|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2018

|

|

|

or

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

Delaware

|

20-4623678

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value

|

The NASDAQ Stock Market LLC

|

|

Large accelerated filer [x]

|

Accelerated filer [ ]

|

Non-accelerated filer [ ]

|

|

Smaller reporting company [ ]

|

Emerging growth company [ ]

|

|

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

•

|

structural imbalances in global supply and demand for PV solar modules;

|

|

•

|

the market for renewable energy, including solar energy;

|

|

•

|

our competitive position and other key competitive factors;

|

|

•

|

reduction, elimination, or expiration of government subsidies, policies, and support programs for solar energy projects;

|

|

•

|

our ability to execute on our long-term strategic plans;

|

|

•

|

our ability to execute on our solar module technology and cost reduction roadmaps;

|

|

•

|

interest rate fluctuations and both our and our customers’ ability to secure financing;

|

|

•

|

our ability to attract new customers and to develop and maintain existing customer and supplier relationships;

|

|

•

|

our ability to successfully develop and complete our systems business projects;

|

|

•

|

our ability to convert existing or construct production facilities to support new product lines, such as Series 6

TM

(“Series 6”) modules;

|

|

•

|

general economic and business conditions, including those influenced by U.S., international, and geopolitical events;

|

|

•

|

environmental responsibility, including with respect to cadmium telluride (“CdTe”) and other semiconductor materials;

|

|

•

|

claims under our limited warranty obligations;

|

|

•

|

changes in, or the failure to comply with, government regulations and environmental, health, and safety requirements;

|

|

•

|

future collection and recycling costs for solar modules covered by our module collection and recycling program;

|

|

•

|

our ability to protect our intellectual property;

|

|

•

|

our ability to prevent and/or minimize the impact of cyber-attacks or other breaches of our information systems;

|

|

•

|

our continued investment in R&D;

|

|

•

|

the supply and price of components and raw materials, including CdTe;

|

|

•

|

our ability to attract and retain key executive officers and associates; and

|

|

•

|

all other matters discussed in Item 1A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K, our subsequently filed Quarterly Reports on Form 10-Q, and our other filings with the Securities and Exchange Commission (the “SEC”).

|

|

•

|

PV Solar Modules

. Our modules couple our leading-edge CdTe technology with the manufacturing excellence and quality control that comes from being one of the world’s most experienced producers of advanced PV solar modules. Our technology demonstrates a proven performance advantage over conventional crystalline silicon solar modules of equivalent efficiency rating by delivering higher real-world energy yield and long-term reliability. We are able to provide such product performance, quality, and reliability to our customers due, in large part, to investing more in R&D than most other solar companies in the world.

|

|

•

|

Utility-Scale Power Plant

. We have extensive, proven experience in developing and constructing reliable grid-connected power systems for utility-scale generation. Our grid-connected systems diversify the energy portfolio, reduce fossil-fuel consumption, mitigate the risk of fuel price volatility, and save costs, proving that centralized solar generation can deliver dependable and affordable solar electricity to the grid around the world. Our plant control systems provide reliability services, such as frequency control, voltage control, ramping capacity, and automated generation control, which enable expanded integration of PV solar power systems into the power grid. Such reliability services also help balance the grid during times of high renewable energy generation. Our solar energy systems also offer a meaningful value proposition by eliminating commodity price risks thereby providing a long-term fixed price with relatively low operating costs. When compared to the price of power derived from a conventional source of energy, a fixed price cannot be achieved unless the cost of hedging is included. Hedging costs of a commodity such as natural gas, along with the costs of credit support required for a long-term hedge, can significantly increase conventional energy costs. Additional benefits of our grid-connected power systems include reductions of fuel imports and improvements in energy security, enhanced peaking generation and faster time-to-power, and managed variability through accurate forecasting.

|

|

•

|

EPC Services

. We provide engineering, procurement, and construction (“EPC”) services to projects developed by us and other system owners such as utilities, independent power producers, and commercial and industrial companies. EPC services include engineering design and related services, BoS procurement, advanced development of grid integration solutions, and construction contracting and management. Depending on the customer and market needs, we may provide our full EPC services or any combination of individual products and services within our EPC capabilities. Our vertical integration combined with our partner collaboration enables us to identify and make system-level innovations, which creates further value for our customers.

|

|

•

|

Battery Storage

. To further enhance the operational capabilities of utility-scale systems, we also provide storage solutions using advanced battery technology. Such storage solutions enable system owners to better align the delivery of energy with periods of peak demand, thereby increasing a system’s overall value. Storage capabilities also allow PV solar plants to meet or exceed the peaking capabilities of fossil fuel-based plants at potentially lower costs. Our advanced plant control systems manage the operations of both the PV solar plant and its storage capabilities to ensure accurate delivery of requested power to the grid. As part of our storage solutions, we also provide proprietary algorithms to design and simulate the optimal dispatch of a system depending on the customer and market needs, including site-specific weather conditions.

|

|

•

|

O&M Services

. By leveraging our extensive experience in plant optimization and advanced diagnostics, we have developed one of the largest and most advanced O&M programs in the industry, including more than 8 GW

DC

of utility-scale PV solar power systems, while maintaining an average fleet system effective availability greater than

99%

. Utilizing a state of the art global operations center, our team of O&M associates provide a variety of services to optimize system performance and comply with power purchase agreements (“PPA”), other project agreements, and regulations. Our products and services are engineered to enable the maximization of energy output and revenue for our customers while significantly reducing their unplanned maintenance costs. Plant owners benefit from predictable expenses over the life of the contract and reduced risk of energy loss. Our O&M program is compliant with the North American Electric Reliability Corporation (“NERC”) standards and is designed to scale to accommodate the growing O&M needs of customers worldwide. We offer our O&M services to solar power plant owners that use either our solar modules or modules manufactured by third-parties.

|

|

Name

|

Age

|

Position

|

||

|

Mark R. Widmar

|

53

|

Chief Executive Officer

|

||

|

Alexander R. Bradley

|

37

|

Chief Financial Officer

|

||

|

Georges Antoun

|

56

|

Chief Commercial Officer

|

||

|

Philip Tymen deJong

|

59

|

Chief Operations Officer

|

||

|

Raffi Garabedian

|

52

|

Chief Technology Officer

|

||

|

Paul Kaleta

|

63

|

Executive Vice President, General Counsel and Secretary

|

||

|

Christopher R. Bueter

|

55

|

Executive Vice President, Human Resources

|

||

|

•

|

cost-effectiveness of the electricity generated by PV solar power systems compared to conventional energy sources, such as natural gas (which fuel source may be subject to significant price fluctuations from time to time), and other renewable energy sources, such as wind, geothermal, and hydroelectric;

|

|

•

|

changes in tax, trade remedies, and other public policy, as well as changes in economic, market, and other conditions that affect the price of, and demand for, conventional energy resources, non-solar renewable energy resources (e.g., wind and hydroelectric), and energy efficiency programs and products, including increases or decreases in the prices of natural gas, coal, oil, and other fossil fuels and in the prices of competing renewable resources;

|

|

•

|

the extent of competition, barriers to entry, and overall conditions and timing related to the development of solar in new and emerging market segments such as commercial and industrial customers, community solar, community choice aggregators, and other customer segments;

|

|

•

|

availability, substance, and magnitude of support programs including federal, state, and local government subsidies, incentives, targets, and renewable portfolio standards, among other policies and programs, to accelerate the development of the solar industry;

|

|

•

|

performance, reliability, and availability of energy generated by PV solar power systems compared to conventional and other non-solar renewable energy sources and products, particularly conventional energy generation capable of providing 24-hour, non-intermittent baseload power;

|

|

•

|

the development, functionality, scale, cost, and timing of storage solutions; and

|

|

•

|

changes in the amount and priorities of capital expenditures by end-users of solar modules and systems (e.g., utilities), which capital expenditures tend to decrease when the economy slows or when interest rates increase, thereby resulting in redirection away from solar generation to development of competing forms of electric generation and to distribution (e.g., smart grid), transmission, and energy efficiency measures.

|

|

•

|

a reduction or removal of clean energy programs and initiatives and the incentives they provide may diminish the market for future solar energy off-take agreements and reduce the ability for solar project developers to compete for future solar energy off-take agreements, which may reduce incentives for such parties to develop solar projects and purchase PV solar modules;

|

|

•

|

any limitations on the value or availability to potential investors of tax incentives that benefit solar energy projects such as the ITC and accelerated depreciation deductions could result in such investors generating reduced revenues and economic returns and facing a reduction in the availability of affordable financing, thereby reducing demand for PV solar modules. The ITC is a U.S. federal incentive that provides an income tax credit to the owner of the project after the project is placed in service of up to 30% of eligible basis. Under the Modified Accelerated Cost-Recovery System, owners of equipment used in a solar project may claim all of their depreciation deductions with respect to such equipment over five years, even though the useful life of such equipment is generally greater than five years. In addition, in December 2017, the U.S. government enacted comprehensive tax reform legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). Under the Tax Act, qualified property placed in service after September 22, 2017 and before January 1, 2023 is generally eligible for 100% expensing, and such property placed in service after December 31, 2022 and before January 1, 2027 is generally eligible for expensing at lower percentages. However, the Tax Act also reduced the U.S. corporate income tax rate to 21% effective January 1, 2018, which could diminish the capacity of potential investors to benefit from incentives such as the ITC and reduce the value of accelerated depreciation deductions and expensing, thereby reducing the relative attractiveness of solar projects as an investment; and

|

|

•

|

any effort to overturn federal and state laws, regulations, or policies that are supportive of solar energy generation or that remove costs or other limitations on other types of electricity generation that compete with solar energy projects could negatively impact our ability to compete with traditional forms of electricity generation and materially and adversely affect our business.

|

|

•

|

difficulty in accurately prioritizing geographic markets that we can most effectively and profitably serve with our PV solar offerings, including miscalculations in overestimating or underestimating addressable market demand;

|

|

•

|

difficulty in competing against companies who may have greater financial resources and/or a more effective or established localized business presence and/or an ability to operate with minimal or negative operating margins for sustained periods of time;

|

|

•

|

difficulty in overcoming the inertia involved in changing local electricity ecosystems as necessary to accommodate large-scale PV solar deployment and integration;

|

|

•

|

adverse public policies in countries we operate in and/or are pursuing, including local content requirements, the imposition of trade remedies, or capital investment requirements;

|

|

•

|

business climates, such as that in China, that may have the effect of putting foreign companies at a disadvantage relative to domestic companies;

|

|

•

|

unstable economic, social, and/or operating environments in foreign jurisdictions, including social unrest, currency, inflation, and interest rate uncertainties;

|

|

•

|

the possibility of applying an ineffective commercial approach to targeted markets, including product offerings that may not meet market needs;

|

|

•

|

difficulty in generating sufficient sales volumes at economically sustainable profitability levels;

|

|

•

|

difficulty in timely identifying, attracting, training, and retaining qualified sales, technical, and other personnel in geographies targeted for expansion;

|

|

•

|

difficulty in maintaining proper controls and procedures as we expand our business operations both in terms of complexity and geographical reach, including transitioning certain business functions to low-cost geographies, with any material control failure potentially leading to reputational damage and loss of confidence in our financial reporting;

|

|

•

|

difficulty in competing successfully for market share in overall solar markets as a result of the success of companies participating in the global rooftop PV solar market, which is a segment in which we do not have significant historical experience;

|

|

•

|

difficulty in establishing and implementing a commercial and operational approach adequate to address the specific needs of the markets we are pursuing;

|

|

•

|

difficulty in identifying effective local partners and developing any necessary partnerships with local businesses on commercially acceptable terms; and

|

|

•

|

difficulty in balancing market demand and manufacturing production in an efficient and timely manner, potentially causing our manufacturing capacity to be constrained in some future periods or over-supplied in others.

|

|

•

|

delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as our inability to secure successful contracts with equipment vendors;

|

|

•

|

our custom-built equipment taking longer and costing more to manufacture than expected and not operating as designed;

|

|

•

|

delays or denial of required approvals by relevant government authorities;

|

|

•

|

being unable to hire qualified staff;

|

|

•

|

failure to execute our expansion or conversion plans effectively;

|

|

•

|

difficulty in balancing market demand and manufacturing production in an efficient and timely manner, potentially causing our manufacturing capacity to be constrained in some future periods or over-supplied in others; and

|

|

•

|

incurring manufacturing asset write-downs, write-offs, and other charges and costs, which may be significant, during those periods in which we idle, slow down, shut down, convert, or otherwise adjust our manufacturing capacity.

|

|

•

|

difficulty in enforcing agreements in foreign legal systems;

|

|

•

|

difficulty in forming appropriate legal entities to conduct business in foreign countries and the associated costs of forming and maintaining those legal entities;

|

|

•

|

varying degrees of protection afforded to foreign investments in the countries in which we operate and irregular interpretations and enforcement of laws and regulations in such jurisdictions;

|

|

•

|

foreign countries may impose additional income and withholding taxes or otherwise tax our foreign operations, impose tariffs, or adopt other restrictions on foreign trade and investment, including currency exchange controls;

|

|

•

|

fluctuations in exchange rates may affect demand for our products and services and may adversely affect our profitability and cash flows in U.S. dollars to the extent that our net sales or our costs are denominated in a foreign currency and the cost associated with hedging the U.S. dollar equivalent of such exposures is prohibitive; the longer the duration of such foreign currency exposure, the greater the risk;

|

|

•

|

anti-corruption compliance issues, including the costs related to the mitigation of such risk;

|

|

•

|

risk of nationalization or other expropriation of private enterprises;

|

|

•

|

changes in general economic and political conditions in the countries in which we operate, including changes in government incentive provisions;

|

|

•

|

unexpected adverse changes in U.S. or foreign laws or regulatory requirements, including those with respect to environmental protection, import or export duties, and quotas;

|

|

•

|

opaque approval processes in which the lack of transparency may cause delays and increase the uncertainty of project approvals;

|

|

•

|

difficulty in staffing and managing widespread operations;

|

|

•

|

difficulty in repatriating earnings;

|

|

•

|

difficulty in negotiating a successful collective bargaining agreement in applicable foreign jurisdictions;

|

|

•

|

trade barriers such as export requirements, tariffs, taxes, local content requirements, anti-dumping regulations and requirements, and other restrictions and expenses, which could increase the effective price of our solar modules and make us less competitive in some countries; and

|

|

•

|

difficulty of, and costs relating to, compliance with the different commercial and legal requirements of the overseas countries in which we offer and sell our solar modules.

|

|

•

|

obtaining financeable land rights, including land rights for the project site, transmission lines, and environmental mitigation;

|

|

•

|

entering into financeable arrangements for the purchase of the electrical output and renewable energy attributes generated by the project;

|

|

•

|

receipt from governmental agencies of required environmental, land-use, and construction and operation permits and approvals;

|

|

•

|

receipt of tribal government approvals for projects on tribal land;

|

|

•

|

receipt of governmental approvals related to the presence of any protected or endangered species or habitats, migratory birds, wetlands or other jurisdictional water resources, and/or cultural resources;

|

|

•

|

negotiation of development agreements, public benefit agreements, and other agreements to compensate local governments for project impacts;

|

|

•

|

negotiation of state and local tax abatement and incentive agreements;

|

|

•

|

receipt of rights to interconnect the project to the electric grid or to transmit energy;

|

|

•

|

negotiation of satisfactory EPC agreements;

|

|

•

|

securing necessary rights of way for access and transmission lines;

|

|

•

|

securing necessary water rights for project construction and operation;

|

|

•

|

securing appropriate title coverage, including coverage for mineral rights, mechanics’ liens, etc.;

|

|

•

|

obtaining financing, including debt, equity, and funds associated with the monetization of tax credits and other tax benefits;

|

|

•

|

payment of PPA, interconnection, and other deposits (some of which are non-refundable);

|

|

•

|

providing required payment and performance security for the development of the project, such as through the provision of letters of credit; and

|

|

•

|

timely implementation and satisfactory completion of construction.

|

|

•

|

delays in obtaining and maintaining required governmental permits and approvals, including appeals of approvals obtained;

|

|

•

|

potential permit and litigation challenges from project stakeholders, including local residents, environmental organizations, labor organizations, tribes, and others who may oppose the project;

|

|

•

|

in connection with any such permit and litigation challenges, grants of injunctive relief to stop development and/or construction of a project;

|

|

•

|

discovery of unknown impacts to protected or endangered species or habitats, migratory birds, wetlands or other jurisdictional water resources, and/or cultural resources at project sites;

|

|

•

|

discovery of unknown title defects;

|

|

•

|

discovery of unknown environmental conditions;

|

|

•

|

unforeseen engineering problems;

|

|

•

|

construction delays and contractor performance shortfalls;

|

|

•

|

work stoppages;

|

|

•

|

cost over-runs;

|

|

•

|

labor, equipment, and material supply shortages, failures, or disruptions;

|

|

•

|

cost or schedule impacts arising from changes in federal, state, or local land-use or regulatory policies;

|

|

•

|

changes in electric utility procurement practices;

|

|

•

|

risks arising from transmission grid congestion issues;

|

|

•

|

project delays that could adversely impact our ability to maintain interconnection rights;

|

|

•

|

additional complexities when conducting project development or construction activities in foreign jurisdictions (either on a stand-alone basis or in collaboration with local business partners), including operating in accordance with the U.S. Foreign Corrupt Practices Act (the “FCPA”) and applicable local laws and customs;

|

|

•

|

unfavorable tax treatment or adverse changes to tax policy;

|

|

•

|

adverse weather conditions;

|

|

•

|

water shortages;

|

|

•

|

adverse environmental and geological conditions; and

|

|

•

|

force majeure and other events out of our control.

|

|

•

|

difficulty in assimilating the operations and personnel of the acquired or partner company;

|

|

•

|

difficulty in effectively integrating the acquired products or technologies with our current products or technologies;

|

|

•

|

difficulty in achieving profitable commercial scale from acquired technologies;

|

|

•

|

difficulty in maintaining controls, procedures, and policies during the transition and integration;

|

|

•

|

disruption of our ongoing business and distraction of our management and associates from other opportunities and challenges due to integration issues;

|

|

•

|

difficulty integrating the acquired or partner company’s accounting, management information, and other administrative systems;

|

|

•

|

difficulty managing joint ventures with our partners, potential litigation with joint venture partners, and reliance upon joint ventures that we do not control;

|

|

•

|

inability to retain key technical and managerial personnel of the acquired business;

|

|

•

|

inability to retain key customers, vendors, and other business partners of the acquired business;

|

|

•

|

inability to achieve the financial and strategic goals for the acquired and combined businesses, as a result of insufficient capital resources or otherwise;

|

|

•

|

incurring acquisition-related costs or amortization costs for acquired intangible assets that could impact our operating results;

|

|

•

|

potential impairment of our relationships with our associates, customers, partners, distributors, or third-party providers of products or technologies;

|

|

•

|

potential failure of the due diligence processes to identify significant issues with product quality, legal and financial liabilities, among other things;

|

|

•

|

potential inability to assert that internal controls over financial reporting are effective;

|

|

•

|

potential inability to obtain, or obtain in a timely manner, approvals from governmental authorities, which could delay or prevent such acquisitions; and

|

|

•

|

potential delay in customer purchasing decisions due to uncertainty about the direction of our product offerings.

|

|

•

|

incur additional debt, assume obligations in connection with letters of credit, or issue guarantees;

|

|

•

|

create liens;

|

|

•

|

enter into certain transactions with our affiliates;

|

|

•

|

sell certain assets; and

|

|

•

|

declare or pay dividends, make other distributions to stockholders, or make other restricted payments.

|

|

Nature

|

Primary Segment(s) Using Property

|

Location

|

Held

|

|||

|

Corporate headquarters

|

Modules & Systems

|

Tempe, Arizona, United States

|

Lease

|

|||

|

Manufacturing plant, R&D facility, and administrative offices (1)

|

Modules

|

Perrysburg, Ohio, United States

|

Own

|

|||

|

Administrative offices

|

Systems

|

San Francisco, California, United States

|

Lease

|

|||

|

R&D facility

|

Modules & Systems

|

Santa Clara, California, United States

|

Lease

|

|||

|

Manufacturing plant and administrative offices

|

Modules

|

Kulim, Kedah, Malaysia

|

Lease land, own buildings

|

|||

|

Administrative offices

|

Modules & Systems

|

Georgetown, Penang, Malaysia

|

Lease

|

|||

|

Manufacturing plant

|

Modules

|

Ho Chi Minh City, Vietnam

|

Lease land, own buildings

|

|||

|

Manufacturing plant (2)

|

Modules

|

Frankfurt/Oder, Germany

|

Own

|

|||

|

(1)

|

Includes our manufacturing plant located in Lake Township, Ohio, a short distance from our plant in Perrysburg, Ohio.

|

|

(2)

|

In December 2012, we ceased manufacturing at our German plant. Since its closure, we have continued to market such property for sale.

|

|

*

|

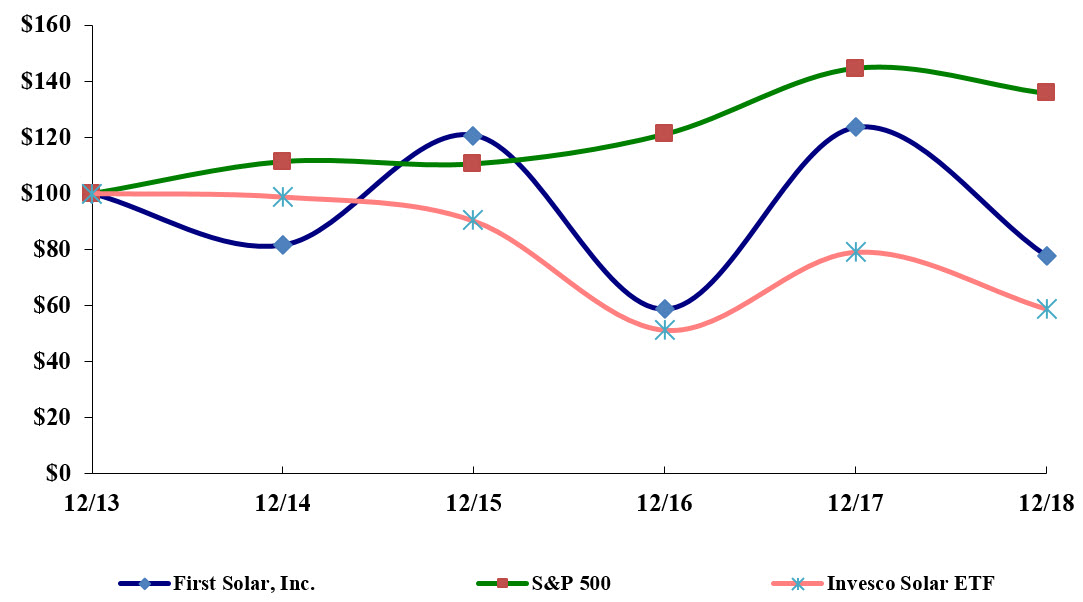

$100 invested on December 31, 2013 in stock or index, including reinvestment of dividends. Index calculated on a month-end basis.

|

|

**

|

In May 2018, the Guggenheim Solar ETF was reorganized into the Invesco Solar ETF subsequent to Invesco Ltd.’s acquisition of Guggenheim Capital LLC’s exchange-traded funds business. The ticker symbol and index did not change as a result of the reorganization.

|

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

(In thousands, except per share amounts)

|

||||||||||||||||||||

|

Net sales

|

$

|

2,244,044

|

|

$

|

2,941,324

|

|

$

|

2,904,563

|

|

$

|

4,112,650

|

|

$

|

3,391,187

|

|

|||||

|

Gross profit

|

392,177

|

|

548,947

|

|

638,418

|

|

1,132,762

|

|

824,941

|

|

||||||||||

|

Operating income (loss)

|

40,113

|

|

177,851

|

|

(568,151

|

)

|

730,159

|

|

421,999

|

|

||||||||||

|

Net income (loss)

|

144,326

|

|

(165,615

|

)

|

(416,112

|

)

|

593,406

|

|

395,964

|

|

||||||||||

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic

|

$

|

1.38

|

|

$

|

(1.59

|

)

|

$

|

(4.05

|

)

|

$

|

5.88

|

|

$

|

3.96

|

|

|||||

|

Diluted

|

$

|

1.36

|

|

$

|

(1.59

|

)

|

$

|

(4.05

|

)

|

$

|

5.83

|

|

$

|

3.90

|

|

|||||

|

Cash dividends declared per common share

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

|

|

|

|

|

||||||||||||||||

|

Net cash (used in) provided by operating activities

|

$

|

(326,809

|

)

|

$

|

1,340,677

|

|

$

|

206,753

|

|

$

|

(325,209

|

)

|

$

|

735,516

|

|

|||||

|

Net cash (used in) provided by investing activities

|

(682,714

|

)

|

(626,802

|

)

|

144,520

|

|

(156,177

|

)

|

(387,818

|

)

|

||||||||||

|

Net cash provided by (used in) financing activities

|

255,228

|

|

192,045

|

|

(136,393

|

)

|

101,207

|

|

(46,907

|

)

|

||||||||||

|

December 31,

|

||||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

1,403,562

|

|

$

|

2,268,534

|

|

$

|

1,347,155

|

|

$

|

1,126,826

|

|

$

|

1,482,054

|

|

|||||

|

Marketable securities

|

1,143,704

|

|

720,379

|

|

607,991

|

|

703,454

|

|

509,032

|

|

||||||||||

|

Total assets

|

7,121,362

|

|

6,864,501

|

|

6,824,368

|

|

7,360,392

|

|

6,720,991

|

|

||||||||||

|

Total long-term debt

|

466,791

|

|

393,540

|

|

188,388

|

|

289,415

|

|

213,473

|

|

||||||||||

|

Total liabilities

|

1,908,959

|

|

1,765,804

|

|

1,606,019

|

|

1,741,996

|

|

1,729,504

|

|

||||||||||

|

Total stockholders’ equity

|

5,212,403

|

|

5,098,697

|

|

5,218,349

|

|

5,618,396

|

|

4,991,487

|

|

||||||||||

|

•

|

Net sales for

2018

decreased

by

24%

to

$2.2 billion

compared to

$2.9 billion

in

2017

. The

decrease

in net sales was primarily attributable to the sale of the Moapa and Switch Station projects in

2017

, which were substantially complete when we entered into the associated sales contracts with the customers, the sale of the California Flats project in 2017 relative to revenue recognized on the project in

2018

from ongoing construction activities, and a decrease in third-party module sales, partially offset by the sale of the Willow Springs, Rosamond, Mashiko, Manildra, and certain India projects in

2018

, and the completion of substantially all construction activities on the Balm Solar, Payne Creek, and Grange Hall projects in

2018

.

|

|

•

|

Gross profit

decreased

1.2 percentage points

to

17.5%

during

2018

from

18.7%

during

2017

primarily due to higher under-utilization and certain other charges associated with the initial ramp of Series 6 manufacturing lines and a reduction to our product warranty liability in

2017

due to lower legacy module replacement costs, partially offset by the mix of higher gross profit projects sold during the period and the settlement of a tax examination with the state of California, which affected our estimates of sales and use taxes due for certain projects.

|

|

•

|

During

2018

, we commenced commercial production of Series 6 modules at our manufacturing facilities in Perrysburg, Ohio; Kulim, Malaysia; and Ho Chi Minh City, Vietnam, bringing our total installed annual nameplate production capacity across all our facilities to

5.0 GW

DC

. In early 2019, we commenced commercial production at our second manufacturing facility in Ho Chi Minh City, Vietnam.

|

|

•

|

We produced

2.7 GW

DC

of solar modules during

2018

, which represented an

18%

increase

from

2017

. The

increase

in production was primarily driven by the incremental Series 6 production capacity added in

2018

, partially offset by the ramp down of certain Series 4 production lines. We expect to produce between

5.2 GW

DC

and

5.5 GW

DC

of solar modules during 2019, including approximately

2 GW

DC

of Series 4 modules.

|

|

Project/Location

|

Project Size in MW

AC

|

PPA Contracted Partner

|

EPC Contract/Partner Developed Project

|

Expected Year Revenue Recognition Will Be Completed

|

% of Revenue Recognized as of December 31, 2018

|

||||||

|

Phoebe, Texas

|

250

|

|

Shell Energy North America

|

Innergix Renewable Energy

|

2019

|

12%

|

|||||

|

GA Solar 4, Georgia (1)

|

200

|

|

Georgia Power Company

|

Origis Energy USA

|

2020

|

11%

|

|||||

|

Rosamond, California

|

150

|

|

SCE

|

Clearway Energy Group

|

2019

|

57%

|

|||||

|

Willow Springs, California

|

100

|

|

SCE

|

D.E. Shaw Renewable Investments

|

2019

|

96%

|

|||||

|

Beryl, Australia

|

87

|

|

(2)

|

New Energy Solar

|

2019

|

—%

|

|||||

|

Grange Hall, Florida

|

61

|

|

(3)

|

Tampa Electric Company

|

2019

|

98%

|

|||||

|

Peace Creek, Florida

|

55

|

|

(3)

|

Tampa Electric Company

|

2019

|

70%

|

|||||

|

Troy Solar, Indiana

|

51

|

|

(3)

|

Southern Indiana Gas and Electric Company

|

2020

|

—%

|

|||||

|

Lake Hancock, Florida

|

50

|

|

(3)

|

Tampa Electric Company

|

2019

|

34%

|

|||||

|

Total

|

1,004

|

|

|||||||||

|

Project/Location

|

Project Size in MW

AC

|

PPA Contracted Partner

|

Fully Permitted

|

Expected or Actual Substantial Completion Year

|

% Complete as of December 31, 2018

|

||||||

|

Muscle Shoals, Alabama

|

227

|

|

Tennessee Valley Authority

|

No

|

2021

|

2%

|

|||||

|

Little Bear, California

|

160

|

|

Marin Clean Energy

|

No

|

2020

|

5%

|

|||||

|

Sun Streams, Arizona

|

150

|

|

SCE

|

Yes

|

2019

|

14%

|

|||||

|

Southwestern U.S.

|

150

|

|

(4)

|

Yes

|

2020/2021

|

4%

|

|||||

|

Luz del Norte, Chile

|

141

|

|

(5)

|

Yes

|

2016

|

100%

|

|||||

|

American Kings Solar, California

|

123

|

|

SCE

|

No

|

2020

|

16%

|

|||||

|

Cove Mountain Solar 2, Utah

|

122

|

|

PacifiCorp

|

No

|

2020

|

1%

|

|||||

|

Sunshine Valley, Nevada

|

100

|

|

SCE

|

Yes

|

2019

|

4%

|

|||||

|

Willow Springs 3, California

|

75

|

|

PG&E

|

Yes

|

2021

|

8%

|

|||||

|

Seabrook, South Carolina

|

73

|

|

South Carolina Electric and Gas Company

|

No

|

2019

|

3%

|

|||||

|

Sun Streams PVS, Arizona

|

65

|

|

APS

|

No

|

2020

|

2%

|

|||||

|

Ishikawa, Japan

|

59

|

|

Hokuriku Electric Power Company

|

Yes

|

2018

|

100%

|

|||||

|

Cove Mountain Solar 1, Utah

|

58

|

|

PacifiCorp

|

No

|

2020

|

1%

|

|||||

|

Japan (multiple locations)

|

44

|

|

(6)

|

No

|

2019/2020

|

9%

|

|||||

|

Miyagi, Japan

|

40

|

|

Tohoku Electric Power Company

|

Yes

|

2021

|

17%

|

|||||

|

India (multiple locations)

|

40

|

|

(7)

|

Yes

|

2017

|

100%

|

|||||

|

Total

|

1,627

|

|

|||||||||

|

(1)

|

Previously known as the Twiggs County Solar project

|

|

(2)

|

Approximately 55 MW

AC

of the plant’s capacity is contracted with Transport for NSW

|

|

(3)

|

Utility-owned generation

|

|

(4)

|

Contracted but not specified

|

|

(5)

|

Approximately 70 MW

AC

of the plant’s capacity is contracted under various PPAs

|

|

(6)

|

Tokyo Electric Power Company – 27 MW

AC

and Hokuriku Electric Power Company – 17 MW

AC

|

|

(7)

|

Gulbarga Electricity Supply Co. – 20 MW

AC

and Chamundeshwari Electricity Supply Co. – 20 MW

AC

|

|

|

Years Ended December 31,

|

||||||||

|

2018

|

2017

|

2016

|

|||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Cost of sales

|

82.5

|

%

|

81.3

|

%

|

78.0

|

%

|

|||

|

Gross profit

|

17.5

|

%

|

18.7

|

%

|

22.0

|

%

|

|||

|

Selling, general and administrative

|

7.9

|

%

|

6.9

|

%

|

9.0

|

%

|

|||

|

Research and development

|

3.8

|

%

|

3.0

|

%

|

4.3

|

%

|

|||

|

Production start-up

|

4.0

|

%

|

1.4

|

%

|

—

|

%

|

|||

|

Restructuring and asset impairments

|

—

|

%

|

1.3

|

%

|

25.6

|

%

|

|||

|

Goodwill impairment

|

—

|

%

|

—

|

%

|

2.6

|

%

|

|||

|

Operating income (loss)

|

1.8

|

%

|

6.0

|

%

|

(19.6

|

)%

|

|||

|

Foreign currency loss, net

|

—

|

%

|

(0.3

|

)%

|

(0.5

|

)%

|

|||

|

Interest income

|

2.7

|

%

|

1.2

|

%

|

0.9

|

%

|

|||

|

Interest expense, net

|

(1.2

|

)%

|

(0.9

|

)%

|

(0.7

|

)%

|

|||

|

Other income, net

|

1.8

|

%

|

0.8

|

%

|

1.4

|

%

|

|||

|

Income tax expense

|

(0.2

|

)%

|

(12.6

|

)%

|

(0.8

|

)%

|

|||

|

Equity in earnings, net of tax

|

1.5

|

%

|

0.1

|

%

|

5.0

|

%

|

|||

|

Net income (loss)

|

6.4

|

%

|

(5.6

|

)%

|

(14.3

|

)%

|

|||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Modules

|

$

|

502,001

|

|

$

|

806,398

|

|

$

|

675,452

|

|

$

|

(304,397

|

)

|

(38

|

)%

|

$

|

130,946

|

|

19

|

%

|

|||||||

|

Systems

|

1,742,043

|

|

2,134,926

|

|

2,229,111

|

|

(392,883

|

)

|

(18

|

)%

|

(94,185

|

)

|

(4

|

)%

|

||||||||||||

|

Net sales

|

$

|

2,244,044

|

|

$

|

2,941,324

|

|

$

|

2,904,563

|

|

$

|

(697,280

|

)

|

(24

|

)%

|

$

|

36,761

|

|

1

|

%

|

|||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Modules

|

$

|

552,468

|

|

$

|

694,060

|

|

$

|

564,942

|

|

$

|

(141,592

|

)

|

(20

|

)%

|

$

|

129,118

|

|

23

|

%

|

|||||||

|

Systems

|

1,299,399

|

|

1,698,317

|

|

1,701,203

|

|

(398,918

|

)

|

(23

|

)%

|

(2,886

|

)

|

—

|

%

|

||||||||||||

|

Cost of sales

|

$

|

1,851,867

|

|

$

|

2,392,377

|

|

$

|

2,266,145

|

|

$

|

(540,510

|

)

|

(23

|

)%

|

$

|

126,232

|

|

6

|

%

|

|||||||

|

% of net sales

|

82.5

|

%

|

81.3

|

%

|

78.0

|

%

|

|

|

||||||||||||||||||

|

•

|

lower costs of

$241.4 million

from a

decrease

in the volume of modules sold;

|

|

•

|

a reduction in our module collection and recycling liability of

$25.4 million

in

2018

due to higher by-product credits for glass, lower capital costs, and adjustments to certain valuation assumptions; and

|

|

•

|

continued cost reductions in the cost per watt of our solar modules, which

decreased

cost of sales by

$22.6 million

; partially offset by

|

|

•

|

higher under-utilization and certain other charges associated with the initial ramp of certain Series 6 manufacturing lines, which

increased

cost of sales by

$113.0 million

;

|

|

•

|

a reduction to our product warranty liability of

$31.3 million

in

2017

due to lower legacy module replacement costs; and

|

|

•

|

a reduction in our module collection and recycling liability of

$13.5 million

in

2017

from updates to several valuation assumptions, including a decrease in certain inflation rates.

|

|

•

|

higher costs of

$366.2 million

from the increased volume of modules sold directly to third parties; partially offset by

|

|

•

|

continued cost reductions in the cost per watt of our solar modules, which decreased cost of sales by

$182.4 million

;

|

|

•

|

the reduction in our product warranty liability of

$31.3 million

in

2017

described above;

|

|

•

|

the reduction in our module collection and recycling liability of

$13.5 million

in

2017

described above; and

|

|

•

|

lower inventory write-downs of

$9.2 million

.

|

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Gross profit

|

$

|

392,177

|

|

$

|

548,947

|

|

$

|

638,418

|

|

$

|

(156,770

|

)

|

(29

|

)%

|

$

|

(89,471

|

)

|

(14

|

)%

|

|||||||

|

% of net sales

|

17.5

|

%

|

18.7

|

%

|

22.0

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Selling, general and administrative

|

$

|

176,857

|

|

$

|

202,699

|

|

$

|

261,994

|

|

$

|

(25,842

|

)

|

(13

|

)%

|

$

|

(59,295

|

)

|

(23

|

)%

|

|||||||

|

% of net sales

|

7.9

|

%

|

6.9

|

%

|

9.0

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Research and development

|

$

|

84,472

|

|

$

|

88,573

|

|

$

|

124,762

|

|

$

|

(4,101

|

)

|

(5

|

)%

|

$

|

(36,189

|

)

|

(29

|

)%

|

|||||||

|

% of net sales

|

3.8

|

%

|

3.0

|

%

|

4.3

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Production start-up

|

$

|

90,735

|

|

$

|

42,643

|

|

$

|

1,021

|

|

$

|

48,092

|

|

113

|

%

|

$

|

41,622

|

|

4,077

|

%

|

|||||||

|

% of net sales

|

4.0

|

%

|

1.4

|

%

|

—

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Restructuring and asset impairments

|

$

|

—

|

|

$

|

37,181

|

|

$

|

743,862

|

|

$

|

(37,181

|

)

|

(100

|

)%

|

$

|

(706,681

|

)

|

(95

|

)%

|

|||||||

|

% of net sales

|

—

|

%

|

1.3

|

%

|

25.6

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Goodwill impairment

|

$

|

—

|

|

$

|

—

|

|

$

|

74,930

|

|

$

|

—

|

|

—

|

%

|

$

|

(74,930

|

)

|

(100

|

)%

|

|||||||

|

% of net sales

|

—

|

%

|

—

|

%

|

2.6

|

%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Foreign currency loss, net

|

$

|

(570

|

)

|

$

|

(9,640

|

)

|

$

|

(14,007

|

)

|

$

|

9,070

|

|

(94

|

)%

|

$

|

4,367

|

|

(31

|

)%

|

|||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Interest income

|

$

|

59,788

|

|

$

|

35,704

|

|

$

|

25,193

|

|

$

|

24,084

|

|

67

|

%

|

$

|

10,511

|

|

42

|

%

|

|||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Interest expense, net

|

$

|

(25,921

|

)

|

$

|

(25,765

|

)

|

$

|

(20,538

|

)

|

$

|

(156

|

)

|

1

|

%

|

$

|

(5,227

|

)

|

25

|

%

|

|||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Other income, net

|

$

|

39,737

|

|

$

|

23,965

|

|

$

|

40,252

|

|

$

|

15,772

|

|

66

|

%

|

$

|

(16,287

|

)

|

(40

|

)%

|

|||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Income tax expense

|

$

|

(3,441

|

)

|

$

|

(371,996

|

)

|

$

|

(23,167

|

)

|

$

|

368,555

|

|

(99

|

)%

|

$

|

(348,829

|

)

|

1,506

|

%

|

|||||||

|

Effective tax rate

|

3.0

|

%

|

184.1

|

%

|

(4.3

|

)%

|

|

|

|

|

||||||||||||||||

|

|

Years Ended

|

Change

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2018 over 2017

|

2017 over 2016

|

|||||||||||||||||||||

|

Equity in earnings, net of tax

|

$

|

34,620

|

|

$

|

4,266

|

|

$

|

144,306

|

|

$

|

30,354

|

|

712

|

%

|

$

|

(140,040

|

)

|

(97

|

)%

|

|||||||

|

•

|

We expect to make significant capital investments over the next several years as we transition our production to Series 6 module technology and purchase the related manufacturing equipment and infrastructure. These investments also include the commencement and expansion of operations at our existing manufacturing plant in Vietnam and the construction of an additional U.S. manufacturing plant in Lake Township, Ohio. We expect the aggregate capital investment for currently planned Series 6 related programs to be approximately

$2.0 billion

, including

$1.1 billion

of capital expenditures already made as of

December 31, 2018

. These capital investments are expected to provide an annual Series 6 manufacturing capacity of approximately

6.6 GW

DC

once completed. During

2019

, we expect to spend

$650 million

to

$750 million

for capital expenditures, the majority of which is associated with the Series 6 transition. We believe these capital expenditures will, over time, increase our aggregate manufacturing capacity, reduce our manufacturing costs, and increase our solar module wattage.

|

|

•

|

Our failure to obtain raw materials and components that meet our quality, quantity, and cost requirements in a timely manner could interrupt or impair our ability to manufacture our solar modules or increase our manufacturing costs. Accordingly, we may enter into long-term supply agreements to mitigate potential risks related to the procurement of key raw materials and components, and such agreements may be noncancelable or cancelable with a significant penalty. For example, we have entered into long-term supply agreements for the purchase of certain specified minimum volumes of substrate glass and cover glass for our PV solar modules. Our actual purchases under these supply agreements are expected to be approximately $2.4 billion of substrate glass and $500 million of cover glass. We have the right to terminate these agreements upon payment of specified termination penalties (which are up to $430 million in the aggregate and decline over time during the respective supply periods).

|

|

•

|

The balance of our solar module inventories and BoS parts was

$309.3 million

as of

December 31, 2018

. As we continue to develop and construct our advanced-stage project pipeline, we must produce solar modules and procure BoS parts in volumes sufficient to support our planned construction schedules. As part of this construction cycle, we typically produce or procure these inventories in advance of receiving payment for such materials, which may temporarily reduce our liquidity. Once solar modules and BoS parts are installed in a project, they are classified as either project assets, PV solar power systems, or cost of sales depending on whether the project is subject to a definitive sales contract and whether other revenue recognition criteria have been met. We also produce significant volumes of modules for sale directly to third-parties, which requires us to carry inventories at levels sufficient to satisfy the demand of our customers and the needs of their utility-scale projects, which may also temporarily reduce our liquidity.

|

|

•

|

We may commit significant working capital over the next several years to advance the construction of various U.S. systems projects or procure the associated BoS parts by specified dates for such projects to qualify for certain federal investment tax credits. Among other requirements, such credits require projects to commence construction in 2019, which may be achieved by certain qualifying procurement activities, to receive a 30% investment tax credit. The credit will step down to 26% for projects that commence construction in 2020, 22% for projects that commence construction in 2021, and 10% for projects that commence construction thereafter.

|

|

•

|

We may also commit working capital to acquire solar power projects in various stages of development, including advanced-stage projects with PPAs, and to continue developing those projects as necessary. Depending upon the size and stage of development, the costs to acquire such solar power projects could be significant. When evaluating project acquisition opportunities, we consider both the strategic and financial benefits of any such acquisitions.

|

|

|

2018

|

2017

|

2016

|

|||||||||

|

Net cash (used in) provided by operating activities

|

$

|

(326,809

|

)

|

$

|

1,340,677

|

|

$

|

206,753

|

|

|||

|

Net cash (used in) provided by investing activities

|

(682,714

|

)

|

(626,802

|

)

|

144,520

|

|

||||||

|

Net cash provided by (used in) financing activities

|

255,228

|

|

192,045

|

|

(136,393

|

)

|

||||||

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash

|

(13,558

|

)

|

8,866

|

|

(6,306

|

)

|

||||||

|

Net (decrease) increase in cash, cash equivalents and restricted cash

|

$

|

(767,853

|

)

|

$

|

914,786

|

|

$

|

208,574

|

|

|||

|

|

|

Payments Due by Year

|

||||||||||||||||||

|

Total

|

Less Than

1 Year

|

1 - 3

Years

|

3 - 5

Years

|

More Than

5 Years

|

||||||||||||||||

|

Long-term debt obligations

|

$

|

479,157

|

|

$

|

5,673

|

|

$

|

92,949

|

|

$

|

83,841

|

|

$

|

296,694

|

|

|||||

|

Interest payments (1)

|

190,760

|

|

20,091

|

|

36,678

|

|

30,403

|

|

103,588

|

|

||||||||||

|

Operating lease obligations

|

146,814

|

|

13,839

|

|

17,340

|

|

15,573

|

|

100,062

|

|

||||||||||

|

Purchase obligations (2)

|

1,388,726

|

|

875,653

|

|

186,218

|

|

164,807

|

|

162,048

|

|

||||||||||

|

Recycling obligations

|

134,442

|

|

—

|

|

—

|

|

—

|

|

134,442

|

|

||||||||||

|

Contingent consideration (3)

|

2,915

|

|

665

|

|

2,250

|

|

—

|

|

—

|

|

||||||||||

|

Transition tax obligations (4)

|

81,186

|

|

4,170

|

|

14,670

|

|

21,088

|

|

41,258

|

|

||||||||||

|

Other obligations (5)

|

20,699

|

|

4,565

|

|

9,138

|

|

6,996

|

|

—

|

|

||||||||||

|

Total

|

$

|

2,444,699

|

|

$

|

924,656

|

|

$

|

359,243

|

|

$

|

322,708

|

|

$

|

838,092

|

|

|||||

|

(1)

|

Includes estimated cash interest to be paid over the remaining terms of the underlying debt. Interest payments are based on fixed and floating rates as of

December 31, 2018

.

|

|

(2)

|

Purchase obligations represent agreements to purchase goods or services, including open purchase orders and contracts with fixed volume commitments, that are noncancelable or cancelable with a significant penalty. Purchase obligations for our long-term supply agreements for the purchase of substrate glass and cover glass represent specified termination penalties, which are up to $430 million in the aggregate under the agreements. Our actual purchases under these supply agreements are expected to be approximately $2.4 billion of substrate glass and $500 million of cover glass.

|

|

(3)

|

In connection with business or project acquisitions, we may agree to pay additional amounts to the selling parties upon achievement of certain milestones.

See Note 15. “Commitments and Contingencies”

to our consolidated financial statements for further information.

|

|

(4)

|

Transition tax obligations represent estimated payments for U.S. federal taxes associated with accumulated earnings and profits of our foreign corporate subsidiaries.

See Note 19. “Income Taxes”

to our consolidated financial statements for further information.

|

|

(5)

|

Includes expected letter of credit fees and unused revolver fees.

|

|

|

Quarters Ended

|

|||||||||||||||||||||||||||||||

|

|

Dec 31,

2018 |

Sep 30,

2018 |

Jun 30,

2018 |

Mar 31,

2018 |

Dec 31, 2017

|

Sep 30,

2017 |

Jun 30,

2017 |

Mar 31,

2017 |

||||||||||||||||||||||||

|

|

(In thousands, except per share amounts)

|

|||||||||||||||||||||||||||||||

|

Net sales

|

$

|

691,241

|

|

$

|

676,220

|

|

$

|

309,318

|

|

$

|

567,265

|

|

$

|

339,181

|

|

$

|

1,087,026

|

|

$

|

623,326

|

|

$

|

891,791

|

|

||||||||

|

Gross profit (loss)

|

98,310

|

|

129,127

|

|

(8,058

|

)

|

172,798

|

|

62,070

|

|

291,800

|

|

110,893

|

|

84,184

|

|

||||||||||||||||

|

Production start-up

|

14,576

|

|

14,723

|

|

24,352

|

|

37,084

|

|

20,488

|

|

12,624

|

|

8,381

|

|

1,150

|

|

||||||||||||||||

|

Restructuring and asset impairments

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,927

|

)

|

791

|

|

18,286

|

|

20,031

|

|

||||||||||||||||

|

Operating income (loss)

|

11,008

|

|

58,475

|

|

(103,634

|

)

|

74,264

|

|

(35,071

|

)

|

206,989

|

|

13,928

|

|

(7,995

|

)

|

||||||||||||||||

|

Net income (loss)

|

52,116

|

|

57,750

|

|

(48,491

|

)

|

82,951

|

|

(432,454

|

)

|

205,747

|

|

51,963

|

|

9,129

|

|

||||||||||||||||

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Basic

|

$

|

0.50

|

|

$

|

0.55

|

|

$

|

(0.46

|

)

|

$

|

0.79

|

|

$

|

(4.14

|

)

|

$

|

1.97

|

|

$

|

0.50

|

|

$

|

0.09

|

|

||||||||

|

Diluted

|

$

|

0.49

|

|

$

|

0.54

|

|

$

|

(0.46

|

)

|

$

|

0.78

|

|

$

|

(4.14

|

)

|

$

|

1.95

|

|

$

|

0.50

|

|

$

|

0.09

|

|

||||||||

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options and Rights

(a)(1) |

Weighted-Average Exercise Price of Outstanding Options and Rights

(b)(2) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

(c)(3) |

|||||||

|

Equity compensation plans approved by stockholders

|

2,474,287

|

|

$

|

—

|

|

3,540,439

|

|

|||

|