|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

75-2677995

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

3000 North Sam Houston Parkway East

|

|

|

Houston, Texas 77032

|

|

|

(Address of principal executive offices)

|

|

|

Telephone Number – Area code (281) 871-2699

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Name of each exchange on

|

|

|

Title of each class

|

which registered

|

|

Common Stock par value $2.50 per share

|

New York Stock Exchange

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

|

|

PAGE

|

||

|

-

|

our Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift, and completion products and services. The segment consists of Production Enhancement, Cementing, Completion Tools, Production Solutions, Pipeline and Process Services, Multi-Chem, and Artificial Lift.

|

|

-

|

our Drilling and Evaluation segment provides field and reservoir modeling, drilling, evaluation, and precise wellbore placement solutions that enable customers to model, measure, drill, and optimize their well construction activities. The segment consists of Baroid, Sperry Drilling, Wireline and Perforating, Drill Bits and Services, Landmark Software and Services, Testing and Subsea, and Consulting and Project Management.

|

|

-

|

create a balanced portfolio of services and products supported by global infrastructure and anchored by technological innovation to further differentiate our company;

|

|

-

|

reach a distinguished level of operational excellence that reduces costs and creates real value;

|

|

-

|

preserve a dynamic workforce by being a preferred employer to attract, develop, and retain the best global talent; and

|

|

-

|

uphold our strong ethical and business standards, and maintain the highest standards of health, safety, and environmental performance.

|

|

-

|

price;

|

|

-

|

health, safety, and environmental standards and practices;

|

|

-

|

service quality;

|

|

-

|

global talent retention;

|

|

-

|

understanding the geological characteristics of the hydrocarbon reservoir;

|

|

-

|

product quality;

|

|

-

|

warranty; and

|

|

-

|

technical proficiency.

|

|

-

|

the severity and duration of the winter in North America can have a significant impact on natural gas storage levels and drilling activity;

|

|

-

|

the timing and duration of the spring thaw in Canada directly affects activity levels due to road restrictions;

|

|

-

|

typhoons and hurricanes can disrupt coastal and offshore operations; and

|

|

-

|

severe weather during the winter months normally results in reduced activity levels in the North Sea and Russia.

|

|

Name and Age

|

Offices Held and Term of Office

|

|

|

James S. Brown

(Age 61)

|

President, Western Hemisphere of Halliburton Company, since January 2008

|

|

|

*

|

Christian A. Garcia

(Age 52)

|

Senior Vice President, Finance and Acting Chief Financial Officer of Halliburton Company, since January 2015

|

|

Senior Vice President and Chief Accounting Officer of Halliburton Company, January 2014 to December 2014

|

||

|

Senior Vice President and Treasurer of Halliburton Company, September 2011 to December 2013

|

||

|

Senior Vice President, Investor Relations of Halliburton Company, January 2011 to August 2011

|

||

|

Charles E. Geer, Jr.

(Age 45)

|

Vice President and Corporate Controller of Halliburton Company, since January 2015

|

|

|

Vice President, Finance of Halliburton Company, December 2013 to December 2014

|

||

|

Vice President and Chief Accounting Officer of Select Energy Services, April 2011 to November 2013

|

||

|

Vice President and Principal Accounting Officer of Weatherford International, June 2010 to March 2011

|

||

|

Myrtle L. Jones

(Age 56) |

Senior Vice President, Tax of Halliburton Company, since March 2013

|

|

|

Senior Managing Director of Tax and Internal Audit, Service Corporation International, February 2008 to February 2013

|

||

|

*

|

David J. Lesar

(Age 62)

|

Chairman of the Board and Chief Executive Officer of Halliburton Company, since August 2014

|

|

Chairman of the Board, President, and Chief Executive Officer of Halliburton Company, August 2000 to July 2014

|

||

|

Mark A. McCollum

(Age 56)

|

Executive Vice President and Chief Integration Officer of Halliburton Company, since January 2015

|

|

|

Executive Vice President and Chief Financial Officer of Halliburton Company, January 2008 to December 2014

|

||

|

Timothy M. McKeon

(Age 43) |

Vice President and Treasurer of Halliburton Company, since January 2014

|

|

|

Assistant Treasurer of Halliburton Company, September 2011 to December 2013

|

||

|

Director of Finance, Drilling & Evaluation Division of Halliburton Company, February 2011 to August 2011

|

||

|

Director of Treasury Operations of Halliburton Company, March 2009 to January 2011

|

||

|

*

|

Jeffrey A. Miller

(Age 52)

|

Member of the Board of Directors and President of Halliburton Company, since August 2014

|

|

Executive Vice President and Chief Operating Officer of Halliburton Company, September 2012 to July 2014

|

||

|

Senior Vice President, Global Business Development and Marketing of Halliburton Company, January 2011 to August 2012

|

||

|

*

|

Lawrence J. Pope

(Age 47)

|

Executive Vice President of Administration and Chief Human Resources Officer of Halliburton Company, since January 2008

|

|

Joe D. Rainey

(Age 59) |

President, Eastern Hemisphere of Halliburton Company, since January 2011

|

|

|

*

|

Robb L. Voyles (Age 58)

|

Executive Vice President, Secretary and General Counsel of Halliburton Company, since May 2015

|

|

Executive Vice President and General Counsel of Halliburton Company, January 2014 to April 2015

|

||

|

Senior Vice President, Law of Halliburton Company, September 2013 to December 2013

|

||

|

Partner, Baker Botts L.L.P., January 1989 to August 2013

|

||

|

-

|

we would not realize the anticipated benefits of the acquisition, including, among other things, increased operating efficiencies;

|

|

-

|

the attention of our management will have been diverted to the acquisition rather than to our own operations and the pursuit of other opportunities that could have been beneficial to us;

|

|

-

|

the potential loss of key personnel during the pendency of the acquisition as employees may have experienced uncertainty about their future roles with the combined company;

|

|

-

|

we will have been subject to certain restrictions on the conduct of our business, which may have prevented us from making certain acquisitions or dispositions or pursuing certain business opportunities while the acquisition is pending; and

|

|

-

|

the trading price of our common stock may decline to the extent that the current market prices reflect a market assumption that the acquisition will be completed.

|

|

-

|

further adverse changes in energy market conditions;

|

|

-

|

commodity prices for oil, natural gas and natural gas liquids;

|

|

-

|

production levels;

|

|

-

|

operating results;

|

|

-

|

competitive conditions;

|

|

-

|

laws and regulations affecting the energy business;

|

|

-

|

capital expenditure obligations;

|

|

-

|

higher than expected integration costs;

|

|

-

|

lower than expected synergies; and

|

|

-

|

general economic conditions.

|

|

-

|

make it more difficult for the combined enterprise to pay or refinance its debts as they become due during adverse economic and industry conditions because any decrease in revenues could cause the combined enterprise to not have sufficient cash flows from operations to make its scheduled debt payments;

|

|

-

|

limit the combined enterprise’s flexibility to pursue other strategic opportunities or react to changes in its business and the industry in which it operates and, consequently, place the combined enterprise at a competitive disadvantage to its competitors with less debt;

|

|

-

|

require a substantial portion of the combined enterprise’s cash flows from operations to be used for debt service payments, thereby reducing the availability of its cash flow to fund working capital, capital expenditures, acquisitions, dividend payments and other general corporate purposes;

|

|

-

|

result in a downgrade in the rating of our indebtedness, which could limit our ability to borrow additional funds and increase the interest rates applicable to our indebtedness (after the announcement of the acquisition, Standard & Poor’s Ratings Services placed all of our ratings on negative watch, and all of Baker Hughes’s ratings on negative watch, and in October 2015 Moody's placed all of our ratings on review for downgrade);

|

|

-

|

result in higher interest expense in the event of increases in interest rates since some of our borrowings are, and will continue to be, at variable rates of interest; or

|

|

-

|

require the combined enterprise to repatriate foreign earnings to meet liquidity demands, resulting in a tax payment that may not be accrued for.

|

|

-

|

the inability to successfully integrate the respective businesses of the two companies in a manner that permits the combined company to achieve the cost savings and operating synergies anticipated to result from the acquisition, which could result in the anticipated benefits of the acquisition not being realized partly or wholly in the time frame currently anticipated or at all;

|

|

-

|

lost sales and customers as a result of certain customers of either or both of the two companies deciding not to do business with the combined company, or deciding to decrease their amount of business in order to reduce their reliance on a single company;

|

|

-

|

integrating personnel from the two companies while maintaining focus on providing consistent, high quality products and services;

|

|

-

|

potential unknown liabilities and unforeseen increased expenses, delays or regulatory conditions associated with the acquisition; and

|

|

-

|

performance shortfalls at one or both of the two companies as a result of the diversion of management’s attention caused by completing the acquisition and integrating the companies’ operations.

|

|

-

|

political and economic instability, including:

|

|

-

|

governmental actions that may:

|

|

-

|

the containment and disposal of hazardous substances, oilfield waste, and other waste materials;

|

|

-

|

the importation and use of radioactive materials;

|

|

-

|

the use of underground storage tanks;

|

|

-

|

the use of underground injection wells; and

|

|

-

|

the protection of worker safety both onshore and offshore.

|

|

-

|

administrative, civil, and criminal penalties;

|

|

-

|

revocation of permits to conduct business; and

|

|

-

|

corrective action orders, including orders to investigate and/or clean up contamination.

|

|

-

|

the level of supply and demand for oil and natural gas, especially demand for natural gas in the United States;

|

|

-

|

governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves;

|

|

-

|

weather conditions and natural disasters;

|

|

-

|

worldwide political, military, and economic conditions;

|

|

-

|

the level of oil production by non-OPEC countries and the available excess production capacity within OPEC;

|

|

-

|

oil refining capacity and shifts in end-customer preferences toward fuel efficiency and the use of natural gas;

|

|

-

|

the cost of producing and delivering oil and natural gas; and

|

|

-

|

potential acceleration of the development of alternative fuels.

|

|

-

|

oil and natural gas prices, including volatility of oil and natural gas prices and expectations regarding future prices;

|

|

-

|

the inability of our customers to access capital on economically advantageous terms;

|

|

-

|

the consolidation of our customers;

|

|

-

|

customer personnel changes; and

|

|

-

|

adverse developments in the business or operations of our customers, including write-downs of reserves and borrowing base reductions under customer credit facilities.

|

|

-

|

evacuation of personnel and curtailment of services;

|

|

-

|

weather-related damage to offshore drilling rigs resulting in suspension of operations;

|

|

-

|

weather-related damage to our facilities and project work sites;

|

|

-

|

inability to deliver materials to jobsites in accordance with contract schedules;

|

|

-

|

decreases in demand for natural gas during unseasonably warm winters; and

|

|

-

|

loss of productivity.

|

|

-

|

foreign currency exchange risks resulting from changes in foreign currency exchange rates and the implementation of exchange controls; and

|

|

-

|

limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations in other countries.

|

|

-

|

any acquisitions would result in an increase in income or provide an adequate return of capital or other anticipated benefits;

|

|

-

|

any acquisitions would be successfully integrated into our operations and internal controls;

|

|

-

|

the due diligence conducted prior to an acquisition would uncover situations that could result in financial or legal exposure, including under the FCPA, or that we will appropriately quantify the exposure from known risks;

|

|

-

|

any disposition would not result in decreased earnings, revenue, or cash flow;

|

|

-

|

use of cash for acquisitions would not adversely affect our cash available for capital expenditures and other uses;

|

|

-

|

any dispositions, investments, or acquisitions, including integration efforts, would not divert management resources; or

|

|

-

|

any dispositions, investments, or acquisitions would not have a material adverse effect on our liquidity, consolidated results of operations, or consolidated financial condition.

|

|

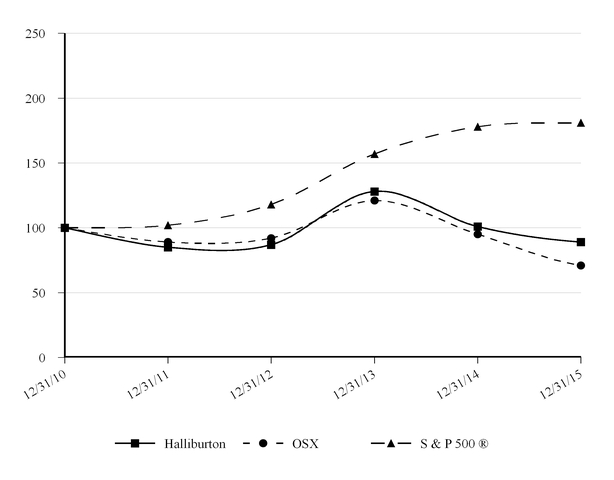

December 31

|

||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

|||||||||||||

|

Halliburton

|

$

|

100.00

|

|

$

|

85.31

|

|

$

|

86.73

|

|

$

|

128.36

|

|

$

|

100.63

|

|

$

|

88.69

|

|

|

Philadelphia Oil Service Index (OSX)

|

100.00

|

|

89.45

|

|

92.26

|

|

121.15

|

|

95.32

|

|

71.30

|

|

||||||

|

Standard & Poor’s 500 ® Index

|

100.00

|

|

102.11

|

|

118.45

|

|

156.82

|

|

178.28

|

|

180.75

|

|

||||||

|

Period

|

Total Number

of Shares Purchased (a) |

Average

Price Paid per Share |

Total Number

of Shares Purchased as Part of Publicly Announced Plans or Programs (b) |

Maximum

Number (or Approximate Dollar Value) of Shares that may yet be Purchased Under the Program (b) |

|

October 1 - 31

|

34,214

|

$38.54

|

—

|

$5,700,004,373

|

|

November 1 - 30

|

60,838

|

$38.65

|

—

|

$5,700,004,373

|

|

December 1 - 31

|

166,766

|

$37.54

|

—

|

$5,700,004,373

|

|

Total

|

261,818

|

$37.93

|

—

|

|

|

(a)

|

All of the

261,818

shares purchased during the three-month period ended

December 31, 2015

were acquired from employees in connection with the settlement of income tax and related benefit withholding obligations arising from vesting in restricted stock grants. These shares were not part of a publicly announced program to purchase common stock.

|

|

(b)

|

Our Board of Directors has authorized a plan to repurchase our common stock from time to time. During the

fourth

quarter of

2015

, we did not repurchase shares of our common stock pursuant to that plan. We have authorization remaining to repurchase up to a total of approximately

$5.7 billion

of our common stock.

|

|

Page No.

|

|

|

Management’s Report on Internal Control Over Financial Reporting

|

|

|

Reports of Independent Registered Public Accounting Firm

|

|

|

Consolidated Statements of Operations for the years ended December 31, 2015, 2014, and 2013

|

|

|

Consolidated Statements of Comprehensive Income for the years ended December 31, 2015, 2014, and 2013

|

|

|

Consolidated Balance Sheets at December 31, 2015 and 2014

|

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2015, 2014, and 2013

|

|

|

Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2015, 2014, and 2013

|

|

|

Notes to Consolidated Financial Statements

|

|

|

Selected Financial Data (Unaudited)

|

|

|

Quarterly Data and Market Price Information (Unaudited)

|

|

|

-

|

leveraging our broad technology offerings to provide value to our customers through integrated solutions and to enable them to more efficiently drill and complete their wells;

|

|

-

|

exploring additional opportunities for acquisitions that will enhance or augment our current portfolio of services and products, including those with technologies or distribution networks in areas where we do not already have significant operations;

|

|

-

|

investing in technology that will help our customers reduce reservoir uncertainty and increase operational efficiency;

|

|

-

|

improving working capital, and managing our balance sheet to maximize our financial flexibility; and

|

|

-

|

continuing to seek ways to be one of the most cost-efficient service providers in the industry by maintaining capital discipline and leveraging our scale and breadth of operations.

|

|

Payments Due

|

|||||||||||||||||||||

|

Millions of dollars

|

2016

|

2017

|

2018

|

2019

|

2020

|

Thereafter

|

Total

|

||||||||||||||

|

Long-term debt (a)

|

$

|

659

|

|

$

|

79

|

|

$

|

823

|

|

$

|

1,013

|

|

$

|

1,261

|

|

$

|

11,643

|

|

$

|

15,478

|

|

|

Interest on debt (b)

|

711

|

|

696

|

|

692

|

|

659

|

|

596

|

|

9,446

|

|

12,800

|

|

|||||||

|

Operating leases

|

257

|

|

171

|

|

132

|

|

96

|

|

60

|

|

228

|

|

944

|

|

|||||||

|

Purchase obligations (c)

|

873

|

|

391

|

|

152

|

|

28

|

|

29

|

|

50

|

|

1,523

|

|

|||||||

|

Other long-term liabilities (d)

|

37

|

|

10

|

|

10

|

|

10

|

|

9

|

|

32

|

|

108

|

|

|||||||

|

Total

|

$

|

2,537

|

|

$

|

1,347

|

|

$

|

1,809

|

|

$

|

1,806

|

|

$

|

1,955

|

|

$

|

21,399

|

|

$

|

30,853

|

|

|

(a)

|

Represents principal amounts of long-term debt, including current maturities, which excludes any unamortized debt issuance costs and discounts. See Note 8 to the consolidated financial statements.

|

|

(b)

|

Interest on debt includes

81

years of interest on

$300 million

of debentures at

7.6%

interest that become due in 2096.

|

|

(c)

|

Amount in

2016

primarily represents certain purchase orders for goods and services utilized in the ordinary course of our business.

|

|

(d)

|

Includes capital lease obligations and pension funding obligations. Amounts for pension funding obligations, which include international plans and are based on assumptions that are subject to change, are only included for

2016

as we are currently not able to reasonably estimate our contributions for years after

2016

.

|

|

2015

|

2014

|

2013

|

|||||||

|

Oil price - WTI

(1)

|

$

|

48.69

|

|

$

|

93.37

|

|

$

|

97.99

|

|

|

Oil price - Brent

(1)

|

52.36

|

|

99.04

|

|

108.71

|

|

|||

|

Natural gas price - Henry Hub

(2)

|

2.63

|

|

4.39

|

|

3.73

|

|

|||

|

(1)

Oil price measured in dollars per barrel

(2) Natural gas price measured in dollars per million British thermal units (Btu), or MMBtu |

|||||||||

|

Land vs. Offshore

|

2015

|

2014

|

2013

|

|||

|

United States:

|

||||||

|

Land

|

943

|

|

1,804

|

|

1,705

|

|

|

Offshore (incl. Gulf of Mexico)

|

35

|

|

57

|

|

56

|

|

|

Total

|

978

|

|

1,861

|

|

1,761

|

|

|

Canada:

|

|

|

|

|

|

|

|

Land

|

189

|

|

378

|

|

352

|

|

|

Offshore

|

2

|

|

2

|

|

2

|

|

|

Total

|

191

|

|

380

|

|

354

|

|

|

International (excluding Canada):

|

||||||

|

Land

|

884

|

|

1,011

|

|

978

|

|

|

Offshore

|

283

|

|

326

|

|

318

|

|

|

Total

|

1,167

|

|

1,337

|

|

1,296

|

|

|

Worldwide total

|

2,336

|

|

3,578

|

|

3,411

|

|

|

Land total

|

2,016

|

|

3,193

|

|

3,035

|

|

|

Offshore total

|

320

|

|

385

|

|

376

|

|

|

Oil vs. Natural Gas

|

2015

|

2014

|

2013

|

|||

|

United States (incl. Gulf of Mexico):

|

||||||

|

Oil

|

751

|

|

1,528

|

|

1,375

|

|

|

Natural gas

|

227

|

|

333

|

|

386

|

|

|

Total

|

978

|

|

1,861

|

|

1,761

|

|

|

Canada:

|

||||||

|

Oil

|

84

|

|

218

|

|

234

|

|

|

Natural gas

|

107

|

|

162

|

|

120

|

|

|

Total

|

191

|

|

380

|

|

354

|

|

|

International (excluding Canada):

|

||||||

|

Oil

|

916

|

|

1,070

|

|

1,029

|

|

|

Natural gas

|

251

|

|

267

|

|

267

|

|

|

Total

|

1,167

|

|

1,337

|

|

1,296

|

|

|

Worldwide total

|

2,336

|

|

3,578

|

|

3,411

|

|

|

Oil total

|

1,751

|

|

2,816

|

|

2,638

|

|

|

Natural gas total

|

585

|

|

762

|

|

773

|

|

|

Drilling Type

|

2015

|

2014

|

2013

|

|

United States (incl. Gulf of Mexico):

|

|||

|

Horizontal

|

744

|

1,274

|

1,102

|

|

Vertical

|

139

|

376

|

435

|

|

Directional

|

95

|

211

|

224

|

|

Total

|

978

|

1,861

|

1,761

|

|

REVENUE:

|

Favorable

|

Percentage

|

|||||||||

|

Millions of dollars

|

2015

|

2014

|

(Unfavorable)

|

Change

|

|||||||

|

Completion and Production

|

$

|

13,682

|

|

$

|

20,253

|

|

$

|

(6,571

|

)

|

(32

|

)%

|

|

Drilling and Evaluation

|

9,951

|

|

12,617

|

|

(2,666

|

)

|

(21

|

)

|

|||

|

Total revenue

|

$

|

23,633

|

|

$

|

32,870

|

|

$

|

(9,237

|

)

|

(28

|

)%

|

|

|

|||||||||||

|

By geographic region:

|

|||||||||||

|

Completion and Production:

|

|||||||||||

|

North America

|

$

|

8,352

|

|

$

|

13,688

|

|

$

|

(5,336

|

)

|

(39

|

)%

|

|

Latin America

|

1,340

|

|

1,633

|

|

(293

|

)

|

(18

|

)

|

|||

|

Europe/Africa/CIS

|

2,081

|

|

2,595

|

|

(514

|

)

|

(20

|

)

|

|||

|

Middle East/Asia

|

1,909

|

|

2,337

|

|

(428

|

)

|

(18

|

)

|

|||

|

Total

|

13,682

|

|

20,253

|

|

(6,571

|

)

|

(32

|

)

|

|||

|

Drilling and Evaluation:

|

|||||||||||

|

North America

|

2,504

|

|

4,010

|

|

(1,506

|

)

|

(38

|

)

|

|||

|

Latin America

|

1,809

|

|

2,242

|

|

(433

|

)

|

(19

|

)

|

|||

|

Europe/Africa/CIS

|

2,094

|

|

2,895

|

|

(801

|

)

|

(28

|

)

|

|||

|

Middle East/Asia

|

3,544

|

|

3,470

|

|

74

|

|

2

|

|

|||

|

Total

|

9,951

|

|

12,617

|

|

(2,666

|

)

|

(21

|

)

|

|||

|

Total revenue by region:

|

|||||||||||

|

North America

|

10,856

|

|

17,698

|

|

(6,842

|

)

|

(39

|

)

|

|||

|

Latin America

|

3,149

|

|

3,875

|

|

(726

|

)

|

(19

|

)

|

|||

|

Europe/Africa/CIS

|

4,175

|

|

5,490

|

|

(1,315

|

)

|

(24

|

)

|

|||

|

Middle East/Asia

|

5,453

|

|

5,807

|

|

(354

|

)

|

(6

|

)

|

|||

|

OPERATING INCOME:

|

Favorable

|

Percentage

|

|||||||||

|

Millions of dollars

|

2015

|

2014

|

(Unfavorable)

|

Change

|

|||||||

|

Completion and Production

|

$

|

1,069

|

|

$

|

3,670

|

|

$

|

(2,601

|

)

|

(71

|

)%

|

|

Drilling and Evaluation

|

1,519

|

|

1,740

|

|

(221

|

)

|

(13

|

)

|

|||

|

Corporate and other

|

(576

|

)

|

(184

|

)

|

(392

|

)

|

213

|

|

|||

|

Impairments and other charges

|

(2,177

|

)

|

(129

|

)

|

(2,048

|

)

|

1,588

|

|

|||

|

Total operating income (loss)

|

$

|

(165

|

)

|

$

|

5,097

|

|

$

|

(5,262

|

)

|

(103

|

)%

|

|

|

|||||||||||

|

By geographic region:

|

|||||||||||

|

Completion and Production:

|

|||||||||||

|

North America

|

$

|

230

|

|

$

|

2,618

|

|

$

|

(2,388

|

)

|

(91

|

)%

|

|

Latin America

|

186

|

|

214

|

|

(28

|

)

|

(13

|

)

|

|||

|

Europe/Africa/CIS

|

280

|

|

389

|

|

(109

|

)

|

(28

|

)

|

|||

|

Middle East/Asia

|

373

|

|

449

|

|

(76

|

)

|

(17

|

)

|

|||

|

Total

|

1,069

|

|

3,670

|

|

(2,601

|

)

|

(71

|

)

|

|||

|

Drilling and Evaluation:

|

|||||||||||

|

North America

|

228

|

|

598

|

|

(370

|

)

|

(62

|

)

|

|||

|

Latin America

|

254

|

|

217

|

|

37

|

|

17

|

|

|||

|

Europe/Africa/CIS

|

243

|

|

300

|

|

(57

|

)

|

(19

|

)

|

|||

|

Middle East/Asia

|

794

|

|

625

|

|

169

|

|

27

|

|

|||

|

Total

|

1,519

|

|

1,740

|

|

(221

|

)

|

(13

|

)

|

|||

|

Total operating income by region

|

|||||||||||

|

(excluding Corporate and other):

|

|||||||||||

|

North America

|

458

|

|

3,216

|

|

(2,758

|

)

|

(86

|

)

|

|||

|

Latin America

|

440

|

|

431

|

|

9

|

|

2

|

|

|||

|

Europe/Africa/CIS

|

523

|

|

689

|

|

(166

|

)

|

(24

|

)

|

|||

|

Middle East/Asia

|

1,167

|

|

1,074

|

|

93

|

|

9

|

|

|||

|

•

|

North America revenue dropped

39%

, across most product service lines, mainly in the United States land market, as a result of steep rig count declines, pricing concessions, and reduced stimulation activity.

|

|

•

|

Latin America revenue decreased

18%

, mainly due to reduced activity and pricing in Mexico, primarily associated with pressure pumping services and production solution services, and decreased cementing activity in Colombia, Brazil, and Ecuador.

|

|

•

|

Europe/Africa/CIS revenue fell

20%

, as a result of reduced well completion services and currency weakness in Norway, lower pressure pumping services and currency weakness in Russia, a decrease in stimulation activity in Egypt, a reduction in completion tools sales in Kazakhstan, and decreased pipeline and process services in the United Kingdom. These reductions were partially offset by improved completion tool sales in Nigeria.

|

|

•

|

Middle East/Asia revenue declined by

18%

, primarily due to decreased pressure pumping and production solution services in Australia and Saudi Arabia, reduced activity in the majority of our product service lines in Malaysia and Indonesia, and lower pressure pumping services and completion tool sales in China, which were partially offset by higher completion tool sales in Saudi Arabia and United Arab Emirates, and improved pipeline and process services in China.

|

|

•

|

Revenue outside of North America was

39%

of total segment revenue in

2015

and

32%

of total segment revenue in

2014

.

|

|

•

|

North America operating income declined

91%

, primarily due to the fall in rig counts and decreased profitability for well completion services and stimulation activity in the United States land market.

|

|

•

|

Latin America operating income declined

13%

, due to lower pressure pumping services in Argentina and Mexico, reduced cementing services in Colombia, and lower production solution services in Mexico, which were partially offset by increased activity across most product service lines in Venezuela.

|

|

•

|

Europe/Africa/CIS operating income fell

28%

compared to

2014

, mainly due to reduced cementing services in Norway and Nigeria, lower completion tool sales in Kazakhstan and Nigeria, and lower stimulation activity in Egypt, which were partially offset by higher stimulation activity in Angola, and increased cementing and production solution services in Algeria.

|

|

•

|

Middle East/Asia operating income dropped

17%

, primarily due to decreased pressure pumping services in Australia and Saudi Arabia, lower completion tool sales in Malaysia, and reduced activity and pricing pressure for production solution services in Saudi Arabia, which were partially offset by increased completion tools sales in Saudi Arabia.

|

|

•

|

North America revenue declined

38%

, due to a drop in activity across all product service lines, primarily as a result of pricing concessions and reduced activity levels in the United States land market, and lower drilling services in the Gulf of Mexico and Canada.

|

|

•

|

Latin America revenue decreased

19%

, as a result of reduced drilling activity in Colombia and Ecuador, lower software sales and project management services in Mexico, and reduced logging services in Mexico and Venezuela, which were partially offset by higher fluid services in Mexico.

|

|

•

|

Europe/Africa/CIS revenue fell

28%

, due to a decline in fluid services in Norway, reduced drilling activity in Angola, Egypt, Russia, and the United Kingdom, and lower offshore services in Nigeria.

|

|

•

|

Middle East/Asia revenue was relatively flat as increased project management services throughout the region and higher drilling services in Saudi Arabia and Kuwait were partially offset by lower drilling and offshore activity in Malaysia.

|

|

•

|

Revenue outside of North America was

75%

of total segment revenue in

2015

and

68%

of total segment revenue in

2014

.

|

|

•

|

North America operating income was down

62%

from

2014

due to a decline in activity across all product service lines, predominately driven by the United States land market.

|

|

•

|

Latin America operating income grew

17%

, mainly due to improved fluid services in Venezuela, which was partially offset by reduced offshore activity in Brazil and lower project management services in Mexico.

|

|

•

|

Europe/Africa/CIS operating income fell

19%

, primarily due to lower fluid services in Norway, reduced drilling services in Angola, and a decrease in logging services in Nigeria, which were partially offset by higher fluid services in Kazakhstan.

|

|

•

|

Middle East/Asia operating income increased

27%

, driven by higher fluid and logging services in Saudi Arabia and Iraq, increased project management services in Saudi Arabia, Iraq, and India, increased fluid services in India, and higher logging services in Kuwait.

|

|

REVENUE:

|

Favorable

|

Percentage

|

|||||||||

|

Millions of dollars

|

2014

|

2013

|

(Unfavorable)

|

Change

|

|||||||

|

Completion and Production

|

$

|

20,253

|

|

$

|

17,506

|

|

$

|

2,747

|

|

16

|

%

|

|

Drilling and Evaluation

|

12,617

|

|

11,896

|

|

721

|

|

6

|

|

|||

|

Total revenue

|

$

|

32,870

|

|

$

|

29,402

|

|

$

|

3,468

|

|

12

|

%

|

|

|

|||||||||||

|

By geographic region:

|

|||||||||||

|

Completion and Production:

|

|||||||||||

|

North America

|

$

|

13,688

|

|

$

|

11,417

|

|

$

|

2,271

|

|

20

|

%

|

|

Latin America

|

1,633

|

|

1,586

|

|

47

|

|

3

|

|

|||

|

Europe/Africa/CIS

|

2,595

|

|

2,391

|

|

204

|

|

9

|

|

|||

|

Middle East/Asia

|

2,337

|

|

2,112

|

|

225

|

|

11

|

|

|||

|

Total

|

20,253

|

|

17,506

|

|

2,747

|

|

16

|

|

|||

|

Drilling and Evaluation:

|

|||||||||||

|

North America

|

4,010

|

|

3,795

|

|

215

|

|

6

|

|

|||

|

Latin America

|

2,242

|

|

2,323

|

|

(81

|

)

|

(3

|

)

|

|||

|

Europe/Africa/CIS

|

2,895

|

|

2,834

|

|

61

|

|

2

|

|

|||

|

Middle East/Asia

|

3,470

|

|

2,944

|

|

526

|

|

18

|

|

|||

|

Total

|

12,617

|

|

11,896

|

|

721

|

|

6

|

|

|||

|

Total revenue by region:

|

|||||||||||

|

North America

|

17,698

|

|

15,212

|

|

2,486

|

|

16

|

|

|||

|

Latin America

|

3,875

|

|

3,909

|

|

(34

|

)

|

(1

|

)

|

|||

|

Europe/Africa/CIS

|

5,490

|

|

5,225

|

|

265

|

|

5

|

|

|||

|

Middle East/Asia

|

5,807

|

|

5,056

|

|

751

|

|

15

|

|

|||

|

OPERATING INCOME:

|

Favorable

|

Percentage

|

|||||||||

|

Millions of dollars

|

2014

|

2013

|

(Unfavorable)

|

Change

|

|||||||

|

Completion and Production

|

$

|

3,670

|

|

$

|

2,875

|

|

$

|

795

|

|

28

|

%

|

|

Drilling and Evaluation

|

1,740

|

|

1,770

|

|

(30

|

)

|

(2

|

)

|

|||

|

Corporate and other

|

(184

|

)

|

(1,507

|

)

|

1,323

|

|

(88

|

)

|

|||

|

Impairments and other charges

|

(129

|

)

|

—

|

|

(129

|

)

|

100

|

|

|||

|

Total operating income

|

$

|

5,097

|

|

$

|

3,138

|

|

$

|

1,959

|

|

62

|

%

|

|

|

|||||||||||

|

By geographic region:

|

|||||||||||

|

Completion and Production:

|

|||||||||||

|

North America

|

$

|

2,618

|

|

$

|

1,916

|

|

$

|

702

|

|

37

|

%

|

|

Latin America

|

214

|

|

211

|

|

3

|

|

1

|

|

|||

|

Europe/Africa/CIS

|

389

|

|

356

|

|

33

|

|

9

|

|

|||

|

Middle East/Asia

|

449

|

|

392

|

|

57

|

|

15

|

|

|||

|

Total

|

3,670

|

|

2,875

|

|

795

|

|

28

|

|

|||

|

Drilling and Evaluation:

|

|||||||||||

|

North America

|

598

|

|

656

|

|

(58

|

)

|

(9

|

)

|

|||

|

Latin America

|

217

|

|

307

|

|

(90

|

)

|

(29

|

)

|

|||

|

Europe/Africa/CIS

|

300

|

|

334

|

|

(34

|

)

|

(10

|

)

|

|||

|

Middle East/Asia

|

625

|

|

473

|

|

152

|

|

32

|

|

|||

|

Total

|

1,740

|

|

1,770

|

|

(30

|

)

|

(2

|

)

|

|||

|

Total operating income by region

|

|||||||||||

|

(excluding Corporate and other):

|

|||||||||||

|

North America

|

3,216

|

|

2,572

|

|

644

|

|

25

|

|

|||

|

Latin America

|

431

|

|

518

|

|

(87

|

)

|

(17

|

)

|

|||

|

Europe/Africa/CIS

|

689

|

|

690

|

|

(1

|

)

|

—

|

|

|||

|

Middle East/Asia

|

1,074

|

|

865

|

|

209

|

|

24

|

|

|||

|

•

|

North America revenue rose

20%

primarily as a result of increased stimulation activity in the United States land market.

|

|

•

|

Latin America revenue improved

3

%, as increased activity levels in the majority of our product service lines in Venezuela and Argentina more than offset a decrease in stimulation activity in Mexico and lower pressure pumping activity in Brazil.

|

|

•

|

Europe/Africa/CIS revenue grew

9

%, driven by

strong growth across most of our product service lines in Angola and the United Kingdom, as well as increased completion tools sales in Nigeria, which were partially offset by lower pressure pumping activity and currency weakness in Norway.

|

|

•

|

Middle East/Asia revenue improved

11

% primarily due to increased activity in the majority of our product service lines in Saudi Arabia, higher cementing activity in Thailand, and increased stimulation and artificial lift activity in Australia, which more than offset reduced activity levels in Oman and a decline in completion tools sales in Malaysia.

|

|

•

|

Revenue outside of North America was

32%

of total segment revenue in

2014

and

35%

of total segment revenue in

2013

.

|

|

•

|

North America operating income rose

37%

from

2013

, primarily due to increased profitability for stimulation activity in the United States land market.

|

|

•

|

Latin America operating income was flat as improved pressure pumping activity in Argentina and increased profitability for well intervention services in Mexico and Venezuela were offset by reduced completion tools sales and profitability in Brazil, Mexico and Trinidad.

|

|

•

|

Europe/Africa/CIS operating income grew

9

% compared to

2013

, primarily due to higher completion products sales in Nigeria, Angola and the United Kingdom, which were partially offset by decreased well completion activity and currency weakness in Russia and Norway.

|

|

•

|

Middle East/Asia operating income rose by

15

% primarily due to increased profitability for the majority of our product services lines in Saudi Arabia, which was partially offset by reduced activity levels in China and Oman.

|

|

•

|

North America revenue rose by

6

% due to increased fluids activity in the United States land market and higher activity in the majority of our product service lines in the Gulf of Mexico.

|

|

•

|

Latin America revenue decreased 3%, as reduced activity across all of our product service lines in Mexico and a decline in drilling activity in Brazil more than offset increased activity across all of our product service lines in Venezuela and Argentina.

|

|

•

|

Europe/Africa/CIS revenue was relatively flat as increased testing activity in Angola and Nigeria was offset by decreased drilling and fluids activity in Egypt and Libya.

|

|

•

|

Middle East/Asia revenue rose

18

% as a result of increased activity in all of our product services lines in Saudi Arabia and increased demand for drilling services in Thailand and fluids activity in Australia, India and Iraq.

|

|

•

|

Revenue outside of North America was

68%

of total segment revenue in both

2014

and

2013

.

|

|

•

|

North America operating income was down

9%

from

2013

due to a decline in drilling services in Canada and the United States land market.

|

|

•

|

Latin America operating income declined

29%

mainly due to reduced activity levels in Mexico and lower drilling activity and pricing in Brazil, which were partially offset by improved activity levels in Argentina.

|

|

•

|

Europe/Africa/CIS operating income fell

10%

primarily due to lower activity and currency weakness in Russia and Norway.

|

|

•

|

Middle East/Asia operating income increased

32%

primarily due to an increase in demand and profitability for drilling activity in Saudi Arabia, as well as improved demand for drilling services in Thailand, which were partially offset by reduced drilling services and logging activity in China.

|

|

-

|

forecasting our effective income tax rate, including our future ability to utilize foreign tax credits and the realizability of deferred tax assets, and providing for uncertain tax positions;

|

|

-

|

legal, environmental, and investigation matters;

|

|

-

|

valuations of long-lived assets, including intangible assets and goodwill;

|

|

-

|

purchase price allocation for acquired businesses;

|

|

-

|

pensions;

|

|

-

|

allowance for bad debts; and

|

|

-

|

percentage-of-completion accounting for long-term, integrated project management contracts.

|

|

-

|

a current tax liability or asset is recognized for the estimated taxes payable or refundable on tax returns for the current year;

|

|

-

|

a deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards;

|

|

-

|

the measurement of current and deferred tax liabilities and assets is based on provisions of the enacted tax law, and the effects of potential future changes in tax laws or rates are not considered; and

|

|

-

|

the value of deferred tax assets is reduced, if necessary, by the amount of any tax benefits that, based on available evidence, are not expected to be realized.

|

|

-

|

identifying the types and amounts of existing temporary differences;

|

|

-

|

measuring the total deferred tax liability for taxable temporary differences using the applicable tax rate;

|

|

-

|

measuring the total deferred tax asset for deductible temporary differences and operating loss carryforwards using the applicable tax rate;

|

|

-

|

measuring the deferred tax assets for each type of tax credit carryforward; and

|

|

-

|

reducing the deferred tax assets by a valuation allowance if, based on available evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

|

|

Effect on

|

||||||

|

Millions of dollars

|

Pretax Pension Expense in 2015

|

Pension Benefit Obligation at December 31, 2015

|

||||

|

50-basis-point decrease in discount rate

|

$

|

2

|

|

$

|

92

|

|

|

50-basis-point increase in discount rate

|

(2

|

)

|

(80

|

)

|

||

|

50-basis-point decrease in expected long-term rate of return

|

4

|

|

NA

|

|

||

|

50-basis-point increase in expected long-term rate of return

|

(4

|

)

|

NA

|

|

||

|

/s/ David J. Lesar

|

/s/ Christian A. Garcia

|

|

|

David J. Lesar

|

Christian A. Garcia

|

|

|

Chairman of the Board and

|

Senior Vice President, Finance and

|

|

|

Chief Executive Officer

|

Acting Chief Financial Officer

|

|

|

HALLIBURTON COMPANY

|

|||||||||

|

Year Ended December 31

|

|||||||||

|

Millions of dollars and shares except per share data

|

2015

|

2014

|

2013

|

||||||

|

Revenue:

|

|||||||||

|

Services

|

$

|

17,482

|

|

$

|

25,039

|

|

$

|

22,257

|

|

|

Product sales

|

6,151

|

|

7,831

|

|

7,145

|

|

|||

|

Total revenue

|

23,633

|

|

32,870

|

|

29,402

|

|

|||

|

Operating costs and expenses:

|

|||||||||

|

Cost of services

|

15,900

|

|

20,959

|

|

18,959

|

|

|||

|

Cost of sales

|

5,213

|

|

6,571

|

|

5,972

|

|

|||

|

Impairment and other charges

|

2,177

|

|

129

|

|

—

|

|

|||

|

Baker Hughes acquisition-related costs

|

308

|

|

17

|

|

—

|

|

|||

|

General and administrative

|

200

|

|

292

|

|

333

|

|

|||

|

Activity related to the Macondo well incident

|

—

|

|

(195

|

)

|

1,000

|

|

|||

|

Total operating costs and expenses

|

23,798

|

|

27,773

|

|

26,264

|

|

|||

|

Operating income (loss)

|

(165

|

)

|

5,097

|

|

3,138

|

|

|||

|

Interest expense, net of interest income of $16, $13, and $8

|

(447

|

)

|

(383

|

)

|

(331

|

)

|

|||

|

Other, net

|

(324

|

)

|

(2

|

)

|

(43

|

)

|

|||

|

Income (loss) from continuing operations before income taxes

|

(936

|

)

|

4,712

|

|

2,764

|

|

|||

|

Income tax benefit (provision)

|

274

|

|

(1,275

|

)

|

(648

|

)

|

|||

|

Income (loss) from continuing operations

|

(662

|

)

|

3,437

|

|

2,116

|

|

|||

|

Income (loss) from discontinued operations, net of income tax benefit (provision) of $3, $(9), and $1

|

(5

|

)

|

64

|

|

19

|

|

|||

|

Net income (loss)

|

$

|

(667

|

)

|

$

|

3,501

|

|

$

|

2,135

|

|

|

Net (income) attributable to noncontrolling interest

|

(4

|

)

|

(1

|

)

|

(10

|

)

|

|||

|

Net income (loss) attributable to company

|

$

|

(671

|

)

|

$

|

3,500

|

|

$

|

2,125

|

|

|

Amounts attributable to company shareholders:

|

|||||||||

|

Income (loss) from continuing operations

|

$

|

(666

|

)

|

$

|

3,436

|

|

$

|

2,106

|

|

|

Income (loss) from discontinued operations, net

|

(5

|

)

|

64

|

|

19

|

|

|||

|

Net income (loss) attributable to company

|

$

|

(671

|

)

|

$

|

3,500

|

|

$

|

2,125

|

|

|

Basic income per share attributable to company shareholders:

|

|||||||||

|

Income (loss) from continuing operations

|

$

|

(0.78

|

)

|

$

|

4.05

|

|

$

|

2.35

|

|

|

Income (loss) from discontinued operations, net

|

(0.01

|

)

|

0.08

|

|

0.02

|

|

|||

|

Net income (loss) per share

|

$

|

(0.79

|

)

|

$

|

4.13

|

|

$

|

2.37

|

|

|

Diluted income per share attributable to company shareholders:

|

|||||||||

|

Income (loss) from continuing operations

|

$

|

(0.78

|

)

|

$

|

4.03

|

|

$

|

2.33

|

|

|

Income (loss)from discontinued operations, net

|

(0.01

|

)

|

0.08

|

|

0.03

|

|

|||

|

Net income (loss) per share

|

$

|

(0.79

|

)

|

$

|

4.11

|

|

$

|

2.36

|

|

|

Basic weighted average common shares outstanding

|

853

|

|

848

|

|

898

|

|

|||

|

Diluted weighted average common shares outstanding

|

853

|

|

852

|

|

902

|

|

|||

|

See notes to consolidated financial statements.

|

|||||||||

|

HALLIBURTON COMPANY

Consolidated Statements of Comprehensive Income

|

|||||||||

|

Year Ended December 31

|

|||||||||

|

Millions of dollars

|

2015

|

2014

|

2013

|

||||||

|

Net income (loss)

|

$

|

(667

|

)

|

$

|

3,501

|

|

$

|

2,135

|

|

|

Other comprehensive income, net of income taxes:

|

|||||||||

|

Defined benefit and other post retirement plans adjustment

|

105

|

|

(84

|

)

|

—

|

|

|||

|

Unrealized loss on cash flow hedges

|

(67

|

)

|

—

|

|

—

|

|

|||

|

Other

|

(2

|

)

|

(7

|

)

|

2

|

|

|||

|

Other comprehensive income (loss), net of income taxes

|

36

|

|

(91

|

)

|

2

|

|

|||

|

Comprehensive income (loss)

|

$

|

(631

|

)

|

$

|

3,410

|

|

$

|

2,137

|

|

|

Comprehensive income attributable to noncontrolling interest

|

(4

|

)

|

(1

|

)

|

(10

|

)

|

|||

|

Comprehensive income (loss) attributable to company shareholders

|

$

|

(635

|

)

|

$

|

3,409

|

|

$

|

2,127

|

|

|

See notes to consolidated financial statements.

|

|||||||||

|

HALLIBURTON COMPANY

|

||||||

|

December 31

|

||||||

|

Millions of dollars and shares except per share data

|

2015

|

2014

|

||||

|

Assets

|

||||||

|

Current assets:

|

||||||

|

Cash and equivalents

|

$

|

10,077

|

|

$

|

2,291

|

|

|

Receivables (net of allowances for bad debts of $145 and $137)

|

5,317

|

|

7,564

|

|

||

|

Inventories

|

2,417

|

|

3,571

|

|

||

|

Assets held for sale

|

2,115

|

|

—

|

|

||

|

Prepaid expenses

|

1,051

|

|

658

|

|

||

|

Other current assets

|

632

|

|

563

|

|

||

|

Total current assets

|

21,609

|

|

14,647

|

|

||

|

Property, plant, and equipment (net of accumulated depreciation of $9,789 and $11,007)

|

10,911

|

|

12,475

|

|

||

|

Goodwill

|

2,109

|

|

2,330

|

|

||

|

Other assets

|

2,313

|

|

2,713

|

|

||

|

Total assets

|

$

|

36,942

|

|

$

|

32,165

|

|

|

Liabilities and Shareholders’ Equity

|

||||||

|

Current liabilities:

|

||||||

|

Accounts payable

|

$

|

2,019

|

|

$

|

2,814

|

|

|

Accrued employee compensation and benefits

|

838

|

|

1,033

|

|

||

|

Current maturities of long-term debt

|

659

|

|

14

|

|

||

|

Liabilities for Macondo well incident

|

400

|

|

367

|

|

||

|

Deferred revenue

|

298

|

|

349

|

|

||

|

Taxes other than income

|

293

|

|

407

|

|

||

|

Other current liabilities

|

852

|

|

882

|

|

||

|

Total current liabilities

|

5,359

|

|

5,866

|

|

||

|

Long-term debt

|

14,687

|

|

7,765

|

|

||

|

Employee compensation and benefits

|

457

|

|

691

|

|

||

|

Other liabilities

|

944

|

|

1,545

|

|

||

|

Total liabilities

|

21,447

|

|

15,867

|

|

||

|

Shareholders’ equity:

|

||||||

|

Common shares, par value $2.50 per share (authorized 2,000 shares,

issued 1,071 and 1,071 shares)

|

2,677

|

|

2,679

|

|

||

|

Paid-in capital in excess of par value

|

274

|

|

309

|

|

||

|

Accumulated other comprehensive loss

|

(363

|

)

|

(399

|

)

|

||

|

Retained earnings

|

20,524

|

|

21,809

|

|

||

|

Treasury stock, at cost (215 and 223 shares)

|

(7,650

|

)

|

(8,131

|

)

|

||

|

Company shareholders’ equity

|

15,462

|

|

16,267

|

|

||

|

Noncontrolling interest in consolidated subsidiaries

|

33

|

|

31

|

|

||

|

Total shareholders’ equity

|

15,495

|

|

16,298

|

|

||

|

Total liabilities and shareholders’ equity

|

$

|

36,942

|

|

$

|

32,165

|

|

|

See notes to consolidated financial statements.

|

||||||

|

HALLIBURTON COMPANY

|

|||||||||

|

Year Ended December 31

|

|||||||||

|

Millions of dollars

|

2015

|

2014

|

2013

|

||||||

|

Cash flows from operating activities:

|

|||||||||

|

Net income (loss)

|

$

|

(667

|

)

|

$

|

3,501

|

|

$

|

2,135

|

|

|

Adjustments to reconcile net income (loss) to net cash flows from operating activities:

|

|||||||||

|

Impairments and other charges

|

2,177

|

|

129

|

|

—

|

|

|||

|

Cash impact of impairments and other charges - severance payments

|

(304

|

)

|

(28

|

)

|

—

|

|

|||

|

Depreciation, depletion, and amortization

|

1,835

|

|

2,126

|

|

1,900

|

|

|||

|

Activity related to the Macondo well incident

|

(333

|

)

|

(569

|

)

|

1,000

|

|

|||

|

Deferred income tax benefit, continuing operations

|

(224

|

)

|

(454

|

)

|

(132

|

)

|

|||

|

Other changes:

|

|||||||||

|

Receivables

|

1,468

|

|

(1,381

|

)

|

(449

|

)

|

|||

|

Accounts payable

|

(603

|

)

|

489

|

|

327

|

|

|||

|

Inventories

|

153

|

|

(271

|

)

|

(107

|

)

|

|||

|

Other

|

(596

|

)

|

520

|

|

(227

|

)

|

|||

|

Total cash flows from operating activities

|

2,906

|

|

4,062

|

|

4,447

|

|

|||

|

Cash flows from investing activities:

|

|||||||||

|

Capital expenditures

|

(2,184

|

)

|

(3,283

|

)

|

(2,934

|

)

|

|||

|

Sales of property, plant, and equipment

|

168

|

|

338

|

|

241

|

|

|||

|

Purchases of investment securities

|

(109

|

)

|

(183

|

)

|

(329

|

)

|

|||

|

Sales of investment securities

|

106

|

|

444

|

|

356

|

|

|||

|

Payments to acquire businesses, net of cash acquired

|

(39

|

)

|

(231

|

)

|

(94

|

)

|

|||

|

Other investing activities

|

(134

|

)

|

(223

|

)

|

(110

|

)

|

|||

|

Total cash flows from investing activities

|

(2,192

|

)

|

(3,138

|

)

|

(2,870

|

)

|

|||

|

Cash flows from financing activities:

|

|||||||||

|

Proceeds from issuance of long-term debt, net

|

7,440

|

|

—

|

|

2,968

|

|

|||

|

Dividends to shareholders

|

(614

|

)

|

(533

|

)

|

(465

|

)

|

|||

|

Proceeds from exercises of stock options

|

167

|

|

332

|

|

277

|

|

|||

|

Payments to reacquire common stock

|

—

|

|

(800

|

)

|

(4,356

|

)

|

|||

|

Other financing activities

|

88

|

|

(29

|

)

|

(178

|

)

|

|||

|

Total cash flows from financing activities

|

7,081

|

|

(1,030

|

)

|

(1,754

|

)

|

|||

|

Effect of exchange rate changes on cash

|

(9

|

)

|

41

|

|

49

|

|

|||

|

Increase (decrease) in cash and equivalents

|

7,786

|

|

(65

|

)

|

(128

|

)

|

|||

|

Cash and equivalents at beginning of year

|

2,291

|

|

2,356

|

|

2,484

|

|

|||

|

Cash and equivalents at end of year

|

$

|

10,077

|

|

$

|

2,291

|

|

$

|

2,356

|

|

|

Supplemental disclosure of cash flow information:

|

|||||||||

|