|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

þ

|

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the quarterly period ended June 30, 2018

|

|

|

Or

|

|

|

¨

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the transition period from to

|

|

|

Delaware

|

46-2286804

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer

Identification Number)

|

|

5660 New Northside Drive,

Atlanta, Georgia

|

30328

(Zip Code)

|

|

(Address of principal executive offices)

|

|

|

Large accelerated filer

þ

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

|

(Do not check if a smaller company)

|

||||

|

PART I.

|

Financial Statements

|

|

|

Item 1

|

||

|

Consolidated Balance Sheets as of June 30, 2018 and December 31, 2017

|

||

|

Consolidated Statements of Income for the six and three months ended June 30, 2018 and 2017

|

||

|

Consolidated Statements of Comprehensive Income for the six and three months ended June 30, 2018 and 2017

|

||

|

Consolidated Statements of Changes in Equity, Accumulated Other Comprehensive Loss and Redeemable Non-Controlling Interest for the six months ended June 30, 2018 and for the year ended December 31, 2017

|

||

|

Consolidated Statements of Cash Flows for the six months ended June 30, 2018 and 2017

|

||

|

Item 2

|

||

|

Item 3

|

||

|

Item 4

|

||

|

PART II.

|

Other Information

|

|

|

Item 1

|

||

|

Item 1A

|

||

|

Item 2

|

||

|

Item 3

|

||

|

Item 4

|

||

|

Item 5

|

||

|

Item 6

|

||

|

As of

|

As of

|

||||||

|

June 30, 2018

|

December 31, 2017

|

||||||

|

Assets:

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

532

|

|

$

|

535

|

|

|

|

Short-term restricted cash and cash equivalents

|

817

|

|

769

|

|

|||

|

Customer accounts receivable, net of allowance for doubtful accounts of $7 and $6 at June 30, 2018 and December 31, 2017, respectively

|

1,049

|

|

903

|

|

|||

|

Margin deposits, guaranty funds and delivery contracts receivable

|

54,991

|

|

51,222

|

|

|||

|

Prepaid expenses and other current assets

|

171

|

|

133

|

|

|||

|

Total current assets

|

57,560

|

|

53,562

|

|

|||

|

Property and equipment, net

|

1,220

|

|

1,246

|

|

|||

|

Other non-current assets:

|

|||||||

|

Goodwill

|

12,484

|

|

12,216

|

|

|||

|

Other intangible assets, net

|

10,223

|

|

10,269

|

|

|||

|

Long-term restricted cash and cash equivalents

|

331

|

|

264

|

|

|||

|

Other non-current assets

|

1,029

|

|

707

|

|

|||

|

Total other non-current assets

|

24,067

|

|

23,456

|

|

|||

|

Total assets

|

$

|

82,847

|

|

$

|

78,264

|

|

|

|

Liabilities and Equity:

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable and accrued liabilities

|

$

|

405

|

|

$

|

462

|

|

|

|

Section 31 fees payable

|

209

|

|

128

|

|

|||

|

Accrued salaries and benefits

|

150

|

|

227

|

|

|||

|

Deferred revenue

|

372

|

|

125

|

|

|||

|

Short-term debt

|

2,645

|

|

1,833

|

|

|||

|

Margin deposits, guaranty funds and delivery contracts payable

|

54,991

|

|

51,222

|

|

|||

|

Other current liabilities

|

122

|

|

178

|

|

|||

|

Total current liabilities

|

58,894

|

|

54,175

|

|

|||

|

Non-current liabilities:

|

|||||||

|

Non-current deferred tax liability, net

|

2,284

|

|

2,298

|

|

|||

|

Long-term debt

|

4,271

|

|

4,267

|

|

|||

|

Accrued employee benefits

|

235

|

|

243

|

|

|||

|

Other non-current liabilities

|

323

|

|

296

|

|

|||

|

Total non-current liabilities

|

7,113

|

|

7,104

|

|

|||

|

Total liabilities

|

66,007

|

|

61,279

|

|

|||

|

Commitments and contingencies

|

|

|

|

|

|||

|

Equity:

|

|||||||

|

Intercontinental Exchange, Inc. stockholders’ equity:

|

|||||||

|

Preferred stock, $0.01 par value; 100 shares authorized; no shares issued or outstanding at June 30, 2018 and December 31, 2017

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value; 1,500 shares authorized; 603 and 600 shares issued at June 30, 2018 and December 31, 2017, respectively, and 574 and 583 shares outstanding at June 30, 2018 and December 31, 2017, respectively

|

6

|

|

6

|

|

|||

|

Treasury stock, at cost; 29 and 17 shares at June 30, 2018 and December 31, 2017, respectively

|

(1,911

|

)

|

(1,076

|

)

|

|||

|

Additional paid-in capital

|

11,477

|

|

11,392

|

|

|||

|

Retained earnings

|

7,498

|

|

6,858

|

|

|||

|

Accumulated other comprehensive loss

|

(265

|

)

|

(223

|

)

|

|||

|

Total Intercontinental Exchange, Inc. stockholders’ equity

|

16,805

|

|

16,957

|

|

|||

|

Non-controlling interest in consolidated subsidiaries

|

35

|

|

28

|

|

|||

|

Total equity

|

16,840

|

|

16,985

|

|

|||

|

Total liabilities and equity

|

$

|

82,847

|

|

$

|

78,264

|

|

|

|

Six Months Ended

June 30, |

Three Months Ended June 30,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Revenues:

|

|||||||||||||||

|

Transaction and clearing, net

|

$

|

1,762

|

|

$

|

1,615

|

|

$

|

864

|

|

$

|

817

|

|

|||

|

Data services

|

1,046

|

|

1,041

|

|

526

|

|

521

|

|

|||||||

|

Listings

|

220

|

|

217

|

|

111

|

|

109

|

|

|||||||

|

Other revenues

|

108

|

|

94

|

|

55

|

|

49

|

|

|||||||

|

Total revenues

|

3,136

|

|

2,967

|

|

1,556

|

|

1,496

|

|

|||||||

|

Transaction-based expenses:

|

|||||||||||||||

|

Section 31 fees

|

211

|

|

183

|

|

90

|

|

92

|

|

|||||||

|

Cash liquidity payments, routing and clearing

|

454

|

|

438

|

|

220

|

|

224

|

|

|||||||

|

Total revenues, less transaction-based expenses

|

2,471

|

|

2,346

|

|

1,246

|

|

1,180

|

|

|||||||

|

Operating expenses:

|

|||||||||||||||

|

Compensation and benefits

|

481

|

|

483

|

|

241

|

|

236

|

|

|||||||

|

Professional services

|

59

|

|

64

|

|

29

|

|

32

|

|

|||||||

|

Acquisition-related transaction and integration costs

|

27

|

|

23

|

|

15

|

|

9

|

|

|||||||

|

Technology and communication

|

213

|

|

195

|

|

108

|

|

97

|

|

|||||||

|

Rent and occupancy

|

33

|

|

35

|

|

16

|

|

17

|

|

|||||||

|

Selling, general and administrative

|

72

|

|

79

|

|

39

|

|

38

|

|

|||||||

|

Depreciation and amortization

|

281

|

|

276

|

|

143

|

|

142

|

|

|||||||

|

Total operating expenses

|

1,166

|

|

1,155

|

|

591

|

|

571

|

|

|||||||

|

Operating income

|

1,305

|

|

1,191

|

|

655

|

|

609

|

|

|||||||

|

Other income (expense):

|

|||||||||||||||

|

Interest expense

|

(107

|

)

|

(90

|

)

|

(55

|

)

|

(45

|

)

|

|||||||

|

Other income, net

|

30

|

|

191

|

|

11

|

|

3

|

|

|||||||

|

Other income (expense), net

|

(77

|

)

|

101

|

|

(44

|

)

|

(42

|

)

|

|||||||

|

Income before income tax expense

|

1,228

|

|

1,292

|

|

611

|

|

567

|

|

|||||||

|

Income tax expense

|

292

|

|

354

|

|

149

|

|

140

|

|

|||||||

|

Net income

|

$

|

936

|

|

$

|

938

|

|

$

|

462

|

|

$

|

427

|

|

|||

|

Net income attributable to non-controlling interest

|

(17

|

)

|

(16

|

)

|

(7

|

)

|

(8

|

)

|

|||||||

|

Net income attributable to Intercontinental Exchange, Inc.

|

$

|

919

|

|

$

|

922

|

|

$

|

455

|

|

$

|

419

|

|

|||

|

Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders:

|

|||||||||||||||

|

Basic

|

$

|

1.59

|

|

$

|

1.56

|

|

$

|

0.79

|

|

$

|

0.71

|

|

|||

|

Diluted

|

$

|

1.58

|

|

$

|

1.55

|

|

$

|

0.78

|

|

$

|

0.71

|

|

|||

|

Weighted average common shares outstanding:

|

|||||||||||||||

|

Basic

|

580

|

|

593

|

|

578

|

|

591

|

|

|||||||

|

Diluted

|

583

|

|

597

|

|

581

|

|

595

|

|

|||||||

|

Dividend per share

|

$

|

0.48

|

|

$

|

0.40

|

|

$

|

0.24

|

|

$

|

0.20

|

|

|||

|

Six Months Ended

June 30, |

Three Months Ended June 30,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Net income

|

$

|

936

|

|

$

|

938

|

|

$

|

462

|

|

$

|

427

|

|

|||

|

Other comprehensive income (loss):

|

|||||||||||||||

|

Foreign currency translation adjustments, net of tax (expense) benefit of $1 and ($7) for the six months ended June 30, 2018 and 2017, respectively, and $1 and ($7) for the three months ended June 30, 2018 and 2017, respectively

|

(42

|

)

|

85

|

|

(75

|

)

|

60

|

|

|||||||

|

Change in fair value of available-for-sale securities

|

—

|

|

68

|

|

—

|

|

—

|

|

|||||||

|

Reclassification of realized gain on available-for-sale investment to other income

|

—

|

|

(176

|

)

|

—

|

|

—

|

|

|||||||

|

Other comprehensive income (loss)

|

(42

|

)

|

(23

|

)

|

(75

|

)

|

60

|

|

|||||||

|

Comprehensive income

|

$

|

894

|

|

$

|

915

|

|

$

|

387

|

|

$

|

487

|

|

|||

|

Comprehensive income attributable to non-controlling interest

|

(17

|

)

|

(16

|

)

|

(7

|

)

|

(8

|

)

|

|||||||

|

Comprehensive income attributable to Intercontinental Exchange, Inc.

|

$

|

877

|

|

$

|

899

|

|

$

|

380

|

|

$

|

479

|

|

|||

|

Intercontinental Exchange, Inc. Stockholders’ Equity

|

Non-

Controlling

Interest in

Consolidated

Subsidiaries

|

Total

Equity

|

Redeemable Non-Controlling Interest

|

||||||||||||||||||||||||||||||||||

|

Common

Stock

|

Treasury Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Loss

|

|||||||||||||||||||||||||||||||||

|

Shares

|

Value

|

Shares

|

Value

|

||||||||||||||||||||||||||||||||||

|

Balance, as of December 31, 2016

|

596

|

|

$

|

6

|

|

(1

|

)

|

$

|

(40

|

)

|

$

|

11,306

|

|

$

|

4,810

|

|

$

|

(344

|

)

|

$

|

37

|

|

$

|

15,775

|

|

$

|

36

|

|

|||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

121

|

|

—

|

|

121

|

|

—

|

|

|||||||||||||||||

|

Exercise of common stock options

|

—

|

|

—

|

|

—

|

|

—

|

|

17

|

|

—

|

|

—

|

|

—

|

|

17

|

|

—

|

|

|||||||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

(15

|

)

|

(949

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(949

|

)

|

—

|

|

|||||||||||||||||

|

Payments relating to treasury shares

|

—

|

|

—

|

|

(1

|

)

|

(88

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(88

|

)

|

—

|

|

|||||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

152

|

|

—

|

|

—

|

|

—

|

|

152

|

|

—

|

|

|||||||||||||||||

|

Issuance of restricted stock

|

4

|

|

—

|

|

—

|

|

1

|

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||||||

|

Acquisition of non-controlling interest

|

—

|

|

—

|

|

—

|

|

—

|

|

(82

|

)

|

—

|

|

—

|

|

(10

|

)

|

(92

|

)

|

—

|

|

|||||||||||||||||

|

Distributions of profits

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(26

|

)

|

(26

|

)

|

—

|

|

|||||||||||||||||

|

Dividends paid to stockholders

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(476

|

)

|

—

|

|

—

|

|

(476

|

)

|

—

|

|

|||||||||||||||||

|

Acquisition of redeemable non-controlling interest

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(2

|

)

|

—

|

|

—

|

|

(2

|

)

|

(37

|

)

|

|||||||||||||||||

|

Net income attributable to non-controlling interest

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(28

|

)

|

—

|

|

27

|

|

(1

|

)

|

1

|

|

|||||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,554

|

|

—

|

|

—

|

|

2,554

|

|

—

|

|

|||||||||||||||||

|

Balance, as of December 31, 2017

|

600

|

|

6

|

|

(17

|

)

|

(1,076

|

)

|

11,392

|

|

6,858

|

|

(223

|

)

|

28

|

|

16,985

|

|

—

|

|

|||||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(42

|

)

|

—

|

|

(42

|

)

|

—

|

|

|||||||||||||||||

|

Exercise of common stock options

|

—

|

|

—

|

|

—

|

|

—

|

|

12

|

|

—

|

|

—

|

|

—

|

|

12

|

|

—

|

|

|||||||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

(10

|

)

|

(759

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(759

|

)

|

—

|

|

|||||||||||||||||

|

Payments relating to treasury shares

|

—

|

|

—

|

|

(2

|

)

|

(76

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(76

|

)

|

—

|

|

|||||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

73

|

|

—

|

|

—

|

|

—

|

|

73

|

|

—

|

|

|||||||||||||||||

|

Issuance of restricted stock

|

3

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||||||

|

Distributions of profits

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

(10

|

)

|

—

|

|

|||||||||||||||||

|

Dividends paid to stockholders

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(279

|

)

|

—

|

|

—

|

|

(279

|

)

|

—

|

|

|||||||||||||||||

|

Net income attributable to non-controlling interest

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(17

|

)

|

—

|

|

17

|

|

—

|

|

—

|

|

|||||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

936

|

|

—

|

|

—

|

|

936

|

|

—

|

|

|||||||||||||||||

|

Balance, as of June 30, 2018

|

603

|

|

$

|

6

|

|

(29

|

)

|

$

|

(1,911

|

)

|

$

|

11,477

|

|

$

|

7,498

|

|

$

|

(265

|

)

|

$

|

35

|

|

$

|

16,840

|

|

$

|

—

|

|

|||||||||

|

As of

|

As of

|

||||||

|

June 30, 2018

|

December 31, 2017

|

||||||

|

Accumulated other comprehensive loss was as follows:

|

|||||||

|

Foreign currency translation adjustments

|

$

|

(178

|

)

|

$

|

(136

|

)

|

|

|

Comprehensive income from equity method investment

|

2

|

|

2

|

|

|||

|

Employee benefit plans adjustments

|

(89

|

)

|

(89

|

)

|

|||

|

Accumulated other comprehensive loss

|

$

|

(265

|

)

|

$

|

(223

|

)

|

|

|

Six Months Ended

June 30, |

|||||||

|

2018

|

2017

|

||||||

|

Operating activities:

|

|||||||

|

Net income

|

$

|

936

|

|

$

|

938

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||

|

Depreciation and amortization

|

281

|

|

276

|

|

|||

|

Stock-based compensation

|

61

|

|

68

|

|

|||

|

Deferred taxes

|

(7

|

)

|

(11

|

)

|

|||

|

Cetip realized investment gain, net

|

—

|

|

(114

|

)

|

|||

|

Other

|

(4

|

)

|

(7

|

)

|

|||

|

Changes in assets and liabilities:

|

|||||||

|

Customer accounts receivable

|

(148

|

)

|

(170

|

)

|

|||

|

Other current and non-current assets

|

(39

|

)

|

(37

|

)

|

|||

|

Section 31 fees payable

|

80

|

|

51

|

|

|||

|

Deferred revenue

|

249

|

|

240

|

|

|||

|

Other current and non-current liabilities

|

(173

|

)

|

(135

|

)

|

|||

|

Total adjustments

|

300

|

|

161

|

|

|||

|

Net cash provided by operating activities

|

1,236

|

|

1,099

|

|

|||

|

Investing activities:

|

|||||||

|

Capital expenditures

|

(33

|

)

|

(81

|

)

|

|||

|

Capitalized software development costs

|

(75

|

)

|

(69

|

)

|

|||

|

Proceeds from sale of Cetip, net

|

—

|

|

438

|

|

|||

|

Cash paid for acquisitions, net of cash received for divestiture

|

(405

|

)

|

10

|

|

|||

|

Purchases of investments

|

(305

|

)

|

—

|

|

|||

|

Net cash provided by (used in) investing activities

|

(818

|

)

|

298

|

|

|||

|

Financing activities:

|

|||||||

|

Proceeds from (repayments of) commercial paper, net

|

812

|

|

(469

|

)

|

|||

|

Repurchases of common stock

|

(759

|

)

|

(469

|

)

|

|||

|

Dividends to stockholders

|

(279

|

)

|

(239

|

)

|

|||

|

Payments relating to treasury shares received for restricted stock tax payments and stock option exercises

|

(76

|

)

|

(81

|

)

|

|||

|

Acquisition of non-controlling interest and redeemable non-controlling interest

|

—

|

|

(55

|

)

|

|||

|

Other

|

1

|

|

(8

|

)

|

|||

|

Net cash used in financing activities

|

(301

|

)

|

(1,321

|

)

|

|||

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents

|

(5

|

)

|

5

|

|

|||

|

Net increase in cash, cash equivalents, and restricted cash and cash equivalents

|

112

|

|

81

|

|

|||

|

Cash, cash equivalents, and restricted cash and cash equivalents, beginning of period

|

1,568

|

|

1,350

|

|

|||

|

Cash, cash equivalents, and restricted cash and cash equivalents, end of period

|

$

|

1,680

|

|

$

|

1,431

|

|

|

|

Supplemental cash flow disclosure:

|

|||||||

|

Cash paid for income taxes

|

$

|

346

|

|

$

|

429

|

|

|

|

Cash paid for interest

|

$

|

104

|

|

$

|

87

|

|

|

|

1.

|

Description of Business

|

|

|

As Reported

|

New Revenue Standard Adjustment

|

As Adjusted

|

||||||||

|

Six months ended June 30, 2017

|

|||||||||||

|

Total revenues

|

$

|

2,963

|

|

$

|

4

|

|

$

|

2,967

|

|

||

|

Total revenues, less transaction-based expenses

|

2,342

|

|

4

|

|

2,346

|

|

|||||

|

Income tax expense

|

352

|

|

2

|

|

354

|

|

|||||

|

Net income attributable to Intercontinental Exchange, Inc.

|

920

|

|

2

|

|

922

|

|

|||||

|

Basic earnings per share

|

$

|

1.55

|

|

$

|

0.01

|

|

$

|

1.56

|

|

||

|

Diluted earnings per share

|

$

|

1.54

|

|

$

|

0.01

|

|

$

|

1.55

|

|

||

|

|

As Reported

|

New Revenue Standard Adjustment

|

As Adjusted

|

||||||||

|

Three months ended June 30, 2017

|

|||||||||||

|

Total revenues

|

$

|

1,494

|

|

$

|

2

|

|

$

|

1,496

|

|

||

|

Total revenues, less transaction-based expenses

|

1,178

|

|

2

|

|

1,180

|

|

|||||

|

Income tax expense

|

139

|

|

1

|

|

140

|

|

|||||

|

Net income attributable to Intercontinental Exchange, Inc.

|

418

|

|

1

|

|

419

|

|

|||||

|

Basic earnings per share

|

$

|

0.71

|

|

$

|

—

|

|

$

|

0.71

|

|

||

|

Diluted earnings per share

|

$

|

0.70

|

|

$

|

0.01

|

|

$

|

0.71

|

|

||

|

|

As Reported

|

New Revenue Standard Adjustment

|

As Adjusted

|

||||||||

|

As of December 31, 2017

|

|||||||||||

|

Deferred revenue, current

|

$

|

121

|

|

$

|

4

|

|

$

|

125

|

|

||

|

Deferred revenue, non-current

|

143

|

|

(52

|

)

|

91

|

|

|||||

|

Net deferred tax liabilities

|

2,280

|

|

15

|

|

2,295

|

|

|||||

|

Retained earnings

|

6,825

|

|

33

|

|

6,858

|

|

|||||

|

3.

|

Acquisitions and Investments

|

|

4.

|

Revenue Recognition

|

|

•

|

Transaction and clearing, net

- Transaction and clearing revenues represent fees charged for the performance obligations of derivatives trading and clearing, and from our cash trading and equity options exchanges. The derivatives trading and clearing fees contain

two

performance obligations: (1) trade execution/clearing novation and (2) risk management of open interest. We allocate the transaction price between these

two

performance obligations; however, both of these generally occur almost simultaneously and no significant deferral results. The impact of our adoption of ASC 606 on our performance obligations in our clearing business was minimal. Cash trading and equity options fees contain

one

performance obligation related to trade execution which occurs instantaneously. Our transaction and clearing revenues are reported net of rebates, except for the NYSE transaction-based expenses. Transaction and clearing fees can be variable based on trade volume discounts used in the determination of rebates; however, virtually all volume discounts are calculated and recorded on a monthly basis. Transaction and clearing fees, as well as any volume discounts rebated to our customers, are calculated and billed monthly in accordance with our published fee schedules. We make liquidity payments to certain customers in our NYSE businesses and recognize those payments as a cost of revenue. In addition, we pay NYSE regulatory oversight fees to the SEC and collect equal amounts from our customers. These are also considered a cost of revenue, and both of these NYSE-related fees are included in transaction-based expenses. Transaction and clearing revenues and the related transaction-based expenses are all recognized in our Trading and Clearing segment.

|

|

•

|

Data services

- Data service revenues

represent the following:

|

|

◦

|

Pricing and analytics services consist of an extensive set of independent continuous and end-of-day evaluated pricing services focused primarily on fixed income and international equity securities, valuation services, reference data, index services and multi-asset class portfolio and risk management analytics.

|

|

◦

|

Desktops and connectivity services comprise hosting, colocation, infrastructure, technology-based information platforms, feeds and connectivity solutions through the ICE Global Network.

|

|

◦

|

Exchange data services represent subscription fees for the provision of our market data that is created from activity in our Trading and Clearing segment.

|

|

•

|

Listings -

Listings revenues include original and annual listing fees, and other corporate action fees. Under ASC 606, each distinct listing fee is allocated to multiple performance obligations including original and incremental listing and investor relations services, as well as a customer’s material right to renew the option to list on our exchanges. In performing this allocation, the standalone selling price of the listing services is based on the original and annual listing fees and the standalone selling price of the investor relation services is based on its market value. All listings fees are billed upfront and the identified performance obligations are satisfied over time. Upon our adoption of the ASC 606 framework, the amount of revenue related to the investor relations performance obligation is recognized ratably over a

two

-year period, with the remaining revenue recognized ratably over time as customers continue to list on our exchanges, which is generally estimated to be over a period of up to

nine

years for NYSE and up to

five

years for NYSE Arca and NYSE American. Listings fees related to other corporate actions are considered contract modifications of our listing contracts and are recognized ratably over time as customers continue to list on our exchanges, which is generally estimated to be a period of

six

years for NYSE and

three

years for NYSE Arca and NYSE American. All listings fees are recognized in our Data and Listings segment.

|

|

•

|

Other revenues -

Other revenues

primarily include interest income on certain clearing margin deposits, regulatory penalties and fines, fees for use of our facilities, regulatory fees charged to member organizations of our U.S. securities exchanges, designated market maker service fees, exchange membership fees and agricultural grading and certification fees. Generally, fees for other revenues contain one performance obligation. Because these contracts primarily consist of single performance obligations with fixed prices, there is no variable consideration and no need to allocate the transaction price. Services for other revenues are primarily satisfied at a point in time. Therefore, there is no need to allocate the fee and no deferral results as we have no further obligation to the customer at that time. Other revenues are recognized in our Trading and Clearing segment.

|

|

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Total Consolidated

|

||||||||

|

Six months ended June 30, 2018

|

|||||||||||

|

Transaction and clearing, net

|

$

|

1,762

|

|

$

|

—

|

|

$

|

1,762

|

|

||

|

Data services

|

—

|

|

1,046

|

|

1,046

|

|

|||||

|

Listings

|

—

|

|

220

|

|

220

|

|

|||||

|

Other revenues

|

108

|

|

—

|

|

108

|

|

|||||

|

Total revenues

|

1,870

|

|

1,266

|

|

3,136

|

|

|||||

|

Transaction-based expenses

|

665

|

|

—

|

|

665

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

1,205

|

|

$

|

1,266

|

|

$

|

2,471

|

|

||

|

Timing of Revenue Recognition

|

|||||||||||

|

Services transferred at a point in time

|

$

|

1,030

|

|

$

|

—

|

|

$

|

1,030

|

|

||

|

Services transferred over time

|

175

|

|

1,266

|

|

1,441

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

1,205

|

|

$

|

1,266

|

|

$

|

2,471

|

|

||

|

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Total Consolidated

|

||||||||

|

Six months ended June 30, 2017

|

|||||||||||

|

Transaction and clearing, net

|

$

|

1,615

|

|

$

|

—

|

|

$

|

1,615

|

|

||

|

Data services

|

—

|

|

1,041

|

|

1,041

|

|

|||||

|

Listings

|

—

|

|

217

|

|

217

|

|

|||||

|

Other revenues

|

94

|

|

—

|

|

94

|

|

|||||

|

Total revenues

|

1,709

|

|

1,258

|

|

2,967

|

|

|||||

|

Transaction-based expenses

|

621

|

|

—

|

|

621

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

1,088

|

|

$

|

1,258

|

|

$

|

2,346

|

|

||

|

Timing of Revenue Recognition

|

|||||||||||

|

Services transferred at a point in time

|

$

|

928

|

|

$

|

—

|

|

$

|

928

|

|

||

|

Services transferred over time

|

160

|

|

1,258

|

|

1,418

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

1,088

|

|

$

|

1,258

|

|

$

|

2,346

|

|

||

|

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Total Consolidated

|

||||||||

|

Three months ended June 30, 2018

|

|||||||||||

|

Transaction and clearing, net

|

$

|

864

|

|

$

|

—

|

|

$

|

864

|

|

||

|

Data services

|

—

|

|

526

|

|

526

|

|

|||||

|

Listings

|

—

|

|

111

|

|

111

|

|

|||||

|

Other revenues

|

55

|

|

—

|

|

55

|

|

|||||

|

Total revenues

|

919

|

|

637

|

|

1,556

|

|

|||||

|

Transaction-based expenses

|

310

|

|

—

|

|

310

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

609

|

|

$

|

637

|

|

$

|

1,246

|

|

||

|

Timing of Revenue Recognition

|

|||||||||||

|

Services transferred at a point in time

|

$

|

521

|

|

$

|

—

|

|

$

|

521

|

|

||

|

Services transferred over time

|

88

|

|

637

|

|

725

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

609

|

|

$

|

637

|

|

$

|

1,246

|

|

||

|

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Total Consolidated

|

||||||||

|

Three months ended June 30, 2017

|

|||||||||||

|

Transaction and clearing, net

|

$

|

817

|

|

$

|

—

|

|

$

|

817

|

|

||

|

Data services

|

—

|

|

521

|

|

521

|

|

|||||

|

Listings

|

—

|

|

109

|

|

109

|

|

|||||

|

Other revenues

|

49

|

|

—

|

|

49

|

|

|||||

|

Total revenues

|

866

|

|

630

|

|

1,496

|

|

|||||

|

Transaction-based expenses

|

316

|

|

—

|

|

316

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

550

|

|

$

|

630

|

|

$

|

1,180

|

|

||

|

Timing of Revenue Recognition

|

|||||||||||

|

Services transferred at a point in time

|

$

|

470

|

|

$

|

—

|

|

$

|

470

|

|

||

|

Services transferred over time

|

80

|

|

630

|

|

710

|

|

|||||

|

Total revenues, less transaction-based expenses

|

$

|

550

|

|

$

|

630

|

|

$

|

1,180

|

|

||

|

5.

|

Goodwill and Other Intangible Assets

|

|

Goodwill balance at December 31, 2017

|

$

|

12,216

|

|

|

Acquisitions

|

267

|

|

|

|

Foreign currency translation

|

(17

|

)

|

|

|

Other activity, net

|

18

|

|

|

|

Goodwill balance at June 30, 2018

|

$

|

12,484

|

|

|

Other intangible assets balance at December 31, 2017

|

$

|

10,269

|

|

|

Acquisitions

|

136

|

|

|

|

Foreign currency translation

|

(22

|

)

|

|

|

Amortization of other intangible assets

|

(142

|

)

|

|

|

Other activity, net

|

(18

|

)

|

|

|

Other intangible assets balance at June 30, 2018

|

$

|

10,223

|

|

|

6.

|

Deferred Revenue

|

|

Annual Listings Revenues

|

Original Listings Revenues

|

Other Listings Revenues

|

Data Services and Other Revenues

|

Total

|

|||||||||||||||

|

Deferred revenue balance at December 31, 2017

|

$

|

—

|

|

$

|

25

|

|

$

|

98

|

|

$

|

93

|

|

$

|

216

|

|

||||

|

Additions

|

383

|

|

13

|

|

26

|

|

230

|

|

652

|

|

|||||||||

|

Amortization

|

(191

|

)

|

(12

|

)

|

(17

|

)

|

(184

|

)

|

(404

|

)

|

|||||||||

|

Deferred revenue balance at June 30, 2018

|

$

|

192

|

|

$

|

26

|

|

$

|

107

|

|

$

|

139

|

|

$

|

464

|

|

||||

|

Annual Listings Revenues

|

Original Listings Revenues

|

Other Listings Revenues

|

Data Services and Other Revenues

|

Total

|

|||||||||||||||

|

Deferred revenue balance at December 31, 2016

|

$

|

—

|

|

$

|

23

|

|

$

|

83

|

|

$

|

88

|

|

$

|

194

|

|

||||

|

Additions

|

366

|

|

11

|

|

39

|

|

232

|

|

648

|

|

|||||||||

|

Amortization

|

(184

|

)

|

(11

|

)

|

(21

|

)

|

(186

|

)

|

(402

|

)

|

|||||||||

|

Divestitures

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

(10

|

)

|

|||||||||

|

Deferred revenue balance at June 30, 2017

|

$

|

182

|

|

$

|

23

|

|

$

|

101

|

|

$

|

124

|

|

$

|

430

|

|

||||

|

Annual Listings Revenues

|

Original Listing Revenues

|

Other Listing Revenues

|

Data Services and Other Revenues

|

Total

|

|||||||||||||||

|

Remainder of 2018

|

$

|

192

|

|

$

|

13

|

|

$

|

10

|

|

$

|

115

|

|

$

|

330

|

|

||||

|

2019

|

—

|

|

12

|

|

34

|

|

20

|

|

66

|

|

|||||||||

|

2020

|

—

|

|

1

|

|

27

|

|

2

|

|

30

|

|

|||||||||

|

2021

|

—

|

|

—

|

|

19

|

|

2

|

|

21

|

|

|||||||||

|

2022

|

—

|

|

—

|

|

13

|

|

—

|

|

13

|

|

|||||||||

|

Thereafter

|

—

|

|

—

|

|

4

|

|

—

|

|

4

|

|

|||||||||

|

Total

|

$

|

192

|

|

$

|

26

|

|

$

|

107

|

|

$

|

139

|

|

$

|

464

|

|

||||

|

7.

|

|

|

As of

June 30, 2018 |

As of

December 31, 2017

|

||||||

|

Debt:

|

|||||||

|

Short-term debt:

|

|||||||

|

Commercial Paper

|

$

|

2,045

|

|

$

|

1,233

|

|

|

|

2018 Senior Notes (2.50% senior unsecured notes due October 15, 2018)

|

600

|

|

600

|

|

|||

|

Total short-term debt

|

2,645

|

|

1,833

|

|

|||

|

Long-term debt:

|

|||||||

|

2020 Senior Notes (2.75% senior unsecured notes due December 1, 2020)

|

1,245

|

|

1,244

|

|

|||

|

2022 Senior Notes (2.35% senior unsecured notes due September 15, 2022)

|

496

|

|

495

|

|

|||

|

2023 Senior Notes (4.00% senior unsecured notes due October 15, 2023)

|

792

|

|

791

|

|

|||

|

2025 Senior Notes (3.75% senior unsecured notes due December 1, 2025)

|

1,243

|

|

1,242

|

|

|||

|

2027 Senior Notes (3.10% senior unsecured notes due September 15, 2027)

|

495

|

|

495

|

|

|||

|

Total long-term debt

|

4,271

|

|

4,267

|

|

|||

|

Total debt

|

$

|

6,916

|

|

$

|

6,100

|

|

|

|

8.

|

Equity

|

|

Number of Options

|

Weighted Average

Exercise Price per Option |

|||||

|

Outstanding at December 31, 2017

|

4,013,388

|

|

$

|

41.13

|

|

|

|

Granted

|

522,881

|

|

67.00

|

|

||

|

Exercised

|

(432,087

|

)

|

28.69

|

|

||

|

Outstanding at June 30, 2018

|

4,104,182

|

|

45.73

|

|

||

|

Number of Options

|

Weighted Average

Exercise Price |

Weighted Average

Remaining Contractual Life (Years) |

Aggregate

Intrinsic Value (In millions) |

|||||||||

|

Vested or expected to vest

|

4,104,182

|

|

$

|

45.73

|

|

6.8

|

$

|

114

|

|

|||

|

Exercisable

|

2,953,324

|

|

$

|

39.86

|

|

6.0

|

$

|

100

|

|

|||

|

Six Months Ended June 30,

|

|||||||

|

Assumptions:

|

2018

|

2017

|

|||||

|

Risk-free interest rate

|

2.66

|

%

|

1.84

|

%

|

|||

|

Expected life in years

|

6.0

|

|

5.0

|

|

|||

|

Expected volatility

|

20

|

%

|

21

|

%

|

|||

|

Expected dividend yield

|

1.43

|

%

|

1.40

|

%

|

|||

|

Estimated weighted-average fair value of options granted per share

|

$

|

13.98

|

|

$

|

10.50

|

|

|

|

Number of

Restricted Stock Shares |

Weighted Average

Grant-Date Fair Value per Share |

||||

|

Non-vested at December 31, 2017

|

5,748,408

|

$

|

52.78

|

|

|

|

Granted

|

1,829,220

|

67.47

|

|

||

|

Vested

|

(2,673,199)

|

49.86

|

|

||

|

Forfeited

|

(246,640)

|

57.59

|

|

||

|

Non-vested at June 30, 2018

|

4,657,789

|

59.97

|

|

||

|

9.

|

Income Taxes

|

|

10.

|

Clearing Organizations

|

|

•

|

ICE Clear Europe performs the clearing and settlement for all futures and options contracts traded through ICE Futures Europe and ICE Endex, for energy futures and options contracts trading through ICE Futures U.S., and for CDS contracts submitted for clearing in Europe.

|

|

•

|

ICE Clear Credit performs the clearing and settlement for CDS contracts submitted for clearing in North America.

|

|

•

|

ICE Clear U.S. performs the clearing and settlement of agricultural, metals, currencies and financial futures and options contracts traded through ICE Futures U.S.

|

|

•

|

ICE Clear Canada performed the clearing and settlement for all futures and options contracts traded through ICE Futures Canada until July 30, 2018, when we transitioned the trading and clearing of our canola contracts from ICE Futures Canada and ICE Clear Canada to ICE Futures U.S. and ICE Clear U.S., respectively. After the transition, ICE Futures Canada and ICE Clear Canada ceased operations.

|

|

•

|

ICE Clear Netherlands has received regulatory approval to offer clearing of Dutch equity options traded through ICE Endex.

|

|

•

|

ICE Clear Singapore performs the clearing and settlement for all futures and options contracts traded through ICE Futures Singapore.

|

|

•

|

ICE NGX performs clearing and settlement for physical North American natural gas, electricity and oil markets.

|

|

ICE Clear

Europe |

ICE Clear

Credit |

ICE Clear U.S.

|

ICE NGX

|

Other ICE Clearing Houses

|

Total

|

||||||||||||||||||

|

Original margin

|

$

|

22,193

|

|

$

|

19,655

|

|

$

|

6,148

|

|

$

|

—

|

|

$

|

93

|

|

$

|

48,089

|

|

|||||

|

Unsettled variation margin, net

|

—

|

|

—

|

|

—

|

|

90

|

|

—

|

|

90

|

|

|||||||||||

|

Guaranty fund

|

3,565

|

|

2,300

|

|

473

|

|

—

|

|

21

|

|

6,359

|

|

|||||||||||

|

Delivery contracts receivable/payable, net

|

—

|

|

—

|

|

—

|

|

453

|

|

—

|

|

453

|

|

|||||||||||

|

Total

|

$

|

25,758

|

|

$

|

21,955

|

|

$

|

6,621

|

|

$

|

543

|

|

$

|

114

|

|

$

|

54,991

|

|

|||||

|

ICE Clear

Europe |

ICE Clear

Credit |

ICE Clear U.S.

|

ICE NGX

|

Other ICE Clearing Houses

|

Total

|

||||||||||||||||||

|

Original margin

|

$

|

19,792

|

|

$

|

20,703

|

|

$

|

3,898

|

|

$

|

—

|

|

$

|

126

|

|

$

|

44,519

|

|

|||||

|

Unsettled variation margin, net

|

—

|

|

—

|

|

—

|

|

227

|

|

1

|

|

228

|

|

|||||||||||

|

Guaranty fund

|

3,037

|

|

2,607

|

|

299

|

|

—

|

|

23

|

|

5,966

|

|

|||||||||||

|

Delivery contracts receivable/payable, net

|

—

|

|

—

|

|

—

|

|

509

|

|

—

|

|

509

|

|

|||||||||||

|

Total

|

$

|

22,829

|

|

$

|

23,310

|

|

$

|

4,197

|

|

$

|

736

|

|

$

|

150

|

|

$

|

51,222

|

|

|||||

|

As of June 30, 2018

|

|||||||||||||||||||

|

ICE Clear

Europe |

ICE Clear

Credit |

ICE Clear U.S.

|

ICE NGX

|

Other ICE Clearing Houses

|

|||||||||||||||

|

Original margin:

|

|||||||||||||||||||

|

Government securities at face value

|

$

|

24,235

|

|

$

|

11,568

|

|

$

|

8,607

|

|

$

|

—

|

|

$

|

25

|

|

||||

|

Letters of credit

|

—

|

|

—

|

|

—

|

|

1,610

|

|

—

|

|

|||||||||

|

ICE NGX cash deposits

|

—

|

|

—

|

|

—

|

|

281

|

|

—

|

|

|||||||||

|

Total

|

$

|

24,235

|

|

$

|

11,568

|

|

$

|

8,607

|

|

$

|

1,891

|

|

$

|

25

|

|

||||

|

Guaranty fund:

|

|||||||||||||||||||

|

Government securities at face value

|

$

|

431

|

|

$

|

169

|

|

$

|

234

|

|

$

|

—

|

|

$

|

3

|

|

||||

|

As of December 31, 2017

|

|||||||||||||||||||

|

ICE Clear

Europe |

ICE Clear

Credit |

ICE Clear U.S.

|

ICE NGX

|

Other ICE Clearing Houses

|

|||||||||||||||

|

Original margin:

|

|||||||||||||||||||

|

Government securities at face value

|

$

|

23,496

|

|

$

|

5,699

|

|

$

|

9,581

|

|

$

|

—

|

|

$

|

18

|

|

||||

|

Letters of credit

|

—

|

|

—

|

|

—

|

|

1,663

|

|

—

|

|

|||||||||

|

ICE NGX cash deposits

|

—

|

|

—

|

|

—

|

|

233

|

|

—

|

|

|||||||||

|

Total

|

$

|

23,496

|

|

$

|

5,699

|

|

$

|

9,581

|

|

$

|

1,896

|

|

$

|

18

|

|

||||

|

Guaranty fund:

|

|||||||||||||||||||

|

Government securities at face value

|

$

|

323

|

|

$

|

176

|

|

$

|

169

|

|

$

|

—

|

|

$

|

2

|

|

||||

|

•

|

Level 1 inputs — quoted prices for identical assets or liabilities in active markets.

|

|

•

|

Level 2 inputs — observable inputs other than Level 1 inputs such as quoted prices for similar assets and liabilities in active markets or inputs other than quoted prices that are directly observable.

|

|

•

|

Level 3 inputs — unobservable inputs supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

|

|

As of June 30, 2018

|

As of December 31, 2017

|

||||||||||||||||||||||

|

Level 1

|

Level 2 and 3

|

Total

|

Level 1

|

Level 2 and 3

|

Total

|

||||||||||||||||||

|

Assets at fair value:

|

|||||||||||||||||||||||

|

U.S. Treasury and other foreign government securities

|

$

|

944

|

|

$

|

—

|

|

$

|

944

|

|

$

|

734

|

|

$

|

—

|

|

$

|

734

|

|

|||||

|

Mutual funds

|

15

|

|

—

|

|

15

|

|

16

|

|

—

|

|

16

|

|

|||||||||||

|

Total assets at fair value

|

$

|

959

|

|

$

|

—

|

|

$

|

959

|

|

$

|

750

|

|

$

|

—

|

|

$

|

750

|

|

|||||

|

13.

|

Segment Reporting

|

|

Six Months Ended June 30, 2018

|

Six Months Ended June 30, 2017

|

||||||||||||||||||||||

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Consolidated

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Consolidated

|

||||||||||||||||||

|

Revenues:

|

|||||||||||||||||||||||

|

Energy futures and options contracts

|

$

|

485

|

|

$

|

—

|

|

$

|

485

|

|

$

|

459

|

|

$

|

—

|

|

$

|

459

|

|

|||||

|

Agricultural and metals futures and options contracts

|

139

|

|

—

|

|

139

|

|

118

|

|

—

|

|

118

|

|

|||||||||||

|

Interest rates and other financial futures and options contracts

|

185

|

|

—

|

|

185

|

|

172

|

|

—

|

|

172

|

|

|||||||||||

|

Cash equities and equity options

|

827

|

|

—

|

|

827

|

|

771

|

|

—

|

|

771

|

|

|||||||||||

|

OTC and other transactions

|

126

|

|

—

|

|

126

|

|

95

|

|

—

|

|

95

|

|

|||||||||||

|

Pricing and analytics

|

—

|

|

516

|

|

516

|

|

—

|

|

480

|

|

480

|

|

|||||||||||

|

Exchange data

|

—

|

|

287

|

|

287

|

|

—

|

|

280

|

|

280

|

|

|||||||||||

|

Desktops and connectivity

|

—

|

|

243

|

|

243

|

|

—

|

|

281

|

|

281

|

|

|||||||||||

|

Listings

|

—

|

|

220

|

|

220

|

|

—

|

|

217

|

|

217

|

|

|||||||||||

|

Other revenues

|

108

|

|

—

|

|

108

|

|

94

|

|

—

|

|

94

|

|

|||||||||||

|

Revenues

|

1,870

|

|

1,266

|

|

3,136

|

|

1,709

|

|

1,258

|

|

2,967

|

|

|||||||||||

|

Transaction-based expenses

|

665

|

|

—

|

|

665

|

|

621

|

|

—

|

|

621

|

|

|||||||||||

|

Revenues, less transaction-based expenses

|

1,205

|

|

1,266

|

|

2,471

|

|

1,088

|

|

1,258

|

|

2,346

|

|

|||||||||||

|

Operating expenses

|

425

|

|

741

|

|

1,166

|

|

397

|

|

758

|

|

1,155

|

|

|||||||||||

|

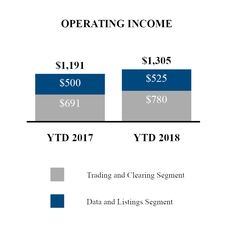

Operating income

|

$

|

780

|

|

$

|

525

|

|

$

|

1,305

|

|

$

|

691

|

|

$

|

500

|

|

$

|

1,191

|

|

|||||

|

Three Months Ended June 30, 2018

|

Three Months Ended June 30, 2017

|

||||||||||||||||||||||

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Consolidated

|

Trading and Clearing Segment

|

Data and Listings Segment

|

Consolidated

|

||||||||||||||||||

|

Revenues:

|

|||||||||||||||||||||||

|

Energy futures and options contracts

|

$

|

250

|

|

$

|

—

|

|

$

|

250

|

|

$

|

231

|

|

$

|

—

|

|

$

|

231

|

|

|||||

|

Agricultural and metals futures and options contracts

|

74

|

|

—

|

|

74

|

|

62

|

|

—

|

|

62

|

|

|||||||||||

|

Interest rates and other financial futures and options contracts

|

94

|

|

—

|

|

94

|

|

89

|

|

—

|

|

89

|

|

|||||||||||

|

Cash equities and equity options

|

389

|

|

—

|

|

389

|

|

390

|

|

—

|

|

390

|

|

|||||||||||

|

OTC and other transactions

|

57

|

|

—

|

|

57

|

|

45

|

|

—

|

|

45

|

|

|||||||||||

|

Pricing and analytics

|

—

|

|

262

|

|

262

|

|

—

|

|

242

|

|

242

|

|

|||||||||||

|

Exchange data

|

—

|

|

144

|

|

144

|

|

—

|

|

142

|

|

142

|

|

|||||||||||

|

Desktops and connectivity

|

—

|

|

120

|

|

120

|

|

—

|

|

137

|

|

137

|

|

|||||||||||

|

Listings

|

—

|

|

111

|

|

111

|

|

—

|

|

109

|

|

109

|

|

|||||||||||

|

Other revenues

|

55

|

|

—

|

|

55

|

|

49

|

|

—

|

|

49

|

|

|||||||||||

|

Revenues

|

919

|

|

637

|

|

1,556

|

|

866

|

|

630

|

|

1,496

|

|

|||||||||||

|

Transaction-based expenses

|

310

|

|

—

|

|

310

|

|

316

|

|

—

|

|

316

|

|

|||||||||||

|

Revenues, less transaction-based expenses

|

609

|

|

637

|

|

1,246

|

|

550

|

|

630

|

|

1,180

|

|

|||||||||||

|

Operating expenses

|

218

|

|

373

|

|

591

|

|

197

|

|

374

|

|

571

|

|

|||||||||||

|

Operating income