|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

13-3711155

(I.R.S. Employer

Identification No.)

|

|

Large accelerated filer

o

|

Accelerated filer

ý

|

Non-accelerated filer

o

(Do not check if a smaller

reporting company)

|

Smaller reporting company

o

|

|||

|

|

|

Page

|

|

Part I

|

||

|

Part II

|

||

|

Part III

|

||

|

Part IV

|

||

|

•

|

customer demand for and adoption of our products;

|

|

•

|

market and competitive conditions in our industry, the semiconductor industry and the economy as a whole;

|

|

•

|

the timing and success of new technologies and product introductions by our competitors and by us;

|

|

•

|

our ability to work efficiently with our customers on their qualification of our new technologies and products;

|

|

•

|

our ability to deliver reliable, cost-effective products that meet our customers’ testing requirements in a timely manner;

|

|

•

|

our ability to transition to new product architectures to solve next-generation semiconductor test and measurement challenges, and to bring new products into volume production on time and at acceptable yields and cost;

|

|

•

|

our ability to implement measures for enabling efficiencies and supporting growth in our design, applications, manufacturing and other operational activities;

|

|

•

|

the reduction, rescheduling or cancellation of orders by our customers;

|

|

•

|

our ability to collect accounts receivables owed by our customers;

|

|

•

|

our product and customer sales mix and geographical sales mix;

|

|

•

|

a reduction in the price or the profitability of our products due to competitive pressures or other factors;

|

|

•

|

the timely availability or the cost of components and materials utilized in our products;

|

|

•

|

our ability to efficiently optimize manufacturing capacity and production yields as necessary to meet customer demand and ramp variable production volumes at our manufacturing facilities;

|

|

•

|

our ability to protect our intellectual property against infringement and continue our investment in research and development and design activities;

|

|

•

|

any disruption in the operation of our manufacturing facilities; and

|

|

•

|

the timing of and return on our investments in research and development.

|

|

Fiscal 2016

|

Fiscal 2015

|

Fiscal 2014

|

||||||

|

Intel

|

30.1

|

%

|

19.6

|

%

|

19.7

|

%

|

||

|

Samsung

|

*

|

|

14.6

|

|

*

|

|

||

|

SK hynix

|

*

|

|

14.3

|

|

16.9

|

|

||

|

Micron

|

*

|

|

11.7

|

|

15.0

|

|

||

|

Total revenues attributable to customers greater than 10%

|

30.1

|

%

|

60.2

|

%

|

51.6

|

%

|

||

|

*

|

Less than 10% of revenues.

|

|

•

|

collaborate with customers to understand their future requirements;

|

|

•

|

design innovative and performance-enhancing product architectures, technologies and features that differentiate our products from those of our competitors;

|

|

•

|

in some cases engage with third parties who have particular expertise in order to complete one or more aspects of the design and manufacturing process;

|

|

•

|

qualify with the customer(s) the new product, or an existing product incorporating new technology;

|

|

•

|

transition our products to new manufacturing technologies;

|

|

•

|

offer our products for sale at competitive price levels while maintaining our gross-margins within our financial model;

|

|

•

|

identify emerging technological trends in our target markets;

|

|

•

|

maintain effective marketing strategies;

|

|

•

|

respond effectively to technological changes or product announcements by others; and

|

|

•

|

adjust to changing market conditions quickly and cost-effectively.

|

|

•

|

cause lower than anticipated yields and lengthen delivery schedules;

|

|

•

|

cause delays in product shipments;

|

|

•

|

cause delays in new product introductions;

|

|

•

|

cause us to incur warranty expenses;

|

|

•

|

result in increased costs and diversion of development resources;

|

|

•

|

cause us to incur increased charges due to unusable inventory;

|

|

•

|

require design modifications; or

|

|

•

|

decrease market acceptance or customer satisfaction with these products.

|

|

•

|

compliance with a wide variety of foreign laws and regulations;

|

|

•

|

legal uncertainties regarding taxes, tariffs, quotas, export controls, export licenses and other trade barriers;

|

|

•

|

political and economic instability or foreign conflicts that involve or affect the countries of our customers;

|

|

•

|

difficulties in collecting accounts receivable and longer accounts receivable payment cycles;

|

|

•

|

difficulties in staffing and managing personnel, distributors and representatives;

|

|

•

|

reduced protection for intellectual property rights in some countries;

|

|

•

|

currency exchange rate fluctuations, which could affect the value of our assets denominated in local currency, as well as the price of our products relative to locally produced products;

|

|

•

|

seasonal fluctuations in purchasing patterns in other countries; and

|

|

•

|

fluctuations in freight rates and transportation disruptions.

|

|

•

|

our means of protecting our proprietary rights will be adequate;

|

|

•

|

patents will be issued from our pending or future applications;

|

|

•

|

our existing or future patents will be sufficient in scope or strength to provide any meaningful protection or commercial advantage to us;

|

|

•

|

our patents or other intellectual property will not be invalidated, circumvented or successfully challenged in the United States or foreign countries; or

|

|

•

|

others will not misappropriate our proprietary technologies or independently develop similar technologies, duplicate our products or design around any of our patents or other intellectual property, or attempt to manufacture and sell infringing products in countries that do not strongly enforce intellectual property rights.

|

|

•

|

whether the combined businesses will perform as expected;

|

|

•

|

the possibility that we paid more for the acquisition of Cascade Microtech than the value we will derive from the acquisition; and

|

|

•

|

the reduction of our cash available for operations and other uses and the incurrence of indebtedness to finance the acquisition.

|

|

•

|

variations in our operating results;

|

|

•

|

our forecasts and financial guidance for future periods;

|

|

•

|

announcements of technological innovations, new products or product enhancements, new product adoptions at semiconductor customers or significant agreements by us or by our competitors;

|

|

•

|

reports regarding our ability to bring new products into volume production efficiently;

|

|

•

|

the gain or loss of significant orders or customers;

|

|

•

|

changes in the estimates of our operating results or changes in recommendations by any securities analysts that elect to follow our common stock;

|

|

•

|

rulings on litigations and proceedings;

|

|

•

|

seasonality, principally due to our customers' purchasing cycles;

|

|

•

|

market and competitive conditions in our industry, the entire semiconductor industry and the economy as a whole;

|

|

•

|

recruitment or departure of key personnel; and

|

|

•

|

announcements of mergers and acquisition transactions and the ability to successfully integrate the business activities of the acquired/merged company.

|

|

•

|

establish a classified board of directors so that not all members of our board are elected at one time;

|

|

•

|

provide that directors may only be removed “for cause” and only with the approval of 66.7% of our stockholders;

|

|

•

|

require super-majority voting to amend some provisions in our certificate of incorporation and bylaws;

|

|

•

|

authorize the issuance of “blank check” preferred stock that our board could issue to increase the number of outstanding shares and to discourage a takeover attempt;

|

|

•

|

limit the ability of our stockholders to call special meetings of stockholders;

|

|

•

|

prohibit stockholder action by written consent, which requires all stockholder actions to be taken at a meeting of our stockholders;

|

|

•

|

provide that the board of directors is expressly authorized to make, alter or repeal our bylaws; and

|

|

•

|

establish advance notice requirements for nominations for election to our board or for proposing matters that can be acted upon by stockholders at stockholder meetings.

|

|

Location

|

Principal Use

|

Square

Footage

|

Ownership

|

||||

|

Livermore, California, United States

|

Corporate headquarters, sales, marketing, administration, product design, manufacturing, service and repair, distribution, research and development

|

168,636

|

|

Leased

|

|||

|

Beaverton, Oregon, United States

|

Sales, marketing, administration, product design, manufacturing, service and repair, distribution, research and development

|

98,946

|

|

Leased

|

|||

|

Carlsbad, California, United States

|

Product design, administration, manufacturing, service and repair, distribution, research and development

|

30,876

|

|

Leased

|

|||

|

San Jose, California, United States

|

Administration, product design, manufacturing, service and repair, distribution, research and development

|

23,680

|

|

Leased

|

|||

|

St. Paul, Minnesota, United States

|

Marketing and design

|

9,122

|

|

Leased

|

|||

|

Thiendorf, Germany

|

Sales, marketing, manufacturing, administration, service and repair, distribution, sales, research and development

|

44,713

|

|

Leased

|

|||

|

Munich, Germany

|

Manufacturing, service and repair, distribution, sales, research and development

|

10,656

|

|

Leased

|

|||

|

Singapore

|

Sales, administration, product design, service, and field service

|

30,088

|

|

Leased

|

|||

|

Jubei City, Hsinchu, Taiwan

|

Sales office, administration, product design, field service and repair center

|

20,430

|

|

Leased

|

|||

|

Bundang, South Korea

|

Sales office, administration, product design, field service, and repair center

|

15,310

|

|

Leased

|

|||

|

Yokohama City, Japan

|

Sales office, administration, marketing, product design, research and development, field service, and repair center, manufacturing and distribution

|

15,210

|

|

Leased

|

|||

|

Tokyo, Japan

|

Sales and service

|

1,862

|

|

Leased

|

|||

|

Hiroshima, Japan

|

Repair center

|

1,615

|

|

Leased

|

|||

|

Suzhou, China

|

Sales, marketing, administration, manufacturing, product design, service and repair, distribution, research and development

|

15,177

|

|

Leased

|

|||

|

Shanghai, China

|

Sales and service

|

1,865

|

|

Leased

|

|||

|

Fiscal 2016

|

High

|

Low

|

|||||

|

First Quarter

|

$

|

9.33

|

|

$

|

6.34

|

|

|

|

Second Quarter

|

9.09

|

|

6.51

|

|

|||

|

Third Quarter

|

10.86

|

|

8.72

|

|

|||

|

Fourth Quarter

|

$

|

11.95

|

|

$

|

8.65

|

|

|

|

Fiscal 2015

|

High

|

Low

|

|||||

|

First Quarter

|

$

|

10.26

|

|

$

|

7.55

|

|

|

|

Second Quarter

|

9.51

|

|

7.97

|

|

|||

|

Third Quarter

|

9.20

|

|

5.93

|

|

|||

|

Fourth Quarter

|

$

|

9.13

|

|

$

|

6.49

|

|

|

|

|

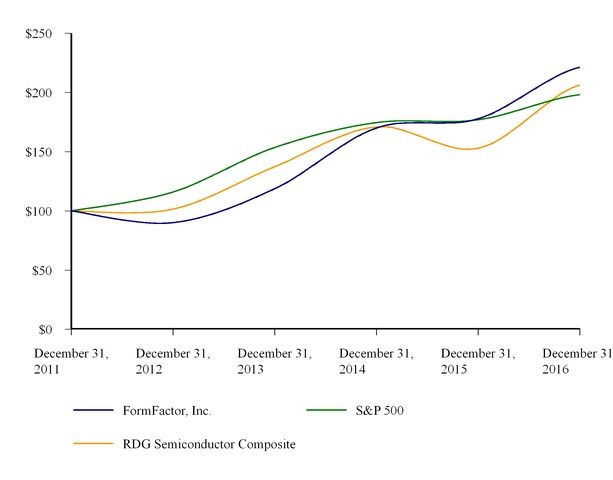

Cumulative Total Return

|

||||||||||||||||||||||

|

|

December 31,

2011 |

December 31,

2012 |

December 31,

2013 |

December 31,

2014 |

December 31,

2015 |

December 31,

2016 |

|||||||||||||||||

|

FormFactor, Inc.

|

$

|

100.00

|

|

$

|

90.12

|

|

$

|

118.77

|

|

$

|

169.96

|

|

$

|

177.87

|

|

$

|

221.34

|

|

|||||

|

S&P 500

|

100.00

|

|

116.00

|

|

153.58

|

|

174.60

|

|

177.01

|

|

198.18

|

|

|||||||||||

|

RDG Semiconductor Composite

|

100.00

|

|

101.55

|

|

137.33

|

|

170.90

|

|

153.05

|

|

206.30

|

|

|||||||||||

|

Fiscal

2016 (1)(2)(7)(8) |

Fiscal

2015 (3) |

Fiscal

2014 (1)(2) |

Fiscal

2013 (1)(2)(4) |

Fiscal

2012 (1)(2)(5)(6) |

|||||||||||||||

|

|

(in thousands, except per share data)

|

||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|||||||||||||||

|

Revenues

|

$

|

383,881

|

|

$

|

282,358

|

|

$

|

268,530

|

|

$

|

231,533

|

|

$

|

178,535

|

|

||||

|

Gross profit

|

102,682

|

|

85,738

|

|

77,439

|

|

42,284

|

|

25,331

|

|

|||||||||

|

Net loss

|

(6,557

|

)

|

(1,523

|

)

|

(19,185

|

)

|

(57,683

|

)

|

(35,546

|

)

|

|||||||||

|

Basic and diluted net loss per share

|

$

|

(0.10

|

)

|

$

|

(0.03

|

)

|

$

|

(0.34

|

)

|

$

|

(1.06

|

)

|

$

|

(0.7

|

)

|

||||

|

Consolidated Balance Sheets Data:

|

|

|

|

||||||||||||||||

|

Cash, cash equivalents and marketable securities

|

$

|

108,905

|

|

$

|

187,589

|

|

$

|

163,837

|

|

$

|

151,091

|

|

$

|

165,788

|

|

||||

|

Working capital

|

172,002

|

|

214,437

|

|

196,412

|

|

173,881

|

|

194,125

|

|

|||||||||

|

Total assets

|

618,982

|

|

342,723

|

|

344,243

|

|

340,708

|

|

395,682

|

|

|||||||||

|

Term loan, net of current portion

|

125,475

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Capital leases, net of current portion

|

—

|

|

—

|

|

—

|

|

—

|

|

340

|

|

|||||||||

|

Total stockholders' equity

|

$

|

401,056

|

|

$

|

294,681

|

|

$

|

289,436

|

|

$

|

294,086

|

|

$

|

339,258

|

|

||||

|

Number of employees

|

1,571

|

|

958

|

|

907

|

|

961

|

|

1,021

|

|

|||||||||

|

(1)

|

Fiscal 2016, 2015, 2014, 2013 and 2012 net losses include restructuring charges, net of

$7.3 million

, $0.6 million, $2.7 million, $4.7 million and $2.9 million, respectively, relating to our global restructuring and reorganization actions. See Note 6—

Restructuring Charges

of the Notes to the Consolidated Financial Statements.

|

|

(2)

|

Fiscal 2016, 2014, 2013 and 2012 net losses include impairment charges of

$12.4 million

, $1.2 million, $0.8 million and $0.4 million, respectively. See Note 7—

Impairment of Long-lived Assets

of the Notes to the Consolidated Financial Statements.

|

|

(3)

|

Fiscal 2015 includes the following: a) a $1.5 million gain from a business interruption insurance claim relating to a factory fire at a customer. See Note-18,

Business Interruption Insurance Claim Recovery

of the Notes to the Consolidated Financial Statements, and b) a $1.0 million net gain from the sale of intellectual property.

|

|

(4)

|

Fiscal 2013 net loss includes $0.3 million attributable to loss on sale of a subsidiary.

|

|

(5)

|

Fiscal 2012 includes a $25.5 million tax benefit from the release of deferred tax asset valuation allowances due to deferred tax liabilities established on the acquired identifiable intangible assets from our acquisition of MicroProbe.

|

|

(6)

|

Fiscal 2012 includes the following as a result of the MicroProbe acquisition: $19.8 million in revenue, $5.4 million in the amortization of intangibles expense, $2.6 million release of pre-existing backlog, $0.2 million charge for step-up depreciation on the fair value of fixed assets, resulting in a $6.4 million net loss. As part of the MicroProbe Acquisition, a patent lawsuit was settled with a benefit of $3.3 million.

|

|

(7)

|

Fiscal 2016 includes a $44.0 million tax benefit from the release of deferred tax asset valuation allowances due to deferred tax liabilities established on the acquired identifiable intangible assets from our acquisition of Cascade Microtech. See Note 14—

Income Taxes

of the Notes to the Consolidated Financial Statements.

|

|

(8)

|

Fiscal 2016 includes the following as a result of the Cascade Microtech acquisition: $82.6 million in revenue, $27.8 million in the amortization of intangibles expense and $7.6 million charge for inventory-related step-up amortization, resulting in a $36.4 million loss.

|

|

|

Fiscal 2016

|

Fiscal 2015

|

Fiscal 2014

|

|||||

|

Revenues

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of revenues

|

73.3

|

|

69.6

|

|

71.2

|

|

||

|

Gross profit

|

26.7

|

|

30.4

|

|

28.8

|

|

||

|

Operating expenses:

|

|

|

|

|||||

|

Research and development

|

15.0

|

|

15.6

|

|

15.9

|

|

||

|

Selling, general and administrative

|

19.1

|

|

16.0

|

|

19.0

|

|

||

|

Restructuring and impairment charges, net

|

5.1

|

|

0.2

|

|

1.5

|

|

||

|

Total operating expenses

|

39.2

|

|

31.8

|

|

36.4

|

|

||

|

Operating loss

|

(12.5

|

)

|

(1.4

|

)

|

(7.6

|

)

|

||

|

Interest income, net

|

0.1

|

|

0.1

|

|

0.1

|

|

||

|

Other income (expense), net

|

(0.7

|

)

|

0.9

|

|

0.1

|

|

||

|

Loss before income taxes

|

(13.1

|

)

|

(0.4

|

)

|

(7.4

|

)

|

||

|

Provision (benefit) from income taxes

|

(11.4

|

)

|

0.1

|

|

(0.3

|

)

|

||

|

Net loss

|

(1.7

|

)%

|

(0.5

|

)%

|

(7.1

|

)%

|

||

|

|

Fiscal 2016

|

Fiscal 2015

|

|||||

|

|

(In thousands)

|

||||||

|

Probe Cards

|

$

|

337,970

|

|

$

|

282,358

|

|

|

|

Systems

|

45,911

|

|

—

|

|

|||

|

Total

|

$

|

383,881

|

|

$

|

282,358

|

|

|

|

Fiscal

|

% of

|

Fiscal

|

% of

|

Change

|

||||||||||||||||

|

2016

|

Revenues

|

2015

|

Revenues

|

$

|

%

|

|||||||||||||||

|

(In thousands, except percentages)

|

||||||||||||||||||||

|

Probe Cards Markets:

|

||||||||||||||||||||

|

Foundry & Logic

|

$

|

237,591

|

|

61.9

|

%

|

$

|

145,839

|

|

51.7

|

%

|

$

|

91,752

|

|

62.9

|

%

|

|||||

|

DRAM

|

86,910

|

|

22.6

|

|

125,512

|

|

44.4

|

|

(38,602

|

)

|

(30.8

|

)

|

||||||||

|

Flash

|

13,469

|

|

3.5

|

|

11,007

|

|

3.9

|

|

2,462

|

|

22.4

|

|

||||||||

|

Systems Market:

|

||||||||||||||||||||

|

Systems

|

45,911

|

|

12.0

|

|

—

|

|

—

|

|

45,911

|

|

100.0

|

|

||||||||

|

Total revenues

|

$

|

383,881

|

|

100.0

|

%

|

$

|

282,358

|

|

100.0

|

%

|

$

|

101,523

|

|

36.0

|

%

|

|||||

|

Fiscal

2016

|

% of

Revenues

|

Fiscal

2015

|

% of

Revenues

|

||||||||||

|

(In thousands, except percentages)

|

|||||||||||||

|

United States

|

$

|

127,641

|

|

33.3

|

%

|

$

|

66,051

|

|

23.4

|

%

|

|||

|

South Korea

|

65,508

|

|

17.1

|

|

71,120

|

|

25.2

|

|

|||||

|

Taiwan

|

57,331

|

|

14.9

|

|

61,711

|

|

21.9

|

|

|||||

|

Europe

|

49,445

|

|

12.9

|

|

25,542

|

|

9.0

|

|

|||||

|

Asia-Pacific (1)

|

43,659

|

|

11.4

|

|

31,389

|

|

11.1

|

|

|||||

|

Japan

|

38,650

|

|

10.0

|

|

26,418

|

|

9.4

|

|

|||||

|

Rest of the world

|

1,647

|

|

0.4

|

|

127

|

|

—

|

|

|||||

|

Total Revenues

|

$

|

383,881

|

|

100.0

|

%

|

$

|

282,358

|

|

100.0

|

%

|

|||

|

(1)

|

Asia-Pacific includes all countries in the region except Taiwan, South Korea, and Japan, which are disclosed separately.

|

|

Fiscal 2016

|

|||||||||||||||

|

Probe Cards

|

Systems

|

Corporate and Other

|

Total

|

||||||||||||

|

Gross profit

|

$

|

121,407

|

|

$

|

23,925

|

|

$

|

(42,650

|

)

|

$

|

102,682

|

|

|||

|

Gross margin

|

35.9

|

%

|

52.1

|

%

|

—

|

%

|

26.7

|

%

|

|||||||

|

Fiscal 2015

|

|||||||||||||||

|

Probe Cards

|

Systems

|

Corporate and Other

|

Total

|

||||||||||||

|

Gross profit

|

$

|

99,199

|

|

$

|

—

|

|

$

|

(13,461

|

)

|

$

|

85,738

|

|

|||

|

Gross margin

|

35.1

|

%

|

—

|

%

|

—

|

%

|

30.4

|

%

|

|||||||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Gross profit

|

$

|

102,682

|

|

$

|

85,738

|

|

|

|

Gross margin

|

26.7

|

%

|

30.4

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Research and development

|

$

|

57,453

|

|

$

|

44,184

|

|

|

|

% of revenues

|

15.0

|

%

|

15.6

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Selling, general and administrative

|

$

|

73,444

|

|

$

|

45,090

|

|

|

|

% of revenues

|

19.1

|

%

|

16.0

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Restructuring and impairment charges, net

|

$

|

19,692

|

|

$

|

567

|

|

|

|

% of revenues

|

5.1

|

%

|

0.2

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Interest income, net

|

$

|

327

|

|

$

|

285

|

|

|

|

% of revenues

|

0.1

|

%

|

0.1

|

%

|

|||

|

Other income (expense), net

|

$

|

(2,615

|

)

|

$

|

2,547

|

|

|

|

% of revenues

|

(0.7

|

)%

|

0.9

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Provision (benefit) from income taxes

|

$

|

(43,638

|

)

|

$

|

252

|

|

|

|

Effective tax rate

|

86.9

|

%

|

(19.8

|

)%

|

|||

|

Fiscal

|

% of

|

Fiscal

|

% of

|

Change

|

||||||||||||||||

|

2015

|

Revenues

|

2014

|

Revenues

|

$

|

%

|

|||||||||||||||

|

(In thousands, except percentages)

|

||||||||||||||||||||

|

Revenues by Market:

|

||||||||||||||||||||

|

Foundry and Logic

|

$

|

145,839

|

|

51.7

|

%

|

$

|

142,360

|

|

53.0

|

%

|

$

|

3,479

|

|

2.4

|

%

|

|||||

|

DRAM

|

125,512

|

|

44.4

|

|

110,800

|

|

41.3

|

|

14,712

|

|

13.3

|

|

||||||||

|

Flash

|

11,007

|

|

3.9

|

|

15,370

|

|

5.7

|

|

(4,363

|

)

|

(28.4

|

)

|

||||||||

|

Total revenues

|

$

|

282,358

|

|

100.0

|

%

|

$

|

268,530

|

|

100.0

|

%

|

$

|

13,828

|

|

5.1

|

%

|

|||||

|

Fiscal

2015

|

% of

Revenues

|

Fiscal

2014

|

% of

Revenues

|

||||||||||

|

(In thousands, except percentages)

|

|||||||||||||

|

South Korea

|

$

|

71,120

|

|

25.2

|

%

|

$

|

52,677

|

|

19.6

|

%

|

|||

|

North America

|

66,178

|

|

23.4

|

|

75,393

|

|

28.1

|

|

|||||

|

Taiwan

|

61,711

|

|

21.9

|

|

49,395

|

|

18.4

|

|

|||||

|

Asia-Pacific (1)

|

31,389

|

|

11.1

|

|

34,705

|

|

12.9

|

|

|||||

|

Japan

|

26,418

|

|

9.4

|

|

25,683

|

|

9.6

|

|

|||||

|

Europe

|

25,542

|

|

9.0

|

|

30,677

|

|

11.4

|

|

|||||

|

Total Revenues

|

$

|

282,358

|

|

100.0

|

%

|

$

|

268,530

|

|

100.0

|

%

|

|||

|

(1)

|

Asia-Pacific includes all countries in the region except Taiwan, South Korea, and Japan, which are disclosed separately.

|

|

•

|

South Korea revenues increased driven primarily by a combination of market share increases at a major South Korean customer based on the adoption of our SmartMatrix product for DRAM applications and increased Foundry and Logic product shipments related to mobile processor demand;

|

|

•

|

North America revenues decreased driven primarily by a shift of Foundry and Logic product shipments for personal computer processors to customers’ test facilities in Europe;

|

|

•

|

Taiwan revenues increased driven primarily by a combination of increased Foundry and Logic product shipments and an increase in commodity or personal computer DRAM demand;

|

|

•

|

Asia-Pacific revenues decreased driven primarily by reduced sales of our SmartMatrix DRAM products;

|

|

•

|

Europe revenues decreased driven primarily due to reduced mobile processor related product demand, partially offset by a shift of Foundry and Logic product shipments for personal computer processors to customers’ test facilities in Europe; and

|

|

•

|

Japan revenues were relatively flat year over year.

|

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Gross profit

|

$

|

85,738

|

|

$

|

77,439

|

|

|

|

Gross margin

|

30.4

|

%

|

28.8

|

%

|

|||

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Research and development

|

$

|

44,184

|

|

$

|

42,725

|

|

|

|

% of revenues

|

15.6

|

%

|

15.9

|

%

|

|||

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Selling, general and administrative

|

$

|

45,090

|

|

$

|

51,385

|

|

|

|

% of revenues

|

16.0

|

%

|

19.0

|

%

|

|||

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Restructuring and impairment charges, net

|

$

|

567

|

|

$

|

3,887

|

|

|

|

% of revenues

|

0.2

|

%

|

1.5

|

%

|

|||

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Interest income, net

|

$

|

285

|

|

$

|

302

|

|

|

|

% of revenues

|

0.1

|

%

|

0.1

|

%

|

|||

|

Other income (expense), net

|

$

|

2,547

|

|

$

|

161

|

|

|

|

% of revenues

|

0.9

|

%

|

0.1

|

%

|

|||

|

Fiscal

2015

|

Fiscal

2014

|

||||||

|

(In thousands, except percentages)

|

|||||||

|

Provision (benefit) from income taxes

|

$

|

252

|

|

$

|

(910

|

)

|

|

|

Effective tax rate

|

(19.8

|

)%

|

4.5

|

%

|

|||

|

Fiscal

2016

|

Fiscal

2015

|

Fiscal

2014

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Net cash provided by operating activities

|

$

|

17,423

|

|

$

|

36,122

|

|

$

|

17,659

|

|

||

|

Net cash (used in) provided by investing activities

|

(206,318

|

)

|

1,129

|

|

37,339

|

|

|||||

|

Net cash provided by (used in) financing activities

|

$

|

143,614

|

|

$

|

(4,792

|

)

|

$

|

2,542

|

|

||

|

Payments Due In Fiscal Years

|

|||||||||||||||||||||||||||

|

2017

|

2018

|

2019

|

2020

|

2021

|

After 2021

|

Total

|

|||||||||||||||||||||

|

(In thousands)

|

|||||||||||||||||||||||||||

|

Operating leases

|

$

|

6,279

|

|

$

|

5,789

|

|

$

|

4,882

|

|

$

|

3,581

|

|

$

|

3,236

|

|

$

|

15,734

|

|

$

|

39,501

|

|

||||||

|

Purchase obligations

|

33,696

|

|

4,550

|

|

515

|

|

—

|

|

—

|

|

—

|

|

38,761

|

|

|||||||||||||

|

Senior secured term loan facility-principal payments (1)

|

13,125

|

|

26,250

|

|

41,250

|

|

50,625

|

|

8,125

|

|

—

|

|

139,375

|

|

|||||||||||||

|

Senior secured term loan facility-interest payments (2)

|

2,828

|

|

2,400

|

|

1,739

|

|

821

|

|

41

|

|

—

|

|

7,829

|

|

|||||||||||||

|

Total

|

$

|

55,928

|

|

$

|

38,989

|

|

$

|

48,386

|

|

$

|

55,027

|

|

$

|

11,402

|

|

$

|

15,734

|

|

$

|

225,466

|

|

||||||

|

(a)

|

The following documents are filed as part of this Annual Report on Form 10-K:

|

|

(b)

|

Financial Statement Schedules:

|

|

(c)

|

Exhibits:

|

|

Incorporated by Reference

|

|||||||||||||||||

|

Exhibit

Number

|

Exhibit Description

|

Form

|

File No

|

Date of

First Filing

|

Exhibit

Number

|

Filed

Herewith

|

|||||||||||

|

2.01***

|

|

Agreement and Plan of Merger, dated February 3, 2016, by and among Cascade Microtech, Inc., FormFactor, Inc. and Cardinal Merger Subsidiary, Inc.

|

8-K

|

|

000-50307

|

|

2/9/2016

|

|

2.1

|

|

|||||||

|

3.01

|

|

Amended and Restated Certificate of Incorporation of the Registrant as filed with the Delaware Secretary of State on June 17, 2003

|

S-1

|

|

333-109815

|

|

10/20/2003

|

|

3.01

|

|

|||||||

|

3.02

|

|

Amended and Restated Bylaws of the Registrant

|

8-K

|

|

000-50307

|

|

7/22/2016

|

|

3.2

|

|

|||||||

|

4.01

|

|

Specimen Common Stock Certificate

|

S-1/A

|

|

333-86738

|

|

5/28/2002

|

|

4.01

|

|

|||||||

|

10.01

|

|

Credit Agreement among FormFactor, Inc. as Borrower, the Guarantors that are from time to time parties thereto, HSBC Bank USA, National Association, as Administrative Agent, Lead Lender, Co-Lead Arranger, Sole Bookrunner, Syndication Agent and Lender, the Lenders that are from time to time parties thereto, and Silicon Valley Bank, as Co-Lead Arranger and Documentation Agent, dated as of June 24, 2016

|

8-K

|

|

000-50307

|

|

6/28/2016

|

|

10.1

|

|

|

||||||

|

10.02+

|

|

Form of Indemnity Agreement

|

S-1/A

|

|

333-86738

|

|

5/28/2002

|

|

10.01

|

|

|||||||

|

10.03+

|

|

Form of Change of Control Severance Agreement

|

10-K

|

|

000-50307

|

|

3/14/2005

|

|

10.48

|

|

|||||||

|

10.04+

|

|

1996 Stock Option Plan, and form of option grant

|

S-1

|

|

333-86738

|

|

4/22/2002

|

|

10.03

|

|

|||||||

|

10.05+

|

|

Incentive Option Plan, and form of option grant

|

S-1

|

|

333-86738

|

|

4/22/2002

|

|

10.04

|

|

|||||||

|

10.06+

|

|

Management Incentive Option Plan, and form of option grant

|

S-1

|

|

333-86738

|

|

4/22/2002

|

|

10.05

|

|

|||||||

|

10.07+

|

|

2002 Equity Incentive Plan, as amended, and forms of plan agreements

|

10-Q

|

|

000-50307

|

|

5/4/2011

|

|

10.06

|

|

|||||||

|

10.08+

|

|

2002 Employee Stock Purchase Plan, as amended

|

10-Q

|

|

000-50307

|

|

8/7/2007

|

|

10.01

|

|

|||||||

|

10.09+

|

|

Key Employee Bonus Plan, as amended

|

10-Q

|

|

000-50307

|

|

5/7/2007

|

|

10.01

|

|

|||||||

|

10.10+

|

|

Equity Incentive Plan, as amended and restated effective April 18, 2012, and forms of plan agreements

|

10-K

|

|

000-50307

|

|

3/13/2013

|

|

10.09

|

|

|||||||

|

10.11+

|

|

Employee Stock Purchase Plan, as amended and restated April 18, 2012

|

10-K

|

|

000-50307

|

|

3/13/2013

|

|

10.1

|

|

|

||||||

|

10.12

|

|

Pacific Corporate Center Lease (Building 1) by and between Greenville Holding Company LLC (successor to Greenville Investors, L.P.) ("Greenville") and the Registrant dated May 3, 2001

|

S-1/A

|

|

333-86738

|

|

6/10/2003

|

|

10.18

|

|

|

||||||

|

10.13

|

|

First Amendment to Pacific Corporate Center Lease (Building 1) by and between Greenville and the Registrant dated January 31, 2003

|

S-1/A

|

|

333-86738

|

|

5/7/2003

|

|

10.18.1

|

|

|

||||||

|

10.14

|

|

Pacific Corporate Center Lease (Building 2) by and between Greenville and the Registrant dated May 3, 2001

|

S-1/A

|

|

333-86738

|

|

6/10/2003

|

|

10.19

|

|

|||||||

|

10.15

|

|

First Amendment to Pacific Corporate Center Lease (Building 2) by and between Greenville and the Registrant dated January 31, 2003

|

S-1/A

|

|

333-86738

|

|

5/7/2003

|

|

10.19.1

|

|

|||||||

|

10.16

|

|

Pacific Corporate Center Lease (Building 3) by and between Greenville and the Registrant dated May 3, 2001

|

S-1/A

|

|

333-86738

|

|

6/10/2003

|

|

10.20

|

|

|||||||

|

10.17+

|

|

First Amendment to Pacific Corporate Center Lease (Building 3) by and between Greenville and the Registrant dated January 31, 2003

|

S-1/A

|

|

333-86738

|

|

5/7/2003

|

|

10.20.1

|

|

|||||||

|

10.18

|

|

Third Amendment, dated December 19, 2016, between FormFactor, Inc. and MOHR PCC, LP, to Pacific Corporate Center Leases (Buildings 1, 2 and 3), dated May 3, 2001, by and between Greenville Investors, L.P. and FormFactor, Inc., as amended

|

8-K

|

|

000-50307

|

|

12/23/2016

|

|

10.2

|

|

|||||||

|

10.19+

|

|

Pacific Corporate Center Lease by and between Greenville and the Registrant dated September 7, 2004., as amended by First Amendment to Building 6 Lease dated August 16, 2006

|

10-Q

|

|

000-50307

|

|

11/7/2006

|

|

10.01

|

|

|||||||

|

10.20

|

|

Second Amendment, dated December 19, 2016, between FormFactor, Inc. and MOHR PCC, LP, to Pacific Corporate Center Lease, dated October 5, 2004, by and between Greenville Investors, L.P. and FormFactor, Inc., as amended

|

8-K

|

|

000-50307

|

|

12/23/2016

|

|

10.1

|

|

|||||||

|

10.21

|

|

Lease Agreements I and II between Amberjack, Ltd. And Cascade Microtech, Inc. dated August 20, 1997, and Amendment No. 2 to Lease Agreement I dated July 23, 1998, and Amendment No. 2 to Lease Agreement II dated April 12, 1999.

|

8-K

|

|

333-47100

|

|

10/2/2000

|

|

10.9

|

|

|||||||

|

10.22

|

|

Third Amendment dated August 11, 2006 to Lease Agreement I dated August 20, 1997 between Amberjack, LTD. and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

11/9/2006

|

|

10.2

|

|

|||||||

|

Incorporated by Reference

|

|||||||||||||||||

|

Exhibit

Number

|

Exhibit Description

|

Form

|

File No

|

Date of

First Filing

|

Exhibit

Number

|

Filed

Herewith

|

|||||||||||

|

10.23

|

|

Third Amendment dated August 11, 2006 to Lease Agreement II dated August 20, 1997 between Amberjack, LTD. and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

11/9/2006

|

|

10.3

|

|

|||||||

|

10.24

|

|

Assignment, Assumption and Amendment of Lease dated as of September 22, 2011 by and among Cascade Microtech, Inc. and R&D Sockets, Inc.

|

8-K

|

|

000-51072

|

|

9/26/2011

|

|

10.1

|

|

|||||||

|

10.25

|

|

Rental Agreement by and between Cascade Microtech Dresden GmbH and Süss Grundstücksverwaltungs GbR dated as of June 17, 2011.

|

10-Q

|

|

000-51072

|

|

8/10/2011

|

|

10.3

|

|

|||||||

|

10.26

|

|

Lease dated April 2, 1999 between Spieker Properties, L.P. and Cascade Microtech, Inc.

|

8-K

|

|

333-47100

|

|

10/2/2000

|

|

10.8

|

|

|||||||

|

10.27

|

|

First amendment to Lease dated January 10, 2007, between Nimbus Center LLC (as successor in interest to Spieker Properties, L.P.) and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

5/9/2014

|

|

10.1

|

|

|||||||

|

10.28

|

|

Second amendment to Lease dated February 25, 2013, between Nimbus Center LLC and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

5/8/2013

|

|

10.2

|

|

|||||||

|

10.29

|

|

Third amendment to Lease dated January 23, 2014, between Nimbus Center LLC and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

5/9/2014

|

|

10.2

|

|

|||||||

|

10.30

|

|

Fourth amendment to Lease dated March 31, 2014, between Nimbus Center LLC and Cascade Microtech, Inc.

|

10-Q

|

|

000-51072

|

|

5/9/2014

|

|

10.3

|

|

|||||||

|

10.31

|

|

Fifth amendment to Lease dated September 24, 2014, between Nimbus Center LLC and Cascade Microtech, Inc.

|

10-K

|

|

000-51072

|

|

3/72016

|

|

10.22

|

|

|||||||

|

10.32

|

|

Sixth amendment to Lease dated July 8, 2015, between Nimbus Center LLC and Cascade Microtech, Inc.

|

10-K

|

|

000-51072

|

|

3/72016

|

|

10.23

|

|

|||||||

|

10.33+

|

|

Employment Offer Letter, dated August 29, 2012 to Mike Slessor

|

10-K

|

|

000-50307

|

|

3/13/2013

|

|

10.19+

|

|

|||||||

|

10.34+

|

|

Tax withholding reimbursement letter between Mike Slessor and the Registrant dated December 30, 2013

|

10-K

|

|

000-50307

|

|

3/6/2015

|

|

10.2

|

|

|||||||

|

10.35+

|

|

CEO Change of Control and Severance Agreement, dated April 28, 2016 by and between Mike Slessor and the Registrant

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

10.36+

|

|

Change of Control and Severance Agreement, dated April 28, 2016 by and between Michael Ludwig and the Registrant

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

21.01

|

|

List of Registrant's subsidiaries

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

23.01

|

|

Consent of Independent Registered Public Accounting Firm - KPMG

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

24.01

|

|

Power of Attorney (included on the signature page of this Form 10-K)

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

31.01

|

|

Certification of Chief Executive Officer pursuant to 15 U.S.C. Section 7241, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

31.02

|

|

Certification of Chief Financial Officer pursuant to 15 U.S.C. Section 7241, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

32.01*

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.INS**

|

|

XBRL Instance Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.SCH**

|

|

XBRL Taxonomy Extension Schema Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.CAL**

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.DEF**

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.LAB**

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

101.PRE**

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

—

|

|

—

|

|

—

|

|

—

|

|

X

|

||||||

|

*

|

This exhibit shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any filings.

|

|

**

|

Pursuant to Rule 406T of Regulation S-T, these interactive data files are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933 or Section 18 of the Securities Exchange Act of 1934 and otherwise are not subject to liability.

|

|

***

|

Confidential treatment has been requested for portions of this document. The schedules, exhibits, and annexes to this exhibit have been omitted in reliance on Item 601(b)(2) of Regulation S-K and will be furnished supplementally to the SEC upon request.

|

|

+

|

Indicates a management contract or compensatory plan or arrangement.

|

|

|

FORMFACTOR, INC.

|

|||

|

By:

|

/s/ MICHAEL M. LUDWIG

|

|||

|

|

|

Michael M. Ludwig

Chief Financial Officer

(Principal Financial Officer and Principal

Accounting Officer)

|

||

|

Signature

|

Title

|

Date

|

||

|

|

|

|

||

|

Principal Executive Officer:

|

|

|

||

|

/s/ MICHAEL D. SLESSOR

|

Chief Executive Officer and Director

|

March 15, 2017

|

||

|

Michael D. Slessor

|

||||

|

Principal Financial Officer and Principal

Accounting Officer:

|

|

|

||

|

/s/ MICHAEL M. LUDWIG

|

Chief Financial Officer

|

March 15, 2017

|

||

|

Michael M. Ludwig

|

||||

|

Signature

|

Title

|

Date

|

||

|

|

|

|

||

|

Additional Directors:

|

|

|

||

|

/s/ LOTHAR MAIER

|

Director

|

March 15, 2017

|

||

|

Lothar Maier

|

||||

|

/s/ EDWARD ROGAS, JR

|

Director

|

March 15, 2017

|

||

|

Edward Rogas, Jr

|

||||

|

/s/ KELLEY STEVEN-WAISS

|

Director

|

March 15, 2017

|

||

|

Kelley Steven-Waiss

|

||||

|

/s/ MICHAEL W. ZELLNER

|

Director

|

March 15, 2017

|

||

|

Michael W. Zellner

|

||||

|

/s/ RAYMOND LINK

|

Director

|

March 15, 2017

|

||

|

Raymond Link

|

||||

|

/s/ RICHARD DELATEUR

|

Director

|

March 15, 2017

|

||

|

Richard DeLateur

|

||||

|

/s/ THOMAS ST. DENNIS

|

Director

|

March 15, 2017

|

||

|

Thomas St. Dennis

|

||||

|

December 31, 2016

|

December 26, 2015

|

||||||

|

|

(In thousands, except share

and per share data)

|

||||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

101,408

|

|

$

|

146,264

|

|

|

|

Marketable securities

|

7,497

|

|

41,325

|

|

|||

|

Accounts receivable, net

|

70,225

|

|

36,725

|

|

|||

|

Inventories, net

|

59,806

|

|

27,223

|

|

|||

|

Restricted cash

|

106

|

|

—

|

|

|||

|

Refundable income taxes

|

1,391

|

|

—

|

|

|||

|

Prepaid expenses and other current assets

|

14,276

|

|

6,481

|

|

|||

|

Total current assets

|

254,709

|

|

258,018

|

|

|||

|

Restricted cash

|

1,082

|

|

435

|

|

|||

|

Property, plant and equipment, net

|

42,663

|

|

23,853

|

|

|||

|

Goodwill

|

188,010

|

|

30,731

|

|

|||

|

Intangibles, net

|

126,608

|

|

25,552

|

|

|||

|

Deferred tax assets

|

3,310

|

|

3,281

|

|

|||

|

Other assets

|

2,600

|

|

853

|

|

|||

|

Total assets

|

$

|

618,982

|

|

$

|

342,723

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Accounts payable

|

$

|

34,075

|

|

$

|

18,072

|

|

|

|

Accrued liabilities

|

30,184

|

|

21,507

|

|

|||

|

Current portion of term loan

|

12,701

|

|

—

|

|

|||

|

Income taxes payable

|

442

|

|

110

|

|

|||

|

Deferred revenue

|

5,305

|

|

3,892

|

|

|||

|

Total current liabilities

|

82,707

|

|

43,581

|

|

|||

|

Long-term income taxes payable

|

1,315

|

|

1,069

|

|

|||

|

Term loan, less current portion

|

125,475

|

|

—

|

|

|||

|

Deferred tax liabilities

|

3,703

|

|

—

|

|

|||

|

Deferred rent and other liabilities

|

4,726

|

|

3,392

|

|

|||

|

Total liabilities

|

217,926

|

|

48,042

|

|

|||

|

Commitments and contingencies (Note 11)

|

|

|

|||||

|

Stockholders' equity:

|

|

|

|||||

|

Preferred stock, $0.001 par value:

|

|

|

|||||

|

10,000,000 shares authorized; no shares issued and outstanding at December 31, 2016 and December 26, 2015

|

—

|

|

—

|

|

|||

|

Common stock, $0.001 par value:

|

|

|

|||||

|

250,000,000 shares authorized; 70,907,847 and 58,088,969 shares issued and outstanding at December 31, 2016 and December 26, 2015, respectively

|

71

|

|

58

|

|

|||

|

Additional paid-in capital

|

833,341

|

|

718,904

|

|

|||

|

Accumulated other comprehensive loss

|

(3,740

|

)

|

(2,222

|

)

|

|||

|

Accumulated deficit

|

(428,616

|

)

|

(422,059

|

)

|

|||

|

Total stockholders' equity

|

401,056

|

|

294,681

|

|

|||

|

Total liabilities and stockholders' equity

|

$

|

618,982

|

|

$

|

342,723

|

|

|

|

|

Fiscal Year Ended

|

||||||||||

|

|

December 31, 2016

|

December 26, 2015

|

December 27, 2014

|

||||||||

|

|

(In thousands, except per share data)

|

||||||||||

|

Revenues

|

$

|

383,881

|

|

$

|

282,358

|

|

$

|

268,530

|

|

||

|

Cost of revenues

|

281,199

|

|

196,620

|

|

191,091

|

|

|||||

|

Gross profit

|

102,682

|

|

85,738

|

|

77,439

|

|

|||||

|

Operating expenses:

|

|

|

|

||||||||

|

Research and development

|

57,453

|

|

44,184

|

|

42,725

|

|

|||||

|

Selling, general and administrative

|

73,444

|

|

45,090

|

|

51,385

|

|

|||||

|

Restructuring and impairment charges, net

|

19,692

|

|

567

|

|

3,887

|

|

|||||

|

Total operating expenses

|

150,589

|

|

89,841

|

|

97,997

|

|

|||||

|

Operating loss

|

(47,907

|

)

|

(4,103

|

)

|

(20,558

|

)

|

|||||

|

Interest income, net

|

327

|

|

285

|

|

302

|

|

|||||

|

Other income (expense), net

|

(2,615

|

)

|

2,547

|

|

161

|

|

|||||

|

Loss before income taxes

|

(50,195

|

)

|

(1,271

|

)

|

(20,095

|

)

|

|||||

|

Provision (benefit) from income taxes

|

(43,638

|

)

|

252

|

|

(910

|

)

|

|||||

|

Net loss

|

$

|

(6,557

|

)

|

$

|

(1,523

|

)

|

$

|

(19,185

|

)

|

||

|

Net loss per share:

|

|

|

|

||||||||

|

Basic and diluted

|

$

|

(0.10

|

)

|

$

|

(0.03

|

)

|

$

|

(0.34

|

)

|

||

|

Weighted-average number of shares used in per share calculations:

|

|

|

|

||||||||

|

Basic and diluted

|

64,941

|

|

57,850

|

|

55,908

|

|

|||||

|

Fiscal Year Ended

|

|||||||||||

|

December 31, 2016

|

December 26, 2015

|

December 27, 2014

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Net loss

|

$

|

(6,557

|

)

|

$

|

(1,523

|

)

|

$

|

(19,185

|

)

|

||

|

Other comprehensive loss, net of tax:

|

|||||||||||

|

Foreign currency translation adjustments

|

(2,042

|

)

|

(397

|

)

|

(1,502

|

)

|

|||||

|

Unrealized gains (losses) on available-for-sale marketable securities

|

29

|

|

(64

|

)

|

(10

|

)

|

|||||

|

Unrealized gains on derivative instruments

|

495

|

|

—

|

|

—

|

|

|||||

|

Other comprehensive loss, net of tax

|

(1,518

|

)

|

(461

|

)

|

(1,512

|

)

|

|||||

|

Comprehensive loss

|

$

|

(8,075

|

)

|

$

|

(1,984

|

)

|

$

|

(20,697

|

)

|

||

|

|

Common Stock

|

Additional Paid-in Capital

|

Accumulated Other Comprehensive Loss

|

Accumulated Deficit

|

Total

|

|||||||||||||||||

|

|

||||||||||||||||||||||

|

|

Shares

|

Amount

|

||||||||||||||||||||

|

|

(In thousands, except shares)

|

|||||||||||||||||||||

|

Balances, December 28, 2013

|

54,649,600

|

|

$

|

55

|

|

$

|

695,631

|

|

$

|

(249

|

)

|

$

|

(401,351

|

)

|

$

|

294,086

|

|

|||||

|

Issuance of common stock pursuant to vesting of restricted stock units, net of stock withheld

|

1,282,442

|

|

1

|

|

—

|

|

—

|

|

—

|

|

1

|

|

||||||||||

|

Issuance of common stock under the Employee Stock Purchase Plan

|

586,386

|

|

1

|

|

2,811

|

|

—

|

|

—

|

|

2,812

|

|

||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

13,234

|

|

—

|

|

—

|

|

13,234

|

|

||||||||||

|

Components of other comprehensive loss:

|

|

|

|

|

|

|||||||||||||||||

|

Change in unrealized gain (loss) on marketable securities, net of tax

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

—

|

|

(10

|

)

|

||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

(1,502

|

)

|

—

|

|

(1,502

|

)

|

||||||||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(19,185

|

)

|

(19,185

|

)

|

||||||||||

|

Balances, December 27, 2014

|

56,518,428

|

|

57

|

|

711,676

|

|

(1,761

|

)

|

(420,536

|

)

|

289,436

|

|

||||||||||

|

Issuance of common stock pursuant to exercise of options for cash

|

24,607

|

|

—

|

|

209

|

|

—

|

|

—

|

|

209

|

|

||||||||||

|

Issuance of common stock pursuant to vesting of restricted stock units, net of stock withheld

|

1,993,603

|

|

2

|

|

—

|

|

—

|

|

—

|

|

2

|

|

||||||||||

|

Issuance of common stock under the Employee Stock Purchase Plan

|

565,493

|

|

—

|

|

3,206

|

|

—

|

|

—

|

|

3,206

|

|

||||||||||

|

Purchase and retirement of common stock

|

(1,013,162

|

)

|

(1

|

)

|

(8,210

|

)

|

—

|

|

—

|

|

(8,211

|

)

|

||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

12,023

|

|

—

|

|

—

|

|

12,023

|

|

||||||||||

|

Components of other comprehensive loss:

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Change in unrealized gain (loss) on marketable securities, net of tax

|

—

|

|

—

|

|

—

|

|

(64

|

)

|

—

|

|

(64

|

)

|

||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

(397

|

)

|

—

|

|