|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

DELAWARE

|

|

34-1560655

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

One Cedar Point Drive

|

||

|

Sandusky, Ohio

|

44870-5259

|

|

|

(Address of principal executive office)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code: (419) 626-0830

|

|

Title of each class

|

Name of each exchange on which registered

|

|||

|

Depositary Units (Representing Limited Partner Interests)

|

New York Stock Exchange

|

|||

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

o

|

|

Non-accelerated filer

|

|

o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

o

|

|

|

PAGE

|

||||

|

|

|

3

|

|

||

|

|

|

7

|

|

||

|

|

|

11

|

|

||

|

|

|

11

|

|

||

|

12

|

|

||||

|

12

|

|

||||

|

|

|||||

|

|

|

12

|

|

||

|

|

|

14

|

|

||

|

|

|

15

|

|

||

|

24

|

|

||||

|

25

|

|

||||

|

56

|

|

||||

|

56

|

|

||||

|

58

|

|

||||

|

58

|

|

||||

|

58

|

|

||||

|

58

|

|

||||

|

59

|

|

||||

|

59

|

|

||||

|

60

|

|

||||

|

|

64

|

|

|||

|

|

65

|

|

|||

|

Consent

|

122

|

|

|||

|

Certifications

|

123

|

|

|||

|

Name

|

Age

|

Position(s)

|

|||

|

Matthew A. Ouimet

|

55

|

|

Matt Ouimet has served as Chief Executive Officer since January 2012. Prior to that, he served as President of Cedar Fair since June 2011. Before joining Cedar Fair, Matt served as President and Chief Operating Officer for Corinthian Colleges from July 2009 to October 2010 and as Executive Vice President – Operations from January 2009 to June 2009. Prior to joining Corinthian Colleges, he served as President, Hotel Group for Starwood Hotels and Resorts Worldwide from August 2006 to September 2008.

|

||

|

Richard A. Zimmerman

|

53

|

|

Richard Zimmerman has served as Chief Operating Officer since October of 2011. Prior to that, he served as Executive Vice President since November 2010, previously serving as Regional Vice President since June 2007. Before serving as Regional Vice President, he served as Vice President and General Manager of Kings Dominion since 1998.

|

||

|

Brian C. Witherow

|

47

|

|

Brian Witherow has served as Executive Vice President and Chief Financial Officer since January 2012. Prior to that, he served as Vice President and Corporate Controller beginning in July 2005. He served as Corporate Treasurer from May 2004 to June 2005 and as Corporate Director of Investor Relations from 1995 through 2004.

|

||

|

H. Philip Bender

|

58

|

|

Phil Bender has served as Executive Vice President, Operations, since November 2010, previously serving as Regional Vice President beginning in June 2006. Prior to that, he served as Vice President & General Manager of Worlds of Fun / Oceans of Fun since the end of 2000.

|

||

|

Robert A. Decker

|

53

|

|

Rob Decker has served as Corporate Vice President of Planning & Design since the end of 2002. Prior to that, he served as Corporate Director of Planning and Design since 1999.

|

||

|

Craig J. Freeman

|

60

|

|

Craig Freeman has served as Corporate Vice President of Administration since September 2005. Prior to that, he served as Vice President and General Manager of Knott's Camp Snoopy at the Mall of America from 1996 through 2005.

|

||

|

Duffield E. Milkie

|

48

|

|

Duff Milkie has served as Corporate Vice President and General Counsel since February 2008 and Corporate Secretary since February 2012. Prior to that, he was a partner in the law firm of Wickens, Herzer, Panza, Cook, & Batista since 1998.

|

||

|

David R. Hoffman

|

45

|

|

Dave Hoffman has served as Senior Vice President and Chief Accounting Officer since January 2012. Prior to that, he served as Vice President of Finance and Corporate Tax since November 2010. He served as Vice President of Corporate Tax from October 2006 until November 2010. Before joining Cedar Fair in 2006, he served as a business advisor with Ernst & Young.

|

||

|

Kelley Semmelroth

|

49

|

|

Kelley Semmelroth has served as Executive Vice President and Chief Marketing Officer since February 2012. Prior to joining Cedar Fair, Kelley served as Senior Vice President, Marketing Planning Director for TD Bank beginning in 2010. From 2005 to 2010, Kelley served as Senior Vice President of Brand Strategy and Management at Bank of America.

|

||

|

•

|

pay distributions on or make distributions in respect of our capital stock or units or make other restricted payments;

|

|

•

|

incur additional debt or issue certain preferred equity;

|

|

•

|

make certain investments;

|

|

•

|

sell certain assets;

|

|

•

|

create restrictions on distributions from restricted subsidiaries;

|

|

•

|

create liens on certain assets to secure debt;

|

|

•

|

consolidate, merge, amalgamate, sell or otherwise dispose of all or substantially all of our assets;

|

|

•

|

enter into certain transactions with our affiliates; and

|

|

•

|

designate our subsidiaries as unrestricted subsidiaries.

|

|

•

|

limit our ability to borrow money for our working capital, capital expenditures, debt service requirements, strategic initiatives or other purposes;

|

|

•

|

limit our flexibility in planning or reacting to changes in business and future business operations; and

|

|

•

|

make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing other indebtedness.

|

|

2013

|

Distribution

|

High

|

Low

|

||||||||

|

4th quarter

|

$

|

0.70

|

|

$

|

50.16

|

|

$

|

42.67

|

|

||

|

3rd quarter

|

0.63

|

|

44.49

|

|

41.11

|

|

|||||

|

2nd quarter

|

0.63

|

|

44.29

|

|

38.28

|

|

|||||

|

1st quarter

|

0.63

|

|

39.90

|

|

33.95

|

|

|||||

|

2012

|

|||||||||||

|

4th quarter

|

$

|

0.40

|

|

$

|

37.69

|

|

$

|

30.90

|

|

||

|

3rd quarter

|

0.40

|

|

34.96

|

|

30.06

|

|

|||||

|

2nd quarter

|

0.40

|

|

31.74

|

|

25.24

|

|

|||||

|

1st quarter

|

0.40

|

|

29.98

|

|

21.75

|

|

|||||

|

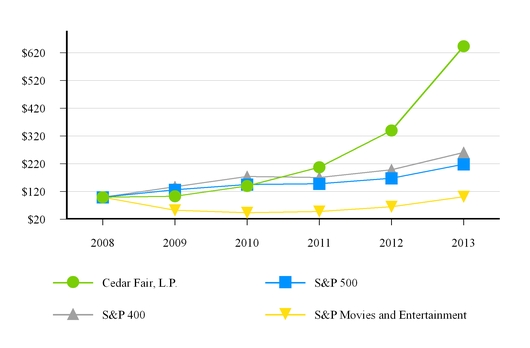

Base Period

|

Return

|

|||||||||||||||||||||||||

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

|||||||||||||||||||||

|

Cedar Fair, L.P.

|

$

|

100.00

|

|

$

|

103.48

|

|

$

|

139.82

|

|

$

|

207.82

|

|

$

|

340.32

|

|

$

|

643.57

|

|

||||||||

|

S&P 500

|

100.00

|

|

126.46

|

|

145.49

|

|

148.56

|

|

168.48

|

|

218.36

|

|

||||||||||||||

|

S&P 400

|

100.00

|

|

137.38

|

|

173.98

|

|

170.97

|

|

198.44

|

|

261.08

|

|

||||||||||||||

|

S&P Movies and Entertainment

|

100.00

|

|

52.36

|

|

43.59

|

|

48.54

|

|

65.35

|

|

101.67

|

|

||||||||||||||

|

2013

|

2012

(1)

|

2011

|

2010

(2)

|

2009

(3)

|

||||||||||||||||

|

(In thousands, except per unit and per capita amounts)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Net revenues

|

$

|

1,134,572

|

|

$

|

1,068,454

|

|

$

|

1,028,472

|

|

$

|

977,592

|

|

$

|

916,075

|

|

|||||

|

Operating income

|

301,761

|

|

233,675

|

|

227,946

|

|

151,669

|

|

183,890

|

|

||||||||||

|

Income (loss) before taxes

|

128,447

|

|

133,614

|

|

73,173

|

|

(30,382

|

)

|

48,754

|

|

||||||||||

|

Net income (loss)

|

108,204

|

|

101,857

|

|

65,296

|

|

(33,052

|

)

|

34,184

|

|

||||||||||

|

Net income (loss) per unit - basic

|

1.95

|

|

1.83

|

|

1.18

|

|

(0.60

|

)

|

0.62

|

|

||||||||||

|

Net income (loss) per unit - diluted

|

1.94

|

|

1.82

|

|

1.17

|

|

(0.60

|

)

|

0.61

|

|

||||||||||

|

Balance Sheet Data

|

||||||||||||||||||||

|

Total assets

|

$

|

2,014,627

|

|

$

|

2,019,865

|

|

$

|

2,047,168

|

|

$

|

2,065,877

|

|

$

|

2,130,932

|

|

|||||

|

Working capital (deficit)

|

27,698

|

|

2,904

|

|

(104,928

|

)

|

(98,518

|

)

|

(70,212

|

)

|

||||||||||

|

Long-term debt

|

1,520,632

|

|

1,532,180

|

|

1,556,379

|

|

1,579,703

|

|

1,626,346

|

|

||||||||||

|

Partners' equity

|

139,131

|

|

154,451

|

|

136,350

|

|

121,628

|

|

113,839

|

|

||||||||||

|

Distributions

|

||||||||||||||||||||

|

Declared per limited partner unit

|

$

|

2.58

|

|

$

|

1.60

|

|

$

|

1.00

|

|

$

|

0.25

|

|

$

|

1.23

|

|

|||||

|

Paid per limited partner unit

|

2.58

|

|

1.60

|

|

1.00

|

|

0.25

|

|

1.23

|

|

||||||||||

|

Other Data

|

||||||||||||||||||||

|

Depreciation and amortization

|

$

|

122,487

|

|

$

|

126,306

|

|

$

|

125,837

|

|

$

|

128,856

|

|

$

|

134,398

|

|

|||||

|

Adjusted EBITDA

(4)

|

425,430

|

|

390,954

|

|

374,576

|

|

359,231

|

|

316,512

|

|

||||||||||

|

Capital expenditures

|

120,488

|

|

96,232

|

|

90,190

|

|

71,706

|

|

69,136

|

|

||||||||||

|

Combined attendance

(5)

|

23,519

|

|

23,300

|

|

23,386

|

|

22,794

|

|

21,136

|

|

||||||||||

|

Combined in-park guest per capita spending

(6)

|

$

|

44.15

|

|

$

|

41.95

|

|

$

|

40.03

|

|

$

|

39.21

|

|

$

|

39.56

|

|

|||||

|

(1)

|

Operating results for 2012 include a non-cash charge of $25.0 million for the impairment of long-lived assets at Wildwater Kingdom.

|

|

(2)

|

Operating results for 2010 include a loss on debt extinguishment of $35.3 million and a non-cash charge of $62.0 million for the impairment of long-lived assets at Great America, the majority of which were originally recorded with the PPI acquisition.

|

|

(3)

|

Operating results for 2009 include a gain of $23.1 million for the sale of excess land near Canada's Wonderland and a $4.5 million non-cash charge for the impairment of trade-names originally recorded with the PPI acquisition.

|

|

(4)

|

Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in our current credit agreement. Adjusted EBITDA is not a measurement of operating performance computed in accordance with GAAP and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in accordance with GAAP. We believe that Adjusted EBITDA is a meaningful measure of park-level operating profitability and we use it for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. A reconciliation of net income (loss) to Adjusted EBITDA is provided below.

|

|

(5)

|

Combined attendance includes attendance figures from the eleven amusement parks and all separately gated outdoor water parks.

|

|

(6)

|

Combined in-park guest per capita spending ("per capita spending") includes all amusement park, outdoor water park, causeway tolls and parking revenues for the amusement park and water park operating seasons. Revenues from indoor water park, hotel,

campground, marina and other out-of-park operations are excluded from per capita statistics.

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||

|

|

(In thousands )

|

|||||||||||||||||||

|

Net income (loss)

|

$

|

108,204

|

|

$

|

101,857

|

|

$

|

65,296

|

|

$

|

(33,052

|

)

|

$

|

34,184

|

|

|||||

|

Interest expense

|

103,071

|

|

110,619

|

|

157,185

|

|

150,285

|

|

124,706

|

|

||||||||||

|

Interest income

|

(154

|

)

|

(68

|

)

|

(157

|

)

|

(1,154

|

)

|

(44

|

)

|

||||||||||

|

Provision for taxes

|

20,243

|

|

31,757

|

|

7,877

|

|

2,670

|

|

14,570

|

|

||||||||||

|

Depreciation and amortization

|

122,487

|

|

126,306

|

|

125,837

|

|

128,856

|

|

134,398

|

|

||||||||||

|

EBITDA

|

353,851

|

|

370,471

|

|

356,038

|

|

247,605

|

|

307,814

|

|

||||||||||

|

Loss on early debt extinguishment

|

34,573

|

|

—

|

|

—

|

|

35,289

|

|

—

|

|

||||||||||

|

Net effect of swaps

|

6,883

|

|

(1,492

|

)

|

(13,119

|

)

|

18,194

|

|

9,170

|

|

||||||||||

|

Unrealized foreign currency (gain) loss

|

29,085

|

|

(9,181

|

)

|

9,830

|

|

(17,464

|

)

|

—

|

|

||||||||||

|

Equity-based compensation

|

5,535

|

|

3,265

|

|

(239

|

)

|

(89

|

)

|

(26

|

)

|

||||||||||

|

Loss on impairment of goodwill and other intangibles

|

—

|

|

—

|

|

—

|

|

2,293

|

|

4,500

|

|

||||||||||

|

Loss on impairment/retirement of fixed assets, net

|

2,539

|

|

30,336

|

|

11,355

|

|

62,752

|

|

244

|

|

||||||||||

|

Gain on sale of other assets

|

(8,743

|

)

|

(6,625

|

)

|

—

|

|

—

|

|

(23,098

|

)

|

||||||||||

|

Terminated merger costs

|

—

|

|

—

|

|

230

|

|

10,375

|

|

5,619

|

|

||||||||||

|

Refinancing costs

|

—

|

|

—

|

|

955

|

|

—

|

|

832

|

|

||||||||||

|

Licensing dispute settlement costs

|

—

|

|

—

|

|

—

|

|

—

|

|

1,980

|

|

||||||||||

|

Class action settlement costs

|

—

|

|

—

|

|

—

|

|

276

|

|

9,477

|

|

||||||||||

|

Other non-recurring costs

(1)

|

1,707

|

|

4,180

|

|

9,526

|

|

—

|

|

—

|

|

||||||||||

|

Adjusted EBITDA

|

$

|

425,430

|

|

$

|

390,954

|

|

$

|

374,576

|

|

$

|

359,231

|

|

$

|

316,512

|

|

|||||

|

|

|

|

|

|

||||||||||||||||

|

(1)

|

The Company's 2010, 2011 and 2013 Credit Agreements reference certain costs as non-recurring or unusual. These items are excluded in the calculation of Adjusted EBITDA and have included litigation expenses and costs for SEC compliance matters related to Special Meeting requests, costs associated with certain unusual ride abandonment and relocation expenses, and costs associated with the transition to a new advertising agency.

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

|

For the years ended December 31,

|

2013

|

2012

|

2011

|

|||||||||||||||||||

|

( amounts in millions, except attendance, per capita spending and percentages)

|

||||||||||||||||||||||

|

Net revenues:

|

||||||||||||||||||||||

|

Admissions

|

$

|

647.0

|

|

57.0

|

%

|

$

|

612.1

|

|

57.3

|

%

|

$

|

596.0

|

|

57.9

|

%

|

|||||||

|

Food, merchandise and games

|

356.1

|

|

31.4

|

%

|

342.2

|

|

32.0

|

%

|

349.5

|

|

34.0

|

%

|

||||||||||

|

Accommodations and other

|

131.5

|

|

11.6

|

%

|

114.1

|

|

10.7

|

%

|

83.0

|

|

8.1

|

%

|

||||||||||

|

Net revenues

|

1,134.6

|

|

100.0

|

%

|

1,068.4

|

|

100.0

|

%

|

1,028.5

|

|

100.0

|

%

|

||||||||||

|

Operating costs and expenses

|

716.5

|

|

63.2

|

%

|

684.7

|

|

64.1

|

%

|

663.3

|

|

64.5

|

%

|

||||||||||

|

Depreciation and amortization

|

122.5

|

|

10.8

|

%

|

126.3

|

|

11.8

|

%

|

125.8

|

|

12.2

|

%

|

||||||||||

|

Loss on impairment / retirement of fixed assets

|

2.5

|

|

0.2

|

%

|

30.3

|

|

2.8

|

%

|

11.4

|

|

1.1

|

%

|

||||||||||

|

Gain on sale of other assets

|

(8.7

|

)

|

(0.8

|

)%

|

(6.6

|

)

|

(0.6

|

)%

|

—

|

|

—

|

%

|

||||||||||

|

Operating income

|

301.8

|

|

26.6

|

%

|

233.7

|

|

21.9

|

%

|

228.0

|

|

22.2

|

%

|

||||||||||

|

Interest and other expense, net

|

102.9

|

|

9.0

|

%

|

110.6

|

|

10.3

|

%

|

158.0

|

|

15.4

|

%

|

||||||||||

|

Net effect of swaps

|

6.9

|

|

0.6

|

%

|

(1.5

|

)

|

(0.1

|

)%

|

(13.1

|

)

|

(1.3

|

)%

|

||||||||||

|

Loss on early debt extinguishment

|

34.6

|

|

3.0

|

%

|

—

|

|

—

|

%

|

—

|

|

—

|

%

|

||||||||||

|

Unrealized / realized foreign currency (gain) loss

|

28.9

|

|

2.5

|

%

|

(9.0

|

)

|

(0.8

|

)%

|

9.9

|

|

1.0

|

%

|

||||||||||

|

Provision for taxes

|

20.3

|

|

1.8

|

%

|

31.7

|

|

3.0

|

%

|

7.9

|

|

0.8

|

%

|

||||||||||

|

Net income

|

$

|

108.2

|

|

9.5

|

%

|

$

|

101.9

|

|

9.5

|

%

|

$

|

65.3

|

|

6.3

|

%

|

|||||||

|

Other data:

|

||||||||||||||||||||||

|

Combined attendance (in thousands)

|

23,519

|

|

23,300

|

|

23,386

|

|

||||||||||||||||

|

Combined in-park guest per capita spending

|

$

|

44.15

|

|

$

|

41.95

|

|

$

|

40.03

|

|

|||||||||||||

|

|

Increase (Decrease)

|

||||||||||||||

|

|

12/31/13

|

12/31/12

|

$

|

%

|

|||||||||||

|

Net revenues

|

$

|

1,134,572

|

|

$

|

1,068,454

|

|

$

|

66,118

|

|

6.2

|

%

|

||||

|

Operating costs and expenses

|

716,528

|

|

684,762

|

|

31,766

|

|

4.6

|

%

|

|||||||

|

Depreciation and amortization

|

122,487

|

|

126,306

|

|

(3,819

|

)

|

(3.0

|

)%

|

|||||||

|

Loss on impairment/retirement of fixed assets

|

2,539

|

|

30,336

|

|

(27,797

|

)

|

N/M

|

|

|||||||

|

Gain on sale of other assets

|

(8,743

|

)

|

(6,625

|

)

|

(2,118

|

)

|

N/M

|

|

|||||||

|

Operating income

|

$

|

301,761

|

|

$

|

233,675

|

|

$

|

68,086

|

|

29.1

|

%

|

||||

|

Other Data:

|

|||||||||||||||

|

Adjusted EBITDA

(1)

|

$

|

425,430

|

|

$

|

390,954

|

|

$

|

34,476

|

|

8.8

|

%

|

||||

|

Adjusted EBITDA margin

|

37.5

|

%

|

36.6

|

%

|

—

|

|

0.9

|

%

|

|||||||

|

Attendance

|

23,519

|

|

23,300

|

|

219

|

|

0.9

|

%

|

|||||||

|

Per capita spending

|

$

|

44.15

|

|

$

|

41.95

|

|

$

|

2.20

|

|

5.2

|

%

|

||||

|

Out-of-park revenues

|

$

|

124,164

|

|

$

|

116,767

|

|

$

|

7,397

|

|

6.3

|

%

|

||||

|

N/M - Not meaningful

|

|||||||||||||||

|

(1) for additional information regarding Adjusted EBITDA, including how we define and use Adjusted EBITDA, as well as a reconciliation from net income, see Item 6, "Selected Financial Data," on pages 14-15.

|

|||||||||||||||

|

|

Increase (Decrease)

|

||||||||||||||

|

|

12/31/12

|

12/31/11

|

$

|

%

|

|||||||||||

|

Net revenues

|

$

|

1,068,454

|

|

$

|

1,028,472

|

|

$

|

39,982

|

|

3.9

|

%

|

||||

|

Operating costs and expenses

|

684,762

|

|

663,334

|

|

21,428

|

|

3.2

|

%

|

|||||||

|

Depreciation and amortization

|

126,306

|

|

125,837

|

|

469

|

|

0.4

|

%

|

|||||||

|

Loss on impairment/retirement of fixed assets

|

30,336

|

|

11,355

|

|

18,981

|

|

N/M

|

|

|||||||

|

Gain on sale of other assets

|

(6,625

|

)

|

—

|

|

(6,625

|

)

|

N/M

|

|

|||||||

|

Operating income

|

$

|

233,675

|

|

$

|

227,946

|

|

$

|

5,729

|

|

2.5

|

%

|

||||

|

Other Data:

|

|||||||||||||||

|

Adjusted EBITDA

(1)

|

$

|

390,954

|

|

$

|

374,576

|

|

$

|

16,378

|

|

4.4

|

%

|

||||

|

Adjusted EBITDA margin

|

36.6

|

%

|

36.4

|

%

|

—

|

|

0.2

|

%

|

|||||||

|

Attendance

|

23,300

|

|

23,386

|

|

(86

|

)

|

(0.4

|

)%

|

|||||||

|

Per capita spending

|

$

|

41.95

|

|

$

|

40.03

|

|

$

|

1.92

|

|

4.8

|

%

|

||||

|

Out-of-park revenues

|

$

|

116,767

|

|

$

|

117,556

|

|

$

|

(789

|

)

|

(0.7

|

)%

|

||||

|

N/M - Not meaningful

|

|||||||||||||||

|

(1) for additional information regarding Adjusted EBITDA, including how we define and use Adjusted EBITDA, as well as a reconciliation from net income, see Item 6, "Selected Financial Data," on pages 14-15.

|

|||||||||||||||

|

Payments Due by Period

|

|||||||||||||||||||

|

2019 -

|

|||||||||||||||||||

|

Total

|

2014

|

2015-2016

|

2017-2018

|

Thereafter

|

|||||||||||||||

|

|

|

||||||||||||||||||

|

Long-term debt

(1)

|

$

|

2,103.2

|

|

$

|

102.7

|

|

$

|

209.8

|

|

$

|

606.8

|

|

$

|

1,183.9

|

|

||||

|

Capital expenditures

(2)

|

76.5

|

|

68.2

|

|

8.3

|

|

—

|

|

—

|

|

|||||||||

|

Lease & other obligations

(3)

|

169.4

|

|

21.6

|

|

18.7

|

|

15.7

|

|

113.4

|

|

|||||||||

|

Total

|

$

|

2,349.1

|

|

$

|

192.5

|

|

$

|

236.8

|

|

$

|

622.5

|

|

$

|

1,297.3

|

|

||||

|

(1)

|

Represents maturities and mandatory prepayments on long-term debt obligations, fixed interest on senior notes, variable interest on term debt assuming current LIBOR interest rates, and the impact of our various derivative contracts. See Note 5 in “Notes to Consolidated Financial Statements” for further information.

|

|

(2)

|

Represents contractual obligations in place at year-end for the purchase of new rides and attractions. Obligations not denominated in U.S. dollars have been converted based on the currency exchange rates as of

December 31, 2013

.

|

|

(3)

|

Represents contractual lease and purchase obligations in place at year-end.

|

|

Net income

|

Net income

|

|||||||||||||||||||

|

(loss) per

|

(loss) per

|

|||||||||||||||||||

|

Operating income

|

Net income

|

limited partner

|

limited partner

|

|||||||||||||||||

|

(Unaudited)

|

Net revenues

|

(loss)

|

(loss)

|

unit-basic

|

unit-diluted

|

|||||||||||||||

|

2013

|

||||||||||||||||||||

|

1st Quarter

(1)

|

$

|

41,799

|

|

$

|

(66,320

|

)

|

$

|

(109,126

|

)

|

$

|

(1.95

|

)

|

$

|

(1.95

|

)

|

|||||

|

2nd Quarter

|

361,620

|

|

97,455

|

|

47,390

|

|

0.85

|

|

0.85

|

|

||||||||||

|

3rd Quarter

|

592,076

|

|

266,723

|

|

190,424

|

|

3.43

|

|

3.41

|

|

||||||||||

|

4th Quarter

|

139,077

|

|

3,903

|

|

(20,484

|

)

|

(0.37

|

)

|

(0.37

|

)

|

||||||||||

|

$

|

1,134,572

|

|

$

|

301,761

|

|

$

|

108,204

|

|

$

|

1.95

|

|

$

|

1.94

|

|

||||||

|

2012

|

||||||||||||||||||||

|

1st Quarter

|

$

|

28,198

|

|

$

|

(69,329

|

)

|

$

|

(65,415

|

)

|

$

|

(1.18

|

)

|

$

|

(1.18

|

)

|

|||||

|

2nd Quarter

|

357,606

|

|

87,326

|

|

36,583

|

|

0.65

|

|

0.65

|

|

||||||||||

|

3rd Quarter

(2)

|

553,445

|

|

204,565

|

|

141,013

|

|

2.54

|

|

2.52

|

|

||||||||||

|

4th Quarter

|

129,205

|

|

11,113

|

|

(10,324

|

)

|

(0.19

|

)

|

(0.19

|

)

|

||||||||||

|

$

|

1,068,454

|

|

$

|

233,675

|

|

$

|

101,857

|

|

$

|

1.83

|

|

$

|

1.82

|

|

||||||

|

Note:

|

To assure that our highly seasonal operations will not result in misleading comparisons of interim periods, the Partnership has adopted the following reporting procedures: (a) seasonal operating costs are expensed over the operating season, including some costs incurred prior to the season, which are deferred and amortized over the season, and (b) all other costs are expensed as incurred or ratably over the entire year.

|

|

|

12/31/2013

|

12/31/2012

|

||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

118,056

|

|

$

|

78,830

|

|

||

|

Receivables

|

21,333

|

|

18,192

|

|

||||

|

Inventories

|

26,080

|

|

27,840

|

|

||||

|

Current deferred tax asset

|

9,675

|

|

8,184

|

|

||||

|

Other current assets

|

11,353

|

|

8,060

|

|

||||

|

186,497

|

|

141,106

|

|

|||||

|

Property and Equipment:

|

||||||||

|

Land

|

283,313

|

|

303,348

|

|

||||

|

Land improvements

|

350,869

|

|

339,081

|

|

||||

|

Buildings

|

584,659

|

|

584,854

|

|

||||

|

Rides and equipment

|

1,494,112

|

|

1,450,231

|

|

||||

|

Construction in progress

|

44,550

|

|

28,971

|

|

||||

|

2,757,503

|

|

2,706,485

|

|

|||||

|

Less accumulated depreciation

|

(1,251,740

|

)

|

(1,162,213

|

)

|

||||

|

1,505,763

|

|

1,544,272

|

|

|||||

|

Goodwill

|

238,089

|

|

246,221

|

|

||||

|

Other Intangibles, net

|

39,471

|

|

40,652

|

|

||||

|

Other Assets

|

44,807

|

|

47,614

|

|

||||

|

$

|

2,014,627

|

|

$

|

2,019,865

|

|

|||

|

LIABILITIES AND PARTNERS’ EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$

|

13,222

|

|

$

|

10,734

|

|

||

|

Deferred revenue

|

44,521

|

|

39,485

|

|

||||

|

Accrued interest

|

23,201

|

|

15,512

|

|

||||

|

Accrued taxes

|

19,481

|

|

17,813

|

|

||||

|

Accrued salaries, wages and benefits

|

29,200

|

|

24,836

|

|

||||

|

Self-insurance reserves

|

23,653

|

|

23,906

|

|

||||

|

Other accrued liabilities

|

5,521

|

|

5,916

|

|

||||

|

158,799

|

|

138,202

|

|

|||||

|

Deferred Tax Liability

|

158,113

|

|

153,792

|

|

||||

|

Derivative Liability

|

26,662

|

|

32,260

|

|

||||

|

Other Liabilities

|

11,290

|

|

8,980

|

|

||||

|

Long-Term Debt:

|

||||||||

|

Term debt

|

618,850

|

|

1,131,100

|

|

||||

|

Notes

|

901,782

|

|

401,080

|

|

||||

|

1,520,632

|

|

1,532,180

|

|

|||||

|

Commitments and Contingencies (Note 10)

|

|

|

||||||

|

Partners’ Equity:

|

||||||||

|

Special L.P. interests

|

5,290

|

|

5,290

|

|

||||

|

General partner

|

2

|

|

1

|

|

||||

|

Limited partners, 55,716, and 55,618 units outstanding at December 31, 2013 and December 31, 2012, respectively

|

148,847

|

|

177,660

|

|

||||

|

Accumulated other comprehensive loss

|

(15,008

|

)

|

(28,500

|

)

|

||||

|

139,131

|

|

154,451

|

|

|||||

|

$

|

2,014,627

|

|

$

|

2,019,865

|

|

|||

|

For the years ended December 31,

|

2013

|

2012

|

2011

|

|||||||||

|

Net revenues:

|

||||||||||||

|

Admissions

|

$

|

647,007

|

|

$

|

612,069

|

|

$

|

596,042

|

|

|||

|

Food, merchandise and games

|

356,105

|

|

342,214

|

|

349,436

|

|

||||||

|

Accommodations and other

|

131,460

|

|

114,171

|

|

82,994

|

|

||||||

|

1,134,572

|

|

1,068,454

|

|

1,028,472

|

|

|||||||

|

Costs and expenses:

|

|

|||||||||||

|

Cost of food, merchandise and games revenues

|

91,772

|

|

95,048

|

|

92,057

|

|

||||||

|

Operating expenses

|

472,344

|

|

451,403

|

|

430,851

|

|

||||||

|

Selling, general and administrative

|

152,412

|

|

138,311

|

|

140,426

|

|

||||||

|

Depreciation and amortization

|

122,487

|

|

126,306

|

|

125,837

|

|

||||||

|

Loss on impairment / retirement of fixed assets, net

|

2,539

|

|

30,336

|

|

11,355

|

|

||||||

|

Gain on sale of other assets

|

(8,743

|

)

|

(6,625

|

)

|

—

|

|

||||||

|

832,811

|

|

834,779

|

|

800,526

|

|

|||||||

|

Operating income

|

301,761

|

|

233,675

|

|

227,946

|

|

||||||

|

Interest expense

|

103,071

|

|

110,619

|

|

157,185

|

|

||||||

|

Net effect of swaps

|

6,883

|

|

(1,492

|

)

|

(13,119

|

)

|

||||||

|

Loss on early debt extinguishment

|

34,573

|

|

—

|

|

—

|

|

||||||

|

Unrealized/realized foreign currency (gain) loss

|

28,941

|

|

(8,998

|

)

|

9,909

|

|

||||||

|

Other (income) expense

|

(154

|

)

|

(68

|

)

|

798

|

|

||||||

|

Income before taxes

|

128,447

|

|

133,614

|

|

73,173

|

|

||||||

|

Provision for taxes

|

20,243

|

|

31,757

|

|

7,877

|

|

||||||

|

Net income

|

108,204

|

|

101,857

|

|

65,296

|

|

||||||

|

Net income allocated to general partner

|

1

|

|

1

|

|

1

|

|

||||||

|

Net income allocated to limited partners

|

$

|

108,203

|

|

$

|

101,856

|

|

$

|

65,295

|

|

|||

|

Net income

|

$

|

108,204

|

|

$

|

101,857

|

|

$

|

65,296

|

|

|||

|

Other comprehensive income, (net of tax):

|

||||||||||||

|

Cumulative foreign currency translation adjustment

|

2,756

|

|

369

|

|

933

|

|

||||||

|

Unrealized income on cash flow hedging derivatives

|

10,736

|

|

139

|

|

3,767

|

|

||||||

|

Other comprehensive income, (net of tax)

|

13,492

|

|

508

|

|

4,700

|

|

||||||

|

Total comprehensive income

|

$

|

121,696

|

|

$

|

102,365

|

|

$

|

69,996

|

|

|||

|

Basic earnings per limited partner unit:

|

||||||||||||

|

Weighted average limited partner units outstanding

|

55,476

|

|

55,518

|

|

55,345

|

|

||||||

|

Net income per limited partner unit

|

$

|

1.95

|

|

$

|

1.83

|

|

$

|

1.18

|

|

|||

|

Diluted earnings per limited partner unit:

|

||||||||||||

|

Weighted average limited partner units outstanding

|

55,825

|

|

55,895

|

|

55,886

|

|

||||||

|

Net income per limited partner unit

|

$

|

1.94

|

|

$

|

1.82

|

|

$

|

1.17

|

|

|||

|

For the years ended December 31,

|

2013

|

2012

|

2011

|

|||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net income

|

$

|

108,204

|

|

$

|

101,857

|

|

$

|

65,296

|

|

|||

|

Adjustments to reconcile net income to net cash from operating activities:

|

||||||||||||

|

Depreciation and amortization

|

122,487

|

|

126,306

|

|

125,837

|

|

||||||

|

Non-cash equity based compensation expense

|

6,391

|

|

4,476

|

|

(239

|

)

|

||||||

|

Loss on early debt extinguishment

|

34,573

|

|

—

|

|

—

|

|

||||||

|

Loss on impairment / retirement of fixed assets, net

|

2,539

|

|

30,336

|

|

11,355

|

|

||||||

|

Gain on sale of other assets

|

(8,743

|

)

|

(6,625

|

)

|

—

|

|

||||||

|

Net effect of swaps

|

6,883

|

|

(1,492

|

)

|

(13,119

|

)

|

||||||

|

Amortization of debt issuance costs

|

6,130

|

|

10,417

|

|

10,000

|

|

||||||

|

Unrealized foreign currency (gain) loss on notes

|

27,786

|

|

(8,758

|

)

|

8,753

|

|

||||||

|

Deferred income taxes

|

3,348

|

|

27,502

|

|

677

|

|

||||||

|

Excess tax benefit from unit-based compensation expense

|

(855

|

)

|

(1,208

|

)

|

—

|

|

||||||

|

Change in operating assets and liabilities:

|

||||||||||||

|

(Increase) decrease in receivables

|

(6,257

|

)

|

(10,543

|

)

|

4,516

|

|

||||||

|

(Increase) decrease in inventories

|

1,535

|

|

5,251

|

|

(1,045

|

)

|

||||||

|

(Increase) decrease in current assets

|

(317

|

)

|

3,923

|

|

(1,785

|

)

|

||||||

|

(Increase) decrease in other assets

|

(1,737

|

)

|

(2,739

|

)

|

173

|

|

||||||

|

Increase (decrease) in accounts payable

|

174

|

|

170

|

|

(1,144

|

)

|

||||||

|

Increase (decrease) in deferred revenue

|

5,491

|

|

9,804

|

|

3,724

|

|

||||||

|

Increase (decrease) in accrued interest

|

8,714

|

|

(587

|

)

|

(4,399

|

)

|

||||||

|

Increase (decrease) in accrued taxes

|

1,690

|

|

1,883

|

|

835

|

|

||||||

|

Increase (decrease) in accrued salaries and wages

|

4,440

|

|

(8,576

|

)

|

15,406

|

|

||||||

|

Increase (decrease) in self-insurance reserves

|

(136

|

)

|

2,625

|

|

(206

|

)

|

||||||

|

Increase (decrease) in other current liabilities

|

(386

|

)

|

(1,986

|

)

|

(561

|

)

|

||||||

|

Increase (decrease) in other liabilities

|

2,503

|

|

3,897

|

|

(5,897

|

)

|

||||||

|

Net cash from operating activities

|

324,457

|

|

285,933

|

|

218,177

|

|

||||||

|

CASH FLOWS FOR INVESTING ACTIVITIES

|

||||||||||||

|

Proceeds from the sale of other assets

|

15,297

|

|

16,058

|

|

—

|

|

||||||

|

Capital expenditures

|

(120,448

|

)

|

(96,232

|

)

|

(90,190

|

)

|

||||||

|

Net cash for investing activities

|

(105,151

|

)

|

(80,174

|

)

|

(90,190

|

)

|

||||||

|

CASH FLOWS FOR FINANCING ACTIVITIES

|

||||||||||||

|

Net (payments) borrowings on revolving credit loans

|

—

|

|

—

|

|

(23,200

|

)

|

||||||

|

Term debt borrowings

|

630,000

|

|

—

|

|

22,938

|

|

||||||

|

Note borrowings

|

500,000

|

|

—

|

|

—

|

|

||||||

|

Derivative settlement

|

—

|

|

(50,450

|

)

|

—

|

|

||||||

|

Term debt payments, including early termination penalties

|

(1,142,250

|

)

|

(25,000

|

)

|

(23,900

|

)

|

||||||

|

Distributions paid to partners

|

(143,457

|

)

|

(88,813

|

)

|

(55,347

|

)

|

||||||

|

Payment of debt issuance costs

|

(23,532

|

)

|

—

|

|

(21,214

|

)

|

||||||

|

Exercise of limited partnership unit options

|

52

|

|

76

|

|

5

|

|

||||||

|

Excess tax benefit from unit-based compensation expense

|

855

|

|

1,208

|

|

—

|

|

||||||

|

Net cash for financing activities

|

(178,332

|

)

|

(162,979

|

)

|

(100,718

|

)

|

||||||

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS

|

(1,748

|

)

|

526

|

|

(1,510

|

)

|

||||||

|

CASH AND CASH EQUIVALENTS

|

||||||||||||

|

Net increase for the year

|

39,226

|

|

43,306

|

|

25,759

|

|

||||||

|

Balance, beginning of year

|

78,830

|

|

35,524

|

|

9,765

|

|

||||||

|

Balance, end of year

|

$

|

118,056

|

|

$

|

78,830

|

|

$

|

35,524

|

|

|||

|

SUPPLEMENTAL INFORMATION

|

||||||||||||

|

Cash payments for interest expense

|

$

|

90,834

|

|

$

|

101,883

|

|

$

|

153,326

|

|

|||

|

Interest capitalized

|

1,610

|

|

1,322

|

|

1,835

|

|

||||||

|

Cash payments for income taxes, net of refunds

|

14,822

|

|

1,783

|

|

6,135

|

|

||||||

|

For the years ended December 31,

|

2013

|

2012

|

2011

|

||||||||

|

|

|||||||||||

|

Limited Partnership Units Outstanding

|

|||||||||||

|

Beginning balance

|

55,618

|

|

55,346

|

|

55,334

|

|

|||||

|

Limited partnership unit options exercised

|

6

|

|

16

|

|

—

|

|

|||||

|

Limited partnership unit forfeitures

|

(1

|

)

|

—

|

|

—

|

|

|||||

|

Issuance of limited partnership units as compensation

|

93

|

|

256

|

|

12

|

|

|||||

|

55,716

|

|

55,618

|

|

55,346

|

|

||||||

|

Limited Partners’ Equity

|

|||||||||||

|

Beginning balance

|

$

|

177,660

|

|

$

|

160,068

|

|

$

|

150,047

|

|

||

|

Net income

|

108,203

|

|

101,856

|

|

65,295

|

|

|||||

|

Partnership distribution declared (2013 - $2.58; 2012 - $1.60; 2011 - $1.00)

|

(143,457

|

)

|

(88,813

|

)

|

(55,347

|

)

|

|||||

|

Expense (income) recognized for limited partnership unit options

|

903

|

|

345

|

|

(239

|

)

|

|||||

|

Limited partnership unit options exercised

|

52

|

|

76

|

|

5

|

|

|||||

|

Tax effect of units involved in option exercises and treasury unit transactions

|

855

|

|

1,208

|

|

127

|

|

|||||

|

Issuance of limited partnership units as compensation

|

4,631

|

|

2,920

|

|

180

|

|

|||||

|

148,847

|

|

177,660

|

|

160,068

|

|

||||||

|

General Partner’s Equity

|

|||||||||||

|

Beginning balance

|

1

|

|

—

|

|

(1

|

)

|

|||||

|

Net income

|

1

|

|

1

|

|

1

|

|

|||||

|

2

|

|

1

|

|

—

|

|

||||||

|

Special L.P. Interests

|

5,290

|

|

5,290

|

|

5,290

|

|

|||||

|

Accumulated Other Comprehensive Income (Loss)

|

|||||||||||

|

Cumulative foreign currency translation adjustment:

|

|||||||||||

|

Beginning balance

|

(2,751

|

)

|

(3,120

|

)

|

(4,053

|

)

|

|||||

|

Current year activity, net of tax (($1,586) in 2013, ($213) in 2012, $245 in 2011)

|

2,756

|

|

369

|

|

933

|

|

|||||

|

5

|

|

(2,751

|

)

|

(3,120

|

)

|

||||||

|

Unrealized loss on cash flow hedging derivatives:

|

|||||||||||

|

Beginning balance

|

(25,749

|

)

|

(25,888

|

)

|

(29,655

|

)

|

|||||

|

Current year activity, net of tax (($1,745) in 2013, ($210) in 2012, $5,508 in 2011)

|

10,736

|

|

139

|

|

3,767

|

|

|||||

|

(15,013

|

)

|

(25,749

|

)

|

(25,888

|

)

|

||||||

|

(15,008

|

)

|

(28,500

|

)

|

(29,008

|

)

|

||||||

|

Total Partners’ Equity

|

$

|

139,131

|

|

$

|

154,451

|

|

$

|

136,350

|

|

||

|

Land improvements

|

Approximately

|

25 years

|

||

|

Buildings

|

25 years

|

-

|

40 years

|

|

|

Rides

|

Approximately

|

20 years

|

||

|

Equipment

|

3 years

|

-

|

10 years

|

|

|

2013

|

2012

|

2011

|

||||||||||

|

(In thousands except per unit amounts)

|

||||||||||||

|

Basic weighted average units outstanding

|

55,476

|

|

55,518

|

|

55,345

|

|

||||||

|

Effect of dilutive units:

|

||||||||||||

|

Unit options (Note 7)

|

162

|

|

43

|

|

—

|

|

||||||

|

Phantom units (Note 7)

|

187

|

|

334

|

|

541

|

|

||||||

|

Diluted weighted average units outstanding

|

55,825

|

|

55,895

|

|

55,886

|

|

||||||

|

Net income per unit - basic

|

$

|

1.95

|

|

$

|

1.83

|

|

$

|

1.18

|

|

|||

|

Net income per unit - diluted

|

$

|

1.94

|

|

$

|

1.82

|

|

$

|

1.17

|

|

|||

|

•

|

The amount the reporting entity agreed to pay on the basis of its arrangement among its co-obligors.

|

|

•

|

Any additional amount the reporting entity expects to pay on behalf of its co-obligors.

|

|

•

|

An NOL carryforward, a similar tax loss, or a tax credit carryforward is not available as of the reporting date under the governing tax law to settle taxes that would result from the disallowance of the tax position.

|

|

•

|

The entity does not intend to use the DTA for this purpose (provided that the tax law permits a choice).

|

|

Accumulated

|

||||||||||||

|

Goodwill

|

Impairment

|

Goodwill

|

||||||||||

|

(gross)

|

Losses

|

(net)

|

||||||||||

|

($'s in thousands)

|

||||||||||||

|

Balance at December 31, 2011

|

$

|

323,358

|

|

$

|

(79,868

|

)

|

$

|

243,490

|

|

|||

|

Foreign currency exchange translation

|

2,731

|

|

—

|

|

2,731

|

|

||||||

|

Balance at December 31, 2012

|

326,089

|

|

(79,868

|

)

|

246,221

|

|

||||||

|

Foreign currency exchange translation

|

(8,132

|

)

|

—

|

|

(8,132

|

)

|

||||||

|

Balance at December 31, 2013

|

$

|

317,957

|

|

$

|

(79,868

|

)

|

$

|

238,089

|

|

|||

|

Weighted

|

|||||||||||||||

|

Average

|

Gross

|

Net

|

|||||||||||||

|

Amortization

|

Carrying

|

Accumulated

|

Carrying

|

||||||||||||

|

Period

|

Amount

|

Amortization

|

Value

|

||||||||||||

|

($'s in thousands)

|

|||||||||||||||

|

December 31, 2013

|

|||||||||||||||

|

Other intangible assets:

|

|||||||||||||||

|

Trade names

|

—

|

|

$

|

39,070

|

|

$

|

—

|

|

$

|

39,070

|

|

||||

|

License / franchise agreements

|

14.7 years

|

|

800

|

|

399

|

|

401

|

|

|||||||

|

Total other intangible assets

|

14.7 years

|

|

$

|

39,870

|

|

$

|

399

|

|

$

|

39,471

|

|

||||

|

December 31, 2012

|

|||||||||||||||

|

Other intangible assets:

|

|||||||||||||||

|

Trade names

|

—

|

|

$

|

40,222

|

|

$

|

—

|

|

$

|

40,222

|

|

||||

|

License / franchise agreements

|

14.3 years

|

|

790

|

|

360

|

|

430

|

|

|||||||

|

Total other intangible assets

|

14.3 years

|

|

$

|

41,012

|

|

$

|

360

|

|

$

|

40,652

|

|

||||

|

($'s in thousands)

|

2013

|

2012

|

||||||

|

Revolving credit facility (due 2018)

|

$

|

—

|

|

$

|

—

|

|

||

|

Term debt

(1)

|

||||||||

|

March 2013 U.S. term loan averaging 3.25% at 2013 (due 2013-2020)

|

618,850

|

|

—

|

|

||||

|

February 2011 Amended U.S. term loan averaging 4.0% at 2011 (due 2011-2017)

|

—

|

|

1,131,100

|

|

||||

|

Notes

|

||||||||

|

March 2013 U.S. fixed rate note at 5.25% (due 2021)

|

500,000

|

|

—

|

|

||||

|

July 2010 U.S. fixed rate note at 9.125% (due 2018)

|

401,782

|

|

401,080

|

|

||||

|

1,520,632

|

|

1,532,180

|

|

|||||

|

Less: current portion

|

—

|

|

—

|

|

||||

|

$

|

1,520,632

|

|

$

|

1,532,180

|

|

|||

|

(1)

|

These average interest rates do not reflect the effect of interest rate swap agreements entered into on variable-rate term debt (see Note 6).

|

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019 and beyond

|

Total

|

|||||||||||||||||||||

|

U.S. Term loan maturing in 2020

|

$

|

—

|

|

$

|

6,175

|

|

$

|

6,300

|

|

$

|

6,300

|

|

$

|

6,300

|

|

$

|

593,775

|

|

$

|

618,850

|

|

||||||

|

($'s in thousands):

|

Consolidated

Balance Sheet Location

|

Fair Value as of

|

Fair Value as of

|

|||||||

|

December 31, 2013

|

December 31, 2012

|

|||||||||

|

Derivatives designated as hedging instruments:

|

||||||||||

|

Interest rate swaps

|

Derivative Liability

|

$

|

(3,916

|

)

|

$

|

(32,260

|

)

|

|||

|

Total derivatives designated as hedging instruments:

|

(3,916

|

)

|

(32,260

|

)

|

||||||

|

|

|

|||||||||

|

Derivatives not designated as hedging instruments:

|

||||||||||

|

Interest rate swaps

|

Derivative Liability

|

(22,746

|

)

|

—

|

|

|||||

|

Total derivatives not designated as hedging instruments:

|

(22,746

|

)

|

—

|

|

||||||

|

Net derivative liability

|

$

|

(26,662

|

)

|

$

|

(32,260

|

)

|

||||

|

Interest Rate Swaps

|

|||||||||||||

|

($'s in thousands)

|

Derivatives designated as hedging instruments

|

Derivatives not designated as hedging instruments

|

|||||||||||

|

Notional Amounts

|

LIBOR Rate

|

Notional Amounts

|

LIBOR Rate

|

||||||||||

|

$

|

200,000

|

|

3.00

|

%

|

$

|

200,000

|

|

2.27

|

%

|

||||

|

100,000

|

|

3.00

|

%

|

150,000

|

|

2.43

|

%

|

||||||

|

100,000

|

|

3.00

|

%

|

75,000

|

|

2.30

|

%

|

||||||

|

100,000

|

|

2.70

|

%

|

70,000

|

|

2.54

|

%

|

||||||

|

50,000

|

|

2.54

|

%

|

||||||||||

|

50,000

|

|

2.54

|

%

|

||||||||||

|

50,000

|

|

2.43

|

%

|

||||||||||

|

50,000

|

|

2.29

|

%

|

||||||||||

|

50,000

|

|

2.29

|

%

|

||||||||||

|

30,000

|

|

2.54

|

%

|

||||||||||

|

25,000

|

|

2.30

|

%

|

||||||||||

|

Total $'s / Average Rate

|

$

|

500,000

|

|

2.94

|

%

|

$

|

800,000

|

|

2.38

|

%

|

|||

|

($'s in thousands):

|

Amount of Gain (Loss)

recognized in OCI on Derivatives (Effective Portion) |

Amount and Location of (Loss)

Reclassified from Accumulated OCI into Income (Effective Portion) |

Amount and Location of Gain Recognized in Income on Derivative (Ineffective Portion)

|

|||||||||||||||||||||||||

|

Year ended 12/31/13

|

Year ended 12/31/12

|

|

Year ended 12/31/13

|

Year ended 12/31/12

|

|

Year ended 12/31/13

|

Year ended 12/31/12

|

|||||||||||||||||||||

|

Interest rate swaps

|

$

|

(1,650

|

)

|

$

|

140

|

|

Interest Expense

|

$

|

(2,797

|

)

|

$

|

(12,027

|

)

|

Net effect of swaps

|

$

|

3,703

|

|

$

|

—

|

|

||||||||

|

(In thousands):

|

Amount and Location of Gain (Loss) Recognized

in Income on Derivatives

|

||||||||||

|

Derivatives not designated as Cash Flow

Hedging Relationships

|

|||||||||||

|

|

Year ended 12/31/13

|

Year ended 12/31/12

|

|||||||||

|

Interest rate swaps

|

Net effect of swaps

|

$

|

3,547

|

|

$

|

—

|

|

||||

|

Cross-currency swaps

|

Net effect of swaps

|

—

|

|

(4,999

|

)

|

||||||

|

Foreign currency swaps

|

Net effect of swaps

|

—

|

|

6,278

|

|

||||||

|

$

|

3,547

|

|

$

|

1,279

|

|

||||||

|

2013

|

2012

|

||||||||||||||

|

Weighted Average

|

Weighted Average

|

||||||||||||||

|

Unit Options

|

Exercise Price

|

Unit Options

|

Exercise Price

|

||||||||||||

|

Outstanding, beginning of year

|

294,022

|

|

$

|

29.45

|

|

224,500

|

|

$

|

24.40

|

|

|||||

|

Granted

|

413,248

|

|

36.95

|

|

280,672

|

|

29.53

|

|

|||||||

|

Exercised

|

(16,278

|

)

|

28.36

|

|

(206,150

|

)

|

24.19

|

|

|||||||

|

Forfeited

|

(6,170

|

)

|

32.93

|

|

(5,000

|

)

|

23.81

|

|

|||||||

|

Outstanding, end of year

|

684,822

|

|

$

|

33.97

|

|

294,022

|

|

$

|

29.45

|

|

|||||

|

Options exercisable, end of year

|

274,252

|

|

$

|

32.61

|

|

83,518

|

|

$

|

29.26

|

|

|||||

|

Vested Options Outstanding

|

||||||||||||||||||

|

Type

|