|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland (First Industrial Realty Trust, Inc.)

|

36-3935116 (First Industrial Realty Trust, Inc.)

|

|

|

Delaware (First Industrial, L.P.)

|

36-3924586 (First Industrial, L.P.)

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

1 N. Wacker Drive,

Suite 4200, Chicago, Illinois

|

60606

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

First Industrial Realty Trust, Inc.

|

Yes

þ

No

o

|

|

First Industrial, L.P.

|

Yes

þ

No

o

|

|

First Industrial Realty Trust, Inc.

|

Yes

o

No

þ

|

|

First Industrial, L.P.

|

Yes

o

No

þ

|

|

First Industrial Realty Trust, Inc.

|

Yes

þ

No

o

|

|

First Industrial, L.P.

|

Yes

þ

No

o

|

|

First Industrial Realty Trust, Inc.

|

Yes

þ

No

o

|

|

First Industrial, L.P.

|

Yes

þ

No

o

|

|

First Industrial Realty Trust, Inc.:

|

|||||||

|

Large accelerated filer

|

þ

|

Accelerated filer

|

o

|

||||

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

||||

|

(Do not check if a smaller reporting company)

|

Emerging growth company

|

o

|

|||||

|

First Industrial, L.P.:

|

|||||||

|

Large accelerated filer

|

o

|

Accelerated filer

|

þ

|

||||

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

||||

|

(Do not check if a smaller reporting company)

|

Emerging growth company

|

o

|

|||||

|

First Industrial Realty Trust, Inc.

|

o

|

|

First Industrial, L.P.

|

o

|

|

First Industrial Realty Trust, Inc.

|

Yes

o

No

þ

|

|

First Industrial, L.P.

|

Yes

o

No

þ

|

|

•

|

Stockholders' Equity, Noncontrolling Interest and Partners' Capital.

The 2.0% equity interest in the Operating Partnership held by entities other than the Company are classified within partners' capital in the Operating Partnership's financial statements and as a noncontrolling interest in the Company's financial statements.

|

|

•

|

Relationship to Other Real Estate Partnerships.

The Company's operations are conducted primarily through the Operating Partnership and its subsidiaries, though operations are also conducted through eight other limited partnerships, which are referred to as the "Other Real Estate Partnerships." The Operating Partnership is a limited partner, holding at least a 99% interest, and the Company is a general partner, holding at least a .01% general partnership interest through eight separate wholly-owned corporations, in each of the Other Real Estate Partnerships. The Other Real Estate Partnerships are variable interest entities that both the Company and the Operating Partnership consolidate. The Company's direct general partnership interest in the Other Real Estate Partnerships is reflected as noncontrolling interest within the Operating Partnership's financial statements.

|

|

•

|

Relationship to Service Subsidiary.

The Company has a direct wholly-owned subsidiary that does not own any real estate but provides services to various other entities owned by the Company. Since the Operating Partnership does not have an ownership interest in this entity, its operations are reflected in the consolidated results of the Company but not the Operating Partnership. Also, this entity owes certain amounts to the Operating Partnership, for which a receivable is included on the Operating Partnership's balance sheet but is eliminated on the Company's consolidated balance sheet, since both this entity and the Operating Partnership are fully consolidated by the Company.

|

|

•

|

enhances investors' understanding of the Company and the Operating Partnership by enabling them to view the business as a whole and in the same manner as management views and operates the business;

|

|

•

|

creates time and cost efficiencies through the preparation of one combined report instead of two separate reports; and

|

|

•

|

eliminates duplicative disclosures and provides a more streamlined and readable presentation for our investors to review since a substantial portion of the Company's disclosure applies to both the Company and the Operating Partnership.

|

|

•

|

consolidated financial statements;

|

|

•

|

a single set of consolidated notes to such financial statements that includes separate discussions of each entity's stockholders' equity or partners' capital, as applicable; and

|

|

•

|

a combined Management's Discussion and Analysis of Financial Condition and Results of Operations section that includes distinct information related to each entity.

|

|

|

|

Page

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

•

|

changes in national, international, regional and local economic conditions generally and real estate markets specifically;

|

|

•

|

changes in legislation/regulation (including changes to laws governing the taxation of real estate investment trusts) and actions of regulatory authorities;

|

|

•

|

our ability to qualify and maintain our status as a real estate investment trust;

|

|

•

|

the availability and attractiveness of financing (including both public and private capital) and changes in interest rates;

|

|

•

|

the availability and attractiveness of terms of additional debt repurchases;

|

|

•

|

changes in our credit agency ratings;

|

|

•

|

our ability to comply with applicable financial covenants;

|

|

•

|

our competitive environment;

|

|

•

|

changes in supply, demand and valuation of industrial properties and land in our current and potential market areas;

|

|

•

|

difficulties in identifying and consummating acquisitions and dispositions;

|

|

•

|

our ability to manage the integration of properties we acquire;

|

|

•

|

potential liability relating to environmental matters;

|

|

•

|

defaults on or non-renewal of leases by our tenants;

|

|

•

|

decreased rental rates or increased vacancy rates;

|

|

•

|

higher-than-expected real estate construction costs and delays in development or lease-up schedules;

|

|

•

|

changes in general accounting principles, policies and guidelines applicable to real estate investment trusts; and

|

|

•

|

other risks and uncertainties described in Item 1A, "Risk Factors" and elsewhere in this report as well as those risks and uncertainties discussed from time to time in our other Exchange Act reports and in our other public filings with the Securities and Exchange Commission (the "SEC").

|

|

Item 1.

|

Business

|

|

•

|

Internal Growth.

We seek to grow internally by (i) increasing revenues by renewing or re-leasing spaces subject to expiring leases at higher rental levels; (ii) contractual rent escalations on our long-term leases; (iii) increasing occupancy levels at properties where vacancies exist and maintaining occupancy elsewhere; (iv) controlling and minimizing property operating and general and administrative expenses; and (v) renovating existing properties.

|

|

•

|

External Growth.

We seek to grow externally through (i) the development of industrial properties; (ii) the acquisition of portfolios of industrial properties or individual properties which meet our investment parameters within our target markets; (iii) the expansion of our properties; and (iv) possible additional joint venture investments.

|

|

•

|

Portfolio Enhancement.

We continually seek to upgrade our overall portfolio via new investments as well as through the sale of select assets that we believe do not exhibit favorable characteristics for long-term cash flow growth.

|

|

•

|

Organizational Strategy.

We implement our decentralized property operations strategy through the deployment of experienced regional management teams and local property managers. We provide acquisition, development and financing assistance, asset management oversight and financial reporting functions from our headquarters in Chicago, Illinois to support our regional operations. We believe the size of our portfolio enables us to realize operating efficiencies by spreading overhead among many properties and by negotiating purchasing discounts.

|

|

•

|

Market Strategy.

Our market strategy is to concentrate on the top industrial real estate markets in the United States. These markets have one or more of the following characteristics: (i) favorable industrial real estate fundamentals, including improving industrial demand and constrained supply that can lead to long-term rent growth; (ii) warehouse distribution markets with favorable economic and business environments that should benefit from increases in distribution activity driven by growth in global trade and local consumption; and (iii) sufficient size to provide ample opportunity for growth through incremental investments as well as offer asset liquidity.

|

|

•

|

Leasing and Marketing Strategy.

We have an operational management strategy designed to enhance tenant satisfaction and portfolio performance. We pursue an active leasing strategy, which includes broadly marketing available space, seeking to renew existing leases at higher rents per square foot and seeking leases which provide for the pass-through of property-related expenses to the tenant. We also have local and national marketing programs which focus on the business and real estate brokerage communities and multi-national tenants.

|

|

•

|

Acquisition/Development Strategy.

Our acquisition/development strategy is to invest in industrial properties in the top industrial real estate markets in the United States through the deployment of experienced regional management teams.

|

|

•

|

Disposition Strategy.

We continually evaluate local market conditions and property-related factors in all of our markets for purposes of identifying assets suitable for disposition.

|

|

•

|

Financing Strategy.

To finance acquisitions, developments and debt maturities, as market conditions permit, we may utilize a portion of proceeds from property sales, unsecured debt offerings, term loans, mortgage financings and line of credit borrowings under our $725.0 million unsecured revolving credit agreement (the "Unsecured Credit Facility"), and proceeds from the issuance, when and as warranted, of additional equity securities. We also continually evaluate joint venture arrangements as another source of capital to finance acquisitions and developments. As of

February 15, 2019

, we had approximately $713.4 million available for additional borrowings under the Unsecured Credit Facility.

|

|

Item 1A.

|

Risk Factors

|

|

•

|

general economic conditions;

|

|

•

|

local, regional, national and international economic conditions and other events and occurrences that affect the markets in which we own properties;

|

|

•

|

local conditions such as oversupply or a reduction in demand in an area;

|

|

•

|

increasing labor and material costs;

|

|

•

|

the ability to collect on a timely basis all rents from tenants;

|

|

•

|

changes in tenant operations, real estate needs and credit;

|

|

•

|

changes in interest rates and in the availability, cost and terms of mortgage funding;

|

|

•

|

zoning or other regulatory restrictions;

|

|

•

|

competition from other available real estate;

|

|

•

|

operating costs, including maintenance, insurance premiums and real estate taxes; and

|

|

•

|

other factors that are beyond our control.

|

|

•

|

we may not be able to obtain financing for these projects on favorable terms;

|

|

•

|

we may not complete construction on schedule or within budget;

|

|

•

|

we may not be able to obtain, or may experience delays in obtaining, all necessary zoning, land-use, building, occupancy and other governmental permits and authorizations;

|

|

•

|

contractor and subcontractor disputes, strikes, labor disputes or supply chain disruptions may occur; and

|

|

•

|

properties may perform below anticipated levels, producing cash flow below budgeted amounts, which may result in us paying too much for a property, cause the property to not be profitable and limit our ability to sell such properties to third parties.

|

|

•

|

interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates;

|

|

•

|

available interest rate hedges may not correspond directly with the interest rate risk for which protection is sought;

|

|

•

|

the duration of the hedge may not match the duration of the related liability;

|

|

•

|

the amount of income that a REIT may earn from hedging transactions (other than through taxable REIT subsidiaries) is limited by U.S. federal tax provisions governing REITs;

|

|

•

|

the credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction;

|

|

•

|

the party owing money in the hedging transaction may default on its obligation to pay;

|

|

•

|

we could incur significant costs associated with the settlement of the agreements;

|

|

•

|

the underlying transactions could fail to qualify as highly-effective cash flow hedges under generally accepted accounting practices; and

|

|

•

|

a court could rule that such an agreement is not legally enforceable.

|

|

•

|

compromise the confidential information of our employees, tenants and vendors;

|

|

•

|

disrupt the proper functioning of our networks and systems, and therefore our operations and/or those of certain of our tenants;

|

|

•

|

result in our inability to maintain the building systems relied upon by our tenants for the efficient use of their leased space;

|

|

•

|

result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of proprietary, confidential, sensitive or otherwise valuable information of ours or others, which others could use to compete against us or for disruptive, destructive or otherwise harmful purposes and outcomes;

|

|

•

|

result in misstated financial reports, violations of loan covenants and/or missed reporting deadlines;

|

|

•

|

result in our inability to properly monitor our compliance with the rules and regulations regarding our qualification as a REIT;

|

|

•

|

require significant management attention and resources to remedy any damages that result;

|

|

•

|

subject us to claims for breach of contract, damages, credits, penalties or termination of leases or other agreements; or

|

|

•

|

damage our reputation among our tenants, investors and associates.

|

|

•

|

joint venturers may share certain approval rights over major decisions, which might (i) significantly delay or make impossible actions and decisions we believe are necessary or advisable with respect to properties owned through a joint venture, and/or (ii) adversely affect our ability to develop, finance, lease or sell properties owned through a joint venture at the most advantageous time for us, if at all;

|

|

•

|

joint venturers might become bankrupt or otherwise fail to fund their share of any required capital contributions;

|

|

•

|

joint venturers might have economic or other business interests or goals that are competitive or inconsistent with our business interests or goals that would affect our ability to develop, finance, lease, operate, manage or sell any properties owned by the applicable joint venture;

|

|

•

|

joint venturers may have the power to act contrary to our instructions, requests, policies or objectives, including our current policy with respect to maintaining the Company's qualification as a REIT;

|

|

•

|

joint venture agreements often restrict the transfer of a member’s or joint venturer’s interest or may otherwise restrict our ability to sell our interest when we would like to or on advantageous terms;

|

|

•

|

disputes between us and our joint venturers may result in litigation or arbitration that would increase our expenses and prevent our officers and directors from focusing their time and effort on our business and subject the properties owned by the applicable joint venture to additional risk; and

|

|

•

|

we may in certain circumstances be liable for the actions of our joint venturers.

|

|

Item 1B.

|

Unresolved SEC Comments

|

|

Item 2.

|

Properties

|

|

•

|

Bulk warehouse buildings are of more than 100,000 square feet, have a ceiling height of at least 22 feet and are comprised of 5%-15% of office space;

|

|

•

|

Regional warehouses are of less than 100,000 square feet, have a ceiling height of at least 22 feet and are comprised of 5%-15% of office space;

|

|

•

|

Light industrial properties are of less than 100,000 square feet, have a ceiling height of 16-21 feet and are comprised of 5%-50% of office space; and

|

|

•

|

R&D/flex buildings are of less than 100,000 square feet, have a ceiling height of less than 16 feet and are comprised of 50% or more of office space.

|

|

|

Bulk Warehouse

|

Regional

Warehouse

|

Light Industrial

|

R&D/Flex

|

Total

|

|||||||||||||||||||||||||||

|

Metropolitan Area

|

GLA

(in 000's) |

Number of

Properties

|

GLA

(in 000's) |

Number of

Properties

|

GLA

(in 000's) |

Number of

Properties

|

GLA

(in 000's) |

Number of

Properties

|

GLA

(in 000's) |

Number of

Properties

|

Occupancy

at 12/31/18

|

|||||||||||||||||||||

|

Atlanta, GA

|

3,859

|

|

13

|

|

340

|

|

4

|

|

347

|

|

5

|

|

—

|

|

—

|

|

4,546

|

|

22

|

|

94.5

|

%

|

||||||||||

|

Baltimore, MD

|

1,579

|

|

5

|

|

—

|

|

—

|

|

315

|

|

5

|

|

52

|

|

1

|

|

1,946

|

|

11

|

|

100.0

|

%

|

||||||||||

|

Central/Eastern PA

(A)

|

5,957

|

|

14

|

|

580

|

|

6

|

|

346

|

|

7

|

|

—

|

|

—

|

|

6,883

|

|

27

|

|

96.4

|

%

|

||||||||||

|

Chicago, IL

|

4,737

|

|

14

|

|

326

|

|

6

|

|

255

|

|

5

|

|

—

|

|

—

|

|

5,318

|

|

25

|

|

98.9

|

%

|

||||||||||

|

Cincinnati, OH

|

683

|

|

3

|

|

311

|

|

3

|

|

278

|

|

5

|

|

100

|

|

2

|

|

1,372

|

|

13

|

|

98.0

|

%

|

||||||||||

|

Cleveland, OH

|

1,128

|

|

6

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,128

|

|

6

|

|

100.0

|

%

|

||||||||||

|

Dallas/Ft. Worth, TX

|

3,781

|

|

24

|

|

483

|

|

6

|

|

971

|

|

17

|

|

—

|

|

—

|

|

5,235

|

|

47

|

|

98.6

|

%

|

||||||||||

|

Denver, CO

|

579

|

|

4

|

|

632

|

|

6

|

|

986

|

|

21

|

|

156

|

|

5

|

|

2,353

|

|

36

|

|

99.4

|

%

|

||||||||||

|

Detroit, MI

|

399

|

|

3

|

|

509

|

|

11

|

|

652

|

|

27

|

|

136

|

|

3

|

|

1,696

|

|

44

|

|

100.0

|

%

|

||||||||||

|

Houston, TX

|

2,592

|

|

12

|

|

377

|

|

5

|

|

470

|

|

8

|

|

—

|

|

—

|

|

3,439

|

|

25

|

|

99.9

|

%

|

||||||||||

|

Indianapolis, IN

|

1,968

|

|

6

|

|

603

|

|

7

|

|

125

|

|

4

|

|

20

|

|

1

|

|

2,716

|

|

18

|

|

99.3

|

%

|

||||||||||

|

Miami, FL

|

315

|

|

2

|

|

345

|

|

7

|

|

72

|

|

1

|

|

—

|

|

—

|

|

732

|

|

10

|

|

96.8

|

%

|

||||||||||

|

Milwaukee, WI

|

873

|

|

4

|

|

90

|

|

1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

963

|

|

5

|

|

100.0

|

%

|

||||||||||

|

Minneapolis/St. Paul, MN

|

2,779

|

|

13

|

|

145

|

|

2

|

|

322

|

|

4

|

|

406

|

|

5

|

|

3,652

|

|

24

|

|

96.9

|

%

|

||||||||||

|

Nashville, TN

|

979

|

|

3

|

|

—

|

|

—

|

|

164

|

|

2

|

|

—

|

|

—

|

|

1,143

|

|

5

|

|

100.0

|

%

|

||||||||||

|

New Jersey

(A)

|

1,239

|

|

5

|

|

—

|

|

—

|

|

781

|

|

14

|

|

172

|

|

3

|

|

2,192

|

|

22

|

|

98.9

|

%

|

||||||||||

|

Orlando, FL

|

427

|

|

3

|

|

180

|

|

2

|

|

79

|

|

1

|

|

—

|

|

—

|

|

686

|

|

6

|

|

100.0

|

%

|

||||||||||

|

Phoenix, AZ

|

2,197

|

|

7

|

|

395

|

|

6

|

|

38

|

|

1

|

|

—

|

|

—

|

|

2,630

|

|

14

|

|

99.9

|

%

|

||||||||||

|

Seattle, WA

|

101

|

|

1

|

|

162

|

|

3

|

|

—

|

|

—

|

|

—

|

|

—

|

|

263

|

|

4

|

|

100.0

|

%

|

||||||||||

|

Southern California

(A)

|

6,383

|

|

21

|

|

1,156

|

|

18

|

|

825

|

|

21

|

|

—

|

|

—

|

|

8,364

|

|

60

|

|

99.6

|

%

|

||||||||||

|

St. Louis, MO

|

1,238

|

|

2

|

|

—

|

|

—

|

|

65

|

|

1

|

|

192

|

|

2

|

|

1,495

|

|

5

|

|

98.9

|

%

|

||||||||||

|

Tampa, FL

|

210

|

|

1

|

|

—

|

|

—

|

|

83

|

|

3

|

|

217

|

|

9

|

|

510

|

|

13

|

|

95.1

|

%

|

||||||||||

|

Other

(B)

|

1,440

|

|

5

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,440

|

|

5

|

|

100.0

|

%

|

||||||||||

|

Total

|

45,443

|

|

171

|

|

6,634

|

|

93

|

|

7,174

|

|

152

|

|

1,451

|

|

31

|

|

60,702

|

|

447

|

|

98.5

|

%

|

||||||||||

|

Occupancy by Industrial Property Type

|

98.6

|

%

|

99.5

|

%

|

97.1

|

%

|

94.7

|

%

|

98.5

|

%

|

||||||||||||||||||||||

|

(A)

|

Central/Eastern PA includes the markets of Central Pennsylvania and Philadelphia. New Jersey includes the markets of Northern and Southern New Jersey. Southern California includes the markets of Los Angeles, the Inland Empire and San Diego.

|

|

(B)

|

Properties are located in Kansas City, MO; Jefferson County, KY; Greenville, KY; Winchester, VA; and Salt Lake City, UT.

|

|

Metropolitan Area

|

Number of

Properties

|

GLA

|

Property Type

|

Occupancy

at 12/31/18

|

||||||||

|

Houston, TX

|

2

|

|

334,360

|

|

Bulk Warehouse

|

10

|

%

|

(A)

|

||||

|

New Jersey

|

1

|

|

119,922

|

|

Bulk Warehouse

|

100

|

%

|

|||||

|

Orlando, FL

|

1

|

|

93,608

|

|

Regional Warehouse

|

100

|

%

|

|||||

|

Seattle, WA

|

2

|

|

91,468

|

|

Regional Warehouse

|

38

|

%

|

|||||

|

Southern California

|

4

|

|

396,045

|

|

Bulk Warehouse, Regional Warehouse

|

57

|

%

|

|||||

|

Total

|

10

|

|

1,035,403

|

|

||||||||

|

Metropolitan Area

|

Number of

Properties

|

GLA

|

Property Type

|

Occupancy

at 12/31/18

|

|||||||

|

Chicago, IL

|

1

|

|

602,348

|

|

Bulk Warehouse

|

100

|

%

|

||||

|

Phoenix, AZ

|

1

|

|

643,798

|

|

Bulk Warehouse

|

100

|

%

|

||||

|

Southern California

|

6

|

|

2,208,414

|

|

Bulk Warehouse, Regional Warehouse

|

100

|

%

|

||||

|

Total

|

8

|

|

3,454,560

|

|

|||||||

|

Metropolitan Area

|

Number of

Properties

|

GLA

|

Property Type

|

Occupancy

at 12/31/18

|

||||||

|

Central/Eastern PA

|

2

|

|

988,920

|

|

Bulk Warehouse

|

0%

|

||||

|

Chicago, IL

|

1

|

|

355,199

|

|

Bulk Warehouse

|

0%

|

||||

|

Houston, TX

|

1

|

|

126,250

|

|

Bulk Warehouse

|

0%

|

||||

|

Southern California

|

2

|

|

358,065

|

|

Bulk Warehouse

|

0%

|

||||

|

Total

|

6

|

|

1,828,434

|

|

||||||

|

Metropolitan Area

|

Number of

Properties

|

GLA

|

Property Type

|

Anticipated Quarter of Building Completion

|

||||||

|

Seattle, WA

|

1

|

|

66,751

|

|

Regional Warehouse

|

Q2 2019

|

||||

|

Dallas/Fort Worth, TX

|

2

|

|

345,280

|

|

Bulk Warehouse

|

Q2 2019

|

||||

|

Denver, CO

|

1

|

|

555,840

|

|

Bulk Warehouse

|

Q3 2019

|

||||

|

Southern California

|

1

|

|

239,950

|

|

Bulk Warehouse

|

Q3 2019

|

||||

|

Atlanta, GA

|

1

|

|

703,080

|

|

Bulk Warehouse

|

Q3 2019

|

||||

|

Dallas/Fort Worth, TX

|

1

|

|

863,328

|

|

Bulk Warehouse

|

Q4 2019

|

||||

|

Total

|

7

|

|

2,774,229

|

|

||||||

|

Metropolitan Area

|

Number of

Properties

|

GLA

|

Property Type

|

|||||

|

Atlanta, GA

|

1

|

|

364,000

|

|

Regional Warehouse

|

|||

|

Baltimore/Washington

|

7

|

|

322,239

|

|

R & D/Flex, Regional Warehouse, Light Industrial

|

|||

|

Chicago, IL

|

1

|

|

85,955

|

|

R & D/Flex

|

|||

|

Dallas/Ft. Worth, TX

|

18

|

|

445,559

|

|

R & D/Flex, Regional Warehouse, Light Industrial

|

|||

|

Denver, CO

|

4

|

|

145,700

|

|

Light Industrial

|

|||

|

Detroit, MI

|

2

|

|

29,006

|

|

Light Industrial

|

|||

|

Indianapolis, IN

|

1

|

|

54,000

|

|

Light Industrial

|

|||

|

Miami, FL

(A)

|

1

|

|

9,500

|

|

Light Industrial

|

|||

|

New Jersey

|

2

|

|

196,026

|

|

Regional Warehouse, Light Industrial

|

|||

|

Phoenix, AZ

|

2

|

|

210,417

|

|

Bulk Warehouse, Regional Warehouse

|

|||

|

Southern California

|

2

|

|

142,241

|

|

Regional Warehouse, Light Industrial

|

|||

|

St. Louis, MO

|

4

|

|

317,109

|

|

Light Industrial

|

|||

|

Tampa, FL

|

8

|

|

266,362

|

|

R & D/Flex, Light Industrial

|

|||

|

Total

|

53

|

|

2,588,114

|

|

||||

|

Number of

Leases

Commenced

|

Square Feet

Commenced

(in 000's)

|

Net Rent Per

Square Foot

(A)

|

Straight Line Basis

Rent Growth

(B)

|

Weighted

Average Lease

Term

(C)

|

Lease Costs

Per Square

Foot

(D)

|

Weighted

Average Tenant

Retention

(E)

|

||||||||||||||||

|

New Leases

|

128

|

|

2,342

|

|

$

|

5.82

|

|

21.1

|

%

|

6.2

|

|

$

|

5.10

|

|

N/A

|

|

||||||

|

Renewal Leases

|

187

|

|

7,421

|

|

$

|

5.11

|

|

20.4

|

%

|

4.5

|

|

$

|

1.43

|

|

82.8

|

%

|

||||||

|

Development / Acquisition Leases

|

18

|

|

3,485

|

|

$

|

5.39

|

|

N/A

|

|

8.8

|

|

N/A

|

|

N/A

|

|

|||||||

|

Total / Weighted Average

|

333

|

|

13,248

|

|

$

|

5.31

|

|

20.6

|

%

|

5.9

|

|

$

|

2.31

|

|

82.8

|

%

|

||||||

|

(A)

|

Net rent is the average base rent calculated in accordance with GAAP, over the term of the lease.

|

|

(B)

|

Straight Line basis rent growth is a ratio of the change in net rent (including straight-line rent adjustments) on a new or renewal lease compared to the net rent (including straight-line rent adjustments) of the comparable lease. New leases where there were no prior comparable leases are excluded.

|

|

(C)

|

The lease term is expressed in years. Assumes no exercise of lease renewal options, if any.

|

|

(D)

|

Lease costs are comprised of the costs incurred or capitalized for improvements of vacant and renewal spaces, as well as the commissions paid and costs capitalized for leasing transactions. Lease costs per square foot represent the total turnover costs expected to be incurred on the leases signed during the period and do not reflect actual expenditures for the period.

|

|

(E)

|

Represents the weighted average square feet of tenants renewing their respective leases.

|

|

Number of

Leases

With Rent Concessions

|

Square Feet

(in 000's)

|

Rent Concessions ($)

|

|||||||

|

New Leases

|

74

|

|

1,601

|

|

$

|

2,071

|

|

||

|

Renewal Leases

|

12

|

|

422

|

|

$

|

688

|

|

||

|

Development / Acquisition Leases

|

17

|

|

3,467

|

|

$

|

7,392

|

|

||

|

Total

|

103

|

|

5,490

|

|

$

|

10,151

|

|

||

|

Year of Expiration

(A)

|

Number of

Leases

Expiring

|

GLA

Expiring

(B)

|

Percentage

of GLA

Expiring

(B)

|

Annualized Base Rent

Under

Expiring

Leases

(In thousands)

(C)

|

Percentage

of Total

Annualized

Base Rent

Expiring

(C)

|

|||||||||||

|

2019

|

158

|

|

4,250,316

|

|

7

|

%

|

$

|

21,729

|

|

7

|

%

|

|||||

|

2020

|

222

|

|

7,290,840

|

|

12

|

%

|

38,731

|

|

13

|

%

|

||||||

|

2021

|

240

|

|

10,170,890

|

|

17

|

%

|

51,266

|

|

17

|

%

|

||||||

|

2022

|

163

|

|

6,363,198

|

|

11

|

%

|

32,996

|

|

11

|

%

|

||||||

|

2023

|

174

|

|

7,929,705

|

|

13

|

%

|

40,506

|

|

14

|

%

|

||||||

|

2024

|

100

|

|

5,973,426

|

|

10

|

%

|

29,181

|

|

10

|

%

|

||||||

|

2025

|

48

|

|

4,707,745

|

|

8

|

%

|

22,478

|

|

7

|

%

|

||||||

|

2026

|

38

|

|

4,086,190

|

|

7

|

%

|

17,432

|

|

6

|

%

|

||||||

|

2027

|

16

|

|

2,720,602

|

|

5

|

%

|

13,992

|

|

5

|

%

|

||||||

|

2028

|

12

|

|

1,765,484

|

|

3

|

%

|

8,445

|

|

3

|

%

|

||||||

|

Thereafter

|

24

|

|

3,894,574

|

|

7

|

%

|

20,637

|

|

7

|

%

|

||||||

|

Total

|

1,195

|

|

59,152,970

|

|

100

|

%

|

$

|

297,393

|

|

100

|

%

|

|||||

|

(A)

|

Includes leases that expire on or after January 1, 2019 and assumes tenants do not exercise existing renewal, termination or purchase options.

|

|

(B)

|

Does not include existing vacancies of 931,314 aggregate square feet and December 31, 2018 move outs of 618,032 aggregate square feet.

|

|

(C)

|

Annualized base rent is calculated as monthly base rent (cash basis) per the terms of the lease, as of December 31, 2018, multiplied by 12. If free rent is granted, then the first positive rent value is used.

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant's Common Equity / Partners' Capital, Related Stockholder / Unitholder Matters and Issuer Purchases of Equity Securities

|

|

Quarter Ended

|

Closing High

|

Closing Low

|

Dividend/Distribution

Declared

|

|||||||||

|

December 31, 2018

|

$

|

32.40

|

|

$

|

27.60

|

|

$

|

0.2175

|

|

|||

|

September 30, 2018

|

$

|

33.87

|

|

$

|

30.78

|

|

$

|

0.2175

|

|

|||

|

June 30, 2018

|

$

|

33.67

|

|

$

|

28.58

|

|

$

|

0.2175

|

|

|||

|

March 31, 2018

|

$

|

31.17

|

|

$

|

27.75

|

|

$

|

0.2175

|

|

|||

|

December 31, 2017

|

$

|

32.82

|

|

$

|

30.49

|

|

$

|

0.2100

|

|

|||

|

September 30, 2017

|

$

|

31.74

|

|

$

|

28.21

|

|

$

|

0.2100

|

|

|||

|

June 30, 2017

|

$

|

30.04

|

|

$

|

26.88

|

|

$

|

0.2100

|

|

|||

|

March 31, 2017

|

$

|

28.66

|

|

$

|

25.35

|

|

$

|

0.2100

|

|

|||

|

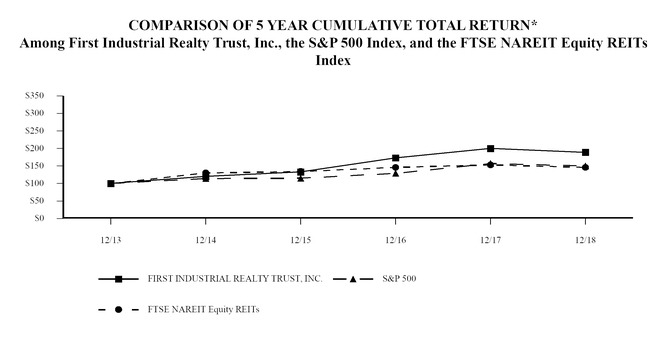

*

|

$100 invested on 12/31/13 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

|

|

|

12/13

|

12/14

|

12/15

|

12/16

|

12/17

|

12/18

|

|||||||||||||||||

|

FIRST INDUSTRIAL REALTY TRUST, INC.

|

$

|

100.00

|

|

$

|

120.39

|

|

$

|

132.80

|

|

$

|

173.25

|

|

$

|

200.06

|

|

$

|

188.79

|

|

|||||

|

S&P 500

|

$

|

100.00

|

|

$

|

113.69

|

|

$

|

115.26

|

|

$

|

129.05

|

|

$

|

157.22

|

|

$

|

150.33

|

|

|||||

|

FTSE NAREIT Equity REITs

|

$

|

100.00

|

|

$

|

130.14

|

|

$

|

134.30

|

|

$

|

145.74

|

|

$

|

153.36

|

|

$

|

146.27

|

|

|||||

|

*

|

The information provided in this performance graph shall not be deemed to be “soliciting material,” to be “filed” or to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 unless specifically treated as such.

|

|

Item 6.

|

Selected Financial Data

|

|

Year Ended

12/31/18

|

Year Ended

12/31/17

|

Year Ended

12/31/16

|

Year Ended

12/31/15

|

Year Ended

12/31/14

|

|||||||||||||||

|

|

(In thousands, except per share data)

|

||||||||||||||||||

|

Statement of Operations Data:

|

|||||||||||||||||||

|

Total Revenues

|

$

|

403,954

|

|

$

|

396,402

|

|

$

|

378,020

|

|

$

|

365,823

|

|

$

|

346,709

|

|

||||

|

Income from Continuing Operations

|

167,334

|

|

208,301

|

|

125,684

|

|

76,705

|

|

23,182

|

|

|||||||||

|

Net Income Available to First Industrial Realty Trust, Inc.'s Common Stockholders and Participating Securities

|

163,239

|

|

201,456

|

|

121,232

|

|

73,802

|

|

46,629

|

|

|||||||||

|

Basic Per Share Data:

|

|||||||||||||||||||

|

Income from Continuing Operations Available to First Industrial Realty Trust, Inc.'s Common Stockholders

|

$

|

1.31

|

|

$

|

1.70

|

|

$

|

1.05

|

|

$

|

0.67

|

|

$

|

0.18

|

|

||||

|

Net Income Available to First Industrial Realty Trust, Inc.'s Common Stockholders

|

1.31

|

|

1.70

|

|

1.05

|

|

0.67

|

|

0.42

|

|

|||||||||

|

Diluted Per Share Data:

|

|||||||||||||||||||

|

Income from Continuing Operations Available to First Industrial Realty Trust, Inc.'s Common Stockholders

|

$

|

1.31

|

|

$

|

1.69

|

|

$

|

1.05

|

|

$

|

0.66

|

|

$

|

0.18

|

|

||||

|

Net Income Available to First Industrial Realty Trust, Inc.'s Common Stockholders

|

1.31

|

|

1.69

|

|

1.05

|

|

0.66

|

|

0.42

|

|

|||||||||

|

Dividends/Distributions Per Share

|

$

|

0.87

|

|

$

|

0.84

|

|

$

|

0.76

|

|

$

|

0.51

|

|

$

|

0.41

|

|

||||

|

Basic Weighted Average Shares

|

123,804

|

|

118,272

|

|

115,030

|

|

110,352

|

|

109,922

|

|

|||||||||

|

Diluted Weighted Average Shares

|

124,191

|

|

118,787

|

|

115,370

|

|

110,781

|

|

110,325

|

|

|||||||||

|

Balance Sheet Data (End of Period):

|

|||||||||||||||||||

|

Real Estate, Before Accumulated Depreciation

|

$

|

3,673,644

|

|

$

|

3,495,745

|

|

$

|

3,384,914

|

|

$

|

3,293,968

|

|

$

|

3,183,369

|

|

||||

|

Total Assets

|

3,142,691

|

|

2,941,062

|

|

2,793,263

|

|

2,709,808

|

|

2,574,911

|

|

|||||||||

|

Indebtedness

|

1,297,783

|

|

1,296,997

|

|

1,347,092

|

|

1,434,168

|

|

1,342,762

|

|

|||||||||

|

Total Equity

|

1,679,911

|

|

1,475,877

|

|

1,284,625

|

|

1,115,135

|

|

1,090,827

|

|

|||||||||

|

Cash Flow Data:

|

|||||||||||||||||||

|

Cash Flow From Operating Activities

|

$

|

210,495

|

|

$

|

192,562

|

|

$

|

173,889

|

|

$

|

162,149

|

|

$

|

137,609

|

|

||||

|

Cash Flow From Investing Activities

|

(223,398

|

)

|

(82,495

|

)

|

(122,395

|

)

|

(175,898

|

)

|

(67,240

|

)

|

|||||||||

|

Cash Flow From Financing Activities

|

16,794

|

|

(85,046

|

)

|

(57,025

|

)

|

29,426

|

|

(66,599

|

)

|

|||||||||

|

Other Data:

|

|||||||||||||||||||

|

Funds from Operations Available to First Industrial Realty Trust, Inc.'s Common Stockholders and Participating Securities

(A)

|

$

|

199,391

|

|

$

|

186,496

|

|

$

|

167,811

|

|

$

|

140,841

|

|

$

|

127,890

|

|

||||

|

(A)

|

Funds from operations ("FFO") is a non-GAAP measure used in the real estate industry. See definition and a complete reconciliation of FFO to Net Income Available to First Industrial Realty Trust, Inc.'s Common Stockholders and Participating Securities under the caption "Supplemental Earnings Measure" under Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations."

|

|

Year Ended

12/31/18

|

Year Ended

12/31/17

|

Year Ended

12/31/16

|

Year Ended

12/31/15

|

Year Ended

12/31/14

|

|||||||||||||||

|

|

(In thousands, except per Unit data)

|

||||||||||||||||||

|

Statement of Operations Data:

|

|||||||||||||||||||

|

Total Revenues

|

$

|

403,954

|

|

$

|

396,402

|

|

$

|

378,020

|

|

$

|

365,823

|

|

$

|

346,709

|

|

||||

|

Income from Continuing Operations

|

167,334

|

|

208,301

|

|

125,684

|

|

76,820

|

|

23,434

|

|

|||||||||

|

Net Income Available to Unitholders and Participating Securities

|

167,246

|

|

208,158

|

|

125,547

|

|

76,682

|

|

48,704

|

|

|||||||||

|

Basic Per Unit Data:

|

|||||||||||||||||||

|

Income from Continuing Operations Available to Unitholders

|

$

|

1.31

|

|

$

|

1.70

|

|

$

|

1.05

|

|

$

|

0.67

|

|

$

|

0.18

|

|

||||

|

Net Income Available to Unitholders

|

1.31

|

|

1.70

|

|

1.05

|

|

0.67

|

|

0.42

|

|

|||||||||

|

Diluted Per Unit Data:

|

|||||||||||||||||||

|

Income from Continuing Operations Available to Unitholders

|

$

|

1.31

|

|

$

|

1.69

|

|

$

|

1.05

|

|

$

|

0.66

|

|

$

|

0.18

|

|

||||

|

Net Income Available to Unitholders

|

1.31

|

|

1.69

|

|

1.05

|

|

0.66

|

|

0.42

|

|

|||||||||

|

Distributions Per Unit

|

$

|

0.87

|

|

$

|

0.84

|

|

$

|

0.76

|

|

$

|

0.51

|

|

$

|

0.41

|

|

||||

|

Basic Weighted Average Units

|

126,921

|

|

122,306

|

|

119,274

|

|

114,709

|

|

114,388

|

|

|||||||||

|

Diluted Weighted Average Units

|

127,308

|

|

122,821

|

|

119,614

|

|

115,138

|

|

114,791

|

|

|||||||||

|

Balance Sheet Data (End of Period):

|

|||||||||||||||||||

|

Real Estate, Before Accumulated Depreciation

|

$

|

3,673,644

|

|

$

|

3,495,745

|

|

$

|

3,384,914

|

|

$

|

3,293,968

|

|

$

|

3,183,369

|

|

||||

|

Total Assets

|

3,152,799

|

|

2,951,180

|

|

2,803,701

|

|

2,720,523

|

|

2,585,624

|

|

|||||||||

|

Indebtedness

|

1,297,783

|

|

1,296,997

|

|

1,347,092

|

|

1,434,168

|

|

1,342,762

|

|

|||||||||

|

Total Partners' Capital

|

1,690,019

|

|

1,485,995

|

|

1,295,063

|

|

1,125,850

|

|

1,101,590

|

|

|||||||||

|

Cash Flow Data:

|

|||||||||||||||||||

|

Cash Flow From Operating Activities

|

$

|

210,505

|

|

$

|

192,881

|

|

$

|

174,166

|

|

$

|

162,286

|

|

$

|

138,352

|

|

||||

|

Cash Flow From Investing Activities

|

(223,398

|

)

|

(82,494

|

)

|

(122,395

|

)

|

(175,898

|

)

|

(67,895

|

)

|

|||||||||

|

Cash Flow From Financing Activities

|

16,784

|

|

(85,366

|

)

|

(57,302

|

)

|

29,304

|

|

(66,687

|

)

|

|||||||||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|

•

|

We acquired 10 industrial properties comprised of approximately 1.0 million square feet of GLA located in our Seattle, Orlando, Southern California, New Jersey and Houston markets for an aggregate purchase price of $124.9 million.

|

|

•

|

We acquired 271.7 acres of land for development located in our Dallas, Denver, Seattle, Southern California, New Jersey and Miami markets for an aggregate purchase price of $42.6 million.

|

|

•

|

We developed, placed in-service and leased at 100%, 8 industrial properties comprising approximately 3.5 million square feet of GLA located in Southern California, Chicago and Phoenix at an estimated total cost of $226.6 million.

|

|

•

|

We sold 53 industrial properties comprised of approximately 2.6 million square feet of GLA and several land parcels for total gross sales proceeds of $192.0 million.

|

|

•

|

We entered into the Joint Venture with a third party and acquired, for a purchase price of $49.0 million, approximately 532 net developable acres of land located in Phoenix for the purpose of developing, selling, leasing and operating industrial properties.

|

|

•

|

We issued $150.0 million of ten-year private placement notes at a rate of 3.86% and $150.0 million of twelve-year private placement notes at a rate of 3.96%.

|

|

•

|

We issued 4,800,000 shares of the Company's common stock in an underwritten public offering. Proceeds to the Company, net of the underwriter's discount, were $145.6 million.

|

|

•

|

We paid off $157.8 million in mortgage loans payable.

|

|

•

|

We declared an annual cash dividend of $0.87 per common share or Unit, an increase of 3.6% from 2017.

|

|

|

2018

|

2017

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

REVENUES

|

||||||||||||||

|

Same Store Properties

|

$

|

365,873

|

|

$

|

349,196

|

|

$

|

16,677

|

|

4.8

|

%

|

|||

|

Acquired Properties

|

12,462

|

|

4,243

|

|

8,219

|

|

193.7

|

%

|

||||||

|

Sold Properties

|

11,354

|

|

36,484

|

|

(25,130

|

)

|

(68.9

|

)%

|

||||||

|

(Re) Developments

|

11,393

|

|

4,626

|

|

6,767

|

|

146.3

|

%

|

||||||

|

Other

|

2,872

|

|

1,853

|

|

1,019

|

|

55.0

|

%

|

||||||

|

Total Revenues

|

$

|

403,954

|

|

$

|

396,402

|

|

$

|

7,552

|

|

1.9

|

%

|

|||

|

|

2018

|

2017

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

PROPERTY EXPENSES

|

||||||||||||||

|

Same Store Properties

|

$

|

97,053

|

|

$

|

91,417

|

|

$

|

5,636

|

|

6.2

|

%

|

|||

|

Acquired Properties

|

3,850

|

|

1,105

|

|

2,745

|

|

248.4

|

%

|

||||||

|

Sold Properties

|

3,461

|

|

11,695

|

|

(8,234

|

)

|

(70.4

|

)%

|

||||||

|

(Re) Developments

|

4,090

|

|

1,392

|

|

2,698

|

|

193.8

|

%

|

||||||

|

Other

|

8,400

|

|

7,885

|

|

515

|

|

6.5

|

%

|

||||||

|

Total Property Expenses

|

$

|

116,854

|

|

$

|

113,494

|

|

$

|

3,360

|

|

3.0

|

%

|

|||

|

|

2018

|

2017

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

DEPRECIATION AND OTHER AMORTIZATION

|

||||||||||||||

|

Same Store Properties

|

$

|

100,525

|

|

$

|

101,770

|

|

$

|

(1,245

|

)

|

(1.2

|

)%

|

|||

|

Acquired Properties

|

7,293

|

|

2,476

|

|

4,817

|

|

194.5

|

%

|

||||||

|

Sold Properties

|

2,703

|

|

9,388

|

|

(6,685

|

)

|

(71.2

|

)%

|

||||||

|

(Re) Developments

|

4,571

|

|

1,582

|

|

2,989

|

|

188.9

|

%

|

||||||

|

Corporate Furniture, Fixtures and Equipment and Other

|

1,367

|

|

1,148

|

|

219

|

|

19.1

|

%

|

||||||

|

Total Depreciation and Other Amortization

|

$

|

116,459

|

|

$

|

116,364

|

|

$

|

95

|

|

0.1

|

%

|

|||

|

|

2017

|

2016

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

REVENUES

|

||||||||||||||

|

Same Store Properties

|

$

|

339,403

|

|

$

|

329,704

|

|

$

|

9,699

|

|

2.9

|

%

|

|||

|

Acquired Properties

|

9,021

|

|

2,409

|

|

6,612

|

|

274.5

|

%

|

||||||

|

Sold Properties

|

17,010

|

|

33,260

|

|

(16,250

|

)

|

(48.9

|

)%

|

||||||

|

(Re) Developments

|

26,850

|

|

10,036

|

|

16,814

|

|

167.5

|

%

|

||||||

|

Other

|

4,118

|

|

2,611

|

|

1,507

|

|

57.7

|

%

|

||||||

|

Total Revenues

|

$

|

396,402

|

|

$

|

378,020

|

|

$

|

18,382

|

|

4.9

|

%

|

|||

|

|

2017

|

2016

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

PROPERTY EXPENSES

|

||||||||||||||

|

Same Store Properties

|

$

|

90,755

|

|

$

|

88,218

|

|

$

|

2,537

|

|

2.9

|

%

|

|||

|

Acquired Properties

|

2,462

|

|

600

|

|

1,862

|

|

310.3

|

%

|

||||||

|

Sold Properties

|

5,527

|

|

11,684

|

|

(6,157

|

)

|

(52.7

|

)%

|

||||||

|

(Re) Developments

|

5,797

|

|

2,449

|

|

3,348

|

|

136.7

|

%

|

||||||

|

Other

|

8,953

|

|

9,373

|

|

(420

|

)

|

(4.5

|

)%

|

||||||

|

Total Property Expenses

|

$

|

113,494

|

|

$

|

112,324

|

|

$

|

1,170

|

|

1.0

|

%

|

|||

|

|

2017

|

2016

|

$ Change

|

% Change

|

||||||||||

|

|

(In thousands)

|

|||||||||||||

|

DEPRECIATION AND OTHER AMORTIZATION

|

||||||||||||||

|

Same Store Properties

|

$

|

97,516

|

|

$

|

98,909

|

|

$

|

(1,393

|

)

|

(1.4

|

)%

|

|||

|

Acquired Properties

|

4,874

|

|

1,358

|

|

3,516

|

|

258.9

|

%

|

||||||

|

Sold Properties

|

4,305

|

|

9,352

|

|

(5,047

|

)

|

(54.0

|

)%

|

||||||

|

(Re) Developments

|

7,223

|

|

5,404

|

|

1,819

|

|

33.7

|

%

|

||||||

|

Corporate Furniture, Fixtures and Equipment and Other

|

2,446

|

|

2,259

|

|

187

|

|

8.3

|

%

|

||||||

|

Total Depreciation and Other Amortization

|

$

|

116,364

|

|

$

|

117,282

|

|

$

|

(918

|

)

|

(0.8

|

)%

|

|||

|

•

|

Acquisitions of Real Estate Assets:

We allocate the purchase price of acquired real estate, including real estate acquired as a portfolio, to the fair value of tangible assets (land, building, and improvements) by valuing the real estate as if it were vacant. The determination of fair value includes estimates such as discount rates, terminal capitalization rates and market rent assumptions. Above-market and below-market lease and below market ground lease obligation values are recorded based on the present value (using a discount rate which reflects the risks associated with the leases acquired) of the difference between (i) the contractual amounts to be paid pursuant to each in-place lease and (ii) our estimate of fair market lease rents for each corresponding in-place lease. The purchase price is further allocated to leasing commissions, in-place lease and tenant relationship values based on our evaluation of the specific characteristics of each tenant's lease and our overall relationship with the respective tenant. The value allocated to tenant relationships is amortized to depreciation and amortization expense over the expected term of the relationship, which includes an estimate of the probability of lease renewal and its estimated term.

|

|

•

|

Impairment of Real Estate Assets:

We review our real estate assets for possible impairment whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. The judgments regarding the existence of indicators of impairment are based on the operating performance, market conditions, as well as our ability to hold and our intent with regard to each property. The judgments regarding whether the carrying amounts of these assets may not be recoverable are based on estimates of future undiscounted cash flows from properties which include estimates of future operating performance and market conditions. If any real estate investment is considered impaired, a loss is recorded to reduce the carrying value of the property to its estimated fair value.

|

|

Year Ended December 31,

|

||||||||

|

2018

|

2017

|

|||||||

|

(In thousands)

|

||||||||

|

Net cash provided by operating activities

|

$

|

210,495

|

|

$

|

192,562

|

|

||

|

Net cash used in investing activities

|

(223,398

|

)

|

(82,495

|

)

|

||||

|

Net cash provided by (used in) financing activities

|

16,794

|

|

(85,046

|

)

|

||||

|

Year Ended December 31,

|

||||||||

|

2018

|

2017

|

|||||||

|

(In thousands)

|

||||||||

|

Net cash provided by operating activities

|

$

|

210,505

|

|

$

|

192,881

|

|

||

|

Net cash used in investing activities

|

(223,398

|

)

|

(82,494

|

)

|

||||

|

Net cash provided by (used in) financing activities

|

16,784

|

|

(85,366

|

)

|

||||

|

•

|

Decrease in interest expense of $6.4 million;

|

|

•

|

Increase in cash NOI from same store properties, acquired properties, and recently developed properties offset by decreases in cash NOI due to building disposals for a net total increase of approximately $6.8 million;

|

|

•

|

Increase in accounts payable, accrued expenses and other liabilities as well as a decrease in other assets due to timing of cash payments and cash receipts.

|

|

•

|

Increase in cash used of $78.5 million related to non-acquisition additions and improvements to real estate primarily due to an increase in development expenditures in 2018;

|

|

•

|

Increase in cash used of $23.4 million related to our net contributions to the Joint Venture in 2018;

|

|

•

|

Decrease in cash received of $43.3 million related to the disposition of real estate in 2018;

|

|

•

|

Decrease in cash received of $9.2 million related to insurance proceeds on casualty losses;

|

|

•

|

Decrease in cash used to acquire real estate in 2018 of $17.5 million.

|

|

•

|

Increase in cash provided of $100.0 million related to the issuance of unsecured notes in a private placement in 2018;

|

|

•

|

Increase in cash provided of $70.7 million related to the proceeds received from the issuance of common stock in an underwritten public offering in 2018 compared to 2017;

|

|

•

|

The payoff of senior unsecured notes during 2017 in the amount of $156.9 million;

|

|

•

|

Increase in repayments of mortgage loans payable of $118.8 million;

|

|

•

|

Increase in net repayments of our Unsecured Credit Facility of $99.5 million; and

|

|

•

|

Increase in dividend and unit distributions of $9.1 million primarily due to the Company raising the dividend rate in 2018.

|

|

|

Payments Due by Period

(In thousands)

|

||||||||||||||||||

|

|

Total

|

Less Than

1 Year

|

1-3 Years

|

3-5 Years

|

Over 5 Years

|

||||||||||||||

|

Operating and Ground Leases

(A)

|

$

|

36,322

|

|

$

|

1,464

|

|

$

|

3,039

|

|

$

|

2,794

|

|

$

|

29,025

|

|

||||

|

Real Estate Development Costs

(A)(B)

|

140,300

|

|

140,300

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Long Term Debt

|

1,306,181

|

|

79,600

|

|

326,159

|

|

341,873

|

|

558,549

|

|

|||||||||

|

Interest Expense on Long Term Debt

(A)(C)

|

309,800