|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

Delaware

|

|

38-1747023

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

2800 Executive Way Miramar, Florida

|

|

33025

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Voting Common Stock, $0.0001 par value Non-Voting Common Stock, $0.0001 par value

|

|

NASDAQ Global Select Market None

|

|

Class

|

Number of Shares

|

|

|

Voting Common Stock, $0.0001 par value per share

|

67,691,819

|

|

|

Non-Voting Common Stock, $0.0001 par value per share

|

4,827,600

|

|

|

PART I

|

Page

|

|

PART II

|

|

|

PART III

|

|

|

PART IV

|

|

|

•

|

high aircraft utilization;

|

|

•

|

high-density seating configurations on our aircraft;

|

|

•

|

our simple operations;

|

|

•

|

no hub-and-spoke inefficiencies ;

|

|

•

|

highly productive workforce;

|

|

•

|

opportunistic outsourcing of operating functions;

|

|

•

|

operating a modern single fleet type of Airbus A320-family aircraft, with associated lower maintenance costs and common flight crews across the fleet;

|

|

•

|

minimizing sales, marketing and distribution costs through direct-to-consumer marketing;

|

|

•

|

efficient flight scheduling, including minimal ground times between flights; and

|

|

•

|

creating a company-wide business culture that is keenly focused on driving costs lower.

|

|

•

|

charging for checked and carry-on baggage;

|

|

•

|

passing through all distribution-related expenses;

|

|

•

|

charging for premium seats and advance seat selection;

|

|

•

|

enforcing ticketing policies, including change fees;

|

|

•

|

generating subscription fees from our $9 Fare Club ultra low-fare subscription service;

|

|

•

|

deriving brand-based fees from proprietary services, such as our FREE SPIRIT affinity credit card program;

|

|

•

|

selling itinerary attachments, such as hotel and car rental reservations and airport parking, through our website; and

|

|

•

|

selling in-flight products and onboard advertising.

|

|

•

|

keeping a consistent focus on maintaining low unit operating costs;

|

|

•

|

maintaining disciplined capacity control and fleet size;

|

|

•

|

ensuring our sourcing arrangements with key third parties are continually benchmarked against the best industry standards; and

|

|

•

|

maintaining a simple operation that focuses on delivering transportation.

|

|

•

|

deploying additional cost-efficient Airbus A320-family aircraft for high-utilization flying;

|

|

•

|

spreading our low fixed-cost infrastructure over a larger-scale operation;

|

|

•

|

continuing to leverage our Fort Lauderdale base of operations;

|

|

•

|

opportunistically outsourcing operating functions;

|

|

•

|

using technology to create further operating efficiencies;

|

|

•

|

leveraging the labor productivity and scale benefits of our five-year pilot contract; and

|

|

•

|

continuing our aggressive procurement strategy.

|

|

•

|

using our knowledge of local U.S. domestic, Caribbean and Latin American markets and expertise in local regulatory and business practices to optimize our route structure and schedule;

|

|

•

|

pursuing attractive new route opportunities in markets that limit air carrier competition through frequency or carrier designation restrictions;

|

|

•

|

attempting to maintain profitability across our network by selecting viable new routes and quickly reducing or discontinuing routes that do not deliver acceptable margins; and

|

|

•

|

selectively expanding our presence in markets where there are high fares or that are underserved by low-fare carriers that present opportunity for demand stimulation when fares are reduced.

|

|

2011

|

2010

|

2009

|

||||||

|

On-Time Performance (1)(2)

|

71.2

|

%

|

73.1

|

%

|

75.0

|

%

|

||

|

Completion Factor (2)(3)

|

99.2

|

%

|

97.2

|

%

|

99.3

|

%

|

||

|

Mishandled Baggage (2)(4)

|

2.25

|

|

2.61

|

|

3.09

|

|

||

|

(1)

|

Percentage of our scheduled flights that were operated by us that were on-time (within 15 minutes).

|

|

(2)

|

As per Part 234 of the DOT regulations, we are not required to report this information to the DOT.

|

|

(3)

|

Percentage of our scheduled flights that were operated by us, whether or not delayed (i.e., not cancelled). Includes the impact of cancelled flights due to the June 2010 pilot strike.

|

|

(4)

|

Our incidence of delayed, mishandled or lost baggage per 1,000 passengers.

|

|

Employee Groups

|

Representative

|

Status of Agreement/Amendable Date

|

|

Pilots

|

Airline Pilots Association, International (ALPA)

|

Becomes amendable on August 1, 2015.

|

|

Flight Attendants

|

Association of Flight Attendants (AFA)

|

In negotiation. Became amendable in 2007.

|

|

Dispatchers

|

Transport Workers Union (TWU)

|

Becomes amendable in July 2012.

|

|

•

|

changes and volatility in general economic conditions, including the severity and duration of any downturn in the U.S. or global economy and financial markets;

|

|

•

|

changes in consumer preferences, perceptions, spending patterns or demographic trends, including any increased preference for higher-fare carriers offering higher amenity levels, and reduced preferences for low-fare carriers offering more basic transportation, during better economic times;

|

|

•

|

higher levels of unemployment and varying levels of disposable or discretionary income;

|

|

•

|

depressed housing and stock market prices; and

|

|

•

|

lower levels of actual or perceived consumer confidence.

|

|

•

|

substantial loss of revenue and flight disruption costs caused by the grounding of all commercial air traffic in or headed to the United States by the Federal Aviation Administration, or FAA, for about three days after the terrorist attacks;

|

|

•

|

increased security and insurance costs;

|

|

•

|

increased concerns about future terrorist attacks;

|

|

•

|

airport shutdowns and flight cancellations and delays due to security breaches and perceived safety threats; and

|

|

•

|

significantly reduced passenger traffic and yields due to the subsequent dramatic drop in demand for air travel.

|

|

•

|

require a substantial portion of cash flow from operations for operating lease and maintenance deposit payments, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes;

|

|

•

|

limit our ability to make required pre-delivery deposit payment, or PDPs, including those payable to Airbus or IAE for our aircraft and spare engines on order;

|

|

•

|

limit our ability to obtain additional financing to support our expansion plans and for working capital and other purposes on acceptable terms or at all;

|

|

•

|

make it more difficult for us to pay our other obligations as they become due during adverse general economic and market industry conditions because any related decrease in revenues could cause us to not have sufficient cash flows from operations to make our scheduled payments;

|

|

•

|

reduce our flexibility in planning for, or reacting to, changes in our business and the airline industry and, consequently, place us at a competitive disadvantage to our competitors with less fixed payment obligations; and

|

|

•

|

cause us to lose access to one or more aircraft and forfeit our rent deposits if we are unable to make our required aircraft lease rental payments and our lessors exercise their remedies under the lease agreement including under cross default provisions in certain of our leases.

|

|

•

|

maintain profitability;

|

|

•

|

obtain financing to acquire new aircraft;

|

|

•

|

access airports located in our targeted geographic markets where we can operate routes in a manner that is consistent with our cost strategy;

|

|

•

|

gain access to international routes; and

|

|

•

|

access sufficient gates and other services at airports we currently serve or may seek to serve.

|

|

•

|

increases in airport rates and charges;

|

|

•

|

limitations on take-off and landing slots, airport gate capacity or other use of airport facilities;

|

|

•

|

termination of our airport use agreements, some of which can be terminated by airport authorities with little notice to us;

|

|

•

|

increases in airport capacity that could facilitate increased competition, such as the planned expansion of the international terminal at FLL Airport;

|

|

•

|

international travel regulations such as customs and immigration;

|

|

•

|

increases in taxes;

|

|

•

|

changes in the law that affect the services that can be offered by airlines in particular markets and at particular airports;

|

|

•

|

restrictions on competitive practices;

|

|

•

|

the adoption of statutes or regulations that impact customer service standards, including security standards; and

|

|

•

|

the adoption of more restrictive locally-imposed noise regulations or curfews.

|

|

•

|

announcements concerning our competitors, the airline industry or the economy in general;

|

|

•

|

strategic actions by us or our competitors, such as acquisitions or restructurings;

|

|

•

|

media reports and publications about the safety of our aircraft or the aircraft type we operate;

|

|

•

|

new regulatory pronouncements and changes in regulatory guidelines;

|

|

•

|

changes in the price of aircraft fuel;

|

|

•

|

announcements concerning the availability of the type of aircraft we use;

|

|

•

|

general and industry-specific economic conditions;

|

|

•

|

changes in financial estimates or recommendations by securities analysts or failure to meet analysts’ performance expectations;

|

|

•

|

sales of our common stock or other actions by investors with significant shareholdings, including sales by our controlling stockholders;

|

|

•

|

trading strategies related to changes in fuel or oil prices; and

|

|

•

|

general market, political and economic conditions.

|

|

•

|

our board of directors is divided into three classes, with each class serving for a staggered three-year term, which prevents stockholders from electing an entirely new board of directors at an annual meeting;

|

|

•

|

actions to be taken by our stockholders may only be effected at an annual or special meeting of our stockholders and not by written consent;

|

|

•

|

special meetings of our stockholders can be called only by the Chairman of the Board or by our corporate secretary at the direction of our board of directors;

|

|

•

|

advance notice procedures that stockholders must comply with in order to nominate candidates to our board of directors and propose matters to be brought before an annual meeting of our stockholders may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company; and

|

|

•

|

our board of directors may, without stockholder approval, issue series of preferred stock, or rights to acquire preferred stock, that could dilute the interest of, or impair the voting power of, holders of our common stock or could also be used as a method of discouraging, delaying or preventing a change of control.

|

|

Aircraft Type

|

Seats

|

Average Age (years)

|

Number of Aircraft

|

|

A319

|

145

|

5.5

|

26

|

|

A320

|

178

|

1.0

|

9

|

|

A321

|

218

|

6.4

|

2

|

|

4.5

|

37

|

||

|

Number of Aircraft at Year-End *

|

||||||||||

|

Aircraft Type

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

|

A319

|

26

|

26

|

26

|

26

|

26

|

17

|

8

|

2

|

—

|

—

|

|

A320

|

16

|

23

|

30

|

40

|

50

|

63

|

68

|

68

|

68

|

68

|

|

A320 NEO

|

—

|

—

|

—

|

—

|

—

|

—

|

6

|

19

|

32

|

45

|

|

A321

|

2

|

2

|

2

|

2

|

2

|

—

|

—

|

—

|

—

|

—

|

|

Total Aircraft

|

44

|

51

|

58

|

68

|

78

|

80

|

82

|

89

|

100

|

113

|

|

Fiscal year ending December 31, 2011

|

High

|

Low

|

|||||

|

Second Quarter (from May 26, 2011)

|

$

|

12.33

|

|

$

|

11.11

|

|

|

|

Third Quarter

|

14.43

|

|

10.18

|

|

|||

|

Fourth Quarter

|

17.48

|

|

11.45

|

|

|||

|

ISSUER PURCHASES OF EQUITY SECURITIES

|

|||||||||||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet be Purchased Under Plans or Programs.

|

|||||||||

|

October 1-31, 2011

|

—

|

|

N/A

|

|

—

|

|

—

|

|

|||||

|

November 1-30, 2011

|

—

|

|

N/A

|

|

—

|

|

—

|

|

|||||

|

December 1-31, 2011

|

8,215

|

|

$

|

15.70

|

|

—

|

|

—

|

|

||||

|

Total

|

8,215

|

|

$

|

15.70

|

|

—

|

|

—

|

|

||||

|

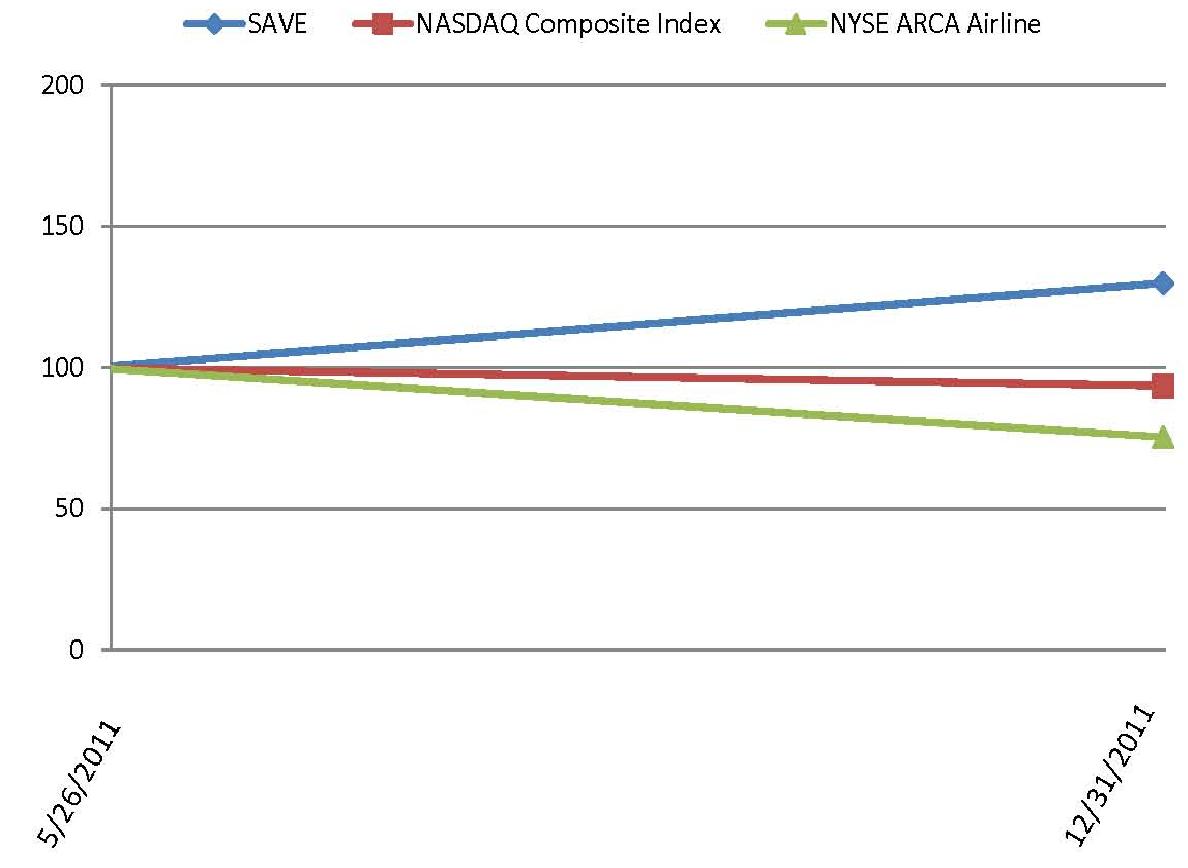

5/26/2011

|

12/31/2011

|

|||||||

|

SAVE

|

$

|

100.00

|

|

$

|

130.00

|

|

||

|

NASDAQ Composite Index

|

$

|

100.00

|

|

$

|

93.61

|

|

||

|

NYSE ARCA Airline Index

|

$

|

100.00

|

|

$

|

75.49

|

|

||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

2011

|

2010 (1)

|

2009

|

2008

|

2007

|

|||||||||||||||

|

(in thousands except share and per share data)

|

|||||||||||||||||||

|

Operating revenues:

|

|||||||||||||||||||

|

Passenger

|

$

|

689,650

|

|

$

|

537,969

|

|

$

|

536,181

|

|

$

|

657,448

|

|

$

|

686,447

|

|

||||

|

Non-ticket

|

381,536

|

|

243,296

|

|

163,856

|

|

129,809

|

|

76,432

|

|

|||||||||

|

Total operating revenue

|

1,071,186

|

|

781,265

|

|

700,037

|

|

787,257

|

|

762,879

|

|

|||||||||

|

Operating expenses:

|

|

|

|||||||||||||||||

|

Aircraft fuel (2)

|

388,046

|

|

248,206

|

|

181,107

|

|

299,094

|

|

251,230

|

|

|||||||||

|

Salaries, wages and benefits

|

181,742

|

|

156,443

|

|

135,420

|

|

147,015

|

|

146,626

|

|

|||||||||

|

Aircraft rent

|

116,485

|

|

101,345

|

|

89,974

|

|

105,605

|

|

119,686

|

|

|||||||||

|

Landing fees and other rents

|

52,794

|

|

48,118

|

|

42,061

|

|

43,331

|

|

42,441

|

|

|||||||||

|

Distribution

|

51,349

|

|

41,179

|

|

34,067

|

|

37,816

|

|

36,315

|

|

|||||||||

|

Maintenance, materials and repairs

|

35,553

|

|

28,189

|

|

27,536

|

|

24,237

|

|

23,448

|

|

|||||||||

|

Depreciation and amortization

|

7,760

|

|

5,620

|

|

4,924

|

|

4,236

|

|

5,401

|

|

|||||||||

|

Other operating

|

89,636

|

|

82,594

|

|

72,921

|

|

85,608

|

|

105,503

|

|

|||||||||

|

Loss on disposal of assets

|

255

|

|

77

|

|

1,010

|

|

4,122

|

|

94

|

|

|||||||||

|

Special charges (3)

|

3,184

|

|

621

|

|

(392

|

)

|

17,902

|

|

142

|

|

|||||||||

|

Total operating expenses

|

926,804

|

|

712,392

|

|

588,628

|

|

768,966

|

|

730,886

|

|

|||||||||

|

Operating income

|

144,382

|

|

68,873

|

|

111,409

|

|

18,291

|

|

31,993

|

|

|||||||||

|

Other expense (income):

|

|

|

|||||||||||||||||

|

Interest expense (4)

|

24,781

|

|

50,313

|

|

46,892

|

|

40,245

|

|

38,163

|

|

|||||||||

|

Capitalized interest (5)

|

(2,890

|

)

|

(1,491

|

)

|

(951

|

)

|

(166

|

)

|

(1,755

|

)

|

|||||||||

|

Interest income

|

(575

|

)

|

(328

|

)

|

(345

|

)

|

(1,976

|

)

|

(5,951

|

)

|

|||||||||

|

Gain on extinguishment of debt (6)

|

—

|

|

—

|

|

(19,711

|

)

|

(53,673

|

)

|

—

|

|

|||||||||

|

Other expense

|

235

|

|

194

|

|

298

|

|

214

|

|

130

|

|

|||||||||

|

Total other expense (income)

|

21,551

|

|

48,688

|

|

26,183

|

|

(15,356

|

)

|

30,587

|

|

|||||||||

|

Income before income taxes

|

122,831

|

|

20,185

|

|

85,226

|

|

33,647

|

|

1,406

|

|

|||||||||

|

Provision (benefit) for income taxes (7)

|

46,383

|

|

(52,296

|

)

|

1,533

|

|

388

|

|

44

|

|

|||||||||

|

Net income

|

$

|

76,448

|

|

$

|

72,481

|

|

$

|

83,693

|

|

$

|

33,259

|

|

$

|

1,362

|

|

||||

|

Earnings Per Share:

|

|||||||||||||||||||

|

Basic

|

$

|

1.44

|

|

$

|

2.77

|

|

$

|

3.23

|

|

$

|

1.29

|

|

$

|

0.05

|

|

||||

|

Diluted

|

$

|

1.43

|

|

$

|

2.72

|

|

$

|

3.18

|

|

$

|

1.29

|

|

$

|

0.05

|

|

||||

|

Weighted average shares outstanding:

|

|||||||||||||||||||

|

Basic

|

53,240,898

|

|

26,183,772

|

|

25,910,766

|

|

25,780,070

|

|

25,746,445

|

|

|||||||||

|

Diluted

|

53,515,348

|

|

26,689,855

|

|

26,315,121

|

|

25,879,860

|

|

25,861,095

|

|

|||||||||

|

(1)

|

We estimate that the 2010 pilot strike had a net negative impact on our operating income for 2010 of approximately $24 million consisting of an estimated $28 million in lost revenues and approximately $4 million of incremental costs resulting from the strike, offset in part by a reduction of variable expenses during the strike of approximately $8 million for flights not flown. Additionally, under the terms of the pilot contract, we also paid $2.3 million in return-to-work payments during the second quarter, which are not included in the strike impact costs described above.

|

|

(2)

|

Aircraft fuel expense is the sum of (i) “into-plane fuel cost,” which includes the cost of jet fuel and certain other charges such as fuel taxes and oil,

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

2011

|

2010

|

2009

|

2008 (*)

|

2007

|

|||||||||||||||

|

(in thousands)

|

|||||||||||||||||||

|

Into-plane fuel cost

|

$

|

392,278

|

|

$

|

251,754

|

|

$

|

181,806

|

|

$

|

359,097

|

|

$

|

265,226

|

|

||||

|

Settlement (gains) losses

|

(7,436

|

)

|

(1,483

|

)

|

750

|

|

(69,876

|

)

|

(3,714

|

)

|

|||||||||

|

Unrealized mark-to-market (gains) losses

|

3,204

|

|

(2,065

|

)

|

(1,449

|

)

|

9,873

|

|

(10,282

|

)

|

|||||||||

|

Aircraft Fuel

|

$

|

388,046

|

|

$

|

248,206

|

|

$

|

181,107

|

|

$

|

299,094

|

|

$

|

251,230

|

|

||||

|

(*)

|

In July 2008, we monetized all of our fuel hedge contracts, which included hedges that had scheduled settlement dates during the remainder of 2008 and in 2009. We recognized a gain of $37.8 million representing cash received upon monetization of these contracts, of which a gain of $14.2 million related to 2009 fuel hedge positions on these contracts.

|

|

(3)

|

Special charges include: (i) for 2007, amounts relating to the accelerated retirement of our MD-80 fleet; (ii) for 2008 and 2009, amounts relating to the early termination in mid-2008 of leases for seven Airbus A319 aircraft, a related reduction in workforce and the exit facility costs associated with returning planes to lessors in 2008; (iii) for 2009 and 2010, amounts relating to the sale of previously expensed MD-80 parts; (iv) for 2010 and 2011 amounts relating to exit facility costs associated with moving our Detroit, Michigan maintenance operations to Fort Lauderdale, Florida; and (v) termination costs in connection with the IPO during the three months ended June 30, 2011 comprised of amounts paid to Indigo Partners, LLC to terminate its professional services agreement with us and fees paid to three individual, unaffiliated holders of our subordinated notes. Special charges for 2011 also include legal, accounting, printing, and filing fees connected with the secondary offering which was consummated on

January 25, 2012

. For more information, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Operating Expenses—Special Charges.”

|

|

(4)

|

Substantially all of the interest expense recorded in 2007, 2008, 2009, 2010 and 2011 relates to notes and preferred stock held by our principal stockholders that were repaid or redeemed, or exchanged for shares of common stock, in connection with the 2011 Recapitalization.

|

|

(5)

|

Interest attributable to funds used to finance the acquisition of new aircraft, including PDPs is capitalized as an additional cost of the related asset. Interest is capitalized at the weighted average implicit lease rate of our aircraft.

|

|

(6)

|

Gain on extinguishment of debt represents the recognition of contingencies provided for in our 2006 recapitalization agreements, which provided for the cancellation of shares of Class A preferred stock and reduction of the liquidation preference of the remaining Class A preferred stock and associated accrued but unpaid dividends based on the outcome of the contingencies.

|

|

(7)

|

Net income for 2010 includes a $52.3 million net tax benefit primarily due to the release of a valuation allowance resulting in a deferred tax benefit of $52.8 million in 2010. Absent the release of the valuation allowance and corresponding tax benefit, our net income would have been $19.7 million for 2010. Pursuant to the Tax Receivable Agreement, we distributed to the Pre-IPO Stockholders the right to receive a pro rata share of the future payments to be made under such agreement. These future payments to the Pre-IPO Stockholders (estimated as of December 31, 2011 to be approximately $36.5 million) will be in an amount equal to 90% of the cash savings in federal income tax realized by us by virtue of our future use of the federal net operating loss, deferred interest deductions and certain tax credits held by us as of March 31, 2011. Please see "Notes to Financial Statements- 20. Initial Public Offering and Tax Receivable Agreement".

|

|

As of December 31,

|

|||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Balance Sheet Data:

|

(in thousands)

|

||||||||||||||||||

|

Cash and cash equivalents

|

$

|

343,328

|

|

$

|

82,714

|

|

$

|

86,147

|

|

$

|

16,229

|

|

$

|

54,603

|

|

||||

|

Total assets

|

745,813

|

|

475,757

|

|

327,866

|

|

240,009

|

|

257,382

|

|

|||||||||

|

Long-term debt, including current portion

|

—

|

|

260,827

|

|

242,232

|

|

214,480

|

|

180,784

|

|

|||||||||

|

Mandatorily redeemable preferred stock

|

—

|

|

79,717

|

|

75,110

|

|

89,685

|

|

138,777

|

|

|||||||||

|

Stockholders' equity (deficit)

|

466,706

|

|

(105,077

|

)

|

(178,127

|

)

|

(261,890

|

)

|

(295,154

|

)

|

|||||||||

|

|

Year Ended December 31,

|

|||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||

|

Operating Statistics (unaudited) (A)

|

||||||||||||||

|

Average aircraft

|

34.8

|

|

30.5

|

|

28.0

|

|

32.8

|

|

35.9

|

|

||||

|

Aircraft at end of period

|

37

|

|

32

|

|

28

|

|

28

|

|

36

|

|

||||

|

Airports served in the period

|

48

|

|

39

|

|

43

|

|

45

|

|

40

|

|

||||

|

Average daily Aircraft utilization (hours)

|

12.7

|

|

12.8

|

|

13.0

|

|

12.6

|

|

11.5

|

|

||||

|

Average stage length (miles)

|

921

|

|

941

|

|

931

|

|

925

|

|

956

|

|

||||

|

Block hours

|

161,898

|

|

141,864

|

|

133,227

|

|

150,827

|

|

150,644

|

|

||||

|

Passenger flight segments (thousands)

|

8,518

|

|

6,952

|

|

6,325

|

|

6,976

|

|

6,974

|

|

||||

|

Revenue passenger miles (RPMs) (thousands)

|

8,006,748

|

|

6,664,395

|

|

6,039,064

|

|

6,599,809

|

|

6,850,565

|

|

||||

|

Available seat miles (ASMs) (thousands)

|

9,352,553

|

|

8,119,923

|

|

7,485,141

|

|

8,262,230

|

|

8,461,861

|

|

||||

|

Load factor (%)

|

85.6

|

|

82.1

|

|

80.7

|

|

79.9

|

|

81.0

|

|

||||

|

Average ticket revenue per passenger flight segment ($)

|

80.97

|

|

77.39

|

|

84.77

|

|

94.24

|

|

98.44

|

|

||||

|

Average non-ticket revenue per passenger flight segment ($)

|

44.79

|

|

35.00

|

|

25.91

|

|

18.61

|

|

10.96

|

|

||||

|

Total revenue per passenger segment ($)

|

125.76

|

|

112.39

|

|

110.68

|

|

112.85

|

|

109.40

|

|

||||

|

Average yield (cents)

|

13.38

|

|

11.72

|

|

11.59

|

|

11.93

|

|

11.14

|

|

||||

|

RASM (cents)

|

11.45

|

|

9.62

|

|

9.35

|

|

9.53

|

|

9.02

|

|

||||

|

CASM (cents)

|

9.91

|

|

8.77

|

|

7.86

|

|

9.31

|

|

8.64

|

|

||||

|

Adjusted CASM (cents) (B)

|

9.84

|

|

8.79

|

|

7.89

|

|

8.97

|

|

8.76

|

|

||||

|

Adjusted CASM ex fuel (cents) (B)

|

5.72

|

|

5.71

|

|

5.45

|

|

5.47

|

|

5.67

|

|

||||

|

Fuel gallons consumed (thousands)

|

121,030

|

|

106,628

|

|

98,422

|

|

109,562

|

|

113,842

|

|

||||

|

Average economic fuel cost per gallon ($)

|

3.18

|

|

2.35

|

|

1.85

|

|

2.64

|

|

2.30

|

|

||||

|

(A)

|

See “Glossary of Airline Terms” elsewhere in this annual report for definitions of terms used in this table.

|

|

(B)

|

Excludes restructuring and termination costs of $0.1 million (less than 0.01 cents per ASM) in 2007 and $17.9 million (0.22 cents per ASM) in 2008; and credits of $0.4 million (less than 0.01 cents per ASM) in 2009, and $0.6 million (less than 0.01 cents per ASM) in 2010, and $3.2 million (0.03 cents per ASM) in 2011. These amounts are excluded from all calculations of Adjusted CASM provided in this prospectus. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Operating Expenses—Special charges” Also excludes unrealized mark-to-market, or MTM, (gains) and losses of $(10.3) million ((0.12) cents per ASM) in 2007, $9.9 million (0.12 cents per ASM) in 2008, $(1.4) million ((0.02) cents per ASM) in 2009 and $(2.1) million ((0.03) cents per ASM) in 2010, and $3.2 million (0.03 cents per ASM) in 2011. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates.”

|

|

Year Ended 2011

|

% change 2011 versus 2010

|

Year Ended 2010

|

% change 2010 versus 2009

|

Year Ended 2009

|

|||||||||||||

|

Passenger

|

$

|

689,650

|

|

28.2 %

|

|

$

|

537,969

|

|

0.3 %

|

|

$

|

536,181

|

|

||||

|

Non-ticket

|

381,536

|

|

56.8 %

|

|

243,296

|

|

48.5 %

|

|

163,856

|

|

|||||||

|

Total operating revenue

|

$

|

1,071,186

|

|

37.1 %

|

|

$

|

781,265

|

|

11.6 %

|

|

$

|

700,037

|

|

||||

|

RASM (cents)

|

11.45

|

|

19.1

|

%

|

9.62

|

|

2.9 %

|

|

9.35

|

|

|||||||

|

Average ticket revenue per passenger flight segment

|

$

|

80.97

|

|

4.6 %

|

|

$

|

77.39

|

|

(8.7

|

)%

|

$

|

84.77

|

|

||||

|

Average non-ticket revenue per passenger flight segment

|

44.79

|

|

28.0 %

|

|

35.00

|

|

35.1 %

|

|

25.91

|

|

|||||||

|

Total revenue per passenger flight segment

|

$

|

125.76

|

|

11.9 %

|

|

$

|

112.39

|

|

1.5 %

|

|

$

|

110.68

|

|

||||

|

•

|

in January 2010, we introduced booking fees for reservations made through our call center and third-party vendors and a separate fee to upgrade to our Big Front Seat

®

;

|

|

•

|

in August 2010, we introduced a fee for carry-on bags that do not fit under an aircraft seat;

|

|

•

|

in February 2011, we reduced the weight threshold for overweight bags;

|

|

•

|

in March 2011, we increased the change fee for modifying or canceling a reservation;

|

|

•

|

in May 2011, we increased bag rates purchased at check-in on the web;

|

|

•

|

in June 2011, we increased the bag rates purchased at the airport and the kiosk;

|

|

•

|

in August 2011, we began offering hotels and rental car travel packages; and

|

|

•

|

in September 2011 and November 2011, we increased our passenger usage fee.

|

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||||||||||

|

|

% of

Revenue

|

CASM

|

% of

Revenue

|

CASM

|

% of

Revenue

|

CASM

|

||||||||||||||

|

Operating revenue

|

100.0 %

|

|

100.0 %

|

|

100.0 %

|

|

||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Aircraft fuel (1)

|

36.2

|

%

|

|

4.15

|

¢

|

31.8

|

%

|

|

3.06

|

¢

|

25.9

|

%

|

|

2.42

|

¢

|

|||||

|

Salaries, wages, and benefits

|

17.0

|

|

1.94

|

|

20.0

|

|

1.93

|

|

19.3

|

|

1.81

|

|

||||||||

|

Aircraft rent

|

10.9

|

|

1.25

|

|

13.0

|

|

1.25

|

|

12.9

|

|

1.20

|

|

||||||||

|

Landing fees and other rentals

|

4.9

|

|

0.56

|

|

6.2

|

|

0.59

|

|

6.0

|

|

0.56

|

|

||||||||

|

Distribution

|

4.8

|

|

0.55

|

|

5.3

|

|

0.51

|

|

4.9

|

|

0.46

|

|

||||||||

|

Maintenance, materials and repairs

|

3.3

|

|

0.38

|

|

3.6

|

|

0.35

|

|

3.9

|

|

0.37

|

|

||||||||

|

Depreciation and amortization

|

0.7

|

|

0.08

|

|

0.7

|

|

0.07

|

|

0.7

|

|

0.07

|

|

||||||||

|

Other operating expenses

|

8.4

|

|

0.96

|

|

10.6

|

|

1.02

|

|

10.4

|

|

0.97

|

|

||||||||

|

Loss on disposal of assets

|

—

|

|

—

|

|

—

|

|

—

|

|

0.1

|

|

0.01

|

|

||||||||

|

Special charges (2)

|

0.3

|

|

0.03

|

|

0.1

|

|

0.01

|

|

(0.1

|

)

|

(0.01

|

)

|

||||||||

|

Total operating expense

|

86.5

|

%

|

91.2

|

%

|

84.1

|

%

|

||||||||||||||

|

CASM

|

|

9.91

|

¢

|

|

8.77

|

¢

|

|

7.86

|

¢

|

|||||||||||

|

MTM gains (losses) per ASM

|

0.03

|

|

0.03

|

|

0.02

|

|

||||||||||||||

|

Restructuring per ASM

|

0.03

|

|

0.01

|

|

(0.01

|

)

|

||||||||||||||

|

Adjusted CASM (excludes Restructuring and MTM gains (losses)

|

9.84

|

|

8.79

|

|

7.89

|

|

||||||||||||||

|

Adjusted CASM excluding fuel

|

5.72

|

|

5.71

|

|

5.45

|

|

||||||||||||||

|

(1)

|

Aircraft fuel expense is the sum of (i) “into-plane fuel cost,” which includes the cost of jet fuel and certain other charges such as fuel taxes and oil, (ii) settlement gains and losses, and (iii) unrealized mark-to-market gains and losses associated with fuel hedge contracts. The following table summarizes the components of aircraft fuel expense for the periods presented:

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2011

|

2010

|

2009

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Into-plane fuel cost

|

$

|

392,278

|

|

$

|

251,754

|

|

$

|

181,806

|

|

||

|

Settlement (gains) losses

|

(7,436

|

)

|

(1,483

|

)

|

750

|

|

|||||

|

Unrealized mark-to-market (gains) losses

|

3,204

|

|

(2,065

|

)

|

(1,449

|

)

|

|||||

|

Aircraft Fuel

|

$

|

388,046

|

|

$

|

248,206

|

|

$

|

181,107

|

|

||

|

(2)

|

Includes special charges of

$3.2 million

(0.03 cents per ASM) in

2011

, $0.6 million (less than 0.01 cents per ASM) in 2010 and credits of $0.4 million (less than 0.01 cents per ASM) in 2009. Special charges for 2011 include $2.3 million of termination costs in connection with the IPO comprised of amounts paid to Indigo Partners, LLC to terminate its professional services agreement with us and fees paid to three individual, unaffiliated holders of our subordinated notes and in the fourth quarter include legal, accounting, printing, and filing fees connected with the secondary offering which was consummated on

January 25, 2012

. Special charges for 2010 and 2009 include exit facility costs associated with amounts relating to the sale of previously-expensed MD-80 parts and exit facility costs associated with moving our Detroit, Michigan maintenance activities to Fort Lauderdale, Florida, and for 2011 included termination costs in connection with the IPO during the three months ended June 30, 2011 comprised of amounts paid to Indigo Partners, LLC to terminate its professional services agreement with us and fees paid to three individual, unaffiliated holders of our subordinated notes. Special charges for 2009 include amounts relating to the early termination in mid-2008 of leases for seven Airbus A319 aircraft, a related reduction in workforce and exit facility costs associated with returning planes in 2008. Please see “—Our Operating Expenses—Special Charges.”

|

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||

|

|

2011

|

2010

|

|||||||

|

|

(in thousands, except per-gallon amounts)

|

||||||||

|

Fuel gallons consumed

|

121,030

|

|

106,628

|

|

13.5 %

|

||||

|

Into-plane fuel cost per gallon

|

$3.24

|

$2.36

|

37.3 %

|

||||||

|

Total into-plane fuel expense

|

$

|

392,278

|

|

$

|

251,754

|

|

55.8 %

|

||

|

Impact on fuel expense from (gains) and losses arising from fuel-derivative activities

|

(4,232

|

)

|

(3,548

|

)

|

19.3 %

|

||||

|

Aircraft fuel expense

|

$

|

388,046

|

|

$

|

248,206

|

|

56.3 %

|

||

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||

|

|

2011

|

2010

|

||||||||

|

|

(in thousands, except per-gallon

amounts)

|

|||||||||

|

Into-plane fuel expense

|

$

|

392,278

|

|

$

|

251,754

|

|

55.8 %

|

|

||

|

Less: Cash received from settled derivatives, net of cash settlements paid

|

$

|

(7,436

|

)

|

$

|

(1,483

|

)

|

401.4 %

|

|

||

|

Economic fuel expense

|

$

|

384,842

|

|

$

|

250,271

|

|

53.8 %

|

|

||

|

Fuel gallons consumed

|

121,030

|

|

106,628

|

|

13.5 %

|

|

||||

|

Economic fuel cost per gallon

|

$

|

3.18

|

|

$

|

2.35

|

|

35.3

|

%

|

||

|

|

Year Ended December 31,

|

|

||||||

|

|

2011

|

2010

|

Change

|

|||||

|

Website

|

67.1

|

%

|

76.5

|

%

|

(9.4

|

)

|

||

|

Third-party travel agents

|

22.5

|

|

14.0

|

|

8.5

|

|

||

|

Call center

|

10.4

|

|

9.5

|

|

0.9

|

|

||

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||

|

2010

|

2009

|

|||||||||

|

(in thousands, except percentage and per-gallon amounts)

|

||||||||||

|

Fuel gallons consumed

|

106,628

|

|

98,422

|

|

8.3 %

|

|

||||

|

Into-plane fuel cost per gallon

|

$

|

2.36

|

|

$

|

1.85

|

|

27.6 %

|

|

||

|

Total into-plane fuel expense

|

251,754

|

|

181,806

|

|

38.5 %

|

|

||||

|

Impact on fuel expense from (gains) and losses arising from fuel-derivative activities

|

(3,548

|

)

|

(699

|

)

|

—

|

|

||||

|

Aircraft fuel expense

|

$

|

248,206

|

|

$

|

181,107

|

|

37.0 %

|

|

||

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||

|

2010

|

2009

|

|||||||||

|

(in thousands, except percentage and per-gallon amounts)

|

||||||||||

|

Into-plane fuel expense

|

$

|

251,754

|

|

$

|

181,806

|

|

38.5 %

|

|

||

|

Less: Cash received from settled derivatives, net of cash settlements paid

|

(1,483

|

)

|

750

|

|

(297.7

|

)%

|

||||

|

Economic fuel expense

|

250,271

|

|

182,556

|

|

37.1 %

|

|

||||

|

Fuel gallons consumed

|

106,628

|

|

98,422

|

|

8.3 %

|

|

||||

|

Economic fuel cost per gallon

|

$

|

2.35

|

|

$

|

1.85

|

|

27.0 %

|

|

||

|

|

Three Months Ended

|

|||||||||||||||||||||||||||||||

|

|

March 31, 2010

|

June 30, 2010

|

September 30, 2010

|

December 31, 2010

|

March 31, 2011

|

June 30, 2011

|

September 30, 2011

|

December 31, 2011

|

||||||||||||||||||||||||

|

|

(in thousands except share and per share amounts)

|

|||||||||||||||||||||||||||||||

|

Total operating revenue

|

$

|

184,051

|

|

$

|

177,359

|

|

$

|

203,655

|

|

$

|

216,200

|

|

$

|

232,662

|

|

$

|

275,891

|

|

$

|

288,714

|

|

$

|

273,919

|

|

||||||||

|

Passenger

|

136,909

|

|

126,372

|

|

138,232

|

|

136,456

|

|

153,280

|

|

180,418

|

|

186,682

|

|

169,270

|

|

||||||||||||||||

|

Non-ticket

|

47,142

|

|

50,987

|

|

65,423

|

|

79,744

|

|

79,382

|

|

95,473

|

|

102,032

|

|

104,649

|

|

||||||||||||||||

|

Operating income

|

24,124

|

|

1,791

|

|

20,982

|

|

21,976

|

|

26,844

|

|

34,959

|

|

44,556

|

|

38,023

|

|

||||||||||||||||

|

Net income (loss)

|

$

|

11,276

|

|

$

|

(10,066

|

)

|

$

|

61,740

|

|

$

|

9,531

|

|

$

|

7,883

|

|

$

|

16,917

|

|

27,657

|

|

23,991

|

|

||||||||||

|

Earnings Per Share:

|

||||||||||||||||||||||||||||||||

|

Basic

|

$

|

0.43

|

|

$

|

(0.38

|

)

|

$

|

2.35

|

|

$

|

0.36

|

|

$

|

0.30

|

|

$

|

0.41

|

|

$

|

0.38

|

|

$

|

0.33

|

|

||||||||

|

Diluted

|

$

|

0.42

|

|

$

|

(0.38

|

)

|

$

|

2.33

|

|

$

|

0.36

|

|

$

|

0.30

|

|

$

|

0.41

|

|

$

|

0.38

|

|

$

|

0.33

|

|

||||||||

|

Weighted average shares outstanding

|

||||||||||||||||||||||||||||||||

|

Basic

|

26,056,908

|

|

26,164,318

|

|

26,240,764

|

|

26,270,129

|

|

26,347,875

|

|

41,493,312

|

|

72,175,478

|

|

72,242,360

|

|

||||||||||||||||

|

Diluted

|

26,760,781

|

|

26,164,318

|

|

26,524,727

|

|

26,677,645

|

|

26,689,151

|

|

41,769,049

|

|

72,427,286

|

|

72,472,524

|

|

||||||||||||||||

|

|

Three Months Ended

|

|||||||||||||||||||||||

|

|

March 31, 2010

|

June 30, 2010

|

September 30, 2010

|

December 31, 2010

|

March 31, 2011

|

June 30, 2011

|

September 30, 2011

|

December 31, 2011

|

||||||||||||||||

|

Other operating statistics

|

||||||||||||||||||||||||

|

Aircraft at end of period

|

29

|

|

31

|

|

32

|

|

32

|

|

35

|

|

35

|

|

35

|

|

37

|

|

||||||||

|

Airports served

|

39

|

|

39

|

|

39

|

|

39

|

|

44

|

|

45

|

|

47

|

|

48

|

|

||||||||

|

Average daily Aircraft utilization (hours)

|

12.9

|

|

12.1

|

|

13.1

|

|

12.9

|

|

12.6

|

|

13.1

|

|

12.9

|

|

12.3

|

|

||||||||

|

Average stage length (miles)

|

942

|

|

928

|

|

940

|

|

952

|

|

961

|

|

932

|

|

909

|

|

885

|

|

||||||||

|

Passenger flight segments (thousands)

|

1,526

|

|

1,611

|

|

1,910

|

|

1,905

|

|

1,863

|

|

2,200

|

|

2,285

|

|

2,170

|

|

||||||||

|

Revenue passenger miles (RPMs) (thousands)

|

1,464,645

|

|

1,519,609

|

|

1,824,795

|

|

1,855,346

|

|

1,847,280

|

|

2,083,804

|

|

2,109,119

|

|

1,966,545

|

|

||||||||

|

Available seat miles (ASMs) (thousands)

|

1,820,131

|

|

1,905,053

|

|

2,194,099

|

|

2,200,640

|

|

2,200,097

|

|

2,425,642

|

|

2,422,962

|

|

2,303,852

|

|

||||||||

|

Load factor (%)

|

80.5

|

|

79.8

|

|

83.2

|

|

84.3

|

|

84.0

|

|

85.9

|

|

87.0

|

|

85.4

|

|

||||||||

|

Average ticket revenue per passenger flight segment ($)

|

89.74

|

|

78.43

|

|

72.38

|

|

71.62

|

|

82.30

|

|

82.00

|

|

81.71

|

|

78.00

|

|

||||||||

|

Average non-ticket revenue per passenger flight segment ($)

|

30.90

|

|

31.64

|

|

34.26

|

|

41.86

|

|

42.62

|

|

43.39

|

|

44.66

|

|

48.22

|

|

||||||||

|

Operating revenue per ASM (RASM) (cents)

|

10.11

|

|

9.31

|

|

9.28

|

|

9.82

|

|

10.58

|

|

11.37

|

|

11.92

|

|

11.89

|

|

||||||||

|

CASM (cents)

|

8.79

|

|

9.22

|

|

8.33

|

|

8.83

|

|

9.35

|

|

9.93

|

|

10.08

|

|

10.24

|

|

||||||||

|

CASM excluding restructuring, or Adjusted CASM (cents) (1)(2)

|

8.82

|

|

9.10

|

|

8.43

|

|

8.86

|

|

9.38

|

|

9.70

|

|

10.01

|

|

10.25

|

|

||||||||

|

Adjusted CASM ex fuel (cents) (1)

|

5.83

|

|

6.03

|

|

5.42

|

|

5.62

|

|

5.67

|

|

5.41

|

|

5.74

|

|

6.08

|

|

||||||||

|

Fuel gallons consumed (thousands)

|

24,200

|

|

24,965

|

|

28,791

|

|

28,672

|

|

28,172

|

|

31,264

|

|

31,640

|

|

29,954

|

|

||||||||

|

Average economic fuel cost per gallon ($)

|

2.25

|

|

2.34

|

|

2.30

|

|

2.48

|

|

2.89

|

|

3.32

|

|

3.27

|

|

3.21

|

|

||||||||

|

2012

|

2013 - 2014

|

2015 - 2016

|

2017 and beyond

|

Total

|

||||||||||||||||

|

Operating lease obligations

|

$

|

147

|

|

$

|

302

|

|

$

|

295

|

|

$

|

450

|

|

$

|

1,194

|

|

|||||

|

Flight equipment purchase obligations

|

304

|

|

672

|

|

1,031

|

|

2,955

|

|

4,962

|

|

||||||||||

|

Total future payments on contractual obligations (1)

|

$

|

451

|

|

$

|

974

|

|

$

|

1,326

|

|

$

|

3,405

|

|

$

|

6,156

|

|

|||||

|

|

Years Ended December 31,

|

||||||||||

|

2011

|

2010

|

2009

|

|||||||||

|

|

|

|

|||||||||

|

Operating revenues:

|

|||||||||||

|

Passenger

|

$

|

689,650

|

|

$

|

537,969

|

|

$

|

536,181

|

|

||

|

Non-ticket

|

381,536

|

|

243,296

|

|

163,856

|

|

|||||

|

Total operating revenue

|

1,071,186

|

|

781,265

|

|

700,037

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Aircraft fuel

|

388,046

|

|

248,206

|

|

181,107

|

|

|||||

|

Salaries, wages and benefits

|

181,742

|

|

156,443

|

|

135,420

|

|

|||||

|

Aircraft rent

|

116,485

|

|

101,345

|

|

89,974

|

|

|||||

|

Landing fees and other rents

|

52,794

|

|

48,118

|

|

42,061

|

|

|||||

|

Distribution

|

51,349

|

|

41,179

|

|

34,067

|

|

|||||

|

Maintenance, materials and repairs

|

35,553

|

|

28,189

|

|

27,536

|

|

|||||

|

Depreciation and amortization

|

7,760

|

|

5,620

|

|

4,924

|

|

|||||

|

Other operating

|

89,636

|

|

82,594

|

|

72,921

|

|

|||||

|

Loss on disposal of assets

|

255

|

|

77

|

|

1,010

|

|

|||||

|

Special charges

|

3,184

|

|

621

|

|

(392

|

)

|

|||||

|

Total operating expenses

|

926,804

|

|

712,392

|

|

588,628

|

|

|||||

|

Operating income

|

144,382

|

|

68,873

|

|

111,409

|

|

|||||

|

Other expense (income):

|

|||||||||||

|

Interest expense

|

24,781

|

|

50,313

|

|

46,892

|

|

|||||

|

Capitalized interest

|

(2,890

|

)

|

(1,491

|

)

|

(951

|

)

|

|||||

|

Interest income

|

(575

|

)

|

(328

|

)

|

(345

|

)

|

|||||

|

Gain on extinguishment of debt

|

—

|

|

—

|

|

(19,711

|

)

|

|||||

|

Other expense

|

235

|

|

194

|

|

298

|

|

|||||

|

Total other expense (income)

|

21,551

|

|

48,688

|

|

26,183

|

|

|||||

|

Income before income taxes

|

122,831

|

|

20,185

|

|

85,226

|

|

|||||

|

Provision (benefit) for income taxes

|

46,383

|

|

(52,296

|

)

|

1,533

|

|

|||||

|

Net income

|

$

|

76,448

|

|

$

|

72,481

|

|

$

|

83,693

|

|

||

|

Net income per share, basic

|

$

|

1.44

|

|

$

|

2.77

|

|

$

|

3.23

|

|

||

|

Net income per share, diluted

|

$

|

1.43

|

|

$

|

2.72

|

|

$

|

3.18

|

|

||

|

|

December 31,

|

||||||

|

2011

|

2010

|

||||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

343,328

|

|

$

|

82,714

|

|

|

|

Restricted cash

|

—

|

|

72,736

|

|

|||

|

Accounts receivable, net

|

15,425

|

|

9,471

|

|

|||

|

Deferred income taxes

|

20,738

|

|

51,492

|

|

|||

|

Other current assets

|

63,217

|

|

34,806

|

|

|||

|

Total current assets

|

442,708

|

|

251,219

|

|

|||

|

Property and equipment:

|

|||||||

|

Flight equipment

|

4,182

|

|

3,901

|

|

|||

|

Ground and other equipment

|

46,608

|

|

39,441

|

|

|||

|

Less accumulated depreciation

|

(27,580

|

)

|

(24,013

|

)

|

|||

|

23,210

|

|

19,329

|

|

||||

|

Deposits on flight equipment purchase contracts

|

91,450

|

|

44,188

|

|

|||

|

Prepaid aircraft maintenance to lessors

|

120,615

|

|

116,857

|

|

|||

|

Long-term deferred income taxes

|

—

|

|

1,319

|

|

|||

|

Security deposits and other long-term assets

|

67,830

|

|

42,845

|

|

|||

|

Total assets

|

$

|

745,813

|

|

$

|

475,757

|

|

|

|

Liabilities and shareholders’ equity (deficit)

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

15,928

|

|

$

|

13,360

|

|

|

|

Air traffic liability

|

112,280

|

|

104,788

|

|

|||

|

Other current liabilities

|

98,856

|

|

73,041

|

|

|||

|

Current maturities of long-term debt and obligations, due to related parties

|

—

|

|

20,000

|

|

|||

|

Current maturities of long-term debt and obligations, due to non-related parties

|

—

|

|

3,240

|

|

|||

|

Total current liabilities

|

227,064

|

|

214,429

|

|

|||

|

Deferred credits and other long-term liabilities

|

52,043

|

|

29,101

|

|

|||

|

Due to related parties, less current maturities

|

—

|

|

245,621

|

|

|||

|

Long-term debt, less current maturities

|

—

|

|

11,966

|

|

|||

|

Mandatorily redeemable preferred stock

|

—

|

|

79,717

|

|

|||

|

Shareholders’ equity (deficit)

|

|||||||

|

Common stock: Class A common stock, $0.0001 par value, 0 and 25,000,000 shares authorized at December 31, 2011 and 2010, respectively; 0 and 20,848,847 shares issued and outstanding as of December 31, 2011 and 2010, respectively

|

—

|

|

2

|

|

|||

|

Common stock: Class B common stock, $0.0001 par value, 0 and 6,500,000 shares authorized at December 31, 2011 and 2010, respectively; 0 and 6,009,978 shares issued and outstanding as of December 31, 2011 and 2010, respectively

|

—

|

|

1

|

|

|||

|

Common stock: Common stock, $.0001 par value, 240,000,000 and 0 shares authorized at December 31, 2011 and 2010, respectively; 61,954,576 and 0 issued and 61,946,361 and 0 outstanding as of December 31, 2011 and 2010, respectively

|

6

|

|

—

|

|

|||

|

Common stock: Non-Voting common stock: $.0001 par value, 50,000,000 and 0 shares authorized at December 31, 2011 and 2010, respectively; 10,576,180 and 0 issued and outstanding as of December 31, 2011 and 2010, respectively

|

1

|

|

—

|

|

|||

|

Additional paid-in-capital

|

496,136

|

|

676

|

|

|||

|

Treasury Stock, at cost 8,215 shares in 2011 and 0 shares in 2010

|

(129

|

)

|

—

|

|

|||

|

Accumulated deficit

|

(29,308

|

)

|

(105,756

|

)

|

|||

|

Total shareholders’ equity (deficit)

|

$

|

466,706

|

|

$

|

(105,077

|

)

|

|

|

Total liabilities and shareholders’ equity (deficit)

|

$

|

745,813

|

|

$

|

475,757

|

|

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2011

|

2010

|

2009

|

||||||||

|

Operating activities:

|

|||||||||||

|

Net income

|

$

|

76,448

|

|

$

|

72,481

|

|

$

|

83,693

|

|

||

|

Adjustments to reconcile net income to net cash provided by operations:

|

|||||||||||

|

Changes in fair value of open fuel hedge contracts

|

3,203

|

|

(2,064

|

)

|

(1,449

|

)

|

|||||

|

Gain on debt extinguishment

|

—

|

|

—

|

|

(19,711

|

)

|

|||||

|

Non-cash restructuring credit charges, net

|

—

|

|

22

|

|

60

|

|

|||||

|

Equity based stock compensation, net

|

530

|

|

569

|

|

113

|

|

|||||

|

Allowance for doubtful accounts

|

27

|

|

(110

|

)

|

109

|

|

|||||

|

Amortization of deferred gains, losses and debt issuance costs

|

(1,047

|

)

|

(574

|

)

|

(255

|

)

|

|||||

|

Depreciation and amortization

|

7,760

|

|

5,620

|

|

4,924

|

|

|||||

|

Deferred income tax benefit (loss)

|

44,180

|

|

(52,811

|

)

|

—

|

|

|||||

|

Loss on disposal of assets

|

255

|

|

77

|

|

1,010

|

|

|||||

|

Interest and dividends incurred but not paid

|

21,875

|

|

43,202

|

|

38,080

|

|

|||||

|

Capitalized interest

|

(2,890

|

)

|

(1,491

|

)

|

(951

|

)

|

|||||

|

Changes in operating assets and liabilities:

|

|||||||||||

|

Restricted cash

|

72,736

|

|

(20,196

|

)

|

16,857

|

|

|||||

|

Accounts receivable

|

(5,728

|

)

|

(1,014

|

)

|

(2,450

|

)

|

|||||

|

Prepaid maintenance reserves

|

(36,848

|

)

|

(35,694

|

)

|

(26,923

|

)

|

|||||

|

Long-term deposits and other assets

|