|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 10-K

|

||

|

x

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the fiscal year ended December 31, 2016

|

|

|

or

|

|

|

¨

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Delaware

|

26-1501877

|

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

|

707 17th Street, Suite 4200, Denver, Colorado

|

80202

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $0.001 per share

|

New York Stock Exchange

|

|

|

Large accelerated filer

¨

|

Accelerated filer

x

|

Non‑accelerated filer

¨

(Do not check if a smaller reporting company) |

Smaller reporting company

¨

|

|

Page

|

||

|

•

|

"Intrepid," "our," "we," or "us" means Intrepid Potash, Inc. and its consolidated subsidiaries.

|

|

•

|

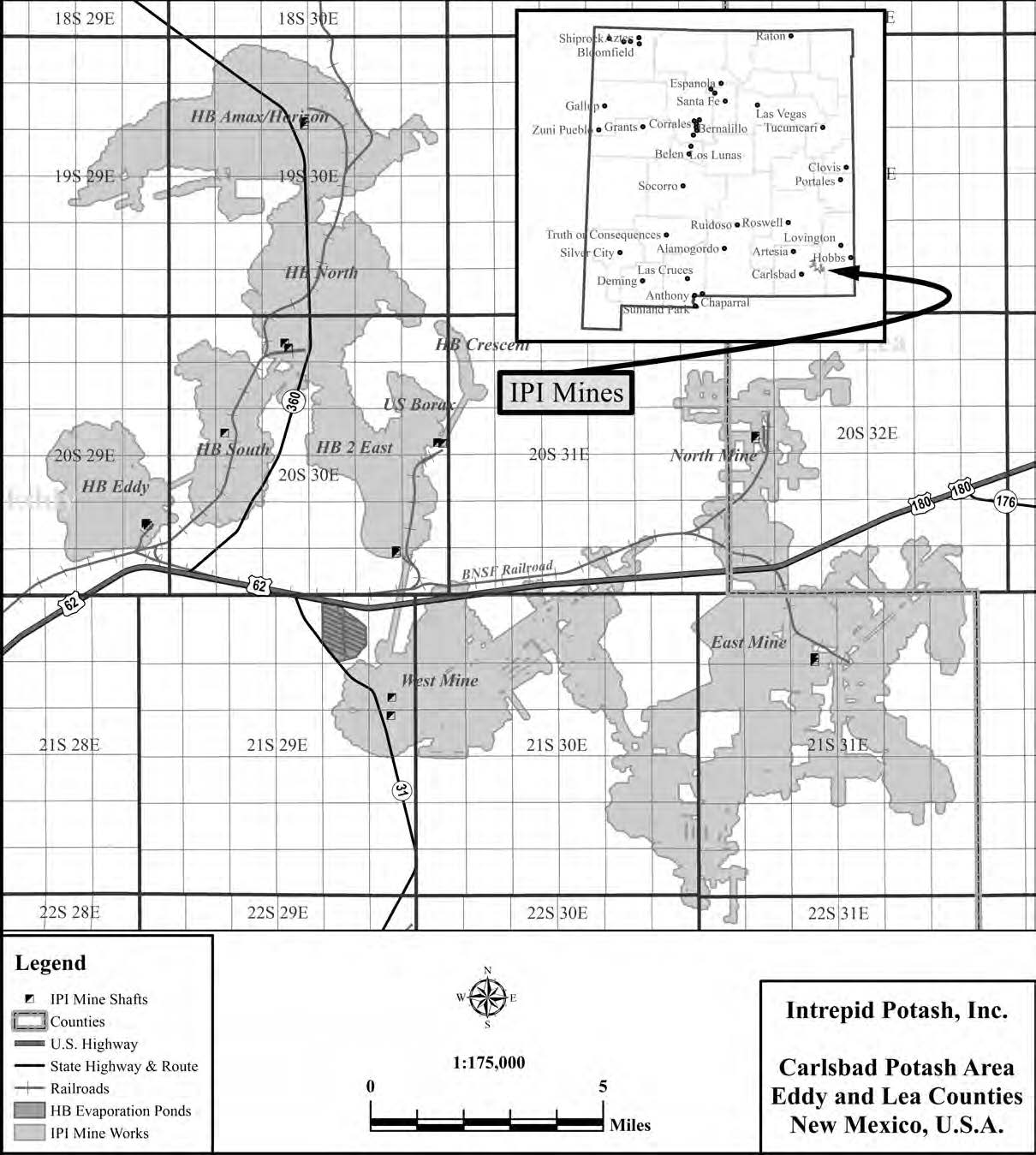

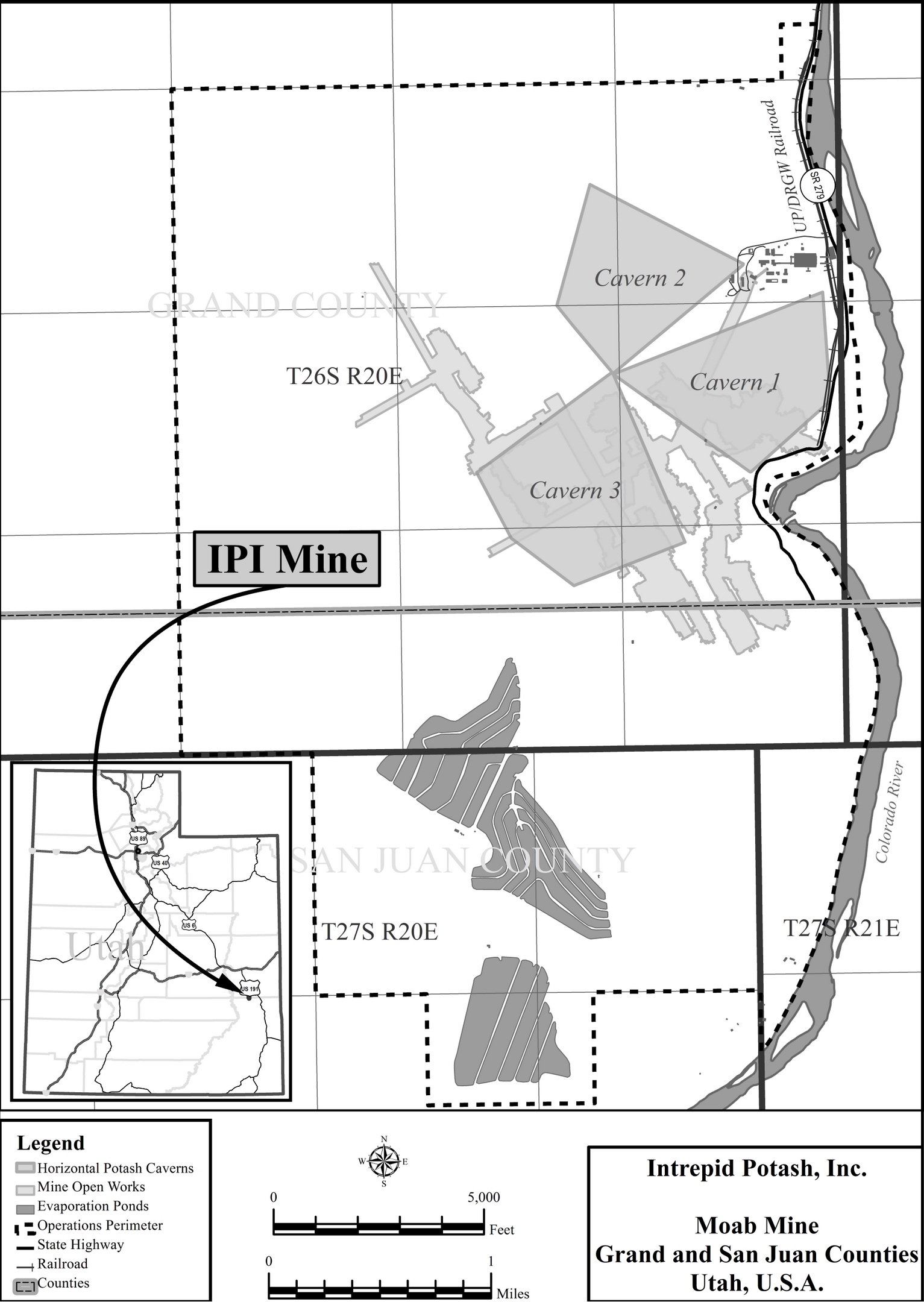

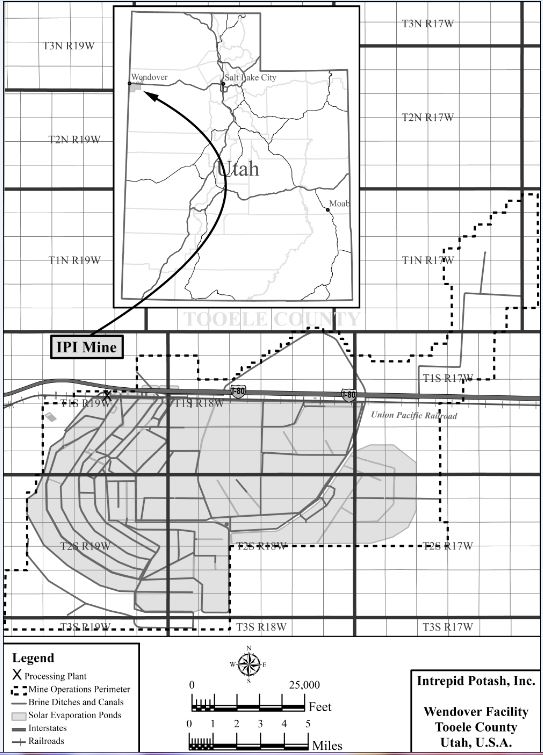

"East," "North," and "HB" mean our three operating facilities in Carlsbad, New Mexico. "Moab" means our operating facility in Moab, Utah. "Wendover" means our operating facility in Wendover, Utah. "West" means our previous operating facility in Carlsbad, New Mexico, which was placed in care-and-maintenance mode in mid‑2016. You can find more information about our facilities in Item 2 of this Annual Report on Form 10-K.

|

|

•

|

"Ton" means a short ton, or a measurement of mass equal to 2,000 pounds.

|

|

ITEM 1.

|

BUSINESS

|

|

Year Ended December 31,

|

|||||||||

|

2016

|

2015

|

2014

|

|||||||

|

Potash

|

76

|

%

|

77

|

%

|

83

|

%

|

|||

|

Trio

®

|

24

|

%

|

23

|

%

|

17

|

%

|

|||

|

•

|

Expanding Trio

®

sales.

Over the long term, we believe demand for Trio

®

will exceed supply, providing an opportunity to increase our gross margin. In light of this opportunity, in mid-2016, we transitioned our East facility to a Trio

®

-only facility, which significantly increased our production rate and our effective production capacity for Trio

®

. We continue our efforts to expand our sales and marketing efforts for Trio

®

, particularly internationally. We operate our East facility at production levels that approximate demand and expect to continue to do so for the foreseeable future.

|

|

•

|

Maximize potash margin.

In 2016, we idled potash production at our West and East conventional mines due in part to declining potash pricing. As a result, all of our potash production now comes from solar solution mines, which carry a lower cost structure than our previous conventional potash mines. With our lower cost structure and lower production, we are able to selectively participate in the markets that provide the highest average net realized sales price per ton. We have the advantage of being located close to the markets we serve, and the North American market is significantly larger than our production capacity. We also attempt to maximize our gross margin by leveraging our freight advantage to key geographies, our diverse customer and market base, and our flexible marketing approach.

|

|

•

|

Expand marketing and sales of by-products and other products.

We are in the process of implementing or considering a number of initiatives designed to maximize the value of our existing assets, such as increased production and sales of salt, water, and brine. In addition, we may enter into new or complementary businesses

|

|

•

|

Optimize potash production.

We have optimization and expansion opportunities at our solution mining facilities that, over time, could reduce our per-ton costs and increase our potash production. For example, we have potential expansion opportunities at our HB mine. Our per-ton costs are lower for solution mining than conventional mining as solution mining requires less labor, energy, and equipment. In addition, if potash prices increase significantly, we could restart potash production at our West mine.

|

|

•

|

Evaluate strategic alternatives.

Under the terms of our senior notes, in December 2016 we engaged Cantor Fitzgerald & Co., a nationally-recognized investment bank, to assess, evaluate, and assist in pursuing potential strategic alternatives available to us, as we determine to be appropriate. These potential strategic alternatives could include, but are not limited to, continuing our current operating plan, equity offerings or balance sheet restructurings, merger and acquisition opportunities, partnership or joint venture opportunities, entering into new or complementary businesses, or a sale of Intrepid or some or all of our assets. This evaluation is ongoing.

|

|

•

|

U.S.-based producer.

We are the only producer of potash in the United States. We are located in a market that consumes significantly more potash than we can produce on an annual basis. Our geographic location provides us with a transportation advantage over our competitors for shipping our product to our customers. In general, this allows us to obtain a higher average net realized sales price per ton than our competitors, who must ship their products across longer distances to consuming markets, which are often export markets. Our location allows us to target sales to the markets in which we have the greatest transportation advantage, maximizing our average net realized sales price per ton. Our access to strategic rail destination points and our location along major agricultural trucking routes support this advantage.

|

|

•

|

Solar evaporation operations.

The HB mine, located in the New Mexico desert, the Moab mine and the Wendover facility, both located in the Utah desert, use solar evaporation to crystallize potash from brines. Solar evaporation is a cost efficient production method because it significantly reduces our labor and energy consumption, which are two of the largest costs of production. Our understanding and application of low cost solution mining, combined with our reserves being located where a favorable climate for evaporation exists, make solar solution mining difficult for other producers to replicate. We also have significant reserves for future expansion of our solution mining operations.

|

|

•

|

Participation in specialty markets.

Given the greater scarcity of langbeinite relative to potash and its agronomic suitability for certain soils and crops, we believe there is a market for Trio

®

outside of our core potash markets. We also believe that there is a market for Trio

®

beyond the United States, and we are working to capture and grow this market. Through our existing operations and assets, we also have the potential to grow our offerings of salt, water, and brine with low capital investments.

|

|

•

|

Diversity of potash markets.

We sell potash into three different markets—the agricultural, industrial, and feed markets. During 2016, these markets represented approximately

89%

,

5%

, and

6%

of our potash sales, respectively. The agricultural market supplies farmers producing a wide range of crops in different geographies. In addition, based on our geographic proximity to increased activity in the oil and gas sector, we believe we have an opportunity to increase our industrial sales volumes to more historical percentages of our total volume.

|

|

•

|

Marketing flexibility.

We have the ability to convert all of our standard-sized potash product into granular-sized product as market conditions warrant. This also provides us with increased marketing flexibility as well as decreased dependence on any one particular market.

|

|

•

|

Significant reserve life and water rights.

Our potash and langbeinite reserves each have substantial years of reserve life, with remaining reserve lives ranging from 16 years to greater than 100 years, based on proven and

|

|

•

|

Existing facilities and infrastructure.

Constructing a new potash production facility requires substantial time and extensive capital investment in mining, milling, and infrastructure to process, store and ship product. Our operating facilities already have significant facilities and infrastructure in place. We also have the ability to expand our business using existing installed infrastructure, in less time and with lower expenditures than would be required to construct entirely new mines. In addition, if potash prices significantly increase, we could restart potash production at our West mine, which has been in care-and-maintenance mode since mid-2016.

|

|

Name

|

Age

|

Position

|

||

|

Robert P. Jornayvaz III

|

58

|

Executive Chairman of the Board, President, and Chief Executive Officer

|

||

|

James N. Whyte

|

58

|

Executive Vice President

|

||

|

Brian D. Frantz

|

54

|

Senior Vice President and Chief Accounting Officer

|

||

|

John G. Mansanti

|

61

|

Senior Vice President of Strategic Initiatives and Technical Services

|

||

|

Margaret E. McCandless

|

44

|

Vice President, General Counsel, and Secretary

|

||

|

Jeffrey C. Blair

|

44

|

Vice President of Sales and Marketing

|

||

|

ITEM 1A.

|

RISK FACTORS

|

|

•

|

it could limit our ability to borrow additional money or sell additional shares of common stock to fund our working capital, capital expenditures, and debt service requirements

|

|

•

|

it could limit our flexibility in planning for, or reacting to, changes in our business

|

|

•

|

we could be more highly leveraged than some of our competitors, which could place us at a competitive disadvantage

|

|

•

|

it could make us more vulnerable to a downturn in our business or the economy

|

|

•

|

it could require us to dedicate a substantial portion of our cash flow from operations to the repayment of our indebtedness, thereby reducing the availability of our cash flow for other purposes

|

|

•

|

it could adversely affect our business and financial condition if we default on or are unable to service our indebtedness or are unable to obtain additional financing, as needed

|

|

•

|

geologic and mining conditions, which may not be fully identified by available exploration data and may differ from our experiences in areas where we currently mine or operate

|

|

•

|

future potash prices, operating costs, capital expenditures, royalties, severance and excise taxes, and development and reclamation costs

|

|

•

|

future mining technology improvements

|

|

•

|

the effects of governmental regulation

|

|

•

|

variations in mineralogy

|

|

•

|

changes in the interpretation of environmental laws

|

|

•

|

modifications to current environmental laws

|

|

•

|

the issuance of more stringent environmental laws

|

|

•

|

malfunctioning process or pollution control equipment

|

|

•

|

factors relating to our evaluation and assessment of potential strategic alternatives

|

|

•

|

our operating performance and the performance of our competitors

|

|

•

|

the public's reaction to our press releases, other public announcements or filings with the SEC

|

|

•

|

changes in earnings estimates or recommendations by research analysts who follow us or other companies in our industry

|

|

•

|

variations in general economic, market, and political conditions

|

|

•

|

changes in certain commodity prices or foreign currency exchange rates

|

|

•

|

actions of our current stockholders, including sales of common stock by our directors and executive officers

|

|

•

|

the arrival or departure of key personnel

|

|

•

|

other developments affecting us, our industry, or our competitors

|

|

•

|

the other risks described in this report

|

|

•

|

our pre-existing stockholders' proportionate ownership interest in us will decrease

|

|

•

|

the relative voting strength of each previously outstanding common share may be diminished

|

|

•

|

the market price of the common stock may decline

|

|

•

|

allow our board of directors to create and issue preferred stock with rights senior to those of our common stock without prior stockholder approval, except as may be required by applicable NYSE rules

|

|

•

|

do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates

|

|

•

|

prohibit stockholders from calling special meetings of stockholders

|

|

•

|

prohibit stockholders from acting by written consent, thereby requiring all stockholder actions to be taken at a meeting of our stockholders

|

|

•

|

require vacancies and newly created directorships on the board of directors to be filled only by affirmative vote of a majority of the directors then serving on the board

|

|

•

|

establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting

|

|

•

|

classify our board of directors so that only some of our directors are elected each year

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

(tons in thousands)

|

|

|

|

Proven

4

|

Probable

7

|

|||||||||||||||||||

|

Product/Operations

|

Date Mine Opened

2

|

Current Extraction Method

|

Minimum Remaining Life (years)

3

|

Recoverable Ore Tons

5

|

Ore Grade

6

(% KCl)

|

Product Tons as KCl

|

Recoverable Ore Tons

5

|

Ore Grade

6

(% KCl)

|

Product Tons as KCl

|

|||||||||||||||

|

Potash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

West

2

|

1931

|

Underground

|

75

|

112,430

|

|

22.9

|

%

|

21,380

|

|

59,920

|

|

22.0

|

%

|

11,070

|

|

|||||||||

|

East

|

1965

|

Underground

|

16

|

25,320

|

|

21.9

|

%

|

4,260

|

|

17,160

|

|

22.5

|

%

|

2,920

|

|

|||||||||

|

HB Mine

2, 9

|

2012

|

Solution

|

40

|

19,180

|

|

36.7

|

%

|

6,430

|

|

2,190

|

|

40.2

|

%

|

800

|

|

|||||||||

|

Moab

|

1965

|

Solution

|

100+

|

30,160

|

|

42.5

|

%

|

12,000

|

|

32,110

|

|

44.0

|

%

|

14,800

|

|

|||||||||

|

Wendover

10

|

1932

|

Brine Evaporation

|

30

|

—

|

|

—

|

|

—

|

|

—

|

|

0.7

|

%

|

3,170

|

|

|||||||||

|

Total Potash

|

|

|

|

|

|

30.2

|

%

|

44,070

|

|

|

|

30.4

|

%

|

32,760

|

|

|||||||||

|

(tons in thousands)

|

Proven

4

|

Probable

7

|

||||||||||||||||||||||

|

Product/Operations

|

Date Mine Opened

2

|

Current Extraction Method

|

Minimum Remaining Life (years)

3

|

Recoverable Ore Tons

5

|

Ore Grade

6

(% Lang)

|

Product Tons as Langbeinite

|

Recoverable Ore Tons

5

|

Ore Grade

6

(% Lang)

|

Product Tons as Langbeinite

|

|||||||||||||||

|

Langbeinite

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

East

8,11

|

1965

|

Underground

|

100+

|

102,880

|

|

26.0

|

%

|

32,060

|

|

79,430

|

|

26.9

|

%

|

24,960

|

|

|||||||||

|

1

|

The determination of estimated reserves has been prepared by us and is based on an independent review and analysis of our mine plans and geologic, financial and other data by Agapito, which is familiar with our mines. The most recent review performed by Agapito for the New Mexico East, West, and HB properties was in 2016. Agapito's analysis for the West, East and HB mines was based on detailed examination of our geologic site data and mine plan, which was updated with information from 2016, 2015, and 2014. As a result of Agapito's 2016 review, sylvite reserves in the West and East mines and the langbeinite reserves in the East mine decreased compared to previously reported reserves. The reduction was primarily due to an increased economic cut-off grade for both sylvite and langbeinite ore reserves and for depletion for the 2016 production from both mines. The HB mine reserve estimate decreased due to depletion for 2016 production from the HB mine. The Moab property reserves are based on Agapito's 2015 mine reserve estimate adjusted for depletion for the 2016 production. The Wendover property reserves are based on Agapito's 2015 brine aquifer reserve estimate. However, depletion did not change the reserve life of 30 years as discussed in footnote 3 below. Because reserves are estimates, they cannot be audited for the purpose of verifying exactness. Instead, reserve information was reviewed in sufficient detail to determine if, in the aggregate, the data provided by us is reasonable and sufficient to estimate reserves in conformity with practices and standards generally employed by, and within the mining industry, and that are consistent with the requirements of U.S. securities laws.

|

|

2

|

These mines, excluding the HB and West mines, have operated in a substantially continuous manner since the dates set forth in this table. The HB mine was originally opened in 1934 and operated continuously as an underground mine until 1996. In July 2016, we transitioned our West facility into care-and-maintenance mode due to the decline in potash prices.

|

|

3

|

Minimum remaining lives are calculated by dividing reserves by annual effective capacity. Effective capacity is the estimated amount of production that will likely be achieved based on the amount and quality of ore that we estimate can be mined, milled, and/or processed, assuming an estimated average reserve grade, potential future modifications to the systems, a normal amount of scheduled down time, average or typical mine development efforts and operation of all of our mines and facilities at or near full capacity. Minimum remaining lives at the West, East, HB mine, and Moab mines are based on reserves (product tons) divided by annual effective capacity over the full expected life of the ore body, and corrections for purity: one ton of red muriate of potash equals 0.95 ton of KCl; one ton of Moab white muriate of potash equals 0.97 ton of KCl; one ton of sulfate of potash magnesia equals 0.97 ton of langbeinite. East langbeinite minimum remaining life was based on a langbeinite-only plant and associated plant capacity. Langbeinite-only production commenced in April 2016 at the East facility and the sylvite plant was shut down at that time. The West facility was shut down and placed into care-and-maintenance mode in July 2016 due to low potash prices. If we decided to produce potash from our East and West mine sylvite ore reserves in the future, we expect that we would reopen the West facility and be required to construct a new plant to replace the East sylvite plant closed in 2016 to process the remaining reserves. Calculated mine lives that exceed 100 years are reported at 100+ years to balance the reserve life with the uncertainties associated with those extended time frames. We

|

|

4

|

Generally, "proven reserves" are reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling, and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well-defined that the size, shape, and depth and mineral content of the reserves are well-established. Proven reserve tonnages are computed from projection of data using the inverse distance squared method taking into account mining dilution, mine extraction efficiency, ore body impurities, metallurgical recovery factors, sales prices and operating costs from potash ore zone measurements as observed and recorded either in drill holes using cores, or channel samples in mine workings. This classification has the highest degree of geologic assurance. The data points for measurement are adequately spaced and the geologic character so well defined that the thickness, areal extent, size, shape, and depth of the potash ore zone are well-established. The maximum acceptable distance for projection from ore zone data points varies with the geologic nature of the ore zone being studied.

|

|

5

|

Recovery is the percentage of valuable material in the ore that is beneficiated prior to further treatment to develop a saleable product. Recoverable ore tons is defined as the hoisted ore for the conventionally mined ore in our East and West mines. This figure was derived from the in-place ore estimate that has been adjusted for factors such as geologic impurities and mine extraction ratios. For the HB mine and the Moab property, recoverable ore tons are defined as the potassium that can be extracted from the underground workings and pumped to the surface. This figure was derived from the in-place ore estimate that has been adjusted for factors such as geologic impurities, potash that dissolves but remains in the cavern (dissolution factor), and an extraction factor that accounts for potash that may not be recovered because solution may be channeled away or stranded due to cavern geometry. We do not calculate recoverable ore tons for the Wendover property as it is a lake brine resource, not an in-place ore deposit.

|

|

6

|

Ore grade expressed as expected mill feed grade to account for minimum mining height for the East and West mines. Potash ore grade is reported in % KCl and langbeinite ore grade is reported in % langbeinite. The ore grade for the Moab and HB mines is the in-place KCl grade.

|

|

7

|

"Probable reserves" are reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance of probable (indicated) reserves, although lower than that for proven (measured) reserves, is high enough to assume geological continuity between points of observation. The classification of minerals as probable reserves requires that we believe with reasonable certainty that access to the reserves can be obtained, even though currently-issued permits are not required. Probable reserve tonnages are computed by projection of data using the inverse distance squared method taking into account mining dilution, mine extraction efficiency, ore body impurities, metallurgical recovery factors, sales prices and operating costs from available ore zone measurements as observed either in drill holes using cores or in mine workings for a distance beyond potash classified as proven reserves. This classification has a moderate degree of geological assurance.

|

|

8

|

Our reserves in the 1

st

, 3

rd

, 4

th

, 7

th

, 8

th

and 10

th

ore zones contain either sylvite (KCl) or langbeinite (K

2

SO

4

(MgSO

4

)

2

) separately. Ore reserves in the East 5

th

ore zone contain both sylvite and langbeinite which we call mixed ore. We ceased processing sylvite at the East facility in April 2016, and only the langbeinite ore contained in the East 5

th

ore zone is included in the mine reserve estimate. Additionally, the reserve amounts include West mine 3

rd

and 4

th

ore zones which contain langbeinite that we anticipate will be processed at the East facility.

|

|

9

|

The HB mine reserves were based on solution mining of old workings and recovery of potash from the residual pillars. Reserves are based on thicknesses, grades, and mine maps provided by us. The data presented here includes reserves available via the AMAX/Horizon mine as further described below under

Our Development Assets

.

|

|

10

|

The Wendover facility reserves are the combination of a shallow and a deep aquifer. There were no proven reserves reported for either aquifer because the shallow aquifer represents an unconventional resource and there is uncertainty of the hydrogeology of the deep aquifer. The estimating method for the shallow aquifer was based on brine concentration, brine density, soil porosity within the aquifer, and aquifer thickness from historical reports. The brine concentrations and brine density were confirmed by us recently, but values for the aquifer thickness and the porosity were obtained from literature published by other sources. Probable reserves for the shallow brine at the Wendover facility were calculated from KCl contained in the shallow aquifer based on estimates of porosity and thickness over the reserve area. The distance for projection of probable reserves is a radius of three‑quarters of a mile from points of measurement of brine concentration. Probable reserves for the deep-brine aquifer were estimated based on historical draw-down and KCl brine concentrations. The ore grade (% KCl) for both the shallow and deep aquifer is the percentage by weight of KCl in the brine.

|

|

11

|

A portion of these reserves are within the West mine boundary. The classification of the reserve as being associated with the East mine is a result of where the ore is intended to be processed.

|

|

•

|

The HB mine has a current estimated productive capacity of 180,000 tons annually. The productive capacity may vary between approximately 160,000 and 200,000 tons of potash. Potash produced from our HB mine is shipped to the North facility for compaction.

|

|

•

|

Potash ore at Moab is mined from two stacked ore zones: the original mine workings in Potash 5 and the horizontal caverns in Potash 9.

|

|

•

|

The Moab mine has a current estimated productive capacity of approximately 110,000 tons of potash annually; evaporation rates have historically varied and, consequently, productive capacity may vary between approximately 75,000 and 120,000 tons of potash.

|

|

•

|

Potash at Wendover is produced primarily from brine containing salt, potash, and magnesium chloride that is collected in ditches from the shallow aquifers of the West Desert. These materials are also collected from a deeper aquifer by means of deep-brine wells.

|

|

•

|

The Wendover facility has a current estimated productive capacity of approximately 100,000 tons of potash annually; evaporation rates have historically resulted in actual production between approximately 65,000 and 100,000 tons of potash.

|

|

•

|

Sylvite and langbeinite ore at our Carlsbad locations is mined from a stacked ore body containing at least 10 different mineralized zones, seven of which contain proven and probable reserves.

|

|

•

|

The West mine was idled in July 2016 and placed in care-and-maintenance mode. When operational, it has an estimated productive capacity of approximately 400,000 tons of red potash annually. Potash produced from our West mine is shipped to the North facility for compaction.

|

|

•

|

The East mine was converted to a Trio

®

-only operation in April 2016 and potash is no longer produced from the East mine. The Trio

®

productive capacity of the East mine increased in 2016 as a result of transition to a Trio

®

‑only operation. The East mine has a current estimated productive capacity of approximately 400,000 tons of Trio

®

annually, based on current design.

|

|

•

|

The North facility receives compactor feed from the West, when operating, and HB facilities via truck and converts the compactor feed to finished granular-sized product and standard-sized product.

|

|

•

|

We acquired the potash leases associated with the AMAX/Horizon mine in October 2012. The AMAX/Horizon mine was in continuous operation between 1952 and 1993. This mine, similar to the HB mine, is a viable candidate for solution mining in a manner that is consistent with the HB mine.

|

|

•

|

State and federal permits were obtained in 2015 to utilize these leases for solution mining. The AMAX/Horizon solution mine is expected to utilize the same evaporation ponds and processing mill as the HB mine. We have not yet made a determination to proceed with this potential development project; however, future work may be performed to determine the ability to convert this idled underground mine to a solution mining opportunity.

|

|

•

|

As noted in footnote 9 to Our Proven and Probable Reserves table, these tons are included in the data presented for the HB Mine.

|

|

•

|

The North mine operated from 1957 to 1982 when it was idled mainly due to low potash prices and mineralogy changes which negatively impacted mineral processing at the facilities. Although the mining and processing equipment has been removed, the mine shafts remain open. The compaction facility at the North mine is where we granulate, store, and ship potash produced at the HB mine (and previously the West mine). Two abandoned mine shafts, rail access, storage facilities, water rights, utilities and leases covering potash deposits, are already in place. As part of our long-term mine planning efforts, we may choose to evaluate our strategic development options with respect to the shafts at the North mine and their access to mineralized deposits of potash.

|

|

(tons in thousands)

|

Year Ended December 31,

|

||||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||

|

Ore Production

|

Mill Feed Grade

1

|

Finished Product

|

Ore Production

|

Mill Feed Grade

1

|

Finished Product

|

Ore Production

|

Mill Feed Grade

1

|

Finished Product

|

|||||||||||||||||||

|

Potash

|

|||||||||||||||||||||||||||

|

West

|

1,425

|

|

11.9

|

%

|

191

|

|

2,532

|

|

11.1

|

%

|

322

|

|

2,991

|

|

10.9

|

%

|

352

|

|

|||||||||

|

East

2

|

1,935

|

|

7.9

|

%

|

32

|

|

2,368

|

|

7.8

|

%

|

145

|

|

2,535

|

|

8.8

|

%

|

217

|

|

|||||||||

|

HB

|

587

|

|

16.1

|

%

|

124

|

|

695

|

|

14.9

|

%

|

134

|

|

623

|

|

14.3

|

%

|

98

|

|

|||||||||

|

Moab

|

429

|

|

16.6

|

%

|

97

|

|

411

|

|

16.0

|

%

|

93

|

|

457

|

|

14.9

|

%

|

95

|

|

|||||||||

|

Wendover

|

239

|

|

16.3

|

%

|

49

|

|

379

|

|

16.2

|

%

|

74

|

|

462

|

|

17.2

|

%

|

97

|

|

|||||||||

|

4,615

|

|

493

|

|

6,385

|

|

768

|

|

7,068

|

|

859

|

|

||||||||||||||||

|

Langbeinite

|

|||||||||||||||||||||||||||

|

East

2

|

1,935

|

|

6.2

|

%

|

279

|

|

2,368

|

|

4.7

|

%

|

162

|

|

2,535

|

|

4.3

|

%

|

160

|

|

|||||||||

|

Total Primary Products

|

772

|

|

930

|

|

1,019

|

|

|||||||||||||||||||||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

High

|

Low

|

||

|

2016

|

|||

|

Quarter ended December 31, 2016

|

$3.04

|

$0.93

|

|

|

Quarter ended September 30, 2016

|

$1.68

|

$1.05

|

|

|

Quarter ended June 30, 2016

|

$1.83

|

$0.85

|

|

|

Quarter ended March 31, 2016

|

$3.26

|

$0.65

|

|

|

2015

|

|||

|

Quarter ended December 31, 2015

|

$7.14

|

$2.63

|

|

|

Quarter ended September 30, 2015

|

$12.02

|

$5.35

|

|

|

Quarter ended June 30, 2015

|

$13.24

|

$10.85

|

|

|

Quarter ended March 31, 2015

|

$15.09

|

$10.92

|

|

|

Dow Jones U.S.

|

|||||||||||||||

|

IPI

|

Peer Group

|

S&P 500

|

Basic Materials

|

||||||||||||

|

December 31, 2011

|

$

|

100.00

|

|

$

|

100.00

|

|

$

|

100.00

|

|

$

|

100.00

|

|

|||

|

December 31, 2012

|

$

|

94.84

|

|

$

|

112.92

|

|

$

|

116.00

|

|

$

|

110.49

|

|

|||

|

December 31, 2013

|

$

|

70.56

|

|

$

|

95.41

|

|

$

|

153.57

|

|

$

|

133.00

|

|

|||

|

December 31, 2014

|

$

|

61.83

|

|

$

|

98.63

|

|

$

|

174.60

|

|

$

|

137.51

|

|

|||

|

December 31, 2015

|

$

|

13.14

|

|

$

|

62.32

|

|

$

|

177.01

|

|

$

|

120.42

|

|

|||

|

December 31, 2016

|

$

|

9.27

|

|

$

|

67.97

|

|

$

|

198.18

|

|

$

|

144.83

|

|

|||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

Sales

|

$

|

210,948

|

|

$

|

287,183

|

|

$

|

410,389

|

|

$

|

336,312

|

|

$

|

451,316

|

|

|||||

|

Net (loss) Income

|

$

|

(66,633

|

)

|

$

|

(524,776

|

)

|

$

|

9,761

|

|

$

|

22,275

|

|

$

|

87,443

|

|

|||||

|

(Loss) Earnings Per Share:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic

|

$

|

(0.88

|

)

|

$

|

(6.94

|

)

|

$

|

0.13

|

|

$

|

0.30

|

|

$

|

1.16

|

|

|||||

|

Diluted

|

$

|

(0.88

|

)

|

$

|

(6.94

|

)

|

$

|

0.13

|

|

$

|

0.30

|

|

$

|

1.16

|

|

|||||

|

Cash dividends declared and paid per common share

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

0.75

|

|

|||||

|

December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

Total assets

|

$

|

540,901

|

|

$

|

639,969

|

|

$

|

1,166,119

|

|

$

|

1,174,590

|

|

$

|

994,623

|

|

|||||

|

Total debt

|

$

|

133,434

|

|

$

|

149,485

|

|

$

|

149,402

|

|

$

|

149,318

|

|

$

|

—

|

|

|||||

|

December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

Cash, cash equivalents and investments

|

$

|

4,464

|

|

$

|

63,629

|

|

$

|

89,879

|

|

$

|

25,113

|

|

$

|

57,747

|

|

|||||

|

Stockholders' equity

|

$

|

363,371

|

|

$

|

426,526

|

|

$

|

947,285

|

|

$

|

933,971

|

|

$

|

905,736

|

|

|||||

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

|

|

(in thousands)

|

Year Ended December 31,

|

|||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

Sales

|

$

|

210,948

|

|

$

|

287,183

|

|

$

|

410,389

|

|

|||

|

Cost of goods sold

2

|

$

|

170,852

|

|

$

|

217,821

|

|

$

|

303,914

|

|

|||

|

Gross (Deficit) Margin

|

$

|

(29,247

|

)

|

$

|

(15,477

|

)

|

$

|

42,004

|

|

|||

|

Net (Loss) Income

|

$

|

(66,633

|

)

|

$

|

(524,776

|

)

|

$

|

9,761

|

|

|||

|

Production volume (in thousands of tons):

|

|||||||||

|

Potash

|

493

|

|

768

|

|

859

|

|

|||

|

Langbeinite

|

279

|

|

162

|

|

160

|

|

|||

|

Sales volume (in thousands of tons):

|

|||||||||

|

Potash

|

681

|

|

587

|

|

915

|

|

|||

|

Trio

®

|

146

|

|

163

|

|

182

|

|

|||

|

Average Net Realized Sales Price per Ton

1

|

||||||||||||

|

Potash

|

$

|

195

|

|

$

|

339

|

|

$

|

332

|

|

|||

|

Trio

®

|

$

|

287

|

|

$

|

364

|

|

$

|

349

|

|

|||

|

Year Ended December 31,

|

||||||||||||

|

(in thousands)

|

2016

|

2015

|

2014

|

|||||||||

|

Sales

|

$

|

159,494

|

|

$

|

217,467

|

|

$

|

334,323

|

|

|||

|

Less: Freight costs

|

26,661

|

|

18,262

|

|

30,615

|

|

||||||

|

Warehousing and handling costs

|

8,439

|

|

11,213

|

|

10,742

|

|

||||||

|

Cost of goods sold

4

|

134,017

|

|

172,355

|

|

254,753

|

|

||||||

|

Lower-of-cost-or-market inventory adjustments

|

18,380

|

|

31,772

|

|

8,186

|

|

||||||

|

Costs associated with abnormal production and other

|

649

|

|

10,405

|

|

—

|

|

||||||

|

Gross (Deficit) Margin

|

$

|

(28,652

|

)

|

$

|

(26,540

|

)

|

$

|

30,027

|

|

|||

|

Depreciation, depletion and amortization incurred

2, 3

|

$

|

37,936

|

|

$

|

68,562

|

|

$

|

67,712

|

|

|||

|

Sales Volumes (tons in thousands)

|

681

|

|

587

|

|

915

|

|

||||||

|

Production Volumes (tons in thousands)

|

493

|

|

768

|

|

859

|

|

||||||

|

Average Net Realized Sales Price per Ton

1

|

$

|

195

|

|

$

|

339

|

|

$

|

332

|

|

|||

|

Year Ended December 31,

|

|||||||||

|

|

2016

|

2015

|

2014

|

||||||

|

Agricultural

|

89

|

%

|

75

|

%

|

76

|

%

|

|||

|

Industrial

|

5

|

%

|

17

|

%

|

19

|

%

|

|||

|

Feed

|

6

|

%

|

8

|

%

|

5

|

%

|

|||

|

Year Ended December 31,

|

||||||||||||

|

(in thousands)

|

2016

|

2015

|

2014

|

|||||||||

|

Sales

|

$

|

51,454

|

|

$

|

69,716

|

|

$

|

76,066

|

|

|||

|

Less: Freight costs

|

9,595

|

|

10,461

|

|

12,608

|

|

||||||

|

Warehousing and handling costs

|

2,567

|

|

2,726

|

|

2,320

|

|

||||||

|

Cost of goods sold

|

36,835

|

|

45,466

|

|

49,161

|

|

||||||

|

Lower-of-cost-or-market inventory adjustments

|

1,994

|

|

—

|

|

—

|

|

||||||

|

Costs associated with abnormal production and other

|

1,058

|

|

—

|

|

—

|

|

||||||

|

Gross (Deficit) Margin

|

$

|

(595

|

)

|

$

|

11,063

|

|

$

|

11,977

|

|

|||

|

Depreciation, depletion and amortization incurred

2, 3

|

$

|

3,836

|

|

$

|

16,993

|

|

$

|

11,433

|

|

|||

|

Sales Volumes (tons in thousands)

|

146

|

|

163

|

|

182

|

|

||||||

|

Production Volumes (tons in thousands)

|

279

|

|

162

|

|

160

|

|

||||||

|

Average Net Realized Sales Price per Ton

1

|

$

|

287

|

|

$

|

364

|

|

$

|

349

|

|

|||

|

Trio

®

only

|

United States

|

Export

|

||||

|

For the year ended December 31, 2016

|

94

|

%

|

6

|

%

|

||

|

For the year ended December 31, 2015

|

91

|

%

|

9

|

%

|

||

|

For the year ended December 31, 2014

|

91

|

%

|

9

|

%

|

||

|

Year ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

(In thousands)

|

||||||||||||

|

Cash flows (used in) provided by operating activities

|

$

|

(18,270

|

)

|

$

|

22,690

|

|

$

|

127,486

|

|

|||

|

Cash flows provided by (used in) investing activities

|

$

|

32,510

|

|

$

|

(79,577

|

)

|

$

|

(59,624

|

)

|

|||

|

Cash flows used in financing activities

|

$

|

(19,083

|

)

|

$

|

(1,395

|

)

|

$

|

(667

|

)

|

|||

|

•

|

$54 million of Senior Notes, Series A, due April 16, 2020

|

|

•

|

$40.5 million of Senior Notes, Series B, due April 14, 2023

|

|

•

|

$40.5 million of Senior Notes, Series C, due April 16, 2025

|

|

•

|

The agreement includes a minimum adjusted EBITDA covenant, which adjusts over time and is measured quarterly through March 2018, ranging from negative $20 million in the quarter ended September 30, 2016, to negative $7.5 million in the quarter ending March 31, 2018. Adjusted EBITDA is a non-GAAP measure that is calculated as adjusted earnings before interest, income taxes, depreciation, amortization, and certain other expenses for the prior four quarters, as defined under the agreement.

|

|

•

|

The agreement requires us to maintain a minimum fixed charge coverage amount of negative $15 million and negative $10 million for the quarters ending June 30, 2018, and September 30, 2018, respectively. The agreement includes requirements relating to a leverage ratio and a fixed charge coverage ratio to be tested on a quarterly basis commencing with the quarter ending June 30, 2018, with respect to the leverage ratio, and December 31, 2018, with respect to the fixed charge coverage ratio. The maximum leverage ratio will be 11.5 to 1.0 for the quarter ending June 30, 2018, and decreases to 3.5 to 1.0 for the quarter ending September 30, 2019, and each quarter thereafter. The minimum fixed charge coverage ratio will be 0.25 to 1.0 for the quarter ending December 31, 2018, and increases to 1.3 to 1.0 for the quarter ending September 30, 2019, and each quarter thereafter. In general, our minimum fixed charge coverage is calculated as adjusted EBITDA for the prior four quarters, minus maintenance capital expenditures, cash paid for income taxes and interest expense, plus scheduled principal amortization of long-term funded indebtedness; our leverage ratio is calculated as the ratio of funded indebtedness to adjusted EBITDA for the prior four quarters, and our fixed charge coverage ratio is calculated as the ratio of adjusted EBITDA for the prior four quarters, minus maintenance capital expenditures and cash paid for income taxes, to interest expense plus scheduled principal amortization of long-term funded indebtedness.

|

|

•

|

The interest rates for the Notes increased by 4.5% above the previous rates such that, as of December 31, 2016, the Series A Senior Notes bear interest at 7.73%, the Series B Senior Notes bear interest at 8.63%, and the Series C Senior Notes bear interest at 8.78%, which reflect the highest rates in a pricing grid. These interest rates are based on a pricing grid set forth in the revised agreement and will be adjusted quarterly based upon our financial performance and certain financial covenant levels. In addition, additional interest of 2%, which may be paid in kind, will begin to accrue on April 1, 2018, unless we satisfy certain financial covenant tests.

|

|

•

|

We are required to make certain offers to prepay the Notes with the proceeds of dispositions of certain specified property and with the proceeds of certain equity issuances, as set forth in the agreement.

|

|

December 31,

|

|||||||

|

2016

|

2015

|

||||||

|

Senior Notes

|

$

|

135,000

|

|

$

|

150,000

|

|

|

|

Less deferred financing costs

|

(1,566

|

)

|

(515

|

)

|

|||

|

Long-term debt, net

|

$

|

133,434

|

|

$

|

149,485

|

|

|

|

Payments Due By Period

|

||||||||||||||||||||||||||||

|

Total

|

2017

|

2018

|

2019

|

2020

|

2021

|

More Than 5 Years

|

||||||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||||||

|

Long-term debt

|

$

|

135,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

54,000

|

|

$

|

—

|

|

$

|

81,000

|

|

|||||||

|

Variable rate interest obligations on long-term debt

1

|

67,553

|

|

11,225

|

|

11,225

|

|

11,225

|

|

9,138

|

|

7,051

|

|

17,689

|

|

||||||||||||||

|

Operating lease obligations

2

|

8,236

|

|

3,175

|

|

2,598

|

|

809

|

|

548

|

|

230

|

|

876

|

|

||||||||||||||

|

Purchase commitments

3

|

4,065

|

|

4,065

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Asset retirement obligation

4

|

59,323

|

|

35

|

|

1,622

|

|

—

|

|

1,000

|

|

1,325

|

|

55,341

|

|

||||||||||||||

|

Minimum royalty payments

5

|

15,867

|

|

635

|

|

635

|

|

635

|

|

635

|

|

635

|

|

12,692

|

|

||||||||||||||

|

Total

|

$

|

290,044

|

|

$

|

19,135

|

|

$

|

16,080

|

|

$

|

12,669

|

|

$

|

65,321

|

|

$

|

9,241

|

|

$

|

167,598

|

|

|||||||

|

1

|

See "Senior Notes" section above for more detail on the variable rate interest associated with our long-term debt. Amounts in the table above represent interest calculated at rates in effect as of December 31, 2016.

|

|

2

|

Amounts include all operating lease payments, inclusive of sales tax, for leases for office space, an airplane, railcars, and other equipment.

|

|

3

|

Purchase contractual commitments include the approximate amount due to vendors for non-cancelable purchase commitments for materials and services.

|

|

4

|

We are obligated to reclaim and remediate lands that our operations have disturbed, but, because of the long-term nature of our reserves and facilities, we estimate that the majority of those expenditures will not be required until after 2021. Although our reclamation obligation activities are not required to begin until after we cease operations, we anticipate certain activities to occur prior to then related to reclamation of facilities that have been replaced with newly constructed assets, as well as certain shaft closure activities for shafts that are no longer in use. Commitments shown are in today's dollars and are undiscounted.

|

|

5

|

Estimated annual minimum royalties due under mineral leases, assuming approximately a 25-year life, consistent with estimated useful lives of plant assets.

|

|

•

|

significant underperformance relative to expected operating results or operating losses

|

|

•

|

significant changes in the manner of use of assets or the strategy for our overall business

|

|

•

|

the denial or delay of necessary permits or approvals that would affect the utilization of our tangible assets

|

|

•

|

underutilization of our tangible assets

|

|

•

|

discontinuance of certain products by us or our customers

|

|

•

|

a decrease in estimated mineral reserves

|

|

•

|

significant negative industry or economic trends

|

|

Year Ended December 31, 2016

|

||||||||||||

|

Potash

|

Trio

®

|

Total

|

||||||||||

|

Sales

|

$

|

159,494

|

|

$

|

51,454

|

|

$

|

210,948

|

|

|||

|

Freight costs

|

26,661

|

|

9,595

|

|

36,256

|

|

||||||

|

Subtotal

|

$

|

132,833

|

|

$

|

41,859

|

|

$

|

174,692

|

|

|||

|

Divided by:

|

||||||||||||

|

Tons sold (in thousands)

|

681

|

|

146

|

|

||||||||

|

Average net realized sales price per ton

|

$

|

195

|

|

$

|

287

|

|

||||||

|

Year Ended December 31, 2015

|

||||||||||||

|

Potash

|

Trio

®

|

Total

|

||||||||||

|

Sales

|

$

|

217,467

|

|

$

|

69,716

|

|

$

|

287,183

|

|

|||

|

Freight costs

|

18,262

|

|

10,461

|

|

28,723

|

|

||||||

|

Subtotal

|

$

|

199,205

|

|

$

|

59,255

|

|

$

|

258,460

|

|

|||

|

Divided by:

|

||||||||||||

|

Tons sold (in thousands)

|

587

|

|

163

|

|

||||||||

|

Average net realized sales price per ton

|

$

|

339

|

|

$

|

364

|

|

||||||

|

Year Ended December 31, 2014

|

||||||||||||

|

Potash

|

Trio

®

|

Total

|

||||||||||

|

Sales

|

$

|

334,323

|

|

$

|

76,066

|

|

$

|

410,389

|

|

|||

|

Freight costs

|

30,615

|

|

12,608

|

|

43,223

|

|

||||||

|

Subtotal

|

$

|

303,708

|

|

$

|

63,458

|

|

$

|

367,166

|

|

|||

|

Divided by:

|

||||||||||||

|

Tons sold (in thousands)

|

915

|

|

182

|

|

||||||||

|

Average net realized sales price per ton

|

$

|

332

|

|

$

|

349

|

|

||||||

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

December 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

$

|

4,464

|

|

$

|

9,307

|

|

||

|

Short-term investments

|

—

|

|

50,523

|

|

||||

|

Accounts receivable:

|

||||||||

|

Trade, net

|

10,343

|

|

9,743

|

|

||||

|

Other receivables, net

|

492

|

|

1,470

|

|

||||

|

Refundable income taxes

|

1,379

|

|

315

|

|

||||

|

Inventory, net

|

94,355

|

|

106,531

|

|

||||

|

Other current assets

|

12,710

|

|

17,826

|

|

||||

|

Total current assets

|

123,743

|

|

195,715

|

|

||||

|

Property, plant, equipment, and mineral properties, net

|

388,490

|

|

419,476

|

|

||||

|

Long-term parts inventory, net

|

21,037

|

|

17,344

|

|

||||

|

Long-term investments

|

—

|

|

3,799

|

|

||||

|

Other assets, net

|

7,631

|

|

3,635

|

|

||||

|

Total Assets

|

$

|

540,901

|

|

$

|

639,969

|

|

||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Accounts payable:

|

||||||||

|

Trade

|

$

|

10,210

|

|

$

|

15,709

|

|

||

|

Related parties

|

31

|

|

45

|

|

||||

|

Accrued liabilities

|

8,690

|

|

15,429

|

|

||||

|

Accrued employee compensation and benefits

|

4,225

|

|

7,409

|

|

||||

|

Other current liabilities

|

964

|

|

547

|

|

||||

|

Total current liabilities

|

24,120

|

|

39,139

|

|

||||

|

Long-term debt, net

|

133,434

|

|

149,485

|

|

||||

|

Asset retirement obligation

|

19,976

|

|

22,951

|

|

||||

|

Other non-current liabilities

|

—

|

|

1,868

|

|

||||

|

Total Liabilities

|

177,530

|

|

213,443

|

|

||||

|

Commitments and Contingencies

|

|

|

||||||

|

Common stock, $0.001 par value; 400,000,000 and 100,000,000 shares

|

||||||||

|

authorized; and 75,839,998 and 75,702,700 shares

|

||||||||

|

outstanding at December 31, 2016, and 2015, respectively

|

76

|

|

76

|

|

||||

|

Additional paid-in capital

|

583,653

|

|

580,227

|

|

||||

|

Accumulated other comprehensive loss

|

—

|

|

(52

|

)

|

||||

|

Retained deficit

|

(220,358

|

)

|

(153,725

|

)

|

||||

|

Total Stockholders' Equity

|

363,371

|

|

426,526

|

|

||||

|

Total Liabilities and Stockholders' Equity

|

$

|

540,901

|

|

$

|

639,969

|

|

||

|

Year Ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

Sales

|

$

|

210,948

|

|

$

|

287,183

|

|

$

|

410,389

|

|

|||

|

Less:

|

||||||||||||

|

Freight costs

|

36,256

|

|

28,723

|

|

43,223

|

|

||||||

|

Warehousing and handling costs

|

11,006

|

|

13,939

|

|

13,062

|

|

||||||

|

Cost of goods sold

|

170,852

|

|

217,821

|

|

303,914

|

|

||||||

|

Lower-of-cost-or-market inventory adjustments

|

20,374

|

|

31,772

|

|

8,186

|

|

||||||

|

Costs associated with abnormal production and other

|

1,707

|

|

10,405

|

|

—

|

|

||||||

|

Gross (Deficit) Margin

|

(29,247

|

)

|

(15,477

|

)

|

42,004

|

|

||||||

|

Selling and administrative

|

20,034

|

|

27,486

|

|

27,223

|

|

||||||

|

Debt restructuring expense

|

3,072

|

|

—

|

|

—

|

|

||||||

|

Accretion of asset retirement obligation

|

1,768

|

|

1,696

|

|

1,623

|

|

||||||

|

Restructuring expense

|

2,723

|

|

—

|

|

1,827

|

|

||||||

|

Impairment of long-lived assets

|

—

|

|

323,796

|

|

—

|

|

||||||

|

Care and maintenance expense

|

2,603

|

|

—

|

|

—

|

|

||||||

|

Other operating (income) expense

|

(1,666

|

)

|

1,335

|

|

(4,449

|

)

|

||||||

|

Operating (Loss) Income

|

(57,781

|

)

|

(369,790

|

)

|

15,780

|

|

||||||

|

Other Income (Expense)

|

||||||||||||

|

Interest expense, net

|

(11,622

|

)

|

(6,351

|

)

|

(6,232

|

)

|

||||||

|

Interest income

|

286

|

|

763

|

|

186

|

|

||||||

|

Other income

|

1,122

|

|

575

|

|

1,077

|

|

||||||

|

(Loss) Income Before Income Taxes

|

(67,995

|

)

|

(374,803

|

)

|

10,811

|

|

||||||

|

Income Tax Benefit (Expense)

|

1,362

|

|

(149,973

|

)

|

(1,050

|

)

|

||||||

|

Net (Loss) Income

|

$

|

(66,633

|

)

|

$

|

(524,776

|

)

|

$

|

9,761

|

|

|||

|

Weighted Average Shares Outstanding:

|

||||||||||||

|

Basic

|

75,818,735

|

|

75,669,489

|

|

75,504,677

|

|

||||||

|

Diluted

|

75,818,735

|

|

75,669,489

|

|

75,630,323

|

|

||||||

|

(Loss) Earnings Per Share:

|

||||||||||||

|

Basic

|

$

|

(0.88

|

)

|

$

|

(6.94

|

)

|

$

|

0.13

|

|

|||

|

Diluted

|

$

|

(0.88

|

)

|

$

|

(6.94

|

)

|

$

|

0.13

|

|

|||

|

Year Ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

Net (Loss) Income

|

$

|

(66,633

|

)

|

$

|

(524,776

|

)

|

$

|

9,761

|

|

|||

|

Other Comprehensive Income (Loss):

|

||||||||||||

|

Net change in unrealized gains (losses) on investments available for sale

|

52

|

|

(24

|

)

|

(18

|

)

|

||||||

|

Other Comprehensive Income (Loss)

|

52

|

|

(24

|

)

|

(18

|

)

|

||||||

|

Comprehensive (Loss) Income

|

$

|

(66,581

|

)

|

$

|

(524,800

|

)

|

$

|

9,743

|

|

|||

|

Common Stock

|

Additional Paid-in Capital

|

Accumulated Other Comprehensive Loss

|

Retained Earnings (Deficit)

|

Total Stockholders' Equity

|

|||||||||||||||||||

|

Shares

|

Amount

|

||||||||||||||||||||||

|

Balance, December 31, 2013

|

75,405,410

|

|

$

|

75

|

|

$

|

572,616

|

|

$

|

(10

|

)

|

$

|

361,290

|

|

$

|

933,971

|

|

||||||

|

Net change in other comprehensive loss

|

—

|

|

—

|

|

—

|

|

(18

|

)

|

—

|

|

(18

|

)

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

9,761

|

|

9,761

|

|

|||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

4,237

|

|

—

|

|

—

|

|

4,237

|

|

|||||||||||

|

Vesting of restricted stock, net of common stock

used to fund employee income tax withholding due upon vesting |

131,331

|

|

1

|

|

(667

|

)

|

—

|

|

—

|

|

(666

|

)

|

|||||||||||

|

Balance, December 31, 2014

|

75,536,741

|

|

76

|

|

576,186

|

|

(28

|

)

|

371,051

|

|

947,285

|

|

|||||||||||

|

Net change in other comprehensive loss

|

—

|

|

—

|

|

—

|

|

(24

|

)

|

—

|

|

(24

|

)

|

|||||||||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(524,776

|

)

|

(524,776

|

)

|

|||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

5,080

|

|

—

|

|

—

|

|

5,080

|

|

|||||||||||

|

Vesting of restricted stock, net of common stock

used to fund employee income tax withholding due upon vesting |

165,959

|

|

—

|

|

(1,039

|

)

|

—

|

|

—

|

|

(1,039

|

)

|

|||||||||||

|

Balance, December 31, 2015

|

75,702,700

|

|

76

|

|

580,227

|

|

(52

|

)

|

(153,725

|

)

|

426,526

|

|

|||||||||||

|

Net change in other comprehensive loss

|

—

|

|

—

|

|

—

|

|

52

|

|

—

|

|

52

|

|

|||||||||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(66,633

|

)

|

(66,633

|

)

|

|||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

3,599

|

|

—

|

|

—

|

|

3,599

|

|

|||||||||||

|

Vesting of restricted stock, net of common stock

used to fund employee income tax withholding due upon vesting |

137,298

|

|

—

|

|

(173

|

)

|

—

|

|

—

|

|

(173

|

)

|