|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended

Commission

File No.

(Exact name of registrant as specified in its charter)

|

|||

| (State of other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| None |

Securities registered under Section 12(g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days. [X]

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

[X]

As of May 18, 2022, the Issuer had shares of its common stock outstanding.

KAYA HOLDINGS, INC.

INDEX TO QUARTERLY REPORT ON FORM 10 Q

Part I – Financial Information Page

| Item 1. Condensed Consolidated Financial Statements | Page |

| Condensed Consolidated Balance Sheet | 1 |

| Condensed Consolidated Statements of Operation | 2 |

| Condensed Consolidated Statements of Cash Flows | 4 |

| Statement of Stockholder’s deficit for the three month period ended March 31, 2022 and the year ended December 31, 2021 | 5 |

| Notes to Condensed Consolidated Financial Statements | 6 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 54 |

| Item 4. Controls and Procedures | 55 |

| Part II Other Information | |

| Item 1. Legal Proceedings | 56 |

| Item 1A. Risk Factors | 58 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 58 |

| Item 3. Defaults Upon Senior Securities | 58 |

| Item 4. Mine Safety Disclosures | 58 |

| Item 5. Other Information | 58 |

| Item 6. Exhibits | 58 |

| Signatures | 58 |

In this Quarterly Report on Form 10-Q, the terms “ KAYS ,” “ the Company ,” “ we ,” “ us ” and “ our ” refer to Kaya Holdings, Inc. and its owned and controlled subsidiaries, unless the context indicates otherwise.

Cautionary Note Regarding Forward Looking Statements

Information contained in this Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the ‘Exchange Act”). These forward-looking statements are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

The forward-looking statements herein represent our expectations, beliefs, plans, intentions or strategies concerning future events. Our forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections or other expectations included in any forward-looking statements will come to pass. Moreover, our forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.

Except as required by applicable laws, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Available Information

We file annual, quarterly and special reports and other information with the Securities and Exchange Commission (“SEC”) that can be obtained from the SEC by telephoning 1-800-SEC-0330. The Company’s filings are also available through the SEC’s Electronic Data Gathering Analysis and Retrieval System, known as EDGAR, through the SEC’s website (www.sec.gov).

Part I

Item 1 Condensed Consolidated Financial Statements

Kaya Holdings, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

March 31, 2022 and December 31, 2021

| ASSETS | ||||||||

| (Unaudited) | (Audited) | |||||||

| March 31, 2022 | December 31, 2021 | |||||||

| CURRENT ASSETS: | ||||||||

| Cash and equivalents | $ | $ | ||||||

| Inventory | ||||||||

| Prepaid expenses | ||||||||

| Total current assets | ||||||||

| NON-CURRENT ASSETS: | ||||||||

| Right-of-use asset - operating lease | ||||||||

| Property

and equipment, net of accumulated depreciation of $ | ||||||||

| as of March 31, 2022 and December 31, 2021, respectively | ||||||||

| Investment in subsidaries | ||||||||

| Other Assets | ||||||||

| Total non-current assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable and accrued expense | $ | $ | ||||||

| Accounts payable and accrued expense-related parties | ||||||||

| Accrued interest | ||||||||

| Right-of-use liability - operating lease | ||||||||

| Taxable Payable | ||||||||

| Convertible

notes payable, net of discount of $ | ||||||||

| Notes payable | ||||||||

| Derivative liabilities | ||||||||

| Total current liabilities | ||||||||

| NON-CURRENT LIABILITIES: | ||||||||

| Notes payable-related party | ||||||||

| Convertible

notes payable, net of discount of $ | ||||||||

| Accounts payable and accrued expense-related parties | ||||||||

| Right-of-use liabiliy - operating lease | ||||||||

| Total non-current liabilities | ||||||||

| Total liabilities | ||||||||

| STOCKHOLDERS' DEFICIT: | ||||||||

| Convertible preferred stock, Series C, par value $; shares authorized; | ||||||||

| and issued and outstanding at March 31, 2022 | ||||||||

| and December 31, 2021, respectively | ||||||||

| Convertible preferred stock, Series D, par value $; shares authorized; | ||||||||

| and issued and outstanding at March 31, 2022 | ||||||||

| and December 31, 2021, respectively | ||||||||

| Common stock , par value $; shares authorized; | ||||||||

| shares issued as of March 31, 2022 and shares | ||||||||

| outstanding as of December 31, 2021, respectively | ||||||||

| Subscriptions payable | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive income | ( | ) | ( | ) | ||||

| Total stockholders' deficit attributable to parent company | ( | ) | ( | ) | ||||

| Non-controlling interest | ( | ) | ( | ) | ||||

| Total stockholders' deficit | ( | ) | ( | ) | ||||

| Total liabilities and stockholders' deficit | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 1 |

| Kaya Holdings, Inc. and Subsidiaries |

| Condensed Consolidated Statements of Operations |

| (Unaudited) | (Uaudited) | |||||||

| For The Three | For The Three | |||||||

| Months Ended | Months Ended | |||||||

| March 31, 2022 | March 31, 2021 | |||||||

| Net sales | $ | $ | ||||||

| Cost of sales | ||||||||

| Gross profit | ||||||||

| Operating expenses: | ||||||||

| Professional fees | ||||||||

| Salaries and wages | ||||||||

| (Gain) Loss on impairment of assets | ( | ) | ||||||

| General and administrative | ||||||||

| Total operating expenses | ||||||||

| Operating loss | ( | ) | ( | ) | ||||

| Other income (expense): | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Amortization of debt discount | ( | ) | ( | ) | ||||

| Derivative liabilities expense | ( | ) | ||||||

| Gain (loss) on extinguishment of debt | ||||||||

| Gain (loss) on Settlement | ||||||||

| Gain (loss) on disposal | ||||||||

| Change in derivative liabilities expense | ( | ) | ( | ) | ||||

| Other income (expense) | — | — | ||||||

| Total other expense | ( | ) | ( | ) | ||||

| Net income (loss) before income taxes | ( | ) | ( | ) | ||||

| Provision for Income Taxes | ||||||||

| Net income (loss) | ( | ) | ( | ) | ||||

| Net Income (loss) attributed to non-controlling interest | ( | ) | ||||||

| Net income (loss) attributed to Kaya Holdings, Inc. | ( | ) | ( | ) | ||||

| Basic net income (loss) per common share | $ | ( | ) | $ | ( | ) | ||

| Weighted average number of common shares outstanding - Basic | ||||||||

| Diluted net income (loss) per common share | $ | ( | ) | $ | ( | ) | ||

| Weighted average number of common shares outstanding - Diluted |

The accompanying notes are an integral part of these consolidated financial statements.

| 2 |

Kaya Holdings, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

| (Unaudited) | (Uaudited) | |||||||

| For The Three | For The Three | |||||||

| Months Ended | Months Ended | |||||||

| March 31, 2022 | March 31, 2021 | |||||||

| Net income (loss) | $ | ( | ) | $ | ( | ) | ||

| Other comprehensive income (expense) | ||||||||

| Derivative expenses | ||||||||

| Change in fair value of embedded derivative liabilities | ||||||||

| Loss on debt extinguishment | ||||||||

| Foreign currency adjustments | ( | ) | ||||||

| Comprehensive income (loss) | ( | ) | ( | ) | ||||

| Other comprehensive income (expense) | ||||||||

| Net loss attirbuted to non-controlling interest | ( | ) | ||||||

| Comprehensive loss attributatable to Kaya Holdings | ( | ) | ( | ) |

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

Kaya Holdings, Inc. and Subsidiaries

Condensed Consolidated Statement of Cashflows

| (Unaudited) | (Unaudited) | |||||||

| For The Three | For The Three | |||||||

| Months Ended | Months Ended | |||||||

| March 31, 2022 | March 31, 2021 | |||||||

| OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net income / loss to net cash used in operating activities: | ||||||||

| Adjustment to non-controlling interest | ( | ) | ||||||

| Depreciation | ||||||||

| Imputed interest | ||||||||

| Loss (gain) on impairment of right-of-use asset | ( | ) | ||||||

| Derivative expense | ||||||||

| Change in derivative liabilities | ||||||||

| Amortization of debt discount | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expense | ( | ) | ||||||

| Inventory | ( | ) | ||||||

| Right-of-use asset | ||||||||

| Other assets | ( | ) | ||||||

| Deposits | ( | ) | ||||||

| Accrued interest | ||||||||

| Accounts payable and accrued expenses | ( | ) | ||||||

| Accounts payable and accrued expenses - Related Parties | ( | ) | ||||||

| Right-of-use liabilities | ( | ) | ( | ) | ||||

| Net cash provided by(used in) operating activities | ( | ) | ( | ) | ||||

| INVESTING ACTIVITIES: | ||||||||

| Investment in Subsidiaries | ( | ) | ||||||

| Net cash provided by (used in) investing activities | ( | ) | ||||||

| FINANCING ACTIVITIES: | ||||||||

| Proceeds from common stock subscriptions | ||||||||

| Proceeds from convertible debt | ||||||||

| Net cash provided by financing activities | ||||||||

| NET INCREASE (DECREASE) IN CASH | ( | ) | ||||||

| Effects of currency translation on cash and cash equivalents | ( | ) | ||||||

| CASH BEGINNING BALANCE | ||||||||

| CASH ENDING BALANCE | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Interest paid | ||||||||

| NON-CASH TRANSACTIONS AFFECTING OPERATING, INVESTING | ||||||||

| AND FINANCING ACTIVITIES: | ||||||||

| Derivative liability on convertible note payable | ||||||||

| Capitalization of interest pursuant to amended agreement | ||||||||

| Shares issued for cash from stock payable | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 4 |

Kaya Holdings, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Deficit

For the year ended March 31, 2022 (Unaudited) and the year ended December 31, 2021 (Audited)

| Additional Paid-in Capital | Accumulated Deficit | Accumulated Comprehensive Loss | Noncontrolling Interest | Total Stockholders' Deficit | ||||||||||||||||||||

| Subscription Payable | ||||||||||||||||||||||||

| Preferred Stock - Series C | Preferred Stock - Series D | Common Stock | ||||||||||||||||||||||

| Refer | Shares | Amount | Shares | Amount | Shares | Amount | Amount | |||||||||||||||||

| to tab | ||||||||||||||||||||||||

| Balance, December 31, 2020 | |

$ |

- | $ - | |

|

$ |

$ |

$ ( |

$ - | $ ( |

$ ( | ||||||||||||

| Imputed interest | - | - | - | - | - | - | - | |

- | - | - | | ||||||||||||

| Common stock issued for Cash | - | - | - | - | |

|

( |

|

- | - | - | | ||||||||||||

| Common stock issued for debt conversion and interest | - | - | - | - | |

|

- | |

- | - | - | | ||||||||||||

| Share Cancellation | - | - | - | - | ( |

( |

- | |

- | - | - | - | ||||||||||||

| Exchanges of preferred shares - sereies C to series D | ( |

( |

|

- | - | - | - | |

- | - | - | - | ||||||||||||

| Settlment of related party acccrued compensation | - | - | - | - | - | - | - | |

- | - | - | | ||||||||||||

| Reclassification of derivative liabilities to additional paid in capital | - | - | - | - | - | - | - | |

- | - | - | | ||||||||||||

| Business combination of foreign entities | - | - | - | - | - | - | - | - | - | - | |

| ||||||||||||

| Translation Adjustment | - | - | - | - | - | - | - | - | - | ( |

( |

( | ||||||||||||

| Net loss | - | - | - | - | - | - | - | - | |

- | ( |

| ||||||||||||

| Balance, December 31, 2021 (Audited) | - | $ - | |

$ - | |

$ |

$ |

$ |

$

( |

$ ( |

$ ( |

$ ( | ||||||||||||

| Balance, December 31, 2021 | - | $ - | |

$ - | |

$ |

$ |

$ |

$ ( |

$ ( |

$ ( |

$ ( | ||||||||||||

| Imputed interest | - | - | - | - | - | - | - | |

- | - | - | | ||||||||||||

| Translation Adjustment | - | - | - | - | - | - | - | - | - | ( |

( |

( | ||||||||||||

| Net Income | - | - | - | - | - | - | - | - | ( |

- | ( |

( | ||||||||||||

| Balance, March 31, 2022 (Unaudited) | - | $ - | |

$ - | |

$ |

$ |

$ |

$

( |

$ ( |

$ ( |

$ ( | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

NOTE 1 – ORGANIZATION AND NATURE OF THE BUSINESS

Organization

Kaya Holdings, Inc. FKA (Alternative Fuels Americas, Inc.) is a holding company. The Company was incorporated in 1993 and has engaged in a number of businesses. Its name was changed on May 11, 2007 to NetSpace International Holdings, Inc. (a Delaware corporation) (“NetSpace”). NetSpace acquired 100% of Alternative Fuels Americas, Inc. (a Florida corporation) in January 2010 in a stock-for-member interest transaction and issued 6,567,247 shares of common stock and 100,000 shares of Series C convertible preferred stock to existing shareholders. Certificate of Amendment to the Certificate of Incorporation was filed in October 2010 changing the Company’s name from NetSpace International Holdings, Inc. to Alternative Fuels Americas, Inc. (a Delaware corporation). Certificate of Amendment to the Certificate of Incorporation was filed in March 2015 changing the Company’s name from Alternative Fuels Americas, Inc. (a Delaware corporation) to Kaya Holdings, Inc.

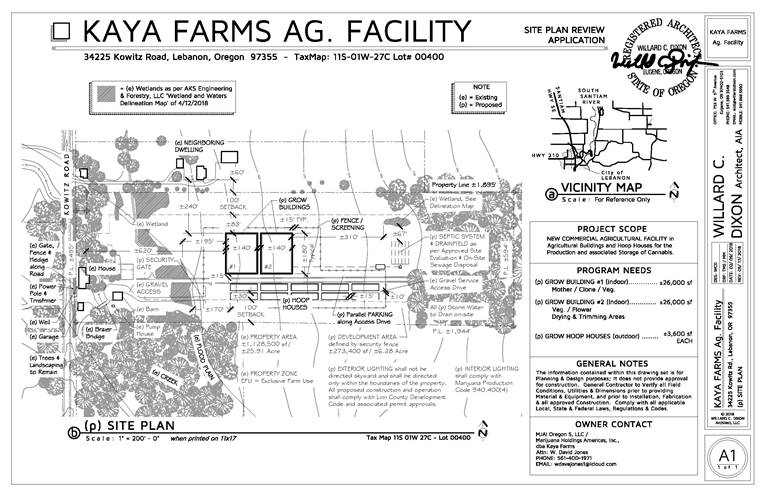

The Company has four subsidiaries: Alternative Fuels Americas, Inc, a Florida corporation, which is wholly-owned, Marijuana Holdings Americas, Inc., a Florida corporation (“MJAI”), which is majority-owned, 34225 Kowitz Road, LLC, a wholly-owned Oregon limited liability company which holds ownership of the Company’s 26 acre property in Lebanon, Oregon on which it plans to develop a legal cannabis cultivation and manufacturing facility, and Kaya Brand International, Inc. (KBI) a Florida Corporation which the Company owns 85% of which was formed on October 14, 2019 to expand the business overseas

MJAI develops and operates the Company’s legal cannabis retail operations in Oregon through controlling ownership interests in five Oregon limited liability companies: MJAI Oregon 1 LLC, MJAI Oregon 2 LLC (inactive), MJAI Oregon 3 LLC (inactive) , MJAI Oregon 4 LLC (inactive) and MJAI Oregon 5 LLC.

MJAI Oregon 1 LLC is the entity that holds the licenses for the Company’s retail store operations and pending OLCC Production and Processing license transfer applications for the 260 Grimes Street property in Eugene, Oregon. MJAI Oregon 5 LLC maintains the Company’s pending OLCC Producer Application for the Company’s 26 acre farm property in Lebanon Oregon.

KBI is the entity that holds controlling ownership interests in Kaya Farms Greece, S.A. (a Greek corporation) and Kaya Shalvah (“Kaya Farms Israel”, an Israeli corporation). These two entities were formed to facilitate expansion of the Company’s business in Greece and Israel respectively.

Nature of the Business

In January 2014, KAYS incorporated MJAI, a wholly-owned subsidiary, to focus on opportunities in the legal recreational and medical marijuana in the United States. MJAI has concentrated its efforts in Oregon, where through controlled Oregon limited liability companies, it initially secured licenses to operate a medical marijuana dispensary (an “MMD”) and following legalization of recreational cannabis use in Oregon, has secured licenses to operate four retail outlets and purchased 26 acres for development as a legal cannabis cultivation and manufacturing facility. The Company has developed the Kaya Shack™ brand for its retail operations and the Kaya Farms ™ brand for its cannabis gowing and processing operations.

On July 3, 2014 opened its first Kaya Shack™ MMD in Portland, Oregon. In April 2015, KAYS commenced its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana thereby becoming the first publicly traded U.S. company to own a majority interest in a vertically integrated legal marijuana enterprise in the United States. In October 2015, concurrent with Oregon commencing legal sales of recreational marijuana through MMDs, KAYS opened its second retail outlet in Salem, Oregon, the Kaya Shack™ Marijuana Superstore. During 2015, the Company also consolidated its grow operations and manufacturing operations into a single facility in Portland, Oregon.

In 2016, Oregon began the process to transition legal marijuana sales from Oregon Health Authority (“OHA”) licensed MMDs and grow operations to Oregon Liquor Control Commission (“OLCC”) licensed recreational marijuana retailers and producer and processing facilities. Effective January 1, 2017, all retailers of recreational marijuana were required to have a recreational marijuana sales license issued by the OLLC for each retail outlet operated.

In 2016 the Company applied for OLLC licenses for its two initial Kaya Shack™ retail outlets (Portland, Oregon and South Salem, Oregon), and also submitted license applications for its two new locations under construction and development at that time.

In late December 2016, we received our OLCC recreational license for the South Salem Kaya Shack™ Marijuana Superstore (Kaya Shack™ OLCC Marijuana Retailer License #1) and recreational and medical sales continued without interruption from 2016 through the present at that location.

| 7 |

On March 21, 2017, we received our North Salem Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #2) a 2,600-square foot Kaya Shack™ Marijuana Superstore in North Salem, Oregon, whereupon the location opened for business with both recreational and medical sales.

On May 2, 2017, we received our OLCC recreational license for our Portland Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #3) after a delay of approximately four months. During that period, we were limited to solely medical sales at the Portland location. Upon receipt of Kaya Shack™ OLCC Marijuana Retailer License #3, recreational sales recommenced at that location.

During August of 2017, the Company purchased a 26 acre parcel in Lebanon, Linn County, Oregon, on which we intend to construct an 85,000 square foot Kaya Farms™ Greenhouse Grow and Production Facility at the property.

On February 15, 2018, we received our OLCC recreational, medical and home delivery license for the Central Salem Kaya ShackTM outlet (Kaya ShackTM OLCC Marijuana Retailer License #4) a 3,100-square foot Kaya ShackTM Marijuana Superstore in Central Salem, Oregon. After various construction and permitting delays, On April 12, 2018, the location opened for business with both recreational and medical sales.

On August 18, 2018, the Company had concluded the purchase of the Eugene, Oregon based Sunstone Farms manufacturing facility, which was licensed by the OLCC for both the production of medical and recreational marijuana flower and the processing of cannabis concentrates/extracts/edibles. The purchase included a 12,000 square foot building housing and indoor grow facility, as well as equipment for growing and extraction activity. The purchase price of $1.3 was paid for by the issuance of 12 million shares of KAYS restricted stock to the seller at closing. Additionally, the seller purchased 2.5 million restricted shares for $250,000 in cash in a private transaction with the Company, and became a Board Member of Kaya Holdings. While the shares carried a lock-up-restriction allowing for their staged eligibility for resale over a 61-month period from the date of the purchase of the facility by KAYS, none of the shares have been submitted for resale.

In mid-April, 2019 the Company was notified by Sunstone that the OLCC had filed an administrative proceeding and was proposing that Sunstone’s licenses for the facility purchased by KAYS be cancelled, claiming that Sunstone had not filed paperwork correctly with respect to the transaction and the historical ownership of Bruce Burwick, the seller of the facility to the Company. Neither the Issuer nor any of its agents, consultants, employees or related entities was named as a respondent to the action and accordingly could not respond to the proceedings.

On September 26, 2019, the Company formed the majority owned subsidiary Kaya Brands International, Inc. (“KBI”) to serve as the Company’s vehicle for expansion into worldwide cannabis markets.

On November 4, 2019 the Company filed an 8-K announcing that its majority owned subsidiary, Kaya Brands International, Inc. (“KBI”), had executed a memorandum of understanding (“MOU”) setting forth the terms for KBI’s acquisition of a 50% ownership interest in Greekkannabis, PC (“GKC”), an Athens, Greece based cannabis company which at the time was awaiting issuance of a medical cannabis cultivation, processing, and export license from the Greek government.

In February, 2020 the Company renewed the OLCC Marijuana Retailer Licenses #1, 2 and 4 listed above and did not renew OLCC Marijuana Retailer License #3 and ceased operations at that location. The Company is currently seeking to transfer OLCC License #4 to another location.

| 8 |

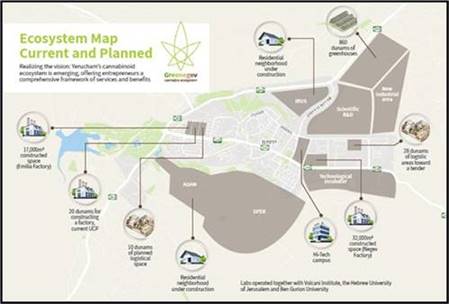

On April 22, 2020 KAYS/KBI received confirmation from its Greek Counsel that the Greek Government had approved and issued the Crucial Installation License for the GKC facility which is the subject of the previously announced MoU executed by and between KBI and GKC. The license allows for construction of a medical cannabis cultivation and process facility which includes twelve (12) 35,000 square foot of light deprivation greenhouses and an additional 50,000 square foot building for workspace, storage and administrative offices situated on fifteen acres of land in Thibes, Greece.

On June 7, 2020 Kaya Shalvah (“Kaya Farms Israel”) was incorporated by the Company’s Israel Counsel, Sullivan Worcester. KBI owns a majority of Kaya Farms Israel.

On October 15, 2020 the OLCC approved a settlement between the OLCC and Sunstone Marketing Partners that required that the licenses for the Eugene Oregon based Sunstone Farms facility be sold to a third party (other than KAYS) or surrendered. For more information, please see Note 15, Subsequent Events and Part II-Other Information, Item 1, Legal Proceedings elsewhere in this filing.

On November 27, 2020 Kaya Farms Greece, S.A. (“KFG)” was incorporated by the Company’s Greek Counsel Dalakos, Fassolis and Theofanopoulos of Piraeus, Greece. KBI owns a majority of KFG.

On December 31, 2020, the Company entered into a joint venture agreement with Greekkbannabis. The current joint venture arrangements are in the developmental stage and therefore only the initial start-up costs are included in the financial statement for the year ended December 31, 2020. For more information, please see Note, 16 Subsequent Events, and also information on Kaya Farms Greece elsewhere in this filing.

On January 11, 2021, KAYS/KBI, through a majority owned subsidiary of KBI (Kaya Farms Greece or “KFG") and Greekkannabis (“GKC") executed an agreement for KBI to acquire 50% of GKC. The terms are as follows:

1. Prior to the execution of the transaction, the GKC shareholders owned a total of 320 shares (100%) of GKC.

2. Pursuant to first section of the contract, KBI has initially acquired 80 shares of GKC (from the current shareholders) for payment of 30,000 Euros- 20,000 Euros have been paid from the $31,688 (25,000 Euros) sent to Greece on December 31, 2020 and the remaining 10,000 Euros is due to be paid by June 30, 2021. This leaves current shareholders on GKC side with 240 shares.

3. GKC is in process of issuing an additional 160 shares of GKC to KFG in exchange for additional paid in capital by KFG of 16,000 Euros. At the conclusion of the process (minutes of meetings have to be published in Greek Government publications, etc which will take a few months), KFG will own 50% of GKC (240 shares) and the current shareholders of GKC will own 50% (240 shares).

5. An operating agreement is currently being drafted that allows for 5 board members (2 from KFG and 3 from GKC). Ilias will become the President and Panos will become the vice president and Managing Director. Final terms will include the provision that a super majority (80%) is required to enter into a transaction in excess of 100K Euros and also to issue new shares, encumber/sell existing shares, enter into decisions regarding infrastructure, development and construction decisions, etc.

On March 31, 2021 the Company entered into a settlement with Sunstone Capital Partners, LLC, Sunstone Marketing Partners LLC and Bruce Burwick, the principal of Sunstone and a director of Kays, regarding the failure to deliver to KAYS the Oregon Cannabis Production and Processing Licenses that were part of a warehouse purchase transaction in August 2018.

On July 28, 2021 the Company announced that all terms had been satisfied. Pursuant to the terms of the settlement, Bruce Burwick surrendered to KAYS 1,006,671 shares of our common stock issued to him in connection with the transaction (800,003 shares which were issued for the facility purchase, 166,667 shares which were issued for $250,000 in cash and 40,001 shares which were issued as annual compensation for Burwick serving as a director of KAYS). The shares have been submitted to KAYS' transfer agent for cancellation. In addition, the Company received clear title to the warehouse facility, which enables the Company to sell it without restriction. As part of the settlement, Burwick received $160,000 from the net proceeds of the sale of the facility's grow license to an unrelated third party, resigned from the Company's board of directors and agreed to work as a non-exclusive consultant to the Company for the next four years for a yearly fee of $35,000.00.

| 9 |

On October 12, 2021, KAYS completed the sale of its Eugene, Oregon Cannabis Production and Processing Facility for gross proceeds of $1,325,000, generating a cash influx of approximately $0.09 per share for the Company (the “Eugene Warehouse Sale”). The sale was part of our recently announced settlement with Sunstone Farms, and it also resulted in the cancellation of 1,006,671 shares of KAYS stock, decreasing the Company’s issued and outstanding shares by approximately 6.5% to 14.7 million shares. Funds received from the sale were and are being used to repay certain debt and strengthen our balance sheet and for general working capital purposes, as well as provide the initial stage capital for some of the Company’s U.S. and global expansion activities, including its planned cultivation sites in Greece and Israel.

NOTE 2 – LIQUIDITY AND GOING CONCERN

The

Company’s consolidated financial statements as of March 31, 2022 have been prepared on a going concern basis, which contemplates

the realization of assets and the settlement of liabilities and commitments in the normal course of business. The Company incurred a

net loss of $

| • | the sale of additional equity and debt securities, |

| • | alliances and/or partnerships with entities interested in and having the resources to support the further development of the Company’s business plan, |

| • | business transactions to assure continuation of the Company’s development and operations, |

| • | development of a unified brand and the pursuit of licenses to operate recreational and medical marijuana facilities under the branded name. |

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Basis of Presentation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP) under the accrual basis of accounting.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes.

Such estimates and assumptions impact both assets and liabilities, including but not limited to: net realizable value of accounts receivable and inventory, estimated useful lives and potential impairment of property and equipment, the valuation of intangible assets, estimate of fair value of share based payments and derivative liabilities, estimates of fair value of warrants issued and recorded as debt discount, estimates of tax liabilities and estimates of the probability and potential magnitude of contingent liabilities.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the financial statements, which management considered in formulating its estimate could change in the near term due to one or more future non-conforming events. Accordingly, actual results could differ significantly from estimates.

Risks and Uncertainties

The Company’s operations are subject to risk and uncertainties including financial, operational, regulatory and other risks including the potential risk of business failure.

The Company has experienced, and in the future expects to continue to experience, variability in its sales and earnings. The factors expected to contribute to this variability include, among others, (i) the uncertainty associated with the commercialization and ultimate success of the product, (ii) competition inherent at other locations where product is expected to be sold (iii) general economic conditions and (iv) the related volatility of prices pertaining to the cost of sales.

| 10 |

Fiscal Year

The Company’s fiscal year-end is December 31.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Kaya Holdings, Inc. and all wholly and majority-owned subsidiaries. All significant intercompany balances have been eliminated.

Wholly-owned subsidiaries:

| · | Alternative Fuels Americas, Inc. (a Florida corporation) |

| · | 34225 Kowitz Road, LLC (an Oregon LLC) | |

Majority-owned subsidiaries:

Kaya Brands International, Inc. (a Florida Corporation)

Kaya Shalvah (“Kaya Farms Israel”, an Israeli corporation) majority owned subsidiary of KBI)

Kaya Farms Greece, S.A. (a Greek Corporation) majority owned subsidiary of KBI)

| · | Marijuana Holdings Americas, Inc. (a Florida corporation) |

| o | MJAI Oregon 1 LLC |

| o | MJAI Oregon 2 LLC (inactive) |

| o | MJAI Oregon 3 LLC (inactive) |

| o | MJAI Oregon 4 LLC (inactive) |

| o | MJAI Oregon 5 LLC |

Non-Controlling Interest

The company owned 55% of Marijuana Holdings Americas until September 30, 2019. Starting October 1, 2019, Kaya Holding, Inc. owns 65% of Marijuana Holdings Americas, Inc. As of March 30, 2022, Kaya owns 65% of Marijuana Holdings Americas, Inc.

The company owned 85% of Kaya Brands International, Inc. until July 31, 2020. Starting August 1, 2020, Kaya Holding, Inc. owns 65% of Kaya Brands International, Inc.

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less. The Company had no cash equivalents.

Inventory

Inventory

consists of finished goods purchased, which are valued at the lower of cost or market value, with cost being determined on the first-in,

first-out method. The Company periodically reviews historical sales activity to determine potentially obsolete items and also

evaluates the impact of any anticipated changes in future demand. Total Value of Finished goods inventory as of March 31,

2022 is $

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation and is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

| 11 |

Depreciation of property and equipment is provided utilizing the straight-line method over the estimated useful lives, ranging from 5-30 years of the respective assets. Expenditures for maintenance and repairs are charged to expense as incurred.

Upon sale or retirement of property and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the statements of operations.

Long-lived assets

The Company reviews long-lived assets and certain identifiable intangibles held and used for possible impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In evaluating the fair value and future benefits of its intangible assets, management performs an analysis of the anticipated undiscounted future net cash flow of the individual assets over the remaining amortization period. The Company recognizes an impairment loss if the carrying value of the asset exceeds the expected future cash flows.

Accounting for the Impairment of Long-Lived Assets

We evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Upon such an occurrence, recoverability of assets to be held and used is measured by comparing the carrying amount of an asset to forecasted undiscounted net cash flows expected to be generated by the asset. If the carrying amount of the asset exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset. For long-lived assets held for sale, assets are written down to fair value, less cost to sell. Fair value is determined based on discounted cash flows, appraised values or management's estimates, depending upon the nature of the assets.

Operating Leases

We lease our retail stores under non-cancellable operating leases. Most store leases include tenant allowances from landlords, rent escalation clauses and/or contingent rent provisions. We recognize rent expense on a straight-line basis over the lease term, excluding contingent rent, and record the difference between the amount charged to expense and the rent paid as a deferred rent liability.

Deferred Rent and Tenant Allowances

Deferred Rent and Tenant AllowancesDeferred rent is recognized when a lease contains fixed rent escalations. We recognize the related rent expense on a straight-line basis starting from the date of possession and record the difference between the recognized rental expense and cash rent payable as deferred rent. Deferred rent also includes tenant allowances received from landlords in accordance with negotiated lease terms. The tenant allowances are amortized as a reduction to rent expense on a straight-line basis over the term of the lease starting at the date of possession.

In accordance with ASC 260, Earnings per Share, the Company calculates basic earnings per share by dividing net income (loss) by the weighted average number of common shares outstanding during the period. Diluted earnings per share are computed if the Company has net income; otherwise it would be anti-dilutive, and would result from the conversion of a convertible note.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740, Accounting for Income Taxes, as clarified by ASC 740-10, Accounting for Uncertainty in Income Taxes. Under this method, deferred income taxes are determined based on the estimated future tax effects of differences between the financial statement and tax basis of assets and liabilities given the provisions of enacted tax laws. Deferred income tax provisions and benefits are based on changes to the assets or liabilities from year to year. In providing for deferred taxes, the Company considers tax regulations of the jurisdictions in which the Company operates, estimates of future taxable income, and available tax planning strategies. If tax regulations, operating results or the ability to implement tax-planning strategies vary, adjustments to the carrying value of deferred tax assets and liabilities may be required. Valuation allowances are recorded related to deferred tax assets based on the “more likely than not” criteria of ASC 740.

ASC 740-10 requires that the Company recognize the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions meeting the “more-likely-than-not” threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50 percent likelihood of being realized upon ultimate settlement with the relevant tax authority.

| 12 |

We are subject to certain tax risks and treatments that could negatively impact our results of operations

Section 280E of the Internal Revenue Code, as amended, prohibits businesses from deducting certain expenses associated with trafficking controlled substances (within the meaning of Schedule I and II of the Controlled Substances Act). The IRS has invoked Section 280E in tax audits against various cannabis businesses in the U.S. that are permitted under applicable state laws. Although the IRS issued a clarification allowing the deduction of certain expenses, the scope of such items is interpreted very narrowly and the bulk of operating costs and general administrative costs are not permitted to be deducted. While there are currently several pending cases before various administrative and federal courts challenging these restrictions, there is no guarantee that these courts will issue an interpretation of Section 280E favorable to cannabis businesses.

Provision for Income Taxes

We

recorded a provision for income taxes in the amount of $

Fair Value of Financial Instruments

The Company measures assets and liabilities at fair value based on an expected exit price as defined by the authoritative guidance on fair value measurements, which represents the amount that would be received on the sale of an asset or paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability. The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level.

The following are the hierarchical levels of inputs to measure fair value:

| • | Level 1 – Observable inputs that reflect quoted market prices in active markets for identical assets or liabilities. |

| • | Level 2 - Inputs reflect quoted prices for identical assets or liabilities in markets that are not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are observable for the assets or liabilities; or inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| • | Level 3 – Unobservable inputs reflecting the Company’s assumptions incorporated in valuation techniques used to determine fair value. These assumptions are required to be consistent with market participant assumptions that are reasonably available. |

| Fair Value Measurements at March 31, 2022 | |||||||||||

| Level 1 | Level 2 | Level 3 | |||||||||

| Assets | |||||||||||

| Cash | $ | $ | $ | ||||||||

| Total assets | |||||||||||

| Liabilities | |||||||||||

| Convertible debentures, net of discounts of $410,552 | |||||||||||

| Short term debt, net of discounts of $-0- | |||||||||||

| Derivative liability | |||||||||||

| Total liabilities | |||||||||||

| $ | $ | $ | ( |

||||||||

| Fair Value Measurements at December 31, 2021 | |||||||||||

| Level 1 | Level 2 | Level 3 | |||||||||

| Assets | |||||||||||

| Cash | $ | $ | $ | ||||||||

| Total assets | |||||||||||

| Liabilities | |||||||||||

| Convertible debentures, net of discounts of $477,634 | |||||||||||

| Short term debt, net of discounts of $-0- | |||||||||||

| Derivative liability | |||||||||||

| Total liabilities | |||||||||||

| $ | $ | $ | ( |

||||||||

The carrying amounts of the Company’s financial assets and liabilities, such as cash, prepaid expenses, other current assets, accounts payable accrued expenses, certain notes payable and notes payable – related party, approximate their fair values because of the short maturity of these instruments.

| 13 |

The Company accounts for its derivative liabilities, at fair value, on a recurring basis under level 3. See Note 7.

Embedded Conversion Features

The Company evaluates embedded conversion features within convertible debt under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature(s) should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates all of it financial instruments, including stock purchase warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives.

For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported as charges or credits to income. For option-based simple derivative financial instruments, the Company uses the Binomial option-pricing model to value the derivative instruments at inception and subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period.

In July 2017, the FASB issued ASU 2017-11 Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivative and Hedging (Topic 815). The amendments in Part I of this Update change the classification analysis of certain equity-linked financial instruments (or embedded features) with down round features. When determining whether certain financial instruments should be classified as liabilities or equity instruments, a down round feature no longer precludes equity classification when assessing whether the instrument is indexed to an entity’s own stock. The amendment also clarifies existing disclosure requirements for equity-classified instruments. As a result, a freestanding equity-linked financial instrument (or embedded conversion option) no longer would be accounted for as a derivative liability at fair value as a result of the existence of a down round feature. For freestanding equity classified financial instruments, the amendments require entities that present earnings per share (“EPS”) in accordance with Topic 260 to recognize the effect of the down round feature when it is triggered. That effect is treated as a dividend and as a reduction of income available to common shareholders in basic EPS. Convertible instruments with embedded conversion options that have down round features are now subject to the specialized guidance for contingent beneficial conversion features (in Subtopic 470-20, Debt-Debt with Conversion and Other Options), including related EPS guidance (in Topic 260). The amendments in Part II of this Update recharacterize the indefinite deferral of certain provisions of Topic 480 that now are presented as pending content in the Codification, to a scope exception. Those amendments do not have an accounting effect.

Prior to this Update, an equity-linked financial instrument with a down round feature that otherwise is not required to be classified as a liability under the guidance in Topic 480 is evaluated under the guidance in Topic 815, Derivatives and Hedging, to determine whether it meets the definition of a derivative. If it meets that definition, the instrument (or embedded feature) is evaluated to determine whether it is indexed to an entity’s own stock as part of the analysis of whether it qualifies for a scope exception from derivative accounting. Generally, for warrants and conversion options embedded in financial instruments that are deemed to have a debt host (assuming the underlying shares are readily convertible to cash or the contract provides for net settlement such that the embedded conversion option meets the definition of a derivative), the existence of a down round feature results in an instrument not being considered indexed to an entity’s own stock. This results in a reporting entity being required to classify the freestanding financial instrument or the bifurcated conversion option as a liability, which the entity must measure at fair value initially and at each subsequent reporting date.

The amendments in this Update revise the guidance for instruments with down round features in Subtopic 815-40, Derivatives and Hedging—Contracts in Entity’s Own Equity, which is considered in determining whether an equity-linked financial instrument qualifies for a scope exception from derivative accounting. An entity still is required to determine whether instruments would be classified in equity under the guidance in Subtopic 815-40 in determining whether they qualify for that scope exception. If they do qualify, freestanding instruments with down round features are no longer classified as liabilities and embedded conversion options with down round features are no longer bifurcated.

For entities that present EPS in accordance with Topic 260, and when the down round feature is included in an equity-classified freestanding financial instrument, the value of the effect of the down round feature is treated as a dividend when it is triggered and as a numerator adjustment in the basic EPS calculation. This reflects the occurrence of an economic transfer of value to the holder of the instrument, while alleviating the complexity and income statement volatility associated with fair value measurement on an ongoing basis. Convertible instruments are unaffected by the Topic 260 amendments in this Update.

The amendments in Part 1 of this Update are a cost savings relative to former accounting. This is because, assuming the required criteria for equity classification in Subtopic 815-40 are met, an entity that issued such an instrument no longer measures the instrument at fair value at each reporting period (in the case of warrants) or separately accounts for a bifurcated derivative (in the case of convertible instruments) on the basis of the existence of a down round feature. For convertible instruments with embedded conversion options that have down round features, applying specialized guidance such as the model for contingent beneficial conversion features rather than bifurcating an embedded derivative also reduces cost and complexity. Under that specialized guidance, the issuer recognizes the intrinsic value of the feature only when the feature becomes beneficial instead of bifurcating the conversion option and measuring it at fair value each reporting period.

| 14 |

The amendments in Part II of this Update replace the indefinite deferral of certain guidance in Topic 480 with a scope exception. This has the benefit of improving the readability of the Codification and reducing the complexity associated with navigating the guidance in Topic 480.

The Company adopted this new standard on January 1, 2019; however, the Company needs to continue the derivative liabilities due to variable conversion price on some of the convertible instruments. As such, it did not have a material impact on the Company’s consolidated financial statements.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Debt Issue Costs and Debt Discount

The Company may record debt issue costs and/or debt discounts in connection with raising funds through the issuance of debt. These costs may be paid in the form of cash, or equity (such as warrants). These costs are amortized to interest expense over the life of the debt. If a conversion of the underlying debt occurs, a proportionate share of the unamortized amounts is immediately expensed.

Original Issue Discount

For certain convertible debt issued, the Company may provide the debt holder with an original issue discount. The original issue discount would be recorded to debt discount, reducing the face amount of the note and is amortized to interest expense over the life of the debt.

Extinguishments of Liabilities

The Company accounts for extinguishments of liabilities in accordance with ASC 860-10 (formerly SFAS 140) “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities”. When the conditions are met for extinguishment accounting, the liabilities are derecognized and the gain or loss on the sale is recognized.

Stock-Based Compensation - Employees

The Company accounts for its stock-based compensation in which the Company obtains employee services in share-based payment transactions under the recognition and measurement principles of the fair value recognition provisions of section 718-10-30 of the FASB Accounting Standards Codification. Pursuant to paragraph 718-10-30-6 of the FASB Accounting Standards Codification, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

If the Company is a newly formed corporation or shares of the Company are thinly traded, the use of share prices established in the Company’s most recent private placement memorandum (based on sales to third parties) (“PPM”), or weekly or monthly price observations would generally be more appropriate than the use of daily price observations as such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

The fair value of share options and similar instruments is estimated on the date of grant using a Binomial Option Model option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| 15 |

| • | Expected term of share options and similar instruments: The expected life of options and similar instruments represents the period of time the option and/or warrant are expected to be outstanding. Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and employees’ expected exercise and post-vesting employment termination behavior into the fair value (or calculated value) of the instruments. Pursuant to paragraph 718-10-S99-1, it may be appropriate to use the simplified method, i.e., expected term = ((vesting term + original contractual term) / 2), if (i) A company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term due to the limited period of time its equity shares have been publicly traded; (ii) A company significantly changes the terms of its share option grants or the types of employees that receive share option grants such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term; or (iii) A company has or expects to have significant structural changes in its business such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term. The Company uses the simplified method to calculate expected term of share options and similar instruments as the company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term.

| |

| • | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

| |

| • | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments.

| |

| • | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments.

|

Generally, all forms of share-based payments, including stock option grants, warrants and restricted stock grants and stock appreciation rights are measured at their fair value on the awards’ grant date, based on estimated number of awards that are ultimately expected to vest.

The expense resulting from share-based payments is recorded in general and administrative expense in the statements of operations.

Equity Instruments Issued to Parties Other Than Employees for Acquiring Goods or Services

In June 2018, the FASB issued ASU No. 2018-07, Compensation – Stock Compensation: Improvement to Nonemployee Share-Based Payment Accounting (Topic 718). The ASU supersedes ASC 505-50, Equity-Based Payment to Non-Employment and expends the scope of the Topic 718 to include stock-based payments granted to non-employees. Under the new guidance, the measurement date and performance and vesting conditions for stock-based payments to non-employees are aligned with those of employees, most notably aligning the award measurement date with the grant date of an award. The new guidance is required to be adopted using the modified retrospective transition approach. The Company adopted the new guidance effective January 1, 2019, with an immaterial impact on its financial statements and related disclosures.

| 16 |

The fair value of share options and similar instruments is estimated on the date of grant using a Binomial option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| • | Expected term of share options and similar instruments: Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and holder’s expected exercise behavior into the fair value (or calculated value) of the instruments. The Company uses historical data to estimate holder’s expected exercise behavior. If the Company is a newly formed corporation or shares of the Company are thinly traded the contractual term of the share options and similar instruments is used as the expected term of share options and similar instruments as the Company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term.

| |

| • | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

| |

| • | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments.

| |

| • | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments.

|

Revenue Recognition

Effective January 1, 2018, the Company adopted ASC 606 – Revenue from Contracts with Customers. Under ASC 606, the Company recognizes revenue from the commercial sales of products, licensing agreements and contracts to perform pilot studies by applying the following steps: (1) identifying the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied.

To confirm, all of our OLCC licensed cannabis retail sales operations are conducted and operated on a “cash and carry” basis- product(s) from our inventory accounts are sold to the customer(s) and the customer settles the account at time of receipt of product via cash payment at our retail store; the transaction is recorded at the time of sale in our point of sale software system. Revenue is only reported after product has been delivered to the customer and the customer has paid for the product with cash.

To date the only other revenue we have received is for ATM transactions and revenue from this activity is only reported after we receive payment via check from the ATM service provider company.

Cost of Sales

Cost of sales represents costs directly related to the purchase of goods and third party testing of the Company’s products.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the related parties include a. affiliates of the Company; b. Entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c. trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d. principal owners of the Company; e. management of the Company; f. other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g. Other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements.

| 17 |

The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, consolidated financial position, and consolidated results of operations or consolidated cash flows.

Uncertain Tax Positions

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the provisions of Section 740-10-25 for the reporting period ended March 31, 2022.

Subsequent Events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements are issued.

Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies that are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the effect of recently issued standards that are not yet effective will not have a material effect on its consolidated financial position or results of operations upon adoption.

In August 2020, the FASB issued ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815 – 40)” (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The ASU is part of the FASB’s simplification initiative, which aims to reduce unnecessary complexity in U.S. GAAP. The ASU’s amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. The Company is currently evaluating the impact ASU 2020-06 will have on its financial statements.

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following at March 31, 2022 and December 31, 2021:

| March 31, 2021 | December 31, 2021 | |||||||

| (Unaudited) | (Audited) | |||||||

| ATM Machine | $ | $ | ||||||

| Computer | ||||||||

| Furniture Fixtures | ||||||||

| HVAC | ||||||||

| Land | ||||||||

| Leasehold Improvements | ||||||||

| Machinery and Equipment | ||||||||

| Sign | ||||||||

| Structural | ||||||||

| Vehicle | ||||||||

| Total | ||||||||

| Less: Accumulated Depreciation | ( |

( |

||||||

| Property, Plant and Equipment - net | $ | $ | ||||||

| 18 |

Depreciation

expense totaled of $

On August 30, 2021 the Company elected to dispose of two (2) of the four (4) Fiat cars that it owned that it was not using. The four cars were originally purchased in September of 2017 for prices ranging from $13,584 to $14,992.

After a review of market pricing the Company was able to sell one of the cars to Carvana for $14,460, after adjustments for cost removed and accumulated depreciation removal, the sale resulted in a gain on settlement. The Company recorded a net gain on disposal of assets of $28,983.

Additionally, the second Fiat was transferred to Mr. Frank in lieu of $15,000.00 in fees owed him. See Note 11 for additional information.

On October 12, 2021, KAYS completed the sale of its Eugene, Oregon Cannabis Production and Processing Facility for gross proceeds of $1,325,000. The Company recorded a net gain on disposal of $113,861. Due to the closure of 2 stores, the Company removed net right of use assets of $173,658 and recorded a loss on disposal of assets of $173,658, during the years ended December 31, 2020.

NOTE 5 – NON-CURRENT ASSETS

Other assets consisted of the following at March 31, 2022 and December 31, 2021:

March 31, 2022 (Unaudited) | December 31, 2021 (Audited) | |||||||

| Rent Deposits | $ | $ | ||||||

| Security Deposits | ||||||||

| Other Receivable | ||||||||

| Non-Current Assets | $ | $ | ||||||

Due to the closure of 2 stores, the Company recorded a loss on deposits expensed against rent of $11,016, during year ended December 31, 2021.

NOTE 6 – CONVERTIBLE DEBT

These debts have a price adjustment provision. Therefore, the Company accounted for these Notes under ASC Topic 815-15 “Embedded Derivative.” The derivative component of the obligation is initially valued and classified as a derivative liability with an offset to discounts on convertible debt. Discounts have been amortized to interest expense over the respective term of the related note. In determining the indicated value of the convertible note issued, the Company used the Binomial Options Pricing Model with a risk-free interest rate of ranging from

0.09%

to 0.76%, volatility ranging from 131.33% to 145.54%, trading prices ranging from $0.09 per share to $0.65 per share and a conversion

price ranging from $0.15 per share. The total derivative liabilities associated with these notes were $

| 19 |

See Below Summary Table

| Convertible Debt Summary | |||||||

| Debt Type | Debt Classification | Interest Rate | Due Date | Ending | |||

| CT | LT | 3/31/2022 | 12/31/2021 | ||||

| A | Convertible | X | |

$ | |||

| B | Convertible | X | |

| |||

| C | Convertible | X | |

| |||

| D | Convertible | X | |

| |||

| O | Convertible | X | |

| |||

| P | Convertible | X | |

| |||

| Q | Convertible | X | |

| |||

| S | Convertible | X | |

| |||

| T | Convertible | X | |

| |||

| CC | Convertible | X | |

| |||

| KK | Convertible | X | |

| |||

| LL | Convertible | X | |

| |||

| MM | Convertible | X | |

| |||

| NN | Convertible | X | |

| |||

| OO | Convertible | X | |

| |||

| PP | Convertible | X | |

| |||

| Convertible | X | |

| ||||

| RR | Convertible | X | |

| |||

| SS | Convertible | X | |

| |||

| TT | Convertible | X | |

| |||

| UU | Convertible | X | |

| |||

| VV | Convertible | X | |

| |||

| XX | Convertible | X | |

| |||

| YY | Convertible | X | |

| |||

| ZZ | Convertible | X | |

| |||

| AAA | Convertible | X | |

| |||

| BBB | Convertible | X | |

| |||

| DDD | Convertible | X | |

| |||

| EEE | Convertible | X | |

| |||

| GGG | Convertible | X | |

| |||

| JJJ | Convertible | X | |

| |||

| LLL | Convertible | X | |

| |||

| MMM | Convertible | X | |

| |||

| PPP | Convertible | X | |

| |||

| SSS | Convertible | X | |

| |||

| TTT | Convertible | X | |

| |||

| VVV | Convertible | X | |

| |||

| WWW | Convertible | X | |

| |||

| XXX | Convertible | X | |

| |||

| YYY | Convertible | X | |

| |||

| ZZZ | Convertible | X | |

| |||

| AAAA | Convertible | X | |

| |||

| Total Convertible Debt | |

| |||||

| Less: Discount | ( |

( | |||||

| Convertible Debt, Net of Discounts | $ |

$ | |||||

| Convertible Debt, Net of Discounts, Current | $ |

$ | |||||

| Convertible Debt, Net of Discounts, Long-term | $ |

$ | |||||

| 20 |

FOOTNOTES FOR CONVERTIBLE DEBT ACTIVITY FOR THREE MONTHS ENDED MARCH 31, 2022

During the three months ended March 31, 2022, there was no new or converted activity to convertible notes payable.

NOTE 7 – NON-CONVERTIBLE DEBT

March 31, 2021 | December 31, 2020 | |||||||

| Note 5 | ||||||||

| Total Non-Convertible Debt | ||||||||

(5) On September 16, 2016, the Company received a total of $31,661 to be used for equipment in exchange for a two year note in the aggregate amount of $31,661 with interest accruing at 18% per year and a 10% loan fee. The note is default as of March 31, 2021 with an outstanding balance of $9,312.

| B-Related Party | ||||||||

| Loan payable - Stockholder, 0%, Due December 31, 2021 (1) | $ | $ | ||||||

| $ | $ | |||||||

| (1) |

NOTE 8 – STOCKHOLDERS’ EQUITY

The Company has 10,000,000 shares of preferred stock authorized with a par value of $0.001, of which 100,000 shares have been designated as Series C convertible preferred stock (“Series C” or “Series C preferred stock”). The Company has 10,000,000 shares of preferred stock authorized The Board has the authority to issue the shares in one or more series and to fix the designations, preferences, powers and other rights, as it deems appropriate.

Each share of Series C has 434 votes on any matters submitted to a vote of the stockholders of the Company and is entitled to dividends equal to the dividends of 434 shares of common stock. Each share of Series C preferred stock is convertible at any time at the option of the holder into 434 shares of common stock.

On December 27, 2021 the Company entered into an Exchange Agreement with Craig Frank and BMN Consultants, Inc. for the 50,000 Series C Preferred Shares of Kaya Holdings that they each held, 100,000 total shares.