|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

Virginia

|

54-0251350 |

| ( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number)

|

|

Title of Each Class

|

Name of Each Exchange

on Which Registered

|

| Common Stock, no par value |

NASDAQ Global Select Market

|

| Large accelerated Filer ☐ |

Accelerated Filer ☒

|

| Non-accelerated Filer ☐ |

Smaller reporting company ☐

|

| (Do not check if a smaller reporting company) |

Emerging growth company ☐

|

|

Common stock, no par value

|

11,762,409 |

| (Class of common stock) |

(Number of shares)

|

|

Part I

|

Page

|

|

|

Item 1.

|

5

|

|

|

Item 1A.

|

9

|

|

|

Item 1B.

|

15

|

|

|

Item 2.

|

16

|

|

|

Item 3.

|

16

|

|

|

Item 4.

|

16

|

|

|

17

|

||

|

Part II

|

||

|

Item 5.

|

18

|

|

|

Item 6.

|

20

|

|

|

Item 7.

|

21

|

|

|

Item 7A.

|

38

|

|

|

Item 8.

|

39

|

|

|

Item 9.

|

39

|

|

|

Item 9A.

|

39

|

|

|

Item 9B.

|

40

|

|

|

Part III

|

||

|

Item 10.

|

41

|

|

|

Item 11.

|

41

|

|

|

Item 12.

|

41

|

|

|

Item 13.

|

41

|

|

|

Item 14.

|

41

|

|

|

Part IV

|

||

|

Item 15.

|

42

|

|

|

Item 16.

|

43

|

|

|

44

|

||

|

F-1

|

||

|

§

|

general economic or business conditions, both domestically and internationally, and instability in the financial and credit markets, including their potential impact on our (i) sales and operating costs and access to financing or (ii) customers and suppliers and their ability to obtain financing or generate the cash necessary to conduct their respective businesses;

|

|

§

|

the risks related to the recent Shenandoah acquisition including integration costs, costs related to acquisition debt, maintaining Shenandoah’s existing customer relationships, debt service costs, interest rate volatility, the use of operating cash flows to service debt to the detriment of other corporate initiatives or strategic opportunities, financial statement charges related to the application of current accounting guidance in accounting for the Shenandoah acquisition, the recognition of significant additional depreciation and amortization expenses by the combined entity, the loss of key employees from Shenandoah, the disruption of ongoing businesses or inconsistencies in standards, controls, procedures and policies across the business which could adversely affect our internal control or information systems and the costs of bringing them into compliance and failure to realize benefits anticipated from the Shenandoah acquisition;

|

|

§

|

the risks specifically related to the concentrations of a material part of our sales and accounts receivable in only a few customers;

|

|

§

|

achieving and managing growth and change, and the risks associated with new business lines, acquisitions, restructurings, strategic alliances and international operations;

|

|

§

|

risks associated with our reliance on offshore sourcing and the cost of imported goods, including fluctuation in the prices of purchased finished goods and transportation and warehousing costs;

|

|

§

|

adverse political acts or developments in, or affecting, the international markets from which we import products, including duties or tariffs imposed on those products by foreign governments or the U.S. government;

|

|

§

|

our ability to successfully implement our business plan to increase sales and improve financial performance;

|

|

§

|

changes in actuarial assumptions, the interest rate environment, the return on plan assets and future funding obligations related to the Home Meridian segment’s legacy Pension Plan, which can affect future funding obligations, costs and plan liabilities;

|

|

§

|

the possible impairment of our long-lived assets, which can result in reduced earnings and net worth;

|

|

§

|

the cost and difficulty of marketing and selling our products in foreign markets;

|

|

§

|

disruptions involving our vendors or the transportation and handling industries, particularly those affecting imported products from Vietnam and China, including customs issues, labor stoppages, strikes or slowdowns and the availability of shipping containers and cargo ships;

|

|

§

|

the interruption, inadequacy, security breaches or integration failure of our information systems or information technology infrastructure, related service providers or the internet;

|

|

§

|

disruptions affecting our Virginia, North Carolina or

California warehouses, our Virginia or North Carolina administrative facilities or our representative offices in Vietnam and China;

|

|

§

|

price competition in the furniture industry;

|

|

§

|

changes in domestic and international monetary policies and fluctuations in foreign currency exchange rates affecting the price of our imported products and raw materials;

|

|

§

|

the cyclical nature of the furniture industry, which is particularly sensitive to changes in consumer confidence, the amount of consumers’ income available for discretionary purchases, and the availability and terms of consumer credit;

|

|

§

|

risks associated with domestic manufacturing operations, including fluctuations in capacity utilization and the prices and availability of key raw materials, as well as changes in transportation, warehousing and domestic labor costs, availability of skilled labor, and environmental compliance and remediation costs;

|

|

§

|

risks associated with distribution through third-party retailers, such as non-binding dealership arrangements;

|

|

§

|

capital requirements and costs, including the servicing of our floating-rate term loans;

|

|

§

|

competition from non-traditional outlets, such as catalog and internet retailers and home improvement centers;

|

|

§

|

changes in consumer preferences, including increased demand for lower-quality, lower-priced furniture due to, among other things, declines in consumer confidence, amounts of discretionary income available for furniture purchases and the availability of consumer credit;

|

|

§

|

higher than expected costs associated with product quality and safety, including regulatory compliance costs related to the sale of consumer products and costs related to defective or non-compliant products; and

|

|

§

|

higher than expected employee medical and workers’ compensation costs that may increase the cost of our self-insured healthcare and workers compensation plans.

|

|

§

|

The Hooker Branded segment includes two businesses:

|

|

□

|

Hooker Casegoods, which covers a wide range of design categories and includes home entertainment, home office, accent, dining and bedroom furniture in the upper-medium price points sold under the Hooker Furniture brand; and

|

|

□

|

Hooker Upholstery, imported upholstered furniture targeted at the upper-medium price-range.

|

|

§

|

The Home Meridian segment’s brands/marketing units include:

|

|

□

|

Accentrics Home, home furnishings centered around an eclectic mix of unique pieces and materials that offer a fresh take on home fashion;

|

|

□

|

Pulaski Furniture, specializing in casegoods covering the complete design spectrum in a wide range of bedroom, dining room, accent and display cabinets at medium price points;

|

|

□

|

Samuel Lawrence Furniture, specializing in value-conscious offerings in bedroom, dining room, home office and youth furnishings;

|

|

□

|

Prime Resources, value-conscious imported leather motion upholstery; and

|

|

□

|

Samuel Lawrence Hospitality, a designer and supplier of hotel furnishings targeted toward four and five-star hotels.

|

|

§

|

All Other consists of:

|

|

□

|

Bradington-Young, a seating specialist in upscale motion and stationary leather furniture;

|

|

□

|

Sam Moore Furniture, a specialist in upscale occasional chairs, settees, sofas and sectional seating with an emphasis on cover-to-frame customization;

|

|

□

|

Shenandoah Furniture, an upscale upholstered furniture business specializing in private label sectionals, modulars, sofas, chairs, ottomans, benches, beds and dining chairs in the upper-medium price points for lifestyle specialty retailers;

|

|

□

|

The H Contract product line which supplies upholstered seating and casegoods to upscale senior living and assisted living facilities through designers, design firms, industry dealers and distributors that service that market; and

|

|

□

|

Homeware product line, which offered customer-assembled, modular upholstered and Hooker Casegoods products designed for younger and more mobile furniture customers. We note that Homeware failed to reach critical mass and its operations were wound down during the fiscal 2018 second quarter.

|

|

Order Backlog

|

||||||||||||||||

|

(Dollars in 000s)

|

||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

|||||||||||||||

|

Reporting Entity

|

Dollars

|

Weeks

|

Dollars

|

Weeks

|

||||||||||||

|

Hooker Branded

|

$

|

15,189

|

4.7

|

$

|

13,335

|

4.4

|

||||||||||

|

Home Meridian

|

76,563

|

10.9

|

82,843

|

12.5

|

||||||||||||

|

All Other

|

14,527

|

8.5

|

8,378

|

5.9

|

||||||||||||

|

Consolidated

|

$

|

106,279

|

8.9

|

$

|

104,556

|

9.4

|

||||||||||

|

§

|

A disruption in supply from Vietnam or China or from our most significant Vietnamese or Chinese suppliers could adversely affect our ability to timely fill customer orders for these products and decrease our sales, earnings and liquidity.

|

|

§

|

Increased freight costs on imported products could

decrease earnings and liquidity.

|

|

§

|

We are subject to changes in U.S. and foreign government regulations and in the political, social and economic climates of the countries from which we source our products

.

|

|

§

|

Our dependence on non-U.S. suppliers could, over time, adversely affect our ability to service customers

.

|

|

§

|

Our inability to accurately forecast demand for our imported products could cause us to purchase too much, too little or the wrong mix of inventory.

|

|

§

|

Changes in the value of the U.S. Dollar compared to the currencies for the countries from which we obtain our imported products could adversely affect our sales, earnings, financial condition and liquidity.

|

|

§

|

Supplier transitions, including cost or quality issues, could result in longer lead times and shipping delays.

|

|

§

|

may limit our flexibility to pursue other strategic opportunities or react to changes in our business and the industry in which we operate and, consequently, place us at a competitive disadvantage to competitors with less debt;

|

|

§

|

will require a portion of our cash flows from operations to be used for debt service payments, thereby reducing the availability of cash flows to fund working capital, capital expenditures, dividend payments and other general corporate purposes;

|

|

§

|

may result in higher interest expense in the event of increases in market interest rates for both long

‑

term debt as well as any borrowings under our line of credit at variable rates; and

|

|

§

|

may require that additional terms, conditions or covenants be placed on us.

|

|

§

|

a supplemental retirement income plan (“SRIP”) for certain former and current executives of Hooker Furniture Corporation;

|

|

§

|

the Pulaski Furniture Corporation Supplemental Executive Retirement Plan (“SERP”) for certain former executives; and

|

|

§

|

the Pulaski Furniture Corporation Pension Plan (“Pension Plan”) for former Pulaski Furniture Corporation employees.

|

|

Location

|

Segment Use

|

Primary Use

|

Approximate Size in Square Feet

|

Owned or Leased

|

||||

|

Martinsville, Va.

|

All segments

|

Corporate Headquarters

|

43,000

|

Owned

|

||||

|

Martinsville, Va.

|

HB, AO

|

Distribution and Imports

|

580,000

|

Owned

|

||||

|

Martinsville, Va.

|

HB, AO

|

Customer Support Center

|

146,000

|

Owned

|

||||

|

Martinsville, Va.

|

HB, AO

|

Distribution

|

628,000

|

Leased

|

||||

|

High Point, N.C.

|

HB, AO

|

Showroom

|

80,000

|

Leased

|

||||

|

Cherryville, N.C.

|

AO

|

Manufacturing Supply Plant

|

53,000

|

Owned

|

||||

|

Hickory, N.C.

|

AO

|

Manufacturing

|

91,000

|

Owned

|

||||

|

Hickory, N.C.

|

AO

|

Manufacturing and Offices

|

36,400

|

Leased

|

||||

|

Bedford, Va.

|

AO

|

Manufacturing and Offices

|

327,000

|

Owned

|

||||

|

High Point, N.C.

|

HM

|

Showroom

|

92,750

|

Leased

|

||||

|

High Point, N.C.

|

HM

|

Office

|

23,796

|

Leased

|

||||

|

High Point, N.C.

|

HM

|

Warehouse

|

10,400

|

Leased

|

||||

|

Madison, N.C.

|

HM

|

Warehouse

|

500,000

|

Leased

|

||||

|

Mayodan, N.C.

|

HM

|

Warehouse

|

235,144

|

Leased

|

||||

|

Mayodan, N.C.

|

HM

|

Warehouse

|

200,000

|

Leased

|

||||

|

Redlands, CA.

|

HM

|

Warehouse

|

327,790

|

Leased

|

||||

|

Ho Chi Minh City, VN

|

HM

|

Office and Warehouse

|

4,893

|

Leased

|

||||

|

Haining, China

|

HM

|

Warehouse

|

5,920

|

Leased

|

||||

|

Haining, China

|

HM

|

Office

|

1,690

|

Leased

|

||||

|

Dongguan, China

|

HM

|

Office

|

1,571

|

Leased

|

||||

|

Dongguan, China

|

HB

|

Office

|

1,855

|

Leased

|

||||

|

Thu Dau Mot, VN

|

HB

|

Office

|

1,722

|

Leased

|

||||

|

Valdese, N.C.

|

AO

|

Manufacturing and warehousing

|

102,905

|

Leased

|

||||

|

Mt. Airy, N.C.

|

AO

|

Manufacturing and warehousing

|

104,150

|

Leased

|

||||

|

Martinsville, Va.

|

AO

|

Manufacturing and warehousing

|

92,766

|

Leased

|

||||

|

High Point, N.C.

|

AO

|

Office

|

18,346

|

Leased

|

|

Location

|

Segment Use

|

Primary Use

|

Approximate Size in Square Feet

|

|||

|

Guangdong, China

|

HB

|

Distribution

|

210,000

|

|||

|

Ho Chi Minh City, VN

|

HB

|

Distribution

|

25,000

|

|

Name

|

Age

|

Position

|

Year Joined Company

|

||||

|

Paul B. Toms, Jr.

|

63

|

Chairman and Chief Executive Officer

|

1983

|

||||

|

Paul A. Huckfeldt

|

60

|

Chief Financial Officer and

|

2004

|

||||

|

Senior Vice President - Finance and Accounting

|

|||||||

|

George Revington

|

71

|

Chief Operating Officer - Hooker Furniture Corporation,

|

2016

|

||||

|

President and Chief Operating Officer- Home Meridian

|

|||||||

|

Anne M. Jacobsen

|

56

|

Senior Vice President-Administration

|

2008

|

||||

|

Michael W. Delgatti, Jr.

|

64

|

President - Hooker Brands

|

2009

|

|

Sales Price Per Share

|

Dividends

|

|||||||||||

|

High

|

Low

|

Per Share

|

||||||||||

|

October 30, 2017 - January 28, 2018

|

$

|

52.75

|

$

|

38.85

|

$

|

0.14

|

||||||

|

July 31, - October 29, 2017

|

50.53

|

38.85

|

0.12

|

|||||||||

|

May 1, - July 30, 2017

|

46.60

|

37.80

|

0.12

|

|||||||||

|

January 30 - April 30, 2017

|

45.35

|

29.75

|

0.12

|

|||||||||

|

October 31, 2016 - January 29, 2017

|

$

|

39.50

|

$

|

25.55

|

$

|

0.12

|

||||||

|

August 1, - October 30, 2016

|

27.47

|

22.16

|

0.10

|

|||||||||

|

May 2, - July 31, 2016

|

25.07

|

20.29

|

0.10

|

|||||||||

|

February 1 - May 1, 2016

|

35.95

|

24.23

|

0.10

|

|||||||||

|

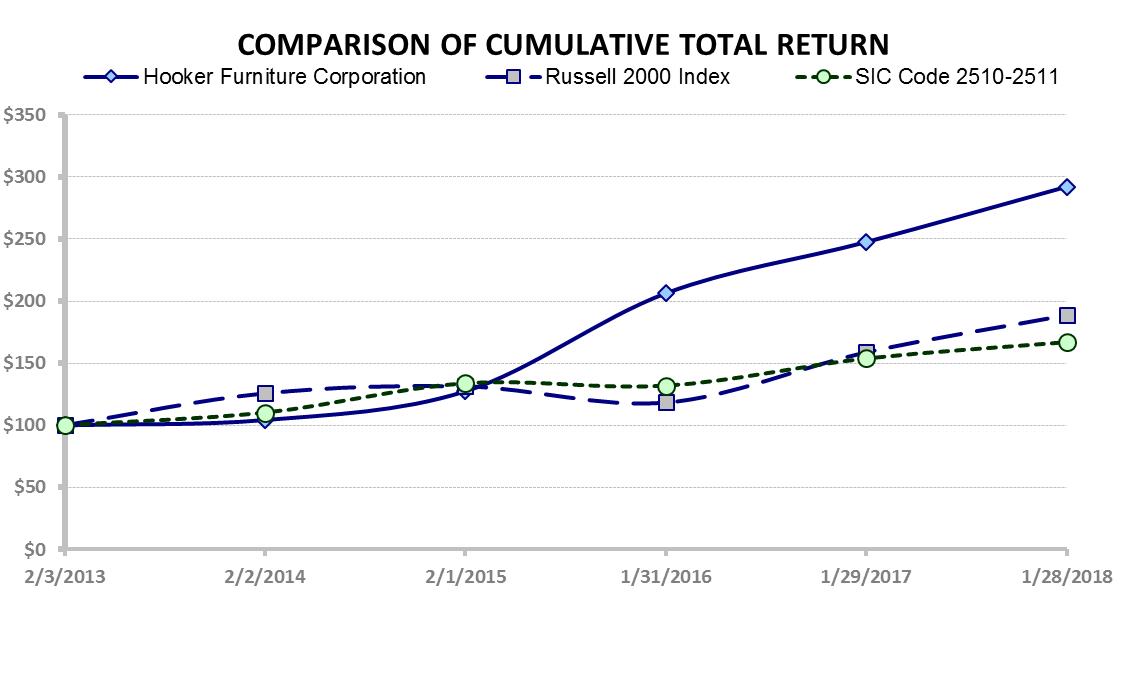

(1)

|

The graph shows the cumulative total return on $100 invested at the beginning of the measurement period in our common stock or the specified index, including reinvestment of dividends.

|

|

(2)

|

The Russell 2000

®

Index, prepared by Frank Russell Company, measures the performance of the 2,000 smallest companies out of the 3,000 largest U.S. companies based on total market capitalization and includes the Company.

|

|

(3)

|

Household Furniture Index as prepared by Zacks Investment Research, Inc. consists of companies under SIC Codes 2510 and 2511, which includes home furnishings companies that are publicly traded in the United States or Canada. At January 28, 2018, Zacks Investment Research, Inc. reported that these two SIC Codes consisted of Nova Lifestyle, Inc., La-Z-Boy, Inc., Leggett & Platt, Inc., Flexsteel Industries, Inc., Hooker Furniture Corporation, Sleep Number Corp., Kimball International, Inc., Luvu Brands, Inc., Tempur Sealy International, Inc., Sichuan Leaders Petrochemical Company, Compass Diversified Holdings, Natuzzi Spa, Purple Innovation, Inc., Bassett Furniture Industries, Inc., Ethan Allen Interiors, Inc., Stanley Furniture Co., Inc. and Dorel Industries.

|

| Fiscal Year Ended (1) | ||||||||||||||||||||

|

January 28,

|

January 29,

|

January 31,

|

February 1,

|

February 2,

|

||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

(In thousands, except per share data)

|

||||||||||||||||||||

|

Income Statement Data:

|

||||||||||||||||||||

|

Net sales

|

$

|

620,632

|

$

|

577,219

|

$

|

246,999

|

$

|

244,350

|

$

|

228,293

|

||||||||||

|

Cost of sales

|

485,815

|

451,098

|

178,311

|

181,550

|

173,568

|

|||||||||||||||

|

Gross profit

|

134,817

|

126,121

|

68,688

|

62,800

|

54,725

|

|||||||||||||||

|

Selling and administrative expenses (2)

|

87,249

|

83,767

|

44,426

|

43,752

|

42,222

|

|||||||||||||||

|

Intangible asset amortization (3)

|

2,084

|

3,134

|

-

|

-

|

-

|

|||||||||||||||

|

Operating income

|

45,484

|

39,220

|

24,262

|

19,048

|

12,503

|

|||||||||||||||

|

Other income, net

|

1,536

|

930

|

261

|

403

|

47

|

|||||||||||||||

|

Interest Expense, net

|

1,248

|

954

|

64

|

53

|

82

|

|||||||||||||||

|

Income before income taxes

|

45,772

|

39,196

|

24,459

|

19,398

|

12,468

|

|||||||||||||||

|

Income taxes

|

17,522

|

13,909

|

8,274

|

6,820

|

4,539

|

|||||||||||||||

|

Net income

|

28,250

|

25,287

|

16,185

|

12,578

|

7,929

|

|||||||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Basic earnings per share

|

$

|

2.42

|

$

|

2.19

|

$

|

1.50

|

$

|

1.17

|

$

|

0.74

|

||||||||||

|

Diluted earnings per share

|

$

|

2.42

|

$

|

2.18

|

$

|

1.49

|

$

|

1.16

|

$

|

0.74

|

||||||||||

|

Cash dividends per share

|

0.50

|

0.42

|

0.40

|

0.40

|

0.40

|

|||||||||||||||

|

Net book value per share (4)

|

19.53

|

17.16

|

14.46

|

13.30

|

12.57

|

|||||||||||||||

|

Weighted average shares outstanding (basic) (5)

|

11,633

|

11,531

|

10,779

|

10,736

|

10,722

|

|||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

30,915

|

$

|

39,792

|

$

|

53,922

|

$

|

38,663

|

$

|

23,882

|

||||||||||

|

Trade accounts receivable

|

92,461

|

92,578

|

28,176

|

32,245

|

29,393

|

|||||||||||||||

|

Inventories

|

84,459

|

75,303

|

43,713

|

44,973

|

49,016

|

|||||||||||||||

|

Working capital

|

153,161

|

147,856

|

111,462

|

100,871

|

94,142

|

|||||||||||||||

|

Total assets

|

349,716

|

318,696

|

181,653

|

170,755

|

155,481

|

|||||||||||||||

|

Long-term debt (including current maturities) (6)

|

53,425

|

47,710

|

-

|

-

|

-

|

|||||||||||||||

|

Shareholders' equity

|

229,460

|

197,927

|

156,061

|

142,909

|

134,803

|

|||||||||||||||

|

(1)

|

Our fiscal years end on the Sunday closest to January 31. The fiscal years presented above all had 52 weeks.

|

|

(2)

|

Selling and administrative expenses for fiscal 2014 included $2.1 million of startup costs pre-tax ($1.4 million, or $0.13 per share after tax) for our H Contract and Homeware business initiatives.

|

|

(3)

|

We recorded amortization expense of $2.1 million ($1.3 million, or $0.11 per share after tax) in fiscal 2018 on amortizable intangible assets recorded as a result of Home Meridian and Shenandoah acquisitions.

|

|

(4)

|

Net book value per share is derived by dividing “shareholders’ equity” by the number of common shares issued and outstanding, excluding unvested restricted shares, all determined as of the end of each fiscal period.

|

|

(5)

|

Weighted average outstanding shares outstanding changed materially as a result of issuing 716,910 shares of common stock to the designees of HMI as partial consideration for the Home Meridian acquisition and 176,018 shares of common stock to the shareholders of SFI as partial consideration for the Shenandoah acquisition.

|

|

(6)

|

Long-term debt (including current maturities) consists of term loans incurred to fund a portion of the Home Meridian and Shenandoah acquisitions.

|

|

§

|

All of our recent public filings made with the Securities and Exchange Commission (“SEC”) are available, without charge, at www.sec.gov and at http://investors.hookerfurniture.com;

|

|

§

|

The forward-looking statements disclaimer contained prior to Item 1 of this report, which describe the significant risks and uncertainties that could cause actual results to differ materially from those forward-looking statements made in this report, including those contained in this section of our annual report on Form 10-K;

|

|

§

|

The company-specific risks found in Item 1A. “Risk Factors” of this report. This section contains critical information regarding significant risks and uncertainties that we face. If any of these risks materialize, our business, financial condition and future prospects could be adversely impacted; and

|

|

§

|

Our commitments and contractual obligations and off-balance sheet arrangements described on page 33 and in Note 16 on page F-38 of this report. These sections describe commitments, contractual obligations and off-balance sheet arrangements, some of which are not reflected in our consolidated financial statements.

|

|

§

|

Gross profit.

Consolidated gross profit increased $8.7 million or 6.9% primarily due to sales increases in the Home Meridian segment and in All Other. Gross profit as a percentage of net sales was flat as compared to the prior year period, primarily due to increased core cost of goods sold in the Hooker Branded segment.

|

|

§

|

Selling and administrative expenses.

Consolidated selling and administrative (S&A) expenses increased in absolute terms primarily due to higher compensation, benefits and bonus expenses, the addition of Shenandoah’s operations for the last four months of our fiscal year and $800,000 in Shenandoah acquisition-related costs in the current year. These increases were partially offset by the absence of $1.2 million of Home Meridian acquisition-related costs from the prior year.

|

|

§

|

Intangible asset amortization expense.

Consolidated intangible amortization expense decreased $1.0 million due to lower Home Meridian segment amortization expense, partially offset by expense on Shenandoah’s acquisition-related intangibles acquired in the fiscal 2018 second-half.

|

|

§

|

Operating income.

Consolidated operating income increased $6.3 million or 16% in fiscal 2018.

|

|

Fifty-two

|

Fifty-two

|

Fifty-two

|

||||||||||

|

weeks ended

|

weeks ended

|

weeks ended

|

||||||||||

|

January 28,

|

January 29,

|

January 31,

|

||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||

|

Cost of sales

|

78.3

|

78.2

|

72.2

|

|||||||||

|

Gross profit

|

21.7

|

21.8

|

27.8

|

|||||||||

|

Selling and administrative expenses

|

14.1

|

14.5

|

18.0

|

|||||||||

|

Intangible asset amortization

|

0.3

|

0.5

|

-

|

|||||||||

|

Operating income

|

7.3

|

6.8

|

9.8

|

|||||||||

|

Other income (expense), net

|

0.2

|

0.2

|

0.1

|

|||||||||

|

Interest expense, net

|

0.2

|

0.2

|

-

|

|||||||||

|

Income before income taxes

|

7.4

|

6.8

|

9.9

|

|||||||||

|

Income taxes

|

2.8

|

2.4

|

3.3

|

|||||||||

|

Net income

|

4.6

|

4.4

|

6.6

|

|||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

|

January 29, 2017

|

|

$ Change

|

% Change

|

|||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

166,754

|

26.9

|

%

|

$

|

158,685

|

27.5

|

%

|

$

|

8,069

|

5.1

|

%

|

||||||||||||

|

Home Meridian

|

365,472

|

58.9

|

%

|

344,635

|

59.7

|

%

|

20,837

|

6.0

|

%

|

|||||||||||||||

|

All Other

|

88,406

|

14.2

|

%

|

73,899

|

12.8

|

%

|

14,507

|

19.6

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

620,632

|

100.0

|

%

|

$

|

577,219

|

100.0

|

%

|

$

|

43,413

|

7.5

|

%

|

||||||||||||

|

Unit Volume

|

FY18 % Increase/

-Decrease

vs. FY17

|

Average Selling Price

|

FY18 % Increase/

-Decrease

vs. FY17

|

|||||||

|

Hooker Branded

|

5.3

|

%

|

Hooker Branded

|

0.0

|

%

|

|||||

|

Home Meridian

|

14.8

|

%

|

Home Meridian

|

-7.4

|

%

|

|||||

|

All Other

|

19.5

|

%

|

All Other

|

-0.5

|

%

|

|||||

|

Consolidated

|

13.8

|

%

|

Consolidated

|

-5.4

|

%

|

|||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

|

January 29, 2017

|

|

$ Change

|

% Change

|

|||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

53,007

|

31.8

|

%

|

$

|

51,653

|

32.6

|

%

|

$

|

1,354

|

2.6

|

%

|

||||||||||||

|

Home Meridian

|

62,325

|

17.1

|

%

|

57,289

|

16.6

|

%

|

5,036

|

8.8

|

%

|

|||||||||||||||

|

All Other

|

19,485

|

22.0

|

%

|

17,179

|

23.2

|

%

|

2,306

|

13.4

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

134,817

|

21.7

|

%

|

$

|

126,121

|

21.8

|

%

|

$

|

8,696

|

6.9

|

%

|

||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

|

January 29, 2017

|

|

$ Change

|

% Change

|

|||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

31,275

|

18.8

|

%

|

$

|

31,451

|

19.8

|

%

|

$

|

(176

|

)

|

-0.6

|

%

|

|||||||||||

|

Home Meridian

|

42,727

|

11.7

|

%

|

39,780

|

11.5

|

%

|

2,947

|

7.4

|

%

|

|||||||||||||||

|

All Other

|

13,247

|

15.0

|

%

|

12,536

|

17.0

|

%

|

711

|

5.7

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

87,249

|

14.1

|

%

|

$

|

83,767

|

14.5

|

%

|

$

|

3,482

|

4.2

|

%

|

||||||||||||

|

Fifty-two Weeks Ended

|

Fifty-two Weeks Ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Intangible asset amortization

|

$

|

2,084

|

0.3

|

%

|

$

|

3,134

|

0.5

|

%

|

$

|

(1,050

|

)

|

-33.5

|

%

|

|||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

21,732

|

13.0

|

%

|

$

|

20,203

|

12.7

|

%

|

$

|

1,529

|

7.6

|

%

|

||||||||||||

|

Home Meridian

|

18,265

|

5.0

|

%

|

14,375

|

4.2

|

%

|

3,890

|

27.1

|

%

|

|||||||||||||||

|

All Other

|

5,487

|

6.2

|

%

|

4,642

|

6.3

|

%

|

845

|

18.2

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

45,484

|

7.3

|

%

|

$

|

39,220

|

6.8

|

%

|

$

|

6,264

|

16.0

|

%

|

||||||||||||

|

Fifty-two Weeks Ended

|

Fifty-two Weeks Ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Interest expense, net

|

$

|

1,248

|

0.2

|

%

|

$

|

954

|

0.2

|

%

|

$

|

294

|

30.8

|

%

|

||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Consolidated income tax expense

|

$

|

17,522

|

2.8

|

%

|

$

|

13,909

|

2.4

|

%

|

$

|

3,613

|

26.0

|

%

|

||||||||||||

|

Effective Tax Rate

|

38.3

|

%

|

35.5

|

%

|

||||||||||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 28, 2018

|

January 29, 2017

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Net Income

|

|

|

||||||||||||||||||||||

|

Consolidated

|

$

|

28,250

|

4.6

|

%

|

$

|

25,287

|

4.4

|

%

|

$

|

2,963

|

11.7

|

%

|

||||||||||||

|

Diluted earnings per share

|

$

|

2.42

|

$

|

2.18

|

||||||||||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

158,685

|

27.5

|

%

|

$

|

173,011

|

70.0

|

%

|

$

|

(14,326

|

)

|

-8.3

|

%

|

|||||||||||

|

Home Meridian

|

344,635

|

59.7

|

%

|

-

|

0.0

|

%

|

344,635

|

|||||||||||||||||

|

All other

|

73,899

|

12.8

|

%

|

73,988

|

30.0

|

%

|

(89

|

)

|

-0.1

|

%

|

||||||||||||||

|

Consolidated

|

$

|

577,219

|

100.0

|

%

|

$

|

246,999

|

100.0

|

%

|

$

|

330,220

|

133.7

|

%

|

||||||||||||

|

Unit Volume

|

FY17 % Increase/

-Decrease

vs. FY16

|

Average Selling Price

|

FY17 % Increase/

-Decrease

vs. FY16

|

|||||||

|

Hooker Branded

|

-9.5

|

%

|

Hooker Branded

|

1.7

|

%

|

|||||

|

Home Meridian

|

-

|

Home Meridian

|

-

|

|||||||

|

All Other

|

-5.6

|

%

|

All Other

|

5.8

|

%

|

|||||

|

Consolidated

|

-7.7

|

%

|

Consolidated

|

2.3

|

%

|

|||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

51,653

|

32.6

|

%

|

$

|

51,693

|

29.9

|

%

|

$

|

(40

|

)

|

-0.1

|

%

|

|||||||||||

|

Home Meridian

|

57,289

|

16.6

|

%

|

-

|

0.0

|

%

|

57,289

|

|||||||||||||||||

|

All Other

|

17,179

|

23.2

|

%

|

16,995

|

23.0

|

%

|

184

|

1.1

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

126,121

|

21.8

|

%

|

$

|

68,688

|

27.8

|

%

|

$

|

57,433

|

83.6

|

%

|

||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

31,451

|

19.8

|

%

|

$

|

31,669

|

18.3

|

%

|

$

|

(218

|

)

|

-0.7

|

%

|

|||||||||||

|

Home Meridian

|

39,780

|

11.5

|

%

|

-

|

0.0

|

%

|

39,780

|

|||||||||||||||||

|

All Other

|

12,536

|

17.0

|

%

|

12,757

|

17.2

|

%

|

(221

|

)

|

-1.7

|

%

|

||||||||||||||

|

Consolidated

|

$

|

83,767

|

14.5

|

%

|

$

|

44,426

|

18.0

|

%

|

$

|

39,341

|

88.6

|

%

|

||||||||||||

|

Fifty-two Weeks Ended

|

||||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Intangible asset amortization

|

$

|

3,134

|

0.5

|

%

|

$

|

-

|

0.0

|

%

|

$

|

3,134

|

100.0

|

%

|

||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Segment Net Sales

|

% Segment Net Sales

|

|||||||||||||||||||||||

|

Hooker Branded

|

$

|

20,203

|

12.7

|

%

|

$

|

20,024

|

11.6

|

%

|

$

|

179

|

0.9

|

%

|

||||||||||||

|

Home Meridian

|

14,375

|

4.2

|

%

|

-

|

0.0

|

%

|

14,375

|

|||||||||||||||||

|

All Other

|

4,642

|

6.3

|

%

|

4,238

|

5.7

|

%

|

404

|

-9.5

|

%

|

|||||||||||||||

|

Consolidated

|

$

|

39,220

|

6.8

|

%

|

$

|

24,262

|

9.8

|

%

|

$

|

14,958

|

61.7

|

%

|

||||||||||||

|

Fifty-two Weeks Ended

|

||||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Interest expense, net

|

$

|

954

|

0.2

|

%

|

$

|

64

|

0.0

|

%

|

$

|

890

|

1390.6

|

%

|

||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Consolidated income tax expense

|

$

|

13,909

|

2.4

|

%

|

$

|

8,274

|

3.3

|

%

|

$

|

5,635

|

68.1

|

%

|

||||||||||||

|

Effective Tax Rate

|

35.5

|

%

|

33.8

|

%

|

||||||||||||||||||||

|

Fifty-two weeks ended

|

Fifty-two weeks ended

|

|||||||||||||||||||||||

|

January 29, 2017

|

January 31, 2016

|

$ Change

|

% Change

|

|||||||||||||||||||||

|

% Net Sales

|

% Net Sales

|

|||||||||||||||||||||||

|

Net Income

|

|

|

||||||||||||||||||||||

|

Consolidated

|

$

|

25,287

|

4.4

|

%

|

$

|

16,185

|

6.6

|

%

|

$

|

9,102

|

56.2

|

%

|

||||||||||||

|

Diluted earnings per share

|

$

|

2.18

|

$

|

1.49

|

||||||||||||||||||||

|

Fifty-Two Weeks Ended

|

Fifty-Two Weeks Ended

|

Fifty-Two Weeks Ended

|

||||||||||

|

January 28,

|

January 29,

|

January 31,

|

||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Net cash provided by operating activities

|

$

|

27,746

|

$

|

31,240

|

$

|

23,036

|

||||||

|

Net cash used in investing activities

|

(36,483

|

)

|

(88,061

|

)

|

(3,455

|

)

|

||||||

|

Net cash provided by (used in) financing activities

|

(140

|

)

|

42,691

|

(4,322

|

)

|

|||||||

|

Net (decrease) increase in cash and cash equivalents

|

$

|

(8,877

|

)

|

$

|

(14,130

|

)

|

$

|

15,259

|

||||

|

§

|

available cash and cash equivalents, which are highly dependent on incoming order rates and our operating performance;

|

|

§

|

expected cash flow from operations; and

|

|

§

|

available lines of credit.

|

|

§

|

capital expenditures;

|

|

§

|

working capital, including capital required to fund our Pension Plan, SERP and SRIP plans;

|

|

§

|

the payment of regular quarterly cash dividends on our common stock; and

|

|

§

|

the servicing of our acquisition-related debt.

|

|

§

|

Unsecured revolving credit facility.

The Original Loan Agreement increased the amount available under our existing unsecured revolving credit facility from $15 million to $30 million and increased the sublimit of the facility available for the issuance of letters of credit from $3 million to $4 million. Amounts outstanding under the revolving facility bear interest at a rate, adjusted monthly, equal to the then-current LIBOR monthly rate plus 1.50%. We must also pay a quarterly unused commitment fee that is based on the average daily amount of the facility utilized during the applicable quarter;

|

|

§

|

Unsecured Term Loan.

The Original Loan Agreement provided us with a $41 million Unsecured Term Loan. Any amount borrowed under the Unsecured Term Loan will bear interest at a rate, adjusted monthly, equal to the then-current LIBOR monthly rate plus 1.50%. We must repay any principal amount borrowed under the Unsecured Term Loan in monthly installments of approximately $490,000, together with any accrued interest, until the full amount borrowed is repaid or until February 1, 2021, at which time all amounts outstanding under the Unsecured Term Loan will become due and payable; and

|

|

§

|

Secured Term Loan.

The Original Loan Agreement provided us with a $19 million term loan secured by a security interest in certain Company-owned life insurance policies granted to BofA under a security agreement, dated as of February 1, 2016 (the “Security Agreement”). Any amounts borrowed under the Secured Term Loan will bear interest at a rate, adjusted monthly, equal to the then-current LIBOR monthly rate plus 0.50%. We must pay the interest accrued on any principal amounts borrowed under the Secured Term Loan on a monthly basis until the full principal amount borrowed is repaid or until February 1, 2021, at which time all amounts outstanding under the Secured Term Loan will become due and payable. BofA’s rights under the Security Agreement are enforceable upon the occurrence of an event of default under the Original Loan Agreement.

|

|

§

|

amends and restates the Original Loan Agreement detailed above such that our existing $30 million unsecured revolving credit facility (the “Existing Revolver”), Unsecured Term Loan, and Secured Term Loan all remain outstanding under the New Loan Agreement; and

|

|

§

|

provides us with a new $12 million unsecured term loan (the “New Unsecured Term Loan”). Amounts outstanding under the New Unsecured Term Loan will bear interest at a rate, adjusted monthly, equal to the then current LIBOR monthly rate plus 1.50%. We must repay the principal amount borrowed under the New Unsecured Term Loan in monthly installments of approximately $143,000, together with any accrued interest, until the full amount borrowed is repaid or until the earlier of September 30, 2022 or the expiration of the Existing Revolver, at which time all amounts outstanding under the New Unsecured Term Loan will become due and payable. We may prepay the outstanding principal amount under the New Unsecured Term Loan, in full or in part, on any interest payment date without penalty. On September 29, 2017, we borrowed the full $12 million available under the New Unsecured Term Loan to partially fund the cash consideration used in the Shenandoah acquisition.

|

|

·

|

Maintain a ratio of funded debt to EBITDA not exceeding:

|

|

o

|

2.50:1.0 through August 31, 2018;

|

|

o

|

2.25:1.0 through August 31, 2019; and

|

|

o

|

2.00:1.00 thereafter.

|

|

·

|

A basic fixed charge coverage ratio of at least 1.25:1.00; and

|

|

·

|

Limit capital expenditures to no more than $15.0 million during any fiscal year beginning in fiscal 2019.

|

|

Cash Payments Due by Period (In thousands)

|

||||||||||||||||||||

|

Less than

|

More than

|

|||||||||||||||||||

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 years

|

Total

|

||||||||||||||||

|

Long Term Debt

(1)

|

$

|

8,202

|

$

|

38,938

|

$

|

6,285

|

$

|

-

|

$

|

53,425

|

||||||||||

|

Deferred compensation payments

(2)

|

1,393

|

3,442

|

3,413

|

8,580

|

16,828

|

|||||||||||||||

|

Operating leases

(3)

|

7,449

|

13,423

|

9,008

|

3,212

|

33,092

|

|||||||||||||||

|

Total contractual cash obligations

|

$

|

17,044

|

$

|

55,803

|

$

|

18,706

|

$

|

11,792

|

$

|

103,345

|

||||||||||

|

(1)

|

These amounts represent obligations due under the Unsecured Term Loan and the Secured Term Loan. See Note 10 to the consolidated financial statements beginning on page F-24 for additional information about our long-term debt obligations.

Subsequent to the end the recently completed fiscal year, we made an unscheduled $10 million payment on the Unsecured Term Loan.

|

|

(2)

|

These amounts represent estimated cash payments to be paid to participants in our SRIP through fiscal year 2043, which is 15 years after the last current SRIP plan participant is assumed to have retired. SERP benefits are paid over the lifetimes of plan participants, so the year of final payment is unknown. The present value of these benefits (the actuarially derived projected benefit obligation for the SRIP and SERP) were approximately $9.4 million and $2.0 million, respectively, at January 28, 2018, and are shown on our consolidated balance sheets, with $699,000 recorded in current liabilities and $10.7 million recorded in long-term liabilities. Under the SRIP, the monthly retirement benefit for each participant, regardless of age, would become fully vested and the present value of that benefit would be paid to each participant in a lump sum upon a change in control of the Company as defined in the plan. See Note 11 to the consolidated financial statements beginning on page F-26 for additional information about the SRIP and SERP.

|

|

(3)

|

These amounts represent estimated cash payments due under operating leases for real estate utilized in our operations and warehouse and office equipment.

|

|

§

|

A significant decrease in the market value of the long-lived asset;

|

|

§

|

A significant adverse change in the extent or manner in which a long-lived asset group is being used, or in its physical condition;

|

|

§

|

A significant adverse change in the legal factors or in the business climate that could affect the value of a long-lived asset, including an adverse action or assessment by a regulator;

|

|

§

|

An accumulation of costs significantly in excess of the amount originally expected to acquire or construct a long-lived asset;

|

|

§

|

A current period operating or cash flow loss or a projection or forecast that demonstrates continuing losses associated with the long-lived asset’s use; and

|

|

§

|

A current expectation that more-likely-than-not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its previously estimated useful life.

|

|

§

|

a significant adverse change in the economic or business climate either within the furniture industry or the national or global economy;

|

|

§

|

significant changes in demand for our products;

|

|

§

|

loss of key personnel; and

|

|

§

|

the likelihood that a reporting unit or significant portion of a reporting unit will be sold or otherwise subject to disposal.

|

|

(1)

|

The following reports and financial statements are included in this report on Form 10-K:

|

| (2) |

Financial Statement Schedules:

|

| (b) |

Exhibits:

|

|

2.1

|

|

|

2.2

|

|

|

3.1

|

|

|

3.2

|

|

|

4.1

|

Amended and Restated Articles of Incorporation of the Company (See Exhibit 3.1)

|

|

4.2

|

Amended and Restated Bylaws of the Company (See Exhibit 3.2)

|

|

Pursuant to Regulation S-K, Item 601(b)(4)(iii), instruments, if any, evidencing long-term debt not exceeding 10% of the Company’s total assets have been omitted and will be furnished to the Securities and Exchange Commission upon request.

|

|

|

10.1(a)

|

|

10.1(b)

|

|

|

10.1(c)

|

|

|

10.1(d)

|

|

|

10.1(e)

|

|

|

10.1(f)

|

|

|

10.1(g)

|

|

|

10.1(h)

|

|

|

10.2(a)

|

|

|

10.2(b)

|

|

|

10.2 (c)

|

|

|

21

|

List of Subsidiaries:

|

|

Bradington-Young LLC, a North Carolina limited liability company

|

|

|

Home Meridian Group, LLC, a North Carolina limited liability company

|

|

|

Sam Moore Furniture LLC, a Virginia limited liability company

|

|

|

23

|

|

|

31.1

|

|

|

31.2

|

|

|

32.1

|

|

|

101

|

The following financial statements from the Company's Annual Report on Form 10-K for the fiscal year ended January 28, 2018, formatted in Extensible Business Reporting Language (“XBRL”): (i) consolidated balance sheets, (ii) consolidated statements of income, (iii) consolidated statements of comprehensive income, (iv) consolidated statements of cash flows, (v) consolidated statements of shareholders’ equity and (vi) the notes to the consolidated financial statements, tagged as blocks of text (filed herewith)

|

| HOOKER FURNITURE CORPORATION | |||

|

April 13, 2018

|

By:

|

/s/ Paul B. Toms, Jr. | |

| Paul B. Toms, Jr. | |||

| Chairman and Chief Executive Officer | |||

|

Signature

|

Title

|

Date

|

||

|

/s/ Paul B. Toms, Jr.

|

Chairman, Chief Executive Officer and

|

April 13, 2018

|

||

|

Paul B. Toms, Jr.

|

Director (Principal Executive Officer)

|

|||

|

/s/ Paul A. Huckfeldt

|

Senior Vice President - Finance and Accounting

|

April 13, 2018

|

||

|

Paul A. Huckfeldt

|

and Chief Financial Officer (Principal

|

|||

|

|

Financial and Accounting Officer) | |||

|

/s/ W. Christopher Beeler, Jr.

|

Director

|

April 13, 2018

|

||

|

W. Christopher Beeler, Jr.

|

||||

|

/s/ Paulette Garafalo

|

Director

|

April 13, 2018

|

||

|

Paulette Garafalo

|

||||

|

/s/ John L. Gregory, III

|

Director

|

April 13, 2018

|

||

|

John L. Gregory, III

|

||||

|

/s/ Tonya H. Jackson

|

Director

|

April 13, 2018

|

||

|

Tonya H. Jackson

|

||||

|

/s/ E. Larry Ryder

|

Director

|

April 13, 2018

|

||

|

E. Larry Ryder

|

||||

|

/s/ David G. Sweet

|

Director

|

April 13, 2018

|

||

|

David G. Sweet

|

||||

|

/s/ Ellen C. Taaffe

|

Director

|

April 13, 2018

|

||

|

Ellen C. Taaffe

|

||||

|

/s/ Henry G. Williamson, Jr

|

.

|

Director

|

April 13, 2018

|

|

|

Henry G. Williamson, Jr.

|

|

Page

|

|

|

F-2

|

|

|

F-3

|

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

|

F-8

|

|

|

F-9

|

|

|

F-10

|

April 13, 2018

|

HOOKER FURNITURE CORPORATION AND SUBSIDIARIES

|

||||||||

|

|

||||||||

|

(In thousands)

|

||||||||

|

As of

|

January 28,

|

January 29,

|

||||||

|

2018

|

2017

|

|||||||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$

|

30,915

|

$

|

39,792

|

||||

|

Trade accounts receivable, net

(See notes 4 and 5)

|

92,461

|

92,578

|

||||||

|

Inventories (see note 6)

|

84,459

|

75,303

|

||||||

|

Prepaid expenses and other current assets

|

5,314

|

4,244

|

||||||

|

Total current assets

|

213,149

|

211,917

|

||||||

|

Property, plant and equipment, net

|

29,249

|

25,803

|

||||||

|

Cash surrender value of life insurance policies (See note 10)

|

23,622

|

22,366

|

||||||

|

Deferred taxes (See note 14)

|

3,264

|

7,264

|

||||||

|

Intangible assets, net (See note 8)

|

38,139

|

25,923

|

||||||

|

Goodwill (See notes 3 and 8)

|

40,058

|

23,187

|

||||||

|

Other assets

|

2,235

|

2,236

|

||||||

|

Total non-current assets

|

136,567

|

106,779

|

||||||

|

Total assets

|

$

|

349,716

|

$

|

318,696

|

||||

|

Liabilities and Shareholders’ Equity

|

||||||||

|

Current liabilities

|

||||||||

|

Current portion of term loans

|

$

|

7,528

|

$

|

5,817

|

||||

|

Trade accounts payable

|

32,685

|

36,552

|

||||||

|

Accrued salaries, wages and benefits

|

9,218

|

8,394

|

||||||

|

Income tax accrual (See note 14)

|

3,711

|

4,323

|

||||||

|

Customer deposits

|

3,951

|

5,605

|

||||||

|

Other accrued expenses

|

2,894

|

3,369

|

||||||

|

Total current liabilities

|

59,987

|

64,060

|

||||||

|

Long term debt (See note 11)

|

45,778

|

41,772

|

||||||

|

Deferred compensation (See note 12)

|

11,164

|

10,849

|

||||||

|

Pension plan (See note 12)

|

2,441

|

3,499

|

||||||

|

Other liabilities

|

886

|

589

|

||||||

|

Total long-term liabilities

|

60,269

|

56,709

|

||||||

|

Total liabilities

|

120,256

|

120,769

|

||||||

|

Shareholders’ equity

|

||||||||

|

Common stock, no par value, 20,000 shares authorized,

11,762

and 11,563

shares issued and outstanding on each date

|

48,970

|

39,753

|

||||||

|

Retained earnings

|

180,122

|

157,688

|

||||||

|

Accumulated other comprehensive income

|

368

|

486

|

||||||

|

Total shareholders’ equity

|

229,460

|

197,927

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

349,716

|

$

|

318,696

|

||||

|

HOOKER FURNITURE CORPORATION AND SUBSIDIARIES

|

||||||||||||

|

|

||||||||||||

|

(In thousands, except per share data)

|

||||||||||||

|

For the 52 Week Periods Ended January 28, 2018, January 29, 2017, and January 31, 2016.

|

||||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Net sales

|

$

|

620,632

|

$

|

577,219

|

$

|

246,999

|

||||||

|

Cost of sales

|

485,815

|

451,098

|

178,311

|

|||||||||

|

Gross profit

|

134,817

|

126,121

|

68,688

|

|||||||||

|

Selling and administrative expenses

|

87,249

|

83,767

|

44,426

|

|||||||||

|

Intangible asset amortization

|

2,084

|

3,134

|

-

|

|||||||||

|

Operating income

|

45,484

|

39,220

|

24,262

|

|||||||||

|

Other income (expense), net

|

1,536

|

930

|

261

|

|||||||||

|

Interest expense, net

|

1,248

|

954

|

64

|

|||||||||

|

Income before income taxes

|

45,772

|

39,196

|

24,459

|

|||||||||

|

Income taxes

|

17,522

|

13,909

|

8,274

|

|||||||||

|

Net income

|

$

|

28,250

|

$

|

25,287

|

$

|

16,185

|

||||||

|

Earnings per share:

|

||||||||||||

|

Basic

|

$

|

2.42

|

$

|

2.19

|

$

|

1.50

|

||||||

|

Diluted

|

$

|

2.42

|

$

|

2.18

|

$

|

1.49

|

||||||

|

Weighted average shares outstanding:

|

||||||||||||

|

Basic

|

11,633

|

11,531

|

10,779

|

|||||||||

|

Diluted

|

11,663

|

11,563

|

10,807

|

|||||||||

|

Cash dividends declared per share

|

$

|

0.50

|

$

|

0.42

|

$

|

0.40

|

||||||

|

HOOKER FURNITURE CORPORATION AND SUBSIDIARIES

|

||||||||||||

|

(In thousands)

|

||||||||||||

|

For the 52 Week Periods Ended January 28, 2018, January 29, 2017, and January 31, 2016.

|

||||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Net Income

|

$

|

28,250

|

$

|

25,287

|

$

|

16,185

|

||||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Amortization of actuarial (loss) gain

|

(144

|

)

|

551

|

751

|

||||||||

|

Income tax effect on amortization

|

26

|

(204

|

)

|

(277

|

)

|

|||||||

|

Adjustments to net periodic benefit cost

|

(118

|

)

|

347

|

474

|

||||||||

|

Total Comprehensive Income

|

$

|

28,132

|

$

|

25,634

|

$

|

16,659

|

||||||

|

HOOKER FURNITURE CORPORATION AND SUBSIDIARIES

|

||||||||||||

|

(In thousands)

|

||||||||||||

|

For the 52 Week Periods Ended January 28, 2018, January 29, 2017, and January 31, 2016.

|

||||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Operating Activities:

|

||||||||||||

|

Net income

|

$

|

28,250

|

$

|

25,287

|

$

|

16,185

|

||||||

|

Adjustments to reconcile net income to net cash

provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

6,647

|

8,000

|

2,946

|

|||||||||

|

Loss/(gain) on disposal of assets

|

571

|

(72

|

)

|

83

|

||||||||

|

Deferred income tax expense (benefit)

|

4,110

|

(2,224

|

)

|

544

|

||||||||

|

Non-cash restricted stock and performance awards

|

1,175

|

1,157

|

829

|

|||||||||

|

Provision for doubtful accounts and sales allowances

|

(531

|

)

|

2,188

|

(105

|

)

|

|||||||

|

Gain on life insurance policies

|

(582

|

)

|

(964

|

)

|

(799

|

)

|

||||||

|

Changes in assets and liabilities

|

||||||||||||

|

Trade accounts receivable

|

4,224

|

(21,507

|

)

|

4,174

|

||||||||

|

Inventories

|

(6,776

|

)

|

6,016

|

1,260

|

||||||||

|

Prepaid expenses and other current assets

|

(1,067

|

)

|

(115

|

)

|

(207

|

)

|

||||||

|

Trade accounts payable

|

(4,623

|

)

|

4,662

|

(1,273

|

)

|

|||||||

|

Accrued salaries, wages and benefits

|

129

|

1,950

|

273

|

|||||||||

|

Accrued income taxes