|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended September 30, 2018

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

Delaware

|

|

|

|

44-0663509

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification No.)

|

|

|

427 West 12th Street,

Kansas City, Missouri

|

|

|

64105 |

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

|

Class

|

|

October 12, 2018

|

|

Common Stock, $0.01 per share par value

|

|

101,697,441 Shares

|

|

|

Page

|

|

|

PART I — FINANCIAL INFORMATION

|

||

|

Item 1.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II — OTHER INFORMATION

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 1.

|

Financial Statements (unaudited)

|

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

(In millions, except share and per share amounts)

(Unaudited)

|

|||||||||||||||

|

Revenues

|

$

|

699.0

|

|

$

|

656.6

|

|

$

|

2,020.0

|

|

$

|

1,922.5

|

|

|||

|

Operating expenses:

|

|||||||||||||||

|

Compensation and benefits

|

123.5

|

|

129.0

|

|

367.4

|

|

371.6

|

|

|||||||

|

Purchased services

|

52.6

|

|

46.3

|

|

149.2

|

|

146.5

|

|

|||||||

|

Fuel

|

90.2

|

|

80.1

|

|

257.0

|

|

234.4

|

|

|||||||

|

Mexican fuel excise tax credit

|

(9.4

|

)

|

(11.1

|

)

|

(26.6

|

)

|

(35.6

|

)

|

|||||||

|

Equipment costs

|

33.0

|

|

30.9

|

|

95.9

|

|

93.3

|

|

|||||||

|

Depreciation and amortization

|

87.5

|

|

81.9

|

|

257.1

|

|

241.6

|

|

|||||||

|

Materials and other

|

65.6

|

|

65.7

|

|

199.5

|

|

186.9

|

|

|||||||

|

Gain on insurance recoveries related to hurricane damage

|

(9.4

|

)

|

—

|

|

(9.4

|

)

|

—

|

|

|||||||

|

Total operating expenses

|

433.6

|

|

422.8

|

|

1,290.1

|

|

1,238.7

|

|

|||||||

|

Operating income

|

265.4

|

|

233.8

|

|

729.9

|

|

683.8

|

|

|||||||

|

Equity in net earnings (losses) of affiliates

|

(0.2

|

)

|

2.8

|

|

1.8

|

|

9.7

|

|

|||||||

|

Interest expense

|

(28.3

|

)

|

(25.2

|

)

|

(81.8

|

)

|

(74.9

|

)

|

|||||||

|

Debt retirement costs

|

—

|

|

—

|

|

(2.2

|

)

|

—

|

|

|||||||

|

Foreign exchange gain

|

9.5

|

|

0.8

|

|

16.3

|

|

61.8

|

|

|||||||

|

Other income (expense), net

|

0.6

|

|

(0.3

|

)

|

0.8

|

|

0.7

|

|

|||||||

|

Income before income taxes

|

247.0

|

|

211.9

|

|

664.8

|

|

681.1

|

|

|||||||

|

Income tax expense

|

73.0

|

|

82.0

|

|

197.2

|

|

269.6

|

|

|||||||

|

Net income

|

174.0

|

|

129.9

|

|

467.6

|

|

411.5

|

|

|||||||

|

Less: Net income attributable to noncontrolling interest

|

0.4

|

|

0.6

|

|

1.3

|

|

1.2

|

|

|||||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

173.6

|

|

129.3

|

|

466.3

|

|

410.3

|

|

|||||||

|

Preferred stock dividends

|

0.1

|

|

0.1

|

|

0.2

|

|

0.2

|

|

|||||||

|

Net income available to common stockholders

|

$

|

173.5

|

|

$

|

129.2

|

|

$

|

466.1

|

|

$

|

410.1

|

|

|||

|

Earnings per share:

|

|||||||||||||||

|

Basic earnings per share

|

$

|

1.71

|

|

$

|

1.24

|

|

$

|

4.56

|

|

$

|

3.89

|

|

|||

|

Diluted earnings per share

|

$

|

1.70

|

|

$

|

1.23

|

|

$

|

4.55

|

|

$

|

3.88

|

|

|||

|

Average shares outstanding

(in thousands):

|

|||||||||||||||

|

Basic

|

101,658

|

|

104,324

|

|

102,106

|

|

105,297

|

|

|||||||

|

Potentially dilutive common shares

|

452

|

|

354

|

|

418

|

|

285

|

|

|||||||

|

Diluted

|

102,110

|

|

104,678

|

|

102,524

|

|

105,582

|

|

|||||||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

(In millions)

(Unaudited) |

|||||||||||||||

|

Net income

|

$

|

174.0

|

|

$

|

129.9

|

|

$

|

467.6

|

|

$

|

411.5

|

|

|||

|

Other comprehensive income (loss):

|

|||||||||||||||

|

Unrealized gain (loss) on interest rate derivative instruments during the period, net of tax of $1.1 million, $(0.3) million, $3.2 million and $(1.8) million, respectively

|

3.5

|

|

(0.5

|

)

|

9.5

|

|

(2.8

|

)

|

|||||||

|

Foreign currency translation adjustments, net of tax of $(0.1) million and $0.7 million, respectively, for 2017

|

0.7

|

|

(0.2

|

)

|

0.7

|

|

1.1

|

|

|||||||

|

Other comprehensive income (loss)

|

4.2

|

|

(0.7

|

)

|

10.2

|

|

(1.7

|

)

|

|||||||

|

Comprehensive income

|

178.2

|

|

129.2

|

|

477.8

|

|

409.8

|

|

|||||||

|

Less: Comprehensive income attributable to noncontrolling interest

|

0.4

|

|

0.6

|

|

1.3

|

|

1.2

|

|

|||||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

177.8

|

|

$

|

128.6

|

|

$

|

476.5

|

|

$

|

408.6

|

|

|||

|

September 30,

2018 |

December 31,

2017 |

||||||

|

(In millions, except share and per share amounts)

|

|||||||

|

(Unaudited)

|

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

107.1

|

|

$

|

134.1

|

|

|

|

Accounts receivable, net

|

272.0

|

|

237.8

|

|

|||

|

Materials and supplies

|

155.2

|

|

150.8

|

|

|||

|

Other current assets

|

81.6

|

|

157.4

|

|

|||

|

Total current assets

|

615.9

|

|

680.1

|

|

|||

|

Investments

|

46.5

|

|

44.6

|

|

|||

|

Property and equipment (including concession assets), net

|

8,644.5

|

|

8,403.8

|

|

|||

|

Other assets

|

102.2

|

|

70.2

|

|

|||

|

Total assets

|

$

|

9,409.1

|

|

$

|

9,198.7

|

|

|

|

LIABILITIES AND EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Long-term debt due within one year

|

$

|

10.5

|

|

$

|

38.8

|

|

|

|

Short-term borrowings

|

—

|

|

345.1

|

|

|||

|

Accounts payable and accrued liabilities

|

455.4

|

|

587.8

|

|

|||

|

Total current liabilities

|

465.9

|

|

971.7

|

|

|||

|

Long-term debt

|

2,680.7

|

|

2,235.5

|

|

|||

|

Deferred income taxes

|

1,069.2

|

|

987.2

|

|

|||

|

Other noncurrent liabilities and deferred credits

|

102.5

|

|

138.9

|

|

|||

|

Total liabilities

|

4,318.3

|

|

4,333.3

|

|

|||

|

Stockholders’ equity:

|

|||||||

|

$25 par, 4% noncumulative, preferred stock, 840,000 shares authorized, 649,736 shares issued; 232,945 and 242,170 shares outstanding at September 30, 2018 and December 31, 2017, respectively

|

5.9

|

|

6.1

|

|

|||

|

$.01 par, common stock, 400,000,000 shares authorized; 123,352,185 shares issued; 101,697,129 and 103,036,805 shares outstanding at September 30, 2018 and December 31, 2017, respectively

|

1.0

|

|

1.0

|

|

|||

|

Additional paid-in capital

|

949.9

|

|

943.3

|

|

|||

|

Retained earnings

|

3,818.4

|

|

3,611.4

|

|

|||

|

Accumulated other comprehensive loss

|

(3.4

|

)

|

(12.9

|

)

|

|||

|

Total stockholders’ equity

|

4,771.8

|

|

4,548.9

|

|

|||

|

Noncontrolling interest

|

319.0

|

|

316.5

|

|

|||

|

Total equity

|

5,090.8

|

|

4,865.4

|

|

|||

|

Total liabilities and equity

|

$

|

9,409.1

|

|

$

|

9,198.7

|

|

|

|

Nine Months Ended

|

|||||||

|

September 30,

|

|||||||

|

2018

|

2017

|

||||||

|

(In millions)

(Unaudited)

|

|||||||

|

Operating activities:

|

|||||||

|

Net income

|

$

|

467.6

|

|

$

|

411.5

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||

|

Depreciation and amortization

|

257.1

|

|

241.6

|

|

|||

|

Deferred income taxes

|

78.8

|

|

146.6

|

|

|||

|

Equity in net earnings of affiliates

|

(1.8

|

)

|

(9.7

|

)

|

|||

|

Share-based compensation

|

16.0

|

|

14.6

|

|

|||

|

Distributions from affiliates

|

2.5

|

|

5.0

|

|

|||

|

Settlement of foreign currency derivative instruments

|

13.8

|

|

(14.4

|

)

|

|||

|

Gain on foreign currency derivative instruments

|

(10.3

|

)

|

(45.5

|

)

|

|||

|

Mexican fuel excise tax credit

|

(26.6

|

)

|

(35.6

|

)

|

|||

|

Gain on insurance recoveries related to hurricane damage

|

(9.4

|

)

|

—

|

|

|||

|

Deemed mandatory repatriation tax

|

(18.7

|

)

|

—

|

|

|||

|

Changes in working capital items:

|

|||||||

|

Accounts receivable

|

(39.2

|

)

|

(46.8

|

)

|

|||

|

Materials and supplies

|

1.3

|

|

1.1

|

|

|||

|

Other current assets

|

2.2

|

|

(24.4

|

)

|

|||

|

Accounts payable and accrued liabilities

|

(22.5

|

)

|

109.0

|

|

|||

|

Other, net

|

(5.0

|

)

|

(19.3

|

)

|

|||

|

Net cash provided by operating activities

|

705.8

|

|

733.7

|

|

|||

|

Investing activities:

|

|||||||

|

Capital expenditures

|

(396.8

|

)

|

(446.9

|

)

|

|||

|

Purchase or replacement of equipment under operating leases

|

(98.9

|

)

|

(42.6

|

)

|

|||

|

Property investments in MSLLC

|

(24.0

|

)

|

(23.7

|

)

|

|||

|

Investments in and advances to affiliates

|

(10.3

|

)

|

(20.3

|

)

|

|||

|

Proceeds from disposal of property

|

7.2

|

|

6.6

|

|

|||

|

Other, net

|

(2.2

|

)

|

(15.1

|

)

|

|||

|

Net cash used for investing activities

|

(525.0

|

)

|

(542.0

|

)

|

|||

|

Financing activities:

|

|||||||

|

Proceeds from short-term borrowings

|

4,158.0

|

|

9,772.2

|

|

|||

|

Repayment of short-term borrowings

|

(4,506.1

|

)

|

(9,600.9

|

)

|

|||

|

Proceeds from issuance of long-term debt

|

499.4

|

|

—

|

|

|||

|

Repayment of long-term debt

|

(78.7

|

)

|

(20.2

|

)

|

|||

|

Dividends paid

|

(110.9

|

)

|

(105.1

|

)

|

|||

|

Shares repurchased

|

(163.3

|

)

|

(320.4

|

)

|

|||

|

Debt issuance and retirement costs paid

|

(8.0

|

)

|

—

|

|

|||

|

Proceeds from employee stock plans

|

1.8

|

|

0.5

|

|

|||

|

Net cash used for financing activities

|

(207.8

|

)

|

(273.9

|

)

|

|||

|

Cash and cash equivalents:

|

|||||||

|

Net decrease during each period

|

(27.0

|

)

|

(82.2

|

)

|

|||

|

At beginning of year

|

134.1

|

|

170.6

|

|

|||

|

At end of period

|

$

|

107.1

|

|

$

|

88.4

|

|

|

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

2018

(ASC 606)

|

2017

(ASC 605)

|

2018

(ASC 606)

|

2017

(ASC 605)

|

||||||||||||

|

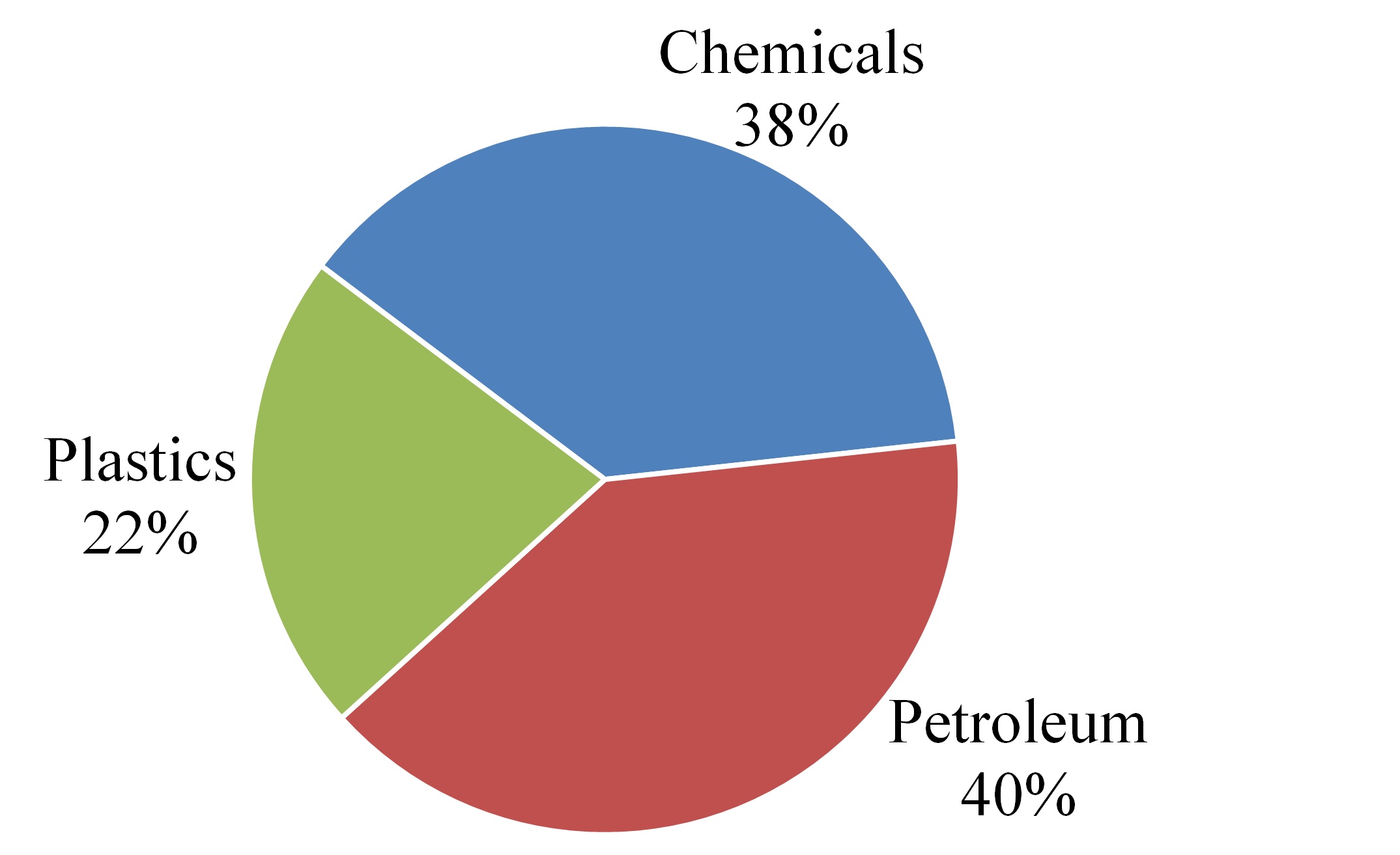

Chemical & Petroleum

|

|||||||||||||||

|

Chemicals

|

$

|

60.9

|

|

$

|

57.0

|

|

$

|

179.0

|

|

$

|

167.6

|

|

|||

|

Petroleum

|

64.5

|

|

47.6

|

|

171.3

|

|

137.2

|

|

|||||||

|

Plastics

|

35.2

|

|

32.3

|

|

107.8

|

|

97.4

|

|

|||||||

|

Total

|

160.6

|

|

136.9

|

|

458.1

|

|

402.2

|

|

|||||||

|

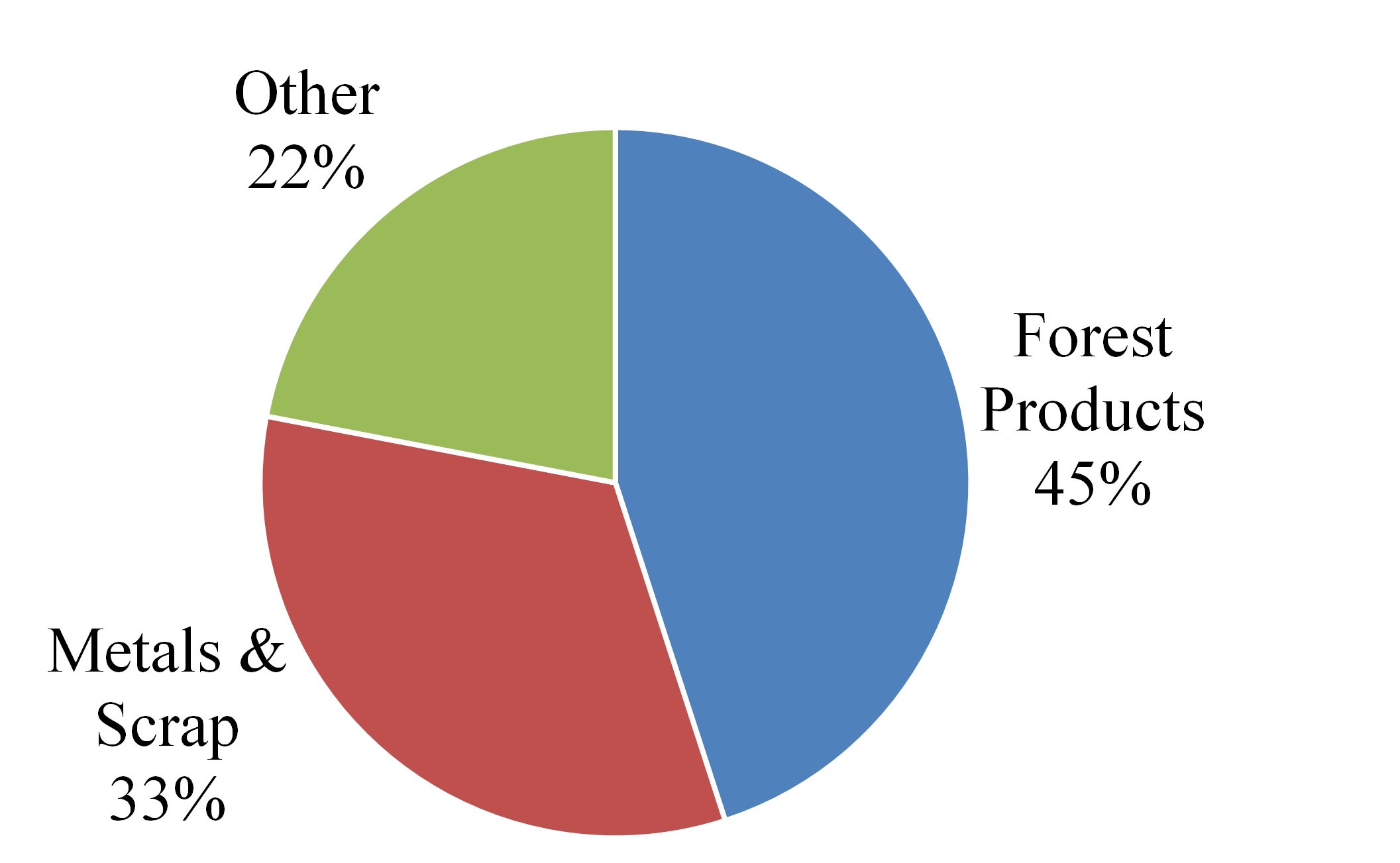

Industrial & Consumer Products

|

|||||||||||||||

|

Forest Products

|

68.7

|

|

64.3

|

|

203.2

|

|

190.0

|

|

|||||||

|

Metals & Scrap

|

50.1

|

|

58.9

|

|

157.9

|

|

170.5

|

|

|||||||

|

Other

|

33.7

|

|

29.3

|

|

90.4

|

|

80.7

|

|

|||||||

|

Total

|

152.5

|

|

152.5

|

|

451.5

|

|

441.2

|

|

|||||||

|

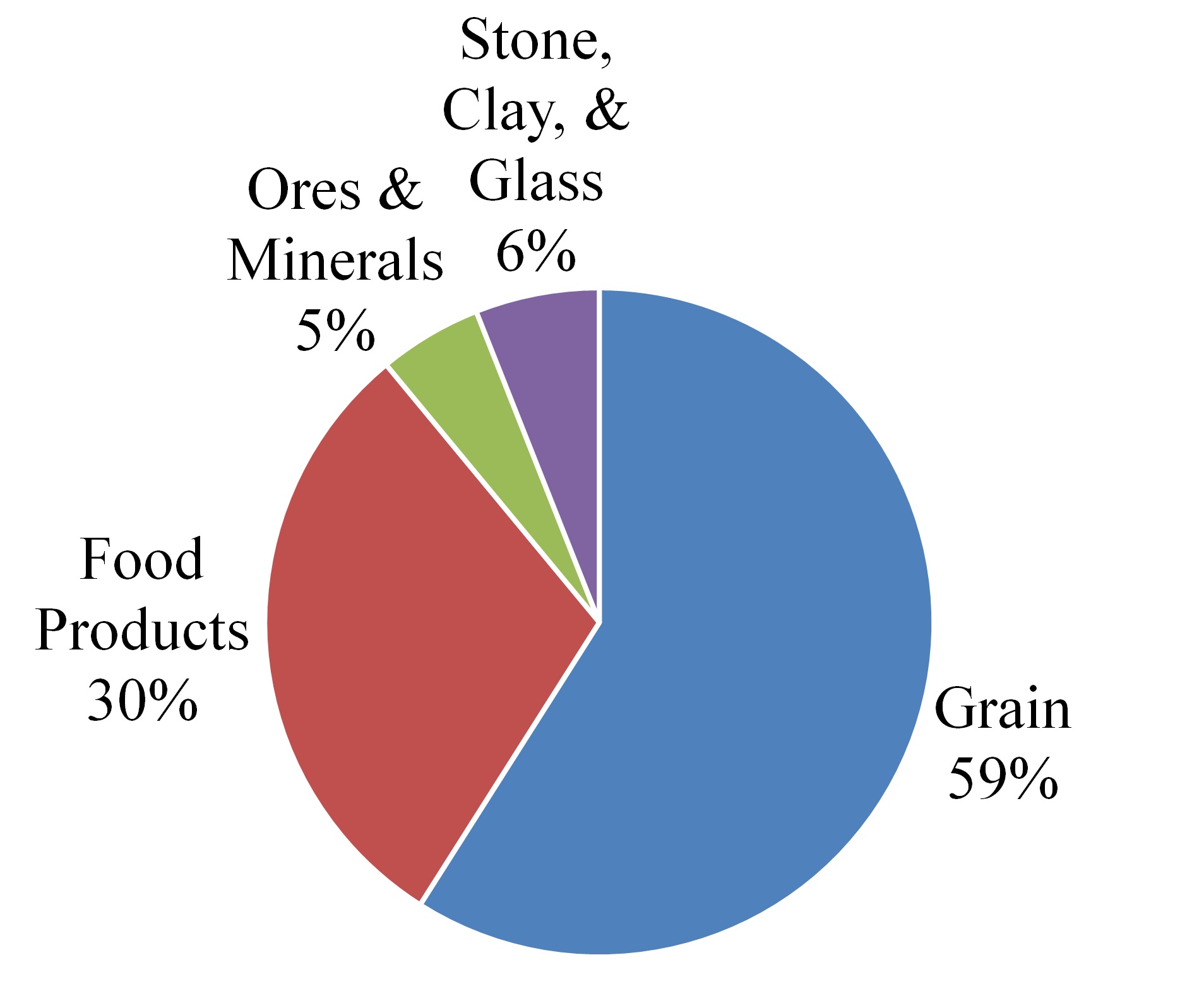

Agriculture & Minerals

|

|||||||||||||||

|

Grain

|

68.5

|

|

68.6

|

|

209.1

|

|

207.9

|

|

|||||||

|

Food Products

|

34.9

|

|

34.7

|

|

107.4

|

|

111.1

|

|

|||||||

|

Ores & Minerals

|

5.4

|

|

5.8

|

|

16.1

|

|

14.9

|

|

|||||||

|

Stone, Clay & Glass

|

7.4

|

|

6.9

|

|

22.1

|

|

21.8

|

|

|||||||

|

Total

|

116.2

|

|

116.0

|

|

354.7

|

|

355.7

|

|

|||||||

|

Energy

|

|||||||||||||||

|

Utility Coal

|

35.4

|

|

46.0

|

|

88.6

|

|

127.8

|

|

|||||||

|

Coal & Petroleum Coke

|

11.9

|

|

9.4

|

|

33.3

|

|

30.7

|

|

|||||||

|

Frac Sand

|

8.8

|

|

13.8

|

|

30.4

|

|

38.5

|

|

|||||||

|

Crude Oil

|

17.1

|

|

5.3

|

|

38.7

|

|

17.0

|

|

|||||||

|

Total

|

73.2

|

|

74.5

|

|

191.0

|

|

214.0

|

|

|||||||

|

Intermodal

|

100.0

|

|

92.3

|

|

284.6

|

|

266.4

|

|

|||||||

|

Automotive

|

66.2

|

|

61.4

|

|

193.3

|

|

170.2

|

|

|||||||

|

Total Freight Revenues

|

668.7

|

|

633.6

|

|

1,933.2

|

|

1,849.7

|

|

|||||||

|

Other Revenue

|

30.3

|

|

23.0

|

|

86.8

|

|

72.8

|

|

|||||||

|

Total Revenues

|

$

|

699.0

|

|

$

|

656.6

|

|

$

|

2,020.0

|

|

$

|

1,922.5

|

|

|||

|

Contract liabilities

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

||||||||||||||

|

2018

(ASC 606)

|

2017

(ASC 605)

|

2018

(ASC 606)

|

2017

(ASC 605)

|

|||||||||||||

|

Beginning balance

|

$

|

16.6

|

|

$

|

5.9

|

|

$

|

26.8

|

|

$

|

13.7

|

|

||||

|

Revenue recognized that was included in the contract liability balance at the beginning of the period

|

(9.3

|

)

|

(4.6

|

)

|

(23.7

|

)

|

(13.7

|

)

|

||||||||

|

Increases due to cash received, excluding amounts recognized as revenue during the period

|

0.9

|

|

2.2

|

|

5.1

|

|

3.5

|

|

||||||||

|

Ending balance

|

$

|

8.2

|

|

$

|

3.5

|

|

$

|

8.2

|

|

$

|

3.5

|

|

||||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

Net income available to common stockholders for purposes of computing basic and diluted earnings per share

|

$

|

173.5

|

|

$

|

129.2

|

|

$

|

466.1

|

|

$

|

410.1

|

|

|||

|

Weighted-average number of shares outstanding (

in thousands

):

|

|||||||||||||||

|

Basic shares

|

101,658

|

|

104,324

|

|

102,106

|

|

105,297

|

|

|||||||

|

Effect of dilution

|

452

|

|

354

|

|

418

|

|

285

|

|

|||||||

|

Diluted shares

|

102,110

|

|

104,678

|

|

102,524

|

|

105,582

|

|

|||||||

|

Earnings per share:

|

|||||||||||||||

|

Basic earnings per share

|

$

|

1.71

|

|

$

|

1.24

|

|

$

|

4.56

|

|

$

|

3.89

|

|

|||

|

Diluted earnings per share

|

$

|

1.70

|

|

$

|

1.23

|

|

$

|

4.55

|

|

$

|

3.88

|

|

|||

|

Stock options excluded as their inclusion would be anti-dilutive

|

93

|

|

14

|

|

116

|

|

159

|

|

|||

|

September 30,

2018 |

December 31,

2017 |

||||||

|

Land

|

$

|

219.4

|

|

$

|

218.6

|

|

|

|

Concession land rights

|

141.2

|

|

141.2

|

|

|||

|

Road property

|

7,507.4

|

|

7,557.1

|

|

|||

|

Equipment

|

2,726.1

|

|

2,534.9

|

|

|||

|

Technology and other

|

297.6

|

|

229.1

|

|

|||

|

Construction in progress

|

196.2

|

|

223.7

|

|

|||

|

Total property

|

11,087.9

|

|

10,904.6

|

|

|||

|

Accumulated depreciation and amortization

|

2,443.4

|

|

2,500.8

|

|

|||

|

Property and equipment (including concession assets), net

|

$

|

8,644.5

|

|

$

|

8,403.8

|

|

|

|

September 30, 2018

|

December 31, 2017

|

|||||||

|

Level 2

|

Level 2

|

|||||||

|

Assets

|

||||||||

|

Foreign currency derivative instruments

|

$

|

4.4

|

|

$

|

7.9

|

|

||

|

Treasury lock agreements

|

7.1

|

|

—

|

|

||||

|

Liabilities

|

||||||||

|

Debt instruments

|

2,648.0

|

|

2,377.8

|

|

||||

|

Treasury lock agreements

|

—

|

|

5.6

|

|

||||

|

Foreign currency forward contracts

|

|||||||||||||||||||||||||||||||||

|

Contracts to purchase Ps./pay USD

|

Offsetting contracts to sell Ps./receive USD

|

||||||||||||||||||||||||||||||||

|

Notional amount

|

Notional amount

|

Weighted-average exchange rate

(in Ps./USD)

|

Maturity date

|

Notional amount

|

Notional amount

|

Weighted-average exchange rate

(in Ps./USD)

|

Maturity date

|

Cash received/(paid) on settlement

|

|||||||||||||||||||||||||

|

Contracts executed in 2016 and settled in 2017

|

$

|

340.0

|

|

Ps.

|

6,207.7

|

|

Ps.

|

18.3

|

|

1/17/2017

|

|

$

|

287.0

|

|

Ps.

|

6,207.7

|

|

Ps.

|

21.6

|

|

1/17/2017

|

$

|

(53.0

|

)

|

|||||||||

|

Foreign currency zero-cost collar contracts

|

|||||||||||||||||||||||||||||||||

|

Notional amount

|

Weighted-average call rate outstanding options

(in Ps./USD)

|

Weighted-average put rate outstanding options

(in Ps./USD)

|

Cash received/(paid) on settlement

|

||||||||||||||||||||||||||||||

|

Contracts executed in 2018 and outstanding

|

$

|

140.0

|

|

Ps.

|

19.3

|

|

Ps.

|

22.6

|

|

—

|

|

||||||||||||||||||||||

|

Contracts executed in 2018 and settled in 2018

|

$

|

200.0

|

|

$

|

3.8

|

|

|||||||||||||||||||||||||||

|

Contracts executed in 2017 and settled in 2018

|

$

|

80.0

|

|

$

|

10.0

|

|

|||||||||||||||||||||||||||

|

Contracts executed in 2017 and settled in 2017 (i)

|

$

|

450.0

|

|

$

|

42.2

|

|

|||||||||||||||||||||||||||

|

Derivative Assets

|

|||||||||

|

|

Balance Sheet Location

|

September 30,

2018 |

December 31, 2017

|

||||||

|

Derivatives designated as hedging instruments:

|

|||||||||

|

Treasury lock agreements

|

Other assets

|

$

|

7.1

|

|

$

|

—

|

|

||

|

Total derivatives designated as hedging instruments

|

7.1

|

|

—

|

|

|||||

|

Derivatives not designated as hedging instruments:

|

|||||||||

|

Foreign currency zero-cost collar contracts

|

Other current assets

|

$

|

4.4

|

|

$

|

7.9

|

|

||

|

Total derivatives not designated as hedging instruments

|

4.4

|

|

7.9

|

|

|||||

|

Total derivative assets

|

$

|

11.5

|

|

$

|

7.9

|

|

|||

|

Derivative Liabilities

|

|||||||||

|

Balance Sheet Location

|

September 30,

2018 |

December 31, 2017

|

|||||||

|

Derivatives designated as hedging instruments:

|

|||||||||

|

Treasury lock agreements

|

Other noncurrent liabilities and deferred credits

|

$

|

—

|

|

$

|

5.6

|

|

||

|

Total derivatives designated as hedging instruments

|

—

|

|

5.6

|

|

|||||

|

Total derivative liabilities

|

$

|

—

|

|

$

|

5.6

|

|

|||

|

Offsetting of Derivative Assets

|

||||||||||||

|

As of September 30, 2018

|

Gross Assets

|

Gross Liabilities

|

Net Amounts Presented in the Consolidated Balance Sheets

|

|||||||||

|

Derivatives subject to a master netting arrangement or similar agreement

|

$

|

4.6

|

|

$

|

(0.2

|

)

|

$

|

4.4

|

|

|||

|

As of December 31, 2017

|

||||||||||||

|

Derivatives subject to a master netting arrangement or similar agreement

|

$

|

7.9

|

|

$

|

—

|

|

$

|

7.9

|

|

|||

|

Offsetting of Derivative Liabilities

|

||||||||||||

|

As of September 30, 2018

|

Gross Liabilities

|

Gross Assets

|

Net Amounts Presented in the Consolidated Balance Sheets

|

|||||||||

|

Derivatives subject to a master netting arrangement or similar agreement

|

$

|

(0.2

|

)

|

$

|

0.2

|

|

$

|

—

|

|

|||

|

As of December 31, 2017

|

||||||||||||

|

Derivatives subject to a master netting arrangement or similar agreement

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||

|

Derivatives in Cash Flow Hedging Relationships

|

Amount of Gain/(Loss) Recognized in OCI on Derivative

|

|||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

||||||||||||||

|

Treasury lock agreements

|

$

|

4.6

|

|

$

|

(0.8

|

)

|

$

|

12.7

|

|

$

|

(4.6

|

)

|

||||||

|

Total

|

$

|

4.6

|

|

$

|

(0.8

|

)

|

$

|

12.7

|

|

$

|

(4.6

|

)

|

||||||

|

|

||||||||||||||||||

|

Derivatives Not Designated as Hedging Instruments

|

Location of Gain/(Loss) Recognized in Income on Derivative

|

Amount of Gain/(Loss) Recognized in Income on Derivative

|

||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||

|

Foreign currency zero-cost collar contracts

|

Foreign exchange gain

|

$

|

6.2

|

|

$

|

3.3

|

|

$

|

10.3

|

|

$

|

57.4

|

|

|||||

|

Foreign currency forward contracts

|

Foreign exchange gain

|

—

|

|

—

|

|

—

|

|

(11.9

|

)

|

|||||||||

|

Total

|

$

|

6.2

|

|

$

|

3.3

|

|

$

|

10.3

|

|

$

|

45.5

|

|

||||||

|

Three Months Ended September 30, 2018

|

Three Months Ended September 30, 2017

|

||||||||||||||||||||||

|

|

Kansas City

Southern

Stockholders’

Equity

|

Noncontrolling

Interest

|

Total

Equity

|

Kansas City

Southern

Stockholders’

Equity

|

Noncontrolling

Interest

|

Total

Equity

|

|||||||||||||||||

|

Beginning balance

|

$

|

4,677.6

|

|

$

|

318.6

|

|

$

|

4,996.2

|

|

$

|

4,192.6

|

|

$

|

315.2

|

|

$

|

4,507.8

|

|

|||||

|

Net income

|

173.6

|

|

0.4

|

|

174.0

|

|

129.3

|

|

0.6

|

|

129.9

|

|

|||||||||||

|

Other comprehensive income (loss)

|

4.2

|

|

—

|

|

4.2

|

|

(0.7

|

)

|

—

|

|

(0.7

|

)

|

|||||||||||

|

Dividends on common stock

|

(36.6

|

)

|

—

|

|

(36.6

|

)

|

(37.3

|

)

|

—

|

|

(37.3

|

)

|

|||||||||||

|

Dividends on $25 par preferred stock

|

(0.1

|

)

|

—

|

|

(0.1

|

)

|

(0.1

|

)

|

—

|

|

(0.1

|

)

|

|||||||||||

|

Share repurchases

|

(54.8

|

)

|

—

|

|

(54.8

|

)

|

(200.0

|

)

|

—

|

|

(200.0

|

)

|

|||||||||||

|

Options exercised and stock subscribed, net of shares withheld for employee taxes

|

3.5

|

|

—

|

|

3.5

|

|

2.7

|

|

—

|

|

2.7

|

|

|||||||||||

|

Share-based compensation

|

4.4

|

|

—

|

|

4.4

|

|

4.1

|

|

—

|

|

4.1

|

|

|||||||||||

|

Ending balance

|

$

|

4,771.8

|

|

$

|

319.0

|

|

$

|

5,090.8

|

|

$

|

4,090.6

|

|

$

|

315.8

|

|

$

|

4,406.4

|

|

|||||

|

Nine Months Ended September 30, 2018

|

Nine Months Ended September 30, 2017

|

||||||||||||||||||||||

|

|

Kansas City

Southern

Stockholders’

Equity

|

Noncontrolling

Interest

|

Total

Equity

|

Kansas City

Southern

Stockholders’

Equity

|

Noncontrolling

Interest

|

Total

Equity

|

|||||||||||||||||

|

Beginning balance

|

$

|

4,548.9

|

|

$

|

316.5

|

|

$

|

4,865.4

|

|

$

|

4,089.9

|

|

$

|

314.6

|

|

$

|

4,404.5

|

|

|||||

|

Cumulative-effect adjustment (i)

|

—

|

|

—

|

|

—

|

|

2.5

|

|

—

|

|

2.5

|

|

|||||||||||

|

Net income

|

466.3

|

|

1.3

|

|

467.6

|

|

410.3

|

|

1.2

|

|

411.5

|

|

|||||||||||

|

Other comprehensive income (loss)

|

10.2

|

|

—

|

|

10.2

|

|

(1.7

|

)

|

—

|

|

(1.7

|

)

|

|||||||||||

|

Contribution from noncontrolling interest

|

—

|

|

1.2

|

|

1.2

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Dividends on common stock

|

(110.3

|

)

|

—

|

|

(110.3

|

)

|

(107.2

|

)

|

—

|

|

(107.2

|

)

|

|||||||||||

|

Dividends on $25 par preferred stock

|

(0.2

|

)

|

—

|

|

(0.2

|

)

|

(0.2

|

)

|

—

|

|

(0.2

|

)

|

|||||||||||

|

Share repurchases

|

(163.3

|

)

|

—

|

|

(163.3

|

)

|

(320.4

|

)

|

—

|

|

(320.4

|

)

|

|||||||||||

|

Options exercised and stock subscribed, net of shares withheld for employee taxes

|

4.2

|

|

—

|

|

4.2

|

|

2.8

|

|

—

|

|

2.8

|

|

|||||||||||

|

Share-based compensation

|

16.0

|

|

—

|

|

16.0

|

|

14.6

|

|

—

|

|

14.6

|

|

|||||||||||

|

Ending balance (ii)

|

$

|

4,771.8

|

|

$

|

319.0

|

|

$

|

5,090.8

|

|

$

|

4,090.6

|

|

$

|

315.8

|

|

$

|

4,406.4

|

|

|||||

|

(i)

|

The Company recognized a

$2.5 million

net cumulative-effect adjustment to equity as of January 1, 2017, due to the adoption of ASU 2016-09,

Improvements to Employee Share-Based Payment Accounting

.

|

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

Cash dividends declared per common share

|

$

|

0.36

|

|

$

|

0.36

|

|

$

|

1.08

|

|

$

|

1.02

|

|

|||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

||||||||||||||

|

Revenues

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

U.S.

|

$

|

373.3

|

|

$

|

345.9

|

|

$

|

1,060.2

|

|

$

|

1,011.5

|

|

|||

|

Mexico

|

325.7

|

|

310.7

|

|

959.8

|

|

911.0

|

|

|||||||

|

Total revenues

|

$

|

699.0

|

|

$

|

656.6

|

|

$

|

2,020.0

|

|

$

|

1,922.5

|

|

|||

|

Property and equipment (including concession assets), net

|

|

|

September 30,

2018 |

December 31,

2017 |

|||||||||||

|

U.S.

|

$

|

5,375.0

|

|

$

|

5,227.3

|

|

|||||||||

|

Mexico

|

3,269.5

|

|

3,176.5

|

|

|||||||||||

|

Total property and equipment (including concession assets), net

|

$

|

8,644.5

|

|

$

|

8,403.8

|

|

|||||||||

|

Three Months Ended September 30, 2018

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Revenues

|

$

|

—

|

|

$

|

339.1

|

|

$

|

12.1

|

|

$

|

359.1

|

|

$

|

(11.3

|

)

|

$

|

699.0

|

|

|||||

|

Operating expenses

|

0.7

|

|

219.2

|

|

10.6

|

|

214.4

|

|

(11.3

|

)

|

433.6

|

|

|||||||||||

|

Operating income (loss)

|

(0.7

|

)

|

119.9

|

|

1.5

|

|

144.7

|

|

—

|

|

265.4

|

|

|||||||||||

|

Equity in net earnings (losses) of affiliates

|

201.9

|

|

(0.4

|

)

|

0.7

|

|

(0.6

|

)

|

(201.8

|

)

|

(0.2

|

)

|

|||||||||||

|

Interest expense

|

(22.4

|

)

|

(19.1

|

)

|

—

|

|

(7.3

|

)

|

20.5

|

|

(28.3

|

)

|

|||||||||||

|

Debt retirement costs

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Foreign exchange gain

|

—

|

|

—

|

|

—

|

|

9.5

|

|

—

|

|

9.5

|

|

|||||||||||

|

Other income, net

|

20.2

|

|

—

|

|

—

|

|

0.9

|

|

(20.5

|

)

|

0.6

|

|

|||||||||||

|

Income before income taxes

|

199.0

|

|

100.4

|

|

2.2

|

|

147.2

|

|

(201.8

|

)

|

247.0

|

|

|||||||||||

|

Income tax expense

|

25.4

|

|

23.6

|

|

0.6

|

|

23.4

|

|

—

|

|

73.0

|

|

|||||||||||

|

Net income

|

173.6

|

|

76.8

|

|

1.6

|

|

123.8

|

|

(201.8

|

)

|

174.0

|

|

|||||||||||

|

Less: Net income attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

0.4

|

|

—

|

|

0.4

|

|

|||||||||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

173.6

|

|

76.8

|

|

1.6

|

|

123.4

|

|

(201.8

|

)

|

173.6

|

|

|||||||||||

|

Other comprehensive income

|

4.2

|

|

—

|

|

—

|

|

0.7

|

|

(0.7

|

)

|

4.2

|

|

|||||||||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

177.8

|

|

$

|

76.8

|

|

$

|

1.6

|

|

$

|

124.1

|

|

$

|

(202.5

|

)

|

$

|

177.8

|

|

|||||

|

Three Months Ended September 30, 2017

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Revenues

|

$

|

—

|

|

$

|

310.7

|

|

$

|

9.9

|

|

$

|

344.9

|

|

$

|

(8.9

|

)

|

$

|

656.6

|

|

|||||

|

Operating expenses

|

0.8

|

|

216.5

|

|

9.6

|

|

204.8

|

|

(8.9

|

)

|

422.8

|

|

|||||||||||

|

Operating income (loss)

|

(0.8

|

)

|

94.2

|

|

0.3

|

|

140.1

|

|

—

|

|

233.8

|

|

|||||||||||

|

Equity in net earnings (losses) of affiliates

|

130.2

|

|

(0.3

|

)

|

1.5

|

|

2.2

|

|

(130.8

|

)

|

2.8

|

|

|||||||||||

|

Interest expense

|

(20.3

|

)

|

(17.7

|

)

|

—

|

|

(8.8

|

)

|

21.6

|

|

(25.2

|

)

|

|||||||||||

|

Debt retirement costs

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Foreign exchange gain

|

—

|

|

—

|

|

—

|

|

0.8

|

|

—

|

|

0.8

|

|

|||||||||||

|

Other income (expense), net

|

20.8

|

|

(0.3

|

)

|

—

|

|

0.7

|

|

(21.5

|

)

|

(0.3

|

)

|

|||||||||||

|

Income before income taxes

|

129.9

|

|

75.9

|

|

1.8

|

|

135.0

|

|

(130.7

|

)

|

211.9

|

|

|||||||||||

|

Income tax expense

|

0.6

|

|

25.4

|

|

1.0

|

|

55.0

|

|

—

|

|

82.0

|

|

|||||||||||

|

Net income

|

129.3

|

|

50.5

|

|

0.8

|

|

80.0

|

|

(130.7

|

)

|

129.9

|

|

|||||||||||

|

Less: Net income attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

0.6

|

|

—

|

|

0.6

|

|

|||||||||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

129.3

|

|

50.5

|

|

0.8

|

|

79.4

|

|

(130.7

|

)

|

129.3

|

|

|||||||||||

|

Other comprehensive loss

|

(0.7

|

)

|

—

|

|

—

|

|

(0.3

|

)

|

0.3

|

|

(0.7

|

)

|

|||||||||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

128.6

|

|

$

|

50.5

|

|

$

|

0.8

|

|

$

|

79.1

|

|

$

|

(130.4

|

)

|

$

|

128.6

|

|

|||||

|

Nine Months Ended September 30, 2018

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Revenues

|

$

|

—

|

|

$

|

955.0

|

|

$

|

32.5

|

|

$

|

1,063.4

|

|

$

|

(30.9

|

)

|

$

|

2,020.0

|

|

|||||

|

Operating expenses

|

4.2

|

|

671.9

|

|

28.5

|

|

616.4

|

|

(30.9

|

)

|

1,290.1

|

|

|||||||||||

|

Operating income (loss)

|

(4.2

|

)

|

283.1

|

|

4.0

|

|

447.0

|

|

—

|

|

729.9

|

|

|||||||||||

|

Equity in net earnings (losses) of affiliates

|

481.9

|

|

(1.1

|

)

|

2.4

|

|

0.5

|

|

(481.9

|

)

|

1.8

|

|

|||||||||||

|

Interest expense

|

(66.8

|

)

|

(54.2

|

)

|

—

|

|

(21.5

|

)

|

60.7

|

|

(81.8

|

)

|

|||||||||||

|

Debt retirement costs

|

—

|

|

—

|

|

—

|

|

(2.2

|

)

|

—

|

|

(2.2

|

)

|

|||||||||||

|

Foreign exchange gain

|

—

|

|

—

|

|

—

|

|

16.3

|

|

—

|

|

16.3

|

|

|||||||||||

|

Other income, net

|

59.8

|

|

0.3

|

|

—

|

|

1.4

|

|

(60.7

|

)

|

0.8

|

|

|||||||||||

|

Income before income taxes

|

470.7

|

|

228.1

|

|

|

6.4

|

|

|

441.5

|

|

|

(481.9

|

)

|

664.8

|

|

||||||||

|

Income tax expense

|

4.4

|

|

48.6

|

|

1.9

|

|

142.3

|

|

—

|

|

197.2

|

|

|||||||||||

|

Net income

|

466.3

|

|

179.5

|

|

|

4.5

|

|

|

299.2

|

|

|

(481.9

|

)

|

467.6

|

|

||||||||

|

Less: Net income attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

1.3

|

|

—

|

|

1.3

|

|

|||||||||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

466.3

|

|

179.5

|

|

|

4.5

|

|

|

297.9

|

|

|

(481.9

|

)

|

466.3

|

|

||||||||

|

Other comprehensive income

|

10.2

|

|

—

|

|

—

|

|

0.7

|

|

(0.7

|

)

|

10.2

|

|

|||||||||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

476.5

|

|

$

|

179.5

|

|

$

|

4.5

|

|

$

|

298.6

|

|

$

|

(482.6

|

)

|

$

|

476.5

|

|

|||||

|

Nine Months Ended September 30, 2017

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Revenues

|

$

|

—

|

|

$

|

906.4

|

|

$

|

33.0

|

|

$

|

1,011.2

|

|

$

|

(28.1

|

)

|

$

|

1,922.5

|

|

|||||

|

Operating expenses

|

4.9

|

|

647.0

|

|

29.4

|

|

585.5

|

|

(28.1

|

)

|

1,238.7

|

|

|||||||||||

|

Operating income (loss)

|

(4.9

|

)

|

259.4

|

|

3.6

|

|

425.7

|

|

—

|

|

683.8

|

|

|||||||||||

|

Equity in net earnings (losses) of affiliates

|

410.8

|

|

(0.6

|

)

|

2.7

|

|

8.2

|

|

(411.4

|

)

|

9.7

|

|

|||||||||||

|

Interest expense

|

(61.0

|

)

|

(54.6

|

)

|

—

|

|

(27.1

|

)

|

67.8

|

|

(74.9

|

)

|

|||||||||||

|

Debt retirement costs

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Foreign exchange gain

|

—

|

|

—

|

|

—

|

|

61.8

|

|

—

|

|

61.8

|

|

|||||||||||

|

Other income, net

|

66.7

|

|

0.5

|

|

—

|

|

1.3

|

|

(67.8

|

)

|

0.7

|

|

|||||||||||

|

Income before income taxes

|

411.6

|

|

204.7

|

|

6.3

|

|

469.9

|

|

(411.4

|

)

|

681.1

|

|

|||||||||||

|

Income tax expense

|

1.3

|

|

75.2

|

|

2.9

|

|

190.2

|

|

—

|

|

269.6

|

|

|||||||||||

|

Net income

|

410.3

|

|

129.5

|

|

3.4

|

|

279.7

|

|

(411.4

|

)

|

411.5

|

|

|||||||||||

|

Less: Net income attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

1.2

|

|

—

|

|

1.2

|

|

|||||||||||

|

Net income attributable to Kansas City Southern and subsidiaries

|

410.3

|

|

129.5

|

|

3.4

|

|

278.5

|

|

(411.4

|

)

|

410.3

|

|

|||||||||||

|

Other comprehensive income (loss)

|

(1.7

|

)

|

—

|

|

—

|

|

1.8

|

|

(1.8

|

)

|

(1.7

|

)

|

|||||||||||

|

Comprehensive income attributable to Kansas City Southern and subsidiaries

|

$

|

408.6

|

|

$

|

129.5

|

|

$

|

3.4

|

|

$

|

280.3

|

|

$

|

(413.2

|

)

|

$

|

408.6

|

|

|||||

|

September 30, 2018

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Assets:

|

|||||||||||||||||||||||

|

Current assets

|

$

|

649.5

|

|

$

|

227.1

|

|

$

|

6.0

|

|

$

|

342.3

|

|

$

|

(609.0

|

)

|

$

|

615.9

|

|

|||||

|

Investments

|

—

|

|

3.8

|

|

2.7

|

|

40.0

|

|

—

|

|

46.5

|

|

|||||||||||

|

Investments in consolidated subsidiaries

|

4,741.9

|

|

4.9

|

|

188.2

|

|

—

|

|

(4,935.0

|

)

|

—

|

|

|||||||||||

|

Property and equipment (including concession assets), net

|

—

|

|

4,409.7

|

|

166.5

|

|

4,074.0

|

|

(5.7

|

)

|

8,644.5

|

|

|||||||||||

|

Other assets

|

2,209.7

|

|

61.7

|

|

—

|

|

30.6

|

|

(2,199.8

|

)

|

102.2

|

|

|||||||||||

|

Total assets

|

$

|

7,601.1

|

|

$

|

4,707.2

|

|

$

|

363.4

|

|

$

|

4,486.9

|

|

$

|

(7,749.5

|

)

|

$

|

9,409.1

|

|

|||||

|

Liabilities and equity:

|

|||||||||||||||||||||||

|

Current liabilities

|

$

|

253.6

|

|

$

|

518.9

|

|

$

|

83.2

|

|

$

|

220.7

|

|

$

|

(610.5

|

)

|

$

|

465.9

|

|

|||||

|

Long-term debt

|

2,561.9

|

|

1,508.2

|

|

—

|

|

810.4

|

|

(2,199.8

|

)

|

2,680.7

|

|

|||||||||||

|

Deferred income taxes

|

6.6

|

|

779.1

|

|

86.0

|

|

198.9

|

|

(1.4

|

)

|

1,069.2

|

|

|||||||||||

|

Other liabilities

|

7.2

|

|

66.9

|

|

0.2

|

|

28.2

|

|

—

|

|

102.5

|

|

|||||||||||

|

Stockholders’ equity

|

4,771.8

|

|

1,834.1

|

|

194.0

|

|

2,909.7

|

|

(4,937.8

|

)

|

4,771.8

|

|

|||||||||||

|

Noncontrolling interest

|

—

|

|

—

|

|

—

|

|

319.0

|

|

—

|

|

319.0

|

|

|||||||||||

|

Total liabilities and equity

|

$

|

7,601.1

|

|

$

|

4,707.2

|

|

$

|

363.4

|

|

$

|

4,486.9

|

|

$

|

(7,749.5

|

)

|

$

|

9,409.1

|

|

|||||

|

|

December 31, 2017

|

||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Assets:

|

|||||||||||||||||||||||

|

Current assets

|

$

|

292.0

|

|

$

|

214.1

|

|

$

|

8.8

|

|

$

|

475.5

|

|

$

|

(310.3

|

)

|

$

|

680.1

|

|

|||||

|

Investments

|

—

|

|

3.9

|

|

—

|

|

40.7

|

|

—

|

|

44.6

|

|

|||||||||||

|

Investments in consolidated subsidiaries

|

4,462.4

|

|

7.4

|

|

182.2

|

|

—

|

|

(4,652.0

|

)

|

—

|

|

|||||||||||

|

Property and equipment (including concession assets), net

|

—

|

|

4,283.2

|

|

171.6

|

|

3,954.9

|

|

(5.9

|

)

|

8,403.8

|

|

|||||||||||

|

Other assets

|

2,159.6

|

|

46.8

|

|

—

|

|

252.5

|

|

(2,388.7

|

)

|

70.2

|

|

|||||||||||

|

Total assets

|

$

|

6,914.0

|

|

$

|

4,555.4

|

|

$

|

362.6

|

|

$

|

4,723.6

|

|

$

|

(7,356.9

|

)

|

$

|

9,198.7

|

|

|||||

|

Liabilities and equity:

|

|||||||||||||||||||||||

|

Current liabilities

|

$

|

277.9

|

|

$

|

578.7

|

|

$

|

94.9

|

|

$

|

332.0

|

|

$

|

(311.8

|

)

|

$

|

971.7

|

|

|||||

|

Long-term debt

|

2,066.8

|

|

1,517.2

|

|

—

|

|

1,040.3

|

|

(2,388.8

|

)

|

2,235.5

|

|

|||||||||||

|

Deferred income taxes

|

(7.1

|

)

|

734.8

|

|

84.0

|

|

177.0

|

|

(1.5

|

)

|

987.2

|

|

|||||||||||

|

Other liabilities

|

13.5

|

|

70.0

|

|

0.3

|

|

55.1

|

|

—

|

|

138.9

|

|

|||||||||||

|

Stockholders’ equity

|

4,562.9

|

|

1,654.7

|

|

183.4

|

|

2,802.7

|

|

(4,654.8

|

)

|

4,548.9

|

|

|||||||||||

|

Noncontrolling interest

|

—

|

|

—

|

|

—

|

|

316.5

|

|

—

|

|

316.5

|

|

|||||||||||

|

Total liabilities and equity

|

$

|

6,914.0

|

|

$

|

4,555.4

|

|

$

|

362.6

|

|

$

|

4,723.6

|

|

$

|

(7,356.9

|

)

|

$

|

9,198.7

|

|

|||||

|

Nine Months Ended September 30, 2018

|

|||||||||||||||||||||||

|

Parent

|

KCSR

|

Guarantor

Subsidiaries

|

Non-Guarantor

Subsidiaries

|

Consolidating

Adjustments

|

Consolidated

KCS

|

||||||||||||||||||

|

Operating activities:

|

|||||||||||||||||||||||

|

Net cash provided

|

$

|

151.2

|

|

$

|

353.5

|

|

$

|

0.6

|

|

$

|

395.6

|

|

$

|

(195.1

|

)

|

$

|

705.8

|

|

|||||

|

Investing activities:

|

|||||||||||||||||||||||

|

Capital expenditures

|

—

|

|

(185.3

|

)

|

(0.5

|

)

|

(211.0

|

)

|

—

|

|

(396.8

|

)

|

|||||||||||

|

Purchase or replacement of equipment under operating leases

|

—

|

|

(88.4

|

)

|

—

|

|

(10.5

|

)

|

—

|

|

(98.9

|

)

|

|||||||||||

|

Property investments in MSLLC

|

—

|

|

—

|

|

—

|

|

(24.0

|

)

|

—

|

|

(24.0

|

)

|

|||||||||||

|

Investments in and advances to affiliates

|

(6.1

|

)

|

—

|

|

(6.1

|

)

|

(7.6

|

)

|

9.5

|

|

(10.3

|

)

|

|||||||||||

|

Proceeds from repayment of loans to affiliates

|

4,094.1

|

|

—

|

|

—

|

|

125.0

|

|

(4,219.1

|

)

|

—

|

|

|||||||||||

|

Loans to affiliates

|

(4,061.9

|

)

|

—

|

|

—

|

|

(125.0

|

)

|

4,186.9

|

|

—

|

|

|||||||||||

|

Proceeds from disposal of property

|

—

|

|

3.3

|

|

—

|

|

3.9

|

|

—

|

|

7.2

|

|

|||||||||||

|

Other investing activities

|

—

|

|

(2.1

|

)

|

—

|

|

(0.1

|

)

|

—

|

|

(2.2

|

)

|

|||||||||||

|

Net cash provided (used)

|

26.1

|

|

(272.5

|

)

|

(6.6

|

)

|

(249.3

|

)

|

(22.7

|

)

|

(525.0

|

)

|

|||||||||||

|

Financing activities:

|

|||||||||||||||||||||||

|

Proceeds from short-term borrowings

|

4,158.0

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4,158.0

|

|

|||||||||||

|

Repayment of short-term borrowings

|

(4,506.1

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(4,506.1

|

)

|

|||||||||||

|

Proceeds from issuance of long-term debt

|

499.4

|

|

—

|

|

—

|

|

—

|

|

—

|

|

499.4

|

|

|||||||||||

|

Repayment of long-term debt

|

—

|

|

(2.8

|

)

|

(0.1

|

)

|

(75.8

|

)

|

—

|

|

(78.7

|

)

|

|||||||||||

|

Debt issuance and retirement costs paid

|

(6.2

|

)

|

—

|

|

—

|

|

(1.8

|

)

|

—

|

|

(8.0

|

)

|

|||||||||||

|

Dividends paid

|

(110.9

|

)

|

—

|

|

—

|

|

(195.1

|

)

|

195.1

|

|

(110.9

|

)

|

|||||||||||

|

Shares repurchased

|

(163.3

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(163.3

|

)

|

|||||||||||

|

Proceeds from loans from affiliates

|

125.0

|

|

4,011.9

|

|

—

|

|

50.0

|

|

(4,186.9

|

)