|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2017

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

Bermuda

(State or other jurisdiction of

incorporation or organization)

|

98‑0686001

(I.R.S. Employer

Identification No.)

|

|

Clarendon House

2 Church Street

Hamilton, Bermuda

(Address of principal executive offices)

|

HM 11

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered:

|

|

|

Common Shares $0.01 par value

|

New York Stock Exchange

|

|

|

London Stock Exchange

|

||

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non‑accelerated filer ☐

(Do not check if a smaller reporting company)

|

Smaller reporting company ☐

|

Emerging growth company ☐

|

|

|

|

Page

|

|

|

||

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“2D seismic data”

|

|

Two‑dimensional seismic data, serving as interpretive data that allows a view of a vertical cross‑section beneath a prospective area.

|

|

“3D seismic data”

|

|

Three‑dimensional seismic data, serving as geophysical data that depicts the subsurface strata in three dimensions. 3D seismic data typically provides a more detailed and accurate interpretation of the subsurface strata than 2D seismic data.

|

|

“API”

|

|

A specific gravity scale, expressed in degrees, that denotes the relative density of various petroleum liquids. The scale increases inversely with density. Thus lighter petroleum liquids will have a higher API than heavier ones.

|

|

“ASC”

|

|

Financial Accounting Standards Board Accounting Standards Codification.

|

|

“ASU”

|

|

Financial Accounting Standards Board Accounting Standards Update.

|

|

“Barrel” or “Bbl”

|

|

A standard measure of volume for petroleum corresponding to approximately 42 gallons at 60 degrees Fahrenheit.

|

|

“BBbl”

|

|

Billion barrels of oil.

|

|

“BBoe”

|

|

Billion barrels of oil equivalent.

|

|

“Bcf”

|

|

Billion cubic feet.

|

|

“Boe”

|

|

Barrels of oil equivalent. Volumes of natural gas converted to barrels of oil using a conversion factor of 6,000 cubic feet of natural gas to one barrel of oil.

|

|

“Boepd”

|

|

Barrels of oil equivalent per day.

|

|

“Bopd”

|

|

Barrels of oil per day.

|

|

“Bwpd”

|

|

Barrels of water per day.

|

|

“Debt cover ratio”

|

|

The “debt cover ratio” is broadly defined, for each applicable calculation date, as the ratio of (x) total long‑term debt less cash and cash equivalents and restricted cash, to (y) the aggregate EBITDAX (see below) of the Company for the previous twelve months.

|

|

“Developed acreage”

|

|

The number of acres that are allocated or assignable to productive wells or wells capable of production.

|

|

“Development”

|

|

The phase in which an oil or natural gas field is brought into production by drilling development wells and installing appropriate production systems.

|

|

“Dry hole”

|

|

A well that has not encountered a hydrocarbon bearing reservoir expected to produce in commercial quantities.

|

|

“EBITDAX”

|

|

Net income (loss) plus (i) exploration expense, (ii) depletion, depreciation and amortization expense, (iii) equity‑based compensation expense, (iv) unrealized (gain) loss on commodity derivatives (realized losses are deducted and realized gains are added back), (v) (gain) loss on sale of oil and gas properties, (vi) interest (income) expense, (vii) income taxes, (viii) loss on extinguishment of debt, (ix) doubtful accounts expense and (x) similar other material items which management believes affect the comparability of operating results. The Facility EBITDAX definition includes 50% of the EBITDAX adjustments of Kosmos-Trident International Petroleum Inc.

|

|

“E&P”

|

|

Exploration and production.

|

|

“FASB”

|

|

Financial Accounting Standards Board.

|

|

“Farm‑in”

|

|

An agreement whereby a party acquires a portion of the participating interest in a block from the owner of such interest, usually in return for cash and for taking on a portion of the drilling costs of one or more specific wells or other performance by the assignee as a condition of the assignment.

|

|

“Farm‑out”

|

|

An agreement whereby the owner of the participating interest agrees to assign a portion of its participating interest in a block to another party for cash and/or for the assignee taking on a portion of the drilling costs of one or more specific wells and/or other work as a condition of the assignment.

|

|

“Field life cover ratio”

|

|

The “field life cover ratio” is broadly defined, for each applicable forecast period, as the ratio of (x) the forecasted net present value of net cash flow through depletion plus the net present value of the forecast of certain capital expenditures incurred in relation to the Ghana and Equatorial Guinea assets, to (y) the aggregate loan amounts outstanding under the Facility.

|

|

“FPSO”

|

|

Floating production, storage and offloading vessel.

|

|

“Interest cover ratio”

|

|

The “interest cover ratio” is broadly defined, for each applicable calculation date, as the ratio of (x) the aggregate EBITDAX (see above) of the Company for the previous twelve months, to (y) interest expense less interest income for the Company for the previous twelve months.

|

|

“Loan life cover ratio”

|

|

The “loan life cover ratio” is broadly defined, for each applicable forecast period, as the ratio of (x) net present value of forecasted net cash flow through the final maturity date of the Facility plus the net present value of forecasted capital expenditures incurred in relation to the Ghana and Equatorial Guinea assets, to (y) the aggregate loan amounts outstanding under the Facility.

|

|

"LNG"

|

Liquefied natural gas.

|

|

|

“MBbl”

|

|

Thousand barrels of oil.

|

|

“Mcf”

|

|

Thousand cubic feet of natural gas.

|

|

“Mcfpd”

|

|

Thousand cubic feet per day of natural gas.

|

|

“MMBbl”

|

|

Million barrels of oil.

|

|

“MMBoe”

|

|

Million barrels of oil equivalent.

|

|

“MMcf”

|

|

Million cubic feet of natural gas.

|

|

“MMcfd”

|

|

Million cubic feet per day of natural gas.

|

|

“Natural gas liquid” or “NGL”

|

|

Components of natural gas that are separated from the gas state in the form of liquids. These include propane, butane, and ethane, among others.

|

|

“Petroleum contract”

|

|

A contract in which the owner of hydrocarbons gives an E&P company temporary and limited rights, including an exclusive option to explore for, develop, and produce hydrocarbons from the lease area.

|

|

“Petroleum system”

|

|

A petroleum system consists of organic material that has been buried at a sufficient depth to allow adequate temperature and pressure to expel hydrocarbons and cause the movement of oil and natural gas from the area in which it was formed to a reservoir rock where it can accumulate.

|

|

“Plan of development” or “PoD”

|

|

A written document outlining the steps to be undertaken to develop a field.

|

|

“Productive well”

|

|

An exploratory or development well found to be capable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas well.

|

|

“Prospect(s)”

|

|

A potential trap that may contain hydrocarbons and is supported by the necessary amount and quality of geologic and geophysical data to indicate a probability of oil and/or natural gas accumulation ready to be drilled. The five required elements (generation, migration, reservoir, seal and trap) must be present for a prospect to work and if any of these fail neither oil nor natural gas may be present, at least not in commercial volumes.

|

|

“Proved reserves”

|

|

Estimated quantities of crude oil, natural gas and natural gas liquids that geological and engineering data demonstrate with reasonable certainty to be economically recoverable in future years from known reservoirs under existing economic and operating conditions, as well as additional reserves expected to be obtained through confirmed improved recovery techniques, as defined in SEC Regulation S‑X 4‑10(a)(2).

|

|

“Proved developed reserves”

|

|

Those proved reserves that can be expected to be recovered through existing wells and facilities and by existing operating methods.

|

|

“Proved undeveloped reserves”

|

|

Those proved reserves that are expected to be recovered from future wells and facilities, including future improved recovery projects which are anticipated with a high degree of certainty in reservoirs which have previously shown favorable response to improved recovery projects.

|

|

“Shelf margin”

|

|

The path created by the change in direction of the shoreline in reaction to the filling of a sedimentary basin.

|

|

“Stratigraphy”

|

|

The study of the composition, relative ages and distribution of layers of sedimentary rock.

|

|

“Stratigraphic trap”

|

|

A stratigraphic trap is formed from a change in the character of the rock rather than faulting or folding of the rock and oil is held in place by changes in the porosity and permeability of overlying rocks.

|

|

“Structural trap”

|

|

A topographic feature in the earth’s subsurface that forms a high point in the rock strata. This facilitates the accumulation of oil and gas in the strata.

|

|

“Structural‑stratigraphic trap”

|

|

A structural‑stratigraphic trap is a combination trap with structural and stratigraphic features.

|

|

“Submarine fan”

|

|

A fan‑shaped deposit of sediments occurring in a deep water setting where sediments have been transported via mass flow, gravity induced, processes from the shallow to deep water. These systems commonly develop at the bottom of sedimentary basins or at the end of large rivers.

|

|

“Three‑way fault trap”

|

|

A structural trap where at least one of the components of closure is formed by offset of rock layers across a fault.

|

|

“Trap”

|

|

A configuration of rocks suitable for containing hydrocarbons and sealed by a relatively impermeable formation through which hydrocarbons will not migrate.

|

|

“Undeveloped acreage”

|

|

Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of natural gas and oil regardless of whether such acreage contains discovered resources.

|

|

•

|

our ability to find, acquire or gain access to other discoveries and prospects and to successfully develop and produce from our current discoveries and prospects;

|

|

•

|

uncertainties inherent in making estimates of our oil and natural gas data;

|

|

•

|

the successful implementation of our and our block partners’ prospect discovery and development and drilling plans;

|

|

•

|

projected and targeted capital expenditures and other costs, commitments and revenues;

|

|

•

|

termination of or intervention in concessions, rights or authorizations granted by the governments of Cote d'Ivoire, Equatorial Guinea, Ghana, Mauritania, Morocco, Sao Tome and Principe, Senegal or Suriname (or their respective national oil companies) or any other federal, state or local governments or authorities, to us;

|

|

•

|

our dependence on our key management personnel and our ability to attract and retain qualified technical personnel;

|

|

•

|

the ability to obtain financing and to comply with the terms under which such financing may be available;

|

|

•

|

the volatility of oil and natural gas prices;

|

|

•

|

the availability, cost, function and reliability of developing appropriate infrastructure around and transportation to our discoveries and prospects;

|

|

•

|

the availability and cost of drilling rigs, production equipment, supplies, personnel and oilfield services;

|

|

•

|

other competitive pressures;

|

|

•

|

potential liabilities inherent in oil and natural gas operations, including drilling and production risks and other operational and environmental risks and hazards;

|

|

•

|

current and future government regulation of the oil and gas industry or regulation of the investment in or ability to do business with certain countries or regimes;

|

|

•

|

cost of compliance with laws and regulations;

|

|

•

|

changes in environmental, health and safety or climate change or greenhouse gas (“GHG”) laws and regulations or the implementation, or interpretation, of those laws and regulations;

|

|

•

|

adverse effects of sovereign boundary disputes in the jurisdictions in which we operate;

|

|

•

|

environmental liabilities;

|

|

•

|

geological, geophysical and other technical and operations problems including drilling and oil and gas production and processing;

|

|

•

|

military operations, civil unrest, outbreaks of disease, terrorist acts, wars or embargoes;

|

|

•

|

the cost and availability of adequate insurance coverage and whether such coverage is enough to sufficiently mitigate potential losses and whether our insurers comply with their obligations under our coverage agreements;

|

|

•

|

our vulnerability to severe weather events;

|

|

•

|

our ability to meet our obligations under the agreements governing our indebtedness;

|

|

•

|

the availability and cost of financing and refinancing our indebtedness;

|

|

•

|

the amount of collateral required to be posted from time to time in our hedging transactions, letters of credit and other secured debt;

|

|

•

|

the result of any legal proceedings, arbitrations, or investigations we may be subject to or involved in;

|

|

•

|

our success in risk management activities, including the use of derivative financial instruments to hedge commodity and interest rate risks; and

|

|

•

|

other risk factors discussed in the “Item 1A. Risk Factors” section of this annual report on Form 10‑K.

|

|

|

|

|

Kosmos

|

|

|

|

|

||||||||

|

|

|

|

Participating

|

|

|

|

|

||||||||

|

Fields

|

License

|

|

Interest

|

|

Operator

|

|

Stage

|

||||||||

|

Ghana

|

|

|

|

|

|

|

|

||||||||

|

Jubilee(1)

|

WCTP/DT

|

(2)

|

24.1

|

%

|

(2)

|

Tullow

|

|

Production

|

|||||||

|

TEN(1)

|

DT

|

|

17.0

|

%

|

(4)

|

Tullow

|

|

Production

|

|||||||

|

Akasa

|

WCTP

|

|

30.9

|

%

|

(5,6)

|

Kosmos

|

(5)

|

Appraisal

|

|||||||

|

Wawa

|

DT

|

|

18.0

|

%

|

(6)

|

Tullow

|

|

Appraisal

|

|||||||

|

Mauritania

|

|

|

|

|

|

|

|

||||||||

|

Ahmeyim

|

Block C8

|

(3)

|

28.0

|

%

|

(7)

|

BP

|

|

Appraisal

|

|||||||

|

Marsouin

|

Block C8

|

|

28.0

|

%

|

(7)

|

BP

|

|

Appraisal

|

|||||||

|

Senegal

|

|

|

|

|

|

|

|

||||||||

|

Guembeul

|

Saint Louis Offshore Profond

|

(3)

|

30.0

|

%

|

(8)

|

BP

|

(8)

|

Appraisal

|

|||||||

|

Teranga

|

Cayar Offshore Profond

|

|

30.0

|

%

|

(8)

|

BP

|

(8)

|

Appraisal

|

|||||||

|

Yakaar

|

Cayar Offshore Profond

|

30.0

|

%

|

(8)

|

BP

|

(8)

|

Appraisal

|

||||||||

|

Equatorial Guinea

|

|||||||||||||||

|

Ceiba Field and Okume Complex - Equity Method Investment(1)

|

Block G

|

40.4

|

%

|

(9)

|

KTEGI

|

(9)

|

Production

|

||||||||

|

(1)

|

For information concerning our estimated proved reserves as of

December 31, 2017

, see “—Our Reserves.”

|

|

(2)

|

The Jubilee Field straddles the boundary between the West Cape Three Points (“WCTP”) petroleum contract and the Deepwater Tano (“DT”) petroleum contract offshore Ghana. To optimize resource recovery in this field, we entered into the Unitization and Unit Operating Agreement (the “UUOA”) in July 2009 with the Ghana National Petroleum Corporation (“GNPC”) and the other block partners of each of these two blocks. The UUOA governs the interests in and development of the Jubilee Field and created the Jubilee Unit from portions of the WCTP petroleum contract and the DT petroleum contract areas. As a result of the approval of the GJFFDP by Ghana’s Ministry of Energy in October 2017, operatorship for the Mahogany and Teak discoveries transferred to Tullow which are now included in the Jubilee Field.

|

|

(3)

|

The Greater Tortue resource, which includes the Ahmeyim discovery in Mauritania Block C8 and the Guembeul discovery in the Senegal Saint Louis Offshore Profond Block, straddles the border between Mauritania and Senegal.

|

|

(4)

|

Our paying interest on development activities in the TEN fields is 19%.

|

|

(5)

|

Our paying interest on development activities in this discovery is 26.9%. Our participating interest as of

December 31, 2017

is 30.0%.

The WCTP partners transferred operatorship of the remaining portions of the WCTP Block, including the Akasa discovery, to Tullow effective February 1, 2018. Kosmos continues to assist Tullow with the transition process, which is expected to extend into the first half of 2018.

|

|

(6)

|

GNPC has the option to acquire additional paying interests in a commercial discovery on the WCTP Block and the DT Block of 2.5% and 5.0%, respectively. These interest percentages do not give effect to the exercise of such options.

|

|

(7)

|

SMHPM has the option to acquire up to an additional 4% paying interests in a commercial development. These interest percentages do not give effect to the exercise of such option.

|

|

(8)

|

PETROSEN has the option to acquire up to an additional 10% paying interests in a commercial development on the Saint Louis Offshore Profond and Cayar Offshore Profond blocks. The interest percentage does not give effect to the exercise of such option.

|

|

(9)

|

Kosmos owns a 50% interest in KTIPI which holds an 85% interest in the Ceiba Field and Okume Complex through its wholly-owned subsidiary, Kosmos-Trident Equatorial Guinea Inc. ("KTEGI"), representing a 40.375% net indirect interest to Kosmos. Kosmos and Trident provide operational management and support to KTEGI, who is operator of the Ceiba Field and Okume Complex.

|

|

|

Operator

|

|

|

||

|

|

(Participating

|

|

|

||

|

|

Interest)

|

|

Partners (Participating Interest)

|

||

|

Cote D'Ivoire

|

|||||

|

Block CI-526

|

Kosmos (45%)

|

(1)

|

BP (45%), PETROCI (10%)

|

||

|

Block CI-602

|

Kosmos (45%)

|

(1)

|

BP (45%), PETROCI (10%)

|

||

|

Block CI-603

|

Kosmos (45%)

|

(1)

|

BP (45%), PETROCI (10%)

|

||

|

Block CI-707

|

Kosmos (45%)

|

(1)

|

BP (45%), PETROCI (10%)

|

||

|

Block CI-708

|

Kosmos (45%)

|

(1)

|

BP (45%), PETROCI (10%)

|

||

|

Equatorial Guinea

|

|||||

|

Block EG-21

|

Kosmos (40%)

|

(2)

|

Trident (40%), GEPetrol (20%)

|

||

|

Block S

|

Kosmos (40%)

|

(2)

|

Trident (40%), GEPetrol (20%)

|

||

|

Block W

|

Kosmos (40%)

|

(2)

|

Trident (40%), GEPetrol (20%)

|

||

|

Mauritania

|

|

|

|

||

|

Block C6

|

BP (62%)

|

(3)

|

Kosmos (28%), SMHPM (10%)

|

||

|

Block C8

|

BP (62%)

|

(3)

|

Kosmos (28%), SMHPM (10%)

|

||

|

Block C12

|

BP (62%)

|

(3)

|

Kosmos (28%), SMHPM (10%)

|

||

|

Block C13

|

BP (62%)

|

(3)

|

Kosmos (28%), SMHPM (10%)

|

||

|

Block C18

|

Total (45%)

|

(3)

|

Kosmos (15%), BP (15%), Tullow (15%), SMHPM (10%)

|

||

|

Morocco

|

|

|

|

||

|

Essaouira

|

Kosmos (75%)

|

|

ONHYM (25%)

|

||

|

Sao Tome and Principe (4)

|

|

|

|

||

|

Block 5

|

Kosmos (45%)

|

|

Galp (20%), Equator (20%), ANP (15%),

|

||

|

Block 6

|

Galp (45%)

|

|

Kosmos (45%), ANP (10%)

|

||

|

Block 11

|

Kosmos (65%)

|

|

Galp (20%), ANP (15%)

|

||

|

Block 12

|

Kosmos (45%)

|

|

Galp (20%), Equator (22.5%), ANP (12.5%),

|

||

|

Senegal

|

|

|

|

||

|

Cayar Offshore Profond

|

BP (60%)

|

(5)

|

Kosmos (30%), PETROSEN (10%)

|

||

|

Saint Louis Offshore Profond

|

BP (60%)

|

(5)

|

Kosmos (30%), PETROSEN (10%)

|

||

|

Suriname

|

|

|

|

||

|

Block 42

|

Kosmos (33%)

|

|

Chevron (33%), Hess (33%)

|

||

|

Block 45

|

Kosmos (50%)

|

|

Chevron (50%)

|

||

|

(1)

|

PETROCI has the option to acquire up to an additional 2% paying interests in a commercial development. The interest percentage does not give effect to the exercise of such option.

|

|

(2)

|

These agreements are fully executed, but are pending Presidential ratification. We presently have an 80% interest and are the operator in all three blocks, but pursuant to an agreement with Trident we expect to assign a 40% interest in the blocks to an affiliate of Trident after presidential ratification. The interest percentage gives effect to the 40% interest assignment to Trident. Should a commercial discovery be made, GEPetrol's 20% carried interest will convert to a 20% participating interest for all development and production operations.

|

|

(3)

|

BP is the operator of record while Kosmos provides technical exploration operator services. Should a commercial discovery be made, SMHPM’s 10% carried interest is extinguished and SMHPM will have an option to acquire a participating interest in the discovery area between 10% and 14% (blocks C8, C12 and C13), 10% and 15% (Block C18) and 10% and 18% (Block C6). SMHPM will pay its portion of development and production costs in a commercial development on the blocks. The interest percentage does not give effect to the exercise of such option.

|

|

(4)

|

Kosmos and BP have been awarded the rights to negotiate petroleum contracts for blocks 10 and 13.

|

|

(5)

|

PETROSEN has the option to acquire up to an additional 10% paying interest in a commercial development on the Saint Louis Offshore Profond and Cayar Offshore Profond blocks. The interest percentage does not give effect to the exercise of such option.

|

|

|

2017 Net Proved Reserves(1)

|

2016 Net Proved Reserves(1)

|

2015 Net Proved Reserves(1)

|

|||||||||||||||||||||||

|

|

Oil,

Condensate,

NGLs

|

Natural

Gas(2)

|

Total

|

Oil,

Condensate,

NGLs

|

Natural

Gas(2)

|

Total

|

Oil,

Condensate,

NGLs

|

Natural

Gas(2)

|

Total

|

|||||||||||||||||

|

|

(MMBbl)

|

(Bcf)

|

(MMBoe)

|

(MMBbl)

|

(Bcf)

|

(MMBoe)

|

(MMBbl)

|

(Bcf)

|

(MMBoe)

|

|||||||||||||||||

|

Reserves Category

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Proved developed

|

59

|

|

38

|

|

65

|

|

64

|

|

13

|

|

66

|

|

50

|

|

10

|

|

52

|

|

||||||||

|

Proved undeveloped(3)

|

23

|

|

11

|

|

24

|

|

10

|

|

2

|

|

11

|

|

24

|

|

4

|

|

25

|

|

||||||||

|

Total Kosmos

|

82

|

|

49

|

|

89

|

|

74

|

|

15

|

|

77

|

|

74

|

|

14

|

|

77

|

|

||||||||

|

Equity method investment(4)

|

19

|

|

13

|

|

21

|

|

||||||||||||||||||||

|

Total reserves

|

100

|

|

61

|

|

110

|

|

||||||||||||||||||||

|

(1)

|

Our reserves associated with the Jubilee Field are based on the 54.4%/45.6% redetermination split, between the WCTP Block and DT Block. Totals within the table may not add as a result of rounding.

|

|

(2)

|

These reserves represent the estimated quantities of fuel gas required to operate the Jubilee and TEN FPSOs during normal field operations and the associated gas forecasted to be exported from TEN. This volume of associated gas is included as of December 31, 2017 as a result of the finalization of the TEN Associated-Gas Gas Sales Agreement (TAG GSA). If and when a subsequent gas sales agreement is executed for Jubilee, a portion of the remaining Jubilee gas may be recognized as reserves. If and when a gas sales agreement and the related infrastructure are in place for the TEN fields non-associated gas, a portion of the remaining gas may be recognized as reserves.

|

|

(3)

|

All of our proved undeveloped reserves are expected to be developed within six years or less. Proved undeveloped reserves expected to be developed beyond five years are related to long-term projects which will be completed under a continuous drilling program. As of

December 31, 2017

, we recognized 24.4 MMBoe of proved undeveloped reserves related to the Jubilee and TEN fields, representing approved future drilling in both fields.

|

|

(4)

|

We disclose our share of reserves that are accounted for by the equity method.

|

|

|

Estimated Future Net Revenues(4)

|

||||||||||

|

(in millions except $/Bbl)

|

|||||||||||

|

Kosmos

|

Equity Method Investment

|

Total

|

|||||||||

|

Estimated future net revenues

|

$

|

1,286

|

|

$

|

9

|

|

$

|

1,295

|

|

||

|

Present value of estimated future net revenues:

|

|

||||||||||

|

PV-10(1)

|

$

|

971

|

|

$

|

130

|

|

$

|

1,101

|

|

||

|

Future income tax expense (levied at a corporate parent and intermediate subsidiary level)

|

—

|

|

—

|

|

—

|

|

|||||

|

Discount of future income tax expense (levied at a corporate parent and intermediate subsidiary level) at 10% per annum

|

—

|

|

—

|

|

—

|

|

|||||

|

Standardized Measure(2)

|

$

|

971

|

|

$

|

130

|

|

$

|

1,101

|

|

||

|

|

|

|

|||||||||

|

Benchmark and differential oil price($/Bbl)(3)

|

$

|

54.42

|

|

$

|

54.42

|

|

|||||

|

(1)

|

PV‑10 represents the present value of estimated future revenues to be generated from the production of proved oil and natural gas reserves, net of future development and production costs, royalties, additional oil entitlements and future tax expense levied at an asset level, using prices based on an average of the first‑day‑of‑the‑months throughout

2017

and costs as of the date of estimation without future escalation, without giving effect to hedging activities, non‑property related expenses such as general and administrative expenses, debt service and depreciation, depletion and amortization, and discounted using an annual discount rate of 10% to reflect the timing of future cash flows. PV‑10 is a non‑GAAP financial measure and often differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of future income tax expense related to proved oil and gas reserves levied at a corporate parent level on future net revenues. However, it does include the effects of future tax expense levied at an asset level. Neither PV‑10 nor Standardized Measure represents an estimate of the fair market value of our oil and natural gas assets. PV‑10 should not be considered as an alternative to the Standardized Measure as computed under GAAP; however, we and others in the industry use PV‑10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific corporate tax characteristics of such entities.

|

|

(2)

|

Standardized Measure represents the present value of estimated future cash inflows to be generated from the production of proved oil and natural gas reserves, net of future development and production costs, future income tax expense related to our proved oil and gas reserves levied at a corporate parent and intermediate subsidiary level, royalties, additional oil entitlements and future tax expense levied at an asset level, without giving effect to hedging activities, non‑property related expenses such as general and administrative expenses, debt service and depreciation, depletion and amortization, and discounted using an annual discount rate of 10% to reflect timing of future cash flows and using the same pricing assumptions as were used to calculate PV‑10. Standardized Measure often differs from PV‑10 because Standardized Measure includes the effects of future income tax expense related to our proved oil and gas reserves levied at a corporate parent level on future net revenues. However, as we are a tax exempted company incorporated pursuant to the laws of Bermuda, we do not expect to be subject to future income tax expense related to our proved oil and gas reserves levied at a corporate parent level on future net revenues. Therefore, the year‑end

2017

estimate of PV‑10 is equivalent to the Standardized Measure.

|

|

(3)

|

The unweighted arithmetic average first‑day‑of‑the‑month prices for the prior 12 months was

$54.42

for Dated Brent at

December 31, 2017

. The price was adjusted for crude handling, transportation fees, quality, and a regional price differential. These adjustments are estimated to include a

$0.10

premium

, a

$0.02

premium

and a

$0.53

discount

relative to Dated Brent for the Jubilee Field, TEN fields and our equity method investment, respectively. The adjusted price utilized to derive the Jubilee Field PV‑10, TEN PV-10 and equity method investment PV-10 is

$54.52

,

$54.44

and

$53.89

, respectively.

|

|

(4)

|

Future net revenues and PV-10 have been adjusted from the reserve report which is based on the entitlements method as we account for oil and gas revenues under the sales method of accounting.

|

|

|

Developed Area

|

Undeveloped Area

|

|

|

|||||||||||||

|

|

(Acres)

|

(Acres)

|

Total Area (Acres)

|

||||||||||||||

|

|

Gross

|

Net(1)

|

Gross

|

Net(1)

|

Gross

|

Net(1)

|

|||||||||||

|

|

(In thousands)

|

||||||||||||||||

|

Ghana

|

|

|

|

|

|

|

|||||||||||

|

Jubilee Unit

|

52

|

|

13

|

|

—

|

|

—

|

|

52

|

|

13

|

|

|||||

|

TEN

|

111

|

|

19

|

|

—

|

|

—

|

|

111

|

|

19

|

|

|||||

|

West Cape Three Points(2)

|

—

|

|

—

|

|

28

|

|

9

|

|

28

|

|

9

|

|

|||||

|

Deepwater Tano(2)

|

—

|

|

—

|

|

27

|

|

4

|

|

27

|

|

4

|

|

|||||

|

Equatorial Guinea(3)

|

|||||||||||||||||

|

Block EG-21

|

—

|

|

—

|

|

617

|

|

247

|

|

617

|

|

247

|

|

|||||

|

Block S

|

—

|

|

—

|

|

308

|

|

123

|

|

308

|

|

123

|

|

|||||

|

Block W

|

—

|

|

—

|

|

557

|

|

223

|

|

557

|

|

223

|

|

|||||

|

Mauritania

|

|

|

|

|

|

|

|||||||||||

|

Block C6

|

—

|

|

—

|

|

1,063

|

|

298

|

|

1,063

|

|

298

|

|

|||||

|

Block C8

|

—

|

|

—

|

|

2,220

|

|

622

|

|

2,220

|

|

622

|

|

|||||

|

Block C12

|

—

|

|

—

|

|

1,273

|

|

356

|

|

1,273

|

|

356

|

|

|||||

|

Block C13

|

—

|

|

—

|

|

1,452

|

|

407

|

|

1,452

|

|

407

|

|

|||||

|

Block C18

|

—

|

|

—

|

|

3,268

|

|

490

|

|

3,268

|

|

490

|

|

|||||

|

Morocco

|

|

|

|

|

|

|

|||||||||||

|

Essaouira

|

—

|

|

—

|

|

2,171

|

|

1,628

|

|

2,171

|

|

1,628

|

|

|||||

|

Sao Tome and Principe

|

|

|

|

|

|

|

|||||||||||

|

Block 5

|

—

|

|

—

|

|

703

|

|

316

|

|

703

|

|

316

|

|

|||||

|

Block 6

|

—

|

|

—

|

|

1,241

|

|

559

|

|

1,241

|

|

559

|

|

|||||

|

Block 11

|

—

|

|

—

|

|

2,209

|

|

1,436

|

|

2,209

|

|

1,436

|

|

|||||

|

Block 12

|

—

|

|

—

|

|

1,738

|

|

782

|

|

1,738

|

|

782

|

|

|||||

|

Senegal

|

|

|

|

|

|

|

|||||||||||

|

Cayar Offshore Profond

|

—

|

|

—

|

|

1,350

|

|

405

|

|

1,350

|

|

405

|

|

|||||

|

Saint Louis Offshore Profond

|

—

|

|

—

|

|

1,650

|

|

495

|

|

1,650

|

|

495

|

|

|||||

|

Suriname

|

|

|

|

|

|

|

|||||||||||

|

Block 42

|

—

|

|

—

|

|

1,526

|

|

509

|

|

1,526

|

|

509

|

|

|||||

|

Block 45

|

—

|

|

—

|

|

1,267

|

|

633

|

|

1,267

|

|

633

|

|

|||||

|

Total Kosmos

|

163

|

|

32

|

|

24,668

|

|

9,542

|

|

24,831

|

|

9,574

|

|

|||||

|

Equity method investment(4)

|

65

|

|

28

|

|

—

|

|

—

|

|

65

|

|

28

|

|

|||||

|

Total

|

228

|

|

60

|

|

24,668

|

|

9,542

|

|

24,896

|

|

9,602

|

|

|||||

|

(1)

|

Net acreage based on Kosmos’ participating interest, before the exercise of any options or back‑in rights, except for our net acreage associated with the Jubilee and TEN fields, which are after the exercise of options or back‑in rights. Our net acreage in Ghana may be affected by any redetermination of interests in the Jubilee Unit.

|

|

(2)

|

The Exploration Period of the WCTP petroleum contract and DT petroleum contract has expired. The undeveloped area reflected in the table above represents acreage within our discovery areas that were not subject to relinquishment on the expiry of the Exploration Period.

|

|

(3)

|

Ratification of the petroleum contracts by the President of Equatorial Guinea is required before the petroleum contracts become effective.

|

|

(4)

|

Represents our 50% interest in KTIPI.

|

|

|

Productive

|

Productive

|

|

|

|||||||||||||

|

|

Oil Wells

|

Gas Wells

|

Total

|

||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||

|

Ghana—Jubilee Unit

|

26

|

|

6.24

|

|

—

|

|

—

|

|

26

|

|

6.24

|

|

|||||

|

Ghana—Ten(1)

|

11

|

|

1.87

|

|

—

|

|

—

|

|

11

|

|

1.87

|

|

|||||

|

Kosmos Total

|

37

|

|

8.11

|

|

—

|

|

—

|

|

37

|

|

8.11

|

|

|||||

|

Equity Method Investment(2)(3)

|

96

|

|

38.78

|

|

—

|

|

—

|

|

96

|

|

38.78

|

|

|||||

|

Total

|

133

|

|

46.89

|

|

—

|

|

—

|

|

133

|

|

46.89

|

|

|||||

|

(1)

|

Of the 11 productive wells, 10 (gross) or 1.70 (net) have multiple completions within the wellbore.

|

|

(2)

|

Represents our 50% interest in KTIPI.

|

|

(3)

|

Of the 96 productive wells, 6 (gross) or 2.42 (net) have multiple completions within the wellbore.

|

|

|

Exploratory and Appraisal Wells(1)

|

Development Wells(1)

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

Productive(2)

|

Dry(3)

|

Total

|

Productive(2)

|

Dry(3)

|

Total

|

Total

|

Total

|

|||||||||||||||||||||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||||||||||||||||

|

Year Ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Ghana

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Jubilee Unit

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

TEN

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Mauritania

|

|||||||||||||||||||||||||||||||||||||||||

|

Block C8

|

—

|

|

—

|

|

1

|

|

0.28

|

|

1

|

|

0.28

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.28

|

|

|||||||||||||

|

Block C12

|

—

|

|

—

|

|

1

|

|

0.28

|

|

1

|

|

0.28

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.28

|

|

|||||||||||||

|

Total

|

—

|

|

—

|

|

2

|

|

0.56

|

|

2

|

|

0.56

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2

|

|

0.56

|

|

|||||||||||||

|

Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Ghana

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Jubilee Unit

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

TEN

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

7

|

|

1.19

|

|

—

|

|

—

|

|

7

|

|

1.19

|

|

7

|

|

1.19

|

|

|||||||||||||

|

Total

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

7

|

|

1.19

|

|

—

|

|

—

|

|

7

|

|

1.19

|

|

7

|

|

1.19

|

|

|||||||||||||

|

Year Ended December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Ghana

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Jubilee Unit

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

3

|

|

0.72

|

|

—

|

|

—

|

|

3

|

|

0.72

|

|

3

|

|

0.72

|

|

|||||||||||||

|

TEN

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4

|

|

0.68

|

|

—

|

|

—

|

|

4

|

|

0.68

|

|

4

|

|

0.68

|

|

|||||||||||||

|

Morocco (including Western Sahara)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Cap Boujdour

|

—

|

|

—

|

|

1

|

|

0.55

|

|

1

|

|

0.55

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.55

|

|

|||||||||||||

|

Total

|

—

|

|

—

|

|

1

|

|

0.55

|

|

1

|

|

0.55

|

|

7

|

|

1.40

|

|

—

|

|

—

|

|

7

|

|

1.40

|

|

8

|

|

1.95

|

|

|||||||||||||

|

(1)

|

As of

December 31, 2017

, nine exploratory and appraisal wells have been excluded from the table until a determination is made if the wells have found proved reserves. Also excluded from the table are 14 development wells awaiting completion. These wells are shown as “Wells Suspended or Waiting on Completion” in the table below.

|

|

(2)

|

A productive well is an exploratory or development well found to be capable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas producing well. Productive wells are included in the table in the year they were determined to be productive, as opposed to the year the well was drilled.

|

|

(3)

|

A dry well is an exploratory or development well that is not a productive well. Dry wells are included in the table in the year they were determined not to be a productive well, as opposed to the year the well was drilled.

|

|

|

Actively Drilling or

|

Wells Suspended or

|

|||||||||||||||||||||

|

|

Completing

|

Waiting on Completion

|

|||||||||||||||||||||

|

|

Exploration

|

Development

|

Exploration

|

Development

|

|||||||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||||

|

Ghana

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Jubilee Unit

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

9

|

|

2.17

|

|

|||||||

|

West Cape Three Points

|

—

|

|

—

|

|

—

|

|

—

|

|

2

|

|

0.62

|

|

—

|

|

—

|

|

|||||||

|

TEN

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

5

|

|

0.85

|

|

|||||||

|

Deepwater Tano

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

0.18

|

|

—

|

|

—

|

|

|||||||

|

Mauritania

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

C8

|

—

|

|

—

|

|

—

|

|

—

|

|

3

|

|

0.84

|

|

—

|

|

—

|

|

|||||||

|

Senegal

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Saint Louis Offshore Profond

|

1

|

|

0.30

|

|

—

|

|

—

|

|

1

|

|

0.30

|

|

—

|

|

—

|

|

|||||||

|

Cayar Profond

|

—

|

|

—

|

|

—

|

|

—

|

|

2

|

|

0.60

|

|

—

|

|

—

|

|

|||||||

|

Total

|

1

|

|

0.30

|

|

—

|

|

—

|

|

9

|

|

2.54

|

|

14

|

|

3.02

|

|

|||||||

|

•

|

require the acquisition of various permits before operations commence;

|

|

•

|

enjoin some or all of the operations or facilities deemed not in compliance with permits;

|

|

•

|

restrict the types, quantities and concentration of various substances that can be released into the environment in connection with oil and natural gas drilling, production and transportation activities;

|

|

•

|

limit, cap, tax or otherwise restrict emissions of GHG and other air pollutants or otherwise seek to address or minimize the effects of climate change;

|

|

•

|

limit or prohibit drilling activities in certain locations lying within protected or otherwise sensitive areas; and

|

|

•

|

require measures to mitigate or remediate pollution, including pollution resulting from our block partners’ or our contractors’ operations.

|

|

•

|

changes in supply and demand for oil and natural gas;

|

|

•

|

the actions of the Organization of the Petroleum Exporting Countries;

|

|

•

|

speculation as to the future price of oil and natural gas and the speculative trading of oil and natural gas futures contracts;

|

|

•

|

global economic conditions;

|

|

•

|

political and economic conditions, including embargoes in oil‑producing countries or affecting other oil‑producing activities, particularly in the Middle East, Africa, Russia and Central and South America;

|

|

•

|

the continued threat of terrorism and the impact of military and other action, including U.S. military operations in the Middle East;

|

|

•

|

the level of global oil and natural gas exploration and production activity;

|

|

•

|

the level of global oil inventories and oil refining capacities;

|

|

•

|

weather conditions and natural or man‑made disasters;

|

|

•

|

technological advances affecting energy consumption;

|

|

•

|

governmental regulations and taxation policies;

|

|

•

|

proximity and capacity of transportation facilities;

|

|

•

|

the development and exploitation of alternative fuels or energy sources;

|

|

•

|

the price and availability of competitors’ supplies of oil and natural gas; and

|

|

•

|

the price, availability or mandated use of alternative fuels or energy sources.

|

|

•

|

the timing and amount of capital expenditures;

|

|

•

|

if the activity is operated by one of our block partners, the operator’s expertise and financial resources;

|

|

•

|

approval of other block partners in drilling wells;

|

|

•

|

the scheduling, pre‑design, planning, design and approvals of activities and processes;

|

|

•

|

selection of technology; and

|

|

•

|

the rate of production of reserves, if any.

|

|

•

|

actual prices we receive for oil and natural gas;

|

|

•

|

actual cost of development and production expenditures;

|

|

•

|

derivative transactions;

|

|

•

|

the amount and timing of actual production; and

|

|

•

|

changes in governmental regulations or taxation.

|

|

•

|

the scope, rate of progress and cost of our exploration, appraisal, development and production activities;

|

|

•

|

the success of our exploration, appraisal, development and production activities;

|

|

•

|

oil and natural gas prices;

|

|

•

|

our ability to locate and acquire hydrocarbon reserves;

|

|

•

|

our ability to produce oil or natural gas from those reserves;

|

|

•

|

the terms and timing of any drilling and other production‑related arrangements that we may enter into;

|

|

•

|

the cost and timing of governmental approvals and/or concessions; and

|

|

•

|

the effects of competition by larger companies operating in the oil and gas industry.

|

|

•

|

fires, blowouts, spills, cratering and explosions;

|

|

•

|

mechanical and equipment problems, including unforeseen engineering complications. For example, following a February 2016 inspection of the turret area of the Jubilee field FPSO, by SOFEC, Inc., the original turret manufacturer, a potential issue was identified with the turret bearing. As a precautionary measure, additional operating procedures to monitor the turret bearing and reduce the degree of rotation of the vessel have been put in place until this situation has been remediated;

|

|

•

|

uncontrolled flows or leaks of oil, well fluids, natural gas, brine, toxic gas or other pollutants or hazardous materials;

|

|

•

|

gas flaring operations;

|

|

•

|

marine hazards with respect to offshore operations;

|

|

•

|

formations with abnormal pressures;

|

|

•

|

pollution, environmental risks, and geological problems; and

|

|

•

|

weather conditions and natural or man‑made disasters.

|

|

•

|

severe weather, natural or man‑made disasters or acts of God;

|

|

•

|

delays or decreases in production, the availability of equipment, facilities, personnel or services;

|

|

•

|

delays or decreases in the availability of capacity to transport, gather or process production;

|

|

•

|

military conflicts, civil unrest or political strife; and/or

|

|

•

|

international border disputes.

|

|

•

|

disrupt our operations;

|

|

•

|

require us to incur greater costs for security;

|

|

•

|

restrict the movement of funds or limit repatriation of profits;

|

|

•

|

lead to U.S. government or international sanctions; or

|

|

•

|

limit access to markets for periods of time.

|

|

•

|

licenses for drilling operations;

|

|

•

|

tax increases, including retroactive claims;

|

|

•

|

unitization of oil accumulations;

|

|

•

|

local content requirements (including the mandatory use of local partners and vendors); and

|

|

•

|

safety, health and environmental requirements, liabilities and obligations, including those related to remediation, investigation or permitting.

|

|

•

|

delay or denial of drilling permits;

|

|

•

|

shortening of lease terms or reduction in lease size;

|

|

•

|

restrictions or delays on our ability to obtain additional seismic data;

|

|

•

|

restrictions on installation or operation of gathering or processing facilities;

|

|

•

|

restrictions on the use of certain operating practices;

|

|

•

|

legal challenges or lawsuits;

|

|

•

|

damaging publicity about us;

|

|

•

|

increased regulation;

|

|

•

|

increased costs of doing business;

|

|

•

|

reduction in demand for our products; and

|

|

•

|

other adverse effects on our ability to develop our properties.

|

|

•

|

production is less than the volume covered by the derivative instruments;

|

|

•

|

the counter‑party to the derivative instrument defaults on its contract obligations; or

|

|

•

|

there is an increase in the differential between the underlying price and actual prices received in the derivative instrument.

|

|

•

|

our investments, loans and advances and certain of our subsidiaries’ payment of dividends and other restricted payments;

|

|

•

|

our incurrence of additional indebtedness;

|

|

•

|

the granting of liens, other than liens created pursuant to the commercial debt facility, revolving credit facility or the indenture governing the Senior Notes and certain permitted liens;

|

|

•

|

mergers, consolidations and sales of all or a substantial part of our business or licenses;

|

|

•

|

the hedging, forward sale or swap of our production of crude oil or natural gas or other commodities;

|

|

•

|

the sale of assets (other than production sold in the ordinary course of business); and

|

|

•

|

in the case of the commercial debt facility and the revolving credit facility, our capital expenditures that we can fund with the proceeds of our commercial debt facility, and revolving credit facility.

|

|

•

|

a significant portion or all of our cash flows, when generated, could be used to service our indebtedness;

|

|

•

|

a high level of indebtedness could increase our vulnerability to general adverse economic and industry conditions;

|

|

•

|

the covenants contained in the agreements governing our outstanding indebtedness will limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments;

|

|

•

|

a high level of indebtedness may place us at a competitive disadvantage compared to our competitors that are less leveraged and therefore, may be able to take advantage of opportunities that our indebtedness could prevent us from pursuing;

|

|

•

|

our debt covenants may also affect our flexibility in planning for, and reacting to, changes in the economy and in our industry;

|

|

•

|

additional hedging instruments may be required as a result of our indebtedness;

|

|

•

|

a high level of indebtedness may make it more likely that a reduction in our borrowing base following a periodic redetermination could require us to repay a portion of our then‑outstanding bank borrowings; and

|

|

•

|

a high level of indebtedness may impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate or other purposes.

|

|

•

|

recoverable reserves;

|

|

•

|

future oil and natural gas prices and their appropriate differentials;

|

|

•

|

development and operating costs; and

|

|

•

|

potential environmental and other liabilities.

|

|

•

|

diversion of our management’s attention to evaluating, negotiating and integrating significant acquisitions and strategic transactions;

|

|

•

|

the challenge and cost of integrating acquired operations, information management and other technology systems and business cultures with those of ours while carrying on our ongoing business;

|

|

•

|

difficulty associated with coordinating geographically separate organizations; and

|

|

•

|

the challenge of attracting and retaining personnel associated with acquired operations.

|

|

•

|

the price of oil and natural gas;

|

|

•

|

the success of our exploration and development operations, and the marketing of any oil and natural gas we produce;

|

|

•

|

operational incidents;

|

|

•

|

regulatory developments in Bermuda, the United States and foreign countries where we operate;

|

|

•

|

the recruitment or departure of key personnel;

|

|

•

|

quarterly or annual variations in our financial results or those of companies that are perceived to be similar to us;

|

|

•

|

market conditions in the industries in which we compete and issuance of new or changed securities;

|

|

•

|

analysts’ reports or recommendations;

|

|

•

|

the failure of securities analysts to cover our common shares or changes in financial estimates by analysts;

|

|

•

|

the inability to meet the financial estimates of analysts who follow our common shares;

|

|

•

|

the issuance or sale of any additional securities of ours;

|

|

•

|

investor perception of our company and of the industry in which we compete; and

|

|

•

|

general economic, political and market conditions.

|

|

|

2017

|

2016

|

|||||||||||||

|

|

High

|

Low

|

High

|

Low

|

|||||||||||

|

First Quarter

|

$

|

7.39

|

|

$

|

5.53

|

|

$

|

6.41

|

|

$

|

3.17

|

|

|||

|

Second Quarter

|

7.90

|

|

5.65

|

|

6.79

|

|

4.63

|

|

|||||||

|

Third Quarter

|

8.21

|

|

5.99

|

|

6.63

|

|

5.16

|

|

|||||||

|

Fourth Quarter

|

8.62

|

|

6.55

|

|

7.14

|

|

4.39

|

|

|||||||

|

|

Total Number

|

Average

|

||||

|

|

of Shares

|

Price Paid

|

||||

|

|

Purchased

|

per Share

|

||||

|

|

(In thousands)

|

|

||||

|

January 1, 2017—January 31, 2017

|

74

|

|

$

|

7.01

|

|

|

|

February 1, 2017—February 29, 2017

|

—

|

|

—

|

|

||

|

March 1, 2017—March 31, 2017

|

—

|

|

—

|

|

||

|

April 1, 2017—April 30, 2017

|

—

|

|

—

|

|

||

|

May 1, 2017—May 31, 2017

|

—

|

|

—

|

|

||

|

June 1, 2017—June 30, 2017

|

13

|

|

6.12

|

|

||

|

July 1, 2017—July 31, 2017

|

—

|

|

—

|

|

||

|

August 1, 2017—August 31, 2017

|

—

|

|

—

|

|

||

|

September 1, 2017—September 30, 2017

|

—

|

|

—

|

|

||

|

October 1, 2017—October 31, 2017

|

—

|

|

—

|

|

||

|

November 1, 2017—November 30, 2017

|

—

|

|

—

|

|

||

|

December 1, 2017—December 31, 2017

|

—

|

|

—

|

|

||

|

Total

|

87

|

|

6.87

|

|

||

|

|

December 31,

|

|||||||||||||||||

|

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

||||||||||||

|

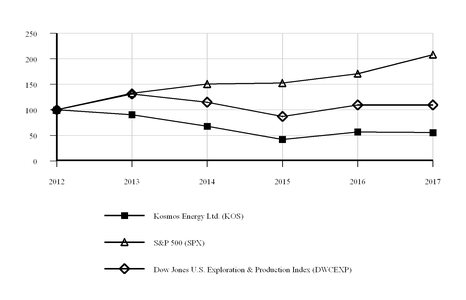

Kosmos Energy Ltd. (KOS)

|

$

|

100.00

|

|

$

|

90.53

|

|

$

|

67.94

|

|

$

|

42.11

|

|

$

|

56.76

|

|

$

|

55.47

|

|

|

S&P 500 (SPX)

|

100.00

|

|

132.37

|

|

150.48

|

|

152.55

|

|

170.78

|

|

208.05

|

|

||||||

|

Dow Jones U.S. Exploration & Production Index (DWCEXP)

|

100.00

|

|

131.17

|

|

114.81

|

|

87.02

|

|

109.40

|

|

109.70

|

|

||||||

|

|

Years Ended December 31,

|

||||||||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||

|

|

(In thousands, except per share data)

|

||||||||||||||||||

|

Revenues and other income:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Oil and gas revenue

|

$

|

578,139

|

|

$

|

310,377

|

|

$

|

446,696

|

|

$

|

855,877

|

|

$

|

851,212

|

|

||||

|

Gain on sale of assets

|

—

|

|

—

|

|

24,651

|

|

23,769

|

|

—

|

|

|||||||||

|

Other income, net

|

58,697

|

|

74,978

|

|

209

|

|

3,092

|

|

941

|

|

|||||||||

|

Total revenues and other income

|

636,836

|

|

385,355

|

|

471,556

|

|

882,738

|

|

852,153

|

|

|||||||||

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Oil and gas production

|

126,850

|

|

119,367

|

|

105,336

|

|

100,122

|

|

96,791

|

|

|||||||||

|

Facilities insurance modifications, net

|

(820

|

)

|

14,961

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Exploration expenses

|

216,050

|

|

202,280

|

|

156,203

|

|

93,519

|

|

230,314

|

|

|||||||||

|

General and administrative

|

68,302

|

|

87,623

|

|

136,809

|

|

135,231

|

|

158,421

|

|

|||||||||

|

Depletion and depreciation

|

255,203

|

|

140,404

|

|

155,966

|

|

198,080

|

|

222,544

|

|

|||||||||