|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended April 30, 2018

|

||

|

OR

|

||

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from to

|

||

|

MISSOURI

|

44-0607856

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, without par value

|

New York Stock Exchange

|

|

|

INTRODUCTION AND FORWARD-LOOKING STATEMENTS

|

||

|

ITEM 1.

|

BUSINESS

|

|

|

ITEM 1A.

|

RISK FACTORS

|

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

|

ITEM 2.

|

PROPERTIES

|

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

|

|

ITEM 9B.

|

OTHER INFORMATION

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

|

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

|

|

SIGNATURES

|

||

|

EXHIBIT INDEX

|

||

|

H&R Block, Inc.

| 2018 Form 10-K

|

1

|

|

2

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

3

|

|

4

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

5

|

|

Name, age

|

Current position

|

Business experience since May 1, 2013

|

||

|

Jeffrey J. Jones II,

age 50

|

President and Chief Executive Officer

|

President and Chief Executive Officer since October 2017; President and Chief Executive Officer-Designate from August 2017 to October 2017; President of Ridesharing at Uber Technologies, Inc. from October 2016 until March 2017; Executive Vice President and Chief Marketing Officer of Target Corporation from April 2012 until September 2016.

|

||

|

Tony G. Bowen,

age 43

|

Chief Financial Officer

|

Chief Financial Officer since May 2016; Vice President, U.S. Tax Services Finance from May 2013 through April 2016.

|

||

|

Kellie J. Logerwell,

age 48

|

Chief Accounting Officer

|

Chief Accounting Officer since July 2016; Vice President of Corporate and Field Accounting from December 2014 until July 2016; Assistant Controller from December 2010 until December 2014.

|

||

|

Thomas A. Gerke,

age 62

|

General Counsel and Chief Administrative Officer

|

General Counsel and Chief Administrative Officer since May 2016; served as Chief Executive Officer (in an interim capacity) from August 2017 until October 2017; Chief Legal Officer (formerly titled Senior Vice President and General Counsel) from January 2012 through April 2016; Executive Vice President, General Counsel and Secretary of YRC Worldwide from January 2011 until April 2011; Executive Vice Chairman, Century Link, Inc. from July 2009 until December 2010; President and Chief Executive Officer, Embarq Corporation (in an interim capacity from December 2007 until March 2008 and by appointment from March 2008 until June 2009).

|

||

|

Karen Orosco

,

age 47

|

Senior Vice President, U.S. Retail

|

Senior Vice President, U.S. Retail since May 2016; Vice President of Retail Operations from May 2011 until May 2016.

|

||

|

▪

|

The Amended and Restated Articles of Incorporation of H&R Block, Inc.;

|

|

▪

|

The Amended and Restated Bylaws of H&R Block, Inc.;

|

|

▪

|

The H&R Block, Inc. Corporate Governance Guidelines;

|

|

▪

|

The H&R Block, Inc. Code of Business Ethics and Conduct;

|

|

▪

|

The H&R Block, Inc. Board of Directors Independence Standards;

|

|

▪

|

The H&R Block, Inc. Audit Committee Charter;

|

|

▪

|

The H&R Block, Inc. Compensation Committee Charter;

|

|

▪

|

The H&R Block, Inc. Finance Committee Charter; and

|

|

▪

|

The H&R Block, Inc. Governance and Nominating Committee Charter.

|

|

6

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

7

|

|

8

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

9

|

|

10

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

11

|

|

▪

|

On November 17, 2017, the CFPB officially published its final rule changing the regulation of certain consumer credit products, including payday loans, vehicle title loans, and high-cost installment loans (the "Payday Rule"). Certain limited provisions of the Payday Rule became effective on January 16, 2018, but most provisions do not become effective until August 19, 2019. However, on January 16, 2018, the CFPB stated its intention to engage in a rulemaking process so that the CFPB may reconsider the Payday Rule, and industry groups have filed lawsuits challenging the rule. Given these developments, we are unsure whether, and in what form, the Payday Rule will to into effect. Depending on the outcome of the rulemaking process and litigation, which may include the Payday Rule becoming effective in its current form, the Payday Rule may have a material adverse impact on the EA product, our business, and our consolidated financial position, results of operations, and cash flows. We will continue to analyze the potential impact on the Company as the CFPB’s rulemaking process progresses.

|

|

▪

|

On October 5, 2016, the CFPB released its final rule regulating certain prepaid products (the "Prepaid Card Rule"). The Prepaid Card Rule was scheduled to take effect on April 1, 2018, with certain provisions phased in over time following that date. However, on January 25, 2018, the CFPB amended the Prepaid Card Rule and extended the general effective date until April 1, 2019. Once effective, the Prepaid Card Rule will apply to the Emerald Card. The Prepaid Card Rule, among other things: (i) requires consumer disclosures to be made prior to acquiring a prepaid account; (ii) requires periodic statements or online access to specified account information; and (iii) requires online posting of the Cardholder Agreement and submission of new and revised Cardholder Agreements to the CFPB. We do not expect that the Prepaid Card Rule will have a material adverse effect on our business or our consolidated financial position, results of operations, and cash flows.

|

|

12

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

13

|

|

14

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

15

|

|

16

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

17

|

|

18

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

19

|

|

(in 000s, except per share amounts)

|

||||||||||||||

|

Total Number of

Shares Purchased

(1)

|

|

Average

Price Paid

per Share

|

|

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

(2)

|

|

Maximum Dollar Value of

Shares that May be Purchased

Under the Plans or Programs

(2)

|

|

|||||||

|

February 1 – February 28

|

51

|

|

$

|

26.15

|

|

—

|

|

$

|

1,183,190

|

|

||||

|

March 1 – March 31

|

3

|

|

$

|

24.82

|

|

—

|

|

$

|

1,183,190

|

|

||||

|

April 1 – April 30

|

—

|

|

$

|

—

|

|

—

|

|

$

|

1,183,190

|

|

||||

|

54

|

|

$

|

26.07

|

|

—

|

|

||||||||

|

(1)

|

We purchased approximately

54 thousand

shares in connection with funding employee income tax withholding obligations arising upon the lapse of restrictions on restricted shares and restricted share units.

|

|

(2)

|

In September 2015, we announced that our Board of Directors approved a

$3.5 billion

share repurchase program, effective through June 2019.

|

|

Note:

|

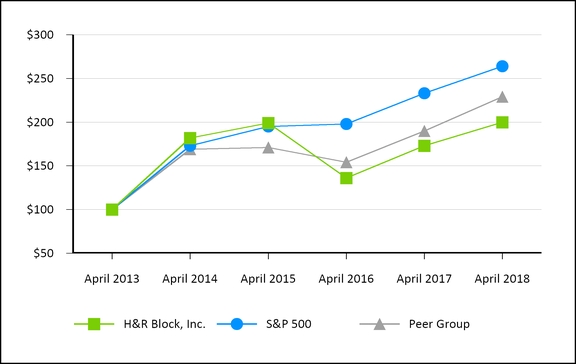

The peer group includes the following companies: Intuit Inc., Blucora, Inc., Liberty Tax, Inc., CBIZ, Inc., Resources Connection, Inc., ICF International, Inc., Willis Towers Watson PLC, Navigant Consulting, Inc., and Huron Consulting Group Inc.

|

|

20

|

2018 Form 10-K |

H&R Block, Inc.

|

|

(in 000s, except per share amounts)

|

||||||||||||||||||||

|

April 30,

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

||||||||||

|

Revenues

|

$

|

3,159,931

|

|

$

|

3,036,314

|

|

$

|

3,038,153

|

|

$

|

3,078,658

|

|

$

|

3,024,295

|

|

|||||

|

Net income from continuing operations

|

626,909

|

|

420,917

|

|

383,553

|

|

486,744

|

|

500,097

|

|

||||||||||

|

Net income

|

613,149

|

|

408,945

|

|

374,267

|

|

473,663

|

|

475,157

|

|

||||||||||

|

Basic earnings per share:

|

||||||||||||||||||||

|

Net income from continuing operations

|

$

|

2.99

|

|

$

|

1.97

|

|

$

|

1.54

|

|

$

|

1.77

|

|

$

|

1.82

|

|

|||||

|

Net income

|

2.93

|

|

1.92

|

|

1.50

|

|

1.72

|

|

1.73

|

|

||||||||||

|

Diluted earnings per share:

|

||||||||||||||||||||

|

Net income from continuing operations

|

$

|

2.98

|

|

$

|

1.96

|

|

$

|

1.53

|

|

$

|

1.75

|

|

$

|

1.81

|

|

|||||

|

Net income

|

2.91

|

|

1.91

|

|

1.49

|

|

1.71

|

|

1.72

|

|

||||||||||

|

Total assets

|

$

|

3,140,949

|

|

$

|

2,694,108

|

|

$

|

2,847,225

|

|

$

|

4,512,071

|

|

$

|

4,689,590

|

|

|||||

|

Long-term debt

(1)

|

1,495,635

|

|

1,493,998

|

|

1,492,201

|

|

502,739

|

|

902,535

|

|

||||||||||

|

Stockholders’ equity (deficiency)

|

393,711

|

|

(60,883

|

)

|

23,103

|

|

1,832,949

|

|

1,556,549

|

|

||||||||||

|

Shares outstanding

|

209,254

|

|

207,171

|

|

220,517

|

|

275,275

|

|

274,228

|

|

||||||||||

|

Dividends per share

|

$

|

0.96

|

|

$

|

0.88

|

|

$

|

0.80

|

|

$

|

0.80

|

|

$

|

0.80

|

|

|||||

|

(1)

|

Includes current portion of long-term debt.

|

|

▪

|

Tax returns prepared worldwide increased

1.5%

, and returns prepared in the U.S. increased

2.5%

. Our paid U.S. DIY returns increased by

7.8%

, while our U.S. assisted returns declined

0.6%

compared to the prior year.

|

|

▪

|

Revenues increased

$123.6 million

, or

4.1%

, compared to the prior year. Revenues were impacted by a

0.7%

increase in U.S. assisted tax returns prepared in company-owned offices and a

7.8%

increase in paid U.S. DIY returns, coupled with favorable pricing and mix changes on our assisted tax returns and RTs, our international operations and POM.

|

|

▪

|

Operating expenses increased

$87.6 million

, or

3.8%

, due to a combination of higher compensation costs, higher rent and bad debt expenses, partially offset by lower marketing spend.

|

|

▪

|

Pretax earnings increased

$39.4 million

, or

6.3%

, due primarily to the revenue changes mentioned above.

|

|

▪

|

Income tax expense decreased

$166.5 million

, or

79.9%

, due to Tax Legislation enacted during the fiscal year.

|

|

▪

|

Net income from continuing operations increased

$206.0 million

or

48.9%

compared with the prior year, primarily due to lower income taxes. Diluted earnings per share from continuing operations increased

52.0%

from the prior year to

$2.98

primarily due to a lower effective tax rate and higher net income.

|

|

▪

|

Earnings from continuing operations before interest, taxes, depreciation and amortization (EBITDA) increased

$37.0 million

, or

4.1%

, to

$941.4 million

. See "Non-GAAP Financial Information" at the end of this item for a reconciliation of non-GAAP measures.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

21

|

|

Operating Statistics

|

||||||||||||||||||

|

Percent change

|

||||||||||||||||||

|

Year ended April 30,

|

2018

|

|

2017

|

|

2016

|

|

2018 vs. 2017

|

|

2017 vs. 2016

|

|

||||||||

|

TAX RETURNS PREPARED :

(in 000s)

(1)

|

||||||||||||||||||

|

United States:

|

||||||||||||||||||

|

Company-owned operations

|

8,050

|

|

7,994

|

|

8,077

|

|

0.7

|

%

|

(1.0

|

)%

|

||||||||

|

Franchise operations

|

3,769

|

|

3,901

|

|

4,138

|

|

(3.4

|

)%

|

(5.7

|

)%

|

||||||||

|

Total assisted

|

11,819

|

|

11,895

|

|

12,215

|

|

(0.6

|

)%

|

(2.6

|

)%

|

||||||||

|

Desktop

|

2,031

|

|

2,003

|

|

2,085

|

|

1.4

|

%

|

(3.9

|

)%

|

||||||||

|

Online

|

5,502

|

|

4,988

|

|

4,670

|

|

10.3

|

%

|

6.8

|

%

|

||||||||

|

Total DIY

|

7,533

|

|

6,991

|

|

6,755

|

|

7.8

|

%

|

3.5

|

%

|

||||||||

|

IRS Free File

|

613

|

|

588

|

|

678

|

|

4.3

|

%

|

(13.3

|

)%

|

||||||||

|

Total U.S. returns

|

19,965

|

|

19,474

|

|

19,648

|

|

2.5

|

%

|

(0.9

|

)%

|

||||||||

|

International operations:

|

||||||||||||||||||

|

Canada

(2)

|

2,423

|

|

2,460

|

|

2,551

|

|

(1.5

|

)%

|

(3.6

|

)%

|

||||||||

|

Australia

|

757

|

|

750

|

|

769

|

|

0.9

|

%

|

(2.5

|

)%

|

||||||||

|

Other

|

187

|

|

293

|

|

153

|

|

(36.2

|

)%

|

91.5

|

%

|

||||||||

|

Total international operations returns

|

3,367

|

|

3,503

|

|

3,473

|

|

(3.9

|

)%

|

0.9

|

%

|

||||||||

|

Tax returns prepared worldwide

|

23,332

|

|

22,977

|

|

23,121

|

|

1.5

|

%

|

(0.6

|

)%

|

||||||||

|

NET AVERAGE CHARGE (U.S. ONLY):

(3)

|

||||||||||||||||||

|

Company-owned operations

|

$

|

241.35

|

|

$

|

237.42

|

|

$

|

233.90

|

|

1.7

|

%

|

1.5

|

%

|

|||||

|

Franchise operations

(4)

|

$

|

211.88

|

|

$

|

207.80

|

|

$

|

201.52

|

|

2.0

|

%

|

3.1

|

%

|

|||||

|

Total DIY

|

$

|

32.28

|

|

$

|

31.34

|

|

$

|

34.69

|

|

3.0

|

%

|

(9.7

|

)%

|

|||||

|

TAX OFFICES

(at the peak of the tax season)

:

|

||||||||||||||||||

|

U.S. offices:

|

||||||||||||||||||

|

Total company-owned offices

|

6,690

|

|

6,650

|

|

6,614

|

|

0.6

|

%

|

0.5

|

%

|

||||||||

|

Total franchise offices

|

3,291

|

|

3,386

|

|

3,599

|

|

(2.8

|

)%

|

(5.9

|

)%

|

||||||||

|

Total U.S. offices

|

9,981

|

|

10,036

|

|

10,213

|

|

(0.5

|

)%

|

(1.7

|

)%

|

||||||||

|

International offices

:

|

||||||||||||||||||

|

Canada

|

1,166

|

|

1,216

|

|

1,282

|

|

(4.1

|

)%

|

(5.1

|

)%

|

||||||||

|

Australia

|

453

|

|

449

|

|

438

|

|

0.9

|

%

|

2.5

|

%

|

||||||||

|

Total international offices

|

1,619

|

|

1,665

|

|

1,720

|

|

(2.8

|

)%

|

(3.2

|

)%

|

||||||||

|

Tax offices worldwide

|

11,600

|

|

11,701

|

|

11,933

|

|

(0.9

|

)%

|

(1.9

|

)%

|

||||||||

|

(1)

|

An assisted tax return is defined as a current or prior year individual tax return that has been accepted and paid for by the client. Also included are business returns. The count methodology has been adjusted in the current and prior years periods to exclude business extensions and to recognize the corresponding tax returns when filed. A DIY return is defined as a return that has been electronically filed and accepted by the IRS. Also included are online returns paid and printed.

|

|

(2)

|

In fiscal years

2017

and

2016

, the end of the Canadian tax season was extended from April 30 into May. Tax returns prepared in Canada in fiscal years

2017

and

2016

includes approximately

59 thousand

and

93 thousand

returns, respectively, in both company-owned and franchise offices which were accepted by the client after April 30. The revenues related to these returns were recognized in fiscal years

2018

and

2017

, respectively.

|

|

(3)

|

Net average charge is calculated as tax preparation fees divided by tax returns prepared. For DIY, net average charge excludes IRS Free File.

|

|

(4)

|

Net average charge related to H&R Block Franchise Operations represents tax preparation fees collected by H&R Block franchisees divided by returns prepared in franchise offices. H&R Block will recognize a portion of franchise revenues as franchise royalties based on the terms of franchise agreements.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

22

|

|

Consolidated – Financial Results

|

(in 000s, except per share amounts)

|

||||||||||||||

|

Year ended April 30,

|

2018

|

2017

|

$ Change

|

% Change

|

|||||||||||

|

Revenues:

|

|||||||||||||||

|

U.S. assisted tax preparation fees

|

$

|

1,947,160

|

|

$

|

1,902,212

|

|

$

|

44,948

|

|

2.4

|

%

|

||||

|

U.S. royalties

|

245,444

|

|

250,270

|

|

(4,826

|

)

|

(1.9

|

)%

|

|||||||

|

U.S. DIY tax preparation fees

|

243,159

|

|

219,123

|

|

24,036

|

|

11.0

|

%

|

|||||||

|

International revenues

|

227,266

|

|

210,320

|

|

16,946

|

|

8.1

|

%

|

|||||||

|

Revenues from Refund Transfers

|

171,959

|

|

148,212

|

|

23,747

|

|

16.0

|

%

|

|||||||

|

Revenues from Emerald Card®

|

102,640

|

|

95,221

|

|

7,419

|

|

7.8

|

%

|

|||||||

|

Revenues from Peace of Mind® Extended Service Plan

|

101,572

|

|

92,820

|

|

8,752

|

|

9.4

|

%

|

|||||||

|

Interest and fee income on Emerald Advance

|

56,986

|

|

57,022

|

|

(36

|

)

|

(0.1

|

)%

|

|||||||

|

Other

|

63,745

|

|

61,114

|

|

2,631

|

|

4.3

|

%

|

|||||||

|

Total revenues

|

3,159,931

|

|

3,036,314

|

|

123,617

|

|

4.1

|

%

|

|||||||

|

Compensation and benefits:

|

|||||||||||||||

|

Field wages

|

740,675

|

|

702,518

|

|

38,157

|

|

5.4

|

%

|

|||||||

|

Other wages

|

191,981

|

|

181,735

|

|

10,246

|

|

5.6

|

%

|

|||||||

|

Benefits and other compensation

|

173,221

|

|

163,368

|

|

9,853

|

|

6.0

|

%

|

|||||||

|

1,105,877

|

|

1,047,621

|

|

58,256

|

|

5.6

|

%

|

||||||||

|

Occupancy

(1)

|

401,524

|

|

377,420

|

|

24,104

|

|

6.4

|

%

|

|||||||

|

Marketing and advertising

|

249,142

|

|

261,281

|

|

(12,139

|

)

|

(4.6

|

)%

|

|||||||

|

Depreciation and amortization

|

183,295

|

|

182,168

|

|

1,127

|

|

0.6

|

%

|

|||||||

|

Provision for bad debt

|

74,489

|

|

52,776

|

|

21,713

|

|

41.1

|

%

|

|||||||

|

Supplies

|

31,026

|

|

33,847

|

|

(2,821

|

)

|

(8.3

|

)%

|

|||||||

|

Other

(1)

|

362,528

|

|

365,217

|

|

(2,689

|

)

|

(0.7

|

)%

|

|||||||

|

Total operating expenses

|

2,407,881

|

|

2,320,330

|

|

87,551

|

|

3.8

|

%

|

|||||||

|

Other income (expense), net

|

6,054

|

|

6,254

|

|

(200

|

)

|

(3.2

|

)%

|

|||||||

|

Interest expense on borrowings

|

(89,372

|

)

|

(92,951

|

)

|

3,579

|

|

3.9

|

%

|

|||||||

|

Income from continuing operations before income taxes

|

668,732

|

|

629,287

|

|

39,445

|

|

6.3

|

%

|

|||||||

|

Income taxes

|

41,823

|

|

208,370

|

|

(166,547

|

)

|

(79.9

|

)%

|

|||||||

|

Net income from continuing operations

|

626,909

|

|

420,917

|

|

205,992

|

|

48.9

|

%

|

|||||||

|

Net loss from discontinued operations

|

(13,760

|

)

|

(11,972

|

)

|

(1,788

|

)

|

(14.9

|

)%

|

|||||||

|

Net income

|

$

|

613,149

|

|

$

|

408,945

|

|

$

|

204,204

|

|

49.9

|

%

|

||||

|

Basic earnings (loss) per share:

|

|||||||||||||||

|

Continuing operations

|

$

|

2.99

|

|

$

|

1.97

|

|

$

|

1.02

|

|

51.8

|

%

|

||||

|

Discontinued operations

|

(0.06

|

)

|

(0.05

|

)

|

(0.01

|

)

|

(20.0

|

)%

|

|||||||

|

Consolidated

|

$

|

2.93

|

|

$

|

1.92

|

|

$

|

1.01

|

|

52.6

|

%

|

||||

|

Diluted earnings (loss) per share:

|

|||||||||||||||

|

Continuing operations

|

$

|

2.98

|

|

$

|

1.96

|

|

$

|

1.02

|

|

52.0

|

%

|

||||

|

Discontinued operations

|

(0.07

|

)

|

(0.05

|

)

|

(0.02

|

)

|

(40.0

|

)%

|

|||||||

|

Consolidated

|

$

|

2.91

|

|

$

|

1.91

|

|

$

|

1.00

|

|

52.4

|

%

|

||||

|

EBITDA from continuing operations

(2)

|

$

|

941,399

|

|

$

|

904,406

|

|

$

|

36,993

|

|

4.1

|

%

|

||||

|

EBITDA margin of continuing operations

(2)

|

29.8

|

%

|

29.8

|

%

|

—

|

%

|

—

|

%

|

|||||||

|

(1)

|

We reclassified

$37.6 million

of software and information technology (IT) maintenance expenses from occupancy to other expenses for fiscal year

2017

to conform to the current year presentation.

|

|

(2)

|

See "Non-GAAP Financial Information" at the end of this item for a reconciliation of non-GAAP measures.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

23

|

|

Year ended April 30,

|

2018

|

2017

|

$ Change

|

% Change

|

|||||||||||

|

Consulting and outsourced services

|

$

|

97,457

|

|

$

|

104,995

|

|

$

|

(7,538

|

)

|

(7.2

|

)%

|

||||

|

Bank partner fees

|

47,773

|

|

47,479

|

|

294

|

|

0.6

|

%

|

|||||||

|

Client claims and refunds

|

46,130

|

|

42,618

|

|

3,512

|

|

8.2

|

%

|

|||||||

|

Employee travel and related expenses

|

40,025

|

|

38,719

|

|

1,306

|

|

3.4

|

%

|

|||||||

|

Software and IT maintenance expenses

|

40,566

|

|

37,582

|

|

2,984

|

|

7.9

|

%

|

|||||||

|

Credit card/bank charges

|

32,736

|

|

28,658

|

|

4,078

|

|

14.2

|

%

|

|||||||

|

Insurance

|

8,448

|

|

13,320

|

|

(4,872

|

)

|

(36.6

|

)%

|

|||||||

|

Legal fees and settlements

|

12,874

|

|

12,589

|

|

285

|

|

2.3

|

%

|

|||||||

|

Other

|

36,519

|

|

39,257

|

|

(2,738

|

)

|

(7.0

|

)%

|

|||||||

|

$

|

362,528

|

|

$

|

365,217

|

|

$

|

(2,689

|

)

|

(0.7

|

)%

|

|||||

|

24

|

2018 Form 10-K |

H&R Block, Inc.

|

|

Consolidated – Financial Results

|

(in 000s, except per share amounts)

|

||||||||||||||

|

Year ended April 30,

|

2017

|

2016

|

$ Change

|

% Change

|

|||||||||||

|

Revenues:

|

|||||||||||||||

|

U.S. assisted tax preparation fees

|

$

|

1,902,212

|

|

$

|

1,890,175

|

|

$

|

12,037

|

|

0.6

|

%

|

||||

|

U.S. royalties

|

250,270

|

|

249,433

|

|

837

|

|

0.3

|

%

|

|||||||

|

U.S. DIY tax preparation fees

|

219,123

|

|

234,341

|

|

(15,218

|

)

|

(6.5

|

)%

|

|||||||

|

International revenues

|

210,320

|

|

213,400

|

|

(3,080

|

)

|

(1.4

|

)%

|

|||||||

|

Revenues from Refund Transfers

|

148,212

|

|

162,560

|

|

(14,348

|

)

|

(8.8

|

)%

|

|||||||

|

Revenues from Emerald Card®

|

95,221

|

|

92,608

|

|

2,613

|

|

2.8

|

%

|

|||||||

|

Revenues from Peace of Mind® Extended Service Plan

|

92,820

|

|

86,830

|

|

5,990

|

|

6.9

|

%

|

|||||||

|

Interest and fee income on Emerald Advance

|

57,022

|

|

57,268

|

|

(246

|

)

|

(0.4

|

)%

|

|||||||

|

Other

|

61,114

|

|

51,538

|

|

9,576

|

|

18.6

|

%

|

|||||||

|

Total revenues

|

3,036,314

|

|

3,038,153

|

|

(1,839

|

)

|

(0.1

|

)%

|

|||||||

|

Compensation and benefits:

|

|||||||||||||||

|

Field wages

|

702,518

|

|

724,019

|

|

(21,501

|

)

|

(3.0

|

)%

|

|||||||

|

Other wages

|

181,735

|

|

166,445

|

|

15,290

|

|

9.2

|

%

|

|||||||

|

Benefits and other compensation

|

163,368

|

|

183,512

|

|

(20,144

|

)

|

(11.0

|

)%

|

|||||||

|

1,047,621

|

|

1,073,976

|

|

(26,355

|

)

|

(2.5

|

)%

|

||||||||

|

Occupancy

(1)

|

377,420

|

|

368,629

|

|

8,791

|

|

2.4

|

%

|

|||||||

|

Marketing and advertising

|

261,281

|

|

297,762

|

|

(36,481

|

)

|

(12.3

|

)%

|

|||||||

|

Depreciation and amortization

|

182,168

|

|

173,598

|

|

8,570

|

|

4.9

|

%

|

|||||||

|

Provision for bad debt

|

52,776

|

|

75,395

|

|

(22,619

|

)

|

(30.0

|

)%

|

|||||||

|

Supplies

|

33,847

|

|

36,340

|

|

(2,493

|

)

|

(6.9

|

)%

|

|||||||

|

Other

(1)

|

365,217

|

|

379,261

|

|

(14,044

|

)

|

(3.7

|

)%

|

|||||||

|

Total operating expenses

|

2,320,330

|

|

2,404,961

|

|

(84,631

|

)

|

(3.5

|

)%

|

|||||||

|

Other income (expense), net

|

6,254

|

|

5,249

|

|

1,005

|

|

19.1

|

%

|

|||||||

|

Interest expense on borrowings

|

(92,951

|

)

|

(68,962

|

)

|

(23,989

|

)

|

(34.8

|

)%

|

|||||||

|

Income from continuing operations before income taxes

|

629,287

|

|

569,479

|

|

59,808

|

|

10.5

|

%

|

|||||||

|

Income taxes

|

208,370

|

|

185,926

|

|

22,444

|

|

12.1

|

%

|

|||||||

|

Net income from continuing operations

|

420,917

|

|

383,553

|

|

37,364

|

|

9.7

|

%

|

|||||||

|

Net loss from discontinued operations

|

(11,972

|

)

|

(9,286

|

)

|

(2,686

|

)

|

(28.9

|

)%

|

|||||||

|

Net income

|

$

|

408,945

|

|

$

|

374,267

|

|

$

|

34,678

|

|

9.3

|

%

|

||||

|

Basic earnings (loss) per share:

|

|||||||||||||||

|

Continuing operations

|

$

|

1.97

|

|

$

|

1.54

|

|

$

|

0.43

|

|

27.9

|

%

|

||||

|

Discontinued operations

|

(0.05

|

)

|

(0.04

|

)

|

(0.01

|

)

|

(25.0

|

)%

|

|||||||

|

Consolidated

|

$

|

1.92

|

|

$

|

1.50

|

|

$

|

0.42

|

|

28.0

|

%

|

||||

|

Diluted earnings (loss) per share:

|

|||||||||||||||

|

Continuing operations

|

$

|

1.96

|

|

$

|

1.53

|

|

$

|

0.43

|

|

28.1

|

%

|

||||

|

Discontinued operations

|

(0.05

|

)

|

(0.04

|

)

|

(0.01

|

)

|

(25.0

|

)%

|

|||||||

|

Consolidated

|

$

|

1.91

|

|

$

|

1.49

|

|

$

|

0.42

|

|

28.2

|

%

|

||||

|

EBITDA from continuing operations

(2)

|

$

|

904,406

|

|

$

|

812,218

|

|

$

|

92,188

|

|

11.4

|

%

|

||||

|

EBITDA margin from continuing operations

(2)

|

29.8

|

%

|

26.7

|

%

|

3.1

|

%

|

11.6

|

%

|

|||||||

|

(1)

|

We reclassified

$37.6 million

and

$36.9 million

of software and information technology (IT) maintenance expenses from occupancy to other expenses for fiscal years

2017

and 2016, respectively, to conform to the current year presentation.

|

|

(2)

|

See "Non-GAAP Financial Information" at the end of this item for a reconciliation of non-GAAP measures.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

25

|

|

Year ended April 30,

|

2017

|

2016

|

$ Change

|

% Change

|

|||||||||||

|

Consulting and outsourced services

|

$

|

104,995

|

|

$

|

140,052

|

|

$

|

(35,057

|

)

|

(25.0

|

)%

|

||||

|

Bank partner fees

|

47,479

|

|

16,980

|

|

30,499

|

|

179.6

|

%

|

|||||||

|

Client claims and refunds

|

42,618

|

|

39,782

|

|

2,836

|

|

7.1

|

%

|

|||||||

|

Employee travel and related expenses

|

38,719

|

|

46,665

|

|

(7,946

|

)

|

(17.0

|

)%

|

|||||||

|

Software and IT maintenance expenses

|

37,582

|

|

36,864

|

|

718

|

|

1.9

|

%

|

|||||||

|

Credit card/bank charges

|

28,658

|

|

28,618

|

|

40

|

|

0.1

|

%

|

|||||||

|

Insurance

|

13,320

|

|

12,167

|

|

1,153

|

|

9.5

|

%

|

|||||||

|

Legal fees and settlements

|

12,589

|

|

18,707

|

|

(6,118

|

)

|

(32.7

|

)%

|

|||||||

|

Other

|

39,257

|

|

39,426

|

|

(169

|

)

|

(0.4

|

)%

|

|||||||

|

$

|

365,217

|

|

$

|

379,261

|

|

$

|

(14,044

|

)

|

(3.7

|

)%

|

|||||

|

26

|

2018 Form 10-K |

H&R Block, Inc.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

27

|

|

(in 000s)

|

|

|||||||||||

|

Year ended April 30,

|

2018

|

|

2017

|

|

2016

|

|

||||||

|

Net cash provided by (used in):

|

||||||||||||

|

Operating activities

|

$

|

850,003

|

|

$

|

552,197

|

|

$

|

544,553

|

|

|||

|

Investing activities

|

(112,057

|

)

|

99,319

|

|

329,515

|

|

||||||

|

Financing activities

|

(190,664

|

)

|

(530,424

|

)

|

(1,961,729

|

)

|

||||||

|

Effects of exchange rate changes on cash

|

(1,143

|

)

|

(4,464

|

)

|

(10,590

|

)

|

||||||

|

Net change in cash and cash equivalents

|

$

|

546,139

|

|

$

|

116,628

|

|

$

|

(1,098,251

|

)

|

|||

|

28

|

2018 Form 10-K |

H&R Block, Inc.

|

|

As of

|

April 30, 2018

|

April 30, 2017

|

||||||||||

|

Short-term

|

Long-term

|

Outlook

|

Short-term

|

Long-term

|

Outlook

|

|||||||

|

Moody's

(1)

|

P-3

|

Baa3

|

Stable

|

P-3

|

Baa3

|

Stable

|

||||||

|

S&P

|

A-2

|

BBB

|

Stable

|

A-2

|

BBB

|

Negative

|

||||||

|

H&R Block, Inc.

| 2018 Form 10-K

|

29

|

|

(in 000s)

|

||||||||||||||||||||

|

Total

|

|

Less Than

1 Year

|

|

1 - 3 Years

|

|

4 - 5 Years

|

|

After 5 Years

|

|

|||||||||||

|

Long-term debt (including future interest payments)

|

$

|

1,841,887

|

|

$

|

72,688

|

|

$

|

781,969

|

|

$

|

591,292

|

|

$

|

395,938

|

|

|||||

|

Contingent acquisition payments

|

12,060

|

|

6,979

|

|

5,081

|

|

—

|

|

—

|

|

||||||||||

|

Capital lease obligations

|

5,628

|

|

1,026

|

|

2,197

|

|

2,405

|

|

—

|

|

||||||||||

|

Operating leases

|

820,905

|

|

230,163

|

|

401,809

|

|

155,120

|

|

33,813

|

|

||||||||||

|

One-time transition tax liability

|

17,721

|

|

2,448

|

|

4,053

|

|

3,795

|

|

7,425

|

|

||||||||||

|

Guaranty on Refund Advance loans

|

1,571

|

|

1,571

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Total contractual cash obligations

|

$

|

2,699,772

|

|

$

|

314,875

|

|

$

|

1,195,109

|

|

$

|

752,612

|

|

$

|

437,176

|

|

|||||

|

30

|

2018 Form 10-K |

H&R Block, Inc.

|

|

(in 000s)

|

|

|||||||||||

|

Year ended April 30,

|

2018

|

|

2017

|

|

2016

|

|

||||||

|

Net income - as reported

|

$

|

613,149

|

|

$

|

408,945

|

|

$

|

374,267

|

|

|||

|

Discontinued operations, net

|

13,760

|

|

11,972

|

|

9,286

|

|

||||||

|

Net income from continuing operations - as reported

|

626,909

|

|

420,917

|

|

383,553

|

|

||||||

|

Add back:

|

||||||||||||

|

Income taxes of continuing operations

|

41,823

|

|

208,370

|

|

185,926

|

|

||||||

|

Interest expense of continuing operations

|

89,372

|

|

92,951

|

|

69,141

|

|

||||||

|

Depreciation and amortization of continuing operations

|

183,295

|

|

182,168

|

|

173,598

|

|

||||||

|

314,490

|

|

483,489

|

|

428,665

|

|

|||||||

|

EBITDA from continuing operations

|

$

|

941,399

|

|

$

|

904,406

|

|

$

|

812,218

|

|

|||

|

EBITDA margin from continuing operations

(1)

|

29.8

|

%

|

29.8

|

%

|

26.7

|

%

|

||||||

|

(1)

|

EBITDA margin from continuing operations is computed as EBITDA from continuing operations divided by revenues from continuing operations.

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

31

|

|

32

|

2018 Form 10-K |

H&R Block, Inc.

|

|

/s/ Jeffrey J. Jones II

|

/s/ Tony G. Bowen

|

|

|

Jeffrey J. Jones II

|

Tony G. Bowen

|

|

|

President and Chief Executive Officer

|

Chief Financial Officer

|

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

33

|

|

/s/ Deloitte & Touche LLP

|

|

Kansas City, Missouri

|

|

June 15, 2018

|

|

34

|

2018 Form 10-K |

H&R Block, Inc.

|

|

/s/ Deloitte & Touche LLP

|

|

Kansas City, Missouri

|

|

June 15, 2018

|

|

H&R Block, Inc.

| 2018 Form 10-K

|

35

|

|

AND COMPREHENSIVE INCOME

|

(in 000s, except per share amounts)

|

|||||||||||

|

Year ended April 30,

|

2018

|

|

2017

|

|

2016

|

|

||||||

|

REVENUES:

|

||||||||||||

|

Service revenues

|

$

|

2,766,426

|

|

$

|

2,648,349

|

|

$

|

2,653,936

|

|

|||

|

Royalty, product and other revenues

|

393,505

|

|

387,965

|

|

384,217

|

|

||||||

|

3,159,931

|

|

3,036,314

|

|

3,038,153

|

|

|||||||

|

OPERATING EXPENSES:

|

||||||||||||

|

Costs of revenues

|

1,739,729

|

|

1,644,377

|

|

1,685,552

|

|

||||||

|

Selling, general and administrative

|

668,152

|

|

675,953

|

|

719,409

|

|

||||||

|

Total operating expenses

|

2,407,881

|

|

2,320,330

|

|

2,404,961

|

|

||||||

|

Other income (expense), net

|

6,054

|

|

6,254

|

|

5,249

|

|

||||||

|

Interest expense on borrowings

|

(89,372

|

)

|

(92,951

|

)

|

(68,962

|

)

|

||||||

|

Income from continuing operations before income taxes

|

668,732

|

|

629,287

|

|

569,479

|

|

||||||

|

Income taxes

|

41,823

|

|

208,370

|

|

185,926

|

|

||||||

|

Net income from continuing operations

|

626,909

|

|

420,917

|

|

383,553

|

|

||||||

|

Net loss from discontinued operations, net of tax benefits of $7,016, $6,986 and $5,414

|

(13,760

|

)

|

(11,972

|

)

|

(9,286

|

)

|

||||||

|

NET INCOME

|

$

|

613,149

|

|

$

|

408,945

|

|

$

|

374,267

|

|

|||

|

BASIC EARNINGS (LOSS) PER SHARE:

|

||||||||||||

|

Continuing operations

|

$

|

2.99

|

|

$

|

1.97

|

|

$

|

1.54

|

|

|||

|

Discontinued operations

|

(0.06

|

)

|

(0.05

|

)

|

(0.04

|

)

|

||||||

|

Consolidated

|

$

|

2.93

|

|

$

|

1.92

|

|

$

|

1.50

|

|

|||

|

DILUTED EARNINGS (LOSS) PER SHARE:

|

||||||||||||

|

Continuing operations

|

$

|

2.98

|

|

$

|

1.96

|

|

$

|

1.53

|

|

|||

|

Discontinued operations

|

(0.07

|

)

|

(0.05

|

)

|

(0.04

|

)

|

||||||

|

Consolidated

|

$

|

2.91

|

|

$

|

1.91

|

|

$

|

1.49

|

|

|||

|

COMPREHENSIVE INCOME:

|

||||||||||||

|

Net income

|

$

|

613,149

|

|

$

|

408,945

|

|

$

|

374,267

|

|

|||

|

Unrealized gains (losses) on securities, net of taxes:

|

||||||||||||

|

Unrealized holding gains (losses) arising during the year, net of taxes of $ - , ($9) and ($2,270)

|

1

|

|

(16

|

)

|

(3,530

|

)

|

||||||

|

Reclassification adjustment for losses (gains) included in income, net of taxes of $ - , $ - and ($3,214)

|

—

|

|

—

|

|

(4,982

|

)

|

||||||

|

Change in foreign currency translation adjustments

|

995

|

|

(4,050

|

)

|

(4,461

|

)

|

||||||

|

Other comprehensive income(loss)

|

996

|

|

(4,066

|

)

|

(12,973

|

)

|

||||||

|

Comprehensive income

|

$

|

614,145

|

|

$

|

404,879

|

|

$

|

361,294

|

|

|||

|

36

|

2018 Form 10-K |

H&R Block, Inc.

|

|

|

(in 000s, except share and

per share amounts)

|

|||||||

|

As of April 30,

|

2018

|

|

2017

|

|

||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

$

|

1,544,944

|

|

$

|

1,011,331

|

|

||

|

Cash and cash equivalents - restricted

|

118,734

|

|

106,208

|

|

||||

|

Receivables, less allowance for doubtful accounts of $81,813 and $55,296

|

146,774

|

|

162,775

|

|

||||

|

Income taxes receivable

|

12,310

|

|

—

|

|

||||

|

Prepaid expenses and other current assets

|

68,951

|

|

65,725

|

|

||||

|

Total current assets

|

1,891,713

|

|

1,346,039

|

|

||||

|

Property and equipment, at cost, less accumulated depreciation and amortization of $745,397 and $678,161

|

231,888

|

|

263,827

|

|

||||

|

Intangible assets, net

|

373,981

|

|

409,364

|

|

||||

|

Goodwill

|

507,871

|

|

491,207

|

|

||||

|

Deferred tax assets and income taxes receivable

|

34,095

|

|

83,728

|

|

||||

|

Other noncurrent assets

|

101,401

|

|

99,943

|

|

||||

|

Total assets

|

$

|

3,140,949

|

|

$

|

2,694,108

|

|

||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

LIABILITIES:

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

251,975

|

|

$

|

217,028

|

|

||

|

Accrued salaries, wages and payroll taxes

|

141,499

|

|

183,856

|

|

||||

|

Accrued income taxes and reserves for uncertain tax positions

|

263,050

|

|

348,199

|

|

||||

|

Current portion of long-term debt

|

1,026

|

|

981

|

|

||||

|

Deferred revenue and other current liabilities

|

186,101

|

|

189,216

|

|

||||

|

Total current liabilities

|

843,651

|

|

939,280

|

|

||||

|

Long-term debt

|

1,494,609

|

|

1,493,017

|

|

||||

|

Deferred tax liabilities and reserves for uncertain tax positions

|

229,430

|

|

159,085

|

|

||||

|

Deferred revenue and other noncurrent liabilities

|

179,548

|

|

163,609

|

|

||||

|

Total liabilities

|

2,747,238

|

|

2,754,991

|

|

||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

STOCKHOLDERS' EQUITY:

|

||||||||

|

Common stock, no par, stated value $.01 per share, 800,000,000 shares

authorized, shares issued of 246,198,878 |

2,462

|

|

2,462

|

|

||||

|

Additional paid-in capital

|

760,250

|

|

754,912

|

|

||||

|

Accumulated other comprehensive loss

|

(14,303

|

)

|

(15,299

|

)

|

||||

|

Retained earnings (deficit)

|

362,980

|

|

(48,206

|

)

|

||||

|

Less treasury shares, at cost, of 36,944,789 and 39,027,573

|

(717,678

|

)

|

(754,752

|

)

|

||||

|

Total stockholders' equity (deficiency)

|

393,711

|

|

(60,883

|

)

|

||||

|

Total liabilities and stockholders' equity

|

$

|

3,140,949

|

|

$

|

2,694,108

|

|

||

|

H&R Block, Inc.

| 2018 Form 10-K

|

37

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

(in 000s)

|

|

||||||||||

|

Year ended April 30,

|

2018

|

|

2017

|

|

2016

|

|

||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net income

|

$

|

613,149

|

|

$

|

408,945

|

|

$

|

374,267

|

|

|||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

183,295

|

|

182,168

|

|

173,598

|

|

||||||

|

Provision for bad debt

|

74,489

|

|

52,776

|

|

75,395

|

|

||||||

|

Deferred taxes

|

112,140

|

|

46,455

|

|

36,276

|

|

||||||

|

Stock-based compensation

|

21,954

|

|

19,285

|

|

23,540

|

|

||||||

|

Changes in assets and liabilities, net of acquisitions:

|

||||||||||||

|

Receivables

|

(65,602

|

)

|

(77,873

|

)

|

(70,721

|

)

|

||||||

|

Prepaid expenses and other current assets

|

(3,365

|

)

|

(4,542

|

)

|

4,321

|

|

||||||

|

Other noncurrent assets

|

(1,421

|

)

|

(6,364

|

)

|

4,197

|

|

||||||

|

Accounts payable and accrued expenses

|

32,610

|

|

(30,472

|

)

|

16,723

|

|

||||||

|

Accrued salaries, wages and payroll taxes

|

(43,142

|

)

|

22,789

|

|

17,388

|

|

||||||

|

Deferred revenue and other current liabilities

|

(3,562

|

)

|

(59,998

|

)

|

(77,510

|

)

|

||||||

|

Deferred revenue and other noncurrent liabilities

|

12,689

|

|

4,314

|

|

3,055

|

|

||||||

|

Income tax receivables, accrued income taxes and income tax reserves

|

(75,491

|

)

|

129

|

|

(12,499

|

)

|

||||||

|

Other, net

|

(7,740

|

)

|

(5,415

|

)

|

(23,477

|

)

|

||||||

|

Net cash provided by operating activities

|

850,003

|

|

552,197

|

|

544,553

|

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Sales, maturities and payments received on available-for-sale securities

|

—

|

|

1,144

|

|

436,471

|

|

||||||

|

Principal payments and sales of mortgage loans and real estate owned, net

|

—

|

|

207,174

|

|

38,481

|

|

||||||

|

Capital expenditures

|

(98,583

|

)

|

(89,255

|

)

|

(99,923

|

)

|

||||||

|

Payments made for business acquisitions, net of cash acquired

|

(42,539

|

)

|

(54,816

|

)

|

(88,776

|

)

|

||||||

|

Franchise loans funded

|

(22,320

|

)

|

(34,473

|

)

|

(22,820

|

)

|

||||||

|

Payments received on franchise loans

|

39,968

|

|

61,437

|

|

55,007

|

|

||||||

|

Other, net

|

11,417

|

|

8,108

|

|

11,075

|

|

||||||

|

Net cash provided by (used in) investing activities

|

(112,057

|

)

|

99,319

|

|

329,515

|

|

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Repayments of line of credit borrowings

|

(830,000

|

)

|

(1,700,000

|

)

|

(1,465,000

|

)

|

||||||

|

Proceeds from line of credit borrowings

|

830,000

|

|

1,700,000

|

|

1,465,000

|

|

||||||

|

Proceeds from issuance of long-term debt

|

—

|

|

—

|

|

996,831

|

|

||||||

|

Transfer of HRB Bank deposits

|

—

|

|

—

|

|

(419,028

|

)

|

||||||

|

Customer banking deposits, net

|

—

|

|

—

|

|

(326,705

|

)

|

||||||

|

Dividends paid

|

(200,469

|

)

|

(187,115

|

)

|

(201,688

|

)

|

||||||

|

Repurchase of common stock, including shares surrendered

|

(9,147

|

)

|

(322,850

|

)

|

(2,018,338

|

)

|

||||||

|

Proceeds from exercise of stock options

|

28,340

|

|

2,371

|

|

25,775

|

|

||||||

|

Other, net

|

(9,388

|

)

|

(22,830

|

)

|

(18,576

|

)

|

||||||

|

Net cash used in financing activities

|

(190,664

|

)

|

(530,424

|

)

|

(1,961,729

|

)

|

||||||

|

Effects of exchange rate changes on cash

|

(1,143

|

)

|

(4,464

|

)

|

(10,590

|

)

|

||||||

|

Net increase (decrease) in cash and cash equivalents and restricted cash

|

546,139

|

|

116,628

|

|

(1,098,251

|

)

|

||||||

|

Cash, cash equivalents and restricted cash, beginning of the year

|

1,117,539

|

|

1,000,911

|

|

2,099,162

|

|

||||||

|

Cash, cash equivalents and restricted cash, end of the year

|

$

|

1,663,678

|

|

$

|

1,117,539

|

|

$

|

1,000,911

|

|

|||

|

SUPPLEMENTARY CASH FLOW DATA:

|

||||||||||||

|

Income taxes paid, net of refunds received

|

$

|

8,276

|

|

$

|

163,539

|

|

$

|

165,154

|

|

|||

|

Interest paid on borrowings

|

84,320

|

|

87,185

|

|

59,058

|

|

||||||

|

Accrued additions to property and equipment

|

3,010

|

|

2,433

|

|

2,822

|

|

||||||

|

38

|

2018 Form 10-K |

H&R Block, Inc.

|

|

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

|

(amounts in 000s, except per share amounts)

|

|||||||||||||||||||||||||||||

|

Common Stock

|

Additional

Paid-in Capital |

|

Accumulated

Other Comprehensive Income (Loss) |

|

Retained

Earnings |

|

Treasury Stock

|

Total

Stockholders’ Equity |

|

|||||||||||||||||||||

|

Shares

|

|

Amount

|

|

Shares

|

|

Amount

|

|

|||||||||||||||||||||||

|

Balances as of May 1, 2015

|

316,628

|

|

$

|

3,166

|

|

$

|

783,793

|

|

$

|

1,740

|

|

$

|

1,836,442

|

|

(41,353

|

)

|

$

|

(792,192

|

)

|

$

|

1,832,949

|

|

||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

374,267

|

|

—

|

|

—

|

|

374,267

|

|

||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

(12,973

|

)

|

—

|

|

—

|

|

—

|

|

(12,973

|

)

|

||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

23,540

|

|

—

|

|

—

|

|

—

|

|

—

|

|

23,540

|

|

||||||||||||||

|

Stock-based awards exercised or vested

|

—

|

|

—

|

|

(15,257

|

)

|

—

|

|

(2,848

|

)

|

2,262

|

|

43,451

|

|

25,346

|

|

||||||||||||||

|

Acquisition of treasury shares

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(610

|

)

|

(18,102

|

)

|

(18,102

|

)

|

||||||||||||||

|

Repurchase and retirement of common shares

|

(56,409

|

)

|

(564

|

)

|

(33,846

|

)

|

—

|

|

(1,965,826

|

)

|

—

|

|

—

|

|

(2,000,236

|

)

|

||||||||||||||

|

Cash dividends declared - $0.80 per share

|

—

|

|

—

|

|

—

|

|

—

|

|

(201,688

|

)

|

—

|

|

—

|

|

(201,688

|

)

|

||||||||||||||

|

Balances as of April 30, 2016

|

260,219

|

|

2,602

|

|

758,230

|

|

(11,233

|

)

|

40,347

|

|

(39,701

|

)

|

(766,843

|

)

|

23,103

|

|

||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

408,945

|

|

—

|

|

—

|

|

408,945

|

|

||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

(4,066

|

)

|

—

|

|

—

|

|

—

|

|

(4,066

|

)

|

||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

19,285

|

|

—

|

|

—

|

|

—

|

|

—

|

|

19,285

|

|

||||||||||||||

|

Stock-based awards exercised or vested

|

—

|

|

—

|

|

(14,191

|

)

|

—

|

|

(1,915

|

)

|

928

|

|

17,921

|

|

1,815

|

|

||||||||||||||

|

Acquisition of treasury shares

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(255

|

)

|

(5,830

|

)

|

(5,830

|