|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

o

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Montana

(State or other jurisdiction of incorporation or organization)

|

|

81-0331430

(IRS Employer Identification No.)

|

|

401 North 31st Street

Billings, Montana

(Address of principal executive offices)

|

|

59116

(Zip Code)

|

|

Class A common stock

(Title of each class)

|

|

NASDAQ Stock Market

(Name of each exchange on which registered)

|

|

þ

Large accelerated filer

|

o

Accelerated filer

|

o

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

Smaller reporting company

|

|

o

Emerging growth company

|

|||

|

Class A common stock

|

38,179,174

|

|

|

Class B common stock

|

22,451,963

|

|

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

|

||

|

Index

|

||

|

December 31, 2018

|

||

|

Page Nos.

|

||

|

Item 1

|

||

|

Item 1A

|

||

|

Item 1B

|

||

|

Item 2

|

||

|

Item 3

|

||

|

Item 4

|

||

|

Item 5

|

||

|

Item 6

|

||

|

Item 7

|

||

|

Item 7A

|

||

|

Item 8

|

||

|

Item 9

|

||

|

Item 9A

|

||

|

Item 9B

|

||

|

Item 10

|

||

|

Item 11

|

||

|

Item 12

|

||

|

Item 13

|

||

|

Item 14

|

||

|

Item 15

|

||

|

Financial Statement Schedules (None required)

|

||

|

Item 16

|

Form 10-K Summary (None)

|

|

|

Deposit Market Share and Branch Locations by State

|

|||||

|

|

% of Market Deposits

(1)

|

Deposit Market Share Rank

(1)

|

Number of Branches

(2)

|

||

|

Montana

|

17.83%

|

2nd

|

48

|

||

|

Idaho

|

2.53

|

12th

|

17

|

||

|

Oregon

|

2.42

|

9th

|

33

|

||

|

South Dakota

|

0.14

|

12th

|

15

|

||

|

Washington

|

0.38

|

30th

|

18

|

||

|

Wyoming

|

15.53

|

2nd

|

16

|

||

|

Total

|

147

|

||||

|

•

|

demand for our products and services may decline;

|

|

•

|

loan delinquencies, problem assets, and foreclosures may increase;

|

|

•

|

collateral for loans, especially real estate, may decline in value;

|

|

•

|

future borrowing power of our customers may be reduced;

|

|

•

|

the value of our securities portfolio may decline; and

|

|

•

|

the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us.

|

|

Phase-In

|

Fully Phased-In

|

Well-Capitalized Minimums

|

|||||

|

Minimum Regulatory

|

Minimum Ratio + Capital

|

Minimum Ratio + Capital

|

|||||

|

Capital Ratio

|

Conservation Buffer

|

Conservation Buffer

|

For the Company

|

For the Bank

|

The Company

|

The Bank

|

|

|

Common Equity Tier 1 Capital Ratio

|

4.50%

|

6.375%

|

7.00%

|

N/A

|

6.50%

|

11.40%

|

11.27%

|

|

Tier 1 Capital Ratio

|

6.00%

|

7.875%

|

8.50%

|

6.00%

|

8.00%

|

12.26%

|

11.27%

|

|

Total Capital Ratio

|

8.00%

|

9.875%

|

10.50%

|

8.00%

|

10.00%

|

12.99%

|

12.01%

|

|

Tier 1 Leverage Ratio

|

4.00%

|

N/A

|

N/A

|

N/A

|

5.00%

|

9.47%

|

8.97%

|

|

•

|

prevailing market conditions;

|

|

•

|

our historical performance and capital structure;

|

|

•

|

estimates of our business potential and earnings prospects;

|

|

•

|

an overall assessment of our management;

|

|

•

|

conversion by our Class B shareholders of their shares into Class A common stock to liquidate their holdings;

|

|

•

|

our performance relative to our peers;

|

|

•

|

market demand for our shares;

|

|

•

|

perceptions of the banking industry in general;

|

|

•

|

political influences on investor sentiment; and

|

|

•

|

consumer confidence.

|

|

•

|

a majority of the board of directors consist of independent directors;

|

|

•

|

the compensation of officers be determined, or recommended to the board of directors for determination, by a majority of the independent directors or a compensation committee comprised solely of independent directors; and

|

|

•

|

director nominees be selected, or recommended for the board of directors’ selection, by a majority of the independent directors or a nominating committee comprised solely of independent directors with a written charter or board resolution addressing the nomination process.

|

|

•

|

100,000,000

shares are designated as Class A common stock;

|

|

•

|

100,000,000

shares are designated as Class B common stock; and

|

|

•

|

100,000

shares are designated as preferred stock.

|

|

•

|

when the number of shares of Class B Common Stock constitutes less than 20% of the aggregate number of shares of Common Stock then outstanding as of the record date for a shareholder meeting, as determined by the Board of Directors of the Corporation, each share of Class B Common Stock then issued and outstanding is automatically converted into one fully paid and non-assessable share of Class A Common Stock and will have one vote per share; or

|

|

•

|

upon any transfer, whether or not for value, except for transfers to the holder’s spouse, certain of the holder’s relatives, the trustees of certain trusts established for their benefit, corporations and partnerships wholly-owned by the holders and their relatives, the holder’s estate and other holders of Class B common stock.

|

|

Quarter Ended

|

High

|

Low

|

Common Dividends Paid

|

|||

|

March 31, 2017

|

$45.35

|

$37.15

|

$0.24

|

|||

|

June 30, 2017

|

41.05

|

33.70

|

0.24

|

|||

|

September 30, 2017

|

38.40

|

33.33

|

0.24

|

|||

|

December 31, 2017

|

41.25

|

36.00

|

0.24

|

|||

|

March 31, 2018

|

42.90

|

38.10

|

0.28

|

|||

|

June 30, 2018

|

44.95

|

38.70

|

0.28

|

|||

|

September 30, 2018

|

47.05

|

41.95

|

0.28

|

|||

|

December 31, 2018

|

46.51

|

34.61

|

0.28

|

|||

|

Total Number of

|

Maximum Number

|

|||||||||

|

Shares Purchased as Part

|

of Shares That May

|

|||||||||

|

Total Number of

|

Average Price

|

of Publicly Announced

|

Yet Be Purchased Under

|

|||||||

|

Period

|

Shares Purchased (1)

|

Paid Per Share

|

Plans or Programs

|

the Plans or Programs

|

||||||

|

October 2018

|

—

|

$

|

—

|

|

—

|

24,123

|

||||

|

November 2018

|

—

|

—

|

|

—

|

24,123

|

|||||

|

December 2018

|

581

|

44.07

|

|

—

|

24,123

|

|||||

|

Total

|

581

|

$

|

44.07

|

|

—

|

24,123

|

||||

|

(1)

|

Stock repurchases were redemptions of vested restricted shares tendered in lieu of cash for payment of income tax withholding amounts by participants of the Company’s 2015 Equity Compensation Plan.

|

|

|

||||||||||||||||||

|

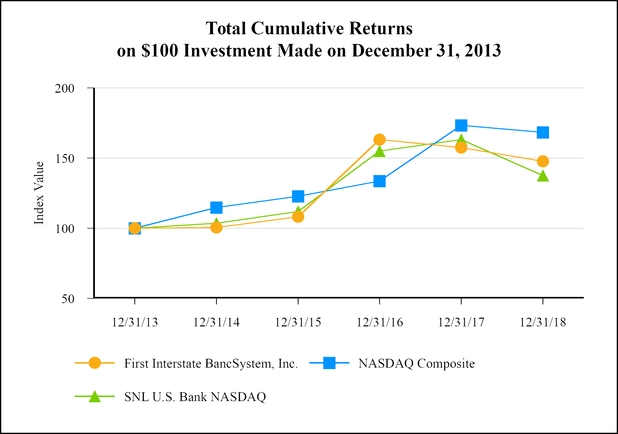

Index

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

||||||||||||

|

First Interstate BancSystem, Inc.

|

$

|

100.00

|

|

$

|

100.49

|

|

$

|

108.15

|

|

$

|

163.23

|

|

$

|

157.53

|

|

$

|

147.67

|

|

|

NASDAQ Composite

|

100.00

|

|

114.75

|

|

122.74

|

|

133.62

|

|

173.22

|

|

168.30

|

|

||||||

|

SNL U.S. Bank NASDAQ

|

100.00

|

|

103.57

|

|

111.80

|

|

155.02

|

|

163.20

|

|

137.56

|

|

||||||

|

Five Year Summary

(Dollars in millions except share and per share data)

|

|||||||||||||||

|

As of or for the year ended December 31,

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||

|

Selected Balance Sheet Data:

|

|

|

|

|

|

||||||||||

|

Net loans

|

$

|

8,430.7

|

|

$

|

7,542.2

|

|

$

|

5,402.3

|

|

$

|

5,169.4

|

|

$

|

4,823.2

|

|

|

Investment securities

|

2,677.5

|

|

2,693.2

|

|

2,124.5

|

|

2,057.5

|

|

2,287.1

|

|

|||||

|

Total assets

|

13,300.2

|

|

12,213.3

|

|

9,063.9

|

|

8,728.2

|

|

8,609.9

|

|

|||||

|

Deposits

|

10,680.7

|

|

9,934.9

|

|

7,376.1

|

|

7,088.9

|

|

7,006.2

|

|

|||||

|

Securities sold under repurchase agreements

|

712.4

|

|

643.0

|

|

537.6

|

|

510.6

|

|

502.3

|

|

|||||

|

Long-term debt

|

15.8

|

|

13.1

|

|

28.0

|

|

27.9

|

|

38.1

|

|

|||||

|

Subordinated debentures held by subsidiary trusts

|

86.9

|

|

82.5

|

|

82.5

|

|

82.5

|

|

82.5

|

|

|||||

|

Common stockholders’ equity

|

$

|

1,693.9

|

|

$

|

1,427.6

|

|

$

|

982.6

|

|

$

|

950.5

|

|

$

|

908.9

|

|

|

Selected Income Statement Data:

|

|||||||||||||||

|

Interest income

|

$

|

473.4

|

|

$

|

377.8

|

|

$

|

297.4

|

|

$

|

282.4

|

|

$

|

267.1

|

|

|

Interest expense

|

40.9

|

|

28.0

|

|

17.6

|

|

18.1

|

|

18.6

|

|

|||||

|

Net interest income

|

432.5

|

|

349.8

|

|

279.8

|

|

264.3

|

|

248.5

|

|

|||||

|

Provision for loan losses

|

8.6

|

|

11.0

|

|

10.0

|

|

6.8

|

|

(6.6

|

)

|

|||||

|

Net interest income after provision for loan losses

|

423.9

|

|

338.8

|

|

269.8

|

|

257.5

|

|

255.1

|

|

|||||

|

Non-interest income

|

143.3

|

|

141.8

|

|

136.5

|

|

121.5

|

|

111.8

|

|

|||||

|

Non-interest expense

|

360.9

|

|

323.9

|

|

261.0

|

|

248.6

|

|

237.3

|

|

|||||

|

Income before income taxes

|

206.3

|

|

156.7

|

|

145.3

|

|

130.4

|

|

129.6

|

|

|||||

|

Income tax expense

|

46.1

|

|

50.2

|

|

49.6

|

|

43.7

|

|

45.2

|

|

|||||

|

Net income available to common shareholders

|

$

|

160.2

|

|

$

|

106.5

|

|

$

|

95.7

|

|

$

|

86.7

|

|

$

|

84.4

|

|

|

Common Share Data:

|

|||||||||||||||

|

Earnings per share:

|

|||||||||||||||

|

Basic

|

$

|

2.77

|

|

$

|

2.07

|

|

$

|

2.15

|

|

$

|

1.92

|

|

$

|

1.89

|

|

|

Diluted

|

2.75

|

|

2.05

|

|

2.13

|

|

1.90

|

|

1.87

|

|

|||||

|

Dividends per share

|

1.12

|

|

0.96

|

|

0.88

|

|

0.80

|

|

0.64

|

|

|||||

|

Book value per share (1)

|

27.94

|

|

25.28

|

|

21.87

|

|

20.92

|

|

19.85

|

|

|||||

|

Tangible book value per share (2)

|

$

|

17.52

|

|

$

|

16.04

|

|

$

|

16.92

|

|

$

|

16.19

|

|

$

|

15.07

|

|

|

Weighted average shares outstanding:

|

|||||||||||||||

|

Basic

|

57,778,857

|

|

51,429,366

|

|

44,511,774

|

|

45,184,091

|

|

44,615,060

|

|

|||||

|

Diluted

|

58,217,123

|

|

51,903,209

|

|

44,910,396

|

|

45,646,418

|

|

45,210,561

|

|

|||||

|

Five Year Summary (continued)

(Dollars in millions except share and per share data)

|

|||||||||||||||

|

As of or for the year ended December 31,

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||

|

Financial Ratios:

|

|

|

|

|

|

||||||||||

|

Return on average assets

|

1.27

|

%

|

0.98

|

%

|

1.10

|

%

|

1.02

|

%

|

1.06

|

%

|

|||||

|

Return on average common stockholders’ equity

|

10.50

|

|

8.57

|

|

9.93

|

|

9.37

|

|

9.86

|

|

|||||

|

Return on average tangible common equity (3)

|

16.70

|

|

12.76

|

|

12.81

|

|

12.23

|

|

12.88

|

|

|||||

|

Average stockholders’ equity to average assets

|

12.10

|

|

11.45

|

|

11.04

|

|

10.87

|

|

10.77

|

|

|||||

|

Yield on average earning assets

|

4.24

|

|

3.93

|

|

3.80

|

|

3.70

|

|

3.75

|

|

|||||

|

Cost of average interest bearing liabilities

|

0.51

|

|

0.39

|

|

0.30

|

|

0.31

|

|

0.34

|

|

|||||

|

Interest rate spread

|

3.73

|

|

3.54

|

|

3.50

|

|

3.39

|

|

3.41

|

|

|||||

|

Net interest margin (4)

|

3.88

|

|

3.64

|

|

3.57

|

|

3.46

|

|

3.49

|

|

|||||

|

Efficiency ratio (5)

|

61.31

|

|

64.77

|

|

61.88

|

|

63.55

|

|

65.24

|

|

|||||

|

Common stock dividend payout ratio (6)

|

40.43

|

|

46.38

|

|

40.93

|

|

41.65

|

|

33.83

|

|

|||||

|

Loan to deposit ratio

|

79.62

|

|

76.64

|

|

74.27

|

|

74.01

|

|

69.90

|

|

|||||

|

Asset Quality Ratios:

|

|

|

|

|

|

|

|

|

|||||||

|

Non-performing loans to total loans (7)

|

0.68

|

%

|

0.95

|

%

|

1.40

|

%

|

1.37

|

%

|

1.32

|

%

|

|||||

|

Non-performing assets to total loans and other real estate owned (OREO) (8)

|

0.85

|

|

1.08

|

|

1.58

|

|

1.49

|

|

1.59

|

|

|||||

|

Non-performing assets to total assets

|

0.55

|

|

0.68

|

|

0.96

|

|

0.90

|

|

0.91

|

|

|||||

|

Allowance for loan losses to total loans

|

0.86

|

|

0.95

|

|

1.39

|

|

1.46

|

|

1.52

|

|

|||||

|

Allowance for loan losses to non-performing loans

|

125.65

|

|

99.40

|

|

99.52

|

|

106.71

|

|

114.58

|

|

|||||

|

Net charge-offs to average loans

|

0.10

|

|

0.23

|

|

0.20

|

|

0.08

|

|

0.10

|

|

|||||

|

Capital Ratios:

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Tangible common equity to tangible assets (9)

|

8.39

|

%

|

7.75

|

%

|

8.60

|

%

|

8.64

|

%

|

8.22

|

%

|

|||||

|

Common equity tier 1 capital ratio (10)

|

11.40

|

|

11.04

|

|

12.65

|

|

12.69

|

|

13.08

|

|

|||||

|

Tier 1 capital ratio

|

12.26

|

|

11.93

|

|

13.89

|

|

13.99

|

|

14.52

|

|

|||||

|

Total capital ratio

|

12.99

|

|

12.76

|

|

15.13

|

|

15.36

|

|

16.15

|

|

|||||

|

Tier 1 leverage ratio

|

9.47

|

|

8.86

|

|

10.11

|

|

10.12

|

|

9.61

|

|

|||||

|

(1)

|

For purposes of computing book value per share, book value equals common stockholders’ equity.

|

|

(2)

|

Tangible book value per share is a non-GAAP financial measure that management uses to evaluate our capital adequacy. For purposes of computing tangible book value per share, tangible book value equals total common stockholders’ equity less goodwill, and other intangible assets (excluding mortgage servicing rights). Tangible book value per share is calculated as tangible common stockholders’ equity divided by common shares outstanding, and its most directly comparable GAAP financial measure is book value per share. See below our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measures” in this Part II, Item 6.

|

|

(3)

|

Return on average tangible common equity is a non-GAAP financial measure. For purposes of computing return on average tangible common equity, average tangible common stockholders’ equity equals average total stockholders’ equity less average goodwill and average other intangible assets (excluding mortgage servicing rights). Return on average tangible common equity is calculated as net income available to common shareholders divided by average tangible common stockholders’ equity, and its most directly comparable GAAP financial measure is return on average common stockholders’ equity. See below our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measures” in this Part II, Item 6.

|

|

(4)

|

Net interest margin ratio is presented on a fully taxable equivalent, or FTE, basis.

|

|

(5)

|

In 2017, the Company conformed our efficiency ratio definition to the FDIC definition for all periods presented as non-interest expense less amortization of intangible assets divided by net interest income plus non-interest income.

|

|

(6)

|

Common stock dividend payout ratio represents dividends per common share divided by basic earnings per common share.

|

|

(7)

|

Non-performing loans include non-accrual loans and loans past due 90 days or more and still accruing interest.

|

|

(8)

|

Non-performing assets include non-accrual loans, loans past due 90 days or more and still accruing interest and OREO.

|

|

(9)

|

Tangible common equity to tangible assets is a non-GAAP financial measure that management uses to evaluate our capital adequacy. For purposes of computing tangible common equity to tangible assets, tangible common equity is calculated as total common stockholders’ equity less goodwill and other intangible assets (excluding mortgage servicing assets), and tangible assets is calculated as total assets less goodwill and other intangible assets (excluding mortgage servicing rights). The most directly comparable GAAP financial measure to tangible common equity to tangible assets is common equity to assets. See below our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measures” in this Part II, Item 6.

|

|

(10)

|

For purposes of computing tier 1 common capital to total risk-weighted assets, tier 1 common capital excludes preferred stock and trust preferred securities.

|

|

Non-GAAP Financial Measures - Five Year Summary

(Dollars in millions except share and per share data)

|

|||||||||||||||

|

As of December 31,

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||

|

Total common stockholders’ equity (GAAP)

|

$

|

1,693.9

|

|

$

|

1,427.6

|

|

$

|

982.6

|

|

$

|

950.5

|

|

$

|

908.9

|

|

|

Less goodwill and other intangible assets

(excluding mortgage servicing rights)

|

631.6

|

|

521.8

|

|

222.5

|

|

215.1

|

|

218.9

|

|

|||||

|

Tangible common stockholders’ equity

(Non-GAAP)

|

1,062.3

|

|

905.8

|

|

760.1

|

|

735.4

|

|

690.0

|

|

|||||

|

Total Assets (GAAP)

|

$

|

13,300.2

|

|

$

|

12,213.3

|

|

$

|

9,063.9

|

|

$

|

8,728.2

|

|

$

|

8,609.9

|

|

|

Less goodwill and other intangible assets

(excluding mortgage servicing rights)

|

631.6

|

|

521.8

|

|

222.5

|

|

215.1

|

|

218.9

|

|

|||||

|

Tangible assets (Non-GAAP)

|

$

|

12,668.6

|

|

$

|

11,691.5

|

|

$

|

8,841.4

|

|

$

|

8,513.1

|

|

$

|

8,391.0

|

|

|

Average Balances:

|

|||||||||||||||

|

Total common stockholders’ equity (GAAP)

|

$

|

1,525.8

|

|

$

|

1,243.7

|

|

$

|

963.5

|

|

$

|

926.1

|

|

$

|

855.9

|

|

|

Less goodwill and other intangible assets

(excluding mortgage servicing rights)

|

566.6

|

|

408.9

|

|

216.7

|

|

216.5

|

|

200.7

|

|

|||||

|

Average tangible common stockholders’ equity (Non-GAAP)

|

$

|

959.2

|

|

$

|

834.8

|

|

$

|

746.8

|

|

$

|

709.6

|

|

$

|

655.2

|

|

|

Common shares outstanding

|

60,623,247

|

|

56,465,559

|

|

44,926,176

|

|

45,458,255

|

|

45,788,415

|

|

|||||

|

Net income available to common shareholders

|

$

|

160.2

|

|

$

|

106.5

|

|

$

|

95.7

|

|

$

|

86.8

|

|

$

|

84.4

|

|

|

Book value per common share (GAAP)

|

$

|

27.94

|

|

$

|

25.28

|

|

$

|

21.87

|

|

$

|

20.91

|

|

$

|

19.85

|

|

|

Tangible book value per common share

(Non-GAAP)

|

17.52

|

|

16.04

|

|

16.92

|

|

16.18

|

|

15.07

|

|

|||||

|

Tangible common equity to tangible assets (Non-GAAP)

|

8.39

|

%

|

7.75

|

%

|

8.60

|

%

|

8.64

|

%

|

8.22

|

%

|

|||||

|

Return on average common tangible equity (Non-GAAP)

|

16.70

|

|

12.76

|

|

12.81

|

|

12.23

|

|

12.88

|

|

|||||

|

•

|

political, legal, regulatory, and general economic or business conditions, either nationally or regionally;

|

|

•

|

geopolitical uncertainties throughout the world that may impact our business and our customers’ businesses;

|

|

•

|

weather-related, disease, and other adverse climate or other conditions that may impact our business and our customers’ business;

|

|

•

|

changes in the interest rate environment or interest rate changes made by the Federal Reserve;

|

|

•

|

credit performance of our loan portfolio;

|

|

•

|

adequacy of the allowance for loan losses and access to low-cost funding sources;

|

|

•

|

the unavailability of LIBOR:

|

|

•

|

impairment of goodwill;

|

|

•

|

dependence on the Company’s management team and ability to attract and retain qualified employees;

|

|

•

|

governmental regulation and changes in regulatory, tax and accounting rules and interpretations;

|

|

•

|

stringent capital requirements;

|

|

•

|

future FDIC insurance premium increases;

|

|

•

|

CFPB restrictions on our ability to originate and sell mortgage loans;

|

|

•

|

cyber-security risks, including items such as “denial of service,” “hacking” and “identity theft”;

|

|

•

|

significant litigation and regulatory proceedings;

|

|

•

|

inability to meet liquidity requirements;

|

|

•

|

environmental remediation and other costs;

|

|

•

|

ineffective internal operational controls;

|

|

•

|

competitive pressures among depository and other financial institutions may increase significantly;

|

|

•

|

competitors may have greater financial resources or develop products that enable them to compete more successfully and may be subject to different regulatory standards than us;

|

|

•

|

reliance on external vendors;

|

|

•

|

soundness of other financial institutions;

|

|

•

|

failure of technology and failure to effectively implement technology-driven products and services;

|

|

•

|

risks associated with introducing and implementing new lines of business, products or services;

|

|

•

|

failure to execute on strategic or operational plans, including the ability to complete mergers and acquisitions or fully achieve expected cost savings or revenue growth associated with mergers and acquisitions;

|

|

•

|

deposit attrition, customer loss and/or revenue loss following completed mergers/acquisitions;

|

|

•

|

anti-takeover provisions;

|

|

•

|

change in dividend policy and the inability of our bank subsidiary to pay dividends;

|

|

•

|

uninsured nature of any investment in Class A and Class B common stock;

|

|

•

|

decline in market price and volatility of Class A and Class B common stock;

|

|

•

|

voting control of Class B stockholders;

|

|

•

|

dilution as a result of future equity issuances;

|

|

•

|

controlled company status; and,

|

|

•

|

subordination of Class A and Class B common stock to Company debt.

|

|

|

Year Ended December 31,

|

|||||||||||||||||||||||||

|

|

2018

|

2017

|

2016

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

|

Average

Rate

|

Average

Balance |

Interest

|

Average

Rate |

Average

Balance |

Interest

|

Average

Rate |

||||||||||||||||||

|

Interest earning assets:

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Loans (1) (2)

|

$

|

7,985.0

|

|

$

|

405.9

|

|

5.08

|

%

|

$

|

6,675.4

|

|

$

|

327.4

|

|

4.90

|

%

|

$

|

5,378.3

|

|

$

|

261.7

|

|

4.87

|

%

|

||

|

Investment securities (2)

|

2,639.4

|

|

58.4

|

|

2.21

|

|

2,417.5

|

|

47.6

|

|

1.97

|

|

2,093.5

|

|

37.6

|

|

1.80

|

|

||||||||

|

Interest bearing deposits in banks

|

573.6

|

|

11.3

|

|

1.97

|

|

634.2

|

|

7.1

|

|

1.13

|

|

478.9

|

|

2.6

|

|

0.54

|

|

||||||||

|

Federal funds sold

|

11.1

|

|

—

|

|

—

|

|

0.7

|

|

—

|

|

—

|

|

1.6

|

|

—

|

|

—

|

|

||||||||

|

Total interest earnings assets

|

11,209.1

|

|

475.6

|

|

4.24

|

|

9,727.8

|

|

382.1

|

|

3.93

|

|

7,952.3

|

|

301.9

|

|

3.80

|

|

||||||||

|

Non-earning assets

|

1,405.6

|

|

1,133.7

|

|

772.1

|

|

||||||||||||||||||||

|

Total assets

|

$

|

12,614.7

|

|

$

|

10,861.5

|

|

$

|

8,724.4

|

|

|||||||||||||||||

|

Interest bearing liabilities:

|

|

|

|

|||||||||||||||||||||||

|

Demand deposits

|

$

|

2,882.8

|

|

$

|

8.1

|

|

0.28

|

%

|

$

|

2,553.1

|

|

$

|

5.5

|

|

0.21

|

%

|

$

|

2,162.6

|

|

$

|

2.2

|

|

0.10

|

%

|

||

|

Savings deposits

|

3,166.7

|

|

12.5

|

|

0.39

|

|

2,739.2

|

|

7.7

|

|

0.28

|

|

2,037.4

|

|

2.7

|

|

0.13

|

|

||||||||

|

Time deposits

|

1,199.5

|

|

12.0

|

|

1.00

|

|

1,112.7

|

|

8.2

|

|

0.73

|

|

1,094.2

|

|

7.8

|

|

0.71

|

|

||||||||

|

Repurchase agreements

|

642.8

|

|

2.7

|

|

0.42

|

|

587.1

|

|

1.3

|

|

0.21

|

|

481.0

|

|

0.4

|

|

0.09

|

|

||||||||

|

Other borrowed funds

|

1.7

|

|

0.2

|

|

11.76

|

|

23.9

|

|

1.5

|

|

6.42

|

|

—

|

|

—

|

|

—

|

|

||||||||

|

Long-term debt

|

17.6

|

|

1.3

|

|

7.39

|

|

8.0

|

|

0.6

|

|

7.48

|

|

28.2

|

|

1.8

|

|

6.43

|

|

||||||||

|

Subordinated debentures held by subsidiary trusts

|

84.1

|

|

4.1

|

|

4.88

|

|

82.5

|

|

3.1

|

|

3.85

|

|

82.5

|

|

2.8

|

|

3.34

|

|

||||||||

|

Total interest bearing liabilities

|

7,995.2

|

|

40.9

|

|

0.51

|

|

7,106.5

|

|

27.9

|

|

0.39

|

|

5,885.9

|

|

17.7

|

|

0.30

|

|

||||||||

|

Non-interest bearing deposits

|

2,984.3

|

|

2,430.9

|

|

1,812.6

|

|

||||||||||||||||||||

|

Other non-interest bearing liabilities

|

109.4

|

|

80.4

|

|

62.4

|

|

||||||||||||||||||||

|

Stockholders’ equity

|

1,525.8

|

|

1,243.7

|

|

963.5

|

|

||||||||||||||||||||

|

Total liabilities and stockholders’ equity

|

$

|

12,614.7

|

|

$

|

10,861.5

|

|

$

|

8,724.4

|

|

|||||||||||||||||

|

Net FTE interest income

|

$

|

434.7

|

|

|

$

|

354.2

|

|

$

|

284.2

|

|

||||||||||||||||

|

Less FTE adjustments (2)

|

(2.2

|

)

|

|

(4.4

|

)

|

(4.5

|

)

|

|||||||||||||||||||

|

Net interest income from consolidated statements of income

|

$

|

432.5

|

|

|

$

|

349.8

|

|

$

|

279.7

|

|

||||||||||||||||

|

Interest rate spread

|

3.73

|

%

|

|

3.54

|

%

|

3.50

|

%

|

|||||||||||||||||||

|

Net FTE interest margin (3)

|

3.88

|

%

|

|

3.64

|

%

|

3.57

|

%

|

|||||||||||||||||||

|

Cost of funds, including non-interest bearing demand deposits (4)

|

0.37

|

%

|

0.29

|

%

|

0.23

|

%

|

||||||||||||||||||||

|

(1)

|

Average loan balances include non-accrual loans. Interest income on loans includes amortization of deferred loan fees net of deferred loan costs, which is not material.

|

|

(2)

|

Interest income and average rates for tax exempt loans and securities are presented on a fully taxable equivalent, or FTE, basis. The federal income tax rate of 21%, 35%, and 35% was utilized at

December 31, 2018

,

2017

, and

2016

, respectively.

|

|

(3)

|

Net FTE interest margin during the period equals (i) the difference between interest income on interest earning assets and the interest expense on interest bearing liabilities, divided by (ii) average interest earning assets for the period.

|

|

(4)

|

Cost of funds including non-interest bearing demand deposits is calculated by dividing total interest on interest bearing liabilities by the sum of total interest bearing liabilities plus non-interest bearing deposits.

|

|

Analysis of Interest Changes Due To Volume and Rates

(Dollars in millions)

|

|||||||||||||||||||||||||||||

|

Year Ended December 31, 2018

compared with

December 31, 2017

|

Year Ended December 31, 2017

compared with December 31, 2016 |

Year Ended December 31, 2016

compared with December 31, 2015 |

|||||||||||||||||||||||||||

|

|

Volume

|

Rate

|

Net

|

Volume

|

Rate

|

Net

|

Volume

|

Rate

|

Net

|

||||||||||||||||||||

|

Interest earning assets:

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Loans (1)

|

$

|

64.2

|

|

$

|

14.3

|

|

$

|

78.5

|

|

$

|

63.1

|

|

$

|

2.6

|

|

$

|

65.7

|

|

$

|

15.8

|

|

$

|

(2.1

|

)

|

$

|

13.7

|

|

||

|

Investment Securities (1)

|

4.4

|

|

6.4

|

|

10.8

|

|

5.8

|

|

4.1

|

|

9.9

|

|

(1.7

|

)

|

2.1

|

|

0.4

|

|

|||||||||||

|

Interest bearing deposits in banks

|

(0.7

|

)

|

4.9

|

|

4.2

|

|

0.8

|

|

3.7

|

|

4.5

|

|

(0.1

|

)

|

1.1

|

|

1.0

|

|

|||||||||||

|

Total change

|

67.9

|

|

25.6

|

|

93.5

|

|

69.7

|

|

10.4

|

|

80.1

|

|

14.0

|

|

1.1

|

|

15.1

|

|

|||||||||||

|

Interest bearing liabilities:

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Demand deposits

|

0.7

|

|

1.9

|

|

2.6

|

|

0.4

|

|

2.9

|

|

3.3

|

|

0.1

|

|

—

|

|

0.1

|

|

|||||||||||

|

Savings deposits

|

1.2

|

|

3.6

|

|

4.8

|

|

0.9

|

|

4.1

|

|

5.0

|

|

0.1

|

|

—

|

|

0.1

|

|

|||||||||||

|

Time deposits

|

0.6

|

|

3.2

|

|

3.8

|

|

0.1

|

|

0.2

|

|

0.3

|

|

(0.6

|

)

|

(0.1

|

)

|

(0.7

|

)

|

|||||||||||

|

Repurchase agreements

|

0.1

|

|

1.3

|

|

1.4

|

|

0.1

|

|

0.7

|

|

0.8

|

|

—

|

|

0.2

|

|

0.2

|

|

|||||||||||

|

Other borrowed funds

|

(1.4

|

)

|

0.1

|

|

(1.3

|

)

|

—

|

|

1.5

|

|

1.5

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Long-term debt

|

0.7

|

|

—

|

|

0.7

|

|

(1.3

|

)

|

0.1

|

|

(1.2

|

)

|

(0.8

|

)

|

0.4

|

|

(0.4

|

)

|

|||||||||||

|

Subordinated debentures held by subsidiary trusts

|

0.1

|

|

0.9

|

|

1.0

|

|

—

|

|

0.4

|

|

0.4

|

|

—

|

|

0.3

|

|

0.3

|

|

|||||||||||

|

Total change

|

2.0

|

|

11.0

|

|

13.0

|

|

0.2

|

|

9.9

|

|

10.1

|

|

(1.2

|

)

|

0.8

|

|

(0.4

|

)

|

|||||||||||

|

Increase (decrease) in FTE net interest income (1)

|

$

|

65.9

|

|

$

|

14.6

|

|

$

|

80.5

|

|

$

|

69.5

|

|

$

|

0.5

|

|

$

|

70.0

|

|

$

|

15.2

|

|

$

|

0.3

|

|

$

|

15.5

|

|

||

|

(1)

|

Interest income and average rates for tax exempt loans and securities are presented on a FTE basis.

|

|

Non-interest income

(Dollars in millions)

|

||||||||||||||||||

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs 2017

|

2017 vs 2016

|

|||||||||||||

|

Payment services revenues

|

$

|

43.3

|

|

$

|

43.3

|

|

$

|

34.4

|

|

—

|

%

|

25.9

|

%

|

|||||

|

Mortgage banking revenues

|

24.9

|

|

28.9

|

|

37.2

|

|

(13.8

|

)

|

(22.3

|

)

|

||||||||

|

Wealth management revenues

|

23.2

|

|

21.1

|

|

20.5

|

|

10.0

|

|

2.9

|

|

||||||||

|

Service charges on deposit accounts

|

21.8

|

|

21.3

|

|

18.4

|

|

2.3

|

|

15.8

|

|

||||||||

|

Other service charges, commissions and fees

|

15.1

|

|

13.3

|

|

11.5

|

|

13.5

|

|

15.7

|

|

||||||||

|

Loss on termination of interest rate swap

|

—

|

|

(1.1

|

)

|

—

|

|

NM

|

|

NM

|

|

||||||||

|

Investment securities (losses) gains, net

|

(0.1

|

)

|

0.7

|

|

0.3

|

|

NM

|

|

NM

|

|

||||||||

|

Other income

|

15.1

|

|

14.3

|

|

10.0

|

|

5.6

|

|

43.0

|

|

||||||||

|

Non-recurring litigation recovery

|

—

|

|

—

|

|

4.2

|

|

NM

|

|

NM

|

|

||||||||

|

Total non-interest income

|

$

|

143.3

|

|

$

|

141.8

|

|

$

|

136.5

|

|

1.1

|

%

|

3.9

|

%

|

|||||

|

Non-interest expense

(Dollars in millions)

|

||||||||||||||||||

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs 2017

|

2017 vs 2016

|

|||||||||||||

|

Salaries and wages

|

$

|

146.4

|

|

$

|

122.7

|

|

$

|

108.7

|

|

19.3

|

%

|

12.9

|

%

|

|||||

|

Employee benefits

|

47.9

|

|

37.6

|

|

35.2

|

|

27.4

|

|

6.8

|

|

||||||||

|

Outsourced technology services

|

28.7

|

|

25.1

|

|

20.5

|

|

14.3

|

|

22.4

|

|

||||||||

|

Occupancy, net

|

25.4

|

|

22.4

|

|

17.7

|

|

13.4

|

|

26.6

|

|

||||||||

|

Furniture and equipment

|

12.7

|

|

11.5

|

|

9.6

|

|

10.4

|

|

19.8

|

|

||||||||

|

OREO expense, net of income

|

0.3

|

|

0.4

|

|

—

|

|

(25.0

|

)

|

—

|

|

||||||||

|

Professional fees

|

6.9

|

|

6.8

|

|

5.0

|

|

1.5

|

|

36.0

|

|

||||||||

|

FDIC insurance premiums

|

5.6

|

|

4.7

|

|

4.5

|

|

19.1

|

|

4.4

|

|

||||||||

|

Mortgage servicing rights amortization

|

3.1

|

|

3.0

|

|

3.0

|

|

3.3

|

|

—

|

|

||||||||

|

Mortgage servicing rights impairment recovery

|

—

|

|

(0.1

|

)

|

—

|

|

NM

|

|

NM

|

|

||||||||

|

Core deposit intangibles amortization

|

7.9

|

|

5.5

|

|

3.4

|

|

43.6

|

|

61.8

|

|

||||||||

|

Other expenses

|

63.6

|

|

57.1

|

|

50.6

|

|

11.4

|

|

12.8

|

|

||||||||

|

Acquisition related expenses

|

12.4

|

|

27.2

|

|

2.8

|

|

(54.4

|

)

|

871.4

|

|

||||||||

|

Total non-interest expense

|

$

|

360.9

|

|

$

|

323.9

|

|

$

|

261.0

|

|

11.4

|

%

|

24.1

|

%

|

|||||

|

Quarterly Results

(Unaudited)

(Dollars in millions except per share data)

|

||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

|||||||||

|

Year Ended December 31, 2018

(1)

|

|

|

|

|

||||||||

|

Interest income

|

$

|

107.6

|

|

$

|

113.0

|

|

$

|

121.2

|

|

$

|

131.6

|

|

|

Interest expense

|

7.8

|

|

9.2

|

|

11.2

|

|

12.7

|

|

||||

|

Net interest income

|

99.8

|

|

103.8

|

|

110.0

|

|

118.9

|

|

||||

|

Provision for loan losses

|

2.1

|

|

2.9

|

|

2.0

|

|

1.6

|

|

||||

|

Net interest income after provision for loan losses

|

97.7

|

|

100.9

|

|

108.0

|

|

117.3

|

|

||||

|

Non-interest income

|

35.2

|

|

37.6

|

|

36.2

|

|

34.3

|

|

||||

|

Non-interest expense

|

85.9

|

|

84.9

|

|

90.7

|

|

99.4

|

|

||||

|

Income before income taxes

|

47.0

|

|

53.6

|

|

53.5

|

|

52.2

|

|

||||

|

Income tax expense

|

10.3

|

|

11.9

|

|

12.1

|

|

11.8

|

|

||||

|

Net income

|

$

|

36.7

|

|

$

|

41.7

|

|

$

|

41.4

|

|

$

|

40.4

|

|

|

Basic earnings per common share

|

$

|

0.65

|

|

$

|

0.74

|

|

$

|

0.71

|

|

$

|

0.67

|

|

|

Diluted earnings per common share

|

0.65

|

|

0.74

|

|

0.71

|

|

0.67

|

|

||||

|

Dividends paid per common share

|

0.28

|

|

0.28

|

|

0.28

|

|

0.28

|

|

||||

|

(1)

Quarterly amounts may not add to annual amounts due to the effect of rounding on a quarterly basis.

|

||||||||||||

|

Quarterly Results

(Unaudited)

(Dollars in millions except per share data)

|

||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

|||||||||

|

Year Ended December 31, 2017:

|

|

|

|

|

||||||||

|

Interest income

|

$

|

74.4

|

|

$

|

85.8

|

|

$

|

108.8

|

|

$

|

108.7

|

|

|

Interest expense

|

5.5

|

|

6.5

|

|

8.0

|

|

7.9

|

|

||||

|

Net interest income

|

68.9

|

|

79.3

|

|

100.8

|

|

100.8

|

|

||||

|

Provision for loan losses

|

1.7

|

|

2.3

|

|

3.5

|

|

3.5

|

|

||||

|

Net interest income after provision for loan losses

|

67.2

|

|

77.0

|

|

97.3

|

|

97.3

|

|

||||

|

Non-interest income

|

29.1

|

|

37.1

|

|

38.3

|

|

37.2

|

|

||||

|

Non-interest expense

|

63.7

|

|

80.4

|

|

94.6

|

|

85.1

|

|

||||

|

Income before income taxes

|

32.6

|

|

33.7

|

|

41.0

|

|

49.4

|

|

||||

|

Income tax expense

|

9.4

|

|

11.8

|

|

13.7

|

|

15.2

|

|

||||

|

Net income

|

$

|

23.2

|

|

$

|

21.9

|

|

$

|

27.3

|

|

$

|

34.2

|

|

|

Basic earnings per common share

|

$

|

0.52

|

|

$

|

0.46

|

|

$

|

0.49

|

|

$

|

0.61

|

|

|

Diluted earnings per common share

|

0.51

|

|

0.45

|

|

0.48

|

|

0.61

|

|

||||

|

Dividends paid per common share

|

0.24

|

|

0.24

|

|

0.24

|

|

0.24

|

|

||||

|

(1)

Quarterly amounts may not add to annual amounts due to the effect of rounding on a quarterly basis.

|

||||||||||||

|

Loans Outstanding

(Dollars in millions)

|

|||||||||||||||||||||||||||||

|

|

As of December 31,

|

||||||||||||||||||||||||||||

|

|

2018

|

Percent

|

2017

|

Percent

|

2016

|

Percent

|

2015

|

Percent

|

2014

|

Percent

|

|||||||||||||||||||

|

Loans

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Real estate:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Commercial

|

$

|

3,235.4

|

|

38.0

|

%

|

$

|

2,822.9

|

|

37.1

|

%

|

$

|

1,834.4

|

|

33.5

|

%

|

$

|

1,793.3

|

|

34.2

|

%

|

$

|

1,639.4

|

|

33.6

|

%

|

||||

|

Construction

|

838.7

|

|

9.9

|

|

708.3

|

|

9.3

|

|

482.0

|

|

8.8

|

|

430.7

|

|

8.2

|

|

418.3

|

|

8.5

|

|

|||||||||

|

Residential

|

1,542.0

|

|

18.1

|

|

1,487.4

|

|

19.5

|

|

1,027.4

|

|

18.8

|

|

1,032.9

|

|

19.7

|

|

999.9

|

|

20.4

|

|

|||||||||

|

Agricultural

|

217.4

|

|

2.6

|

|

158.2

|

|

2.1

|

|

170.2

|

|

3.1

|

|

156.2

|

|

3.0

|

|

167.6

|

|

3.4

|

|

|||||||||

|

Consumer

|

1,070.2

|

|

12.6

|

|

1,034.4

|

|

13.6

|

|

970.3

|

|

17.7

|

|

844.4

|

|

16.1

|

|

762.5

|

|

15.6

|

|

|||||||||

|

Commercial

|

1,310.3

|

|

15.4

|

|

1,215.4

|

|

15.9

|

|

797.9

|

|

14.6

|

|

792.4

|

|

15.1

|

|

740.1

|

|

15.1

|

|

|||||||||

|

Agricultural

|

254.8

|

|

3.0

|

|

136.2

|

|

1.8

|

|

132.9

|

|

2.4

|

|

142.2

|

|

2.7

|

|

124.8

|

|

2.5

|

|

|||||||||

|

Other loans

|

1.6

|

|

—

|

|

4.9

|

|

0.1

|

|

1.6

|

|

—

|

|

1.3

|

|

—

|

|

4.0

|

|

0.1

|

|

|||||||||

|

Mortgage loans held for sale

|

33.3

|

|

0.4

|

|

46.6

|

|

0.6

|

|

61.8

|

|

1.1

|

|

52.9

|

|

1.0

|

|

40.8

|

|

0.8

|

|

|||||||||

|

Total loans

|

8,503.7

|

|

100.0

|

%

|

7,614.3

|

|

100.0

|

%

|

5,478.5

|

|

100.0

|

%

|

5,246.3

|

|

100.0

|

%

|

4,897.4

|

|

100.0

|

%

|

|||||||||

|

Less allowance for loan losses

|

73.0

|

|

|

72.1

|

|

|

76.2

|

|

|

76.8

|

|

|

74.2

|

|

|

||||||||||||||

|

Net loans

|

$

|

8,430.7

|

|

|

$

|

7,542.2

|

|

|

$

|

5,402.3

|

|

|

$

|

5,169.5

|

|

|

$

|

4,823.2

|

|

|

|||||||||

|

Ratio of allowance to total loans

|

0.86

|

%

|

|

0.95

|

%

|

|

1.39

|

%

|

|

1.46

|

%

|

|

1.52

|

%

|

|

||||||||||||||

|

Maturities and Interest Rate Sensitivities

(Dollars in millions)

|

||||||||||||

|

Within

One Year

|

One Year to

Five Years

|

After

Five Years

|

Total

|

|||||||||

|

Real estate

|

$

|

1,605.1

|

|

$

|

2,388.6

|

|

$

|

1,839.8

|

|

$

|

5,833.5

|

|

|

Consumer

|

329.7

|

|

649.7

|

|

90.8

|

|

1,070.2

|

|

||||

|

Commercial

|

621.0

|

|

529.7

|

|

159.6

|

|

1,310.3

|

|

||||

|

Agricultural

|

205.6

|

|

45.7

|

|

3.5

|

|

254.8

|

|

||||

|

Other

|

—

|

|

—

|

|

1.6

|

|

1.6

|

|

||||

|

Mortgage loans held for sale

|

33.3

|

|

—

|

|

—

|

|

33.3

|

|

||||

|

Total loans

|

$

|

2,794.7

|

|

$

|

3,613.7

|

|

$

|

2,095.3

|

|

$

|

8,503.7

|

|

|

Loans at fixed interest rates

|

$

|

1,517.1

|

|

$

|

2,216.8

|

|

$

|

339.9

|

|

$

|

4,073.8

|

|

|

Loans at variable interest rates

|

1,277.6

|

|

1,396.9

|

|

1,701.1

|

|

4,375.6

|

|

||||

|

Non-accrual loans

|

—

|

|

—

|

|

54.3

|

|

54.3

|

|

||||

|

Total loans

|

$

|

2,794.7

|

|

$

|

3,613.7

|

|

$

|

2,095.3

|

|

$

|

8,503.7

|

|

|

Non-Performing Assets and Troubled Debt Restructurings

(Dollars in thousands)

|

|||||||||||||||

|

As of December 31,

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||

|

Non-performing loans:

|

|

|

|

|

|

||||||||||

|

Non-accrual loans

|

$

|

54.3

|

|

$

|

69.4

|

|

$

|

72.8

|

|

$

|

66.3

|

|

$

|

62.2

|

|

|

Accruing loans past due 90 days or more

|

3.8

|

|

3.1

|

|

3.8

|

|

5.6

|

|

2.5

|

|

|||||

|

Total non-performing loans

|

58.1

|

|

72.5

|

|

76.6

|

|

71.9

|

|

64.7

|

|

|||||

|

OREO

|

14.4

|

|

10.1

|

|

10.0

|

|

6.3

|

|

13.6

|

|

|||||

|

Total non-performing assets

|

$

|

72.5

|

|

$

|

82.6

|

|

$

|

86.6

|

|

$

|

78.2

|

|

$

|

78.3

|

|

|

Troubled debt restructurings not included above (1)

|

$

|

5.6

|

|

$

|

12.6

|

|

$

|

22.3

|

|

$

|

15.4

|

|

$

|

21.0

|

|

|

Non-performing loans to total loans (2)

|

0.68

|

%

|

0.95

|

%

|

1.40

|

%

|

1.37

|

%

|

1.32

|

%

|

|||||

|

Non-performing assets to total loans and OREO (3)

|

0.85

|

|

1.08

|

|

1.58

|

|

1.49

|

|

1.59

|

|

|||||

|

Non-performing assets to total assets (4)

|

0.55

|

|

0.68

|

|

0.96

|

|

0.90

|

|

0.91

|

|

|||||

|

Allowance for loan losses to non-performing loans (5)

|

125.65

|

|

99.40

|

|

99.52

|

|

106.71

|

|

114.58

|

|

|||||

|

(1)

|

Accruing loans modified in troubled debt restructurings are not considered non-performing loans. While still considered impaired under applicable accounting guidance, these loans are performing as agreed under their modified terms and management expects performance to continue.

|

|

(2)

|

Including accruing troubled debt restructurings described in footnote 1, the ratio of non-performing loans to total loans would be

0.75%

,

1.12%

,

1.81%

,

1.67%

and

1.75%

as of

December 31, 2018

,

2017

,

2016

,

2015

and

2014

, respectively.

|

|

(3)

|

Including accruing troubled debt restructurings described in footnote 1, the ratio of non-performing assets to total loans and OREO would be

0.92%

,

1.25%

,

1.98%

,

1.78%

and

2.02%

as of

December 31, 2018

,

2017

,

2016

,

2015

and

2014

, respectively.

|

|

(4)

|

Including accruing troubled debt restructurings described in footnote 1, the ratio of non-performing assets to total assets would be

0.59%

,

0.78%

,

1.20%

,

1.07%

and

1.15%

as of

December 31, 2018

,

2017

,

2016

,

2015

and

2014

, respectively.

|

|

(5)

|

Including accruing troubled debt restructurings described in footnote 1, the ratio of allowance for loan losses to non-performing loans would be

114.55%

,

84.72%

,

77.04%

,

87.89%

and

86.57%

as of

December 31, 2018

,

2017

,

2016

,

2015

, and

2014

, respectively.

|

|

Non-Performing Loans by Loan Type

(Dollars in millions)

|

|||||||||||||||||||||||||||||

|

|

As of December 31,

|

||||||||||||||||||||||||||||

|

|

2018

|

Percent

|

2017

|

Percent

|

2016

|

Percent

|

2015

|

Percent

|

2014

|

Percent

|

|||||||||||||||||||

|

Real estate:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Commercial

|

$

|

10.0

|

|

17.2

|

%

|

$

|

27.1

|

|

37.4

|

%

|

$

|

26.5

|

|

34.6

|

%

|

$

|

24.2

|

|

33.6

|

%

|

$

|

27.7

|

|

42.8

|

%

|

||||

|

Construction:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Land acquisition and development

|

3.9

|

|

6.7

|

|

3.3

|

|

4.6

|

|

5.3

|

|

6.9

|

|

7.9

|

|

11.0

|

|

8.2

|

|

12.7

|

|

|||||||||

|

Residential

|

1.0

|

|

1.7

|

|

1.7

|

|

2.3

|

|

0.5

|

|

0.6

|

|

0.3

|

|

0.4

|

|

0.3

|

|

0.4

|

|

|||||||||

|

Commercial

|

0.2

|

|

0.3

|

|

3.8

|

|

5.2

|

|

0.8

|

|

1.0

|

|

1.0

|

|

1.3

|

|

2.6

|

|

4.0

|

|

|||||||||

|

Total construction

|

5.1

|

|

8.7

|

|

8.8

|

|

12.1

|

|

6.6

|

|

8.5

|

|

9.2

|

|

12.7

|

|

11.1

|

|

17.1

|

|

|||||||||

|

Residential

|

6.8

|

|

11.8

|

|

8.6

|

|

11.8

|

|

7.1

|

|

9.3

|

|

7.3

|

|

10.2

|

|

4.6

|

|

7.0

|

|

|||||||||

|

Agricultural

|

12.6

|

|

21.7

|

|

3.6

|

|

5.0

|

|

4.3

|

|

5.7

|

|

5.3

|

|

7.4

|

|

6.8

|

|

10.6

|

|

|||||||||

|

Total real estate

|

34.5

|

|

59.4

|

|

48.1

|

|

66.3

|

|

44.5

|

|

58.1

|

|

46.0

|

|

63.9

|

|

50.2

|