|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ X ]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

[____]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Wisconsin

|

39-1536083

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

| Title of Each Class | Name of Exchange on Which Registered |

| Class A Common Stock, $.05 par value per share | NASDAQ Global Market SM |

Securities registered pursuant to section 12(g) of the Act: None

|

TABLE OF CONTENTS

|

Page

|

|

Business

|

1

|

|

Risk Factors

|

7

|

|

Properties

|

12

|

|

Legal Proceedings

|

12

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

Selected Financial Data

|

14

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

|

Quantitative and Qualitative Disclosures about Market Risk

|

23

|

|

Financial Statements and Supplementary Data

|

23

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

23

|

|

Controls and Procedures

|

23

|

|

Other Information

|

24

|

|

Directors, and Executive Officers and Corporate Governance

|

24

|

|

Executive Compensation

|

24

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

24

|

|

Certain Relationships and Related Transactions, and Director Independence

|

25

|

|

Principal Accountant Fees and Services

|

25

|

|

Exhibits and Financial Statement Schedules

|

25

|

|

Signatures

|

26

|

|

Exhibit Index

|

28

|

|

Consolidated Financial Statements

|

F-1

|

|

Fiscal Year Ended

|

||||||||||||||||

| 2011 | 2010 | |||||||||||||||

|

Quarter Ended

|

Net

Sales

|

Operating

Profit

|

Net

Sales

|

Operating

Profit

|

||||||||||||

|

December

|

19 | % | -8 | % | 18 | % | -24 | % | ||||||||

|

March

|

32 | % | 65 | % | 30 | % | 55 | % | ||||||||

|

June

|

30 | % | 67 | % | 32 | % | 92 | % | ||||||||

|

September

|

19 | % | -24 | % | 20 | % | -23 | % | ||||||||

| 100 | % | 100 | % | 100 | % | 100 | % | |||||||||

| ● | the timing of our announcements or those of our competitors concerning significant product developments, acquisitions or financial performance; | |

| ● | fluctuation in our quarterly operating results; | |

| ● | substantial sales of our common stock; | |

| ● | general stock market conditions; or | |

| ● | other economic or external factors. |

| ● | the acquired business may experience losses which could adversely affect our profitability; | |

| ● | unanticipated costs relating to the integration of acquired businesses may increase our expenses and reduce our profitability; | |

| ● | possible failure to obtain any necessary consents to the transfer of licenses or other agreements of the acquired company; | |

| ● | possible failure to maintain customer, licensor and other relationships of the acquired company after the closing of the transaction with the acquired company; | |

| ● | difficulties in achieving planned cost savings and synergies may increase our expenses; | |

| ● | diversion of our management’s attention could impair their ability to effectively manage our other business operations; and | |

| ● | unanticipated management or operational problems or liabilities may adversely affect our profitability and financial condition. |

| ● | economic and political instability; | |

| ● | restrictive actions by foreign governments; | |

| ● | opportunity costs and reputational damage related to the presence of counterfeit versions of the Company’s products in such foreign markets; | |

| ● | greater difficulty enforcing intellectual property rights and weaker laws protecting intellectual property rights; | |

| ● | changes in import duties or import or export restrictions; | |

| ● | timely shipping of product and unloading of product, including the timely rail/truck delivery to our warehouses and/or a customer’s warehouse of our products; | |

| ● | complications in complying with the laws and policies of the United States affecting the importation of goods, including duties, quotas and taxes; and | |

| ● | complications in complying with trade and foreign tax laws. |

| ● | incur additional debt; | |

| ● | create liens on our assets or make guarantees; | |

| ● | make certain investments or loans; | |

| ● | pay dividends; or | |

| ● | dispose of or sell assets, make acquisitions above certain amounts or enter into a merger or similar transaction. |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES EQUITY SECURITIES |

| First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||||||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||||||||||||||

|

Stock prices:

|

||||||||||||||||||||||||||||||||

|

High

|

$ | 15.22 | $ | 10.75 | $ | 15.81 | $ | 11.52 | $ | 17.98 | $ | 14.67 | $ | 20.99 | $ | 13.21 | ||||||||||||||||

|

Low

|

12.16 | 8.65 | 13.00 | 10.25 | 14.57 | 11.00 | 14.60 | 8.96 | ||||||||||||||||||||||||

| ● | Pursuant to the Company’s revolving credit and security agreement, dated September 29, 2009, the Company is limited in the amount of restricted payments (primarily dividends and repurchases of common stock) made during each fiscal year. The Company may declare, and pay, dividends in accordance with historical practices, but in no event may the aggregate amount of all dividends for any fiscal year exceed 25% of the Company’s net income for that fiscal year. | |

| ● | The Company’s Articles of Incorporation provide that no dividend, other than a dividend payable in shares of the Company’s common stock, may be declared or paid upon the Class B common stock unless such dividend is declared or paid upon both classes of common stock. Whenever a dividend (other than a dividend payable in shares of Company common stock) is declared or paid upon any shares of Class B common stock, at the same time there must be declared and paid a dividend on shares of Class A common stock equal in value to 110% of the amount per share of the dividend declared and paid on shares of Class B common stock. Whenever a dividend is payable in shares of Company common stock, such dividend must be declared or paid at the same rate on the Class A common stock and the Class B common stock. |

|

||

|

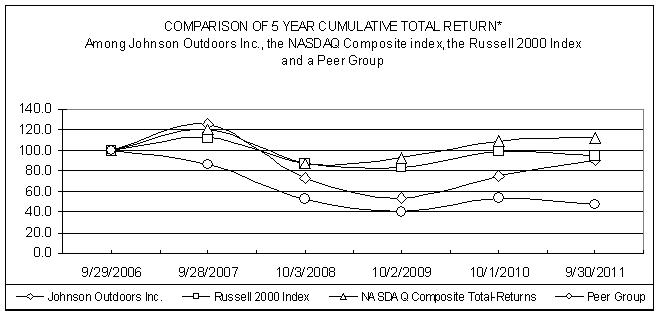

* $100 invested on September 29, 2006 in stock or index, including reinvestment of dividends.

Indexes calculated on a mid-month basis

|

|

9/29/2006

|

9/28/2007

|

10/3/2008

|

10/2/2009

|

10/1/2010

|

9/30/2011

|

|||||||||||||||||||

|

Johnson Outdoors Inc.

|

$ | 100.0 | $ | 125.6 | $ | 73.0 | $ | 53.9 | $ | 75.5 | $ | 91.1 | ||||||||||||

|

NASDAQ Composite

|

100.0 | 120.5 | 87.7 | 93.1 | 108.8 | 112.0 | ||||||||||||||||||

|

Russell 2000 Index

|

100.0 | 112.4 | 87.8 | 83.4 | 98.8 | 95.1 | ||||||||||||||||||

|

Peer Group

|

100.0 | 86.5 | 52.8 | 39.9 | 53.1 | 47.3 | ||||||||||||||||||

|

(millions, except per share data)

|

2011

|

2010

|

||||||

|

Net sales

|

$ | 407.4 | $ | 382.4 | ||||

|

Gross profit

|

163.1 | 153.5 | ||||||

|

Operating expenses

|

145.4 | 138.9 | ||||||

|

Operating profit

|

17.7 | 14.6 | ||||||

|

Interest expense

|

3.2 | 5.1 | ||||||

|

Tax (benefit) expense

|

(20.4 | ) | 2.7 | |||||

|

Net income

|

32.6 | 6.5 | ||||||

|

(millions)

|

2011

|

2010

|

||||||

|

Net sales:

|

||||||||

|

Marine Electronics

|

$ | 222.1 | $ | 185.4 | ||||

|

Outdoor Equipment

|

38.9 | 48.7 | ||||||

|

Watercraft

|

57.7 | 64.0 | ||||||

|

Diving

|

89.5 | 85.1 | ||||||

|

Other/corporate/eliminations

|

(0.8 | ) | (0.8 | ) | ||||

| $ | 407.4 | $ | 382.4 | |||||

|

Operating profit (loss):

|

||||||||

|

Marine Electronics

|

$ | 21.1 | $ | 13.9 | ||||

|

Outdoor Equipment

|

3.0 | 5.9 | ||||||

|

Watercraft

|

(1.3 | ) | 1.8 | |||||

|

Diving

|

3.6 | 3.0 | ||||||

|

Other/corporate/eliminations

|

(8.7 | ) | (10.0 | ) | ||||

| $ | 17.7 | $ | 14.6 | |||||

|

(millions)

|

2011

|

2010

|

||||||

|

Cash provided by (used for):

|

||||||||

|

Operating activities

|

$ | 31.0 | $ | 19.8 | ||||

|

Investing activities

|

(13.3 | ) | (9.3 | ) | ||||

|

Financing activities

|

(8.6 | ) | (7.6 | ) | ||||

|

Effect of exchange rate changes on cash and cash equivalents

|

2.1 | 2.5 | ||||||

|

Increase in cash and cash equivalents

|

$ | 11.2 | $ | 5.4 | ||||

|

(millions)

|

2011

|

2010

|

||||||

|

Current assets

|

$ | 176.4 | $ | 160.1 | ||||

|

Current liabilities

|

65.0 | 67.0 | ||||||

|

Working capital

|

$ | 111.4 | $ | 93.1 | ||||

|

Current ratio

|

2.7:1

|

2.4:1

|

||||||

|

(millions)

|

2011

|

2010

|

||||||

|

Current debt

|

$ | 3.5 | $ | 8.9 | ||||

|

Long-term debt

|

11.5 | 14.9 | ||||||

|

Total debt

|

15.0 | 23.8 | ||||||

|

Shareholders’ equity

|

163.5 | 126.4 | ||||||

|

Total capitalization

|

$ | 178.5 | $ | 150.2 | ||||

|

Total debt to total capitalization

|

8.4 | % | 15.8 | % | ||||

| ● | Persuasive evidence of an arrangement exists. Contracts, internet commerce agreements, and customer purchase orders are generally used to determine the existence of an arrangement. | |

| ● | All substantial risk of ownership transfers to the customer. Shipping documents and customer acceptance, when applicable, are used to verify delivery. | |

| ● | The fee is fixed or determinable. This is assessed based on the payment terms associated with the transaction and whether the sales price is subject to refund or adjustment. | |

| ● | Collectability is reasonably assured. We assess collectability based on the creditworthiness of the customer as determined by credit checks and analysis, as well as by the customer’s payment history. |

|

Plan Category

|

Number of

Common Shares

to Be Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights

|

Weighted-average

Exercise Price of

Outstanding

Options, Warrants

a

nd Rights

|

Number of

Common Shares

Available for Future

Issuance Under

Equity

Compensation

Plans

|

|||||||||

|

Equity compensation plans approved by shareholders

|

68,590 | $ | 10.37 | 974,138 | (1) | |||||||

|

(1)

|

All of the available shares under the 2003 Non-Employee Director Stock Ownership Plan (62,116) and under the 2010 Long-Term Stock Incentive Plan (847,945) may be issued upon the exercise of stock options or granted as non-vested stock, and, in the case of the 2010 Long-Term Stock Incentive Plan, as share units. No shares are available for future issuance under the 2000 Long-Term Stock Incentive Plan. Also, includes 64,077 shares available for issuance under the 2009 Employee Stock Purchase Plan.

|

|

(2)

|

Non-vested restricted shares outstanding totaled 472,761 at September 30, 2011.

|

| ● | Report of Independent Registered Public Accounting Firm | |

| ● | Consolidated Balance Sheets – September 30, 2011 and October 1, 2010 | |

| ● | Consolidated Statements of Operations – Years ended September 30, 2011 and October 1, 2010 | |

| ● | Consolidated Statements of Shareholders’ Equity – Years ended September 30, 2011 and October 1, 2010 | |

| ● | Consolidated Statements of Cash Flows – Years ended September 30, 2011 and October 1, 2010 | |

| ● | Notes to Consolidated Financial Statements |

| /s/ Helen P. Johnson-Leipold |

Chairman and Chief Executive Officer

|

|

|

(Helen P. Johnson-Leipold)

|

and Director

|

|

|

(Principal Executive Officer)

|

||

| /s/ Thomas F. Pye, Jr. |

Vice Chairman of the Board

|

|

|

(Thomas F. Pyle, Jr.)

|

and Lead Outside Director

|

|

| /s/ Terry E. London |

Director

|

|

|

(Terry E. London)

|

||

| /s/ John M. Fahey, Jr. |

Director

|

|

|

(John M. Fahey, Jr.)

|

||

| /s/ W. Lee McCollum |

Director

|

|

|

(W. Lee McCollum)

|

||

| /s/ Edward F. Lang, III |

Director

|

|

|

(Edward F. Lang, III)

|

||

| /s/ David W. Johnson |

Vice President and Chief Financial Officer

|

|

|

(David W. Johnson)

|

(Principal Financial and Accounting Officer)

|

|

Exhibit

|

Title

|

|

2

|

Agreement and Plan of Merger, dated October 28, 2004, by and between JO Acquisition Corp. and Johnson Outdoors Inc (Filed as Exhibit 2 to the Company’s Form 8-K dated October 28, 2004 and incorporated herein by reference.)

|

|

3.1

|

Articles of Incorporation of the Company as amended through February 17, 2000. (Filed as Exhibit 3.1(a) to the Company’s Form 10-Q for the quarter ended March 31, 2000 and incorporated herein by reference.)

|

|

3.2

|

Bylaws of the Company as amended and restated through December 6, 2010. (Filed as Exhibit 3.2 to the Company’s Form 10-K for the year ended October 1, 2010 and incorporated herein by reference.)

|

|

4.1

|

Note Agreement dated October 1, 1995. (Filed as Exhibit 4.1 to the Company’s Form 10-Q for the quarter ended December 29, 1995 and incorporated herein by reference.)

|

|

4.2

|

First Amendment dated October 11, 1996 to Note Agreement dated October 1, 1995. (Filed as Exhibit 4.3 to the Company’s Form 10-Q for the quarter ended December 27, 1996 and incorporated herein by reference.)

|

|

4.3

|

Second Amendment dated September 30, 1997 to Note Agreement dated October 1, 1995. (Filed as Exhibit 4.8 to the Company’s Form 10-K for the year ended October 1, 1997 and incorporated herein by reference.)

|

|

4.4

|

Third Amendment dated October 1, 1997 to Note Agreement dated October 1, 1995. (Filed as Exhibit 4.9 to the Company’s Form 10-K for the year ended October 1, 1997 and incorporated herein by reference.)

|

|

4.5

|

Fourth Amendment dated January 10, 2000 to Note Agreement dated October 1, 1995. (Filed as Exhibit 4.9 to the Company’s Form 10-Q for the quarter ended March 31, 2000 and incorporated herein by reference.)

|

|

4.7

|

Consent and Amendment dated September 6, 2002 to Note Agreement dated October 1, 1995. (Filed as Exhibit 4.7 to the Company’s Form 10-K for the year ended October 3, 2003 and incorporated herein by reference.)

|

|

4.8

|

Note Agreement dated as of September 15, 1997. (Filed as Exhibit 4.15 to the Company’s Form 10-K for the year ended October 1, 1997 and incorporated herein by reference.)

|

|

4.9

|

First Amendment dated January 10, 2000 to Note Agreement dated September 15, 1997. (Filed as Exhibit 4.10 to the Company’s Form 10-Q for the quarter ended March 31, 2000 and incorporated herein by reference.)

|

|

4.10

|

Second Amendment dated December 13, 2001 to Note Agreement dated September 15, 1997. (Filed as Exhibit 4.9 to the Company’s Form 10-K for the year ended October 3, 2003 and incorporated herein by reference.)

|

|

4.11

|

Consent and Amendment dated as of September 6, 2002 to Note Agreement dated September 15, 1997. (Filed as Exhibit 4.11 to the Company’s Form 10-K for the year ended October 3, 2003 and incorporated herein by reference.)

|

|

4.12

|

Note Agreement dated as of December 13, 2001. (Filed as Exhibit 4.12 to the Company’s Form 10-K for the year ended October 3, 2003 and incorporated herein by reference.)

|

|

4.13

|

Consent and Amendment dated as of September 6, 2002 to Note Agreement dated as of December 13, 2001. (Filed as Exhibit 4.15 to the Company’s Form 10-K for the year ended October 3, 2003 and incorporated herein by reference.)

|

|

9.1

|

Johnson Outdoors Inc. Class B common stock Amended and Restated Voting Trust Agreement, dated as of February 16, 2010 (Filed as Exhibit 1 to Amendment No. 13 to the Schedule 13D filed by Helen P. Johnson-Leipold on February 3, 2011 and incorporated herein by reference.)

|

|

10.1

|

Stock Purchase Agreement, dated as of January 12, 2000, by and between Johnson Outdoors Inc. and Berkley Inc. (Filed as Exhibit 2.1 to the Company’s Form 8-K dated March 31, 2000 and incorporated herein by reference.)

|

|

10.2

|

Amendment to Stock Purchase Agreement, dated as of February 28, 2000, by and between Johnson Outdoors Inc. and Berkley Inc. (Filed as Exhibit 2.2 to the Company’s Form 8-K dated March 31, 2000 and incorporated herein by reference.)

|

|

10.3

+

|

Johnson Outdoors Inc. Amended and Restated 1986 Stock Option Plan. (Filed as Exhibit 10 to the Company’s Form 10-Q for the quarter ended July 2, 1993 and incorporated herein by reference.)

|

|

10.4

|

Registration Rights Agreement regarding Johnson Outdoors Inc. common stock issued to the Johnson family prior to the acquisition of Johnson Diversified, Inc. (Filed as Exhibit 10.6 to the Company’s Form S-1 Registration Statement No. 33-16998 and incorporated herein by reference.)

|

|

10.5

|

Registration Rights Agreement regarding Johnson Outdoors Inc. Class A common stock held by Mr. Samuel C. Johnson. (Filed as Exhibit 28 to the Company’s Form 10-Q for the quarter ended March 29, 1991 and incorporated herein by reference.)

|

|

10.6

+

|

Form of Restricted Stock Agreement. (Filed as Exhibit 10.8 to the Company’s Form S-1 Registration Statement No. 33-23299 and incorporated herein by reference.)

|

|

10.7

+

|

Form of Supplemental Retirement Agreement of Johnson Diversified, Inc. (Filed as Exhibit 10.9 to the Company’s Form S-1 Registration Statement No. 33-16998 and incorporated herein by reference.)

|

|

10.8

+

|

Johnson Outdoors Retirement and Savings Plan. (Filed as Exhibit 10.9 to the Company’s Form 10-K for the year ended September 29, 1989 and incorporated herein by reference.)

|

|

10.9

+

|

Form of Agreement of Indemnity and Exoneration with Directors and Officers. (Filed as Exhibit 10.11 to the Company’s Form S-1 Registration Statement No. 33-16998 and incorporated herein by reference.)

|

|

10.10

|

Consulting and administrative agreements with S. C. Johnson & Son, Inc. (Filed as Exhibit 10.12 to the Company’s Form S-1 Registration Statement No. 33-16998 and incorporated herein by reference.)

|

|

10.11

+

|

Johnson Outdoors Inc. 1994 Long-Term Stock Incentive Plan. (Filed as Exhibit 4 to the Company’s Form S-8 Registration Statement No. 333-88091 and incorporated herein by reference.)

|

|

10.12

+

|

Johnson Outdoors Inc. 1994 Non-Employee Director Stock Ownership Plan. (Filed as Exhibit 4 to the Company’s Form S-8 Registration Statement No. 333-88089 and incorporated herein by reference.)

|

|

10.13

+

|

Johnson Outdoors Economic Value Added Bonus Plan (Filed as Exhibit 10.15 to the Company’s Form 10-K for the year ended October 1, 1997 and incorporated herein by reference.)

|

|

10.14

+

|

Johnson Outdoors Inc. 2000 Long-Term Stock Incentive Plan. (Filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated July 29, 2005 and incorporated herein by reference.)

|

|

10.15

+

|

Share Purchase and Transfer Agreement, dated as of August 28, 2002, by and between, among others, Johnson Outdoors Inc. and an affiliate of Bain Capital Fund VII-E (UK), Limited Partnership. (Filed as Exhibit 2.1 to the Company’s Form 8-K dated September 9, 2002 and incorporated herein by reference.)

|

|

10.16

+

|

Johnson Outdoors Inc. Worldwide Key Executive Phantom Share Long-Term Incentive Plan (Filed as Exhibit 10.1 to the Company’s Form 10-Q dated March 28, 2003 and incorporated herein by reference.)

|

|

10.17

+

|

Johnson Outdoors Inc. Worldwide Key Executives’ Discretionary Bonus Plan. (Filed as Exhibit 99.3 to the Company’s Current Report on Form 8-K dated July 29, 2005 and incorporated herein by reference.)

|

|

10.18

|

Stock Purchase Agreement by and between Johnson Outdoors Inc. and TFX Equities Incorporated. (Filed as Exhibit 2.1 to the Company’s Form 10-Q dated April 2, 2004 and incorporated herein by reference.)

|

|

10.19

|

Intellectual Property Purchase Agreement by and among Johnson Outdoors Inc., Technology Holding Company II and Teleflex Incorporated. (Filed as Exhibit 2.2 to the Company’s Form 10-Q dated April 2, 2004 and incorporated herein by reference.)

|

|

10.20

+

|

Johnson Outdoors Inc. 1987 Employees’ Stock Purchase Plan as amended. (Filed as Exhibit 99.2 to the Company’s Current Report on Form 8-K dated July 29, 2005 and incorporated herein by reference.)

|

|

10.21

+

|

Johnson Outdoors Inc. 2003 Non-Employee Director Stock Ownership Plan. (Filed as Exhibit 10.2 to the Company’s Form 10-Q dated April 2, 2004 and incorporated herein by reference.)

|

|

10.22

+

|

Form of Restricted Stock Agreement under Johnson Outdoors Inc. 2003 Non-Employee Director Stock Ownership Plan. (Filed as Exhibit 4.2 to the Company’s Form S-8 Registration Statement No. 333-115298 and incorporated herein by reference.)

|

|

10.23

+

|

Form of Stock Option Agreement under Johnson Outdoors Inc. 2003 Non-Employee Director Stock Ownership Plan. (Filed as Exhibit 10.2 to the Company’s Form S-8 Registration Statement No. 333-115298 and incorporated herein by reference.)

|

|

10.24

|

Revolving Credit and Security Agreement dated as of September 29, 2009 among Johnson Outdoors Inc., certain subsidiaries of Johnson Outdoors Inc., PNC Bank, National Association, as lender, as administrative agent and collateral agent, and the other lenders named therein (filed as Exhibit 99.2 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.25

|

Term Loan Agreement (loan number 15613) dated as of September 29, 2009 among Techsonic Industries Inc., Johnson Outdoors Marine Electronics LLC and Ridgestone Bank (filed as Exhibit 99.3 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.26

|

Term Loan Agreement (loan number 15612) dated as of September 29, 2009 between Johnson Outdoors Gear LLC and Ridgestone Bank (filed as Exhibit 99.4 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.27

|

Term Loan Agreement (loan number 15628) dated as of September 29, 2009 between Johnson Outdoors Watercraft Inc. and Ridgestone Bank (filed as Exhibit 99.5 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.28

|

Term Loan Agreement (loan number 15614) dated as of September 29, 2009 between Johnson Outdoors Watercraft Inc. and Ridgestone Bank (filed as Exhibit 99.6 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.29

|

Term Loan Agreement (loan number 15627) dated as of September 29, 2009 between Johnson Outdoors Watercraft Inc. and Ridgestone Bank (filed as Exhibit 99.7 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on September 30, 2009).

|

|

10.30

|

Revolving Credit and Security Agreement dated as of November 4, 2009 among Johnson Outdoors Canada Inc., National City Bank, Canada branch, as administrative agent and collateral agent and the other lenders named therein(filed as Exhibit 10.30 to the annual report on Form 10-K dated and filed with the Securities and Exchange Commission on December 11, 2010).

|

|

10.31

|

First Amendment to Revolving Credit and Security Agreement, made as of November 16, 2010, among Johnson Outdoors Inc., certain subsidiaries of Johnson Outdoors, Inc., PNC Bank National Association as lender, as administrative agent and collateral agent, and the other lenders named therein (filed as Exhibit 99.1 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on November 22, 2010).

|

|

10.32

|

First Amendment to Canadian Revolving Credit and Security Agreement, made as of November 16, 2010, among Johnson Outdoors Canada Inc., PNC Bank Canada Branch as lender, as administrative agent and collateral agent, and the other lenders named therein (filed as Exhibit 99.2 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on November 22, 2010).

|

|

10.33+

|

Johnson Outdoors Inc. 2009 Employees’ Stock Purchase Plan (filed as Exhibit 99.2 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on March 8, 2010.

|

|

10.34+

|

Johnson Outdoors Inc. 2010 Long Term Stock Incentive Plan (filed as Exhibit 99.2 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on March 8, 2010.

|

|

16

|

Letter Regarding Change in Auditors (filed as Exhibit 16.1 to the current report on Form 8-K dated and filed with the Securities and Exchange Commission on March 8, 2010).

|

|

21

|

Subsidiaries of the Company as of September 30, 2011.

|

|

23

|

Consent of Independent Registered Public Accounting Firm.

|

|

31.1

|

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a).

|

|

31.2

|

Certification of Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a).

|

|

32.1

|

Certifications of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350.

(1)

|

| 101 |

The following materials from Johnson Outdoors Inc.’s Annual Report on Form 10-K for the fiscal year ended September 30, 2011 formatted in XBRL (eXtensible Business Reporting Language) and furnished electronically herewith: (i) Consolidated Balance Sheets; (ii) Consolidated Statements of Operations; (iii) Consolidated Statements of Shareholders' Equity; (iv) Consolidated Statements of Cash Flows; and (v) Notes to Consolidated Financial Statements*

|

|

(1)

|

This certification is not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

|

|

CONSOLIDATED FINANCIAL STATEMENTS

|

||

|

Table of Contents

|

Page

|

|

|

Management’s Report on Internal Control over Financial Reporting

|

F-2

|

|

|

Report of Independent Registered Public Accounting Firm

|

F-3

|

|

|

Consolidated Balance Sheets

|

F-4

|

|

|

Consolidated Statements of Operations

|

F-5

|

|

|

Consolidated Statements of Shareholders’ Equity

|

F-6

|

|

|

Consolidated Statements of Cash Flows

|

F-7

|

|

|

Notes to Consolidated Financial Statements

|

F-8

|

|

|

(a)

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

|

|

(b)

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

|

|

(c)

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

|

| /s/ Helen P. Johnson-Leipold | /s/ David W. Johnson |

|

Helen P. Johnson-Leipold

|

David W. Johnson

|

|

Chairman and Chief Executive Officer

|

Vice President and Chief Financial Officer

|

|

September 30

|

October 1

|

|||||||

|

(thousands, except share data)

|

2011

|

2010

|

||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 44,514 | $ | 33,316 | ||||

|

Accounts receivable, less allowance for doubtful accounts of $3,076 and $2,988, respectively

|

47,209 | 46,928 | ||||||

|

Inventories

|

68,462 | 72,095 | ||||||

|

Deferred income taxes

|

9,732 | 1,844 | ||||||

|

Other current assets

|

6,528 | 5,945 | ||||||

|

Total current assets

|

176,445 | 160,128 | ||||||

|

Property, plant and equipment, net

|

35,158 | 33,767 | ||||||

|

Deferred income taxes

|

19,531 | 3,320 | ||||||

|

Goodwill

|

14,651 | 13,729 | ||||||

|

Other intangible assets, net

|

5,403 | 5,720 | ||||||

|

Other assets

|

8,168 | 10,092 | ||||||

|

Total assets

|

$ | 259,356 | $ | 226,756 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Short-term notes payable and revolving credit lines

|

$ | - | $ | 7,544 | ||||

|

Current maturities of long-term debt

|

3,494 | 1,327 | ||||||

|

Accounts payable

|

28,339 | 24,103 | ||||||

|

Accrued liabilities:

|

||||||||

|

Salaries, wages and benefits

|

14,286 | 14,481 | ||||||

|

Accrued warranty

|

5,155 | 4,589 | ||||||

|

Income taxes payable

|

1,635 | 1,062 | ||||||

|

Other accrued liabilities

|

12,091 | 13,909 | ||||||

|

Total current liabilities

|

65,000 | 67,015 | ||||||

|

Long-term debt, less current maturities

|

11,478 | 14,939 | ||||||

|

Deferred income taxes

|

348 | 601 | ||||||

|

Retirement benefits

|

10,074 | 8,522 | ||||||

|

Other liabilities

|

8,931 | 9,310 | ||||||

|

Total liabilities

|

95,831 | 100,387 | ||||||

|

Shareholders' equity:

|

||||||||

|

Preferred stock: none issued

|

- | - | ||||||

|

Common stock:

|

||||||||

|

Class A shares issued and outstanding:

|

428 | 418 | ||||||

|

September 30, 2011: 8,567,549

|

||||||||

|

October 1, 2010: 8,363,313

|

||||||||

|

Class B shares issued and outstanding:

|

61 | 61 | ||||||

|

September 30, 2011: 1,215,842

|

||||||||

|

October 1, 2010: 1,216,464

|

||||||||

|

Capital in excess of par value

|

61,521 | 59,779 | ||||||

|

Retained earnings

|

82,683 | 50,039 | ||||||

|

Accumulated other comprehensive income

|

18,832 | 16,073 | ||||||

|

Treasury stock at cost, 0 and 172 shares of Class A

common stock, respectively

|

- | (1 | ) | |||||

|

Total shareholders' equity

|

163,525 | 126,369 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 259,356 | $ | 226,756 | ||||

|

Year Ended

|

||||||||

|

(thousands, except per share data)

|

September 30

2011

|

October 1

2010

|

||||||

|

Net sales

|

$ | 407,422 | $ | 382,432 | ||||

|

Cost of sales

|

244,287 | 228,909 | ||||||

|

Gross profit

|

163,135 | 153,523 | ||||||

|

Operating expenses:

|

||||||||

|

Marketing and selling

|

90,336 | 86,677 | ||||||

|

Administrative management, finance and information

systems

|

40,310 | 38,842 | ||||||

|

Research and development

|

14,819 | 13,450 | ||||||

|

Total operating expenses

|

145,465 | 138,969 | ||||||

|

Operating profit

|

17,670 | 14,554 | ||||||

|

Interest income

|

(90 | ) | (62 | ) | ||||

|

Interest expense

|

3,220 | 5,057 | ||||||

|

Other expense, net

|

2,290 | 367 | ||||||

|

Income before income taxes

|

12,250 | 9,192 | ||||||

|

Income tax (benefit) expense

|

(20,394 | ) | 2,653 | |||||

|

Net income

|

$ | 32,644 | $ | 6,539 | ||||

|

Weighted average common shares – Basic:

|

||||||||

|

Class A

|

8,045 | 8,008 | ||||||

|

Class B

|

1,216 | 1,217 | ||||||

|

Dilutive stock options

|

26 | 42 | ||||||

|

Weighted average common shares – Dilutive

|

9,287 | 9,267 | ||||||

|

Net income per common share – Basic:

|

||||||||

|

Class A

|

$ | 3.40 | $ | 0.69 | ||||

|

Class B

|

$ | 3.07 | $ | 0.63 | ||||

|

Net income per common Class A and B share – Dilutive

|

$ | 3.36 | $ | 0.68 | ||||

|

(thousands)

|

Shares

|

Common

Stock

|

Capital in

Excess of

Par Value

|

Retained

Earnings

|

Treasury

Stock

|

Accumulated

Other

Comprehensive Income (Loss)

|

Comprehensive Income (Loss)

|

|||||||||||||||||||||

|

BALANCE AT OCTOBER 2, 2009

|

9,283,429 | $ | 465 | $ | 58,343 | $ | 43,500 | $ | (43 | ) | $ | 13,560 | - | |||||||||||||||

|

Net income

|

- | - | 6,539 | - | - | $ | 6,539 | |||||||||||||||||||||

|

Exercise of stock options

|

55,250 | 2 | 373 | - | - | - | - | |||||||||||||||||||||

|

Issuance of stock under employee stock

purchase plan

|

10,448 | - | 109 | - | - | - | - | |||||||||||||||||||||

|

Award of non-vested shares

|

230,650 | 12 | - | - | - | - | - | |||||||||||||||||||||

|

Stock-based compensation

|

- | - | 944 | - | - | - | - | |||||||||||||||||||||

|

Currency translation adjustment

|

- | - | - | - | - | 965 | 965 | |||||||||||||||||||||

|

Change in pension plans

|

- | - | - | - | - | (497 | ) | (497 | ) | |||||||||||||||||||

|

Reissue of treasury stock

|

- | - | 10 | - | 42 | - | - | |||||||||||||||||||||

|

Amoritzation of unrealized loss

on interest rate swaps

|

- | - | - | - | - | 2,045 | 2,045 | |||||||||||||||||||||

|

Comprehensive income

|

- | - | - | - | - | - | $ | 9,052 | ||||||||||||||||||||

|

BALANCE AT OCTOBER 1, 2010

|

9,579,777 | 479 | 59,779 | 50,039 | (1 | ) | 16,073 | - | ||||||||||||||||||||

|

Net income

|

- | - | - | 32,644 | - | - | $ | 32,644 | ||||||||||||||||||||

|

Exercise of stock options

|

40,780 | 2 | 218 | - | - | - | ||||||||||||||||||||||

|

Issuance of stock under employee stock

purchase plan

|

5,475 | - | 88 | - | - | - | ||||||||||||||||||||||

|

Award of non-vested shares

|

157,359 | 8 | - | - | - | - | ||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 1,436 | - | - | - | ||||||||||||||||||||||

|

Currency translation adjustment

|

- | - | - | - | - | 2,506 | 2,506 | |||||||||||||||||||||

|

Change in pension plans, net of tax

|

- | - | - | - | - | (737 | ) | (737 | ) | |||||||||||||||||||

|

Reissue of treasury stock

|

- | - | - | - | 1 | - | ||||||||||||||||||||||

|

Amoritzation of unrealized loss on interest

rate swaps

|

- | - | - | - | - | 990 | 990 | |||||||||||||||||||||

|

Comprehensive income

|

- | - | - | - | - | - | $ | 35,403 | ||||||||||||||||||||

|

BALANCE AT SEPTEMBER 30, 2011

|

9,783,391 | $ | 489 | $ | 61,521 | $ | 82,683 | $ | - | $ | 18,832 | |||||||||||||||||

|

Year Ended

|

||||||||

|

(thousands)

|

September 30

2011

|

October 1

2010

|

||||||

|

CASH PROVIDED BY OPERATING ACTIVITIES

|

||||||||

|

Net income

|

$ | 32,644 | $ | 6,539 | ||||

|

Adjustments to reconcile net income to net cash provided

by operating activities:

|

||||||||

|

Depreciation

|

9,843 | 8,875 | ||||||

|

Amortization of intangible assets

|

729 | 681 | ||||||

|

Amortization of deferred financing costs

|

305 | 421 | ||||||

|

Impairment losses

|

334 | 114 | ||||||

|

Stock-based compensation

|

1,436 | 956 | ||||||

|

Amortization of deferred loss on interest rate swap

|

990 | 2,045 | ||||||

|

Provision for doubtful accounts receivable

|

448 | 995 | ||||||

|

Provision for inventory reserves

|

3,317 | 1,404 | ||||||

|

Deferred income taxes

|

(21,999 | ) | 415 | |||||

|

Change in operating assets and liabilities, net of effect of businesses acquired:

|

||||||||

|

Accounts receivable

|

(581 | ) | (4,857 | ) | ||||

|

Inventories

|

588 | (12,563 | ) | |||||

|

Accounts payable and accrued liabilities

|

3,095 | 13,114 | ||||||

|

Other current assets

|

708 | 1,986 | ||||||

|

Other non-current assets

|

242 | (913 | ) | |||||

|

Other long-term liabilities

|

(1,276 | ) | 358 | |||||

|

Other, net

|

157 | 181 | ||||||

| 30,980 | 19,751 | |||||||

|

CASH USED FOR INVESTING ACTIVITIES

|

||||||||

|

Payments for purchase of business

|

(3,969 | ) | - | |||||

|

Additions to property, plant and equipment

|

(9,367 | ) | (9,966 | ) | ||||

|

Proceeds from sale of property, plant and equipment

|

13 | 695 | ||||||

| (13,323 | ) | (9,271 | ) | |||||

|

CASH USED FOR FINANCING ACTIVITIES

|

||||||||

|

Net repayments on short-term debt and revolving credit lines

|

(7,546 | ) | (7,289 | ) | ||||

|

Principal payments on senior notes and other long-term debt

|

(1,292 | ) | (594 | ) | ||||

|

Deferred financing costs paid to lenders

|

(133 | ) | (173 | ) | ||||

|

Common stock transactions

|

323 | 484 | ||||||

| (8,648 | ) | (7,572 | ) | |||||

|

Effect of foreign currency fluctuations on cash

|

2,189 | 2,513 | ||||||

|

Increase in cash and cash equivalents

|

11,198 | 5,421 | ||||||

|

CASH AND CASH EQUIVALENTS

|

||||||||

|

Beginning of year

|

33,316 | 27,895 | ||||||

|

End of year

|

$ | 44,514 | $ | 33,316 | ||||

|

2011

|

2010

|

|||||||

|

Raw materials

|

$ | 24,260 | $ | 27,777 | ||||

|

Work in process

|

1,780 | 2,341 | ||||||

|

Finished goods

|

42,422 | 41,977 | ||||||

| $ | 68,462 | $ | 72,095 | |||||

|

Property improvements

|

5-20 years

|

|

Buildings and improvements

|

20-40 years

|

|

Furniture, fixtures and equipment

|

3-10 years

|

|

2011

|

2010

|

|||||||

|

Property and improvements

|

$ | 620 | $ | 651 | ||||

|

Buildings and improvements

|

22,040 | 21,604 | ||||||

|

Furniture, fixtures and equipment

|

109,727 | 99,697 | ||||||

| 132,387 | 121,952 | |||||||

|

Less accumulated depreciation

|

97,229 | 88,185 | ||||||

| $ | 35,158 | $ | 33,767 | |||||

|

Marine

Electronics

|

Diving

|

Consolidated

|

||||||||||

|

Balance at October 2, 2009

|

$ | 10,705 | $ | 3,954 | $ | 14,659 | ||||||

|

Tax adjustments related to purchase price allocation

|

(994 | ) | - | (994 | ) | |||||||

|

Currency translations

|

(37 | ) | 101 | 64 | ||||||||

|

Balance at October 1, 2010

|

9,674 | 4,055 | 13,729 | |||||||||

|

LakeMaster® acquisition

|

732 | - | 732 | |||||||||

|

Currency translations

|

(9 | ) | 199 | 190 | ||||||||

|

Balance at September 30, 2011

|

$ | 10,397 | $ | 4,254 | $ | 14,651 | ||||||

|

2011

|

2010

|

|||||||||||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||||||||||

|

Gross

|

Amortization

|

Net

|

Gross

|

Amortization

|

Net

|

|||||||||||||||||||

| Amortized other intangible assets: | ||||||||||||||||||||||||

|

Patents

|

$ | 3,687 | $ | (3,430 | ) | $ | 257 | $ | 3,644 | $ | (3,328 | ) | $ | 316 | ||||||||||

|

Trademarks

|

1,976 | (1,094 | ) | 882 | 2,000 | (610 | ) | 1,390 | ||||||||||||||||

|

Other

|

1,335 | (611 | ) | 724 | 1,228 | (464 | ) | 764 | ||||||||||||||||

| Non-amortized trademarks | 3,540 | - | 3,540 | 3,250 | - | 3,250 | ||||||||||||||||||

| $ | 10,538 | $ | (5,135 | ) | $ | 5,403 | $ | 10,122 | $ | (4,402 | ) | $ | 5,720 | |||||||||||

|

Balance at October 2, 2009

|

$ | 4,196 | ||

|

Expense accruals for warranties issued during the year

|

3,671 | |||

|

Less current year warranty claims paid

|

3,278 | |||

|

Balance at October 1, 2010

|

4,589 | |||

|

Expense accruals for warranties issued during the year

|

4,551 | |||

|

Less current year warranty claims paid

|

3,985 | |||

|

Balance at September 30, 2011

|

$ | 5,155 |

|

2011

|

2010

|

|||||||

|

Foreign currency translation adjustment

|

$ | 25,811 | $ | 23,305 | ||||

|

Unamortized loss on pension plans, net of

|

||||||||

|

tax of $1,584 and $0, respectively

|

(6,052 | ) | (5,315 | ) | ||||

|

Unrealized loss on interest rate swaps, net of

|

||||||||

|

tax of $0 and $0, respectively

|

(927 | ) | (1,917 | ) | ||||

|

Accumulated other comprehensive income

|

$ | 18,832 | $ | 16,073 | ||||

|

2011

|

2010

|

|||||||

|

Net income

|

$ | 32,644 | $ | 6,539 | ||||

|

Less: Undistributed earnings reallocated to non-vested shareholders

|

(1,429 | ) | (201 | ) | ||||

|

Dilutive earnings

|

$ | 31,215 | $ | 6,338 | ||||

|

Weighted average common shares – Basic:

|

||||||||

|

Class A

|

8,045 | 8,008 | ||||||

|

Class B

|

1,216 | 1,217 | ||||||

|

Dilutive stock options

|

26 | 42 | ||||||

|

Weighted average common shares - Dilutive

|

9,287 | 9,267 | ||||||

|

Net income per common share – Basic:

|

||||||||

|

Class A

|

$ | 3.40 | $ | 0.69 | ||||

|

Class B

|

3.07 | 0.63 | ||||||

|

Net income per common Class A and B share – Dilutive

|

3.36 | 0.68 | ||||||

| ● | Persuasive evidence of an arrangement exists. Contracts, internet commerce agreements, and customer purchase orders are generally used to determine the existence of an arrangement. | |

| ● | All substantial risk of ownership transfers to the customer. Shipping documents and customer acceptance, when applicable, are used to verify delivery. | |

| ● | The fee is fixed or determinable. This is assessed based on the payment terms associated with the transaction and whether the sales price is subject to refund or adjustment. | |

| ● | Collectability is reasonably assured. We assess collectability based on the creditworthiness of the customer as determined by credit checks and analysis, as well as by the customer’s payment history. |

|

Accounts receivable

|

$ | 138 | ||

|

Inventories

|

77 | |||

|

Other current assets

|

2 | |||

|

Property, plant and equipment

|

2,212 | |||

|

Deferred tax asset

|

625 | |||

|

Trademark

|

290 | |||

|

Goodwill

|

732 | |||

|

Total assets acquired

|

4,076 | |||

|

Total liabilities assumed

|

107 | |||

|

Net assets acquired

|

$ | 3,969 |

|

2011

|

2010

|

|||||||

|

Term loans

|

$ | 14,367 | $ | 15,474 | ||||

|

Revolvers

|

- | 7,544 | ||||||

|

Other

|

605 | 792 | ||||||

|

Total debt

|

14,972 | 23,810 | ||||||

|

Less current maturities

|

3,494 | 1,327 | ||||||

|

Less Revolvers

|

- | 7,544 | ||||||

|

Total long-term debt

|

$ | 11,478 | $ | 14,939 | ||||

|

Fiscal Year

|

||||

|

2012

|

$ | 3,494 | ||

|

2013

|

683 | |||

|

2014

|

670 | |||

|

2015

|

530 | |||

|

2016

|

548 | |||

|

Thereafter

|

9,047 | |||

|

Total

|

$ | 14,972 | ||

|

Loss reclassified from AOCI into:

|

2011

|

2010

|

||||||

|

Interest expense

|

$ | 990 | $ | 2,045 | ||||

The following discloses the location and amount of income or loss recognized for changes in the fair value of derivative instruments not designated as hedging instruments for the years ended September 30, 2011 and October 1, 2010, respectively:

|

Derivatives not designated as hedging instruments

|

Location of (income) or loss

recognized in statement of

operations

|

2011 |

2010

|

|

|

Foreign exchange forward contracts

|

Other expense, net

|

$ (361)

|

$ 565

|

|

| ● | Level 1 - Quoted prices in active markets for identical assets or liabilities. These are typically obtained from real-time quotes for transactions in active exchange markets involving identical assets. | |

| ● | Level 2 - Inputs, other than quoted prices included within Level 1, which are observable for the asset or liability, either directly or indirectly. These are typically obtained from readily-available pricing sources for comparable instruments. | |

| ● | Level 3 - Unobservable inputs, where there is little or no market activity for the asset or liability. These inputs reflect the reporting entity’s own assumptions of the data that market participants would use in pricing the asset or liability, based on the best information available in the circumstances. |

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Assets:

|

||||||||||||||||

|

Rabbi trust assets

|

$ | 5,385 | $ | - | $ | - | $ | 5,385 | ||||||||

|

Liabilities:

|

||||||||||||||||

|

Foreign currency forward contracts

|

$ | - | $ | 128 | $ | - | $ | 128 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Assets:

|

||||||||||||||||

|

Rabbi trust assets

|

$ | 5,452 | $ | - | $ | - | $ | 5,452 | ||||||||

|

Liabilities:

|

||||||||||||||||

|

Foreign currency forward contracts

|

$ | - | $ | 8 | $ | - | $ | 8 | ||||||||

|

Location of (income) loss

recognized in Statements of

Operations

|

2011

|

2010

|

|||||||

|

Rabbi trust assets

|

Other expense, net

|

$ | 382 | $ | (730 | ) | |||

|

Foreign exchange forward contracts

|

Other expense, net

|

$ | (361 | ) | $ | 565 | |||

|

Level 1

|

Level 2

|

Level 3

|

Losses incurred

|

|||||||||||||

|

Property, plant and equipment

|

$ | - | $ | - | $ | 1,300 | $ | 334 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Losses incurred

|

|||||||||||||

|

Property, plant and equipment

|

$ | - | $ | - | $ | 656 | $ | 114 | ||||||||

|

Year

|

Related parties included in total

|

Total

|

|||||

|

2012

|

$ | 1,014 | $ | 6,648 | |||

|

2013

|

820 | 4,455 | |||||

|

2014

|

849 | 3,536 | |||||

|

2015

|

878 | 2,889 | |||||

|

2016

|

939 | 2,643 | |||||

|

Thereafter

|

- | 1,437 | |||||

|

2011

|

2010

|

|||||||

|

United States

|

$ | 11,133 | $ | 7,873 | ||||

|

Foreign

|

1,117 | 1,319 | ||||||

| $ | 12,250 | $ | 9,192 | |||||

|

2011

|

2010

|

|||||||

|

Current:

|

||||||||

|

Federal (net of tax benefit from operating loss carryforward of $2,505 and $5,260, respectively)

|

$ | - | $ | - | ||||

|

State

|

642 | 483 | ||||||

|

Foreign

|

2,000 | 1,164 | ||||||

|

Deferred

|

(23,036 | ) | 1,006 | |||||

| $ | (20,394 | ) | $ | 2,653 | ||||

|

2011

|

2010

|

|||||||

|

Deferred tax assets:

|

||||||||

|

Inventories

|

$ | 3,902 | $ | 4,049 | ||||

|

Compensation

|

10,258 | 10,042 | ||||||

|

Tax credit carryforwards

|

8,519 | 8,684 | ||||||

|

Goodwill and other intangibles

|

3,639 | 2,440 | ||||||

|

Net operating loss carryforwards

|

11,109 | 11,069 | ||||||

|

Depreciation and amortization

|

751 | 2,267 | ||||||

|

Other

|

5,385 | 5,791 | ||||||

|

Total gross deferred tax assets

|

43,563 | 44,342 | ||||||

|

Less valuation allowance

|

14,300 | 39,178 | ||||||

|

Deferred tax assets

|

29,263 | 5,164 | ||||||

|

Deferred tax liabilities:

|

||||||||

|

Foreign statutory reserves

|

348 | 601 | ||||||

|

Net deferred tax assets

|

$ | 28,915 | $ | 4,563 | ||||

|

2011

|

2010

|

|||||||

|

Current assets

|

$ | 9,732 | $ | 1,844 | ||||

|

Non-current assets

|

19,531 | 3,320 | ||||||

|

Non-current liabilities

|

348 | 601 | ||||||

|

Net deferred tax assets

|

$ | 28,915 | $ | 4,563 | ||||

|

2011

|

2010

|

|||||||

|

Statutory U.S. federal income tax rate

|

35.0 | % | 35.0 | % | ||||

|

Foreign rate differential

|

-0.9 | % | -3.6 | % | ||||

|

State income tax, net of federal benefit

|

4.2 | % | 5.3 | % | ||||

|

Decrease in valuation reserve for deferred assets

|

-211.0 | % | -8.1 | % | ||||

|

Other

|

6.2 | % | 0.3 | % | ||||

| -166.5 | % | 28.9 | % | |||||

|

Balance at October 2, 2009

|

$ | 1,290 | ||

|

Lapse of statute of limitations

|

(240 | ) | ||

|

Gross increases - tax positions in current period

|

205 | |||

|

Balance at October 1, 2010

|

1,255 | |||

|

Settlement

|

(168 | ) | ||

|

Lapse of statute of limitations

|

(122 | ) | ||

|

Gross increases - tax positions in current period

|

719 | |||

|

Balance at September 30, 2011

|

$ | 1,684 |

|

Jurisdiction

|

Fiscal Years

|

|

|

United States

|

2008-2011

|

|

|

Canada

|

2006-2011

|

|

|

France

|

2008-2011

|

|

|

Germany

|

2009-2011

|

|

|

Italy

|

2006-2011

|

|

|

Japan

|

2009-2011

|

|

|

Switzerland

|

2001-2011

|

|

2011

|

2010

|

|||||||

|

Projected benefit obligation:

|

||||||||

|

Projected benefit obligation, beginning of year

|

$ | 19,369 | $ | 18,393 | ||||

|

Service cost

|

- | - | ||||||

|

Interest cost

|

1,003 | 993 | ||||||

|

Actuarial loss

|

1,446 | 767 | ||||||

|

Benefits paid

|

(786 | ) | (784 | ) | ||||

|

Projected benefit obligation, end of year

|

$ | 21,032 | $ | 19,369 | ||||

|

Fair value of plan assets:

|

||||||||

|

Fair value of plan assets, beginning of year

|

$ | 11,817 | $ | 10,346 | ||||

|

Actual (loss) gain on plan assets

|

(91 | ) | 1,148 | |||||

|

Company contributions

|

364 | 1,107 | ||||||

|

Benefits paid

|

(786 | ) | (784 | ) | ||||

|

Fair value of plan assets, end of year

|

$ | 11,304 | $ | 11,817 | ||||

|

Funded status of the plan

|

$ | (9,728 | ) | $ | (7,552 | ) | ||

|

Amounts recognized in the Consolidated Balance Sheets consist of:

|

||||||||

|

Current pension liabilities

|

$ | 197 | $ | 192 | ||||

|

Noncurrent pension liabilities

|

9,531 | 7,360 | ||||||

|

Accumulated other comprehensive loss

|

(7,636 | ) | (5,315 | ) | ||||

|

Components of accumulated other comprehensive loss:

|

||||||||

|

Net actuarial loss

|

(7,636 | ) | (5,315 | ) | ||||

|

Accumulated other comprehensive loss

|

$ | (7,636 | ) | $ | (5,315 | ) | ||

|

2011

|

2010

|

|||||||

|

Service cost

|

$ | - | $ | - | ||||

|

Interest cost

|

1,003 | 993 | ||||||

|

Expected return on plan assets

|

(962 | ) | (972 | ) | ||||

|

Amortization of unrecognized net loss

|

177 | 94 | ||||||

|

Net periodic pension cost

|

218 | 115 | ||||||

|

Other changes in benefit obligations recognized i

n other comprehensive income (loss), (OCI):

|

||||||||

|

Net loss

|

2,321 | 497 | ||||||

|

Total recognized in net periodic pension cost and OCI

|

$ | 2,539 | $ | 612 | ||||

|

Year

|

||||

|

2012

|

$ | 837 | ||

|

2013

|

843 | |||

|

2014

|

854 | |||

|

2015

|

868 | |||

|

2016

|

876 | |||

|

Five years thereafter

|

4,886 | |||

|

Projected Benefit

|

Net Periodic

|

|||||||||||||||

|

Obligation

|

Pension Cost

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Discount rate

|

5.00 | % | 5.25 | % | 5.25 | % | 5.50 | % | ||||||||

|

Long-term rate of return

|

N/A | N/A | 7.50 | % | 8.00 | % | ||||||||||

|

Average salary increase rate

|

N/A | N/A | N/A | N/A | ||||||||||||

|

2011

|

2010

|

|||||||

|

Equity securities

|

75 | % | 71 | % | ||||

| Fixed income securities | 24 | 27 | ||||||

| Other securities | 1 | 2 | ||||||

| Total | 100 | % | 100 | % | ||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Description:

|

||||||||||||||||

|

Mutual fund

|

$ | 10,854 | $ | - | $ | - | $ | 10,854 | ||||||||

|

Money market funds

|

3 | - | - | 3 | ||||||||||||

|

Group annuity contract

|

- | - | 411 | 411 | ||||||||||||

|

Total

|

$ | 10,857 | $ | - | $ | 411 | $ | 11,268 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Description:

|

||||||||||||||||

|

Mutual fund

|

$ | 11,303 | $ | - | $ | - | $ | 11,303 | ||||||||

|

Money market funds

|

43 | - | - | 43 | ||||||||||||

|

Group annuity contract

|

- | - | 471 | 471 | ||||||||||||

|

Total

|

$ | 11,346 | $ | - | $ | 471 | $ | 11,817 | ||||||||

|

2011

|

2010

|

|||||||

|

Level 3 assets, beginning of year

|

$ | 471 | $ | 533 | ||||

|

Unrealized gain (loss)

|

16 | 14 | ||||||

|

Purchases, sales, issuances and settlements, net

|

(76 | ) | (76 | ) | ||||

|

Level 3 assets, end of year

|

$ | 411 | $ | 471 | ||||

|

2011

|

2010

|

|||||||

|

Class A, $0.05 par value:

|

||||||||

|

Authorized

|

20,000,000 | 20,000,000 | ||||||

|

Outstanding

|

8,567,549 | 8,363,313 | ||||||

|

Class B, $0.05 par value:

|

||||||||

|

Authorized

|

3,000,000 | 3,000,000 | ||||||

|

Outstanding

|

1,215,842 | 1,216,464 | ||||||

|

Shares

|

Weighted

Average

Exercise Price

|

Weighted

Average

Remaining

Contractural

Term (in years)

|

Aggregate

Intrinsic

Value

|

||||||||||

|

Outstanding at October 2, 2009

|

180,288 | $ | 8.23 | ||||||||||

|

Exercised

|

(55,250 | ) | 7.29 | ||||||||||

|

Cancelled

|

(11,334 | ) | 9.39 | ||||||||||

|

Outstanding at October 1, 2010

|

113,704 | 8.57 | |||||||||||

|

Exercised

|

(40,780 | ) | 5.79 | $ | 331 | ||||||||

|

Cancelled

|

(4,334 | ) | 6.28 | 40 | |||||||||

|

Outstanding and exercisable at September 30, 2011

|

68,590 | 10.37 |

1.1

|

397 | |||||||||

|

Shares

|

Weighted

Average

Grant

Price

|

|||||||

|

Non-vested stock at October 2, 2009

|

105,827 | $ | 14.08 | |||||

|

Non-vested stock grants

|

230,650 | 9.58 | ||||||

|

Restricted stock vested

|

(11,305 | ) | 11.06 | |||||

|

Non-vested stock at October 1, 2010

|

325,172 | 10.99 | ||||||

|

Non-vested stock grants

|

161,825 | 13.74 | ||||||

|

Non-vested stock cancelled

|

(4,466 | ) | 9.12 | |||||

|

Restricted stock vested

|

(9,770 | ) | 15.35 | |||||

|

Non-vested stock at September 30, 2011

|

472,761 | $ | 11.86 | |||||

|

2011

|

2010

|

||||||||

|

Net sales:

|

|||||||||

|

Marine Electronics:

|

Unaffiliated customers

|

$ | 221,839 | $ | 185,206 | ||||

|

Interunit transfers

|

276 | 288 | |||||||

|

Outdoor Equipment:

|

Unaffiliated customers

|

38,832 | 48,623 | ||||||

|

Interunit transfers

|

50 | 67 | |||||||

|

Watercraft:

|

Unaffiliated customers

|

57,583 | 63,857 | ||||||

|

Interunit transfers

|

149 | 144 | |||||||

|

Diving:

|

Unaffiliated customers

|

88,627 | 84,222 | ||||||

|

Interunit transfers

|

917 | 854 | |||||||

|

Other/Corporate

|

541 | 524 | |||||||

|

Eliminations

|

(1,392 | ) | (1,353 | ) | |||||

| $ | 407,422 | $ | 382,432 | ||||||

|

Operating profit (loss):

|

|||||||||

|

Marine Electronics

|

$ | 21,074 | $ | 13,938 | |||||

|

Outdoor Equipment

|

2,996 | 5,881 | |||||||

|

Watercraft

|

(1,351 | ) | 1,826 | ||||||

|

Diving

|

3,610 | 3,030 | |||||||

|

Other/Corporate

|

(8,659 | ) | (10,121 | ) | |||||

| $ | 17,670 | $ | 14,554 | ||||||

|

Depreciation and amortization expense:

|

|||||||||

|

Marine Electronics

|

$ | 5,694 | $ | 4,923 | |||||

|

Outdoor Equipment

|

479 | 521 | |||||||

|

Watercraft

|

1,454 | 1,455 | |||||||

|

Diving

|

1,942 | 1,574 | |||||||

|

Other/Corporate

|

1,308 | 1,504 | |||||||

| $ | 10,877 | $ | 9,977 | ||||||

|

Additions to property, plant and equipment:

|

|||||||||

|

Marine Electronics

|

$ | 5,283 | $ | 6,923 | |||||

|

Outdoor Equipment

|

262 | 201 | |||||||

|

Watercraft

|

1,274 | 1,314 | |||||||

|

Diving

|

1,269 | 811 | |||||||

|

Other/Corporate

|

1,279 | 717 | |||||||

| $ | 9,367 | $ | 9,966 | ||||||

|

Total assets:

|

|||||||||

|

Marine Electronics

|

$ | 101,739 | $ | 85,164 | |||||

|

Outdoor Equipment

|

24,046 | 23,192 | |||||||

|

Watercraft

|

34,614 | 34,420 | |||||||

|

Diving

|

67,969 | 70,388 | |||||||

|

Other/Corporate

|

30,988 | 13,592 | |||||||

| $ | 259,356 | $ | 226,756 | ||||||

|

Goodwill, net:

|

|||||||||

|

Marine Electronics

|

$ | 10,397 | $ | 9,674 | |||||

|

Outdoor Equipment

|

- | - | |||||||

|

Watercraft

|

- | - | |||||||

|

Diving

|

4,254 | 4,055 | |||||||

| $ | 14,651 | $ | 13,729 | ||||||

|

2011

|

2010

|

|||||||

|

Net sales:

|

||||||||

|

United States:

|

||||||||

|

Unaffiliated customers

|

$ | 298,193 | $ | 274,998 | ||||

|

Interarea transfers

|

18,276 | 15,785 | ||||||

|

Europe:

|

||||||||

|

Unaffiliated customers

|

66,681 | 65,622 | ||||||

|

Interarea transfers

|

9,854 | 9,670 | ||||||

|

Other:

|

||||||||

|

Unaffiliated customers

|

42,548 | 41,812 | ||||||

|

Interarea transfers

|

2,324 | 2,386 | ||||||

|

Eliminations

|

(30,454 | ) | (27,841 | ) | ||||

| $ | 407,422 | $ | 382,432 | |||||

|

Total assets:

|

||||||||

|

United States

|

$ | 161,355 | $ | 128,534 | ||||

|

Europe

|

64,218 | 68,657 | ||||||

|

Other

|

33,783 | 29,565 | ||||||

| $ | 259,356 | $ | 226,756 | |||||

|

Long-term assets:

(1)

|

||||||||

|

United States

|

$ | 53,316 | $ | 52,475 | ||||

|

Europe

|

9,348 | 10,051 | ||||||

|

Other

|

716 | 782 | ||||||

| $ | 63,380 | $ | 63,308 | |||||

|

(1)

Long-term assets consist of net property, plant and equipment, net intangible assets,

|

||||||||

|

goodwill and other assets excluding deferred income taxes.

|

||||||||