|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

||||||

|

SECURITIES AND EXCHANGE COMMISSION

|

||||||

|

FORM 10-K

|

||||||

|

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||||||

|

For the fiscal year ended

March 31, 2017

|

||||||

|

or

|

||||||

|

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

|

||||||

|

For the transition period from _______________________ to ___________________________

|

||||||

|

Commission file number

001-38021

|

||||||

|

HAMILTON LANE INCORPORATED

|

||||||

|

(Exact name of Registrant as specified in its charter)

|

||||||

|

Delaware

(State or other jurisdiction of incorporation or organization) |

26-2482738

(I.R.S. Employer

Identification No.) |

|||||

|

Hamilton Lane Incorporated

One Presidential Blvd., 4th Floor

Bala Cynwyd, PA 19004

Telephone: (610) 934-2222

(Address of principal executive offices)

|

||||||

|

Registrant’s telephone number, including area code:

(610) 934-2222

|

||||||

|

Title of each class

|

Name of each exchange on which registered

|

|||||

|

Class A Common Stock, $0.001 par value per share

|

The NASDAQ Stock Market LLC

|

|||||

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

|

Non-accelerated filer

x

(Do not check if a smaller reporting company)

|

Smaller reporting company

¨

|

|

Emerging growth company

x

|

|

|

Page

|

|

|

•

|

Customized Separate Accounts

: We design and build customized portfolios of private markets funds and direct investments to meet our clients’ specific portfolio objectives with regard to return, risk tolerance, diversification and liquidity. We generally have discretionary investment authority over our customized separate accounts, which comprised approximately $33 billion of our AUM as of

March 31, 2017

.

|

|

•

|

Specialized Funds

: We organize, invest and manage specialized primary, secondary and direct/co-investment funds. Our specialized funds invest across a variety of private markets and include equity, equity-linked and credit funds offered on standard terms as well as shorter duration, opportunistically oriented funds. We launched our first specialized fund in 1997, and our product offerings have grown steadily, comprising approximately $9 billion of our AUM as of

March 31, 2017

.

|

|

•

|

Advisory Services

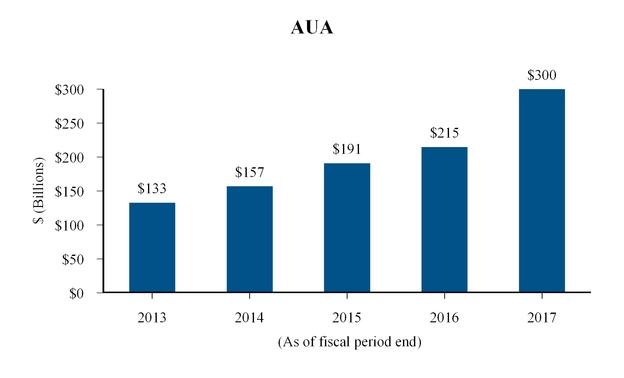

: We offer investment advisory services to assist clients in developing and implementing their private markets investment programs. Our investment advisory services include asset allocation, strategic plan creation, development of investment policies and guidelines, the screening and recommending of investments, legal negotiations, the monitoring of and reporting on investments and investment manager review and due diligence. Our advisory clients include some of the largest and most sophisticated private markets investors in the world. We had approximately $300 billion of AUA as of

March 31, 2017

.

|

|

•

|

Distribution Management

: We offer distribution management services to our clients through active portfolio management to enhance the realized value of publicly traded stock they receive as

|

|

•

|

Reporting, Monitoring, Data and Analytics:

We provide our clients with comprehensive reporting and investment monitoring services, usually bundled into our broader investment solutions offerings, but occasionally on a stand-alone, fee-for-service basis. Private markets investments are unusually difficult to monitor, report on and administer, and our clients are able to benefit from our sophisticated infrastructure, which provides real-time access to reliable and transparent investment data, and our high-touch service approach, which allows for timely and informed responses to the multiplicity of issues that can arise. We also provide comprehensive research and analytical services as part of our investment solutions, leveraging our large, global, proprietary and high-quality database of private markets investment performance and our suite of proprietary analytical investment tools. Spanning 40 years and covering over 1,200 fund managers and approximately 3,300 funds, our database contains detailed information on over $3 trillion of private markets investments and over 50,000 portfolio companies.

|

|

•

|

Desire to lower the expense ratio associated with investment programs, since concentrating business with fewer providers allows investors more negotiating leverage and efficiency in managing their portfolios.

|

|

•

|

Awareness that portfolios can be over-diversified by virtue of having too many managers and an increased desire to maintain appropriate diversification both across investment types and within asset classes.

|

|

•

|

Acknowledgment of the difficulties of building in-house resources capable of developing an in-depth understanding of the myriad choices of investment types and locations, as well as building relationships with the plethora of investment managers within each type.

|

|

•

|

The use of strategic partners to leverage additional knowledge and insights and to achieve quality extension of staff resources.

|

|

•

|

the limited liability company agreement of HLA was amended and restated (as amended, the “HLA Operating Agreement”) to, among other things, (i) effect a reverse split of existing membership interests; (ii) exchange all of the then-existing membership interests of the members of HLA for Class B and Class C units, (iii) reclassify all membership interests held by us as Class A units, and (iv) appoint us as the sole managing member of HLA;

|

|

•

|

our certificate of incorporation was amended and restated to, among other things, (i) provide for Class A common stock and Class B common stock, (ii) set forth the voting rights of the Class A common stock and Class B common stock, and (iii) establish a classified board of directors;

|

|

•

|

certain HLA members exchanged their HLA units for 3,899,169 shares of Class A common stock of HLI;

|

|

•

|

HLI issued to the Class B unitholders of HLA one share of HLI Class B common stock for each Class B unit that they owned, in exchange for a payment of its par value; and

|

|

•

|

HLI entered into an exchange agreement with the direct owners of HLA pursuant to which they will be entitled to exchange HLA units for shares of our Class A common stock on a one-for-one basis.

|

|

(1)

|

The Class B Holders and Class C Holders are pre-IPO owners of our business who continue to hold their interests directly in HLA. Class B units and Class C units may be exchanged for shares of Class A common stock pursuant to and subject to the restrictions set forth in the exchange agreement.

|

|

(2)

|

As part of the Reorganization, the other members of HLA exchanged their ownership interests of HLA for 3,899,169 shares of Class A common stock and hold these shares directly.

|

|

(3)

|

We hold all of the Class A units of HLA, representing the right to receive approximately 34.4% of the distributions made by HLA. We act as the sole manager of HLA and operate and control all of its business and affairs.

|

|

•

|

Primary Investments.

Primary investments are investments in private markets funds at the time the funds are initially launched. We apply the same rigorous analytical process to all primary investment opportunities for advisory accounts, customized separate accounts and specialized funds. In most cases, fund managers seeking institutional capital actively market their funds to us due to our broad client base and market position. We regularly review and discuss investment opportunities with customized separate account clients, certain of which have discretion over final investment decisions. Advisory clients often request that we review funds that are marketed directly to the clients or with which the clients have an existing relationship. For advisory clients, we may issue a report recommending in favor of or against an investment in each fund that we review.

|

|

•

|

Secondary Investments.

Secondary investments are investments in private markets funds through secondary market purchases of existing fund interests from existing limited partners in those funds. The private secondary market is a non-regulated private market in which buyers and sellers directly negotiate the terms of transactions. The secondary market has grown dramatically in the last 20 years and today provides a reliable liquidity option for owners of private markets interests as well as attractive buying opportunities for secondary investors. Institutional investors utilize

|

|

◦

|

Single Funds:

These transactions are often too small for the larger secondary funds and brokers and can be accessed through proprietary or less competitive sourcing methods. The relatively modest size of our secondary funds, market knowledge and relationships with general partners make us an ideal buyer in these transactions.

|

|

◦

|

Subset Portfolios:

In these transactions, we typically target a multi-fund portfolio with limited information and/or transfer restrictions. By creating subset portfolios around restricted funds, we are able to serve as a solutions provider to investors and brokers while accessing transactions with favorable competitive dynamics.

|

|

◦

|

Structured/Direct Transactions:

These transactions typically involve the direct purchase of companies alongside an existing or new manager, including fund manager spin-outs and fund manager restructurings. We are an attractive partner to managers seeking to build relationships with potential future primary investors.

|

|

•

|

Direct/co-investments.

Direct/co-investments are direct investments alongside private markets funds in underlying portfolio companies. Our direct/co-investment strategy starts with actively soliciting the managers of private markets funds in which we have made investments to offer our specialized funds and customized separate accounts all direct/co-investment opportunities that may arise from their investment operations. While we utilize our current relationships to generate deal flow, we also actively develop relationships with less familiar private markets fund managers to source significant deal flow. In fact, approximately 60% of our direct/co-investment deal flow over the last 10 years came from general partners that we did not broadly recommend. The value proposition for general partners to offer co-investments to us falls into three primary categories: (1) we can be a source of additional capital for deals that may otherwise be too large for general partners seeking targeted diversification; (2) a co-investment can present an opportunity for a general partner to further develop their relationship with us, one of the largest providers of capital to the private markets; and (3) we believe we are increasingly viewed as a strategic investor in some manner (e.g., geographic assistance, industry knowledge and brand reputation). In addition to private markets fund managers, relationships are developed with other sources of deal flow,

|

|

•

|

Strategic Opportunities funds:

Our Strategic Opportunities funds are short duration, private markets funds that seek to create a portfolio of opportunistically oriented, private markets investments that generate attractive risk-adjusted returns through a flexible and diversified investment strategy. The funds seek to invest across the entire capital structure and primarily utilize credit direct/co-investments, as well as tail-end secondary investments, to create a portfolio biased toward shorter-duration exposures and downside protection, including a current yield component. The Strategic Opportunities funds also may seek to layer into the portfolio construction opportunistic investments, including unique equity positions and investments in areas of market dislocation. These funds leverage our existing platform to generate additional attractive deal flow.

|

|

•

|

Investment Origination

. Fund managers raising new funds and seeking institutional investors typically market their funds directly to us. For secondary investments and direct/co-investments, we aggressively pursue attractive opportunities through our network of fund manager relationships, consultants and, to a lesser extent, third-party distributors.

|

|

•

|

Preliminary Screening

. For primary fund investment opportunities, including real estate, the screening process consists of a formal review of any private placement memorandum that we receive from a prospective fund manager. A screening memo is prepared by the fund investment team and the investment committee makes a decision whether to proceed to due diligence or decline the investment opportunity. For secondary and direct/co-investment opportunities, each investment is evaluated by the respective investment teams and the most attractive opportunities are reviewed in a formal screening process by the investment committee.

|

|

•

|

Due Diligence Evaluation

. For primary fund investments that proceed past the initial screening process, we meet in person with the fund manager. A meeting memo prepared by the investment team based on the meeting is presented to the investment committee for a formal vote. If we elect to move forward, we issue a detailed questionnaire to the fund manager. We subsequently conduct a site visit at the fund manager’s office. Lastly, we prepare a final investment report, which provides details on the manager’s performance, merits and issues, as well as in-depth analysis of the portfolio.

|

|

•

|

Financial Analysis

. All investment opportunities that pass the initial due diligence review undergo a quantitative, rigorous financial and valuation review. For primary investments, financial analysis includes a thorough review of the fund manager’s historical track record, in which we seek to identify the drivers of return.

|

|

•

|

Investment Evaluation and Decision-Making

. Throughout the due diligence process, the investment team meets periodically with members of the investment committee in an iterative, dynamic “give and take” process leading to the investment decision stage.

|

|

•

|

Negotiation, Documentation and Closing

. Upon recommendation of an investment, we attend to all aspects of the negotiation, documentation and closing processes. Our in-house legal team is mobilized to review the transaction documents, including, in the case of direct/co-investments, the governing documents of the direct/co-investment vehicle and stockholders or comparable agreement setting forth the rights of the direct/co-investors. Throughout the documentation and closing process, the investment team and the legal team work closely together to maximize economic terms and legal rights and protections for our clients and our specialized funds.

|

|

•

|

market conditions and investment opportunities during previous periods may have been significantly more favorable for generating positive performance than those we may experience in the future;

|

|

•

|

the performance of our funds is generally calculated on the basis of NAV of the funds’ investments, including unrealized gains, which may never be realized;

|

|

•

|

our historical returns derive largely from the performance of our earlier funds, whereas future fund returns will depend increasingly on the performance of our newer funds or funds not yet formed;

|

|

•

|

our newly established funds may generate lower returns during the period that they take to deploy their capital;

|

|

•

|

in recent years, there has been increased competition for investment opportunities resulting from the increased amount of capital invested in private markets alternatives and high liquidity in debt markets, and the increased competition for investments may reduce our returns in the future; and

|

|

•

|

the performance of particular funds also will be affected by risks of the industries and businesses in which they invest.

|

|

Fund

|

Vintage

year

|

Fund size ($M)

|

Realized

Capital

invested ($M)

|

Realized

Gross

multiple

|

Realized

Gross

IRR (%)

|

Realized Gross

Spread vs.

S&P 500 PME

|

Realized Gross

Spread vs.

MSCI World PME

|

|

Primaries

(Diversified)

|

|||||||

|

PEF I

|

1998

|

122

|

117

|

1.3

|

5.4%

|

378 bps

|

271 bps

|

|

PEF IV

|

2000

|

250

|

238

|

1.7

|

16.2%

|

1,302 bps

|

1,117 bps

|

|

PEF V

|

2003

|

135

|

113

|

1.8

|

17.1%

|

1,176 bps

|

1,219 bps

|

|

PEF VI

|

2007

|

494

|

382

|

1.6

|

14.2%

|

370 bps

|

670 bps

|

|

PEF VII

|

2010

|

262

|

52

|

1.6

|

23.8%

|

798 bps

|

1,203 bps

|

|

PEF VIII

|

2012

|

427

|

1

|

1.2

|

14.0%

|

587 bps

|

1,144 bps

|

|

PEF IX

|

2015

|

462

|

—

|

—

|

—

|

—

|

—

|

|

Secondaries

|

|||||||

|

Pre-Fund

|

—

|

—

|

363

|

1.5

|

17.2%

|

1,326 bps

|

1,135 bps

|

|

Secondary Fund I

|

2005

|

360

|

247

|

1.4

|

8.8%

|

470 bps

|

623 bps

|

|

Secondary Fund II

|

2008

|

591

|

484

|

1.6

|

23.7%

|

869 bps

|

1,227 bps

|

|

Secondary Fund III

|

2012

|

909

|

145

|

1.8

|

39.9%

|

2,475 bps

|

2,925 bps

|

|

Secondary Fund IV

|

2016

|

1,074

|

—

|

—

|

—

|

—

|

—

|

|

Co-investments

|

|||||||

|

Pre-Fund

|

—

|

—

|

239

|

1.9

|

21.7%

|

1,716 bps

|

1,610 bps

|

|

Co-Investment Fund

|

2005

|

604

|

342

|

1.5

|

6.5%

|

74 bps

|

258 bps

|

|

Co-Investment Fund II

|

2008

|

1,195

|

562

|

2.4

|

23.2%

|

1,146 bps

|

1,475 bps

|

|

Co-Investment Fund III

|

2014

|

1,243

|

15

|

5.0

|

136.0%

|

12,860 bps

|

13,393 bps

|

|

Strategic Opportunities

(Tail-end secondaries and credit)

|

|||||||

|

Strat Opps 2015

|

2015

|

71

|

9

|

1.5

|

44.8%

|

4,060 bps

|

4,438 bps

|

|

Strat Opps 2016

|

2016

|

214

|

7

|

1.1

|

42.9%

|

3,757 bps

|

4,088 bps

|

|

Fund

|

Vintage

year

|

Fund size ($M)

|

Capital invested

($M)

|

Gross multiple

|

Net Multiple

|

Gross IRR (%)

|

Net

IRR (%)

|

Gross Spread vs.

S&P 500 PME

|

Net Spread vs. S&P 500 PME

|

Gross Spread vs. MSCI World PME

|

Net Spread vs. MSCI World PME

|

|

Primaries

(Diversified)

|

|||||||||||

|

PEF I

|

1998

|

122

|

117

|

1.3

|

1.2

|

5.4%

|

2.5%

|

378 bps

|

76 bps

|

271 bps

|

(31) bps

|

|

PEF IV

|

2000

|

250

|

238

|

1.7

|

1.5

|

16.2%

|

11.2%

|

1,302 bps

|

828 bps

|

1,117 bps

|

654 bps

|

|

PEF V

|

2003

|

135

|

132

|

1.7

|

1.6

|

14.7%

|

10.1%

|

901 bps

|

421 bps

|

961 bps

|

474 bps

|

|

PEF VI

|

2007

|

494

|

503

|

1.6

|

1.6

|

12.4%

|

9.7%

|

183 bps

|

(53) bps

|

485 bps

|

245 bps

|

|

PEF VII

|

2010

|

262

|

260

|

1.4

|

1.3

|

14.3%

|

9.7%

|

90 bps

|

(375) bps

|

504 bps

|

29 bps

|

|

PEF VIII

|

2012

|

427

|

254

|

1.1

|

1.1

|

10.0%

|

5.3%

|

27 bps

|

(480) bps

|

448 bps

|

(73) bps

|

|

PEF IX

|

2015

|

462

|

159

|

1.1

|

1.1

|

16.1%

|

12.7%

|

376 bps

|

(172) bps

|

762 bps

|

168 bps

|

|

Secondaries

|

|||||||||||

|

Pre-Fund

|

—

|

—

|

363

|

1.5

|

N/A

|

17.2%

|

N/A

|

1,326 bps

|

N/A

|

1,135 bps

|

N/A

|

|

Secondary Fund I

|

2005

|

360

|

353

|

1.3

|

1.2

|

5.8%

|

4.4%

|

168 bps

|

(2) bps

|

354 bps

|

176 bps

|

|

Secondary Fund II

|

2008

|

591

|

569

|

1.6

|

1.5

|

20.9%

|

15.0%

|

566 bps

|

(32) bps

|

931 bps

|

321 bps

|

|

Secondary Fund III

|

2012

|

909

|

759

|

1.3

|

1.3

|

21.5%

|

17.6%

|

990 bps

|

562 bps

|

1,437 bps

|

1,018 bps

|

|

Secondary Fund IV

|

2016

|

1,074

|

287

|

1.1

|

1.4

|

34.8%

|

>100%

|

2,064 bps

|

8,463 bps

|

2,318 bps

|

8,909 bps

|

|

Co-investments

|

|||||||||||

|

Pre-Fund

|

—

|

—

|

244

|

1.9

|

N/A

|

21.4%

|

N/A

|

1,655 bps

|

N/A

|

1,559 bps

|

N/A

|

|

Co-Investment Fund

|

2005

|

604

|

577

|

1.1

|

1.0

|

1.7%

|

0.3%

|

(421) bps

|

(590) bps

|

(213) bps

|

(387) bps

|

|

Co-Investment Fund II

|

2008

|

1,195

|

1,129

|

2.0

|

1.8

|

20.4%

|

16.3%

|

854 bps

|

436 bps

|

1,209 bps

|

786 bps

|

|

Co-Investment Fund III

|

2014

|

1,243

|

805

|

1.2

|

1.1

|

22.7%

|

15.8%

|

1,316 bps

|

662 bps

|

1,764 bps

|

1,063 bps

|

|

Strategic Opportunities

(Tail-end secondaries and credit)

|

|||||||||||

|

Strat Opps 2015

|

2015

|

71

|

67

|

1.2

|

1.2

|

18.1%

|

14.1%

|

803 bps

|

392 bps

|

1,164 bps

|

764 bps

|

|

Strat Opps 2016

|

2016

|

214

|

142

|

1.1

|

1.1

|

19.2%

|

20.3%

|

295 bps

|

294 bps

|

786 bps

|

759 bps

|

|

|

(1)

|

the NAV of our clients’ and funds’ underlying investments;

|

|

(2)

|

the unfunded commitments to our clients’ and funds’ underlying investments; and

|

|

(3)

|

the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment.

|

|

•

|

Global access to private markets investment opportunities through our size, scale, reputation and strong relationships with private markets fund managers;

|

|

•

|

Brand recognition and reputation within the investing community;

|

|

•

|

Performance of investment strategies;

|

|

•

|

Quality of service and duration of client relationships;

|

|

•

|

Ability to provide cost effective and comprehensive range of services and products; and

|

|

•

|

Clients’ perceptions of our independence and the alignment of our interests with theirs created through our investment in our own products.

|

|

•

|

market conditions and investment opportunities during previous periods may have been significantly more favorable for generating positive performance than those we may experience in the future;

|

|

•

|

the performance of our funds is generally calculated on the basis of NAV of the funds’ investments, including unrealized gains, which may never be realized;

|

|

•

|

our historical returns derive largely from the performance of our earlier funds, whereas future fund returns will depend increasingly on the performance of our newer funds or funds not yet formed;

|

|

•

|

our newly established funds may generate lower returns during the period that they initially deploy their capital;

|

|

•

|

in recent years, there has been increased competition for investment opportunities resulting from the increased amount of capital invested in private markets alternatives and high liquidity in debt markets, and the increased competition for investments may reduce our returns in the future; and

|

|

•

|

the performance of particular funds also will be affected by risks of the industries and businesses in which they invest.

|

|

•

|

incur additional debt;

|

|

•

|

provide guarantees in respect of obligations of other persons;

|

|

•

|

make loans, advances and investments;

|

|

•

|

make certain payments in respect of equity interests, including, among others, the payment of dividends and other distributions, redemptions and similar payments, payments in respect of warrants, options and other rights, and payments in respect of subordinated indebtedness;

|

|

•

|

enter into transactions with investment funds and affiliates;

|

|

•

|

create or incur liens;

|

|

•

|

enter into negative pledges;

|

|

•

|

sell all or any part of the business, assets or property, or otherwise dispose of assets;

|

|

•

|

make acquisitions or consolidate or merge with other persons;

|

|

•

|

enter into sale-leaseback transactions;

|

|

•

|

change the nature of our business;

|

|

•

|

change our fiscal year;

|

|

•

|

make certain modifications to organizational documents or certain material contracts;

|

|

•

|

make certain modifications to certain other debt documents; and

|

|

•

|

enter into certain agreements, including agreements limiting the payment of dividends or other distributions in respect of equity interests, the repayment of indebtedness, the making of loans or advances, or the transfer of assets.

|

|

•

|

greater difficulties in managing and staffing foreign operations;

|

|

•

|

fluctuations in foreign currency exchange rates that could adversely affect our results;

|

|

•

|

unexpected changes in trading policies, regulatory requirements, tariffs and other barriers;

|

|

•

|

longer transaction cycles;

|

|

•

|

higher operating costs;

|

|

•

|

local labor conditions and regulations;

|

|

•

|

adverse consequences or restrictions on the repatriation of earnings;

|

|

•

|

potentially adverse tax consequences, such as trapped foreign losses;

|

|

•

|

less stable political and economic environments;

|

|

•

|

terrorism, political hostilities, war and other civil disturbances or other catastrophic events that reduce business activity;

|

|

•

|

cultural and language barriers and the need to adopt different business practices in different geographic areas; and

|

|

•

|

difficulty collecting fees and, if necessary, enforcing judgments.

|

|

•

|

some of our competitors have more relevant experience, greater financial and other resources and more personnel than we do;

|

|

•

|

there are relatively few barriers to entry impeding new asset management firms, including a relatively low cost of entering these lines of business, and the successful efforts of new entrants into our various lines of business have resulted in increased competition;

|

|

•

|

if, as we expect, allocation of assets to alternative investment strategies increases, there may be increased competition for alternative investments and access to fund general partners and managers;

|

|

•

|

certain investors may prefer to invest with private partnerships; and

|

|

•

|

other industry participants will from time to time seek to recruit our investment professionals and other employees away from us.

|

|

•

|

it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or

|

|

•

|

absent an applicable exemption, it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis.

|

|

•

|

provide that vacancies on our board of directors may be filled only by a majority of directors then in office, even though less than a quorum;

|

|

•

|

establish that our board of directors is divided into three classes, with each class serving three-year staggered terms;

|

|

•

|

require that any action to be taken by our stockholders be effected at a duly called annual or special meeting and not by written consent, except that action by written consent will be allowed for as long as we are a controlled company;

|

|

•

|

specify that special meetings of our stockholders can be called only by our board of directors or the chairman of our board of directors;

|

|

•

|

establish an advance notice procedure for stockholder proposals to be brought before an annual meeting, including proposed nominations of persons for election to our board of directors;

|

|

•

|

authorize our board of directors to issue, without further action by the stockholders, up to 10,000,000 shares of undesignated preferred stock; and

|

|

•

|

reflect two classes of common stock, as discussed above.

|

|

Highest

|

Lowest

|

|||||||

|

Fiscal 2017

|

||||||||

|

Fourth quarter (from March 1)

|

$

|

19.66

|

|

$

|

17.74

|

|

||

|

3/1/2017

|

|

3/31/17

|

||||||

|

Hamilton Lane Incorporated

|

$

|

100.00

|

|

|

$

|

103.61

|

|

|

|

S&P 500

|

100.00

|

|

|

98.75

|

|

|||

|

Dow Jones US Asset Managers Index

|

100.00

|

|

|

96.85

|

|

|||

|

•

|

We used approximately $37.2 million of the net proceeds to purchase membership units in HLA from certain of its then-existing members, at a per-unit price equal to the IPO price per share of our Class A common stock. Accordingly, we did not retain any of those proceeds. Certain of these owners are or were affiliates of our directors, officers or persons owning 10% or more of our Class A common stock.

|

|

•

|

We used approximately $166.0 million of the net proceeds from our IPO to purchase newly issued membership units in HLA at a per-unit price equal to the IPO price per share of our Class A common stock. As sole managing member of HLA, we caused HLA to use approximately $160.0 million of these proceeds to repay principal under the Term Loan and approximately $6.0 million to pay the expenses incurred in connection with our IPO and the Reorganization and for general corporate purposes.

|

|

Period

|

|

Total

Number of

Shares

Purchased(1)

|

|

Average Price

Paid per

Share

|

|

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

|

|

Maximum Approximate

Dollar Value of

Shares

that May Yet Be

Purchased Under the

Plans or Programs

|

|||

|

January 1-31, 2017

|

|

—

|

|

$

|

—

|

|

|

—

|

|

—

|

|

|

February 1-28, 2017

|

|

—

|

|

$

|

—

|

|

|

—

|

|

—

|

|

|

March 1-31, 2017

|

|

114,529

|

|

|

$

|

18.79

|

|

|

—

|

|

—

|

|

Total

|

114,529

|

|

$

|

18.79

|

|

||||||

|

Year Ended March 31,

|

|||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||

|

Income Statement Data

|

(in thousands, except per share amounts)

|

||||||||||||||||||

|

Revenues

|

|||||||||||||||||||

|

Management and advisory fees

|

$

|

172,674

|

|

$

|

157,630

|

|

$

|

145,876

|

|

$

|

130,455

|

|

$

|

112,982

|

|

||||

|

Incentive fees

|

7,146

|

|

23,167

|

|

9,509

|

|

9,309

|

|

6,179

|

|

|||||||||

|

Total revenues

|

179,820

|

|

180,797

|

|

155,385

|

|

139,764

|

|

119,161

|

|

|||||||||

|

Total expenses

|

103,705

|

|

118,963

|

|

87,022

|

|

80,710

|

|

68,999

|

|

|||||||||

|

Total other income (expense)

|

(1,361

|

)

|

(5,113

|

)

|

3,622

|

|

7,845

|

|

848

|

|

|||||||||

|

Income before income taxes

|

74,754

|

|

56,721

|

|

71,985

|

|

66,899

|

|

51,010

|

|

|||||||||

|

Income tax expense (benefit)

|

316

|

|

869

|

|

483

|

|

(128

|

)

|

(827

|

)

|

|||||||||

|

Net income

|

74,438

|

|

55,852

|

|

71,502

|

|

67,027

|

|

51,837

|

|

|||||||||

|

Less: Income attributable to non-controlling interests

|

73,826

|

|

55,852

|

|

71,502

|

|

67,027

|

|

51,837

|

|

|||||||||

|

Net income attributable to Hamilton Lane Incorporated

|

$

|

612

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Earnings per share of Class A common stock

(1)

:

|

|||||||||||||||||||

|

Basic

|

$

|

0.03

|

|

||||||||||||||||

|

Diluted

|

$

|

0.03

|

|

||||||||||||||||

|

Non-GAAP Financial Measures

|

|||||||||||||||||||

|

Fee Related Earnings

(2)

|

72,252

|

|

70,381

|

|

63,396

|

|

54,256

|

|

46,837

|

|

|||||||||

|

Adjusted EBITDA

(2)

|

83,031

|

|

67,785

|

|

73,707

|

|

64,119

|

|

55,335

|

|

|||||||||

|

Other Data

|

|||||||||||||||||||

|

Compensation expense on deferred incentive fee revenue

(3)

|

—

|

|

20,348

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Balance Sheet Data

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

32,286

|

|

$

|

68,584

|

|

$

|

67,089

|

|

$

|

75,818

|

|

$

|

57,416

|

|

||||

|

Investments

|

120,147

|

|

102,749

|

|

103,360

|

|

92,123

|

|

77,861

|

|

|||||||||

|

Total assets

|

240,617

|

|

196,636

|

|

201,500

|

|

195,231

|

|

170,893

|

|

|||||||||

|

Deferred incentive fee revenue

|

45,166

|

|

45,166

|

|

1,960

|

|

—

|

|

—

|

|

|||||||||

|

Senior secured term loan payable, net

|

84,310

|

|

243,317

|

|

107,719

|

|

122,426

|

|

147,514

|

|

|||||||||

|

Total liabilities

|

153,990

|

|

308,574

|

|

127,810

|

|

138,119

|

|

159,952

|

|

|||||||||

|

Total equity (deficit)

|

86,627

|

|

(111,938

|

)

|

73,690

|

|

57,112

|

|

10,941

|

|

|||||||||

|

Total liabilities and equity

|

240,617

|

|

196,636

|

|

201,500

|

|

195,231

|

|

170,893

|

|

|||||||||

|

(1)

|

Represents earnings per share of Class A common stock and weighted-average shares of Class A common stock outstanding for the period from March 6, 2017 through March 31, 2017, the period following the Reorganization and IPO.

|

|

(2)

|

Adjusted EBITDA and Fee Related Earnings (“FRE”) are non-GAAP measures. For a further discussion of our non-GAAP measures and a reconciliation from GAAP financial measures to non-GAAP financial measures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” included in Part II, Item 7 of this Form 10-K.

|

|

(3)

|

In accordance with our accounting policy with respect to the recognition of incentive fee income, we did not recognize $41.5 million in carried interest distributions received from specialized funds in fiscal 2016, as all contingencies had not been resolved. However, incentive fee compensation expense of $20.3 million related to the receipt of this carried interest was recognized in fiscal 2016 as we believe it is probable that we will incur the expenses. The $20.3 million is separately presented above to highlight the incentive fee compensation expense for which we did not recognize the associated incentive fee revenue. The compensation expense on deferred incentive fee revenue comprises $9.9 million of bonus and other revenue sharing allocations classified as base compensation and $10.4 million of incentive fee compensation. If none of the associated incentive fee revenue is recognized in a future period and we determine that its recognition is no longer probable, we will reverse the $20.3 million of previously recognized compensation expense through a clawback and a reduction in bonus payments. We incurred additional incentive fee compensation expense of $11.4 million in fiscal 2016 associated with incentive fee revenue that is not reflected in this figure.

|

|

•

|

Customized Separate Accounts

: We design and build customized portfolios of private markets funds and direct investments to meet our clients’ specific portfolio objectives with regard to return, risk tolerance, diversification and liquidity. We generally have discretionary investment authority over our customized separate accounts, which comprised approximately $33 billion of our AUM as of

March 31, 2017

.

|

|

•

|

Specialized Funds

: We organize, invest and manage specialized primary, secondary and direct/co-investment funds. Our specialized funds invest across a variety of private markets and include equity, equity-linked and credit funds offered on standard terms as well as shorter duration, opportunistically oriented funds. We launched our first specialized fund in 1997, and our product offerings have grown steadily, comprising approximately $9 billion of our AUM as of

March 31, 2017

.

|

|

•

|

Advisory Services

: We offer investment advisory services to assist clients in developing and implementing their private markets investment programs. Our investment advisory services include asset allocation, strategic plan creation, development of investment policies and guidelines, the screening and recommending of investments, legal negotiations, the monitoring of and reporting on investments and investment manager review and due diligence. Our advisory clients include some of the largest and most sophisticated private markets investors in the world. We had approximately $300 billion of AUA as of

March 31, 2017

.

|

|

•

|

Distribution Management

: We offer distribution management services to our clients through active portfolio management to enhance the realized value of publicly traded stock they receive as distributions from private equity funds.

|

|

•

|

Reporting, Monitoring, Data and Analytics:

We provide our clients with comprehensive reporting and investment monitoring services, usually bundled into our broader investment solutions offerings, but occasionally on a stand-alone, fee-for-service basis. Private markets investments are unusually difficult to monitor, report on and administer, and our clients are able to benefit from our sophisticated infrastructure, which provides clients with real time access to reliable and transparent investment data, and our high-touch service approach, which allows for timely and informed responses to the multiplicity of issues that can arise. We also provide comprehensive research and analytical services as part of our investment solutions, leveraging our large, global, proprietary and high-quality database of private markets investment performance and our suite of proprietary analytical investment tools.

|

|

•

|

The extent to which investors favor alternative investments.

Our ability to attract new capital is partially dependent on investors’ views of alternative assets relative to traditional publicly listed equity and debt securities. We believe fundraising efforts will continue to be impacted by certain fundamental asset management trends that include: (1) the increasing importance and market share of alternative investment strategies to investors in light of an increased focus on lower-correlated and absolute levels of return; (2) the increasing demands of the investing community, including the potential for fee compression and changes to other terms; (3) shifting asset allocation policies of institutional investors; and (4) increasing barriers to entry and growth.

|

|

•

|

Our ability to generate strong returns.

We must continue to generate strong returns for our investors through our disciplined investment diligence process in an increasingly competitive market. The ability to attract and retain clients is partially dependent on returns we are able to deliver versus our peers. The capital we are able to attract drives the growth of our AUM and AUA and the management and advisory fees we earn.

|

|

•

|

Our ability to source investments with attractive risk-adjusted returns.

An increasing part of our management fee and incentive fee revenue has been from our co-investment and secondary investment platforms. The continued growth of this revenue is dependent on our continued ability to source attractive investments and deploy the capital that we have raised or manage on behalf of our clients. Because we are selective in the opportunities in which we invest, the capital deployed can vary from year to year. Our ability to identify attractive investments and execute on those investments is dependent on a number of factors, including the general macroeconomic environment, valuation, transaction size, and expected duration of such investment opportunity. A significant decrease in the quality or quantity of potential opportunities could adversely affect our ability to source investments with attractive risk-adjusted returns.

|

|

•

|

Our ability to maintain our data advantage relative to competitors.

We believe that the general trend towards transparency and consistency in private markets reporting will create new opportunities for us to leverage our databases and analytical capabilities. We intend to use these advantages afforded to us by our proprietary databases, analytical tools and deep industry knowledge to drive our performance, provide our clients with customized solutions across private markets asset classes and continue to differentiate our products and services from those of our competitors. Our ability to maintain our data advantage is dependent on a number of factors, including our continued access to a broad set of private market information on an on-going basis, as well as our ability to maintain our investment scale, considering the evolving competitive landscape and potential industry consolidation.

|

|

•

|

Our ability to continue to expand globally

. We believe that many institutional investors outside the United States are currently underinvested in private markets asset classes and that capturing capital inflows into private capital investing from non-U.S. global markets represents a significant growth opportunity for us. Our ability to continue to expand globally is dependent on our ability to continue building successful relationships with investors internationally and subject to the evolving macroeconomic and regulatory environment of the various countries where we operate or in which we invest.

|

|

•

|

Increased competition to work with top private equity fund managers.

There has been a trend amongst private markets investors to consolidate the number of general partners in which they invest. At the same time, an increasing flow of capital to the private markets has often times resulted in certain funds being oversubscribed. This has resulted in some investors, primarily smaller investors or less strategically important investors, not being able to gain access to certain funds. Our ability to invest and maintain our sphere of influence with these high-performing fund managers is critical to our investors’ success and our ability to maintain our competitive position and grow our revenue.

|

|

•

|

Unpredictable global macroeconomic conditions

. Global economic conditions, including political environments, financial market performance, interest rates, credit spreads or other conditions beyond our control, all of which affect the performance of the assets underlying private market investments, are unpredictable and could negatively affect the performance of our clients’ portfolios or the ability to raise funds in the future.

|

|

•

|

Increasing regulatory requirements

. The complex regulatory and tax environment could restrict our operations and subject us to increased compliance costs and administrative burdens, as well as restrictions on our business activities.

|

|

•

|

the limited liability company operating agreement of HLA was amended and restated to, among other things, (i) effect a reverse split of existing membership interests; (ii) exchange all of the then-existing membership interests of the members of HLA for Class B and Class C units, (iii) reclassify all membership interests held by us as Class A units, and (iv) appoint us as the sole managing member of HLA;

|

|

•

|

our certificate of incorporation was amended and restated to, among other things, (i) provide for Class A common stock and Class B common stock, (ii) set forth the voting rights of the Class A common stock and Class B common stock, and (iii) establish a classified board of directors;

|

|

•

|

certain HLA members exchanged their HLA units for 3,899,169 shares of Class A common stock of HLI;

|

|

•

|

HLI issued to the Class B unitholders of HLA one share of Class B common stock for each Class B unit that they owned, in exchange for a payment of its par value; and

|

|

•

|

HLI entered into an exchange agreement with the direct owners of HLA pursuant to which they will be entitled to exchange HLA units for shares of our Class A common stock on a one-for-one basis.

|

|

Year Ended March 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Revenues

|

||||||||||||

|

Management and advisory fees

|

$

|

172,674

|

|

$

|

157,630

|

|

$

|

145,876

|

|

|||

|

Incentive fees

|

7,146

|

|

23,167

|

|

9,509

|

|

||||||

|

Total revenues

|

179,820

|

|

180,797

|

|

155,385

|

|

||||||

|

Expenses

|

|

|

||||||||||

|

Compensation and benefits

|

72,116

|

|

92,065

|

|

60,157

|

|

||||||

|

General, administrative and other

|

31,589

|

|

26,898

|

|

26,865

|

|

||||||

|

Total expenses

|

103,705

|

|

118,963

|

|

87,022

|

|

||||||

|

Other income (expense)

|

|

|

||||||||||

|

Equity in income of investees

|

12,801

|

|

1,518

|

|

10,474

|

|

||||||

|

Interest expense

|

(14,565

|

)

|

(12,641

|

)

|

(5,883

|

)

|

||||||

|

Interest income

|

320

|

|

194

|

|

87

|

|

||||||

|

Other non-operating income (loss)

|

83

|

|

5,816

|

|

(1,056

|

)

|

||||||

|

Total other income (expense)

|

(1,361

|

)

|

(5,113

|

)

|

3,622

|

|

||||||

|

Income before income taxes

|

74,754

|

|

56,721

|

|

71,985

|

|

||||||

|

Income tax expense

|

316

|

|

869

|

|

483

|

|

||||||

|

Net income

|

74,438

|

|

55,852

|

|

71,502

|

|

||||||

|

Less: Income (loss) attributable to non-controlling interests in general partnerships

|

1,192

|

|

(1,255

|

)

|

2,242

|

|

||||||

|

Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C.

|

72,634

|

|

57,107

|

|

69,260

|

|

||||||

|

Net income attributable to Hamilton Lane Incorporated

|

$

|

612

|

|

$

|

—

|

|

$

|

—

|

|

|||

|

Year Ended March 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Management and advisory fees

|

||||||||||||

|

Customized separate accounts

|

$

|

71,261

|

|

$

|

67,879

|

|

$

|

63,275

|

|

|||

|

Specialized funds

|

74,675

|

|

62,340

|

|

51,315

|

|

||||||

|

Advisory and reporting

|

23,798

|

|

22,536

|

|

22,388

|

|

||||||

|

Distribution management

|

2,940

|

|

4,875

|

|

8,898

|

|

||||||

|

Total management and advisory fees

|

172,674

|

|

157,630

|

|

145,876

|

|

||||||

|

Incentive fees

|

7,146

|

|

23,167

|

|

9,509

|

|

||||||

|

Total revenues

|

$

|

179,820

|

|

$

|

180,797

|

|

$

|

155,385

|

|

|||

|

Year Ended March 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Equity in income of investees

|

||||||||||||

|

Primary funds

|

$

|

1,749

|

|

$

|

609

|

|

$

|

1,379

|

|

|||

|

Direct/co-investment funds

|

4,652

|

|

(1,455

|

)

|

4,621

|

|

||||||

|

Secondary funds

|

1,275

|

|

222

|

|

794

|

|

||||||

|

Customized separate accounts

|

5,125

|

|

2,142

|

|

3,680

|

|

||||||

|

Total equity in income of investees

|

$

|

12,801

|

|

$

|

1,518

|

|

$

|

10,474

|

|

|||

|

Year Ended March 31,

|

Year Ended March 31,

|

|||||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Customized Separate Accounts

|

Specialized Funds

|

Total

|

Customized Separate Accounts

|

Specialized Funds

|

Total

|

|||||||||||||||

|

Balance, beginning of period

|

$

|

16,976

|

|

$

|

7,019

|

|

$

|

23,995

|

|

$

|

16,336

|

|

$

|

6,064

|

|

$

|

22,400

|

|

||

|

Contributions

(1)

|

3,214

|

|

1,949

|

|

5,163

|

|

3,289

|

|

1,472

|

|

4,761

|

|

||||||||

|

Distributions

(2)

|

(1,959

|

)

|

(184

|

)

|

(2,143

|

)

|

(2,605

|

)

|

(501

|

)

|

(3,106

|

)

|

||||||||

|

Foreign exchange, market value and other

(3)

|

(203

|

)

|

9

|

|

(194

|

)

|

(44

|

)

|

(16

|

)

|

(60

|

)

|

||||||||

|

Balance, end of period

|

$

|

18,028

|

|

$

|

8,793

|

|

$

|

26,821

|

|

$

|

16,976

|

|

$

|

7,019

|

|

$

|

23,995

|

|

||

|

(1)

|

Contributions represent new commitments from customized separate accounts and specialized funds that earn fees on a committed capital fee base and capital contributions to underlying investments from customized separate accounts and specialized funds that earn fees on a net invested capital or NAV fee base.

|

|

(2)

|

Distributions represent returns of capital in customized separate accounts and specialized funds that earn fees on a net invested capital or NAV fee base, reductions in fee-earning AUM from separate accounts and specialized funds that moved from a committed capital to net invested capital fee base and reductions in fee-earning AUM from customized separate accounts and specialized funds that are no longer earning fees.

|

|

(3)

|

Foreign exchange, market value and other consists primarily of the impact of foreign exchange rate fluctuations for customized separate accounts and specialized funds that earn fees on non-U.S. dollar denominated commitments and market value appreciation (depreciation) from customized separate accounts that earn fees on a NAV fee base.

|

|

Year Ended March 31,

|

||||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Net income attributable to Hamilton Lane Incorporated

(1)

|

$

|

612

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Income (loss) attributable to non-controlling interests in general partnerships

|

1,192

|

|

(1,255

|

)

|

2,242

|

|

4,565

|

|

3,157

|

|

||||||||||

|

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C.

|

72,634

|

|

57,107

|

|

69,260

|

|

62,462

|

|

48,680

|

|

||||||||||

|

Incentive fees

|

(7,146

|

)

|

(23,167

|

)

|

(9,509

|

)

|

(9,309

|

)

|

(6,179

|

)

|

||||||||||

|

Incentive fee related compensation

(2)

|

3,283

|

|

31,714

|

|

4,542

|

|

4,511

|

|

2,854

|

|

||||||||||

|

Interest income

|

(320

|

)

|

(194

|

)

|

(87

|

)

|

(142

|

)

|

(296

|

)

|

||||||||||

|

Interest expense

|

14,565

|

|

12,641

|

|

5,883

|

|

8,503

|

|

11,136

|

|

||||||||||

|

Income tax expense (benefit)

|

316

|

|

869

|

|

483

|

|

(128

|

)

|

(827

|

)

|

||||||||||

|

Equity in income of investees

|

(12,801

|

)

|

(1,518

|

)

|

(10,474

|

)

|

(16,905

|

)

|

(12,149

|

)

|

||||||||||

|

Other non-operating (income) loss

|

(83

|

)

|

(5,816

|

)

|

1,056

|

|

699

|

|

461

|

|

||||||||||

|

Fee Related Earnings

|

$

|

72,252

|

|

$

|

70,381

|

|

$

|

63,396

|

|

$

|

54,256

|

|

$

|

46,837

|

|

|||||

|

Depreciation and amortization

|

1,915

|

|

2,027

|

|

1,867

|

|

1,853

|

|

2,074

|

|

||||||||||

|

Equity-based compensation

|

4,681

|

|

3,730

|

|

3,390

|

|

3,070

|

|

2,803

|

|

||||||||||

|

Incentive fees

|

7,146

|

|

23,167

|

|

9,509

|

|

9,309

|

|

6,179

|

|

||||||||||

|

Incentive fee related compensation

(2)

|

(3,283

|

)

|

(31,714

|

)

|

(4,542

|

)

|

(4,511

|

)

|

(2,854

|

)

|

||||||||||

|

Interest income

|

320

|

|

194

|

|

87

|

|

142

|

|

296

|

|

||||||||||

|

Adjusted EBITDA

|

$

|

83,031

|

|

$

|

67,785

|

|

$

|

73,707

|

|

$

|

64,119

|

|

$

|

55,335

|

|

|||||

|

(1)

|

Prior to our IPO, HLI was a wholly-owned subsidiary of HLA with no operations or assets.

|

|

(2)

|

Incentive fee related compensation includes incentive fee compensation expense and bonus and other revenue sharing allocated to carried interest classified as base compensation.

|

|

Year Ended March 31,

|

|||||

|

2017

|

|||||

|

(in thousands, except share and per-share amounts)

|

|||||

|

Net income attributable to Hamilton Lane Incorporated

|

$

|

612

|

|

||

|

Income attributable to non-controlling interests in general partnerships

|

1,192

|

|

|||

|

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C.

|

72,634

|

|

|||

|

Income tax expense

|

316

|

|

|||

|

IPO related expenses

(1)

|

1,935

|

|

|||

|

Write-off of deferred financing costs

(2)

|

3,359

|

|

|||

|

Adjusted pre-tax net income

|

$

|

80,048

|

|

||

|

Adjusted income taxes

(3)

|

(32,211

|

)

|

|||

|

Adjusted net income

|

$

|

47,837

|

|

||

|

Weighted-average shares of Class A common stock outstanding - diluted

|

18,341,079

|

|

|||

|

Exchange of Class B and Class C units in HLA

(4)

|

34,438,669

|

|

|||

|

Adjusted shares

|

52,779,748

|

|

|||

|

Non-GAAP earnings per share

|

$

|

0.91

|

|

||

|

(1)

|

Represents accrual of one-time payments to induce members of HLA to exchange their HLA units for HLI common stock in the Reorganization.

|

|

(2)

|

Represents write-down of amortized discount and debt issuance related to the $160 million paydown of outstanding indebtedness under the Term Loan with proceeds from the IPO.

|

|

(3)

|

Represents corporate income taxes at assumed effective tax rate of 40.24% applied to adjusted pre-tax net income. The 40.24% is based on a federal tax statutory rate of 35.00% and a combined state income tax rate net of federal benefits of 5.24%.

|

|

(4)

|

Assumes the full exchange of Class B and Class C units in HLA for Class A common stock of HLI pursuant to the exchange agreement.

|

|

Year Ended March 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Net cash provided by operating activities

|

$

|

81,679

|

|

|

$

|

109,175

|

|

|

$

|

76,903

|

|

|

|

Net cash provided by (used in) investing activities

|

(16,715

|

)

|

|

2,502

|

|

|

(10,059

|

)

|

||||

|

Net cash (used in) financing activities

|

(101,211

|

)

|

|

(110,104

|

)

|

|

(74,901

|

)

|

||||

|

Increase (decrease) in cash, cash equivalents and restricted cash

|

$

|

(36,247

|

)

|

$

|

1,573

|

|

$

|

(8,057

|

)

|

|||

|

•

|

net income of $74.4 million, $55.9 million and $71.5 million during the years ended

March 31, 2017

,

2016

and

2015

, respectively, and changes in operating assets and liabilities;

|

|

•

|

deferred incentive fee revenue of $0.0 million, $43.2 million and $2.0 million during the years ended

March 31, 2017

,

2016

and

2015

, respectively, due to the receipt and deferral of incentive fees allocated and subject to continuing contingencies; and

|

|

•

|

proceeds received from investments of $10.8 million, $4.1 million and $8.1 million during the years ended

March 31, 2017

,

2016

and

2015

, respectively, which represent a return on investment from specialized funds and certain customized separate accounts.

|

|

•

|

contributions to and distributions from investments that netted to ($15.4) million, $3.4 million and ($6.2) million for fiscal 2017, 2016 and 2015, respectively; and

|

|

•

|

purchases of furniture, fixtures and equipment consisting primarily of computers and equipment and costs associated with the build out of office space totaling ($1.3) million, ($0.9) million and ($3.9) million in fiscal 2017, 2016 and 2015, respectively.

|

|

•

|

the payoff of our previous term loan of ($108.8) million in fiscal 2016;

|

|

•

|

debt issuance of the Term Loan of $260.0 million offset by related deferred financing costs in fiscal 2016;

|

|

•

|

debt repayments of ($162.6) million, ($12.9) million and $(15.6) million during fiscal 2017, 2016 and 2015, respectively;

|

|

•

|

proceeds from our IPO, net of underwriting discount of $203.2 million, along with deferred offering costs of ($5.8) million in fiscal 2017;

|

|

•

|

the repurchase of equity due to the fiscal 2016 recapitalization of HLA and other purchases of equity interests during fiscal 2016 totaling ($173.6) million and purchases of equity interests and restricted stock of ($58.1) million and ($12.0) million in fiscal 2017 and 2015, respectively; and

|

|

•

|

distributions to equity holders of ($80.5) million, ($67.8) million and ($47.1) million for fiscal 2017, 2016 and 2015, respectively.

|

|

Contractual Obligations, Commitments and Contingencies

|

|||||||||||||||||||

|

(in thousands)

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

More than 5 years

|

||||||||||||||

|

Operating leases

|

$

|

16,582

|

|

$

|

4,103

|

|

$

|

7,088

|

|

$

|

5,391

|

|

$

|

—

|

|

||||

|

Debt obligations payable

(1)

|

86,100

|

|

2,600

|

|

5,200

|

|

5,200

|

|

73,100

|

|

|||||||||

|

Interest on debt obligations payable

(2)

|

19,072

|

|

3,867

|

|

7,389

|

|

6,907

|

|

909

|

|

|||||||||

|

Capital commitments to our investments

(3)

|

76,908

|

|

76,908

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total

|

$

|

198,662

|

|

$

|

87,478

|

|

$

|

19,677

|

|

$

|

17,498

|

|

$

|

74,009

|

|

||||

|

(2)

|

Represents interest to be paid over the maturity of the related debt obligations, which has been calculated assuming no pre-payments will be made and debt will be held until its final maturity date. The future interest payments are calculated using the variable interest rate of 4.48% in effect as of March 31, 2017.

|

|

(3)

|