|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

|

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

o

|

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Delaware

(State of incorporation)

|

|

77-0034661

(IRS Employer Identification No.)

|

|

|

Title of Each Class

|

|

Name of Exchange on Which Registered

|

|

|

Common Stock, $0.01 par value

|

|

NASDAQ Global Select Market

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|||

|

|

|

(Do not check if a smaller reporting company)

|

|

|||

|

Item

|

Page

|

||

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

EX-10.21

|

|||

|

EX-10.52

|

|||

|

EX-10.61

|

|||

|

EX-21.01

|

|||

|

EX-23.01

|

|||

|

EX-31.01

|

|||

|

EX-31.02

|

|||

|

EX-32.01

|

|||

|

EX-32.02

|

|||

|

EX-101.INS XBRL Instance Document

|

|||

|

EX-101.SCH XBRL Taxonomy Extension Schema

|

|||

|

EX-101.CAL XBRL Taxonomy Extension Calculation Linkbase

|

|||

|

EX-101.LAB XBRL Taxonomy Extensions Label Linkbase

|

|||

|

EX-101.PRE XBRL Taxonomy Extension Presentation Linkbase

|

|||

|

EX-101.DEF XBRL Taxonomy Extension Definition Linkbase

|

|||

|

•

|

Improving financial strength – Helping consumers make and save money and small businesses to grow and profit.

|

|

•

|

Increasing productivity – Turning drudgery into time for what matters most.

|

|

•

|

Maintaining compliance – Helping customers comply with regulations.

|

|

•

|

Building confidence – Sharing the wisdom and experience of others.

|

|

•

|

To be the operating system behind small business success.

|

|

•

|

To do the nations’ taxes in the United States and Canada.

|

|

•

|

Focus on the product – we call it “Delivering awesome product experiences.”

As computers have moved to the palm of our hands in the form of tablets and smart phones, so have our products and services. Our TurboTax solutions, for example, let customers prepare and file their entire tax returns online via tablet, mobile phone, or computer. A key factor in growing our customer base is to deliver an amazing first-use experience so our customers can get the value they expect from our offerings as quickly and easily as possible.

|

|

•

|

Creating network effect platforms – we call it “Enabling the contributions of others.”

We expect to solve our customers’ problems faster and more efficiently by moving to more open platforms with application programming interfaces that integrate the contributions of end users and third-party developers. One example of this is our QuickBooks Online Ecosystem, where small businesses and accountants around the world can install apps created by third-party developers to create an experience that is personalized and configured for their specific needs.

|

|

•

|

Leveraging our data for our customers’ benefit – we call it “Using data to create delight.”

Our customers generate valuable data that we seek to use appropriately to deliver better products and breakthrough benefits by eliminating the need to enter data, helping them make better decisions, and improving transactions and interactions.

|

|

Fiscal 2016

|

Fiscal 2015

|

Fiscal 2014

|

||||||

|

Small Business

|

49

|

%

|

50

|

%

|

51

|

%

|

||

|

Consumer Tax

|

42

|

%

|

43

|

%

|

39

|

%

|

||

|

ProConnect

|

9

|

%

|

7

|

%

|

10

|

%

|

||

|

•

|

QuickBooks Basic Payroll, which provides payroll tax tables, direct deposit of employee paychecks, and payroll reports;

|

|

•

|

QuickBooks Enhanced Payroll, which provides payroll tax tables, direct deposit of employee paychecks, payroll reports, federal and state payroll tax forms, and eFile & Pay for federal and state payroll taxes; and

|

|

•

|

QuickBooks Enhanced Payroll for Accountants, which has several accountant-specific features in addition to the features in QuickBooks Enhanced Payroll.

|

|

•

|

our expectations and beliefs regarding future conduct and growth of the business;

|

|

•

|

our beliefs and expectations regarding seasonality, competition and other trends that affect our business;

|

|

•

|

our expectation that we will solve problems faster and more efficiently for our growing base of customers by moving to more open platforms with application programming interfaces that enable the contributions of end users and third-party developers;

|

|

•

|

our expectation that we will continue to invest significant resources in our product development, marketing and sales capabilities;

|

|

•

|

our expectation that we will continue to invest significant management attention and resources in our information technology infrastructure and in our privacy and security capabilities;

|

|

•

|

our expectation that we will work with the broader industry and government to protect our customers from fraud;

|

|

•

|

our expectation that we will be able to protect our customers’ data and prevent third parties from using stolen customer information to perpetrate fraud in our tax and other offerings;

|

|

•

|

our expectation that we will generate significant cash from operations;

|

|

•

|

our expectation that connected services revenue as a percentage of our total revenue will continue to grow;

|

|

•

|

our expectations regarding the development of future products, services, business models and technology platforms and our research and development efforts;

|

|

•

|

our assumptions underlying critical accounting policies and estimates, including our estimates regarding product rebate and return reserves; the collectability of accounts receivable; stock volatility and other assumptions used to estimate the fair value of share-based compensation; the fair value of goodwill; and expected future amortization of acquired intangible assets;

|

|

•

|

our intention not to sell our investments and our belief that it is more likely than not that we will not be required to sell them before recovery at par;

|

|

•

|

our belief that the investments we hold are not other-than-temporarily impaired;

|

|

•

|

our belief that we take prudent measures to mitigate investment related risks;

|

|

•

|

our belief that our exposure to currency exchange fluctuation risk will not be significant in the future;

|

|

•

|

our assessments and estimates that determine our effective tax rate;

|

|

•

|

our belief that our income tax valuation allowance is sufficient;

|

|

•

|

our belief that it is not reasonably possible that there will be a significant increase or decrease in our unrecognized tax benefits over the next 12 months;

|

|

•

|

our intent to permanently reinvest a significant portion of our earnings from foreign operations, and our belief that we will not need funds generated from foreign operations to fund our domestic operations;

|

|

•

|

our belief that our cash and cash equivalents, investments and cash generated from operations will be sufficient to meet our seasonal working capital needs, capital expenditure requirements, contractual obligations, debt service requirements and other liquidity requirements associated with our operations for at least the next 12 months;

|

|

•

|

our expectation that we will return excess cash generated by operations to our stockholders through repurchases of our common stock and the payment of cash dividends;

|

|

•

|

our assessments and beliefs regarding the future outcome of pending legal proceedings and inquiries by regulatory authorities, the liability, if any, that Intuit may incur as a result of those proceedings and inquiries, and the impact of any potential losses associated with such proceedings or inquiries on our financial statements.

|

|

•

|

different or more restrictive privacy, data protection, data localization, and other laws that could require us to make changes to our products, services and operations, such as mandating that certain types of data collected in a particular country be stored and/or processed within that country;

|

|

•

|

difficulties in developing, staffing, and simultaneously managing a large number of varying foreign operations as a result of distance, language, and cultural differences;

|

|

•

|

stringent local labor laws and regulations;

|

|

•

|

credit risk and higher levels of payment fraud;

|

|

•

|

profit repatriation restrictions, and foreign currency exchange restrictions;

|

|

•

|

geopolitical events, including natural disasters, acts of war and terrorism;

|

|

•

|

import or export regulations;

|

|

•

|

compliance with U.S. laws such as the Foreign Corrupt Practices Act, and local laws prohibiting corrupt payments to government officials;

|

|

•

|

antitrust and competition regulations;

|

|

•

|

potentially adverse tax developments;

|

|

•

|

economic uncertainties relating to European sovereign and other debt;

|

|

•

|

trade barriers and changes in trade regulations;

|

|

•

|

political or social unrest, economic instability, repression, or human rights issues; and

|

|

•

|

risks related to other government regulation or required compliance with local laws.

|

|

•

|

inability to successfully integrate the acquired technology, data assets and operations into our business and maintain uniform standards, controls, policies, and procedures;

|

|

•

|

inability to realize synergies expected to result from an acquisition;

|

|

•

|

disruption of our ongoing business and distraction of management;

|

|

•

|

challenges retaining the key employees, customers, resellers and other business partners of the acquired operation;

|

|

•

|

the internal control environment of an acquired entity may not be consistent with our standards and may require significant time and resources to improve;

|

|

•

|

unidentified issues not discovered in our due diligence process, including product or service quality issues, intellectual property issues and legal contingencies;

|

|

•

|

failure to successfully further develop an acquired business or technology and any resulting impairment of amounts currently capitalized as intangible assets;

|

|

•

|

in the case of foreign acquisitions and investments, the impact of particular economic, tax, currency, political, legal and regulatory risks associated with specific countries.

|

|

•

|

inability to find potential buyers on favorable terms;

|

|

•

|

failure to effectively transfer liabilities, contracts, facilities and employees to buyers;

|

|

•

|

requirements that we retain or indemnify buyers against certain liabilities and obligations;

|

|

•

|

the possibility that we will become subject to third-party claims arising out of such divestiture;

|

|

•

|

challenges in identifying and separating the intellectual properties and data to be divested from the intellectual properties and data that we wish to retain;

|

|

•

|

inability to reduce fixed costs previously associated with the divested assets or business;

|

|

•

|

challenges in collecting the proceeds from any divestiture;

|

|

•

|

disruption of our ongoing business and distraction of management;

|

|

•

|

loss of key employees who leave the Company as a result of a divestiture

;

|

|

•

|

if customers or partners of the divested business do not receive the same level of service from the new owners, our other businesses may be adversely affected, to the extent that these customers or partners also purchase other products offered by us or otherwise conduct business with our retained business.

|

|

•

|

increasing our vulnerability to downturns in our business, to competitive pressures and to adverse economic and industry conditions;

|

|

•

|

requiring the dedication of a portion of our expected cash from operations to service our indebtedness, thereby reducing the amount of expected cash flow available for other purposes, including capital expenditures and acquisitions; and

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our businesses and our industries.

|

|

Location

|

Purpose

|

Approximate

Square

Feet

|

Principal

Lease

Expiration

Dates

|

|||

|

Mountain View, California

|

Corporate headquarters and principal offices for Small Business segment

|

711,000

|

2024 - 2026

|

|||

|

San Diego, California

|

Principal offices for Consumer Tax segment

|

466,000

|

Owned

|

|||

|

Bangalore, India

|

Principal offices for Intuit India

|

359,000

|

2016 - 2022

|

|||

|

Quincy, Washington

|

Primary data center

|

240,000

|

Owned

|

|||

|

Menlo Park, California

|

Subleased office space

|

210,000

|

2025

|

|||

|

San Francisco, California

|

General office space

|

202,000

|

2025

|

|||

|

Woodland Hills, California

|

Principal offices for Small Business payment solutions business

|

168,000

|

2018

|

|||

|

Plano, Texas

|

Principal offices for ProConnect segment and data center

|

166,000

|

2026

|

|||

|

High

|

Low

|

||

|

Fiscal year ended July 31, 2015

|

|

|

|

|

First quarter

|

$88.84

|

$77.96

|

|

|

Second quarter

|

95.84

|

84.75

|

|

|

Third quarter

|

102.17

|

85.77

|

|

|

Fourth quarter

|

109.21

|

99.02

|

|

|

Fiscal year ended July 31, 2016

|

|

|

|

|

First quarter

|

$107.75

|

$79.63

|

|

|

Second quarter

|

108.00

|

88.66

|

|

|

Third quarter

|

105.32

|

88.17

|

|

|

Fourth quarter

|

116.97

|

99.25

|

|

|

Period

|

Total Number

of Shares

Purchased

|

Average

Price Paid

per Share

|

Total Number

of Shares

Purchased

as Part of

Publicly

Announced

Plans

|

Approximate

Dollar Value

of Shares

That May Yet

Be Purchased

Under

the Plans

|

||||||||

|

May 1, 2016 through May 31, 2016

|

731,282

|

|

$102.35

|

731,282

|

|

|

$360,162,917

|

|

||||

|

June 1, 2016 through June 30, 2016

|

—

|

|

$—

|

—

|

|

|

$360,162,917

|

|

||||

|

July 1, 2016 through July 31, 2016

|

—

|

|

$—

|

—

|

|

|

$360,162,917

|

|

||||

|

Total

|

731,282

|

|

$102.35

|

731,282

|

|

|

||||||

|

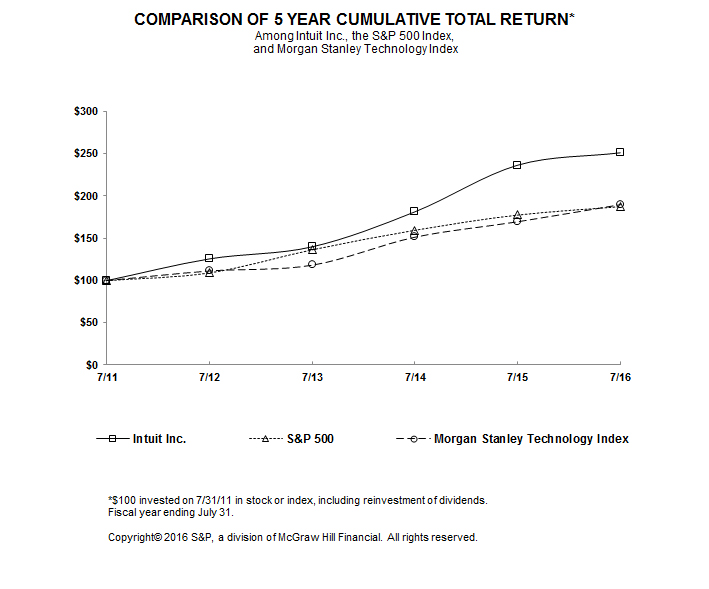

July 31, 2011

|

July 31, 2012

|

July 31, 2013

|

July 31, 2014

|

July 31, 2015

|

July 31, 2016

|

||||||||||||||||||

|

Intuit Inc.

|

$

|

100.00

|

|

$

|

125.62

|

|

$

|

139.91

|

|

$

|

181.28

|

|

$

|

236.44

|

|

$

|

251.09

|

|

|||||

|

S&P 500

|

$

|

100.00

|

|

$

|

109.13

|

|

$

|

136.41

|

|

$

|

159.52

|

|

$

|

177.40

|

|

$

|

187.36

|

|

|||||

|

Morgan Stanley Technology Index

|

$

|

100.00

|

|

$

|

111.45

|

|

$

|

118.36

|

|

$

|

151.58

|

|

$

|

169.91

|

|

$

|

190.19

|

|

|||||

|

Consolidated Statement of Operations Data

|

Fiscal

|

||||||||||||||||||

|

(In millions, except per share amounts)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Total net revenue

|

$

|

4,694

|

|

$

|

4,192

|

|

$

|

4,243

|

|

$

|

3,946

|

|

$

|

3,662

|

|

||||

|

Total costs and expenses

|

3,452

|

|

3,454

|

|

2,943

|

|

2,738

|

|

2,546

|

|

|||||||||

|

Operating income from continuing operations

|

1,242

|

|

738

|

|

1,300

|

|

1,208

|

|

1,116

|

|

|||||||||

|

Total share-based compensation expense included in total costs and expenses

|

278

|

|

242

|

|

186

|

|

166

|

|

154

|

|

|||||||||

|

Net income from continuing operations

|

806

|

|

413

|

|

853

|

|

807

|

|

730

|

|

|||||||||

|

Net income (loss) from discontinued operations

|

173

|

|

(48

|

)

|

54

|

|

51

|

|

62

|

|

|||||||||

|

Net income

|

979

|

|

365

|

|

907

|

|

858

|

|

792

|

|

|||||||||

|

Net income per common share:

|

|

|

|

|

|

||||||||||||||

|

Basic net income per share from continuing operations

|

$

|

3.08

|

|

$

|

1.47

|

|

$

|

2.99

|

|

$

|

2.72

|

|

$

|

2.46

|

|

||||

|

Basic net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.19

|

|

0.17

|

|

0.21

|

|

|||||||||

|

Basic net income per share

|

$

|

3.73

|

|

$

|

1.30

|

|

$

|

3.18

|

|

$

|

2.89

|

|

$

|

2.67

|

|

||||

|

Diluted net income per share from continuing operations

|

$

|

3.04

|

|

$

|

1.45

|

|

$

|

2.94

|

|

$

|

2.66

|

|

$

|

2.40

|

|

||||

|

Diluted net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.18

|

|

0.17

|

|

0.20

|

|

|||||||||

|

Diluted net income per share

|

$

|

3.69

|

|

$

|

1.28

|

|

$

|

3.12

|

|

$

|

2.83

|

|

$

|

2.60

|

|

||||

|

Dividends declared per common share

|

$

|

1.20

|

|

$

|

1.00

|

|

$

|

0.76

|

|

$

|

0.68

|

|

$

|

0.60

|

|

||||

|

Consolidated Balance Sheet Data

|

At July 31,

|

||||||||||||||||||

|

(In millions)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Cash, cash equivalents and investments

|

$

|

1,080

|

|

$

|

1,697

|

|

$

|

1,914

|

|

$

|

1,661

|

|

$

|

744

|

|

||||

|

Long-term investments

|

28

|

|

27

|

|

31

|

|

83

|

|

75

|

|

|||||||||

|

Working capital (deficit)

|

(637

|

)

|

816

|

|

1,200

|

|

1,116

|

|

258

|

|

|||||||||

|

Total assets

|

4,250

|

|

4,968

|

|

5,201

|

|

5,486

|

|

4,684

|

|

|||||||||

|

Short-term debt

|

512

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Long-term debt

|

488

|

|

500

|

|

499

|

|

499

|

|

499

|

|

|||||||||

|

Other long-term obligations

|

146

|

|

172

|

|

166

|

|

135

|

|

135

|

|

|||||||||

|

Total stockholders’ equity

|

1,161

|

|

2,332

|

|

3,078

|

|

3,531

|

|

2,744

|

|

|||||||||

|

•

|

Executive Overview that discusses at a high level our operating results and some of the trends that affect our business.

|

|

•

|

Critical Accounting Policies and Estimates that we believe are important to understanding the assumptions and judgments underlying our financial statements.

|

|

•

|

Results of Operations that includes a more detailed discussion of our revenue and expenses.

|

|

•

|

Liquidity and Capital Resources which discusses key aspects of our statements of cash flows, changes in our balance sheets and our financial commitments.

|

|

•

|

Revenue Recognition

|

|

•

|

Business Combinations

|

|

•

|

Goodwill, Acquired Intangible Assets, and Other Long-Lived Assets – Impairment Assessments

|

|

•

|

Accounting for Share-Based Compensation Plans

|

|

•

|

Legal Contingencies

|

|

•

|

Accounting for Income Taxes

– Estimates of Deferred Taxes, Valuation Allowances, and Uncertain Tax Positions

|

|

(Dollars in millions, except per share amounts)

|

Fiscal

2016

|

Fiscal

2015

|

Fiscal

2014 |

2016-2015

% Change

|

2015-2014

% Change

|

||||||||||||

|

Total net revenue

|

|

$4,694

|

|

|

$4,192

|

|

|

$4,243

|

|

12

|

%

|

(1

|

%)

|

||||

|

Operating income from continuing operations

|

1,242

|

|

738

|

|

1,300

|

|

68

|

%

|

(43

|

%)

|

|||||||

|

Net income from continuing operations

|

806

|

|

413

|

|

853

|

|

95

|

%

|

(52

|

%)

|

|||||||

|

Diluted net income per share from continuing operations

|

|

$3.04

|

|

|

$1.45

|

|

|

$2.94

|

|

110

|

%

|

(51

|

%)

|

||||

|

(Dollars in millions)

|

Fiscal

2016

|

Fiscal

2015

|

Fiscal

2014

|

2016-2015

% Change

|

2015-2014

% Change

|

||||||||||||

|

Product revenue

|

$

|

709

|

|

$

|

709

|

|

$

|

851

|

|

|

|

||||||

|

Service and other revenue

|

1,584

|

|

1,399

|

|

1,307

|

|

|

|

|||||||||

|

Total segment revenue

|

$

|

2,293

|

|

$

|

2,108

|

|

$

|

2,158

|

|

9

|

%

|

(2

|

%)

|

||||

|

% of total revenue

|

49

|

%

|

50

|

%

|

51

|

%

|

|||||||||||

|

Segment operating income

|

$

|

874

|

|

$

|

696

|

|

$

|

852

|

|

26

|

%

|

(18

|

%)

|

||||

|

% of related revenue

|

38

|

%

|

33

|

%

|

39

|

%

|

|

|

|||||||||

|

(Dollars in millions)

|

Fiscal

2016 |

Fiscal

2015 |

Fiscal

2014 |

2016-2015

% Change |

2015-2014

% Change |

||||||||||||

|

Product revenue

|

$

|

226

|

|

$

|

212

|

|

$

|

246

|

|

|

|

||||||

|

Service and other revenue

|

1,747

|

|

1,588

|

|

1,417

|

|

|

|

|||||||||

|

Total segment revenue

|

$

|

1,973

|

|

$

|

1,800

|

|

$

|

1,663

|

|

10

|

%

|

8

|

%

|

||||

|

% of total revenue

|

42

|

%

|

43

|

%

|

39

|

%

|

|||||||||||

|

Segment operating income

|

$

|

1,287

|

|

$

|

1,131

|

|

$

|

1,075

|

|

14

|

%

|

5

|

%

|

||||

|

% of related revenue

|

65

|

%

|

63

|

%

|

65

|

%

|

|

|

|||||||||

|

(Dollars in millions)

|

Fiscal

2016 |

Fiscal

2015 |

Fiscal

2014 |

2016-2015

% Change |

2015-2014

% Change |

||||||||||||

|

Product revenue

|

$

|

354

|

|

$

|

225

|

|

$

|

362

|

|

|

|

||||||

|

Service and other revenue

|

74

|

|

59

|

|

60

|

|

|

|

|||||||||

|

Total segment revenue

|

$

|

428

|

|

$

|

284

|

|

$

|

422

|

|

51

|

%

|

(33

|

%)

|

||||

|

% of total revenue

|

9

|

%

|

7

|

%

|

10

|

%

|

|||||||||||

|

Segment operating income

|

$

|

268

|

|

$

|

108

|

|

$

|

268

|

|

148

|

%

|

(60

|

%)

|

||||

|

% of related revenue

|

62

|

%

|

38

|

%

|

64

|

%

|

|

|

|||||||||

|

(Dollars in millions)

|

Fiscal

2016

|

% of

Related

Revenue

|

Fiscal

2015 |

% of

Related

Revenue

|

Fiscal

2014 |

% of

Related

Revenue

|

||||||||||||||

|

Cost of product revenue

|

$

|

131

|

|

10

|

%

|

$

|

139

|

|

12

|

%

|

$

|

137

|

|

9

|

%

|

|||||

|

Cost of service and other revenue

|

599

|

|

18

|

%

|

556

|

|

18

|

%

|

466

|

|

17

|

%

|

||||||||

|

Amortization of acquired technology

|

22

|

|

n/a

|

|

30

|

|

n/a

|

|

18

|

|

n/a

|

|

||||||||

|

Total cost of revenue

|

$

|

752

|

|

16

|

%

|

$

|

725

|

|

17

|

%

|

$

|

621

|

|

15

|

%

|

|||||

|

(Dollars in millions)

|

Fiscal

2016

|

% of

Total

Net

Revenue

|

Fiscal

2015 |

% of

Total

Net

Revenue

|

Fiscal

2014 |

% of

Total

Net

Revenue

|

||||||||||||||

|

Selling and marketing

|

$

|

1,289

|

|

28

|

%

|

$

|

1,288

|

|

31

|

%

|

$

|

1,157

|

|

28

|

%

|

|||||

|

Research and development

|

881

|

|

19

|

%

|

798

|

|

19

|

%

|

714

|

|

17

|

%

|

||||||||

|

General and administrative

|

518

|

|

11

|

%

|

483

|

|

11

|

%

|

444

|

|

10

|

%

|

||||||||

|

Amortization of other acquired intangible assets

|

12

|

|

—

|

%

|

12

|

|

—

|

%

|

7

|

|

—

|

%

|

||||||||

|

Goodwill and intangible asset impairment charges

|

—

|

|

—

|

%

|

148

|

|

4

|

%

|

—

|

|

—

|

%

|

||||||||

|

Total operating expenses

|

$

|

2,700

|

|

58

|

%

|

$

|

2,729

|

|

65

|

%

|

$

|

2,322

|

|

55

|

%

|

|||||

|

(In millions)

|

Fiscal 2016

|

Fiscal 2015

|

Fiscal 2014

|

||||||||

|

Interest income

|

$

|

3

|

|

$

|

8

|

|

$

|

6

|

|

||

|

Net gains (losses) on executive deferred compensation plan assets

|

—

|

|

3

|

|

6

|

|

|||||

|

Gain on sale of available-for-sale equity security

|

—

|

|

—

|

|

21

|

|

|||||

|

Other

|

(7

|

)

|

(10

|

)

|

(2

|

)

|

|||||

|

Total interest and other income (expense), net

|

$

|

(4

|

)

|

$

|

1

|

|

$

|

31

|

|

||

|

(Dollars in millions)

|

July 31,

2016 |

July 31,

2015 |

$

Change

|

%

Change

|

||||||||||

|

Cash, cash equivalents and investments

|

$

|

1,080

|

|

$

|

1,697

|

|

$

|

(617

|

)

|

(36

|

)%

|

|||

|

Long-term investments

|

28

|

|

27

|

|

1

|

|

4

|

%

|

||||||

|

Short-term debt

|

512

|

|

—

|

|

512

|

|

NM

|

|

||||||

|

Long-term debt

|

488

|

|

500

|

|

(12

|

)

|

(2

|

)%

|

||||||

|

Working capital (deficit)

|

(637

|

)

|

816

|

|

(1,453

|

)

|

NM

|

|

||||||

|

Ratio of current assets to current liabilities

|

0.7 : 1

|

|

1.5 : 1

|

|

|

|

||||||||

|

Fiscal

|

Fiscal

|

Fiscal

|

|||||||||

|

(Dollars in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Net cash provided by (used in):

|

|

|

|

||||||||

|

Operating activities

|

$

|

1,401

|

|

$

|

1,504

|

|

$

|

1,446

|

|

||

|

Investing activities

|

371

|

|

(182

|

)

|

(49

|

)

|

|||||

|

Financing activities

|

(1,940

|

)

|

(1,337

|

)

|

(1,551

|

)

|

|||||

|

Effect of exchange rates on cash and cash equivalents

|

(2

|

)

|

(26

|

)

|

(6

|

)

|

|||||

|

Net decrease in cash and cash equivalents

|

$

|

(170

|

)

|

$

|

(41

|

)

|

$

|

(160

|

)

|

||

|

Payments Due by Period

|

|||||||||||||||||||

|

|

Less than

|

1-3

|

3-5

|

More than

|

|

||||||||||||||

|

(In millions)

|

1 year

|

years

|

years

|

5 years

|

Total

|

||||||||||||||

|

Amounts due under executive deferred compensation plan

|

$

|

69

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

69

|

|

||||

|

Senior unsecured notes

|

500

|

|

—

|

|

—

|

|

—

|

|

500

|

|

|||||||||

|

Unsecured term loan

|

12

|

|

100

|

|

388

|

|

—

|

|

500

|

|

|||||||||

|

Interest and fees due on debt

|

39

|

|

18

|

|

12

|

|

—

|

|

69

|

|

|||||||||

|

License fee payable (1)

|

10

|

|

20

|

|

—

|

|

—

|

|

30

|

|

|||||||||

|

Operating leases (2)

|

60

|

|

108

|

|

94

|

|

176

|

|

438

|

|

|||||||||

|

Purchase obligations (3)

|

29

|

|

32

|

|

—

|

|

—

|

|

61

|

|

|||||||||

|

Total contractual obligations (4)

|

$

|

719

|

|

$

|

278

|

|

$

|

494

|

|

$

|

176

|

|

$

|

1,667

|

|

||||

|

(1)

|

In May 2009 we entered into an agreement to license certain technology for $20 million in cash and $100 million payable over ten fiscal years. See Note 9 to the financial statements in Item 8 of this Annual Report for more information.

|

|

(2)

|

Includes operating leases for facilities and equipment. Amounts do not include $91 million of future sublease income. We had no significant capital leases at

July 31, 2016

. See Note 9 to the financial statements in Item 8 of this Annual Report for more information.

|

|

(3)

|

Represents agreements to purchase products and services that are enforceable, legally binding and specify terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the payments.

|

|

(4)

|

Other long-term obligations on our balance sheet at

July 31, 2016

included non-current income tax liabilities of

$54 million

which related primarily to unrecognized tax benefits. We have not included this amount in the table above because we cannot make a reasonably reliable estimate regarding the timing of settlements with taxing authorities, if any.

|

|

1.

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

INDEX TO FINANCIAL STATEMENT SCHEDULES

|

|

Schedule

|

Page

|

||

|

|

All other schedules not listed above have been omitted because they are inapplicable or are not required.

|

|

|

|

Twelve Months Ended July 31,

|

||||||||||

|

(In millions, except per share amounts)

|

2016

|

2015

|

2014

|

||||||||

|

Net revenue:

|

|

|

|||||||||

|

Product

|

$

|

1,289

|

|

$

|

1,146

|

|

$

|

1,459

|

|

||

|

Service and other

|

3,405

|

|

3,046

|

|

2,784

|

|

|||||

|

Total net revenue

|

4,694

|

|

4,192

|

|

4,243

|

|

|||||

|

Costs and expenses:

|

|

|

|

||||||||

|

Cost of revenue:

|

|

|

|

||||||||

|

Cost of product revenue

|

131

|

|

139

|

|

137

|

|

|||||

|

Cost of service and other revenue

|

599

|

|

556

|

|

466

|

|

|||||

|

Amortization of acquired technology

|

22

|

|

30

|

|

18

|

|

|||||

|

Selling and marketing

|

1,289

|

|

1,288

|

|

1,157

|

|

|||||

|

Research and development

|

881

|

|

798

|

|

714

|

|

|||||

|

General and administrative

|

518

|

|

483

|

|

444

|

|

|||||

|

Amortization of other acquired intangible assets

|

12

|

|

12

|

|

7

|

|

|||||

|

Goodwill and intangible asset impairment charges

|

—

|

|

148

|

|

—

|

|

|||||

|

Total costs and expenses

|

3,452

|

|

3,454

|

|

2,943

|

|

|||||

|

Operating income from continuing operations

|

1,242

|

|

738

|

|

1,300

|

|

|||||

|

Interest expense

|

(35

|

)

|

(27

|

)

|

(31

|

)

|

|||||

|

Interest and other income (expense), net

|

(4

|

)

|

1

|

|

31

|

|

|||||

|

Income from continuing operations before income taxes

|

1,203

|

|

712

|

|

1,300

|

|

|||||

|

Income tax provision

|

397

|

|

299

|

|

447

|

|

|||||

|

Net income from continuing operations

|

806

|

|

413

|

|

853

|

|

|||||

|

Net income (loss) from discontinued operations

|

173

|

|

(48

|

)

|

54

|

|

|||||

|

Net income

|

$

|

979

|

|

$

|

365

|

|

$

|

907

|

|

||

|

Basic net income per share from continuing operations

|

$

|

3.08

|

|

$

|

1.47

|

|

$

|

2.99

|

|

||

|

Basic net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.19

|

|

|||||

|

Basic net income per share

|

$

|

3.73

|

|

$

|

1.30

|

|

$

|

3.18

|

|

||

|

Shares used in basic per share calculations

|

262

|

|

281

|

|

285

|

|

|||||

|

Diluted net income per share from continuing operations

|

$

|

3.04

|

|

$

|

1.45

|

|

$

|

2.94

|

|

||

|

Diluted net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.18

|

|

|||||

|

Diluted net income per share

|

$

|

3.69

|

|

$

|

1.28

|

|

$

|

3.12

|

|

||

|

Shares used in diluted per share calculations

|

265

|

|

286

|

|

291

|

|

|||||

|

Cash dividends declared per common share

|

$

|

1.20

|

|

$

|

1.00

|

|

$

|

0.76

|

|

||

|

|

Twelve Months Ended July 31,

|

||||||||||

|

(In millions)

|

2016

|

2015

|

2014

|

||||||||

|

Net income

|

$

|

979

|

|

$

|

365

|

|

$

|

907

|

|

||

|

Other comprehensive income (loss), net of income taxes:

|

|||||||||||

|

Unrealized gains (losses) on available-for-sale debt securities

|

1

|

|

(1

|

)

|

1

|

|

|||||

|

Unrealized losses on available-for-sale equity security

|

—

|

|

—

|

|

(5

|

)

|

|||||

|

Realized gain reclassified to net income (1)

|

—

|

|

—

|

|

(13

|

)

|

|||||

|

Foreign currency translation losses

|

(3

|

)

|

(27

|

)

|

(5

|

)

|

|||||

|

Total other comprehensive loss, net

|

(2

|

)

|

(28

|

)

|

(22

|

)

|

|||||

|

Comprehensive income

|

$

|

977

|

|

$

|

337

|

|

$

|

885

|

|

||

|

(1)

|

Includes

$21 million

of realized gain on an available-for-sale equity security reclassified into interest and other income (expense), net on the consolidated statements of operations and

$8 million

of related income taxes.

|

|

|

July 31,

|

||||||

|

(Dollars in millions, except par value; shares in thousands)

|

2016

|

2015

|

|||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

638

|

|

$

|

808

|

|

|

|

Investments

|

442

|

|

889

|

|

|||

|

Accounts receivable, net of allowance for doubtful accounts of $51 and $45

|

108

|

|

91

|

|

|||

|

Income taxes receivable

|

20

|

|

84

|

|

|||

|

Deferred income taxes

|

—

|

|

231

|

|

|||

|

Prepaid expenses and other current assets

|

102

|

|

94

|

|

|||

|

Current assets of discontinued operations

|

—

|

|

26

|

|

|||

|

Current assets before funds held for customers

|

1,310

|

|

2,223

|

|

|||

|

Funds held for customers

|

304

|

|

337

|

|

|||

|

Total current assets

|

1,614

|

|

2,560

|

|

|||

|

Long-term investments

|

28

|

|

27

|

|

|||

|

Property and equipment, net

|

1,031

|

|

682

|

|

|||

|

Goodwill

|

1,282

|

|

1,266

|

|

|||

|

Acquired intangible assets, net

|

44

|

|

87

|

|

|||

|

Long-term deferred income taxes

|

139

|

|

5

|

|

|||

|

Other assets

|

112

|

|

106

|

|

|||

|

Long-term assets of discontinued operations

|

—

|

|

235

|

|

|||

|

Total assets

|

$

|

4,250

|

|

$

|

4,968

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Short-term debt

|

$

|

512

|

|

$

|

—

|

|

|

|

Accounts payable

|

184

|

|

190

|

|

|||

|

Accrued compensation and related liabilities

|

289

|

|

283

|

|

|||

|

Deferred revenue

|

801

|

|

691

|

|

|||

|

Other current liabilities

|

161

|

|

150

|

|

|||

|

Current liabilities of discontinued operations

|

—

|

|

93

|

|

|||

|

Current liabilities before customer fund deposits

|

1,947

|

|

1,407

|

|

|||

|

Customer fund deposits

|

304

|

|

337

|

|

|||

|

Total current liabilities

|

2,251

|

|

1,744

|

|

|||

|

Long-term debt

|

488

|

|

500

|

|

|||

|

Long-term deferred revenue

|

204

|

|

152

|

|

|||

|

Other long-term obligations

|

146

|

|

172

|

|

|||

|

Long-term obligations of discontinued operations

|

—

|

|

68

|

|

|||

|

Total liabilities

|

3,089

|

|

2,636

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Stockholders’ equity:

|

|

|

|||||

|

Preferred stock, $0.01 par value

Authorized - 1,345 shares total; 145 shares designated Series A;

250 shares designated Series B Junior Participating

Issued and outstanding - None

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value

Authorized - 750,000 shares

Outstanding - 257,853 shares at July 31, 2016 and 277,706 shares at July 31, 2015

|

3

|

|

3

|

|

|||

|

Additional paid-in capital

|

4,442

|

|

4,007

|

|

|||

|

Treasury stock, at cost

|

(9,939

|

)

|

(7,675

|

)

|

|||

|

Accumulated other comprehensive loss

|

(32

|

)

|

(30

|

)

|

|||

|

Retained earnings

|

6,687

|

|

6,027

|

|

|||

|

Total stockholders’ equity

|

1,161

|

|

2,332

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

4,250

|

|

$

|

4,968

|

|

|

|

|

Common Stock

|

Additional

Paid-In Capital

|

Treasury Stock

|

Accumulated

Other

Comprehensive Income (Loss)

|

Retained Earnings

|

Total

Stockholders’ Equity

|

||||||||||||||

|

(Dollars in millions, shares in thousands)

|

Shares

|

Amount

|

||||||||||||||||||

|

Balance at July 31, 2013

|

299,503

|

|

$

|

3

|

|

$

|

3,198

|

|

$

|

(4,952

|

)

|

$

|

20

|

|

$

|

5,262

|

|

$

|

3,531

|

|

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

(22

|

)

|

907

|

|

885

|

|

||||||

|

Issuance of stock under employee stock plans

|

7,914

|

|

—

|

|

74

|

|

99

|

|

—

|

|

—

|

|

173

|

|

||||||

|

Stock repurchases under stock repurchase programs

|

(22,467

|

)

|

—

|

|

—

|

|

(1,577

|

)

|

—

|

|

—

|

|

(1,577

|

)

|

||||||

|

Dividends and dividend rights declared ($0.76 per share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(220

|

)

|

(220

|

)

|

||||||

|

Tax benefit from share-based compensation plans

|

—

|

|

—

|

|

82

|

|

—

|

|

—

|

|

—

|

|

82

|

|

||||||

|

Share-based compensation expense

|

—

|

|

—

|

|

204

|

|

—

|

|

—

|

|

—

|

|

204

|

|

||||||

|

Balance at July 31, 2014

|

284,950

|

|

3

|

|

3,558

|

|

(6,430

|

)

|

(2

|

)

|

5,949

|

|

3,078

|

|

||||||

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

(28

|

)

|

365

|

|

337

|

|

||||||

|

Issuance of stock under employee stock plans

|

6,565

|

|

—

|

|

107

|

|

—

|

|

—

|

|

—

|

|

107

|

|

||||||

|

Stock repurchases under stock repurchase programs

|

(13,809

|

)

|

—

|

|

—

|

|

(1,245

|

)

|

—

|

|

—

|

|

(1,245

|

)

|

||||||

|

Dividends and dividend rights declared ($1.00 per share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(287

|

)

|

(287

|

)

|

||||||

|

Tax benefit from share-based compensation plans

|

—

|

|

—

|

|

85

|

|

—

|

|

—

|

|

—

|

|

85

|

|

||||||

|

Share-based compensation expense

|

—

|

|

—

|

|

257

|

|

—

|

|

—

|

|

—

|

|

257

|

|

||||||

|

Balance at July 31, 2015

|

277,706

|

|

3

|

|

4,007

|

|

(7,675

|

)

|

(30

|

)

|

6,027

|

|

2,332

|

|

||||||

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

(2

|

)

|

979

|

|

977

|

|

||||||

|

Issuance of stock under employee stock plans

|

4,963

|

|

—

|

|

89

|

|

—

|

|

—

|

|

—

|

|

89

|

|

||||||

|

Stock repurchases under stock repurchase programs

|

(24,816

|

)

|

—

|

|

—

|

|

(2,264

|

)

|

—

|

|

—

|

|

(2,264

|

)

|

||||||

|

Dividends and dividend rights declared ($1.20 per share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(319

|

)

|

(319

|

)

|

||||||

|

Tax benefit from share-based compensation plans

|

—

|

|

—

|

|

59

|

|

—

|

|

—

|

|

—

|

|

59

|

|

||||||

|

Share-based compensation expense

|

—

|

|

—

|

|

287

|

|

—

|

|

—

|

|

—

|

|

287

|

|

||||||

|

Balance at July 31, 2016

|

257,853

|

|

$

|

3

|

|

$

|

4,442

|

|

$

|

(9,939

|

)

|

$

|

(32

|

)

|

$

|

6,687

|

|

$

|

1,161

|

|

|

|

Twelve Months Ended July 31,

|

||||||||||

|

(In millions)

|

2016

|

|

2015

|

|

2014

|

||||||

|

Cash flows from operating activities:

|

|

|

|

||||||||

|

Net income

|

$

|

979

|

|

$

|

365

|

|

$

|

907

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|||||||||

|

Depreciation

|

195

|

|

157

|

|

144

|

|

|||||

|

Amortization of acquired intangible assets

|

43

|

|

74

|

|

53

|

|

|||||

|

Goodwill and intangible asset impairment charges

|

—

|

|

297

|

|

—

|

|

|||||

|

Share-based compensation expense

|

281

|

|

257

|

|

204

|

|

|||||

|

Pre-tax gain on sale of discontinued operations (1)

|

(354

|

)

|

—

|

|

(40

|

)

|

|||||

|

Net realized gain on sale of available-for-sale equity securities

|

—

|

|

—

|

|

(21

|

)

|

|||||

|

Deferred income taxes

|

70

|

|

(100

|

)

|

93

|

|

|||||

|

Tax benefit from share-based compensation plans

|

59

|

|

85

|

|

82

|

|

|||||

|

Excess tax benefit from share-based compensation plans

|

(59

|

)

|

(85

|

)

|

(82

|

)

|

|||||

|

Other

|

17

|

|

4

|

|

24

|

|

|||||

|

Total adjustments

|

252

|

|

689

|

|

457

|

|

|||||

|

Changes in operating assets and liabilities:

|

|

|

|

||||||||

|

Accounts receivable

|

(20

|

)

|

24

|

|

(5

|

)

|

|||||

|

Income taxes receivable

|

64

|

|

(49

|

)

|

27

|

|

|||||

|

Prepaid expenses and other assets

|

(10

|

)

|

22

|

|

(14

|

)

|

|||||

|

Accounts payable

|

(23

|

)

|

35

|

|

15

|

|

|||||

|

Accrued compensation and related liabilities

|

(11

|

)

|

24

|

|

43

|

|

|||||

|

Deferred revenue

|

192

|

|

398

|

|

15

|

|

|||||

|

Other liabilities

|

(22

|

)

|

(4

|

)

|

1

|

|

|||||

|

Total changes in operating assets and liabilities

|

170

|

|

450

|

|

82

|

|

|||||

|

Net cash provided by operating activities

|

1,401

|

|

1,504

|

|

1,446

|

|

|||||

|

Cash flows from investing activities:

|

|

|

|

||||||||

|

Purchases of corporate and customer fund investments

|

(934

|

)

|

(939

|

)

|

(1,334

|

)

|

|||||

|

Sales of corporate and customer fund investments

|

1,165

|

|

620

|

|

346

|

|

|||||

|

Maturities of corporate and customer fund investments

|

187

|

|

475

|

|

567

|

|

|||||

|

Net change in money market funds and other cash equivalents held to satisfy customer fund obligations

|

58

|

|

(49

|

)

|

(54

|

)

|

|||||

|

Net change in customer fund deposits

|

(33

|

)

|

49

|

|

54

|

|

|||||

|

Proceeds from the sale of available-for-sale equity securities

|

—

|

|

—

|

|

26

|

|

|||||

|

Purchases of property and equipment

|

(416

|

)

|

(142

|

)

|

(104

|

)

|

|||||

|

Capitalization of internal use software

|

(106

|

)

|

(119

|

)

|

(82

|

)

|

|||||

|

Acquisitions of businesses, net of cash acquired

|

—

|

|

(95

|

)

|

(471

|

)

|

|||||

|

Proceeds from divestiture of businesses

|

463

|

|

—

|

|

1,025

|

|

|||||

|

Other

|

(13

|

)

|

18

|

|

(22

|

)

|

|||||

|

Net cash provided by (used in) investing activities

|

371

|

|

(182

|

)

|

(49

|

)

|

|||||

|

Cash flows from financing activities:

|

|

|

|

||||||||

|

Proceeds from borrowings under revolving credit facilities

|

995

|

|

—

|

|

—

|

|

|||||

|

Repayments on borrowings under revolving credit facilities

|

(995

|

)

|

—

|

|

—

|

|

|||||

|

Proceeds from long-term debt

|

500

|

|

—

|

|

—

|

|

|||||

|

|

Twelve Months Ended July 31,

|

||||||||||

|

(In millions)

|

2016

|

|

2015

|

|

2014

|

||||||

|

Net proceeds from issuance of stock under employee stock plans

|

89

|

|

107

|

|

165

|

|

|||||

|

Cash paid for purchases of treasury stock

|

(2,264

|

)

|

(1,245

|

)

|

(1,577

|

)

|

|||||

|

Dividends and dividend rights paid

|

(318

|

)

|

(283

|

)

|

(220

|

)

|

|||||

|

Excess tax benefit from share-based compensation plans

|

59

|

|

85

|

|

82

|

|

|||||

|

Other

|

(6

|

)

|

(1

|

)

|

(1

|

)

|

|||||

|

Net cash used in financing activities

|

(1,940

|

)

|

(1,337

|

)

|

(1,551

|

)

|

|||||

|

Effect of exchange rates on cash and cash equivalents

|

(2

|

)

|

(26

|

)

|

(6

|

)

|

|||||

|

Net decrease in cash and cash equivalents

|

(170

|

)

|

(41

|

)

|

(160

|

)

|

|||||

|

Cash and cash equivalents at beginning of period

|

808

|

|

849

|

|

1,009

|

|

|||||

|

Cash and cash equivalents at end of period

|

$

|

638

|

|

$

|

808

|

|

$

|

849

|

|

||

|

Supplemental disclosure of cash flow information:

|

|

|

|

||||||||

|

Interest paid

|

$

|

37

|

|

$

|

32

|

|

$

|

32

|

|

||

|

Income taxes paid

|

$

|

389

|

|

$

|

222

|

|

$

|

240

|

|

||

|

(1)

|

Because the cash flows of our discontinued operations were not material for any period presented, we have not segregated the cash flows of those businesses on these statements of cash flows. We have presented the effect of the pre-tax gains on the disposals on these statements of cash flows. See Note 7,

“Discontinued Operations,”

for more information.

|

|

|

Twelve Months Ended July 31,

|

||||||||||

|

(In millions, except per share amounts)

|

2016

|

2015

|

2014

|

||||||||

|

Numerator:

|

|

|

|||||||||

|

Net income from continuing operations

|

$

|

806

|

|

$

|

413

|

|

$

|

853

|

|

||

|

Net income (loss) from discontinued operations

|

173

|

|

(48

|

)

|

54

|

|

|||||

|

Net income

|

$

|

979

|

|

$

|

365

|

|

$

|

907

|

|

||

|

Denominator:

|

|

|

|

||||||||

|

Shares used in basic per share amounts:

|

|

|

|

||||||||

|

Weighted average common shares outstanding

|

262

|

|

281

|

|

285

|

|

|||||

|

Shares used in diluted per share amounts:

|

|

|

|

||||||||

|

Weighted average common shares outstanding

|

262

|

|

281

|

|

285

|

|

|||||

|

Dilutive common equivalent shares from stock options and restricted stock awards

|

3

|

|

5

|

|

6

|

|

|||||

|

Dilutive weighted average common shares outstanding

|

265

|

|

286

|

|

291

|

|

|||||

|

Basic and diluted net income per share:

|

|

|

|

||||||||

|

Basic net income per share from continuing operations

|

$

|

3.08

|

|

$

|

1.47

|

|

$

|

2.99

|

|

||

|

Basic net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.19

|

|

|||||

|

Basic net income per share

|

$

|

3.73

|

|

$

|

1.30

|

|

$

|

3.18

|

|

||

|

Diluted net income per share from continuing operations

|

$

|

3.04

|

|

$

|

1.45

|

|

$

|

2.94

|

|

||

|

Diluted net income (loss) per share from discontinued operations

|

0.65

|

|

(0.17

|

)

|

0.18

|

|

|||||

|

Diluted net income per share

|

$

|

3.69

|

|

$

|

1.28

|

|

$

|

3.12

|

|

||

|

Weighted average stock options and restricted stock units excluded from

calculation due to anti-dilutive effect

|

2

|

|

2

|

|

—

|

|

|||||

|

•

|

Level 1

uses unadjusted quoted prices that are available in active markets for identical assets or liabilities.

|

|

•

|

Level 2