|

Loan to Value

(2)

|

|

Senior 30

|

Office

|

13,986

|

1M LIBOR + 4.75%

|

6.0%

|

74.4%

|

|

Senior 31

|

Multifamily

|

24,387

|

1M LIBOR + 4.25%

|

5.5%

|

69.6%

|

|

Senior 32

|

Multifamily

|

44,192

|

1M LIBOR + 4.00%

|

5.3%

|

77.0%

|

|

Senior 33

|

Multifamily

|

25,200

|

1M LIBOR + 3.85%

|

5.0%

|

76.8%

|

|

Senior 34

|

Multifamily

|

8,707

|

1M LIBOR + 3.95%

|

5.1%

|

77.5%

|

|

Senior 35

|

Multifamily

|

13,120

|

1M LIBOR + 3.95%

|

5.1%

|

78.2%

|

|

Senior 36

|

Multifamily

|

5,894

|

1M LIBOR + 4.05%

|

5.2%

|

80.0%

|

|

Senior 37

|

Industrial

|

33,655

|

1M LIBOR + 4.00%

|

5.2%

|

65.0%

|

|

Senior 38

|

Office

|

12,000

|

1M LIBOR + 4.75%

|

6.0%

|

54.1%

|

|

Senior 39

|

Office

|

35,000

|

1M LIBOR + 5.00%

|

6.2%

|

79.0%

|

|

Senior 40

|

Office

|

19,979

|

1M LIBOR + 4.55%

|

5.8%

|

70.0%

|

|

Senior 41

|

Office

|

28,489

|

1M LIBOR + 4.25%

|

5.5%

|

73.3%

|

|

Senior 42

|

Office

|

15,030

|

1M LIBOR + 5.35%

|

6.7%

|

47.1%

|

|

Senior 43

|

Multifamily

|

14,000

|

1M LIBOR + 5.00%

|

6.2%

|

56.3%

|

|

Senior 44

|

Office

|

16,300

|

1M LIBOR + 6.00%

|

7.5%

|

74.8%

|

|

Senior 45

|

Retail

|

13,700

|

1M LIBOR + 4.75%

|

6.1%

|

62.6%

|

|

Senior 46

|

Retail

|

28,500

|

1M LIBOR + 4.73%

|

6.0%

|

73.1%

|

|

Senior 47

|

Retail

|

12,700

|

1M LIBOR + 5.00%

|

6.3%

|

73.3%

|

|

Senior 48

|

Multifamily

|

23,150

|

1M LIBOR + 5.00%

|

6.3%

|

71.7%

|

|

Senior 49

|

Multifamily

|

54,200

|

1M LIBOR + 6.75%

|

8.0%

|

83.4%

|

|

Senior 50

|

Retail

|

15,750

|

1M LIBOR + 5.25%

|

6.5%

|

70.5%

|

|

Senior 51

|

Retail

|

25,000

|

1M LIBOR + 4.40%

|

5.7%

|

71.4%

|

|

Senior 52

|

Multifamily

|

13,444

|

1M LIBOR + 7.10%

|

8.3%

|

76.4%

|

|

Senior 53

|

Hospitality

|

12,600

|

1M LIBOR + 5.50%

|

6.9%

|

61.6%

|

|

Senior 54

|

Hospitality

|

11,750

|

1M LIBOR + 5.50%

|

6.9%

|

71.2%

|

|

Senior 55

|

Retail

|

20,450

|

1M LIBOR + 5.00%

|

6.3%

|

60.9%

|

|

Senior 56

|

Retail

|

7,500

|

1M LIBOR + 5.25%

|

6.6%

|

70.5%

|

|

Senior 57

|

Office

|

62,040

|

1M LIBOR + 4.50%

|

5.9%

|

69.2%

|

|

Senior 58

|

Multifamily

|

38,775

|

1M LIBOR + 4.50%

|

5.7%

|

73.8%

|

|

Mezzanine 1

|

Multifamily

|

4,000

|

12.00%

|

11.9%

|

74.5%

|

|

Mezzanine 2

|

Hospitality

|

11,000

|

1M LIBOR + 7.05%

|

8.2%

|

70.0%

|

|

Mezzanine 3

|

Office

|

7,000

|

12.00%

|

11.9%

|

78.3%

|

|

Mezzanine 4

|

Retail

|

1,963

|

13.00%

|

13.0%

|

85.0%

|

|

Mezzanine 5

|

Multifamily

|

3,480

|

9.50%

|

9.5%

|

84.5%

|

|

Mezzanine 6

|

Office

|

5,073

|

3M LIBOR + 10.00%

|

11.2%

|

79.5%

|

|

Mezzanine 7

|

Office

|

10,000

|

10.00%

|

10.4%

|

79.0%

|

|

Mezzanine 8

|

Office

|

10,000

|

1M LIBOR + 10.75%

|

15.4%

|

80.0%

|

|

Mezzanine 9

|

Hospitality

|

7,140

|

10.00%

|

10.6%

|

73.9%

|

|

Mezzanine 10

|

Hospitality

|

3,900

|

10.00%

|

10.6%

|

73.9%

|

|

Mezzanine 11

|

Hospitality

|

12,510

|

10.00%

|

10.6%

|

73.9%

|

|

Mezzanine 12

|

Hospitality

|

8,050

|

10.00%

|

10.6%

|

73.9%

|

|

$1,265,851

|

6.4%

|

72.8%

|

|||

|

•

|

The real estate debt business focuses on originating, acquiring and asset managing commercial real estate debt investments, including first mortgage loans, subordinate mortgages, mezzanine loans and participations in such loans.

|

|

•

|

The real estate securities business focuses on investing in and asset managing commercial real estate securities primarily consisting of CMBS and may include unsecured REIT debt, CDO notes and other securities.

|

|

Three Months Ended June 30,

|

||||||||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||||

|

Average Carrying Value

(1)

|

Interest Income / Expense

(2)

|

WA Yield / Financing Cost

(3)(4)

|

Average Carrying Value

(1)

|

Interest Income / Expense

(2)

|

WA Yield / Financing Cost

(3)(4)

|

|||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||

|

Real estate debt

|

$

|

1,131,476

|

|

$

|

20,439

|

|

7.2

|

%

|

$

|

1,136,418

|

|

$

|

18,615

|

|

6.6

|

%

|

||||||

|

Real estate securities

|

20,119

|

|

404

|

|

8.0

|

%

|

131,040

|

|

1,607

|

|

4.9

|

%

|

||||||||||

|

Total

|

$

|

1,151,595

|

|

$

|

20,843

|

|

7.2

|

%

|

$

|

1,267,458

|

|

$

|

20,222

|

|

6.4

|

%

|

||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||

|

Repurchase Agreements - Loans

|

$

|

387,988

|

|

$

|

4,903

|

|

5.1

|

%

|

$

|

238,439

|

|

$

|

2,585

|

|

4.3

|

%

|

||||||

|

Other - PWB Financing

|

17,901

|

|

240

|

|

5.4

|

%

|

—

|

|

—

|

|

—

|

%

|

||||||||||

|

Repurchase Agreements - Securities

|

69,996

|

|

410

|

|

2.3

|

%

|

122,539

|

|

683

|

|

2.2

|

%

|

||||||||||

|

Collateralized loan obligations

|

222,087

|

|

2,164

|

|

3.9

|

%

|

288,128

|

|

2,125

|

|

3.0

|

%

|

||||||||||

|

Total

|

$

|

697,972

|

|

$

|

7,717

|

|

4.4

|

%

|

$

|

649,106

|

|

$

|

5,393

|

|

3.3

|

%

|

||||||

|

Net interest income/spread

|

$

|

13,126

|

|

2.8

|

%

|

$

|

14,829

|

|

3.1

|

%

|

||||||||||||

|

Average leverage %

(5)

|

60.6

|

%

|

51.2

|

%

|

||||||||||||||||||

|

Weighted average levered yield

(6)

|

|

|

|

|

8.9

|

%

|

8.0

|

%

|

||||||||||||||

|

Three Months Ended June 30,

|

||||||||

|

2017

|

2016

|

|||||||

|

Asset management and subordinated performance fee

|

$

|

2,341

|

|

$

|

3,015

|

|

||

|

Acquisition fees

and acquisition expenses

|

1,866

|

|

223

|

|

||||

|

Professional fees

|

1,205

|

|

811

|

|

||||

|

Administrative services expenses

|

950

|

|

539

|

|

||||

|

Other expenses

|

756

|

|

712

|

|

||||

|

Total expenses from operations

|

$

|

7,118

|

|

$

|

5,300

|

|

||

|

Six Months Ended June 30,

|

||||||||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||||

|

Average Carrying Value

(1)

|

Interest Income / Expense

(2)

|

WA Yield / Financing Cost

(3)(4)

|

Average Carrying Value

(1)

|

Interest Income / Expense

(2)

|

WA Yield / Financing Cost

(3)(4)

|

|||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||

|

Real estate debt

|

$

|

1,098,116

|

|

$

|

38,647

|

|

7.0

|

%

|

$

|

1,127,898

|

|

$

|

37,291

|

|

6.6

|

%

|

||||||

|

Real estate securities

|

31,867

|

|

1,075

|

|

6.7

|

%

|

131,592

|

|

3,222

|

|

4.9

|

%

|

||||||||||

|

Total

|

$

|

1,129,983

|

|

$

|

39,722

|

|

7.0

|

%

|

$

|

1,259,490

|

|

$

|

40,513

|

|

6.4

|

%

|

||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||

|

Repurchase agreements - loans

|

$

|

334,525

|

|

$

|

7,727

|

|

4.6

|

%

|

$

|

245,693

|

|

$

|

4,568

|

|

3.7

|

%

|

||||||

|

Other - PWB Financing

|

9,000

|

|

240

|

|

5.3

|

%

|

—

|

|

—

|

|

—

|

%

|

||||||||||

|

Repurchase agreements - securities

|

59,579

|

|

845

|

|

2.8

|

%

|

121,565

|

|

1,360

|

|

2.2

|

%

|

||||||||||

|

Collateralized loan obligations

|

239,859

|

|

4,333

|

|

3.6

|

%

|

288,149

|

|

4,233

|

|

2.9

|

%

|

||||||||||

|

Total

|

$

|

642,963

|

|

$

|

13,145

|

|

4.1

|

%

|

$

|

655,407

|

|

$

|

10,161

|

|

3.1

|

%

|

||||||

|

Net interest income/spread

|

$

|

26,577

|

|

2.9

|

%

|

$

|

30,352

|

|

3.3

|

%

|

||||||||||||

|

Average leverage %

(5)

|

56.9

|

%

|

52.0

|

%

|

||||||||||||||||||

|

Weighted average levered yield

(6)

|

|

|

|

|

8.7

|

%

|

8.1

|

%

|

||||||||||||||

|

Six Months Ended June 30,

|

||||||||

|

2017

|

2016

|

|||||||

|

Asset management and subordinated performance fee

|

$

|

4,653

|

|

$

|

6,025

|

|

||

|

Acquisition fees

and acquisition expenses

|

2,490

|

|

380

|

|

||||

|

Professional fees

|

1,972

|

|

2,072

|

|

||||

|

Administrative services expenses

|

1,805

|

|

1,355

|

|

||||

|

Other expenses

|

1,362

|

|

1,406

|

|

||||

|

Total expenses from operations

|

$

|

12,282

|

|

$

|

11,238

|

|

||

|

Amount

|

Weighted Average

|

||||||||||||||||

|

Counterparty

|

Outstanding

|

Accrued Interest

|

Collateral Pledged (*)

|

Interest Rate

|

Days to Maturity

|

||||||||||||

|

As of June 30, 2017

|

|||||||||||||||||

|

J.P. Morgan Securities LLC

|

$

|

49,071

|

|

$

|

96

|

|

$

|

71,058

|

|

3.09

|

%

|

39

|

|||||

|

Total/Weighted Average

|

$

|

49,071

|

|

$

|

96

|

|

$

|

71,058

|

|

3.09

|

%

|

39

|

|||||

|

As of December 31, 2016

|

|||||||||||||||||

|

J.P. Morgan Securities LLC

|

$

|

59,122

|

|

$

|

96

|

|

$

|

92,658

|

|

2.55

|

%

|

6

|

|||||

|

Citigroup Global Markets, Inc.

|

3,879

|

|

1

|

|

4,850

|

|

2.11

|

%

|

26

|

||||||||

|

Wells Fargo Securities, LLC

|

3,638

|

|

4

|

|

4,850

|

|

2.05

|

%

|

13

|

||||||||

|

Total/Weighted Average

|

$

|

66,639

|

|

$

|

101

|

|

$

|

102,358

|

|

2.50

|

%

|

8

|

|||||

|

Six Months Ended June 30, 2017

Payment Date |

Amount Paid in Cash

|

Amount Issued under DRIP

|

||||||||

|

January 3, 2017

|

$

|

3,575

|

|

$

|

2,007

|

|

||||

|

February 1, 2017

|

3,560

|

|

1,957

|

|

||||||

|

March 1, 2017

|

3,231

|

|

1,770

|

|

||||||

|

April 3, 2017

|

3,621

|

|

1,926

|

|

||||||

|

May 1, 2017

|

3,536

|

|

1,846

|

|

||||||

|

June 1, 2017

|

3,692

|

|

1,887

|

|

||||||

|

Total

|

$

|

21,215

|

|

$

|

11,393

|

|

||||

|

Six Months Ended June 30, 2016

Payment Date |

Amount Paid in Cash

|

Amount Issued under DRIP

|

||||||||

|

January 4, 2016

|

$

|

3,225

|

|

$

|

2,324

|

|

||||

|

February 2, 2016

|

3,337

|

|

2,159

|

|

||||||

|

March 2, 2016

|

3,057

|

|

2,099

|

|

||||||

|

April 1, 2016

|

3,342

|

|

2,188

|

|

||||||

|

May 2, 2016

|

3,296

|

|

2,068

|

|

||||||

|

June 1, 2016

|

3,446

|

|

2,112

|

|

||||||

|

Total

|

$

|

19,703

|

|

$

|

12,950

|

|

||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

|||||||||||||||||||||||||

|

Distributions:

|

||||||||||||||||||||||||||||

|

Cash distributions paid

|

$

|

10,852

|

|

$

|

10,084

|

|

$

|

21,215

|

|

$

|

19,703

|

|

||||||||||||||||

|

Distributions reinvested

|

5,659

|

|

6,368

|

|

11,393

|

|

12,950

|

|

||||||||||||||||||||

|

Total distributions

|

$

|

16,511

|

|

$

|

16,452

|

|

$

|

32,608

|

|

$

|

32,653

|

|

||||||||||||||||

|

Source of distribution coverage:

|

||||||||||||||||||||||||||||

|

Cash flows provided by operations

|

$

|

7,531

|

|

45.6

|

%

|

$

|

9,116

|

|

55.4

|

%

|

$

|

16,070

|

|

49.3

|

%

|

$

|

19,204

|

|

58.8

|

%

|

||||||||

|

Available cash on hand

|

3,321

|

|

20.1

|

%

|

968

|

|

5.9

|

%

|

5,148

|

|

15.8

|

%

|

499

|

|

1.5

|

%

|

||||||||||||

|

Common stock issued under DRIP

|

5,659

|

|

34.3

|

%

|

6,368

|

|

38.7

|

%

|

11,393

|

|

34.9

|

%

|

12,950

|

|

39.7

|

%

|

||||||||||||

|

Total sources of distributions

|

$

|

16,511

|

|

100.0

|

%

|

$

|

16,452

|

|

100.0

|

%

|

$

|

32,611

|

|

100.0

|

%

|

$

|

32,653

|

|

100.0

|

%

|

||||||||