|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

UNITED STATES

|

||

|

SECURITIES AND EXCHANGE COMMISSION

|

||

|

Washington, D.C. 20549

|

||

|

|

||

|

FORM 10-K

|

||

|

|

||

|

(Mark One)

|

||

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the fiscal year ended December 31, 2014

|

||

|

OR

|

||

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the transition period from

|

|

to

|

|

Commission File Number: 001-11307-01

|

||

|

Freeport-McMoRan Inc.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Delaware

|

74-2480931

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

333 North Central Avenue

|

|

|

Phoenix, Arizona

|

85004-2189

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

(602) 366-8100

|

|

|

(Registrant's telephone number, including area code)

|

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10 per share

|

|

New York Stock Exchange

|

|

Portions of our proxy statement for our 2014 annual meeting of stockholders are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this report.

|

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

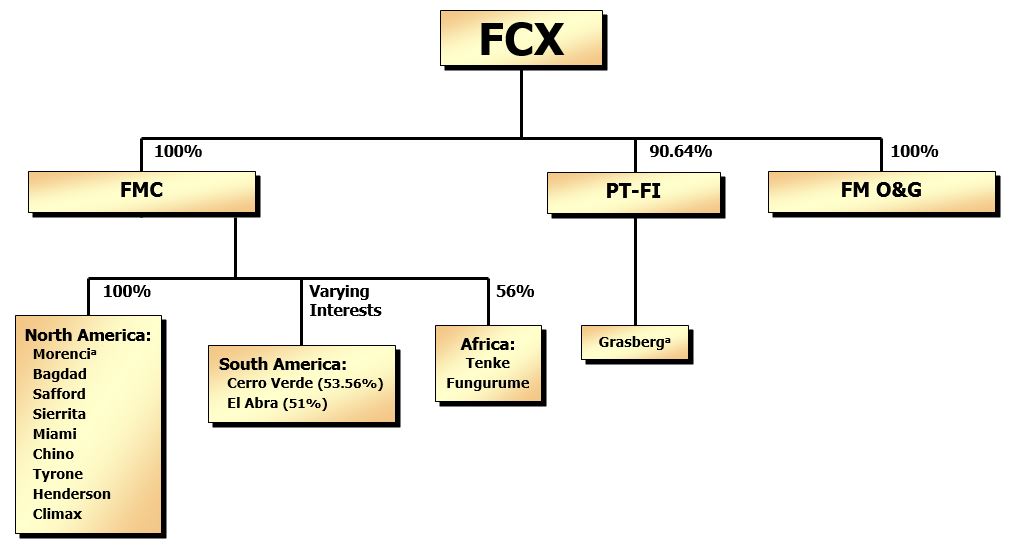

a.

|

FMC has an 85 percent undivided interest in Morenci via an unincorporated joint venture. Additionally, PT-FI has established an unincorporated joint venture with Rio Tinto plc (Rio Tinto) related to our Indonesia operations. Refer to Note

3

for further discussion of our ownership in subsidiaries and joint ventures.

|

|

Copper

|

Gold

|

Molybdenum

|

Silver

|

Cobalt

|

|||||

|

North America

|

34%

|

1%

|

78%

|

30%

|

—

|

||||

|

South America

|

31%

|

—

|

22%

|

31%

|

—

|

||||

|

Indonesia

|

28%

|

99%

|

—

|

39%

|

—

|

||||

|

Africa

|

7%

|

—

|

—

|

—

|

100%

|

||||

|

100%

|

100%

|

100%

|

100%

|

100%

|

|||||

|

Copper

|

Gold

|

Molybdenum

|

||||

|

North America

|

43%

|

1%

|

88%

|

|||

|

South America

|

30%

|

a

|

6%

|

a

|

12%

|

|

|

Indonesia

|

16%

|

93%

|

—

|

|||

|

Africa

|

11%

|

—

|

—

|

|||

|

100%

|

100%

|

100%

|

||||

|

a.

|

Includes production from the Candelaria and Ojos del Salado mines totaling 284 million pound of copper (7 percent of consolidated FCX production) and 72 thousand ounces of gold (6 percent of consolidated FCX production). On November 3, 2014, FCX completed the sale of its 80 percent ownership interests in the Candelaria and Ojos del Salado mining operations.

|

|

|

2014

|

2013

|

2012

|

|||||

|

PT Smelting

|

58

|

%

|

41

|

%

|

52

|

%

|

||

|

Atlantic Copper

|

6

|

%

|

9

|

%

|

11

|

%

|

||

|

Third parties

|

36

|

%

|

50

|

%

|

37

|

%

|

||

|

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

Location

|

Number of Unions

|

Number of

Union-

Represented Employees

|

Expiration Date

|

|||

|

PT-FI – Indonesia

|

1

|

9,244

|

|

September 2015

|

||

|

TFM – DRC

|

11

|

3,404

|

|

N/A

|

a

|

|

|

Cerro Verde – Peru

|

3

|

2,058

|

|

August 2018

|

||

|

El Abra – Chile

|

2

|

1,069

|

|

May 2016

|

||

|

Atlantic Copper – Spain

|

2

|

434

|

|

December 2015

|

||

|

Kokkola - Finland

|

3

|

412

|

|

November 2016

|

||

|

Rotterdam – The Netherlands

|

2

|

59

|

|

March 2015

|

||

|

Bayway – New Jersey

|

1

|

37

|

|

April 2016

|

||

|

Stowmarket – United Kingdom

|

1

|

35

|

|

May 2017

|

||

|

a.

|

The Collective Labor Agreement between TFM and its workers’ unions has no expiration date, but can be amended at any time in accordance with an established process. In September 2012, TFM negotiated a 4-year salary scale with union-represented employees.

|

|

|

2014

|

2013

|

2012

|

|||||

|

North America copper mines

|

21

|

%

|

13

|

%

|

16

|

%

|

||

|

South America mining

|

21

|

%

|

32

|

%

|

31

|

%

|

||

|

Indonesia mining

|

8

|

%

|

16

|

%

|

10

|

%

|

||

|

Third parties

|

50

|

%

|

39

|

%

|

43

|

%

|

||

|

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

•

|

comprehensive job training programs

|

|

•

|

basic education programs

|

|

•

|

public health programs, including malaria control and HIV

|

|

•

|

agricultural assistance programs

|

|

•

|

small and medium enterprise development programs

|

|

•

|

cultural promotion and preservation programs

|

|

•

|

clean water and sanitation projects

|

|

•

|

community infrastructure development

|

|

•

|

charitable donations

|

|

Years Ended December 31,

|

|

||||||||||||||

|

(FCX’s net interest in %)

|

2014

|

2013

|

2012

|

2011

|

|

2010

|

|

||||||||

|

COPPER

(millions of recoverable pounds)

|

|

|

|

|

|

|

|

|

|||||||

|

North America

|

|

|

|

|

|

|

|

|

|||||||

|

Morenci (85%)

a

|

691

|

|

564

|

|

537

|

|

|

522

|

|

|

437

|

|

|

||

|

Bagdad (100%)

|

237

|

|

216

|

|

197

|

|

|

194

|

|

|

203

|

|

|

||

|

Safford (100%)

|

139

|

|

146

|

|

175

|

|

|

151

|

|

|

143

|

|

|

||

|

Sierrita (100%)

|

195

|

|

171

|

|

157

|

|

|

177

|

|

|

147

|

|

|

||

|

Miami (100%)

|

57

|

|

61

|

|

66

|

|

|

66

|

|

|

18

|

|

|||

|

Chino (100%)

|

250

|

|

171

|

|

144

|

|

|

69

|

|

|

34

|

|

|

||

|

Tyrone (100%)

|

94

|

|

96

|

|

83

|

|

|

76

|

|

|

82

|

|

|

||

|

Other (100%)

|

7

|

|

6

|

|

4

|

|

|

3

|

|

|

3

|

|

|

||

|

Total North America

|

1,670

|

|

1,431

|

|

1,363

|

|

|

1,258

|

|

1,067

|

|

||||

|

South America

|

|

|

|

|

|

|

|

|

|||||||

|

Cerro Verde (53.56%)

|

500

|

|

558

|

|

595

|

|

647

|

|

668

|

|

|

||||

|

El Abra (51%)

|

367

|

|

343

|

|

338

|

|

274

|

|

320

|

|

|

||||

|

Candelaria/Ojos del Salado (80%)

b

|

284

|

|

422

|

|

324

|

|

385

|

|

366

|

|

|

||||

|

Total South America

|

1,151

|

|

1,323

|

|

1,257

|

|

1,306

|

|

1,354

|

|

|||||

|

Indonesia

|

|

|

|

|

|

|

|

|

|||||||

|

Grasberg (90.64%)

c

|

636

|

|

915

|

|

695

|

|

846

|

|

1,222

|

|

|

||||

|

Africa

|

|

|

|

|

|

|

|

|

|||||||

|

Tenke Fungurume (56%)

d

|

447

|

|

462

|

|

348

|

|

281

|

|

265

|

|

|

||||

|

Consolidated

|

3,904

|

|

4,131

|

|

3,663

|

|

3,691

|

|

3,908

|

|

|

||||

|

Less noncontrolling interests

|

725

|

|

801

|

|

723

|

|

710

|

|

766

|

|

|

||||

|

Net

|

3,179

|

|

3,330

|

|

2,940

|

|

2,981

|

|

3,142

|

|

|

||||

|

GOLD

(thousands of recoverable ounces)

|

|

|

|

|

|

|

|

|

|||||||

|

North America (100%)

a

|

12

|

|

7

|

|

13

|

|

10

|

|

7

|

|

|

||||

|

South America (80%)

b

|

72

|

|

101

|

|

83

|

|

101

|

|

93

|

|

|||||

|

Indonesia (90.64%)

c

|

1,130

|

|

1,142

|

|

862

|

|

1,272

|

|

1,786

|

|

|

||||

|

Consolidated

|

1,214

|

|

1,250

|

|

958

|

|

|

1,383

|

|

|

1,886

|

|

|||

|

Less noncontrolling interests

|

120

|

|

127

|

|

98

|

|

139

|

|

186

|

|

|

||||

|

Net

|

1,094

|

|

1,123

|

|

860

|

|

1,244

|

|

1,700

|

|

|

||||

|

MOLYBDENUM

(millions of recoverable pounds)

|

|

|

|

|

|

|

|

|

|||||||

|

Henderson (100%)

|

30

|

|

30

|

|

34

|

|

38

|

|

40

|

|

|||||

|

Climax (100%)

e

|

21

|

|

19

|

|

7

|

|

—

|

|

—

|

|

|||||

|

North America copper mines (100%)

a

|

33

|

|

32

|

|

36

|

|

35

|

|

25

|

|

|||||

|

Cerro Verde (53.56%)

|

11

|

|

13

|

|

8

|

|

10

|

|

7

|

|

|

||||

|

Consolidated

|

95

|

|

94

|

|

85

|

|

83

|

|

72

|

|

|||||

|

Less noncontrolling interest

|

5

|

|

6

|

|

4

|

|

5

|

|

3

|

|

|

||||

|

Net

|

90

|

|

88

|

|

81

|

|

78

|

|

69

|

|

|

||||

|

COBALT

(millions of contained pounds)

|

|||||||||||||||

|

Consolidated - Tenke Fungurume (56%)

d

|

29

|

|

28

|

|

26

|

|

25

|

|

20

|

|

|||||

|

Less noncontrolling interests

|

13

|

|

12

|

|

11

|

|

11

|

|

8

|

|

|

||||

|

Net

|

16

|

|

16

|

|

15

|

|

14

|

|

12

|

|

|

||||

|

a.

|

Amounts are net of Morenci’s 15 percent joint venture partner interest.

|

|

b.

|

On November 3, 2014, FCX completed the sale of its 80 percent interests in the Candelaria and Ojos del Salado mines.

|

|

c.

|

Amounts are net of joint venture partner interest, which varies in accordance with terms of the joint venture agreement (refer to Note 3). Under the joint venture arrangements, PT-FI's share of copper production totaled

98 percent

in

2014

,

99 percent

in

2013

,

100 percent

in

2012

, 96 percent in 2011 and 92 percent in 2010.

|

|

d.

|

Effective March 26, 2012, FCX's effective ownership interest in TFM was prospectively reduced from 57.75 percent to 56 percent.

|

|

e.

|

The Climax molybdenum mine began commercial operations in May 2012.

|

|

Years Ended December 31,

|

|

|||||||||||||||||||

|

(FCX’s net interest in %)

|

2014

|

2013

|

2012

|

|

2011

|

|

2010

|

|

||||||||||||

|

COPPER

(millions of recoverable pounds)

|

|

|

|

|

|

|

|

|||||||||||||

|

North America

|

|

|

|

|

|

|

|

|||||||||||||

|

Morenci (85%)

a

|

680

|

|

561

|

|

532

|

|

521

|

|

|

434

|

|

|

||||||||

|

Bagdad (100%)

|

240

|

|

212

|

|

196

|

|

201

|

|

|

206

|

|

|

||||||||

|

Safford (100%)

|

142

|

|

151

|

|

175

|

|

147

|

|

|

155

|

|

|

||||||||

|

Sierrita (100%)

|

196

|

|

170

|

|

162

|

|

175

|

|

|

152

|

|

|

||||||||

|

Miami (100%)

|

60

|

|

60

|

|

68

|

|

59

|

|

|

17

|

|

|||||||||

|

Chino (100%)

|

243

|

|

168

|

|

132

|

|

62

|

|

|

35

|

|

|

||||||||

|

Tyrone (100%)

|

96

|

|

94

|

|

82

|

|

79

|

|

|

83

|

|

|

||||||||

|

Other (100%)

|

7

|

|

6

|

|

4

|

|

3

|

|

|

3

|

|

|

||||||||

|

Total North America

|

1,664

|

|

1,422

|

|

1,351

|

|

1,247

|

|

1,085

|

|

||||||||||

|

South America

|

|

|

|

|

|

|

|

|||||||||||||

|

Cerro Verde (53.56%)

|

501

|

|

560

|

|

589

|

|

657

|

|

654

|

|

|

|||||||||

|

El Abra (51%)

|

366

|

|

341

|

|

338

|

|

276

|

|

315

|

|

|

|||||||||

|

Candelaria/Ojos del Salado (80%)

b

|

268

|

|

424

|

|

318

|

|

389

|

|

366

|

|

|

|||||||||

|

Total South America

|

1,135

|

|

1,325

|

|

1,245

|

|

1,322

|

|

1,335

|

|

||||||||||

|

Indonesia

|

|

|

|

|

|

|

|

|||||||||||||

|

Grasberg (90.64%)

c

|

664

|

|

885

|

|

716

|

|

846

|

|

1,214

|

|

|

|||||||||

|

Africa

|

|

|

|

|

|

|

|

|||||||||||||

|

Tenke Fungurume (56%)

d

|

425

|

|

454

|

|

336

|

|

283

|

|

262

|

|

|

|||||||||

|

Consolidated sales from mines

|

3,888

|

|

4,086

|

|

3,648

|

|

3,698

|

|

3,896

|

|

|

|||||||||

|

Less noncontrolling interests

|

715

|

|

795

|

|

717

|

|

717

|

|

756

|

|

|

|||||||||

|

Net

|

3,173

|

|

3,291

|

|

2,931

|

|

2,981

|

|

3,140

|

|

|

|||||||||

|

Consolidated sales from mines

|

3,888

|

|

4,086

|

|

3,648

|

|

3,698

|

|

3,896

|

|

|

|||||||||

|

Purchased copper

|

125

|

|

223

|

|

125

|

|

223

|

|

182

|

|

|

|||||||||

|

Total copper sales, including purchases

|

4,013

|

|

4,309

|

|

3,773

|

|

3,921

|

|

4,078

|

|

|

|||||||||

|

Average realized price per pound

|

$

|

3.09

|

|

$

|

3.30

|

|

$

|

3.60

|

|

$

|

3.86

|

|

$

|

3.59

|

|

|||||

|

GOLD

(thousands of recoverable ounces)

|

|

|

|

|

|

|

|

|||||||||||||

|

North America (100%)

a

|

13

|

|

6

|

|

13

|

|

7

|

|

5

|

|

|

|||||||||

|

South America (80%)

b

|

67

|

|

102

|

|

82

|

|

101

|

|

93

|

|

||||||||||

|

Indonesia (90.64%)

c

|

1,168

|

|

1,096

|

|

915

|

|

1,270

|

|

1,765

|

|

|

|||||||||

|

Consolidated sales from mines

|

1,248

|

|

1,204

|

|

1,010

|

|

1,378

|

|

1,863

|

|

||||||||||

|

Less noncontrolling interests

|

123

|

|

123

|

|

102

|

|

139

|

|

184

|

|

|

|||||||||

|

Net

|

1,125

|

|

1,081

|

|

908

|

|

1,239

|

|

1,679

|

|

|

|||||||||

|

Average realized price per ounce

|

$

|

1,231

|

|

$

|

1,315

|

|

$

|

1,665

|

|

$

|

1,583

|

|

$

|

1,271

|

|

|||||

|

MOLYBDENUM

(millions of recoverable pounds)

|

|

|

|

|

|

|

|

|||||||||||||

|

Consolidated sales from mines

|

95

|

|

93

|

|

83

|

|

79

|

|

67

|

|

||||||||||

|

Less noncontrolling interests

|

5

|

|

5

|

|

4

|

|

4

|

|

3

|

|

|

|||||||||

|

Net

|

90

|

|

88

|

|

79

|

|

75

|

|

64

|

|

|

|||||||||

|

Average realized price per pound

|

$

|

12.74

|

|

$

|

11.85

|

|

$

|

14.26

|

|

$

|

16.98

|

|

$

|

16.47

|

|

|

||||

|

COBALT

(millions of contained pounds)

|

||||||||||||||||||||

|

Consolidated

-

Tenke Fungurume (56%)

d

|

30

|

|

25

|

|

25

|

|

25

|

|

20

|

|

||||||||||

|

Less noncontrolling interests

|

13

|

|

11

|

|

11

|

|

10

|

|

8

|

|

||||||||||

|

Net

|

17

|

|

14

|

|

14

|

|

15

|

|

12

|

|

||||||||||

|

Average realized price per pound

|

$

|

9.66

|

|

$

|

8.02

|

|

$

|

7.83

|

|

$

|

9.99

|

|

$

|

10.95

|

|

|||||

|

a.

|

Amounts are net of Morenci’s joint venture partner’s 15 percent interest.

|

|

b.

|

On November 3, 2014, FCX completed the sale of its 80 percent interests in the Candelaria and Ojos del Salado mines.

|

|

c.

|

Amounts are net of joint venture partner interest, which varies in accordance with terms of the joint venture agreement (refer to Note 3). Under the joint venture arrangements, PT-FI's share of copper sales totaled

98 percent

in

2014

,

99 percent

in

2013

,

100 percent

in

2012

, 96 percent in 2011 and 92 percent in 2010.

|

|

d.

|

Effective March 26, 2012, FCX's effective ownership interest in TFM was prospectively reduced from 57.75 percent to 56 percent.

|

|

|

Recoverable Proven and Probable Mineral Reserves

Estimated at December 31, 2014

|

|||||||||||||

|

Copper

a

(billion pounds)

|

Gold

(million ounces)

|

Molybdenum

(billion pounds)

|

Silver

b

(million ounces)

|

Cobalt

b

(billion pounds)

|

||||||||||

|

North America

|

35.6

|

|

0.3

|

|

2.42

|

|

86.2

|

|

—

|

|

||||

|

South America

|

31.8

|

|

—

|

|

0.69

|

|

86.6

|

|

—

|

|

||||

|

Indonesia

|

29.0

|

|

28.2

|

|

—

|

|

110.1

|

|

—

|

|

||||

|

Africa

|

7.1

|

|

—

|

|

—

|

|

—

|

|

0.85

|

|

||||

|

Consolidated basis

c

|

103.5

|

|

28.5

|

|

3.11

|

|

282.9

|

|

0.85

|

|

||||

|

Net equity interest

d

|

82.8

|

|

25.9

|

|

2.79

|

|

232.4

|

|

0.47

|

|

||||

|

a.

|

Consolidated recoverable copper reserves include

3.6 billion

pounds in leach stockpiles and

0.9 billion

pounds in mill stockpiles (refer to “Mill and Leach Stockpiles” for further discussion).

|

|

b.

|

Determined using long-term average prices of

$15

per ounce for silver and

$10

per pound for cobalt.

|

|

c.

|

Consolidated reserves represent estimated metal quantities after reduction for joint venture partner interests at the Morenci mine in North America and at the Grasberg minerals district in Indonesia.

|

|

d.

|

Net equity interest reserves represent estimated consolidated metal quantities further reduced for noncontrolling interest ownership.

|

|

Recoverable Proven and Probable Mineral Reserves

|

||||||||||||||||||||||||||||||||||||||

|

Estimated at December 31, 2014

|

||||||||||||||||||||||||||||||||||||||

|

|

|

Proven Reserves

|

Probable Reserves

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

Average Ore Grade

|

|

Average Ore Grade

|

|||||||||||||||||||||||||||||||||

|

|

Processing

|

Million

|

Copper

|

Gold

|

|

Moly

|

Silver

|

Cobalt

|

Million

|

Copper

|

Gold

|

|

Moly

|

Silver

|

Cobalt

|

|||||||||||||||||||||||

|

|

Method

|

metric tons

|

%

|

g/t

|

|

%

|

g/t

|

%

|

metric tons

|

%

|

g/t

|

|

%

|

g/t

|

%

|

|||||||||||||||||||||||

|

North America

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Morenci

|

Mill

|

635

|

|

0.44

|

|

—

|

|

|

0.02

|

|

—

|

|

—

|

|

130

|

|

0.45

|

|

—

|

|

|

0.02

|

|

—

|

|

—

|

|

|||||||||||

|

|

Crushed leach

|

379

|

|

0.49

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

102

|

|

0.46

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

1,976

|

|

0.18

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

701

|

|

0.17

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Bagdad

|

Mill

|

1,007

|

|

0.34

|

|

—

|

|

a

|

0.02

|

|

1.63

|

|

—

|

|

152

|

|

0.32

|

|

—

|

|

a

|

0.02

|

|

1.54

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

129

|

|

0.21

|

|

—

|

|

—

|

|

—

|

|

—

|

|

46

|

|

0.19

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Safford

|

Crushed leach

|

81

|

|

0.46

|

|

—

|

|

—

|

|

—

|

|

—

|

|

41

|

|

0.47

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Sierrita

|

Mill

|

2,252

|

|

0.24

|

|

—

|

|

a

|

0.03

|

|

1.42

|

|

—

|

|

212

|

|

0.20

|

|

—

|

|

a

|

0.02

|

|

1.20

|

|

—

|

|

|||||||||||

|

Miami

|

ROM leach

|

2

|

|

0.59

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.57

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Chino

|

Mill

|

97

|

|

0.53

|

|

0.04

|

|

0.01

|

|

0.46

|

|

—

|

|

63

|

|

0.49

|

|

0.03

|

|

|

0.01

|

|

0.42

|

|

—

|

|

||||||||||||

|

|

ROM leach

|

112

|

|

0.26

|

|

—

|

|

—

|

|

—

|

|

—

|

|

29

|

|

0.20

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Tyrone

|

ROM leach

|

57

|

|

0.33

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2

|

|

0.21

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Henderson

|

Mill

|

74

|

|

—

|

|

—

|

|

0.18

|

|

—

|

|

—

|

|

16

|

|

—

|

|

—

|

|

|

0.14

|

|

—

|

|

—

|

|

||||||||||||

|

Climax

|

Mill

|

162

|

|

—

|

|

—

|

|

0.17

|

|

—

|

|

—

|

|

23

|

|

—

|

|

—

|

|

|

0.10

|

|

—

|

|

—

|

|

||||||||||||

|

Cobre

b

|

Mill

|

12

|

|

0.61

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.53

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

ROM leach

|

57

|

|

0.32

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.31

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

|

|

7,032

|

|

1,520

|

|

|||||||||||||||||||||||||||||||||

|

South America

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Cerro Verde

|

Mill

|

881

|

|

0.39

|

|

—

|

|

0.02

|

|

1.62

|

|

—

|

|

2,904

|

|

0.37

|

|

—

|

|

0.01

|

|

1.52

|

|

—

|

|

|||||||||||||

|

|

Crushed leach

|

36

|

|

0.52

|

|

—

|

|

—

|

|

—

|

|

—

|

|

64

|

|

0.45

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

|

ROM leach

|

10

|

|

0.26

|

|

—

|

|

—

|

|

—

|

|

—

|

|

58

|

|

0.24

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

El Abra

|

Crushed leach

|

287

|

|

0.51

|

|

—

|

|

—

|

|

—

|

|

—

|

|

77

|

|

0.49

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

|

ROM leach

|

61

|

|

0.24

|

|

—

|

|

—

|

|

—

|

|

—

|

|

19

|

|

0.22

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

|

|

1,275

|

|

3,122

|

|

|||||||||||||||||||||||||||||||||

|

Indonesia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Grasberg open pit

|

Mill

|

77

|

|

1.10

|

|

1.37

|

|

—

|

|

2.83

|

|

—

|

|

102

|

|

0.86

|

|

0.82

|

|

—

|

|

2.10

|

|

—

|

|

|||||||||||||

|

Deep Ore Zone

|

Mill

|

47

|

|

0.56

|

|

0.68

|

|

—

|

|

2.27

|

|

—

|

|

99

|

|

0.53

|

|

0.69

|

|

—

|

|

2.20

|

|

—

|

|

|||||||||||||

|

Big Gossan

|

Mill

|

17

|

|

2.39

|

|

1.02

|

|

—

|

|

15.15

|

|

—

|

|

37

|

|

2.20

|

|

0.98

|

|

—

|

|

13.22

|

|

—

|

|

|||||||||||||

|

Grasberg Block Cave

b

|

Mill

|

447

|

|

1.19

|

|

0.96

|

|

—

|

|

3.75

|

|

—

|

|

565

|

|

0.85

|

|

0.61

|

|

—

|

|

3.28

|

|

—

|

|

|||||||||||||

|

Kucing Liar

b

|

Mill

|

152

|

|

1.31

|

|

1.11

|

|

—

|

|

7.45

|

|

—

|

|

254

|

|

1.21

|

|

1.04

|

|

—

|

|

6.21

|

|

—

|

|

|||||||||||||

|

Deep Mill Level Zone

b

|

Mill

|

65

|

|

0.92

|

|

0.74

|

|

—

|

|

4.60

|

|

—

|

|

407

|

|

0.86

|

|

0.71

|

|

—

|

|

4.33

|

|

—

|

|

|||||||||||||

|

|

|

805

|

|

1,464

|

|

|||||||||||||||||||||||||||||||||

|

Africa

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Tenke Fungurume

|

Agitation leach

|

47

|

|

3.56

|

|

—

|

|

—

|

|

—

|

|

0.43

|

|

51

|

|

3.01

|

|

—

|

|

—

|

|

—

|

|

0.34

|

|

|||||||||||||

|

Total FCX - 100% Basis

|

|

9,159

|

|

6,157

|

|

|||||||||||||||||||||||||||||||||

|

a.

|

Grade not shown because of rounding.

|

|

b.

|

Undeveloped reserves that would require additional capital investment, which could be significant, to bring into production.

|

|

•

|

g/t – grams per metric ton

|

|

•

|

Moly – Molybdenum

|

|

•

|

ROM – Run of Mine

|

|

Recoverable Proven and Probable Mineral Reserves

|

||||||||||||||||||||||||||||||||||

|

Estimated at December 31, 2014

|

||||||||||||||||||||||||||||||||||

|

(continued)

|

||||||||||||||||||||||||||||||||||

|

Proven and

|

||||||||||||||||||||||||||||||||||

|

|

|

Probable

|

Average Ore Grade

|

Recoveries

a

|

||||||||||||||||||||||||||||||

|

|

Processing

|

Million

|

Copper

|

Gold

|

|

Moly

|

Silver

|

Cobalt

|

Copper

|

Gold

|

Moly

|

Silver

|

Cobalt

|

|||||||||||||||||||||

|

|

Method

|

metric tons

|

%

|

g/t

|

|

%

|

g/t

|

%

|

%

|

%

|

%

|

%

|

%

|

|||||||||||||||||||||

|

North America

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Morenci

|

Mill

|

765

|

|

0.44

|

|

—

|

|

0.02

|

|

—

|

|

—

|

|

79.7

|

|

—

|

|

50.7

|

|

—

|

|

—

|

|

|||||||||||

|

|

Crushed leach

|

481

|

|

0.49

|

|

—

|

|

—

|

|

—

|

|

—

|

|

75.7

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

2,677

|

|

0.18

|

|

—

|

|

—

|

|

—

|

|

—

|

|

42.7

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Bagdad

|

Mill

|

1,159

|

|

0.34

|

|

—

|

|

b

|

0.02

|

|

1.62

|

|

—

|

|

85.9

|

|

59.1

|

|

70.8

|

|

49.3

|

|

—

|

|

||||||||||

|

|

ROM leach

|

175

|

|

0.21

|

|

—

|

|

—

|

|

—

|

|

—

|

|

23.0

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Safford

|

Crushed leach

|

122

|

|

0.47

|

|

—

|

|

—

|

|

—

|

|

—

|

|

63.9

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Sierrita

|

Mill

|

2,464

|

|

0.23

|

|

—

|

|

b

|

0.02

|

|

1.40

|

|

—

|

|

83.9

|

|

59.1

|

|

75.9

|

|

49.3

|

|

—

|

|

||||||||||

|

Miami

|

ROM leach

|

3

|

|

0.58

|

|

—

|

|

—

|

|

—

|

|

—

|

|

53.6

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Chino

|

Mill

|

160

|

|

0.51

|

|

0.03

|

|

0.01

|

|

0.45

|

|

—

|

|

79.4

|

|

77.9

|

|

42.7

|

|

78.5

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

141

|

|

0.24

|

|

—

|

|

—

|

|

—

|

|

—

|

|

42.9

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Tyrone

|

ROM leach

|

59

|

|

0.32

|

|

—

|

|

—

|

|

—

|

|

—

|

|

58.7

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Henderson

|

Mill

|

90

|

|

—

|

|

—

|

|

0.17

|

|

—

|

|

—

|

|

—

|

|

—

|

|

84.4

|

|

—

|

|

—

|

|

|||||||||||

|

Climax

|

Mill

|

185

|

|

—

|

|

—

|

|

0.16

|

|

—

|

|

—

|

|

—

|

|

—

|

|

88.8

|

|

—

|

|

—

|

|

|||||||||||

|

Cobre

c

|

Mill

|

13

|

|

0.61

|

|

—

|

|

—

|

|

—

|

|

—

|

|

79.9

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

ROM leach

|

58

|

|

0.32

|

|

—

|

|

—

|

|

—

|

|

—

|

|

49.6

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

|

|

8,552

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

South America

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Cerro Verde

|

Mill

|

3,785

|

|

0.37

|

|

—

|

|

0.02

|

|

1.54

|

|

—

|

|

86.2

|

|

—

|

|

54.3

|

|

44.7

|

|

—

|

|

|||||||||||

|

|

Crushed leach

|

100

|

|

0.47

|

|

—

|

|

—

|

|

—

|

|

—

|

|

79.9

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

68

|

|

0.24

|

|

—

|

|

—

|

|

—

|

|

—

|

|

53.1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

El Abra

|

Crushed leach

|

364

|

|

0.51

|

|

—

|

|

—

|

|

—

|

|

—

|

|

57.6

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

|

ROM leach

|

80

|

|

0.23

|

|

—

|

|

—

|

|

—

|

|

—

|

|

43.4

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

|

|

4,397

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Indonesia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Grasberg open pit

|

Mill

|

179

|

|

0.96

|

|

1.06

|

|

—

|

|

2.41

|

|

—

|

|

84.1

|

|

81.1

|

|

—

|

|

43.5

|

|

—

|

|

|||||||||||

|

Deep Ore Zone

|

Mill

|

146

|

|

0.54

|

|

0.69

|

|

—

|

|

2.22

|

|

—

|

|

86.4

|

|

77.2

|

|

—

|

|

65.8

|

|

—

|

|

|||||||||||

|

Big Gossan

|

Mill

|

54

|

|

2.26

|

|

0.99

|

|

—

|

|

13.82

|

|

—

|

|

91.5

|

|

65.6

|

|

—

|

|

63.7

|

|

—

|

|

|||||||||||

|

Grasberg Block Cave

c

|

Mill

|

1,012

|

|

1.00

|

|

0.77

|

|

—

|

|

3.49

|

|

—

|

|

84.3

|

|

65.0

|

|

—

|

|

57.1

|

|

—

|

|

|||||||||||

|

Kucing Liar

c

|

Mill

|

406

|

|

1.25

|

|

1.07

|

|

—

|

|

6.67

|

|

—

|

|

85.0

|

|

45.1

|

|

—

|

|

38.8

|

|

—

|

|

|||||||||||

|

Deep Mill Level Zone

c

|

Mill

|

472

|

|

0.87

|

|

0.71

|

|

—

|

|

4.36

|

|

—

|

|

86.8

|

|

79.3

|

|

—

|

|

64.9

|

|

—

|

|

|||||||||||

|

|

|

2,269

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Africa

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Tenke Fungurume

|

Agitation leach

|

98

|

|

3.27

|

|

—

|

|

—

|

|

—

|

|

0.38

|

|

86.4

|

|

—

|

|

—

|

|

—

|

|

75.9

|

|

|||||||||||

|

Total FCX - 100% Basis

|

|

15,316

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

a.

|

Recoveries are net of estimated mill and smelter losses.

|

|

b.

|

Grade not shown because of rounding.

|

|

c.

|

Undeveloped reserves that would require additional capital investment, which could be significant, to bring into production.

|

|

Recoverable Proven and Probable Mineral Reserves

|

||||||||||||||||||

|

Estimated at December 31, 2014

|

||||||||||||||||||

|

(continued)

|

||||||||||||||||||

|

|

|

|

Recoverable Reserves

|

|||||||||||||||

|

|

|

|

Copper

|

Gold

|

Moly

|

Silver

|

Cobalt

|

|||||||||||

|

|

FCX’s

|

Processing

|

billion

|

million

|

billion

|

million

|

billion

|

|||||||||||

|

|

Interest

|

Method

|

lbs.

|

ozs.

|

lbs.

|

ozs.

|

lbs.

|

|||||||||||

|

North America

|

|

|

|

|

|

|

|

|||||||||||

|

Morenci

|

85%

|

Mill

|

6.0

|

|

—

|

|

0.17

|

|

—

|

|

—

|

|

||||||

|

|

|

Crushed leach

|

3.9

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

|

|

ROM leach

|

4.5

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Bagdad

|

100%

|

Mill

|

7.5

|

|

0.1

|

|

0.38

|

|

29.8

|

|

—

|

|

||||||

|

|

|

ROM leach

|

0.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Safford

|

100%

|

Crushed leach

|

0.8

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Sierrita

|

100%

|

Mill

|

10.6

|

|

0.1

|

|

1.01

|

|

54.6

|

|

—

|

|

||||||

|

Miami

|

100%

|

ROM leach

|

—

|

|

a

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Chino

|

100%

|

Mill

|

1.4

|

|

0.1

|

|

0.01

|

|

1.8

|

|

—

|

|

||||||

|

|

|

ROM leach

|

0.3

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Tyrone

|

100%

|

ROM leach

|

0.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Henderson

|

100%

|

Mill

|

—

|

|

—

|

|

0.28

|

|

—

|

|

—

|

|

||||||

|

Climax

|

100%

|

Mill

|

—

|

|

—

|

|

0.58

|

|

—

|

|

—

|

|

||||||

|

Cobre

|

100%

|

Mill

|

0.1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

ROM leach

|

0.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||

|

|

|

|

35.7

|

|

0.3

|

|

2.43

|

|

86.2

|

|

—

|

|

||||||

|

Recoverable metal in stockpiles

b

|

|

2.1

|

|

—

|

|

0.01

|

|

—

|

|

—

|

|

|||||||

|

100% operations

|

|

37.8

|

|

0.3

|

|

2.44

|

|

86.2

|

|

—

|

|

|||||||

|

Consolidated

c

|

|

35.6

|

|

0.3

|

|

2.42

|

|

86.2

|

|

—

|

|

|||||||

|

Net equity interest

d

|

|

35.6

|

|

0.3

|

|

2.42

|

|

86.2

|

|

—

|

|

|||||||

|

South America

|

|

|

|

|

|

|

|

|||||||||||

|

Cerro Verde

|

53.56%

|

Mill

|

26.8

|

|

—

|

|

0.66

|

|

83.9

|

|

—

|

|

||||||

|

|

|

Crushed leach

|

0.8

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

|

|

ROM leach

|

0.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

El Abra

|

51%

|

Crushed leach

|

2.3

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

|

|

ROM leach

|

0.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

|

|

|

30.3

|

|

—

|

|

0.66

|

|

83.9

|

|

—

|

|

||||||

|

Recoverable metal in stockpiles

b

|

|

1.5

|

|

—

|

|

0.03

|

|

2.7

|

|

—

|

|

|||||||

|

100% operations

|

|

31.8

|

|

—

|

|

0.69

|

|

86.6

|

|

—

|

|

|||||||

|

Consolidated

c

|

|

31.8

|

|

—

|

|

0.69

|

|

86.6

|

|

—

|

|

|||||||

|

Net equity interest

d

|

|

16.9

|

|

—

|

|

0.37

|

|

46.4

|

|

—

|

|

|||||||

|

Indonesia

|

|

|

|

|

|

|

|

|||||||||||

|

Grasberg open pit

|

e

|

Mill

|

3.2

|

|

4.9

|

|

—

|

|

6.1

|

|

—

|

|

||||||

|

Deep Ore Zone

|

e

|

Mill

|

1.5

|

|

2.5

|

|

—

|

|

6.8

|

|

—

|

|

||||||

|

Big Gossan

|

e

|

Mill

|

2.4

|

|

1.1

|

|

—

|

|

15.3

|

|

—

|

|

||||||

|

Grasberg Block Cave

|

e

|

Mill

|

18.9

|

|

16.3

|

|

—

|

|

64.7

|

|

—

|

|

||||||

|

Kucing Liar

|

e

|

Mill

|

9.5

|

|

6.3

|

|

—

|

|

33.8

|

|

—

|

|

||||||

|

Deep Mill Level Zone

|

e

|

Mill

|

7.9

|

|

8.6

|

|

—

|

|

43.0

|

|

—

|

|

||||||

|

100% operations

|

|

43.4

|

|

39.7

|

|

—

|

|

169.7

|

|

—

|

|

|||||||

|

Consolidated

c

|

|

29.0

|

|

28.2

|

|

—

|

|

110.1

|

|

—

|

|

|||||||

|

Net equity interest

d

|

|

26.3

|

|

25.6

|

|

—

|

|

99.8

|

|

—

|

|

|||||||

|

Africa

|

|

|

|

|

|

|

|

|||||||||||

|

Tenke Fungurume

|

56%

|

Agitation leach

|

6.1

|

|

—

|

|

—

|

|

—

|

|

0.62

|

|

||||||

|

Recoverable metal in stockpiles

b

|

|

1.0

|

|

—

|

|

—

|

|

—

|

|

0.23

|

|

|||||||

|

100% operations

|

|

7.1

|

|

—

|

|

—

|

|

—

|

|

0.85

|

|

|||||||

|

Consolidated

c

|

|

7.1

|

|

—

|

|

—

|

|

—

|

|

0.85

|

|

|||||||

|

Net equity interest

d

|

|

4.0

|

|

—

|

|

—

|

|

—

|

|

0.47

|

|

|||||||

|

Total FCX – 100% basis

|

|

120.1

|

|

40.0

|

|

3.13

|

|

342.5

|

|

0.85

|

|

|||||||

|

Total FCX – Consolidated basis

c

|

|

103.5

|

|

28.5

|

|

3.11

|

|

282.9

|

|

0.85

|

|

|||||||

|

Total FCX – Net equity interest

d

|

|

82.8

|

|

25.9

|

|

2.79

|

|

232.4

|

|

0.47

|

|

|||||||

|

a.

|

Amounts not shown because of rounding.

|

|

b.

|

Refer to "Mill and Leach Stockpiles" for additional information.

|

|

c.

|

Consolidated reserves represent estimated metal quantities after reduction for joint venture partner interests at the Morenci mine in North America and at the Grasberg minerals district in Indonesia.

|

|

d.

|

Net equity interest represents estimated consolidated metal quantities further reduced for noncontrolling interest ownership.

|

|

e.

|

Our joint venture agreement with Rio Tinto provides that PT-FI will receive cash flow from specified annual amounts of copper, gold and silver through 2021, calculated by reference to its proven and probable reserves as of December 31, 1994, and 60 percent of all remaining cash flow.

|

|

Copper Equivalent Cutoff Grade (Percent)

|

Molybdenum

Cutoff Grade

(Percent)

|

||||||

|

Mill

|

Crushed or

Agitation Leach

|

ROM

Leach

|

Mill

|

||||

|

North America

|

|

|

|

|

|||

|

Morenci

|

0.25

|

0.19

|

0.03

|

—

|

|||

|

Bagdad

|

0.18

|

—

|

0.08

|

—

|

|||

|

Safford

|

—

|

0.13

|

—

|

—

|

|||

|

Sierrita

|

0.18

|

—

|

—

|

—

|

|||

|

Miami

|

—

|

—

|

0.05

|

—

|

|||

|

Chino

|

0.20

|

—

|

0.08

|

—

|

|||

|

Tyrone

|

—

|

—

|

0.07

|

—

|

|||

|

Henderson

|

—

|

—

|

—

|

0.12

|

|||

|

Climax

|

—

|

—

|

—

|

0.05

|

|||

|

Cobre

|

0.50

|

—

|

0.10

|

—

|

|||

|

South America

|

|

|

|

|

|||

|

Cerro Verde

|

0.17

|

0.19

|

0.14

|

—

|

|||

|

El Abra

|

—

|

0.11

|

0.08

|

—

|

|||

|

Indonesia

|

|

|

|

|

|||

|

Grasberg open pit

|

0.25

|

—

|

—

|

—

|

|||

|

Deep Ore Zone

|

0.83

|

—

|

—

|

—

|

|||

|

Big Gossan

|

1.88

|

—

|

—

|

—

|

|||

|

Grasberg Block Cave

|

0.74

|

—

|

—

|

—

|

|||

|

Kucing Liar

|

0.86

|

—

|

—

|

—

|

|||

|

Deep Mill Level Zone

|

0.75

|

—

|

—

|

—

|

|||

|

Africa

|

|

|

|

|

|||

|

Tenke Fungurume

|

—

|

1.31

|

—

|

—

|

|||

|

Average Drill Hole Spacing (in Meters)

|

|||||||||

|

|

|

Proven

|

Probable

|

||||||

|

|

Mining Unit

|

Mill

|

Leach

|

Mill

|

Leach

|

||||

|

North America

|

|

|

|

|

|

||||

|

Morenci

|

Open Pit

|

86

|

86

|

122

|

122

|

||||

|

Bagdad

|

Open Pit

|

86

|

86

|

122

|

122

|

||||

|

Safford

|

Open Pit

|

—

|

86

|

—

|

122

|

||||

|

Sierrita

|

Open Pit

|

73

|

—

|

104

|

—

|

||||

|

Miami

|

Open Pit

|

—

|

61

|

—

|

91

|

||||

|

Chino

|

Open Pit

|

43

|

86

|

86

|

122

|

||||

|

Tyrone

|

Open Pit

|

—

|

86

|

—

|

86

|

||||

|

Henderson

|

Block Cave

|

38

|

—

|

85

|

—

|

||||

|

Climax

|

Open Pit

|

61

|

—

|

91

|

—

|

||||

|

Cobre

|

Open Pit

|

61

|

61

|

91

|

91

|

||||

|

South America

|

|

|

|

|

|

||||

|

Cerro Verde

|

Open Pit

|

50

|

50

|

100

|

100

|

||||

|

El Abra

|

Open Pit

|

—

|

75

|

—

|

120

|

||||

|

Indonesia

|

|

|

|

|

|

||||

|

Grasberg

|

Open Pit

|

35

|

—

|

82

|

—

|

||||

|

Deep Ore Zone

|

Block Cave

|

29

|

—

|

57

|

—

|

||||

|

Big Gossan

|

Open Stope

|

12

|

—

|

36

|

—

|

||||

|

Grasberg

|

Block Cave

|

34

|

—

|

80

|

—

|

||||

|

Kucing Liar

|

Block Cave

|

39

|

—

|

99

|

—

|

||||

|

Deep Mill Level Zone

|

Block Cave

|

16

|

—

|

61

|

—

|

||||

|

Africa

|

|

|

|

|

|

||||

|

Tenke Fungurume

|

Open Pit

|

—

|

50

|

—

|

100

|

||||

|

Recoverable

|

||||||||||||

|

Million

|

Average

|

Recovery

|

Copper

|

|||||||||

|

Metric Tons

|

Ore Grade (%)

|

Rate (%)

|

(billion pounds)

|

|||||||||

|

Mill stockpiles

|

||||||||||||

|

Cerro Verde

|

131

|

|

0.37

|

|

81.4

|

|

0.9

|

|

||||

|

Leach stockpiles

|

||||||||||||

|

Morenci

|

5,730

|

|

0.24

|

|

2.4

|

|

0.7

|

|

||||

|

Bagdad

|

498

|

|

0.25

|

|

2.0

|

|

0.1

|

|

||||

|

Safford

|

187

|

|

0.41

|

|

15.2

|

|

0.3

|

|

||||

|

Sierrita

|

650

|

|

0.15

|

|

11.4

|

|

0.2

|

|

||||

|

Miami

|

494

|

|

0.39

|

|

3.2

|

|

0.1

|

|

||||

|

Chino

|

1,665

|

|

0.26

|

|

5.2

|

|

0.5

|

|

||||

|

Tyrone

|

1,107

|

|

0.28

|

|

2.7

|

|

0.2

|

|

||||

|

Cerro Verde

|

479

|

|

0.51

|

|

3.4

|

|

0.2

|

|

||||

|

El Abra

|

592

|

|

0.43

|

|

7.7

|

|

0.4

|