|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

The Cayman Islands

|

N/A

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S Employer

Identification No.)

|

|

c/o Walkers Corporate Services Limited

Walker House, 87 Mary Street

George Town, Grand Cayman, KY1-9002

Cayman Islands

|

N/A

|

|

(Address of Registrant’s Principal Executive Offices)

|

(Zip Code)

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Ordinary Shares, par value $0.01 per share

|

New York Stock Exchange

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

¨

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

Page

|

||

|

1

|

||

|

14

|

||

|

20

|

||

|

21

|

||

|

22

|

||

|

22

|

||

|

23

|

||

|

26

|

||

|

27

|

||

|

44

|

||

|

46

|

||

|

102

|

||

|

102

|

||

|

102

|

||

|

103

|

||

|

103

|

||

|

103

|

||

|

103

|

||

|

103

|

||

|

104

|

||

|

109

|

||

|

110

|

||

|

Business

|

|

●

|

the number one marketer of fresh pineapples worldwide, including our

Del Monte Gold

®

Extra Sweet

pineapple;

|

|

●

|

the third-largest marketer of bananas worldwide;

|

|

●

|

a leading marketer of branded fresh-cut fruit in the United States and the United Kingdom;

|

|

●

|

a leading re-packer of tomatoes in the United States;

|

|

●

|

a leading year-round marketer of branded grapes in the United States;

|

|

●

|

a leading marketer of branded non-tropical fruit in selected markets; and

|

|

●

|

a leading marketer for canned fruit and pineapple in the European Union (EU) and other European markets.

|

|

Year ended

|

||||||||||||||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||||||||||||||

|

2010

|

2010

|

2008

|

||||||||||||||||||||||

|

(U.S. dollars in millions)

|

||||||||||||||||||||||||

|

Net sales by product category:

|

||||||||||||||||||||||||

|

Banana

|

$ | 1,620.2 | 46 | % | $ | 1,510.9 | 43 | % | $ | 1,420.2 | 40 | % | ||||||||||||

|

Other fresh produce:

|

||||||||||||||||||||||||

|

Gold pineapples

|

506.3 | 14 | % | 475.6 | 14 | % | 458.2 | 13 | % | |||||||||||||||

|

Fresh-cut produce

|

317.3 | 9 | % | 314.8 | 9 | % | 319.2 | 9 | % | |||||||||||||||

|

Non-tropical fruit

|

293.0 | 8 | % | 278.6 | 8 | % | 286.1 | 8 | % | |||||||||||||||

|

Melons

|

179.5 | 5 | % | 242.1 | 7 | % | 221.1 | 6 | % | |||||||||||||||

|

Tomatoes

|

114.3 | 3 | % | 120.0 | 3 | % | 140.0 | 4 | % | |||||||||||||||

|

Vegetables

|

65.4 | 2 | % | 68.4 | 2 | % | 78.8 | 2 | % | |||||||||||||||

|

Other fruit

|

47.9 | 1 | % | 52.0 | 1 | % | 56.4 | 2 | % | |||||||||||||||

|

Total other fresh produce

|

1,523.7 | 42 | % | 1,551.5 | 44 | % | 1,559.8 | 44 | % | |||||||||||||||

|

Prepared food

|

359.8 | 10 | % | 337.4 | 10 | % | 412.4 | 12 | % | |||||||||||||||

|

Other products and services

|

49.2 | 2 | % | 96.6 | 3 | % | 138.6 | 4 | % | |||||||||||||||

|

Total

|

$ | 3,552.9 | 100 | % | $ | 3,496.4 | 100 | % | $ | 3,531.0 | 100 | % | ||||||||||||

|

●

|

sanitary regulations, particularly in the United States and the countries of the EU;

|

|

●

|

regulations governing pesticide use and residue levels, particularly in the United States, United Kingdom, Germany and Japan; and

|

|

●

|

regulations governing traceability, packaging and labeling, particularly in the United States and the countries of the EU.

|

|

●

|

the development of the

Del Monte Gold

®

Extra Sweet

pineapple and other pineapple and melon varieties;

|

|

●

|

improved irrigation methods and soil preparation for melon planting; and

|

|

●

|

the development of our new CRT™ banana packaging created for individual single-serve packages and for our 40-pound bulk banana boxes that improves the ripening and handling process.

|

|

Year ended

|

||||||||

|

December 31,

|

January 1,

|

|||||||

|

2010

|

2010

|

|||||||

|

Net sales:

|

||||||||

|

First quarter

|

$ | 943.1 | $ | 879.7 | ||||

|

Second quarter

|

1,000.0 | 978.4 | ||||||

|

Third quarter

|

793.1 | 766.2 | ||||||

|

Fourth quarter

|

816.7 | 872.1 | ||||||

|

Total

|

$ | 3,552.9 | $ | 3,496.4 | ||||

|

Gross profit:

|

||||||||

|

First quarter

|

$ | 97.8 | $ | 83.8 | ||||

|

Second quarter

|

83.0 | 91.0 | ||||||

|

Third quarter

|

52.0 | 69.0 | ||||||

|

Fourth quarter

|

39.6 | 67.0 | ||||||

|

Total

|

$ | 272.4 | $ | 310.8 | ||||

|

Subsidiary

|

Country of Incorporation

|

|

|

Corporacion de Desarrollo Agricola Del Monte S.A.

|

Costa Rica

|

|

|

Del Monte B.V.

|

Netherlands

|

|

|

Del Monte Fresh Produce (Asia-Pacific) Limited

|

Hong Kong

|

|

|

Del Monte Fresh Produce Company

|

United States

|

|

|

Del Monte Fresh Produce International Inc.

|

Liberia

|

|

|

Del Monte Fresh Produce N.A., Inc.

|

United States

|

|

|

Del Monte Fund B.V.

|

Netherlands Antilles

|

|

| Del Monte International GmbH | Switzerland | |

|

Fresh Del Monte Produce N.V.

|

Netherlands Antilles

|

|

Risk Factors

|

|

●

|

sanitary regulations;

|

|

●

|

regulations governing pesticide use and residue levels; and

|

|

●

|

regulations governing packaging and labeling.

|

|

●

|

a classified board of directors;

|

|

●

|

a prohibition on shareholder action through written consents;

|

|

●

|

a requirement that general meetings of shareholders be called only by a majority of the board of directors or by the Chairman of the Board;

|

|

●

|

advance notice requirements for shareholder proposals and nominations;

|

|

●

|

limitations on the ability of shareholders to amend, alter or repeal our organizational documents; and

|

|

●

|

the authority of the board of directors to issue preferred shares with such terms as the board of directors may determine.

|

|

Unresolved Staff Comments

|

|

Properties

|

|

Acres Under Production

|

||||||

|

Location

|

Acres Owned

|

Acres Leased

|

Products

|

|||

|

Costa Rica

|

42,400

|

10,900

|

Bananas, Pineapples, Melons

|

|||

|

Guatemala

|

5,500

|

11,000

|

Bananas, Melons

|

|||

|

Brazil

|

3,100

|

-

|

Bananas

|

|||

|

Chile

|

4,300

|

800

|

Non-Tropical Fruit

|

|||

|

Kenya

|

-

|

11,100

|

Pineapples

|

|||

|

Philippines

|

200

|

9,900

|

Bananas, Pineapples

|

|||

|

United States

|

-

|

4,300

|

Melons

|

|||

|

Legal Proceedings

|

|

[Reserved]

|

|

Item 5

.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

High

|

Low

|

|||||||

|

2009

|

||||||||

|

First quarter

|

$ | 26.04 | $ | 13.02 | ||||

|

Second quarter

|

$ | 18.75 | $ | 14.52 | ||||

|

Third quarter

|

$ | 24.00 | $ | 15.51 | ||||

|

Fourth quarter

|

$ | 24.43 | $ | 20.91 | ||||

|

2010

|

||||||||

|

First quarter

|

$ | 22.76 | $ | 19.25 | ||||

|

Second quarter

|

$ | 22.39 | $ | 19.49 | ||||

|

Third quarter

|

$ | 23.00 | $ | 19.58 | ||||

|

Fourth quarter

|

$ | 25.08 | $ | 21.34 | ||||

|

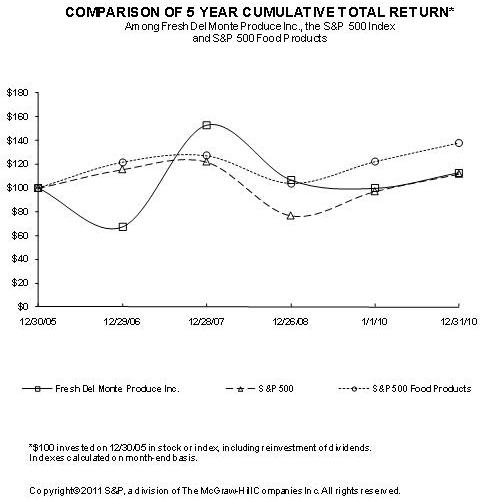

12/30/05

|

12/29/06

|

12/28/07

|

12/26/08

|

1/1/10

|

12/31/10

|

|

|

Fresh Del Monte Produce Inc.

|

100.00

|

67.27

|

152.77

|

106.79

|

99.71

|

112.82

|

|

S&P 500

|

100.00

|

115.80

|

122.16

|

76.96

|

97.33

|

111.99

|

|

S&P 500 Food Products

|

100.00

|

121.95

|

127.41

|

103.91

|

122.38

|

138.28

|

|

Period

|

Total Number of

Shares Purchased

(1)

|

Average Price

Paid per Share

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

|

Maximum Dollar

Value of Shares

that May Yet Be

Purchased Under

the Program

(2)(3)

|

||||||||||||

|

October 2, 2010

through

November 1, 2010

|

883,901 | $ | 21.88 | 883,901 | $ | 201,836,793 | ||||||||||

|

November 2, 2010

through

December 1, 2010

|

454,458 | $ | 21.72 | 454,458 | $ | 191,965,965 | ||||||||||

|

December 2, 2010

through

December 31, 2010

|

- | $ | - | - | $ | 191,965,965 | ||||||||||

|

Total

|

1,338,359 | $ | 21.83 | 1,338,359 | $ | 191,965,965 | ||||||||||

| (1) |

As of December 31, 2010, we retired all 1,338,359 of the repurchased ordinary shares.

|

| (2) |

On August 3, 2009, we announced that our Board of Directors, at their July 31, 2009 board meeting,

approved a three-year stock repurchase program of up to $150.0 million of our ordinary shares.

|

| (3) |

On May 5, 2010, we announced that our Board of Directors, at their May 5, 2010 board meeting,

approved a three-year stock repurchase program of up to $150.0 million of our ordinary shares

in addition to the program announced on August 3, 2009.

|

|

Item 6

.

|

Selected Financial Data

|

|

Year ended

(a)

|

||||||||||||||||||||

|

As adjusted

(b)

|

||||||||||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

December 28,

|

December 29,

|

||||||||||||||||

|

2010

|

2010

|

2008

|

2007

|

2006

|

||||||||||||||||

|

(U.S. Dollars in millions, except share and per share data)

|

||||||||||||||||||||

|

Statement of Income Data:

|

||||||||||||||||||||

|

Net sales

|

$ | 3,552.9 | $ | 3,496.4 | $ | 3,531.0 | $ | 3,365.5 | $ | 3,214.3 | ||||||||||

|

Cost of products sold

|

3,280.5 | 3,185.6 | 3,187.0 | 3,000.6 | 3,024.9 | |||||||||||||||

|

Gross profit

|

272.4 | 310.8 | 344.0 | 364.9 | 189.4 | |||||||||||||||

|

Selling, general and administrative expenses

|

166.8 | 165.8 | 162.5 | 176.8 | 201.6 | |||||||||||||||

|

Gain on sales of property, plant and equipment

|

9.2 | 11.2 | 7.5 | 17.4 | 1.6 | |||||||||||||||

|

Asset impairment and other charges, net

|

37.3 | 8.0 | 18.4 | 12.5 | 105.3 | |||||||||||||||

|

Operating income (loss)

|

77.5 | 148.2 | 170.6 | 193.0 | (115.9 | ) | ||||||||||||||

|

Interest expense, net

|

9.9 | 11.2 | 13.1 | 25.9 | 25.6 | |||||||||||||||

|

Other (expense) income, net

|

(7.5 | ) | (5.2 | ) | 4.5 | 14.3 | (1.4 | ) | ||||||||||||

|

Income (loss) before income taxes

|

60.1 | 131.8 | 162.0 | 181.4 | (142.9 | ) | ||||||||||||||

|

Provision for (benefit from) income taxes

|

(0.7 | ) | (12.8 | ) | 4.8 | 1.4 | (0.5 | ) | ||||||||||||

|

Net income (loss)

|

$ | 60.8 | $ | 144.6 | $ | 157.2 | $ | 180.0 | $ | (142.4 | ) | |||||||||

|

Less: net income (loss) attributable to

|

||||||||||||||||||||

|

noncontrolling interest

(c)

|

(1.4 | ) | 0.7 | (0.5 | ) | 0.2 | (0.2 | ) | ||||||||||||

|

Net income (loss) attributable to

|

||||||||||||||||||||

|

Fresh Del Monte Produce Inc.

|

$ | 62.2 | $ | 143.9 | $ | 157.7 | $ | 179.8 | $ | (142.2 | ) | |||||||||

|

Net income (loss) per ordinary share - Basic

|

$ | 1.03 | $ | 2.26 | $ | 2.49 | $ | 3.07 | $ | (2.46 | ) | |||||||||

|

Net income (loss) per ordinary share - Diluted

|

$ | 1.02 | $ | 2.26 | $ | 2.48 | $ | 3.06 | $ | (2.46 | ) | |||||||||

|

Dividends declared per ordinary share

|

$ | 0.05 | $ | - | $ | - | $ | - | $ | 0.50 | ||||||||||

|

Weighted average number of ordinary shares:

|

||||||||||||||||||||

|

Basic

|

60,535,978 | 63,570,999 | 63,344,941 | 58,490,281 | 57,819,416 | |||||||||||||||

|

Diluted

|

60,710,939 | 63,668,352 | 63,607,786 | 58,772,718 | 57,819,416 | |||||||||||||||

|

Balance Sheet Data (at period end):

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 49.1 | $ | 34.5 | $ | 27.6 | $ | 30.2 | $ | 39.8 | ||||||||||

|

Working capital

|

513.8 | 551.3 | 200.2 | 491.2 | 436.7 | |||||||||||||||

|

Total assets

|

2,517.7 | 2,596.0 | 2,651.0 | 2,185.7 | 2,089.6 | |||||||||||||||

|

Total debt

|

295.6 | 325.2 | 512.8 | 238.6 | 469.9 | |||||||||||||||

|

Shareholders' equity

(c)

|

1,631.5 | 1,695.2 | 1,513.9 | 1,379.6 | 1,038.5 | |||||||||||||||

|

_______________

|

||||||||||||||||||||

|

(a) We reclassified gain on sales of property, plant and equipment in other (expense) income, net on the Consolidated Statements of Income for 2008. Accordingly, we have reclassified these amounts for years prior to 2008 to gain on sales of property, plant and equipment, a component of operating income. See Note 1, "

General

" to our Consolidated Financial Statements.

|

|

(b) Effective December 30, 2006, the first day of our 2007 year, we adopted the deferral method of accounting for planned major maintenance activities related to vessel dry-dock activities, whereby actual costs incurred are deferred and amortized on a straight-line basis over the period until the next scheduled dry-dock activity. We have applied the new guidance included in the ASC related to "

Other Assets and Deferred Costs

" retrospectively to the year ended December 29, 2006. See Note 2, "

Summary of Significant Accounting Policies"

to our Consolidated Financial Statements.

|

|

(c) The ASC on “

Consolidation

” was amended to require classification of noncontrolling interests as a component of consolidated shareholders’ equity and the elimination of “minority interest” accounting in results of operations. Earnings attributable to noncontrolling interests are required to be reported as part of consolidated earnings and not as a separate component of income or expense and are required to be disclosed on the face of the statement of income. We adopted this additional guidance on December 27, 2008, the first day of our 2009 fiscal year. See Note 2, "

Summary of Significant Accounting Policies

" to our Consolidated Financial Statements.

|

|

Item 7

.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Year ended

|

||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||

|

2010

|

2010

|

2008

|

||||||||||

|

Statement of Income Data:

|

||||||||||||

|

Net sales

|

100.0 | % | 100.0 | % | 100.0 | % | ||||||

|

Gross profit

|

7.7 | 8.9 | 9.7 | |||||||||

|

Selling, general and

|

||||||||||||

|

administrative expenses

|

4.7 | 4.7 | 4.6 | |||||||||

|

Operating income

|

2.2 | 4.2 | 4.8 | |||||||||

|

Interest expense

|

0.3 | 0.3 | 0.4 | |||||||||

|

Net income attributable to

|

||||||||||||

|

Fresh Del Monte Produce Inc.

|

1.8 | 4.1 | 4.5 | |||||||||

|

Year ended

|

||||||||||||||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||||||||||||||

|

2010

|

2010

|

2008

|

||||||||||||||||||||||

|

(U.S. dollars in millions)

|

||||||||||||||||||||||||

|

Net sales by geographic region:

|

||||||||||||||||||||||||

|

North America

|

$ | 1,741.3 | 49 | % | $ | 1,675.9 | 48 | % | $ | 1,633.1 | 46 | % | ||||||||||||

|

Europe

|

913.8 | 26 | % | 995.2 | 28 | % | 1,081.4 | 30 | % | |||||||||||||||

|

Middle East

|

421.1 | 12 | % | 314.1 | 9 | % | 275.8 | 8 | % | |||||||||||||||

|

Asia

|

411.1 | 11 | % | 420.2 | 12 | % | 408.1 | 12 | % | |||||||||||||||

|

Other

|

65.6 | 2 | % | 91.0 | 3 | % | 132.6 | 4 | % | |||||||||||||||

|

Total

|

$ | 3,552.9 | 100 | % | $ | 3,496.4 | 100 | % | $ | 3,531.0 | 100 | % | ||||||||||||

|

Year ended

|

||||||||||||||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||||||||||||||

|

2010

|

2010

|

2008

|

||||||||||||||||||||||

|

(U.S. dollars in millions)

|

||||||||||||||||||||||||

|

Net sales by product category:

|

||||||||||||||||||||||||

|

Banana

|

$ | 1,620.2 | 46 | % | $ | 1,510.9 | 43 | % | $ | 1,420.2 | 40 | % | ||||||||||||

|

Other fresh produce

|

1,523.7 | 43 | % | 1,551.5 | 44 | % | 1,559.8 | 44 | % | |||||||||||||||

|

Prepared food

|

359.8 | 10 | % | 337.4 | 10 | % | 412.4 | 12 | % | |||||||||||||||

|

Other products and services

|

49.2 | 1 | % | 96.6 | 3 | % | 138.6 | 4 | % | |||||||||||||||

|

Total

|

$ | 3,552.9 | 100 | % | $ | 3,496.4 | 100 | % | $ | 3,531.0 | 100 | % | ||||||||||||

|

Gross profit (loss) by product category:

|

||||||||||||||||||||||||

|

Banana

|

$ | 31.4 | 11 | % | $ | 108.7 | 35 | % | $ | 117.7 | 34 | % | ||||||||||||

|

Other fresh produce

|

196.1 | 72 | % | 148.7 | 48 | % | 171.1 | 50 | % | |||||||||||||||

|

Prepared food

|

45.6 | 17 | % | 52.2 | 17 | % | 51.9 | 15 | % | |||||||||||||||

|

Other products and services

|

(0.7 | ) | (0 | )% | 1.2 | 0 | % | 3.3 | 1 | % | ||||||||||||||

|

Total

|

$ | 272.4 | 100 | % | $ | 310.8 | 100 | % | $ | 344.0 | 100 | % | ||||||||||||

|

|

●

|

Net sales in the banana segment increased by $109.3 million due to higher sales volume in North America and the Middle East partially offset by lower per unit sales prices in Europe, the Middle East and Asia.

|

|

|

o

|

North America banana sales volume increased as a result of increased supplies. Per unit sales prices increased slightly as compared with prior year.

|

|

|

o

|

Middle East banana sales volume increased significantly as a result of shipments to new markets in this region. Per unit sales prices decreased as compared with prior year as a result of weak market conditions.

|

|

|

o

|

Europe banana sales volume was relatively flat and per unit sales price decreased as compared with prior year. Contributing to the decrease in per unit sales price were unfavorable exchange rates and weak market conditions.

|

|

|

o

|

Asia banana sales volume decreased as a result of unfavorable growing conditions in the Philippines. Per unit sales price decreased as a result of poor market conditions partially offset by favorable exchange rates.

|

|

|

●

|

Net sales in the prepared food segment increased by $22.4 million principally as the result of increased sales in our Jordanian poultry and processed meat business, canned pineapples and deciduous fruit in Europe and beverage products in Sub-Saharan Africa.

|

|

|

●

|

Net sales in the other products and services segment decreased by $47.4 million principally due to lower commodity selling prices affecting our Argentine grain business combined with our decision to exit grain operations in Argentina and lower third-party freight revenue due to the elimination of freight services from Northern Europe to the Caribbean.

|

|

|

●

|

Net sales in the other fresh produce segment decreased by $27.8 million principally as a result of lower net sales of melons, potatoes and tomatoes, partially offset by higher sales of pineapples, non-tropical fruit, vegetables and fresh-cut fruit.

|

|

|

o

|

Net sales of melons decreased principally as a result of planned sales volume reduction, partially offset by higher per unit sales price in North America.

|

|

|

o

|

Net sales of potatoes and tomatoes decreased as a result of continued product rationalization and market conditions.

|

|

|

o

|

Net sales of pineapples increased principally due to an increase in sales volume in North America due to increased production in Costa Rica, combined with higher per unit sales prices in Asia as a result of favorable exchange rates.

|

|

|

o

|

Net sales of non-tropical fruit increased principally as a result of higher apple sales volumes and per unit sales price in the Middle East, higher grapes per unit sales price in Asia and North America, partially offset by lower sales volume and per unit sales prices of avocados in North America.

|

|

|

o

|

Net sale of vegetables increased principally as a result of higher sales volume of onions and bell peppers in North America.

|

|

|

o

|

Net sales of fresh-cut products increased principally due to higher sales volumes in North America and the Middle East that resulted from expansion of our customer base along with increased business with our current retail and foodservice customers in addition to higher per unit sales prices in North America, partially offset by lower sales volume in Europe.

|

|

|

●

|

Gross profit in the banana segment decreased by $77.3 million as a result of higher fuel and containerboard and fruit production and procurement costs combined with lower per unit sales price in Europe, the Middle East and Asia, partially offset by a 10% increase in sales volume. Contributing to the increase in per unit fruit cost in 2010 was the inclement weather in Central America. In Guatemala, we recorded a charge of $2.0 million, net of insurance recoveries, for clean-up costs and packaging materials inventory write-offs related to extensive flood damage.

|

|

|

●

|

Gross profit in the prepared food segment decreased by $6.6 million principally as a result of higher costs of canned pineapples and higher costs in the Jordanian poultry business, partially offset by higher per unit sales prices.

|

|

|

●

|

Gross profit in the other products and services segment decreased by $1.9 million primarily due to lower third-party freight services.

|

|

|

●

|

Gross profit on the other fresh produce segment increased by $47.4 million principally as a result of higher gross profit on gold pineapples, non-tropical fruit and melons.

|

|

|

o

|

Gross profit on gold pineapples increased in 2010 principally as a result higher sales volumes in North America, the Middle East and Asia, combined with the charge of $17.2 million that was recorded in 2009 related to growing crop inventory as a result of our decision to discontinue pineapple operations in Brazil, partially offset by higher freight costs.

|

|

|

o

|

Gross profit in non-tropical fruit increased principally due to higher per unit sales prices of grapes in North America that resulted from favorable market conditions.

|

|

|

o

|

Gross profit on melons increased principally due to improvements in per unit sales prices in North America, partially offset by lower sales volumes, lower per unit sales prices in Europe, higher production, procurement and ocean freight costs combined with a charge of $4.9 million for the discontinuation of our Brazil melon growing operation and costs associated with planned volume reduction in Costa Rica and Guatemala.

|

|

|

●

|

During the second quarter of 2010, we entered into an agreement to sell substantially all of the assets of our South Africa canning operations. As a result, we recognized a $16.7 million asset impairment of our investment in South Africa and $0.1 million in other charges in the prepared food reporting segment.

|

|

|

●

|

$12.7 million in asset impairments related to plant disease affecting an isolated growing area in our banana operations in the Philippines that will be abandoned during the first quarter of 2011.

|

|

|

●

|

$6.1 million in asset impairments and a $(2.4) million insurance reimbursement related to flood damage to our Guatemala banana plantation.

|

|

|

●

|

$1.4 million charge for impairment of the DEL MONTE

®

perpetual, royalty-free brand name license for beverage products in the United Kingdom due to lower than expected sales volume and pricing related to the prepared food segment.

|

|

|

●

|

$1.1 million in asset impairment charges related to damage caused by an earthquake in Chile in the other fresh produce segment.

|

|

|

●

|

$1.3 million in other charges due to the discontinuation of melon growing operations in Brazil related to the other fresh produce segment.

|

|

|

●

|

$0.7 million in asset impairment charges as a result of the relocation of a port facility in North America related to the banana and other fresh produce segments.

|

|

|

●

|

$(0.4) million in insurance proceeds related to the 2008 flood damage to our Brazil banana plantation.

|

|

|

●

|

$10.9 million in asset impairment and other charges as a result of our decision to discontinue pineapple operations in Brazil.

|

|

|

●

|

$1.2 million in termination benefits and contract termination costs resulting from our decision to eliminate our commercial cargo service from Northern Europe to the Caribbean related to the other products and services segment.

|

|

|

●

|

$2.0 million charge for impairment of the DEL MONTE

®

perpetual, royalty-free brand name license for beverage products in the United Kingdom due to lower than expected sales volume and pricing related to the prepared food segment.

|

|

|

●

|

$2.8 million impairment charge related to an intangible asset for a non-compete agreement as a result of the Caribana acquisition related to the banana segment.

|

|

|

●

|

$(0.8) million in reversals of contract termination costs previously recorded related to the closure of an under-utilized distribution center in the United Kingdom related to the banana segment.

|

|

|

●

|

$(4.7) million principally due to a gain from the discontinuance of the retiree medical plan and the reversal of certain contract termination costs related to the previously announced closing of our Hawaii pineapple operations related to the other fresh produce segment.

|

|

|

●

|

$(3.4) million gain due to insurance proceeds related to the 2008 Brazil floods related to the banana segment.

|

|

|

●

|

Net sales in the prepared food segment decreased by $75.0 million principally due to lower sales volume of canned pineapples, beverage and deciduous products due to poor market conditions and unfavorable exchange rates. Also contributing to the decrease in net sales in the prepared food segment was a change to a beverage production and distribution agreement in the United Kingdom, whereby sales are recognized net of production and distribution costs, resulting in approximately $11.0 million of lower net sales in 2009 as compared to 2008.

|

|

|

●

|

Net sales in the other products and services segment decreased by $42.0 million principally due to lower commodity selling prices affecting our Argentine grain business and lower third-party freight revenue due to the elimination of freight services from Northern Europe to the Caribbean.

|

|

|

●

|

Net sales in the other fresh produce segment decreased by $8.3 million principally as a result of lower net sales of tomatoes, other fruits and vegetables, non-tropical fruit and fresh-cut products, partially offset by higher net sales of melons and pineapples.

|

|

|

o

|

Net sales of tomatoes decreased primarily due to lower sales volume resulting from fluctuations in supply and demand. Net sales of other fruits and vegetables decreased primarily due to product rationalization in North America combined with challenging market conditions.

|

|

|

o

|

Net sales of non-tropical fruit decreased principally as a result of lower sales volume of grapes and lower per unit sales prices for apples, partially offset by higher sales volume of avocados.

|

|

|

o

|

Net sales of fresh-cut products decreased primarily due to lower sales in Europe due to unfavorable exchange rates and product rationalization.

|

|

|

o

|

Net sales of melons increased as a result of higher sales volume that resulted principally from improved yields and increased production from Company-operated facilities in Central America, partially offset by a 7% decrease in per unit selling prices that resulted from higher industry volumes.

|

|

|

o

|

Net sales of pineapples increased principally due to an 11% increase in sales volume that resulted from the Caribana acquisition, partially offset by lower per unit sales prices. Pineapple per unit sales prices decreased as a result of the unfavorable current economic conditions and unfavorable exchange rates in Europe and South Korea.

|

|

|

●

|

Net sales in the banana segment increased by $90.8 million due to higher sales volume in North America, the Middle East and Asia combined with higher per unit sales prices in all regions, partially offset by unfavorable exchange rates in Europe and South Korea. Also contributing to the increase in sales volume was the additional sales volume that resulted from the Caribana acquisition.

|

|

|

●

|

Gross profit on the other fresh produce segment decreased by $22.4 million principally as a result of lower gross profit on gold pineapples, melons and non-tropical fruit, partially offset by higher gross profit on fresh-cut products.

|

|

|

o

|

Gross profit on gold pineapples decreased principally as a result of a charge of $17.2 million related to growing crop inventory as a result of our decision to discontinue pineapple operations in Brazil, combined with lower per unit sales prices principally in Europe and North America as a result of poor market conditions and unfavorable exchange rates in Europe, partially offset by higher volume in all markets.

|

|

|

o

|

Gross profit on melons decreased principally due to lower per unit sales prices as a result of higher industry volumes in North America.

|

|

|

o

|

Gross profit in non-tropical fruit decreased principally due to lower gross profit on apples and grapes as a result of unfavorable market conditions, partially offset by higher gross profit on stone fruit (peaches, nectarines, plums, cherries) and avocados as a result of lower fruit costs.

|

|

|

o

|

Gross profit on fresh-cut products increased principally due to lower per unit costs and improved efficiencies in North America.

|

|

|

●

|

Gross profit in the banana segment decreased by $9.0 million principally due to a 5% increase in per unit cost as a result of higher procurement, production and distribution costs, partially offset by higher per unit sales prices and lower per unit ocean freight costs that resulted from lower fuel costs and improvements in vessel utilization. Also affecting gross profit in the banana segment was the effect of the Brazil flood, which decreased gross profit by $2.1 million in 2008 due to inventory write-offs and increased gross profit in 2009 for the same amount due to insurance recovery.

|

|

|

●

|

Gross profit on the other products and services segment decreased by $2.1 million principally due to lower gross profit in our Argentine grain business resulting from lower commodity prices.

|

|

|

●

|

Gross profit in the prepared food segment increased by $0.3 million primarily due to lower freight costs, partially offset by higher distribution costs.

|

|

|

●

|

$10.9 million in asset impairment and other charges as a result of our decision to discontinue pineapple operations in Brazil.

|

|

|

●

|

$1.2 million in termination benefits and contract termination costs resulting from our decision to eliminate our commercial cargo service from Northern Europe to the Caribbean related to the other products and services segment.

|

|

|

●

|

$2.0 million charge for impairment of the DEL MONTE

®

perpetual, royalty-free brand name license for beverage products in the United Kingdom due to lower than expected sales volume and pricing related to the prepared food segment.

|

|

|

●

|

$2.8 million impairment charge related to an intangible asset for a non-compete agreement as a result of the Caribana acquisition related to the banana segment.

|

|

|

●

|

$(0.8) million in reversals of contract termination costs previously recorded related to the closure of an under-utilized distribution center in the United Kingdom related to the banana segment.

|

|

|

●

|

$(4.7) million principally due to a gain from the discontinuance of the retiree medical plan and the reversal of certain contract termination costs related to the previously announced closing of our Hawaii pineapple operations related to the other fresh produce segment.

|

|

|

●

|

$(3.4) million gain due to insurance proceeds related to the 2008 Brazil floods related to the banana segment.

|

|

|

●

|

$11.3 million in asset impairment and other charges as a result of extensive flood damage at our banana farms in Brazil and Costa Rica.

|

|

|

●

|

$10.0 million in asset impairment and contract termination costs principally due to the closure of under-utilized distribution centers and the previously announced closure of our beverage production operation in the United Kingdom related to the banana and prepared food segments.

|

|

|

●

|

$(2.9) million net gain primarily due to unrecognized prior service costs as a result of the previously announced closing of our Hawaii pineapple operations related to the other fresh produce segment.

|

|

Prepared Food Reporting Unit

|

||||||||||||||||||||||

|

Melon

Reporting Unit

Goodwill

|

Banana

Reporting Unit

Goodwill

|

Goodwill

|

U.K.

Beverage

Trademarks

|

Remaining

DEL MONTE®

Trademarks

|

||||||||||||||||||

|

Carrying Value

|

$ | 3.3 | $ | 65.2 | $ | 72.4 | $ | 5.1 | $ | 63.6 | ||||||||||||

|

Approximate percentage by which the fair value

|

||||||||||||||||||||||

|

exceeds the carrying value based on annual

|

3 | % | 8 | % | 3 | % | - | (1) | 16 | % | ||||||||||||

|

impairment test as of 1st day of fourth quarter

|

||||||||||||||||||||||

|

Amount that a one percentage point increase

|

||||||||||||||||||||||

|

in the discount rate and a 5% decrease in cash

|

$ | 3.3 | $ | 55.9 | $ | 34.4 | $ | 0.7 | (2) | $ | - | (3) | ||||||||||

|

flows would cause the carrying value to

|

||||||||||||||||||||||

|

exceed the fair value and trigger a fair

|

||||||||||||||||||||||

|

valuation

|

||||||||||||||||||||||

|

(1) The trademark for beverage products in the United Kingdom was impaired by $1.4 million during the third quarter of 2010.

|

|

(2) Represents additional impairment after applying the sensitivities disclosed above.

|

|

(3) As of December 31, 2010, applying the sensitivities disclosed above does not result in the carrying value exceeding the fair

|

|

value; however, after applying those sensitivities, the fair value exceeds the carrying value by approximately 6%.

|

|

(U.S. dollars in millions)

|

||||||||||||||||||||

|

Contractual obligations by period

|

Total

|

Less than

1 year

|

1 - 3 years

|

3 - 5 years

|

More than

5 years

|

|||||||||||||||

|

Fruit purchase agreements

|

$ | 1,444.0 | $ | 31.5 | $ | 988.7 | $ | 185.2 | $ | 238.6 | ||||||||||

|

Purchase obligations

|

213.0 | 57.6 | 140.6 | 6.5 | 8.3 | |||||||||||||||

|

Operating leases and charter agreements

|

426.5 | 91.2 | 111.1 | 75.4 | 148.8 | |||||||||||||||

|

Capital lease obligations (including interest)

|

3.6 | 2.6 | 1.0 | 0.0 | 0.0 | |||||||||||||||

|

Long-term debt

|

292.2 | 2.7 | 289.5 | 0.0 | 0.0 | |||||||||||||||

|

Retirement benefits

|

76.4 | 7.0 | 14.9 | 15.3 | 39.2 | |||||||||||||||

|

Uncertain tax positions

|

8.3 | 0.0 | 8.3 | 0.0 | 0.0 | |||||||||||||||

|

Totals

|

$ | 2,464.0 | $ | 192.6 | $ | 1,554.1 | $ | 282.4 | $ | 434.9 | ||||||||||

|

Item 7A

.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

Page

|

|

|

Internal Control over Financial Reporting

|

|

|

47

|

|

|

48

|

|

|

|

|

|

Consolidated Financial Statements

|

|

|

|

|

|

49

|

|

|

50

|

|

|

51

|

|

|

52

|

|

|

53

|

|

|

54

|

|

|

Supplemental Financial Statement Schedule

|

|

|

101

|

|

(i)

|

Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets;

|

|

(ii)

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of our management and directors; and

|

|

(iii)

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

|

|

/s/ Ernst & Young LLP

|

|

|

Certified Public Accountants

|

|

/s/ Ernst & Young LLP

|

|

|

Certified Public Accountants

|

|

December 31,

|

January 1,

|

|||||||

|

2010

|

2010

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 49.1 | $ | 34.5 | ||||

|

Trade accounts receivable, net of allowance of

|

||||||||

|

$7.8 and $11.9, respectively

|

313.8 | 309.8 | ||||||

|

Other accounts receivable, net of allowance

|

||||||||

|

of $12.3 and $14.1, respectively

|

63.4 | 65.2 | ||||||

|

Inventories

|

410.4 | 436.9 | ||||||

|

Deferred income taxes

|

17.5 | 16.1 | ||||||

|

Prepaid expenses and other current assets

|

27.1 | 46.1 | ||||||

|

Total current assets

|

881.3 | 908.6 | ||||||

|

Investments in and advances to unconsolidated companies

|

4.0 | 10.4 | ||||||

|

Property, plant and equipment, net

|

1,033.1 | 1,068.5 | ||||||

|

Deferred income taxes

|

57.2 | 60.7 | ||||||

|

Other noncurrent assets

|

135.7 | 138.8 | ||||||

|

Goodwill

|

406.4 | 409.0 | ||||||

|

Total assets

|

$ | 2,517.7 | $ | 2,596.0 | ||||

|

Liabilities and shareholders' equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 331.9 | $ | 316.9 | ||||

|

Current portion of long-term debt and capital lease obligations

|

5.3 | 4.9 | ||||||

|

Deferred income taxes

|

27.5 | 25.8 | ||||||

|

Income taxes and other taxes payable

|

2.8 | 9.7 | ||||||

|

Total current liabilities

|

367.5 | 357.3 | ||||||

|

Long-term debt and capital lease obligations

|

290.3 | 320.3 | ||||||

|

Retirement benefits

|

76.5 | 78.0 | ||||||

|

Other noncurrent liabilities

|

69.6 | 60.1 | ||||||

|

Deferred income taxes

|

82.3 | 85.1 | ||||||

|

Total liabilities

|

886.2 | 900.8 | ||||||

|

Commitments and contingencies

|

||||||||

|

Shareholders' equity:

|

||||||||

|

Preferred shares, $0.01 par value; 50,000,000 shares

|

||||||||

|

authorized; none issued or outstanding

|

- | - | ||||||

|

Ordinary shares, $0.01 par value; 200,000,000 shares

|

||||||||

|

authorized; 58,725,430 issued and outstanding

|

||||||||

|

and 63,615,411 issued and outstanding, respectively

|

0.6 | 0.6 | ||||||

|

Paid-in capital

|

462.9 | 561.2 | ||||||

|

Retained earnings

|

1,167.8 | 1,108.5 | ||||||

|

Accumulated other comprehensive (loss) income

|

(24.1 | ) | 2.8 | |||||

|

Total Fresh Del Monte Produce Inc. shareholders' equity

|

1,607.2 | 1,673.1 | ||||||

|

Noncontrolling interests

|

24.3 | 22.1 | ||||||

|

Total shareholders' equity

|

1,631.5 | 1,695.2 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 2,517.7 | $ | 2,596.0 | ||||

|

Year ended

|

||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||

|

2010

|

2010

|

2008

|

||||||||||

|

Net sales

|

$ | 3,552.9 | $ | 3,496.4 | $ | 3,531.0 | ||||||

|

Cost of products sold

|

3,280.5 | 3,185.6 | 3,187.0 | |||||||||

|

Gross profit

|

272.4 | 310.8 | 344.0 | |||||||||

|

Selling, general and administrative expenses

|

166.8 | 165.8 | 162.5 | |||||||||

|

Gain on sales of property, plant and equipment

|

9.2 | 11.2 | 7.5 | |||||||||

|

Asset impairment and other charges, net

|

37.3 | 8.0 | 18.4 | |||||||||

|

Operating income

|

77.5 | 148.2 | 170.6 | |||||||||

|

Interest expense

|

10.8 | 11.9 | 14.5 | |||||||||

|

Interest income

|

0.9 | 0.7 | 1.4 | |||||||||

|

Other (expense) income, net

|

(7.5 | ) | (5.2 | ) | 4.5 | |||||||

|

Income before income taxes

|

60.1 | 131.8 | 162.0 | |||||||||

|

Provision for (benefit from) income taxes

|

(0.7 | ) | (12.8 | ) | 4.8 | |||||||

|

Net income

|

$ | 60.8 | $ | 144.6 | $ | 157.2 | ||||||

|

Less: net (loss) income attributable to

noncontrolling interests

|

(1.4 | ) | 0.7 | (0.5 | ) | |||||||

|

Net income attributable to

Fresh Del Monte Produce Inc.

|

$ | 62.2 | $ | 143.9 | $ | 157.7 | ||||||

|

Net income per ordinary share attributable to

Fresh Del Monte Produce Inc. - Basic

|

$ | 1.03 | $ | 2.26 | $ | 2.49 | ||||||

|

Net income per ordinary share attributable to

Fresh Del Monte Produce Inc. - Diluted

|

$ | 1.02 | $ | 2.26 | $ | 2.48 | ||||||

|

Weighted average number of ordinary shares:

|

||||||||||||

|

Basic

|

60,535,978 | 63,570,999 | 63,344,941 | |||||||||

|

Diluted

|

60,710,939 | 63,668,352 | 63,607,786 | |||||||||

|

Year ended

|

||||||||||||

|

December 31,

|

January 1,

|

December 26,

|

||||||||||

|

2010

|

2010

|

2008

|

||||||||||

|

Operating activities:

|

||||||||||||

|

Net income

|

$ | 60.8 | $ | 144.6 | $ | 157.2 | ||||||

|

Adjustments to reconcile net income to net cash

|

||||||||||||

|

provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

78.7 | 83.7 | 83.5 | |||||||||

|

Amortization of debt issuance costs

|

2.3 | 3.3 | 1.8 | |||||||||

|

Gain on pension liability

|

- | (3.2 | ) | (2.8 | ) | |||||||

|

Stock-based compensation expense

|

7.5 | 10.4 | 9.7 | |||||||||

|

Asset impairment charges

|

38.7 | 15.3 | 15.7 | |||||||||

|

Change in uncertain tax positions

|

(2.0 | ) | (2.9 | ) | 0.4 | |||||||

|

Gain on sales of property, plant and equipment

|

(9.2 | ) | (11.2 | ) | (7.3 | ) | ||||||

|

Equity in (income) loss of unconsolidated companies

|

0.8 | (0.8 | ) | 2.6 | ||||||||

|

Deferred income taxes

|

(3.3 | ) | (18.1 | ) | (0.8 | ) | ||||||

|

Foreign currency translation adjustment

|

0.6 | 9.4 | (9.5 | ) | ||||||||

|

Other changes

|

0.2 | (0.5 | ) | - | ||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Receivables

|

4.0 | 45.8 | 0.1 | |||||||||

|

Inventories

|

31.1 | 19.8 | (38.8 | ) | ||||||||

|

Prepaid expenses and other current assets

|

5.3 | 5.5 | (10.6 | ) | ||||||||

|

Accounts payable and accrued expenses

|

(8.4 | ) | (40.1 | ) | 8.0 | |||||||

|

Other noncurrent assets and liabilities

|

(9.7 | ) | (3.5 | ) | (22.0 | ) | ||||||

|

Net cash provided by operating activities

|

197.4 | 257.5 | 187.2 | |||||||||

|

Investing activities:

|

||||||||||||

|

Capital expenditures

|

(70.8 | ) | (84.5 | ) | (101.5 | ) | ||||||

|

Proceeds from sales of property, plant and equipment

|

16.0 | 17.6 | 16.5 | |||||||||

|

Purchase of subsidiaries, net of cash acquired

|

- | - | (414.5 | ) | ||||||||

|

Return of investment by an unconsolidated company

|

4.2 | - | - | |||||||||

|

Net cash used in investing activities

|

(50.6 | ) | (66.9 | ) | (499.5 | ) | ||||||

|

Financing activities:

|

||||||||||||

|

Proceeds from long-term debt

|

581.5 | 314.1 | 985.6 | |||||||||

|

Payments on long-term debt

|

(612.8 | ) | (512.1 | ) | (713.8 | ) | ||||||

|

Contributions from noncontrolling interests

|

3.4 | 14.8 | 10.6 | |||||||||

|

Proceeds from stock options exercised

|

2.2 | 1.0 | 22.1 | |||||||||

|

Repurchase of shares

|

(108.1 | ) | - | - | ||||||||

|

Dividends Paid

|

(2.9 | ) | - | - | ||||||||

|

Net cash (used in) provided by financing activities

|

(136.7 | ) | (182.2 | ) | 304.5 | |||||||

|

Effect of exchange rate changes on cash

|

4.5 | (1.5 | ) | 5.2 | ||||||||

|

Net increase (decrease) in cash and cash equivalents

|

14.6 | 6.9 | (2.6 | ) | ||||||||

|

Cash and cash equivalents, beginning

|

34.5 | 27.6 | 30.2 | |||||||||

|

Cash and cash equivalents, ending

|

$ | 49.1 | $ | 34.5 | $ | 27.6 | ||||||

|

Supplemental cash flow information:

|

||||||||||||

|

Cash paid for interest

|

$ | 8.7 | $ | 8.8 | $ | 12.6 | ||||||

|

Cash paid for income taxes

|

$ | 7.1 | $ | 5.9 | $ | 1.1 | ||||||

|

Non-cash financing and investing activities:

|

||||||||||||

|

Purchase of subsidiaries

|

$ | - | $ | 1.2 | $ | - | ||||||

|

Retirement of treasury stock

|

$ | 108.1 | $ | - | $ | - | ||||||

|

Purchases of assets under capital lease obligations

|

$ | 0.5 | $ | 0.3 | $ | 1.0 | ||||||

|

Ordinary Shares Outstanding

|

Ordinary Shares

|

Paid-in Capital

|

Retained Earnings

|

Treasury Shares

|

Accumulated Other Comprehensive Income (Loss)

|

Total Shareholders' Equity

|

Non-Controlling Interests

|

Total

Equity

|

||||||||||||||||||||||||||||

|

Balance at December 28, 2007

|

62,702,916 | $ | 0.6 | $ | 518.0 | $ | 806.9 | $ | - | $ | 39.3 | $ | 1,364.8 | $ | 14.8 | $ | 1,379.6 | |||||||||||||||||||

|

Exercises of stock options

|

850,295 | - | 22.1 | - | - | - | 22.1 | - | 22.1 | |||||||||||||||||||||||||||

|

Share-based payment expense

|

- | - | 9.7 | - | - | - | 9.7 | - | 9.7 | |||||||||||||||||||||||||||

|

Capital contribution from non-controlling interest

|

- | - | - | - | - | - | - | 4.3 | 4.3 | |||||||||||||||||||||||||||

|

Comprehensive income:

|

||||||||||||||||||||||||||||||||||||

|

Net income

|

- | - | - | 157.7 | - | - | 157.7 | (0.5 | ) | 157.2 | ||||||||||||||||||||||||||

|

Unrealized gain on derivatives

|

- | - | - | - | - | 13.4 | 13.4 | - | 13.4 | |||||||||||||||||||||||||||

|

Net foreign currency

|

||||||||||||||||||||||||||||||||||||

|

translation adjustment

|

- | - | - | - | - | (51.6 | ) | (51.6 | ) | (1.6 | ) | (53.2 | ) | |||||||||||||||||||||||

|

Change in retirement benefit

|

||||||||||||||||||||||||||||||||||||

|

adjustment

|

- | - | - | - | - | (19.2 | ) | (19.2 | ) | - | (19.2 | ) | ||||||||||||||||||||||||

|

Comprehensive income

|

100.3 | (2.1 | ) | 98.2 | ||||||||||||||||||||||||||||||||

|

Balance at December 26, 2008

|

63,553,211 | $ | 0.6 | $ | 549.8 | $ | 964.6 | $ | - | $ | (18.1 | ) | $ | 1,496.9 | $ | 17.0 | $ | 1,513.9 | ||||||||||||||||||

|

Exercises of stock options

|

62,200 | - | 1.0 | - | - | - | 1.0 | - | 1.0 | |||||||||||||||||||||||||||

|

Share-based payment expense

|

- | - | 10.4 | - | - | - | 10.4 | - | 10.4 | |||||||||||||||||||||||||||

|

Capital contribution from non-controlling interest

|

- | - | - | - | - | - | - | 3.7 | 3.7 | |||||||||||||||||||||||||||

|

Comprehensive income:

|

||||||||||||||||||||||||||||||||||||

|

Net income

|

- | - | - | 143.9 | - | - | 143.9 | 0.7 | 144.6 | |||||||||||||||||||||||||||

|

Unrealized gain on derivatives

|

- | - | - | - | - | 13.4 | 13.4 | - | 13.4 | |||||||||||||||||||||||||||

|

Net foreign currency

|

||||||||||||||||||||||||||||||||||||

|

translation adjustment

|

- | - | - | - | - | 20.5 | 20.5 | 0.7 | 21.2 | |||||||||||||||||||||||||||

|

Change in retirement benefit

|

||||||||||||||||||||||||||||||||||||

|

adjustment

|

- | - | - | - | - | (13.0 | ) | (13.0 | ) | - | (13.0 | ) | ||||||||||||||||||||||||

|

Comprehensive income

|

164.8 | 1.4 | 166.2 | |||||||||||||||||||||||||||||||||

|

Balance at January 1, 2010

|

63,615,411 | $ | 0.6 | $ | 561.2 | $ | 1,108.5 | $ | - | $ | 2.8 | $ | 1,673.1 | $ | 22.1 | $ | 1,695.2 | |||||||||||||||||||

|

Exercises of stock options

|

135,722 | - | 2.3 | - | - | - | 2.3 | - | 2.3 | |||||||||||||||||||||||||||

|

Issuance of restricted stock awards

|

32,956 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

|

Share-based payment expense

|

- | - | 7.5 | - | - | - | 7.5 | - | 7.5 | |||||||||||||||||||||||||||

|

Capital contribution from non-controlling interest

|

- | - | - | - | - | - | - | 2.7 | 2.7 | |||||||||||||||||||||||||||

|

Treasury shares purchased

|

(5,058,659 | ) | - | - | - | (108.1 | ) | - | (108.1 | ) | - | (108.1 | ) | |||||||||||||||||||||||

|

Treasury shares retired

|

(108.1 | ) | 108.1 | - | ||||||||||||||||||||||||||||||||

|

Dividend declared

|

- | - | - | (2.9 | ) | - | - | (2.9 | ) | - | (2.9 | ) | ||||||||||||||||||||||||

|

Comprehensive income:

|

||||||||||||||||||||||||||||||||||||

|

Net income

|

- | - | - | 62.2 | - | - | 62.2 | (1.4 | ) | 60.8 | ||||||||||||||||||||||||||

|

Unrealized loss on derivatives

|

- | - | - | - | - | (39.1 | ) | (39.1 | ) | - | (39.1 | ) | ||||||||||||||||||||||||

|

Net foreign currency

|

||||||||||||||||||||||||||||||||||||

|

translation adjustment

|

- | - | - | - | - | 10.0 | 10.0 | 0.9 | 10.9 | |||||||||||||||||||||||||||

|

Change in retirement benefit

|

||||||||||||||||||||||||||||||||||||

|

adjustment

|

- | - | - | - | - | 2.2 | 2.2 | - | 2.2 | |||||||||||||||||||||||||||

|

Comprehensive income

|

35.3 | (0.5 | ) | 34.8 | ||||||||||||||||||||||||||||||||

|

Balance at December 31, 2010

|

58,725,430 | $ | 0.6 | $ | 462.9 | $ | 1,167.8 | $ | - | $ | (24.1 | ) | $ | 1,607.2 | $ | 24.3 | $ | 1,631.5 | ||||||||||||||||||

|

Cash acquired

|

$ | 1.6 | ||

|

Property, Plant and Equipment

|

232.7 | |||

|

Other assets, net

|

2.7 | |||

|

Inventories

|

20.8 | |||

|

Non-compete agreements (intangibles)

|

10.3 | |||

|

Current and deferred taxes

|

(26.7 | ) | ||

|

Estimated fair market value of net assets acquired

|

241.4 | |||

|

Purchase price

|

405.9 | |||

|

Goodwill

|

$ | 164.5 | ||

|

Quarter ended

|

Year ended

|

|||||||

|

December 26,

|

December 26,

|

|||||||

|

2008

|

2008

|

|||||||

|

Net sales

|

$ | 831.0 | $ | 3,605.4 | ||||

|

Net income

|

$ | 22.9 | $ | 164.6 | ||||

|

Net income per ordinary share:

|

||||||||

|

Basic

|

$ | 0.36 | $ | 2.60 | ||||

|

Diluted

|

$ | 0.36 | $ | 2.59 | ||||

|

Weighted average number of ordinary shares:

|

||||||||

|

Basic

|

63,540,689 | 63,344,941 | ||||||

|

Diluted

|

63,602,862 | 63,607,786 | ||||||

|

Property, Plant and Equipment

|

$ | 9.8 | ||

|

Inventories

|

1.8 | |||

|

Deferred Taxes

|

(0.6 | ) | ||

|

Estimated fair market value of net assets acquired

|

11.0 | |||

|

Purchase price

|

13.9 | |||

|

Goodwill

|

$ | 2.9 |

|

Year ended

|

||||||||||||

|

Decemer 31,

|

January 1,

|

December 26,

|

||||||||||

|

2010

|

2010

|

2008

|

||||||||||

|

Charges related to asset impairments, net

|

$ | 19.0 | $ | 1.4 | $ | 11.6 | ||||||

|

Asset impairment and other charges related to exit

activities, net

|

18.3 | 6.6 | 6.8 | |||||||||

|

Total asset impairment and other charges, net

|

$ | 37.3 | $ | 8.0 | $ | 18.4 | ||||||

|

Banana Segment

|

Other Fresh Produce Segment

|

Prepared Foods Segment

|

||||||||||||||||||||||||||||||

|

North

|

Central

|

South

|

South

|

|||||||||||||||||||||||||||||

|

America

|

America

|

America

|

Asia

|

America

|

Europe

|

Africa

|

Totals

|

|||||||||||||||||||||||||

|

Impairment of long-lived and other assets

|

$ | 0.7 | $ | 3.7 | $ | (0.4 | ) | $ | 12.7 | $ | 1.1 | $ | 1.4 | $ | 16.7 | $ | 35.9 | |||||||||||||||

|

Total asset impairment charges (credits)

|

0.7 | 3.7 | (0.4 | ) | 12.7 | 1.1 | 1.4 | 16.7 | 35.9 | |||||||||||||||||||||||

|

One-time termination benefits, contract

|

||||||||||||||||||||||||||||||||

|

termination costs and other exit

|

||||||||||||||||||||||||||||||||

|

activity charges

|

- | - | - | - | 1.3 | - | 0.1 | 1.4 | ||||||||||||||||||||||||

|

Total asset impairment and other charges (credits), net

|

$ | 0.7 | $ | 3.7 | $ | (0.4 | ) | $ | 12.7 | $ | 2.4 | $ | 1.4 | $ | 16.8 | $ | 37.3 | |||||||||||||||

|

●

|

$16.7 million impairment of our investment in South Africa and $0.1 million in other charges as a result of entering into an agreement to sell substantially all of the assets of our South Africa canning operations in the prepared food segment.

|

|

●

|

$12.7 million in impairment charges related to plant disease affecting an isolated growing area in an isolated area of our banana operations in the Philippines that will be abandoned during the first quarter of 2011 in the banana segment.

|

|

●

|

$6.1 million in impairment charges and $(2.4) million of insurance reimbursements as a result of flood damage to our Guatemala banana plantation in the banana segment.

|

|

●

|

$1.4 million impairment of the DEL MONTE® perpetual, royalty-free brand name license due to lower than expected sales volume and pricing for beverage products in the United Kingdom related to the prepared food segment.

|

|

●

|

$1.1 million impairment related to damage caused by the February earthquake in Chile in the other fresh produce segment.

|

|

●

|

$1.3 million in termination benefits due to the discontinuation of the melon growing operations in Brazil in the other fresh produce segment.

|

|

●

|

$0.7 million impairment as a result of the relocation of a port facility in North America in the banana segment.

|

|

●

|

$(0.4) million of insurance reimbursements related to the 2008 flood damage in our Brazil banana plantations in the banana segment.

|

|

Banana Segment

|

Other Fresh

Produce Segment

|

Prepared

Foods

Segment

|

Other

Products & Services

|

|||||||||||||||||||||||||||||

|

Central

|

South

|

North

|

South

|

|||||||||||||||||||||||||||||

|

Europe

|

America

|

America

|

America

|

America

|

Europe

|

Europe

|

Totals

|

|||||||||||||||||||||||||

|

Impairment of long-lived and other assets

|

$ | - | $ | 2.8 | $ | (3.4 | ) | $ | - | $ | 10.5 | $ | 2.0 | $ | - | $ | 11.9 | |||||||||||||||

|

Total asset impairment charges (credits)

|

- | 2.8 | (3.4 | ) | - | 10.5 | 2.0 | - | 11.9 | |||||||||||||||||||||||

|

One-time termination benefits, contract

|

||||||||||||||||||||||||||||||||

|

termination costs and other exit

|

||||||||||||||||||||||||||||||||

|

activity charges (credits)

|

(0.8 | ) | - | - | (4.7 | ) | 0.4 | - | 1.2 | (3.9 | ) | |||||||||||||||||||||

|

Total asset impairment and other charges (credits), net

|

$ | (0.8 | ) | $ | 2.8 | $ | (3.4 | ) | $ | (4.7 | ) | $ | 10.9 | $ | 2.0 | $ | 1.2 | $ | 8.0 | |||||||||||||

|

●

|

$10.9 million asset impairment and other charges as a result of our decision to discontinue pineapple planting in Brazil and our decision to not use certain property, plant and equipment as originally intended for other crop production related to the other fresh produce segment.

|

|

●

|

$1.2 million in one-time termination benefits and contract termination costs resulting from our decision to discontinue our commercial cargo service in Europe related to the other products and services segment.

|

|

●

|

$2.0 million impairment of the DEL MONTE® perpetual, royalty-free brand name license due to lower than expected sales volume and pricing for beverage products in the United Kingdom related to the prepared food segment.

|

|

●

|

$2.8 million impairment charge related to an intangible asset for a non-compete agreement as a result of the Caribana acquisition related to the banana segment.

|

|

●

|

$(0.8) million in reversals of contract termination costs previously recorded related to the closure of an under-utilized distribution center in the United Kingdom related to the banana segment.

|

|

●

|

$(4.7) million principally due to a gain from the discontinuance of the retiree medical plan and the reversal of certain contract termination costs related to the previously announced closing of our Hawaii pineapple operations related to the other fresh produce segment.

|

|

●

|

$(3.4) million gain due to insurance recoveries related to the 2008 Brazil floods related to the banana segment.

|

|

Banana Segment

|

Other

Fresh Produce Segment

|

Prepared

Foods Segment

|

|

|||||||||||||||||||||

|

Central

|

South

|

North

|

||||||||||||||||||||||

|

Europe

|

America

|

America

|

America

|

Europe

|

Totals

|

|||||||||||||||||||

|

Impairment of long-lived and other assets

|

$ | 3.1 | $ | 2.8 | $ | 8.5 | $ | 0.3 | $ | - | $ | 14.7 | ||||||||||||

|

Total asset impairment charges

|

3.1 | 2.8 | 8.5 | 0.3 | - | 14.7 | ||||||||||||||||||

|

One-time termination benefits, contract

|

||||||||||||||||||||||||

|

termination costs and other exit

|

||||||||||||||||||||||||

|

activity charges (credits)

|

4.7 | - | - | (2.9 | ) | 1.9 | 3.7 | |||||||||||||||||

|

Total asset impairment and other charges (credits), net

|

$ | 7.8 | $ | 2.8 | $ | 8.5 | $ | (2.6 | ) | $ | 1.9 | $ | 18.4 | |||||||||||

|

●

|

$11.3 million in asset impairment charges, net of an insurance reimbursement, as a result of extensive flood damage at our banana farms in Brazil and Costa Rica related to the banana segment.

|

|

●

|

$10.0 million in asset impairment and contract termination costs principally due to the closure of under-utilized distribution centers and the previously announced closure of our beverage production operation in the United Kingdom related to the banana and prepared food segments.

|

|

●

|

$(2.9) million net gain primarily due to unrecognized prior service costs as a result of the previously announced closing of our Hawaii pineapple operations related to the other fresh produce segment.

|

|

Exit activity and

other reserve

balance at

January 1, 2010

|

Impact to Earnings

|

Cash Paid

|

Exit activity and

other reserve

balance at

December 31, 2010

|

|||||||||||||

|

One-time termination benefits

|

$ | 1.7 | $ | 1.4 | $ | (1.8 | ) | 1.3 | ||||||||

|

Contract termination and other

|

||||||||||||||||

|

exit activity charges

|

1.4 | 0.1 | - | 1.5 | ||||||||||||

| $ | 3.1 | $ | 1.5 | $ | (1.8 | ) | $ | 2.8 | ||||||||

|

December 31,

|

January 1,

|

|||||||

|

2010

|

2010

|

|||||||

|

Finished goods

|

$ | 138.8 | $ | 178.0 | ||||

|

Raw materials and packaging supplies

|

134.1 | 120.5 | ||||||

|

Growing crops

|

137.5 | 138.4 | ||||||

|

Total inventories

|

$ | 410.4 | $ | 436.9 | ||||

|

Company

|

Business

|

Ownership

Interest

|

|

Melones De Costa Rica, S.A.

|

Melon production

|

50%

|

|

Hacienda Filadelfia, S.A.

|

Melon production

|

50%

|

|

Frutas de Parrita, S.A.

|

Melon production

|

50%

|

|

Texas Specialty Produce Investors, LLC, Texas

|

Supplier of specialty produce and herbs

|

50%

|

|

Cartorama S.A.

|

Carton box corrugators

|

10%

|

|

December 31,

|

January 1,

|

|||||||

|

2010

|

2010

|

|||||||

|

Land and land improvements

|

$ | 495.7 | $ | 506.3 | ||||

|

Buildings and leasehold improvements

|

413.0 | 377.2 | ||||||

|

Machinery and equipment

|

405.1 | 386.3 | ||||||

|

Maritime equipment (including containers)

|

204.2 | 221.5 | ||||||

|

Furniture, fixtures and office equipment

|

98.2 | 99.3 | ||||||

|

Automotive equipment

|

44.8 | 44.5 | ||||||

|

Construction-in-progress

|

39.8 | 78.2 | ||||||

| 1,700.8 | 1,713.3 | |||||||

|

Less: accumulated depreciation and amortization

|

(667.7 | ) | (644.8 | ) | ||||

|

Property, plant and equipment, net

|

$ | 1,033.1 | $ | 1,068.5 | ||||

|

December 31,

|

January 1,

|

|||||||

|

2010

|

2010

|

|||||||

|

Goodwill

|

$ | 406.4 | $ | 409.0 | ||||

|

Indefinite-lived intangible assets:

|

||||||||

|

Trademarks

|

68.7 | 70.3 | ||||||

|

Definite-lived intangible assets:

|

||||||||

|

Definite-lived intangible assets

|

12.7 | 12.7 | ||||||

|

Accumulated amortization

|

(5.3 | ) | (3.8 | ) | ||||

|

Definite-lived intangible assets, net

|

7.4 | 8.9 | ||||||

|

Goodwill and other intangible assets, net

|

$ | 482.5 | $ | 488.2 | ||||

|

Bananas

|

Other fresh

produce

|

Prepared food

|

Totals

|

|||||||||||||

|

Goodwill

|

$ | 64.3 | $ | 284.5 | $ | 71.0 | $ | 419.8 | ||||||||

|

Accumulated impairment losses

|

- | (18.7 | ) | - | (18.7 | ) | ||||||||||

|

Balance as of December 26, 2008

|

$ | 64.3 | $ | 265.8 | $ | 71.0 | $ | 401.1 | ||||||||

|

Adjustment resulting from the subsequent

recognition of deferred taxes

|

1.0 | - | - | 1.0 | ||||||||||||

|

Foreign exchange and other

|

0.1 | 0.5 | 6.3 | 6.9 | ||||||||||||

|

Goodwill

|

$ | 65.4 | $ | 285.0 | $ | 77.3 | $ | 427.7 | ||||||||

|

Accumulated impairment losses

|

- | (18.7 | ) | - | (18.7 | ) | ||||||||||

|

Balance as of January 1, 2010

|

$ | 65.4 | $ | 266.3 | $ | 77.3 | $ | 409.0 | ||||||||

|

Adjustment resulting from the subsequent

recognition of deferred taxes

|

- | - | - | - | ||||||||||||

|

Foreign exchange and other

|

(0.1 | ) | (0.2 | ) | (2.3 | ) | (2.60 | ) | ||||||||

|

Goodwill

|

$ | 65.3 | $ | 284.8 | $ | 75.0 | $ | 425.1 | ||||||||

|

Accumulated impairment losses

|

- | (18.7 | ) | - | (18.7 | ) | ||||||||||

|

Balance as of December 31, 2010

|

$ | 65.3 | $ | 266.1 | $ | 75.0 | $ | 406.4 | ||||||||

|

Prepared Food Reporting Unit

|

||||||||||||||||||||||

|

Melon

Reporting Unit

Goodwill

|

Banana

Reporting Unit

Goodwill

|

Goodwill

|

U.K.

Beverage

Trademarks

|

Remaining

DEL MONTE®

Trademarks

|

||||||||||||||||||

|

Carrying Value

|

$ | 3.3 | $ | 65.2 | $ | 72.4 | $ | 5.1 | $ | 63.6 | ||||||||||||

|

Approximate percentage by which the fair value

|

||||||||||||||||||||||

|

exceeds the carrying value based on annual

|

3 | % | 8 | % | 3 | % | - | (1) | 16 | % | ||||||||||||

|

impairment test as of 1st day of fourth quarter

|

||||||||||||||||||||||

|

Amount that a one percentage point increase

|

||||||||||||||||||||||

|

in the discount rate and a 5% decrease in cash

|

$ | 3.3 | $ | 55.9 | $ | 34.4 | $ | 0.7 | (2) | $ | - | (3) | ||||||||||

|

flows would cause the carrying value to

|

||||||||||||||||||||||

|

exceed the fair value and trigger a fair

|

||||||||||||||||||||||

|

valuation

|

||||||||||||||||||||||

|

(1) The trademark for beverage products in the United Kingdom was impaired by $1.4 million during the third quarter of 2010.

|

|

(2) Represents additional impairment after applying the sensitivities disclosed above.

|

|

(3) As of December 31, 2010, applying the sensitivities disclosed above does not result in the carrying value exceeding the fair

value; however, after applying those sensitivities, the fair value exceeds the carrying value by approximately 6%.

|

|

2011

|

$ 1.5

|

|

2012

|

0.8

|

|

2013

|

0.8

|

|

2014