|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 26, 2015.

|

|

|

or

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from

to

.

|

|

|

Delaware

|

94-1672743

|

|

|

State or other jurisdiction of

incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

|

|

2200 Mission College Boulevard, Santa Clara, California

|

95054-1549

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common stock, $0.001 par value

|

The NASDAQ Global Select Market*

|

|

|

Large accelerated filer

x

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

|||

|

|

(Do not check if a smaller reporting company)

|

|||||

|

|

Page

|

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

ITEM 1.

|

BUSINESS

|

|

•

|

sensification of compute

- as computing becomes increasingly personal, users will demand that it capture the human senses such as sight, sound, and touch;

|

|

•

|

smart and connected

- more and more devices will be able to process data and connect to the cloud, other devices, or people; and

|

|

•

|

extension of you

- increasingly personal digital devices and their many form factors will become even more ubiquitous in our lives.

|

|

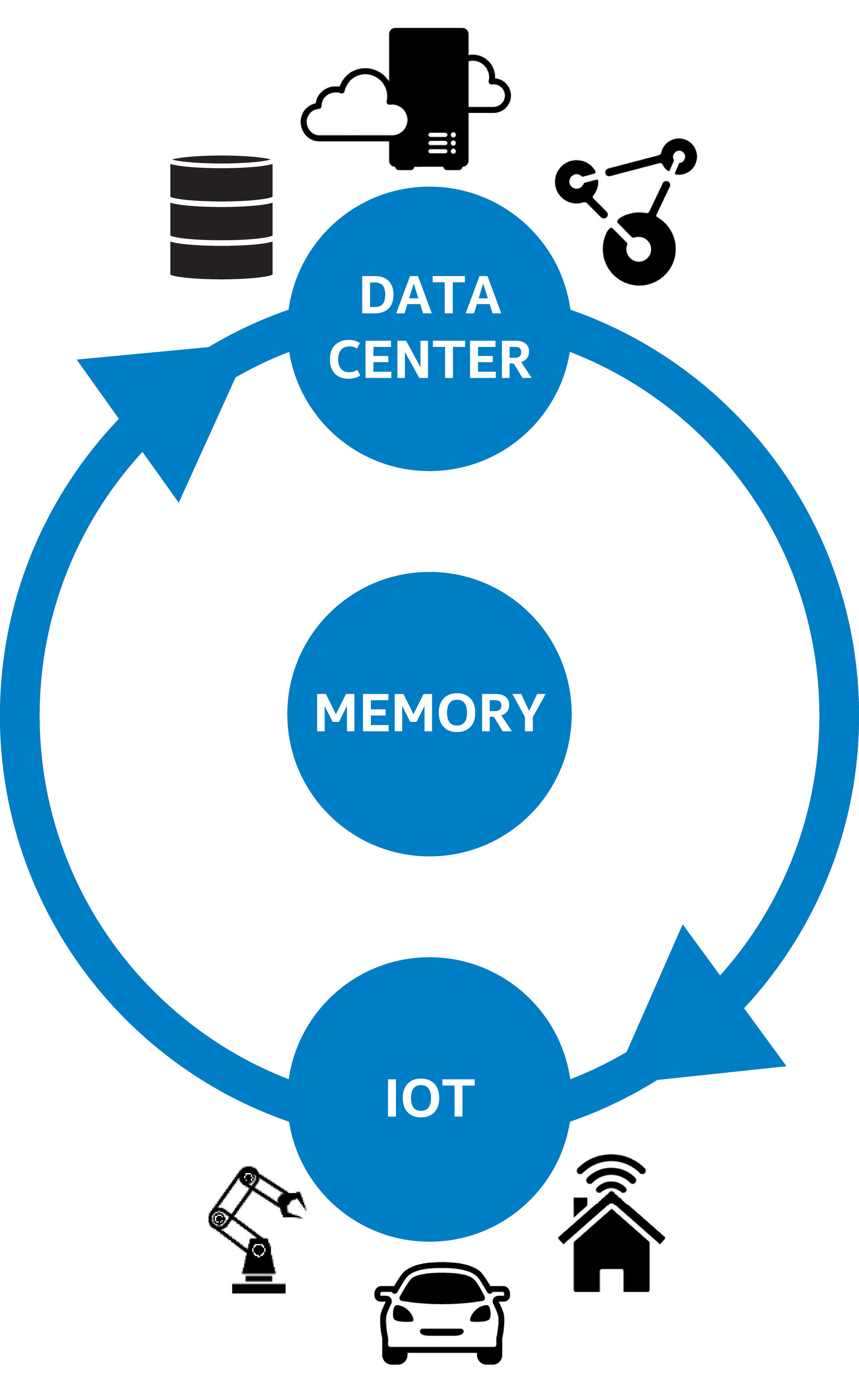

As more devices become smart and connected, specifically in the Internet of Things (IOT), there is greater demand for data centers to not only connect these devices, but also to capture and analyze the data they create. In addition, improvements in memory technology are enabling faster and more efficient microprocessors. We call the cycle of growth that occurs as these three market segments feed each other the “Virtuous Cycle of Growth.” As we execute to our strategy, these market segments will continue to have greater impact on our results and our future as a company.

We expect that our acquisition of Altera Corporation (Altera), completed subsequent to fiscal year-end 2015, will benefit this cycle of growth. The Altera acquisition is an example of our efforts to expand our reach within the compute continuum, as we believe that combining our leading-edge products and manufacturing process with Altera's leading field-programmable gate array (FPGA) technology will enable new classes of platforms that meet customer needs in the data center and Internet of Things market segments.

|

Virtuous Cycle of Growth

|

|

|

|

•

|

relentlessly pursue Moore's Law to maximize and extend our manufacturing technology leadership;

|

|

•

|

strive to ensure that Intel

®

technology is the best choice across the compute continuum and across any operating system;

|

|

•

|

enable smart and connected devices through continued development of industry-leading communications and connectivity technology;

|

|

•

|

expand platforms into adjacent market segments to bring compelling new platform solutions and user experiences to form factors across the compute continuum;

|

|

•

|

increase the utilization of our investments in intellectual property and research and development (R&D) across all market segments;

|

|

•

|

expand the data center, the Internet of Things, and next-generation memory;

|

|

•

|

scale our manufacturing capabilities into foundry; and

|

|

•

|

strive to increase the diversity and inclusion of our workforce, reduce the environmental footprint of our products and operations, and be an asset to the communities where we conduct business.

|

|

•

|

Silicon and Manufacturing Technology Leadership.

We have long been a leader in silicon process technology and manufacturing, and we aim to continue our lead through investment and innovation in this critical area. Intel co-founder Gordon Moore predicted, in what has become known as Moore's Law, that transistor density on integrated circuits would double about every two years. We continue executing to Moore’s Law by enabling

new devices with higher functionality and complexity while controlling power, cost, and size.

In keeping with Moore's Law, we drive a regular and predictable upgrade cycle—introducing the next generation of silicon process technology approximately every two to three years. Through this cycle, we continue to push progress by designing and putting transistor innovations into high-volume production. We aim to have the best process technology, and unlike many semiconductor companies, we primarily manufacture our products in our own facilities. This in-house manufacturing capability enables us to optimize performance, shorten our time-to-market, and scale new products more rapidly. We believe this competitive advantage will be extended in the future as the costs to build leading-edge fabrication facilities increase, and as fewer semiconductor companies will be able to leverage platform design and manufacturing.

|

|

•

|

Architecture and Platforms.

We believe that users want consistent computing experiences and interoperable devices, and that users and developers value consistency of a standardized architecture. This standardized architecture provides a common framework that results in shortened time-to-market, increased innovation, and the ability to leverage technologies across multiple form factors. We have an advantage over most competitors because we are able to share intellectual property across our platforms and operating segments, which reduces our costs and provides a higher return on capital in our growth market segments (e.g., the data center, Internet of Things, and memory)

.

The combination of our shared intellectual property portfolio and our interchangeable manufacturing and assembly and test assets allows us to seamlessly shift our production capabilities to respond to market demand. We believe that we can meet the needs of users and developers by offering complete solutions across the compute continuum through our partnership with the industry on open, standards-based platform innovation around Intel

®

architecture. We continue to invest in improving Intel architecture to deliver increased value to our customers and expand the capabilities of the architecture in adjacent market segments. For example, we focus on delivering improved energy-efficient performance, which involves balancing higher performance with the lowest power. In addition, the personalization of compute continues to drive our strategy as we focus on technologies such as perceptual computing, which brings exciting experiences through devices that sense, perceive, and interact with the user’s actions.

|

|

•

|

Software and Services.

We offer software and services that provide solutions through a combination of hardware and software for consumer and corporate environments. Additionally, we seek to enable and advance the computing ecosystem by providing development tools and support to assist software developers in creating software applications that take advantage of our platforms. We seek to expedite growth in various market segments through our software offerings. We continue to collaborate with companies to develop software platforms that are optimized for Intel

®

processors, and that support multiple hardware architectures and operating systems.

|

|

•

|

Security

. Through our expertise in hardware and software, we are able to embed security into many facets of computing and bring unique hardware, software, and end-to-end security solutions to the market. We offer proactive solutions and services to help secure the world’s most critical systems and networks. Additionally, through our McAfee

®

security products, we protect consumers and businesses of all sizes by helping detect and eliminate ever-evolving security threats.

|

|

•

|

Customer Orientation.

We focus on providing compelling user experiences by developing our next generation of products based on customer needs and expectations. In turn, our products help enable the design and development of new user experiences, form factors, and usage models for businesses and consumers. For example, we enhance the computing experience by providing Intel

®

RealSense

™

technology, password elimination, and our next-generation Thunderbolt

™

3 technology. Our latest Thunderbolt technology significantly increases the speed at which data and video can be transferred on a single cable, while simultaneously supplying power. We offer platforms that incorporate various components and capabilities designed and configured to work together to provide an optimized solution that customers can easily integrate into their products. Additionally, we have entered into strategic partnerships across multiple industries with a variety of manufacturers, including: Microsoft Corporation; Fossil Group, Inc.; LVMH Moët Hennessy Louis Vuitton SE; SMS Audio, LLC; Opening Ceremony, LLC; and others. Furthermore, we promote industry standards that we believe will yield innovation and improved technologies for users.

|

|

•

|

Acquisitions and Strategic Investments.

In Q1 2016, we completed the acquisition of Altera.

Altera is a global semiconductor company that designs and sells programmable semiconductors and related products, including programmable logic devices—which incorporate FPGAs and complex programmable logic devices—and highly integrated System-on-Chip (SoC) devices.

As a result of the acquisition, we expect to integrate approximately 3,000 Altera employees. The acquisition of Altera reflects our strategy to drive Moore's Law and fuel growth in the data center and Internet of Things market segments. As we develop future platforms, the integration of PLDs into our platform solutions will improve the overall performance and lower the cost of ownership for our customers. Additionally, we make investments in companies around the world that we believe will further our vision, mission, and strategic objectives; support our key business initiatives; and generate financial returns. Our investments—including those made through Intel Capital—generally focus on companies and initiatives that we believe will stimulate growth in the digital economy, create new business opportunities for Intel, and expand global markets for our products. During 2015, we invested

$966 million

in Beijing UniSpreadtrum Technology Ltd. (UniSpreadtrum), a holding company under Tsinghua Unigroup Ltd. (an operating subsidiary of Tsinghua Holdings Co. Ltd.), to, among other things, jointly develop Intel architecture-based and communications-based solutions for phones. Additionally, we plan to continue to purchase and license intellectual property to support our current and expanding business.

|

|

•

|

Corporate Responsibility.

Diversity and inclusion are integral parts of Intel's competitive strategy and vision. In January 2015, Intel announced the Diversity in Technology initiative, setting a goal to achieve higher representation of women and underrepresented minorities in Intel's U.S. workforce by 2020. We are also investing $300 million to help build the STEM pipeline, to support hiring and retaining more women and underrepresented minorities, and to fund programs to support more positive representation within the technology and gaming industries. We are committed to empowering people and expanding economic opportunity through education and technology, driven by our corporate and Intel Foundation programs, policy leadership, and collaborative engagements. In addition, we strive to cultivate an inclusive work environment in which engaged, energized employees can thrive in their jobs and in their communities. We work to develop energy-efficient technology solutions that can be used to address major global problems while reducing our environmental impact. We have also led the industry on the "conflict minerals" issue and have worked extensively since 2008 to put in place processes and systems to develop ethical sourcing of tin, tantalum, tungsten, and gold for Intel and to prevent profits from the sale of those minerals from funding conflict in the Democratic Republic of the Congo (DRC) and adjoining countries.

|

|

•

|

Intel vPro™ technology, a solution for manageability, security, and business user experiences in the notebook, desktop, and 2 in 1 systems and select Internet of Things market segments. Intel vPro technology is designed to provide businesses with increased manageability, upgradeability, energy-efficient performance, and security while lowering the total cost of ownership;

|

|

•

|

Intel RealSense technology, which—in conjunction with the latest Intel processors—enables a device to perceive depth similar to how a person does. This technology brings new opportunities for the personalization of compute to evolve; and

|

|

•

|

True Key

™

technology, which allows users to access devices through facial recognition and other biometric technologies, thereby eliminating the need for log-in passwords.

|

|

•

|

enabling platforms that can be used across multiple operating systems, applications, and services across all Intel products;

|

|

•

|

optimizing features and performance by enabling the software ecosystem to quickly take advantage of new platform features and capabilities; and

|

|

•

|

protecting consumers, small businesses, and enterprises from malware and emerging online threats.

|

|

•

|

Transitions to next-generation technologies

. We have a market lead in transitioning to the next-generation process technology and bringing products to market using such technology. Our products utilizing our 14nm process technology are in the market and we are continuing to work on the development of our next-generation 10nm process technology. We believe that these advancements will offer significant improvements in one or more of the following areas: performance, new features, energy efficiency, and cost.

|

|

•

|

Combination of our network of manufacturing and assembly and test facilities with our global architecture design teams

. We have made significant capital and R&D investments into our integrated manufacturing network, which enables us to have more direct control over our design, development, and manufacturing processes; quality control; product cost; production timing; performance; power consumption; and manufacturing yield. The increased cost of constructing new fabrication facilities to support smaller transistor geometries and larger wafers has led to a reduced number of companies that can build and equip leading-edge manufacturing facilities. Most of our competitors rely on third-party foundries and subcontractors for manufacturing and assembly and test needs. We provide foundry services as an alternative to such foundries.

|

|

•

|

Products optimized to operate on multiple operating systems

. Through our collaboration with our customers and other third parties, many of our products can operate on multiple operating systems in end-user products and platforms.

|

|

Products

|

Wafer Size

|

Process Technology

|

Locations

|

|||

|

Microprocessors and other products

|

300mm

|

14nm

|

Arizona, Oregon, Ireland

|

|||

|

Microprocessors and other products

|

300mm

|

22nm

|

Israel, Arizona, Oregon

|

|||

|

Microprocessors and chipsets

|

300mm

|

32nm

|

New Mexico

|

|||

|

Microprocessors

|

300mm

|

45nm

|

New Mexico

|

|||

|

Microprocessors and chipsets

|

300mm

|

65nm

|

China

|

|||

|

Andy D. Bryant

, age 65

|

Gregory R. Pearson

, age 55

|

|||||

|

•

2012 – present

|

Chairman of the Board

|

•

2014 – present

|

Senior VP; General Manager, Sales and Marketing Group

|

|||

|

•

2011 – 2012

|

Vice Chairman of the Board, Executive VP, Technology, Manufacturing and Enterprise Services; Chief Administrative Officer

|

|||||

|

•

2008 – 2013

|

General Manager, Worldwide Sales and Operations Group

|

|||||

|

•

2009 – 2011

|

Executive VP, Technology, Manufacturing, and Enterprise Services; Chief Administrative Officer

|

•

Joined Intel in 1983

|

||||

|

Dr. Venkata S.M. "Murthy" Renduchintala

, age 50

|

||||||

|

•

2007 – 2009

|

Executive VP, Finance and Enterprise Services; Chief Administrative Officer

|

•

2015 – present

|

Executive VP; President, Client and Internet of Things (IoT) Businesses and Systems Architecture Group

|

|||

|

•

2001 – 2007

|

Executive VP; Chief Financial and Enterprise Services Officer

|

|||||

|

•

Joined Intel in 2015

|

||||||

|

•

Member of Intel Corporation Board of Directors

|

||||||

|

•

Member of Columbia Sportswear Company Board of Directors

|

Stacy J. Smith

, age 53

|

|||||

|

•

2012 – present

|

Executive VP; Chief Financial Officer

|

|||||

|

•

Member of McKesson Corporation Board of Directors

|

•

2010 – 2012

|

Senior VP; Chief Financial Officer

|

||||

|

•

Joined Intel in 1981

|

•

2007 – 2010

|

VP; Chief Financial Officer

|

||||

|

•

2006 – 2007

|

VP; Assistant Chief Financial Officer

|

|||||

|

William M. Holt

, age 63

|

•

2004 – 2006

|

VP; Finance and Enterprise Services, Chief Information Officer

|

||||

|

•

2013 – present

|

Executive VP; General Manager, Technology and Manufacturing Group

|

|||||

|

•

Member of Autodesk, Inc. Board of Directors

|

||||||

|

•

2006 – 2013

|

Senior VP; General Manager, Technology and Manufacturing Group

|

•

Member of Virgin America, Inc. Board of Directors

|

||||

|

•

Joined Intel in 1988

|

||||||

|

•

2005 – 2006

|

VP; Co-General Manager, Technology and Manufacturing Group

|

|||||

|

•

Joined Intel in 1974

|

||||||

|

Brian M. Krzanich

, age 55

|

||||||

|

•

2013 – present

|

Chief Executive Officer

|

|||||

|

•

2012 – 2013

|

Executive VP; Chief Operating Officer

|

|||||

|

•

2010 – 2012

|

Senior VP; General Manager, Manufacturing and Supply Chain

|

|||||

|

•

2006 – 2010

|

VP; General Manager, Assembly and Test

|

|||||

|

•

Member of Deere & Company Board of Directors

|

||||||

|

•

Joined Intel in 1982

|

||||||

|

ITEM 1A.

|

RISK FACTORS

|

|

•

|

business conditions, including downturns in the computing industry, or in the global or regional economies;

|

|

•

|

consumer confidence or income levels caused by changes in market conditions, including changes in government borrowing, taxation, or spending policies; the credit market; or expected inflation, employment, and energy or other commodity prices;

|

|

•

|

the level of our customers’ inventories;

|

|

•

|

competitive and pricing pressures, including actions taken by competitors;

|

|

•

|

customer product needs;

|

|

•

|

market acceptance and industry support of our new and maturing products; and

|

|

•

|

the technology supply chain, including supply constraints caused by natural disasters or other events.

|

|

•

|

global and local economic conditions;

|

|

•

|

geopolitical and security issues, such as armed conflict and civil or military unrest, crime, political instability, and terrorist activity;

|

|

•

|

natural disasters, public health issues, and other catastrophic events;

|

|

•

|

inefficient infrastructure and other disruptions, such as supply chain interruptions and large-scale outages or unreliable provision of services from utilities, transportation, data hosting, or telecommunications providers;

|

|

•

|

government restrictions on, or nationalization of our operations in any country, or restrictions on our ability to repatriate earnings from a particular country;

|

|

•

|

differing employment practices and labor issues;

|

|

•

|

formal or informal imposition of new or revised export and/or import and doing-business regulations, which could be changed without notice;

|

|

•

|

ineffective legal protection of our IP rights in certain countries; and

|

|

•

|

local business and cultural factors that differ from our normal standards and practices.

|

|

•

|

writing off some or all of the value of inventory;

|

|

•

|

recalling products that have been shipped;

|

|

•

|

providing product replacements or modifications; and

|

|

•

|

defending against resulting litigation.

|

|

•

|

regulatory penalties, fines, and legal liabilities;

|

|

•

|

suspension of production;

|

|

•

|

alteration of our fabrication and assembly and test processes;

|

|

•

|

reputational challenges; and

|

|

•

|

restrictions on our operations or sales.

|

|

•

|

pay monetary damages, including payments to satisfy indemnification obligations;

|

|

•

|

stop manufacturing, using, selling, offering to sell, or importing products or technology subject to claims;

|

|

•

|

develop other products or technology not subject to claims, which could be time-consuming or costly; and/or

|

|

•

|

enter into settlement and license agreements, which agreements may not be available on commercially reasonable terms.

|

|

•

|

the transaction may not advance our business strategy;

|

|

•

|

we may be unable to identify opportunities on terms acceptable to us;

|

|

•

|

we may not realize a satisfactory return;

|

|

•

|

we may experience disruption of our ongoing operations;

|

|

•

|

we may be unable to retain key personnel;

|

|

•

|

we may experience difficulty in integrating new employees, business systems, and technology;

|

|

•

|

acquired businesses may not have adequate controls, processes, and procedures to ensure compliance with laws and regulations, and our due diligence process may not identify compliance issues or other liabilities;

|

|

•

|

we may have difficulty entering new market segments;

|

|

•

|

we may be unable to retain the customers and partners of acquired businesses; and/or

|

|

•

|

there may be unknown, underestimated, and/or undisclosed commitments or liabilities.

|

|

•

|

failure to obtain regulatory or other approvals;

|

|

•

|

IP disputes or other litigation; or

|

|

•

|

difficulties obtaining financing for the transaction.

|

|

•

|

the jurisdictions in which profits are determined to be earned and taxed;

|

|

•

|

the resolution of issues arising from tax audits;

|

|

•

|

changes in the valuation of our deferred tax assets and liabilities, and in deferred tax valuation allowances;

|

|

•

|

adjustments to income taxes upon finalization of tax returns;

|

|

•

|

increases in expenses not deductible for tax purposes, including impairments of goodwill;

|

|

•

|

changes in available tax credits;

|

|

•

|

changes in tax laws or their interpretation, including changes in the U.S. to the taxation of manufacturing enterprises and of non-U.S. income and expenses;

|

|

•

|

changes in U.S. generally accepted accounting principles; and

|

|

•

|

our decision to repatriate non-U.S. earnings for which we have not previously provided for U.S. taxes.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

(Square Feet in Millions)

|

United

States

|

Other

Countries

|

Total

|

||||||

|

Owned facilities

1

|

30.7

|

|

17.2

|

|

47.9

|

|

|||

|

Leased facilities

2

|

2.1

|

|

6.0

|

|

8.1

|

|

|||

|

Total facilities

|

32.8

|

|

23.2

|

|

56.0

|

|

|||

|

1

|

Leases on portions of the land used for these facilities expire on varying dates through

2062

.

|

|

2

|

Leases expire on varying dates through

2030

and generally include renewals at our option.

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

Period

|

Total Number of

Shares Purchased

(In Millions)

|

Average Price

Paid Per Share

|

Dollar Value of

Shares That May

Yet Be Purchased

(In Millions)

|

||||||||

|

December 28, 2014 – March 28, 2015

|

21.3

|

|

$

|

35.14

|

|

$

|

11,643

|

|

|||

|

March 29, 2015 – June 27, 2015

|

23.6

|

|

31.83

|

|

10,893

|

|

|||||

|

June 28, 2015 – September 26, 2015

|

34.8

|

|

28.78

|

|

9,892

|

|

|||||

|

September 27, 2015 – December 26, 2015

|

16.0

|

|

31.24

|

|

$

|

9,391

|

|

||||

|

Total

|

95.7

|

|

$

|

31.36

|

|

||||||

|

Period

|

Total Number of

Shares Purchased

(In Millions)

|

Average Price

Paid Per Share

|

Dollar Value of

Shares That May

Yet Be Purchased

Under the Plans

(In Millions)

|

||||||||

|

September 27, 2015 – October 24, 2015

|

16.0

|

|

$

|

31.24

|

|

$

|

9,391

|

|

|||

|

October 25, 2015 – November 21, 2015

|

—

|

|

—

|

|

9,391

|

|

|||||

|

November 22, 2015 – December 26, 2015

|

—

|

|

—

|

|

$

|

9,391

|

|

||||

|

Total

|

16.0

|

|

$

|

31.24

|

|

||||||

|

|

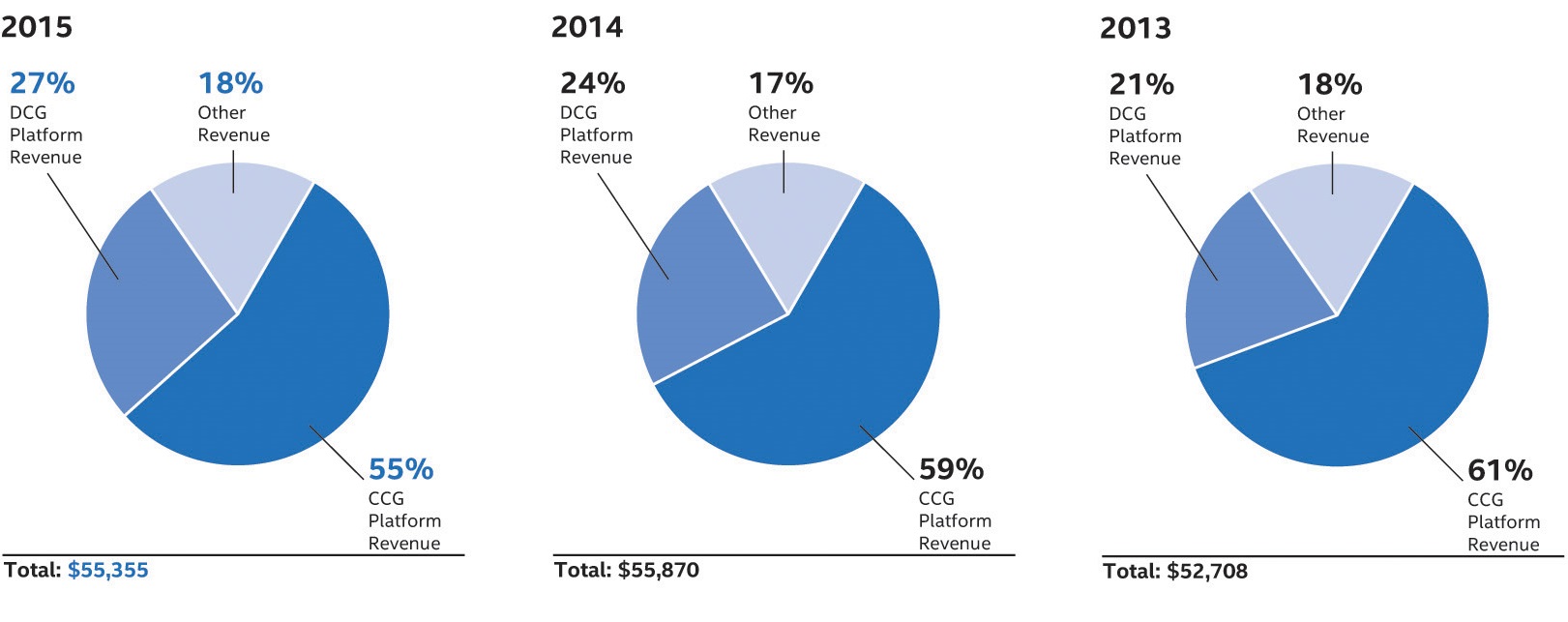

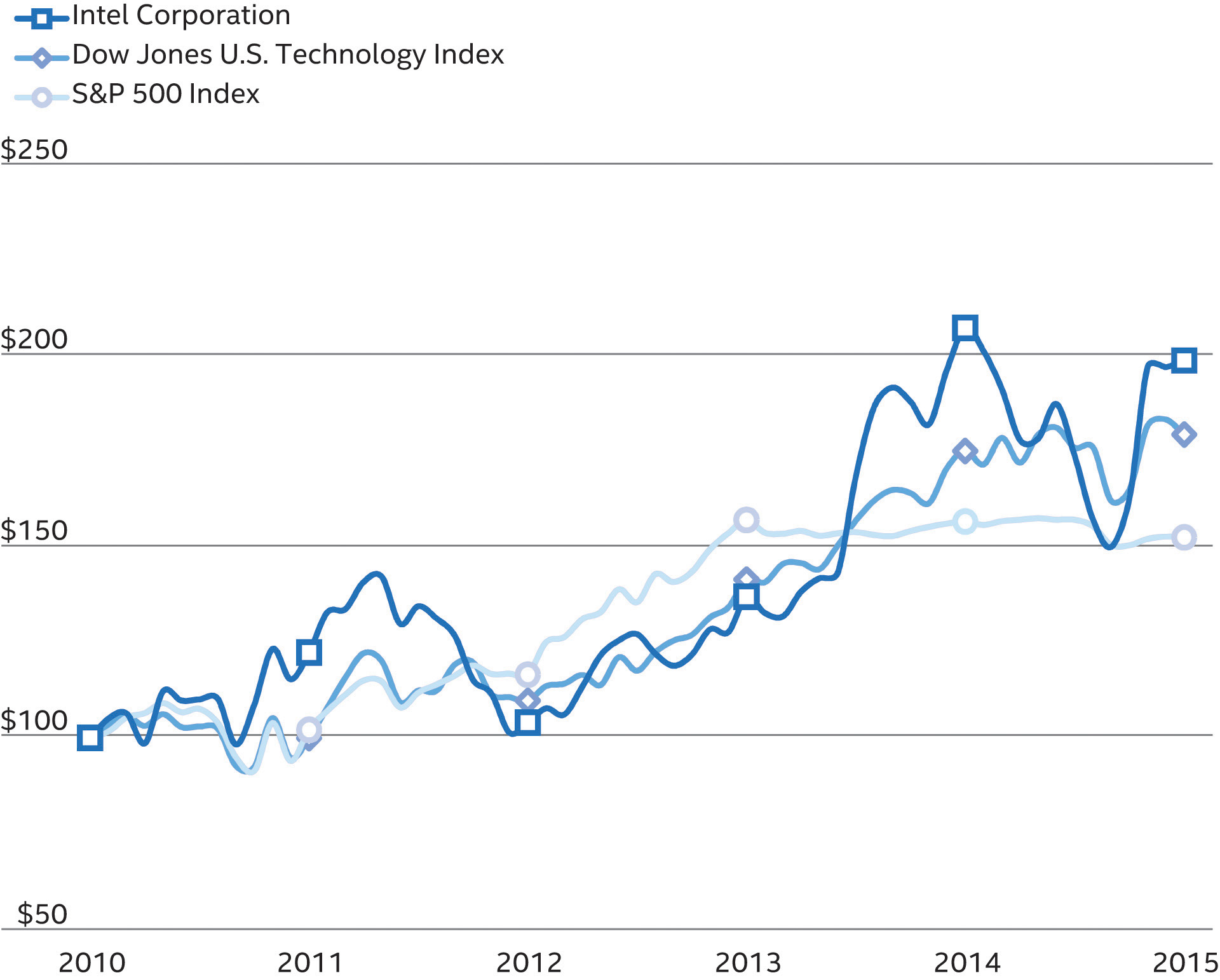

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||||

|

Intel Corporation

|

$

|

100

|

|

$

|

122

|

|

$

|

104

|

|

$

|

137

|

|

$

|

207

|

|

$

|

199

|

|

||||||

|

Dow Jones U.S. Technology Index

|

$

|

100

|

|

$

|

100

|

|

$

|

110

|

|

$

|

141

|

|

$

|

175

|

|

$

|

179

|

|

||||||

|

S&P 500 Index

|

$

|

100

|

|

$

|

102

|

|

$

|

116

|

|

$

|

157

|

|

$

|

157

|

|

$

|

152

|

|

||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

Years Ended

(Dollars in Millions, Except Per Share Amounts) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

Dec 29,

2012 |

Dec 31,

2011 |

|||||||||||||||

|

Net revenue

|

$

|

55,355

|

|

$

|

55,870

|

|

$

|

52,708

|

|

$

|

53,341

|

|

$

|

53,999

|

|

|||||

|

Gross margin

|

$

|

34,679

|

|

$

|

35,609

|

|

$

|

31,521

|

|

$

|

33,151

|

|

$

|

33,757

|

|

|||||

|

Gross margin percentage

|

62.6

|

%

|

63.7

|

%

|

59.8

|

%

|

62.1

|

%

|

62.5

|

%

|

||||||||||

|

Research and development (R&D)

|

$

|

12,128

|

|

$

|

11,537

|

|

$

|

10,611

|

|

$

|

10,148

|

|

$

|

8,350

|

|

|||||

|

Marketing, general and administrative (MG&A)

|

$

|

7,930

|

|

$

|

8,136

|

|

$

|

8,088

|

|

$

|

8,057

|

|

$

|

7,670

|

|

|||||

|

R&D and MG&A as percentage of revenue

|

36.2

|

%

|

35.2

|

%

|

35.5

|

%

|

34.1

|

%

|

29.7

|

%

|

||||||||||

|

Operating income

|

$

|

14,002

|

|

$

|

15,347

|

|

$

|

12,291

|

|

$

|

14,638

|

|

$

|

17,477

|

|

|||||

|

Net income

|

$

|

11,420

|

|

$

|

11,704

|

|

$

|

9,620

|

|

$

|

11,005

|

|

$

|

12,942

|

|

|||||

|

Effective tax rate

|

19.6

|

%

|

25.9

|

%

|

23.7

|

%

|

26.0

|

%

|

27.2

|

%

|

||||||||||

|

Earnings per share of common stock

|

||||||||||||||||||||

|

Basic

|

$

|

2.41

|

|

$

|

2.39

|

|

$

|

1.94

|

|

$

|

2.20

|

|

$

|

2.46

|

|

|||||

|

Diluted

|

$

|

2.33

|

|

$

|

2.31

|

|

$

|

1.89

|

|

$

|

2.13

|

|

$

|

2.39

|

|

|||||

|

Weighted average diluted shares of common stock outstanding

|

4,894

|

|

5,056

|

|

5,097

|

|

5,160

|

|

5,411

|

|

||||||||||

|

Dividends per share of common stock

|

||||||||||||||||||||

|

Declared

|

$

|

0.96

|

|

$

|

0.90

|

|

$

|

0.90

|

|

$

|

0.87

|

|

$

|

0.7824

|

|

|||||

|

Paid

|

$

|

0.96

|

|

$

|

0.90

|

|

$

|

0.90

|

|

$

|

0.87

|

|

$

|

0.7824

|

|

|||||

|

Net cash provided by operating activities

|

$

|

19,017

|

|

$

|

20,418

|

|

$

|

20,776

|

|

$

|

18,884

|

|

$

|

20,963

|

|

|||||

|

Additions to property, plant and equipment

|

$

|

7,326

|

|

$

|

10,105

|

|

$

|

10,711

|

|

$

|

11,027

|

|

$

|

10,764

|

|

|||||

|

Repurchase of common stock

|

$

|

3,001

|

|

$

|

10,792

|

|

$

|

2,147

|

|

$

|

4,765

|

|

$

|

14,133

|

|

|||||

|

Payment of dividends to stockholders

|

$

|

4,556

|

|

$

|

4,409

|

|

$

|

4,479

|

|

$

|

4,350

|

|

$

|

4,127

|

|

|||||

|

(Dollars in Millions)

|

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

Dec 29,

2012 |

Dec 31,

2011 |

|||||||||||||||

|

Property, plant and equipment, net

|

$

|

31,858

|

|

$

|

33,238

|

|

$

|

31,428

|

|

$

|

27,983

|

|

$

|

23,627

|

|

|||||

|

Total assets

|

$

|

103,065

|

|

$

|

91,900

|

|

$

|

92,297

|

|

$

|

84,285

|

|

$

|

71,083

|

|

|||||

|

Debt

|

$

|

22,670

|

|

$

|

13,655

|

|

$

|

13,385

|

|

$

|

13,382

|

|

$

|

7,295

|

|

|||||

|

Temporary equity

|

$

|

897

|

|

$

|

912

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Stockholders’ equity

|

$

|

61,085

|

|

$

|

55,865

|

|

$

|

58,256

|

|

$

|

51,203

|

|

$

|

45,911

|

|

|||||

|

Employees (in thousands)

|

107.3

|

|

106.7

|

|

107.6

|

|

105.0

|

|

100.1

|

|

||||||||||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

•

|

Overview

. Discussion of our business and overall analysis of financial and other highlights affecting the company in order to provide context for the remainder of MD&A.

|

|

•

|

Critical Accounting Estimates

. Accounting estimates that we believe are most important to understanding the assumptions and judgments incorporated in our reported financial results and forecasts.

|

|

•

|

Results of Operations

. Analysis of our financial results comparing

2015

to

2014

and comparing

2014

to

2013

.

|

|

•

|

Liquidity and Capital Resources

. Analysis of changes in our balance sheets and cash flows, and discussion of our financial condition and potential sources of liquidity.

|

|

•

|

Fair Value of Financial Instruments

. Discussion of the methodologies used in the valuation of our financial instruments.

|

|

•

|

Contractual Obligations and Off-Balance-Sheet Arrangements.

Overview of contractual obligations, contingent liabilities, commitments, and off-balance-sheet arrangements outstanding as of

December 26, 2015

, including expected payment schedule.

|

|

Three Months Ended

|

Twelve Months Ended

|

|||||||||||||||||||||||

|

(Dollars in Millions, Except Per Share Amounts)

|

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

||||||||||||||||||

|

Net revenue

|

$

|

14,914

|

|

$

|

14,721

|

|

$

|

193

|

|

$

|

55,355

|

|

$

|

55,870

|

|

$

|

(515

|

)

|

||||||

|

Gross margin

|

$

|

9,590

|

|

$

|

9,621

|

|

$

|

(31

|

)

|

$

|

34,679

|

|

$

|

35,609

|

|

$

|

(930

|

)

|

||||||

|

Gross margin percentage

|

64.3

|

%

|

65.4

|

%

|

(1.1) pts

|

|

62.6

|

%

|

63.7

|

%

|

(1.1) pts

|

|

||||||||||||

|

Operating income

|

$

|

4,299

|

|

$

|

4,453

|

|

$

|

(154

|

)

|

$

|

14,002

|

|

$

|

15,347

|

|

$

|

(1,345

|

)

|

||||||

|

Net income

|

$

|

3,613

|

|

$

|

3,661

|

|

$

|

(48

|

)

|

$

|

11,420

|

|

$

|

11,704

|

|

$

|

(284

|

)

|

||||||

|

Diluted earnings per share of common stock

|

$

|

0.74

|

|

$

|

0.74

|

|

$

|

—

|

|

$

|

2.33

|

|

$

|

2.31

|

|

$

|

0.02

|

|

||||||

|

Effective tax rate

|

16.0

|

%

|

21.4

|

%

|

(5.4) pts

|

|

19.6

|

%

|

25.9

|

%

|

(6.3) pts

|

|

||||||||||||

|

•

|

the valuation of non-marketable equity investments and the determination of other-than-temporary impairments, which impact gains (losses) on equity investments, net when we record impairments;

|

|

•

|

the determination of useful lives for our property, plant and equipment and the related timing of when depreciation should begin;

|

|

•

|

the valuation and allocation of assets acquired and liabilities assumed in connection with business combinations;

|

|

•

|

the valuation and recoverability of long-lived assets (property, plant and equipment; identified intangibles and goodwill), which impact gross margin or operating expenses when we record asset impairments or accelerate their depreciation or amortization;

|

|

•

|

the recognition and measurement of current and deferred income taxes (including the measurement of uncertain tax positions), which impact our provision for taxes;

|

|

•

|

the valuation of inventory, which impacts gross margin; and

|

|

•

|

the recognition and measurement of loss contingencies, which impact gross margin or operating expenses when we recognize a loss contingency, revise the estimate for a loss contingency, or record an asset impairment.

|

|

•

|

Intangible assets, including valuation methodology, estimations of future cash flows, and discount rates, as well as the estimated useful life of the intangible assets;

|

|

•

|

the acquired company’s brand, as well as assumptions about the period of time the acquired brand will continue to be used;

|

|

•

|

deferred tax assets and liabilities, uncertain tax positions, and tax-related valuation allowances, which are initially estimated as of the acquisition date;

|

|

•

|

inventory; property, plant and equipment; pre-existing liabilities or legal claims; deferred revenue; and contingent consideration, each as may be applicable, and

|

|

•

|

goodwill as measured as the excess of consideration transferred over the net of the acquisition date fair values of the assets acquired and the liabilities assumed.

|

|

Years Ended

(In Millions, Except Per Share Amounts) |

December 26, 2015

|

December 27, 2014

|

December 28, 2013

|

||||||||||||||||||

|

Dollars

|

% of Net

Revenue

|

Dollars

|

% of Net

Revenue

|

Dollars

|

% of Net

Revenue

|

||||||||||||||||

|

Net revenue

|

$

|

55,355

|

|

100.0

|

%

|

$

|

55,870

|

|

100.0

|

%

|

$

|

52,708

|

|

100.0

|

%

|

||||||

|

Cost of sales

|

20,676

|

|

37.4

|

%

|

20,261

|

|

36.3

|

%

|

21,187

|

|

40.2

|

%

|

|||||||||

|

Gross margin

|

34,679

|

|

62.6

|

%

|

35,609

|

|

63.7

|

%

|

31,521

|

|

59.8

|

%

|

|||||||||

|

Research and development

|

12,128

|

|

21.9

|

%

|

11,537

|

|

20.6

|

%

|

10,611

|

|

20.1

|

%

|

|||||||||

|

Marketing, general and administrative

|

7,930

|

|

14.3

|

%

|

8,136

|

|

14.6

|

%

|

8,088

|

|

15.3

|

%

|

|||||||||

|

Restructuring and asset impairment charges

|

354

|

|

0.6

|

%

|

295

|

|

0.5

|

%

|

240

|

|

0.5

|

%

|

|||||||||

|

Amortization of acquisition-related intangibles

|

265

|

|

0.5

|

%

|

294

|

|

0.5

|

%

|

291

|

|

0.6

|

%

|

|||||||||

|

Operating income

|

14,002

|

|

25.3

|

%

|

15,347

|

|

27.5

|

%

|

12,291

|

|

23.3

|

%

|

|||||||||

|

Gains (losses) on equity investments, net

|

315

|

|

0.6

|

%

|

411

|

|

0.7

|

%

|

471

|

|

0.9

|

%

|

|||||||||

|

Interest and other, net

|

(105

|

)

|

(0.2

|

)%

|

43

|

|

0.1

|

%

|

(151

|

)

|

(0.3

|

)%

|

|||||||||

|

Income before taxes

|

14,212

|

|

25.7

|

%

|

15,801

|

|

28.3

|

%

|

12,611

|

|

23.9

|

%

|

|||||||||

|

Provision for taxes

|

2,792

|

|

5.1

|

%

|

4,097

|

|

7.4

|

%

|

2,991

|

|

5.6

|

%

|

|||||||||

|

Net income

|

$

|

11,420

|

|

20.6

|

%

|

$

|

11,704

|

|

20.9

|

%

|

$

|

9,620

|

|

18.3

|

%

|

||||||

|

Diluted earnings per share of common stock

|

$

|

2.33

|

|

$

|

2.31

|

|

$

|

1.89

|

|

||||||||||||

|

(In Millions)

|

Gross Margin Reconciliation (2015 compared to 2014):

|

|||

|

$

|

(1,965

|

)

|

Higher platform unit costs, primarily driven by the ramp of our 14nm process technology

|

|

|

400

|

|

Lower factory start-up costs, primarily driven by the ramp of our 14nm process technology

|

||

|

205

|

|

Lower production costs primarily on our 14nm products, which were treated as period charges in 2014, partially offset by higher pre-qualification product costs on 14nm products

|

||

|

430

|

|

Other

|

||

|

$

|

(930

|

)

|

||

|

(In Millions)

|

Gross Margin Reconciliation (2014 compared to 2013):

|

|||

|

$

|

2,575

|

|

Lower platform unit costs

|

|

|

1,160

|

|

Higher gross margin from platform revenue

1

|

||

|

860

|

|

Lower factory start-up costs, primarily driven by our 14nm process technology

|

||

|

(507

|

)

|

Other

|

||

|

$

|

4,088

|

|

||

|

1

|

Higher gross margin from platform revenue was driven by higher platform unit sales, which were partially offset by lower platform average selling prices. The decrease in platform average selling prices was due to a shift in market segment mix (higher tablet and phone platform unit sales with higher cash consideration to our customers associated with integration of our platform) and lower notebook platform average selling prices.

|

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

30,654

|

|

$

|

33,210

|

|

$

|

(2,556

|

)

|

(8

|

)%

|

||||

|

Other

|

1,565

|

|

1,662

|

|

(97

|

)

|

(6

|

)%

|

|||||||

|

Net revenue

|

$

|

32,219

|

|

$

|

34,872

|

|

$

|

(2,653

|

)

|

(8

|

)%

|

||||

|

Operating income

|

$

|

8,165

|

|

$

|

10,323

|

|

$

|

(2,158

|

)

|

(21

|

)%

|

||||

|

CCG platform unit sales

|

(11

|

)%

|

|||||||||||||

|

CCG platform average selling prices

|

4

|

%

|

|||||||||||||

|

(In Millions)

|

Revenue Reconciliation (2015 compared to 2014):

|

|||

|

$

|

(2,304

|

)

|

Lower desktop platform unit sales, down 16%

|

|

|

(1,695

|

)

|

Lower notebook platform unit sales, down 9%

|

||

|

760

|

|

Higher desktop platform average selling prices, up 6%

|

||

|

300

|

|

Higher notebook platform average selling prices, up 2%

|

||

|

272

|

|

Higher tablet platform average selling prices

|

||

|

14

|

|

Other

|

||

|

$

|

(2,653

|

)

|

||

|

(In Millions)

|

Operating Income Reconciliation (2015 compared to 2014):

|

|||

|

$

|

(2,060

|

)

|

Higher CCG platform unit costs

|

|

|

(1,565

|

)

|

Lower CCG platform revenue

1

|

||

|

435

|

|

Lower factory start-up costs, primarily driven by the ramp of our 14nm process technology

|

||

|

430

|

|

Lower production costs primarily on our 14nm products, which were treated as a period charges in 2014

|

||

|

375

|

|

Lower operating expense

|

||

|

227

|

|

Other

|

||

|

$

|

(2,158

|

)

|

||

|

1

|

Lower gross margin from lower CCG platform revenue was driven by lower CCG platform unit sales, partially offset by higher CCG platform average selling prices. CCG platform average selling prices increased due to higher average selling prices on desktop, notebook, and tablet platforms, partially offset by a market segment mix to phone platform from tablet and desktop platforms.

|

|

Years Ended

(In Millions) |

Dec 27,

2014 |

Dec 28,

2013 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

33,210

|

|

$

|

32,385

|

|

$

|

825

|

|

3

|

%

|

||||

|

Other

|

1,662

|

|

2,260

|

|

(598

|

)

|

(26

|

)%

|

|||||||

|

Net revenue

|

$

|

34,872

|

|

$

|

34,645

|

|

$

|

227

|

|

1

|

%

|

||||

|

Operating income

|

$

|

10,323

|

|

$

|

8,708

|

|

$

|

1,615

|

|

19

|

%

|

||||

|

CCG platform unit sales

|

20

|

%

|

|||||||||||||

|

CCG platform average selling prices

|

(15

|

)%

|

|||||||||||||

|

(In Millions)

|

Revenue Reconciliation (2014 compared to 2013):

|

|||

|

$

|

2,101

|

|

Higher notebook platform unit sales, up 11%

|

|

|

501

|

|

Higher desktop platform unit sales, up 3%

|

||

|

305

|

|

Higher tablet platform unit sales

|

||

|

(1,514

|

)

|

Lower notebook platform average selling prices, down 7%

|

||

|

(711

|

)

|

Lower tablet platform average selling prices, primarily driven by higher cash consideration to our customers associated with integrating our platform

|

||

|

(515

|

)

|

Lower phone component unit sales

|

||

|

60

|

|

Other

|

||

|

$

|

227

|

|

||

|

(In Millions)

|

Operating Income Reconciliation (2014 compared to 2013):

|

|||

|

$

|

2,160

|

|

Lower CCG platform unit costs

|

|

|

915

|

|

Lower factory start-up costs, primarily driven by our 14nm process technology

|

||

|

80

|

|

Lower operating expense

|

||

|

(990

|

)

|

Lower gross margin from CCG platform revenue

1

|

||

|

(345

|

)

|

Lower phone component revenue

|

||

|

(205

|

)

|

Other

|

||

|

$

|

1,615

|

|

||

|

1

|

Lower gross margin from CCG platform revenue was driven by lower CCG platform average selling prices, partially offset by higher CCG platform unit sales. Lower CCG platform average selling prices were due to a shift in market segment mix (higher tablet and phone platform unit sales) and lower notebook and tablet platform average selling prices.

|

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

14,882

|

|

$

|

13,366

|

|

$

|

1,516

|

|

11

|

%

|

||||

|

Other

|

1,095

|

|

1,021

|

|

74

|

|

7

|

%

|

|||||||

|

Net revenue

|

$

|

15,977

|

|

$

|

14,387

|

|

$

|

1,590

|

|

11

|

%

|

||||

|

Operating income

|

$

|

7,844

|

|

$

|

7,390

|

|

$

|

454

|

|

6

|

%

|

||||

|

DCG platform unit sales

|

8

|

%

|

|||||||||||||

|

DCG platform average selling prices

|

3

|

%

|

|||||||||||||

|

(In Millions)

|

Revenue Reconciliation (2015 compared to 2014):

|

|||

|

$

|

1,023

|

|

Higher DCG platform unit sales

|

|

|

493

|

|

Higher DCG platform average selling prices

|

||

|

74

|

|

Other

|

||

|

$

|

1,590

|

|

||

|

(In Millions)

|

Operating Income Reconciliation (2015 compared to 2014):

|

|||

|

$

|

1,415

|

|

Higher DCG platform revenue

|

|

|

(725

|

)

|

Higher operating expense, primarily driven by higher shared product development costs

|

||

|

(236

|

)

|

Other

|

||

|

$

|

454

|

|

||

|

Years Ended

(In Millions) |

Dec 27,

2014 |

Dec 28,

2013 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

13,366

|

|

$

|

11,219

|

|

$

|

2,147

|

|

19

|

%

|

||||

|

Other

|

1,021

|

|

944

|

|

77

|

|

8

|

%

|

|||||||

|

Net revenue

|

$

|

14,387

|

|

$

|

12,163

|

|

$

|

2,224

|

|

18

|

%

|

||||

|

Operating income

|

$

|

7,390

|

|

$

|

5,456

|

|

$

|

1,934

|

|

35

|

%

|

||||

|

DCG platform unit sales

|

8

|

%

|

|||||||||||||

|

DCG platform average selling prices

|

10

|

%

|

|||||||||||||

|

(In Millions)

|

Revenue Reconciliation (2014 compared to 2013):

|

|||

|

$

|

1,200

|

|

Higher DCG platform average selling prices

|

|

|

947

|

|

Higher DCG platform unit sales

|

||

|

77

|

|

Other

|

||

|

$

|

2,224

|

|

||

|

(In Millions)

|

Operating Income Reconciliation (2014 compared to 2013):

|

|||

|

$

|

2,020

|

|

Higher DCG platform revenue

|

|

|

220

|

|

Lower DCG platform unit costs

|

||

|

(465

|

)

|

Higher operating expense, primarily driven by higher direct and shared product development costs

|

||

|

159

|

|

Other

|

||

|

$

|

1,934

|

|

||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

1,976

|

|

$

|

1,814

|

|

$

|

162

|

|

9

|

%

|

||||

|

Other

|

322

|

|

328

|

|

(6

|

)

|

(2

|

)%

|

|||||||

|

Net revenue

|

$

|

2,298

|

|

$

|

2,142

|

|

$

|

156

|

|

7

|

%

|

||||

|

Operating income

|

$

|

515

|

|

$

|

583

|

|

$

|

(68

|

)

|

(12

|

)%

|

||||

|

Years Ended

(In Millions) |

Dec 27,

2014 |

Dec 28,

2013 |

Change

|

% Change

|

|||||||||||

|

Platform

|

$

|

1,814

|

|

$

|

1,485

|

|

$

|

329

|

|

22

|

%

|

||||

|

Other

|

328

|

|

316

|

|

12

|

|

4

|

%

|

|||||||

|

Net revenue

|

$

|

2,142

|

|

$

|

1,801

|

|

$

|

341

|

|

19

|

%

|

||||

|

Operating income

|

$

|

583

|

|

$

|

532

|

|

$

|

51

|

|

10

|

%

|

||||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Change

|

% Change

|

|||||||||||

|

Net revenue

|

$

|

2,167

|

|

$

|

2,216

|

|

$

|

(49

|

)

|

(2

|

)%

|

||||

|

Operating income

|

$

|

210

|

|

$

|

81

|

|

$

|

129

|

|

159

|

%

|

||||

|

Years Ended

(In Millions) |

Dec 27,

2014 |

Dec 28,

2013 |

Change

|

% Change

|

|||||||||||

|

Net revenue

|

$

|

2,216

|

|

$

|

2,188

|

|

$

|

28

|

|

1

|

%

|

||||

|

Operating income

|

$

|

81

|

|

$

|

57

|

|

$

|

24

|

|

42

|

%

|

||||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

Research and development (R&D)

|

$

|

12,128

|

|

$

|

11,537

|

|

$

|

10,611

|

|

|||

|

Marketing, general and administrative (MG&A)

|

$

|

7,930

|

|

$

|

8,136

|

|

$

|

8,088

|

|

|||

|

R&D and MG&A as percentage of net revenue

|

36

|

%

|

35

|

%

|

35

|

%

|

||||||

|

Restructuring and asset impairment charges

|

$

|

354

|

|

$

|

295

|

|

$

|

240

|

|

|||

|

Amortization of acquisition-related intangibles

|

$

|

265

|

|

$

|

294

|

|

$

|

291

|

|

|||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

2015 restructuring program

|

$

|

264

|

|

$

|

—

|

|

$

|

—

|

|

|||

|

2013 restructuring program

|

90

|

|

295

|

|

240

|

|

||||||

|

Total restructuring and asset impairment charges

|

$

|

354

|

|

$

|

295

|

|

$

|

240

|

|

|||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

|||

|

Employee severance and benefit arrangements

|

$

|

250

|

|

|

|

Asset impairments and other restructuring charges

|

14

|

|

||

|

Total restructuring and asset impairment charges

|

$

|

264

|

|

|

|

(In Millions)

|

Employee Severance and Benefits

|

Asset Impairments and Other

|

Total

|

|||||||||

|

Accrued restructuring balance as of December 27, 2014

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||

|

Additional accruals

|

292

|

|

14

|

|

306

|

|

||||||

|

Adjustments

|

(42

|

)

|

—

|

|

(42

|

)

|

||||||

|

Cash payments

|

(225

|

)

|

(1

|

)

|

(226

|

)

|

||||||

|

Non-cash settlements

|

—

|

|

(6

|

)

|

(6

|

)

|

||||||

|

Accrued restructuring balance as of December 26, 2015

|

$

|

25

|

|

$

|

7

|

|

$

|

32

|

|

|||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

Employee severance and benefit arrangements

|

$

|

82

|

|

$

|

265

|

|

$

|

201

|

|

|||

|

Asset impairments and other restructuring charges

|

8

|

|

30

|

|

39

|

|

||||||

|

Total restructuring and asset impairment charges

|

$

|

90

|

|

$

|

295

|

|

$

|

240

|

|

|||

|

(In Millions)

|

Employee Severance and Benefits

|

Asset Impairments and Other

|

Total

|

|||||||||

|

Accrued restructuring balance as of December 28, 2013

|

$

|

183

|

|

$

|

—

|

|

$

|

183

|

|

|||

|

Additional accruals

|

252

|

|

31

|

|

283

|

|

||||||

|

Adjustments

|

13

|

|

(1

|

)

|

12

|

|

||||||

|

Cash payments

|

(327

|

)

|

(6

|

)

|

(333

|

)

|

||||||

|

Non-cash settlements

|

—

|

|

(13

|

)

|

(13

|

)

|

||||||

|

Accrued restructuring balance as of December 27, 2014

|

121

|

|

11

|

|

132

|

|

||||||

|

Additional accruals

|

101

|

|

9

|

|

110

|

|

||||||

|

Adjustments

|

(19

|

)

|

(1

|

)

|

(20

|

)

|

||||||

|

Cash payments

|

(171

|

)

|

(10

|

)

|

(181

|

)

|

||||||

|

Non-cash settlements

|

—

|

|

(3

|

)

|

(3

|

)

|

||||||

|

Accrued restructuring balance as of December 26, 2015

|

$

|

32

|

|

$

|

6

|

|

$

|

38

|

|

|||

|

(Dollars in Millions)

|

Unrecognized

Share-Based

Compensation

Costs

|

Weighted

Average

Period

|

||||

|

Restricted stock units

|

$

|

1,789

|

|

1.2 years

|

||

|

Stock options

|

$

|

13

|

|

8 months

|

||

|

Stock Purchase Plan

|

$

|

14

|

|

2 months

|

||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

Gains (losses) on equity investments, net

|

$

|

315

|

|

$

|

411

|

|

$

|

471

|

|

|||

|

Interest and other, net

|

$

|

(105

|

)

|

$

|

43

|

|

$

|

(151

|

)

|

|||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

Income before taxes

|

$

|

14,212

|

|

$

|

15,801

|

|

$

|

12,611

|

|

|||

|

Provision for taxes

|

$

|

2,792

|

|

$

|

4,097

|

|

$

|

2,991

|

|

|||

|

Effective tax rate

|

19.6

|

%

|

25.9

|

%

|

23.7

|

%

|

||||||

|

(Dollars in Millions)

|

Dec 26,

2015 |

Dec 27,

2014 |

||||||

|

Cash and cash equivalents, short-term investments, and trading assets

|

$

|

25,313

|

|

$

|

14,054

|

|

||

|

Other long-term investments

|

$

|

1,891

|

|

$

|

2,023

|

|

||

|

Loans receivable and other

|

$

|

1,170

|

|

$

|

1,335

|

|

||

|

Reverse repurchase agreements with original maturities greater than approximately three months

|

$

|

1,000

|

|

$

|

450

|

|

||

|

Unsettled trade liabilities and other

|

$

|

99

|

|

$

|

77

|

|

||

|

Short-term and long-term debt

|

$

|

22,670

|

|

$

|

13,655

|

|

||

|

Temporary equity

|

$

|

897

|

|

$

|

912

|

|

||

|

Debt as percentage of permanent stockholders’ equity

|

37.1

|

%

|

24.4

|

%

|

||||

|

Years Ended

(In Millions) |

Dec 26,

2015 |

Dec 27,

2014 |

Dec 28,

2013 |

|||||||||

|

Net cash provided by operating activities

|

$

|

19,017

|

|

$

|

20,418

|

|

$

|

20,776

|

|

|||

|

Net cash used for investing activities

|

(8,183

|

)

|

(9,905

|

)

|

(18,073

|

)

|

||||||

|

Net cash provided by (used for) financing activities

|

1,912

|

|

(13,611

|

)

|

(5,498

|

)

|

||||||

|

Effect of exchange rate fluctuations on cash and cash equivalents

|

1

|

|

(15

|

)

|

(9

|

)

|

||||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

12,747

|

|

$

|

(3,113

|

)

|

$

|

(2,804

|

)

|

|||

|

|

Payments Due by Period

|

|||||||||||||||||||