|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20 16

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 1-10899

Kimco Realty Corporation

(Exact name of registrant as specified in its charter)

|

Maryland |

13-2744380 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3333 New Hyde Park Road, New Hyde Park, NY 11042-0020

(Address of principal executive offices) (Zip Code)

(516) 869-9000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on |

|

|

which registered |

||

|

Common Stock, par value $.01 per share. |

|

New York Stock Exchange |

|

Depositary Shares, each representing one-thousandth of a share of 6.00% Class I Cumulative Redeemable

|

|

New York Stock Exchange |

|

Depositary Shares, each representing one-thousandth of a share of 5.50% Class J Cumulative Redeemable

|

New York Stock Exchange |

|

|

Depositary Shares, each representing one-thousandth of a share of 5.625% Class K Cumulative Redeemable

|

|

New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☑ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

(Do not check if a smaller reporting company.) |

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $12.8 billion based upon the closing price on the New York Stock Exchange for such equity on June 30, 2016.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

As of February 22, 2017, the registrant had 425,629,020 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference to the Registrant's definitive proxy statement to be filed with respect to the Annual Meeting of Stockholders expected to be held on April 25, 2017.

Index to Exhibits begins on page 36.

TABLE OF CONTENTS

|

Item No . |

Form 10-K

|

|

|

PART I |

||

|

1. |

3 |

|

|

1A. |

6 |

|

|

1B. |

12 |

|

|

2. |

12 |

|

|

3. |

13 |

|

|

4. |

13 |

|

|

PART II |

||

|

5. |

14 |

|

|

6. |

16 |

|

|

7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

|

7A. |

33 |

|

|

8. |

33 |

|

|

9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

33 |

|

9A. |

33 |

|

|

9B. |

34 |

|

|

PART III |

||

|

10. |

34 |

|

|

11. |

34 |

|

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

34 |

|

13. |

Certain Relationships and Related Transactions, and Director Independence |

34 |

|

14. |

34 |

|

|

PART IV |

||

|

15. |

35 |

|

|

16. |

35 |

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Form 10-K”), together with other statements and information publicly disseminated by Kimco Realty Corporation (the “Company”) contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “target,” “forecast” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and could materially affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to (i) general adverse economic and local real estate conditions, (ii) the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business, (iii) financing risks, such as the inability to obtain equity, debt or other sources of financing or refinancing on favorable terms to the Company, (iv) the Company’s ability to raise capital by selling its assets, (v) changes in governmental laws and regulations, (vi) the level and volatility of interest rates and foreign currency exchange rates and managements’ ability to estimate the impact thereof, (vii) risks related to the Company’s international operations, (viii) the availability of suitable acquisition, disposition, development and redevelopment opportunities, and risks related to acquisitions not performing in accordance with our expectations, (ix) valuation and risks related to the Company’s joint venture and preferred equity investments, (x) valuation of marketable securities and other investments, (xi) increases in operating costs, (xii) changes in the dividend policy for the Company’s common stock, (xiii) the reduction in the Company’s income in the event of multiple lease terminations by tenants or a failure by multiple tenants to occupy their premises in a shopping center, (xiv) impairment charges, (xv) unanticipated changes in the Company’s intention or ability to prepay certain debt prior to maturity and/or hold certain securities until maturity and (xvi) the risks and uncertainties identified under Item 1A, “Risk Factors” and elsewhere in this Form 10-K and in the Company’s other filings with the Securities and Exchange Commission (“SEC”). Accordingly, there is no assurance that the Company’s expectations will be realized. The Company disclaims any intention or obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to refer to any further disclosures the Company makes or related subjects in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K that the Company files with the SEC.

Item 1. Business

Background

Kimco Realty Corporation, a Maryland corporation, is one of the nation's largest owners and operators of open-air shopping centers. The terms "Kimco," the "Company," "we," "our" and "us" each refer to Kimco Realty Corporation and our subsidiaries, unless the context indicates otherwise. The Company is a self-administered real estate investment trust ("REIT") and has owned and operated open-air shopping centers for more than 50 years. The Company has not engaged, nor does it expect to retain, any REIT advisors in connection with the operation of its properties. As of December 31, 2016, the Company had interests in 525 shopping center properties (the “Combined Shopping Center Portfolio”), aggregating 85.4 million square feet of gross leasable area (“GLA”), located in 34 states, Puerto Rico and Canada. In addition, the Company had 384 other property interests, primarily through the Company’s preferred equity investments and other real estate investments, totaling 6.3 million square feet of GLA. The Company’s ownership interests in real estate consist of its consolidated portfolio and portfolios where the Company owns an economic interest, such as properties in the Company’s investment real estate management programs, where the Company partners with institutional investors and also retains management.

The Company's executive offices are located at 3333 New Hyde Park Road, New Hyde Park, New York 11042-0020 and its telephone number is (516) 869-9000. Nearly all operating functions, including leasing, legal, construction, data processing, maintenance, finance and accounting are administered by the Company from its executive offices in New Hyde Park, New York and supported by the Company’s regional offices. As of December 31, 2016, a total of 551 persons were employed by the Company.

The Company’s Web site is located at http://www.kimcorealty.com . The information contained on our Web site does not constitute part of this Form 10-K. On the Company’s Web site you can obtain, free of charge, a copy of this Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended, as soon as reasonably practicable, after we file such material electronically with, or furnish it to, the SEC. The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov .

The Company began operations through its predecessor, The Kimco Corporation, which was organized in 1966 upon the contribution of several shopping center properties owned by its principal stockholders. In 1973, these principals formed the Company as a Delaware corporation, and, in 1985, the operations of The Kimco Corporation were merged into the Company. The Company completed its initial public stock offering (the "IPO") in November 1991, and, commencing with its taxable year which began January 1, 1992, elected to qualify as a REIT in accordance with Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the "Code"). If, as the Company believes, it is organized and operates in such a manner so as to qualify and remain qualified as a REIT under the Code, the Company generally will not be subject to federal income tax, provided that distributions to its stockholders equal at least the amount of its REIT taxable income, as defined under the Code. In 1994, the Company reorganized as a Maryland corporation. In March 2006, the Company was added to the S & P 500 Index, an index containing the stock of 500 Large Cap companies, most of which are U.S. corporations. The Company's common stock, Class I Depositary Shares, Class J Depositary Shares and Class K Depositary Shares are traded on the New York Stock Exchange (“NYSE”) under the trading symbols “KIM”, “KIMprI”, “KIMprJ” and “KIMprK”, respectively.

The Company’s initial growth resulted primarily from real estate under development and the construction of shopping centers. Subsequently, the Company revised its growth strategy to focus on the acquisition of existing shopping centers and continued its expansion across the nation. The Company implemented its investment real estate management format through the establishment of various institutional joint venture programs, in which the Company has noncontrolling interests. The Company earns management fees, acquisition fees, disposition fees as well as promoted interests based on achieving certain performance metrics. The Company continued its geographic expansion with investments in Canada, Puerto Rico, Mexico, Chile, Brazil and Peru; however, during 2013, based upon a perceived change in market conditions, the Company began its efforts to exit its investments in Mexico and South America. During 2015, the Company began its efforts to exit its investments in Canada. As of December 31, 2016, the Company had essentially sold all of its operating properties in Canada, substantially liquidated its investments in Mexico and had completely exited South America by liquidating its investments in Chile, Brazil and Peru. The Company’s revenues and equity in income (including gains on sales and impairment losses) from its foreign investments in U.S. dollar equivalents and their respective local currencies are as follows (in millions):

|

2016 |

2015 |

2014 |

||||||||||

|

Revenues (consolidated in USD): |

||||||||||||

|

Mexico |

$ | 0.6 | $ | 1.9 | $ | 29.4 | ||||||

|

Peru |

$ | - | $ | - | $ | 0.1 | ||||||

|

Chile |

$ | - | $ | 6.7 | $ | 8.1 | ||||||

|

Revenues (consolidated in local currencies): |

||||||||||||

|

Mexico (Mexican Pesos “MXN”) |

11.3 | 28.2 | 382.3 | |||||||||

|

Peru (Peruvian Nuevo Sol) |

- | - | 0.4 | |||||||||

|

Chile (Chilean Pesos “CLP”) |

- | 4,264.9 | 4,485.9 | |||||||||

|

Equity in income (unconsolidated joint ventures, including preferred equity investments in USD): |

||||||||||||

|

Canada (1) |

$ | 152.6 | $ | 409.1 | $ | 49.3 | ||||||

|

Mexico (2) (3) |

$ | (3.6 | ) | $ | (1.6 | ) | $ | (3.7 | ) | |||

|

Chile (4) |

$ | - | $ | 0.9 | $ | (0.1 | ) | |||||

|

Equity in income (unconsolidated joint ventures, including preferred equity investments in local currencies): |

||||||||||||

| Canada (Canadian dollars “CAD”) (1) | 199.5 | 540.1 | 54.6 | |||||||||

|

Mexico (MXN) |

29.2 | (24.0 | ) | 550.8 | ||||||||

|

Chile (CLP) |

- | - | (55.3 | ) | ||||||||

|

(1) |

Includes gains of $141.9 million (CAD 185.9 million) and $373.8 million (CAD 439.9 million) on disposition of equity interests for the years ended December 31, 2016 and 2015, respectively. |

|

(2) |

Includes equity losses of $5.2 million, equity losses of $0.8 million, and equity income of $0.4 million for the years ended December 31, 2016, 2015 and 2014, respectively, related to foreign investments for which the reporting currency is denominated in USD and not subject to foreign translation exposure. |

|

(3) |

Included in the year ended December 31, 2014 is the release of cumulative foreign currency translation adjustment (“CTA”) of $47.3 million in equity losses. |

|

(4) |

Included in the year ended December 31, 2015 is the release of CTA of $0.8 million in equity income. |

The Company maintains certain subsidiaries which made joint elections with the Company to be treated as taxable REIT subsidiaries (“TRSs”), which permit the Company to engage in certain business activities which the REIT may not conduct directly. These activities have included (i) ground-up real estate under development of open-air shopping centers and the subsequent sale thereof upon completion, (ii) retail real estate management and disposition services, which primarily focused on leasing and disposition strategies for real estate property interests of both healthy and distressed retailers and (iii) the Company’s investment in AB Acquisition, LLC, which consists of grocers Safeway, Albertsons, Vons and other banners (collectively “Albertsons”). A TRS is subject to federal and state income taxes on its income, and the Company includes a provision for taxes in its consolidated financial statements. Effective August 1, 2016, the Company merged Kimco Realty Services Inc. ("KRS"), a TRS, into a wholly-owned Limited Liability Company (“LLC”) of the Company (the “Merger”) and no longer operates KRS as a TRS. The Company analyzed the individual assets of KRS and determined that substantially all of KRS’s assets constitute real estate assets and investments that can be directly owned by the Company without adversely affecting the Company’s status as a REIT, including its investment in Albertsons. Any non-REIT qualifying assets or activities were transferred to a newly formed TRS.

In addition, the Company has capitalized on its established expertise in retail real estate by establishing other ventures in which the Company owns a smaller equity interest and provides management, leasing and operational support for those properties. The Company has also provided preferred equity capital in the past to real estate entrepreneurs and, from time to time, provides real estate capital and management services to both healthy and distressed retailers. The Company has also made selective investments in secondary market opportunities where a security or other investment is, in management’s judgment, priced below the value of the underlying assets, however these investments are subject to volatility within the equity and debt markets.

Operati n g and Investment Strategy

The Company’s strategy is to be the premier owner and operator of open-air shopping centers through investments primarily in the U.S. To achieve this strategy the Company is (i) continuing to transform the quality of its portfolio by disposing of lesser quality assets and acquiring larger higher quality properties in key markets identified by the Company, for which substantial progress has been achieved as of the end of 2016, (ii) simplifying its business by: (a) reducing the number of joint venture investments and (b) exiting Mexico, South America and Canada, for which the exit of South America has been completed, Mexico has been substantially completed and the Company essentially sold all operating properties in Canada, (iii) pursuing redevelopment opportunities within its portfolio to increase overall value and (iv) selectively acquiring land parcels in our key markets for real estate development projects for long-term investment. As part of the Company’s strategy each property is evaluated for its highest and best use, which may include residential and mixed-use components. In addition, the Company may consider other opportunistic investments related to retailer controlled real estate such as, repositioning underperforming retail locations, retail real estate financing and bankruptcy transaction support. The Company has an active capital recycling program which provides for the disposition of certain U.S. properties. If the Company accepts sales prices for any of these assets that are less than their net carrying values, the Company would be required to take impairment charges and such amounts could be material. In order to execute the Company’s strategy, the Company intends to continue to strengthen its balance sheet by pursuing deleveraging efforts over time, providing it the necessary flexibility to invest opportunistically and selectively, primarily focusing on U.S. open-air shopping centers.

The Company's investment objective is to increase cash flow, current income and, consequently, the value of its existing portfolio of properties and to seek continued growth in desirable demographic areas with successful retailers through (i) the retail re-tenanting, renovation and expansion of its existing centers and (ii) the selective acquisition of established income-producing real estate properties and properties requiring significant re-tenanting and redevelopment, primarily in open-air shopping centers in geographic regions in which the Company presently operates. The Company may consider investments in other real estate sectors and in geographic markets where it does not presently operate should suitable opportunities arise.

The Company's open-air shopping center properties are designed to attract local area customers and are typically anchored by a national or regional discount department store, grocery store or drugstore tenant offering day-to-day necessities rather than high-priced luxury items. The Company may either purchase or lease income-producing properties in the future and may also participate with other entities in property ownership through partnerships, joint ventures or similar types of co-ownership. Equity investments may be subject to existing mortgage financing and/or other indebtedness. Financing or other indebtedness may be incurred simultaneously or subsequently in connection with such investments. Any such financing or indebtedness would have priority over the Company’s equity interest in such property. The Company may make loans to joint ventures in which it may or may not participate.

The Company seeks to reduce its operating and leasing risks through diversification achieved by the geographic distribution of its properties and a large tenant base. As of December 31, 2016, no single open-air shopping center accounted for more than 1.9% of the Company's annualized base rental revenues, including the proportionate share of base rental revenues from properties in which the Company has less than a 100% economic interest, or more than 1.5% of the Company’s total shopping center GLA. At December 31, 2016, the Company’s five largest tenants were TJX Companies, The Home Depot, Ahold Delhaize, Bed Bath & Beyond and Albertsons which represented 3.4%, 2.4%, 2.1%, 2.0% and 1.8%, respectively, of the Company’s annualized base rental revenues, including the proportionate share of base rental revenues from properties in which the Company has less than a 100% economic interest.

As one of the original participants in the growth of the shopping center industry and one of the nation's largest owners and operators of open-air shopping centers, the Company has established close relationships with a large number of major national and regional retailers and maintains a broad network of industry contacts. Management is associated with and/or actively participates in many shopping center and REIT industry organizations. Notwithstanding these relationships, there are numerous regional and local commercial developers, real estate companies, financial institutions and other investors who compete with the Company for the acquisition of properties and other investment opportunities and in seeking tenants who will lease space in the Company’s properties.

Item 1A. Risk Factors

We are subject to certain business and legal risks including, but not limited to, the following:

Loss of our tax status as a REIT or changes in federal tax laws, regulations, administrative interpretations or court decisions relating to REITs could have significant adverse consequences to us and the value of our securities.

We have elected to be taxed as a REIT for federal income tax purposes under the Code. We believe that we are organized and operate in a manner that has allowed us to qualify and will allow us to remain qualified as a REIT under the Code. However, there can be no assurance that we have qualified or will continue to qualify as a REIT for federal income tax purposes.

Qualification as a REIT involves the application of highly technical and complex Code provisions, for which there are only limited judicial and administrative interpretations. The determination of various factual matters and circumstances not entirely within our control may affect our ability to qualify as a REIT. The rules dealing with federal income taxation are constantly under review by persons involved in the legislative process and by the IRS and U.S. Department of the Treasury. We cannot predict how changes in the tax laws might affect our investors or us. New legislation, regulations, administrative interpretations or court decisions could significantly and negatively change the tax laws with respect to qualification as a REIT, the federal income tax consequences of such qualification or the desirability of an investment in a REIT relative to other investments.

In order to qualify as a REIT, we must satisfy a number of requirements, including requirements regarding the composition of our assets and a requirement that at least 95% of our gross income in any year be derived from qualifying sources, such as “rents from real property.” Also, we must make distributions to stockholders aggregating annually at least 90% of our REIT taxable income, excluding net capital gains. Furthermore, we own a direct or indirect interest in certain subsidiary REITs which elected to be taxed as REITs for federal income tax purposes under the Code. Provided that each subsidiary REIT qualifies as a REIT, our interest in such subsidiary REIT will be treated as a qualifying real estate asset for purposes of the REIT asset tests. To qualify as a REIT, the subsidiary REIT must independently satisfy all of the REIT qualification requirements. The failure of a subsidiary REIT to qualify as a REIT could have an adverse effect on our ability to comply with the REIT income and asset tests, and thus our ability to qualify as a REIT.

If we lose our REIT status, we will face serious tax consequences that will substantially reduce the funds available to pay dividends to stockholders for each of the years involved because:

|

● |

we would not be allowed a deduction for dividends to stockholders in computing our taxable income and we would be subject to federal income tax at regular corporate rates; |

|

● |

we could be subject to the federal alternative minimum tax and possibly increased state and local taxes; |

|

● |

unless we were entitled to relief under statutory provisions, we could not elect to be taxed as a REIT for four taxable years following the year during which we were disqualified; and |

|

● |

we would not be required to make distributions to stockholders. |

As a result of all these factors, our failure to qualify as a REIT or new legislation changes in federal tax laws with respect to qualification as a REIT or the tax consequences of such qualification could also impair our ability to expand our business or raise capital and materially adversely affect the value of our securities.

To maintain our REIT status, we may be forced to borrow funds during unfavorable market conditions , and the unavailability of such capital on favorable terms at the desired times, or at all, may cause us to curtail our inves tment activities and/or to dispose of assets at inopportune times, which could adversely affect our financial condition, results of operations, cash flow and per share trading price of our common stock .

To qualify as a REIT, we generally must distribute to our stockholders at least 90% of our net taxable income each year, excluding net capital gains, and we will be subject to regular corporate income taxes on the amount we distribute that is less than 100% of our net taxable income each year, including capital gains. In addition, we will be subject to a 4% nondeductible excise tax on the amount, if any, by which distributions paid by us in any calendar year are less than the sum of 85% of our ordinary income, 95% of our capital gain net income and 100% of our undistributed income from prior years. While we have historically satisfied these distribution requirements by making cash distributions to our stockholders, a REIT is permitted to satisfy these requirements by making distributions of cash or other property, including, in limited circumstances, its own stock. Assuming we continue to satisfy these distribution requirements with cash, we may need to borrow funds to meet the REIT distribution requirements and avoid the payment of income and excise taxes even if the then prevailing market conditions are not favorable for these borrowings. These borrowing needs could result from differences in timing between the actual receipt of cash and inclusion of income for federal income tax purposes, or the effect of non-deductible capital expenditures, the creation of cash reserves or required debt or amortization payments. These sources, however, may not be available on favorable terms or at all. Our access to third-party sources of capital depends on a number of factors, including the market's perception of our growth potential, our current debt levels, the market price of our common stock, and our current and potential future earnings. We cannot assure you that we will have access to such capital on favorable terms at the desired times, or at all, which may cause us to curtail our investment activities and/or to dispose of assets at inopportune times, and could adversely affect our financial condition, results of operations, cash flow and per share trading price of our common stock.

The tax imposed on REITs engaging in “prohibited transactions” may limit our ability to engage in transactions which would be treated as sales for federal income tax purposes.

A REIT's net income from prohibited transactions is subject to a 100% penalty tax. In general, prohibited transactions are sales or other dispositions of property, other than foreclosure property, held primarily for sale to customers in the ordinary course of business. Although we do not intend to hold any properties that would be characterized as held for sale to customers in the ordinary course of our business, unless a sale or disposition qualifies under certain statutory safe harbors, such characterization is a factual determination and no guarantee can be given that the IRS would agree with our characterization of our properties or that we will always be able to make use of the available safe harbors.

Adverse global market and economic conditions may impede our ability to generate sufficient income and maintain our properties.

The economic performance and value of our properties is subject to all of the risks associated with owning and operating real estate, including but not limited to:

|

● |

changes in the national, regional and local economic climate; |

|

● |

local conditions, including an oversupply of, or a reduction in demand for, space in properties like those that we own; |

|

● |

trends toward smaller store sizes as retailers reduce inventory and new prototypes; |

|

● |

increasing use by customers of e-commerce and online store sites; |

|

● |

the attractiveness of our properties to tenants; |

|

● |

the ability of tenants to pay rent, particularly anchor tenants with leases in multiple locations; |

|

● |

tenants who may declare bankruptcy and/or close stores; |

|

● |

competition from other available properties to attract and retain tenants; |

|

● |

changes in market rental rates; |

|

● |

the need to periodically pay for costs to repair, renovate and re-let space; |

|

● |

changes in operating costs, including costs for maintenance, insurance and real estate taxes; |

|

● |

the expenses of owning and operating properties, which are not necessarily reduced when circumstances such as market factors and competition cause a reduction in income from the properties; |

|

● |

changes in laws and governmental regulations, including those governing usage, zoning, the environment and taxes; |

|

● |

acts of terrorism and war, acts of God and physical and weather-related damage to our properties; and |

|

● |

the potential risk of functional obsolescence of properties over time. |

Competition may limit our ability to purchase new properties or generate sufficient income from tenants and may decrease the occupancy and rental rates for our properties.

Our properties consist primarily of open-air shopping centers and other retail properties. Our performance, therefore, is generally linked to economic conditions in the market for retail space. In the future, the market for retail space could be adversely affected by:

|

● |

weakness in the national, regional and local economies; |

|

● |

the adverse financial condition of some large retailing companies; |

|

● |

the impact of internet sales on the demand for retail space; |

|

● |

ongoing consolidation in the retail sector; and |

|

● |

the excess amount of retail space in a number of markets. |

In addition, numerous commercial developers and real estate companies compete with us in seeking tenants for our existing properties and properties for acquisition. New regional malls, open-air lifestyle centers or other retail shopping centers with more convenient locations or better rents may attract tenants or cause them to seek more favorable lease terms at or prior to renewal. Retailers at our properties may face increasing competition from other retailers, e-commerce, outlet malls, discount shopping clubs, direct mail, telemarketing or home shopping networks, all of which could (i) reduce rents payable to us; (ii) reduce our ability to attract and retain tenants at our properties; or (iii) lead to increased vacancy rates at our properties. We may fail to anticipate the effects of changes in consumer buying practices, particularly of growing online sales and the resulting retailing practices and space needs of our tenants or a general downturn in our tenants’ businesses, which may cause tenants to close stores or default in payment of rent.

Our performance depends on our ability to collect rent from tenants, including anchor tenants, our tenants’ financial condition and our tenants maintaining leases for our properties.

At any time, our tenants may experience a downturn in their business that may significantly weaken their financial condition. As a result, our tenants may delay a number of lease commencements, decline to extend or renew leases upon expiration, fail to make rental payments when due, close stores or declare bankruptcy. Any of these actions could result in the termination of tenants’ leases and the loss of rental income attributable to these tenants’ leases. In the event of a default by a tenant, we may experience delays and costs in enforcing our rights as landlord under the terms of the leases.

In addition, multiple lease terminations by tenants, including anchor tenants, or a failure by multiple tenants to occupy their premises in a shopping center could result in lease terminations or significant reductions in rent by other tenants in the same shopping centers under the terms of some leases. In that event, we may be unable to re-lease the vacated space at attractive rents or at all, and our rental payments from our continuing tenants could significantly decrease. The occurrence of any of the situations described above, particularly if it involves a substantial tenant with leases in multiple locations, could have a material adverse effect on our financial condition, results of operations and cash flows.

A tenant that files for bankruptcy protection may not continue to pay us rent. A bankruptcy filing by, or relating to, one of our tenants or a lease guarantor would bar all efforts by us to collect pre-bankruptcy debts from the tenant or the lease guarantor, or their property, unless the bankruptcy court permits us to do so. A tenant bankruptcy could delay our efforts to collect past due balances under the relevant leases and could ultimately preclude collection of these sums. If a lease is rejected by a tenant in bankruptcy, we would have only a general unsecured claim for damages. As a result, it is likely that we would recover substantially less than the full value of any unsecured claims we hold, if at all.

We may be unable to sell our real estate property investments when appropriate or on terms favorable to us .

Real estate property investments are illiquid and generally cannot be disposed of quickly. In addition, the Code restricts a REIT’s ability to dispose of properties that are not applicable to other types of real estate companies. Therefore, we may not be able to vary our portfolio in response to economic or other conditions promptly or on terms favorable to us within a timeframe that we would need.

We may acquire or develop properties or acquire other real estate related companies, and this may create risks.

We may acquire or develop properties or acquire other real estate related companies when we believe that an acquisition or development is consistent with our business strategies. We may not succeed in consummating desired acquisitions or in completing developments on time or within budget. When we do pursue a project or acquisition, we may not succeed in leasing newly developed or acquired properties at rents sufficient to cover the costs of acquisition or development and operations. Difficulties in integrating acquisitions may prove costly or time-consuming and could divert management’s attention from other activities. Acquisitions or developments in new markets or industries where we do not have the same level of market knowledge may result in poorer than anticipated performance. We may also abandon acquisition or development opportunities that management has begun pursuing and consequently fail to recover expenses already incurred and will have devoted management’s time to a matter not consummated. Furthermore, our acquisitions of new properties or companies will expose us to the liabilities of those properties or companies, some of which we may not be aware of at the time of the acquisition. In addition, development of our existing properties presents similar risks.

Newly acquired or re-developed properties may have characteristics or deficiencies currently unknown to us that affect their value or revenue potential. It is also possible that the operating performance of these properties may decline under our management. As we acquire additional properties, we will be subject to risks associated with managing new properties, including lease-up and tenant retention. In addition, our ability to manage our growth effectively will require us to successfully integrate our new acquisitions into our existing management structure. We may not succeed with this integration or effectively manage additional properties, particularly in secondary markets. Also, newly acquired properties may not perform as expected.

Unsuccessful real estate under development activities or a slowdown in real estate under development activities could have a direct impact on our growth, results of operations and cash flows.

Real estate under development is a component of our operating and investment strategy. We intend to continue pursuing select real estate under development opportunities for long-term investment and construction of retail and/or mixed use properties as opportunities arise. We expect to phase in construction until sufficient preleasing is reached. Our real estate under development and construction activities include the following risks:

|

● |

we may abandon real estate under development opportunities after expending resources and could lose all or part of our investment in such opportunities, including loss of deposits or failure to recover expenses already incurred; |

|

● |

development, construction or operating costs, including increased interest rates and higher materials, transportation, labor, leasing or other costs, may exceed our original estimates; |

|

● |

occupancy rates and rents at a newly completed property may not meet our expectations and may not be sufficient to make the property profitable; |

|

● |

construction or permanent financing may not be available to us on favorable terms or at all; |

|

● |

we may not complete construction and lease-up on schedule due to a variety of factors including construction delays or contractor changes, resulting in increased expenses and construction costs or tenants or operators with the right to terminate pre-construction leases; and |

|

● |

we may not be able to obtain, or may experience delays in obtaining, necessary zoning, land use, building, occupancy and other required governmental permits and authorizations. |

Additionally, new real estate under development activities typically require substantial time and attention from management, and the time frame required for development, construction and lease-up of these properties could require several years to realize any significant cash return. The foregoing risks could cause the development of properties to hinder the Company’s growth and have an adverse effect on its results of operations and cash flows.

Construction and development projects are subject to risks that materially increase the costs of completion.

In the event that we decide to develop and construct new properties or redevelop existing properties, we will be subject to risks and uncertainties associated with construction and development. These risks include, but are not limited to, risks related to obtaining all necessary zoning, land-use, building occupancy and other governmental permits and authorizations, risks related to the environmental concerns of government entities or community groups, risks related to changes in economic and market conditions between development commencement and stabilization, risks related to construction labor disruptions, adverse weather, acts of God or shortages of materials which could cause construction delays and risks related to increases in the cost of labor and materials which could cause construction costs to be greater than projected and adversely impact the amount of our development fees or our results of operations or financial condition.

We face competition in pursuing acquisition or development opportunities that could increase our costs.

We face competition in the acquisition, development, operation and sale of real property from others engaged in real estate investment that could increase our costs associated with purchasing and maintaining assets. Some of these competitors may have greater financial resources than we do. This could result in competition for the acquisition of properties for tenants who lease or consider leasing space in our existing and subsequently acquired properties and for other real estate investment opportunities.

We do not have exclusive control over our joint venture and preferred equity investments, such that we are unable to ensure that our objectives will be pursued.

We have invested in some properties as a co-venturer or partner, instead of owning directly. In these investments, we do not have exclusive control over the development, financing, leasing, management and other aspects of these investments. As a result, the co-venturer or partner might have interests or goals that are inconsistent with ours, take action contrary to our interests or otherwise impede our objectives. These investments involve risks and uncertainties. The co-venturer or partner may fail to provide capital or fulfill its obligations, which may result in certain liabilities to us for guarantees and other commitment. Conflicts arising between us and our partners may be difficult to manage and/or resolve and it could be difficult to manage or otherwise monitor the existing business arrangements. The co-venturer or partner also might become insolvent or bankrupt, which may result in significant losses to us.

In addition, joint venture arrangements may decrease our ability to manage risk and implicate additional risks, such as:

|

● |

potentially inferior financial capacity, diverging business goals and strategies and the need for our venture partner’s continued cooperation; |

|

● |

our inability to take actions with respect to the joint venture activities that we believe are favorable to us if our joint venture partner does not agree; |

|

● |

our inability to control the legal entity that has title to the real estate associated with the joint venture; |

|

● |

our lenders may not be easily able to sell our joint venture assets and investments or may view them less favorably as collateral, which could negatively affect our liquidity and capital resources; |

|

● |

our joint venture partners can take actions that we may not be able to anticipate or prevent, which could result in negative impacts on our debt and equity; and |

|

● |

our joint venture partners’ business decisions or other actions or omissions may result in harm to our reputation or adversely affect the value of our investments. |

Our joint venture and preferred equity investments generally own real estate properties for which the economic performance and value is subject to all the risks associated with owning and operating real estate as described above.

We intend to continue to sell our non-strategic assets and may not be able to recover our investments, which may result in significant losses to us.

There can be no assurance that we will be able to recover the current carrying amount of all of our non-strategic properties and investments and those of our unconsolidated joint ventures in the future. Our failure to do so would require us to recognize impairment charges for the period in which we reached that conclusion, which could materially and adversely affect our business, financial condition, operating results and cash flows.

We have completed, or have nearly completed, our efforts to exit our investments in Mexico, South America and Canada, however, we cannot predict the impact of laws and regulations affecting these international operations, including the United States Foreign Corrupt Practices Act, or the potential that we may face regulatory sanctions.

Our international operations have included properties in Canada, Mexico, Chile, Brazil and Peru and are subject to a variety of United States and foreign laws and regulations, including the United States Foreign Corrupt Practices Act (“FCPA”) and foreign tax laws and regulations. Although we have completely, or have nearly completed, our efforts to exit our investments in Mexico, South America and Canada, we cannot assure you that our past or any current international operations will continue to be found to be in compliance with such laws or regulations. In addition, we cannot predict the manner in which such laws or regulations might be administered or interpreted, or when, or the potential that we may face regulatory sanctions or tax audits as a result of our international operations.

We have received a subpoena from the Enforcement Division of the SEC in connection with the SEC’s investigation, In the Matter of Wal-Mart Stores, Inc. (FW-3678), that the SEC Staff is currently conducting with respect to possible violations of the FCPA. We have cooperated, and will continue to cooperate, with the SEC and the U.S. Department of Justice (“DOJ”), which is conducting a parallel investigation. At this point, we are unable to predict the duration, scope or result of the SEC or DOJ investigations. See “Item 3. Legal Proceedings,” below. The DOJ and the SEC have a broad range of civil and criminal sanctions under the FCPA and other laws and regulations, which they may seek to impose against corporations and individuals in appropriate circumstances including, but not limited to, injunctive relief, disgorgement, fines, penalties and modifications to business practices and compliance programs. Any of these remedial measures, if applicable to us, could have a material adverse impact on our business, results of operations, financial condition and liquidity.

We face risks relating to cybersecurity attacks, loss of confidential information and other business disruptions.

Our business is at risk from and may be impacted by cybersecurity attacks, including attempts to gain unauthorized access to our confidential data and other electronic security breaches. Such cyber-attacks can range from individual attempts to gain unauthorized access to our information technology systems to more sophisticated security threats. There is no guarantee that the measures we employ to prevent, detect and mitigate these threats will be successful in preventing a cyber-attack. Cybersecurity incidents could compromise the confidential information of our tenants, employees and third party vendors and disrupt and effect the efficiency of our business operations.

We may be unable to obtain financing through the debt and equities market, which would have a material adverse effect on our growth strategy, our results of operations and our financial condition.

W e cannot assure you that we will be able to access the credit and/or equity markets to obtain additional debt or equity financing or that we will be able to obtain financing on terms favorable to us. The inability to obtain financing on a timely basis could have negative effects on our business, such as:

|

● |

we could have great difficulty acquiring or developing properties, which would materially adversely affect our business strategy; |

|

● |

our liquidity could be adversely affected; |

|

● |

we may be unable to repay or refinance our indebtedness; |

|

● |

we may need to make higher interest and principal payments or sell some of our assets on terms unfavorable to us to fund our indebtedness; or |

|

● |

we may need to issue additional capital stock, which could further dilute the ownership of our existing shareholders. |

Adverse changes in our credit ratings could impair our ability to obtain additional debt and equity financing on terms favorable to us, if at all, and could significantly reduce the market price of our publicly traded securities.

We are subject to f inancial covenants that may restrict our operating and acquisition activities.

Our revolving credit facility, term loan and the indentures under which our senior unsecured debt is issued contain certain financial and operating covenants, including, among other things, certain coverage ratios and limitations on our ability to incur debt, make dividend payments, sell all or substantially all of our assets and engage in mergers and consolidations and certain acquisitions. These covenants may restrict our ability to pursue certain business initiatives or certain acquisition transactions that might otherwise be advantageous. In addition, failure to meet any of the financial covenants could cause an event of default under our revolving credit facility, term loan and the indentures and/or accelerate some or all of our indebtedness, which would have a material adverse effect on us.

Changes in market conditions could adversely affect the market price of our publicly traded securities.

The market price of our publicly traded securities depends on various market conditions, which may change from time-to-time. Among the market conditions that may affect the market price of our publicly traded securities are the following:

|

● |

the extent of institutional investor interest in us; |

|

● |

the reputation of REITs generally and the reputation of REITs with portfolios similar to ours; |

|

● |

the attractiveness of the securities of REITs in comparison to securities issued by other entities, including securities issued by other real estate companies; |

|

● |

our financial condition and performance; |

|

● |

the market’s perception of our growth potential, potential future cash dividends and risk profile; |

|

● |

an increase in market interest rates, which may lead prospective investors to demand a higher distribution rate in relation to the price paid for our shares; and |

|

● |

general economic and financial market conditions. |

We may change the dividend policy for our common stock in the future.

The decision to declare and pay dividends on our common stock in the future, as well as the timing, amount and composition of any such future dividends, will be at the sole discretion of our Board of Directors and will depend on our earnings, operating cash flows, liquidity, financial condition, capital requirements, contractual prohibitions or other limitations under our indebtedness including preferred stock, the annual distribution requirements under the REIT provisions of the Code, state law and such other factors as our Board of Directors deems relevant or are requirements under the Code or state or federal laws. Any negative change in our dividend policy could have a material adverse effect on the market price of our common stock.

We may not be able to recover our investments in mortgage receivables or other investments , which may result in significant losses to us.

In the event of a default by a borrower, it may be necessary for us to foreclose our mortgage or engage in costly negotiations. Delays in liquidating defaulted mortgage loans and repossessing and selling the underlying properties could reduce our investment returns. Furthermore, in the event of default, the actual value of the property securing the mortgage may decrease. A decline in real estate values will adversely affect the value of our loans and the value of the mortgages securing our loans.

Our mortgage receivables may be or become subordinated to mechanics' or materialmen's liens or property tax liens. In these instances, we may need to protect a particular investment by making payments to maintain the current status of a prior lien or discharge it entirely. Where that occurs, the total amount we recover may be less than our total investment, resulting in a loss. In the event of a major loan default or several loan defaults resulting in losses, our investments in mortgage receivables would be materially and adversely affected.

The economic performance and value of our other investments which we do not control and are in retail operations, are subject to risks associated with owning and operating retail businesses, including:

|

● |

changes in the national, regional and local economic climate; |

|

● |

the adverse financial condition of some large retailing companies; |

|

● |

increasing use by customers of e-commerce and online store sites; and |

|

● |

ongoing consolidation in the retail sector, |

A decline in the value of our other investments may require us to recognize an other-than-temporary impairment (“OTTI”) against such assets. When the fair value of an investment is determined to be less than its amortized cost at the balance sheet date, we assess whether the decline is temporary or other-than-temporary. If we intend to sell an impaired asset, or it is more likely than not that we will be required to sell the impaired asset before any anticipated recovery, then we must recognize an OTTI through charges to earnings equal to the entire difference between the assets amortized cost and its fair value at the balance sheet date. When an OTTI is recognized through earnings, a new cost basis is established for the asset and the new cost basis may not be adjusted through earnings for subsequent recoveries in fair value.

We may be subject to liability under environmental laws, ordinances and regulations.

Under various federal, state, and local laws, ordinances and regulations, we may be considered an owner or operator of real property and may be responsible for paying for the disposal or treatment of hazardous or toxic substances released on or in our property, as well as certain other potential costs relating to hazardous or toxic substances (including governmental fines and injuries to persons and property). This liability may be imposed whether or not we knew about, or were responsible for, the presence of hazardous or toxic substances.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

Real Estate Portfolio . As of December 31, 2016, the Company had interests in 525 shopping center properties aggregating 85.4 million square feet of GLA located in 34 states, Puerto Rico and Canada. In addition, the Company had 384 other property interests, primarily through the Company’s preferred equity investments and other real estate investments, totaling 6.3 million square feet of GLA. The Company’s portfolio includes noncontrolling interests. Open-air shopping centers comprise the primary focus of the Company's current portfolio. As of December 31, 2016, the Company’s Combined Shopping Center Portfolio was 95.4% leased.

The Company's open-air shopping center properties, which are generally owned and operated through subsidiaries or joint ventures, had an average size of 162,618 square feet as of December 31, 2016. The Company generally retains its shopping centers for long-term investment and consequently pursues a program of regular physical maintenance together with major renovations and refurbishing to preserve and increase the value of its properties. This includes renovating existing facades, installing uniform signage, resurfacing parking lots and enhancing parking lot lighting. During 2016, the Company expended $143.5 million in connection with these property improvements and expensed to operations $34.3 million.

The Company's management believes its experience in the real estate industry and its relationships with numerous national and regional tenants gives it an advantage in an industry where ownership is fragmented among a large number of property owners. The Company's open-air shopping centers are usually "anchored" by a national or regional discount department store, grocery store or drugstore. As one of the original participants in the growth of the shopping center industry and one of the nation's largest owners and operators of shopping centers, the Company has established close relationships with a large number of major national and regional retailers. Some of the major national and regional companies that are tenants in the Company's shopping center properties include TJX Companies, The Home Depot, Ahold Delhaize, Bed Bath & Beyond, Albertsons, Ross Stores, Petsmart, Kohl’s, Wal-Mart and Whole Foods.

A substantial portion of the Company's income consists of rent received under long-term leases. Most of the leases provide for the payment of fixed-base rentals monthly in advance and for the payment by tenants of an allocable share of the real estate taxes, insurance, utilities and common area maintenance expenses incurred in operating the shopping centers. Although many of the leases require the Company to make roof and structural repairs as needed, a number of tenant leases place that responsibility on the tenant, and the Company's standard small store lease provides for roof repairs to be reimbursed by the tenant as part of common area maintenance.

Minimum base rental revenues and operating expense reimbursements accounted for 98% and other revenues, including percentage rents, accounted for 2% of the Company's total revenues from rental properties for the year ended December 31, 2016. The Company's management believes that the base rent per leased square foot for many of the Company's existing leases is generally lower than the prevailing market-rate base rents in the geographic regions where the Company operates, reflecting the potential for future growth.

Approximately 29.8% of the Company's leases of consolidated properties also contain provisions requiring the payment of additional rent calculated as a percentage of tenants’ gross sales above predetermined thresholds. Percentage rents accounted for less than 1% of the Company's revenues from rental properties for the year ended December 31, 2016. Additionally, a majority of the Company’s leases have provisions requiring contractual rent increases. The Company’s leases may also include escalation clauses, which provide for increases based upon changes in the consumer price index or similar inflation indices.

As of December 31, 2016, the Company’s consolidated operating portfolio, comprised of 59.2 million square feet of GLA, was 95.2% leased. The consolidated operating portfolio consists entirely of properties located in the U.S., inclusive of Puerto Rico. For the period January 1, 2016 to December 31, 2016, the Company increased the average base rent per leased square foot, which includes the impact of tenant concessions, in its U.S. consolidated portfolio of open-air shopping centers from $14.36 to $14.99, an increase of $0.63. This increase primarily consists of (i) a $0.10 increase relating to acquisitions, (ii) a $0.19 increase relating to dispositions, and (iii) a $0.34 increase relating to new leases signed net of leases vacated and rent step-ups within the portfolio.

The Company has a total of 6,120 leases in the U.S. consolidated operating portfolio. The following table sets forth the aggregate lease expirations for each of the next ten years, assuming no renewal options are exercised. For purposes of the table, the Total Annual Base Rent Expiring represents annualized rental revenue, excluding the impact of straight-line rent, for each lease that expires during the respective year. Amounts in thousands except for number of lease data:

|

Year Ending December 31, |

Number of Leases Expiring |

Square Feet Expiring |

Total Annual Base Rent Expiring |

% of Gross Annual Rent |

|||||||||||||

| (1) | 168 | 484 | $ | 9,892 | 1.2 |

% |

|||||||||||

|

2017 |

717 | 4,075 | $ | 68,822 | 8.2 |

% |

|||||||||||

|

2018 |

894 | 6,309 | $ | 98,788 | 11.7 |

% |

|||||||||||

|

2019 |

903 | 6,653 | $ | 100,430 | 11.9 |

% |

|||||||||||

|

2020 |

819 | 6,101 | $ | 94,589 | 11.2 |

% |

|||||||||||

|

2021 |

793 | 6,745 | $ | 98,678 | 11.7 |

% |

|||||||||||

|

2022 |

518 | 5,280 | $ | 74,069 | 8.8 |

% |

|||||||||||

|

2023 |

273 | 3,425 | $ | 47,962 | 5.7 |

% |

|||||||||||

|

2024 |

237 | 2,954 | $ | 47,138 | 5.6 |

% |

|||||||||||

|

2025 |

225 | 2,168 | $ | 35,144 | 4.2 |

% |

|||||||||||

|

2026 |

234 | 3,735 | $ | 49,768 | 5.9 |

% |

|||||||||||

|

2027 |

156 | 3,033 | $ | 40,761 | 4.8 |

% |

|||||||||||

|

(1) |

Leases currently under month to month lease or in process of renewal |

During 2016, the Company executed 935 leases totaling over 6.8 million square feet in the Company’s consolidated operating portfolio comprised of 344 new leases and 591 renewals and options. The leasing costs associated with these leases are estimated to aggregate $58.4 million or $29.81 per square foot. These costs include $46.4 million of tenant improvements and $12.0 million of leasing commissions. The average rent per square foot on new leases was $18.85 and on renewals and options was $14.97. The Company will seek to obtain rents that are higher than amounts within its expiring leases, however, there are many variables and uncertainties which can significantly affect the leasing market at any time; as such, the Company cannot guarantee that future leases will continue to be signed for rents that are equal to or higher than current amounts.

Ground-Leased Properties . The Company has interests in 44 consolidated shopping center properties that are subject to long-term ground leases where a third party owns and has leased the underlying land to the Company to construct and/or operate a shopping center. The Company pays rent for the use of the land and generally is responsible for all costs and expenses associated with the building and improvements. At the end of these long-term leases, unless extended, the land together with all improvements reverts to the landowner.

More specific information with respect to each of the Company's property interests is set forth in Exhibit 99.1, which is incorporated herein by reference.

Item 3. Legal Proceedings

The Company is not presently involved in any litigation nor, to its knowledge, is any litigation threatened against the Company or its subsidiaries that, in management's opinion, would result in any material adverse effect on the Company's ownership, management or operation of its properties taken as a whole, or which is not covered by the Company's liability insurance.

On January 28, 2013, the Company received a subpoena from the Enforcement Division of the SEC in connection with an investigation, In the Matter of Wal-Mart Stores, Inc. (FW-3678), that the SEC Staff is currently conducting with respect to possible violations of the Foreign Corrupt Practices Act. The Company has cooperated, and will continue to cooperate, with the SEC and the U.S. Department of Justice (“DOJ”), which is conducting a parallel investigation. At this point, we are unable to predict the duration, scope or result of the SEC or DOJ investigations.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information :

The table below sets forth, for the quarterly periods indicated, the high and low sales prices per share reported on the NYSE Composite Tape and declared dividends per share for the Company’s common stock. The Company’s common stock is traded on the NYSE under the trading symbol "KIM".

|

Stock Price |

|||||||||||||

|

Period |

High |

Low |

Dividends |

||||||||||

|

2015: |

|||||||||||||

|

First Quarter |

$ | 28.54 | $ | 25.20 | $ | 0.24 | |||||||

|

Second Quarter |

$ | 27.06 | $ | 22.48 | $ | 0.24 | |||||||

|

Third Quarter |

$ | 25.70 | $ | 22.07 | $ | 0.24 | |||||||

|

Fourth Quarter |

$ | 27.33 | $ | 23.98 | $ | 0.255 | (a) | ||||||

|

201 6 : |

|||||||||||||

|

First Quarter |

$ | 29.11 | $ | 24.75 | $ | 0.255 | |||||||

|

Second Quarter |

$ | 31.38 | $ | 26.79 | $ | 0.255 | |||||||

|

Third Quarter |

$ | 32.24 | $ | 28.34 | $ | 0.255 | |||||||

|

Fourth Quarter |

$ | 29.23 | $ | 24.35 | $ | 0.27 | (b) | ||||||

|

(a) |

Paid on January 15, 2016 to stockholders of record on January 4, 2016. |

|

(b) |

Paid on January 15, 2017 to stockholders of record on January 3, 2017. |

Holders : The number of holders of record of the Company's common stock, par value $0.01 per share, was 2,292 as of January 31, 2017.

Dividends : Since the IPO, the Company has paid regular quarterly cash dividends to its stockholders. While the Company intends to continue paying regular quarterly cash dividends, future dividend declarations will be paid at the discretion of the Board of Directors and will depend on the actual cash flows of the Company, its financial condition, capital requirements, the annual distribution requirements under the REIT provisions of the Code and such other factors as the Board of Directors deems relevant. The Company’s Board of Directors will continue to evaluate the Company’s dividend policy on a quarterly basis as they monitor sources of capital and evaluate operating fundamentals. The Company is required by the Code to distribute at least 90% of its REIT taxable income. The actual cash flow available to pay dividends will be affected by a number of factors, including the revenues received from rental properties, the operating expenses of the Company, the interest expense on its borrowings, the ability of lessees to meet their obligations to the Company, the ability to refinance near-term debt maturities and any unanticipated capital expenditures.

The Company has determined that the $1.02 dividend per common share paid during 2016 consisted of 62% ordinary income, an 8% return of capital and 30% capital gain to its stockholders. The $0.96 dividend per common share paid during 2015 consisted of 100% capital gain to its stockholders.

In addition to its common stock offerings, the Company has capitalized the growth in its business through the issuance of unsecured fixed and floating-rate medium-term notes, underwritten bonds, unsecured bank debt, mortgage debt and construction loans, convertible preferred stock and perpetual preferred stock. Borrowings under the Company's revolving credit facility have also been an interim source of funds to both finance the purchase of properties and other investments and meet any short-term working capital requirements. The various instruments governing the Company's issuance of its unsecured public debt, bank debt, mortgage debt and preferred stock impose certain restrictions on the Company with regard to dividends, voting, liquidation and other preferential rights available to the holders of such instruments. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Footnotes 13, 14 and 17 of the Notes to Consolidated Financial Statements included in this Form 10-K.

The Company does not believe that the preferential rights available to the holders of its Class I Preferred Stock, Class J Preferred Stock and Class K Preferred Stock, the financial covenants contained in its public bond indentures, as amended, its term loan, or its revolving credit agreements will have an adverse impact on the Company's ability to pay dividends in the normal course to its common stockholders or to distribute amounts necessary to maintain its qualification as a REIT.

The Company maintains a dividend reinvestment and direct stock purchase plan (the "Plan") pursuant to which common and preferred stockholders and other interested investors may elect to automatically reinvest their dividends to purchase shares of the Company’s common stock or, through optional cash payments, purchase shares of the Company’s common stock. The Company may, from time-to-time, either (i) purchase shares of its common stock in the open market or (ii) issue new shares of its common stock for the purpose of fulfilling its obligations under the Plan.

Recent Sales of Unregister Securities:

None.

Issuer Purchases of Equity Securities : During the year ended December 31, 2016, the Company repurchased 257,477 shares in connection with common shares surrendered or deemed surrendered to the Company to satisfy statutory minimum tax withholding obligations in connection with the vesting of restricted stock awards under the Company’s equity-based compensation plans. The Company expended approximately $6.9 million to repurchase these shares.

|

Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (in millions) |

||||||||||||||

|

January 1, 2016 |

– | January 31, 2016 | 35,768 | $ | 26.46 | - | $ | - | ||||||||||

|

February 1, 2016 |

– | February 29, 2016 | 186,476 | $ | 26.37 | - | - | |||||||||||

|

March 1, 2016 |

– | March 31, 2016 | 621 | $ | 27.78 | - | - | |||||||||||

|

April 1, 2016 |

– | April 30, 2016 | - | $ | - | - | - | |||||||||||

|

May 1, 2016 |

– | May 31, 2016 | 16,069 | $ | 28.61 | - | - | |||||||||||

|

June 1, 2016 |

– | June 30, 2016 | 1,110 | $ | 29.66 | - | - | |||||||||||

|

July 1, 2016 |

– | July 31, 2016 | - | $ | - | - | - | |||||||||||

|

August 1, 2016 |

– | August 31, 2016 | 11,858 | $ | 31.27 | - | - | |||||||||||

|

September 1, 2016 |

– | September 30, 2016 | 2,056 | $ | 28.64 | - | - | |||||||||||

|

October 1, 2016 |

– | October 31, 2016 | 3,519 | $ | 27.71 | - | - | |||||||||||

|

November 1, 2016 |

– | November 30, 2016 | - | $ | - | - | - | |||||||||||

|

December 1, 2016 |

– | December 31, 2016 | - | $ | - | - | - | |||||||||||

|

Total |

257,477 | $ | 26.80 | - | $ | - | ||||||||||||

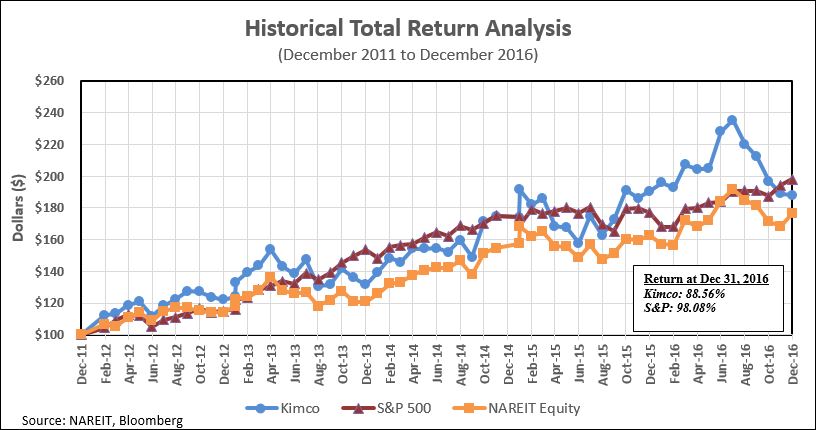

Total Stockholder Return Performance : The following performance chart compares, over the five years ended December 31, 2016, the cumulative total stockholder return on the Company’s common stock with the cumulative total return of the S&P 500 Index and the cumulative total return of the NAREIT Equity REIT Total Return Index (the "NAREIT Equity Index") prepared and published by the National Association of Real Estate Investment Trusts ("NAREIT"). Equity real estate investment trusts are defined as those which derive more than 75% of their income from equity investments in real estate assets. The NAREIT Equity Index includes all tax qualified equity real estate investment trusts listed on the New York Stock Exchange, American Stock Exchange or the NASDAQ National Market System. Stockholder return performance, presented quarterly for the five years ended December 31, 2016, is not necessarily indicative of future results. All stockholder return performance assumes the reinvestment of dividends. The information in this paragraph and the following performance chart are deemed to be furnished, not filed.

|

Item 6. Selected Financial Data

The following table sets forth selected, historical, consolidated financial data for the Company and should be read in conjunction with the Consolidated Financial Statements of the Company and Notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this Form 10-K.

The Company believes that the book value of its real estate assets, which reflects the historical costs of such real estate assets less accumulated depreciation, is not indicative of the current market value of its properties. Historical operating results are not necessarily indicative of future operating performance.

| Year ended December 31, | ||||||||||||||||||||

| 201 6 | 201 5 | 201 4 | 201 3 | 2012(2) | ||||||||||||||||

| (in thousands, except per share information) | ||||||||||||||||||||

|

Operating Data: |

||||||||||||||||||||

|

Revenues from rental properties (1) |

$ | 1,152,401 | $ | 1,144,474 | $ | 958,888 | $ | 825,210 | $ | 755,851 | ||||||||||

|

Interest expense (2) |

$ | 192,549 | $ | 218,891 | $ | 203,759 | $ | 212,240 | $ | 223,736 | ||||||||||

|

Early extinguishment of debt charges |

$ | 45,674 | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Depreciation and amortization (2) |

$ | 355,320 | $ | 344,527 | $ | 258,074 | $ | 224,713 | $ | 214,827 | ||||||||||

|

Gain on sale of operating properties, net (2) |

$ | 92,823 | $ | 132,908 | $ | 618 | $ | 2,798 | $ | 8,475 | ||||||||||

|

Provision for income taxes, net (3) |

$ | 78,583 | $ | 67,325 | $ | 22,438 | $ | 32,654 | $ | 15,603 | ||||||||||

|

Impairment charges (4) |

$ | 93,266 | $ | 45,383 | $ | 39,808 | $ | 32,247 | $ | 10,289 | ||||||||||

|

Income from continuing operations (5) |

$ | 378,850 | $ | 894,190 | $ | 375,133 | $ | 276,884 | $ | 172,760 | ||||||||||

|

Income per common share, from continuing operations: |

||||||||||||||||||||

|

Basic |

$ | 0.79 | $ | 2.01 | $ | 0.77 | $ | 0.53 | $ | 0.19 | ||||||||||

|

Diluted |

$ | 0.79 | $ | 2.00 | $ | 0.77 | $ | 0.53 | $ | 0.19 | ||||||||||

|

Weighted average number of shares of common stock: |

||||||||||||||||||||

|

Basic |

418,402 | 411,319 | 409,088 | 407,631 | 405,997 | |||||||||||||||

|

Diluted |

419,709 | 412,851 | 411,038 | 408,614 | 406,689 | |||||||||||||||

|

Cash dividends declared per common share |

$ | 1.035 | $ | 0.975 | $ | 0.915 | $ | 0.855 | $ | 0.78 | ||||||||||