|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

95-2698708

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

9330 Balboa Avenue, San Diego, CA

|

|

92123

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

The NASDAQ Stock Market LLC (NASDAQ Global Select Market)

|

|

|

|

Page

|

|

|

PART I

|

|

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

|

ITEM 1.

|

BUSINESS

|

|

|

Fiscal Year

|

||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||

|

Company-operated restaurants:

|

|||||||||||||||

|

Beginning of period

|

413

|

|

431

|

|

465

|

|

547

|

|

629

|

|

|||||

|

New

|

4

|

|

2

|

|

1

|

|

6

|

|

19

|

|

|||||

|

Refranchised

|

(1

|

)

|

(21

|

)

|

(37

|

)

|

(78

|

)

|

(97

|

)

|

|||||

|

Closed

|

—

|

|

(6

|

)

|

(2

|

)

|

(11

|

)

|

(4

|

)

|

|||||

|

Acquired from franchisees

|

1

|

|

7

|

|

4

|

|

1

|

|

—

|

|

|||||

|

End of period total

|

417

|

|

413

|

|

431

|

|

465

|

|

547

|

|

|||||

|

% of system

|

18

|

%

|

18

|

%

|

19

|

%

|

21

|

%

|

24

|

%

|

|||||

|

Franchise restaurants:

|

|||||||||||||||

|

Beginning of period

|

1,836

|

|

1,819

|

|

1,786

|

|

1,703

|

|

1,592

|

|

|||||

|

New

|

12

|

|

16

|

|

11

|

|

11

|

|

18

|

|

|||||

|

Refranchised

|

1

|

|

21

|

|

37

|

|

78

|

|

97

|

|

|||||

|

Closed

|

(10

|

)

|

(13

|

)

|

(11

|

)

|

(5

|

)

|

(4

|

)

|

|||||

|

Sold to company

|

(1

|

)

|

(7

|

)

|

(4

|

)

|

(1

|

)

|

—

|

|

|||||

|

End of period total

|

1,838

|

|

1,836

|

|

1,819

|

|

1,786

|

|

1,703

|

|

|||||

|

% of system

|

82

|

%

|

82

|

%

|

81

|

%

|

79

|

%

|

76

|

%

|

|||||

|

System end of period total

|

2,255

|

|

2,249

|

|

2,250

|

|

2,251

|

|

2,250

|

|

|||||

|

|

Fiscal Year

|

||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||

|

Company-operated restaurants:

|

|||||||||||||||

|

Beginning of period

|

322

|

|

310

|

|

296

|

|

316

|

|

245

|

|

|||||

|

New

|

35

|

|

17

|

|

16

|

|

34

|

|

26

|

|

|||||

|

Refranchised

|

—

|

|

—

|

|

—

|

|

(3

|

)

|

—

|

|

|||||

|

Closed

|

(4

|

)

|

(5

|

)

|

(2

|

)

|

(64

|

)

|

(1

|

)

|

|||||

|

Acquired from franchisees

|

14

|

|

—

|

|

—

|

|

13

|

|

46

|

|

|||||

|

End of period total

|

367

|

|

322

|

|

310

|

|

296

|

|

316

|

|

|||||

|

% of system

|

53

|

%

|

49

|

%

|

49

|

%

|

48

|

%

|

50

|

%

|

|||||

|

Franchise restaurants:

|

|||||||||||||||

|

Beginning of period

|

339

|

|

328

|

|

319

|

|

311

|

|

338

|

|

|||||

|

New

|

18

|

|

22

|

|

22

|

|

34

|

|

32

|

|

|||||

|

Refranchised

|

—

|

|

—

|

|

—

|

|

3

|

|

—

|

|

|||||

|

Closed

|

(11

|

)

|

(11

|

)

|

(13

|

)

|

(16

|

)

|

(13

|

)

|

|||||

|

Sold to company

|

(14

|

)

|

—

|

|

—

|

|

(13

|

)

|

(46

|

)

|

|||||

|

End of period total

|

332

|

|

339

|

|

328

|

|

319

|

|

311

|

|

|||||

|

% of system

|

47

|

%

|

51

|

%

|

51

|

%

|

52

|

%

|

50

|

%

|

|||||

|

System end of period total

|

699

|

|

661

|

|

638

|

|

615

|

|

627

|

|

|||||

|

Name

|

Age

|

Positions

|

Years with the

Company

|

|||

|

Leonard A. Comma

|

47

|

Chairman of the Board and Chief Executive Officer

|

15

|

|||

|

Mark H. Blankenship, Ph.D.

|

55

|

Executive Vice President, Chief People, Culture and Corporate Strategy Officer

|

19

|

|||

|

Jerry P. Rebel

|

59

|

Executive Vice President and Chief Financial Officer

|

13

|

|||

|

Phillip H. Rudolph

|

58

|

Executive Vice President, Chief Legal and Risk Officer and Corporate Secretary

|

9

|

|||

|

Frances L. Allen

|

54

|

President, Jack in the Box Brand

|

2

|

|||

|

Keith M. Guilbault

|

53

|

President, Qdoba Brand

|

12

|

|||

|

Paul D. Melancon

|

60

|

Senior Vice President of Finance, Controller and Treasurer

|

11

|

|||

|

Vanessa C. Fox

|

43

|

Vice President, Chief Development Officer

|

19

|

|||

|

Carol A. DiRaimo

|

55

|

Vice President of Investor Relations and Corporate Communications

|

8

|

|||

|

Dean C. Gordon

|

54

|

Vice President of Supply Chain

|

7

|

|||

|

Raymond Pepper

|

55

|

Vice President and General Counsel

|

19

|

|||

|

ITEM 1A.

|

RISK FACTORS

|

|

•

|

seasonal sales fluctuations;

|

|

•

|

severe weather and other natural disasters;

|

|

•

|

unfavorable trends or developments concerning operating costs such as inflation, increased costs of food, fuel, utilities, technology, labor (including due to minimum wage increases or new administrative interpretations of regulations impacting labor costs), insurance, or employee benefits (including healthcare, workers’ compensation and other insurance costs and premiums);

|

|

•

|

the impact of initiatives by competitors and increased competition generally;

|

|

•

|

lack of customer acceptance of new menu items, service initiatives or potential price increases necessary to cover higher input costs;

|

|

•

|

customers trading down to lower priced items and/or shifting to competitive offerings with lower priced products;

|

|

•

|

labor disruptions, unionization, labor shortages or other labor or employee relations issues, and the availability of qualified, experienced management and hourly employees at company and franchise locations; and

|

|

•

|

failure to anticipate or respond quickly to relevant market trends or to implement successful advertising and marketing programs, including technology-based programs.

|

|

•

|

lost restaurant sales when consumers stay home or are physically prevented from reaching the restaurants;

|

|

•

|

property damage, loss of product, and resulting lost sales when locations are forced to close for extended periods of time;

|

|

•

|

interruptions in supply when distributors or vendors suffer damages or transportation is negatively affected; and

|

|

•

|

increased costs if agricultural capacity is diminished or if insurance recoveries do not cover all of our losses.

|

|

•

|

the inability to identify suitable franchisees;

|

|

•

|

limited availability of financing for the Company and for franchisees at acceptable rates and terms;

|

|

•

|

development costs exceeding budgeted or contracted amounts;

|

|

•

|

delays in completion of construction;

|

|

•

|

the inability to identify, or the unavailability of suitable sites at acceptable cost and other leasing or purchase terms;

|

|

•

|

developed properties not achieving desired revenue or cash flow levels once opened;

|

|

•

|

the negative impact of a new restaurant upon sales at nearby existing restaurants;

|

|

•

|

the challenge of developing in areas where competitors are more established or have greater penetration or access to suitable development sites;

|

|

•

|

incurring substantial unrecoverable costs in the event a development project is abandoned prior to completion;

|

|

•

|

impairment charges resulting from underperforming restaurants or decisions to curtail or cease investment in certain locations or markets;

|

|

•

|

in new geographic markets where we have limited or no existing locations, the inability to successfully expand or acquire critical market presence for our brands, acquire name recognition, successfully market our products or attract new customers;

|

|

•

|

operating cost levels that reduce the demand for, or raise the cost of, developing new restaurants;

|

|

•

|

unique regulations or challenges applicable to operating in non-traditional locations, such as airports, college campuses, military or government facilities;

|

|

•

|

the challenge of identifying, recruiting and training qualified restaurant management;

|

|

•

|

the inability to obtain all required permits;

|

|

•

|

changes in laws, regulations and interpretations, including interpretations of the requirements of the Americans with Disabilities Act; and

|

|

•

|

general economic and business conditions.

|

|

•

|

the preparation, ingredients, labeling, packaging, advertising and sale of food and beverages;

|

|

•

|

building and zoning requirements;

|

|

•

|

sanitation and safety standards;

|

|

•

|

employee healthcare, including the implementation and legal, regulatory and cost implications of the Affordable Care Act;

|

|

•

|

labor and employment, including minimum wage adjustments, overtime, working conditions, employment eligibility and documentation, sick leave, and other employee benefit and fringe benefit requirements, Service Contract Act requirements for restaurants located on military bases, and changing judicial, administrative or regulatory interpretations of federal or state labor laws;

|

|

•

|

the registration, offer, sale, termination and renewal of franchises;

|

|

•

|

truth-in-advertising, consumer protection and the security of information;

|

|

•

|

Americans with Disabilities Act;

|

|

•

|

payment cards;

|

|

•

|

alcohol sales; and

|

|

•

|

climate change, including regulations related to the potential impact of greenhouse gases, water consumption, or a tax on carbon emissions.

|

|

•

|

our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions and general corporate or other purposes could be impaired, or any such financing may not be available on terms favorable to us;

|

|

•

|

a substantial portion of our cash flows could be required for debt service and, as a result, might not be available for our operations or other purposes;

|

|

•

|

any substantial decrease in net operating cash flows or any substantial increase in expenses could make it difficult for us to meet our debt service requirements or could force us to modify our operations or sell assets;

|

|

•

|

our ability to operate our business and our ability to repurchase stock or pay cash dividends to our stockholders may be restricted by the financial and other covenants set forth in the credit facility;

|

|

•

|

our ability to withstand competitive pressures may be decreased; and

|

|

•

|

our level of indebtedness may make us more vulnerable to economic downturns and reduce our flexibility in responding to changing business, regulatory and economic conditions.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

Company-

Operated

|

Franchise

|

Total

|

|||||||

|

Company-owned restaurant buildings:

|

|||||||||

|

On company-owned land

|

44

|

|

182

|

|

226

|

|

|||

|

On leased land

|

135

|

|

506

|

|

641

|

|

|||

|

Subtotal

|

179

|

|

688

|

|

867

|

|

|||

|

Company-leased restaurant buildings on leased land

|

605

|

|

924

|

|

1,529

|

|

|||

|

Franchise directly-owned or directly-leased restaurant buildings

|

—

|

|

558

|

|

558

|

|

|||

|

Total restaurant buildings

|

784

|

|

2,170

|

|

2,954

|

|

|||

|

|

Number of Restaurants

|

|||||

|

Fiscal Year

|

Ground

Leases

|

Land and

Building

Leases

|

||||

|

2017 – 2021

|

295

|

|

758

|

|

||

|

2022 – 2026

|

219

|

|

542

|

|

||

|

2027 – 2031

|

111

|

|

166

|

|

||

|

2032 and later

|

16

|

|

63

|

|

||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

13 Weeks Ended

|

12 Weeks Ended

|

16 Weeks

Ended |

|||||||||||||

|

|

October 2,

2016 |

July 3,

2016 |

April 10,

2016 |

January 17,

2016 |

||||||||||||

|

High

|

$

|

102.68

|

|

$

|

88.65

|

|

$

|

78.87

|

|

$

|

82.20

|

|

||||

|

Low

|

$

|

83.64

|

|

$

|

64.30

|

|

$

|

61.78

|

|

$

|

69.60

|

|

||||

|

|

12 Weeks Ended

|

16 Weeks

Ended |

||||||||||||||

|

|

September 27,

2015 |

July 5,

2015 |

April 12,

2015 |

January 18,

2015 |

||||||||||||

|

High

|

$

|

98.26

|

|

$

|

96.40

|

|

$

|

99.99

|

|

$

|

87.50

|

|

||||

|

Low

|

$

|

63.94

|

|

$

|

85.30

|

|

$

|

81.56

|

|

$

|

63.84

|

|

||||

|

(a)

Total Number of Shares Purchased |

(b)

Average Price Paid Per Share |

(c)

Total Number of Shares Purchased as Part of Publicly Announced Programs |

(d)

Maximum Dollar Value That May Yet Be Purchased Under These Programs |

|||||||||||

|

$

|

150,025,646

|

|

||||||||||||

|

July 4, 2016 - July 31, 2016

|

—

|

|

$

|

—

|

|

—

|

|

$

|

150,025,646

|

|

||||

|

August 1, 2016 - August 28, 2016

|

—

|

|

$

|

—

|

|

—

|

|

$

|

150,025,646

|

|

||||

|

August 29, 2016 - October 2, 2016

|

425,254

|

|

$

|

98.42

|

|

425,254

|

|

$

|

408,172,440

|

|

||||

|

Total

|

425,254

|

|

$

|

—

|

|

425,254

|

|

|||||||

|

(a) Number of securities to be issued upon exercise of outstanding options, warrants and rights (1)

|

(b) Weighted-average exercise price of outstanding options (1)

|

(c) Number of securities remaining for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

||||

|

Equity compensation plans approved by security holders (2)

|

965,160

|

$61.73

|

2,465,612

|

|||

|

(1)

|

Includes shares issuable in connection with our outstanding stock options, performance share awards, nonvested stock awards and units, and non-management director deferred stock equivalents. The weighted-average exercise price in column (b) includes the weighted-average exercise price of stock options.

|

|

(2)

|

For a description of our equity compensation plans, refer to Note 12,

Share-Based Employee Compensation

, of the notes to the consolidated financial statements.

|

|

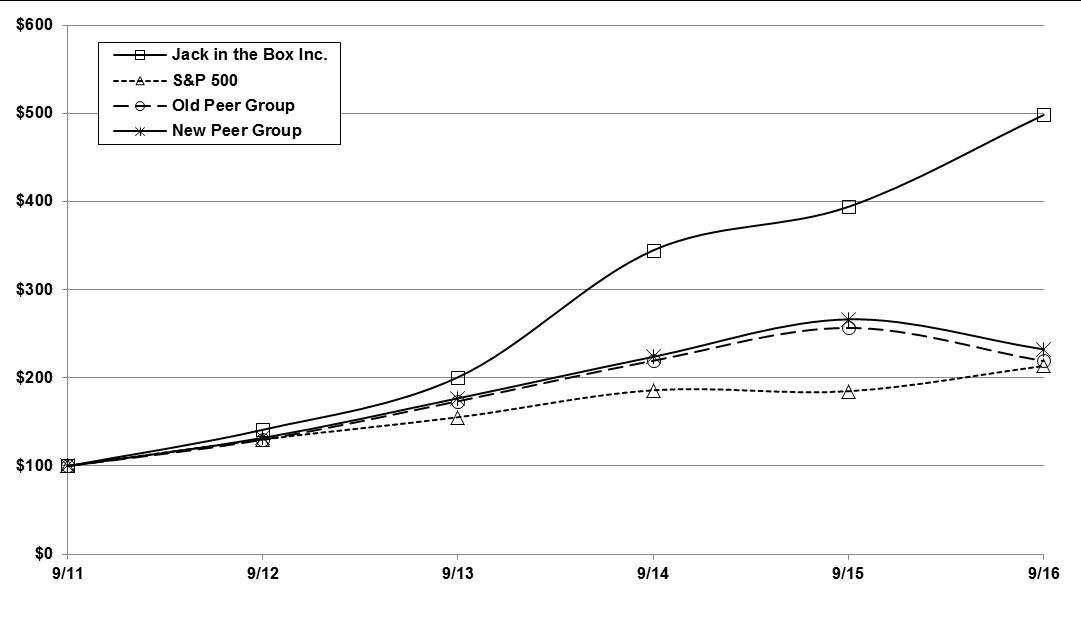

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

|

Jack in the Box Inc.

|

$100

|

$141

|

$201

|

$345

|

$394

|

$498

|

|

S&P 500 Index

|

$100

|

$130

|

$155

|

$186

|

$185

|

$213

|

|

Old Peer Group (1)

|

$100

|

$130

|

$174

|

$219

|

$257

|

$219

|

|

New Peer Group (2)

|

$100

|

$132

|

$177

|

$224

|

$266

|

$232

|

|

(1)

|

The Old Peer Group Index comprises the following companies: Brinker International, Inc.; Buffalo Wild Wings, Inc.; Chipotle Mexican Grill Inc.; Cracker Barrel Old Country Store, Inc.; DineEquity, Inc.; Domino’s Pizza, Inc.; Panera Bread Company; Ruby Tuesday, Inc.; Sonic Corp.; The Cheesecake Factory Inc.; and The Wendy’s Company.

|

|

(2)

|

The New Peer Group Index comprises the following companies: Brinker International, Inc.; Buffalo Wild Wings, Inc.; Chipotle Mexican Grill Inc.; Cracker Barrel Old Country Store, Inc.; DineEquity, Inc.; Domino’s Pizza, Inc.; Panera Bread Company; Papa John's Int'l, Inc.; Sonic Corp.; The Cheesecake Factory Inc.; and The Wendy’s Company.

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

|

Fiscal Year

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

|

(dollars in thousands, except per share data)

|

|||||||||||||||||||

|

Statements of Earnings Data (1):

|

||||||||||||||||||||

|

Total revenues

|

$

|

1,599,331

|

|

$

|

1,540,317

|

|

$

|

1,484,131

|

|

$

|

1,489,867

|

|

$

|

1,509,295

|

|

|||||

|

Operating costs and expenses

|

$

|

1,370,646

|

|

$

|

1,340,005

|

|

$

|

1,318,275

|

|

$

|

1,356,302

|

|

$

|

1,417,624

|

|

|||||

|

(Gains) losses on the sale of company-operated restaurants

|

(1,230

|

)

|

3,139

|

|

3,548

|

|

(4,640

|

)

|

(29,145

|

)

|

||||||||||

|

Total operating costs and expenses, net

|

$

|

1,369,416

|

|

$

|

1,343,144

|

|

$

|

1,321,823

|

|

$

|

1,351,662

|

|

$

|

1,388,479

|

|

|||||

|

Earnings from continuing operations

|

$

|

126,270

|

|

$

|

112,601

|

|

$

|

94,844

|

|

$

|

82,608

|

|

$

|

68,104

|

|

|||||

|

Earnings per Share and Share Data:

|

||||||||||||||||||||

|

Earnings per share from continuing operations (1):

|

||||||||||||||||||||

|

Basic

|

$

|

3.74

|

|

$

|

3.00

|

|

$

|

2.33

|

|

$

|

1.91

|

|

$

|

1.55

|

|

|||||

|

Diluted

|

$

|

3.70

|

|

$

|

2.95

|

|

$

|

2.26

|

|

$

|

1.84

|

|

$

|

1.52

|

|

|||||

|

Cash dividends declared per common share (1)

|

$

|

1.20

|

|

$

|

1.00

|

|

$

|

0.40

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Weighted-average shares outstanding — Basic (1)(2)

|

33,735

|

|

37,587

|

|

40,781

|

|

43,351

|

|

43,999

|

|

||||||||||

|

Weighted-average shares outstanding — Diluted (1)(2)

|

34,146

|

|

38,215

|

|

41,973

|

|

44,899

|

|

44,948

|

|

||||||||||

|

Market price at year-end

|

$

|

95.94

|

|

$

|

79.71

|

|

$

|

65.73

|

|

$

|

40.10

|

|

$

|

28.11

|

|

|||||

|

Other Operating Data:

|

||||||||||||||||||||

|

Jack in the Box restaurants:

|

||||||||||||||||||||

|

Company-operated average unit volume (4)

|

$

|

1,870

|

|

$

|

1,858

|

|

$

|

1,708

|

|

$

|

1,606

|

|

$

|

1,557

|

|

|||||

|

Franchise-operated average unit volume (3)(4)

|

$

|

1,454

|

|

$

|

1,429

|

|

$

|

1,337

|

|

$

|

1,312

|

|

$

|

1,313

|

|

|||||

|

System average unit volume (3)(4)

|

$

|

1,530

|

|

$

|

1,510

|

|

$

|

1,412

|

|

$

|

1,381

|

|

$

|

1,379

|

|

|||||

|

Change in company-operated same-store sales

|

0.0

|

%

|

5.1

|

%

|

2.0

|

%

|

1.0

|

%

|

4.6

|

%

|

||||||||||

|

Change in franchise-operated same-store sales (3)

|

1.6

|

%

|

7.0

|

%

|

2.0

|

%

|

0.1

|

%

|

3.0

|

%

|

||||||||||

|

Change in system same-store sales (3)

|

1.2

|

%

|

6.5

|

%

|

2.0

|

%

|

0.3

|

%

|

3.4

|

%

|

||||||||||

|

Qdoba restaurants:

|

||||||||||||||||||||

|

Company-operated average unit volume (4)

|

$

|

1,209

|

|

$

|

1,199

|

|

$

|

1,114

|

|

$

|

1,080

|

|

$

|

1,060

|

|

|||||

|

Franchise-operated average unit volume (3)(4)

|

$

|

1,150

|

|

$

|

1,140

|

|

$

|

1,028

|

|

$

|

961

|

|

$

|

958

|

|

|||||

|

System average unit volume (3)(4)

|

$

|

1,179

|

|

$

|

1,169

|

|

$

|

1,070

|

|

$

|

1,017

|

|

$

|

1,000

|

|

|||||

|

Change in company-operated same-store sales

|

1.7

|

%

|

8.3

|

%

|

5.7

|

%

|

0.5

|

%

|

3.2

|

%

|

||||||||||

|

Change in franchise-operated same-store sales (3)

|

1.1

|

%

|

10.4

|

%

|

6.3

|

%

|

1.1

|

%

|

1.9

|

%

|

||||||||||

|

Change in system same-store sales (3)

|

1.4

|

%

|

9.3

|

%

|

6.0

|

%

|

0.8

|

%

|

2.5

|

%

|

||||||||||

|

Capital expenditures

|

$

|

96,615

|

|

$

|

86,226

|

|

$

|

60,525

|

|

$

|

84,690

|

|

$

|

80,200

|

|

|||||

|

Balance Sheet Data (at end of period) (1):

|

||||||||||||||||||||

|

Total assets

|

$

|

1,348,791

|

|

$

|

1,303,979

|

|

$

|

1,270,665

|

|

$

|

1,319,209

|

|

$

|

1,463,725

|

|

|||||

|

Long-term debt, excluding current maturities

|

$

|

937,512

|

|

$

|

688,579

|

|

$

|

497,012

|

|

$

|

349,393

|

|

$

|

405,276

|

|

|||||

|

Stockholders’ (deficit) equity (5)

|

$

|

(217,206

|

)

|

$

|

15,953

|

|

$

|

257,911

|

|

$

|

472,018

|

|

$

|

411,945

|

|

|||||

|

(1)

|

Financial data was extracted or derived from our audited financial statements.

|

|

(2)

|

Weighted-average shares reflect the impact of common stock repurchases under Board-approved programs.

|

|

(3)

|

Changes in same-store sales and average unit volumes are presented for franchise restaurants and on a system-wide basis, which includes company and franchise restaurants. Franchise sales represent sales at franchise restaurants and are revenues of our franchisees. We do not record franchise sales as revenues; however, our royalty revenues and percentage rent revenues are calculated based on a percentage of franchise sales. We believe franchise and system sales growth and average unit volume information is useful to investors as a significant indicator of the overall strength of our business as it incorporates our significant revenue drivers which are company and franchise same-store sales as well as net unit development. Company, franchise and system changes in same-store sales include the results of all restaurants that have been open more than one year.

|

|

(4)

|

2016 average unit volume is adjusted to exclude the 53rd week for the purpose of comparison to prior years.

|

|

(5)

|

In 2016, the Company began to accumulate a stockholders’ deficit related to the execution of our share repurchase programs authorized by our Board of Directors.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

•

|

Overview

— a general description of our business and fiscal

2016

highlights.

|

|

•

|

Financial reporting

— a discussion of changes in presentation, if any.

|

|

•

|

Results of operations

— an analysis of our consolidated statements of earnings for the three years presented in our consolidated financial statements.

|

|

•

|

Liquidity and capital resources

— an analysis of cash flows including pension and postretirement health contributions, capital expenditures, our credit facility, share repurchase activity, dividends, aggregate contractual obligations, known trends that may impact liquidity, and the impact of inflation, if applicable.

|

|

•

|

Discussion of critical accounting estimates

— a discussion of accounting policies that require critical judgments and estimates.

|

|

•

|

New accounting pronouncements

— a discussion of new accounting pronouncements, dates of implementation and the impact on our consolidated financial position or results of operations, if any.

|

|

•

|

Changes in sales at restaurants open more than one year (“same-store sales”) and average unit volumes (“AUVs”) are presented for franchised restaurants and on a system-wide basis, which includes company and franchise restaurants. Franchise sales represent sales at franchise restaurants and are revenues of our franchisees. We do not record franchise sales as revenues; however, our royalty revenues and percentage rent revenues are calculated based on a percentage of franchise sales. We believe franchise and system same-store sales and AUV information is useful to investors as a significant indicator of the overall strength of our business.

|

|

•

|

Company restaurant margin (“restaurant margin”) is defined as company restaurant sales less expenses incurred directly by our restaurants in generating those sales (food and packaging costs, payroll and employee benefits costs, and occupancy and other costs). We also present restaurant margin as a percentage of company restaurant sales.

|

|

•

|

Franchise margin is defined as franchise rental revenues and franchise royalties and other, less franchise occupancy expenses, and franchise support and other costs, and is also presented as a percentage of franchise revenues.

|

|

•

|

Same-Store Sales

—

Same-store sales were flat at company-operated Jack in the Box restaurants as the impact of menu price increases offset a decline in transactions. Qdoba’s same-store sales increase of

1.7%

at company-operated restaurants was driven primarily by transaction growth, menu price increases and catering.

|

|

•

|

Commodity Costs

—

Commodity costs decreased approximately

3.0%

and

4.4%

in

2016

at our Jack in the Box and Qdoba restaurants, respectively, compared with a year ago. Beef represents the largest portion, or approximately 20%, of the Company’s overall commodity spend. We typically do not enter into fixed price contracts for our beef needs. In

2017

, we currently expect our beef costs to be slightly deflationary as compared to fiscal

2016

. We expect our overall commodity costs in fiscal

2017

to be approximately flat to down 1% at both our Jack in the Box and Qdoba restaurants.

|

|

•

|

Restaurant Margins

—

Our consolidated company-operated restaurant margin

decreased

in

2016

to

20.2%

from

20.4%

in

2015

. Jack in the Box’s company-operated restaurant margin

improved

in

2016

to

21.2%

from

20.7%

in

2015

due primarily to lower costs for food and packaging and benefits of refranchising, partially offset by minimum wage increases in California that went into effect in January 2016, and by higher costs for equipment upgrades. Restaurant margins at our Qdoba company-operated restaurants

decreased

in

2016

to

18.1%

from

19.7%

in

2015

primarily reflecting an increase in new restaurant activity, unfavorable product mix including higher levels of discounting, and higher costs for equipment upgrades.

|

|

•

|

Jack in the Box Franchising Program

—

In

2016

,

Jack in the Box franchisees opened a total of

12

restaurants. Our Jack in the Box system was

82%

franchised at the end of fiscal

2016

. We plan to increase franchise ownership of the system to over 90%. In fiscal

2017

, we expect to open approximately

20-25

new Jack in the Box restaurants, the majority of which will be franchise locations.

|

|

•

|

Qdoba New Unit Growth

—

In

2016

we opened

35

company-operated restaurants and franchisees opened

18

restaurants of which

six

were in non-traditional locations such as airports and college campuses. In fiscal

2017

,

60-70

new Qdoba restaurants are expected to open system-wide, of which approximately 40 are expected to be company-operated locations

|

|

•

|

Restructuring Costs

—

In 2016, we announced a plan to reduce our general and administrative costs. In connection with this plan, we have recorded

$10.1 million

of restructuring charges which are included in impairment and other charges, net in the accompanying consolidated statements of earnings.

|

|

•

|

Pension Contribution

—

In September 2016, we made an $80.0 million tax-deductible accelerated contribution to our qualified defined benefit pension plan to reduce future pension costs including our exposure to Pension Benefit Guaranty Corporation (“PBGC”) variable-rate premiums that are paid on the unfunded portion of our pension liability, and to improve the funded status of the plan.

|

|

•

|

Credit Facility

—

In September 2016, we amended our existing credit facility to increase our overall borrowing capacity by $400.0 million to $1.6 billion, consisting of a $900.0 million revolving credit agreement and a $700.0 million term loan, both maturing in March 2019.

|

|

•

|

Return of Cash to Shareholders

—

During

2016

, we continued to return cash to shareholders in the form of share repurchases and quarterly cash dividends. We repurchased

3.9 million

shares of our common stock at an average price of

$75.29

per share, totaling

$291.9 million

, including the cost of brokerage fees. We also declared dividends of $1.20 per share totaling

$40.5 million

.

|

|

|

Fiscal Year

|

||||||||

|

|

2016

|

2015

|

2014

|

||||||

|

Revenues:

|

|||||||||

|

Company restaurant sales

|

75.3

|

%

|

75.1

|

%

|

75.5

|

%

|

|||

|

Franchise rental revenues

|

14.6

|

%

|

14.7

|

%

|

14.6

|

%

|

|||

|

Franchise royalties and other

|

10.1

|

%

|

10.2

|

%

|

9.8

|

%

|

|||

|

Total revenues

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Operating costs and expenses, net:

|

|||||||||

|

Company restaurant costs:

|

|||||||||

|

Food and packaging (1)

|

30.1

|

%

|

31.3

|

%

|

31.9

|

%

|

|||

|

Payroll and employee benefits (1)

|

27.8

|

%

|

27.1

|

%

|

27.5

|

%

|

|||

|

Occupancy and other (1)

|

21.9

|

%

|

21.3

|

%

|

22.1

|

%

|

|||

|

Total company restaurant costs (1)

|

79.8

|

%

|

79.6

|

%

|

81.5

|

%

|

|||

|

Franchise occupancy expenses (2)

|

73.1

|

%

|

75.0

|

%

|

77.8

|

%

|

|||

|

Franchise support and other costs (3)

|

9.9

|

%

|

10.0

|

%

|

9.5

|

%

|

|||

|

Selling, general and administrative expenses

|

12.7

|

%

|

14.4

|

%

|

13.9

|

%

|

|||

|

Impairment and other charges, net

|

1.2

|

%

|

0.8

|

%

|

1.0

|

%

|

|||

|

(Gains) losses on the sale of company-operated restaurants

|

(0.1

|

)%

|

0.2

|

%

|

0.2

|

%

|

|||

|

Earnings from operations

|

14.4

|

%

|

12.8

|

%

|

10.9

|

%

|

|||

|

Income tax rate (4)

|

36.5

|

%

|

36.9

|

%

|

35.3

|

%

|

|||

|

(1)

|

As a percentage of company restaurant sales.

|

|

(2)

|

As a percentage of franchise rental revenues.

|

|

(3)

|

As a percentage of franchise royalties and other.

|

|

(4)

|

As a percentage of earnings from continuing operations and before income taxes.

|

|

Fiscal Year

|

||||||

|

2016

|

2015

|

2014

|

||||

|

Jack in the Box:

|

||||||

|

Company

|

0.0%

|

5.1%

|

2.0%

|

|||

|

Franchise

|

1.6%

|

7.0%

|

2.0%

|

|||

|

System

|

1.2%

|

6.5%

|

2.0%

|

|||

|

Qdoba:

|

||||||

|

Company

|

1.7%

|

8.3%

|

5.7%

|

|||

|

Franchise

|

1.1%

|

10.4%

|

6.3%

|

|||

|

System

|

1.4%

|

9.3%

|

6.0%

|

|||

|

|

2016

|

2015

|

2014

|

||||||||||||||||||||||||

|

|

Company

|

Franchise

|

Total

|

Company

|

Franchise

|

Total

|

Company

|

Franchise

|

Total

|

||||||||||||||||||

|

Jack in the Box:

|

|||||||||||||||||||||||||||

|

Beginning of year

|

413

|

|

1,836

|

|

2,249

|

|

431

|

|

1,819

|

|

2,250

|

|

465

|

|

1,786

|

|

2,251

|

|

|||||||||

|

New

|

4

|

|

12

|

|

16

|

|

2

|

|

16

|

|

18

|

|

1

|

|

11

|

|

12

|

|

|||||||||

|

Refranchised

|

(1

|

)

|

1

|

|

—

|

|

(21

|

)

|

21

|

|

—

|

|

(37

|

)

|

37

|

|

—

|

|

|||||||||

|

Acquired from franchisees

|

1

|

|

(1

|

)

|

—

|

|

7

|

|

(7

|

)

|

—

|

|

4

|

|

(4

|

)

|

—

|

|

|||||||||

|

Closed

|

—

|

|

(10

|

)

|

(10

|

)

|

(6

|

)

|

(13

|

)

|

(19

|

)

|

(2

|

)

|

(11

|

)

|

(13

|

)

|

|||||||||

|

End of year

|

417

|

|

1,838

|

|

2,255

|

|

413

|

|

1,836

|

|

2,249

|

|

431

|

|

1,819

|

|

2,250

|

|

|||||||||

|

% of JIB system

|

18

|

%

|

82

|

%

|

100

|

%

|

18

|

%

|

82

|

%

|

100

|

%

|

19

|

%

|

81

|

%

|

100

|

%

|

|||||||||

|

Qdoba:

|

|||||||||||||||||||||||||||

|

Beginning of year

|

322

|

|

339

|

|

661

|

|

310

|

|

328

|

|

638

|

|

296

|

|

319

|

|

615

|

|

|||||||||

|

New

|

35

|

|

18

|

|

53

|

|

17

|

|

22

|

|

39

|

|

16

|

|

22

|

|

38

|

|

|||||||||

|

Acquired from franchisees

|

14

|

|

(14

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Closed

|

(4

|

)

|

(11

|

)

|

(15

|

)

|

(5

|

)

|

(11

|

)

|

(16

|

)

|

(2

|

)

|

(13

|

)

|

(15

|

)

|

|||||||||

|

End of year

|

367

|

|

332

|

|

699

|

|

322

|

|

339

|

|

661

|

|

310

|

|

328

|

|

638

|

|

|||||||||

|

% of Qdoba system

|

53

|

%

|

47

|

%

|

100

|

%

|

49

|

%

|

51

|

%

|

100

|

%

|

49

|

%

|

51

|

%

|

100

|

%

|

|||||||||

|

Consolidated:

|

|

||||||||||||||||||||||||||

|

Total system

|

784

|

|

2,170

|

|

2,954

|

|

735

|

|

2,175

|

|

2,910

|

|

741

|

|

2,147

|

|

2,888

|

|

|||||||||

|

% of consolidated system

|

27

|

%

|

73

|

%

|

100

|

%

|

25

|

%

|

75

|

%

|

100

|

%

|

26

|

%

|

74

|

%

|

100

|

%

|

|||||||||

|

|

2016

|

2015

|

2014

|

||||||||||||||||||

|

Company restaurant sales

|

$

|

789,040

|

|

$

|

782,525

|

|

$

|

782,461

|

|

||||||||||||

|

Company restaurant costs:

|

|||||||||||||||||||||

|

Food and packaging

|

235,538

|

|

29.9

|

%

|

247,931

|

|

31.7

|

%

|

254,891

|

|

32.6

|

%

|

|||||||||

|

Payroll and employee benefits

|

223,019

|

|

28.3

|

%

|

215,598

|

|

27.6

|

%

|

218,000

|

|

27.9

|

%

|

|||||||||

|

Occupancy and other

|

162,869

|

|

20.6

|

%

|

157,281

|

|

20.1

|

%

|

164,433

|

|

21.0

|

%

|

|||||||||

|

Total company restaurant costs

|

621,426

|

|

78.8

|

%

|

620,810

|

|

79.3

|

%

|

637,324

|

|

81.5

|

%

|

|||||||||

|

Restaurant margin

|

$

|

167,614

|

|

21.2

|

%

|

$

|

161,715

|

|

20.7

|

%

|

$

|

145,137

|

|

18.5

|

%

|

||||||

|

2016 vs. 2015

|

2015 vs. 2014

|

|||||||

|

Decrease in the average number of restaurants

|

$

|

(13.9

|

)

|

$

|

(68.7

|

)

|

||

|

AUV increase

|

5.3

|

|

68.8

|

|

||||

|

53rd week

|

15.1

|

|

—

|

|

||||

|

Total increase in company restaurant sales

|

$

|

6.5

|

|

$

|

0.1

|

|

||

|

|

Increase/(Decrease)

|

|||||

|

|

2016 vs. 2015

|

2015 vs. 2014

|

||||

|

Average check (1)

|

2.9

|

%

|

4.2

|

%

|

||

|

Transactions

|

(2.9

|

)%

|

0.9

|

%

|

||

|

Change in same-store sales

|

0.0

|

%

|

5.1

|

%

|

||

|

(1)

|

Includes price increases of approximately

3.0%

and

2.2%

in

2016

and

2015

, respectively.

|

|

2016

|

2015

|

2014

|

||||||||||

|

Franchise rental revenues

|

$

|

232,794

|

|

$

|

226,494

|

|

$

|

216,944

|

|

|||

|

Royalties

|

138,424

|

|

133,726

|

|

124,538

|

|

||||||

|

Re-image contributions to franchisees

|

—

|

|

—

|

|

(22

|

)

|

||||||

|

Franchise fees and other

|

2,000

|

|

2,431

|

|

3,323

|

|

||||||

|

Franchise royalties and other

|

140,424

|

|

136,157

|

|

127,839

|

|

||||||

|

Total franchise revenues

|

373,218

|

|

362,651

|

|

344,783

|

|

||||||

|

Rental expense

|

137,706

|

|

136,782

|

|

134,975

|

|

||||||

|

Depreciation and amortization

|

32,344

|

|

33,128

|

|

33,844

|

|

||||||

|

Franchise occupancy expenses

|

170,050

|

|

169,910

|

|

168,819

|

|

||||||

|

Franchise support and other costs

|

11,107

|

|

11,726

|

|

10,052

|

|

||||||

|

Total franchise costs

|

181,157

|

|

181,636

|

|

178,871

|

|

||||||

|

Franchise margin

|

$

|

192,061

|

|

$

|

181,015

|

|

$

|

165,912

|

|

|||

|

Franchise margin as a % of franchise revenue

|

51.5

|

%

|

49.9

|

%

|

48.1

|

%

|

||||||

|

Average number of franchise restaurants

|

1,838

|

|

1,828

|

|

1,794

|

|

||||||

|

% increase

|

0.5

|

%

|

1.9

|

%

|

4.2

|

%

|

||||||

|

Franchise restaurant AUV (1)

|

$

|

1,454

|

|

$

|

1,429

|

|

$

|

1,337

|

|

|||

|

Increase in franchise-operated same-store sales

|

1.6

|

%

|

7.0

|

%

|

2.0

|

%

|

||||||

|

Royalties as a percentage of franchise restaurant sales

|

5.1

|

%

|

5.1

|

%

|

5.2

|

%

|

||||||

|

|

2016

|

2015

|

2014

|

||||||||||||||||||

|

Company restaurant sales

|

$

|

415,495

|

|

$

|

374,338

|

|

$

|

338,451

|

|

||||||||||||

|

Company restaurant costs:

|

|||||||||||||||||||||

|

Food and packaging

|

127,464

|

|

30.7

|

%

|

114,057

|

|

30.5

|

%

|

102,447

|

|

30.3

|

%

|

|||||||||

|

Payroll and employee benefits

|

111,451

|

|

26.8

|

%

|

97,704

|

|

26.1

|

%

|

90,494

|

|

26.7

|

%

|

|||||||||

|

Occupancy and other

|

101,289

|

|

24.4

|

%

|

88,742

|

|

23.7

|

%

|

83,428

|

|

24.6

|

%

|

|||||||||

|

Total company restaurant costs

|

340,204

|

|

81.9

|

%

|

300,503

|

|

80.3

|

%

|

276,369

|

|

81.7

|

%

|

|||||||||

|

Restaurant margin

|

$

|

75,291

|

|

18.1

|

%

|

$

|

73,835

|

|

19.7

|

%

|

$

|

62,082

|

|

18.3

|

%

|

||||||

|

2016 vs. 2015

|

2015 vs. 2014

|

|||||||

|

Increase in the average number of restaurants

|

$

|

29.6

|

|

$

|

10.0

|

|

||

|

AUV increase

|

3.4

|

|

25.9

|

|

||||

|

53rd week

|

8.2

|

|

—

|

|

||||

|

Total increase in company restaurant sales

|

$

|

41.2

|

|

$

|

35.9

|

|

||

|

|

Increase/(Decrease)

|

|||||

|

|

2016 vs. 2015

|

2015 vs. 2014

|

||||

|

Transactions

|

1.5

|

%

|

(0.1

|

)%

|

||

|

Average check (1)

|

(0.4

|

)%

|

7.3

|

%

|

||

|

Catering

|

0.6

|

%

|

1.1

|

%

|

||

|

Increase in same-store sales

|

1.7

|

%

|

8.3

|

%

|

||

|

(1)

|

Includes price increases of approximately

1.0%

and

0.2%

in

2016

and

2015

, respectively.

|

|

2016

|

2015

|

2014

|

||||||||||

|

Franchise rental revenues

|

$

|

113

|

|

$

|

208

|

|

$

|

238

|

|

|||

|

Royalties

|

20,090

|

|

19,033

|

|

16,448

|

|

||||||

|

Franchise fees and other

|

1,375

|

|

1,562

|

|

1,750

|

|

||||||

|

Franchise royalties and other

|

21,465

|

|

20,595

|

|

18,198

|

|

||||||

|

Total franchise revenues

|

21,578

|

|

20,803

|

|

18,436

|

|

||||||

|

Rental expense (1)

|

102

|

|

192

|

|

215

|

|

||||||

|

Franchise support and other costs

|

4,884

|

|

3,962

|

|

3,800

|

|

||||||

|

Total franchise costs

|

4,986

|

|

4,154

|

|

4,015

|

|

||||||

|

Franchise margin

|

$

|

16,592

|

|

$

|

16,649

|

|

$

|

14,421

|

|

|||

|

Franchise margin as a % of franchise revenue

|

76.9

|

%

|

80.0

|

%

|

78.2

|

%

|

||||||

|

Average number of franchise restaurants

|

343

|

|

333

|

|

322

|

|

||||||

|

% increase

|

3.0

|

%

|

3.4

|

%

|

3.5

|

%

|

||||||

|

Franchise restaurant AUV (2)

|

$

|

1,150

|

|

$

|

1,140

|

|

$

|

1,028

|

|

|||

|

Increase in franchise-operated same-store sales

|

1.1

|

%

|

10.4

|

%

|

6.3

|

%

|

||||||

|

Royalties as a percentage of franchise restaurant sales

|

5.0

|

%

|

5.0

|

%

|

5.0

|

%

|

||||||

|

(1)

|

Included in franchise occupancy expenses in the accompanying consolidated statements of earnings.

|

|

(2)

|

2016 AUV is adjusted to exclude the 53rd week for the purpose of comparison to prior years.

|

|

|

(Decrease)/Increase

|

|||||||

|

|

2016 vs. 2015

|

2015 vs. 2014

|

||||||

|

Incentive compensation (including share-based compensation and related payroll taxes)

|

$

|

(5,839

|

)

|

$

|

3,851

|

|

||

|

Pension and postretirement benefits

|

(5,265

|

)

|

4,989

|

|

||||

|

Cash surrender value of COLI policies, net

|

(3,486

|

)

|

3,833

|

|

||||

|

Legal settlement

|

(2,543

|

)

|

—

|

|

||||

|

Region administration

|

(2,081

|

)

|

(275

|

)

|

||||

|

Employee relocation

|

(1,402

|

)

|

(463

|

)

|

||||

|

Insurance

|

3,423

|

|

(1,163

|

)

|

||||

|

Advertising

|

886

|

|

(982

|

)

|

||||

|

53rd week

|

2,970

|

|

—

|

|

||||

|

Other

|

(3,992

|

)

|

4,567

|

|

||||

|

$

|

(17,329

|

)

|

$

|

14,357

|

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Restructuring costs

|

$

|

10,067

|

|

$

|

29

|

|

$

|

8,621

|

|

|||

|

Costs of closed restaurants (primarily lease obligations) and other

|

3,431

|

|

3,592

|

|

2,841

|

|

||||||

|

Losses on the disposition of property and equipment, net

|

2,801

|

|

1,319

|

|

1,674

|

|

||||||

|

Accelerated depreciation

|

2,214

|

|

6,260

|

|

1,202

|

|

||||||

|

Restaurant impairment charges

|

544

|

|

557

|

|

570

|

|

||||||

|

$

|

19,057

|

|

$

|

11,757

|

|

$

|

14,908

|

|

||||

|

2016

|

2015

|

2014

|

||||||||||

|

Number of restaurants sold to franchisees

|

1

|

|

21

|

|

37

|

|

||||||

|

Gains (losses) on the sale of company-operated restaurants

|

$

|

1,230

|

|

$

|

(3,139

|

)

|

$

|

(1,692

|

)

|

|||

|

Loss on the anticipated sale of a Jack in the Box market

|

—

|

|

—

|

|

(1,856

|

)

|

||||||

|

Total gains (losses) on the sale of company-operated restaurants

|

$

|

1,230

|

|

$

|

(3,139

|

)

|

$

|

(3,548

|

)

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Interest expense

|

$

|

31,426

|

|

$

|

19,180

|

|

$

|

16,531

|

|

|||

|

Interest income

|

(345

|

)

|

(377

|

)

|

(853

|

)

|

||||||

|

Interest expense, net

|

$

|

31,081

|

|

$

|

18,803

|

|

$

|

15,678

|

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Distribution business

|

$

|

(235

|

)

|

$

|

(430

|

)

|

$

|

(790

|

)

|

|||

|

2013 Qdoba Closures

|

(1,962

|

)

|

(3,359

|

)

|

(5,104

|

)

|

||||||

|

$

|

(2,197

|

)

|

$

|

(3,789

|

)

|

$

|

(5,894

|

)

|

||||

|

2016

|

2015

|

2014

|

||||||||||

|

Distribution business

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

$

|

(0.02

|

)

|

|||

|

2013 Qdoba Closures

|

(0.06

|

)

|

(0.09

|

)

|

(0.012

|

)

|

||||||

|

$

|

(0.06

|

)

|

$

|

(0.10

|

)

|

$

|

(0.14

|

)

|

||||

|

•

|

working capital;

|

|

•

|

capital expenditures for new restaurant construction and restaurant renovations;

|

|

•

|

income tax payments;

|

|

•

|

debt service requirements; and

|

|

•

|

obligations related to our benefit plans.

|

|

2016

|

2015

|

2014

|

||||||||||

|

Total cash provided by (used in):

|

||||||||||||

|

Operating activities

|

$

|

134,182

|

|

$

|

226,875

|

|

$

|

201,022

|

|

|||

|

Investing activities

|

(104,398

|

)

|

(84,473

|

)

|

(42,979

|

)

|

||||||

|

Financing activities

|

(30,454

|

)

|

(135,208

|

)

|

(157,116

|

)

|

||||||

|

Effect of exchange rate changes

|

(43

|

)

|

(29

|

)

|

7

|

|

||||||

|

Net (decrease) increase in cash

|

$

|

(713

|

)

|

$

|

7,165

|

|

$

|

934

|

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Jack in the Box:

|

||||||||||||

|

Restaurant facility expenditures

|

$

|

25,985

|

|

$

|

36,062

|

|

$

|

22,680

|

|

|||

|

New restaurants

|

11,526

|

|

2,402

|

|

3,533

|

|

||||||

|

Other, including information technology

|

1,096

|

|

3,464

|

|

4,645

|

|

||||||

|

38,607

|

|

41,928

|

|

30,858

|

|

|||||||

|

Qdoba:

|

||||||||||||

|

Restaurant facility expenditures

|

8,341

|

|

3,762

|

|

4,477

|

|

||||||

|

New restaurants

|

40,235

|

|

26,686

|

|

13,189

|

|

||||||

|

Other, including information technology

|

4,740

|

|

3,623

|

|

301

|

|

||||||

|

53,316

|

|

34,071

|

|

17,967

|

|

|||||||

|

Shared Services:

|

||||||||||||

|

Information technology

|

4,413

|

|

7,315

|

|

5,786

|

|

||||||

|

Other, including facility improvements

|

279

|

|

2,912

|

|

5,914

|

|

||||||

|

4,692

|

|

10,227

|

|

11,700

|

|

|||||||

|

Consolidated capital expenditures

|

$

|

96,615

|

|

$

|

86,226

|

|

$

|

60,525

|

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Number of restaurants sold and leased back

|

8

|

|

—

|

|

3

|

|

||||||

|

Proceeds from sale and leaseback of assets

|

$

|

17,123

|

|

$

|

—

|

|

$

|

5,698

|

|

|||

|

Purchases of assets intended for sale and leaseback

|

$

|

(9,785

|

)

|

$

|

(10,396

|

)

|

$

|

(2,801

|

)

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Number of restaurants sold to franchisees

|

1

|

|

21

|

|

37

|

|

||||||

|

Total proceeds

|

$

|

1,439

|

|

$

|

3,951

|

|

$

|

10,536

|

|

|||

|

2016

|

2015

|

2014

|

||||||||||

|

Number of restaurants acquired from franchisees

|

15

|

|

7

|

|

4

|

|

||||||

|

Cash used to acquire franchise-operated restaurants

|

$

|

19,816

|

|

$

|

—

|

|

$

|

1,750

|

|

|||

|

|

Payments Due by Fiscal Year

|

|||||||||||||||||||

|

Total

|

Less than

1 year

|

1-3 years

|

3-5 years

|

After 5 years

|

||||||||||||||||

|

Contractual Obligations:

|

||||||||||||||||||||

|

Credit facility term loan (1)

|

$

|

733,912

|

|

$

|

71,771

|

|

$

|

662,141

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Revolving credit agreement (1)

|

300,237

|

|

7,126

|

|