|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended March 31, 2018.

|

||

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from

to

|

||

|

Delaware

|

94-1672743

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

2200 Mission College Boulevard, Santa Clara, California

|

95054-1549

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Large accelerated filer

þ

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

|

(Do not check if a smaller reporting company)

|

||||

|

Class

|

Outstanding as of March 31, 2018

|

|

|

Common stock, $0.001 par value

|

4,660 million

|

|

|

FORWARD-LOOKING STATEMENTS

|

|||

|

A QUARTER IN REVIEW

|

|||

|

CONSOLIDATED CONDENSED FINANCIAL STATEMENTS AND SUPPLEMENTAL DETAILS

|

|||

|

Index to Consolidated Condensed Financial Statements and Supplemental Details

|

|||

|

Consolidated Condensed Financial Statements

|

|||

|

Notes to the Consolidated Condensed Financial Statements

|

|||

|

MANAGEMENT'S DISCUSSION AND ANALYSIS (MD&A) - RESULTS OF OPERATIONS

|

|||

|

Overview

|

|||

|

Revenue, Gross Margin, and Operating Expenses

|

|||

|

Business Unit Trends and Results

|

|||

|

Other Consolidated Results of Operations

|

|||

|

Liquidity and Capital Resources

|

|||

|

Quantitative and Qualitative Disclosures about Market Risk

|

|||

|

OTHER KEY INFORMATION

|

|||

|

Risk Factors

|

|||

|

Controls and Procedures

|

|||

|

Non-GAAP Financial Measures

|

|||

|

Issuer Purchases of Equity Securities

|

|||

|

Exhibits

|

|||

|

Form 10-Q Cross-Reference Index

|

|||

|

PLATFORM PRODUCTS

|

A microprocessor (processor or central processing unit (CPU)) and chipset, a stand-alone System-on-Chip (SoC), or a multichip package. Platform products, or platforms, are primarily used in solutions sold through Client Computing Group (CCG), Data Center Group (DCG), and Internet of Things Group (IOTG) segments.

|

|

|

ADJACENT PRODUCTS

|

All of our non-platform products, for CCG, DCG, and IOTG like modem, ethernet and silicon photonics, as well as Non-Volatile Memory Solutions Group (NSG), Programmable Solutions Group (PSG), and Mobileye products. Combined with our platform products, adjacent products form comprehensive platform solutions to meet customer needs.

|

|

|

PC-CENTRIC BUSINESS

|

Is made up of our CCG business, both platform and adjacent products.

|

|

|

DATA-CENTRIC BUSINESSES

|

Includes our DCG, IOTG, NSG, PSG, and all other businesses.

|

|

|

1

|

||

|

A QUARTER IN REVIEW

|

|

REVENUE

|

OPERATING INCOME

|

DILUTED EPS

|

||||||||

|

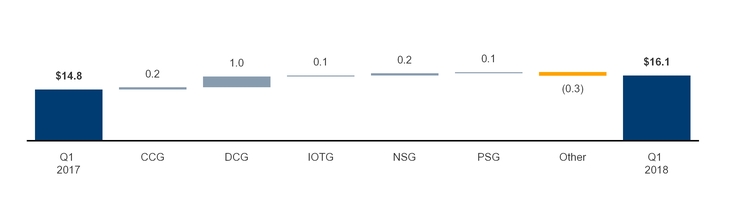

$16.1B

|

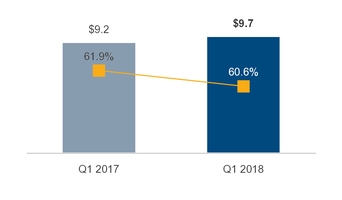

$4.5B

|

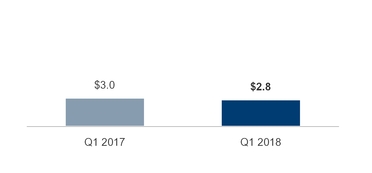

$4.8B

|

$0.93

|

$0.87

|

||||||

|

GAAP

|

GAAP

|

non-GAAP

1

|

GAAP

|

non-GAAP

1

|

||||||

|

up $1.3B or 9% from Q1 2017; up 13% excluding ISecG

|

up $838M or 23% from Q1 2017

|

up $836M or 21% from Q1 2017

|

up $0.32 or 53% from Q1 2017

|

up $0.21 or 32% from Q1 2017

|

||||||

|

Strong results from data-centric businesses driven by double-digit growth across DCG, IOTG, NSG, and PSG

|

Higher ASP and volume with lower spending, offset by 10nm transition costs

|

Data-centric growth, strong operating margin leverage, lower tax rate from Tax Reform

2

, and mark to market gains in GAAP results

|

||||||||

|

■

Data-centric $B

|

■

PC-centric $B

|

■

GAAP $B

|

■

Non-GAAP $B

|

■

GAAP

|

■

Non-GAAP

|

|||||

|

•

|

Data-centric investments are building momentum. Customers are accelerating adoption of Intel

®

Xeon

®

Scalable processors and our field-programmable gate arrays (FPGAs) are winning data-center designs.

|

|

•

|

We announced new products including

the high performance 8th Gen Intel

®

Core™ i9 processor for mobile

and the Intel

®

Optane™ SSD 800P, the latest addition to the growing Intel Optane technology family of products.

|

|

•

|

Mobileye won a high-volume design for EyeQ*5. We also began operating autonomous vehicle test cars in Israel with plans to expand the fleet to other geographies.

|

|

•

|

We are sharpening the focus of IOTG toward growth opportunities that align to our data-centric strategy. We entered into an agreement to divest Wind River Systems, Inc. (Wind River), currently reported under IOTG. The assets and liabilities of Wind River are classified as held for sale and we expect the transaction to close by the end of Q2 this year.

|

|

•

|

We continue to make 14nm process optimizations and architectural innovations in both data-center and client products that will be coming this year.

Intel is currently shipping low volume 10nm product and now expects 10nm volume production to shift to 2019

.

|

|

•

|

The security of our products is one of our most important priorities. We have released microcode updates for Intel products launched in the past nine years that require protection against the side-channel method vulnerabilities referred to as "Spectre" and "Meltdown." In addition, we are making changes to our future hardware design to address certain of these side-channel variants.

|

|

A QUARTER IN REVIEW

|

2

|

|

|

INDEX TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

|

Page

|

|

Consolidated Condensed Statements of Income

|

|

|

Consolidated Condensed Statements of Comprehensive Income

|

|

|

Consolidated Condensed Balance Sheets

|

|

|

Consolidated Condensed Statements of Cash Flows

|

|

|

Notes to Consolidated Condensed Financial Statements

|

|

|

Basis

|

|

|

Note 1: Basis of Presentation

|

|

|

Note 2: Recent Accounting Standards and Accounting Policies

|

|

|

Performance & Operations

|

|

|

Note 3: Operating Segments

|

|

|

Note 4: Earnings Per Share

|

|

|

Note 5: Contract Liabilities

|

|

|

Note 6: Other Financial Statement Details

|

|

|

Note 7: Income Taxes

|

|

|

Investments, Long-term Assets & Debt

|

|

|

Note 8: Investments

|

|

|

Note 9: Identified Intangible Assets

|

|

|

Note 10: Other Long-Term Assets

|

|

|

Note 11: Fair Value

|

|

|

Risk Management & Other

|

|

|

Note 12: Other Comprehensive Income (Loss)

|

|

|

Note 13: Derivative Financial Instruments

|

|

|

Note 14: Employee Equity Incentive Plans

|

|

|

Note 15: Contingencies

|

|

|

3

|

||

|

INTEL CORPORATION

|

|

|

Three Months Ended

|

|||||||

|

(In Millions, Except Per Share Amounts; Unaudited)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Net revenue

|

$

|

16,066

|

|

$

|

14,796

|

|

||

|

Cost of sales

|

6,335

|

|

5,636

|

|

||||

|

Gross margin

|

9,731

|

|

9,160

|

|

||||

|

Research and development

|

3,311

|

|

3,311

|

|

||||

|

Marketing, general and administrative

|

1,900

|

|

2,099

|

|

||||

|

Restructuring and other charges

|

—

|

|

80

|

|

||||

|

Amortization of acquisition-related intangibles

|

50

|

|

38

|

|

||||

|

Operating expenses

|

5,261

|

|

5,528

|

|

||||

|

Operating income

|

4,470

|

|

3,632

|

|

||||

|

Gains (losses) on equity investments, net

|

643

|

|

252

|

|

||||

|

Interest and other, net

|

(102

|

)

|

(69

|

)

|

||||

|

Income before taxes

|

5,011

|

|

3,815

|

|

||||

|

Provision for taxes

|

557

|

|

851

|

|

||||

|

Net income

|

$

|

4,454

|

|

$

|

2,964

|

|

||

|

Earnings per share – Basic

|

$

|

0.95

|

|

$

|

0.63

|

|

||

|

Earnings per share – Diluted

|

$

|

0.93

|

|

$

|

0.61

|

|

||

|

Cash dividends declared per share of common stock

|

$

|

0.60

|

|

$

|

0.5325

|

|

||

|

Weighted average shares of common stock outstanding:

|

||||||||

|

Basic

|

4,674

|

|

4,723

|

|

||||

|

Diluted

|

4,790

|

|

4,881

|

|

||||

|

FINANCIAL STATEMENTS

|

Consolidated Condensed Statements of Income

|

4

|

|

INTEL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME

|

|

Three Months Ended

|

||||||||

|

(In Millions; Unaudited)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Net income

|

$

|

4,454

|

|

$

|

2,964

|

|

||

|

Changes in other comprehensive income, net of tax:

|

||||||||

|

Net unrealized holding gains (losses) on available-for-sale equity investments

|

—

|

|

543

|

|

||||

|

Net unrealized holding gains (losses) on derivatives

|

119

|

|

195

|

|

||||

|

Actuarial valuation and other pension benefits (expenses), net

|

148

|

|

18

|

|

||||

|

Translation adjustments and other

|

(22

|

)

|

1

|

|

||||

|

Other comprehensive income (loss)

|

245

|

|

757

|

|

||||

|

Total comprehensive income

|

$

|

4,699

|

|

$

|

3,721

|

|

||

|

FINANCIAL STATEMENTS

|

Consolidated Condensed Statements of Comprehensive Income

|

5

|

|

INTEL CORPORATION

|

|

(In Millions)

|

Mar 31,

2018 |

Dec 30,

2017 |

||||||

|

(unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

3,554

|

|

$

|

3,433

|

|

||

|

Short-term investments

|

2,020

|

|

1,814

|

|

||||

|

Trading assets

|

10,623

|

|

8,755

|

|

||||

|

Accounts receivable

|

4,879

|

|

5,607

|

|

||||

|

Inventories

|

7,146

|

|

6,983

|

|

||||

|

Other current assets

|

3,408

|

|

2,908

|

|

||||

|

Total current assets

|

31,630

|

|

29,500

|

|

||||

|

Property, plant and equipment, net of accumulated depreciation of $60,665 ($59,286 as of December 30, 2017)

|

43,735

|

|

41,109

|

|

||||

|

Equity investments

|

9,481

|

|

8,579

|

|

||||

|

Other long-term investments

|

3,435

|

|

3,712

|

|

||||

|

Goodwill

|

24,346

|

|

24,389

|

|

||||

|

Identified intangible assets, net

|

12,355

|

|

12,745

|

|

||||

|

Other long-term assets

|

3,614

|

|

3,215

|

|

||||

|

Total assets

|

$

|

128,596

|

|

$

|

123,249

|

|

||

|

Liabilities, temporary equity, and stockholders’ equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Short-term debt

|

$

|

3,842

|

|

$

|

1,776

|

|

||

|

Accounts payable

|

4,415

|

|

2,928

|

|

||||

|

Accrued compensation and benefits

|

2,118

|

|

3,526

|

|

||||

|

Deferred income

|

—

|

|

1,656

|

|

||||

|

Other accrued liabilities

|

9,586

|

|

7,535

|

|

||||

|

Total current liabilities

|

|

19,961

|

|

17,421

|

|

|||

|

Debt

|

24,770

|

|

25,037

|

|

||||

|

Contract liabilities

|

2,479

|

|

—

|

|

||||

|

Income taxes payable, non-current

|

5,774

|

|

4,069

|

|

||||

|

Deferred income taxes

|

1,564

|

|

3,046

|

|

||||

|

Other long-term liabilities

|

3,082

|

|

3,791

|

|

||||

|

Contingencies (Note 15)

|

|

|

||||||

|

Temporary equity

|

801

|

|

866

|

|

||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock

|

—

|

|

—

|

|

||||

|

Common stock and capital in excess of par value, 4,660 issued and outstanding (4,687 issued and outstanding as of December 30, 2017)

|

26,430

|

|

26,074

|

|

||||

|

Accumulated other comprehensive income (loss)

|

(683

|

)

|

862

|

|

||||

|

Retained earnings

|

44,418

|

|

42,083

|

|

||||

|

Total stockholders’ equity

|

70,165

|

|

69,019

|

|

||||

|

Total liabilities, temporary equity, and stockholders’ equity

|

$

|

128,596

|

|

$

|

123,249

|

|

||

|

FINANCIAL STATEMENTS

|

Consolidated Condensed Balance Sheets

|

6

|

|

INTEL CORPORATION

|

|

|

Three Months Ended

|

|||||||

|

(In Millions; Unaudited)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Cash and cash equivalents, beginning of period

|

$

|

3,433

|

|

$

|

5,560

|

|

||

|

Cash flows provided by (used for) operating activities:

|

||||||||

|

Net income

|

4,454

|

|

2,964

|

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation

|

1,806

|

|

1,625

|

|

||||

|

Share-based compensation

|

433

|

|

397

|

|

||||

|

Restructuring and other charges

|

—

|

|

80

|

|

||||

|

Amortization of intangibles

|

390

|

|

321

|

|

||||

|

(Gains) losses on equity investments, net

|

(643

|

)

|

(250

|

)

|

||||

|

Deferred taxes

|

1

|

|

212

|

|

||||

|

Changes in assets and liabilities:

|

||||||||

|

Accounts receivable

|

102

|

|

(105

|

)

|

||||

|

Inventories

|

(96

|

)

|

(232

|

)

|

||||

|

Accounts payable

|

73

|

|

188

|

|

||||

|

Accrued compensation and benefits

|

(1,307

|

)

|

(1,277

|

)

|

||||

|

Customer deposits and prepaid supply agreements

|

1,599

|

|

—

|

|

||||

|

Income taxes payable and receivable

|

294

|

|

427

|

|

||||

|

Other assets and liabilities

|

(822

|

)

|

(452

|

)

|

||||

|

Total adjustments

|

1,830

|

|

934

|

|

||||

|

Net cash provided by operating activities

|

6,284

|

|

3,898

|

|

||||

|

Cash flows provided by (used for) investing activities:

|

||||||||

|

Additions to property, plant and equipment

|

(2,910

|

)

|

(1,952

|

)

|

||||

|

Purchases of available-for-sale debt investments

|

(859

|

)

|

(1,746

|

)

|

||||

|

Maturities of available-for-sale debt investments

|

893

|

|

1,508

|

|

||||

|

Purchases of trading assets

|

(5,398

|

)

|

(3,075

|

)

|

||||

|

Maturities and sales of trading assets

|

3,760

|

|

2,433

|

|

||||

|

Other investing

|

(277

|

)

|

54

|

|

||||

|

Net cash used for investing activities

|

(4,791

|

)

|

(2,778

|

)

|

||||

|

Cash flows provided by (used for) financing activities:

|

||||||||

|

Increase (decrease) in short-term debt, net

|

2,142

|

|

435

|

|

||||

|

Repayment of debt and debt conversion

|

(327

|

)

|

—

|

|

||||

|

Proceeds from sales of common stock through employee equity incentive plans

|

289

|

|

329

|

|

||||

|

Repurchase of common stock

|

(1,914

|

)

|

(1,242

|

)

|

||||

|

Payment of dividends to stockholders

|

(1,400

|

)

|

(1,229

|

)

|

||||

|

Other financing

|

(162

|

)

|

(39

|

)

|

||||

|

Net cash provided by (used for) financing activities

|

(1,372

|

)

|

(1,746

|

)

|

||||

|

Net increase (decrease) in cash and cash equivalents

|

121

|

|

(626

|

)

|

||||

|

Cash and cash equivalents, end of period

|

$

|

3,554

|

|

$

|

4,934

|

|

||

|

Supplemental disclosures of noncash investing activities and cash flow information:

|

||||||||

|

Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities

|

$

|

2,904

|

|

$

|

1,448

|

|

||

|

Cash paid during the period for:

|

||||||||

|

Interest, net of capitalized interest and interest rate swap payments/receipts

|

$

|

60

|

|

$

|

97

|

|

||

|

Income taxes, net of refunds

|

$

|

228

|

|

$

|

171

|

|

||

|

FINANCIAL STATEMENTS

|

Consolidated Condensed Statements of Cash Flows

|

7

|

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

8

|

|

•

|

Marketable equity securities

are equity securities with readily determinable fair value (RDFV) that are measured and recorded at fair value. Prior to fiscal 2018, these securities were measured and recorded at fair value and classified as available-for-sale securities.

|

|

•

|

Non-marketable equity securities

are equity securities without RDFV that are measured and recorded using a measurement alternative which measures the securities at cost minus impairment, if any, plus or minus changes resulting from qualifying observable price changes. These securities were previously accounted for using the cost method of accounting, measured at cost less other-than-temporary impairment.

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

9

|

|

•

|

Equity method investments

are equity securities in investees we do not control but over which we have the ability to exercise significant influence. Equity method investments are measured at cost minus impairment, if any, plus or minus our share of equity method investee income or loss. Our proportionate share of the income or loss from equity method investments is recognized on a one-quarter lag and is recorded in gains (losses) on equity investments, net.

|

|

Adjustments from

|

||||||||||||||||||||

|

(In Millions) |

Balance as of

Dec 30, 2017 |

Revenue Standard

|

Financial Instruments Update

|

Other

1

|

Opening Balance as of

Dec 31, 2017 |

|||||||||||||||

|

Assets:

|

||||||||||||||||||||

|

Accounts receivable

|

$

|

5,607

|

|

$

|

(530

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

5,077

|

|

|||||

|

Inventories

|

$

|

6,983

|

|

$

|

47

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7,030

|

|

|||||

|

Other current assets

|

$

|

2,908

|

|

$

|

64

|

|

$

|

—

|

|

$

|

(8

|

)

|

$

|

2,964

|

|

|||||

|

Equity investments

|

$

|

—

|

|

$

|

—

|

|

$

|

8,579

|

|

$

|

—

|

|

$

|

8,579

|

|

|||||

|

Marketable equity securities

|

$

|

4,192

|

|

$

|

—

|

|

$

|

(4,192

|

)

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Other long-term assets

|

$

|

7,602

|

|

$

|

—

|

|

$

|

(4,387

|

)

|

$

|

(43

|

)

|

$

|

3,172

|

|

|||||

|

Liabilities:

|

||||||||||||||||||||

|

Deferred income

|

$

|

1,656

|

|

$

|

(1,356

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

300

|

|

|||||

|

Other accrued liabilities

|

$

|

7,535

|

|

$

|

81

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7,616

|

|

|||||

|

Deferred income taxes

|

$

|

3,046

|

|

$

|

191

|

|

$

|

—

|

|

$

|

(20

|

)

|

$

|

3,217

|

|

|||||

|

Stockholders' equity:

|

||||||||||||||||||||

|

Accumulated other comprehensive income (loss)

|

$

|

862

|

|

$

|

—

|

|

$

|

(1,745

|

)

|

$

|

(45

|

)

|

$

|

(928

|

)

|

|||||

|

Retained earnings

|

$

|

42,083

|

|

$

|

665

|

|

$

|

1,745

|

|

$

|

14

|

|

$

|

44,507

|

|

|||||

|

1

|

Includes adjustments from adoption of "Income Taxes - Intra-Entity Transfers of Assets Other Than Inventory" and "Income Statement

—

Reporting Comprehensive Income - Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income."

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

10

|

|

For the period ended March 31, 2018

|

||||||||||||

|

(In Millions)

|

As reported

|

Adjustments

|

Without new revenue standard

|

|||||||||

|

Income Statement

|

||||||||||||

|

Net revenue

|

$

|

16,066

|

|

$

|

(462

|

)

|

$

|

15,604

|

|

|||

|

Cost of sales

|

6,335

|

|

(156

|

)

|

6,179

|

|

||||||

|

Gross margin

|

9,731

|

|

(306

|

)

|

9,425

|

|

||||||

|

Marketing, general and administrative

|

1,900

|

|

(52

|

)

|

1,848

|

|

||||||

|

Operating income

|

4,470

|

|

(254

|

)

|

4,216

|

|

||||||

|

Income before taxes

|

5,011

|

|

(254

|

)

|

4,757

|

|

||||||

|

Provision for taxes

|

557

|

|

(47

|

)

|

510

|

|

||||||

|

Net income

|

$

|

4,454

|

|

$

|

(207

|

)

|

$

|

4,247

|

|

|||

|

Balance Sheet

|

||||||||||||

|

Assets:

|

||||||||||||

|

Accounts receivable

|

$

|

4,879

|

|

$

|

346

|

|

$

|

5,225

|

|

|||

|

Inventories

|

$

|

7,146

|

|

$

|

51

|

|

$

|

7,197

|

|

|||

|

Other current assets

|

$

|

3,408

|

|

$

|

(14

|

)

|

$

|

3,394

|

|

|||

|

Liabilities:

|

||||||||||||

|

Deferred income

|

$

|

—

|

|

$

|

1,670

|

|

$

|

1,670

|

|

|||

|

Other accrued liabilities

|

$

|

9,586

|

|

$

|

(181

|

)

|

$

|

9,405

|

|

|||

|

Deferred income taxes

|

$

|

1,564

|

|

$

|

(229

|

)

|

$

|

1,335

|

|

|||

|

Equity:

|

||||||||||||

|

Retained earnings

|

$

|

44,418

|

|

$

|

(877

|

)

|

$

|

43,541

|

|

|||

|

•

|

Client Computing Group (CCG)

|

|

•

|

Data Center Group (DCG)

|

|

•

|

Internet of Things Group (IOTG)

|

|

•

|

Non-Volatile Memory Solutions Group (NSG)

|

|

•

|

Programmable Solutions Group (PSG)

|

|

•

|

All Other

|

|

•

|

results of operations from non-reportable segments not otherwise presented, including Mobileye results;

|

|

•

|

historical results of operations from divested businesses;

|

|

•

|

results of operations of start-up businesses that support our initiatives, including our foundry business;

|

|

•

|

amounts included within restructuring and other charges;

|

|

•

|

a portion of employee benefits, compensation, and other expenses not allocated to the operating segments; and

|

|

•

|

acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill.

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

11

|

|

Three Months Ended

|

||||||||

|

(In Millions)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Net revenue:

|

||||||||

|

Client Computing Group

|

||||||||

|

Platform

|

$

|

7,615

|

|

$

|

7,397

|

|

||

|

Adjacent

|

605

|

|

579

|

|

||||

|

8,220

|

|

7,976

|

|

|||||

|

Data Center Group

|

||||||||

|

Platform

|

4,824

|

|

3,879

|

|

||||

|

Adjacent

|

410

|

|

353

|

|

||||

|

5,234

|

|

4,232

|

|

|||||

|

Internet of Things Group

|

||||||||

|

Platform

|

719

|

|

632

|

|

||||

|

Adjacent

|

121

|

|

89

|

|

||||

|

840

|

|

721

|

|

|||||

|

Non-Volatile Memory Solutions Group

|

1,040

|

|

866

|

|

||||

|

Programmable Solutions Group

|

498

|

|

425

|

|

||||

|

All other

|

234

|

|

576

|

|

||||

|

Total net revenue

|

$

|

16,066

|

|

$

|

14,796

|

|

||

|

Operating income (loss):

|

||||||||

|

Client Computing Group

|

$

|

2,791

|

|

$

|

3,031

|

|

||

|

Data Center Group

|

2,602

|

|

1,487

|

|

||||

|

Internet of Things Group

|

227

|

|

105

|

|

||||

|

Non-Volatile Memory Solutions Group

|

(81

|

)

|

(129

|

)

|

||||

|

Programmable Solutions Group

|

97

|

|

92

|

|

||||

|

All other

|

(1,166

|

)

|

(954

|

)

|

||||

|

Total operating income

|

$

|

4,470

|

|

$

|

3,632

|

|

||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

12

|

|

Three Months Ended

|

||||||||

|

(In Millions)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Platform revenue

|

||||||||

|

Desktop platform

|

$

|

2,907

|

|

$

|

2,855

|

|

||

|

Notebook platform

|

4,689

|

|

4,498

|

|

||||

|

DCG platform

|

4,824

|

|

3,879

|

|

||||

|

Other platform

1

|

738

|

|

676

|

|

||||

|

13,158

|

|

11,908

|

|

|||||

|

Adjacent revenue

2

|

2,908

|

|

2,354

|

|

||||

|

ISecG divested business

|

—

|

|

534

|

|

||||

|

Total revenue

|

$

|

16,066

|

|

$

|

14,796

|

|

||

|

1

|

Includes our tablet, service provider, and IOTG platform revenue.

|

|

2

|

Includes all of our non-platform products for CCG, DCG, and IOTG like modem, ethernet, and silicon photonic, as well as NSG, PSG, and Mobileye products.

|

|

|

Three Months Ended

|

|||||||

|

(In Millions, Except Per Share Amounts)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Net income available to common stockholders

|

$

|

4,454

|

|

$

|

2,964

|

|

||

|

Weighted average shares of common stock outstanding – basic

|

4,674

|

|

4,723

|

|

||||

|

Dilutive effect of employee equity incentive plans

|

65

|

|

58

|

|

||||

|

Dilutive effect of convertible debt

|

51

|

|

100

|

|

||||

|

Weighted average shares of common stock outstanding – diluted

|

4,790

|

|

4,881

|

|

||||

|

Earnings per share – Basic

|

$

|

0.95

|

|

$

|

0.63

|

|

||

|

Earnings per share – Diluted

|

$

|

0.93

|

|

$

|

0.61

|

|

||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

13

|

|

(In Millions)

|

Mar 31,

2018 |

Opening Balance as of Dec 31, 2017

|

||||||

|

Contract liabilities from prepaid supply agreements

|

$

|

2,723

|

|

$

|

105

|

|

||

|

Contract liabilities from software, services and other

|

115

|

|

195

|

|

||||

|

Total contract liabilities

|

$

|

2,838

|

|

$

|

300

|

|

||

|

(In Millions)

|

||||

|

Prepaid supply agreements balance as of Dec 31, 2017

|

$

|

105

|

|

|

|

Additions and adjustments

|

2,692

|

|

||

|

Revenue recognized

|

(74

|

)

|

||

|

Prepaid supply agreements balance as of Mar 31, 2018

|

$

|

2,723

|

|

|

|

(In Millions)

|

Mar 31,

2018 |

Dec 30,

2017 |

||||||

|

Raw materials

|

$

|

1,242

|

|

$

|

1,098

|

|

||

|

Work in process

|

3,750

|

|

3,893

|

|

||||

|

Finished goods

|

2,154

|

|

1,992

|

|

||||

|

Total inventories

|

$

|

7,146

|

|

$

|

6,983

|

|

||

|

|

Three Months Ended

|

|||||||

|

(In Millions)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Interest income

|

$

|

91

|

|

$

|

76

|

|

||

|

Interest expense

|

(112

|

)

|

(146

|

)

|

||||

|

Other, net

|

(81

|

)

|

1

|

|

||||

|

Total interest and other, net

|

$

|

(102

|

)

|

$

|

(69

|

)

|

||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

14

|

|

March 31, 2018

|

December 30, 2017

|

|||||||||||||||||||||||||||||||

|

(In Millions)

|

Adjusted Cost

|

Gross Unrealized Gains

|

Gross Unrealized Losses

|

Fair Value

|

Adjusted Cost

|

Gross Unrealized Gains

|

Gross Unrealized Losses

|

Fair Value

|

||||||||||||||||||||||||

|

Corporate debt

|

$

|

2,440

|

|

$

|

2

|

|

$

|

(27

|

)

|

$

|

2,415

|

|

$

|

2,294

|

|

$

|

4

|

|

$

|

(13

|

)

|

$

|

2,285

|

|

||||||||

|

Financial institution instruments

|

3,303

|

|

3

|

|

(17

|

)

|

3,289

|

|

3,387

|

|

3

|

|

(9

|

)

|

3,381

|

|

||||||||||||||||

|

Government debt

|

956

|

|

—

|

|

(12

|

)

|

944

|

|

961

|

|

—

|

|

(6

|

)

|

955

|

|

||||||||||||||||

|

Total available-for-sale debt investments

|

$

|

6,699

|

|

$

|

5

|

|

$

|

(56

|

)

|

$

|

6,648

|

|

$

|

6,642

|

|

$

|

7

|

|

$

|

(28

|

)

|

$

|

6,621

|

|

||||||||

|

(In Millions)

|

Fair Value

|

|||

|

Due in 1 year or less

|

$

|

2,823

|

|

|

|

Due in 1–2 years

|

1,715

|

|

||

|

Due in 2–5 years

|

1,651

|

|

||

|

Due after 5 years

|

69

|

|

||

|

Instruments not due at a single maturity date

|

390

|

|

||

|

Total

|

$

|

6,648

|

|

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

15

|

|

(In Millions)

|

Mar 31,

2018 |

Dec 30,

2017 |

||||||

|

Marketable equity securities

|

$

|

4,653

|

|

$

|

4,192

|

|

||

|

Non-marketable equity securities

|

2,823

|

|

2,613

|

|

||||

|

Equity method investments

|

2,005

|

|

1,774

|

|

||||

|

Total

|

$

|

9,481

|

|

|

$

|

8,579

|

|

|

|

|

Three Months Ended

|

|||||||

|

(In Millions)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Mark to market adjustments on marketable equity securities

1

|

$

|

606

|

|

$

|

—

|

|

||

|

Gains (losses) on sales

1

|

10

|

|

274

|

|

||||

|

Observable price adjustments on non-marketable equity securities

1

|

124

|

|

—

|

|

||||

|

Impairments

|

(17

|

)

|

(48

|

)

|

||||

|

Share of equity method investee gains (losses)

|

(82

|

)

|

(11

|

)

|

||||

|

Other

|

2

|

|

37

|

|

||||

|

Total gains (losses) on equity investments, net

|

$

|

643

|

|

$

|

252

|

|

||

|

1

|

Mark to market and observable price adjustments relate to the new financial instruments standard adopted in the first quarter of 2018, and are not applicable in prior periods. Gains (losses) on sales includes realized gains (losses) on sales of non-marketable equity securities and equity method investments, and in 2017 also includes realized gains (losses) on sales of available-for-sale equity securities which are now reflected in mark to market adjustments on marketable equity securities.

|

|

(In Millions)

|

Mar 31,

2018 |

|||

|

Net gains (losses) recognized during the period on equity securities

|

$

|

724

|

|

|

|

Less: Net gains and losses recognized during the period on equity securities sold during the period

|

(11

|

)

|

||

|

Unrealized gains (losses) recognized during the reporting period on equity securities still held at the reporting date

|

$

|

713

|

|

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

16

|

|

|

March 31, 2018

|

|||||||||||

|

(In Millions)

|

Gross Assets

|

Accumulated

Amortization |

Net

|

|||||||||

|

Acquisition-related developed technology

|

$

|

9,513

|

|

$

|

(2,197

|

)

|

$

|

7,316

|

|

|||

|

Acquisition-related customer relationships

|

2,036

|

|

(343

|

)

|

1,693

|

|

||||||

|

Acquisition-related brands

|

143

|

|

(34

|

)

|

109

|

|

||||||

|

Licensed technology and patents

|

3,104

|

|

(1,434

|

)

|

1,670

|

|

||||||

|

Identified intangible assets subject to amortization

|

14,796

|

|

(4,008

|

)

|

10,788

|

|

||||||

|

In-process research and development

|

1,567

|

|

—

|

|

1,567

|

|

||||||

|

Identified intangible assets not subject to amortization

|

1,567

|

|

—

|

|

1,567

|

|

||||||

|

Total identified intangible assets

|

$

|

16,363

|

|

$

|

(4,008

|

)

|

$

|

12,355

|

|

|||

|

|

December 30, 2017

|

|||||||||||

|

(In Millions)

|

Gross Assets

|

Accumulated

Amortization |

Net

|

|||||||||

|

Acquisition-related developed technology

|

$

|

8,912

|

|

$

|

(1,922

|

)

|

$

|

6,990

|

|

|||

|

Acquisition-related customer relationships

|

2,052

|

|

(313

|

)

|

1,739

|

|

||||||

|

Acquisition-related brands

|

143

|

|

(29

|

)

|

114

|

|

||||||

|

Licensed technology and patents

|

3,104

|

|

(1,370

|

)

|

1,734

|

|

||||||

|

Identified intangible assets subject to amortization

|

14,211

|

|

(3,634

|

)

|

10,577

|

|

||||||

|

In-process research and development

|

2,168

|

|

—

|

|

2,168

|

|

||||||

|

Identified intangible assets not subject to amortization

|

2,168

|

|

—

|

|

2,168

|

|

||||||

|

Total identified intangible assets

|

$

|

16,379

|

|

$

|

(3,634

|

)

|

$

|

12,745

|

|

|||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

17

|

|

Three Months Ended

|

||||||||||

|

(In Millions)

|

Location

|

Mar 31,

2018 |

Apr 1,

2017 |

|||||||

|

Acquisition-related developed technology

|

Cost of sales

|

$

|

275

|

|

$

|

209

|

|

|||

|

Acquisition-related customer relationships

|

Amortization of acquisition-related intangibles

|

45

|

|

35

|

|

|||||

|

Acquisition-related brands

|

Amortization of acquisition-related intangibles

|

5

|

|

3

|

|

|||||

|

Licensed technology and patents

|

Cost of sales

|

65

|

|

74

|

|

|||||

|

Total amortization expenses

|

$

|

390

|

|

$

|

321

|

|

||||

|

(In Millions)

|

Remainder of 2018

|

2019

|

2020

|

2021

|

2022

|

|||||||||||||||

|

Acquisition-related developed technology

|

$

|

824

|

|

$

|

1,097

|

|

$

|

1,066

|

|

$

|

1,030

|

|

$

|

991

|

|

|||||

|

Acquisition-related customer relationships

|

136

|

|

180

|

|

179

|

|

179

|

|

171

|

|

||||||||||

|

Acquisition-related brands

|

15

|

|

20

|

|

20

|

|

20

|

|

6

|

|

||||||||||

|

Licensed technology and patents

|

195

|

|

246

|

|

214

|

|

195

|

|

190

|

|

||||||||||

|

Total future amortization expenses

|

$

|

1,170

|

|

$

|

1,543

|

|

$

|

1,479

|

|

$

|

1,424

|

|

$

|

1,358

|

|

|||||

|

(In Millions)

|

Mar 31,

2018 |

Dec 30,

2017 |

||||||

|

Non-current deferred tax assets

|

$

|

982

|

|

$

|

840

|

|

||

|

Pre-payments for property, plant and equipment

|

1,145

|

|

714

|

|

||||

|

Loans receivable

|

744

|

|

860

|

|

||||

|

Other

|

743

|

|

801

|

|

||||

|

Total other long-term assets

|

$

|

3,614

|

|

$

|

3,215

|

|

||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

18

|

|

March 31, 2018

|

December 30, 2017

|

|||||||||||||||||||||||||||||||

|

Fair Value Measured and

Recorded at Reporting Date Using

|

|

Fair Value Measured and

Recorded at Reporting Date Using

|

|

|||||||||||||||||||||||||||||

|

(In Millions)

|

Level 1

|

Level 2

|

Level 3

|

Total

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||||||||||

|

Cash equivalents:

|

||||||||||||||||||||||||||||||||

|

Corporate debt

|

$

|

—

|

|

$

|

347

|

|

$

|

—

|

|

$

|

347

|

|

$

|

—

|

|

$

|

30

|

|

$

|

—

|

|

$

|

30

|

|

||||||||

|

Financial institution instruments

1

|

390

|

|

422

|

|

—

|

|

812

|

|

335

|

|

640

|

|

—

|

|

975

|

|

||||||||||||||||

|

Government debt

2

|

—

|

|

34

|

|

—

|

|

34

|

|

—

|

|

90

|

|

—

|

|

90

|

|

||||||||||||||||

|

Reverse repurchase agreements

|

—

|

|

1,399

|

|

—

|

|

1,399

|

|

—

|

|

1,399

|

|

—

|

|

1,399

|

|

||||||||||||||||

|

Short-term investments:

|

||||||||||||||||||||||||||||||||

|

Corporate debt

|

—

|

|

631

|

|

—

|

|

631

|

|

—

|

|

672

|

|

3

|

|

675

|

|

||||||||||||||||

|

Financial institution instruments

1

|

—

|

|

1,184

|

|

—

|

|

1,184

|

|

—

|

|

1,009

|

|

—

|

|

1,009

|

|

||||||||||||||||

|

Government debt

2

|

—

|

|

205

|

|

—

|

|

205

|

|

—

|

|

130

|

|

—

|

|

130

|

|

||||||||||||||||

|

Trading assets:

|

||||||||||||||||||||||||||||||||

|

Asset-backed securities

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2

|

|

—

|

|

2

|

|

||||||||||||||||

|

Corporate debt

|

—

|

|

3,195

|

|

—

|

|

3,195

|

|

—

|

|

2,842

|

|

—

|

|

2,842

|

|

||||||||||||||||

|

Financial institution instruments

1

|

12

|

|

1,920

|

|

—

|

|

1,932

|

|

59

|

|

1,064

|

|

—

|

|

1,123

|

|

||||||||||||||||

|

Government debt

2

|

29

|

|

5,467

|

|

—

|

|

5,496

|

|

30

|

|

4,758

|

|

—

|

|

4,788

|

|

||||||||||||||||

|

Other current assets:

|

||||||||||||||||||||||||||||||||

|

Derivative assets

|

—

|

|

362

|

|

—

|

|

362

|

|

2

|

|

277

|

|

—

|

|

279

|

|

||||||||||||||||

|

Loans receivable

|

—

|

|

166

|

|

—

|

|

166

|

|

—

|

|

30

|

|

—

|

|

30

|

|

||||||||||||||||

|

Marketable equity securities

|

4,578

|

|

75

|

|

—

|

|

4,653

|

|

4,148

|

|

44

|

|

—

|

|

4,192

|

|

||||||||||||||||

|

Other long-term investments:

|

||||||||||||||||||||||||||||||||

|

Corporate debt

|

—

|

|

1,437

|

|

—

|

|

1,437

|

|

—

|

|

1,576

|

|

4

|

|

1,580

|

|

||||||||||||||||

|

Financial institution instruments

1

|

—

|

|

1,293

|

|

—

|

|

1,293

|

|

—

|

|

1,397

|

|

—

|

|

1,397

|

|

||||||||||||||||

|

Government debt

2

|

—

|

|

705

|

|

—

|

|

705

|

|

—

|

|

735

|

|

—

|

|

735

|

|

||||||||||||||||

|

Other long-term assets:

|

||||||||||||||||||||||||||||||||

|

Derivative assets

|

—

|

|

96

|

|

—

|

|

96

|

|

—

|

|

77

|

|

7

|

|

84

|

|

||||||||||||||||

|

Loans receivable

|

—

|

|

494

|

|

—

|

|

494

|

|

—

|

|

610

|

|

—

|

|

610

|

|

||||||||||||||||

|

Total assets measured and recorded at fair value

|

5,009

|

|

19,432

|

|

—

|

|

24,441

|

|

4,574

|

|

17,382

|

|

14

|

|

21,970

|

|

||||||||||||||||

|

Liabilities

|

||||||||||||||||||||||||||||||||

|

Other accrued liabilities:

|

||||||||||||||||||||||||||||||||

|

Derivative liabilities

|

—

|

|

555

|

|

—

|

|

555

|

|

—

|

|

454

|

|

—

|

|

454

|

|

||||||||||||||||

|

Other long-term liabilities:

|

||||||||||||||||||||||||||||||||

|

Derivative liabilities

|

—

|

|

530

|

|

61

|

|

591

|

|

—

|

|

297

|

|

6

|

|

303

|

|

||||||||||||||||

|

Total liabilities measured and recorded at fair value

|

$

|

—

|

|

$

|

1,085

|

|

$

|

61

|

|

$

|

1,146

|

|

$

|

—

|

|

$

|

751

|

|

$

|

6

|

|

$

|

757

|

|

||||||||

|

1

|

Level 1 investments consist of money market funds. Level 2 investments consist primarily of commercial paper, certificates of deposit, time deposits, and notes and bonds issued by financial institutions.

|

|

2

|

Level 1 investments consist primarily of U.S. Treasury securities. Level 2 investments consist primarily of U.S. Agency notes and non-U.S. government debt.

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

19

|

|

(In Millions)

|

Unrealized Holding Gains (Losses) on Available-for-Sale Equity Investments

|

Unrealized Holding Gains (Losses) on Derivatives

|

Actuarial Valuation and Other Pension Expenses

|

Translation adjustments and other

|

Total

|

|||||||||||||||

|

Balance as of December 30, 2017

|

$

|

1,745

|

|

$

|

106

|

|

$

|

(963

|

)

|

$

|

(26

|

)

|

$

|

862

|

|

|||||

|

Impact of change in accounting principle

|

(1,745

|

)

|

24

|

|

(65

|

)

|

(4

|

)

|

(1,790

|

)

|

||||||||||

|

Opening Balance as of December 31, 2017

|

$

|

—

|

|

$

|

130

|

|

$

|

(1,028

|

)

|

$

|

(30

|

)

|

$

|

(928

|

)

|

|||||

|

Other comprehensive income (loss) before reclassifications

|

—

|

|

203

|

|

140

|

|

(29

|

)

|

314

|

|

||||||||||

|

Amounts reclassified out of accumulated other comprehensive income

|

—

|

|

(53

|

)

|

45

|

|

(1

|

)

|

(9

|

)

|

||||||||||

|

Tax effects

|

—

|

|

(31

|

)

|

(37

|

)

|

8

|

|

(60

|

)

|

||||||||||

|

Other comprehensive income (loss)

|

—

|

|

119

|

|

148

|

|

(22

|

)

|

245

|

|

||||||||||

|

Balance as of March 31, 2018

|

$

|

—

|

|

$

|

249

|

|

$

|

(880

|

)

|

$

|

(52

|

)

|

$

|

(683

|

)

|

|||||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

20

|

|

Income Before Taxes Impact

(In Millions) |

||||||||||

|

Three Months Ended

|

||||||||||

|

Comprehensive Income Components

|

Location

|

Mar 31,

2018 |

Apr 1,

2017 |

|||||||

|

Unrealized holding gains (losses) on available-for-sale equity investments:

|

||||||||||

|

Gains (losses) on equity investments, net

|

$

|

—

|

|

$

|

263

|

|

||||

|

—

|

|

263

|

|

|||||||

|

Unrealized holding gains (losses) on derivatives:

|

||||||||||

|

Foreign currency contracts

|

Cost of sales

|

8

|

|

(20

|

)

|

|||||

|

Research and development

|

41

|

|

(16

|

)

|

||||||

|

Marketing, general and administrative

|

14

|

|

(5

|

)

|

||||||

|

Gains (losses) on equity investments, net

|

—

|

|

4

|

|

||||||

|

Interest and other, net

|

(10

|

)

|

38

|

|

||||||

|

53

|

|

1

|

|

|||||||

|

Amortization of pension and postretirement benefit components:

|

||||||||||

|

Actuarial valuation and other pension expenses

|

(45

|

)

|

(24

|

)

|

||||||

|

(45

|

)

|

(24

|

)

|

|||||||

|

Translation adjustments and other

|

Interest and other, net

|

1

|

|

—

|

|

|||||

|

Total amounts reclassified out of accumulated other comprehensive income (loss)

|

$

|

9

|

|

$

|

240

|

|

||||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

21

|

|

(In Millions)

|

Mar 31,

2018 |

Dec 30,

2017 |

Apr 1,

2017 |

|||||||||

|

Foreign currency contracts

|

$

|

22,020

|

|

$

|

19,958

|

|

$

|

18,575

|

|

|||

|

Interest rate contracts

|

20,905

|

|

16,823

|

|

14,815

|

|

||||||

|

Other

|

2,154

|

|

1,636

|

|

1,357

|

|

||||||

|

Total

|

$

|

45,079

|

|

$

|

38,417

|

|

$

|

34,747

|

|

|||

|

|

March 31, 2018

|

December 30, 2017

|

||||||||||||||

|

(In Millions)

|

Assets

1

|

Liabilities

2

|

Assets

1

|

Liabilities

2

|

||||||||||||

|

Derivatives designated as hedging instruments:

|

||||||||||||||||

|

Foreign currency contracts

3

|

$

|

303

|

|

$

|

9

|

|

$

|

283

|

|

$

|

32

|

|

||||

|

Interest rate contracts

|

30

|

|

540

|

|

1

|

|

254

|

|

||||||||

|

Total derivatives designated as hedging instruments

|

333

|

|

549

|

|

284

|

|

286

|

|

||||||||

|

Derivatives not designated as hedging instruments:

|

||||||||||||||||

|

Foreign currency contracts

3

|

94

|

|

575

|

|

52

|

|

447

|

|

||||||||

|

Interest rate contracts

|

31

|

|

22

|

|

18

|

|

24

|

|

||||||||

|

Other

|

—

|

|

—

|

|

9

|

|

—

|

|

||||||||

|

Total derivatives not designated as hedging instruments

|

125

|

|

597

|

|

79

|

|

471

|

|

||||||||

|

Total derivatives

|

$

|

458

|

|

$

|

1,146

|

|

$

|

363

|

|

$

|

757

|

|

||||

|

1

|

Derivative assets are recorded as other assets, current and non-current.

|

|

2

|

Derivative liabilities are recorded as other liabilities, current and non-current.

|

|

3

|

The majority of these instruments mature within

12 months.

|

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

22

|

|

March 31, 2018

|

||||||||||||||||||||||||

|

Gross Amounts Not Offset in the Balance Sheet

|

||||||||||||||||||||||||

|

(In Millions)

|

Gross Amounts Recognized

|

Gross Amounts Offset in the Balance Sheet

|

Net Amounts Presented in the Balance Sheet

|

Financial Instruments

|

Cash and Non-Cash Collateral Received or Pledged

|

Net Amount

|

||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||

|

Derivative assets subject to master netting arrangements

|

$

|

440

|

|

$

|

—

|

|

$

|

440

|

|

$

|

(327

|

)

|

$

|

(61

|

)

|

$

|

52

|

|

||||||

|

Reverse repurchase agreements

|

1,649

|

|

—

|

|

1,649

|

|

—

|

|

(1,649

|

)

|

—

|

|

||||||||||||

|

Total assets

|

2,089

|

|

—

|

|

2,089

|

|

(327

|

)

|

(1,710

|

)

|

52

|

|

||||||||||||

|

Liabilities:

|

||||||||||||||||||||||||

|

Derivative liabilities subject to master netting arrangements

|

1,133

|

|

—

|

|

1,133

|

|

(327

|

)

|

(753

|

)

|

53

|

|

||||||||||||

|

Total liabilities

|

$

|

1,133

|

|

$

|

—

|

|

$

|

1,133

|

|

$

|

(327

|

)

|

$

|

(753

|

)

|

$

|

53

|

|

||||||

|

December 30, 2017

|

||||||||||||||||||||||||

|

Gross Amounts Not Offset in the Balance Sheet

|

||||||||||||||||||||||||

|

(In Millions)

|

Gross Amounts Recognized

|

Gross Amounts Offset in the Balance Sheet

|

Net Amounts Presented in the Balance Sheet

|

Financial Instruments

|

Cash and Non-Cash Collateral Received or Pledged

|

Net Amount

|

||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||

|

Derivative assets subject to master netting arrangements

|

$

|

350

|

|

$

|

—

|

|

$

|

350

|

|

$

|

(206

|

)

|

$

|

(130

|

)

|

$

|

14

|

|

||||||

|

Reverse repurchase agreements

|

1,649

|

|

—

|

|

1,649

|

|

—

|

|

(1,649

|

)

|

—

|

|

||||||||||||

|

Total assets

|

1,999

|

|

—

|

|

1,999

|

|

(206

|

)

|

(1,779

|

)

|

14

|

|

||||||||||||

|

Liabilities:

|

||||||||||||||||||||||||

|

Derivative liabilities subject to master netting arrangements

|

745

|

|

—

|

|

745

|

|

(206

|

)

|

(504

|

)

|

35

|

|

||||||||||||

|

Total liabilities

|

$

|

745

|

|

$

|

—

|

|

$

|

745

|

|

$

|

(206

|

)

|

$

|

(504

|

)

|

$

|

35

|

|

||||||

|

FINANCIAL STATEMENTS

|

Notes to Financial Statements

|

23

|

|

Three Months Ended

|

||||||||

|

(In Millions)

|

Mar 31,

2018 |

Apr 1,

2017 |

||||||

|

Interest rate contracts

|

$

|

(258

|

)

|

$

|

(14

|

)

|

||

|

Hedged items

|

258

|

|

14

|

|

||||

|

Total

|

$

|

—

|

|

$

|

—

|

|

||

|

Line Item in the Consolidated Condensed Balance Sheet in Which the Hedged Item Is Included

|

Carrying Amount of the Hedged Item Asset/(Liabilities)

|

Cumulative Amount of Fair Value Hedging Adjustment Included in the Carrying Amount Assets/(Liabilities)

|

||||||||||||||

|

Years Ended

(In Millions) |

Mar 31,

2018 |

Dec 30,

2017 |

Mar 31,

2018 |

Dec 30,

2017 |

||||||||||||

|

Long-Term Debt

|

$

|

(16,612

|

)

|

$

|

(12,653

|