|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

77-0239383

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

585 West Beach Street

|

|

|

Watsonville, California

|

95076

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT 101.INS

|

|

|

EXHIBIT 101.SCH

|

|

|

EXHIBIT 101.CAL

|

|

|

EXHIBIT 101.DEF

|

|

|

EXHIBIT 101.LAB

|

|

|

EXHIBIT 101.PRE

|

|

2

|

|||

|

3

|

|||

|

4

|

|||

|

5

|

|||

|

December 31,

|

2011

|

2010

|

||

|

Heavy construction equipment

|

2,006

|

|

2,104

|

|

|

Trucks, truck-tractors, trailers and vehicles

|

4,206

|

|

4,560

|

|

|

6

|

|||

|

7

|

|||

|

8

|

|||

|

Name

|

Age

|

Position

|

|

James H. Roberts

|

55

|

President and Chief Executive Officer

|

|

Laurel J. Krzeminski

|

57

|

Vice President and Chief Financial Officer

|

|

Michael F. Donnino

|

57

|

Senior Vice President and Group Manager

|

|

John A. Franich

|

55

|

Vice President and Group Manager

|

|

Thomas S. Case

|

49

|

Vice President and Group Manager

|

|

9

|

|||

|

•

|

Unfavorable economic conditions have had and are expected to continue to have an adverse impact on our business.

The recent recession and credit crisis and related turmoil in the global financial system has had and may continue to have an adverse impact on our business, financial position, results of operations, cash flows and liquidity. In particular, low tax revenues, budget deficits, financing constraints and competing priorities have resulted in, and may continue to result in, cutbacks in new infrastructure projects in the public sector and could have an adverse impact on collectibility of receivables from government agencies. In addition, levels of new commercial and residential construction projects have been minimal due to oversupply of existing inventories of commercial and residential properties, low property values and a restrictive financing environment. The depressed demand for construction and construction materials in both the public and private sector has resulted in intensified competition in both sectors, which has had an adverse impact on both our revenues and profit margins and could impact growth opportunities. These factors have also had an adverse impact on the levels of activity and financial position, results of operations, cash flows and liquidity of our real estate investment and development business.

|

|

•

|

Deterioration of the United States economy could have a material adverse effect on our business, financial condition and results of operations.

Congress’ inability to lower United States debt substantially could result in a decrease in government spending, which could negatively impact the ability of government agencies to fund existing or new infrastructure projects. In addition, such actions could have a material adverse effect on the financial markets and economic conditions in the United States as well as throughout the world, which may limit our ability and the ability of our customers to obtain financing. Deterioration in general economic activity and infrastructure spending or Congress’ deficit reduction measures could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

We work in a highly competitive marketplace.

We have multiple competitors in all of the areas in which we work, and some of our competitors are larger than we are and may have greater resources than we do. During economic down cycles or times of lower government funding for public works projects, competition for the fewer available public projects typically intensifies and this increased competition may result in a decrease in new awards at acceptable profit margins. In addition, downturns in residential and commercial construction activity increases the competition for available public sector work, further impacting our revenue, contract backlog and profit margins.

|

|

•

|

Accounting for our revenues and costs involves significant estimates.

As further described in “Critical Accounting Policies and Estimates” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” accounting for our contract related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position and results of operations.

|

|

•

|

Our success depends on attracting and retaining qualified personnel, joint venture partners and subcontractors in a competitive environment.

The success of our business is dependent on our ability to attract, develop and retain qualified personnel, joint venture partners, advisors and subcontractors. Changes in general or local economic conditions and the resulting impact on the labor market and on our joint venture partners may make it difficult to attract or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation packages, high-quality training programs, attractive work environments or to establish and maintain successful partnerships, our ability to profitably execute our work could be adversely impacted.

|

|

•

|

Fixed price and fixed unit price contracts subject us to the risk of increased project cost.

As more fully described in “Contract Provisions and Subcontracting” under “Item 1. Business,” the profitability of our fixed price and fixed unit price contracts can be adversely affected by a number of factors that can cause our actual costs to materially exceed the costs estimated at the time of our original bid.

|

|

•

|

Many of our contracts have penalties for late completion.

In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or a loss on that project.

|

|

10

|

|||

|

•

|

Weather can significantly affect our quarterly revenues and profitability.

Our ability to perform work is significantly affected by weather conditions such as precipitation and temperature. Changes in weather conditions can cause delays and otherwise significantly affect our project costs. The impact of weather conditions can result in variability in our quarterly revenues and profitability, particularly in the first and fourth quarters of the year.

|

|

•

|

Force majeure events, including natural disasters and terrorists’ actions, could negatively impact our business, which may affect our financial condition, results of operations or cash flows.

Force majeure or extraordinary events beyond the control of the contracting parties, such as natural and man-made disasters, as well as terrorist actions, could negatively impact the economies in which we operate. We typically remain obligated to perform our services after such extraordinary events unless the contract contains a force majeure clause relieving us of our contractual obligations in such an extraordinary event. If we are not able to react quickly to force majeure events, our operations may be affected significantly, which would have a negative impact on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Failure to maintain safe work sites could result in significant losses.

Construction and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation. Despite having invested significant resources in safety programs and being recognized as an industry leader, a serious accident may nonetheless occur on one of our worksites. As a result, our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Design/build contracts subject us to the risk of design errors and omissions.

Design/build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally subcontract design responsibility to architectural and engineering firms. However, in the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Failure of our subcontractors to perform as anticipated could have a negative impact on our results.

As further described in “Contract Provisions and Subcontracting” under “Item 1. Business,” we subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher risk subcontractors. In this case we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

We may be unable to identify qualified Disadvantaged Business Enterprise (“DBE”) contractors to perform as subcontractors.

Certain of our government agency projects contain minimum DBE participation clauses. If we subsequently fail to complete these projects with the minimum DBE participation, we may be held responsible for breach of contract damages which may include restrictions on our ability to bid on future projects as well as monetary damages. To the extent we are responsible for monetary damages, the total costs of the project could exceed our original estimates, we could experience reduced profits or a loss for that project and there could be a material adverse impact to our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Government contracts generally have strict regulatory requirements.

Approximately

83.8%

of our consolidated revenue in

2011

was derived from contracts funded by federal, state and local government agencies and authorities. Government contracts are subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting and often include express or implied certifications of compliance. Claims for civil or criminal fraud may be brought for violations of regulations, requirements or statutes. We may also be subject to qui tam (“Whistle Blower”) litigation brought by private individuals on behalf of the government under the Federal Civil False Claims Act, which could include claims for up to treble damages. Further, if we fail to comply with any of the regulations, requirements or statutes or if we have a substantial number of accumulated Occupational Safety and Health Administration, Mine Safety and Health Administration or other workplace safety violations, our existing government contracts could be terminated and we could be suspended from government contracting or subcontracting, including federally funded projects at the state level. Should one or more of these events occur, it could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

11

|

|||

|

•

|

Government contractors are subject to suspension or debarment from government contracting.

Our substantial dependence on government contracts exposes us to a variety of risks that differ from those associated with private sector contracts. Various statutes to which our operations are subject, including the Davis-Bacon Act (which regulates wages and benefits), the Walsh-Healy Act (which prescribes a minimum wage and regulates overtime and working conditions), Executive Order 11246 (which establishes equal employment opportunity and affirmative action requirements) and the Drug-Free Workplace Act, provide for mandatory suspension and/or debarment of contractors in certain circumstances involving statutory violations. In addition, the Federal Acquisition Regulation and various state statutes provide for discretionary suspension and/or debarment in certain circumstances that might call into question a contractor’s willingness or ability to act responsibly, including as a result of being convicted of, or being found civilly liable for, fraud or a criminal offense in connection with obtaining, attempting to obtain or performing a public contract or subcontract. The scope and duration of any suspension or debarment may vary depending upon the facts and the statutory or regulatory grounds for debarment and could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

We are subject to environmental and other regulation.

As more fully described in “Environmental Regulations” under “Item 1. Business,” we are subject to a number of federal, state and local laws and regulations relating to the environment, workplace safety and a variety of socioeconomic requirements. Noncompliance with such laws and regulations can result in substantial penalties, or termination or suspension of government contracts as well as civil and criminal liability. In addition, some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. We occasionally evaluate various alternatives with respect to our facilities, including possible dispositions or closures. Investigations undertaken in connection with these activities may lead to discoveries of contamination that must be remediated, and closures of facilities may trigger compliance requirements that are not applicable to operating facilities. While compliance with these laws and regulations has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. Furthermore, we cannot provide assurance that existing or future circumstances or developments with respect to contamination will not require us to make significant remediation or restoration expenditures.

|

|

•

|

A change in tax laws or regulations of any federal or state jurisdiction in which we operate could increase our tax burden and otherwise adversely affect our financial position, results of operations, cash flows and liquidity.

We continue to assess the impact of various U.S. federal and state legislative proposals that could result in a material increase to our U.S. federal and state taxes. We cannot predict whether any specific legislation will be enacted or the terms of any such legislation. However, if such proposals were to be enacted, or if modifications were to be made to certain existing regulations, the consequences could have a material adverse impact on us, including increasing our tax burden, increasing our cost of tax compliance or otherwise adversely affecting our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Strikes or work stoppages could have a negative impact on our operations and results.

We are party to collective bargaining agreements covering a portion of our craft workforce. Although strikes or work stoppages have not had a significant impact on our operations or results in the past, such labor actions could have a significant impact on our operations and results if they occur in the future.

|

|

•

|

We may be required to contribute cash to meet our unfunded pension obligations in certain multi-employer plans.

Two of our wholly owned subsidiaries, Granite Construction Company and Granite Construction Northeast, Inc. (formerly Granite Halmar Construction Company, Inc.) participate in various multi-employer pension plans on behalf of union employees. Union employee benefits generally are based on a fixed amount for each year of service. We are required to make contributions to the plans in amounts established under collective bargaining agreements. Pension expense is recognized as contributions are made. Under the Employee Retirement Income Security Act, a contributor to a multi-employer plan is liable, upon termination or withdrawal from a plan, for its proportionate share of a plan’s unfunded vested liability. While we currently have no intention of withdrawing from a plan and unfunded pension obligations have not significantly affected our operations in the past, there can be no assurance that we will not be required to make material cash contributions to one or more of these plans to satisfy certain underfunded benefit obligations in the future.

|

|

•

|

Unavailability of insurance coverage could have a negative effect on our operations and results.

We maintain insurance coverage as part of our overall risk management strategy and pursuant to requirements to maintain specific coverage that are contained in our financing agreements and in most of our construction contracts. Although we have been able to obtain reasonably priced insurance coverage to meet our requirements in the past, there is no assurance that we will be able to do so in the future, and our inability to obtain such coverage could have an adverse impact on our ability to procure new work, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

12

|

|||

|

•

|

An inability to obtain bonding could have a negative impact on our operations and results.

As more fully described in “Insurance and Bonding” under “Item 1. Business,” we generally are required to provide surety bonds securing our performance under the majority of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Our joint venture contracts with project owners subject us to joint and several liability

.

As further described in “Joint Ventures; Off-Balance Sheet Arrangements” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” we participate in various construction joint venture partnerships in connection with complex construction projects. If our joint venture partner fails to perform under one of these contracts, we could be liable for completion of the entire contract. If the contract were unprofitable, this could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings.

We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects.

|

|

•

|

We use certain commodity products that are subject to significant price fluctuations.

Diesel fuel, liquid asphalt and other petroleum-based products are used to fuel and lubricate our equipment and fire our asphalt concrete processing plants. In addition, they constitute a significant part of the asphalt paving materials that are used in many of our construction projects and are sold to third parties. Although we are partially protected by asphalt or fuel price escalation clauses in some of our contracts, many contracts provide no such protection. We also use steel and other commodities in our construction projects that can be subject to significant price fluctuations. We pre-purchase commodities, enter into supply agreements or enter into financial contracts to secure pricing. We have not been significantly adversely affected by price fluctuations in the past; however, there is no guarantee that we will not be in the future.

|

|

•

|

Increasing restrictions on securing aggregate reserves could negatively affect our future operations and results.

Tighter regulations and the finite nature of property containing suitable aggregate reserves are making it increasingly challenging and costly to secure aggregate reserves. Although we have thus far been able to secure reserves to support our business, our financial position, results of operations, cash flows and liquidity may be adversely affected by an increasingly difficult permitting process.

|

|

•

|

Granite Land Company is greatly affected by the strength of the real estate industry.

Our real estate investment and development activities are subject to numerous factors beyond our control including local real estate market conditions; substantial existing and potential competition; general national, regional and local economic conditions; fluctuations in interest rates and mortgage availability and changes in demographic conditions. If our outlook for a project’s forecasted profitability deteriorates, we may find it necessary to curtail our development activities and evaluate our real estate assets for possible impairment. Our evaluation includes a variety of estimates and assumptions and future changes in these estimates and assumptions could affect future impairment analyses. If our real estate assets are determined to be impaired, the impairment would result in a write-down of the asset in the period of the impairment. See Notes 7 and 11 of “Notes to the Consolidated Financial Statements” for additional information on impairment charges.

|

|

13

|

|||

|

•

|

Our real estate investments are subject to mortgage financing and may require additional funding.

Granite Land Company’s real estate investments generally utilize short-term debt financing for their development activities. Such financing is subject to the terms of the applicable debt or credit agreement and generally is secured by mortgages on the applicable real property. GLC’s failure to comply with the covenants applicable to such financing or to pay principal, interest or other amounts when due thereunder would constitute an event of default under the applicable agreement and could have the effects described in the following risk factor relating to our debt and credit agreements. Due to the tightening of the credit markets, banks have required lower loan-to-value ratios often resulting in the need to pay a portion of the debt when short-term financing is renegotiated. If our real estate investment partners are unable to make their proportional share of a required repayment, GLC may elect to provide the additional funding which could materially affect our financial position, cash flows and liquidity. Also, if we determine we are the primary beneficiary, as defined by the applicable accounting guidance, we may be required to consolidate additional real estate investments in our financial statements.

|

|

•

|

Failure to remain in compliance with covenants under our debt and credit agreements, service our indebtedness, or fund our other liquidity needs could adversely impact our business.

The current recession and credit crisis and related turmoil in the global financial system has had and is expected to continue to have an adverse impact on our business, financial position, results of operations, cash flows and liquidity. Our debt and credit agreements and related restrictive covenants are more fully described in Note 12 of “Notes to the Consolidated Financial Statements.” Our failure to comply with any of these covenants, or to pay principal, interest or other amounts when due thereunder, would constitute an event of default under the applicable agreements. Under certain circumstances, the occurrence of an event of default under one of our debt or credit agreements (or the acceleration of the maturity of the indebtedness under one of our agreements) may constitute an event of default under one or more of our other debt or credit agreements. Default under our debt and credit agreements could result in (1) us no longer being entitled to borrow under the agreements, (2) termination of the agreements, (3) the requirement that any letters of credit under the agreements be cash collateralized, (4) acceleration of the maturity of outstanding indebtedness under the agreements and/or (5) foreclosure on any collateral securing the obligations under the agreements. If we are unable to service our debt obligations or fund our other liquidity needs, we could be forced to curtail our operations, reorganize our capital structure (including through bankruptcy proceedings) or liquidate some or all of our assets in a manner that could cause holders of our securities to experience a partial or total loss of their investment in us.

|

|

•

|

As a part of our growth strategy we may make future acquisitions and acquisitions involve many risks.

These risks include difficulties integrating the operations and personnel of the acquired companies, diversion of management’s attention from ongoing operations, potential difficulties and increased costs associated with completion of any assumed construction projects, insufficient revenues to offset increased expenses associated with acquisitions and the potential loss of key employees or customers of the acquired companies. Acquisitions may also cause us to increase our liabilities, record goodwill or other non-amortizable intangible assets that will be subject to subsequent impairment testing and potential impairment charges, as well as amortization expenses related to certain other intangible assets. Failure to manage and successfully integrate acquisitions could harm our financial position, results of operations, cash flows and liquidity.

|

|

•

|

Changes to our outsourced software vendors as well as any sudden loss, breach of security, disruption or unexpected data or vendor loss associated with our information technology systems could have a material adverse effect on our business.

We rely on third-party software to run critical accounting, project management and financial information systems. If software vendors decide to discontinue further development, integration or long-term software maintenance support for our information systems, or there is any system interruption, delay, breach of security, loss of data or loss of a vendor, we may need to migrate some or all of our accounting, project management and financial information to other systems. Despite business continuity plans, these disruptions could increase our operational expense as well as impact the management of our business operations, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

|

|

•

|

An inability to safeguard our information technology environment could result in business interruptions, remediation costs and/or legal claims

.

To protect confidential customer, vendor, financial and employee information, we employ information security measures that secure our information systems from cybersecurity attacks or breaches. Even with these measures, we may be subject to unauthorized access of digital data with the intent to misappropriate information, corrupt data or cause operational disruptions. If a failure of our safeguarding measures were to occur, it could have a negative impact to our business and result in business interruptions, remediation costs and/or legal claims, which could have a material adverse effect on our financial position, results of operations, cash flow and liquidity.

|

|

14

|

|||

|

15

|

|||

|

|

Type

|

|

||||

|

Quarry Properties

|

Sand & Gravel

|

Hard Rock

|

Permitted Aggregate Reserves (tons)

|

Unpermitted Aggregate Reserves (tons)

|

Three-Year Annual Average Production Rate (tons)

|

Average Reserve Life

|

|

Owned quarry properties

|

31

|

5

|

436.7

|

416.8

|

5.7

|

75 years

|

|

Leased quarry properties

1

|

27

|

17

|

308.2

|

403.8

|

5.5

|

54 years

|

|

|

|

Permitted Reserves

for Each Product Type (tons)

|

Percentage of Permitted Reserves Owned and Leased

|

||||

|

State

|

Number of Properties

|

Sand & Gravel

|

Hard Rock

|

Owned

|

Leased

|

||

|

California

|

41

|

262.2

|

247.5

|

59

|

%

|

41

|

%

|

|

Non-California

|

39

|

150.7

|

84.5

|

58

|

%

|

42

|

%

|

|

December 31,

|

2011

|

2010

|

||

|

Aggregate crushing plants

|

48

|

|

50

|

|

|

Asphalt concrete plants

|

62

|

|

66

|

|

|

Portland cement concrete batch plants

|

20

|

|

21

|

|

|

Asphalt rubber plants

|

5

|

|

5

|

|

|

Lime slurry plants

|

9

|

|

9

|

|

|

|

Land Area (acres)

|

Building Square Feet

|

|

Office and shop space (owned and leased)

|

1,700

|

1,200,000

|

|

Real estate held for development and sale and use

|

3,400

|

3,600

|

|

16

|

|||

|

•

|

US Highway 20 Project:

Our wholly owned subsidiaries, Granite Construction Company (“GCCO”) and Granite Northwest, Inc., are members of a joint venture known as Yaquina River Constructors (“YRC”) which is contracted by the Oregon Department of Transportation (“ODOT”) to construct a new road alignment of US Highway 20 near Eddyville, Oregon. The project involves constructing seven miles of new road through steep and forested terrain in the Coast Range Mountains. During the fall and winter of 2006, extraordinary rain events produced runoff that overwhelmed installed erosion control measures and resulted in discharges to surface water and alleged violations of YRC’s stormwater permit. In June 2009, YRC was informed that the U.S. Department of Justice (“USDOJ”) had assumed the criminal investigation that the Oregon Department of Justice had initiated in connection with stormwater runoff from the project. Although the USDOJ has informed YRC that the USDOJ will not criminally charge YRC or any Granite affiliate in connection with these matters, the USDOJ informed YRC it was continuing to seek an unspecified civil penalty. Under certain circumstances the resolution of this matter could have direct or indirect consequences that could have a material adverse effect on our financial position, results of operations, cash flow and/or liquidity.

|

|

•

|

Grand Avenue Project DBE Issues:

On March 6, 2009, the U.S. Department of Transportation, Office of Inspector General (“OIG”) served upon our wholly-owned subsidiary, Granite Construction Northeast, Inc. (“Granite Northeast”), a United States District Court Eastern District of New York subpoena to testify before a grand jury by producing documents. The subpoena seeks all documents pertaining to the use of a DBE firm (the “Subcontractor”), and the Subcontractor’s use of a non-DBE lower tier subcontractor/consultant, on the Grand Avenue Bus Depot and Central Maintenance Facility for the Borough of Queens Project (the “Grand Avenue Project”), a Granite Northeast project. The subpoena also seeks any documents regarding the use of the Subcontractor as a DBE on any other projects and any other documents related to the Subcontractor or to the lower-tier subcontractor/consultant. We have received two follow-up requests from the USDOJ for additional information and documents. We have complied with the subpoena and the requests, and are fully cooperating with the OIG’s investigation. To date, Granite Northeast has not been notified that it is either a subject or target of the OIG’s investigation. Accordingly, we do not know whether any criminal charges or civil lawsuits will be brought against any party as a result of the investigation. We cannot, however, rule out the possibility of civil or criminal actions or administrative sanctions being brought against Granite Northeast.

|

|

•

|

Other Legal Proceedings/Government Inquiries:

We are a party to a number of other legal proceedings arising in the normal course of business. From time to time, we also receive inquiries from public agencies seeking information concerning our compliance with government construction contracting requirements and related laws and regulations. We believe that the nature and number of these proceedings and compliance inquiries are typical for a construction firm of our size and scope. Our litigation typically involves claims regarding public liability or contract related issues. While management currently believes, after consultation with counsel, that the ultimate outcome of pending proceedings and compliance inquiries, individually and in the aggregate, will not have a material adverse affect on our financial position or results of operations or cash flows, litigation is subject to inherent uncertainties. Were one or more unfavorable rulings to occur, there exists the possibility of a material adverse effect on our financial position, results of operations, cash flows and/or liquidity for the period in which the ruling occurs. In addition, our government contracts could be terminated, we could be suspended or debarred, or payment of our costs disallowed. While any one of our pending legal proceedings is subject to early resolution as a result of our ongoing efforts to settle, whether or when any legal proceeding will be resolved through settlement is neither predictable nor guaranteed.

|

|

17

|

|||

|

Market Price and Dividends of Common Stock

|

|

|

||||||||||

|

2011 Quarters Ended

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

||||||||

|

High

|

$

|

26.78

|

|

$

|

26.08

|

|

$

|

28.75

|

|

$

|

29.68

|

|

|

Low

|

$

|

17.52

|

|

$

|

16.92

|

|

$

|

23.58

|

|

$

|

24.33

|

|

|

Dividends per share

|

$

|

0.13

|

|

$

|

0.13

|

|

$

|

0.13

|

|

$

|

0.13

|

|

|

2010 Quarters Ended

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

||||||||

|

High

|

$

|

29.73

|

|

$

|

25.09

|

|

$

|

34.58

|

|

$

|

36.00

|

|

|

Low

|

$

|

22.51

|

|

$

|

21.22

|

|

$

|

23.53

|

|

$

|

27.14

|

|

|

Dividends per share

|

$

|

0.13

|

|

$

|

0.13

|

|

$

|

0.13

|

|

$

|

0.13

|

|

|

Period

|

Total Number of Shares Purchased

1

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May yet be Purchased Under the Plans or Programs

2

|

|||||

|

October 1 through October 31, 2011

|

2,052

|

|

$

|

18.77

|

|

—

|

$

|

64,065,401

|

|

|

November 1 through November 30, 2011

|

1,703

|

|

$

|

24.89

|

|

—

|

$

|

64,065,401

|

|

|

December 1 through December 31, 2011

|

2,130

|

|

$

|

24.82

|

|

—

|

$

|

64,065,401

|

|

|

Total

|

5,885

|

|

$

|

22.73

|

|

—

|

|

||

|

18

|

|||

|

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

||||||||||||

|

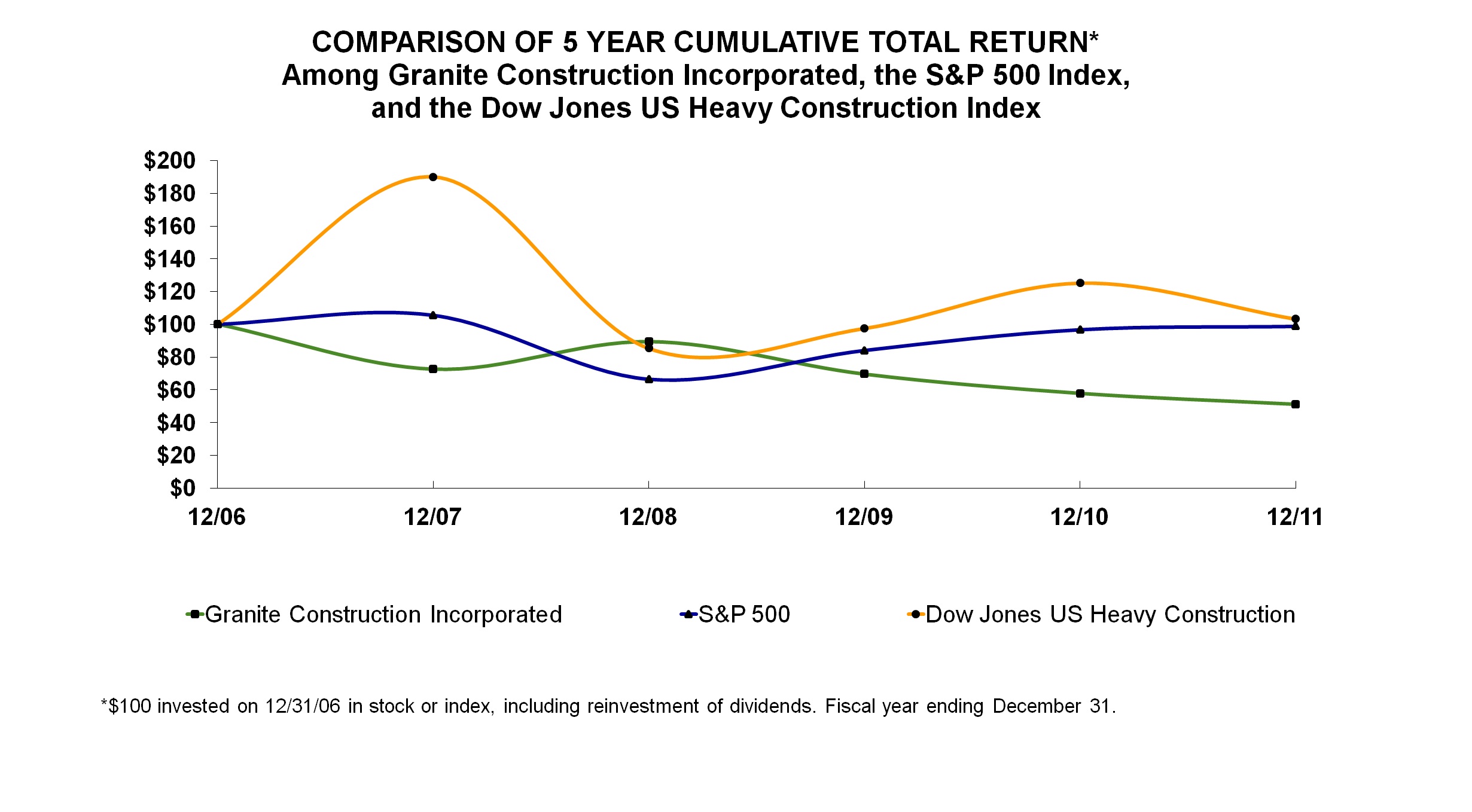

Granite Construction Incorporated

|

$

|

100.00

|

|

$

|

72.52

|

|

$

|

89.37

|

|

$

|

69.51

|

|

$

|

57.78

|

|

$

|

51.10

|

|

|

S&P 500

|

100.00

|

|

105.49

|

|

66.46

|

|

84.05

|

|

96.71

|

|

98.75

|

|

||||||

|

Dow Jones U.S. Heavy Construction

|

100.00

|

|

189.96

|

|

85.25

|

|

97.44

|

|

125.12

|

|

103.15

|

|

||||||

|

19

|

|||

|

Selected Consolidated Financial Data

|

|||||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||

|

Operating Summary

|

(Dollars In Thousands, Except Per Share Data)

|

||||||||||||||

|

Revenue

|

$

|

2,009,531

|

|

$

|

1,762,965

|

|

$

|

1,963,479

|

|

$

|

2,674,244

|

|

$

|

2,737,914

|

|

|

Gross profit

|

247,963

|

|

177,784

|

|

349,509

|

|

471,949

|

|

410,744

|

|

|||||

|

As a percent of revenue

|

12.3

|

%

|

10.1

|

%

|

17.8

|

%

|

17.6

|

%

|

15.0

|

%

|

|||||

|

Selling, general and administrative expenses

|

162,302

|

|

191,593

|

|

228,046

|

|

260,761

|

|

246,202

|

|

|||||

|

As a percent of revenue

|

8.1

|

%

|

10.9

|

%

|

11.6

|

%

|

9.8

|

%

|

9.0

|

%

|

|||||

|

Restructuring charges

1

|

2,181

|

|

109,279

|

|

9,453

|

|

—

|

|

—

|

|

|||||

|

Net income (loss)

|

66,085

|

|

(62,448

|

)

|

100,201

|

|

165,738

|

|

132,924

|

|

|||||

|

Amount attributable to noncontrolling interests

2

|

(14,924

|

)

|

3,465

|

|

(26,701

|

)

|

(43,334

|

)

|

(20,859

|

)

|

|||||

|

Net income (loss) attributable to Granite

|

51,161

|

|

(58,983

|

)

|

73,500

|

|

122,404

|

|

112,065

|

|

|||||

|

As a percent of revenue

|

2.5

|

%

|

-3.3

|

%

|

3.7

|

%

|

4.6

|

%

|

4.1

|

%

|

|||||

|

Net income (loss) per share attributable to

common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Basic

|

$

|

1.32

|

|

$

|

(1.56

|

)

|

$

|

1.91

|

|

$

|

3.19

|

|

$

|

2.69

|

|

|

Diluted

|

$

|

1.31

|

|

$

|

(1.56

|

)

|

$

|

1.90

|

|

$

|

3.18

|

|

$

|

2.68

|

|

|

Weighted average shares of common stock:

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Basic

|

38,117

|

|

37,820

|

|

37,566

|

|

37,606

|

|

40,866

|

|

|||||

|

Diluted

|

38,473

|

|

37,820

|

|

37,683

|

|

37,709

|

|

40,909

|

|

|||||

|

Dividends per common share

|

$

|

0.52

|

|

$

|

0.52

|

|

$

|

0.52

|

|

$

|

0.52

|

|

$

|

0.43

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Total assets

|

$

|

1,547,799

|

|

$

|

1,535,533

|

|

$

|

1,709,575

|

|

$

|

1,743,455

|

|

$

|

1,786,418

|

|

|

Cash, cash equivalents and marketable securities

|

406,648

|

|

395,728

|

|

458,341

|

|

520,402

|

|

485,348

|

|

|||||

|

Working capital

|

461,254

|

|

475,079

|

|

500,605

|

|

475,942

|

|

397,568

|

|

|||||

|

Current maturities of long-term debt

|

32,173

|

|

38,119

|

|

58,978

|

|

39,692

|

|

28,696

|

|

|||||

|

Long-term debt

|

218,413

|

|

242,351

|

|

244,688

|

|

250,687

|

|

268,417

|

|

|||||

|

Other long-term liabilities

|

49,221

|

|

47,996

|

|

48,998

|

|

43,604

|

|

46,441

|

|

|||||

|

Granite shareholders’ equity

|

799,197

|

|

761,031

|

|

830,651

|

|

767,509

|

|

700,199

|

|

|||||

|

Book value per share

|

20.66

|

|

19.64

|

|

21.50

|

|

20.06

|

|

17.75

|

|

|||||

|

Common shares outstanding

|

38,683

|

|

38,746

|

|

38,635

|

|

38,267

|

|

39,451

|

|

|||||

|

Contract backlog

|

$

|

2,022,454

|

|

$

|

1,899,170

|

|

$

|

1,401,988

|

|

$

|

1,699,396

|

|

$

|

2,084,545

|

|

|

20

|

|||

|

21

|

|||

|

22

|

|||

|

•

|

the completeness and accuracy of the original bid;

|

|

•

|

costs associated with added scope changes;

|

|

•

|

costs of labor and/or materials;

|

|

•

|

extended overhead due to owner, weather and other delays;

|

|

•

|

subcontractor performance issues;

|

|

•

|

changes in productivity expectations;

|

|

•

|

site conditions that differ from those assumed in the original bid (to the extent contract remedies are unavailable);

|

|

•

|

the availability and skill level of workers in the geographic location of the project; and

|

|

•

|

a change in the availability and proximity of equipment and materials.

|

|

23

|

|||

|

•

|

significant decreases in the market price of the asset;

|

|

•

|

significant adverse changes in legal factors or the business climate;

|

|

•

|

significant changes to the development or business plans of a project;

|

|

•

|

accumulation of costs significantly in excess of the amount originally expected for the acquisition, development or construction of the asset; and

|

|

•

|

current period cash flow or operating losses combined with a history of losses, or a forecast of continuing losses associated with the use of the asset.

|

|

24

|

|||

|

Comparative Financial Summary

|

||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||

|

(in thousands)

|

||||||||||||

|

Total revenue

|

$

|

2,009,531

|

|

$

|

1,762,965

|

|

$

|

1,963,479

|

|

|||

|

Gross profit

|

247,963

|

|

177,784

|

|

349,509

|

|

||||||

|

Selling, general and administrative expenses

|

162,302

|

|

191,593

|

|

228,046

|

|

||||||

|

Restructuring charges

|

2,181

|

|

109,279

|

|

9,453

|

|

||||||

|

Net income (loss)

|

66,085

|

|

(62,448

|

)

|

100,201

|

|

||||||

|

Amount attributable to noncontrolling interests

|

(14,924

|

)

|

3,465

|

|

(26,701

|

)

|

||||||

|

Net income (loss) attributable to Granite Construction Incorporated

|

51,161

|

|

(58,983

|

)

|

73,500

|

|

||||||

|

25

|

|||

|

Total Revenue by Segment

|

||||||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||||||

|

(dollars in thousands)

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

|||||||

|

Construction

|

$

|

1,043,614

|

|

51.9

|

$

|

943,245

|

|

53.5

|

$

|

1,151,743

|

|

58.7

|

||||

|

Large Project Construction

|

725,043

|

|

36.1

|

584,406

|

|

33.1

|

603,517

|

|

30.7

|

|||||||

|

Construction Materials

|

220,583

|

|

11.0

|

222,058

|

|

12.6

|

205,945

|

|

10.5

|

|||||||

|

Real Estate

|

20,291

|

|

1.0

|

13,256

|

|

0.8

|

2,274

|

|

0.1

|

|||||||

|

Total

|

$

|

2,009,531

|

|

100.0

|

$

|

1,762,965

|

|

100.0

|

$

|

1,963,479

|

|

100.0

|

||||

|

Construction Revenue

|

||||||||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||||||||

|

(dollars in thousands)

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||||||

|

California:

|

|

|

|

|

|

|

||||||||||||

|

Public sector

|

$

|

464,789

|

|

44.4

|

$

|

358,723

|

|

38.0

|

$

|

438,392

|

|

38.1

|

||||||

|

Private sector

|

46,694

|

|

4.5

|

32,139

|

|

3.4

|

35,311

|

|

3.1

|

|||||||||

|

Northwest:

|

|

|

|

|||||||||||||||

|

Public sector

|

386,783

|

|

37.1

|

421,397

|

|

44.7

|

521,447

|

|

45.3

|

|||||||||

|

Private sector

|

36,072

|

|

3.5

|

24,334

|

|

2.6

|

32,487

|

|

2.8

|

|||||||||

|

East:

|

|

|

||||||||||||||||

|

Public sector

|

107,693

|

|

10.3

|

103,398

|

|

11.0

|

117,991

|

|

10.2

|

|||||||||

|

Private sector

|

1,583

|

|

0.2

|

3,254

|

|

0.3

|

6,115

|

|

0.5

|

|||||||||

|

Total

|

$

|

1,043,614

|

|

100.0

|

$

|

943,245

|

|

100.0

|

$

|

1,151,743

|

|

100.0

|

||||||

|

Large Project Construction Revenue

1

|

||||||||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||||||||

|

(dollars in thousands)

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

|||||||||

|

California

|

$

|

78,464

|

|

10.8

|

$

|

49,408

|

|

8.5

|

$

|

52,885

|

|

8.8

|

||||||

|

Northwest

|

201,240

|

|

27.8

|

52,510

|

|

9.0

|

55,457

|

|

9.2

|

|||||||||

|

East

|

445,339

|

|

61.4

|

482,488

|

|

82.5

|

495,175

|

|

82.0

|

|||||||||

|

Total

|

$

|

725,043

|

|

100.0

|

$

|

584,406

|

|

100.0

|

$

|

603,517

|

|

100.0

|

||||||

|

26

|

|||

|

Construction Materials Revenue

|

||||||||||||||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||||||||

|

(dollars in thousands)

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

Amount

|

|

Percent

|

|||||||||

|

California

|

$

|

140,468

|

|

63.7

|

$

|

136,314

|

|

61.4

|

$

|

127,649

|

|

62.0

|

||||||

|

Northwest

|

62,406

|

|

28.3

|

64,966

|

|

29.2

|

63,171

|

|

30.7

|

|||||||||

|

East

|

17,709

|

|

8.0

|

20,778

|

|

9.4

|

15,125

|

|

7.3

|

|||||||||

|

Total

|

$

|

220,583

|

|

100.0

|

$

|

222,058

|

|

100.0

|

$

|

205,945

|

|

100.0

|

||||||

|

Total Contract Backlog by Segment

|

|

|||||||||||

|

December 31,

|

2011

|

2010

|

||||||||||

|

(dollars in thousands)

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||

|

Construction

|

$

|

513,624

|

|

25.4

|

$

|

465,271

|

|

24.5

|

||||

|

Large Project Construction

|

1,508,830

|

|

74.6

|

1,433,899

|

|

75.5

|

||||||

|

Total

|

$

|

2,022,454

|

|

100.0

|

$

|

1,899,170

|

|

100.0

|

||||

|

27

|

|||

|

Construction Contract Backlog

|

|

|

||||||||||

|

December 31,

|

2011

|

2010

|

||||||||||

|

(dollars in thousands)

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||

|

California:

|

|

|

|

|

||||||||

|

Public sector

|

$

|

311,975

|

|

60.7

|

$

|

185,115

|

|

39.9

|

||||

|

Private sector

|

10,899

|

|

2.1

|

15,054

|

|

3.2

|

||||||

|

Northwest:

|

|

|

|

|

||||||||

|

Public sector

|

148,030

|

|

28.8

|

181,996

|

|

39.1

|

||||||

|

Private sector

|

26,543

|

|

5.2

|

13,941

|

|

3.0

|

||||||

|

East:

|

|

|

|

|

||||||||

|

Public sector

|

13,163

|

|

2.6

|

68,508

|

|

14.7

|

||||||

|

Private sector

|

3,014

|

|

0.6

|

657

|

|

0.1

|

||||||

|

Total

|

$

|

513,624

|

|

100.0

|

$

|

465,271

|

|

100.0

|

||||

|

Large Project Construction Contract Backlog

1

|

|

|

||||||||||

|

December 31,

|

2011

|

2010

|

||||||||||

|

(dollars in thousands)

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||

|

California

|

$

|

214,698

|

|

14.2

|

$

|

166,084

|

|

11.6

|

||||

|

Northwest

|

397,957

|

|

26.4

|

501,297

|

|

34.9

|

||||||

|

East

|

896,175

|

|

59.4

|

766,518

|

|

53.5

|

||||||

|

Total

|

$

|

1,508,830

|

|

100.0

|

$

|

1,433,899

|

|

100.0

|

||||

|

28

|

|||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||

|

(dollars in thousands)

|

||||||||||||

|

Construction

|

$

|

124,506

|

|

$

|

95,709

|

|

$

|

209,487

|

|

|||

|

Percent of segment revenue

|

11.9

|

%

|

10.1

|

%

|

18.2

|

%

|

||||||

|

Large Project Construction

|

104,108

|

|

67,307

|

|

120,100

|

|

||||||

|

Percent of segment revenue

|

14.4

|

%

|

11.5

|

%

|

19.9

|

%

|

||||||

|

Construction Materials

|

16,641

|

|

12,018

|

|

21,240

|

|

||||||

|

Percent of segment revenue

|

7.5

|

%

|

5.4

|

%

|

10.3

|

%

|

||||||

|

Real Estate

|

2,708

|

|

2,750

|

|

(1,318

|

)

|

||||||

|

Percent of segment revenue

|

13.3

|

%

|

20.7

|

%

|

-58.0

|

%

|

||||||

|

Total gross profit

|

$

|

247,963

|

|

$

|

177,784

|

|

$

|

349,509

|

|

|||

|

Percent of total revenue

|

12.3

|

%

|

10.1

|

%

|

17.8

|

%

|

||||||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||

|

(in thousands)

|

||||||||||||

|

Construction

|

$

|

10,363

|

|

$

|

13,697

|

|

$

|

5,729

|

|

|||

|

Large Project Construction

|

38,542

|

|

142,965

|

|

63,033

|

|

||||||

|

Total revenue from contracts with deferred profit

|

$

|

48,905

|

|

$

|

156,662

|

|

$

|

68,762

|

|

|||

|

29

|

|||

|

30

|

|||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||

|

(dollars in thousands)

|

||||||||||||

|

Selling

|

|

|

|

|

|

|

||||||

|

Salaries and related expenses

|

$

|

33,342

|

|

$

|

40,332

|

|

$

|

44,672

|

|

|||

|

Other selling expenses

|

9,066

|

|

12,944

|

|

14,009

|

|

||||||

|

Total selling

|

42,408

|

|

53,276

|

|

58,681

|

|

||||||

|

General and administrative

|

|

|

|

|

|

|

||||||

|

Salaries and related expenses

|

51,041

|

|

65,127

|

|

76,333

|

|

||||||

|

Restricted stock amortization and incentive compensation

|

23,925

|

|

21,664

|

|

34,602

|

|

||||||

|

Other general and administrative expenses

|

44,928

|

|

51,526

|

|

58,430

|

|

||||||

|

Total general and administrative

|

119,894

|

|

138,317

|

|

169,365

|

|

||||||

|

Total selling, general and administrative

|

$

|

162,302

|

|

$

|

191,593

|

|

$

|

228,046

|

|

|||

|

Percent of revenue

|

8.1

|

%

|

10.9

|

%

|

11.6

|

%

|

||||||

|

31

|

|||

|

Years ended December 31,

|

2011

|

2010

|

2009

|

||||||

|

(in thousands)

|

|||||||||

|

Impairment and other charges associated with our real estate investments

|

$

|

1,452

|

|

$

|

86,341

|

|

$

|

—

|

|

|

Severance costs

|

471

|

|

12,635

|

|

6,943

|

|

|||

|

Impairment charges on assets held-for-sale or abandoned

|

226

|

|

7,521

|

|

1,449

|

|

|||

|

Lease termination costs, net of estimated sublease income

|

32

|

|

2,782

|

|

1,061

|

|

|||

|

Total

|

$

|

2,181

|

|

$

|

109,279

|

|

$

|

9,453

|

|

|

32

|

|||

|

Years Ended December 31,

|

2011

|

|

2010

|

|

2009

|

|||||||

|

(in thousands)

|

||||||||||||

|

Interest income

|

$

|

2,878

|

|

$

|

4,980

|

|

$

|

5,049

|

|

|||

|

Interest expense

|

(10,362

|

)

|

(9,740

|

)

|

(15,756

|

)

|

||||||

|

Equity in income of affiliates

|

2,193

|

|

756

|

|

7,696

|

|

||||||

|

Other (expense) income, net

|

(4,545

|

)

|

6,968

|

|

12,683

|

|

||||||

|

Total other (expense) income

|

$

|

(9,836

|

)

|

$

|

2,964

|

|

$

|

9,672

|

|

|||

|

Years Ended December 31,

|

2011

|

|

2010

|

|

2009

|

|||||||

|

(dollars in thousands)

|

||||||||||||

|

Provision for (benefit from) income taxes

|

$

|

23,348

|

|

$

|

(43,928

|

)

|

$

|

38,650

|

|

|||

|

Effective tax rate

|

26.1

|

%

|

41.3

|

%

|

27.8

|

%

|

||||||

|

Years Ended December 31,

|

2011

|

|

2010

|

|

2009

|

|||||||

|

(in thousands)

|

||||||||||||

|

Amount attributable to noncontrolling interests

|

$

|

(14,924

|

)

|

$

|

3,465

|

|

$

|

(26,701

|

)

|

|||

|

33

|

|||

|

34

|

|||

|

35

|

|||

|

December 31,

|

2011

|

2010

|

||||||

|

(in thousands)

|

||||||||

|

Cash and cash equivalents excluding consolidated joint ventures

|

$

|

181,868

|

|

$

|

142,642

|

|

||

|

Consolidated construction joint venture cash and cash equivalents

1

|

75,122

|

|

109,380

|

|

||||

|

Total consolidated cash and cash equivalents

|

256,990

|

|

252,022

|

|

||||

|

Short-term and long-term marketable securities

2

|

149,658

|

|

143,706

|

|

||||

|

Total cash, cash equivalents and marketable securities

|

$

|

406,648

|

|

$

|

395,728

|

|

||

|

Years Ended December 31,

|

2011

|

2010

|

2009

|

|||||||||

|

(in thousands)

|

||||||||||||

|

Net cash provided by (used in):

|

|

|

||||||||||

|

Operating activities

|

$

|

92,345

|

|

$

|

29,318

|

|

$

|

64,301

|

|

|||

|

Investing activities

|

(27,728

|

)

|

(60,435

|

)

|

(129,879

|

)

|

||||||

|

Financing activities

|

(59,649

|

)

|

(55,817

|

)

|

(56,309

|

)

|

||||||

|

36

|

|||

|

|

Payments Due by Period

|

||||||||||||||

|

(in thousands)

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

More than 5 years

|

||||||||||

|

Long-term debt - principal

|

$

|

250,586

|

|

$

|

32,173

|

|

$

|

18,265

|

|

$

|

80,046

|

|

$

|

120,102

|

|

|

Long-term debt - interest

1

|

75,746

|

|

13,765

|

|

25,295

|

|

22,011

|

|

14,675

|

|

|||||

|

Operating leases

2

|

36,134

|

|

5,836

|

|

9,743

|

|

7,017

|

|

13,538

|

|

|||||

|

Other purchase obligations

3

|

5,494

|

|

4,125

|

|

1,369

|

|

—

|

|

—

|

|

|||||

|

Deferred compensation obligations

4

|

25,076

|

|

2,235

|

|

6,179

|

|

3,871

|

|

12,791

|

|

|||||

|

Total

|

$

|

393,036

|

|

$

|

58,134

|

|

$

|

60,851

|

|

$

|

112,945

|

|

$

|

161,106

|

|

|

•

|

approximately

$2.3 million

associated with uncertain tax positions filed on our tax returns were excluded because we cannot make a reasonably reliable estimate of the timing of potential payments relative to such reserves; and

|

|

•

|

asset retirement obligations of

$23.2 million

associated with our owned and leased quarry properties were excluded because the majority of them have an estimated settlement date beyond five years (see Note 8 of “Notes to the Consolidated Financial Statements”)

|

|

37

|

|||

|

38

|

|||

|

39

|

|||

|

40

|

|||

|

December 31,

|

2011

|

||

|

Principal payments due in nine equal installments that began in 2005, 6.96%

|

$

|

16.7

|

|

|

Principal payments due in five equal installments beginning in 2015, 6.11%

|

200.0

|

|

|

|

Total

|

$

|

216.7

|

|

|

|

2012

|

2013

|

2014

|

2015

|

2016

|

Thereafter

|

Total

|

||||||||||||||

|

Assets

|

|

|

|

|

|

|

|

||||||||||||||

|

Cash, cash equivalents, held-to-maturity and trading investments

|

$

|

327,398

|

|

$

|

29,250

|

|

$

|

15,000

|

|

$

|

25,000

|

|

$

|

10,000

|

|

$

|

—

|

|

$

|

406,648

|

|

|

Weighted average interest rate

|

0.45

|

%

|

0.78

|

%

|

0.71

|

%

|

1.07

|

%

|

1.45

|

%

|

—

|

%

|

0.55

|

%

|

|||||||

|

Liabilities

|

|||||||||||||||||||||

|

Fixed rate debt

|

|||||||||||||||||||||

|

Senior notes payable

|

$

|

8,333

|

|

$

|

8,333

|

|

$

|

—

|

|

$

|

40,000

|

|

$

|

40,000

|

|

$

|

120,000

|

|

$

|

216,666

|

|

|

Weighted average interest rate

|

6.96

|

%

|

6.96

|

%

|

—

|

%

|

6.11

|

%

|

6.11

|

%

|

6.11

|

%

|

6.18

|

%

|

|||||||

|

41

|

|||

|

42

|

|||

|

43

|

|||

|

Financial Statements

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Consolidated Balance Sheets at December 31, 2011 and 2010

|

F-2

|

|

Consolidated Statements of Operations for the Years Ended December 31, 2011, 2010 and 2009

|

F-3

|

|

Consolidated Statements of Shareholders’ Equity and Comprehensive Income (Loss) for the Years Ended December 31, 2011, 2010 and 2009

|

F-4

|

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2011, 2010 and 2009

|

F-5 to F-6

|

|