|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

26-2749336

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

1555 Peachtree Street, N.E., Suite 1800

Atlanta, Georgia

|

30309

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, par value $0.01 per share

|

New York Stock Exchange

|

|

|

7.75% Series A Cumulative Redeemable Preferred Stock

|

New York Stock Exchange

|

|

|

7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock

|

New York Stock Exchange

|

|

|

Large accelerated filer

|

|

ý

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

|

¨

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

•

|

our business and investment strategy;

|

|

•

|

our investment portfolio;

|

|

•

|

our projected operating results;

|

|

•

|

general volatility of financial markets and effects of governmental responses, including actions and initiatives of the U.S. governmental agencies and changes to U.S. government policies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), mortgage loan modification programs, actions and initiatives of foreign governmental agencies and central banks, monetary policy actions of the Federal Reserve, including actions relating to its agency mortgage-backed securities portfolio and the continuation of re-investment of principal payments, and our ability to respond to and comply with such actions, initiatives and changes;

|

|

•

|

the availability of financing sources, including our ability to obtain additional financing arrangements and the terms of such arrangements;

|

|

•

|

financing and advance rates for our target assets;

|

|

•

|

changes to our expected leverage;

|

|

•

|

our expected investments;

|

|

•

|

our expected book value per share of common stock;

|

|

•

|

interest rate mismatches between our target assets and our borrowings used to fund such investments;

|

|

•

|

the adequacy of our cash flow from operations and borrowings to meet our short-term liquidity needs;

|

|

•

|

our ability to maintain sufficient liquidity to meet any margin calls;

|

|

•

|

changes in the credit rating of the U.S. government;

|

|

•

|

changes in interest rates and interest rate spreads and the market value of our target assets;

|

|

•

|

changes in prepayment rates on our target assets;

|

|

•

|

the impact of any deficiencies in foreclosure practices of third parties and related uncertainty in the timing of collateral disposition;

|

|

•

|

our reliance on third parties in connection with services related to our target assets;

|

|

•

|

effects of hedging instruments on our target assets;

|

|

•

|

rates of default or decreased recovery rates on our target assets;

|

|

•

|

modifications to whole loans or loans underlying securities;

|

|

•

|

the degree to which our hedging strategies may or may not protect us from interest rate and foreign currency exchange rate volatility;

|

|

•

|

the degree to which derivative contracts expose us to contingent liabilities;

|

|

•

|

counterparty defaults;

|

|

•

|

compliance with financial covenants in our financing arrangements;

|

|

•

|

changes in governmental regulations, tax law and rates, and similar matters and our ability to respond to such changes;

|

|

•

|

our ability to maintain our qualification as a real estate investment trust for U.S. federal income tax purposes;

|

|

1

|

||

|

•

|

our ability to maintain our exception from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “1940 Act”);

|

|

•

|

availability of investment opportunities in mortgage-related, real estate-related and other securities;

|

|

•

|

availability of U.S. Government Agency guarantees with regard to payments of principal and interest on securities;

|

|

•

|

the market price and trading volume of our capital stock;

|

|

•

|

availability of qualified personnel of our Manager;

|

|

•

|

the relationship with our Manager;

|

|

•

|

estimates relating to taxable income and our ability to continue to make distributions to our stockholders in the future;

|

|

•

|

estimates relating to fair value of our target assets and loan loss reserves;

|

|

•

|

our understanding of our competition;

|

|

•

|

changes to generally accepted accounting principles in the United States of America (“U.S. GAAP”);

|

|

•

|

the impact of the restatement of our consolidated financial statements as of and for the years ended December 31, 2013 and December 31, 2014 and all interim periods commencing with the quarter ended March 31, 2013 through the quarter ended March 31, 2015, as described in Controls and Procedures included in Part II, Item 9A of this Report;

|

|

•

|

the adequacy of our disclosure controls and procedures and internal controls over financial reporting; and market trends in our industry, interest rates, real estate values, the debt securities markets or the general economy.

|

|

2

|

||

|

•

|

Residential mortgage-backed securities (“RMBS”) that are guaranteed by a U.S. government agency such as the Government National Mortgage Association ("Ginnie Mae") or a federally chartered corporation such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”) (collectively "Agency RMBS");

|

|

•

|

RMBS that are not guaranteed by a U.S. government agency ("non-Agency RMBS");

|

|

•

|

Credit risk transfer securities that are unsecured obligations issued by government-sponsored enterprises ("GSE CRT");

|

|

•

|

Commercial mortgage-backed securities (“CMBS”);

|

|

•

|

Residential and commercial mortgage loans; and

|

|

•

|

Other real estate-related financing arrangements.

|

|

3

|

||

|

4

|

||

|

5

|

||

|

6

|

||

|

7

|

||

|

•

|

no investment shall be made that would cause us to fail to qualify as a REIT for federal income tax purposes;

|

|

•

|

no investment shall be made that would cause us to be regulated as an investment company under the 1940 Act;

|

|

•

|

our assets will be invested within our target assets; and

|

|

•

|

until appropriate investments can be identified, our Manager may pay off short-term debt, or invest the proceeds of any offering in interest-bearing, short-term investments, including funds that are consistent with maintaining our REIT qualification.

|

|

8

|

||

|

9

|

||

|

10

|

||

|

11

|

||

|

•

|

If long-term rates increased significantly, the market value of investments in our target assets would decline, and the duration and weighted average life of the investments may increase. We could realize a loss if the securities were sold. Further, declines in market value may reduce book value and ultimately reduce earnings or result in losses to us.

|

|

•

|

An increase in short-term interest rates would increase the amount of interest owed on the repurchase agreements we enter into to finance the purchase of our investments.

|

|

•

|

If short-term interest rates rise disproportionately relative to longer-term interest rates (a flattening of the yield curve), our borrowing costs may increase more rapidly than the interest income earned on our assets. Because we expect our investments, on average, generally will bear interest based on longer-term rates than our borrowings, a flattening of the yield curve would tend to decrease our net income. Additionally, to the extent cash flows from investments that return scheduled and unscheduled principal are reinvested, the spread between the yields on the new investments and available borrowing rates may decline, which would likely decrease our net income.

|

|

12

|

||

|

•

|

If short-term interest rates exceed longer-term interest rates (a yield curve inversion), our borrowing costs may exceed our interest income and we could incur operating losses.

|

|

•

|

If interest rates fall, we may recognize losses on our swap positions that are not offset by gains on our assets, which may adversely affect our liquidity and financial position.

|

|

13

|

||

|

14

|

||

|

•

|

We may purchase RMBS that have a higher interest rate than the market interest rate at the time. In exchange for this higher interest rate, we may pay a premium over the par value to acquire the security. In accordance with U.S. GAAP, we may amortize this premium over the estimated term of the RMBS. If the RMBS is prepaid in whole or in part prior to its maturity date, however, we may be required to expense the premium that was prepaid at the time of the prepayment.

|

|

•

|

A substantial portion of our adjustable-rate RMBS may bear interest rates that are lower than their fully indexed rates, which are equivalent to the applicable index rate plus a margin. If an adjustable-rate RMBS is prepaid prior to or soon after the time of adjustment to a fully-indexed rate, we will have held that RMBS while it was least profitable and lost the opportunity to receive interest at the fully indexed rate over the remainder of its expected life.

|

|

•

|

If we are unable to acquire new RMBS similar to the prepaid RMBS, our financial condition, results of operation and cash flow would suffer. Prepayment rates generally increase when interest rates fall and decrease when interest rates

|

|

15

|

||

|

16

|

||

|

17

|

||

|

18

|

||

|

•

|

interest rate and/or currency hedging can be expensive, particularly during periods of rising and volatile interest rates;

|

|

•

|

available interest rate hedges may not correspond directly with the interest rate risk for which protection is sought;

|

|

•

|

due to a credit loss, the duration of the hedge may not match the duration of the related liability;

|

|

•

|

the amount of income that a REIT may earn from hedging transactions (other than hedging transactions that satisfy certain requirements of the Internal Revenue Code or that are done through a taxable REIT subsidiary (“TRS”)) to offset interest rate losses is limited by U.S. federal tax provisions governing REITs;

|

|

•

|

the credit quality of the hedging counterparty owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and

|

|

19

|

||

|

20

|

||

|

21

|

||

|

22

|

||

|

23

|

||

|

24

|

||

|

•

|

changes in our earnings estimates or publication of research reports about us or the real estate or specialty finance industry;

|

|

•

|

decreases in the market valuations of our target assets;

|

|

•

|

increased difficulty in maintaining or obtaining financing on attractive terms, or at all;

|

|

•

|

increases in market interest rates that lead our stockholders to demand a higher yield;

|

|

•

|

changes in market valuations of similar companies;

|

|

•

|

adverse market reaction to any increased indebtedness we incur in the future;

|

|

•

|

additions or departures of key management personnel;

|

|

•

|

actions by institutional stockholders;

|

|

•

|

speculation in the press or investment community;

|

|

•

|

general market and economic conditions; and

|

|

•

|

changes to U.S. federal income tax laws or regulations governing REITs or the administrative interpretation of those laws.

|

|

25

|

||

|

26

|

||

|

27

|

||

|

28

|

||

|

29

|

||

|

30

|

||

|

31

|

||

|

32

|

||

|

33

|

||

|

High

|

Low

|

||||||

|

2015

|

|||||||

|

Fourth quarter

|

$

|

13.50

|

|

$

|

11.92

|

|

|

|

Third quarter

|

$

|

15.14

|

|

$

|

12.02

|

|

|

|

Second quarter

|

$

|

16.13

|

|

$

|

14.32

|

|

|

|

First quarter

|

$

|

16.21

|

|

$

|

15.10

|

|

|

|

2014

|

|||||||

|

Fourth quarter

|

$

|

16.66

|

|

$

|

15.19

|

|

|

|

Third quarter

|

$

|

17.64

|

|

$

|

15.72

|

|

|

|

Second quarter

|

$

|

18.00

|

|

$

|

16.36

|

|

|

|

First quarter

|

$

|

17.46

|

|

$

|

14.64

|

|

|

|

Date Declared

|

Dividends Declared Per Share

|

||||

|

|

Amount

|

Date Paid

|

|||

|

2015

|

|||||

|

December 15, 2015

|

$

|

0.40

|

|

January 26, 2016

|

|

|

September 15, 2015

|

$

|

0.40

|

|

October 27, 2015

|

|

|

June 15, 2015

|

$

|

0.45

|

|

July 28, 2015

|

|

|

March 17, 2015

|

$

|

0.45

|

|

April 28, 2015

|

|

|

2014

|

|||||

|

December 16, 2014

|

$

|

0.45

|

|

January 27, 2015

|

|

|

September 15, 2014

|

$

|

0.50

|

|

October 28, 2014

|

|

|

June 16, 2014

|

$

|

0.50

|

|

July 28, 2014

|

|

|

March 18, 2014

|

$

|

0.50

|

|

April 28, 2014

|

|

|

34

|

||

|

Tax Characterization of Dividends

|

||||||||||||

|

Fiscal Tax Year

|

Dividends Declared

|

Ordinary Dividends

|

Capital Gain Distribution

|

Carry Forward

|

||||||||

|

Common Stock Dividends

|

||||||||||||

|

Fiscal tax year 2015

(1)

|

1.700000

|

|

1.615469

|

|

—

|

|

0.257840

|

|

||||

|

Fiscal tax year 2014

|

1.950000

|

|

1.776691

|

|

—

|

|

0.173309

|

|

||||

|

(1)

|

Ordinary dividends include $0.173309 of undistributed taxable income carried-forward from fiscal tax year 2014.

|

|

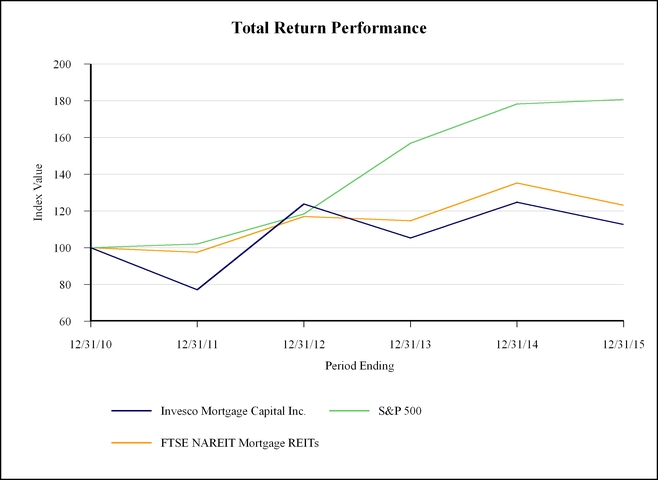

Index

|

12/31/2010

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

|

Invesco Mortgage Capital Inc.

|

100.00

|

77.13

|

123.78

|

105.31

|

124.82

|

112.62

|

|

S&P 500

|

100.00

|

102.11

|

118.45

|

156.82

|

178.28

|

180.75

|

|

FTSE NAREIT Mortgage REITs

|

100.00

|

97.58

|

116.99

|

114.70

|

135.21

|

123.21

|

|

35

|

||

|

Month

|

Total Number of Shares Purchased

|

Average Price Paid Per Share

|

Total Number of Shares Purchased

as Part of

Publicly Announced Plans or Programs

(1)

|

Maximum Number of Shares

that May Yet Be Purchased

Under the Plans

or Programs at end of period

(1)

|

|||||||

|

October 1 - 31, 2015

|

—

|

|

—

|

|

—

|

|

11,146,416

|

|

|||

|

November 1 - 30, 2015

|

3,987,504

|

|

13.03

|

|

3,987,504

|

|

7,158,912

|

|

|||

|

December 1 - 31, 2015

|

1,856,379

|

|

12.74

|

|

1,856,379

|

|

5,302,533

|

|

|||

|

|

5,843,883

|

|

12.94

|

|

5,843,883

|

|

|||||

|

(1)

|

In December 2011, our board of directors approved a share repurchase program to purchase up to 7,000,000 shares of our common shares with no stated expiration date. In December 2013, our board of directors approved an additional share repurchase of up to 20,000,000 of our common shares with no expiration date. The shares may be repurchased from time to time through privately negotiated transactions or open market transactions, including pursuant to a trading plan in accordance with Rules 10b5-1 and 10b-18 under Exchange Act or by any combination of such methods. The manner, price, number and timing of share repurchases are subject to a variety of factors, including market conditions and applicable SEC rules.

|

|

36

|

||

|

|

As of December 31,

|

|||||||||||||

|

$ in thousands

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||

|

Mortgage-backed and credit risk transfer securities, at fair value

|

16,065,935

|

|

17,248,895

|

|

17,348,657

|

|

18,470,563

|

|

14,214,149

|

|

||||

|

Residential loans, held-for-investment

(1)

|

—

|

|

3,365,003

|

|

1,810,262

|

|

—

|

|

—

|

|

||||

|

Commercial loans, held-for-investment

|

209,062

|

|

145,756

|

|

64,599

|

|

—

|

|

—

|

|

||||

|

Total assets

(1)

|

16,772,736

|

|

21,231,017

|

|

20,350,979

|

|

18,914,760

|

|

14,772,167

|

|

||||

|

Repurchase agreements

|

12,126,048

|

|

13,622,677

|

|

15,451,675

|

|

15,720,460

|

|

12,253,038

|

|

||||

|

Secured loans

|

1,650,000

|

|

1,250,000

|

|

—

|

|

—

|

|

—

|

|

||||

|

Asset-backed securities issued by securitization trusts

(1)

|

—

|

|

2,929,820

|

|

1,643,741

|

|

—

|

|

—

|

|

||||

|

Exchangeable senior notes

|

400,000

|

|

400,000

|

|

400,000

|

|

—

|

|

—

|

|

||||

|

Total stockholders’ equity

|

2,241,035

|

|

2,610,315

|

|

2,376,115

|

|

2,558,098

|

|

1,892,338

|

|

||||

|

Non-controlling interest

|

25,873

|

|

28,535

|

|

27,120

|

|

31,422

|

|

25,075

|

|

||||

|

Total equity

|

2,266,908

|

|

2,638,850

|

|

2,403,235

|

|

2,589,520

|

|

1,917,413

|

|

||||

|

(1)

|

As of December 31, 2014 and December 31, 2013, our consolidated balance sheets included assets and liabilities of consolidated variable interest entities (“VIEs”). The Company deconsolidated these VIEs in 2015.

As of

December 31, 2014

and

December 31, 2013

, total assets of the consolidated VIEs were

$3,380,597

and

$1,819,295

, respectively, and total liabilities of the consolidated VIEs were

$2,938,512

and

$1,648,400

, respectively

. Refer to Note 3 - "Variable Interest Entities"

of our consolidated financial statements fo

r further discussion.

|

|

37

|

||

|

|

For the Years ended December 31,

|

|||||||||||||

|

$ in thousands, except share amounts

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||

|

Interest income

|

644,495

|

|

676,643

|

|

682,360

|

|

566,830

|

|

453,352

|

|

||||

|

Interest expense

|

277,973

|

|

281,895

|

|

332,252

|

|

237,405

|

|

155,241

|

|

||||

|

Net interest income

|

366,522

|

|

394,748

|

|

350,108

|

|

329,425

|

|

298,111

|

|

||||

|

(Reduction in) provision for loan losses

|

(213

|

)

|

(142

|

)

|

884

|

|

—

|

|

—

|

|

||||

|

Net interest income after provision for loan losses

|

366,735

|

|

394,890

|

|

349,224

|

|

329,425

|

|

298,111

|

|

||||

|

Other income (loss)

|

(206,904

|

)

|

(572,762

|

)

|

(136,258

|

)

|

53,041

|

|

11,044

|

|

||||

|

Expenses

|

54,620

|

|

52,866

|

|

53,144

|

|

39,684

|

|

30,118

|

|

||||

|

Net income (loss)

|

105,211

|

|

(230,738

|

)

|

159,822

|

|

342,782

|

|

279,037

|

|

||||

|

Net income (loss) attributable to non-controlling interest

|

1,241

|

|

(2,632

|

)

|

1,667

|

|

4,108

|

|

4,788

|

|

||||

|

Net income (loss) attributable to Invesco Mortgage Capital Inc.

|

103,970

|

|

(228,106

|

)

|

158,155

|

|

338,674

|

|

274,249

|

|

||||

|

Dividends to preferred stockholders

|

22,864

|

|

17,378

|

|

10,851

|

|

5,395

|

|

—

|

|

||||

|

Net income (loss) attributable to common stockholders

|

81,106

|

|

(245,484

|

)

|

147,304

|

|

333,279

|

|

274,249

|

|

||||

|

Earnings per share:

|

||||||||||||||

|

Net income (loss) attributable to common stockholders

|

||||||||||||||

|

Basic

|

0.67

|

|

(1.99

|

)

|

1.11

|

|

2.88

|

|

3.18

|

|

||||

|

Diluted

|

0.67

|

|

(1.99

|

)

|

1.11

|

|

2.88

|

|

3.18

|

|

||||

|

Dividends declared per common share

|

1.70

|

|

1.95

|

|

2.30

|

|

2.60

|

|

3.42

|

|

||||

|

Weighted average number of shares of common stock:

|

||||||||||||||

|

Basic

|

121,377,585

|

|

123,104,934

|

|

132,714,012

|

|

115,558,668

|

|

86,364,506

|

|

||||

|

Diluted

|

122,843,838

|

|

124,529,934

|

|

134,173,691

|

|

117,012,500

|

|

87,804,292

|

|

||||

|

•

|

Residential mortgage-backed securities (“RMBS”) that are guaranteed by a U.S. government agency such as the Government National Mortgage Association or a federally chartered corporation such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”) (collectively "Agency RMBS");

|

|

•

|

RMBS that are not guaranteed by a U.S. government agency ("non-Agency RMBS");

|

|

•

|

Credit risk transfer securities that are unsecured obligations issued by government-sponsored enterprises ("GSE CRT");

|

|

•

|

Commercial mortgage-backed securities (“CMBS”);

|

|

•

|

Residential and commercial mortgage loans; and

|

|

38

|

||

|

•

|

Other real estate-related financing arrangements.

|

|

•

|

a dividend of

$0.40

per share of common stock to be paid on

January 26, 2016

to stockholders of record as of the close of business on

December 28, 2015

;

|

|

•

|

a dividend of

$0.4844

per share of Series A Preferred Stock to be paid on

January 25, 2016

to stockholders of record as of the close of business on

January 1, 2016

; and

|

|

•

|

a dividend of

$0.4844

per share of Series B Preferred Stock to be paid on

March 28, 2016

to stockholders of record as of the close of business on

March 5, 2016

.

|

|

39

|

||

|

40

|

||

|

41

|

||

|

As of December 31,

|

|||||

|

|

2015

|

2014

|

|||

|

Agency RMBS

|

37.0

|

%

|

32.0

|

%

|

|

|

Commercial Credit

(1)

|

33.0

|

%

|

34.0

|

%

|

|

|

Residential Credit

(2)

|

30.0

|

%

|

34.0

|

%

|

|

|

Total

|

100.0

|

%

|

100.0

|

%

|

|

|

(1)

|

CMBS, Commercial Loans and Investments in unconsolidated ventures of

$38.4 million

(which are included in Other Investments), are considered commercial credit.

|

|

(2)

|

Non-Agency RMBS, GSE CRT and Residential Loans are considered residential credit.

|

|

$ in thousands

|

As of December 31,

|

||||

|

2015

|

2014

|

||||

|

Agency RMBS:

|

|||||

|

30 year fixed-rate, at fair value

|

4,063,957

|

|

4,790,293

|

|

|

|

15 year fixed-rate, at fair value

|

1,610,930

|

|

1,327,101

|

|

|

|

Hybrid ARM, at fair value

|

3,309,525

|

|

2,976,918

|

|

|

|

ARM, at fair value

|

426,025

|

|

546,782

|

|

|

|

Agency CMO, at fair value

|

388,819

|

|

450,895

|

|

|

|

Non-Agency RMBS, at fair value

|

2,692,487

|

|

3,061,647

|

|

|

|

GSE CRT, at fair value

|

658,228

|

|

625,424

|

|

|

|

CMBS, at fair value

|

2,915,964

|

|

3,469,835

|

|

|

|

Residential loans, at amortized cost

|

—

|

|

3,365,003

|

|

|

|

Commercial loans, at amortized cost

|

209,062

|

|

145,756

|

|

|

|

Total Investment portfolio

|

16,274,997

|

|

20,759,654

|

|

|

|

42

|

||

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

Total

|

||||||||||||||||||||||||||||

|

Prime

|

0.4

|

%

|

1.4

|

%

|

4.0

|

%

|

3.5

|

%

|

7.1

|

%

|

1.9

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

11.3

|

%

|

9.5

|

%

|

1.1

|

%

|

40.2

|

%

|

|||||||||||||

|

Re-REMIC

(1)

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

0.4

|

%

|

—

|

%

|

0.8

|

%

|

4.0

|

%

|

14.6

|

%

|

4.4

|

%

|

0.5

|

%

|

—

|

%

|

—

|

%

|

24.7

|

%

|

|||||||||||||

|

Alt-A

|

—

|

%

|

0.6

|

%

|

6.9

|

%

|

5.8

|

%

|

6.9

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

20.2

|

%

|

|||||||||||||

|

Subprime/reperforming

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

0.3

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

1.9

|

%

|

11.3

|

%

|

1.4

|

%

|

14.9

|

%

|

|||||||||||||

|

Total Non-Agency

|

0.4

|

%

|

2.0

|

%

|

10.9

|

%

|

9.3

|

%

|

14.7

|

%

|

1.9

|

%

|

0.8

|

%

|

4.0

|

%

|

14.6

|

%

|

4.4

|

%

|

13.7

|

%

|

20.8

|

%

|

2.5

|

%

|

100.0

|

%

|

|||||||||||||

|

GSE CRT

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

37.7

|

%

|

51.6

|

%

|

10.7

|

%

|

100.0

|

%

|

|||||||||||||

|

CMBS

|

—

|

%

|

—

|

%

|

0.4

|

%

|

9.5

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

7.4

|

%

|

22.2

|

%

|

12.9

|

%

|

13.9

|

%

|

28.9

|

%

|

4.8

|

%

|

100.0

|

%

|

|||||||||||||

|

(1)

|

For Re-REMICs, the table reflects the year in which the resecuritizations were issued. The vintage distribution of the securities that collateralize our Re-REMIC investments is

10.4%

for 2005,

29.5%

for 2006 and

60.1%

for 2007.

|

|

Non-Agency RMBS

State

|

Percentage

|

GSE CRT

State

|

Percentage

|

CMBS

State

|

Percentage

|

||||||||

|

California

|

42.7

|

%

|

California

|

21.9

|

%

|

California

|

16.3

|

%

|

|||||

|

New York

|

7.0

|

%

|

Texas

|

5.6

|

%

|

New York

|

13.2

|

%

|

|||||

|

Florida

|

6.2

|

%

|

Virginia

|

4.5

|

%

|

Texas

|

9.3

|

%

|

|||||

|

Virginia

|

3.6

|

%

|

New York

|

4.2

|

%

|

Florida

|

5.9

|

%

|

|||||

|

Maryland

|

3.5

|

%

|

Illinois

|

3.9

|

%

|

Pennsylvania

|

4.2

|

%

|

|||||

|

New Jersey

|

3.4

|

%

|

Florida

|

3.6

|

%

|

Illinois

|

4.2

|

%

|

|||||

|

Massachusets

|

2.8

|

%

|

Massachusets

|

3.6

|

%

|

New Jersey

|

3.5

|

%

|

|||||

|

Illinois

|

2.8

|

%

|

Washington

|

3.3

|

%

|

Virginia

|

3.0

|

%

|

|||||

|

Washington

|

2.7

|

%

|

Colorado

|

3.2

|

%

|

Ohio

|

2.9

|

%

|

|||||

|

Arizona

|

2.1

|

%

|

New Jersey

|

3.2

|

%

|

Michigan

|

2.6

|

%

|

|||||

|

Other

|

23.2

|

%

|

Other

|

43.0

|

%

|

Other

|

34.9

|

%

|

|||||

|

Total

|

100.0

|

%

|

100.0

|

%

|

Total

|

100.0

|

%

|

||||||

|

43

|

||

|

•

|

available interest rate hedging may not correspond directly with the interest rate risk for which protection is sought;

|

|

•

|

the duration of the hedge may not match the duration of the related liability;

|

|

•

|

the party owing money in the hedging transaction may default on its obligation to pay;

|

|

•

|

the credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and

|

|

•

|

the value of derivatives used for hedging may be adjusted from time-to-time in accordance with accounting rules to reflect changes in fair value. Downward adjustments or mark-to-market losses would reduce our stockholders’ equity.

|

|

44

|

||

|

45

|

||

|

46

|

||

|

47

|

||

|

|

Years Ended December 31,

|

|||||||

|

In thousands except share amounts

|

2015

|

2014

|

2013

|

|||||

|

Interest Income

|

||||||||

|

Mortgage-backed and credit risk transfer securities

|

518,256

|

|

579,062

|

|

646,787

|

|

||

|

Residential loans

(1)

|

110,908

|

|

88,073

|

|

34,122

|

|

||

|

Commercial loans

|

15,331

|

|

9,508

|

|

1,451

|

|

||

|

Total interest income

|

644,495

|

|

676,643

|

|

682,360

|

|

||

|

Interest Expense

|

||||||||

|

Repurchase agreements

|

166,892

|

|

188,699

|

|

287,547

|

|

||

|

Secured loans

|

6,579

|

|

2,576

|

|

—

|

|

||

|

Exchangeable senior notes

|

22,461

|

|

22,461

|

|

18,023

|

|

||

|

Asset-backed securities

(1)

|

82,041

|

|

68,159

|

|

26,682

|

|

||

|

Total interest expense

|

277,973

|

|

281,895

|

|

332,252

|

|

||

|

Net interest income

|

366,522

|

|

394,748

|

|

350,108

|

|

||

|

(Reduction in) provision for loan losses

|

(213

|

)

|

(142

|

)

|

884

|

|

||

|

Net interest income after (reduction in) provision for loan losses

|

366,735

|

|

394,890

|

|

349,224

|

|

||

|

Other income (loss)

|

||||||||

|

Gain (loss) on investments, net

|

(21,212

|

)

|

(87,168

|

)

|

(182,733

|

)

|

||

|

Equity in earnings of unconsolidated ventures

|

12,630

|

|

6,786

|

|

5,345

|

|

||

|

Gain (loss) on derivative instruments, net

|

(219,048

|

)

|

(487,469

|

)

|

40,003

|

|

||

|

Realized and unrealized credit derivative income (loss), net

|

19,782

|

|

(2,866

|

)

|

1,127

|

|

||

|

Other investment income (loss), net

|

944

|

|

(2,045

|

)

|

—

|

|

||

|

Total other income (loss)

|

(206,904

|

)

|

(572,762

|

)

|

(136,258

|

)

|

||

|

Expenses

|

||||||||

|

Management fee — related party

|

38,632

|

|

37,599

|

|

42,639

|

|

||

|

General and administrative

|

7,769

|

|

9,191

|

|

8,368

|

|

||

|

Consolidated securitization trusts

(1)

|

8,219

|

|

6,076

|

|

2,137

|

|

||

|

Total expenses

|

54,620

|

|

52,866

|

|

53,144

|

|

||

|

Net income (loss)

|

105,211

|

|

(230,738

|

)

|

159,822

|

|

||

|

Net income (loss) attributable to non-controlling interest

|

1,241

|

|

(2,632

|

)

|

1,667

|

|

||

|

Net income (loss) attributable to Invesco Mortgage Capital Inc.

|

103,970

|

|

(228,106

|

)

|

158,155

|

|

||

|

Dividends to preferred stockholders

|

22,864

|

|

17,378

|

|

10,851

|

|

||

|

Net income (loss) attributable to common stockholders

|

81,106

|

|

(245,484

|

)

|

147,304

|

|

||

|

Earnings per share:

|

||||||||

|

Net income (loss) attributable to common stockholders

|

||||||||

|

Basic

|

0.67

|

|

(1.99

|

)

|

1.11

|

|

||

|

Diluted

|

0.67

|

|

(1.99

|

)

|

1.11

|

|

||

|

Weighted average number of shares of common stock:

|

||||||||

|

Basic

|

121,377,585

|

|

123,104,934

|

|

132,714,012

|

|

||

|

Diluted

|

122,843,838

|

|

124,529,934

|

|

134,173,691

|

|

||

|

(1)

|

The consolidated statements of operations include income and expenses of consolidated VIEs. The Company deconsolidated these VIEs in 2015. Refer to Note 3 - “Variable Interest Entities” of our consolidated financial statements for further discussion.

|

|

48

|

||

|

49

|

||

|

|

Years Ended December 31,

|

|||||||

|

$ in thousands, except per share data

|

2015

|

2014

|

2013

|

|||||

|

Net income (loss) attributable to common stockholders

|

81,106

|

|

(245,484

|

)

|

147,304

|

|

||

|

Adjustments:

|

||||||||

|

(Gain) loss on investments, net

|

21,212

|

|

87,168

|

|

182,733

|

|

||

|

Realized (gain) loss on derivative instruments, net (excluding contractual net interest on interest rate swaps of $184,373, $199,783, and $0, respectively)

|

44,272

|

|

72,187

|

|

(53,926

|

)

|

||

|

Unrealized (gain) loss on derivative instruments, net

|

(9,597

|

)

|

215,499

|

|

13,923

|

|

||

|

Realized and unrealized change in fair value of GSE CRT embedded derivatives, net

|

6,411

|

|

21,495

|

|

—

|

|

||

|

(Gain) loss on foreign currency transactions, net

|

1,875

|

|

2,746

|

|

—

|

|

||

|

Reclassification of amortization of net deferred losses on de-designated interest rate swaps to repurchase agreements interest expense

|

66,757

|

|

85,176

|

|

—

|

|

||

|

Subtotal

|

130,930

|

|

484,271

|

|

142,730

|

|

||

|

Adjustment attributable to non-controlling interest

|

(1,500

|

)

|

(5,532

|

)

|

(1,559

|

)

|

||

|

Core earnings

|

210,536

|

|

233,255

|

|

288,475

|

|

||

|

Basic earnings (loss) per common share

|

0.67

|

|

(1.99

|

)

|

1.11

|

|

||

|

Core earnings per share attributable to common stockholders

|

1.73

|

|

1.89

|

|

2.17

|

|

||

|

50

|

||

|

Years Ended December 31,

|

|||||||||||||||||

|

|

2015

|

2014

|

2013

|

||||||||||||||

|

$ in thousands

|

Reconciliation

|

Yield/Effective Yield

|

Reconciliation

|

Yield/Effective Yield

|

Reconciliation

|

Yield/Effective Yield

|

|||||||||||

|

Total interest income

|

644,495

|

|

3.22

|

%

|

676,643

|

|

3.41

|

%

|

682,360

|

|

3.32

|

%

|

|||||

|

Add: GSE CRT embedded derivative coupon interest recorded as realized and unrealized credit derivative income (loss), net

|

24,822

|

|

0.12

|

%

|

17,536

|

|

0.09

|

%

|

—

|

|

—

|

%

|

|||||

|

Effective interest income

|

669,317

|

|

3.34

|

%

|

694,179

|

|

3.50

|

%

|

682,360

|

|

3.32

|

%

|

|||||

|

Years Ended December 31,

|

|||||||||||||||||

|

|

2015

|

2014

|

2013

|

||||||||||||||

|

$ in thousands

|

Reconciliation

|

Cost of Funds / Effective Cost of Funds

|

Reconciliation

|

Cost of Funds / Effective Cost of Funds

|

Reconciliation

|

Cost of Funds / Effective Cost of Funds

|

|||||||||||

|

Total interest expense

|

277,973

|

|

1.56

|

%

|

281,895

|

|

1.61

|

%

|

332,252

|

|

1.84

|

%

|

|||||

|

Less: Reclassification of amortization of net deferred losses on de-designated interest rate swaps to repurchase agreements interest expense

|

(66,757

|

)

|

(0.37

|

)%

|

(85,176

|

)

|

(0.48

|

)%

|

—

|

|

—

|

%

|

|||||

|

Add: Net interest paid - interest rate swaps

|

184,373

|

|

1.03

|

%

|

199,783

|

|

1.14

|

%

|

—

|

|

—

|

%

|

|||||

|

Effective interest expense

|

395,589

|

|

2.22

|

%

|

396,502

|

|

2.27

|

%

|

332,252

|

|

1.84

|

%

|

|||||

|

Years Ended December 31,

|

|||||||||||||||||

|

|

2015

|

2014

|

2013

|

||||||||||||||

|

$ in thousands

|

Reconciliation

|

Net Interest Rate Margin / Effective Interest Rate Margin

|

Reconciliation

|

Net Interest Rate Margin / Effective Interest Rate Margin

|

Reconciliation

|

Net Interest Rate Margin / Effective Interest Rate Margin

|

|||||||||||

|

Net interest income

|

366,522

|

|

1.66

|

%

|

394,748

|

|

1.80

|

%

|

350,108

|

|

1.48

|

%

|

|||||

|

Add: Reclassification of amortization of net deferred losses on de-designated interest rate swaps to repurchase agreements interest expense

|

66,757

|

|

0.37

|

%

|

85,176

|

|

0.48

|

%

|

—

|

|

—

|

%

|

|||||

|

Add: GSE CRT embedded derivative coupon interest recorded as realized and unrealized credit derivative income (loss), net

|

24,822

|

|

0.12

|

%

|

17,536

|

|

0.09

|

%

|

—

|

|

—

|

%

|

|||||

|

Less: Net interest paid - interest rate swaps

|

(184,373

|

)

|

(1.03

|

)%

|

(199,783

|

)

|

(1.14

|

)%

|

—

|

|

—

|

%

|

|||||

|

Effective net interest income

|

273,728

|

|

1.12

|

%

|

297,677

|

|

1.23

|

%

|

350,108

|

|

1.48

|

%

|

|||||

|

51

|

||

|

$ in thousands

|

Agency RMBS

|

Residential Credit

(4)

|

Commercial Credit

(5)

|

Exchangeable Senior Notes

|

Total

|

|||||

|

Investments

|

9,799,257

|

|

3,350,714

|

|

3,163,439

|

|

—

|

|

16,313,410

|

|

|

Cash and cash equivalents

(1)

|

23,484

|

|

16,586

|

|

13,129

|

|

—

|

|

53,199

|

|

|

Derivative assets, at fair value

(2)

|

6,795

|

|

—

|

|

1,864

|

|

—

|

|

8,659

|

|

|

Other assets

|

316,072

|

|

9,780

|

|

71,616

|

|

—

|

|

397,468

|

|

|

Total assets

|

10,145,608

|

|

3,377,080

|

|

3,250,048

|

|

—

|

|

16,772,736

|

|

|

Repurchase agreements

|

8,389,643

|

|

2,565,515

|

|

1,170,890

|

|

—

|

|

12,126,048

|

|

|

Secured loans

(3)

|

472,983

|

|

—

|

|

1,177,017

|

|

—

|

|

1,650,000

|

|

|

Exchangeable senior notes

|

—

|

|

—

|

|

—

|

|

400,000

|

|

400,000

|

|

|

Derivative liabilities, at fair value

|

238,045

|

|

—

|

|

103

|

|

—

|

|

238,148

|

|

|

Other liabilities

|

46,165

|

|

22,540

|

|

22,927

|

|

—

|

|

91,632

|

|

|

Total liabilities

|

9,146,836

|

|

2,588,055

|

|

2,370,937

|

|

400,000

|

|

14,505,828

|

|

|

Total equity (allocated)

|

998,772

|

|

789,025

|

|

879,111

|

|

(400,000

|

)

|

2,266,908

|

|

|

Adjustments to calculate repurchase agreement debt-to-equity:

|

||||||||||

|

Net equity in unsecured assets and exchangeable senior notes

(6)

|

—

|

|

—

|

|

(250,060

|

)

|

400,000

|

|

149,940

|

|

|

Collateral pledged against Secured loans

|

(558,894

|

)

|

—

|

|

(1,390,805

|

)

|

—

|

|

(1,949,699

|

)

|

|

Secured loans

|

472,983

|

|

—

|

|

1,177,017

|

|

—

|

|

1,650,000

|

|

|

Equity related to repurchase agreement debt

|

912,861

|

|

789,025

|

|

415,263

|

|

—

|

|

2,117,149

|

|

|

Debt-to-equity ratio

(7)

|

8.9

|

|

3.3

|

|

2.7

|

|

NA

|

|

6.3

|

|

|

Repurchase agreement debt-to-equity ratio

(8)

|

9.2

|

|

3.3

|

|

2.8

|

|

NA

|

|

5.7

|

|

|

(1)

|

Cash and cash equivalents is allocated based on a percentage of equity for Agency RMBS, Residential Credit and Commercial Credit.

|

|

(2)

|

Derivative assets are allocated based on the hedging strategy for each asset class.

|

|

(3)

|

Secured loans are allocated based on amount of collateral pledged.

|

|

(4)

|

Non-Agency RMBS and GSE CRT are considered residential credit.

|

|

(5)

|

CMBS, Commercial Loans and Investments in unconsolidated ventures are considered commercial credit.

|

|

(6)

|

Net equity in unsecured assets and exchangeable senior notes includes commercial loans, investments in unconsolidated ventures and exchangeable senior notes.

|

|

(7)

|

Debt-to-equity ratio is calculated as the ratio of total debt (sum of repurchase agreements, secured loans and exchangeable senior notes) to total equity.

|

|

(8)

|

Repurchase agreement debt-to-equity ratio is calculated as the ratio of repurchase agreements to equity related to repurchase agreement debt.

|

|

52

|

||

|

$ in thousands

|

Agency RMBS

|

Residential Credit

(4)

|

Commercial Credit

(5)

|

Exchangeable Senior Notes

|

Total

|

|||||

|

Investments

|

10,091,989

|

|

7,052,074

|

|

3,659,589

|

|

—

|

|

20,803,652

|

|

|

Cash and cash equivalents

(1)

|

64,603

|

|

51,732

|

|

47,809

|

|

—

|

|

164,144

|

|

|

Derivative assets, at fair value

(2)

|

23,183

|

|

396

|

|

599

|

|

—

|

|

24,178

|

|

|

Other assets

|

111,817

|

|

43,099

|

|

84,127

|

|

—

|

|

239,043

|

|

|

Total assets

|

10,291,592

|

|

7,147,301

|

|

3,792,124

|

|

—

|

|

21,231,017

|

|

|

Repurchase agreements

|

9,018,818

|

|

3,145,408

|

|

1,458,451

|

|

—

|

|

13,622,677

|

|

|

Secured loans

(3)

|

—

|

|

—

|

|

1,250,000

|

|

—

|

|

1,250,000

|

|

|

Asset-backed securities issued by securitization trusts (ABS)

|

—

|

|

2,929,820

|

|

—

|

|

—

|

|

2,929,820

|

|

|

Exchangeable senior notes

|

—

|

|

—

|

|

—

|

|

400,000

|

|

400,000

|

|

|

Derivative liabilities, at fair value

|

254,026

|

|

—

|

|

—

|

|

—

|

|

254,026

|

|

|

Other liabilities

|

56,894

|

|

35,274

|

|

43,476

|

|

—

|

|

135,644

|

|

|

Total liabilities

|

9,329,738

|

|

6,110,502

|

|

2,751,927

|

|

400,000

|

|

18,592,167

|

|

|

Total equity (allocated)

|

961,854

|

|

1,036,799

|

|

1,040,197

|

|

(400,000

|

)

|

2,638,850

|

|

|

Adjustments to calculate repurchase agreement debt-to-equity:

|

||||||||||

|

Net equity in unsecured assets and exchangeable senior notes

(6)

|

—

|

|

(7,677

|

)

|

(193,384

|

)

|

400,000

|

|

198,939

|

|

|

Collateral pledged against Secured loans

|

—

|

|

—

|

|

(1,550,270

|

)

|

—

|

|

(1,550,270

|

)

|

|

Secured loans

|

—

|

|

—

|

|

1,250,000

|

|

—

|

|

1,250,000

|

|

|

Equity related to repurchase agreement debt

|

961,854

|

|

1,029,122

|

|

546,543

|

|

—

|

|

2,537,519

|

|

|

Debt-to-equity ratio

(7)

|

9.4

|

|

5.9

|

|

2.6

|

|

NA

|

|

6.9

|

|

|

Repurchase agreement debt-to-equity ratio

(8)

|

9.4

|

|

3.1

|

|

2.7

|

|

NA

|

|

5.4

|

|

|

(1)

|

Cash and cash equivalents is allocated based on a percentage of equity for Agency RMBS, Residential Credit and Commercial Credit.

|

|

(2)

|

Derivative assets are allocated based on the hedging strategy for each asset class.

|

|

(3)

|

Secured loans are allocated based on amount of collateral pledged.

|

|

(4)

|

Non-Agency RMBS and GSE CRT are considered residential credit.

|

|

(5)

|

CMBS, Commercial Loans and Investments in unconsolidated ventures are considered commercial credit.

|

|

(6)

|

Net equity in unsecured assets and exchangeable senior notes includes commercial loans, investments in unconsolidated ventures and exchangeable senior notes.

|

|

(7)

|

Debt-to-equity ratio is calculated as the ratio of total debt (sum of repurchase agreements, secured loans and exchangeable senior notes) to total equity.

|

|

(8)

|

Repurchase agreement debt-to-equity ratio is calculated as the ratio of repurchase agreements to equity related to repurchase agreement debt.

|

|

53

|

||

|

|

As of and for the Years Ended

|

|||||||

|

|

December 31,

|

|||||||

|

$ in thousands

|

2015

|

2014

|

2013

|

|||||

|

Average Balances*:

|

||||||||

|

Agency RMBS:

|

||||||||

|

15 year fixed-rate, at amortized cost

|

1,698,573

|

|

1,450,316

|

|

1,897,780

|

|

||

|

30 year fixed-rate, at amortized cost

|

4,368,662

|

|

5,723,270

|

|

10,217,822

|

|

||

|

ARM, at amortized cost

|

446,714

|

|

475,401

|

|

122,225

|

|

||

|

Hybrid ARM, at amortized cost

|

3,219,463

|

|

2,452,062

|

|

758,625

|

|

||

|

MBS-CMO, at amortized cost

|

423,409

|

|

476,636

|

|

496,607

|

|

||

|

Non-Agency RMBS, at amortized cost

|

2,680,493

|

|

3,245,701

|

|

3,593,337

|

|

||

|

GSE CRT, at amortized cost

|

665,471

|

|

478,929

|

|

9,435

|

|

||

|

CMBS, at amortized cost

|

3,173,737

|

|

2,947,733

|

|

2,412,694

|

|

||

|

Residential loans, at amortized cost

|

3,198,666

|

|

2,473,258

|

|

1,006,374

|

|

||

|

Commercial loans, at amortized cost

|

166,150

|

|

109,551

|

|

14,858

|

|

||

|

Average Investment portfolio

|

20,041,338

|

|

19,832,857

|

|

20,529,757

|

|

||

|

Average Portfolio Yields

(1)

:

|

||||||||

|

Agency RMBS:

|

||||||||

|

15 year fixed-rate

|

2.23

|

%

|

2.66

|

%

|

2.32

|

%

|

||

|

30 year fixed-rate

|

2.80

|

%

|

3.05

|

%

|

2.88

|

%

|

||

|

ARM

|

2.30

|

%

|

2.30

|

%

|

2.35

|

%

|

||

|

Hybrid ARM

|

2.13

|

%

|

2.28

|

%

|

2.18

|

%

|

||

|

MBS - CMO

|

3.16

|

%

|

3.56

|

%

|

2.26

|

%

|

||

|

Non-Agency RMBS

|

4.61

|

%

|

4.54

|

%

|

4.59

|

%

|

||

|

GSE CRT

(2)

|

0.54

|

%

|

0.50

|

%

|

5.80

|

%

|

||

|

CMBS

|

4.37

|

%

|

4.47

|

%

|

4.64

|

%

|

||

|

Residential loans

|

3.47

|

%

|

3.57

|

%

|

3.30

|

%

|

||

|

Commercial loans

|

8.36

|

%

|

8.56

|

%

|

9.77

|

%

|

||

|

Average Investment portfolio

|

3.22

|

%

|

3.41

|

%

|

3.32

|

%

|

||

|

*

|

Average amounts for each period are based on weighted month-end balances.

|

|

(1)

|

Average portfolio yield for the period was calculated by dividing interest income, including amortization of premiums and discounts, by our average of the amortized cost of the investments. All yields are annualized.

|

|

(2)

|

GSE CRT average portfolio yield for the year ended December 31,

2015

and

2014

excludes embedded derivative coupon interest recorded as realized and unrealized credit derivative income (loss), net.

|

|

54

|

||

|

|

December 31, 2015

|

September 30, 2015

|

|||||||||

|

|

Company

|

Cohort

|

Company

|

Cohort

|

|||||||

|

15 year Agency RMBS

|

10.7

|

|

12.6

|

|

13.1

|

|

14.7

|

|

|||

|

30 year Agency RMBS

|

12.5

|

|

14.0

|

|

14.8

|

|

16.7

|

|

|||

|

Agency Hybrid ARM RMBS

|

13.9

|

|

NA

|

|

15.2

|

|

NA

|

|

|||

|

Non-Agency RMBS

|

12.5

|

|

NA

|

|

15.3

|

|

NA

|

|

|||

|

GSE CRT

|

10.5

|

|

NA

|

|

12.6

|

|

NA

|

|

|||

|

Weighted average CPR

|

12.6

|

|

NA

|

|

14.7

|

|

NA

|

|

|||

|

|

As of and for the Years Ended

|

|||||||

|

|

December 31,

|

|||||||

|

$ in thousands

|

2015

|

2014

|

2013

|

|||||

|

Average Borrowings*:

|

||||||||

|

Agency RMBS

(1)

|

9,118,307

|

|

9,444,028

|

|

12,107,119

|

|

||

|

Non-Agency RMBS

|

2,439,849

|

|

2,821,132

|

|

2,847,536

|

|

||

|

GSE CRT

|

484,414

|

|

351,900

|

|

6,887

|

|

||

|

CMBS

(1)

|

2,632,338

|

|

2,305,970

|

|

1,900,365

|

|

||

|

Exchangeable senior notes

|

400,000

|

|

400,000

|

|

321,111

|

|

||

|

Asset-backed securities issued by securitization trusts

|

2,779,268

|

|

2,178,362

|

|

916,786

|

|

||

|

Total borrowed funds

|

17,854,176

|

|

17,501,392

|

|

18,099,804

|

|

||

|

Maximum borrowings during the period

(2)

|

18,416,608

|

|

18,202,497

|

|

19,710,901

|

|

||

|

Average Cost of Funds

(3)

:

|

||||||||

|

Agency RMBS

(1)

|

0.39

|

%

|

0.34

|

%

|

0.40

|

%

|

||

|

Non-Agency RMBS

|

1.58

|

%

|

1.54

|

%

|

1.60

|

%

|

||

|

GSE CRT

|

1.73

|

%

|

1.52

|

%

|

1.50

|

%

|

||

|

CMBS

(1)

|

0.93

|

%

|

1.11

|

%

|

1.45

|

%

|

||

|

Exchangeable senior notes

|

5.62

|

%

|

5.62

|

%

|

5.61

|

%

|

||

|

Asset-backed securities issued by securitization trusts

|

2.95

|

%

|

3.13

|

%

|

2.91

|

%

|

||

|

Unhedged cost of funds

(4)

|

1.19

|

%

|

1.13

|

%

|

0.92

|

%

|

||

|

Hedged / Effective cost of funds (non-GAAP measure)

|

2.22

|

%

|

2.27

|

%

|

1.84

|

%

|

||

|

*

|

Average amounts for each period are based on weighted month-end balances.

|

|

(1)

|

Agency RMBS and CMBS average borrowing and cost of funds include borrowings under repurchase agreements and secured loans.

|

|

(2)

|

Amount represents the maximum borrowings at month-end during each of the respective periods.

|

|

55

|

||

|

(3)

|

Average cost of funds is calculated by dividing annualized interest expense by our average borrowings.

|

|

(4)

|

Excludes reclassification of amortization of net deferred losses on de-designated interest rate swaps to repurchase agreement interest expense.

|

|

56

|

||

|

$ in thousands

|

As of December 9, 2015

|

|

|

Gain (loss) related to derecognition of Residential Securitizations, net

|

(13,260

|

)

|

|

Gain (loss) related to remeasurement of retained interest, net

|

3,068

|

|

|

Gain (loss) on sale of the securities, net

|

(9,431

|

)

|

|

Total gain (loss) on deconsolidation of VIEs, net

|

(19,623

|

)

|

|

57

|

||

|

$ in thousands

|

Year ended December 31, 2015

|

||||||||||

|

Derivative

not designated as

hedging instrument

|

Realized gain (loss) on settlement, termination, expiration or

exercise, net

|

Contractual

interest expense

|

Unrealized

gain (loss), net

|

Gain (loss) on derivative instruments, net

|

|||||||

|

Interest Rate Swaps

|

(31,881

|

)

|

(184,373

|

)

|