|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Ohio

|

31-1626393

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

Title of Each Class

|

Name of each exchange

on which registered

|

|

|

None

|

None

|

|

PART I

|

3

|

|

|

Item 1.

Business

|

3

|

|

|

Item 1A.

Risk Factors

|

23

|

|

|

Item 1B.

Unresolved Staff Comments

|

28

|

|

|

Item 2.

Properties

|

29

|

|

|

Item 3.

Legal Proceedings

|

30

|

|

|

Item 4.

Mine Safety Disclosures

|

30

|

|

|

PART II

|

31

|

|

|

31

|

||

|

Item 6.

Selected Financial Data

|

34

|

|

|

36

|

||

|

51

|

||

|

53

|

||

|

53

|

||

|

54

|

||

|

57

|

||

|

104

|

||

|

Item 9A.

Controls and Procedures

|

104

|

|

|

Item 9B.

Other Information

|

104

|

|

|

PART III

|

105

|

|

|

105

|

||

|

Item 11.

Executive Compensation

|

105

|

|

|

105

|

||

|

105

|

||

|

105

|

||

|

PART IV

|

106

|

|

|

106

|

||

|

108

|

||

|

Warren

|

Butler

|

Clinton

|

Hamilton

|

Montgomery

|

||||||||||||||||

|

Population, 2000 census

|

158,383 | 332,807 | 40,543 | 845,303 | 559,062 | |||||||||||||||

|

Population, 2010 census

|

212,693 | 368,130 | 42,040 | 802,374 | 535,153 | |||||||||||||||

|

Percentage increase/decrease in

population

|

34.3 | % | 10.6 | % | 3.0 | % | -5.1 | % | -4.3 | % | ||||||||||

|

Estimated percentage of persons below poverty level

|

6.1 | % | 12.7 | % | 12.9 | % | 14.2 | % | 15.4 | % | ||||||||||

|

Estimated median household income

|

$ | 70,939 | $ | 54,344 | $ | 47,842 | $ | 48,363 | $ | 43,815 | ||||||||||

|

Median age

|

36.8 | 35.4 | 37.4 | 36.8 | 38.2 | |||||||||||||||

|

Unemployment rate:

|

||||||||||||||||||||

|

December 2011

|

7.0 | % | 7.9 | % | 11.1 | % | 7.5 | % | 8.5 | % | ||||||||||

|

December 2010

|

8.4 | % | 8.8 | % | 15.0 | % | 8.5 | % | 10.1 | % | ||||||||||

|

December 2009

|

9.3 | % | 9.9 | % | 18.5 | % | 9.5 | % | 12.0 | % | ||||||||||

Once primarily a rural county (its population according to the 1950 census was only 38,505), Warren County experienced significant growth during the latter half of the twentieth century and into the twenty-first century. Many people who now live in Warren County are employed by companies located in the Cincinnati and Dayton metropolitan areas. People employed within Warren County usually work in the trade, transportation, and utilities sector, the manufacturing sector, the professional and businesses services sector, and the leisure and hospitality sector. A sizable tourist industry that includes King’s Island, the Beach Waterpark, and the Ohio Renaissance Festival provides a number of temporary summer jobs. Not including local government entities and school districts, which are significant sources of employment, the top five major employers in Warren County are Macy’s Credit and Customer Service, Procter and Gamble’s Mason Business Center, Atrium Medical Center (a hospital), WellPoint (health insurance), and Luxottica.

|

|

1.

|

Required regulatory agencies to take "prompt corrective action" with financial institutions that do not meet minimum capital requirements;

|

|

|

2.

|

Established five capital tiers: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized;

|

|

|

3.

|

Imposed significant restrictions on the operations of a financial institution that is not rated well-capitalized or adequately capitalized;

|

|

|

4.

|

Prohibited a depository institution from making any capital distributions, including payments of dividends or paying any management fee to its holding company, if the institution would be undercapitalized as a result;

|

|

|

5.

|

Implemented a risk-based premium system;

|

|

|

6.

|

Required an audit committee to be comprised of outside directors;

|

|

|

7.

|

Required a financial institution with more than $1 billion in total assets to issue annual, audited financial statements prepared in conformity with U.S. generally accepted accounting principles; and

|

|

|

8.

|

Required a financial institution with more than $1 billion in total assets to document, evaluate, and report on the effectiveness of the entity's internal control system and required an independent public accountant to attest to management's assertions concerning the bank's internal control system.

|

At December 31, 2011, the Bank was well capitalized based on FDICIA's guidelines.

|

|

1.

|

securities underwriting, dealing, and market making;

|

|

|

2.

|

sponsoring mutual funds and investment companies;

|

|

|

3.

|

insurance underwriting and agency;

|

|

|

4.

|

merchant banking activities; and

|

|

|

5.

|

other activities that the Federal Reserve Board, in consultation with and subject to the approval of the U.S. Department of the Treasury (the “Treasury Department”), determines are financial in nature.

|

|

|

1.

|

Certification of financial reports by the chief executive officer ("CEO") and the chief financial officer ("CFO"), who are responsible for designing and monitoring internal controls to ensure that material information relating to the issuer and its consolidated subsidiaries is made known to the certifying officers by others within the company;

|

|

|

2.

|

Inclusion of an internal control report in annual reports that include management's assessment of the effectiveness of a company's internal control over financial reporting and a report by the company's independent registered public accounting firm attesting to the effectiveness of internal control over financial reporting;

|

|

|

3.

|

Accelerated reporting of stock trades on Form 4 by directors and executive officers;

|

|

|

4.

|

Disgorgement requirements of incentive pay or stock-based compensation profits received within twelve months of the release of financial statements if the company is later required to restate those financial statements due to material noncompliance with any financial reporting requirement that resulted from misconduct;

|

|

|

5.

|

Disclosure in a company's periodic reports stating if it has adopted a code of ethics for its CFO and principal accounting officer or controller and, if such code of ethics has been implemented, immediate disclosure of any change in or waiver of the code of ethics;

|

|

|

6.

|

Disclosure in a company's periodic reports stating if at least one member of the audit committee is a "financial expert," as that term is defined by the Securities and Exchange Commission (the "SEC"); and

|

|

|

7.

|

Implementation of new duties and responsibilities for a company's audit committee, including independence requirements, the direct responsibility to appoint the outside auditing firm and to provide oversight of the auditing firm's work, and a requirement to establish procedures for the receipt, retention, and treatment of complaints from a company's employees regarding questionable accounting, internal control, or auditing matters.

|

|

|

1.

|

Merging the Bank Insurance Fund and the Savings Association Insurance Fund into a new fund called the Deposit Insurance Fund, effective March 31, 2006;

|

|

|

2.

|

Increasing insurance coverage for retirement accounts from $100,000 to $250,000, effective April 1, 2006;

|

|

|

3.

|

Adjusting deposit insurance levels of $100,000 for non-retirement accounts and $250,000 for retirement accounts every five years based on an inflation index, with the first adjustment to be effective on January 1, 2011;

|

|

|

4.

|

Eliminating a 1.25% hard target Designated Reserve Ratio, as defined, and giving the FDIC discretion to set the Designated Reserve Ratio within a range of 1.15% to 1.50% for any given year;

|

|

|

5.

|

Eliminating certain restrictions on premium rates the FDIC charges covered institutions and establishing a risk-based premium system; and

|

|

|

6.

|

Providing for a one-time credit for institutions that paid premiums to the Bank Insurance Fund or the Savings Association Insurance Fund prior to December 31, 1996.

|

|

|

1.

|

The FDIC guaranteed certain newly issued senior unsecured debt of eligible institutions, including FDIC-insured banks and thrifts and certain holding companies, issued on or after October 14, 2008 and before June 30, 2009; and

|

|

|

2.

|

The FDIC temporarily provided full deposit insurance coverage for non-interest bearing deposit transaction accounts in FDIC-insured institutions, regardless of the dollar amount, through December 31, 2009, later extended to December 31, 2010.

|

|

|

Robert C. Haines II

|

|

|

Executive Vice President, CFO

|

|

|

LCNB Corp.

|

|

|

2 N. Broadway

|

|

|

P.O. Box 59

|

|

|

Lebanon, Ohio 45036

|

|

At December 31,

|

||||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Securities available-for-sale:

|

||||||||||||

|

U.S. Treasury notes

|

$ | 17,550 | 19,585 | 13,308 | ||||||||

|

U.S. Agency notes

|

82,927 | 82,862 | 45,888 | |||||||||

|

U.S. Agency mortgage-backed securities

|

52,287 | 33,094 | 49,624 | |||||||||

|

Corporate securities

|

6,365 | 2,025 | 8,488 | |||||||||

|

Municipal securities

|

91,610 | 96,396 | 83,323 | |||||||||

|

Mutual funds

|

2,125 | 1,053 | 538 | |||||||||

|

Trust preferred securities

|

564 | 604 | 344 | |||||||||

|

Equity securities

|

578 | 263 | 65 | |||||||||

|

Total securities available-for-sale

|

254,006 | 235,882 | 201,578 | |||||||||

|

Securities held-to-maturity:

|

||||||||||||

|

Municipal securities

|

10,734 | 12,141 | 13,030 | |||||||||

|

Federal Reserve Bank Stock

|

940 | 939 | 940 | |||||||||

|

Federal Home Loan Bank Stock

|

2,091 | 2,091 | 2,091 | |||||||||

|

Total securities

|

$ | 267,771 | 251,053 | 217,639 | ||||||||

|

Available-for-Sale

|

Held-to-Maturity

|

|||||||||||||||||||||||

|

Amortized

|

Fair

|

Amortized

|

Fair

|

|||||||||||||||||||||

|

Cost

|

Value

|

Yield

|

Cost

|

Value

|

Yield

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

U.S. Treasury notes:

|

||||||||||||||||||||||||

|

One to five years

|

$ | 7,709 | 7,824 | 0.97 | % | - | - | - | % | |||||||||||||||

|

Five to ten years

|

9,676 | 9,726 | 1.22 | % | - | - | - | % | ||||||||||||||||

|

Total U.S. Treasury notes

|

17,385 | 17,550 | 1.11 | % | - | - | - | % | ||||||||||||||||

|

U.S. Agency notes:

|

||||||||||||||||||||||||

|

One to five years

|

81,415 | 82,927 | 1.42 | % | - | - | - | % | ||||||||||||||||

|

Total U.S. Agency notes

|

81,415 | 82,927 | 1.42 | % | - | - | - | % | ||||||||||||||||

|

Corporate securities:

|

||||||||||||||||||||||||

|

One to five years

|

6,334 | 6,365 | 1.30 | % | - | - | - | % | ||||||||||||||||

|

Total corporate securities

|

6,334 | 6,365 | 1.30 | % | - | - | - | % | ||||||||||||||||

|

Municipal securities (1):

|

||||||||||||||||||||||||

|

Within one year

|

4,364 | 4,398 | 1.70 | % | 1,837 | 1,837 | 3.05 | % | ||||||||||||||||

|

One to five years

|

42,320 | 43,987 | 3.20 | % | 678 | 678 | 5.89 | % | ||||||||||||||||

|

Five to ten years

|

35,159 | 37,833 | 4.58 | % | 4,314 | 4,314 | 6.62 | % | ||||||||||||||||

|

After ten years

|

5,080 | 5,392 | 5.64 | % | 3,905 | 3,905 | 8.62 | % | ||||||||||||||||

|

Total Municipal securities

|

86,923 | 91,610 | 3.89 | % | 10,734 | 10,734 | 6.69 | % | ||||||||||||||||

|

U.S. Agency mortgage- backed securities

|

50,923 | 52,287 | 2.84 | % | - | - | - | % | ||||||||||||||||

|

Mutual Funds

|

2,103 | 2,125 | 2.99 | % | - | - | - | % | ||||||||||||||||

|

Trust preferred securities

|

549 | 564 | 7.98 | % | - | - | - | % | ||||||||||||||||

|

Equity securities

|

526 | 578 | 3.70 | % | - | - | - | % | ||||||||||||||||

|

Totals

|

$ | 246,158 | 254,006 | 2.59 | % | 10,734 | 10,734 | 6.69 | % | |||||||||||||||

|

|

(1)

|

Yields on tax-exempt obligations are computed on a taxable-equivalent basis based upon a 34% statutory Federal income tax rate.

|

Loan Portfolio

Interest rates charged by LCNB vary with degree of risk, type of loan, amount, complexity, repricing frequency and other relevant factors associated with the loan.

|

At December 31,

|

||||||||||||||||||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||||||||||||||||||||

|

Amount

|

%

|

Amount

|

%

|

Amount

|

%

|

Amount

|

%

|

Amount

|

%

|

|||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Commercial and industrial

|

$ | 30,990 | 6.7 | % | 36,122 | 7.9 | % | 42,807 | 9.3 | % | 38,724 | 8.6 | % | 37,325 | 8.4 | % | ||||||||||||||||||||||||

|

Commercial, secured by real estate

|

219,188 | 47.6 | % | 196,136 | 43.1 | % | 185,024 | 40.2 | % | 174,493 | 38.5 | % | 159,384 | 35.8 | % | |||||||||||||||||||||||||

|

Residential real estate

|

186,904 | 40.5 | % | 190,277 | 41.9 | % | 193,293 | 42.0 | % | 194,039 | 42.8 | % | 193,920 | 43.5 | % | |||||||||||||||||||||||||

|

Consumer

|

14,562 | 3.2 | % | 19,691 | 4.3 | % | 26,185 | 5.7 | % | 33,369 | 7.4 | % | 43,410 | 9.7 | % | |||||||||||||||||||||||||

|

Agricultural

|

2,835 | 0.6 | % | 2,966 | 0.7 | % | 3,125 | 0.7 | % | 3,216 | 0.7 | % | 2,707 | 0.6 | % | |||||||||||||||||||||||||

|

Other loans, including deposit overdrafts

|

6,554 | 1.4 | % | 9,413 | 2.1 | % | 9,422 | 2.1 | % | 9,203 | 2.0 | % | 9,114 | 2.0 | % | |||||||||||||||||||||||||

| 461,033 | 100.0 | % | 454,605 | 100.0 | % | 459,856 | 100.0 | % | 453,044 | 100.0 | % | 445,860 | 100.0 | % | ||||||||||||||||||||||||||

|

Deferred origination costs, net

|

229 | 386 | 560 | 767 | 1,027 | |||||||||||||||||||||||||||||||||||

|

Total loans

|

461,262 | 454,991 | 460,416 | 453,811 | 446,887 | |||||||||||||||||||||||||||||||||||

|

Less allowance for loan losses

|

2,931 | 2,641 | 2,998 | 2,468 | 2,468 | |||||||||||||||||||||||||||||||||||

|

Loans, net

|

$ | 458,331 | 452,350 | 457,418 | 451,343 | 444,419 | ||||||||||||||||||||||||||||||||||

Commercial and Industrial Loans. LCNB’s commercial and industrial loan portfolio consists of loans for various purposes, including loans to fund working capital requirements (such as inventory and receivables financing) and purchases of machinery and equipment. LCNB offers a variety of commercial and industrial loan arrangements, including term loans, balloon loans, and line of credit. Most commercial and industrial loans have a variable rate, with adjustments occurring monthly, annually, every three years, or every five years. Adjustments are generally based on a publicly available index rate plus a margin. The margin varies based on the terms and collateral securing the loan. Commercial and industrial loans are offered to businesses and professionals for short and medium terms on both a collateralized and uncollateralized basis. Commercial and industrial loans typically are underwritten on the basis of the borrower’s ability to make repayment from the cash flow of the business. Collateral, when obtained, may include liens on furniture, fixtures, equipment, inventory, receivables, or other assets. As a result, such loans involve complexities, variables, and risks that require thorough underwriting and more robust servicing than other types of loans.

Commercial real estate loans are underwritten based on the ability of the property, in the case of income producing property, or the borrower’s business to generate sufficient cash flow to amortize the debt. Secondary emphasis is placed upon collateral value, financial ability of any guarantors, and other factors. Commercial real estate loans are generally originated with a 75 percent maximum loan to appraised value ratio.

|

(Dollars in thousands)

|

||||

|

Maturing in one year or less

|

$ | 21,401 | ||

|

Maturing after one year, but within five years

|

62,946 | |||

|

Maturing beyond five years

|

168,666 | |||

|

Total commercial and agricultural loans

|

$ | 253,013 | ||

|

Loans maturing beyond one year:

|

||||

|

Fixed rate

|

$ | 70,228 | ||

|

Variable rate

|

161,384 | |||

|

Total

|

$ | 231,612 | ||

|

At December 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Non-accrual loans

|

$ | 3,668 | 3,761 | 2,939 | 2,281 | 120 | ||||||||||||||

|

Past-due 90 days or more

and still accruing

|

39 | 300 | 924 | 806 | 247 | |||||||||||||||

|

Accruing restructured loans

|

14,739 | 9,088 | 7,173 | 332 | 2,222 | |||||||||||||||

|

Total

|

$ | 18,446 | 13,149 | 11,036 | 3,419 | 2,589 | ||||||||||||||

|

Percent to total loans

|

4.00 | % | 2.89 | % | 2.40 | % | 0.75 | % | 0.58 | % | ||||||||||

|

At December 31,

|

||||||||||||||||||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007 |

|

|||||||||||||||||||||||||||||||||||

|

Amount

|

Percent of Loans in Each Category to

Total Loans

|

Amount

|

Percent of Loans in Each Category to Total Loans |

Amount

|

Percent of Loans in Each Category to Total Loans |

Amount

|

Percent of Loans in Each Category to

Total Loans

|

Amount

|

Percent of Loans in Each Categoryto Total Loans |

|

||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Commercial and industrial

|

$ | 162 | 0.04 | % | 305 | 0.07 | % | 546 | 0.12 | % | 369 | 0.08 | % | 340 | 0.08 | % | ||||||||||||||||||||||||

|

Commercial, secured by real estate

|

1,941 | 0.42 | % | 1,625 | 0.36 | % | 1,628 | 0.35 | % | 1,182 | 0.26 | % | 1,233 | 0.27 | % | |||||||||||||||||||||||||

|

Residential real estate

|

656 | 0.14 | % | 459 | 0.10 | % | 491 | 0.11 | % | 471 | 0.10 | % | 388 | 0.09 | % | |||||||||||||||||||||||||

|

Consumer

|

166 | 0.04 | % | 246 | 0.05 | % | 313 | 0.07 | % | 429 | 0.10 | % | 459 | 0.10 | % | |||||||||||||||||||||||||

|

Other loans, including deposit overdrafts

|

6 | - | % | 6 | - | % | 9 | - | % | 13 | - | % | 7 | - | % | |||||||||||||||||||||||||

|

Unallocated

|

- | - | % | - | - | % | 11 | - | % | 4 | - | % | 41 | 0.01 | % | |||||||||||||||||||||||||

|

Total

|

$ | 2,931 | 0.64 | % | 2,641 | 0.58 | % | 2,998 | 0.65 | % | 2,468 | 0.54 | % | 2,468 | 0.55 | % | ||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||

|

Maturity within 3 months

|

$ | 10,541 | ||

|

After 3 but within 6 months

|

8,316 | |||

|

After 6 but within 12 months

|

7,860 | |||

|

After 12 months

|

56,046 | |||

| $ | 82,763 | |||

Proposals to change the laws governing financial institutions are periodically introduced in Congress and proposals to change regulations are periodically considered by the regulatory bodies. Such future legislation and/or changes in regulations could increase or decrease the cost of doing business, limit or expand permissible activities, or affect the competitive balance among banks, savings associations, credit unions, and other financial institutions. The likelihood of any major changes in the future and their effects are impossible to determine.

LCNB’s information systems may experience an interruption or breach in security.

|

Name of Office

|

Address

|

|||||

|

1.

|

Main Office

|

2 North Broadway

Lebanon, Ohio 45036

|

Owned

|

|||

|

2.

|

Auto Bank

|

Silver and Mechanic Streets

Lebanon, Ohio 45036

|

Owned

|

|||

|

3.

|

Centerville Office

|

9605 Dayton-Lebanon Pike

Centerville, Ohio 45458

|

Owned

|

|||

|

4.

|

Colerain Township Office

|

3209 West Galbraith Road

Cincinnati, Ohio 45239

|

Owned

|

|||

|

5.

|

Columbus Avenue Office

|

730 Columbus Avenue

Lebanon, Ohio 45036

|

Owned

|

|||

|

6.

|

Fairfield Office

|

765 Nilles Road

Fairfield, Ohio 45014

|

Leased

|

|||

|

7.

|

Goshen Office

|

6726 Dick Flynn Blvd.

Goshen, Ohio 45122

|

Owned

|

|||

|

8.

|

Hamilton Office

|

794 NW Washington Blvd.

Hamilton, Ohio 45013

|

Owned

|

|||

|

9.

|

Hunter Office

|

3878 State Route 122

Franklin, Ohio 45005

|

Owned

|

|||

|

10.

|

Loveland Office

|

500 Loveland-Madeira Road

Loveland, OH 45140

|

Owned

|

|||

|

11.

|

Maineville Office

|

7795 South State Route 48

Maineville, Ohio 45039

|

Owned

|

|||

|

12.

|

Mason/West Chester Office

|

1050 Reading Road

Mason, Ohio 45040

|

Owned

|

|||

|

13.

|

Mason Christian Village Office

|

Mason Christian Village

411 Western Row Road

Mason, Ohio 45040

|

Leased

|

|||

|

14.

|

Middletown Office

|

4441 Marie Drive

Middletown, Ohio 45044

|

Owned

|

|

Name of Office

|

Address

|

|||||

|

15.

|

Monroe Office

|

101 Clarence F. Warner Drive

Monroe, Ohio 45050

|

Owned

|

|||

|

16.

|

Oakwood Office

|

2705 Far Hills Avenue

Oakwood, Ohio 45419

|

(2)

|

|||

|

17.

|

Okeana Office

|

6225 Cincinnati-Brookville Road

Okeana, Ohio 45053

|

Owned

|

|||

|

18.

|

Otterbein Office

|

Otterbein Retirement Community

State Route 741

Lebanon, Ohio 45036

|

Leased

|

|||

|

19.

|

Oxford Office (1)

|

30 West Park Place

Oxford, Ohio 45056

|

(2)

|

|||

|

20.

|

Rochester/Morrow Office

|

Route 22-3 at 123

Morrow, Ohio 45152

|

Owned

|

|||

|

21.

|

South Lebanon Office

|

603 Corwin Nixon Blvd.

South Lebanon, Ohio 45065

|

Owned

|

|||

|

22.

|

Springboro/Franklin Office

|

525 West Central Avenue

Springboro, Ohio 45066

|

Owned

|

|||

|

23.

|

Warrior Office

|

Lebanon High School

1916 Drake Road

Lebanon, Ohio 45036

|

Leased

|

|||

|

24.

|

Waynesville Office

|

9 North Main Street

Waynesville, Ohio 45068

|

Owned

|

|||

|

25.

|

Wilmington Office

|

1243 Rombach Avenue

Wilmington, Ohio 45177

|

Owned

|

|

|

(1)

|

Excess space in this office is leased to third parties.

|

|

|

(2)

|

The Bank owns the Oakwood and Oxford office buildings and leases the land.

|

|

2011

|

2010

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First Quarter

|

$ | 12.25 | 11.56 | 12.50 | 10.50 | |||||||||||

|

Second Quarter

|

13.00 | 11.70 | 13.00 | 10.34 | ||||||||||||

|

Third Quarter

|

14.22 | 11.85 | 12.50 | 11.25 | ||||||||||||

|

Fourth Quarter

|

13.70 | 12.22 | 12.35 | 11.20 | ||||||||||||

|

2011

|

2010

|

|||||||

|

First Quarter

|

$ | 0.16 | 0.16 | |||||

|

Second Quarter

|

0.16 | 0.16 | ||||||

|

Third Quarter

|

0.16 | 0.16 | ||||||

|

Fourth Quarter

|

0.16 | 0.16 | ||||||

|

Total

|

$ | 0.64 | 0.64 | |||||

|

Plan Category

|

Number of Securities to

be Issued upon Exercise

of Outstanding Options

|

Weighted Average

Exercise Price of

Outstanding Options

|

Number of Securities

Remaining Available

for Future Issuance

|

|||||||||

|

Equity compensation plans approved by security holders

|

124,123

|

$ |

12.54

|

75,877

|

||||||||

|

Equity compensation plans not approved by security holders

|

-

|

-

|

-

|

|||||||||

|

Total

|

124,123

|

$ |

12.54

|

75,877

|

||||||||

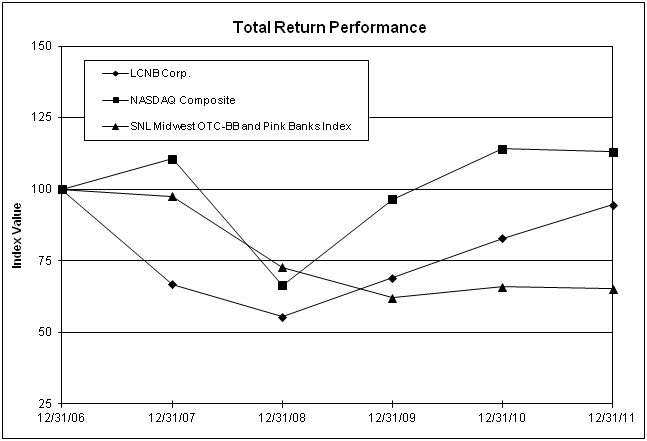

| Period Ending | ||||||||||||||||||||||||

|

Index

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

12/31/11

|

||||||||||||||||||

|

LCNB Corp.

|

100.00 | 66.76 | 55.47 | 69.06 | 82.90 | 94.64 | ||||||||||||||||||

|

NASDAQ Composite

|

100.00 | 110.66 | 66.42 | 96.54 | 114.06 | 113.16 | ||||||||||||||||||

|

SNL Midwest OTC-BB and Pink Banks Index

|

100.00 | 97.62 | 72.76 | 62.08 | 65.89 | 65.27 | ||||||||||||||||||

|

For the Years Ended December 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

(Dollars in thousands, except ratios and per share data)

|

||||||||||||||||||||

|

Income Statement:

|

||||||||||||||||||||

|

Interest income

|

$ | 32,093 | 34,031 | 34,898 | 34,398 | 32,041 | ||||||||||||||

|

Interest expense

|

6,387 | 8,334 | 10,060 | 13,421 | 13,838 | |||||||||||||||

|

Net interest income

|

25,706 | 25,697 | 24,838 | 20,977 | 18,203 | |||||||||||||||

|

Provision for loan losses

|

2,089 | 1,680 | 1,400 | 620 | 266 | |||||||||||||||

|

Net interest income after provision for loan losses

|

23,617 | 24,017 | 23,438 | 20,357 | 17,937 | |||||||||||||||

|

Non-interest income

|

7,764 | 8,887 | 7,180 | 6,759 | 6,614 | |||||||||||||||

|

Non-interest expenses

|

21,849 | 21,277 | 20,686 | 18,555 | 16,991 | |||||||||||||||

|

Income before income taxes

|

9,532 | 11,627 | 9,932 | 8,561 | 7,560 | |||||||||||||||

|

Provision for income taxes

|

2,210 | 2,494 | 2,245 | 2,134 | 1,823 | |||||||||||||||

|

Net income from continuing operations

|

7,322 | 9,133 | 7,687 | 6,427 | 5,737 | |||||||||||||||

|

Income from discontinued operations, net of tax

|

793 | 240 | 79 | 176 | 217 | |||||||||||||||

|

Net income

|

8,115 | 9,373 | 7,766 | 6,603 | 5,954 | |||||||||||||||

|

Preferred stock dividends and discount accretion

|

- | - | 1,108 | - | - | |||||||||||||||

|

Net income available to common shareholders

|

$ | 8,115 | 9,373 | 6,658 | 6,603 | 5,954 | ||||||||||||||

|

Dividends per common share (1)

|

$ | 0.64 | 0.64 | 0.64 | 0.64 | 0.62 | ||||||||||||||

|

Basic earnings per common share (1):

|

||||||||||||||||||||

|

Continuing operations

|

1.09 | 1.37 | 0.99 | 0.96 | 0.90 | |||||||||||||||

|

Discontinued operations

|

0.12 | 0.03 | 0.01 | 0.03 | 0.04 | |||||||||||||||

|

Diluted earnings per common share (1):

|

||||||||||||||||||||

|

Continuing operations

|

1.08 | 1.36 | 0.98 | 0.96 | 0.90 | |||||||||||||||

|

Discontinued operations

|

0.12 | 0.03 | 0.01 | 0.03 | 0.04 | |||||||||||||||

|

Balance Sheet:

|

||||||||||||||||||||

|

Securities

|

$ | 267,771 | 251,053 | 217,639 | 139,272 | 90,154 | ||||||||||||||

|

Loans, net

|

458,331 | 452,350 | 457,418 | 451,343 | 444,419 | |||||||||||||||

|

Total assets

|

791,570 | 760,134 | 734,409 | 649,731 | 604,058 | |||||||||||||||

|

Total deposits

|

663,562 | 638,539 | 624,179 | 577,622 | 535,929 | |||||||||||||||

|

Short-term borrowings

|

21,596 | 21,691 | 14,265 | 2,206 | 1,459 | |||||||||||||||

|

Long-term debt

|

21,373 | 23,120 | 24,960 | 5,000 | 5,000 | |||||||||||||||

|

Total shareholders' equity

|

77,960 | 70,707 | 65,615 | 58,116 | 56,528 | |||||||||||||||

|

Selected Financial Ratios and Other Data:

|

||||||||||||||||||||

|

Return on average assets

|

1.02 | % | 1.22 | % | 1.07 | % | 1.03 | % | 1.08 | % | ||||||||||

|

Return on average equity

|

10.89 | % | 13.36 | % | 10.43 | % | 11.35 | % | 11.41 | % | ||||||||||

|

Equity-to-assets ratio

|

9.85 | % | 9.30 | % | 8.93 | % | 8.94 | % | 9.36 | % | ||||||||||

|

Dividend payout ratio

|

52.89 | % | 45.71 | % | 64.39 | % | 64.65 | % | 65.96 | % | ||||||||||

|

Net interest margin, fully taxable equivalent

|

3.70 | % | 3.89 | % | 3.96 | % | 3.74 | % | 3.77 | % | ||||||||||

|

(1)

|

All per share data in 2007 has been adjusted to reflect a 100% stock dividend accounted for as stock split.

|

|

|

·

|

Bank owned life insurance income was greater during 2010 due to death benefits received. No death benefits were received during 2011 or 2009.

|

|

|

·

|

FDIC premiums for 2009 included an industry-wide FDIC special assessment of $325,000 that LCNB recognized during the second quarter 2009. FDIC premiums for 2011 were less due to a change in the assessment base.

|

|

|

·

|

Other real estate owned expense was greater during 2010 because of valuation write-downs and related increases in holding costs. Other real estate owned expense for 2011 included a loss recognized on the sale of commercial property.

|

|

|

·

|

Gains from sales of securities were significantly greater in 2011 and 2010 than in 2009.

|

|

|

·

|

The $722,000 write-off of pension asset recognized during 2009 related to a restructuring of LCNB’s retirement plans.

|

|

Years ended December 31,

|

||||||||||||||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

||||||||||||||||||||||||||||||||||

|

Average

|

Interest

|

Average

|

Average

|

Interest

|

Average

|

Average

|

Interest

|

Average

|

||||||||||||||||||||||||||||

|

Outstanding

|

Earned/

|

Yield/

|

Outstanding

|

Earned/

|

Yield/

|

Outstanding

|

Earned/

|

Yield/

|

||||||||||||||||||||||||||||

|

Balance

|

Paid

|

Rate

|

Balance

|

Paid

|

Rate

|

Balance

|

Paid

|

Rate

|

||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Loans (1)

|

$ | 458,049 | 25,502 | 5.57 | % | $ | 458,708 | $ | 27,020 | 5.89 | % | $ | 453,869 | $ | 27,538 | 6.07 | % | |||||||||||||||||||

|

Interest-bearing demand deposits

|

13,296 | 32 | 0.24 | % | 20,876 | 51 | 0.24 | % | 18,727 | 49 | 0.26 | % | ||||||||||||||||||||||||

|

Federal Reserve Bank Stock

|

940 | 56 | 5.96 | % | 940 | 56 | 5.96 | % | 939 | 56 | 5.96 | % | ||||||||||||||||||||||||

|

Federal Home Loan Bank Stock

|

2,091 | 89 | 4.26 | % | 2,091 | 92 | 4.40 | % | 2,091 | 97 | 4.64 | % | ||||||||||||||||||||||||

|

Investment securities:

|

||||||||||||||||||||||||||||||||||||

|

Taxable

|

176,922 | 3,843 | 2.17 | % | 133,556 | 3,686 | 2.76 | % | 110,894 | 4,237 | 3.82 | % | ||||||||||||||||||||||||

|

Nontaxable (2)

|

78,917 | 3,895 | 4.94 | % | 85,718 | 4,736 | 5.53 | % | 78,373 | 4,426 | 5.65 | % | ||||||||||||||||||||||||

|

Total earning assets

|

730,215 | 33,417 | 4.58 | % | 701,889 | 35,641 | 5.08 | % | 664,893 | 36,403 | 5.48 | % | ||||||||||||||||||||||||

|

Non-earning assets

|

64,735 | 66,489 | 61,432 | |||||||||||||||||||||||||||||||||

|

Allowance for loan losses

|

(2,936 | ) | (2,815 | ) | (2,638 | ) | ||||||||||||||||||||||||||||||

|

Total assets

|

$ | 792,014 | $ | 765,563 | $ | 723,687 | ||||||||||||||||||||||||||||||

|

Savings deposits

|

$ | 122,987 | 452 | 0.37 | % | $ | 108,734 | 653 | 0.60 | % | $ | 97,813 | 742 | 0.76 | % | |||||||||||||||||||||

|

NOW and money fund

|

232,418 | 667 | 0.29 | % | 221,926 | 1,282 | 0.58 | % | 197,805 | 1,496 | 0.76 | % | ||||||||||||||||||||||||

|

IRA and time certificates

|

219,174 | 4,583 | 2.09 | % | 231,971 | 5,678 | 2.45 | % | 240,783 | 7,196 | 2.99 | % | ||||||||||||||||||||||||

|

Short-term borrowings

|

12,415 | 28 | 0.23 | % | 7,606 | 27 | 0.35 | % | 1,468 | 3 | 0.20 | % | ||||||||||||||||||||||||

|

Long-term debt

|

22,733 | 657 | 2.89 | % | 23,826 | 694 | 2.91 | % | 20,282 | 623 | 3.07 | % | ||||||||||||||||||||||||

|

Total interest-bearing liabilities

|

609,727 | 6,387 | 1.05 | % | 594,063 | 8,334 | 1.40 | % | 558,151 | 10,060 | 1.80 | % | ||||||||||||||||||||||||

|

Demand deposits

|

101,781 | 95,273 | 86,270 | |||||||||||||||||||||||||||||||||

|

Other liabilities

|

5,964 | 6,059 | 4,802 | |||||||||||||||||||||||||||||||||

|

Capital

|

74,542 | 70,168 | 74,464 | |||||||||||||||||||||||||||||||||

|

Total liabilities and capital

|

$ | 792,014 | $ | 765,563 | $ | 723,687 | ||||||||||||||||||||||||||||||

|

Net interest rate spread (3)

|

3.53 | % | 3.68 | % | 3.68 | % | ||||||||||||||||||||||||||||||

|

Net interest income and net interest margin on a tax equivalent basis (4)

|

27,030 | 3.70 | % | $ | 27,307 | 3.89 | % | $ | 26,343 | 3.96 | % | |||||||||||||||||||||||||

|

Ratio of interest-earning assets to interest-bearing liabilities

|

119.76 | % | 118.15 | % | 119.12 | % | ||||||||||||||||||||||||||||||

|

(1)

|

Includes non-accrual loans if any. Income from tax-exempt loans is included in interest income on a taxable-equivalent basis, using an incremental rate of 34%.

|

|

(2)

|

Income from tax-exempt securities is included in interest income on a taxable-equivalent basis. Interest income has been divided by a factor comprised of the complement of the incremental tax rate of 34%.

|

|

(3)

|

The net interest spread is the difference between the average rate on total interest-earning assets and interest-bearing liabilities.

|

|

(4)

|

The net interest margin is the taxable-equivalent net interest income divided by average interest-earning assets.

|

|

For the years ended December 31,

|

||||||||||||||||||||||||

|

2011 vs. 2010

|

2010 vs. 2009

|

|||||||||||||||||||||||

|

Increase (decrease) due to

|

Increase (decrease) due to

|

|||||||||||||||||||||||

|

Volume

|

Rate

|

Total

|

Volume

|

Rate

|

Total

|

|||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||

|

Interest income attributable to:

|

||||||||||||||||||||||||

|

Loans (1)

|

$ | (39 | ) | (1,479 | ) | (1,518 | ) | 291 | (809 | ) | (518 | ) | ||||||||||||

|

Interest-bearing demand deposits

|

(18 | ) | (1 | ) | (19 | ) | 5 | (3 | ) | 2 | ||||||||||||||

|

Interest-bearing deposits in banks

|

- | - | - | - | - | - | ||||||||||||||||||

|

Federal Reserve Bank stock

|

- | - | - | - | - | - | ||||||||||||||||||

|

Federal Home Loan Bank stock

|

- | (3 | ) | (3 | ) | - | (5 | ) | (5 | ) | ||||||||||||||

|

Investment securities:

|

||||||||||||||||||||||||

|

Taxable

|

1,043 | (886 | ) | 157 | 764 | (1,315 | ) | (551 | ) | |||||||||||||||

|

Nontaxable (2)

|

(359 | ) | (482 | ) | (841 | ) | 408 | (98 | ) | 310 | ||||||||||||||

|

Total interest income

|

627 | (2,851 | ) | (2,224 | ) | 1,468 | (2,230 | ) | (762 | ) | ||||||||||||||

|

Interest expense attributable to:

|

||||||||||||||||||||||||

|

Savings deposits

|

77 | (278 | ) | (201 | ) | 77 | (166 | ) | (89 | ) | ||||||||||||||

|

NOW and money fund

|

58 | (673 | ) | (615 | ) | 168 | (382 | ) | (214 | ) | ||||||||||||||

|

IRA and time certificates

|

(301 | ) | (794 | ) | (1,095 | ) | (255 | ) | (1,263 | ) | (1,518 | ) | ||||||||||||

|

Short-term borrowings

|

13 | (12 | ) | 1 | 20 | 4 | 24 | |||||||||||||||||

|

Long-term debt

|

(32 | ) | (5 | ) | (37 | ) | 105 | (34 | ) | 71 | ||||||||||||||

|

Total interest expense

|

(185 | ) | (1,762 | ) | (1,947 | ) | 115 | (1,841 | ) | (1,726 | ) | |||||||||||||

|

Net interest income

|

$ | 812 | (1,089 | ) | (277 | ) | 1,353 | (389 | ) | 964 | ||||||||||||||

|

|

(1)

|

Non-accrual loans, if any, are included in average loan balances.

|

|

|

(2)

|

Change in interest income from nontaxable investment securities is computed based on interest income determined on a taxable-equivalent yield basis. Interest income has been divided by a factor comprised of the complement of the incremental tax rate of 34%.

|

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Balance – Beginning of year

|

$ | 2,641 | 2,998 | 2,468 | 2,468 | 2,050 | ||||||||||||||

|

Allowance related to Sycamore acquisition

|

- | - | - | - | 453 | |||||||||||||||

| 2,641 | 2,998 | 2,468 | 2,468 | 2,503 | ||||||||||||||||

|

Loans charged off:

|

||||||||||||||||||||

|

Commercial and industrial

|

581 | 289 | 36 | 73 | 81 | |||||||||||||||

|

Commercial, secured by real estate

|

598 | 1,105 | 352 | - | - | |||||||||||||||

|

Residential real estate

|

512 | 331 | 152 | 129 | 71 | |||||||||||||||

|

Consumer

|

252 | 422 | 490 | 617 | 231 | |||||||||||||||

|

Agricultural

|

- | - | - | - | - | |||||||||||||||

|

Other loans, including deposit overdrafts

|

127 | 144 | 178 | 228 | 305 | |||||||||||||||

|

Total loans charged off

|

2,070 | 2,291 | 1,208 | 1,047 | 688 | |||||||||||||||

|

Recoveries:

|

||||||||||||||||||||

|

Commercial and industrial

|

- | 35 | 2 | 40 | 17 | |||||||||||||||

|

Commercial, secured by real estate

|

30 | - | - | - | - | |||||||||||||||

|

Residential real estate

|

31 | 2 | 3 | 20 | 2 | |||||||||||||||

|

Consumer, excluding credit card

|

122 | 120 | 203 | 201 | 142 | |||||||||||||||

|

Agricultural

|

- | - | - | - | - | |||||||||||||||

|

Credit Card

|

- | - | - | 1 | 3 | |||||||||||||||

|

Other loans, including deposit overdrafts

|

88 | 97 | 130 | 165 | 223 | |||||||||||||||

|

Total recoveries

|

271 | 254 | 338 | 427 | 387 | |||||||||||||||

|

Net charge offs

|

1,799 | 2,037 | 870 | 620 | 301 | |||||||||||||||

|

Provision charged to operations

|

2,089 | 1,680 | 1,400 | 620 | 266 | |||||||||||||||

|

Balance - End of year

|

$ | 2,931 | 2,641 | 2,998 | 2,468 | 2,468 | ||||||||||||||

|

Ratio of net charge-offs during the period to average loans outstanding

|

0.39 | % | 0.44 | % | 0.19 | % | 0.14 | % | 0.08 | % | ||||||||||

|

Ratio of allowance for loan losses to total loans at year-end

|

0.64 | % | 0.58 | % | 0.65 | % | 0.54 | % | 0.55 | % | ||||||||||

|

At December 31,

|

||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

||||||||||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Specific allocations

|

$ | 399 | 13.62 | % | 296 | 11.20 | % | 858 | 28.62 | % | ||||||||||||||

|

General allocations:

|

||||||||||||||||||||||||

|

Historical loss

|

1,381 | 47.29 | % | 975 | 36.91 | % | 576 | 19.21 | % | |||||||||||||||

|

Adjustments to historical loss

|

1,151 | 39.09 | % | 1,370 | 51.89 | % | 1,553 | 51.80 | % | |||||||||||||||

|

Unallocated

|

- | - | % | - | - | % | 11 | 0.37 | % | |||||||||||||||

|

Total

|

$ | 2,931 | 100.00 | % | 2,641 | 100.00 | % | 2,998 | 100.00 | % | ||||||||||||||

An additional source of funding is borrowings from the FHLB. A short-term advance of $12.0 million and long-term advances totaling $21.4 million were outstanding at December 31, 2011 and the total available borrowing capacity at that date was approximately $14.3 million. LCNB is approved to borrow up to $39.6 million in short-term advances through the FHLB’s Cash Management Advance program. One of the factors limiting availability of FHLB borrowings is a bank’s ownership of FHLB stock. LCNB could increase its available borrowing capacity by purchasing more FHLB stock and would need to purchase more stock if it were to use the full $39.6 million available in short-term advances.

|

Payments due by period

|

||||||||||||||||||||

|

Over 1

|

Over 3

|

|||||||||||||||||||

|

1 year

|

through 3

|

through 5

|

More than

|

|||||||||||||||||

|

Total

|

or less

|

years

|

years

|

5 years

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Long-term debt obligations

|

$ | 21,373 | 6,000 | 2,326 | 5,000 | 8,047 | ||||||||||||||

|

Short-term borrowing from Federal Home Loan Bank

|

12,000 | 12,000 | - | - | - | |||||||||||||||

|

Operating lease obligations

|

5,713 | 360 | 645 | 504 | 4,204 | |||||||||||||||

|

Purchase obligations

|

- | - | - | - | - | |||||||||||||||

|

Estimated pension plan contribution for 2012

|

902 | 902 | - | - | - | |||||||||||||||

|

Certificates of deposit:

|

||||||||||||||||||||

|

$100,000 and over

|

82,763 | 26,717 | 35,256 | 10,846 | 9,944 | |||||||||||||||

|

Other time certificates

|

126,212 | 47,425 | 52,986 | 20,077 | 5,724 | |||||||||||||||

|

Total

|

$ | 248,963 | 93,404 | 91,213 | 36,427 | 27,919 | ||||||||||||||

|

Amount of Commitment Expiration Per Period

|

||||||||||||||||||||

|

Total

|

Over 1

|

Over 3

|

||||||||||||||||||

|

Amounts

|

1 year

|

through 3

|

through 5

|

More than

|

||||||||||||||||

|

Committed

|

or less

|

years

|

years

|

5 years

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Commitments to extend credit

|

$ | 6,717 | 6,717 | - | - | - | ||||||||||||||

|

Unused lines of credit

|

68,967 | 33,929 | 15,048 | 9,110 | 10,880 | |||||||||||||||

|

Standby letters of credit

|

5,575 | 546 | 5,029 | - | - | |||||||||||||||

|

Total

|

$ | 81,259 | 41,192 | 20,077 | 9,110 | 10,880 | ||||||||||||||

|

Year

|

Options

Granted

|

|||

|

2007

|

8,116 | |||

|

2008

|

13,918 | |||

|

2009

|

29,110 | |||

|

2010

|

20,798 | |||

|

2011

|

25,083 | |||

LCNB Corp. did not repurchase the warrant issued to the Treasury Department as part of the CPP. Instead, pursuant to the terms of the repurchase agreement, the warrant has been cancelled and LCNB has issued a substitute warrant to the Treasury Department with the same terms as the original warrant, except that Section 13(H) of the original warrant, which dealt with the reduction of shares subject to the warrant in the event that LCNB raised $13.4 million in a qualified stock offering prior to December 31, 2009, has been removed. A copy of the repurchase agreement was filed by LCNB as Exhibit 10.1 to its Current Report on Form 8-K dated October 21, 2009, and a copy of the substitute warrant is included as Exhibit 4.3 to its Form 10-Q for the quarterly period ended September 30, 2009. Both documents are incorporated by reference and the foregoing summary of certain provisions of these documents is qualified in its entirety by reference thereto. The Treasury Department sold the warrant to an investor during the fourth quarter 2011.

|

Three Months Ended

|

||||||||||||||||

|

March 31

|

June 30

|

Sep. 30

|

Dec. 31

|

|||||||||||||

|

2011

|

||||||||||||||||

|

Interest income

|

$ | 8,130 | 8,099 | 7,976 | 7,888 | |||||||||||

|

Interest expense

|

1,772 | 1,667 | 1,537 | 1,411 | ||||||||||||

|

Net interest income

|

6,358 | 6,432 | 6,439 | 6,477 | ||||||||||||

|

Provision for loan losses

|

664 | 224 | 588 | 613 | ||||||||||||

|

Net interest income after provision

|

5,694 | 6,208 | 5,851 | 5,864 | ||||||||||||

|

Total non-interest income

|

1,915 | 1,835 | 2,033 | 1,981 | ||||||||||||

|

Total non-interest expenses

|

5,785 | 5,307 | 5,436 | 5,321 | ||||||||||||

|

Income before income taxes

|

1,824 | 2,736 | 2,448 | 2,524 | ||||||||||||

|

Provision for income taxes

|

346 | 713 | 581 | 570 | ||||||||||||

|

Net income from continuing operations

|

1,478 | 2,023 | 1,867 | 1,954 | ||||||||||||

|

Income (loss) from discontinued operations, net of tax

|

824 | (31 | ) | - | - | |||||||||||

|

Net income

|

$ | 2,302 | 1,992 | 1,867 | 1,954 | |||||||||||

|

Basic earnings per common share:

|

||||||||||||||||

|

Continuing operations

|

$ | 0.22 | 0.30 | 0.28 | 0.29 | |||||||||||

|

Discontinued operations

|

0.12 | - | - | - | ||||||||||||

|

Diluted earnings per common share:

|

||||||||||||||||

|

Continuing operations

|

0.22 | 0.30 | 0.28 | 0.28 | ||||||||||||

|

Discontinued operations

|

0.12 | - | - | - | ||||||||||||

|

2010

|

||||||||||||||||

|

Interest income

|

$ | 8,602 | 8,532 | 8,472 | 8,425 | |||||||||||

|

Interest expense

|

2,162 | 2,105 | 2,081 | 1,986 | ||||||||||||

|

Net interest income

|

6,440 | 6,427 | 6,391 | 6,439 | ||||||||||||

|

Provision for loan losses

|

208 | 511 | 268 | 693 | ||||||||||||

|

Net interest income after provision

|

6,232 | 5,916 | 6,123 | 5,746 | ||||||||||||

|

Total non-interest income

|

1,738 | 2,527 | 1,928 | 2,694 | ||||||||||||

|

Total non-interest expenses

|

5,192 | 5,231 | 5,540 | 5,314 | ||||||||||||

|

Income before income taxes

|

2,778 | 3,212 | 2,511 | 3,126 | ||||||||||||

|

Provision for income taxes

|

637 | 527 | 561 | 769 | ||||||||||||

|

Net income from continuing operations

|

2,141 | 2,685 | 1,950 | 2,357 | ||||||||||||

|

Income from discontinued operations, net of tax

|

71 | 67 | 39 | 63 | ||||||||||||

|

Net income

|

$ | 2,212 | 2,752 | 1,989 | 2,420 | |||||||||||

|

Basic earnings per common share:

|

||||||||||||||||

|

Continuing operations

|

$ | 0.32 | 0.40 | 0.30 | 0.35 | |||||||||||

|

Discontinued operations

|

0.01 | 0.01 | - | 0.01 | ||||||||||||

|

Diluted earnings per common share:

|

||||||||||||||||

|

Continuing operations

|

0.32 | 0.40 | 0.30 | 0.34 | ||||||||||||

|

Discontinued operations

|

0.01 | 0.01 | - | 0.01 | ||||||||||||

|

Rate Shock Scenario in

Basis Points

|

Amount

(In thousands)

|

$ Change in

Net Interest

Income

|

% Change in

Net Interest

Income

|

|||||||||

|

Up 300

|

$ | 26,497 | 1,115 | 4.39 | % | |||||||

|

Up 200

|

26,093 | 711 | 2.80 | % | ||||||||

|

Up 100

|

25,689 | 307 | 1.21 | % | ||||||||

|

Base

|

25,382 | - | - | % | ||||||||

|

Down 100

|

25,160 | (222 | ) | -0.87 | % | |||||||

|

Rate Shock Scenario in

Basis Points

|

Amount

(In thousands)

|

$ Change in

EVE

|

% Change in

EVE

|

|||||||||

|

Up 300

|

$ | 62,713 | (21,719 | ) | -25.72 | % | ||||||

|

Up 200

|

69,195 | (15,237 | ) | -18.05 | % | |||||||

|

Up 100

|

76,571 | (7,861 | ) | -9.31 | % | |||||||

|

Base

|

84,432 | - | - | % | ||||||||

|

Down 100

|

93,315 | 8,883 | 10.52 | % | ||||||||

|

/s/ Stephen P. Wilson

|

/s/ Robert C. Haines II

|

|

|

Stephen P. Wilson

Chief Executive Officer &

Chairman of the Board of Directors

February 27, 2012

|

Robert C. Haines II

Executive Vice President &

Chief Financial Officer

February 27, 2012

|

| /s/ J.D. Cloud & Co. L.L.P. | |

| Certified Public Accountant |

|

/s/ J.D. Cloud & Co. L.L.P.

|

||

|

Certified Public Accountants

|

||

|

Cincinnati, Ohio

|

||

|

February 27, 2012

|

||

|

2011

|

2010

|

|||||||

|

ASSETS:

|

||||||||

|

Cash and due from banks

|

$

|

12,449

|

10,817

|

|||||

|

Interest-bearing demand deposits

|

7,086

|

182

|

||||||

|

Total cash and cash equivalents

|

19,535

|

10,999

|

||||||

|

Investment securities:

|

||||||||

|

Available-for-sale, at fair value

|

254,006

|

235,882

|

||||||

|

Held-to-maturity, at cost

|

10,734

|

12,141

|

||||||

|

Federal Reserve Bank stock, at cost

|

940

|

939

|

||||||

|

Federal Home Loan Bank stock, at cost

|

2,091

|

2,091

|

||||||

|

Loans, net

|

458,331

|

452,350

|

||||||

|

Premises and equipment, net

|

17,346

|

16,017

|

||||||

|

Goodwill

|

5,915

|

5,915

|

||||||

|

Bank owned life insurance

|

14,837

|

14,242

|

||||||

|

Other assets

|

7,835

|

9,558

|

||||||

|

TOTAL ASSETS

|

$

|

791,570

|

760,134

|

|||||

|

LIABILITIES:

|

||||||||

|

Deposits:

|

||||||||

|

Noninterest-bearing

|

$

|

106,793

|

98,994

|

|||||

|

Interest-bearing

|

556,769

|

539,545

|

||||||

|

Total deposits

|

663,562

|

638,539

|

||||||

|

Short-term borrowings

|

21,596

|

21,691

|

||||||

|

Long-term debt

|

21,373

|

23,120

|

||||||

|

Accrued interest and other liabilities

|

7,079

|

6,077

|

||||||

|

TOTAL LIABILITIES

|

713,610

|

689,427

|

||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Preferred shares - no par value, authorized 1,000,000 shares, none outstanding

|

-

|

-

|

||||||

|

Common shares - no par value, authorized 12,000,000 shares, issued 7,460,494 and 7,445,514 shares at December 31, 2011 and 2010, respectively

|

26,753

|

26,515

|

||||||

|

Retained earnings

|

57,877

|

54,045

|

||||||

|

Treasury shares at cost, 755,771 shares at December 31, 2011 and 2010

|

(11,698)

|

(11,698)

|

||||||

|

Accumulated other comprehensive income, net of taxes

|

5,028

|

1,845

|

||||||

|

TOTAL SHAREHOLDERS' EQUITY

|

77,960

|

70,707

|

||||||

|

TOTAL LIABILITES AND SHAREHOLDERS' EQUITY

|

$

|

791,570

|

760,134

|

|

2011

|

2010

|

2009

|

||||||||||

|

INTEREST INCOME:

|

||||||||||||

|

Interest and fees on loans

|

$ | 25,502 | 27,020 | 27,538 | ||||||||

|

Interest on investment securities:

|

||||||||||||

|

Taxable

|

3,843 | 3,686 | 4,237 | |||||||||

|

Non-taxable

|

2,571 | 3,126 | 2,921 | |||||||||

|

Other investments

|

177 | 199 | 202 | |||||||||

|

TOTAL INTEREST INCOME

|

32,093 | 34,031 | 34,898 | |||||||||

|

INTEREST EXPENSE:

|

||||||||||||

|

Interest on deposits

|

5,702 | 7,613 | 9,434 | |||||||||

|

Interest on short-term borrowings

|

28 | 27 | 3 | |||||||||

|

Interest on long-term debt

|

657 | 694 | 623 | |||||||||

|

TOTAL INTEREST EXPENSE

|

6,387 | 8,334 | 10,060 | |||||||||

|

NET INTEREST INCOME

|

25,706 | 25,697 | 24,838 | |||||||||

|

PROVISION FOR LOAN LOSSES

|

2,089 | 1,680 | 1,400 | |||||||||

|

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES

|

23,617 | 24,017 | 23,438 | |||||||||

|

NON-INTEREST INCOME:

|

||||||||||||

|

Trust income

|

2,099 | 1,897 | 1,916 | |||||||||

|

Service charges and fees on deposit accounts

|

3,739 | 3,904 | 3,931 | |||||||||

|

Net gain on sales of securities

|

948 | 948 | 110 | |||||||||

|

Bank owned life insurance income

|

596 | 1,389 | 637 | |||||||||

|

Gains from sales of mortgage loans

|

177 | 496 | 396 | |||||||||

|

Other operating income

|

205 | 253 | 190 | |||||||||

|

TOTAL NON-INTEREST INCOME

|

7,764 | 8,887 | 7,180 | |||||||||

|

NON-INTEREST EXPENSE:

|

||||||||||||

|

Salaries and employee benefits

|

11,743 | 11,271 | 10,534 | |||||||||

|

Equipment expenses

|

1,038 | 889 | 995 | |||||||||

|

Occupancy expense, net

|

1,761 | 1,875 | 1,721 | |||||||||

|

State franchise tax

|

764 | 703 | 610 | |||||||||

|

Marketing

|

480 | 448 | 408 | |||||||||

|

FDIC premiums

|

545 | 958 | 1,271 | |||||||||

|

ATM expense

|

553 | 513 | 513 | |||||||||

|

Computer maintenance and supplies

|

565 | 456 | 449 | |||||||||

|

Telephone expense

|

407 | 414 | 407 | |||||||||

|

Other real estate owned

|

350 | 506 | 17 | |||||||||

|

Write-off of pension asset

|

- | - | 722 | |||||||||

|

Other non-interest expense

|

3,643 | 3,244 | 3,039 | |||||||||

|

TOTAL NON-INTEREST EXPENSE

|

21,849 | 21,277 | 20,686 | |||||||||

|

INCOME BEFORE INCOME TAXES

|

9,532 | 11,627 | 9,932 | |||||||||

|

PROVISION FOR INCOME TAXES

|

2,210 | 2,494 | 2,245 | |||||||||

|

NET INCOME FROM CONTINUING OPERATIONS

|

7,322 | 9,133 | 7,687 | |||||||||

|

INCOME FROM DISCONTINUED OPERATIONS, NET OF TAX

|

793 | 240 | 79 | |||||||||

|

NET INCOME

|

8,115 | 9,373 | 7,766 | |||||||||

|

PREFERRED STOCK DIVIDENDS AND DISCOUNT ACCRETION

|

- | - | 1,108 | |||||||||

|

NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

|

$ | 8,115 | 9,373 | 6,658 | ||||||||

|

Basic earnings per common share:

|

||||||||||||

|

Continuing Operations

|

$ | 1.09 | 1.37 | 0.99 | ||||||||

|

Discontinued Operations

|

0.12 | 0.03 | 0.01 | |||||||||

|

Diluted earnings per common share:

|

||||||||||||

|

Continuing operations

|

1.08 | 1.36 | 0.98 | |||||||||

|

Discontinued operations

|

0.12 | 0.03 | 0.01 | |||||||||

|

Weighted average shares outstanding:

|

||||||||||||

|

Basic

|

6,692,385 | 6,687,500 | 6,687,232 | |||||||||

|

Diluted

|

6,751,599 | 6,736,622 | 6,701,309 | |||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

Net income

|

$ | 8,115 | 9,373 | 7,766 | ||||||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Net unrealized gain (loss) on available-for-sale securities (net of taxes of $1,994, $231, and $905 for 2011, 2010, and 2009, respectively)

|

3,852 | 448 | 1,756 | |||||||||

|

Change in nonqualified pension plan unrecognized net gain (loss) (net of taxes of $113, $71, and $111 for 2011, 2010 and 2009, respectively)

|

(220 | ) | 138 | (215 | ) | |||||||

|

Reversal of pension plan net unrecognized net loss (net of taxes or $1,564)

|

- | - | 3,037 | |||||||||

|

Nonqualified pension plan curtailment (net of taxes of $80)

|

155 | - | - | |||||||||

|

Reclassification adjustment for:

|

||||||||||||

|

Net realized (gain) loss on sale of available-for-sale securities included in net income (net of taxes of $323, $323, and $38 for 2011, 2010 and 2009, respectively)

|

(625 | ) | (625 | ) | (72 | ) | ||||||

|

Recognition of nonqualified pension plan net (gain) loss (net of taxes of $11 and $16 for 2011 and 2010, respectively)

|

21 | (31 | ) | - | ||||||||

|

TOTAL COMPREHENSIVE INCOME

|

$ | 11,298 | 9,303 | 12,272 | ||||||||

|

SUPPLEMENTAL INFORMATION:

|

||||||||||||

|

COMPONENTS OF ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS), NET OF TAX, AS OF YEAR-END:

|

||||||||||||

|

Net unrealized gain (loss) on securities available-for-sale

|

$ | 5,180 | 1,953 | 2,130 | ||||||||

|

Net unfunded liability for nonqualified pension plan

|

(152 | ) | (108 | ) | (215 | ) | ||||||

|

Balance at year-end

|

$ | 5,028 | 1,845 | 1,915 | ||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Common

|

Other

|

Total

|

||||||||||||||||||||||||||

|

Shares

|

Preferred

|

Common

|

Retained

|

Treasury

|

Comprehensive

|

Shareholders'

|

||||||||||||||||||||||

|

Outstanding

|

Shares

|

Shares

|

Earnings

|

Shares

|

Income (Loss)

|

Equity

|

||||||||||||||||||||||

|

Balance, December 31, 2008

|

6,687,232 | $ | - | 25,860 | 46,584 | (11,737 | ) | (2,591 | ) | 58,116 | ||||||||||||||||||

|

Net income

|

7,766 | 7,766 | ||||||||||||||||||||||||||

|

Issuance of preferred stock and related warrant

|

12,817 | 583 | 13,400 | |||||||||||||||||||||||||

|

Redemption of preferred stock

|

(13,400 | ) | (13,400 | ) | ||||||||||||||||||||||||

|

Net unrealized gain (loss) on available-for-sale securities, net of tax

|

1,756 | 1756 | ||||||||||||||||||||||||||

|

Reclassification adjustment for net realized (gain) loss on sale of available-for-sale securities

included in net income, net of taxes

|

(72 | ) | (72 | ) | ||||||||||||||||||||||||

|

Change in nonqualified pension plan unrecognized net loss, net of tax

|

(215 | ) | (215 | ) | ||||||||||||||||||||||||

|

Reversal of pension plan unrecognized net loss, net of tax

|

3,037 | 3,037 | ||||||||||||||||||||||||||

|

Compensation expense relating to stock options

|

32 | 32 | ||||||||||||||||||||||||||

|

Preferred stock dividends and discount accretion

|

583 | (1,108 | ) | (525 | ) | |||||||||||||||||||||||

|

Common stock dividends, $0.64 per share

|

(4,280 | ) | (4,280 | ) | ||||||||||||||||||||||||

|

Balance, December 31, 2009

|

6,687,232 | $ | - | 26,475 | 48,962 | (11,737 | ) | 1,915 | 65,615 | |||||||||||||||||||

|

Net income

|

9,373 | 9,373 | ||||||||||||||||||||||||||

|

Net unrealized gain (loss) on available-for-sale securities, net of tax

|

448 | 448 | ||||||||||||||||||||||||||

|

Reclassification adjustment for net realized (gain) loss on sale of available-for-sale securities included in net income, net of taxes

|

(625 | ) | (625 | ) | ||||||||||||||||||||||||

|

Change in nonqualified pension plan unrecognized net gain (loss), net of tax

|

138 | 138 | ||||||||||||||||||||||||||

|

Reclassification adjustment for r

ecognition of pension plan net (gain) loss, net of taxes

|

(31 | ) | (31 | ) | ||||||||||||||||||||||||

|

Compensation expense relating to stock options

|

40 | 40 | ||||||||||||||||||||||||||

|

Restricted stock awards

|

2,511 | (10 | ) | 39 | 29 | |||||||||||||||||||||||

|

Common stock dividends, $0.64 per share

|

(4,280 | ) | (4,280 | ) | ||||||||||||||||||||||||

|

Balance, December 31, 2010

|

6,689,743 | $ | - | 26,515 | 54,045 | (11,698 | ) | 1,845 | 70,707 | |||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Common

|

Other

|

Total

|

||||||||||||||||||||||||||

|

Shares

|

Preferred

|

Common

|

Retained

|

Treasury

|

Comprehensive

|

Shareholders'

|

||||||||||||||||||||||

|

Outstanding

|

Shares

|

Shares

|

Earnings

|

Shares

|

Income (Loss)

|

Equity

|

||||||||||||||||||||||

|

Balance, December 31, 2010

|

6,689,743 | $ | - | 26,515 | 54,045 | (11,698 | ) | 1,845 | 70,707 | |||||||||||||||||||

|

Net income

|

8,115 | 8,115 | ||||||||||||||||||||||||||

|

Net unrealized gain (loss) on available-for-sale securities, net of tax

|

3,852 | 3,852 | ||||||||||||||||||||||||||

|

Reclassification adjustment for net realized (gain) loss on sale of available-for-sale securities included in net income, net of taxes

|

(625 | ) | (625 | ) | ||||||||||||||||||||||||

|

Change in nonqualified pension plan unrecognized net gain (loss), net of tax

|

(220 | ) | (220 | ) | ||||||||||||||||||||||||

|

Reclassification adjustment for recognition of pension plan net (gain) loss, net of taxes

|

21 | 21 | ||||||||||||||||||||||||||

|

Nonqualified pension plan curtailment, net of taxes

|

155 | 155 | ||||||||||||||||||||||||||

|

Dividend Reinvestment and Stock Purchase Plan

|

14,980 | 193 | 193 | |||||||||||||||||||||||||

|

Compensation expense relating to stock options

|

45 | 45 | ||||||||||||||||||||||||||

|

Common stock dividends, $0.64 per share

|

(4,283 | ) | (4,283 | ) | ||||||||||||||||||||||||

|

Balance, December 31, 2011

|

6,704,723 | $ | - | 26,753 | 57,877 | (11,698 | ) | 5,028 | 77,960 | |||||||||||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net income

|

8,115 | 9,373 | 7,766 | |||||||||

|

Adjustments to reconcile net income to net cash flows from operating activities-

|

||||||||||||

|

Depreciation, amortization and accretion

|

2,978 | 2,814 | 2,434 | |||||||||

|

Provision for loan losses

|

2,089 | 1,680 | 1,400 | |||||||||

|

Deferred income tax provision (benefit)

|

(231 | ) | (112 | ) | (375 | ) | ||||||

|

Curtailment charge for nonqualified defined benefit retirement plan

|

191 | - | - | |||||||||

|

Increase in cash surrender value of bank owned life insurance

|

(596 | ) | (597 | ) | (637 | ) | ||||||

|

Bank owned life insurance death benefits in excess of cash surrender value

|

- | (792 | ) | - | ||||||||

|

Realized gain on sales of securities available-for-sale

|

(948 | ) | (948 | ) | (110 | ) | ||||||

|

Realized (gain) loss on sale of premises and equipment

|

50 | 16 | (23 | ) | ||||||||

|

Realized gain from sale of insurance agency

|

(1,503 | ) | - | - | ||||||||

|

Realized loss from sale and write-downs of other real estate owned

|

184 | 389 | - | |||||||||

|

Realized gain from sale of repossessed assets

|

(47 | ) | (18 | ) | - | |||||||

|

Origination of mortgage loans for sale

|

(9,352 | ) | (24,200 | ) | (27,857 | ) | ||||||

|

Realized gains from sales of mortgage loans

|

(177 | ) | (496 | ) | (395 | ) | ||||||

|

Proceeds from sales of mortgage loans

|

9,430 | 24,438 | 27,974 | |||||||||

|

Compensation expense related to stock options

|

45 | 40 | 32 | |||||||||

|

Increase (decrease) due to changes in assets and liabilities:

|

||||||||||||

|

Income receivable

|

267 | 275 | (421 | ) | ||||||||

|

Other assets

|

324 | 913 | (3,678 | ) | ||||||||

|

Other liabilities

|

(162 | ) | 1,025 | 2,624 | ||||||||

|

TOTAL ADJUSTMENTS

|

2,542 | 4,427 | 968 | |||||||||

|

NET CASH FLOWS FROM OPERATING ACTIVITIES

|

10,657 | 13,800 | 8,734 | |||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Proceeds from sales of investment securities available-for-sale

|

36,769 | 53,365 | 14,610 | |||||||||

|

Proceeds from maturities and calls of investment securities:

|

||||||||||||

|

Available-for-sale

|

61,424 | 63,203 | 68,578 | |||||||||

|

Held-to-maturity

|

6,521 | 5,474 | 911 | |||||||||

|

Purchases of investment securities:

|

||||||||||||

|

Available-for-sale

|

(111,914 | ) | (151,589 | ) | (148,576 | ) | ||||||

|

Held-to-maturity

|

(5,114 | ) | (4,582 | ) | (11,997 | ) | ||||||

|

Proceeds from redemption of Federal Reserve Bank stock

|

- | 1 | - | |||||||||

|

Purchase of Federal Reserve Bank stock

|

(1 | ) | - | (3 | ) | |||||||

|

Net (increase) decrease in loans

|

(8,438 | ) | 3,003 | (10,196 | ) | |||||||

|

Proceeds from bank owned life insurance death benefits

|

- | 1,269 | - | |||||||||

|

Proceeds from sales of other real estate owned

|

285 | 51 | - | |||||||||

|

Proceeds from sales of repossessed assets

|

295 | 143 | 72 | |||||||||

|

Purchases of premises and equipment

|

(2,578 | ) | (1,447 | ) | (1,322 | ) | ||||||

|

Proceeds from sales of premises and equipment

|

16 | 16 | 24 | |||||||||

|

Proceeds from sale of insurance agency, net of cash disposed

|

1,523 | - | - | |||||||||

|

NET CASH FLOWS FROM INVESTING ACTIVITIES

|

(21,212 | ) | (31,093 | ) | (87,899 | ) | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Net increase in deposits