|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

||

|

ý

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended September 30, 2016

|

||

|

or

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

||

|

Delaware

|

|

27-2326940

|

|

(State or Other Jurisdiction of Incorporation

or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

150 South Wacker Drive, Suite 800, Chicago, IL

|

60606

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.001 per share

|

|

The NASDAQ Stock Market LLC

|

|

Large accelerated filer

x

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

|

Part I.

|

|

|

|

Part II.

|

|

|

|

Part III.

|

|

|

|

Part IV.

|

|

|

|

•

|

“we,” “us,” “our” and “Golub Capital BDC” refer to Golub Capital BDC, Inc., a Delaware corporation, and its consolidated subsidiaries;

|

|

•

|

“Holdings” refers to Golub Capital BDC 2010-1 Holdings LLC, a Delaware limited liability company, or LLC, our direct subsidiary;

|

|

•

|

“2010 Issuer” refers to Golub Capital BDC 2010-1 LLC, a Delaware LLC, our indirect subsidiary;

|

|

•

|

“2014 Issuer” refers to Golub Capital BDC CLO 2014 LLC, a Delaware LLC, our direct subsidiary;

|

|

•

|

“Controlling Class” refers to the most senior class of notes then outstanding of the 2010 Issuer or the 2014 Issuer, as applicable;

|

|

•

|

“2010 Debt Securitization” refers to the $350.0 million term debt securitization that we completed on July 16, 2010 as most recently amended on October 20, 2016, in which the 2010 Issuer issued an aggregate of $350.0 million of notes, or the “2010 Notes,” including $205.0 million of Class A-Refi 2010 Notes, which bear interest at a rate of three-month London Interbank Offered Rate, or LIBOR, plus 1.90%, $10.0 million of Class B-Refi 2010 Notes, which bear interest at a rate of three-month LIBOR plus 2.40% and $135.0 million face amount of Subordinated 2010 Notes that do not bear interest;

|

|

•

|

“2014 Debt Securitization” refers to the $402.6 million term debt securitization that we completed on June 5, 2014, in which the 2014 Issuer issued an aggregate of $402.6 million of notes, or the “2014 Notes,” including $191.0 million of Class A-1 2014 Notes, which bear interest at a rate of three-month LIBOR plus 1.75%, $20.0 million of Class A-2 2014 Notes, which bore interest at a rate of three-month LIBOR plus 1.45% through December 4, 2015 and bear interest at three-month LIBOR plus 1.95% thereafter, $35.0 million of Class B 2014 Notes, which bear interest at a rate of three-month LIBOR plus 2.50%, $37.5 million of Class C 2014 Notes, which bear interest at a rate of three-month LIBOR plus 3.50%, and $119.1 million of LLC equity interests that do not bear interest;

|

|

•

|

“Funding” refers to Golub Capital BDC Funding, LLC, a Delaware LLC, our direct subsidiary;

|

|

•

|

“Credit Facility” refers to the amended and restated senior secured revolving credit facility that Funding originally entered into on July 21, 2011, as most recently amended on March 1, 2016, with Wells Fargo Securities, LLC, as administrative agent, and Wells Fargo Bank, N.A., as lender and collateral agent, that currently allows for borrowing up to $200 million and that bears interest at a rate of one-month LIBOR plus 2.25% per annum through the reinvestment period, which ends July 29, 2017, and bears interest at a rate of one-month LIBOR plus 2.75% for the period following the reinvestment period through the stated maturity date of July 30, 2020;

|

|

•

|

“Revolver Funding” refers to Golub Capital BDC Revolver Funding LLC, a Delaware LLC, our direct subsidiary;

|

|

•

|

“Revolver” refers to the $15.0 million revolving line of credit that Revolver Funding entered into on November 22, 2013 with The PrivateBank and Trust Company, or PrivateBank, as lender and administrative agent, and terminated on October 21, 2015 that bore interest, at the election of Revolver Funding, at a rate of either one-, two- or three-month LIBOR plus 3.50% per annum or PrivateBank’s prime rate plus 1.50% per annum and had a stated maturity date of November 22, 2020;

|

|

•

|

“Adviser Revolver” refers to the $20.0 million line of credit with GC Advisors;

|

|

•

|

“SBIC Funds” refers collectively to our consolidated subsidiaries, GC SBIC IV, L.P. and GC SBIC V, L.P.

|

|

•

|

“SLF” refers to Senior Loan Fund LLC, an unconsolidated Delaware LLC, in which we co-invest with RGA Reinsurance Company, or RGA, primarily in senior secured loans. SLF is capitalized as transactions are completed and all portfolio and investment decisions in respect of SLF must be approved by representatives of each of the members (with unanimous approval required from either (i) one representative of each of us and RGA or (ii) both representatives of each of us and RGA currently). As of September 30, 2016, we owned 87.5% of both the outstanding subordinated notes and LLC equity interests of SLF. As of September 30, 2016, SLF had subordinated note commitments from its members totaling $160.0 million and LLC equity interest subscriptions from its members totaling $40.0 million. We have committed to fund $140.0 million of subordinated notes and $35.0 million of LLC equity interest subscriptions to SLF;

|

|

•

|

“GC Advisors” refers to GC Advisors LLC, a Delaware LLC, our investment adviser;

|

|

•

|

“Administrator” refers to Golub Capital LLC, a Delaware LLC, an affiliate of GC Advisors and our administrator; and

|

|

•

|

“Golub Capital” refers, collectively, to the activities and operations of Golub Capital Incorporated, Golub Capital LLC (formerly Golub Capital Management LLC), which entity employs all of Golub Capital’s investment professionals, GC Advisors and associated investment funds and their respective affiliates.

|

|

•

|

annual EBITDA of $10.0 million to $75.0 million;

|

|

•

|

sustainable leading positions in their respective markets;

|

|

•

|

scalable revenues and operating cash flow;

|

|

•

|

experienced management teams with successful track records;

|

|

•

|

stable, predictable cash flows with low technology and market risks;

|

|

•

|

a substantial equity cushion in the form of capital ranking junior to our investment;

|

|

•

|

low capital expenditures requirements;

|

|

•

|

a North American base of operations;

|

|

•

|

strong customer relationships;

|

|

•

|

products, services or distribution channels having distinctive competitive advantages;

|

|

•

|

defensible niche strategy or other barriers to entry; and

|

|

•

|

demonstrated growth strategies.

|

|

•

|

a thorough review of historical and pro forma financial information;

|

|

•

|

on-site visits;

|

|

•

|

interviews with management and employees;

|

|

•

|

a review of loan documents and material contracts;

|

|

•

|

third-party “quality of earnings” accounting due diligence;

|

|

•

|

when appropriate, background checks on key managers and research relating to the company’s business, industry, markets, customers, suppliers, products and services and competitors; and

|

|

•

|

the commission of third-party market studies when appropriate.

|

|

Internal Performance Ratings

|

||

|

Rating

|

|

Definition

|

|

5

|

|

Involves the least amount of risk in our portfolio. The borrower is performing above expectations, and the trends and risk factors are generally favorable.

|

|

4

|

|

Involves an acceptable level of risk that is similar to the risk at the time of origination. The borrower is generally performing as expected, and the risk factors are neutral to favorable.

|

|

3

|

|

Involves a borrower performing below expectations and indicates that the loan’s risk has increased somewhat since origination. The borrower may be out of compliance with debt covenants; however, loan payments are generally not past due.

|

|

2

|

|

Involves a borrower performing materially below expectations and indicates that the loan’s risk has increased materially since origination. In addition to the borrower being generally out of compliance with debt covenants, loan payments may be past due (but generally not more than 180 days past due).

|

|

1

|

|

Involves a borrower performing substantially below expectations and indicates that the loan’s risk has substantially increased since origination. Most or all of the debt covenants are out of compliance and payments are substantially delinquent. Loans rated 1 are not anticipated to be repaid in full and we will reduce the fair market value of the loan to the amount we anticipate will be recovered.

|

|

September 30, 2016

|

September 30, 2015

|

|||||||||||||

|

Internal

Performance

Rating

|

Investments

at Fair Value

(In thousands)

|

Percentage of

Total

Investments

|

Investments

at Fair Value

(In thousands)

|

Percentage of

Total

Investments

|

||||||||||

|

5

|

$

|

93,768

|

|

5.7

|

%

|

$

|

134,142

|

|

8.8

|

%

|

||||

|

4

|

1,380,274

|

|

83.1

|

1,298,558

|

|

84.9

|

|

|||||||

|

3

|

176,464

|

|

10.6

|

87,687

|

|

5.7

|

|

|||||||

|

2

|

9,950

|

|

0.6

|

9,397

|

|

0.6

|

|

|||||||

|

1

|

156

|

|

0.0

|

*

|

—

|

|

—

|

|||||||

|

Total

|

$

|

1,660,612

|

|

100.0

|

%

|

$

|

1,529,784

|

|

100.0

|

%

|

||||

|

*

|

Represents an amount less than 0.1%.

|

|

•

|

selecting investments that we believe have a very low probability of loss;

|

|

•

|

requiring a total return on our investments that we believe will compensate us appropriately for credit risk; and

|

|

•

|

negotiating covenants in connection with our investments that afford our portfolio companies as much flexibility in managing their businesses as possible, consistent with the preservation of our capital. Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights.

|

|

Portfolio Company

|

Fair Value of

Investments

(In thousands)

|

Percentage of

Total

Investments

|

|||||

|

Atkins Nutritionals, Inc

|

$

|

41,138

|

|

2.5

|

%

|

||

|

Market Track, LLC

|

36,115

|

|

2.2

|

|

|||

|

DCA Investment Holding, LLC

|

34,998

|

|

2.1

|

|

|||

|

Vetcor Professional Practices LLC

|

32,243

|

|

1.9

|

|

|||

|

First Watch Restaurants, Inc.

|

31,424

|

|

1.9

|

|

|||

|

Accellos, Inc.

|

31,051

|

|

1.9

|

|

|||

|

Certara L.P.

|

30,329

|

|

1.8

|

|

|||

|

Integration Appliance, Inc.

|

30,152

|

|

1.8

|

|

|||

|

Chase Industries, Inc.

|

28,186

|

|

1.7

|

|

|||

|

NTS Technical Systems

|

26,746

|

|

1.6

|

|

|||

|

|

$

|

322,382

|

|

19.4

|

%

|

||

|

Industry

|

Fair Value of Investments

(In thousands)

|

Percentage of

Total Investments

|

|||||

|

Healthcare, Education and Childcare

|

$

|

327,287

|

|

19.7

|

%

|

||

|

Diversified/Conglomerate Service

|

274,198

|

|

16.5

|

|

|||

|

Electronics

|

146,319

|

|

8.8

|

|

|||

|

Beverage, Food and Tobacco

|

145,658

|

|

8.8

|

|

|||

|

Retail Stores

|

137,940

|

|

8.3

|

|

|||

|

Diversified/Conglomerate Manufacturing

|

84,306

|

|

5.1

|

|

|||

|

Personal, Food and Miscellaneous Services

|

66,198

|

|

4.0

|

|

|||

|

Aerospace and Defense

|

59,120

|

|

3.6

|

|

|||

|

Leisure, Amusement, Motion Pictures, Entertainment

|

51,397

|

|

3.1

|

|

|||

|

Printing and Publishing

|

46,814

|

|

2.8

|

|

|||

|

|

$

|

1,339,237

|

|

80.7

|

%

|

||

|

•

|

determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes;

|

|

•

|

identifies, evaluates and negotiates the structure of the investments we make;

|

|

•

|

executes, closes, services and monitors the investments we make;

|

|

•

|

determines the securities and other assets that we purchase, retain or sell;

|

|

•

|

performs due diligence on prospective portfolio companies; and

|

|

•

|

provides us with such other investment advisory, research and related services as we may, from time to time, reasonably require for the investment of our funds.

|

|

•

|

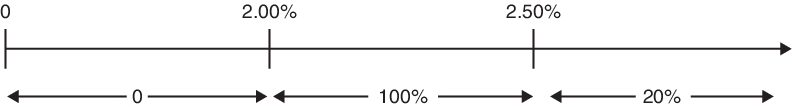

zero in any calendar quarter in which the Pre-Incentive Fee Net Investment Income does not exceed the hurdle rate;

|

|

•

|

100.0% of our Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate but is less than 2.5% in any calendar quarter. We refer to this portion of our Pre-Incentive Fee Net Investment Income (which exceeds the hurdle rate but is less than 2.5%) as the “catch-up” provision. The catch-up is meant to provide GC Advisors with 20.0% of the Pre-Incentive Fee Net Investment Income as if a hurdle rate did not apply if this net investment income exceeds 2.5% in any calendar quarter; and

|

|

•

|

20.0% of the amount of our Pre-Incentive Fee Net Investment Income, if any, that exceeds 2.5% in any calendar quarter.

|

|

•

|

The cumulative aggregate realized capital losses are calculated as the sum of the amounts by which (a) the net sales price of each investment in our portfolio when sold is less than (b) the accreted or amortized cost basis of such investment.

|

|

•

|

The cumulative aggregate realized capital gains are calculated as the sum of the differences, if positive, between (a) the net sales price of each investment in our portfolio when sold and (b) the accreted or amortized cost basis of such investment.

|

|

•

|

The aggregate unrealized capital depreciation is calculated as the sum of the differences, if negative, between (a) the valuation of each investment in our portfolio as of the applicable Capital Gain Incentive Fee calculation date and (b) the accreted or amortized cost basis of such investment.

|

|

(1)

|

The hypothetical amount of Pre-Incentive Fee Net Investment Income shown is based on a percentage of total net assets. In addition, the example assumes that during the most recent four full calendar quarter period ending on or prior to the date the payment set forth in the example is to be made, the sum of (a) our aggregate distributions to our stockholders and (b) our change in net assets (defined as total assets less indebtedness and before taking into account any incentive fees payable during the period) is at least 8.0% of our net assets at the beginning of such period (as adjusted for any share issuances or repurchases).

|

|

(2)

|

Represents a quarter of the 8.0% annualized hurdle rate.

|

|

(3)

|

Represents a quarter of the 1.375% annualized management fee.

|

|

(4)

|

Excludes offering expenses.

|

|

Incentive Fee

|

=

|

100% × “catch-up” + the greater of 0% AND (20% × (Pre-Incentive Fee Net Investment Income – 2.50%))

|

|

|

=

|

(100% × (2.106% – 2.00%)) + 0%

|

|

|

=

|

100% × 0.106%

|

|

|

=

|

0.106%

|

|

Incentive Fee

|

=

|

100% × “catch-up” + the greater of 0% AND (20% × (Pre-Incentive Fee Net Investment Income – 2.50%))

|

|

|

=

|

(100% × (2.50% – 2.00%)) + (20% × (2.806% – 2.50%))

|

|

|

=

|

0.50% + (20% × 0.306%)

|

|

|

=

|

0.50% + 0.061%

|

|

|

=

|

0.561%

|

|

Year 1:

|

$20 million investment made in Company A (“Investment A”) and $30 million investment made in Company B (“Investment B”)

|

|

|

Year 2:

|

Investment A is sold for $15 million and fair market value (“FMV”) of Investment B determined to be $29 million

|

|

|

Year 3:

|

FMV of Investment B determined to be $27 million

|

|

|

Year 4:

|

Investment B sold for $25 million

|

|

|

Year 1:

|

None (No sales transactions)

|

|

|

Year 2:

|

None (Sales transaction resulted in a realized capital loss on Investment A)

|

|

|

Year 3:

|

None (No sales transactions)

|

|

|

Year 4:

|

None (Sales transaction resulted in a realized capital loss on Investment B)

|

|

|

Year 1:

|

No adjustment; no realized capital losses or unrealized capital depreciation

|

|

|

Year 2:

|

Investment A sold at a $5 million loss. Investment B has unrealized capital depreciation of $1 million. Therefore, GC Advisors would not be paid on the $6 million realized/unrealized loss which would result in a lower Incentive Fee by $1.2 million.

|

|

|

Year 3:

|

Investment B has unrealized capital depreciation of $2 million. Therefore, GC Advisors would not be paid on the $2 million unrealized capital depreciation, which would result in a lower Incentive Fee by $400,000.

|

|

|

Year 4:

|

Investment B sold at a $5 million loss. Investment B was previously marked down by $3 million; therefore, we would realize a $5 million loss on Investment B and reverse the previous $3 million in unrealized capital depreciation. The net effect would be a loss of $2 million. GC Advisors would not be paid on the $2 million loss which would result in a lower Incentive Fee by $400,000.

|

|

|

Year 1:

|

$20 million investment made in Company A (“Investment A”), $30 million investment made in Company B (“Investment B”) and $25 million investment made in Company C (“Investment C”)

|

|

|

Year 2:

|

FMV of Investment A determined to be $18 million, FMV of Investment B determined to be $25 million and FMV of Investment C determined to be $25 million

|

|

|

Year 3:

|

Investment A sold for $18 million. FMV of Investment B determined to be $24 million and FMV of Investment C determined to be $25 million.

|

|

|

Year 4:

|

FMV of Investment B determined to be $22 million. Investment C sold for $24 million.

|

|

|

Year 5:

|

Investment B sold for $20 million

|

|

|

Year 1:

|

None (No sales transactions)

|

|

|

Year 2:

|

None (No sales transactions)

|

|

|

Year 3:

|

None (Sales transaction resulted in a realized capital loss on Investment A)

|

|

|

Year 4:

|

None (Sales transaction resulted in a realized capital loss on Investment C)

|

|

|

Year 5:

|

None (Sales transaction resulted in a realized capital loss on Investment B)

|

|

|

Year 1:

|

No adjustment; no realized capital losses or unrealized capital depreciation.

|

|

|

Year 2:

|

Investment A has unrealized capital depreciation of $2 million. Investment B has unrealized capital depreciation of $5 million. Therefore, GC Advisors would not be paid on the $7 million unrealized capital depreciation which would result in a lower Incentive Fee by $1.4 million.

|

|

|

Year 3:

|

Investment A sold at a $2 million loss. Investment A was previously marked down by $2 million; therefore, we would realize a $2 million loss on Investment A and reverse the previous $2 million in unrealized capital depreciation. Investment B has additional unrealized capital depreciation of $1 million. The net effect would be a loss of $1 million. GC Advisors would not be paid on the $1 million loss, which would result in a lower Incentive Fee by $200,000.

|

|

|

Year 4:

|

Investment B has additional unrealized capital depreciation of $2 million. Investment C sold at a $1 million realized loss. Therefore, GC Advisors would not be paid on the $3 million realized/unrealized loss which would result in a lower Incentive Fee by $600,000.

|

|

|

Year 5:

|

Investment B sold at a $10 million loss. Investment B was previously marked down by $8 million; therefore, we would realize a $10 million loss on Investment B and reverse the previous $8 million in unrealized capital depreciation. The net effect would be a loss of $2 million. GC Advisors would not be paid on the $2 million loss, which would result in a lower Incentive Fee by $400,000.

|

|

|

Year 1:

|

$25 million investment made in Company A (“Investment A”) and $20 million investment made in Company B (“Investment B”)

|

|

|

Year 2:

|

Investment A is sold for $30 million, FMV of Investment B determined to be $21 million and $2 million of unamortized deferred financing costs

|

|

|

Year 3:

|

FMV of Investment B determined to be $23 million and $1 million of unamortized deferred financing costs

|

|

|

Year 4:

|

Investment B sold for $23 million and $0 of unamortized deferred financing costs

|

|

|

Year 1:

|

None (No sales transactions)

|

|

|

Year 2:

|

$800,000 (20% multiplied by (i) $5 million realized capital gains on sale of Investment A less (ii) $1 million unamortized deferred financing costs ($2 million of unamortized deferred financing costs less $1 million of unrealized gain))

|

|

|

Year 3:

|

$200,000 (20% multiplied by $5 million realized capital gains on sale of Investment A) less $800,000 (Capital Gains Incentive Fee paid in year 2)

|

|

|

Year 4:

|

$600,000 (20% multiplied by $8 million realized capital gains on sale of Investment A and Investment B less Capital Gains Incentive Fee paid in years 2 and 3).

|

|

|

Year 1:

|

No adjustment necessary

|

|

|

Year 2:

|

No adjustment necessary. GC Advisors would not be paid on the $1 million unrealized gain on Investment B.

|

|

|

Year 3:

|

No adjustment necessary. GC Advisors would not be paid on the $3 million unrealized gain on Investment B.

|

|

|

Year 4:

|

No adjustment necessary

|

|

|

•

|

the nature, extent and quality of services provided to us by GC Advisors;

|

|

•

|

the relative investment performance of us since April 1, 2015 and since our inception;

|

|

•

|

the fees paid by other comparable business development companies; and

|

|

•

|

various other matters.

|

|

(1)

|

Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer that:

|

|

◦

|

is organized under the laws of, and has its principal place of business in, the United States;

|

|

◦

|

is not an investment company (other than a small business investment company, or SBIC, wholly owned by the business development company) or a company that would be an investment company but for certain exclusions under the 1940 Act; and

|

|

◦

|

satisfies either of the following:

|

|

▪

|

does not have any class of securities listed on a national securities exchange or has any class of securities listed on a national securities exchange subject to a $250.0 million market capitalization maximum; or

|

|

▪

|

is controlled by a business development company or a group of companies including a business development company, the business development company actually exercises a controlling influence over the management or policies of the eligible portfolio company, and, as a result, the business development company has an affiliated person who is a director of the eligible portfolio company.

|

|

(2)

|

Securities of any eligible portfolio company which we control.

|

|

(3)

|

Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident to such a private transaction, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities, was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements.

|

|

(4)

|

Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company.

|

|

(5)

|

Securities received in exchange for or distributed on or with respect to securities described above, or pursuant to the exercise of warrants or rights relating to such securities.

|

|

(6)

|

Cash, cash equivalents, U.S. government securities or high-quality debt securities that mature in one year or less from the date of investment.

|

|

•

|

our principal executive officer and principal financial officer must certify the accuracy of the financial statements contained in our periodic reports;

|

|

•

|

our periodic reports must disclose our conclusions about the effectiveness of our disclosure controls and procedures;

|

|

•

|

our management must prepare an annual report regarding its assessment of our internal control over financial reporting, which must be audited by our independent registered public accounting firm; and

|

|

•

|

our periodic reports must disclose whether there were significant changes in our internal controls over financial reporting or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

|

|

•

|

qualify as a RIC; and

|

|

•

|

satisfy the Annual Distribution Requirement;

|

|

•

|

qualify to be treated as a business development company under the 1940 Act at all times during each taxable year;

|

|

•

|

derive in each taxable year at least 90% of our gross income from dividends, interest, payments with respect to certain securities loans, gains from the sale of stock or other securities, or other income derived with respect to our business of investing in such stock or securities, and net income derived from interests in “qualified publicly traded partnerships” (partnerships that are traded on an established securities market or tradable on a secondary market, other than partnerships that derive 90% of their income from interest, dividends and other permitted RIC income), or the 90% Income Test; and

|

|

•

|

diversify our holdings, or the Diversification Tests, so that at the end of each quarter of the taxable year:

|

|

•

|

at least 50% of the value of our assets consists of cash, cash equivalents, U.S. government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer; and

|

|

•

|

no more than 25% of the value of our assets is invested in the securities, other than U.S. government securities or securities of other RICs, of one issuer or of two or more issuers that are controlled, as determined under applicable tax rules, by us and that are engaged in the same or similar or related trades or businesses or in the securities of one or more qualified publicly traded partnerships.

|

|

Assumed Return on Our Portfolio (Net of Expenses)

|

|||||||||

|

|

-10%

|

-5%

|

0%

|

5%

|

10%

|

||||

|

Corresponding return to common stockholder

(1)

|

-22.78%

|

-12.79%

|

-2.80%

|

7.20%

|

17.19%

|

||||

|

(1)

|

Assumes

$1,756.5 million

in total assets,

$865.2 million

in debt and secured borrowings outstanding and

$878.8 million

in net assets as of

September 30, 2016

and an effective annual interest rate of

2.84%

as of

September 30, 2016

.

|

|

•

|

a comparison of the portfolio company’s securities to publicly traded securities;

|

|

•

|

the enterprise value of the portfolio company;

|

|

•

|

the nature and realizable value of any collateral;

|

|

•

|

the portfolio company’s ability to make payments and its earnings and discounted cash flow;

|

|

•

|

the markets in which the portfolio company does business; and

|

|

•

|

changes in the interest rate environment and the credit markets generally that may affect the price at which similar investments may be made in the future and other relevant factors.

|

|

•

|

increase or maintain in whole or in part our position as a creditor or equity ownership percentage in a portfolio company;

|

|

•

|

exercise warrants, options or convertible securities that were acquired in the original or subsequent financing; or

|

|

•

|

preserve or enhance the value of our investment.

|

|

•

|

the ability to cause the commencement of enforcement proceedings against the collateral;

|

|

•

|

the ability to control the conduct of such proceedings;

|

|

•

|

the approval of amendments to collateral documents;

|

|

•

|

releases of liens on the collateral; and

|

|

•

|

waivers of past defaults under collateral documents.

|

|

•

|

significant volatility in the market price and trading volume of securities of business development companies or other companies in our sector, which are not necessarily related to the operating performance of the companies;

|

|

•

|

changes in regulatory policies, accounting pronouncements or tax guidelines, particularly with respect to RICs and business development companies;

|

|

•

|

loss of our qualification as a RIC or business development company;

|

|

•

|

changes in market interest rates and decline in the prices of debt,

|

|

•

|

changes in earnings or variations in operating results;

|

|

•

|

changes in the value of our portfolio investments;

|

|

•

|

changes in accounting guidelines governing valuation of our investments;

|

|

•

|

any shortfall in revenue or net income or any increase in losses from levels expected by investors or securities analysts;

|

|

•

|

departure of GC Advisors’ or any of its affiliates’ key personnel;

|

|

•

|

operating performance of companies comparable to us;

|

|

•

|

general economic trends and other external factors; and

|

|

•

|

loss of a major funding source.

|

|

Period

|

NAV

(1)

|

Closing Sales Price

|

Premium of

High Sales

Price to

NAV

(2)

|

Premium

(Discount) of

Low Sales

Price to

NAV

(2)

|

Dividends and

Distributions

Declared

|

|||||||||||||||||

|

High

|

Low

|

|||||||||||||||||||||

|

Fiscal year ended September 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Fourth quarter

|

$

|

15.96

|

|

$

|

19.75

|

|

$

|

18.18

|

|

23.7

|

%

|

13.9

|

%

|

$

|

0.32

|

|

||||||

|

Third quarter

|

15.88

|

|

18.08

|

|

16.84

|

|

13.9

|

|

6.0

|

|

0.32

|

|

||||||||||

|

Second Quarter

|

15.85

|

|

17.38

|

|

15.23

|

|

9.7

|

|

(3.9

|

)

|

0.32

|

|

||||||||||

|

First Quarter

|

15.89

|

|

17.47

|

|

16.12

|

|

9.9

|

|

1.4

|

|

0.32

|

|

||||||||||

|

Fiscal year ended September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Fourth quarter

|

$

|

15.80

|

|

$

|

17.13

|

|

$

|

15.90

|

|

8.4

|

%

|

0.6

|

%

|

$

|

0.32

|

|

||||||

|

Third quarter

|

15.74

|

|

17.90

|

|

16.56

|

|

13.7

|

|

5.2

|

|

0.32

|

|

||||||||||

|

Second Quarter

|

15.61

|

|

18.04

|

|

17.05

|

|

15.6

|

|

9.2

|

|

0.32

|

|

||||||||||

|

First Quarter

|

15.55

|

|

18.15

|

|

16.15

|

|

16.7

|

|

3.9

|

|

0.32

|

|

||||||||||

|

(1)

|

NAV per share is determined as of the last day in the relevant quarter and therefore may not reflect the NAV per share on the date of the high and low closing sales prices. The NAVs shown are based on outstanding shares at the end of the each period.

|

|

(2)

|

Calculated as of the respective high or low closing sales price divided by the quarter-end NAV.

|

|

Record Dates

|

Payment Date

|

Dividends and

Distributions

Declared

|

||||

|

Fiscal year ended September 30, 2016

|

|

|

|

|||

|

September 5, 2016

|

September 29, 2016

|

$

|

0.32

|

|

||

|

June 6, 2016

|

June 29, 2016

|

0.32

|

|

|||

|

March 7, 2016

|

March 30, 2016

|

0.32

|

|

|||

|

December 11, 2015

|

December 29, 2015

|

0.32

|

|

|||

|

Total

|

|

$

|

1.28

|

|

||

|

Fiscal year ended September 30, 2015

|

|

|

|

|||

|

September 7, 2015

|

September 29, 2015

|

$

|

0.32

|

|

||

|

June 18, 2015

|

June 29, 2015

|

0.32

|

|

|||

|

March 20, 2015

|

March 27, 2015

|

0.32

|

|

|||

|

December 18, 2014

|

December 29, 2014

|

0.32

|

|

|||

|

Total

|

|

$

|

1.28

|

|

||

|

Golub Capital BDC

|

|||||||||||||||||||||

|

As of and for the years ended September 30,

|

|||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

|

(In thousands, except per share data)

|

||||||||||||||||||||

|

Statement of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total investment income

|

$

|

127,871

|

|

$

|

119,968

|

|

$

|

109,526

|

|

$

|

83,774

|

|

$

|

57,859

|

|

||||||

|

Base management fee

|

22,020

|

|

20,330

|

|

17,053

|

|

11,749

|

|

8,495

|

|

|||||||||||

|

Incentive fee

|

7,266

|

|

10,226

|

|

10,128

|

|

9,844

|

|

6,228

|

|

|||||||||||

|

Interest and other debt financing

expenses

|

27,724

|

|

24,510

|

|

20,227

|

|

12,427

|

|

10,781

|

|

|||||||||||

|

All other expenses

|

5,881

|

|

5,905

|

|

5,583

|

|

5,359

|

|

4,479

|

|

|||||||||||

|

Net investment income

|

64,980

|

|

(1

|

)

|

58,997

|

|

|

56,535

|

|

|

44,395

|

|

|

27,876

|

|

||||||

|

Net realized gain (loss) on investments

and derivative instruments

|

6,254

|

|

9,354

|

|

5,384

|

|

(1,363

|

)

|

(3,372

|

)

|

|||||||||||

|

Net change in unrealized appreciation

(depreciation) on investments,

derivative instruments and secured

borrowings

|

(2,030

|

)

|

2,440

|

|

3,469

|

|

3,488

|

|

7,256

|

|

|||||||||||

|

Net increase/(decrease) in net assets

resulting from operations

|

69,204

|

|

|

|

70,791

|

|

|

65,388

|

|

|

46,520

|

|

|

31,760

|

|

||||||

|

Per share data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net asset value

|

$

|

15.96

|

|

$

|

15.80

|

|

$

|

15.55

|

|

$

|

15.21

|

|

$

|

14.60

|

|

||||||

|

Net investment income

|

1.25

|

|

(1

|

)

|

1.20

|

|

1.26

|

|

1.29

|

|

1.15

|

|

|||||||||

|

Net realized gain (loss) on investments

and derivative instruments

|

0.12

|

|

0.19

|

|

0.11

|

|

(0.04

|

)

|

(0.14

|

)

|

|||||||||||

|

Net change in unrealized appreciation

(depreciation) on investments, derivative instruments and secured borrowings |

(0.04

|

)

|

0.05

|

|

0.07

|

|

0.10

|

|

0.30

|

|

|||||||||||

|

Net increase/(decrease) in net assets

resulting from operations |

1.33

|

|

1.44

|

|

1.44

|

|

1.35

|

|

1.31

|

|

|||||||||||

|

Per share distributions declared

|

1.28

|

|

1.28

|

|

1.28

|

|

1.28

|

|

1.28

|

|

|||||||||||

|

From net investment income

|

1.04

|

|

1.18

|

|

1.28

|

|

1.15

|

|

1.24

|

|

|||||||||||

|

From capital gains

|

0.24

|

|

0.10

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

From return of capital

|

—

|

|

—

|

|

—

|

|

0.13

|

|

0.04

|

|

|||||||||||

|

Dollar amount of distributions declared

|

66,879

|

|

62,969

|

|

57,823

|

|

45,394

|

|

31,556

|

|

|||||||||||

|

From net investment income

|

54,461

|

|

58,152

|

|

57,823

|

|

40,605

|

|

30,484

|

|

|||||||||||

|

From capital gains

|

12,418

|

|

4,817

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

From return of capital

|

—

|

|

—

|

|

—

|

|

4,789

|

|

1,072

|

|

|||||||||||

|

Golub Capital BDC

|

|||||||||||||||||||||

|

As of and for the years ended September 30,

|

|||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

|

(In thousands, except per share data)

|

||||||||||||||||||||

|

Balance Sheet data at period end:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Investments, at fair value

|

$

|

1,660,612

|

|

$

|

1,529,784

|

|

$

|

1,347,612

|

|

$

|

1,024,645

|

|

$

|

672,910

|

|

||||||

|

Cash, restricted cash and cash

equivalents

|

89,540

|

|

97,484

|

|

79,943

|

|

54,717

|

|

50,927

|

|

|||||||||||

|

Other assets

|

6,357

|

|

(2)

|

6,158

|

|

(2)

|

6,318

|

|

(2)

|

4,552

|

|

(2)

|

4,361

|

|

(2)

|

||||||

|

Total assets

|

1,756,509

|

|

(2)

|

1,633,426

|

|

(2)

|

1,433,873

|

|

(2)

|

1,083,914

|

|

(2)

|

728,198

|

|

(2)

|

||||||

|

Total debt

|

865,175

|

|

813,605

|

|

697,539

|

|

420,909

|

|

352,300

|

|

|||||||||||

|

Total liabilities

|

877,684

|

|

(2)

|

822,556

|

|

(2)

|

701,134

|

|

(2)

|

425,678

|

|

(2)

|

353,069

|

|

(2)

|

||||||

|

Total net assets

|

878,825

|

|

810,870

|

|

732,739

|

|

658,236

|

|

375,129

|

|

|||||||||||

|

Other data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Weighted average yield on

income producing investments at fair value (3) |

7.6%

|

7.8%

|

8.3%

|

9.1%

|

9.3%

|

||||||||||||||||

|

Number of portfolio companies at

period end |

183

|

164

|

145

|

135

|

121

|

||||||||||||||||

|

(1)

|

Net investment income for the year ended September 30, 2016 is shown after a net expense of $333,000 for U.S. federal excise tax.

|

|

(2)

|

On October 1, 2015, we adopted Accounting Standards Update, or ASU, 2015-03 which requires that debt issuance costs related to a recognized debt liability to be presented on the balance sheet as a direct deduction from the carrying amount of the debt liability rather than as an asset. Adoption of ASU 2015-03 requires the changes to be applied retrospectively.

|

|

(3)

|

Weighted average yield on income producing investments is computed by dividing (a) income from interest, including subordinated notes in SLF, and fees excluding amortization of capitalized fees and discounts on accruing loans and debt securities by (b) total income producing investments at fair value.

|

|

•

|

our future operating results;

|

|

•

|

our business prospects and the prospects of our portfolio companies;

|

|

•

|

the effect of investments that we expect to make and the competition for those investments;

|

|

•

|

our contractual arrangements and relationships with third parties;

|

|

•

|

actual and potential conflicts of interest with GC Advisors and other affiliates of Golub Capital;

|

|

•

|

the dependence of our future success on the general economy and its effect on the industries in which we invest;

|

|

•

|

the ability of our portfolio companies to achieve their objectives;

|

|

•

|

the use of borrowed money to finance a portion of our investments;

|

|

•

|

the adequacy of our financing sources and working capital;

|

|

•

|

the timing of cash flows, if any, from the operations of our portfolio companies;

|

|

•

|

general economic and political trends and other external factors;

|

|

•

|

the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments;

|

|

•

|

the ability of GC Advisors or its affiliates to attract and retain highly talented professionals;

|

|

•

|

our ability to qualify and maintain our qualification as a RIC and as a business development company;

|

|

•

|

general price and volume fluctuations in the stock markets;

|

|

•

|

the impact on our business of Dodd-Frank and the rules and regulations issued thereunder; and

|

|

•

|

the effect of changes to tax legislation and our tax position.

|

|

As of September 30, 2016

|

As of September 30, 2015

|

|||||||||||||

|

Investment Type

|

Investments at

Fair Value

(In thousands)

|

Percentage of

Total Investments |

Investments at

Fair Value

(In thousands)

|

Percentage of

Total

Investments

|

||||||||||

|

Senior secured

|

$

|

162,849

|

|

9.8

|

%

|

$

|

197,329

|

|

12.9

|

%

|

||||

|

One stop

|

1,304,467

|

|

78.5

|

|

1,134,222

|

|

74.1

|

|

||||||

|

Second lien

|

27,909

|

|

1.7

|

|

39,774

|

|

2.6

|

|

||||||

|

Subordinated debt

|

1,427

|

|

0.1

|

|

1,715

|

|

0.1

|

|

||||||

|

Subordinated notes in SLF

(1)

|

77,301

|

|

4.7

|

|

76,563

|

|

5.0

|

|

||||||

|

LLC equity interests in SLF

(1)

|

26,927

|

|

1.6

|

|

22,373

|

|

1.5

|

|

||||||

|

Equity

|

59,732

|

|

3.6

|

|

57,808

|

|

3.8

|

|

||||||

|

Total

|

$

|

1,660,612

|

|

100.0

|

%

|

$

|

1,529,784

|

|

100.0

|

%

|

||||

|

(1)

|

Proceeds from the subordinated notes and LLC equity interests invested in SLF were utilized by SLF to invest in senior secured loans.

|

|

For the years ended September 30,

|

|||||

|

|

2016

|

2015

|

2014

|

||

|

Weighted average income yield

(1)

|

7.6%

|

7.8%

|

8.3%

|

||

|

Weighted average investment income yield

(2)

|

8.2%

|

8.4%

|

9.0%

|

||

|

(1)

|

Represents income from interest, including subordinated notes in SLF, and fees excluding amortization of capitalized fees and discounts divided by the average fair value of earning debt investments.

|

|

(2)

|

Represents income from interest, including subordinated notes in SLF, fees and amortization of capitalized fees and discounts divided by the average fair value of earning debt investments.

|

|

•

|

calculating our NAV (including the cost and expenses of any independent valuation firm);

|

|

•

|

fees and expenses incurred by GC Advisors payable to third parties, including agents, consultants or other advisors, in monitoring financial and legal affairs for us and in monitoring our investments and performing due diligence on our prospective portfolio companies or otherwise relating to, or associated with, evaluating and making investments, which fees and expenses may include, among other items, due diligence reports, appraisal reports, any studies that may be commissioned by GC Advisors and travel and lodging expenses;

|

|

•

|

expenses related to unsuccessful portfolio acquisition efforts;

|

|

•

|

offerings of our common stock and other securities;

|

|

•

|

administration fees and expenses, if any, payable under the Administration Agreement (including payments based upon our allocable portion of the Administrator’s overhead in performing its obligations under the Administration Agreement, including rent and the allocable portion of the cost of our chief compliance officer, chief financial officer and their respective staffs);

|

|

•

|

fees payable to third parties, including agents, consultants or other advisors, relating to, or associated with, evaluating and making investments in portfolio companies, including costs associated with meeting financial sponsors;

|

|

•

|

transfer agent, dividend agent and custodial fees and expenses;

|

|

•

|

U.S. federal and state registration and franchise fees;

|

|

•

|

all costs of registration and listing our shares on any securities exchange;

|

|

•

|

U.S. federal, state and local taxes;

|

|

•

|

independent directors’ fees and expenses;

|

|

•

|

costs of preparing and filing reports or other documents required by the SEC or other regulators;

|

|

•

|

costs of any reports, proxy statements or other notices to stockholders, including printing costs;

|

|

•

|

costs associated with individual or group stockholders;

|

|

•

|

costs associated with compliance under the Sarbanes-Oxley Act;

|

|

•

|

our allocable portion of any fidelity bond, directors and officers/errors and omissions liability insurance, and any other insurance premiums;

|

|

•

|

direct costs and expenses of administration, including printing, mailing, long distance telephone, copying, secretarial and other staff, independent auditors and outside legal costs;

|

|

•

|

proxy voting expenses; and

|

|

•

|

all other expenses incurred by us or the Administrator in connection with administering our business.

|

|

For the years ended September 30,

|

Variances

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2016 vs. 2015

|

2015 vs. 2014

|

||||||||||||||

|

|

(In thousands)

|

||||||||||||||||||

|

Interest income

|

$

|

106,184

|

|

$

|

103,404

|

|

$

|

93,225

|

|

$

|

2,780

|

|

$

|

10,179

|

|

||||

|

Income from accretion of discounts and origination fees

|

8,662

|

|

9,002

|

|

9,158

|

|

(340

|

)

|

(156

|

)

|

|||||||||

|

Interest income from subordinated notes of SLF

|

6,939

|

|

3,735

|

|

1,947

|

|

3,204

|

|

1,788

|

|

|||||||||

|

Dividend income

|

4,638

|

|

1,562

|

|

1,766

|

|

3,076

|

|

(204

|

)

|

|||||||||

|

Fee income

|

1,448

|

|

2,265

|

|

3,430

|

|

(817

|

)

|

(1,165

|

)

|

|||||||||

|

Total investment income

|

127,871

|

|

|

119,968

|

|

|

109,526

|

|

|

7,903

|

|

|

10,442

|

|

|||||

|

Total expenses

|

62,558

|

|

60,971

|

|

52,991

|

|

1,587

|

|

7,980

|

|

|||||||||

|

Net investment income - before excise tax

|

65,313

|

|

|

58,997

|

|

|

56,535

|

|

|

6,316

|

|

|

2,462

|

|

|||||

|

Excise tax

|

333

|

|

—

|

|

—

|

|

|

333

|

|

—

|

|

||||||||

|

Net investment income - after excise tax

|

64,980

|

|

58,997

|

|

56,535

|

|

5,983

|

|

2,462

|

|

|||||||||

|

Net realized gain (loss) on investments

|

6,254

|

|

9,354

|

|

5,384

|

|

(3,100

|

)

|

3,970

|

|

|||||||||

|

Net change in unrealized appreciation

(depreciation) on investments, and secured

borrowings

|

(2,030

|

)

|

2,440

|

|

3,469

|

|

(4,470

|

)

|

(1,029

|

)

|

|||||||||

|

Net increase in net assets resulting from operations

|

$

|

69,204

|

|

|

$

|

70,791

|

|

|

$

|

65,388

|

|

|

$

|

(1,587

|

)

|

|

$

|

5,403

|

|

|

Average earning portfolio company

investments, at fair value

|

$

|

1,500,250

|

|

$

|

1,404,556

|

|

$

|

1,195,099

|

|

$

|

95,694

|

|

$

|

209,457

|

|

||||

|

Average debt outstanding

(1)

|

$

|

826,366

|

|

$

|

752,567

|

|

$

|

587,624

|

|

$

|

73,799

|

|

$

|

164,943

|

|

||||

|

(1)

|

For the years ended

September 30, 2016

,

2015

and

2014

, we have excluded

$0.5 million

, $0.4 million and $14.4 million, respectively, of secured borrowings, at fair value, which were the result of participations and partial loan sales that did not meet the definition of a “participating interest”, as defined in the guidance to ASC Topic 860 — Transfers and Servicing, or ASC Topic 860.

|

|

For the years ended September 30,

|

|||||

|

|

2016

|

2015

|

2014

|

||

|

Senior secured

|

6.3%

|

6.5%

|

7.1%

|

||

|

One stop

|

7.7%

|

7.9%

|

8.3%

|

||

|

Second lien

|

9.9%

|

9.5%

|

11.7%

|

||

|

Subordinated debt

|

5.2%

|

8.1%

|

10.1%

|

||

|

Subordinated notes in SLF

(1)

|

8.4%

|

8.3%

|

7.3%

|

||

|

(1)

|

SLF’s proceeds from the subordinated notes were utilized by SLF to invest in senior secured loans.

|

|

For the years ended September 30,

|

Variances

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2016 vs. 2015

|

2015 vs. 2014

|

|||||||||||||||

|

|

(In thousands)

|

|||||||||||||||||||

|

Interest and other debt financing expenses

|

$

|

23,540

|

|

$

|

20,004

|

|

$

|

17,197

|

|

$

|

3,536

|

|

$

|

2,807

|

|

|||||

|

Amortization of debt issuance costs

|

4,184

|

|

4,506

|

|

3,030

|

|

(322

|

)

|

1,476

|

|

||||||||||

|

Base management fee

|

22,020

|

|

20,330

|

|

17,053

|

|

1,690

|

|

3,277

|

|

||||||||||

|

Income Incentive Fee

|

6,022

|

|

7,489

|

|

10,032

|

|

(1,467

|

)

|

(2,543

|

)

|

||||||||||

|

Capital gain incentive fee accrued under GAAP

|

1,244

|

|

2,737

|

|

96

|

|

(1,493

|

)

|

2,641

|

|

||||||||||

|

Professional fees

|

2,814

|

|

2,942

|

|

2,451

|

|

(128

|

)

|

491

|

|

||||||||||

|

Administrative service fee

|

2,209

|

|

2,372

|

|

2,527

|

|

(163

|

)

|

(155

|

)

|

||||||||||

|

General and administrative expenses

|

525

|

|

591

|

|

605

|

|

(66

|

)

|

(14

|

)

|

||||||||||

|

Total expenses

|

$

|

62,558

|

|

$

|

60,971

|

|

$

|

52,991

|

|

$

|

1,587

|

|

$

|

7,980

|

|

|||||

|

For the years ended September 30,

|

Variances

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2016 vs. 2015

|

2015 vs. 2014

|

||||||||||||||

|

|

(In thousands)

|

||||||||||||||||||

|

Net realized gain (loss) on investments

|

$

|

6,254

|

|

$

|

9,354

|

|

$

|

5,384

|

|

$

|

(3,100

|

)

|

$

|

3,970

|

|

||||

|

Net realized gain (loss)

|

6,254

|

|

9,354

|

|

5,384

|

|

(3,100

|

)

|

3,970

|

|

|||||||||

|

Unrealized appreciation on investments

|

32,943

|

|

26,469

|

|

24,748

|

|

6,474

|

|

1,721

|

|

|||||||||

|

Unrealized (depreciation) on investments

|

(31,411

|

)

|

(23,258

|

)

|

(21,221

|

)

|

(8,153

|

)

|

(2,037

|

)

|

|||||||||

|

Unrealized appreciation on investments in SLF

(1)

|

—

|

|

—

|

|

75

|

|

—

|

|

(75

|

)

|

|||||||||

|

Unrealized (depreciation) on investments in SLF

(1)

|

(3,562

|

)

|

(773

|

)

|

(254

|

)

|

(2,789

|

)

|

(519

|

)

|

|||||||||

|

Unrealized appreciation on secured borrowings

|

—

|

|

2

|

|

126

|

|

(2

|

)

|

(124

|

)

|

|||||||||

|

Unrealized (depreciation) on secured borrowings

|

—

|

|

—

|

|

(5

|

)

|

—

|

|

5

|

|

|||||||||

|

Net change in unrealized appreciation (depreciation) on

investments, investments in SLF, and secured borrowings

|

$

|

(2,030

|

)

|

$

|

2,440

|

|

$

|

3,469

|

|

$

|

(4,470

|

)

|

$

|

(1,029

|

)

|

||||

|

(1)

|

Unrealized appreciation and (depreciation) on investments in SLF include our investments in subordinated notes and LLC equity interests in SLF.

|

|

Years ended September 30,

|

||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

|||||||||||||||||

|

|

(In thousands)

|

Percentage of

Commitments

|

(In thousands)

|

Percentage of

Commitments

|

(In thousands)

|

Percentage of

Commitments

|

||||||||||||||

|

Senior secured

|

$

|

124,392

|

|

19.0

|

|

%

|

$

|

225,442

|

|

24.4

|

%

|

$

|

125,564

|

|

13.0

|

%

|

||||

|

One stop

|

505,058

|

|

76.9

|

|

626,459

|

|

67.6

|

|

743,174

|

|

76.9

|

|

||||||||

|

Subordinated debt

|

42

|

|

—

|

|

*

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Second lien

|

—

|

|

0.0

|

|

—

|

|

—

|

|

39,413

|

|

4.1

|

|

||||||||

|

Subordinated notes of SLF

(1)

|

9,620

|

|

1.5

|

|

50,974

|

|

5.5

|

|

34,658

|

|

3.6

|

|

||||||||

|

LLC equity interests of SLF

(1)

|

10,820

|

|

1.6

|

|

13,904

|

|

1.5

|

|

10,039

|

|

1.0

|

|

||||||||

|

Equity securities

|

6,528

|

|

1.0

|

|

9,494

|

|

1.0

|

|

13,631

|

|

1.4

|

|

||||||||

|

Total new investment commitments

|

$

|

656,460

|

|

100.0

|

|

%

|

$

|

926,273

|

|

100.0

|

%

|

$

|

966,479

|

|

100.0

|

%

|

||||

|

(1)

|

SLF’s proceeds from the subordinated notes and LLC equity interests were utilized by SLF to invest in senior secured loans. As of

September 30, 2016

, SLF had investments in senior secured loans to

62

different borrowers.

|

|

As of and for the years ended September 30,

|

|||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(In thousands)

|

||||||||||

|

Investments, at fair value

|

$

|

1,556,384

|

|

$

|

1,430,848

|

|

$

|

1,312,781

|

|

||

|

Number of portfolio companies (at period end)

(1)

|

183

|

|

164

|

|

145

|

|

|||||

|

Investment in SLF, at fair value

(2)

|

$

|

104,228

|

|

$

|

98,936

|

|

$

|

34,831

|

|

||

|

New investment fundings

|

$

|

654,763

|

|

$

|

858,147

|

|

$

|

878,635

|

|

||

|

Principal payments and sales of portfolio investments

|

$

|

538,609

|

|

$

|

699,075

|

|

$

|

573,201

|

|

||

|

(1)

|

Excludes our investments in SLF.

|

|

(2)

|

The investment in SLF includes the Company’s investments in both subordinated notes and LLC equity interests in SLF.

|

|

As of September 30, 2016

(1)

|

As of September 30, 2015

(2)

|

||||||||||||||||||||||

|

|

Par

|

Amortized

Cost

|

Fair

Value

|

Par

|

Amortized

Cost

|

Fair

Value

|

|||||||||||||||||

|

|

(In thousands)

|

||||||||||||||||||||||

|

Senior secured:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Performing

|

$

|

163,380

|

|

$

|

161,536

|

|

$

|

162,693

|

|

$

|

199,573

|

|

$

|

197,189

|

|

$

|

197,329

|

|

|||||

|

Non-accrual

(2)

|

1,438

|

|

1,433

|

|

156

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

One stop:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Performing

|

1,317,595

|

|

1,299,211

|

|

1,303,297

|

|

1,135,805

|

|

1,120,576

|

|

1,127,735

|

|

|||||||||||

|

Non-accrual

(2)

|

3,899

|

|

3,845

|

|

1,170

|

|

17,645

|

|

17,078

|

|

6,487

|

|

|||||||||||

|

Second lien:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Performing

|

27,909

|

|

27,579

|

|

27,909

|

|

39,924

|

|

39,464

|

|

39,774

|

|

|||||||||||

|

Non-accrual

(2)

|

—

|

|

—

|

|

—

|