|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

95-3679695

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

|

1444 South Alameda Street

Los Angeles, California 90021

(213) 765-3100

(Address, including zip code, and telephone number, including area code)

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

common stock, par value $0.01 per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

ý

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

Item

|

Description

|

Page

|

||

|

Year Ended

|

Year Ended

|

Year Ended

|

||||||||||||||||||

|

|

Feb 1, 2014

|

|

Feb 2, 2013

|

|

Jan 28, 2012

|

|||||||||||||||

|

|

(dollars in thousands)

|

|||||||||||||||||||

|

Net revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

North American Retail

|

$

|

1,075,475

|

|

|

41.9

|

%

|

|

$

|

1,116,836

|

|

|

42.1

|

%

|

|

$

|

1,117,643

|

|

|

41.6

|

%

|

|

Europe

|

903,791

|

|

|

35.1

|

|

|

939,599

|

|

|

35.3

|

|

|

1,010,896

|

|

|

37.6

|

|

|||

|

Asia

|

292,714

|

|

|

11.4

|

|

|

290,655

|

|

|

10.9

|

|

|

250,727

|

|

|

9.3

|

|

|||

|

North American Wholesale

|

179,600

|

|

|

7.0

|

|

|

194,373

|

|

|

7.3

|

|

|

187,362

|

|

|

7.0

|

|

|||

|

Net revenue from product sales

|

2,451,580

|

|

|

95.4

|

|

|

2,541,463

|

|

|

95.6

|

|

|

2,566,628

|

|

|

95.5

|

|

|||

|

Licensing

|

118,206

|

|

|

4.6

|

|

|

117,142

|

|

|

4.4

|

|

|

121,420

|

|

|

4.5

|

|

|||

|

Total net revenue

|

$

|

2,569,786

|

|

|

100.0

|

%

|

|

$

|

2,658,605

|

|

|

100.0

|

%

|

|

$

|

2,688,048

|

|

|

100.0

|

%

|

|

Earnings (loss) from operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

North American Retail

|

$

|

39,540

|

|

|

17.8

|

%

|

|

$

|

78,285

|

|

|

28.5

|

%

|

|

$

|

133,184

|

|

|

33.5

|

%

|

|

Europe

|

97,231

|

|

|

43.7

|

|

|

103,975

|

|

|

37.9

|

|

|

167,014

|

|

|

42.0

|

|

|||

|

Asia

|

25,592

|

|

|

11.5

|

|

|

26,525

|

|

|

9.6

|

|

|

28,463

|

|

|

7.2

|

|

|||

|

North American Wholesale

|

38,771

|

|

|

17.4

|

|

|

45,008

|

|

|

16.4

|

|

|

47,162

|

|

|

11.9

|

|

|||

|

Licensing

|

107,805

|

|

|

48.4

|

|

|

101,182

|

|

|

36.9

|

|

|

108,638

|

|

|

27.3

|

|

|||

|

Corporate Overhead

|

(73,910

|

)

|

|

(33.2

|

)

|

|

(80,450

|

)

|

|

(29.3

|

)

|

|

(87,226

|

)

|

|

(21.9

|

)

|

|||

|

Restructuring Charges

|

(12,442

|

)

|

(5.6

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||

|

Total earnings from operations

|

$

|

222,587

|

|

|

100.0

|

%

|

|

$

|

274,525

|

|

|

100.0

|

%

|

|

$

|

397,235

|

|

|

100.0

|

%

|

|

Feb 1,

2014 |

Feb 2,

2013 |

Jan 28,

2012 |

||||||

|

GUESS? Retail Stores:

|

|

|

|

|||||

|

U.S.

|

121

|

|

128

|

|

141

|

|

||

|

Canada

|

55

|

|

56

|

|

56

|

|

||

|

176

|

|

184

|

|

197

|

|

|||

|

GUESS? Factory Outlet Stores:

|

|

|

|

|||||

|

U.S.

|

113

|

|

113

|

|

109

|

|

||

|

Canada

|

21

|

|

19

|

|

19

|

|

||

|

134

|

|

132

|

|

128

|

|

|||

|

G by GUESS Stores:

|

|

|

|

|||||

|

U.S.

|

82

|

|

85

|

|

63

|

|

||

|

82

|

|

85

|

|

63

|

|

|||

|

GUESS? Accessories Stores:

|

|

|

|

|||||

|

U.S.

|

34

|

|

41

|

|

42

|

|

||

|

Canada

|

18

|

|

18

|

|

19

|

|

||

|

52

|

|

59

|

|

61

|

|

|||

|

MARCIANO Stores:

|

|

|

|

|||||

|

U.S.

|

29

|

|

31

|

|

34

|

|

||

|

Canada

|

21

|

|

21

|

|

21

|

|

||

|

50

|

|

52

|

|

55

|

|

|||

|

Total

|

494

|

|

512

|

|

504

|

|

||

|

Square footage at fiscal year end

|

2,329,000

|

|

2,371,000

|

|

2,338,000

|

|

||

|

•

|

identify desirable locations, the availability of which is out of our control;

|

|

•

|

negotiate acceptable lease terms, including desired tenant improvement allowances;

|

|

•

|

efficiently build and equip the new stores;

|

|

•

|

source sufficient levels of inventory to meet the needs of the new stores;

|

|

•

|

hire, train and retain competent store personnel;

|

|

•

|

successfully integrate the new stores into our existing operations; and

|

|

•

|

satisfy the fashion preferences of customers in the new geographic areas.

|

|

•

|

political instability or acts of terrorism, which disrupt trade with the countries where we operate or in which our contractors, suppliers or customers are located;

|

|

•

|

recessions in foreign economies;

|

|

•

|

inflationary pressures and volatility in foreign economies;

|

|

•

|

reduced global demand resulting in the closing of manufacturing facilities;

|

|

•

|

challenges in managing broadly dispersed foreign operations;

|

|

•

|

local business practices that do not conform to legal or ethical guidelines;

|

|

•

|

adoption of additional or revised quotas, restrictions or regulations relating to imports or exports;

|

|

•

|

additional or increased customs duties, tariffs, taxes and other charges on imports or exports;

|

|

•

|

delays in receipts due to our distribution centers as a result of increasing security requirements at U.S. or other ports;

|

|

•

|

significant fluctuations in the value of the dollar against foreign currencies;

|

|

•

|

increased difficulty in protecting our intellectual property rights in foreign jurisdictions;

|

|

•

|

social, labor, legal or economic instability in the foreign markets in which we do business, which could influence our ability to sell our products in, or distribute our products from, these international markets;

|

|

•

|

restrictions on the transfer of funds between the United States and foreign jurisdictions;

|

|

•

|

our ability and the ability of our international licensees and distributors to locate and continue to open desirable new retail locations; and

|

|

•

|

natural disasters in areas in which our contractors, suppliers, or customers are located.

|

|

•

|

elect our directors;

|

|

•

|

amend or prevent amendment of our Restated Certificate of Incorporation or Bylaws;

|

|

•

|

effect or prevent a merger, sale of assets or other corporate transaction; and

|

|

•

|

control the outcome of any other matter submitted to our stockholders for vote.

|

|

•

|

shifts in consumer tastes and fashion trends;

|

|

•

|

the timing of new store openings and the relative proportion of new stores to mature stores;

|

|

•

|

calendar shifts of holiday or seasonal periods;

|

|

•

|

the timing of seasonal wholesale shipments;

|

|

•

|

the effectiveness of our inventory management;

|

|

•

|

changes in our merchandise mix;

|

|

•

|

changes in our mix of revenues by segment;

|

|

•

|

the timing of promotional events;

|

|

•

|

actions by competitors;

|

|

•

|

weather conditions;

|

|

•

|

changes in the business environment;

|

|

•

|

inflationary changes in prices and costs;

|

|

•

|

changes in currency exchange rates;

|

|

•

|

population trends;

|

|

•

|

changes in patterns of commerce such as the expansion of electronic commerce;

|

|

•

|

the level of pre-operating expenses associated with new stores; and

|

|

•

|

volatility in securities’ markets which could impact the value of our investments in non-operating assets.

|

|

Location

|

Use

|

Approximate

Area in

Square Feet

|

|||

|

Los Angeles, California

|

Principal executive and administrative offices, design facilities, sales offices, distribution and warehouse facilities, and sourcing used by our North American Wholesale, North American Retail and Licensing segments, and our Corporate groups

|

355,000

|

|

||

|

Louisville, Kentucky

|

Distribution and warehousing facility used by our North American Wholesale and North American Retail segments

|

506,000

|

|

||

|

New York, New York

|

Administrative offices, public relations, and showrooms used by our North American Wholesale segment

|

13,400

|

|

||

|

Montreal/Toronto/Vancouver, Canada

|

Administrative offices, showrooms and warehouse facilities used by our North American Wholesale and North American Retail segments

|

111,700

|

|

||

|

Paris, France

|

Administrative office and showrooms used by our Europe segment

|

11,100

|

|

||

|

Dusseldorf/Hamburg/Munich, Germany

|

Showrooms used by our Europe segment

|

19,700

|

|

||

|

Crevalcore/Florence/Milan, Italy

|

Administrative offices, showrooms and warehouse facilities used by our Europe segment

|

188,000

|

|

||

|

Warsaw, Poland

|

Showrooms used by our Europe segment

|

10,200

|

|

||

|

Lisbon, Portugal

|

Showroom and warehouse used by our Europe segment

|

6,000

|

|

||

|

Lugano, Switzerland

|

Administrative, sales and marketing offices, and showrooms used by our Europe segment

|

103,600

|

|

||

|

Barcelona, Spain

|

Administrative, sales and marketing offices, showrooms and warehouse facilities used by our Europe segment

|

10,500

|

|

||

|

London, U.K.

|

Showrooms used by our Europe segment

|

7,800

|

|

||

|

Shanghai/Beijing, China

|

Administrative offices, showrooms and warehouse facility used by our Asia segment

|

33,200

|

|

||

|

Kowloon, Hong Kong

|

Administrative offices, showrooms and licensing coordination facilities used primarily by our Asia segment and sourcing offices used by all trading segments

|

18,500

|

|

||

|

Seoul, South Korea

|

Administrative offices and showrooms used by our Asia segment

|

45,100

|

|

||

|

Tokyo, Japan

|

Administrative offices used by our Asia segment

|

1,500

|

|

||

|

|

Number of Stores and Concessions

|

|||||||||||

|

Years Lease Terms Expire

|

U.S. and

Canada

|

Asia

|

Europe

|

Mexico and Brazil

|

||||||||

|

Fiscal 2015-2017

|

132

|

|

274

|

|

44

|

|

19

|

|

||||

|

Fiscal 2018-2020

|

145

|

|

12

|

|

89

|

|

14

|

|

||||

|

Fiscal 2021-2023

|

150

|

|

—

|

|

77

|

|

3

|

|

||||

|

Fiscal 2024-2026

|

64

|

|

—

|

|

38

|

|

—

|

|

||||

|

Thereafter

|

3

|

|

—

|

|

19

|

|

—

|

|

||||

|

494

|

|

286

|

|

267

|

|

36

|

|

|||||

|

|

Market Price

|

Dividends

Declared and

Paid

|

|||||||||

|

|

High

|

Low

|

|||||||||

|

Fiscal year ended February 2, 2013

|

|

||||||||||

|

First Quarter Ended April 28, 2012

|

$

|

36.72

|

|

$

|

28.43

|

|

$

|

0.20

|

|

||

|

Second Quarter Ended July 28, 2012

|

30.79

|

|

24.44

|

|

0.20

|

|

|||||

|

Third Quarter Ended October 27, 2012

|

33.54

|

|

24.21

|

|

0.20

|

|

|||||

|

Fourth Quarter Ended February 2, 2013

|

27.40

|

|

22.66

|

|

1.40

|

|

|||||

|

Fiscal year ended February 1, 2014

|

|

||||||||||

|

First Quarter Ended May 4, 2013

|

$

|

28.61

|

|

$

|

24.71

|

|

$

|

0.20

|

|

||

|

Second Quarter Ended August 3, 2013

|

34.16

|

|

27.64

|

|

0.20

|

|

|||||

|

Third Quarter Ended November 2, 2013

|

34.11

|

|

27.23

|

|

0.20

|

|

|||||

|

Fourth Quarter Ended February 1, 2014

|

34.64

|

|

27.70

|

|

0.20

|

|

|||||

|

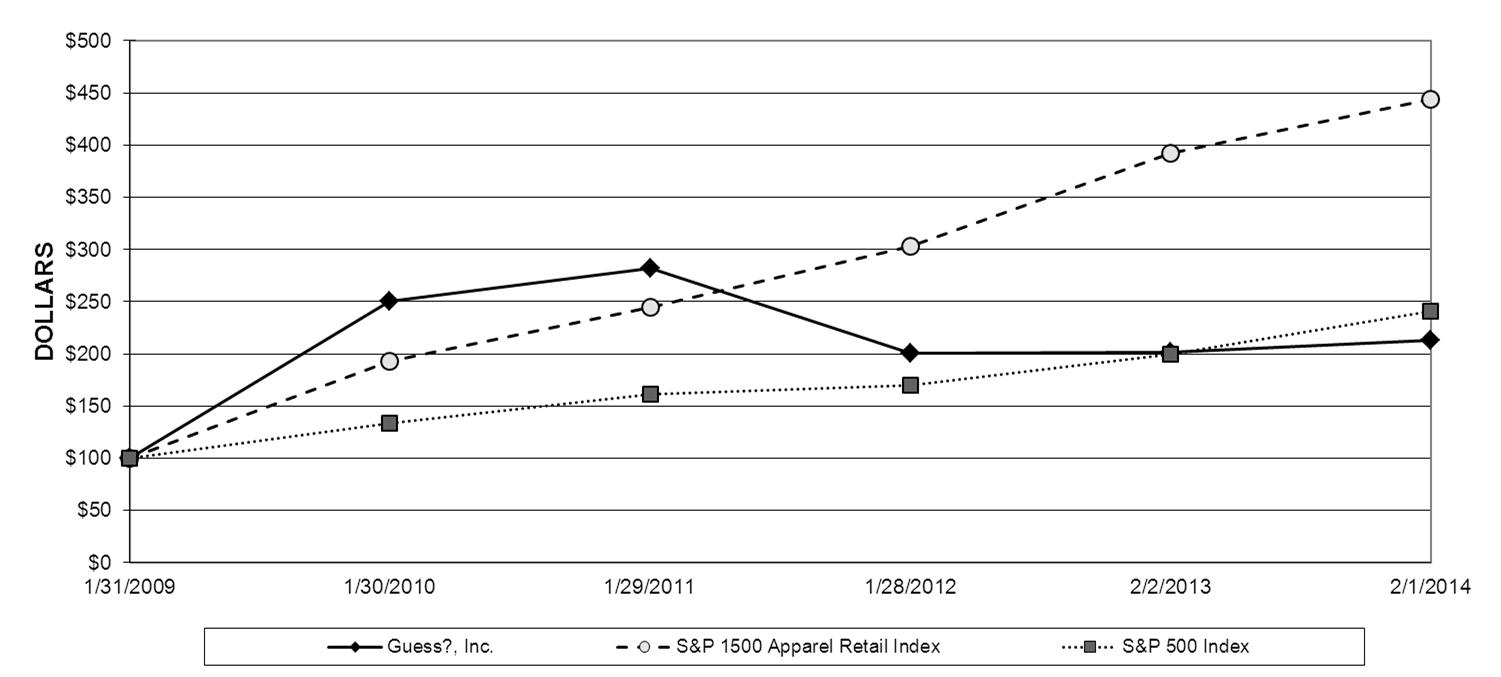

Company/Market/Peer Group

|

1/31/2009

|

1/30/2010

|

1/29/2011

|

1/28/2012

|

2/2/2013

|

2/1/2014

|

||||||||||||||||||

|

Guess?, Inc.

|

$

|

100.00

|

|

$

|

250.68

|

|

$

|

281.66

|

|

$

|

200.47

|

|

$

|

201.76

|

|

$

|

213.26

|

|

||||||

|

S&P 1500 Apparel Retail Index

|

$

|

100.00

|

|

$

|

193.34

|

|

$

|

244.55

|

|

$

|

303.07

|

|

$

|

392.34

|

|

$

|

443.54

|

|

||||||

|

S&P 500 Index

|

$

|

100.00

|

|

$

|

133.14

|

|

$

|

161.44

|

|

$

|

170.04

|

|

$

|

199.98

|

|

$

|

240.58

|

|

||||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid

per Share

|

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

|

Maximum Number

(or Approximate Dollar Value)

of Shares That May

Yet Be Purchased

Under the Plans

or Programs

|

|||||||||

|

November 3, 2013 to November 30, 2013

|

|

|

|

|

|||||||||

|

Repurchase program(1)

|

—

|

|

—

|

|

—

|

|

$

|

495,786,484

|

|

||||

|

Employee transactions(2)

|

—

|

|

—

|

|

—

|

|

|

|

|||||

|

December 1, 2013 to January 4, 2014

|

|

|

|

|

|||||||||

|

Repurchase program(1)

|

—

|

|

—

|

|

—

|

|

$

|

495,786,484

|

|

||||

|

Employee transactions(2)

|

17,879

|

|

$

|

31.09

|

|

—

|

|

|

|

||||

|

January 5, 2014 to February 1, 2014

|

|

|

|

|

|||||||||

|

Repurchase program(1)

|

—

|

|

—

|

|

—

|

|

$

|

495,786,484

|

|

||||

|

Employee transactions(2)

|

41,720

|

|

$

|

31.44

|

|

—

|

|

|

|

||||

|

Total

|

|

|

|

|

|||||||||

|

Repurchase program(1)

|

—

|

|

—

|

|

—

|

|

|

|

|||||

|

Employee transactions(2)

|

59,599

|

|

$

|

31.33

|

|

—

|

|

|

|

||||

|

(1)

|

On June 26, 2012, the Company’s Board of Directors authorized a program to repurchase, from time-to-time and as market and business conditions warrant, up to

$500 million

of the Company’s common stock. Repurchases under the program may be made on the open market or in privately negotiated transactions, pursuant to Rule 10b5-1 trading plans or other available means. There is no minimum or maximum number of shares to be repurchased under the program, which may be discontinued at any time, without prior notice.

|

|

(2)

|

Consists of shares surrendered to, or withheld by, the Company in satisfaction of employee tax withholding obligations that occur upon vesting of restricted stock awards granted under the Company’s 2004 Equity Incentive Plan, as amended.

|

|

|

Year Ended (1)

|

||||||||||||||||||

|

|

Feb 1,

2014 |

|

Feb 2,

2013 |

|

Jan 28,

2012 |

|

Jan 29,

2011 |

Jan 30,

2010 |

|||||||||||

|

|

(in thousands, except per share data)

|

||||||||||||||||||

|

Statement of income data:

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net revenue

|

$

|

2,569,786

|

|

$

|

2,658,605

|

|

$

|

2,688,048

|

|

$

|

2,487,294

|

|

$

|

2,128,466

|

|

||||

|

Earnings from operations

|

222,587

|

|

274,525

|

|

397,235

|

|

404,633

|

|

358,816

|

|

|||||||||

|

Income tax expense

|

75,248

|

|

99,128

|

|

128,691

|

|

126,874

|

|

115,599

|

|

|||||||||

|

Net earnings attributable to Guess?, Inc.

|

153,434

|

|

178,744

|

|

265,500

|

|

289,508

|

|

242,761

|

|

|||||||||

|

Net earnings per common share attributable to common stockholders:

|

|

|

|

|

|

||||||||||||||

|

Basic

|

$

|

1.81

|

|

$

|

2.06

|

|

$

|

2.88

|

|

$

|

3.14

|

|

$

|

2.63

|

|

||||

|

Diluted

|

$

|

1.80

|

|

$

|

2.05

|

|

$

|

2.86

|

|

$

|

3.11

|

|

$

|

2.61

|

|

||||

|

Dividends declared per common share

|

$

|

0.80

|

|

$

|

2.00

|

|

$

|

0.80

|

|

$

|

2.68

|

|

$

|

0.45

|

|

||||

|

Weighted average common shares outstanding—basic

|

84,271

|

|

86,262

|

|

91,533

|

|

91,410

|

|

90,893

|

|

|||||||||

|

Weighted average common shares outstanding—diluted

|

84,522

|

|

86,540

|

|

91,948

|

|

92,115

|

|

91,592

|

|

|||||||||

|

|

Feb 1,

2014 |

Feb 2,

2013 |

Jan 28,

2012 |

Jan 29,

2011 |

Jan 30,

2010 |

||||||||||||||

|

Balance sheet data:

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Working capital

|

$

|

846,061

|

|

$

|

722,259

|

|

|

$

|

841,446

|

|

$

|

732,564

|

|

$

|

781,410

|

|

|||

|

Total assets

|

1,764,431

|

|

1,713,506

|

|

|

1,844,475

|

|

1,685,804

|

|

1,531,249

|

|

||||||||

|

Borrowings and capital lease, excluding current installments

|

7,580

|

|

8,314

|

|

|

10,206

|

|

12,218

|

|

14,137

|

|

||||||||

|

Stockholders’ equity

|

1,169,986

|

|

1,100,868

|

|

|

1,194,265

|

|

1,066,194

|

|

1,026,343

|

|

||||||||

|

(1)

|

The Company operates on a

52

/

53

-week fiscal year calendar, which ends on the Saturday nearest to January 31 of each year.

The results for fiscal 2013 included the impact of an additional week which occurred during the fourth quarter ended

February 2, 2013

.

|

|

•

|

Total net revenue

de

creased

3.3%

to $

2.57 billion

for fiscal

2014

, from $

2.66 billion

in the prior year.

In constant currency, net revenue

decrease

d by

4.4%

.

|

|

•

|

Gross margin (gross profit as a percentage of total net revenue)

de

clined

210

basis points to

38.0%

for fiscal

2014

, compared to

40.1%

in the prior year.

|

|

•

|

Selling, general and administrative (“SG&A”) expenses

de

creased

6.5%

to $

741.1 million

for fiscal

2014

, compared to $

792.6 million

in the prior year. SG&A expenses as a percentage of revenue (“SG&A rate”)

de

creased

by

90

basis points to

28.9%

for fiscal 2014

, compared to

29.8%

in the prior year.

|

|

•

|

The Company incurred

$12.4 million

in restructuring charges during fiscal

2014

.

|

|

•

|

Earnings from operations

de

creased

18.9%

to $

222.6 million

for fiscal

2014

, compared to $

274.5 million

in the prior year. Operating margin

de

clined

160

basis points to

8.7%

for fiscal

2014

, compared to

10.3%

in the prior year. The restructuring charges of

$12.4 million

negatively impacted the operating margin for fiscal

2014

by

40

basis points.

|

|

•

|

Other

income

, net (including interest income and expense), totaled $

10.4 million

for fiscal

2014

, compared to other

income

, net, of $

6.1 million

in the prior year.

|

|

•

|

The effective income tax rate

de

creased

300

basis points to

32.3%

for fiscal

2014

, compared to

35.3%

in the prior year. The effective tax rate for fiscal

2013

included the unfavorable impact of the

$12.8 million

Italian tax settlement charge, partially offset by unrelated tax benefits of

$4.0 million

.

|

|

•

|

The Company had

$508.1 million

in cash and cash equivalents and short-term investments as of

February 1, 2014

,

up

$172.2 million

, compared to

$335.9 million

as of

February 2, 2013

.

|

|

◦

|

The Company invested

$22.1 million

to repurchase approximately

0.9 million

of its common shares during fiscal

2014

. In fiscal

2013

, the Company invested $

140.1 million

to repurchase approximately

5.0 million

shares of its common stock.

|

|

◦

|

Dividends paid to shareholders during fiscal

2014

were

$68.2 million

compared to

$172.8 million

during fiscal

2013

, which included a special dividend of $1.20 per common share paid during the fourth quarter of fiscal

2013

.

|

|

•

|

Accounts receivable, which

relates primarily to the Company’s wholesale business in Europe, and to a lesser extent, to its wholesale businesses in North America and Asia and its international licensing business

,

de

creased by $

40.3 million

, or

12.7%

, to $

276.6 million

at

February 1, 2014

, compared to $

316.9 million

at

February 2, 2013

.

On a constant currency basis, accounts receivable

decreased

$37.7 million

, or

11.9%

.

|

|

•

|

Inventory

de

creased by $

18.8 million

, or

5.1%

, to $

350.9 million

as of

February 1, 2014

, compared to $

369.7 million

as of

February 2, 2013

.

When measured in terms of finished goods units, inventory volumes

were flat

as of

February 1, 2014

, when compared to

February 2, 2013

.

|

|

Region

|

Total Stores

|

Directly

Operated Stores

|

Licensee Stores

|

||||||

|

United States and Canada

|

494

|

|

494

|

|

—

|

|

|||

|

Europe and the Middle East

|

627

|

|

263

|

|

364

|

|

|||

|

Asia

|

499

|

|

47

|

|

452

|

|

|||

|

Central and South America

|

88

|

|

36

|

|

52

|

|

|||

|

Total

|

1,708

|

|

840

|

|

868

|

|

|||

|

|

Year Ended

|

|||||||

|

|

Feb 1,

2014 |

Feb 2,

2013 |

Jan 28,

2012 |

|||||

|

Product sales

|

95.4

|

%

|

95.6

|

%

|

95.5

|

%

|

||

|

Net royalties

|

4.6

|

|

4.4

|

|

4.5

|

|

||

|

Net revenue

|

100.0

|

|

100.0

|

|

100.0

|

|

||

|

Cost of product sales

|

62.0

|

|

59.9

|

|

57.0

|

|

||

|

Gross profit

|

38.0

|

|

40.1

|

|

43.0

|

|

||

|

Selling, general and administrative expenses

|

28.9

|

|

29.8

|

|

27.5

|

|

||

|

Restructuring charges

|

0.4

|

|

—

|

|

—

|

|

||

|

Settlement charge

|

—

|

|

—

|

|

0.7

|

|

||

|

Pension curtailment expense

|

—

|

|

—

|

|

0.0

|

|

||

|

Earnings from operations

|

8.7

|

|

10.3

|

|

14.8

|

|

||

|

Interest expense

|

(0.1

|

)

|

(0.0

|

)

|

(0.1

|

)

|

||

|

Interest income

|

0.1

|

|

0.1

|

|

0.2

|

|

||

|

Other income, net

|

0.4

|

|

0.2

|

|

0.0

|

|

||

|

Earnings before income tax expense

|

9.1

|

|

10.6

|

|

14.9

|

|

||

|

Income tax expense

|

3.0

|

|

3.8

|

|

4.8

|

|

||

|

Net earnings

|

6.1

|

|

6.8

|

|

10.1

|

|

||

|

Net earnings attributable to noncontrolling interests

|

0.1

|

|

0.1

|

|

0.2

|

|

||

|

Net earnings attributable to Guess?, Inc.

|

6.0

|

%

|

6.7

|

%

|

9.9

|

%

|

||

|

Fiscal 2014

|

Fiscal 2013

|

Change

|

% Change

|

|||||||||||

|

(dollars in thousands)

|

||||||||||||||

|

Net revenue:

|

|

|

|

|

||||||||||

|

North American Retail

|

$

|

1,075,475

|

|

$

|

1,116,836

|

|

$

|

(41,361

|

)

|

(3.7

|

%)

|

|||

|

Europe

|

903,791

|

|

939,599

|

|

(35,808

|

)

|

(3.8

|

)

|

||||||

|

Asia

|

292,714

|

|

290,655

|

|

2,059

|

|

0.7

|

|

||||||

|

North American Wholesale

|

179,600

|

|

194,373

|

|

(14,773

|

)

|

(7.6

|

)

|

||||||

|

Licensing

|

118,206

|

|

117,142

|

|

1,064

|

|

0.9

|

|

||||||

|

Total net revenue

|

$

|

2,569,786

|

|

$

|

2,658,605

|

|

$

|

(88,819

|

)

|

(3.3

|

%)

|

|||

|

Earnings (loss) from operations:

|

|

|

|

|||||||||||

|

North American Retail

|

$

|

39,540

|

|

$

|

78,285

|

|

$

|

(38,745

|

)

|

(49.5

|

%)

|

|||

|

Europe

|

97,231

|

|

103,975

|

|

(6,744

|

)

|

(6.5

|

)

|

||||||

|

Asia

|

25,592

|

|

26,525

|

|

(933

|

)

|

(3.5

|

)

|

||||||

|

North American Wholesale

|

38,771

|

|

45,008

|

|

(6,237

|

)

|

(13.9

|

)

|

||||||

|

Licensing

|

107,805

|

|

101,182

|

|

6,623

|

|

6.5

|

|

||||||

|

Corporate Overhead

|

(73,910

|

)

|

(80,450

|

)

|

6,540

|

|

(8.1

|

)

|

||||||

|

Restructuring Charges

|

(12,442

|

)

|

—

|

|

(12,442

|

)

|

||||||||

|

Total earnings from operations

|

$

|

222,587

|

|

$

|

274,525

|

|

$

|

(51,938

|

)

|

(18.9

|

%)

|

|||

|

Operating margins:

|

||||||||||||||

|

North American Retail

|

3.7

|

%

|

7.0

|

%

|

||||||||||

|

Europe

|

10.8

|

%

|

11.1

|

%

|

||||||||||

|

Asia

|

8.7

|

%

|

9.1

|

%

|

||||||||||

|

North American Wholesale

|

21.6

|

%

|

23.2

|

%

|

||||||||||

|

Licensing

|

91.2

|

%

|

86.4

|

%

|

||||||||||

|

Total Company

|

8.7

|

%

|

10.3

|

%

|

||||||||||

|

Fiscal 2013

|

Fiscal 2012

|

Change

|

% Change

|

|||||||||||

|

(dollars in thousands)

|

||||||||||||||

|

Net revenue:

|

|

|

|

|

||||||||||

|

North American Retail

|

$

|

1,116,836

|

|

$

|

1,117,643

|

|

$

|

(807

|

)

|

(0.1

|

%)

|

|||

|

Europe

|

939,599

|

|

1,010,896

|

|

(71,297

|

)

|

(7.1

|

)

|

||||||

|

Asia

|

290,655

|

|

250,727

|

|

39,928

|

|

15.9

|

|

||||||

|

North American Wholesale

|

194,373

|

|

187,362

|

|

7,011

|

|

3.7

|

|

||||||

|

Licensing

|

117,142

|

|

121,420

|

|

(4,278

|

)

|

(3.5

|

)

|

||||||

|

Total net revenue

|

$

|

2,658,605

|

|

$

|

2,688,048

|

|

$

|

(29,443

|

)

|

(1.1

|

%)

|

|||

|

Earnings (loss) from operations:

|

|

|

||||||||||||

|

North American Retail

|

$

|

78,285

|

|

$

|

133,184

|

|

$

|

(54,899

|

)

|

(41.2

|

%)

|

|||

|

Europe

|

103,975

|

|

167,014

|

|

(63,039

|

)

|

(37.7

|

)

|

||||||

|

Asia

|

26,525

|

|

28,463

|

|

(1,938

|

)

|

(6.8

|

)

|

||||||

|

North American Wholesale

|

45,008

|

|

47,162

|

|

(2,154

|

)

|

(4.6

|

)

|

||||||

|

Licensing

|

101,182

|

|

108,638

|

|

(7,456

|

)

|

(6.9

|

)

|

||||||

|

Corporate Overhead

|

(80,450

|

)

|

(87,226

|

)

|

6,776

|

|

(7.8

|

)

|

||||||

|

Total earnings from operations

|

$

|

274,525

|

|

$

|

397,235

|

|

$

|

(122,710

|

)

|

(30.9

|

%)

|

|||

|

Operating margins:

|

||||||||||||||

|

North American Retail

|

7.0

|

%

|

11.9

|

%

|

||||||||||

|

Europe

|

11.1

|

%

|

16.5

|

%

|

||||||||||

|

Asia

|

9.1

|

%

|

11.4

|

%

|

||||||||||

|

North American Wholesale

|

23.2

|

%

|

25.2

|

%

|

||||||||||

|

Licensing

|

86.4

|

%

|

89.5

|

%

|

||||||||||

|

Total Company

|

10.3

|

%

|

14.8

|

%

|

||||||||||

|

|

Payments due by period

|

||||||||||||||||||

|

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

More than

5 years |

||||||||||||||

|

Contractual Obligations:

|

|

|

|

|

|

||||||||||||||

|

Short-term borrowings

|

$

|

2,391

|

|

$

|

2,391

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Long-term debt (1)

|

828

|

|

25

|

|

50

|

|

753

|

|

—

|

|

|||||||||

|

Capital lease obligations (1)

|

9,287

|

|

2,128

|

|

7,159

|

|

—

|

|

—

|

|

|||||||||

|

Operating lease obligations (2)

|

1,022,514

|

|

198,639

|

|

321,616

|

|

242,292

|

|

259,967

|

|

|||||||||

|

Purchase obligations (3)

|

210,275

|

|

210,275

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Benefit obligations (4)

|

98,003

|

|

2,542

|

|

4,681

|

|

3,698

|

|

87,082

|

|

|||||||||

|

Total

|

$

|

1,343,298

|

|

$

|

416,000

|

|

$

|

333,506

|

|

$

|

246,743

|

|

$

|

347,049

|

|

||||

|

Other commercial commitments (5)

|

$

|

3,932

|

|

$

|

3,932

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

(1)

|

Includes interest payments.

|

|

(2)

|

Does not include rent based on a percentage of annual sales volume, insurance, taxes and common area maintenance charges. In fiscal

2014

, these variable charges totaled $145.7 million.

|

|

(3)

|

Purchase obligations represent open purchase orders for raw materials and merchandise at the end of the fiscal year. These purchase orders can be impacted by various factors, including the scheduling of market weeks, the timing of issuing orders, the timing of the shipment of orders and currency fluctuations. Accordingly, a comparison of purchase orders from period to period is not necessarily meaningful.

|

|

(4)

|

Includes expected payments associated with the deferred compensation plan and the Supplemental Executive Retirement Plan through fiscal 2046.

|

|

(5)

|

Consists of standby letters of credit for guarantee of certain subsidiaries’ borrowings and workers’ compensation and general liability insurance.

|

|

Year Ended Feb 1, 2014

|

Year Ended Feb 2, 2013

|

||||||

|

Beginning balance gain (loss)

|

$

|

(1,782

|

)

|

$

|

4,259

|

|

|

|

Net gains from changes in cash flow hedges

|

4,092

|

|

2,044

|

|

|||

|

Net gains reclassified to income

|

(2,423

|

)

|

(8,085

|

)

|

|||

|

Ending balance loss

|

$

|

(113

|

)

|

$

|

(1,782

|

)

|

|

|

|

/s/ ERNST & YOUNG LLP

|

|

(1)

|

Consolidated Financial Statements

|

|

(2)

|

Consolidated Financial Statement Schedule

|

|

(3)

|

Exhibits

|

|

|

||||

|

|

/s/ ERNST & YOUNG LLP

|

|

February 1,

2014 |

February 2,

2013 |

||||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

502,945

|

|

$

|

329,021

|

|

|

|

Short-term investments

|

5,123

|

|

6,906

|

|

|||

|

Accounts receivable, net

|

276,565

|

|

316,863

|

|

|||

|

Inventories

|

350,899

|

|

369,712

|

|

|||

|

Deferred tax assets

|

24,400

|

|

21,053

|

|

|||

|

Other current assets

|

56,154

|

|

63,670

|

|

|||

|

Total current assets

|

1,216,086

|

|

1,107,225

|

|

|||

|

Property and equipment, net

|

324,606

|

|

355,729

|

|

|||

|

Goodwill

|

38,992

|

|

39,287

|

|

|||

|

Other intangible assets, net

|

13,143

|

|

16,032

|

|

|||

|

Long-term deferred tax assets

|

54,973

|

|

43,063

|

|

|||

|

Other assets

|

116,631

|

|

152,170

|

|

|||

|

$

|

1,764,431

|

|

$

|

1,713,506

|

|

||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Current portion of capital lease obligations and borrowings

|

$

|

4,160

|

|

$

|

1,901

|

|

|

|

Accounts payable

|

191,532

|

|

191,143

|

|

|||

|

Accrued expenses

|

174,333

|

|

191,922

|

|

|||

|

Total current liabilities

|

370,025

|

|

384,966

|

|

|||

|

Capital lease obligations and other long-term debt

|

7,580

|

|

8,314

|

|

|||

|

Deferred rent and lease incentives

|

90,492

|

|

94,218

|

|

|||

|

Other long-term liabilities

|

120,518

|

|

121,996

|

|

|||

|

588,615

|

|

609,494

|

|

||||

|

Redeemable noncontrolling interests

|

5,830

|

|

3,144

|

|

|||

|

Commitments and contingencies (Note 14)

|

|

|

|

||||

|

Stockholders’ equity:

|

|

|

|||||

|

Preferred stock, $.01 par value. Authorized 10,000,000 shares; no shares issued and outstanding

|

—

|

|

—

|

|

|||

|

Common stock, $.01 par value. Authorized 150,000,000 shares; issued 139,245,729 and 138,812,082 shares, outstanding 84,962,345 and 85,367,984 shares, at February 1, 2014 and February 2, 2013, respectively

|

850

|

|

853

|

|

|||

|

Paid-in capital

|

439,742

|

|

423,387

|

|

|||

|

Retained earnings

|

1,247,180

|

|

1,162,982

|

|

|||

|

Accumulated other comprehensive loss

|

(13,801

|

)

|

(2,461

|

)

|

|||

|

Treasury stock, 54,283,384 and 53,444,098 shares at February 1, 2014 and February 2, 2013, respectively

|

(519,457

|

)

|

(497,769

|

)

|

|||

|

Guess?, Inc. stockholders’ equity

|

1,154,514

|

|

1,086,992

|

|

|||

|

Nonredeemable noncontrolling interests

|

15,472

|

|

13,876

|

|

|||

|

Total stockholders’ equity

|

1,169,986

|

|

1,100,868

|

|

|||

|

$

|

1,764,431

|

|

$

|

1,713,506

|

|

||

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||

|

Feb 1, 2014

|

Feb 2, 2013

|

Jan 28, 2012

|

|||||||||

|

Product sales

|

$

|

2,451,580

|

|

$

|

2,541,463

|

|

$

|

2,566,628

|

|

||

|

Net royalties

|

118,206

|

|

117,142

|

|

121,420

|

|

|||||

|

Net revenue

|

2,569,786

|

|

2,658,605

|

|

2,688,048

|

|

|||||

|

Cost of product sales

|

1,593,652

|

|

1,591,482

|

|

1,531,823

|

|

|||||

|

Gross profit

|

976,134

|

|

1,067,123

|

|

1,156,225

|

|

|||||

|

Selling, general and administrative expenses

|

741,105

|

|

792,598

|

|

738,285

|

|

|||||

|

Restructuring charges

|

12,442

|

|

—

|

|

—

|

|

|||||

|

Settlement charge

|

—

|

|

—

|

|

19,463

|

|

|||||

|

Pension curtailment expense

|

—

|

|

—

|

|

1,242

|

|

|||||

|

Earnings from operations

|

222,587

|

|

274,525

|

|

397,235

|

|

|||||

|

Other income (expense):

|

|

|

|

||||||||

|

Interest expense

|

(1,923

|

)

|

(1,640

|

)

|

(2,002

|

)

|

|||||

|

Interest income

|

2,015

|

|

2,016

|

|

3,147

|

|

|||||

|

Other income, net

|

10,280

|

|

5,713

|

|

961

|

|

|||||

|

10,372

|

|

6,089

|

|

2,106

|

|

||||||

|

Earnings before income tax expense

|

232,959

|

|

280,614

|

|

399,341

|

|

|||||

|

Income tax expense

|

75,248

|

|

99,128

|

|

128,691

|

|

|||||

|

Net earnings

|

157,711

|

|

181,486

|

|

270,650

|

|

|||||

|

Net earnings attributable to noncontrolling interests

|

4,277

|

|

2,742

|

|

5,150

|

|

|||||

|

Net earnings attributable to Guess?, Inc.

|

$

|

153,434

|

|

$

|

178,744

|

|

$

|

265,500

|

|

||

|

Net earnings per common share attributable to common stockholders (Note 18):

|

|

|

|

||||||||

|

Basic

|

$

|

1.81

|

|

$

|

2.06

|

|

$

|

2.88

|

|

||

|

Diluted

|

$

|

1.80

|

|

$

|

2.05

|

|

$

|

2.86

|

|

||

|

Weighted average common shares outstanding attributable to common stockholders (Note 18):

|

|

|

|

||||||||

|

Basic

|

84,271

|

|

86,262

|

|

91,533

|

|

|||||

|

Diluted

|

84,522

|

|

86,540

|

|

91,948

|

|

|||||

|

Dividends declared per common share

|

$

|

0.80

|

|

$

|

2.00

|

|

$

|

0.80

|

|

||

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||

|

Feb 1, 2014

|

Feb 2, 2013

|

Jan 28, 2012

|

|||||||||

|

Net earnings

|

$

|

157,711

|

|

$

|

181,486

|

|

$

|

270,650

|

|

||

|

Other comprehensive income (loss):

|

|

|

|

||||||||

|

Foreign currency translation adjustment

|

|||||||||||

|

Gains (losses) arising during the period

|

(18,642

|

)

|

22,347

|

|

(17,453

|

)

|

|||||

|

Reclassification to net income for losses realized

|

217

|

|

—

|

|

—

|

|

|||||

|

Derivative financial instruments designated as cash flow hedges

|

|

|

|

||||||||

|

Gains arising during the period

|

4,965

|

|

2,231

|

|

845

|

|

|||||

|

Less income tax effect

|

(873

|

)

|

(187

|

)

|

(183

|

)

|

|||||

|

Reclassification to net income for (gains) losses realized

|

(3,059

|

)

|

(9,328

|

)

|

6,373

|

|

|||||

|

Less income tax effect

|

636

|

|

1,243

|

|

(987

|

)

|

|||||

|

Marketable securities

|

|

|

|

||||||||

|

Gains (losses) arising during the period

|

(11

|

)

|

218

|

|

(67

|

)

|

|||||

|

Less income tax effect

|

4

|

|

(83

|

)

|

24

|

|

|||||

|

Reclassification to net income for losses realized

|

—

|

|

6

|

|

—

|

|

|||||

|

Less income tax effect

|

—

|

|

(2

|

)

|

—

|

|

|||||

|

Supplemental Executive Retirement Plan (“SERP”)

|

|

|

|

||||||||

|

Plan amendment

|

4,529

|

|

—

|

|

—

|

|

|||||

|

Actuarial gain (loss)

|

1,751

|

|

3,508

|

|

(9,342

|

)

|

|||||

|

Curtailment

|

—

|

|

—

|

|

1,242

|

|

|||||

|

Less income tax effect

|

(2,465

|

)

|

(1,342

|

)

|

3,144

|

|

|||||

|

Actuarial loss amortization

|

1,108

|

|

3,340

|

|

2,048

|

|

|||||

|

Prior service cost amortization

|

194

|

|

620

|

|

940

|

|

|||||

|

Less income tax effect

|

(498

|

)

|

(1,513

|

)

|

(1,087

|

)

|

|||||

|

Total comprehensive income

|

145,567

|

|

202,544

|

|

256,147

|

|

|||||

|

Less comprehensive income attributable to noncontrolling interests:

|

|

|

|

||||||||

|

Net earnings

|

4,277

|

|

2,742

|

|

5,150

|

|

|||||

|

Foreign currency translation adjustment

|

(804

|

)

|

322

|

|

116

|

|

|||||

|

Amounts attributable to noncontrolling interests

|

3,473

|

|

3,064

|

|

5,266

|

|

|||||

|

Comprehensive income attributable to Guess?, Inc.

|

$

|

142,094

|

|

$

|

199,480

|

|

$

|

250,881

|

|

||

|

GUESS?, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

|

|||||||||||||||||||||||||||

|

|

Guess?, Inc. Stockholders’ Equity

|

|

|

||||||||||||||||||||||||

|

|

Common

Stock

|

Paid-in

Capital

|

Retained Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Treasury

Stock

|

Nonredeemable

Noncontrolling

Interests

|

Total

|

||||||||||||||||||||

|

Balance at January 29, 2011

|

$

|

923

|

|

$

|

368,225

|

|

$

|

960,460

|

|

$

|

(8,578

|

)

|

$

|

(266,154

|

)

|

$

|

11,318

|

|

$

|

1,066,194

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

265,500

|

|

—

|

|

—

|

|

5,150

|

|

270,650

|

|

|||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(17,569

|

)

|

—

|

|

116

|

|

(17,453

|

)

|

|||||||||||||

|

Gain on derivative financial instruments designated as cash flow hedges

|

—

|

|

—

|

|

—

|

|

6,048

|

|

—

|

|

—

|

|

6,048

|

|

|||||||||||||

|

Loss on marketable securities

|

—

|

|

—

|

|

—

|

|

(43

|

)

|

—

|

|

—

|

|

(43

|

)

|

|||||||||||||

|

SERP prior service cost amortization, curtailment and actuarial valuation loss and related amortization

|

—

|

|

—

|

|

—

|

|

(3,055

|

)

|

—

|

|

—

|

|

(3,055

|

)

|

|||||||||||||

|

Issuance of common stock under stock compensation plans including tax effect

|

5

|

|

2,918

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,923

|

|

|||||||||||||

|

Issuance of stock under Employee Stock Purchase Plan

|

—

|

|

1,084

|

|

—

|

|

—

|

|

293

|

|

—

|

|

1,377

|

|

|||||||||||||

|

Share-based compensation

|

—

|

|

27,919

|

|

181

|

|

—

|

|

—

|

|

—

|

|

28,100

|

|

|||||||||||||

|

Dividends

|

—

|

|

—

|

|

(74,166

|

)

|

—

|

|

—

|

|

—

|

|

(74,166

|

)

|

|||||||||||||

|

Share repurchases

|

(32

|

)

|

32

|

|

—

|

|

—

|

|

(92,082

|

)

|

—

|

|

(92,082

|

)

|

|||||||||||||

|

Redeemable noncontrolling interest redemption value adjustment

|

—

|

|

—

|

|

3,721

|

|

—

|

|

—

|

|

2,051

|

|

5,772

|

|

|||||||||||||

|

Balance at January 28, 2012

|

$

|

896

|

|

$

|

400,178

|

|

$

|

1,155,696

|

|

$

|

(23,197

|

)

|

$

|

(357,943

|

)

|

$

|

18,635

|

|

$

|

1,194,265

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

178,744

|

|

—

|

|

—

|

|

2,742

|

|

181,486

|

|

|||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

22,025

|

|

—

|

|

322

|

|

22,347

|

|

|||||||||||||

|

Loss on derivative financial instruments designated as cash flow hedges

|

—

|

|

—

|

|

—

|

|

(6,041

|

)

|

—

|

|

—

|

|

(6,041

|

)

|

|||||||||||||

|

Gain on marketable securities

|

—

|

|

—

|

|

—

|

|

139

|

|

—

|

|

—

|

|

139

|

|

|||||||||||||

|

SERP prior service cost amortization and actuarial valuation gain (loss) and related amortization

|

—

|

|

—

|

|

—

|

|

4,613

|

|

—

|

|

—

|

|

4,613

|

|

|||||||||||||

|

Issuance of common stock under stock compensation plans including tax effect

|

7

|

|

1,355

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,362

|

|

|||||||||||||

|

Issuance of stock under Employee Stock Purchase Plan

|

—

|

|

750

|

|

—

|

|

—

|

|

436

|

|

—

|

|

1,186

|

|

|||||||||||||

|

Share-based compensation

|

—

|

|

16,197

|

|

88

|

|

—

|

|

—

|

|

—

|

|

16,285

|

|

|||||||||||||

|

Dividends

|

—

|

|

—

|

|

(172,792

|

)

|

—

|

|

—

|

|

—

|

|

(172,792

|

)

|

|||||||||||||

|

Share repurchases

|

(50

|

)

|

50

|

|

—

|

|

—

|

|

(140,262

|

)

|

—

|

|

(140,262

|

)

|

|||||||||||||

|

Purchase of redeemable noncontrolling interest

|

—

|

|

4,857

|

|

—

|

|

—

|

|

—

|

|

(4,857

|

)

|

—

|

|

|||||||||||||

|

Noncontrolling interest capital contribution

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,488

|

|

1,488

|

|

|||||||||||||

|

Noncontrolling interest capital distribution

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(4,237

|

)

|

(4,237

|

)

|

|||||||||||||

|

Redeemable noncontrolling interest redemption value adjustment

|

—

|

|

—

|

|

1,246

|

|

—

|

|

—

|

|

(217

|

)

|

1,029

|

|

|||||||||||||

|

Balance at February 2, 2013

|

$

|

853

|

|

$

|

423,387

|

|

$

|

1,162,982

|

|

$

|

(2,461

|

)

|

$

|

(497,769

|

)

|

$

|

13,876

|

|

$

|

1,100,868

|

|

||||||

|

Net earnings

|

—

|

|

—

|

|

153,434

|

|

—

|

|

—

|

|

4,277

|

|

157,711

|

|

|||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(17,621

|

)

|

—

|

|

(804

|

)

|

(18,425

|

)

|

|||||||||||||

|

Gain on derivative financial instruments designated as cash flow hedges

|

—

|

|

—

|

|

—

|

|

1,669

|

|

—

|

|

—

|

|

1,669

|

|

|||||||||||||

|

Loss on marketable securities

|

—

|

|

—

|

|

—

|

|

(7

|

)

|

—

|

|

—

|

|

(7

|

)

|

|||||||||||||

|

SERP plan amendment, prior service cost amortization and actuarial valuation gain (loss) and related amortization

|

—

|

|

—

|

|

—

|

|

4,619

|

|

—

|

|

—

|

|

4,619

|

|

|||||||||||||

|

Issuance of common stock under stock compensation plans including tax effect

|

6

|

|

2,398

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,404

|

|

|||||||||||||

|

Issuance of stock under Employee Stock Purchase Plan

|

—

|

|

569

|

|

—

|

|

—

|

|

411

|

|

—

|

|

980

|

|

|||||||||||||

|

Share-based compensation

|

—

|

|

13,379

|

|

570

|

|

—

|

|

—

|

|

—

|

|

13,949

|

|

|||||||||||||

|

Dividends

|

—

|

|

—

|

|

(68,215

|

)

|

—

|

|

—

|

|

—

|

|

(68,215

|

)

|

|||||||||||||

|

Share repurchases

|

(9

|

)

|

9

|

|

—

|

|

—

|

|

(22,099

|

)

|

—

|

|

(22,099

|

)

|

|||||||||||||

|

Noncontrolling interest capital distribution

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,877

|

)

|

(1,877

|

)

|

|||||||||||||

|

Redeemable noncontrolling interest redemption value adjustment

|

—

|

|

—

|

|

(1,591

|

)

|

—

|

|

—

|

|

—

|

|

(1,591

|

)

|

|||||||||||||

|

Balance at February 1, 2014

|

$

|

850

|

|

$

|

439,742

|

|

$

|

1,247,180

|

|

$

|

(13,801

|

)

|

$

|

(519,457

|

)

|

$

|

15,472

|

|

$

|

1,169,986

|

|

||||||

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||

|

Feb 1, 2014

|

Feb 2, 2013

|

Jan 28, 2012

|

|||||||||

|

Cash flows from operating activities:

|

|

|

|

||||||||

|

Net earnings

|

$

|

157,711

|

|

$

|

181,486

|

|

$

|

270,650

|

|

||

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

|

|

|

||||||||

|

Depreciation and amortization of property and equipment

|

85,817

|

|

87,197

|

|

77,044

|

|

|||||

|

Amortization of intangible assets

|

2,552

|

|

2,501

|

|

2,242

|

|

|||||

|

Share-based compensation expense

|

13,949

|

|

16,285

|

|

28,100

|

|

|||||

|

Unrealized forward contract (gains) losses

|

(562

|

)

|

734

|

|

(4,020

|

)

|

|||||

|

Deferred income taxes

|

(17,804

|

)

|

7,303

|

|

(885

|

)

|

|||||

|

Net loss on disposition of property and equipment and long-term assets

|

16,337

|

|

11,096

|

|

6,148

|

|

|||||

|

Pension curtailment expense

|

—

|

|

—

|

|

1,242

|

|

|||||

|

Other items, net

|