|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

||||

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|||||

|

|

||||||

|

|

,

|

|

|

|||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

PART I

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

Item 1.

|

Business

|

|

•

|

KCSM Servicios, S.A. de C.V. (“KCSM Servicios”), a wholly-owned and consolidated subsidiary that provides employee services to KCSM;

|

|

•

|

Meridian Speedway, LLC (“MSLLC”), a

seventy percent-owned

consolidated affiliate that owns the former KCSR rail line between Meridian, Mississippi and Shreveport, Louisiana, which is the portion of the rail line between Dallas, Texas and Meridian known as the “Meridian Speedway.” Norfolk Southern Corporation, through its wholly-owned subsidiary, The Alabama Great Southern Railroad Company, owns the remaining

thirty percent

of MSLLC;

|

|

•

|

TFCM, S. de R.L. de C.V. (“TCM”), a

forty-five percent-owned

unconsolidated affiliate that operates a bulk liquid terminal in San Luis Potosí, Mexico;

|

|

•

|

Ferrocarril y Terminal del Valle de México, S.A. de C.V. (“FTVM”), a

twenty-five percent-owned

unconsolidated affiliate that provides railroad services as well as ancillary services in the greater Mexico City area; and

|

|

•

|

PTC-220, LLC (“PTC-220”), a

fourteen percent-owned

unconsolidated affiliate that holds the licenses to large blocks of radio spectrum and other assets for the deployment of Positive Train Control (“PTC”). See Government Regulation section for further information regarding PTC.

|

|

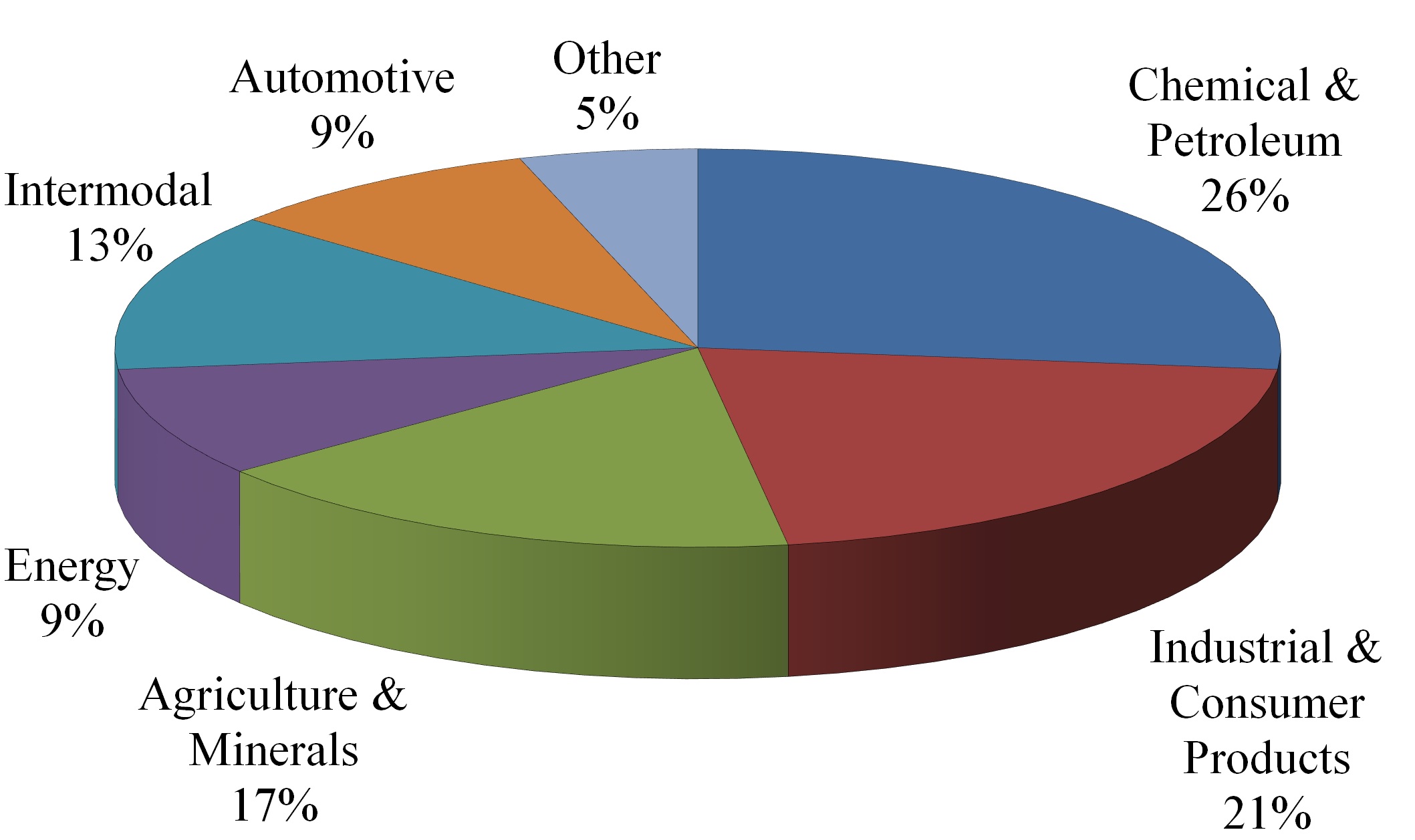

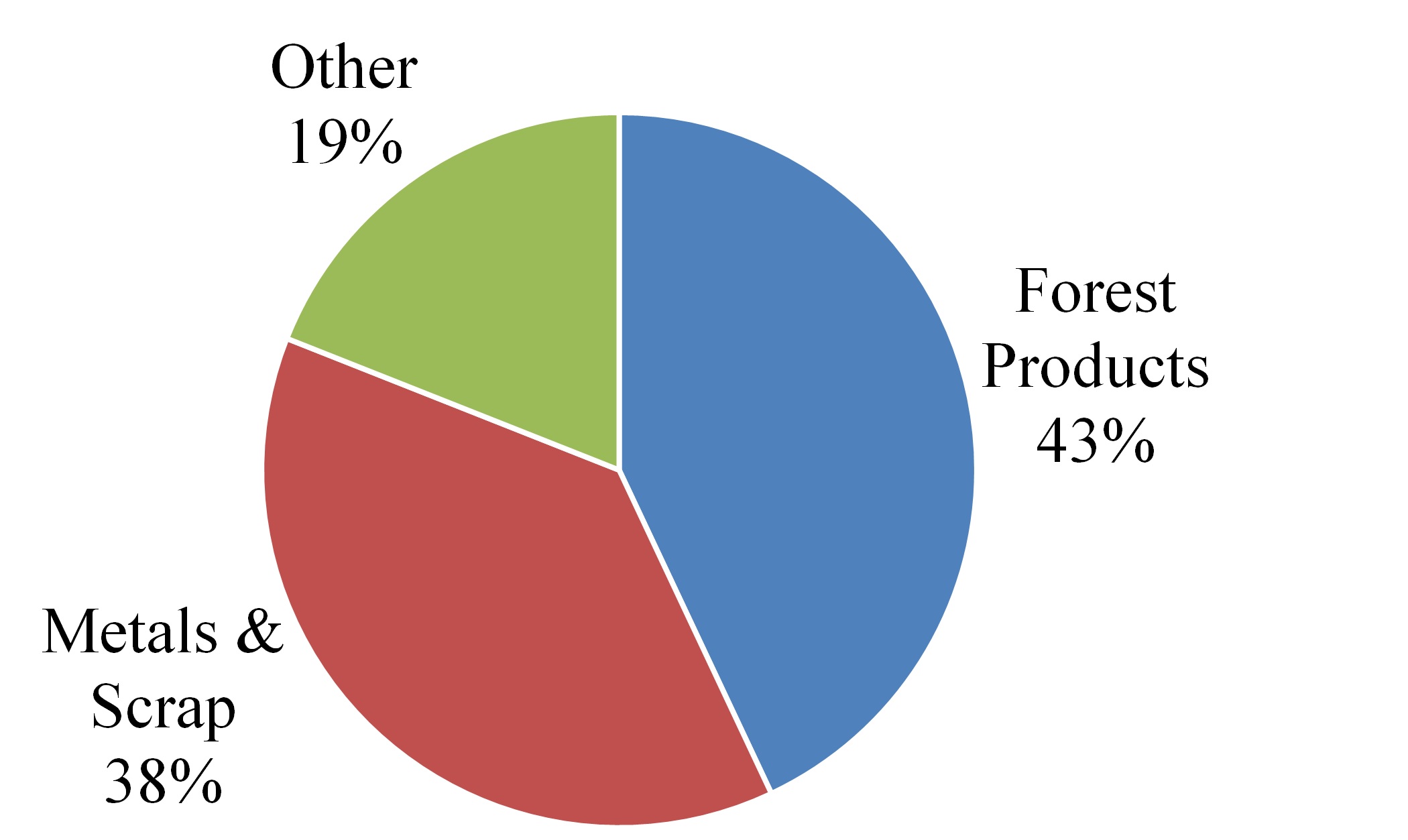

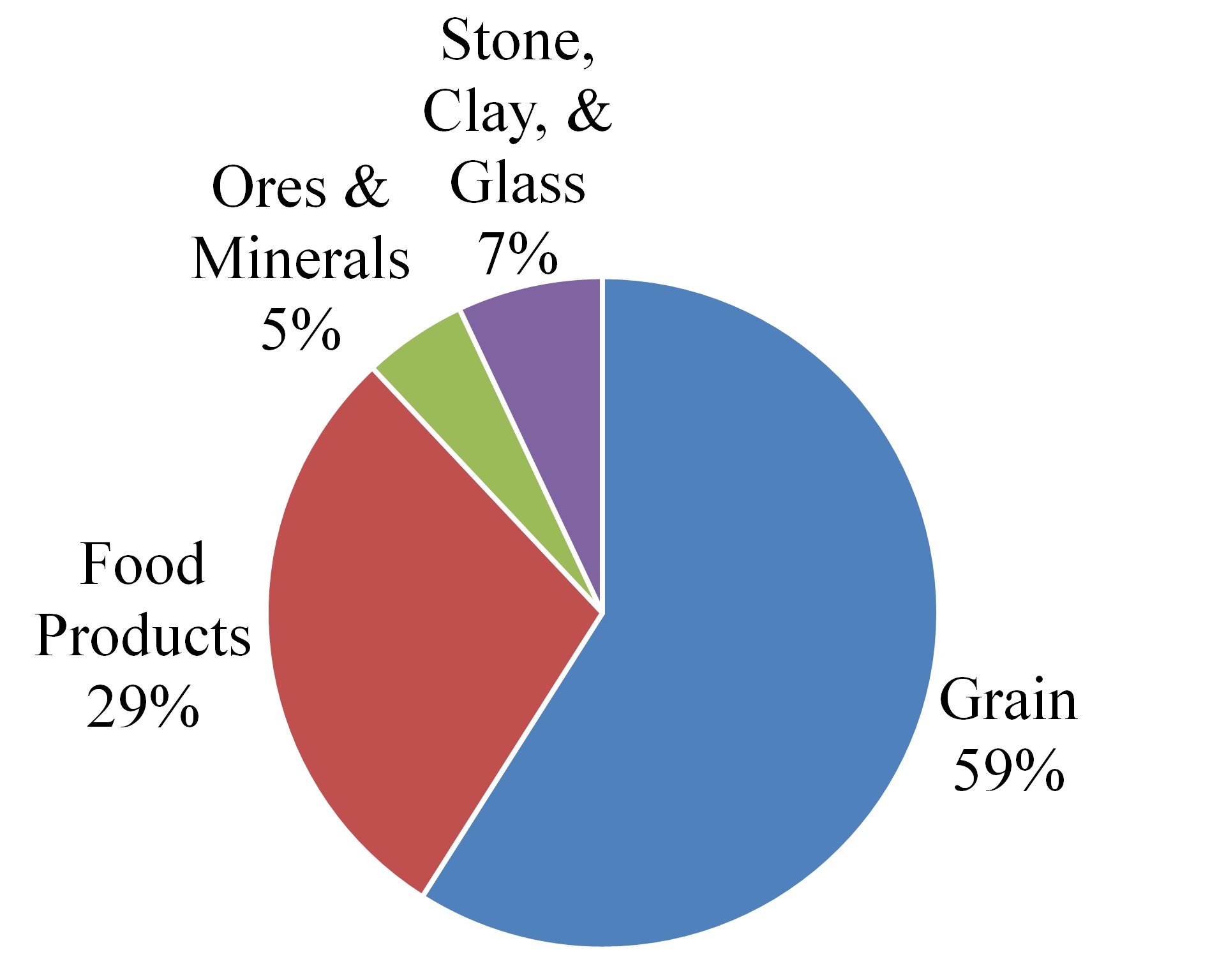

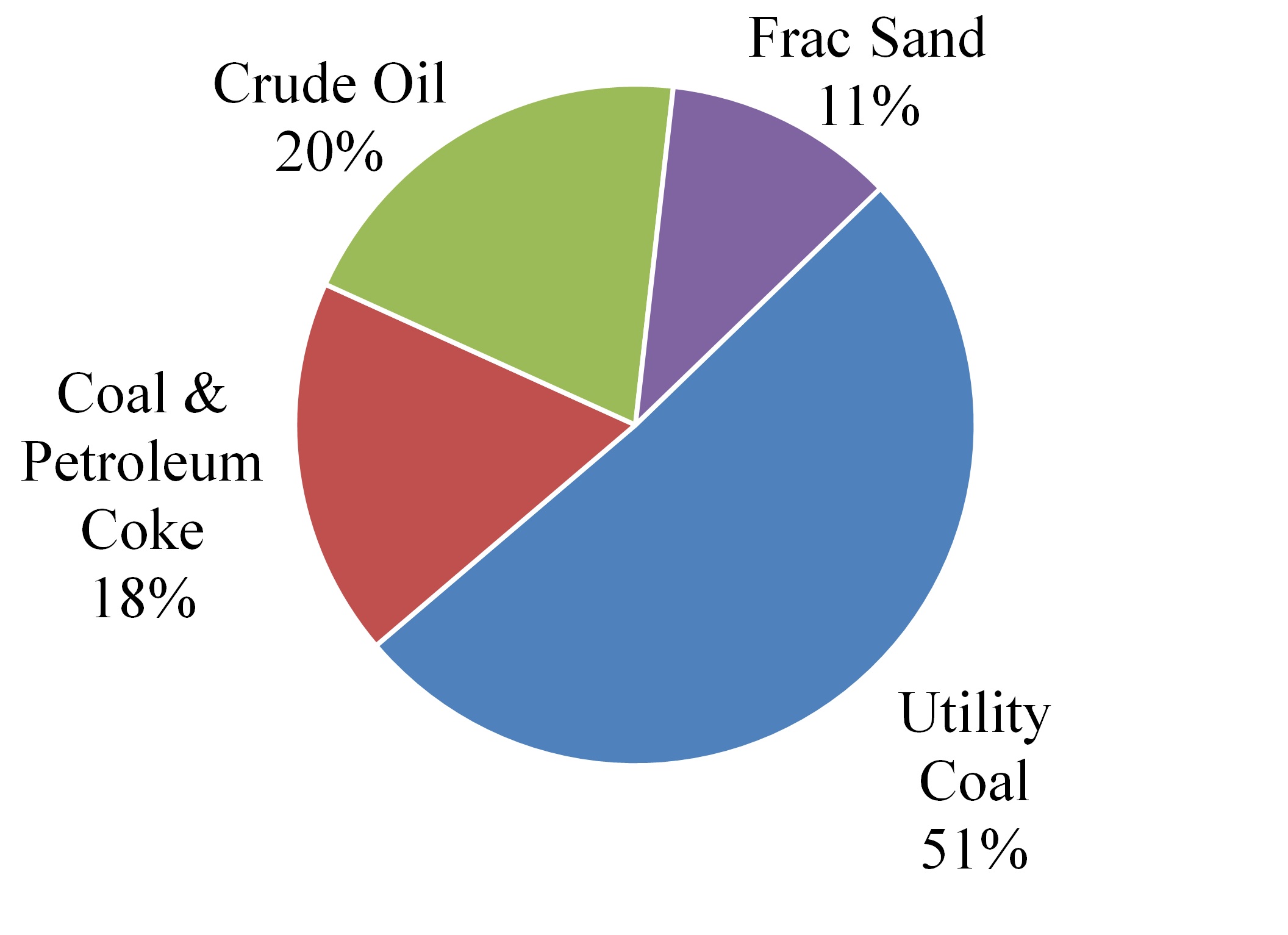

2019 Revenues

Business Mix

|

|

|

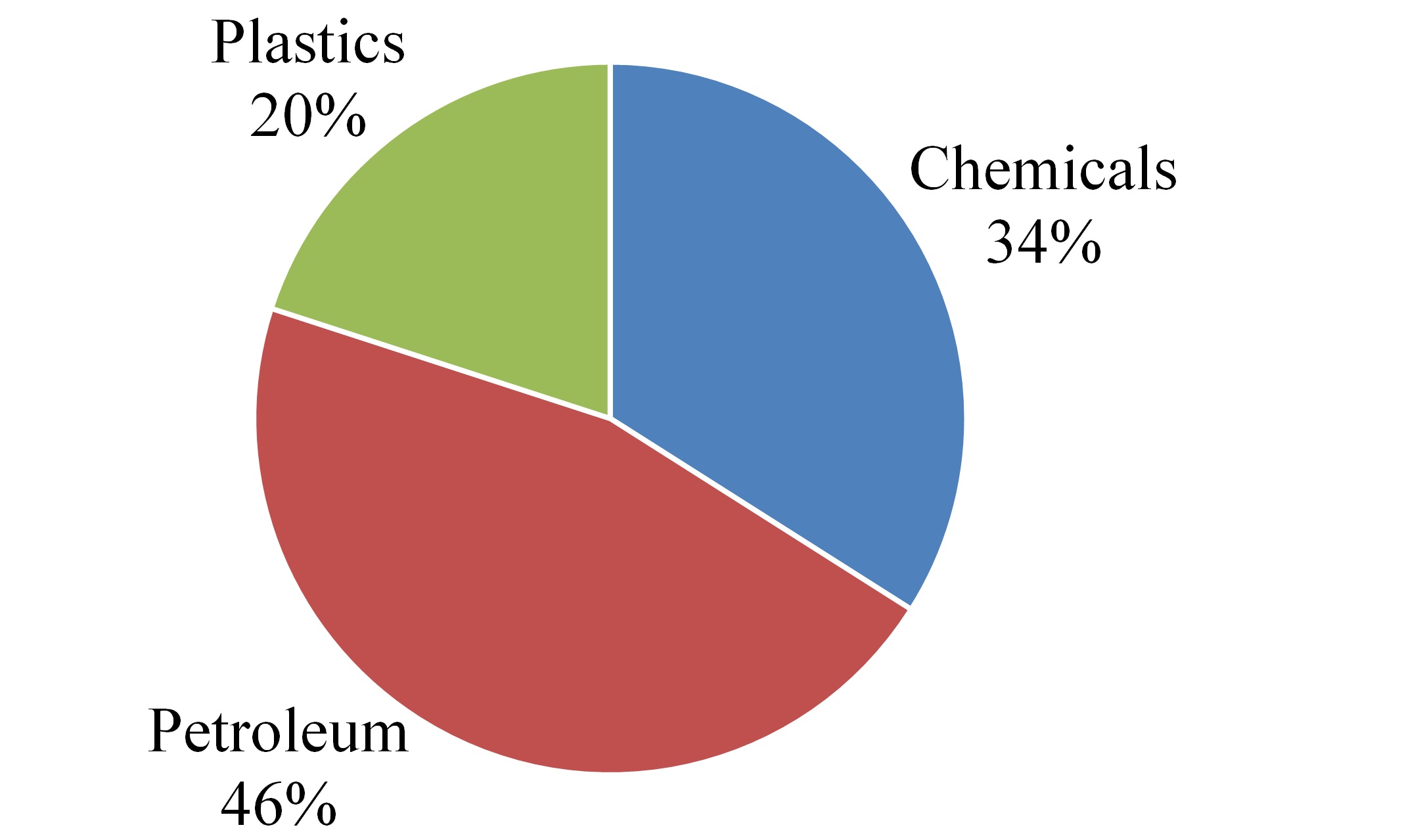

Chemical and petroleum.

This commodity group includes products such as chemicals, plastics, petroleum, liquefied petroleum gas, and petroleum refined products, such as gasoline and diesel. KCS transports these products across its network and through interchanges with other rail carriers. The chemical and plastic products are used in the automotive, housing and packaging industries as well as in general manufacturing. KCS hauls petroleum products across its network and as U.S. petroleum refineries have continued to increase their refining capacity, they have coordinated with KCS to develop additional long-term storage opportunities which complement a fluid freight railroad operation.

|

|

|

•

|

Conferring regularly with other railroads’ security personnel and with industry experts on security issues;

|

|

•

|

Routing shipments of certain chemicals, which might be toxic if inhaled, pursuant to federal regulations;

|

|

•

|

Initiating a series of over 20 voluntary action items agreed to between AAR and DHS as enhancing security in the rail industry;

|

|

•

|

Conducting constant and targeted security training as part of the scheduled training for operating employees and managers;

|

|

•

|

Developing smartphone applications to ensure immediate information, live video and pictures from security supervisors and protection assets pertaining to potential operational risks;

|

|

•

|

Developing a multi-layered security model using high-speed digital imaging, system velocity and covert and overt security filters to mitigate the risk of illicit activity;

|

|

•

|

Measuring key security metrics to ensure positive risk mitigation and product integrity trends;

|

|

•

|

Performing constant due diligence with the existing security model and by benchmarking rail security, including cyber security, on a world-wide basis to monitor threat streams related to rail incidents;

|

|

•

|

Implementing a Tactical Intelligence Center by KCSM, which provides constant training with core members in new technology helping to prevent, detect, deter, deny and respond to potentially illicit activities; and

|

|

•

|

Deploying an array of non-intrusive technologies including, but not limited to, digital video surveillance and analytics as part of an intelligent video security solution, including a closed circuit television platform with geo-fencing for intrusion detection, to allow for remote viewing access to monitor ports of entry, intermodal and rail yards.

|

|

Item 1A.

|

Risk Factors

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 2.

|

Properties

|

|

2019

|

2018

|

||||||||||||||||

|

|

Owned

|

Leased

|

Total

|

Owned

|

Leased

|

Total

|

|||||||||||

|

Freight Cars:

|

|||||||||||||||||

|

Box cars

|

2,106

|

|

716

|

|

2,822

|

|

3,178

|

|

991

|

|

4,169

|

|

|||||

|

Hoppers (covered and open top)

|

4,998

|

|

1,073

|

|

6,071

|

|

5,419

|

|

1,108

|

|

6,527

|

|

|||||

|

Gondolas

|

2,172

|

|

158

|

|

2,330

|

|

2,560

|

|

169

|

|

2,729

|

|

|||||

|

Automotive

|

3,316

|

|

535

|

|

3,851

|

|

3,316

|

|

742

|

|

4,058

|

|

|||||

|

Flat cars (intermodal and other)

|

1,121

|

|

1,075

|

|

2,196

|

|

1,142

|

|

1,075

|

|

2,217

|

|

|||||

|

Tank cars

|

—

|

|

477

|

|

477

|

|

4

|

|

570

|

|

574

|

|

|||||

|

Total

|

13,713

|

|

4,034

|

|

17,747

|

|

15,619

|

|

4,655

|

|

20,274

|

|

|||||

|

Locomotives:

|

|||||||||||||||||

|

Freight

|

662

|

|

88

|

|

750

|

|

708

|

|

119

|

|

827

|

|

|||||

|

Switching

|

199

|

|

—

|

|

199

|

|

222

|

|

—

|

|

222

|

|

|||||

|

Total

|

861

|

|

88

|

|

949

|

|

930

|

|

119

|

|

1,049

|

|

|||||

|

Average Age (in Years) of Owned and Leased Locomotives:

|

2019

|

2018

|

|||

|

Freight

|

15.5

|

|

15.3

|

|

|

|

Switching

|

45.8

|

|

44.4

|

|

|

|

All locomotives

|

21.9

|

|

21.5

|

|

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

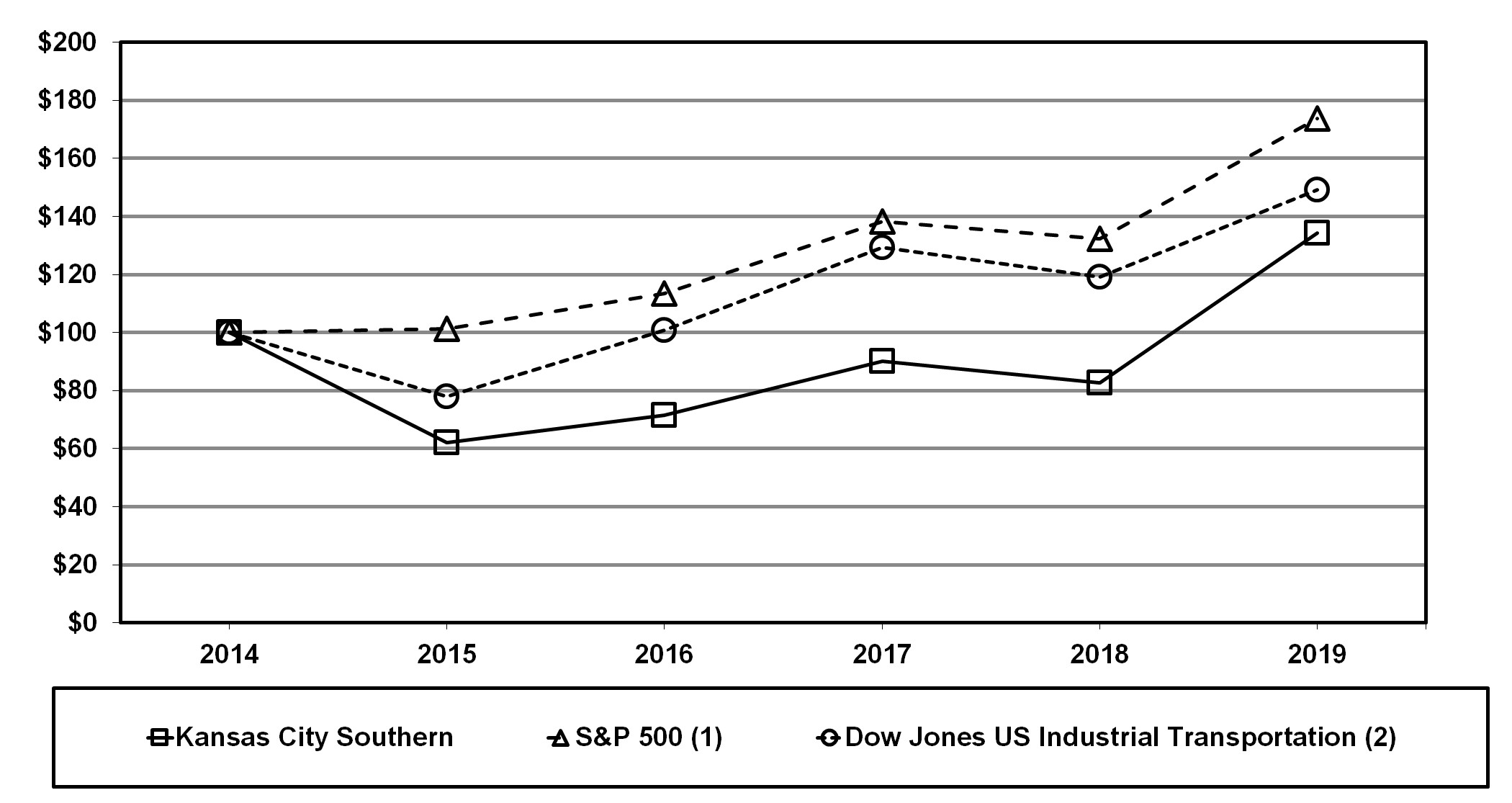

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|||||||||||||

|

Kansas City Southern

|

$

|

100.00

|

|

$

|

62.07

|

|

$

|

71.60

|

|

$

|

90.03

|

|

$

|

82.77

|

|

$

|

134.37

|

|

|

S&P 500

(1)

|

100.00

|

|

101.38

|

|

113.51

|

|

138.29

|

|

132.23

|

|

173.86

|

|

||||||

|

Dow Jones U.S. Industrial Transportation

(2)

|

100.00

|

|

77.85

|

|

100.82

|

|

129.29

|

|

119.16

|

|

149.32

|

|

||||||

|

(1)

|

The S&P 500 is a registered trademark of Standard & Poor’s, a division of S&P Global, Inc. The S&P 500 Index reflects the weighted average market value for 500 companies whose shares are traded on the New York Stock Exchange, American Stock Exchange and the Nasdaq Stock Market.

|

|

(2)

|

The Dow Jones U.S. Industrial Transportation Index is a registered trademark of S&P Dow Jones Indices LLC, a division of S&P Global, Inc.

|

|

Period

|

|

(a) Total

Number

of Shares

(or Units)

Purchased

(1)

|

|

(b) Average

Price Paid

per Share (or Unit)

|

|

(c) Total

Number of

Shares

(or Units)

Purchased

as Part of

Publicly

Announced

Plans or

Programs

|

|

(d) Maximum

Number (or

Approximate

Dollar Value)

of Shares (or Units)

that may yet be

purchased under

the Plans

or

Programs

|

|

||||||||||

|

Common stock

|

|||||||||||||||||||

|

October 1-31, 2019

|

|

—

|

|

|

—

|

|

|

—

|

|

|

$

|

59,329,074

|

|

|

|||||

|

November 1-30, 2019

(2)

|

|

3,022,760

|

|

|

$

|

154.66

|

|

|

3,022,760

|

|

|

$

|

1,532,500,000

|

|

|

||||

|

December 1-31, 2019

|

|

—

|

|

|

—

|

|

|

—

|

|

|

$

|

1,532,500,000

|

|

|

|||||

|

Total

|

|

3,022,760

|

|

|

|

|

|

3,022,760

|

|

|

|

|

|

||||||

|

$25 Par preferred stock

|

|||||||||||||||||||

|

October 1-31, 2019

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

November 1-30, 2019

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

December 1-31, 2019

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Total

|

—

|

|

—

|

|

|||||||||||||||

|

(1

|

)

|

All $25 par preferred stock repurchases were made other than through a publicly disclosed plan or program. Repurchases of $25 par preferred stock were made through open market purchases and/or privately negotiated transactions.

|

|

(2

|

)

|

On November 19, 2019, the Company paid $550.0 million under two ASR agreements and received an aggregate initial delivery of 3,022,760 shares, which represents approximately 85% of the total shares to be received under the agreements. The initial delivery of shares and their market price at time of delivery are included in the table above. The final number of shares repurchased and cost of shares repurchased will be based on the volume-weighted-average price of the Company’s common stock during the term of the agreements, which are expected to be settled in the first quarter of 2020, at which time the Company will receive the remaining amount of shares. See Item 8, Financial Statements and Supplementary Data — Note 16, Stockholders’ Equity for additional information.

|

|

Item 6.

|

Selected Financial Data

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Earnings From Continuing Operations

|

|||||||||||||||||||

|

Revenues

|

$

|

2,866.0

|

|

$

|

2,714.0

|

|

$

|

2,582.9

|

|

$

|

2,334.2

|

|

$

|

2,418.8

|

|

||||

|

Operating expenses (i) (ii) (iii) (iv)

|

1,979.7

|

|

1,727.7

|

|

1,661.3

|

|

1,515.7

|

|

1,615.0

|

|

|||||||||

|

Operating income

|

$

|

886.3

|

|

$

|

986.3

|

|

$

|

921.6

|

|

$

|

818.5

|

|

$

|

803.8

|

|

||||

|

Net income (v) (vi) (vii)

|

$

|

540.8

|

|

$

|

629.4

|

|

$

|

963.9

|

|

$

|

479.9

|

|

$

|

485.3

|

|

||||

|

Earnings per common share:

|

|||||||||||||||||||

|

Basic

|

$

|

5.42

|

|

$

|

6.16

|

|

$

|

9.18

|

|

$

|

4.44

|

|

$

|

4.41

|

|

||||

|

Diluted

|

5.40

|

|

6.13

|

|

9.16

|

|

4.43

|

|

4.40

|

|

|||||||||

|

Financial Position

|

|||||||||||||||||||

|

Total assets

|

$

|

9,786.8

|

|

$

|

9,469.8

|

|

$

|

9,198.7

|

|

$

|

8,817.5

|

|

$

|

8,341.0

|

|

||||

|

Total long-term debt obligations,

including current portion and short-term borrowings

|

3,246.0

|

|

2,689.4

|

|

2,619.4

|

|

2,478.2

|

|

2,401.1

|

|

|||||||||

|

Total stockholders’ equity

|

4,422.5

|

|

4,813.0

|

|

4,548.9

|

|

4,089.9

|

|

3,914.3

|

|

|||||||||

|

Total equity

|

4,745.9

|

|

5,132.7

|

|

4,865.4

|

|

4,404.5

|

|

4,224.7

|

|

|||||||||

|

Other Data Per Common Share

|

|||||||||||||||||||

|

Cash dividends declared per common share

|

$

|

1.48

|

|

$

|

1.44

|

|

$

|

1.38

|

|

$

|

1.32

|

|

$

|

1.32

|

|

||||

|

(i)

|

During 2019, the Company recognized pre-tax restructuring charges of

$168.8 million

within operating expenses related to the implementation of Precision Scheduled Railroading initiatives.

|

|

(ii)

|

During 2018, the Company recognized a pre-tax gain of

$17.9 million

within operating expenses for insurance recoveries related to damage from Hurricane Harvey in 2017.

|

|

(iii)

|

During 2018, 2017 and 2016, the Company recognized a pre-tax benefit of

$37.7 million

,

$44.1 million

and $62.8 million, respectively, within operating expenses related to a credit that was available for the excise tax included in the price of fuel that was purchased and consumed in locomotives and certain work equipment in Mexico. Effective January 1, 2019, the Company began recognizing the benefit as a reduction of income tax expense due to changes in Mexican tax law; and beginning April 30, 2019, railroads in Mexico are no longer eligible for the tax credit due to changes in Mexican tax regulations.

|

|

(iv)

|

During 2015, the Company recognized pre-tax lease termination costs of $9.6 million within operating expenses due to the early termination of certain operating leases and the related purchase of equipment.

|

|

(v)

|

During 2019, 2018 and 2015, the Company recognized pre-tax debt retirement and exchange costs of

$1.1 million

, $2.2 million and $7.6 million, respectively, related to debt retirement and restructuring activities that occurred during the periods.

|

|

(vi)

|

During 2019, the Company recognized a $12.8 million net tax benefit related to the Mexican fuel excise tax credit generated through April 29, 2019, noted in (iii) above.

|

|

(vii)

|

During 2017, the Company recognized a provisional $413.0 million net tax benefit, as a result of the Tax Cuts and Jobs Act (the “Tax Reform Act”), which was signed into law December 22, 2017. During 2018, the Company recognized a $20.9 million net tax benefit for adjustments to the provisional tax impacts of the Tax Reform Act recognized in 2017.

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

•

|

the outcome of claims and litigation, including those related to environmental contamination, personal injuries and property damage;

|

|

•

|

changes in legislation and regulations or revisions of controlling authority;

|

|

•

|

the adverse impact of any termination or revocation of Kansas City Southern de México, S.A. de C.V. (“KCSM”)’s Concession by the Mexican government;

|

|

•

|

United States, Mexican and global economic, political and social conditions;

|

|

•

|

the effects of current and future multinational trade agreements on the level of trade among the United States, Mexico and Canada;

|

|

•

|

the level of trade between the United States and Asia or Mexico;

|

|

•

|

the effects of fluctuations in the peso-dollar exchange rate;

|

|

•

|

natural events such as severe weather, fire, floods, hurricanes, earthquakes or other disruptions to the Company’s operating systems, structures and equipment or the ability of customers to produce or deliver their products;

|

|

•

|

the effects of adverse general economic conditions affecting customer demand and the industries and geographic areas that produce and consume the commodities KCS carries;

|

|

•

|

the dependence on the stability, availability and security of the information technology systems to operate its business;

|

|

•

|

the effect of demand for KCS’s services exceeding network capacity or traffic congestion on operating efficiencies and service reliability;

|

|

•

|

uncertainties regarding the litigation KCS faces and any future claims and litigation;

|

|

•

|

the impact of competition, including competition from other rail carriers, trucking companies and maritime shippers in the United States and Mexico;

|

|

•

|

KCS’s reliance on agreements with other railroads and third parties to successfully implement its business strategy, operations and growth and expansion plans, including the strategy to convert customers from using trucking services to rail transportation services;

|

|

•

|

compliance with environmental regulations;

|

|

•

|

disruption in fuel supplies, changes in fuel prices and the Company’s ability to recapture its costs of fuel from customers;

|

|

•

|

material adverse changes in economic and industry conditions, including the availability of short and long-term financing, both within the United States and Mexico and globally;

|

|

•

|

climate change and the market and regulatory responses to climate change;

|

|

•

|

changes in labor costs and labor difficulties, including strikes and work stoppages affecting either operations or customers’ abilities to deliver goods for shipment;

|

|

•

|

KCS’s reliance on certain key suppliers of core rail equipment;

|

|

•

|

unavailability of qualified personnel; and

|

|

•

|

acts of terrorism, war or other acts of violence or crime or risk of such activities.

|

|

•

|

The Kansas City Southern Railway Company (“KCSR”), a wholly-owned subsidiary;

|

|

•

|

KCSM, a wholly-owned subsidiary;

|

|

•

|

Mexrail, Inc. (“Mexrail”), a wholly-owned consolidated subsidiary which, in turn, wholly owns The Texas Mexican Railway Company (“Tex-Mex”);

|

|

•

|

KCSM Servicios, S.A. de C.V. (“KCSM Servicios”), a wholly-owned subsidiary;

|

|

•

|

Meridian Speedway, LLC (“MSLLC”), a

seventy percent-owned

consolidated affiliate;

|

|

•

|

Panama Canal Railway Company (“PCRC”), a

fifty percent-owned

unconsolidated affiliate;

|

|

•

|

TFCM, S. de R.L. de C.V. (“TCM”), a

forty-five percent-owned

unconsolidated affiliate;

|

|

•

|

Ferrocarril y Terminal del Valle de México, S.A. de C.V. (“FTVM”), a

twenty-five percent-owned

unconsolidated affiliate; and

|

|

•

|

PTC-220, LLC (“PTC-220”), a

fourteen percent-owned

unconsolidated affiliate.

|

|

•

|

Customer service

—

improve and sustain consistency and reliability of service and create a more resilient and dependable network;

|

|

•

|

Facilitating growth — additional capacity for new opportunities;

|

|

•

|

Improving asset utilization — meet growing demand with the same or fewer assets; and

|

|

•

|

Improving the cost profile of the Company — increased profitability driven by volume and revenue growth and improved productivity and asset utilization.

|

|

Year ended

|

Improvement/ (Deterioration)

|

FY 2020

Goal

|

||||||

|

December 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Gross velocity (mph) (i)

|

13.5

|

11.1

|

22%

|

17.0

|

||||

|

Terminal dwell (hours) (ii)

|

20.8

|

24.8

|

16%

|

18.0

|

||||

|

Train length (feet) (iii)

|

5,981

|

5,812

|

3%

|

6,350

|

||||

|

Car miles per day (iv)

|

110.9

|

93.3

|

19%

|

135.0

|

||||

|

Fuel efficiency (gallons per 1,000 GTM's) (v)

|

1.31

|

1.37

|

4%

|

1.24

|

||||

|

(i) Gross velocity is the average train speed between origin and destination in miles per hour calculated as the sum of the miles traveled divided by the sum of total transit hours. Transit hours are measured as the difference between a train’s origin departure and destination arrival date and times broken down by segment across the train route (includes all time spent including crew changes, terminal dwell, delays, and incidents).

|

|||||

|

(ii) Terminal dwell is the average amount of time in hours between car arrival to and departure from the yard (excludes cars that move through a terminal on a run-through train, stored, bad ordered, and maintenance-of-way cars). Calculated by dividing the total number of hours cars spent in terminals by the total count of car dwell events.

|

|||||

|

(iii) Train length is the average length of a train across its reporting stations, including the origin and intermediate stations. Length of a train is the sum of car and locomotive lengths measured in feet.

|

|||||

|

(iv) Car miles per day is the miles a car travels divided by total transit days. Transit days are measured from opening event to closing event (includes all time spent in terminals and on trains).

|

|||||

|

(v) Fuel efficiency is calculated by taking locomotive fuel consumed in gallons divided by thousand gross ton miles (“GTM’s”) net of detours with no associated fuel gallons. GTM’s are the movement of one ton of train weight over one mile calculated by multiplying total train weight by distance the train moved. GTM’s exclude locomotive gross ton miles.

|

|||||

|

2019

|

2018

|

Change

|

|||||||||

|

Revenues

|

$

|

2,866.0

|

|

$

|

2,714.0

|

|

$

|

152.0

|

|

||

|

Operating expenses

|

1,979.7

|

|

1,727.7

|

|

252.0

|

|

|||||

|

Operating income

|

886.3

|

|

986.3

|

|

(100.0

|

)

|

|||||

|

Equity in net earnings of affiliates

|

1.0

|

|

2.6

|

|

(1.6

|

)

|

|||||

|

Interest expense

|

(115.9

|

)

|

(110.0

|

)

|

(5.9

|

)

|

|||||

|

Debt retirement costs

|

(1.1

|

)

|

(2.2

|

)

|

1.1

|

|

|||||

|

Foreign exchange gain

|

17.1

|

|

7.8

|

|

9.3

|

|

|||||

|

Other income, net

|

1.0

|

|

2.4

|

|

(1.4

|

)

|

|||||

|

Income before income taxes

|

788.4

|

|

886.9

|

|

(98.5

|

)

|

|||||

|

Income tax expense

|

247.6

|

|

257.5

|

|

(9.9

|

)

|

|||||

|

Net income

|

540.8

|

|

629.4

|

|

(88.6

|

)

|

|||||

|

Less: Net income attributable to noncontrolling interest

|

1.9

|

|

2.0

|

|

(0.1

|

)

|

|||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

$

|

538.9

|

|

$

|

627.4

|

|

$

|

(88.5

|

)

|

||

|

Revenues

|

Carloads and Units

|

Revenue per Carload/Unit

|

||||||||||||||||||||||||||||

|

2019

|

2018

|

% Change

|

2019

|

2018

|

% Change

|

2019

|

2018

|

% Change

|

||||||||||||||||||||||

|

Chemical and petroleum

|

$

|

737.2

|

|

$

|

622.1

|

|

19

|

%

|

337.4

|

|

297.9

|

|

13

|

%

|

$

|

2,185

|

|

$

|

2,088

|

|

5

|

%

|

||||||||

|

Industrial and consumer products

|

610.4

|

|

591.0

|

|

3

|

%

|

320.9

|

|

324.9

|

|

(1

|

%)

|

1,902

|

|

1,819

|

|

5

|

%

|

||||||||||||

|

Agriculture and minerals

|

506.3

|

|

486.4

|

|

4

|

%

|

253.3

|

|

241.9

|

|

5

|

%

|

1,999

|

|

2,011

|

|

(1

|

%)

|

||||||||||||

|

Energy

|

246.2

|

|

256.3

|

|

(4

|

%)

|

244.7

|

|

248.6

|

|

(2

|

%)

|

1,006

|

|

1,031

|

|

(2

|

%)

|

||||||||||||

|

Intermodal

|

370.2

|

|

382.8

|

|

(3

|

%)

|

979.8

|

|

1,030.4

|

|

(5

|

%)

|

378

|

|

372

|

|

2

|

%

|

||||||||||||

|

Automotive

|

255.6

|

|

253.2

|

|

1

|

%

|

154.9

|

|

161.9

|

|

(4

|

%)

|

1,650

|

|

1,564

|

|

5

|

%

|

||||||||||||

|

Carload revenues, carloads and units

|

2,725.9

|

|

2,591.8

|

|

5

|

%

|

2,291.0

|

|

2,305.6

|

|

(1

|

%)

|

$

|

1,190

|

|

$

|

1,124

|

|

6

|

%

|

||||||||||

|

Other revenue

|

140.1

|

|

122.2

|

|

15

|

%

|

||||||||||||||||||||||||

|

Total revenues (i)

|

$

|

2,866.0

|

|

$

|

2,714.0

|

|

6

|

%

|

||||||||||||||||||||||

|

(i) Included in revenues:

|

||||||||||||||||||||||||||||||

|

Fuel surcharge

|

$

|

298.1

|

|

$

|

253.1

|

|

||||||||||||||||||||||||

|

Chemical and petroleum.

Reven

ues

increased $115.1 million for the year ended December 31, 2019, compared to 2018, due to a 13% increase in carload/unit volumes and a 5% increase in revenue per carload/unit. Volumes increased primarily due to increased refined fuel products and liquid petroleum gas shipments to Mexico. Revenue per carload/unit increased due to longer average length of haul, positive pricing impacts, and higher fuel surcharge.

|

|

|

Industrial and consumer products.

Revenue increased $19.4 million for the year ended December 31, 2019, compared to 2018, due to a 5% increase in revenue per carload/unit as a result of positive pricing impacts, higher fuel surcharge, and longer average length of haul. This increase was partially offset by a 1% decrease in carload/unit volumes primarily driven by paper shipments as a result of lower demand and available truck capacity, partially offset by an increase in metals volumes due to a customer’s change in sourcing location.

|

|

|

Agriculture and minerals.

Revenues increased $19.9 million for the year ended December 31, 2019 compared to 2018, due to a 5% increase in carload/unit volumes as a result of improved cycle times for grain and an increase in ores and minerals due to increased U.S. government infrastructure spending. This increase was partially offset by a 1% decrease in revenue per carload/unit due to negative mix impacts.

|

|

|

Energy.

Revenues decreased $10.1 million for the year ended December 31, 2019, compared to 2018, due to a 2% decrease in carload/unit volumes and revenue per carload/unit. Volumes decreased due to crude oil attributable to decreasing Canadian crude spreads, and frac sand attributable to changes in sourcing patterns, partially offset by an increase in utility coal volumes caused by improved cycle times and demand. Revenue per carload/unit decreased due to shorter average length of haul and mix, partially offset by positive pricing impacts.

|

|

|

Change

|

||||||||||||||

|

2019

|

2018

|

Dollars

|

Percent

|

|||||||||||

|

Compensation and benefits

|

$

|

529.1

|

|

$

|

495.7

|

|

$

|

33.4

|

|

7

|

%

|

|||

|

Purchased services

|

219.2

|

|

200.7

|

|

18.5

|

|

9

|

%

|

||||||

|

Fuel

|

340.4

|

|

348.2

|

|

(7.8

|

)

|

(2

|

%)

|

||||||

|

Mexican fuel excise tax credit

|

—

|

|

(37.7

|

)

|

37.7

|

|

(100

|

%)

|

||||||

|

Equipment costs

|

108.6

|

|

126.1

|

|

(17.5

|

)

|

(14

|

%)

|

||||||

|

Depreciation and amortization

|

350.7

|

|

346.7

|

|

4.0

|

|

1

|

%

|

||||||

|

Materials and other

|

262.9

|

|

265.9

|

|

(3.0

|

)

|

(1

|

%)

|

||||||

|

Restructuring charges

|

168.8

|

|

—

|

|

168.8

|

|

100

|

%

|

||||||

|

Gain on insurance recoveries related to hurricane damage

|

—

|

|

(17.9

|

)

|

17.9

|

|

(100

|

%)

|

||||||

|

Total operating expenses

|

$

|

1,979.7

|

|

$

|

1,727.7

|

|

$

|

252.0

|

|

15

|

%

|

|||

|

2019

|

2018

|

Change

|

||||||||||||||||||

|

Dollars

|

Percent

|

Dollars

|

Percent

|

Dollars

|

Percent

|

|||||||||||||||

|

Income tax expense using the statutory rate in effect

|

$

|

165.6

|

|

21.0

|

%

|

$

|

186.2

|

|

21.0

|

%

|

$

|

(20.6

|

)

|

—

|

|

|||||

|

Tax effect of:

|

|

|

||||||||||||||||||

|

Difference between U.S. and foreign tax rate

|

47.6

|

|

6.0

|

%

|

46.1

|

|

5.2

|

%

|

1.5

|

|

0.8

|

%

|

||||||||

|

Foreign exchange (i)

|

35.9

|

|

4.6

|

%

|

21.8

|

|

2.5

|

%

|

14.1

|

|

2.1

|

%

|

||||||||

|

Tax credits

|

(16.8

|

)

|

(2.1

|

%)

|

(14.2

|

)

|

(1.6

|

%)

|

(2.6

|

)

|

(0.5

|

%)

|

||||||||

|

Mexican fuel excise tax credit, net (ii)

|

(12.8

|

)

|

(1.6

|

%)

|

—

|

|

—

|

|

(12.8

|

)

|

(1.6

|

%)

|

||||||||

|

State and local income tax provision, net

|

11.5

|

|

1.5

|

%

|

7.5

|

|

0.8

|

%

|

4.0

|

|

0.7

|

%

|

||||||||

|

Withholding tax

|

9.5

|

|

1.2

|

%

|

11.2

|

|

1.3

|

%

|

(1.7

|

)

|

(0.1

|

%)

|

||||||||

|

Global intangible low-taxed income (“GILTI”) tax, net

|

2.7

|

|

0.3

|

%

|

11.8

|

|

1.3

|

%

|

(9.1

|

)

|

(1.0

|

%)

|

||||||||

|

Change in U.S. tax rate

|

—

|

|

—

|

|

(2.2

|

)

|

(0.3

|

%)

|

2.2

|

|

0.3

|

%

|

||||||||

|

Deemed mandatory repatriation

|

—

|

|

—

|

|

(18.7

|

)

|

(2.1

|

%)

|

18.7

|

|

2.1

|

%

|

||||||||

|

Other, net

|

4.4

|

|

0.5

|

%

|

8.0

|

|

0.9

|

%

|

(3.6

|

)

|

(0.4

|

%)

|

||||||||

|

Income tax expense

|

$

|

247.6

|

|

31.4

|

%

|

$

|

257.5

|

|

29.0

|

%

|

$

|

(9.9

|

)

|

2.4

|

%

|

|||||

|

(i)

|

Mexican income taxes are paid in Mexican pesos, and as a result, the effective income tax rate reflects fluctuations in the value of the Mexican peso against the U.S. dollar. The foreign exchange impact on income taxes includes the gain or loss from the revaluation of the Company’s net U.S. dollar-denominated monetary liabilities into Mexican pesos which is included in Mexican taxable income under Mexican tax law. As a result, a strengthening of the Mexican peso against the U.S. dollar for the reporting period will generally increase the Mexican cash tax obligation and the effective income tax rate, and a weakening of the Mexican peso against the U.S. dollar for the reporting period will generally decrease the Mexican cash tax obligation and the effective tax rate. To hedge its exposure to this cash tax risk, the Company enters into foreign currency derivative contracts, which are measured at fair value each period and any change in fair value is recognized in foreign exchange gain (loss) within the consolidated statements of income. Refer to Note

12

, Derivative Instruments for further information.

|

|

(ii)

|

See discussion of the inclusion of the Mexican fuel excise tax credit, net within the effective tax rate in the Mexico Tax Reform section, below.

|

|

•

|

Approximately 40-50% to capital projects and strategic investments; and

|

|

•

|

Approximately 50-60% to share repurchases and dividends.

|

|

•

|

An increase in the quarterly dividend on KCS’s common stock from $0.36 to $0.40 per share. The Board declared a cash dividend on its outstanding common stock for this increased amount payable on January 22, 2020, to stockholders of record at the close of business on December 31, 2019, and

|

|

•

|

A new $2.0 billion share repurchase program (“2019 Program”), expiring December 31, 2022. This new program replaced the $800 million stock repurchase authorization announced in 2017 under which the Company purchased approximately $741 million of Company stock.

|

|

2019

|

2018

|

||||||

|

Cash flows provided by (used for):

|

|||||||

|

Operating activities

|

$

|

1,103.5

|

|

$

|

945.7

|

|

|

|

Investing activities

|

(676.3

|

)

|

(651.9

|

)

|

|||

|

Financing activities

|

(378.9

|

)

|

(327.4

|

)

|

|||

|

Net increase (decrease) in cash and cash equivalents

|

48.3

|

|

(33.6

|

)

|

|||

|

Cash and cash equivalents beginning of year

|

100.5

|

|

134.1

|

|

|||

|

Cash and cash equivalents end of year

|

$

|

148.8

|

|

$

|

100.5

|

|

|

|

Payments Due by Period

|

|||||||||||||||||||

|

Total

|

Less Than

1 Year

|

1-3 Years

|

3-5 Years

|

More than

5 years

|

|||||||||||||||

|

Long-term debt and short-term borrowings (including interest and finance lease obligations) (i)

|

$

|

6,219.5

|

|

$

|

149.9

|

|

$

|

271.4

|

|

$

|

885.3

|

|

$

|

4,912.9

|

|

||||

|

Operating leases

|

141.6

|

|

50.3

|

|

53.0

|

|

29.9

|

|

8.4

|

|

|||||||||

|

Deemed mandatory repatriation tax (ii)

|

5.8

|

|

—

|

|

—

|

|

1.0

|

|

4.8

|

|

|||||||||

|

Obligations due to uncertainty in income taxes

|

2.2

|

|

—

|

|

—

|

|

2.2

|

|

—

|

|

|||||||||

|

Capital expenditure obligations (iii)

|

176.2

|

|

153.1

|

|

23.1

|

|

—

|

|

—

|

|

|||||||||

|

Other contractual obligations (iv)

|

448.0

|

|

79.7

|

|

120.5

|

|

88.8

|

|

159.0

|

|

|||||||||

|

Total

|

$

|

6,993.3

|

|

$

|

433.0

|

|

$

|

468.0

|

|

$

|

1,007.2

|

|

$

|

5,085.1

|

|

||||

|

(i)

|

For variable rate obligations, interest payments were calculated using the December 31, 2019 rate. For fixed rate obligations, interest payments were calculated based on the applicable rates and payment dates.

|

|

(ii)

|

U.S. federal income tax on deemed mandatory repatriation is payable over 8 years pursuant to the Tax Reform Act.

|

|

(iii)

|

Capital expenditure obligations include minimum capital expenditures under the KCSM Concession agreement and other regulatory requirements.

|

|

(iv)

|

Other contractual obligations include purchase commitments and certain maintenance agreements.

|

|

2019

|

2018

|

|||||||

|

Roadway capital program

|

$

|

264.9

|

|

$

|

245.7

|

|

||

|

Locomotives and freight cars

|

182.8

|

|

101.2

|

|

||||

|

Capacity

|

84.8

|

|

69.8

|

|

||||

|

Positive train control

|

15.5

|

|

28.9

|

|

||||

|

Information technology

|

29.8

|

|

35.4

|

|

||||

|

Other

|

6.5

|

|

31.3

|

|

||||

|

Total capital expenditures (accrual basis)

|

584.3

|

|

512.3

|

|

||||

|

Change in capital accruals

|

2.9

|

|

8.0

|

|

||||

|

Total cash capital expenditures

|

$

|

587.2

|

|

$

|

520.3

|

|

||

|

Purchase or replacement of assets under operating leases:

|

||||||||

|

Locomotives

|

$

|

—

|

|

$

|

50.6

|

|

||

|

Freight cars

|

0.9

|

|

49.9

|

|

||||

|

Office building

|

38.1

|

|

—

|

|

||||

|

Total purchase or replacement of assets under operating leases (accrual basis)

|

39.0

|

|

100.5

|

|

||||

|

Change in capital accruals

|

—

|

|

(1.6

|

)

|

||||

|

Total cash purchase or replacement of assets under operating leases

|

$

|

39.0

|

|

$

|

98.9

|

|

||

|

2019

|

2018

|

||||

|

Track miles of rail installed

|

122

|

|

166

|

|

|

|

Cross ties installed (thousands)

|

627

|

|

651

|

|

|

|

•

|

Statistical analysis of historical patterns of use and retirements of each asset class;

|

|

•

|

Evaluation of any expected changes in current operations and the outlook for the continued use of the assets;

|

|

•

|

Evaluation of technological advances and changes to maintenance practices;

|

|

•

|

Historical and expected salvage to be received upon retirement;

|

|

•

|

Review of accounting policies and assumptions; and

|

|

•

|

Industry precedents and trends.

|

|

•

|

The Company’s executive management is dedicated to ensuring compliance with the various provisions of the Concession and to maintaining positive relationships with the SCT and other Mexican federal, state, and municipal governmental authorities;

|

|

•

|

During the time since the Concession was granted, the relationships between KCSM and the various Mexican governmental authorities have matured and the guidelines for operating under the Concession have become more defined with experience;

|

|

•

|

There are no known supportable sanctions or compliance issues that would cause the SCT to revoke the Concession or prevent KCSM from renewing the Concession; and

|

|

•

|

KCSM operations are an integral part of the KCS operations strategy, and related investment analyses and operational decisions assume that the Company’s cross border rail business operates into perpetuity, and do not assume that Mexico operations terminate at the end of the current Concession term.

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

Hypothetical Change in Exchange Rate

|

Amount of Gain (Loss)

|

Affected Line Item in the Consolidated Statements of Income

|

||||

|

Net monetary assets denominated in Mexican pesos at December 31, 2019:

|

||||||

|

Ps.1,956.9 million

|

From Ps.18.8 to Ps.19.8

|

($5.2 million)

|

Foreign exchange gain (loss)

|

|||

|

Ps.1,956.9 million

|

From Ps.18.8 to Ps.17.8

|

$5.8 million

|

Foreign exchange gain (loss)

|

|||

|

Hypothetical Change in Exchange Rate

|

Increase (Decrease) in Effective Income Tax Rate

|

Amount of Expense (Benefit)

|

Affected Line Item in the Consolidated Statements of Income

|

|||

|

From Ps.18.8 to Ps.19.8

|

(2.0%)

|

($15.7 million)

|

Income tax expense (benefit)

|

|||

|

From Ps.18.8 to Ps.17.8

|

2.2%

|

$17.5 million

|

Income tax expense (benefit)

|

|||

|

Aggregate notional amount:

|

Hypothetical Change in Exchange Rate

|

Amount of Gain (Loss)

|

Affected Line Item in the Consolidated Statements of Income

|

|||

|

$250.0 million

|

From Ps.19.0 to Ps.20.0

|

($12.5 million)

|

Foreign exchange gain (loss)

|

|||

|

$250.0 million

|

From Ps.19.0 to Ps.18.0

|

$13.9 million

|

Foreign exchange gain (loss)

|

|||

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Page

|

|

Financial Statement Schedules:

|

|

|

2019

|

2018

|

2017

|

|||||||||

|

(In millions, except share

and per share amounts)

|

|||||||||||

|

Revenues

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Operating expenses:

|

|||||||||||

|

Compensation and benefits

|

|

|

|

|

|

|

|||||

|

Purchased services

|

|

|

|

|

|

|

|||||

|

Fuel

|

|

|

|

|

|

|

|||||

|

Mexican fuel excise tax credit

|

|

|

(

|

)

|

(

|

)

|

|||||

|

Equipment costs

|

|

|

|

|

|

|

|||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|||||

|

Materials and other

|

|

|

|

|

|

|

|||||

|

Restructuring charges

|

|

|

|

|

|

|

|||||

|

Gain on insurance recoveries related to hurricane damage

|

|

|

(

|

)

|

|

|

|||||

|

Total operating expenses

|

|

|

|

|

|

|

|||||

|

Operating income

|

|

|

|

|

|

|

|||||

|

Equity in net earnings of affiliates

|

|

|

|

|

|

|

|||||

|

Interest expense

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Debt retirement costs

|

(

|

)

|

(

|

)

|

|

|

|||||

|

Foreign exchange gain

|

|

|

|

|

|

|

|||||

|

Other income (expense), net

|

|

|

|

|

(

|

)

|

|||||

|

Income before income taxes

|

|

|

|

|

|

|

|||||

|

Income tax expense (benefit)

|

|

|

|

|

(

|

)

|

|||||

|

Net income

|

|

|

|

|

|

|

|||||

|

Less: Net income attributable to noncontrolling interest

|

|

|

|

|

|

|

|||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

|

|

|

|

|

|

|||||

|

Preferred stock dividends

|

|

|

|

|

|

|

|||||

|

Net income available to common stockholders

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Earnings per share:

|

|||||||||||

|

Basic earnings per share

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Diluted earnings per share

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Average shares outstanding

(in thousands):

|

|||||||||||

|

Basic

|

|

|

|

|

|

|

|||||

|

Potentially dilutive common shares

|

|

|

|

|

|

|

|||||

|

Diluted

|

|

|

|

|

|

|

|||||

|

2019

|

2018

|

2017

|

|||||||||

|

|

(In millions)

|

||||||||||

|

Net income

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Other comprehensive income (loss):

|

|||||||||||

|

Unrealized gain (loss) on interest rate derivative instruments during the period, net of tax of $(4.9) million, $1.0 million and $(2.2) million

|

(

|

)

|

|

|

(

|

)

|

|||||

|

Reclassification adjustment from cash flow hedges included in net income, net of tax of less than $0.1 million

|

|

|

|

|

|

|

|||||

|

Foreign currency translation adjustments, net of tax of $3.8 million for 2017

|

|

|

|

|

(

|

)

|

|||||

|

Other comprehensive income (loss)

|

(

|

)

|

|

|

(

|

)

|

|||||

|

Comprehensive income

|

|

|

|

|

|

|

|||||

|

Less: comprehensive income attributable to noncontrolling interest

|

|

|

|

|

|

|

|||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

2019

|

2018

|

||||||

|

(In millions, except share

and per share amounts)

|

|||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

|

|

$

|

|

|

|

|

Accounts receivable, net

|

|

|

|

|

|||

|

Materials and supplies

|

|

|

|

|

|||

|

Other current assets

|

|

|

|

|

|||

|

Total current assets

|

|

|

|

|

|||

|

Operating lease right-of-use assets

|

|

|

|

|

|||

|

Investments

|

|

|

|

|

|||

|

Property and equipment (including concession assets), net

|

|

|

|

|

|||

|

Other assets

|

|

|

|

|

|||

|

Total assets

|

$

|

|

|

$

|

|

|

|

|

LIABILITIES AND EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Long-term debt due within one year

|

$

|

|

|

$

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

|

|

|

|||

|

Total current liabilities

|

|

|

|

|

|||

|

Long-term operating lease liabilities

|

|

|

|

|

|||

|

Long-term debt

|

|

|

|

|

|||

|

Deferred income taxes

|

|

|

|

|

|||

|

Other noncurrent liabilities and deferred credits

|

|

|

|

|

|||

|

Total liabilities

|

|

|

|

|

|||

|

Stockholders’ equity:

|

|||||||

|

$25 par, 4% noncumulative, preferred stock, 840,000 shares authorized, 649,736 shares issued; 222,625 and 228,395 shares outstanding at December 31, 2019 and 2018, respectively

|

|

|

|

|

|||

|

$.01 par, common stock, 400,000,000 shares authorized, 123,352,185 shares issued; 96,115,669 and 100,896,678 shares outstanding at December 31, 2019 and 2018, respectively

|

|

|

|

|

|||

|

Additional paid-in capital

|

|

|

|

|

|||

|

Retained earnings

|

|

|

|

|

|||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

|||

|

Total stockholders’ equity

|

|

|

|

|

|||

|

Noncontrolling interest

|

|

|

|

|

|||

|

Total equity

|

|

|

|

|

|||

|

Total liabilities and equity

|

$

|

|

|

$

|

|

|

|

|

2019

|

2018

|

2017

|

|||||||||

|

(In millions)

|

|||||||||||

|

Operating activities:

|

|||||||||||

|

Net income

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|||||

|

Deferred income taxes

|

|

|

|

|

(

|

)

|

|||||

|

Equity in net earnings of affiliates

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Share-based compensation

|

|

|

|

|

|

|

|||||

|

Distributions from affiliates

|

|

|

|

|

|

|

|||||

|

Settlement of foreign currency derivative instruments

|

|

|

|

|

(

|

)

|

|||||

|

Gain on foreign currency derivative instruments

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Restructuring charges

|

|

|

|

|

|

|

|||||

|

Cash payments for restructuring charges

|

(

|

)

|

|

|

|

|

|||||

|

Settlement of treasury lock agreements

|

(

|

)

|

|

|

|

|

|||||

|

Gain on insurance recoveries related to hurricane damage

|

|

|

(

|

)

|

|

|

|||||

|

Insurance proceeds related to hurricane damage

|

|

|

|

|

|

|

|||||

|

Deemed mandatory repatriation tax

|

|

|

(

|

)

|

|

|

|||||

|

Changes in working capital items:

|

|||||||||||

|

Accounts receivable

|

|

|

(

|

)

|

(

|

)

|

|||||

|

Materials and supplies

|

|

|

(

|

)

|

|

|

|||||

|

Other current assets

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Accounts payable and accrued liabilities

|

|

|

(

|

)

|

|

|

|||||

|

Other, net

|

|

|

(

|

)

|

(

|

)

|

|||||

|

Net cash provided by operating activities

|

|

|

|

|

|

|

|||||

|

Investing activities:

|

|||||||||||

|

Capital expenditures

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Purchase or replacement of assets under operating leases

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Property investments in MSLLC

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Investments in and advances to affiliates

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Insurance proceeds related to hurricane damage

|

|

|

|

|

|

|

|||||

|

Proceeds from disposal of property

|

|

|

|

|

|

|

|||||

|

Other, net

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Net cash used for investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Financing activities:

|

|||||||||||

|

Net short-term borrowings

|

|

|

(

|

)

|

|

|

|||||

|

Proceeds from issuance of long-term debt

|

|

|

|

|

|

|

|||||

|

Repayment of long-term debt

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Dividends paid

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Shares repurchased

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Debt issuance and retirement costs paid

|

(

|

)

|

(

|

)

|

|

|

|||||

|

Proceeds from employee stock plans

|

|

|

|

|

|

|

|||||

|

Net cash used for financing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||

|

Cash and cash equivalents:

|

|||||||||||

|

Net increase (decrease) during each year

|

|

|

(

|

)

|

(

|

)

|

|||||

|

At beginning of year

|

|

|

|

|

|

|

|||||

|

At end of year

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Supplemental cash flow information

|

|||||||||||

|

Non-cash investing and financing activities:

|

|||||||||||

|

Capital expenditures and purchase or replacement of assets under operating lease accrued but not yet paid at end of year

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Other investing activities accrued but not yet paid at the end of the year

|

|

|

|

|

|

|

|||||

|

Non-cash asset acquisitions

|

|

|

|

|

|

|

|||||

|

Dividends accrued but not yet paid at end of year

|

|

|

|

|

|

|

|||||

|

Cash payments:

|

|||||||||||

|

Interest paid, net of amounts capitalized

|

$

|

|

|

$

|

|

|

$

|

|

|

||

|

Income tax payments, net of refunds

|

|

|

|

|

|

|

|||||

|

$25 Par

Preferred

Stock

|

$.01 Par

Common

Stock

|

Additional Paid-in

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Loss

|

Non-

controlling

Interest

|

Total

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance at December 31, 2016

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

(

|

)

|

$

|

|

|

$

|

|

|

|||||||

|

Cumulative-effect adjustment due to adoption of ASU 2016-09, Improvements to Employee Share-Based Payment Accounting

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||

|

Dividends on common stock ($1.38/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Dividends on $25 par preferred stock ($1.00/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Share repurchases

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||

|

Options exercised and stock subscribed, net of shares withheld for employee taxes

|

|

|

|

|

||||||||||||||||||||||||

|

Share-based compensation

|

|

|

|

|

||||||||||||||||||||||||

|

Balance at December 31, 2017

|

|

|

|

|

|

|

|

|

(

|

)

|

|

|

|

|

||||||||||||||

|

Reclassification due to adoption of ASU 2018-02, Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income

|

|

|

(

|

)

|

|

|

||||||||||||||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Contributions from noncontrolling interest

|

—

|

|

|

|

|

|

||||||||||||||||||||||

|

Dividends on common stock ($1.44/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Dividends on $25 par preferred stock ($1.00/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Share repurchases

|

(

|

)

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||

|

Options exercised and stock subscribed, net of shares withheld for employee taxes

|

|

|

|

|

||||||||||||||||||||||||

|

Share-based compensation

|

|

|

|

|

||||||||||||||||||||||||

|

Balance at December 31, 2018

|

|

|

|

|

|

|

|

|

(

|

)

|

|

|

|

|

||||||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Other comprehensive loss

|

|

|

|

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

|

Contributions from noncontrolling interest

|

|

|

|

|

||||||||||||||||||||||||

|

Dividends on common stock ($1.48/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Dividends on $25 par preferred stock ($1.00/share)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Share repurchases

|

(

|

)

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||

|

Forward contract for accelerated share repurchases

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Options exercised and stock subscribed, net of shares withheld for employee taxes

|

|

|

|

|

||||||||||||||||||||||||

|

Share-based compensation

|

|

|

|

|

|

|||||||||||||||||||||||

|

Balance at December 31, 2019

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

(

|

)

|

$

|

|

|

$

|

|

|

|||||||

|

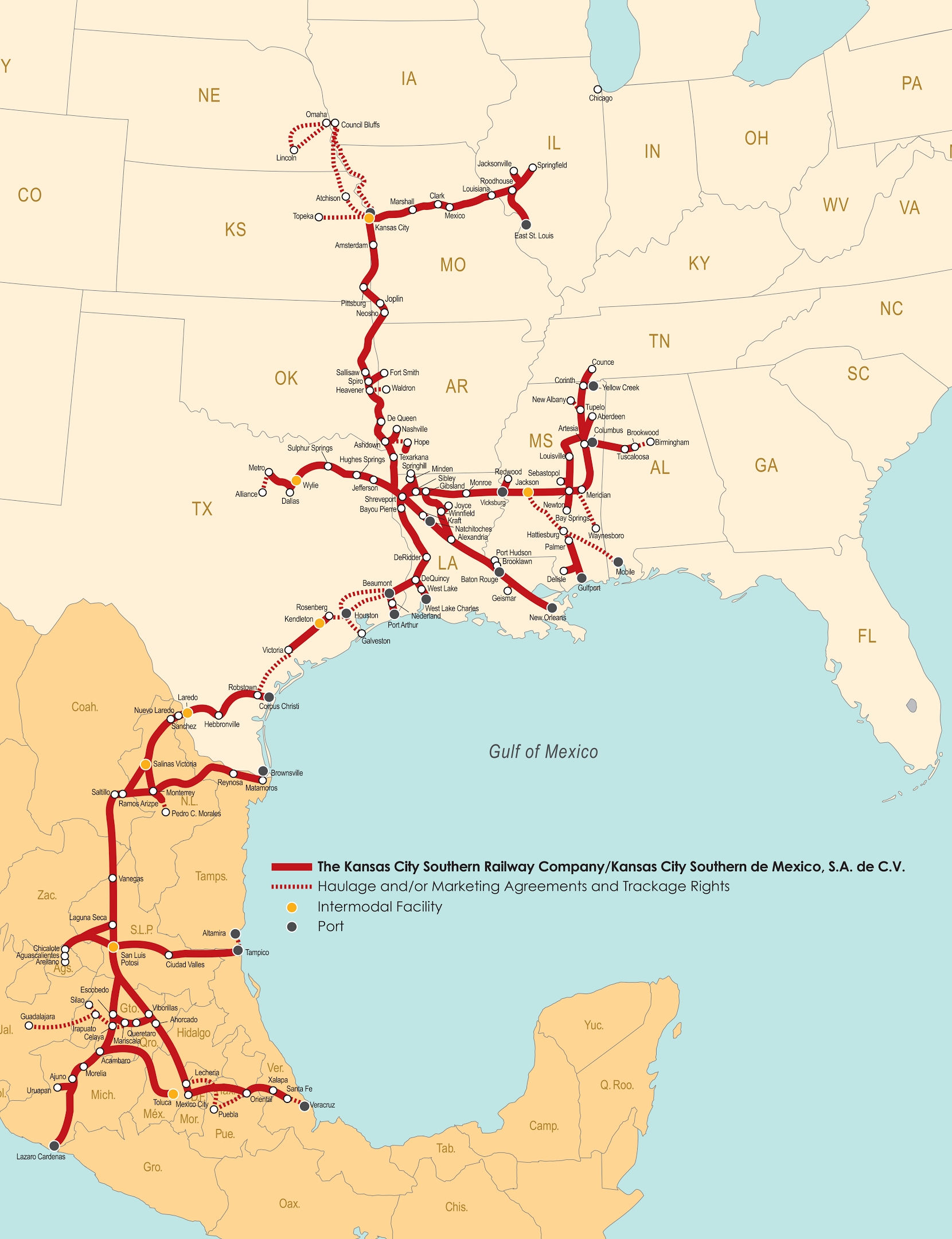

•

|

The Kansas City Southern Railway Company (“KCSR”), a wholly-owned consolidated subsidiary. KCSR is a U.S. Class I railroad that services the midwest and southeast regions of the United States;

|

|

•

|

Kansas City Southern de México, S.A. de C.V. (“KCSM”), a wholly-owned consolidated subsidiary which operates under the rights granted by the concession acquired from the Mexican government in 1997 (the “Concession”) as described below;

|

|

•

|

Mexrail, Inc. (“Mexrail”), a wholly-owned consolidated subsidiary; which wholly owns The Texas Mexican Railway Company (“Tex-Mex”);

|

|

•

|

KCSM Servicios, S.A. de C.V. (“KCSM Servicios”), a wholly-owned consolidated subsidiary which provides employee services to KCSM; and

|

|

•

|

Meridian Speedway, LLC (“MSLLC”), a

|

|

•

|

Panama Canal Railway Company (“PCRC”), a

|

|

•

|

TFCM, S. de R.L. de C.V. (“TCM”), a

|

|

•

|

Ferrocarril y Terminal del Valle de México, S.A. de C.V. (“FTVM”), a

|

|

•

|

PTC-220, LLC (“PTC-220”), a

|

|

2019

|