|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

ý

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended September 26, 2014

|

||

|

OR

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Switzerland

(Jurisdiction of Incorporation)

|

|

98-0390500

(I.R.S. Employer Identification Number)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Shares, Par Value CHF 0.50

|

|

New York Stock Exchange

|

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

|

|

|

|

Page

|

|

Part I

|

|

|

|

Part II

|

|

|

|

Part III

|

|

|

|

Part IV

|

|

|

|

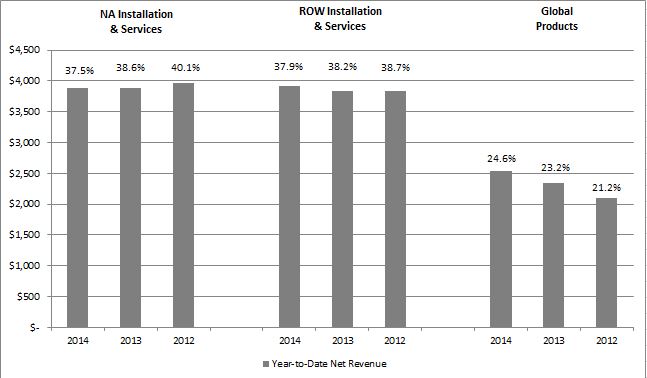

•

|

North America Installation & Services ("NA Installation & Services")

designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, institutional and governmental customers in North America.

|

|

•

|

Rest of World ("ROW") Installation & Services ("ROW Installation & Services")

designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, residential, small business, institutional and governmental customers in the ROW regions.

|

|

•

|

Global Products

designs, manufactures and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus and access control and video management systems, for commercial, industrial, retail, residential, small business, institutional and governmental customers worldwide, including products installed and serviced by our NA and ROW Installation & Services segments.

|

|

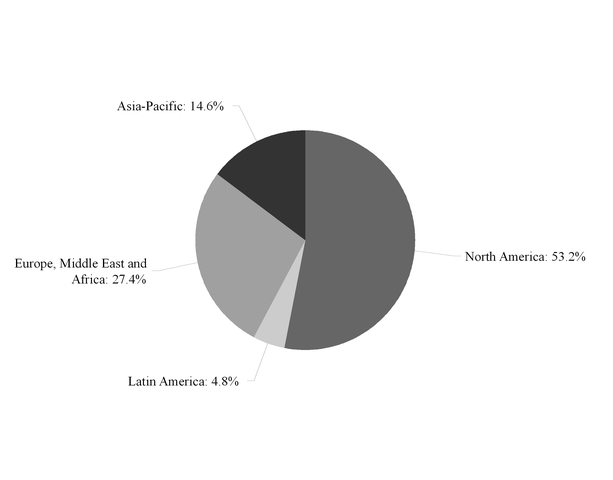

Net

Revenue

|

Percent of

Total

Net

Revenue

|

Key Brands

|

||||||

|

NA Installation & Services

|

$

|

3,876

|

|

37

|

%

|

Tyco Fire & Security, Tyco Integrated Security, SimplexGrinnell, Sensormatic

|

||

|

ROW Installation & Services

|

3,920

|

|

38

|

%

|

Tyco Fire & Security, Wormald, Sensormatic, ADT

|

|||

|

Global Products

|

2,544

|

|

25

|

%

|

Tyco, Simplex, Ansul, DSC, Scott, American Dynamics, Software House, Visonic, Chemguard, Exacq

|

|||

|

$

|

10,340

|

|

100

|

%

|

|

|||

|

•

|

Commercial customers, including residential and commercial property developers, financial institutions, food service businesses and commercial enterprises;

|

|

•

|

Industrial customers, including companies in the oil and gas, power generation, mining, petrochemical and other industries;

|

|

•

|

Retail customers, including international, regional and local consumer outlets;

|

|

•

|

Institutional customers, including a broad range of healthcare facilities, academic institutions, museums and foundations;

|

|

•

|

Governmental customers, including federal, state and local governments, defense installations, mass transportation networks, public utilities and other government-affiliated entities and applications; and

|

|

•

|

Residential and small business customers outside of North America, including owners of single-family homes and local providers of a wide range of goods and services.

|

|

•

|

economic volatility and the impact of economic conditions in various regions;

|

|

•

|

the difficulty of enforcing agreements, collecting receivables and protecting assets, especially our intellectual property rights, through non-U.S. legal systems;

|

|

•

|

possibility of unfavorable circumstances from host country laws, regulations or licensing requirements;

|

|

•

|

fluctuations in revenues, operating margins and other financial measures due to currency exchange rate fluctuations and restrictions on currency and earnings repatriation;

|

|

•

|

trade protection measures, import or export restrictions, licensing requirements and local fire and security codes and standards;

|

|

•

|

increased costs and risks of developing, staffing and simultaneously managing a number of foreign operations as a result of distance as well as language and cultural differences;

|

|

•

|

issues related to occupational safety and adherence to local labor laws and regulations;

|

|

•

|

potentially adverse tax developments;

|

|

•

|

longer payment cycles;

|

|

•

|

changes in the general political, social and economic conditions in the countries where we operate, particularly in emerging markets;

|

|

•

|

the threat of nationalization and expropriation, as well as new or changed restrictions regarding foreign ownership of assets - in particular with respect to security products or services that may be viewed by certain governments as sovereign security interests;

|

|

•

|

the presence of corruption in certain countries; and

|

|

•

|

fluctuations in available municipal funding in those instances where a project is government financed.

|

|

•

|

diversion of management time and attention from daily operations;

|

|

•

|

difficulties integrating acquired businesses, technologies and personnel into our business;

|

|

•

|

inability to obtain required regulatory approvals and/or required financing on favorable terms;

|

|

•

|

potential loss of key employees, key contractual relationships, or key customers of acquired companies or of us;

|

|

•

|

assumption of the liabilities and exposure to unforeseen liabilities of acquired companies; and

|

|

•

|

dilution of interests of holders of our common shares through the issuance of equity securities or equity-linked securities.

|

|

•

|

solvent, oil, metal and other hazardous substance contamination cleanup; and

|

|

•

|

structure decontamination and demolition, including asbestos abatement.

|

|

•

|

require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other corporate purposes, including dividend payments;

|

|

•

|

increase our vulnerability to adverse economic and industry conditions;

|

|

•

|

limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate;

|

|

•

|

restrict our ability to introduce new technologies or exploit business opportunities;

|

|

•

|

make it more difficult for us to satisfy our payment obligations with respect to our outstanding indebtedness; and

|

|

•

|

increase the difficulty and/or cost to us of refinancing our indebtedness.

|

|

As of September 27, 2013

|

(Charge)/Benefit

|

Payments/(Receipts)

|

As of September 26, 2014

|

|||||||||||||

|

Yarway:

|

||||||||||||||||

|

Insurance assets

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Gross asbestos liabilities

|

(90

|

)

|

(225

|

)

|

—

|

|

(315

|

)

|

||||||||

|

Net liability position

|

$

|

(90

|

)

|

$

|

(225

|

)

|

$

|

—

|

|

$

|

(315

|

)

|

||||

|

Other Claims:

|

||||||||||||||||

|

Insurance assets

|

$

|

152

|

|

$

|

93

|

|

$

|

—

|

|

$

|

245

|

|

||||

|

Gross asbestos liabilities

|

(231

|

)

|

(325

|

)

|

18

|

|

(538

|

)

|

||||||||

|

Net liability position

|

$

|

(79

|

)

|

$

|

(232

|

)

|

$

|

18

|

|

$

|

(293

|

)

|

||||

|

Total Tyco:

|

||||||||||||||||

|

Insurance assets

|

$

|

152

|

|

$

|

93

|

|

$

|

—

|

|

$

|

245

|

|

||||

|

Gross asbestos liabilities

|

(321

|

)

|

(550

|

)

|

18

|

|

(853

|

)

|

||||||||

|

Total net liability position

|

$

|

(169

|

)

|

$

|

(457

|

)

|

$

|

18

|

|

$

|

(608

|

)

|

||||

|

|

Year Ended September 26, 2014

|

Year Ended September 27, 2013

|

|||||||||||||||||||||

|

|

Market Price

Range

|

|

Market Price

Range

|

|

|||||||||||||||||||

|

|

Dividends Declared

Per Common

Share

(1)

|

Dividends Declared

Per Common

Share

(1)

|

|||||||||||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

|||||||||||||||||||

|

First

|

$

|

41.21

|

|

$

|

34.20

|

|

$

|

0.16

|

|

$

|

29.48

|

|

$

|

26.50

|

|

$

|

0.15

|

|

|||||

|

Second

|

43.82

|

|

39.40

|

|

0.16

|

|

32.34

|

|

29.25

|

|

0.15

|

|

|||||||||||

|

Third

|

46.46

|

|

40.61

|

|

0.18

|

|

34.50

|

|

30.70

|

|

0.16

|

|

|||||||||||

|

Fourth

|

45.95

|

|

42.70

|

|

0.18

|

|

35.91

|

|

32.93

|

|

0.16

|

|

|||||||||||

|

|

|

|

|

$

|

0.68

|

|

|

|

|

|

$

|

0.62

|

|

||||||||||

|

(1)

|

Dividends proposed by Tyco's Board of Directors are subject to shareholder approval. Shareholders approved an annual cash dividend of $0.72 at the Company's annual general meeting on March 5, 2014, covering quarterly dividend payments from May 2014 through February 2015. Shareholders approved an annual cash dividend of $0.64 at the Company's annual general meeting on March 6, 2013, covering quarterly dividend payments from May 2013 through February 2014. Shareholders approved cash dividends of $0.50 (pre-2012 Separation) and $0.30 (reflecting the impact of the 2012 Separation) at the annual meeting held on March 7, 2012 and the special general meeting held on September 17, 2012, respectively, covering quarterly dividend payments through February 2013.

|

|

|

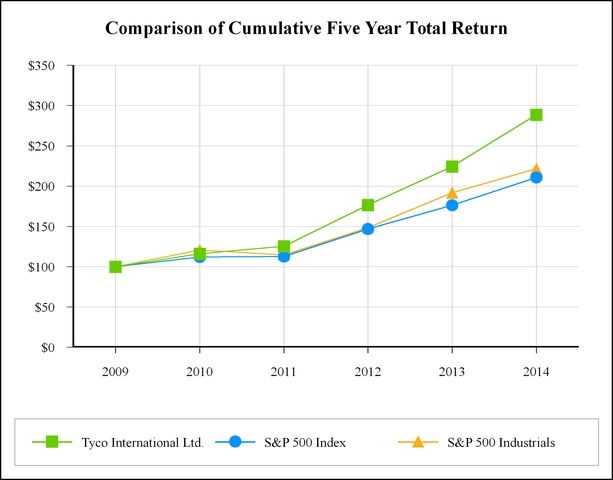

Annual Return Percentage Years Ended

|

|||||||||||||

|

Company/Index

|

9/10

|

9/11

|

9/12

|

9/13

|

9/14

|

|||||||||

|

Tyco International Ltd.

|

16.16

|

|

8.06

|

|

40.85

|

|

26.95

|

|

28.66

|

|

||||

|

S&P 500 Index

|

12.23

|

|

0.49

|

|

30.20

|

|

20.06

|

|

19.64

|

|

||||

|

S&P 500 Industrials Index

|

20.95

|

|

(5.28

|

)

|

29.60

|

|

29.29

|

|

15.42

|

|

||||

|

9/09

|

9/10

|

9/11

|

9/12

|

9/13

|

9/14

|

||||||||||||||||||

|

Tyco International Ltd.

|

$

|

100

|

|

$

|

116.16

|

|

$

|

125.52

|

|

$

|

176.79

|

|

$

|

224.44

|

|

$

|

288.76

|

|

|||||

|

S&P 500 Index

|

100

|

|

112.23

|

|

112.77

|

|

146.83

|

|

176.29

|

|

210.91

|

|

|||||||||||

|

S&P 500 Industrials Index

|

100

|

|

120.95

|

|

114.57

|

|

148.49

|

|

191.98

|

|

221.59

|

|

|||||||||||

|

|

Equity Compensation Plan

|

||||||||

|

Plan Category

|

Number of

securities to be

issued upon

exercise of

outstanding

options

(a)

|

Weighted-average

exercise price of

outstanding

options

(b)

|

Number of

securities remaining

available for future

issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

|

||||||

|

Equity compensation plans approved by shareholders:

|

|

||||||||

|

2012 Stock and Incentive Plan

(1)

|

8,519,966

|

|

$

|

30.83

|

|

35,087,826

|

|

||

|

2004 Stock and Incentive Plan

(2)

|

10,461,375

|

|

20.54

|

|

—

|

|

|||

|

ESPP

(3)

|

—

|

|

2,919,845

|

|

|||||

|

18,981,341

|

|

38,007,671

|

|

||||||

|

Equity compensation plans not approved by shareholders:

|

|

|

|||||||

|

Broadview Security Plans

(4)

|

19,526

|

|

12.00

|

|

—

|

|

|||

|

19,526

|

|

—

|

|

||||||

|

Total

|

19,000,867

|

|

38,007,671

|

|

|||||

|

(1)

|

The Tyco International Ltd. 2012 Stock and Incentive Plan ("2012 Plan") provides for the award of stock options, restricted stock units, performance share units and other equity and equity-based awards to members of the Board of Directors, officers and non-officer employees. The amount in column (a) consists of:

|

|

5,555,909

|

|

Shares that may be issued upon the exercise of stock options;

|

|

1,573,753

|

|

Shares that may be issued upon the vesting of restricted stock units;

|

|

1,387,651

|

|

Shares that may be issued upon the vesting of performance share units; and

|

|

2,653

|

|

Dividend equivalents earned on deferred stock units ("DSU") granted under the Company’s Long Term Incentive Plan ("LTIP I") and its 2004 Stock and Incentive Plan ("2004 Plan").

|

|

8,519,966

|

|

Total

|

|

(2)

|

The 2004 Plan provided for the award of stock options, restricted stock units, performance share units and other equity and equity-based awards to members of the Board of Directors, officers and non-officer employees. The amount in column (a) consists of:

|

|

9,550,930

|

|

Shares that may be issued upon the exercise of stock options;

|

|

837,547

|

|

Shares that may be issued upon the vesting of restricted stock units; and

|

|

72,898

|

|

DSUs and dividend equivalents earned on DSUs.

|

|

10,461,375

|

|

Total

|

|

(3)

|

Shares available for future issuance under the Tyco Employee Stock Purchase Plan ("ESPP"), which represents the number of remaining shares registered for issuance under this plan. All of the shares delivered to participants under the ESPP were purchased in the open market. The ESPP was suspended indefinitely during the fourth quarter of 2009.

|

|

(4)

|

In connection with the acquisition of Broadview Security in May 2010, options outstanding under the Brink's Home Security Holdings, Inc. 2008 Equity Incentive Plan and the Brink's Home Security Holdings, Inc. Non-Employee Director's Equity Plan were converted into options to purchase Tyco common shares.

|

|

Period

|

Total Number of

Shares

Purchased

|

Average

Price Paid

Per Share

|

Total Number of

Shares Purchased as

Part of Publicly

Announced

Plans or Programs

|

Maximum Approximate Dollar

Value of Shares that

May Yet Be Purchased

Under Publicly

Announced

Plans or Programs

(1)

|

|||||||||

|

6/28/2014 - 7/25/2014

|

7,034,189

|

|

$

|

45.44

|

|

7,029,336

|

|

|

|

||||

|

7/26/2014 - 8/29/2014

|

8,068,419

|

|

44.18

|

|

8,068,419

|

|

|

|

|||||

|

8/30/2014 - 9/26/2014

|

7,896,692

|

|

44.44

|

|

7,894,970

|

|

$

|

1,416,789,994

|

|

||||

|

2014

|

2013

|

2012

(3)(4)

|

2011

|

2010

|

|||||||||||||||

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|

||||||||||||||

|

Net revenue

|

$

|

10,340

|

|

$

|

10,073

|

|

$

|

9,892

|

|

$

|

10,081

|

|

$

|

10,610

|

|

||||

|

Income (loss) from continuing operations attributable to Tyco common shareholders

(1)

|

794

|

|

443

|

|

(412

|

)

|

548

|

|

233

|

|

|||||||||

|

Net income attributable to Tyco common shareholders

(2)

|

1,838

|

|

536

|

|

472

|

|

1,719

|

|

1,130

|

|

|||||||||

|

Basic earnings per share attributable to Tyco

common shareholders:

|

|

|

|

|

|||||||||||||||

|

Income (loss) from continuing operations

|

1.74

|

|

0.96

|

|

(0.89

|

)

|

1.16

|

|

0.48

|

|

|||||||||

|

Net income

|

4.04

|

|

1.15

|

|

1.02

|

|

3.63

|

|

2.33

|

|

|||||||||

|

Diluted earnings per share attributable to Tyco common shareholders:

|

|

|

|

|

|||||||||||||||

|

Income (loss) from continuing operations

|

1.71

|

|

0.94

|

|

(0.89

|

)

|

1.14

|

|

0.48

|

|

|||||||||

|

Net income

|

3.97

|

|

1.14

|

|

1.02

|

|

3.59

|

|

2.31

|

|

|||||||||

|

Cash dividends per share

|

0.68

|

|

0.62

|

|

0.90

|

|

0.99

|

|

0.86

|

|

|||||||||

|

Consolidated Balance Sheet Data (End of Year):

|

|

|

|

|

|||||||||||||||

|

Total assets

|

$

|

11,809

|

|

$

|

12,176

|

|

$

|

12,365

|

|

$

|

26,702

|

|

$

|

27,066

|

|

||||

|

Long-term debt

|

1,443

|

|

1,443

|

|

1,481

|

|

4,105

|

|

3,608

|

|

|||||||||

|

Total Tyco shareholders' equity

|

4,647

|

|

5,098

|

|

4,994

|

|

14,149

|

|

14,066

|

|

|||||||||

|

(1)

|

Income (loss) from continuing operations attributable to Tyco common shareholders for the fiscal years 2014 and 2012 includes asbestos related charges of $462 million and $111 million, respectively. Fiscal 2014 also includes $96 million of legacy legal reversal and recoveries. In addition, fiscal 2013 includes $100 million in environmental remediation costs related to our Marinette facility. See Note 13 to the Consolidated Financial Statements.

|

|

(2)

|

Net income attributable to Tyco common shareholders for the fiscal years 2014, 2013, 2012, 2011 and 2010 includes Income from discontinued operations of $1,044 million, $93 million, $80 million, $69 million and $62 million primarily related to ADT Korea. Net income (loss) attributable to Tyco common shareholders for the fiscal years 2012, 2011, and 2010 also includes Income from discontinued operations of $804 million, $1,102 million, and $835 million, respectively, which is primarily related to ADT and Tyco Flow Control. The increase in net income attributable to common shareholders for 2014 also includes a gain of $216 million relating to the sale of Atkore. See Note 3 to the Consolidated Financial Statements.

|

|

(3)

|

The decrease in total assets and total Tyco shareholders' equity in fiscal 2012 is due to the distribution of our former North American residential security and flow control businesses.

|

|

(4)

|

The decrease in long-term debt is due to the $2.6 billion redemption of various debt securities in connection with the 2012 Separation. See Note 10 to the Consolidated Financial Statements.

|

|

•

|

North America Installation & Services ("NA Installation & Services")

designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, institutional and governmental customers in North America.

|

|

•

|

Rest of World Installation & Services ("ROW Installation & Services")

designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, residential, small business, institutional and governmental customers in the Rest of World ("ROW") regions.

|

|

•

|

Global Products

designs, manufactures and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus and access control and video management systems, for commercial, industrial, retail, residential, small business, institutional and governmental customers worldwide, including products installed and serviced by our NA and ROW Installation & Services segments.

|

|

•

|

Commercial customers, including residential and commercial property developers, financial institutions, food service businesses and commercial enterprises;

|

|

•

|

Industrial customers, including companies in the oil and gas, power generation, mining, petrochemical and other industries;

|

|

•

|

Retail customers, including international, regional and local consumer outlets, from national chains to specialty stores;

|

|

•

|

Institutional customers, including a broad range of healthcare facilities, academic institutions, museums and foundations;

|

|

•

|

Governmental customers, including federal, state and local governments, defense installations, mass transportation networks, public utilities and other government-affiliated entities and applications; and

|

|

•

|

Residential and small business customers outside of North America, including owners of single family homes and local providers of a wide range of goods and services.

|

|

|

For the Years Ended

|

|||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

|||||||||

|

Net revenue

|

$

|

10,340

|

|

$

|

10,073

|

|

$

|

9,892

|

|

|||

|

Net revenue growth

|

2.7

|

%

|

1.8

|

%

|

NA

|

|

||||||

|

Organic revenue growth

|

2.6

|

%

|

0.8

|

%

|

NA

|

|

||||||

|

Operating income

|

$

|

697

|

|

$

|

709

|

|

$

|

578

|

|

|||

|

Operating margin

|

6.7

|

%

|

7.0

|

%

|

5.8

|

%

|

||||||

|

Interest income

|

$

|

14

|

|

$

|

16

|

|

$

|

18

|

|

|||

|

Interest expense

|

97

|

|

100

|

|

209

|

|

||||||

|

Other expense, net

|

1

|

|

29

|

|

454

|

|

||||||

|

Income tax expense

|

(24

|

)

|

(108

|

)

|

(320

|

)

|

||||||

|

Equity income (loss) in earnings of unconsolidated subsidiaries

|

206

|

|

(48

|

)

|

(26

|

)

|

||||||

|

Income (loss) from continuing operations attributable to Tyco common shareholders

|

794

|

|

443

|

|

(412

|

)

|

||||||

|

|

For the Years Ended

|

||||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||||

|

Restructuring, repositioning and asset impairment charges, net

|

$

|

93

|

|

$

|

131

|

|

$

|

104

|

|

||||

|

Environmental remediation costs - Marinette

|

—

|

|

100

|

|

17

|

|

|||||||

|

Asbestos related charges

|

462

|

|

12

|

|

111

|

|

|||||||

|

(Gain) loss on divestitures

|

(2

|

)

|

20

|

|

14

|

|

|||||||

|

Separation costs

|

53

|

|

69

|

|

75

|

|

|||||||

|

Legacy legal (gains) charges

|

(96

|

)

|

27

|

|

(4

|

)

|

|||||||

|

China insurance recovery

|

(21

|

)

|

—

|

|

—

|

|

|||||||

|

CIT settlement gain

|

(16

|

)

|

—

|

|

—

|

|

|||||||

|

Loss on sale of investment

|

7

|

|

—

|

|

—

|

|

|||||||

|

Acquisition and integration costs

|

3

|

|

4

|

|

9

|

|

|||||||

|

IRS litigation costs

|

4

|

|

—

|

|

—

|

|

|||||||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Loss on extinguishment of debt (see Note 10 to the Consolidated Financial Statements)

|

$

|

—

|

|

$

|

—

|

|

$

|

(453

|

)

|

||

|

2012 Tax Sharing Agreement income (see Note 6 to the Consolidated Financial Statements)

|

15

|

|

(32

|

)

|

—

|

|

|||||

|

2007 Tax Sharing Agreement loss (see Note 6 to the Consolidated Financial Statements)

|

(21

|

)

|

—

|

|

(4

|

)

|

|||||

|

Other

|

5

|

3

|

3

|

|

|||||||

|

Total

|

$

|

(1

|

)

|

$

|

(29

|

)

|

$

|

(454

|

)

|

||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Net revenue

|

$

|

3,876

|

|

$

|

3,891

|

|

$

|

3,962

|

|

||

|

Net revenue decline

|

(0.4

|

)%

|

(1.8

|

)%

|

NA

|

|

|||||

|

Organic revenue growth (decline)

|

1.0

|

%

|

(1.1

|

)%

|

NA

|

|

|||||

|

Operating income

|

$

|

450

|

|

$

|

388

|

|

$

|

374

|

|

||

|

Operating margin

|

11.6

|

%

|

10.0

|

%

|

9.4

|

%

|

|||||

|

Factors Contributing to Year-Over-Year Change

|

Fiscal 2014

Compared to

Fiscal 2013

|

Fiscal 2013

Compared to

Fiscal 2012

|

|||||

|

Organic revenue growth (decline)

|

$

|

37

|

|

$

|

(45

|

)

|

|

|

Acquisitions

|

19

|

|

7

|

|

|||

|

Divestitures

|

(42

|

)

|

(28

|

)

|

|||

|

Impact of foreign currency

|

(29

|

)

|

(3

|

)

|

|||

|

Other

|

—

|

|

(2

|

)

|

|||

|

Total change

|

$

|

(15

|

)

|

$

|

(71

|

)

|

|

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Separation costs

|

$

|

51

|

|

$

|

49

|

|

$

|

2

|

|

||

|

Restructuring, repositioning and asset impairment charges, net

|

13

|

|

36

|

|

45

|

|

|||||

|

Legacy legal charges

|

—

|

|

—

|

|

29

|

|

|||||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Net revenue

|

$

|

3,920

|

|

$

|

3,843

|

|

$

|

3,830

|

|

||

|

Net revenue growth (decline)

|

2.0

|

%

|

0.3

|

%

|

NA

|

|

|||||

|

Organic revenue growth

|

1.9

|

%

|

(0.2

|

)%

|

NA

|

|

|||||

|

Operating income

|

$

|

409

|

|

$

|

333

|

|

$

|

349

|

|

||

|

Operating margin

|

10.4

|

%

|

8.7

|

%

|

9.1

|

%

|

|||||

|

Factors Contributing to Year-Over-Year Change

|

Fiscal 2014

Compared to

Fiscal 2013

|

Fiscal 2013

Compared to

Fiscal 2012

|

|||||

|

Organic revenue growth

|

$

|

71

|

|

$

|

(6

|

)

|

|

|

Acquisitions

|

119

|

|

93

|

|

|||

|

Divestitures

|

(67

|

)

|

(10

|

)

|

|||

|

Impact of foreign currency

|

(46

|

)

|

(64

|

)

|

|||

|

Total change

|

$

|

77

|

|

$

|

13

|

|

|

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Restructuring, repositioning and asset impairment charges, net

|

$

|

31

|

|

$

|

64

|

|

$

|

36

|

|

||

|

China insurance recovery

|

(21

|

)

|

—

|

|

—

|

|

|||||

|

Loss on divestitures

|

1

|

|

14

|

|

7

|

|

|||||

|

Acquisition and integration costs

|

3

|

|

2

|

|

4

|

|

|||||

|

Loss on sale of investment

|

7

|

|

—

|

|

—

|

|

|||||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Net revenue

|

$

|

2,544

|

|

$

|

2,339

|

|

$

|

2,100

|

|

||

|

Net revenue growth

|

8.8

|

%

|

11.4

|

%

|

NA

|

|

|||||

|

Organic revenue growth

|

6.3

|

%

|

6.3

|

%

|

NA

|

|

|||||

|

Operating income

|

$

|

458

|

|

$

|

307

|

|

$

|

353

|

|

||

|

Operating margin

|

18.0

|

%

|

13.1

|

%

|

16.8

|

%

|

|||||

|

Factors Contributing to Year-Over-Year Change

|

Fiscal 2014

Compared to

Fiscal 2013

|

Fiscal 2013

Compared to

Fiscal 2012

|

|||||

|

Organic revenue growth

|

$

|

147

|

|

$

|

133

|

|

|

|

Acquisitions

|

63

|

|

68

|

|

|||

|

Impact of foreign currency

|

(7

|

)

|

(3

|

)

|

|||

|

Other

|

2

|

|

41

|

|

|||

|

Total change

|

$

|

205

|

|

$

|

239

|

|

|

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Environmental remediation costs - Marinette

|

$

|

—

|

|

$

|

100

|

|

$

|

17

|

|

||

|

Restructuring, repositioning and asset impairment charges, net

|

12

|

|

12

|

|

10

|

|

|||||

|

Acquisition and integration costs

|

—

|

|

2

|

|

4

|

|

|||||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Legacy legal (gains) charges

|

$

|

(96

|

)

|

$

|

27

|

|

$

|

17

|

|

||

|

Separation costs

|

2

|

|

20

|

|

70

|

|

|||||

|

Restructuring, repositioning and asset impairment charges, net

|

37

|

|

19

|

|

13

|

|

|||||

|

Asbestos related charges

|

462

|

|

12

|

|

111

|

|

|||||

|

(Gain) loss on divestitures

|

(3

|

)

|

5

|

|

7

|

|

|||||

|

Former management compensation reversal

|

—

|

|

—

|

|

(50

|

)

|

|||||

|

CIT settlement gain

|

(16

|

)

|

—

|

|

—

|

|

|||||

|

IRS litigation costs

|

4

|

|

—

|

|

—

|

|

|||||

|

•

|

A prolonged downturn in the business environment in which the reporting units operate (i.e. sales volumes and prices) especially in the commercial construction and retailer end markets;

|

|

•

|

An economic recovery that significantly differs from our assumptions in timing or degree;

|

|

•

|

Volatility in equity and debt markets resulting in higher discount rates; and

|

|

•

|

Unexpected regulatory changes.

|

|

|

As of

|

||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

|||||

|

Cash and cash equivalents

|

$

|

892

|

|

$

|

563

|

|

|

|

Total debt

|

$

|

1,463

|

|

$

|

1,463

|

|

|

|

Shareholders' equity

|

$

|

4,647

|

|

$

|

5,098

|

|

|

|

Total debt as a % of total capital

(1)

|

23.9

|

%

|

22.3

|

%

|

|||

|

|

For the Years Ended

|

||||||||||

|

($ in millions)

|

September 26, 2014

|

September 27, 2013

|

September 28, 2012

|

||||||||

|

Net cash provided by operating activities

|

$

|

831

|

|

$

|

694

|

|

$

|

556

|

|

||

|

Net cash used in investing activities

|

(221

|

)

|

(545

|

)

|

(470

|

)

|

|||||

|

Net cash used in financing activities

|

(261

|

)

|

(419

|

)

|

(475

|

)

|

|||||

|

|

Fiscal Year

|

|

|

||||||||||||||||||||||||

|

|

2015

|

2016

|

2017

|

2018

|

2019

|

Thereafter

|

Total

|

||||||||||||||||||||

|

Debt principal

(1)

|

$

|

—

|

|

$

|

258

|

|

$

|

—

|

|

$

|

67

|

|

$

|

364

|

|

$

|

746

|

|

$

|

1,435

|

|

||||||

|

Interest payments

(2)

|

93

|

|

88

|

|

84

|

|

83

|

|

66

|

|

63

|

|

477

|

|

|||||||||||||

|

Operating leases

|

185

|

|

163

|

|

122

|

|

81

|

|

44

|

|

82

|

|

677

|

|

|||||||||||||

|

Purchase obligations

(3)

|

375

|

|

66

|

|

28

|

|

1

|

|

1

|

|

—

|

|

471

|

|

|||||||||||||

|

Total contractual cash obligations

(4)

|

$

|

653

|

|

$

|

575

|

|

$

|

234

|

|

$

|

232

|

|

$

|

475

|

|

$

|

891

|

|

$

|

3,060

|

|

||||||

|

(1)

|

Debt principal consists of the aggregate principal amount of our public debt outstanding, excluding debt discount, swap activity and interest.

|

|

(2)

|

Interest payments consist of interest on our fixed interest rate debt.

|

|

(3)

|

Purchase obligations consist of commitments for purchases of goods and services.

|

|

(4)

|

Other long-term liabilities excluded from the above contractual obligation table primarily consist of the following: pension and postretirement costs (see Note 14 to the Consolidated Financial Statements), income taxes (see Note 6 to the Consolidated Financial Statements), contingent consideration (see Note 5 to the Consolidated Financial Statements), warranties (see Note 11 to the Consolidated Financial Statements) and environmental liabilities (see Note 13 to the Consolidated Financial Statements). We are unable to estimate the timing of payment for these items due to the inherent uncertainties related to these obligations. However, the minimum required contributions to our pension plans are expected to be approximately $36 million in 2015 and we do not expect to make any material contributions in 2015 related to other postretirement benefit plans.

|

|

NA Installation

& Services

|

ROW

Installation

& Services

|

Global

Products

|

Total

|

||||||||||||

|

As of September 27, 2013

|

|

|

|

|

|||||||||||

|

Backlog

|

$

|

908

|

|

$

|

939

|

|

$

|

196

|

|

$

|

2,043

|

|

|||

|

Recurring Revenue in Force

|

1,239

|

|

1,194

|

|

—

|

|

2,433

|

|

|||||||

|

Deferred Revenue

|

296

|

|

40

|

|

—

|

|

336

|

|

|||||||

|

Total Backlog

|

$

|

2,443

|

|

$

|

2,173

|

|

$

|

196

|

|

$

|

4,812

|

|

|||

|

As of September 26, 2014

|

|||||||||||||||

|

Backlog

|

$

|

992

|

|

$

|

999

|

|

$

|

181

|

|

$

|

2,172

|

|

|||

|

Recurring Revenue in Force

|

1,243

|

|

1,143

|

|

—

|

|

2,386

|

|

|||||||

|

Deferred Revenue

|

266

|

|

38

|

|

—

|

|

304

|

|

|||||||

|

Total Backlog

|

$

|

2,501

|

|

$

|

2,180

|

|

$

|

181

|

|

$

|

4,862

|

|

|||

|

Net

Revenue

for

Fiscal 2013

|

Base Year

Adjustments

(Divestitures)

|

Adjusted

Fiscal 2013

Base Revenue

|

Foreign

Currency

|

Acquisitions

|

Organic

Revenue

|

Organic Growth

Percentage

(1)

|

Net

Revenue

for

Fiscal 2014

|

|||||||||||||||||||||||

|

|

($ in millions)

|

|||||||||||||||||||||||||||||

|

NA Installation & Services

|

$

|

3,891

|

|

$

|

(42

|

)

|

$

|

3,849

|

|

$

|

(29

|

)

|

$

|

19

|

|

$

|

37

|

|

1.0

|

%

|

$

|

3,876

|

|

|||||||

|

ROW Installation & Services

|

3,843

|

|

(67

|

)

|

3,776

|

|

(46

|

)

|

119

|

|

71

|

|

1.9

|

%

|

3,920

|

|

||||||||||||||

|

Global Products

|

2,339

|

|

2

|

|

2,341

|

|

(7

|

)

|

63

|

|

147

|

|

6.3

|

%

|

2,544

|

|

||||||||||||||

|

Total Net Revenue

|

$

|

10,073

|

|

$

|

(107

|

)

|

$

|

9,966

|

|

$

|

(82

|

)

|

$

|

201

|

|

$

|

255

|

|

2.6

|

%

|

$

|

10,340

|

|

|||||||

|

(1)

|

Organic revenue growth percentage based on adjusted fiscal 2013 base revenue.

|

|

Net

Revenue

for

Fiscal 2012

|

Base Year

Adjustments

(Divestitures)

|

Adjusted

Fiscal 2012

Base Revenue

|

Foreign

Currency

|

Acquisitions

|

Other

(2)

|

Organic

Revenue

|

Organic

Growth (Decline)

Percentage

(1)

|

Net

Revenue

for

Fiscal 2013

|

||||||||||||||||||||||||||

|

|

($ in millions)

|

|||||||||||||||||||||||||||||||||

|

NA Installation & Services

|

$

|

3,962

|

|

$

|

(30

|

)

|

$

|

3,932

|

|

$

|

(3

|

)

|

$

|

7

|

|

$

|

—

|

|

$

|

(45

|

)

|

(1.1

|

)%

|

$

|

3,891

|

|

||||||||

|

ROW Installation & Services

|

3,830

|

|

(10

|

)

|

3,820

|

|

(64

|

)

|

93

|

|

—

|

|

(6

|

)

|

(0.2

|

)%

|

3,843

|

|

||||||||||||||||

|

Global Products

|

2,100

|

|

2

|

|

2,102

|

|

(3

|

)

|

68

|

|

39

|

|

133

|

|

6.3

|

%

|

2,339

|

|

||||||||||||||||

|

Total Net Revenue

|

$

|

9,892

|

|

$

|

(38

|

)

|

$

|

9,854

|

|

$

|

(70

|

)

|

$

|

168

|

|

$

|

39

|

|

$

|

82

|

|

0.8

|

%

|

$

|

10,073

|

|

||||||||

|

(1)

|

Organic revenue growth percentage based on adjusted fiscal 2012 base revenue.

|

|

(2)

|

Amount represents contractual revenue from ADT under the 2012 Separation and Distribution Agreement which is excluded from the organic revenue calculation

|

|

•

|

overall economic and business conditions, and overall demand for Tyco's goods and services;

|

|

•

|

economic and competitive conditions in the industries, end markets and regions served by our businesses;

|

|

•

|

changes in legal and tax requirements (including tax rate changes, new tax laws or treaties and revised tax law interpretations);

|

|

•

|

our, and our employees' and agents' ability to comply with complex and continually changing laws and regulations that govern our international operations, including the U.S. Foreign Corrupt Practices Act, similar anti-bribery laws in other jurisdictions, a variety of export control, customs, currency exchange control and transfer pricing regulations, and our corporate policies governing these matters;

|

|

•

|

the outcome of litigation, arbitrations and governmental proceedings;

|

|

•

|

effect of income tax audits, litigation, settlements and appeals;

|

|

•

|

our ability to repay or refinance our outstanding indebtedness as it matures;

|

|

•

|

our ability to operate within the limitations imposed by financing arrangements and to maintain our credit ratings;

|

|

•

|

interest rate fluctuations and other changes in borrowing costs, or other consequences of volatility in the capital or credit markets;

|

|

•

|

other capital market conditions, including availability of funding sources and currency exchange rate fluctuations;

|

|

•

|

availability of and fluctuations in the prices of key raw materials;

|

|

•

|

changes affecting customers or suppliers;

|

|

•

|

economic and political conditions in international markets, including governmental changes and restrictions on the ability to transfer capital across borders;

|

|

•

|

our ability to achieve anticipated cost savings;

|

|

•

|

our ability to execute our portfolio refinement and acquisition strategies, including successfully integrating acquired operations;

|

|

•

|

potential impairment of our goodwill, intangibles and/or our long-lived assets;

|

|

•

|

our ability to realize the intended benefits of the 2012 Separation, including the integration of our commercial security and fire protection businesses;

|

|

•

|

other risks associated with the 2012 Separation, for example the risk that we may be liable for certain contingent liabilities of the spun-off entities if they were to become insolvent;

|

|

•

|

risks associated with our jurisdiction of incorporation, including the possibility of reduced flexibility with respect to certain aspects of capital management and corporate governance, increased or different regulatory burdens, and the possibility that we may not realize anticipated tax benefits;

|

|

•

|

the possible effects on Tyco of future legislation in the United States that may limit or eliminate potential U.S. tax benefits resulting from Tyco International's incorporation outside of the U.S. or deny U.S. government contracts to Tyco based upon its jurisdiction of incorporation;

|

|

•

|

risks associated with the proposed change in our global headquarters to Ireland; and

|

|

•

|

natural events such as severe weather, fires, floods and earthquakes, or acts of terrorism or cyber-attacks.

|

|

Management's Responsibility for Financial Statements

|

|

Reports of Independent Registered Public Accounting Firm

|

|

Consolidated Statements of Operations for the years ended September 26, 2014, September, 27, 2013 and September 28, 2012

|

|

Consolidated Statements of Comprehensive Income for the years ended September, 26, 2014, September 27, 2013 and September 28, 2012

|

|

Consolidated Balance Sheets as of the years ended September 26, 2014 and September 27, 2013

|

|

Consolidated Statements of Shareholders' Equity for the years ended September 26, 2014, September 27, 2013 and September 28, 2012

|

|

Consolidated Statements of Cash Flows for the years ended September 26, 2014, September 27, 2013 and September 28, 2012

|

|

Notes to Consolidated Financial Statements

|

|

(a)

|

(1) and (2) Financial Statements and Supplementary Data—See Item 8.

|

|

(b)

|

Exhibit Index:

|

|

Exhibit

Number

|

|

|

|

2.1

|

|

Separation and Distribution Agreement by and among Tyco International Ltd., Covidien Ltd., and Tyco Electronics Ltd., dated as of June 29, 2007 (Incorporated by reference to Exhibit 2.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on July 6, 2007).

|

|

2.2

|

|

Amended and Restated Separation and Distribution Agreement, dated September 27, 2012 among Tyco International Ltd., Pentair Ltd. and The ADT Corporation (Incorporated by reference to Exhibit 2.1 to Tyco International Ltd.'s current Report on Form 8-K filed on October 1, 2012).

|

|

2.3

|

|

Separation and Distribution Agreement, dated September 26, 2012 among Tyco International Ltd., Tyco International Finance S.A., The ADT Corporation and ADT LLC (Incorporated by reference to Exhibit 2.2 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 1, 2012).

|

|

2.4

|

|

Merger Agreement, dated as of March 30, 2014, between Tyco International Ltd., and Tyco International plc (Incorporated by reference to Exhibit 2.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on June 4, 2014).

|

|

3.1

|

|

Articles of Association of Tyco International Ltd. (Tyco International AG) (Tyco International SA) (Incorporated by reference to Exhibit 3.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on May 17, 2013).

|

|

3.2

|

|

Organizational Regulations (Incorporated by reference to Exhibit 3.2 of Tyco International Ltd.'s Current Report on Form 8-K filed on March 17, 2009).

|

|

4.1

|

|

Form of Indenture, dated as of June 9, 1998, among Tyco International Group S.A., Tyco and Wilmington Trust Company as successor to The Bank of New York, as trustee (Incorporated by reference to Exhibit 4.1 to Post-effective Amendment No.1 to Tyco's and Tyco International Group S.A.'s Co-Registration Statement on Form S-3 (No. 333-50855) filed on June 9, 1998).

|

|

4.2

|

|

Supplemental Indenture 2008-2 by and among Tyco International Ltd., Tyco International Finance S.A. and Wilmington Trust Company, as trustee, dated as of May 15, 2008 relating to the co-obligor's 6.875% Notes due 2021 (Incorporated by reference to Exhibit 4.3 to Tyco International Ltd.'s Current Report on Form 8-K filed on June 5, 2008).

|

|

4.3

|

|

Supplemental Indenture 2008-3 by and among Tyco International Ltd., Tyco International Finance S.A. and Wilmington Trust Company, as trustee, dated as of May 15, 2008 relating to the co-obligor's 7.0% Notes due 2019 (Incorporated by reference to Exhibit 4.4 to Tyco International Ltd.'s Current Report on Form 8-K filed on June 5, 2008).

|

|

Exhibit

Number

|

|

|

|

4.4

|

|

Indenture, dated as of January 9, 2009, by and among Tyco International Finance S.A., as issuer, Tyco International Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee (Incorporated by reference to Exhibit 4.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on January 9, 2009).

|

|

4.5

|

|

Supplemental Indenture, dated as of January 9, 2009, by and among Tyco International Finance S.A., as issuer, Tyco International Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee relating to the issuer's 8.5% notes due 2019 (Incorporated by reference to Exhibit 4.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on January 9, 2009).

|

|

4.6

|

|

Third Supplemental Indenture, dated as of May 5, 2010, by and among Tyco International Finance S.A., as issuer, Tyco International Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee relating to the issuer's 3.375% notes due 2015 (Incorporated by reference to Exhibit 4.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on May 5, 2010).

|

|

4.7

|

|

Fourth Supplemental Indenture, dated as of January 12, 2011, by and among Tyco International Finance S.A., as issuer, Tyco International Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee relating to the issuer's 3.75% notes due 2018 (Incorporated by reference to Exhibit 4.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on January 12, 2011).

|

|

4.8

|

|

Fifth Supplemental Indenture, dated as of January 12, 2011, by and among Tyco International Finance S.A., as issuer, Tyco International Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee relating to the issuer's 4.625% notes due 2023 (Incorporated by reference to Exhibit 4.2 to Tyco International Ltd.'s Current Report on Form 8-K filed on January 12, 2011).

|

|

10.1

|

|

Tyco International Ltd. 2004 Stock and Incentive Plan amended and restated effective January 1, 2009 (Incorporated by reference to Appendix A to Tyco International Ltd.'s Definitive Proxy Statement on Schedule 14A for the Annual General Meeting of Shareholders on March 12, 2009 filed on January 16, 2009).

(1)

|

|

10.2

|

|

Tyco International Ltd. 2012 Stock and Incentive Plan (Incorporated by reference to Exhibit 10.4 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 1, 2012).

(1)

|

|

10.3

|

|

Change in Control Severance Plan for Certain U.S. Officers and Executives, amended and restated as of October 1, 2012 (Incorporated by reference to Exhibit 10.3 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.4

|

|

Tyco International (US) Inc. Severance Plan for U.S. Officers and Executives Plan, amended and restated as of October 1, 2012 (Incorporated by reference to Exhibit 10.4 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.5

|

|

Employment Offer Letter dated April 2, 2012 between Tyco International Ltd. and George R. Oliver (Incorporated by reference to Exhibit 10.5 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.6

|

|

Employment Offer Letter dated May 3, 2012 between Tyco International Ltd. and Arun Nayar (Incorporated by reference to Exhibit 10.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on May 8, 2012).

(1)

|

|

10.7

|

|

Tyco Supplemental Savings and Retirement Plan, amended and restated effective January 1, 2005 (Incorporated by reference to Exhibit 10.27 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 30, 2005 filed on December 9, 2005).

(1)

|

|

Exhibit

Number

|

|

|

|

10.8

|

|

Agreement and General Release dated September 28, 2012 between Tyco International Ltd. and Edward D. Breen (Incorporated by reference to Exhibit 10.4 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.9

|

|

Form of terms and conditions for Option Awards, Restricted Unit Awards, Performance Share Awards under the 2012 Stock and Incentive Plan for fiscal 2015 (filed herewith).

(1)

|

|

10.10

|

|

Form of terms and conditions for Option Awards, Restricted Unit Awards, Performance Share Awards under the 2012 Stock and Incentive Plan for fiscal 2014 (Incorporated by reference to Exhibit 10.9 to Tyco International Ltd's Annual Report on Form 10-K for the year ended September 27, 2013 filed on November 14, 2013).

(1)

|

|

10.10

|

|

Form of terms and conditions for Option Awards, Restricted Unit Awards and Performance Share Awards under the 2012 Stock and Incentive Plan for fiscal 2013 (Incorporated by reference to Exhibit 10.11 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.11

|

|

Form of terms and conditions for Option Awards, Restricted Unit Awards and Performance Share Awards under the 2004 Stock and Incentive Plan for fiscal 2012 (Incorporated by reference to Exhibits 99.1, 99.2 and 99.3 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 14, 2011).

(1)

|

|

10.12

|

|

Form of terms and conditions for Restricted Stock Unit Awards for Directors under the 2012 Stock and Incentive Plan (Incorporated by reference to Exhibit 10.13 to Tyco International Ltd.'s Annual Report on Form 10-K for the year ended September 28, 2012 filed on November 16, 2012).

(1)

|

|

10.13

|

|

Credit Agreement, dated as of June 22, 2012, among Tyco International Finance S.A., Tyco International Ltd., the Lenders party thereto, and Citibank, N.A. as Administrative Agent (Incorporated by reference to Exhibit 10.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on June 27, 2012).

|

|

10.14

|

|

Tax Sharing Agreement by and among Tyco International Ltd., Covidien Ltd., and Tyco Electronics Ltd., dated June 29, 2007 (Incorporated by reference to Exhibit 10.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on July 6, 2007).

|

|

10.15

|

|

Tax Sharing Agreement, dated September 28, 2012 by and among Pentair Ltd., Tyco International Ltd., Tyco International Finance S.A. and The ADT Corporation (Incorporated by reference to Exhibit 10.1 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 1, 2012).

|

|

10.16

|

|

Non-Income Tax Sharing Agreement dated September 28, 2012 by and among Tyco International Ltd., Tyco International Finance S.A. and The ADT Corporation (Incorporated by reference to Exhibit 10.2 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 1, 2012).

|

|

10.17

|

|

Trademark Agreement, dated as of September 25, 2012, by and among ADT Services GmbH, ADT US Holdings, Inc., Tyco International Ltd. and The ADT Corporation (Incorporated by reference to Exhibit 10.3 to Tyco International Ltd.'s Current Report on Form 8-K filed on October 1, 2012).

|

|

21.1

|

|

Subsidiaries of Tyco International Ltd. (Filed herewith).

|

|

23.1

|

|

Consent of Deloitte & Touche LLP (Filed herewith).

|

|

24.1

|

|

Power of Attorney with respect to Tyco International Ltd. signatories (filed herewith).

|

|

31.1

|

|

Certification by the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Filed herewith).

|

|

31.2

|

|

Certification by the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Filed herewith).

|

|

32.1

|

|

Certification by the Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Filed herewith).

|

|

101

|

|

Financial statements from the Annual Report on Form 10-K of Tyco International Ltd. for the fiscal year ended September 26, 2014 formatted in XBRL: (i) the Consolidated Statements of Operations, (ii) the Consolidated Statements of Comprehensive Income, (iii) the Consolidated Balance Sheets, (iv) the Consolidated Statements of Cash Flows, (v) the Consolidated Statements of Shareholders' Equity, and (vi) the Notes to Consolidated Financial Statements.

|

|

(1)

|

Management contract or compensatory plan.

|

|

(2)

|

See Item 15(a)(3) above.

|

|

(3)

|

See Item 15(a)(2) above.

|

|

|

TYCO INTERNATIONAL LTD.

|

|

|

By:

|

/s/ ARUN NAYAR

|

|

|

|

Arun Nayar

Executive Vice President and

Chief Financial Officer

(Principal Financial Officer)

|

|

|

Name

|

|

Title

|

|

|

|

|

|

/s/ GEORGE R. OLIVER

|

Chief Executive Officer and Director (Principal

Executive Officer)

|

|

|

George R. Oliver

|

|

|

|

/s/ ARUN NAYAR

|

Executive Vice President and Chief Financial

Officer (Principal Financial Officer)

|

|

|

Arun Nayar

|

|

|

|

/s/ SAM ELDESSOUKY

|

Senior Vice President, Controller and Chief Accounting Officer (Principal Accounting Officer)

|

|

|

Sam Eldessouky

|

|

|

|

Name

|

|

Title

|

|

|

|

|

|

*

|

||

|

Edward D. Breen

|

|

Director

|

|

*

|

||

|

Herman E. Bulls

|

|

Director

|

|

*

|

||

|

Michael E. Daniels

|

|

Director

|

|

*

|

||

|

Frank M. Drendel

|

|

Director

|

|

*

|

||

|

Brian Duperreault

|

|

Director

|

|

*

|

||

|

Rajiv L. Gupta

|

|

Director

|

|

*

|

||

|

Dr. Brendan R. O'Neill

|

|

Director

|

|

*

|

||

|

Jürgen Tinggren

|

|

Director

|

|

*

|

||

|

Sandra S. Wijnberg

|

|

Director

|

|

*

|

||

|

R. David Yost

|

|

Director

|

|

/s/ JUDITH A. REINSDORF

|

||||

|

|

|

By:

|

|

Judith A. Reinsdorf

Attorney-in-fact

|

|

|

Page

|

|

/s/ GEORGE R. OLIVER

|

/s/ ARUN NAYAR

|

|

|

George R. Oliver

Chief Executive Officer and Director

|

|

Arun Nayar

Executive Vice President and

Chief Financial Officer

|

|

2014

|

2013

|

2012

|

|||||||||

|

Revenue from product sales

|

$

|

6,221

|

|

$

|

5,855

|

|

$

|

5,763

|

|

||

|

Service revenue

|

4,119

|

|

4,218

|

|

4,129

|

|

|||||

|

Net revenue

|

10,340

|

|

10,073

|

|

9,892

|

|

|||||

|

Cost of product sales

|

4,253

|

|

3,990

|

|

3,905

|

|

|||||

|

Cost of services

|

2,302

|

|

2,412

|

|

2,411

|

|

|||||

|

Selling, general and administrative expenses

|

3,040

|

|

2,843

|

|

2,823

|

|

|||||

|

Separation costs (see Note 2)

|

1

|

|

8

|

|

71

|

|

|||||

|

Restructuring and asset impairment charges, net (see Note 4)

|

47

|

|

111

|

|

104

|

|

|||||

|

Operating income

|

697

|

|

709

|

|

578

|

|

|||||

|

Interest income

|

14

|

|

16

|

|

18

|

|

|||||

|

Interest expense

|

(97

|

)

|

(100

|

)

|

(209

|

)

|

|||||

|

Other expense, net

|

(1

|

)

|

(29

|

)

|

(454

|

)

|

|||||

|

Income (loss) from continuing operations before income taxes

|

613

|

|

596

|

|

(67

|

)

|

|||||

|

Income tax expense

|

(24

|

)

|

(108

|

)

|

(320

|

)

|

|||||

|

Equity income (loss) in earnings of unconsolidated subsidiaries

|

206

|

|

(48

|

)

|

(26

|

)

|

|||||

|

Income (loss) from continuing operations

|

795

|

|

440

|

|

(413

|

)

|

|||||

|

Income from discontinued operations, net of income taxes

|

1,044

|