|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

77-0560389

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

899 Kifer Road

Sunnyvale, California

|

94086

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Common Stock, $0.001 Par Value

|

|

The Nasdaq Stock Market LLC

|

|

(Title of each class)

|

|

(Name of exchange on which registered)

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

||

|

Non-accelerated filer

|

o

|

(Do not check if smaller reporting company)

|

Smaller reporting company

|

o

|

|

|

Emerging growth company

|

o

|

||||

|

|

|

Page

|

|

Part I

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Part II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Part III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Part IV

|

||

|

Item 15.

|

||

|

•

|

Core Business (FortiGate)

—We derive a majority of product sales from our FortiGate appliances. Our FortiGate appliances include the FortiGate-20 to -100 series, designed for small businesses and enterprises with distributed offices (“low-end products”), the FortiGate-200 to -900 series for medium-sized businesses (“mid-range products”) and the FortiGate-1000 to -7000 series for large businesses and service providers (“high-end products”). In February 2018, we launched the new FortiGate 6000 series, which is built upon a new hardware process and architecture that delivers over 100 gigabytes of advanced threat protection and secure sockets layer (“SSL”) inspection to handle the volume of traffic driven by increased adoption of the cloud.

|

|

•

|

Fortinet Security Fabric

—We developed the Fortinet Security Fabric to provide unified security across the entire digital attack surface, including network core, endpoints, applications, data centers, access and private and public cloud. The Fortinet Security Fabric is designed to enable traditionally disparate security devices to work together as an integrated and collaborative whole. It delivers integrated scalability, access control, awareness, security, traffic segmentation, centralized management, visibility and orchestration. The breadth of the Fortinet Security Fabric helps businesses and government agencies defend the expanding attack surface.

|

|

•

|

Fortinet Cloud Security

—Our technology positions us to deliver security to the cloud and for the cloud. We help our customers secure their cloud implementations by offering integration, visibility and automation across multi-cloud and hybrid deployments. We have a variety of software products designed to extend traditional network security protection into the cloud as standalone solutions, or as part of our distributed Security Fabric architecture. Our FortiCASB extends the core capabilities of our security fabric architecture to provide businesses the same level of cybersecurity and threat intelligence in cloud environments as they do on their physical networks. The Fortinet cloud security is available across all major cloud providers, including Microsoft Azure, Amazon Web Services, Google Cloud, IBM Cloud and Oracle Cloud.

|

|

•

|

Internet of Things (“IoT”) and Operational Technology Security (“OT”)

—The emergence of the IoT has created an environment where data moves freely between devices across locations, network environments, remote offices, mobile workers and public cloud environments, making it difficult to consistently track and secure. We are continuing to extend broad security to these IoT and OT environments. Our products enable critical infrastructure and industrial organizations to deliver advanced segmentation, access control and malware protection needed to unify their security architecture and defend their OT networks regardless of the operating environment.

|

|

•

|

key enablement for the Fortinet Security Fabric architecture;

|

|

•

|

allowing for FortiGate appliances to be configured into different security environments such as our Internal Network Firewall, NGFW and DCFW;

|

|

•

|

configuration of the physical aspects of the appliance such as ports, onboard Wi-Fi and switching;

|

|

•

|

extending the Fortinet Security Fabric by directly managing FortiSwitch and FortiAP devices;

|

|

•

|

key network functions such as routing and deployment modes (network routing, transparent, sniffer, etc.);

|

|

•

|

implementation of security updates from our FortiGuard distribution network, delivering ATP, such as IPS, antivirus and application control;

|

|

•

|

access to cloud-based web and email filtering databases;

|

|

•

|

direct integration with both cloud and on premises FortiSandbox technology;

|

|

•

|

security policy objects and enforcement;

|

|

•

|

data leak prevention and document finger printing; and

|

|

•

|

real-time reporting and logging.

|

|

•

|

our ability to attract and retain new end-customers or sell additional products and subscriptions to our existing end-customers;

|

|

•

|

the level of demand for our products and services, which may render forecasts inaccurate;

|

|

•

|

the timing of channel partner and end-customer orders, and our reliance on a concentration of shipments at the end of each quarter;

|

|

•

|

the timing of shipments, which may depend on factors such as inventory levels, logistics, manufacturing or shipping delays, our ability to ship new products on schedule and our ability to accurately forecast inventory requirements;

|

|

•

|

inventory management;

|

|

•

|

the mix of products sold and the mix of revenue between products and services, as well as the degree to which products and services are bundled and sold together for a package price;

|

|

•

|

the purchasing practices and budgeting cycles of our channel partners and end-customers;

|

|

•

|

the effectiveness of our sales organization, generally or in a particular geographic region, the time it takes to hire sales personnel and the timing of hiring, and our ability to retain, sales personnel;

|

|

•

|

the seasonal buying patterns of our end-customers;

|

|

•

|

the timing and level of our investments in sales and marketing, and the impact of such investments on our operating expenses, operating margin and the productivity and effectiveness of execution of our sales and marketing teams;

|

|

•

|

the timing of revenue recognition for our sales;

|

|

•

|

the level of perceived threats to network security, which may fluctuate from period to period;

|

|

•

|

changes in the requirements, market needs or buying practices and patterns of our distributors, resellers or end-customers;

|

|

•

|

changes in the growth rate of the network security market;

|

|

•

|

the timing and success of new product and service introductions or enhancements by us or our competitors, or any other change in the competitive landscape of our industry, including consolidation among our competitors, partners or end-customers;

|

|

•

|

the deferral of orders from distributors, resellers or end-customers in anticipation of new products or product enhancements announced by us or our competitors;

|

|

•

|

increases or decreases in our billings, revenue and expenses caused by fluctuations in foreign currency exchange rates or a strengthening of the U.S. dollar, as a significant portion of our expenses is incurred and paid in currencies other than the U.S. dollar, and the impact such fluctuations may have on the actual prices that our partners and customers are willing to pay for our products and services;

|

|

•

|

compliance with existing laws and regulations that are applicable to our ability to conduct business with the public sector;

|

|

•

|

the impact of cloud-based platforms on the timing of our revenue recognition, billings and free cash flow;

|

|

•

|

decisions by potential end-customers to purchase network security solutions from newer technology providers, from larger, more established security vendors or from their primary network equipment vendors;

|

|

•

|

price competition and increased competitiveness in our market;

|

|

•

|

our ability to both increase revenues and manage and control operating expenses in order to improve our operating margins;

|

|

•

|

changes in customer renewal rates for our services;

|

|

•

|

changes in the payment terms of services contracts or the length of services contracts sold;

|

|

•

|

changes in our estimated annual effective tax rates;

|

|

•

|

changes in circumstances and challenges in business conditions, including decreased demand, which may negatively impact our channel partners’ ability to sell the current inventory they hold and negatively impact their future purchases of products from us;

|

|

•

|

increased demand for cloud-based services and the uncertainty associated with transitioning to providing such services;

|

|

•

|

increased expenses, unforeseen liabilities or write-downs and any impact on results of operations from any acquisition consummated;

|

|

•

|

our channel partners having insufficient financial resources to withstand changes and challenges in business conditions;

|

|

•

|

disruptions in our channel or termination of our relationship with important channel partners, including as a result of consolidation among distributors and resellers of security solutions;

|

|

•

|

insolvency, credit or other difficulties confronting our key suppliers and channel partners, which could affect their ability to purchase or pay for products and services and which could disrupt our supply or distribution chain;

|

|

•

|

policy changes and uncertainty with respect to immigration laws, trade policy, foreign imports and tax laws related to international commerce;

|

|

•

|

political, economic and social instability;

|

|

•

|

general economic conditions, both in domestic and foreign markets;

|

|

•

|

future accounting pronouncements or changes in our accounting policies, such as changes in the revenue recognition standards or accounting for leases, as well as the significant costs that may be incurred to adopt and comply with these new pronouncements;

|

|

•

|

possible impairments or acceleration of depreciation of our existing real estate due to our current real estate holdings and future development plans; and

|

|

•

|

legislative or regulatory changes, such as with respect to privacy, information and cybersecurity, exports, the environment and applicable accounting standards.

|

|

•

|

economic or political instability in foreign markets;

|

|

•

|

greater difficulty in enforcing contracts and accounts receivable collection, including longer collection periods;

|

|

•

|

longer sales processes for larger deals, particularly during the summer months;

|

|

•

|

changes in regulatory requirements;

|

|

•

|

difficulties and costs of staffing and managing foreign operations;

|

|

•

|

the uncertainty of protection for intellectual property rights in some countries;

|

|

•

|

costs of compliance with foreign policies, laws and regulations and the risks and costs of non-compliance with such policies, laws and regulations;

|

|

•

|

protectionist policies and penalties, and local laws, requirements, policies and perceptions that may adversely impact a U.S.-headquartered business’s sales in certain countries outside of the United States;

|

|

•

|

costs of complying with, and the risks and costs of non-compliance with, U.S. or other foreign laws and regulations for foreign operations, including the U.S. Foreign Corrupt Practices Act, the United Kingdom Bribery Act 2010, the General Data Protection Regulation (which will be implemented by the European Union in May 2018), import and export control laws, tariffs, trade barriers and economic sanctions;

|

|

•

|

other regulatory or contractual limitations on our ability to sell our products in certain foreign markets, and the risks and costs of non-compliance;

|

|

•

|

heightened risks of unfair or corrupt business practices in certain geographies and of improper or fraudulent sales or sales-related arrangements that could disrupt the sales team through terminations of employment or otherwise, and may adversely impact financial results as compared to those already reported or forecasted and result in restatements of financial statements and irregularities in financial statements;

|

|

•

|

our ability to effectively implement and maintain adequate internal controls to properly manage our international sales and operations;

|

|

•

|

the potential for political unrest, changes and uncertainty, and for terrorism, hostilities, war or natural disasters;

|

|

•

|

changes in foreign currency exchange rates;

|

|

•

|

management communication and integration problems resulting from cultural differences and geographic dispersion; and

|

|

•

|

changes in tax, employment and other laws.

|

|

•

|

increased competition from competitors that traditionally target large and medium-sized businesses, service providers and government organizations and that may already have purchase commitments from those end-customers;

|

|

•

|

increased purchasing power and leverage held by large end-customers in negotiating contractual arrangements;

|

|

•

|

unanticipated changes in the capital resources or purchasing behavior of large end-customers, including changes in the volume and frequency of their purchases and changes in the mix of products and services and related payment terms;

|

|

•

|

more stringent support requirements in our support service contracts, including stricter support response times, more complex requirements and increased penalties for any failure to meet support requirements;

|

|

•

|

longer sales cycles and the associated risk that substantial time and resources may be spent on a potential end-customer that elects not to purchase our products and services; and

|

|

•

|

longer ramp-up periods for enterprise sales personnel as compared to other sales personnel.

|

|

•

|

the expenditure of significant financial and product development resources in efforts to analyze, correct, eliminate or work around errors or defects or to address and eliminate vulnerabilities;

|

|

•

|

the loss of existing or potential end-customers or channel partners;

|

|

•

|

delayed or lost revenue;

|

|

•

|

delay or failure to attain market acceptance;

|

|

•

|

negative publicity and harm to our reputation; and

|

|

•

|

litigation, regulatory inquiries or investigations that may be costly and harm our reputation and, in some instances, subject us to potential liability that is not contractually limited.

|

|

•

|

a potential inability to obtain an adequate supply of required parts or components when required;

|

|

•

|

financial or other difficulties faced by our suppliers;

|

|

•

|

infringement or misappropriation of our intellectual property;

|

|

•

|

price increases;

|

|

•

|

failure of a component to meet environmental or other regulatory requirements;

|

|

•

|

failure to meet delivery obligations in a timely fashion; and

|

|

•

|

failure in component quality.

|

|

•

|

public sector budgetary cycles;

|

|

•

|

funding authorizations and requirements unique to government agencies, with funding or purchasing reductions or delays adversely affecting public sector demand for our products;

|

|

•

|

geopolitical matters; and

|

|

•

|

rules and regulations applicable to certain government sales, including GSA regulations.

|

|

•

|

earnings being lower than anticipated in countries that have lower tax rates or higher than anticipated in countries that have higher tax rates;

|

|

•

|

the mix of earnings in countries with differing statutory tax rates or withholding taxes;

|

|

•

|

changes in the valuation of our deferred tax assets and liabilities;

|

|

•

|

transfer pricing adjustments;

|

|

•

|

an increase in non-deductible expenses for tax purposes, including certain stock-based compensation expense, write-offs of acquired in-process research and development and impairment of goodwill;

|

|

•

|

tax costs related to intercompany realignments;

|

|

•

|

tax assessments resulting from income tax audits or any related tax interest or penalties that could significantly affect our provision for income taxes for the period in which the settlement takes place;

|

|

•

|

a change in our decision to indefinitely reinvest foreign earnings;

|

|

•

|

changes in accounting principles;

|

|

•

|

court decisions, tax rulings and interpretations of tax laws, and regulations by international, federal or local governmental authorities; or

|

|

•

|

changes in tax laws and regulations.

|

|

•

|

delays in releasing our new products or enhancements to the market;

|

|

•

|

failure to accurately predict market demand in terms of product functionality and to supply products that meet this demand in a timely fashion;

|

|

•

|

failure of our sales force and partners to focus on selling new products;

|

|

•

|

inability to interoperate effectively with the networks or applications of our prospective end-customers;

|

|

•

|

inability to protect against new types of attacks or techniques used by hackers;

|

|

•

|

actual or perceived defects, vulnerabilities, errors or failures;

|

|

•

|

negative publicity about their performance or effectiveness;

|

|

•

|

introduction or anticipated introduction of competing products by our competitors;

|

|

•

|

poor business conditions for our end-customers, causing them to delay IT purchases;

|

|

•

|

changes to the regulatory requirements around security; and

|

|

•

|

reluctance of customers to purchase products incorporating open source software.

|

|

•

|

greater name recognition and longer operating histories;

|

|

•

|

larger sales and marketing budgets and resources;

|

|

•

|

broader distribution and established relationships with distribution partners and end-customers;

|

|

•

|

access to larger customer bases;

|

|

•

|

greater customer support resources;

|

|

•

|

greater resources to make acquisitions;

|

|

•

|

lower labor and development costs; and

|

|

•

|

substantially greater financial, technical and other resources.

|

|

•

|

providing for a classified board of directors whose members serve staggered three-year terms;

|

|

•

|

authorizing “blank check” preferred stock, which could be issued by the board without stockholder approval and may contain voting, liquidation, dividend and other rights superior to our common stock;

|

|

•

|

limiting the liability of, and providing indemnification to, our directors and officers;

|

|

•

|

limiting the ability of our stockholders to call and bring business before special meetings;

|

|

•

|

requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our board of directors;

|

|

•

|

providing that certain litigation matters may only be brought against us in state or federal courts in the State of Delaware;

|

|

•

|

controlling the procedures for the conduct and scheduling of board and stockholder meetings; and

|

|

•

|

providing the board of directors with the express power to postpone previously scheduled annual meetings and to cancel previously scheduled special meetings.

|

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

2017

|

2016

|

||||||||||||||

|

|

High

|

Low

|

High

|

Low

|

|||||||||||

|

Fourth Quarter

|

$

|

45.09

|

|

$

|

36.35

|

|

$

|

36.94

|

|

$

|

28.61

|

|

|||

|

Third Quarter

|

$

|

41.10

|

|

$

|

35.84

|

|

$

|

37.17

|

|

$

|

31.57

|

|

|||

|

Second Quarter

|

$

|

40.97

|

|

$

|

37.20

|

|

$

|

34.78

|

|

$

|

28.79

|

|

|||

|

First Quarter

|

$

|

38.35

|

|

$

|

30.12

|

|

$

|

30.63

|

|

$

|

23.83

|

|

|||

|

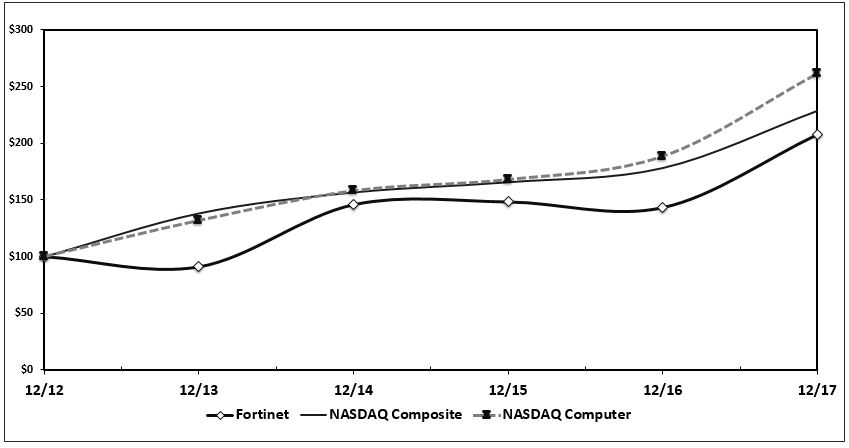

December 2012 *

|

December 2013

|

December 2014

|

December 2015

|

December 2016

|

December 2017

|

|||||||||||||||||||

|

Fortinet, Inc.

|

$

|

100

|

|

$

|

91

|

|

$

|

146

|

|

$

|

148

|

|

$

|

143

|

|

$

|

208

|

|

||||||

|

NASDAQ Composite

|

$

|

100

|

|

$

|

138

|

|

$

|

157

|

|

$

|

166

|

|

$

|

178

|

|

$

|

229

|

|

||||||

|

NASDAQ Computer

|

$

|

100

|

|

$

|

132

|

|

$

|

158

|

|

$

|

168

|

|

$

|

189

|

|

$

|

262

|

|

||||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plan or Program

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

|

||||||||||

|

October 1 - October 31, 2017

|

955,867

|

|

$

|

38.68

|

|

955,867

|

|

$

|

728,242

|

|

||||

|

November 1 - November 30, 2017

|

4,688,088

|

|

$

|

40.18

|

|

4,688,088

|

|

$

|

539,865

|

|

||||

|

December 1 - December 31, 2017

|

2,270,446

|

|

$

|

42.73

|

|

2,270,446

|

|

$

|

442,839

|

|

||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||

|

(in thousands, except per share amounts)

|

|||||||||||||||||||

|

Consolidated Statement of Operations Data:

|

|||||||||||||||||||

|

Total revenue

|

$

|

1,494,930

|

|

$

|

1,275,443

|

|

$

|

1,009,268

|

|

$

|

770,364

|

|

$

|

615,297

|

|

||||

|

Gross profit

|

$

|

1,109,646

|

|

$

|

937,606

|

|

$

|

722,491

|

|

$

|

539,355

|

|

$

|

434,654

|

|

||||

|

Operating income

|

$

|

109,804

|

|

$

|

42,944

|

|

$

|

14,877

|

|

$

|

59,324

|

|

$

|

72,090

|

|

||||

|

Net income

|

$

|

31,399

|

|

$

|

32,187

|

|

$

|

7,987

|

|

$

|

25,343

|

|

$

|

44,273

|

|

||||

|

Net income per share

:

|

|||||||||||||||||||

|

Basic

|

$

|

0.18

|

|

$

|

0.19

|

|

$

|

0.05

|

|

$

|

0.15

|

|

$

|

0.27

|

|

||||

|

Diluted

|

$

|

0.18

|

|

$

|

0.18

|

|

$

|

0.05

|

|

$

|

0.15

|

|

$

|

0.26

|

|

||||

|

Weighted-average shares outstanding:

|

|||||||||||||||||||

|

Basic

|

174,315

|

|

172,621

|

|

170,385

|

|

163,831

|

|

162,435

|

|

|||||||||

|

Diluted

|

178,079

|

|

176,338

|

|

176,141

|

|

169,289

|

|

168,183

|

|

|||||||||

|

|

As of December 31,

|

||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||

|

(in thousands)

|

|||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

|||||||||||||||||||

|

Cash, cash equivalents and investments

|

$

|

1,349,299

|

|

$

|

1,310,508

|

|

$

|

1,164,310

|

|

$

|

991,744

|

|

$

|

843,045

|

|

||||

|

Total assets

|

$

|

2,257,916

|

|

$

|

2,139,941

|

|

$

|

1,790,510

|

|

$

|

1,424,774

|

|

$

|

1,168,464

|

|

||||

|

Total stockholders’ equity

|

$

|

589,377

|

|

$

|

837,681

|

|

$

|

755,377

|

|

$

|

675,966

|

|

$

|

585,760

|

|

||||

|

•

|

continued growth and market share gains;

|

|

•

|

variability in sales in certain product categories from year to year and between quarters;

|

|

•

|

expected impact of sales of certain products and services;

|

|

•

|

the impact of macro-economic and geopolitical factors on our international sales;

|

|

•

|

the proportion of our revenue that consists of our product and service revenue, and the mix of billings between products and services, and the duration of service contracts;

|

|

•

|

the impact of our product innovation strategy;

|

|

•

|

drivers of long-term growth and operating leverage, such as increased sales productivity, functionality and value in our standalone and bundled subscription service offerings;

|

|

•

|

growing our sales to businesses, service providers and government organizations, the impact of sales to these organizations on our long-term growth, expansion and operating results, and the effectiveness of our internal sales organization;

|

|

•

|

trends in revenue, costs of revenue and gross margin;

|

|

•

|

trends in our operating expenses, including sales and marketing expense, research and development expense, general and administrative expense, and expectations regarding these expenses as a percentage of total revenue;

|

|

•

|

continued investments in research and development;

|

|

•

|

managing our continued investments in sales and marketing, and the impact of those investments;

|

|

•

|

expectations regarding uncertain tax benefits and our effective tax rate;

|

|

•

|

the impact of the 2017 Tax Act;

|

|

•

|

expectations regarding spending related to real estate and other capital expenditures and to the impact on free cash flows;

|

|

•

|

competition in our markets;

|

|

•

|

our intentions regarding repatriation of cash, cash equivalents and investments held by our international subsidiaries and the sufficiency of our existing cash, cash equivalents and investments to meet our cash needs for at least the next 12 months;

|

|

•

|

other statements regarding our future operations, financial condition and prospects and business strategies; and

|

|

•

|

adoption and impact of new accounting standards, including those related to revenue recognition and accounting for leases.

|

|

•

|

We recorded total revenue of

$1.49 billion

in

2017

, an increase of

17%

compared to

$1.28 billion

in

2016

. Product revenue was

$577.2 million

in 2017, an increase of

5%

compared to

$548.1 million

in

2016

. Service revenue was

$917.8 million

in

2017

, an increase of

26%

compared to

$727.3 million

in

2016

.

|

|

•

|

We generated operating income of

$109.8 million

in 2017, an increase of 156% compared to

$42.9 million

in 2016.

|

|

•

|

Cash, cash equivalents and investments were

$1.35 billion

as of

December 31, 2017

, an increase of

$38.8 million

, or

3%

, from

December 31, 2016

.

|

|

•

|

Deferred revenue was

$1.34 billion

as of

December 31, 2017

, an increase of

$301.0 million

, or

29%

, from

December 31, 2016

.

|

|

•

|

We generated cash flows from operating activities of

$594.4 million

in

2017

, an increase of

$248.7 million

, or

72%

, compared to

2016

.

|

|

•

|

In 2017, we repurchased

11.2 million

shares of common stock under the Repurchase Program for an aggregate purchase price of

$446.3 million

. In 2016, we repurchased 3.9 million shares of common stock for a total purchase price of $110.8 million.

|

|

|

Year Ended or As of December 31,

|

||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

(in thousands)

|

|||||||||||

|

Revenue

|

$

|

1,494,930

|

|

$

|

1,275,443

|

|

$

|

1,009,268

|

|

||

|

Deferred revenue

|

$

|

1,336,314

|

|

$

|

1,035,349

|

|

$

|

791,303

|

|

||

|

Billings (non-GAAP)

|

$

|

1,795,895

|

|

$

|

1,515,089

|

|

$

|

1,232,014

|

|

||

|

Cash, cash equivalents and investments

|

$

|

1,349,299

|

|

$

|

1,310,508

|

|

$

|

1,164,310

|

|

||

|

Net cash provided by operating activities

|

$

|

594,405

|

|

$

|

345,708

|

|

$

|

282,547

|

|

||

|

Free cash flow (non-GAAP)

|

$

|

459,093

|

|

$

|

278,526

|

|

$

|

245,189

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

(in thousands)

|

|||||||||||

|

Billings:

|

|||||||||||

|

Revenue

|

$

|

1,494,930

|

|

$

|

1,275,443

|

|

$

|

1,009,268

|

|

||

|

Add change in deferred revenue

|

300,965

|

|

244,046

|

|

232,546

|

|

|||||

|

Less deferred revenue balance acquired in business combination

|

—

|

|

(4,400

|

)

|

(9,800

|

)

|

|||||

|

Total billings (non-GAAP)

|

$

|

1,795,895

|

|

$

|

1,515,089

|

|

$

|

1,232,014

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

(in thousands)

|

|||||||||||

|

Free Cash Flow:

|

|||||||||||

|

Net cash provided by operating activities

|

$

|

594,405

|

|

$

|

345,708

|

|

$

|

282,547

|

|

||

|

Less purchases of property and equipment

|

(135,312

|

)

|

(67,182

|

)

|

(37,358

|

)

|

|||||

|

Free cash flow (non-GAAP)

|

$

|

459,093

|

|

$

|

278,526

|

|

$

|

245,189

|

|

||

|

Net cash used in investing activities

|

$

|

(76,803

|

)

|

$

|

(74,123

|

)

|

$

|

(967

|

)

|

||

|

Net cash used in financing activities

|

$

|

(415,601

|

)

|

$

|

(105,859

|

)

|

$

|

(21,557

|

)

|

||

|

•

|

Product revenue

. Product revenue is primarily generated from sales of our appliances. The majority of our product revenue has been generated by our FortiGate line of appliances, and we do not expect this to change in the foreseeable future. Product revenue also includes revenue derived from sales of software. As a percentage of total revenue, we expect that our product revenue may vary from quarter-to-quarter based on certain factors, as discussed below under “—Quarterly Results of Operations,” and we expect the trend to continue in 2018.

|

|

•

|

Service revenue

. Service revenue is generated primarily from FortiGuard security subscription services related to application control, antivirus, intrusion prevention, web filtering, anti-spam, ATP and vulnerability management updates, and from FortiCare technical support services for software updates, maintenance releases and patches, internet access to technical content, telephone and internet access to technical support personnel and hardware support. We recognize revenue from FortiGuard security subscription and FortiCare technical support services over the contractual service period. Our typical contractual support and subscription term is one to three years and, to a lesser extent, five years. We also generate a small portion of our revenue from professional services and training services, for which we recognize revenue as the services are provided, and cloud-based services, for which we recognize revenue as the subscription service is delivered over the term, which is typically one year, or on a monthly usage basis. We continue to see a shift from product revenue to higher-margin, recurring service revenue, which reflects our ongoing success in driving sales of mid-range and high-end service bundles, as well as increases in certain software and other time based service models. Our service revenue growth rate depends significantly on the growth of our customer base, the expansion of our service bundle offerings, the expansion and introduction of new service offerings and the renewal of service contracts by our existing customers.

|

|

•

|

Cost of product revenue

. A substantial majority of the cost of product revenue consists of third-party contract manufacturers' costs, as well as other costs of materials used in production. Our cost of product revenue also includes supplies, shipping costs, personnel costs associated with logistics and quality control, facility-related costs, excess and obsolete inventory costs, warranty costs, and amortization and impairment of intangible assets, if applicable. Personnel costs include direct compensation and benefits.

|

|

•

|

Cost of service revenue

. Cost of service revenue is primarily comprised of salaries, benefits and bonuses, as well as stock-based compensation. Cost of service revenue also includes supplies and facility-related costs.

|

|

•

|

Research and development

. Research and development expense consists primarily of personnel costs. Additional research and development expenses include ASIC and system prototypes and certification-related expenses, depreciation of capital equipment and facility-related expenses. The majority of our research and development is focused on both software development and the ongoing development of our hardware platform. We record all research and development expenses as incurred. Our research and development teams are primarily located in Canada and the United States.

|

|

•

|

Sales and marketing

. Sales and marketing expense is the largest component of our operating expenses and primarily consists of personnel costs. Additional sales and marketing expenses include promotional lead generation and other marketing expenses, travel, depreciation of capital equipment and facility-related expenses. We intend to hire additional personnel focused on sales and marketing and expand our sales and marketing efforts worldwide in order to capture additional market share in the high-return enterprise market, where customers tend to provide a higher lifetime value.

|

|

•

|

General and administrative

. General and administrative expense consists of personnel costs, as well as professional fees, depreciation of capital equipment and software, facility-related expenses, expenses associated with the ERP system implementation and business acquisition costs. General and administrative personnel include our executive, finance, human resources, information technology and legal organizations. Our professional fees principally consist of outside legal, auditing, accounting, tax, information technology and other consulting costs.

|

|

•

|

Restructuring charges

. Restructuring charges relate to alignment activities performed in connection with the Meru Networks, Inc. (“Meru”) and AccelOps, Inc. (“AccelOps”) acquisitions to reduce our cost structure and improve operational efficiencies, resulting in workforce reductions, contract terminations and other charges.

|

|

•

|

Persuasive evidence of an arrangement exists.

Binding contracts or purchase orders are generally used to determine the existence of an arrangement.

|

|

•

|

Delivery has occurred or services have been rendered.

Product delivery occurs when we fulfill an order and title and risk of loss has been transferred. Service revenue is deferred and recognized ratably over the contractual service period, which is typically from one to three years and, to a lesser extent,

five

years, and is generally recognized upon delivery or completion of service.

|

|

•

|

Sales price is fixed or determinable.

We assess whether the sales price is fixed or determinable based on the payment terms associated with the transaction and when the sales price is deemed final.

|

|

•

|

Collectability is reasonably assured

. We assess collectability based primarily on creditworthiness as determined by credit checks, analysis, and payment history.

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Consolidated Statement of Operations Data:

|

|||||||||||

|

Revenue:

|

|||||||||||

|

Product

|

$

|

577,171

|

|

$

|

548,110

|

|

$

|

476,782

|

|

||

|

Service

|

917,759

|

|

727,333

|

|

532,486

|

|

|||||

|

Total revenue

|

1,494,930

|

|

1,275,443

|

|

1,009,268

|

|

|||||

|

Cost of revenue:

|

|||||||||||

|

Product

|

243,824

|

|

208,984

|

|

190,398

|

|

|||||

|

Service

|

141,460

|

|

128,853

|

|

96,379

|

|

|||||

|

Total cost of revenue

|

385,284

|

|

337,837

|

|

286,777

|

|

|||||

|

Gross profit:

|

|||||||||||

|

Product

|

333,347

|

|

339,126

|

|

286,384

|

|

|||||

|

Service

|

776,299

|

|

598,480

|

|

436,107

|

|

|||||

|

Total gross profit

|

1,109,646

|

|

937,606

|

|

722,491

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Research and development

|

210,614

|

|

183,084

|

|

158,129

|

|

|||||

|

Sales and marketing

|

701,026

|

|

626,501

|

|

470,371

|

|

|||||

|

General and administrative

|

87,862

|

|

81,080

|

|

71,514

|

|

|||||

|

Restructuring charges

|

340

|

|

3,997

|

|

7,600

|

|

|||||

|

Total operating expenses

|

999,842

|

|

894,662

|

|

707,614

|

|

|||||

|

Operating income

|

109,804

|

|

42,944

|

|

14,877

|

|

|||||

|

Interest income

|

13,482

|

|

7,303

|

|

5,295

|

|

|||||

|

Other income (expense)—net

|

708

|

|

(7,099

|

)

|

(3,167

|

)

|

|||||

|

Income before income taxes

|

123,994

|

|

43,148

|

|

17,005

|

|

|||||

|

Provision for income taxes

|

92,595

|

|

10,961

|

|

9,018

|

|

|||||

|

Net income

|

$

|

31,399

|

|

$

|

32,187

|

|

$

|

7,987

|

|

||

|

|

Year Ended December 31,

|

|||||||

|

2017

|

2016

|

2015

|

||||||

|

(as percentage of revenue)

|

||||||||

|

Revenue:

|

||||||||

|

Product

|

39

|

%

|

43

|

%

|

47

|

%

|

||

|

Service

|

61

|

|

57

|

|

53

|

|

||

|

Total revenue

|

100

|

|

100

|

|

100

|

|

||

|

Cost of revenue:

|

||||||||

|

Product

|

16

|

|

16

|

|

19

|

|

||

|

Service

|

9

|

|

10

|

|

10

|

|

||

|

Total cost of revenue

|

26

|

|

26

|

|

28

|

|

||

|

Gross margin:

|

||||||||

|

Product

|

58

|

|

62

|

|

60

|

|

||

|

Service

|

85

|

|

82

|

|

82

|

|

||

|

Total gross margin

|

74

|

|

74

|

|

72

|

|

||

|

Operating expenses:

|

||||||||

|

Research and development

|

14

|

|

14

|

|

16

|

|

||

|

Sales and marketing

|

47

|

|

49

|

|

47

|

|

||

|

General and administrative

|

6

|

|

6

|

|

7

|

|

||

|

Restructuring charges

|

—

|

|

0.3

|

|

1

|

|

||

|

Total operating expenses

|

67

|

|

70

|

|

70

|

|

||

|

Operating margin

|

7

|

|

3

|

|

1

|

|

||

|

Interest income

|

1

|

|

1

|

|

1

|

|

||

|

Other income (expense)—net

|

—

|

|

(1

|

)

|

—

|

|

||

|

Income before income taxes

|

8

|

|

3

|

|

2

|

|

||

|

Provision for income taxes

|

6

|

|

1

|

|

1

|

|

||

|

Net income

|

2

|

%

|

3

|

%

|

1

|

%

|

||

|

|

Year Ended December 31,

|

|

|

|||||||||||||||||

|

2017

|

2016

|

|

|

|||||||||||||||||

|

Amount

|

% of

Revenue

|

Amount

|

% of

Revenue

|

Change

|

% Change

|

|||||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||||||||

|

Revenue:

|

||||||||||||||||||||

|

Product

|

$

|

577,171

|

|

39

|

%

|

$

|

548,110

|

|

43

|

%

|

$

|

29,061

|

|

5

|

%

|

|||||

|

Service

|

917,759

|

|

61

|

|

727,333

|

|

57

|

|

190,426

|

|

26

|

|

||||||||

|

Total revenue

|

$

|

1,494,930

|

|

100

|

%

|

$

|

1,275,443

|

|

100

|

%

|

$

|

219,487

|

|

17

|

%

|

|||||

|

Revenue by geography:

|

||||||||||||||||||||

|

Americas

|

$

|

642,331

|

|

43

|

%

|

$

|

536,706

|

|

42

|

%

|

$

|

105,625

|

|

20

|

%

|

|||||

|

Europe, Middle East and Africa (“EMEA”)

|

554,569

|

|

37

|

|

477,393

|

|

37

|

|

77,176

|

|

16

|

|

||||||||

|

Asia Pacific (“APAC”)

|

298,030

|

|

20

|

|

261,344

|

|

21

|

|

36,686

|

|

14

|

|

||||||||

|

Total revenue

|

$

|

1,494,930

|

|

100

|

%

|

$

|

1,275,443

|

|

100

|

%

|

$

|

219,487

|

|

17

|

%

|

|||||

|

|

Year Ended December 31,

|

|

|

|||||||||||

|

2017

|

2016

|

Change

|

% Change

|

|||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Cost of revenue:

|

||||||||||||||

|

Product

|

$

|

243,824

|

|

$

|

208,984

|

|

$

|

34,840

|

|

17

|

%

|

|||

|

Service

|

141,460

|

|

128,853

|

|

12,607

|

|

10

|

|

||||||

|

Total cost of revenue

|

$

|

385,284

|

|

$

|

337,837

|

|

$

|

47,447

|

|

14

|

%

|

|||

|

Gross margin (%):

|

||||||||||||||

|

Product

|

57.8

|

%

|

61.9

|

%

|

(4.1

|

)%

|

||||||||

|

Service

|

84.6

|

|

82.3

|

|

2.3

|

|

||||||||

|

Total gross margin

|

74.2

|

%

|

73.5

|

%

|

0.7

|

%

|

||||||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||

|

Amount

|

% of

Revenue

|

Amount

|

% of

Revenue

|

|||||||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Research and development

|

$

|

210,614

|

|

14

|

%

|

$

|

183,084

|

|

14

|

%

|

$

|

27,530

|

|

15

|

%

|

|||||

|

Sales and marketing

|

701,026

|

|

47

|

|

626,501

|

|

49

|

|

74,525

|

|

12

|

|

||||||||

|

General and administrative

|

87,862

|

|

6

|

|

81,080

|

|

6

|

|

6,782

|

|

8

|

|

||||||||

|

Restructuring charges

|

340

|

|

—

|

|

3,997

|

|

0.3

|

|

(3,657

|

)

|

(91

|

)

|

||||||||

|

Total operating expenses

|

$

|

999,842

|

|

67

|

%

|

$

|

894,662

|

|

70

|

%

|

$

|

105,180

|

|

12

|

%

|

|||||

|

|

Year Ended December 31,

|

|

|

|||||||||||

|

2017

|

2016

|

Change

|

% Change

|

|||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Interest income

|

$

|

13,482

|

|

$

|

7,303

|

|

$

|

6,179

|

|

85

|

%

|

|||

|

Other income (expense)—net

|

708

|

|

(7,099

|

)

|

7,807

|

|

(110

|

)

|

||||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||

|

2017

|

2016

|

|||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Provision for income taxes

|

$

|

92,595

|

|

$

|

10,961

|

|

$

|

81,634

|

|

745

|

%

|

|||

|

Effective tax rate (%)

|

75

|

%

|

25

|

%

|

50

|

%

|

—

|

|

||||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||||||||

|

2016

|

2015

|

|||||||||||||||||||

|

Amount

|

% of

Revenue

|

Amount

|

% of

Revenue

|

|||||||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||||||||

|

Revenue:

|

||||||||||||||||||||

|

Product

|

$

|

548,110

|

|

43

|

%

|

$

|

476,782

|

|

47

|

%

|

$

|

71,328

|

|

15

|

%

|

|||||

|

Service

|

727,333

|

|

57

|

|

532,486

|

|

53

|

|

194,847

|

|

37

|

|

||||||||

|

Total revenue

|

$

|

1,275,443

|

|

100

|

%

|

$

|

1,009,268

|

|

100

|

%

|

$

|

266,175

|

|

26

|

%

|

|||||

|

Revenue by geography:

|

||||||||||||||||||||

|

Americas

|

$

|

536,706

|

|

42

|

%

|

$

|

435,282

|

|

43

|

%

|

$

|

101,424

|

|

23

|

%

|

|||||

|

EMEA

|

477,393

|

|

37

|

|

366,018

|

|

36

|

|

111,375

|

|

30

|

|

||||||||

|

APAC

|

261,344

|

|

21

|

|

207,968

|

|

21

|

|

53,376

|

|

26

|

|

||||||||

|

Total revenue

|

$

|

1,275,443

|

|

100

|

%

|

$

|

1,009,268

|

|

100

|

%

|

$

|

266,175

|

|

26

|

%

|

|||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||

|

2016

|

2015

|

|||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Cost of revenue:

|

||||||||||||||

|

Product

|

$

|

208,984

|

|

$

|

190,398

|

|

$

|

18,586

|

|

10

|

%

|

|||

|

Service

|

128,853

|

|

96,379

|

|

32,474

|

|

34

|

|

||||||

|

Total cost of revenue

|

$

|

337,837

|

|

$

|

286,777

|

|

$

|

51,060

|

|

18

|

%

|

|||

|

Gross margin (%):

|

||||||||||||||

|

Product

|

61.9

|

%

|

60.1

|

%

|

1.8

|

%

|

||||||||

|

Service

|

82.3

|

|

81.9

|

|

0.4

|

|

||||||||

|

Total gross margin

|

73.5

|

%

|

71.6

|

%

|

1.9

|

%

|

||||||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||||||||

|

2016

|

2015

|

|||||||||||||||||||

|

Amount

|

% of

Revenue

|

Amount

|

% of

Revenue

|

|||||||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Research and development

|

$

|

183,084

|

|

14

|

%

|

$

|

158,129

|

|

16

|

%

|

$

|

24,955

|

|

16

|

%

|

|||||

|

Sales and marketing

|

626,501

|

|

49

|

|

470,371

|

|

47

|

|

156,130

|

|

33

|

|

||||||||

|

General and administrative

|

81,080

|

|

6

|

|

71,514

|

|

7

|

|

9,566

|

|

13

|

|

||||||||

|

Restructuring charges

|

3,997

|

|

0.3

|

|

7,600

|

|

1

|

|

(3,603

|

)

|

(47

|

)

|

||||||||

|

Total operating expenses

|

$

|

894,662

|

|

70

|

%

|

$

|

707,614

|

|

70

|

%

|

$

|

187,048

|

|

26

|

%

|

|||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||

|

2016

|

2015

|

|||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Interest income

|

$

|

7,303

|

|

$

|

5,295

|

|

$

|

2,008

|

|

38

|

%

|

|||

|

Other income (expense)—net

|

(7,099

|

)

|

(3,167

|

)

|

(3,932

|

)

|

124

|

|

||||||

|

|

Year Ended December 31,

|

Change

|

% Change

|

|||||||||||

|

2016

|

2015

|

|||||||||||||

|

(in thousands, except percentages)

|

||||||||||||||

|

Provision for income taxes

|

$

|

10,961

|

|

$

|

9,018

|

|

$

|

1,943

|

|

22

|

%

|

|||

|

Effective tax rate (%)

|

25

|

%

|

53

|

%

|

(28

|

)%

|

—

|

|

||||||

|

|

Three Months Ended

|

||||||||||||||||||||||||||||||

|

|

Dec 31,

2017 |

Sept 30,

2017 |

Jun 30,

2017 |

Mar 31,

2017 |

Dec 31,

2016 |

Sept 30,

2016 |

Jun 30,

2016 |

Mar 31,

2016 |

|||||||||||||||||||||||

|

|

(in thousands, except per share amounts)

|

||||||||||||||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

|||||||||||||||||||||||||||||||

|

Revenue:

|

|||||||||||||||||||||||||||||||

|

Product

|

$

|

162,118

|

|

$

|

137,095

|

|

$

|

142,705

|

|

$

|

135,253

|

|

$

|

158,925

|

|

$

|

127,972

|

|

$

|

136,641

|

|

$

|

124,572

|

|

|||||||

|

Service

|

254,550

|

|

237,122

|

|

220,764

|

|

205,323

|

|

203,905

|

|

188,674

|

|

174,750

|

|

160,004

|

|

|||||||||||||||

|

Total revenue

|

416,668

|

|

374,217

|

|

363,469

|

|

340,576

|

|

362,830

|

|

316,646

|

|

311,391

|

|

284,576

|

|

|||||||||||||||

|

Cost of revenue:

|

|||||||||||||||||||||||||||||||

|

Product

(1)(2)

|

69,634

|

|

58,106

|

|

60,787

|

|

55,297

|

|

56,616

|

|

50,267

|

|

52,788

|

|

49,313

|

|

|||||||||||||||

|

Service

(1)(2)

|

35,785

|

|

35,543

|

|

34,865

|

|

35,267

|

|

34,275

|

|

34,532

|

|

31,715

|

|

28,331

|

|

|||||||||||||||

|

Total cost of revenue

|

105,419

|

|

93,649

|

|

95,652

|

|

90,564

|

|

90,891

|

|

84,799

|

|

84,503

|

|

77,644

|

|

|||||||||||||||

|

Total gross profit

|

311,249

|

|

280,568

|

|

267,817

|

|

250,012

|

|

271,939

|

|

231,847

|

|

226,888

|

|

206,932

|

|

|||||||||||||||

|

Operating expenses:

|

|||||||||||||||||||||||||||||||

|

Research and development

(1)

|

54,774

|

|

53,486

|

|

51,159

|

|

51,195

|

|

45,589

|

|

47,239

|

|

45,502

|

|

44,754

|

|

|||||||||||||||

|

Sales and marketing

(1)(2)

|

191,928

|

|

172,361

|

|

166,337

|

|

170,400

|

|

162,873

|

|

154,831

|

|

162,694

|

|

146,103

|

|

|||||||||||||||

|

General and administrative

(1)

|

22,349

|

|

21,025

|

|

21,911

|

|

22,577

|

|

17,451

|

|

22,006

|

|

22,184

|

|

19,439

|

|

|||||||||||||||

|

Restructuring charges

|

—

|

|

—

|

|

(90

|

)

|

430

|

|

833

|

|

2,283

|

|

553

|

|

328

|

|

|||||||||||||||

|

Total operating expenses

|

269,051

|

|

246,872

|

|

239,317

|

|

244,602

|

|

226,746

|

|

226,359

|

|

230,933

|

|

210,624

|

|

|||||||||||||||

|

Operating income (loss)

|

42,198

|

|

33,696

|

|

28,500

|

|

5,410

|

|

45,193

|

|

5,488

|

|

(4,045

|

)

|

(3,692

|

)

|

|||||||||||||||

|

Interest income

|

4,061

|

|

3,866

|

|

3,163

|

|

2,392

|

|

1,964

|

|

1,888

|

|

1,705

|

|

1,746

|

|

|||||||||||||||

|

Other income (expense)—net

|

(1,181

|

)

|

344

|

|

1,243

|

|

302

|

|

(3,650

|

)

|

(787

|

)

|

(1,350

|

)

|

(1,312

|

)

|

|||||||||||||||

|

Income (loss) before income taxes

|

45,078

|

|

37,906

|

|

32,906

|

|

8,104

|

|

43,507

|

|

6,589

|

|

(3,690

|

)

|

(3,258

|

)

|

|||||||||||||||

|

Provision for (benefit from) income taxes

|

74,039

|

|

11,296

|

|

9,873

|

|

(2,613

|

)

|

18,341

|

|

298

|

|

(2,302

|

)

|

(5,376

|

)

|

|||||||||||||||

|

Net income (loss)

|

$

|

(28,961

|

)

|

$

|

26,610

|

|

$

|

23,033

|

|

$

|

10,717

|

|

$

|

25,166

|

|

$

|

6,291

|

|

$

|

(1,388

|

)

|

$

|

2,118

|

|

|||||||

|

Net income (loss) per share

:

|

|||||||||||||||||||||||||||||||

|

Basic

|

$

|

(0.17

|

)

|

$

|

0.15

|

|

$

|

0.13

|

|

$

|

0.06

|

|

$

|

0.15

|

|

$

|

0.04

|

|

$

|

(0.01

|

)

|

$

|

0.01

|

|

|||||||

|

Diluted

|

$

|

(0.17

|

)

|

$

|

0.15

|

|

$

|

0.13

|

|

$

|

0.06

|

|

$

|

0.14

|

|

$

|

0.04

|

|

$

|

(0.01

|

)

|

$

|

0.01

|

|

|||||||

|

(1)

|

Includes stock-based compensation as follows:

|

|

|

Three Months Ended

|

||||||||||||||||||||||||||||||

|

|

Dec 31,

2017 |

Sept 30,

2017 |

Jun 30,

2017 |

Mar 31,

2017 |

Dec 31,

2016 |

Sept 30,

2016 |

Jun 30,

2016 |

Mar 31,

2016 |

|||||||||||||||||||||||

|

|

(in thousands)

|

||||||||||||||||||||||||||||||

|

Cost of product revenue

|

$

|

341

|

|

$

|

314

|

|

$

|

383

|

|

$

|

342

|

|

$

|

313

|

|

$

|

309

|

|

$

|

298

|

|

$

|

280

|

|

|||||||

|

Cost of service revenue

|

2,349

|

|

2,371

|

|

2,473

|

|

2,310

|

|

2,276

|

|

2,238

|

|

2,123

|

|

2,134

|

|

|||||||||||||||

|

Research and development

|

8,067

|

|

7,976

|

|

8,253

|

|

7,898

|

|

7,871

|

|

7,648

|

|

7,458

|

|

7,143

|

|

|||||||||||||||

|

Sales and marketing

|

19,614

|

|

19,609

|

|

19,745

|

|

19,026

|

|

17,930

|

|

17,378

|

|

16,990

|

|

15,815

|

|

|||||||||||||||

|

General and administrative

|

4,083

|

|

4,037

|

|

4,237

|

|

3,755

|

|

3,691

|

|

3,520

|

|

3,478

|

|

3,530

|

|

|||||||||||||||

|

Total stock-based compensation expense

|

$

|

34,454

|

|

$

|

34,307

|

|

$

|

35,091

|

|

$

|

33,331

|

|

$

|

32,081

|

|

$

|