|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 000-51609

Inland American Real Estate Trust, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 34-2019608 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| 2901 Butterfield Road, Oak Brook, Illinois | 60523 | |

| (Address of principal executive offices) | (Zip Code) | |

630-218-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, $0.001 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act).

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There is no established market for the registrant’s shares of common stock. The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2011 (the last business day of the registrant’s most recently completed second quarter) was approximately $6,698,005,345, based on the estimated per share value of $8.03, as established by the registrant on September 21, 2010.

As of March 1, 2012, there were 873,737,630 shares of the registrant’s common stock outstanding.

The registrant incorporates by reference portions of its Definitive Proxy Statement for the 2012 Annual Meeting of Stockholders, which is expected to be filed no later than April 29, 2012, into Part III of this Form 10-K to the extent stated herein.

Table of Contents

INLAND AMERICAN REAL ESTATE TRUST, INC.

| Page | ||||||

| Part I | ||||||

|

Item 1. |

01 | |||||

|

Item 1A. |

06 | |||||

|

Item 1B. |

28 | |||||

|

Item 2. |

28 | |||||

|

Item 3. |

32 | |||||

|

Item 4. |

32 | |||||

| Part II | ||||||

|

Item 5. |

33 | |||||

|

Item 6. |

36 | |||||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | ||||

|

Item 7A. |

60 | |||||

|

Item 8. |

62 | |||||

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

199 | ||||

|

Item 9A. |

199 | |||||

|

Item 9B. |

199 | |||||

| Part III | ||||||

|

Item 10. |

200 | |||||

|

Item 11. |

200 | |||||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

200 | ||||

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

200 | ||||

|

Item 14. |

200 | |||||

| Part IV | ||||||

|

Item 15. |

201 | |||||

| 202 | ||||||

This Annual Report on Form 10-K includes references to certain trademarks. Courtyard by Marriott ® , Marriott ® , Marriott Suites ® , Residence Inn by Marriott ® and SpringHill Suites by Marriott ® trademarks are the property of Marriott International, Inc. (“Marriott”) or one of its affiliates. Doubletree ® , Embassy Suites ® , Hampton Inn ® , Hilton Garden Inn ® , Hilton Hotels ® and Homewood Suites by Hilton ® trademarks are the property of Hilton Hotels Corporation (“Hilton”) or one or more of its affiliates. Hyatt Place ® trademark is the property of Hyatt Corporation (“Hyatt”). Intercontinental Hotels ® trademark is the property of IHG. Wyndham ® and Baymont Inn & Suites ® trademarks are the property of Wyndham Worldwide. Comfort Inn ® trademark is the property of Choice Hotels International. Fairmont Hotels and Resorts is a trademark. The Aloft service name is the property of Starwood. For convenience, the applicable trademark or service mark symbol has been omitted but will be deemed to be included wherever the above-referenced terms are used.

-i-

Table of Contents

General

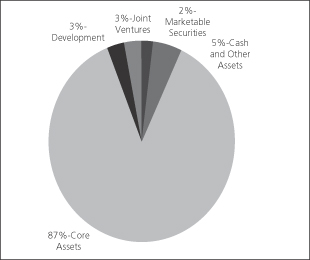

Inland American Real Estate Trust, Inc., a Maryland corporation, was incorporated in October 2004. We have elected to be taxed, and currently qualify, as a real estate investment trust (“REIT”) for federal tax purposes. We acquire, own, operate and develop a diversified portfolio of commercial real estate, including retail, multi-family, industrial, lodging, and office properties, located in the United States. In addition, we own assets through joint ventures in which we do not own a controlling interest, as well as properties in development. We also invest in marketable securities and other assets. The following chart depicts the allocation of each type of asset, as of December 31, 2011, based on undepreciated values.

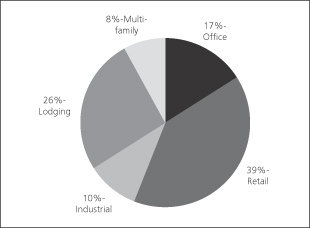

As of December 31, 2011, 86% of our total portfolio was comprised of our “core” assets, which consisted of 964 properties comprised of 49.3 million square feet of retail, office and industrial space, 9,563 multi-family units and 15,597 hotel rooms. We believe that a diversified portfolio balances our risk exposure compared to a portfolio with a single asset class. We believe that a diversified portfolio like ours provides our stockholders with significant benefits, and reduces their risk relative to a portfolio concentrated on one property sector or properties located in one geographical area or region. Because we believe that most real estate markets are cyclical in nature, we believe that our diversified investment strategy allows us to more effectively deploy capital into sectors and locations where the underlying investment fundamentals are relatively strong and away from sectors where the fundamentals are relatively weak. Further, we believe that an investment strategy that combines real property investments with other real estate-related investments, like ours, provides our stockholders with additional diversification benefits. The following chart depicts the allocation of our core assets for each segment, as of December 31, 2011, based on undepreciated assets within our property portfolio.

-1-

Table of Contents

Objectives & Strategy

We focus on maximizing stockholder value by utilizing the depth of our expertise to capitalize on opportunities in the real estate industry. We believe our capacity to identify and react to investment opportunities is one of our biggest strengths. Our strategies for reaching this objective are:

| • |

Maintaining a reliable and sustainable distribution rate |

| • |

Disposing of less strategic assets and deploying capital into quality assets in higher performing asset segments to further enhance the value of our segments |

| • |

Positioning our capital structure to capture near-term acquisition opportunities through a conservative balance sheet and manageable debt maturities |

| • |

Maximizing revenue from our existing properties by improving occupancy at market rents, controlling both operating and capital expenditures |

| • |

Maximizing stockholder value through liquidity events on a segment by segment basis |

2011 Highlights

Distributions

We have paid a monthly cash distribution to our stockholders which totaled $428.7 million for the year ended December 31, 2011, which was equal to $0.50 per share for 2011. The distributions paid for the year ended December 31, 2011 were funded from cash flow from operations and distributions from unconsolidated joint ventures.

Investing Activities

During 2011, we continued to refine our asset portfolio. We acquired three upper upscale lodging properties consisting of 1,172 rooms for $166.5 million. In addition, we acquired seven high quality multi-tenant retail properties consisting of 1,673,701 square feet for $282.8 million. As part of our strategy to realign our asset segments with higher performing assets, we sold 26 properties for a gross disposition price of $242.3 million, including fourteen retail properties, six midscale lodging properties, four office properties, one industrial property, and one multi-family property.

Financing Activities

We successfully refinanced our 2011 maturities of approximately $540 million and placed debt on new and existing properties. We were able to obtain favorable rates while still maintaining a manageable debt maturity schedule for future years. As of December 31, 2011, we had mortgage debt of approximately $5.8 billion, of which $671 million matures in 2012. Subsequently, we have refinanced or extended approximately $200 million. Our debt increased by $303.9 million from 2010 and have a weighted average interest rate of 5.2% per annum.

Operating Results

We saw significant net operating income increases in our same store lodging and multi-family properties from the year ended December 31, 2010 to 2011, offset by a slight decrease in net operating income in our retail, office and industrial portfolios. In 2012, we expect similar operating results in our lodging and multi-family portfolios due to the growth projected in these segments. We expect to maintain high occupancy in our retail, office, and industrial portfolios, which will result in consistent operating performance in the retail and industrial segments and a slight decrease in our office performance.

-2-

Table of Contents

The following table represents our same store net operating results for the years ended December 31, 2011 and 2010.

|

2011 Net

operating income |

2010 Net

operating income |

Increase

(decrease) |

Increase

(decrease) |

Economic

Occupancy as of December 31, 2011 |

Economic

Occupancy as of December 31, 2010 |

|||||||||||||||||||

|

Retail |

$ | 220,592 | $ | 222,908 | $ | (2,316 | ) | -1.0 | % | 94 | % | 94 | % | |||||||||||

|

Lodging |

158,567 | 143,161 | 15,406 | 10.8 | % | 71 | % | 70 | % | |||||||||||||||

|

Office |

129,383 | 132,956 | (3,573 | ) | -2.7 | % | 92 | % | 94 | % | ||||||||||||||

|

Industrial |

76,206 | 76,917 | (711 | ) | -0.9 | % | 92 | % | 92 | % | ||||||||||||||

|

Multi-Family |

43,554 | 37,336 | 6,218 | 16.7 | % | 92 | % | 91 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 628,302 | $ | 613,278 | $ | 15,024 | 2.4 | % | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Segment Data

We have five business segments: Retail, Lodging, Office, Industrial, and Multi-family. We evaluate segment performance primarily based on net property operations. Net property operations of the segments do not include interest expense, depreciation and amortization, general and administrative expenses, or interest and other investment income from corporate investments. The non-segmented assets include our cash and cash equivalents, investment in marketable securities, construction in progress, and investment in unconsolidated entities. Information related to our business segments including a measure of profits or loss and revenues from external customers for each of the last three fiscal years and total assets for each of the last two fiscal years is set forth in Note 14 to our consolidated financial statements in Item 8 of this Annual Report on Form 10-K.

Significant Tenants

For the year ended December 31, 2011, we generated more than 16% of our rental revenue from two tenants, SunTrust Bank and AT&T, Inc. SunTrust Bank leases multiple properties throughout the United States, which collectively generated approximately 9% of our rental revenue for the year ended December 31, 2011. For the year ended December 31, 2011, approximately 7% of our rental revenue was generated by three properties leased to AT&T, Inc.

Tax Status

We have elected to be taxed as a REIT, under Sections 856 through 860 of the Internal Revenue Code of 1986 as amended (the “Code”) beginning with the tax year ended December 31, 2005. Because we qualify for taxation as a REIT, we generally will not be subject to federal income tax on taxable income that is distributed to stockholders. If we fail to qualify as a REIT in any taxable year, without the benefit of certain relief provisions, we will be subject to federal and state income tax on our taxable income at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to certain state and local taxes on our income, property or net worth, respectively, and to Federal income and excise taxes on our undistributed income.

Competition

The commercial real estate market is highly competitive. We compete in all of our markets with other owners and operators of commercial properties. We compete based on a number of factors that include location, rental rates, security, suitability of the property’s design to tenants’ needs and the manner in which the property is operated and marketed. The number of competing properties in a particular market could have a material effect on a property’s occupancy levels, rental rates and operating income.

-3-

Table of Contents

We compete with many third parties engaged in real estate investment activities including other REITs, including other REITs sponsored by our sponsor, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, lenders, hedge funds, governmental bodies and other entities. There are also other REITs with investment objectives similar to ours and others may be organized in the future. In addition, these same entities seek financing through the same channels that we do. Therefore, we compete for funding in a market where funds for real estate investment may decrease, or grow less than the underlying demand.

Employees

As of December 31, 2011, we have 99 full-time individuals employed primarily by our multi-family subsidiaries.

Our executive officers do not receive any compensation from us for their services as such officers. Our executive officers are officers of one or more of The Inland Group, Inc.’s affiliated entities, including our business manager, and are compensated by these entities, in part, for their services rendered to us. For the purposes of reimbursement, our secretary is not considered an “executive officer.”

We have entered into a business management agreement with Inland American Business Manager & Advisor, Inc. to serve as our business manager, with responsibility for overseeing and managing our day-to-day operations. We have also entered into property management agreements with each of our property managers. We pay fees to our business manager and our property managers in consideration for the services they perform for us pursuant to these agreements.

Conflicts of Interest

Our governing documents require a majority of our directors to be independent. Further, any transactions between The Inland Group, Inc. or its affiliates and us must be approved by a majority of our independent directors.

Environmental Matters

Compliance with federal, state and local environmental laws has not had a material adverse effect on our business, assets, or results of operations, financial condition and ability to pay distributions, and we do not believe that our existing portfolio will require us to incur material expenditures to comply with these laws and regulations. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on our properties.

Seasonality

The lodging segment is seasonal in nature, reflecting higher revenue and operating income during the second and third quarters. This seasonality can be expected to cause fluctuations in our net property operations for the lodging segment. None of our other segments are seasonal in nature.

Access to Company Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (“SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800)-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available, free of charge, by responding to requests addressed to our customer relations group, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all

-4-

Table of Contents

amendments to those reports on our website, www.inland-american.com. These reports are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC.

Certifications

We have filed with the Securities and Exchange Commission the principal executive officer and principal financial officer certifications required pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached as Exhibits 31.1 and 31.2 to this Annual Report on Form 10-K.

-5-

Table of Contents

The occurrence of any of the risks discussed below could have a material adverse effect on our business, financial condition, results of operations and ability to pay distributions to our stockholders.

Risks Related to Our Business

Recent disruptions in the financial markets and current economic conditions could adversely affect our ability to refinance or secure additional debt financing at attractive terms and the values of our investments.

The capital and credit markets have been extremely volatile since the fall of 2008. In particular, the real estate debt markets have experienced volatility as a result of certain factors, including the tightening of underwriting standards by lenders and credit rating agencies, therefore making it more costly to refinance our existing debt and to obtain new financing on attractive terms. If overall borrowing costs continue to increase, either by increases in the index rates or by increases in lender spreads, our operations may generate lower returns.

In addition, the disruptions in the financial markets and recent economic conditions have negatively impacted commercial real estate fundamentals, which could have, and in some cases have already had, various negative impacts on the value of our investments, including:

| • |

a decrease in the values of our investments in commercial properties, below the amounts paid for such investments; or |

| • |

a decrease in revenues from our properties, due to lower occupancy and rental rates, which may make it more difficult for us to pay distributions or meet our debt service obligations on debt financing. |

Our ongoing strategy depends, in part, upon future acquisitions, and we may not be successful in identifying and consummating these transactions .

Our business strategy involves realigning on assets through disposal of assets and acquisition of higher performing properties. We may not be successful in identifying suitable properties or other assets or in consummating these transactions on satisfactory terms, if at all.

Further, we face significant competition for attractive investment opportunities from an indeterminate number of other real estate investors, including investors with significant capital resources such as domestic and foreign corporations and financial institutions, publicly traded and privately held REITs, private institutional investment funds, investment banking firms, life insurance companies and pension funds. As a result of competition, we may be unable to acquire additional properties as we desire or the purchase price may be significantly elevated.

In light of current market conditions and depressed real estate values, property owners in many markets remain hesitant to sell their properties, resulting in fewer opportunities to acquire properties. Of the limited number of desirable properties that we are seeing come to market, we are either facing significant competition to acquire stabilized properties, or having to accept lease-up risk associated with properties that have lower occupancy. As market conditions and real estate values recover, more properties may become available for acquisition, but we can provide no assurances that these properties will meet our investment objectives or that we will be successful in acquiring these properties. Although conditions in the credit markets have improved over the past year, the ability of buyers to utilize higher levels of leverage to finance property acquisitions has been, and remains, somewhat limited. If we are unable to acquire sufficient debt financing at suitable rates or at all, we may be unable to acquire as many additional properties as we anticipate.

Our ongoing strategy involves the disposition of properties; however, we may be unable to sell a property on acceptable terms and conditions, if at all.

Another one of our strategies is to dispose of certain properties. We believe that in certain instances, it makes economic sense to sell properties in today’s market, such as when we believe the value of the leases in place at a

-6-

Table of Contents

property will significantly decline over the remaining lease term, when the property has limited or no equity with a near-term debt maturity, when a property has equity but the projected returns do not justify further investment or when the equity in a property can be redeployed in the portfolio in order to achieve better returns or strategic goals. However, the general economic climate along with property specific issues, such as vacancies and lease terminations, have negatively affected the value of certain of our properties and therefore reduced our ability to sell these properties on acceptable terms. Real estate investments often cannot be sold quickly. As a result of current economic conditions, potential purchasers may be unable to obtain financing on acceptable terms, if at all, thereby delaying our ability to sell our properties. In addition, the capitalization rates at which properties may be sold could have risen since our acquisition of the properties, thereby reducing our potential proceeds from sale. Furthermore, properties that we have owned for a significant period of time or that we acquired in exchange for partnership interests in our operating partnership may have a low tax basis. If we were to dispose of any of these properties in a taxable transaction, we may be required under provisions of the Code applicable to REITs to distribute a significant amount of the taxable gain, if any, to our stockholders and this could, in turn, impact our cash flow. In some cases, tax protection agreements with third parties may prevent us from selling certain properties in a taxable transaction without incurring substantial costs. In addition, purchase options and rights of first refusal held by tenants or partners in joint ventures may also limit our ability to sell certain properties.

If we lose or are unable to obtain key personnel, our ability to implement our investment strategies could be delayed or hindered.

Our success depends to a significant degree upon the contributions of certain of our executive officers and other key personnel of our business manager and property managers. If any of the key personnel of our business manager or property managers were to cease their affiliation with our business manager or property managers, respectively, our operating results could suffer. Further, we do not separately maintain “key person” life insurance that would provide us with proceeds in the event of death or disability of these persons. We believe our future success depends, in part, upon the ability of our business manager and property managers to hire and retain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and we cannot assure you that our business manager or property managers will be successful in attracting and retaining skilled personnel.

If we internalize our management functions, your interest in us could be diluted and we may be unable to retain key personnel.

At some point in the future, we may consider internalizing the functions performed for us by our business manager or property managers. The method by which we could internalize these functions could take many forms, and the method and cost of internalizing cannot be determined or estimated at this time. If we acquired our business manager or property managers as part of an internalization, the amount and form of any consideration that we would pay in this type of transaction could take many forms. For example, we could acquire the business manager or property managers through a merger in which we issue shares of our common stock for all of the outstanding common stock or assets of these entities. Issuing shares of our common stock would reduce the percentage of our outstanding shares owned by stockholders prior to any transaction. Issuing promissory notes could reduce our net income, cash flow from operating activities and our ability to make distributions, particularly if internalizing these functions does not produce cost savings. Further, if we internalize our management functions, certain key employees may not become our employees but may instead remain employees of our business manager and property managers, or their respective affiliates, especially if we internalize our management functions but do not acquire our business manager or property managers. See If we seek to internalize our management functions, other than by acquiring our business manager or property managers, we could incur greater costs and lose key personnel below. An inability to manage an internalization transaction could effectively result in our incurring excess costs and suffering deficiencies in our disclosure controls and procedures or our internal control over financial reporting. These deficiencies could cause us to incur additional costs, and our management’s attention could be diverted from most effectively managing our investments, which could result in us being sued and incurring litigation-associated costs in connection with the internalization transaction.

-7-

Table of Contents

If we pursue the acquisition of our business manager or property managers, there is no assurance that we will reach an agreement with these parties as to the terms of the transaction.

Even if we pursue the acquisition of our business manager and property managers, neither entity is obligated to enter into a transaction with us or to do so at any particular price. If we desire to internalize our management functions by acquiring our business manager and property managers, our independent directors, as a whole, or a committee thereof, will have to negotiate the specific terms and conditions of any agreement or agreements to acquire these entities, including the actual purchase price. There is no assurance that we will be able to enter into an agreement with the business manager and property managers on mutually acceptable terms. Accordingly, we would have to seek alternative courses of actions to internalize our management functions.

If we seek to internalize our management functions, other than by acquiring our business manager or property managers, we could incur greater costs and lose key personnel.

If our board deems an internalization to be in our best interests, it may decided that we should pursue an internalization by hiring our own group of executives and other employees or entering into an agreement with a third party, such as a merger, instead of by acquiring our business manager and property managers. The costs that we would incur in this case are uncertain and may be substantial. In addition, certain key personnel of the business manager and or property managers have employment agreements with those entities, which could restrict our ability to retain such personnel if we do not acquire the business manager and or property managers. Further, we would lose the benefit of the experience of business manager and property managers.

The failure of any bank in which we deposit our funds could reduce the amount of cash we have available to pay distributions and make additional investments.

We have deposited our cash and cash equivalents in several banking institutions in an attempt to minimize exposure to the failure or takeover of any one of these entities. However, the Federal Insurance Deposit Corporation, or “FDIC,” generally only insures limited amounts per depositor per insured bank. At December 31, 2011, we had cash and cash equivalents and restricted cash deposited in interest bearing transaction accounts at certain financial institutions exceeding these federally insured levels. If any of the banking institutions in which we have deposited funds ultimately fails, we may lose our deposits over the federally insured levels. The loss of our deposits could reduce the amount of cash we have available to distribute or invest.

Risks Related to our Real Estate Assets

There are inherent risks with real estate investments.

Investments in real estate assets are subject to varying degrees of risk. For example, an investment in real estate cannot generally be quickly converted to cash, limiting our ability to promptly vary our portfolio in response to changing economic, financial and investment conditions. Investments in real estate assets also are subject to adverse changes in general economic conditions which, for example, reduce the demand for rental space.

Among the factors that could impact our real estate assets and the value of an investment in us are:

| • |

local conditions such as an oversupply of space or reduced demand for real estate assets of the type that we own or seek to acquire, including, with respect to our lodging facilities, quick changes in supply of and demand for rooms that are rented or leased on a day-to-day basis; |

| • |

inability to collect rent from tenants; |

| • |

vacancies or inability to rent space on favorable terms; |

| • |

inflation and other increases in operating costs, including insurance premiums, utilities and real estate taxes; |

| • |

increases in energy costs or airline fares or terrorist incidents which impact the propensity of people to travel and therefore impact revenues from our lodging facilities, although operating costs cannot be adjusted as quickly; |

-8-

Table of Contents

| • |

adverse changes in the federal, state or local laws and regulations applicable to us, including those affecting rents, zoning, prices of goods, fuel and energy consumption, water and environmental restrictions; |

| • |

the relative illiquidity of real estate investments; |

| • |

changing market demographics; |

| • |

an inability to acquire and finance, or refinance, properties on favorable terms, if at all; |

| • |

acts of God, such as earthquakes, floods or other uninsured losses; and |

| • |

changes or increases in interest rates and availability of financing. |

In addition, periods of economic slowdown or recession, or declining demand for real estate, or the public perception that any of these events may occur, could result in a general decline in rents or increased defaults under existing leases.

We depend on tenants for our revenue, and accordingly, lease terminations and tenant defaults could adversely affect the income produced by our properties.

The success of our investments depends on the financial stability of our tenants. The current economic conditions have adversely affected, and may continue to adversely affect, one or more of our tenants. For example, business failures and downsizings have affected the tenants of our office and industrial properties, and reduced consumer demand for retail products and services has affected the tenants of our retail properties. In addition, our retail shopping center properties typically are anchored by large, nationally recognized tenants, any of which may experience a downturn in their business that may weaken significantly their financial condition. Further, mergers or consolidations among large retail establishments could result in the closure of existing stores or duplicate or geographically overlapping store locations, which could include tenants at our retail properties.

As a result of these factors, our tenants may delay lease commencements, decline to extend or renew their leases upon expiration, fail to make rental payments when due, or declare bankruptcy. Any of these actions could result in the termination of the tenants’ leases, the expiration of existing leases without renewal, or the loss of rental income attributable to the terminated or expired leases. In the event of a tenant default or bankruptcy, we may experience delays in enforcing our rights as a landlord and may incur substantial costs in protecting our investment and re-leasing our property. Specifically, a bankruptcy filing by, or relating to, one of our tenants or a lease guarantor would bar efforts by us to collect pre-bankruptcy debts from that tenant or lease guarantor, or its property, unless we receive an order permitting us to do so from the bankruptcy court. In addition, we cannot evict a tenant solely because of bankruptcy. The bankruptcy of a tenant or lease guarantor could delay our efforts to collect past due balances under the relevant leases, and could ultimately preclude collection of these sums. If a lease is assumed by the tenant in bankruptcy, all pre-bankruptcy balances due under the lease must be paid to us in full. If, however, a lease is rejected by a tenant in bankruptcy, we would have only a general, unsecured claim for damages. An unsecured claim would only be paid to the extent that funds are available and only in the same percentage as is paid to all other holders of general, unsecured claims. Restrictions under the bankruptcy laws further limit the amount of any other claims that we can make if a lease is rejected. As a result, it is likely that we would recover substantially less than the full value of the remaining rent during the term.

Two of our tenants generated a significant portion of our revenue, and rental payment defaults by these significant tenants could adversely affect our results of operations.

For the year ended December 31, 2011, approximately 9% of our rental revenue was generated by over 400 retail banking properties leased to SunTrust Bank. Also, for the year ended December 31, 2011, approximately 7% of our rental revenue was generated by three properties leased to AT&T, Inc. The lease for one of the AT&T

-9-

Table of Contents

properties, with approximately 1.7 million square feet, expires in 2016. As a result of the concentration of revenue generated from these properties, if either SunTrust or AT&T were to cease paying rent or fulfilling its other monetary obligations, we could have significantly reduced rental revenues or higher expenses until the defaults were cured or the properties were leased to a new tenant or tenants.

We may suffer adverse consequences due to the financial difficulties, bankruptcy or insolvency of our tenants.

Recent economic conditions have caused, and may continue to cause, our tenants to experience financial difficulties, including bankruptcy, insolvency, or a general downturn in their business. The retail sector in particular has been, and could continue to be, adversely affected by weakness in the national, regional and local economies, the level of consumer spending and consumer confidence, the adverse financial condition of some large retailing companies, the ongoing consolidation in the retail sector, the excess amount of retail space in a number of markets and increasing competition from discount retailers, outlet malls, internet retailers and other online businesses. We cannot provide assurance that any tenant that files for bankruptcy protection will continue to pay us rent. A bankruptcy filing by, or relating to, one of our tenants or a lease guarantor would bar efforts by us to collect pre-bankruptcy debts from that tenant or lease guarantor, or its property, unless we receive an order permitting us to do so from the bankruptcy court. In addition, we cannot evict a tenant solely because of bankruptcy. The bankruptcy of a tenant or lease guarantor could delay our efforts to collect past due balances under the relevant leases, and could ultimately preclude collection of these sums. If a lease is assumed by the tenant in bankruptcy, all pre-bankruptcy balances due under the lease must be paid to us in full. If, however, a lease is rejected by a tenant in bankruptcy, we would have only a general, unsecured claim for damages. An unsecured claim would only be paid to the extent that funds are available and only in the same percentage as is paid to all other holders of general, unsecured claims. Restrictions under the bankruptcy laws further limit the amount of any other claims that we can make if a lease is rejected. As a result, it is likely that we would recover substantially less than the full value of the remaining rent during the term.

Leases representing approximately 5.4% of the rentable square feet of our retail, office, and industrial portfolio are scheduled to expire in 2012. We may be unable to renew leases or lease vacant space at favorable rates or at all.

As of December 31, 2011, leases representing approximately 5.4% of the 49,267,633 rentable square feet of our retail, office, and industrial portfolio were scheduled to expire in 2012, and an additional 7.0% of the square footage of our retail, office, and industrial portfolio was available for lease. We may be unable to extend or renew any of these leases, or we may be able to lease these spaces only at rental rates equal to or below existing rental rates. In addition, some of our tenants have leases that include early termination provisions that permit the lessee to terminate all or a portion of its lease with us after a specified date or upon the occurrence of certain events with little or no liability to us. We may be required to offer substantial rent abatements, tenant improvements, early termination rights or below-market renewal options to retain these tenants or attract new ones. Portions of our properties may remain vacant for extended periods of time. Further, some of our leases currently provide tenants with options to renew the terms of their leases at rates that are less than the current market rate or to terminate their leases prior to the expiration date thereof. If we are unable to obtain new rental rates that are on average comparable to our asking rents across our portfolio, then our ability to generate cash flow growth will be negatively impacted.

We may be required to make significant capital expenditures to improve our properties in order to retain and attract tenants.

We expect that, upon the expiration of leases at our properties, we may be required to make rent or other concessions to tenants, accommodate requests for renovations, build-to-suit remodeling and other improvements or provide additional services to our tenants. As a result, we may have to pay for significant leasing costs or tenant improvements in order to retain tenants whose leases are expiring and to attract new tenants in sufficient numbers. Additionally, we may need to raise capital to make such expenditures. If we are unable to do so or

-10-

Table of Contents

capital is otherwise unavailable, we may be unable to make the required expenditures. This could result in non-renewals by tenants upon expiration of their leases, which would result in declines in revenues from operations.

We face significant competition in the leasing market, which may decrease or prevent increases in the occupancy and rental rates of our properties.

We own properties located throughout the United States. We compete with numerous developers, owners and operators of commercial properties, many of which own properties similar to, and in the same market areas as, our properties. If our competitors offer space at rental rates below current market rates, or below the rental rates we currently charge our tenants, we may lose existing or potential tenants and we may be pressured to reduce our rental rates below those we currently charge in order to attract new tenants and retain existing tenants when their leases expire. Also, if our competitors develop additional properties in locations near our properties, there may be increased competition for creditworthy tenants, which may require us to make capital improvements to properties that we would not have otherwise made.

Geographic concentration of our portfolio may make us particularly susceptible to adverse economic developments in the real estate markets of those areas or natural disasters in those areas.

Because our properties are concentrated in certain geographic areas, our operating results are likely to be impacted by economic changes affecting the real estate markets in those areas. As of December 31, 2011, approximately, 4%, 5%, 7% and 12% of our base rental income of our consolidated portfolio, excluding our lodging facilities, was generated by properties located in the Minneapolis, Dallas, Chicago and Houston metropolitan areas, respectively.

Additionally, at December 31, 2011, 34 of our lodging facilities, or approximately 36% of our lodging portfolio, were located in Washington D.C. and the eight eastern seaboard states ranging from Connecticut to Florida, which includes 11 hotels in North Carolina. Additionally, 19 properties were located in Texas. Adverse events in these areas, such as recessions, hurricanes or other natural disasters, could cause a loss of revenues from these hotels. Further, several of the hotels are located near the water and are exposed to more severe weather than hotels located inland. Elements such as salt water and humidity can increase or accelerate wear on the hotels’ weatherproofing and mechanical, electrical and other systems, and cause mold issues. As a result, we may incur additional operating costs and expenditures for capital improvements at these hotels. Geographic concentration also exposes us to risks of oversupply and competition in these markets. Significant increases in the supply of certain property types, including hotels, without corresponding increases in demand could have a material adverse effect on our financial condition, results of operations and our ability to pay distributions.

To qualify as a REIT, we must rely on third parties to operate our hotels.

To continue qualifying as a REIT, we may not, among other things, operate any hotel, or directly participate in the decisions affecting the daily operations of any hotel. Thus, we have retained third party managers to operate our hotel properties. We do not have the authority to directly control any particular aspect of the daily operations of any hotel, such as setting room rates. Thus, even if we believe our hotels are being operated in an inefficient or sub-optimal manner, we may not be able to require an immediate change to the method of operation. Our only alternative for changing the operation of our hotels may be to replace the third party manager of one or more hotels in situations where the applicable management agreement permits us to terminate the existing manager. Certain of these agreements may not be terminated without cause, which generally requires fraud, misrepresentation and other illegal acts. Even if we terminate or replace any manager, there is no assurance that we will be able to find another manager or that we will be able to enter into new management agreements favorable to us. Any change of hotel management would cause a disruption in operations.

-11-

Table of Contents

Conditions of franchise agreements could adversely affect us.

Our lodging properties are operated pursuant to agreements with nationally recognized franchisors including Marriott International, Inc., Hilton Hotels Corporation, Intercontinental Hotels Group PLC, Hyatt Corporation, Wyndham Worldwide Corporation and Choice Hotels International. These agreements generally contain specific standards for, and restrictions and limitations on, the operation and maintenance of a hotel in order to maintain uniformity within the franchisor’s system. These standards are subject to change over time, in some cases at the discretion of the franchisor, and may restrict our ability to make improvements or modifications to a hotel, causing us to incur significant costs, without the consent of the franchisor. Conversely, these standards may require us to make certain improvements or modifications to a hotel, even if we do not believe the capital improvements are necessary or desirable or will result in an acceptable return on our investment.

These agreements also permit the franchisor to terminate the agreement in certain cases such as a failure to pay royalties and fees or to perform under covenants under the franchise agreement, bankruptcy, abandonment of the franchise, commission of a felony, assignment of the franchise without the consent of the franchisor or failure to comply with applicable law or maintain applicable standards in the operation and condition of the relevant hotel. If a franchise license terminates due to our failure to comply with the terms and conditions of the agreement, we may be liable to the franchisor for a termination payment. These payments vary. Also, these franchise agreements do not renew automatically.

Actions of our joint venture partners could negatively impact our performance.

As of December 31, 2011 we had entered into joint venture agreements with 11 entities to fund the investment of office, industrial/distribution, retail, lodging, and mixed use properties. The carrying value of our investment in these joint ventures, which we do not consolidate for financial reporting purposes, was $317 million. For the year ended December 31, 2011, we recorded losses of $13 million and impairments net of gains of $106 million associated with these ventures.

With respect to these investments, we are not in a position to exercise sole decision-making authority regarding the property, partnership, joint venture or other entity. Consequently, our joint venture investments may involve risks not otherwise present with other methods of investing in real estate. For example, our co-member, co-venturer or partner may have economic or business interests or goals which are or which become inconsistent with our business interests or goals or may take action contrary to our instructions or requests or contrary to our policies or objectives. We have experienced these events from time to time with our current venture partners, which in some cases has resulted in litigation with these partners. There can be no assurance that an adverse outcome in any lawsuit will not have a material effect on our results of operations for any particular period. In addition, any litigation increases our expenses and prevents our officers and directors from focusing their time and effort on other aspects of our business. Our relationships with our venture partners are contractual in nature. These agreements may restrict our ability to sell our interest when we desire or on advantageous terms and, on the other hand, may be terminated or dissolved under the terms of the agreements and, in each event, we may not continue to own or operate the interests or assets underlying the relationship or may need to purchase these interests or assets at an above-market price to continue ownership.

Current credit market disruptions and recent economic trends may increase the likelihood of a commercial developer defaulting on its obligations with respect to our development projects, including projects where we have notes receivable, or becoming bankrupt or insolvent.

We have entered into, and may continue to enter into, projects that are in various stages of pre-development and development. Investing in properties under development, and in lodging facilities in particular, which typically must be renovated or otherwise improved on a regular basis, including renovations and improvements required by existing franchise agreements, subjects us to uncertainties such as the ability to achieve desired zoning for

-12-

Table of Contents

development, environmental concerns of governmental entities or community groups, ability to control construction costs or to build in conformity with plans, specifications and timetables. The current economic climate has continued to impact real estate developments as well. The current slow-down in consumer spending has negatively impacted the retail environment in particular, and is causing many retailers to reduce new leasing and expansion plans. We believe that our retail developments will experience longer lease-up periods and that actual lease rates will be less than the leasing rates originally underwritten.

In addition, recent economic conditions have caused an increase in developer failures. The developers of the projects in which we have invested are exposed to risks not only with respect to our projects, but also other projects in which they are involved. A default by a developer in respect of one of our development project investments, or the bankruptcy, insolvency or other failure of a developer for one of these projects, may require that we determine whether we want to assume the senior loan, fund monies beyond what we are contractually obligated to fund, take over development of the project, find another developer for the project, or sell our interest in the project. Developer failures could give tenants the right to terminate pre-construction leases, delay efforts to complete or sell the development project and could ultimately preclude us from realizing our anticipated returns. These events could cause a decrease in the value of our assets and compel us to seek additional sources of liquidity, which may or may not be available, in order to hold and complete the development project.

Generally, under bankruptcy law and the bankruptcy guarantees we have required of certain of our joint venture development partners, we may seek recourse from the developer-guarantor to complete our development project with a substitute developer partner. However, in the event of a bankruptcy by the developer-guarantor, we cannot provide assurance that the developer or its trustee will satisfy its obligations. The bankruptcy of any developer or the failure of the developer to satisfy its obligations would likely cause us to have to complete the development or find a replacement developer on our own, which could result in delays and increased costs. We cannot provide assurance that we would be able to complete the development on terms as favorable as when we first entered into the project. If we are not able to, or elect not to, proceed with a development opportunity, the development costs ordinarily would be charged against income for the then-current period if we determine our costs are not recoverable.

Sale leaseback transactions may be recharacterized in a manner unfavorable to us.

From time to time we have entered into a sale leaseback transaction where we purchase a property and then lease the property to the seller. These transactions could, however, be characterized as a financing instead of a sale in the case of the seller’s bankruptcy. In this case, we would not be treated as the owner of the property but rather as a creditor with no interest in the property itself. The seller may have the ability in a bankruptcy proceeding to restructure the financing by imposing new terms and conditions. The transaction also may be recharacterized as a joint venture. In this case, we would be treated as a joint venturer with liability, under some circumstances, for debts incurred by the seller relating to the property.

Our investments in equity and debt securities have materially impacted, and may in the future materially impact, our results.

As of December 31, 2011, we had investments valued at $289 million in real estate related equity and debt securities. Real estate related equity securities are always unsecured and subordinated to other obligations of the issuer. Investments in real estate-related equity securities are subject to numerous risks including: (1) limited liquidity in the secondary trading market in the case of unlisted or thinly traded securities; (2) substantial market price volatility resulting from, among other things, changes in prevailing interest rates in the overall market or related to a specific issuer, as well as changing investor perceptions of the market as a whole, REIT or real estate securities in particular or the specific issuer in question; (3) subordination to the liabilities of the issuer; (4) the possibility that earnings of the issuer may be insufficient to meet its debt service obligations or to pay distributions; and (5) with respect to investments in real estate-related preferred equity securities, the operation of mandatory sinking fund or call/redemption provisions during periods of declining interest rates that could cause

-13-

Table of Contents

the issuer to redeem the securities. In addition, investments in real estate-related securities involve special risks relating to the particular issuer of the securities, including the financial condition and business outlook of the issuer. Issuers of real estate-related securities generally invest in real estate or real estate-related assets and are subject to the inherent risks associated with real estate-related investments discussed herein. In fact, many of the entities that we have invested in have reduced the dividends paid on their securities. The stock prices for some of these entities have declined since our initial purchase, and in certain cases we have sold these investments at a loss.

Any mortgage loans that we originate or purchase are subject to the risks of delinquency and foreclosure.

We may originate and purchase mortgage loans. These loans are subject to risks of delinquency and foreclosure, and risks of loss. The ability of a borrower to repay a loan secured by an income-producing property depends primarily upon the successful operation of the property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower’s ability to repay the loan may be impaired. A property’s net operating income can be affected by the any of the potential issues associated with real estate-related investments as discussed herein. We bear the risks of loss of principal to the extent of any deficiency between the value of the collateral and the principal and accrued interest of the mortgage loan. In the event of the bankruptcy of a mortgage loan borrower, the mortgage loan to that borrower will be deemed to be collateralized only to the extent of the value of the underlying collateral at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the mortgage loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law. Foreclosure of a mortgage loan can be an expensive and lengthy process that could have a substantial negative effect on our anticipated return on the foreclosed mortgage loan. We may also be forced to foreclose on certain properties, be unable to sell these properties and be forced to incur substantial expenses to improve operations at the property.

We may make a mortgage loan to affiliates of, or entities sponsored by, our sponsor.

If we have excess working capital, we may, from time to time, and subject to the conditions in our articles, make a mortgage loan to affiliates of, or entities sponsored by, our sponsor. These loan arrangements will not be negotiated at arm’s length and may contain terms and conditions that are not in our best interest and would not otherwise be applicable if we entered into arrangements with a third-party borrower not affiliated with these entities.

An increase in real estate taxes may decrease our income from properties.

From time to time, the amount we pay for property taxes increases as either property values increase or assessment rates are adjusted. Increases in a property’s value or in the assessment rate result in an increase in the real estate taxes due on that property. If we are unable to pass the increase in taxes through to our tenants, our net operating income for the property decreases.

Uninsured losses or premiums for insurance coverage may adversely affect a stockholder’s returns.

We attempt to adequately insure all of our properties against casualty losses. There are types of losses, generally catastrophic in nature, such as losses due to wars, acts of terrorism, earthquakes, floods, hurricanes, pollution or environmental matters that are uninsurable or not economically insurable, or may be insured subject to limitations, such as large deductibles or co-payments. Risks associated with potential acts of terrorism could sharply increase the premiums we pay for coverage against property and casualty claims. Additionally, mortgage lenders sometimes require commercial property owners to purchase specific coverage against terrorism as a condition for providing mortgage loans. These policies may not be available at a reasonable cost, if at all, which could inhibit our ability to finance or refinance our properties. In such instances, we may be required to provide

-14-

Table of Contents

other financial support, either through financial assurances or self-insurance, to cover potential losses. If we incur any casualty losses not fully covered by insurance, the value of our assets will be reduced by the amount of the uninsured loss. In addition, other than any reserves we may establish, we have no designated source of funding to repair or reconstruct any uninsured damaged property.

Terrorist attacks and other acts of violence or war may affect the markets in which we operate, our operations and our profitability.

We own estate assets located in areas that are susceptible to attack. These attacks may directly impact the value of our assets through damage, destruction, loss or increased security costs. Although we may obtain terrorism insurance, we may not be able to obtain sufficient coverage to fund any losses we may incur. Risks associated with potential acts of terrorism could sharply increase the premiums we pay for coverage against property and casualty claims. Further, certain losses resulting from these types of events are uninsurable or not insurable at reasonable costs.

More generally, any terrorist attack, other act of violence or war, including armed conflicts, could result in increased volatility in, or damage to, the United States and worldwide financial markets and economy. Any terrorist incident may, for example, deter people from traveling, which could affect the ability of our hotels to generate operating income and therefore our ability to pay distributions. Additionally, increased economic volatility could adversely affect our tenants’ ability to pay rent on their leases or our ability to borrow money or issue capital stock at acceptable prices.

The cost of complying with environmental and other governmental laws and regulations may adversely affect us.

All real property and the operations conducted on real property are subject to federal, state and local laws and regulations (including those of foreign jurisdictions) relating to environmental protection and human health and safety. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid and hazardous materials, and the remediation of contamination associated with disposals. We also are required to comply with various local, state and federal fire, health, life-safety and similar regulations. Some of these laws and regulations may impose joint and several liability on tenants or owners for the costs of investigating or remediating contaminated properties. These laws and regulations often impose liability whether or not the owner knew of, or was responsible for, the presence of the hazardous or toxic substances. The cost of removing or remediating could be substantial. In addition, the presence of these substances, or the failure to properly remediate these substances, may adversely affect our ability to sell or rent a property or to use the property as collateral for borrowing.

Environmental laws and regulations also may impose restrictions on the manner in which properties may be used or businesses may be operated, and these restrictions may require substantial expenditures by us. Environmental laws and regulations provide for sanctions in the event of noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Third parties may seek recovery from owners of real properties for personal injury or property damage associated with exposure to released hazardous substances. Compliance with new or more stringent laws or regulations or stricter interpretations of existing laws may require material expenditures by us. For example, various federal, regional and state laws and regulations have been implemented or are under consideration to mitigate the effects of climate change caused by greenhouse gas emissions. Among other things, “green” building codes may seek to reduce emissions through the imposition of standards for design, construction materials, water and energy usage and efficiency, and waste management. We are not aware of any such existing requirements that we believe will have a material impact on our current operations. However, future requirements could increase the costs of maintaining or improving our existing properties or developing new properties.

-15-

Table of Contents

Our properties may contain or develop harmful mold, which could lead to liability for adverse health effects and costs of remediating the problem.

The presence of mold at any of our properties could require us to undertake a costly program to remediate, contain or remove the mold. Mold growth may occur when moisture accumulates in buildings or on building materials. Some molds may produce airborne toxins or irritants. Concern about indoor exposure to mold has been increasing because exposure to mold may cause a variety of adverse health effects and symptoms, including allergic or other reactions. The presence of mold could expose us to liability from our tenants, their employees and others if property damage or health concerns arise.

We may incur significant costs to comply with the Americans With Disabilities Act.

Our properties generally are subject to the Americans With Disabilities Act of 1990, as amended. Under this act, all places of public accommodation are required to comply with federal requirements related to access and use by disabled persons. The act has separate compliance requirements for “public accommodations” and “commercial facilities” that generally require that buildings and services be made accessible and available to people with disabilities. The act’s requirements could require us to remove access barriers and could result in the imposition of injunctive relief, monetary penalties or, in some cases, an award of damages.

Borrowings may reduce the funds available for distribution and increase the risk of loss since defaults may cause us to lose the properties securing the loans.

We have acquired, and may continue to acquire, real estate assets by using either existing financing or borrowing new monies. Our articles generally limit the total amount we may borrow to 300% of our net assets. In addition, we may obtain loans secured by some or all of our properties or other assets to fund additional acquisitions or operations including to satisfy the requirement that we distribute at least 90% of our annual “REIT taxable income” (subject to certain adjustments) to our stockholders, or as is otherwise necessary or advisable to assure that we qualify as a REIT for federal income tax purposes. Payments required on any amounts we borrow reduce the funds available for, among other things, distributions to our stockholders because cash otherwise available for distribution is required to pay principal and interest associated with amounts we borrow.

Defaults on loans secured by a property we own may result in us losing the property or properties securing the loan that is in default as a result of foreclosure actions initiated by a lender. For tax purposes, a foreclosure would be treated as a sale of the property for a purchase price equal to the outstanding balance of the debt secured by the property. If the outstanding balance of the debt exceeds our tax basis in the property, we would recognize taxable gain on the foreclosure but would not receive any cash proceeds. We also may fully or partially guarantee any monies that subsidiaries borrow to purchase or operate real estate assets. In these cases, we will be responsible to the lender for repaying the loans if the subsidiary is unable to do so. If any mortgage contains cross-collateralization or cross-default provisions, more than one property may be affected by a default.

Lenders may restrict certain aspects of our operations, which could, among other things, limit our ability to make distributions.

The terms and conditions contained in any of our loan documents may require us to maintain cash reserves; limit the aggregate amount we may borrow on a secured and unsecured basis; require us to satisfy restrictive financial covenants; prevent us from entering into certain business transactions, such as a merger, sale of assets or other business combination; restrict our leasing operations; or require us to obtain consent from the lender to complete transactions or make investments that are ordinarily approved only by our board of directors. In addition, secured lenders typically restrict our ability to discontinue insurance coverage on a mortgaged property even though we may believe that the insurance premiums paid to insure against certain losses, such as losses due to wars, acts of terrorism, earthquakes, floods, hurricanes, pollution or environmental matters, are greater than the potential risk of loss.

-16-

Table of Contents

Interest-only indebtedness may increase our risk of default.

We have obtained, and continue to incur interest related to, interest-only mortgage indebtedness. During the interest only period, the amount of each scheduled payment is less than that of a traditional amortizing mortgage loan. The principal balance of the mortgage loan is not reduced (except in the case of prepayments) because there are no scheduled monthly payments of principal during this period. After the interest-only period, we are required either to make scheduled payments of amortized principal and interest or to make a lump-sum or “balloon” payment at maturity. These required principal or balloon payments increase the amount of our scheduled payments and may increase our risk of default under the related mortgage loan and reduce the funds available for distribution to our stockholders.

Increases in interest rates could increase the amount of our debt payments.

As of December 31, 2011, approximately $1.5 billion of our indebtedness bore interest at variable rates. Increases in interest rates in variable rate debt that has not otherwise been hedged through the use of swap agreements reduce the funds available for other needs, including distribution to our stockholders. As fixed rate debt matures, we may not be able to secure low fixed rate financing. In addition, if rising interest rates cause us to need additional capital to repay indebtedness, we may be forced to sell one or more of our properties or investments in real estate at times which may not permit us to realize the return on the investments we would have otherwise realized.

To hedge against interest rate fluctuations, we use derivative financial instruments, which may be costly and ineffective.

From time to time, we use derivative financial instruments to hedge exposures to changes in interest rates on certain loans secured by our assets. Our derivative instruments currently consist of interest rate swap contracts but may, in the future, include, interest rate cap or floor contracts, futures or forward contracts, options or repurchase agreements. Our actual hedging decisions are determined in light of the facts and circumstances existing at the time of the hedge. There is no assurance that our hedging strategy will achieve our objectives. We may be subject to costs, such as transaction fees or breakage costs, if we terminate these arrangements.

To the extent that we use derivative financial instruments to hedge against interest rate fluctuations, we are exposed to credit risk, basis risk and legal enforceability risks. In this context, credit risk is the failure of the counterparty to perform under the terms of the derivative contract. Basis risk occurs when the index upon which the contract is based is more or less variable than the index upon which the hedged asset or liability is based, thereby making the hedge less effective. Finally, legal enforceability risks encompass general contractual risks including the risk that the counterparty will breach the terms of, or fail to perform its obligations under, the derivative contract. A counterparty could fail, shut down, file for bankruptcy or be unable to pay out contracts. The business failure of a hedging counterparty with whom we enter into a hedging transaction will most likely result in a default. Default by a party with whom we enter into a hedging transaction may result in the loss of unrealized profits and force us to cover our resale commitments, if any, at the then current market price. Although generally we will seek to reserve the right to terminate our hedging positions, it may not always be possible to dispose of or close out a hedging position without the consent of the hedging counterparty, and we may not be able to enter into an offsetting contract to cover our risk. We cannot provide assurance that a liquid secondary market will exist for hedging instruments purchased or sold, and we may be required to maintain a position until exercise or expiration, which could result in losses.

Further, the REIT provisions of the Code may limit our ability to hedge the risks inherent to our operations. We may be unable to manage these risks effectively.

-17-

Table of Contents

We may be contractually obligated to purchase property even if we are unable to secure financing for the acquisition.

We typically finance a portion of the purchase price for each property that we acquire. However, to ensure that our offers are as competitive as possible, we generally do not enter into contracts to purchase property that include financing contingencies. Thus, we may be contractually obligated to purchase a property even if we are unable to secure financing for the acquisition. In this event, we may choose to close on the property by using cash on hand, which would result in less cash available for our operations and distributions to stockholders. Alternatively, we may choose not to close on the acquisition of the property and default on the purchase contract. If we default on any purchase contract, we could lose our earnest money and become subject to liquidated or other contractual damages and remedies.

Risks Related to Our Common Stock

There is no public market for our shares, and you may not be able to sell your shares, including through our share repurchase program.

There is no public market for our shares and no assurance that one may develop. Our charter does not require our directors to seek stockholder approval to liquidate our assets by a specified date, nor does our charter require our directors to list our shares for trading by a specified date. Further, our amended and restated share repurchase program permits us to repurchase shares only from a beneficiary of a stockholder that has died or from stockholders that have a qualifying disability or that are confined to a long-term care facility.

There is no assurance that we will be able to continue paying cash distributions or that distributions will increase over time.

We intend to continue paying regular monthly cash distributions to our stockholders. However, there are many factors that can affect the availability and timing of cash distributions to stockholders such as our ability to earn positive yields on our real estate assets, the yields on securities of other entities in which we invest, our operating expense levels, as well as many other variables. Actual cash available for distributions may vary substantially from estimates. There is no assurance that we will be able to continue paying distributions at the current level or that the amount of distributions will increase, or not decrease, over time. Even if we are able to continue paying distributions, the actual amount and timing of distributions is determined by our board of directors in its discretion and typically depends on the amount of funds available for distribution, which depends on items such as current and projected cash requirements and tax considerations. As a result, our distribution rate and payment frequency may vary from time to time.

Funding distributions from sources other than cash flow from operating activities may negatively impact our ability to sustain or pay distributions and will result in us having less cash available for other uses.

If our cash flow from operating activities is not sufficient to fully fund the payment of distributions, the level of our distributions may not be sustainable and some or all of our distributions will be paid from other sources. For example, from time to time, our business manager has determined, in its sole discretion, to either forgo or defer a portion of the business management fee, which has had the effect of increasing cash flow from operations for the relevant period because we have not had to use that cash to pay any fee or reimbursement which was foregone or deferred during the relevant period. For the year ended December 31, 2011, we paid a business management fee of $40 million, or approximately 0.35% of our average invested assets on an annual basis, as well as an investment advisory fee of approximately $1.6 million, together which are less than the full 1% fee that the business manager could be paid. However, there is no assurance that our business manager will forgo or defer any portion of its business management fee in the future. Further, we would need to use cash at some point in the future to pay any fee or reimbursement that is deferred. We also may use cash from financing activities, components of which may include borrowings (including borrowings secured by our assets), as well as proceeds from the sales of our properties, to fund distributions. To the extent distributions are paid from financing activities, we will have less money available for other uses, such as cash needed to refinance existing indebtedness.

-18-

Table of Contents

Risks Related to Conflicts of Interest

There are conflicts of interest between us and affiliates of our sponsor that may affect our acquisition of properties and financial performance.