|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

13-3757370

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

358 South Main Street,

|

|

|

Burlington, North Carolina

|

27215

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

|

Name of exchange on which registered

|

|

Common Stock, $0.10 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer [X]

|

Accelerated Filer [ ]

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [ ]

|

|

|

|

Page

|

|

|

|

|

|

Item 1.

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

|

|

|

|

|

|

|

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

|

|

|

|

|

|

|

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

|

|

|

|

|

|

|

|

Item 15.

|

||

|

Item 1.

|

BUSINESS

|

|

•

|

accuracy, timeliness and consistency in reporting test results;

|

|

•

|

reputation of the laboratory in the medical community or field of specialty;

|

|

•

|

contractual relationships with managed care companies;

|

|

•

|

service capability and convenience offered by the laboratory;

|

|

•

|

number and type of tests performed;

|

|

•

|

connectivity solutions offered; and

|

|

•

|

pricing of the laboratory’s services.

|

|

•

|

Deploy capital to investments that enhance its business and return capital to shareholders,

|

|

•

|

Enhance IT capabilities to improve the physician and patient experience,

|

|

•

|

Continue to improve efficiency to remain the most efficient and highest value provider of laboratory services,

|

|

•

|

Continue scientific innovation to offer new tests at reasonable and appropriate pricing, and

|

|

•

|

Participate in the development of alternative delivery models to improve patient outcomes and reduce the cost of care

|

|

•

|

Physician, patient and payor portals

|

|

•

|

Express electronic ordering for essentially all of the Company's brands and services

|

|

•

|

Integrated results viewing and enhanced reports

|

|

•

|

Lab analytics that provide one-click trending of patient, test and population data

|

|

•

|

Clinical decision support tools at the point of ordering and resulting

|

|

•

|

AccuDraw

®

which assists phlebotomists in improving accuracy, workflow and turnaround time

|

|

•

|

Online appointment scheduling

|

|

•

|

Mobility solutions for market leading mobile devices

|

|

•

|

Services-oriented architecture with rules-based engines, content aggregation and a plug in model for seamless integration with practice workflow

|

|

Specialty Lab

|

Area of Expertise

|

|

Cellmark Forensics

|

Forensics

|

|

CMBP

|

Molecular-based diagnostics

|

|

Colorado Coagulation

|

Advanced coagulation testing

|

|

Correlagen Diagnostics

|

Molecular diagnosis of cardiac disease

|

|

DNA Identity Lab

|

Molecular-based diagnostics for paternity and HLA testing

|

|

Endocrine Sciences

|

Advanced endocrine testing

|

|

Integrated Genetics

|

Genetic and cytogenetic testing

|

|

Integrated Oncology/DIANON

|

Surgical pathology

|

|

Medtox Laboratories

|

Occupational testing and pain management

|

|

Monogram Biosciences

|

Molecular and phenotypic-based drug resistance testing

|

|

Powell Center for Esoteric Testing

|

Therapeutic drug monitoring, molecular diagnostics

|

|

and a broad array of additional esoteric tests

|

|

|

Viromed/NGI

|

Infectious disease

|

|

Requisition

Volume

as a % of Total

|

Revenue

per

Requisition

|

|||||

|

Private Patients

|

1.6

|

%

|

$

|

177.02

|

|

|

|

Medicare and Medicaid

|

16.2

|

%

|

$

|

53.34

|

|

|

|

Commercial Clients

|

32.8

|

%

|

$

|

41.73

|

|

|

|

Managed Care

|

49.4

|

%

|

$

|

42.24

|

|

|

|

•

|

Integrated Oncology, Brentwood, CA - April, 2012

|

|

•

|

Integrated Oncology, Irvine, CA - April, 2012

|

|

•

|

Viromed, Minnetonka, MN - January, 2012

|

|

•

|

Center for Molecular Biology and Pathology (CMBP), Research Triangle Park, North Carolina - February, 2011

|

|

•

|

Integrated Genetics, Monrovia, CA - April, 2010

|

|

•

|

LabCorp's Regional Testing Facility, Tampa, FL - January, 2010

|

|

•

|

Integrated Oncology, Phoenix, AZ - September, 2009

|

|

Item 1A.

|

Risk Factors

|

|

•

|

the circumstances under which the use and disclosure of protected health information are permitted or required without a specific authorization by the patient, including but not limited to treatment purposes, activities to obtain payments for the Company’s services, and its healthcare operations activities;

|

|

•

|

a patient’s rights to access, amend and receive an accounting of certain disclosures of protected health information;

|

|

•

|

the content of notices of privacy practices for protected health information;

|

|

•

|

administrative, technical and physical safeguards required of entities that use or receive protected health information; and

|

|

•

|

the protection of computing systems maintaining ePHI.

|

|

•

|

private patients – 1.6%

|

|

•

|

Medicare and Medicaid – 16.2%

|

|

•

|

commercial clients – 32.8%

|

|

•

|

managed care – 49.4%.

|

|

•

|

failure to obtain regulatory clearance, including due to antitrust concerns;

|

|

•

|

loss of key customers or employees;

|

|

•

|

difficulty in consolidating redundant facilities and infrastructure and in standardizing information and other systems;

|

|

•

|

unidentified regulatory problems;

|

|

•

|

failure to maintain the quality of services that such companies have historically provided;

|

|

•

|

coordination of geographically-separated facilities and workforces; and

|

|

•

|

diversion of management's attention from the day-to-day business of the Company.

|

|

Location

|

Nature of

Occupancy

|

|

Primary Laboratories:

|

|

|

Birmingham, Alabama

|

Leased

|

|

Phoenix, Arizona

|

Leased

|

|

Calabasas, California

|

Leased

|

|

Irvine, California

|

Leased

|

|

Los Angeles, California

|

Leased

|

|

Monrovia, California

|

Leased

|

|

San Diego, California

|

Leased

|

|

San Francisco, California

|

Leased

|

|

Denver, Colorado

|

Leased

|

|

Shelton, Connecticut

|

Leased

|

|

Ft. Myers, Florida

|

Owned

|

|

Tampa, Florida

|

Leased

|

|

Chicago, Illinois

|

Leased

|

|

Indianapolis, Indiana

|

Leased

|

|

Westborough, Massachusetts

|

Leased

|

|

Eden Prairie, Minnesota

|

Leased

|

|

St. Paul, Minnesota

|

Owned

|

|

Southaven, Mississippi

|

Owned

|

|

Kansas City, Missouri

|

Owned

|

|

Cranford, New Jersey

|

Leased

|

|

Raritan, New Jersey

|

Owned

|

|

South Brunswick, New Jersey

|

Leased

|

|

Santa Fe, New Mexico

|

Owned

|

|

New Hartford, New York

|

Leased

|

|

New York, New York

|

Leased

|

|

Burlington, North Carolina

|

Owned

|

|

Greensboro, North Carolina

|

Leased

|

|

Research Triangle Park, North Carolina

|

Leased

|

|

Dublin, Ohio

|

Owned

|

|

Oklahoma City, Oklahoma

|

Leased

|

|

Brentwood, Tennessee

|

Leased

|

|

Knoxville, Tennessee

|

Leased

|

|

Austin, Texas

|

Leased

|

|

Dallas, Texas

|

Leased

|

|

Houston, Texas

|

Leased

|

|

San Antonio, Texas

|

Leased

|

|

Salt Lake City, Utah

|

Leased

|

|

Seattle, Washington

|

Leased

|

|

Milwaukee, Wisconsin

|

Leased

|

|

Charleston, West Virginia

|

Leased

|

|

Mechelen, Belgium

|

Leased

|

|

Edmonton, Canada

|

Leased

|

|

Ontario, Canada

|

Owned

|

|

Mississauga, Canada

|

Leased

|

|

Beijing, China

|

Leased

|

|

Singapore

|

Leased

|

|

Chorley, United Kingdom

|

Leased

|

|

Oxfordshire, United Kingdom

|

Leased

|

|

Corporate Headquarters Facilities:

|

|

|

Burlington, North Carolina

|

Owned

|

|

Burlington, North Carolina

|

Leased

|

|

Item 3.

|

LEGAL PROCEEDINGS

|

|

Item 4.

|

MINE SAFETY DISCLOSURES

|

|

|

High

|

Low

|

|||||

|

Year Ended December 31, 2011

|

|

|

|

|

|||

|

First Quarter

|

$

|

92.98

|

|

$

|

86.19

|

|

|

|

Second Quarter

|

$

|

100.94

|

|

$

|

92.09

|

|

|

|

Third Quarter

|

$

|

99.76

|

|

$

|

76.91

|

|

|

|

Fourth Quarter

|

$

|

88.15

|

|

$

|

74.57

|

|

|

|

Year Ended December 31, 2012

|

|

|

|

|

|||

|

First Quarter

|

$

|

93.30

|

|

$

|

85.58

|

|

|

|

Second Quarter

|

$

|

94.33

|

|

$

|

81.56

|

|

|

|

Third Quarter

|

$

|

95.30

|

|

$

|

83.50

|

|

|

|

Fourth Quarter

|

$

|

94.30

|

|

$

|

82.15

|

|

|

|

|

12/2007

|

12/2008

|

12/2009

|

12/2010

|

12/2011

|

12/2012

|

|||||||||||||||||

|

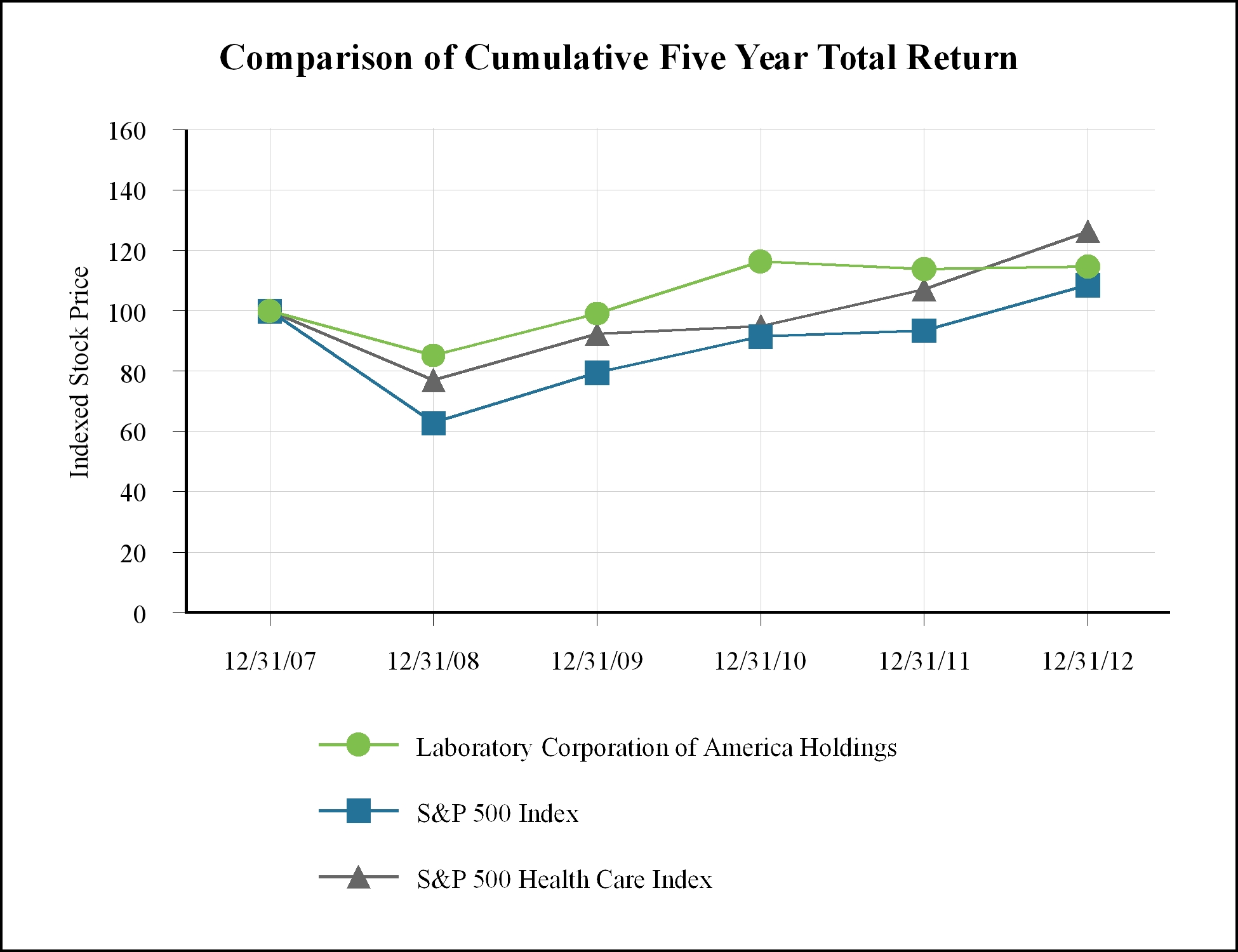

Laboratory Corporation of America Holdings

|

$

|

100

|

|

$

|

85

|

|

$

|

99

|

|

$

|

116

|

|

$

|

114

|

|

$

|

115

|

|

|||||

|

S&P 500 Index

|

$

|

100

|

|

$

|

63

|

|

$

|

80

|

|

$

|

92

|

|

$

|

94

|

|

$

|

109

|

|

|||||

|

S&P 500 Health Care Index

|

$

|

100

|

|

$

|

77

|

|

$

|

92

|

|

$

|

95

|

|

$

|

107

|

|

$

|

126

|

|

|||||

|

Total

Number

of Shares

Repurchased

|

Average

Price

Paid

Per

Share

|

Total Number

of Shares

Repurchased as

Part of Publicly

Announced

Program

|

Maximum

Dollar Value

of Shares

that May Yet Be

Repurchased

Under

the Program

|

||||||||||

|

October 1 – October 31

|

0.5

|

|

$

|

90.05

|

|

0.5

|

|

$

|

161.1

|

|

|||

|

November 1 – November 30

|

0.6

|

|

83.97

|

|

0.6

|

|

111.0

|

|

|||||

|

December 1 – December 31

|

0.5

|

|

86.08

|

|

0.5

|

|

68.0

|

|

|||||

|

|

1.6

|

|

$

|

86.48

|

|

1.6

|

|

|

|

||||

|

Item 6.

|

SELECTED FINANCIAL DATA

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

(a)

2012

|

(b) (c)

2011

|

(d)

2010

|

(e)

2009

|

(f)

2008

|

|||||||||||||||

|

|

(In millions, except per share amounts)

|

||||||||||||||||||

|

Statement of Operations Data

:

|

|

|

|

|

|

||||||||||||||

|

Net sales

|

$

|

5,671.4

|

|

$

|

5,542.3

|

|

$

|

5,003.9

|

|

$

|

4,694.7

|

|

$

|

4,505.2

|

|

||||

|

Gross profit

|

2,249.7

|

|

2,274.7

|

|

2,097.8

|

|

1,970.9

|

|

1,873.8

|

|

|||||||||

|

Operating income

|

1,023.5

|

|

948.4

|

|

978.8

|

|

935.9

|

|

842.9

|

|

|||||||||

|

Net earnings attributable to Laboratory

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Corporation of America Holdings

|

583.1

|

|

519.7

|

|

558.2

|

|

543.3

|

|

464.5

|

|

|||||||||

|

Basic earnings per common share

|

$

|

6.09

|

|

$

|

5.20

|

|

$

|

5.42

|

|

$

|

5.06

|

|

$

|

4.23

|

|

||||

|

Diluted earnings per common share

|

$

|

5.99

|

|

$

|

5.11

|

|

$

|

5.29

|

|

$

|

4.98

|

|

$

|

4.16

|

|

||||

|

Basic weighted average common

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

shares outstanding

|

95.7

|

|

100.0

|

|

103.0

|

|

107.4

|

|

109.7

|

|

|||||||||

|

Diluted weighted average common

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

shares outstanding

|

97.4

|

|

101.8

|

|

105.4

|

|

109.1

|

|

111.8

|

|

|||||||||

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Cash and cash equivalents, and

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

short-term investments

|

$

|

466.8

|

|

$

|

159.3

|

|

$

|

230.7

|

|

$

|

148.5

|

|

$

|

219.7

|

|

||||

|

Goodwill and intangible assets, net

|

4,569.4

|

|

4,302.5

|

|

4,275.4

|

|

3,239.3

|

|

2,994.8

|

|

|||||||||

|

Total assets

|

6,795.0

|

|

6,111.8

|

|

6,187.8

|

|

4,837.8

|

|

4,669.5

|

|

|||||||||

|

Long-term obligations (g)

|

2,655.0

|

|

2,221.0

|

|

2,188.4

|

|

1,394.4

|

|

1,721.3

|

|

|||||||||

|

Total shareholders' equity

|

2,717.4

|

|

2,503.5

|

|

2,466.3

|

|

2,106.1

|

|

1,688.3

|

|

|||||||||

|

(a)

|

During

2012

, the Company recorded net restructuring charges of

$25.3

. The charges were comprised of

$16.2

in severance and other personnel costs and

$19.6

in facility-related costs primarily associated with the ongoing integration activities of Orchid and the Integrated Genetics Division (formerly Genzyme Genetics) and costs associated with the previously announced termination of an executive vice president. These charges were offset by the reversal of previously established reserves of

$6.3

in unused severance and

$4.2

in unused facility-related costs. As part of the Clearstone integration, the Company also recorded a

$6.9

loss on the disposal of one of its European subsidiaries in Other, net under Other income (expenses) during

2012

. In addition, the Company recorded $6.2 in accelerated amortization relating to the termination of a licensing agreement.

|

|

(b)

|

During 2011, the Company recorded net restructuring charges of $44.6. Of this amount, $27.4 related to severance and other personnel costs, and $22.0 primarily related to facility-related costs associated with the ongoing integration of certain acquisitions including Genzyme Genetics and Westcliff Medical Laboratories, Inc. ("Westcliff"). These charges were offset by restructuring credits of $4.8 resulting from the reversal of unused severance and facility closure liabilities. In addition, the Company recorded fixed assets impairment charges of $18.9 primarily related to equipment, computer systems and leasehold improvements in closed facilities. The Company also recorded special charges of $14.8 related to the write-off of certain assets and liabilities related to an investment made in prior years, along with a $2.6 write-off of an uncollectible receivable from a past installment sale of one of the Company's lab operations.

|

|

(c)

|

Following the closing of its acquisition of Orchid Cellmark Inc. ("Orchid") in mid-December 2011, the Company recorded a net $2.8 loss on its divestiture of certain assets of Orchid's U.S. government paternity business, under the terms of the agreement reached with the U.S. Federal Trade Commission. This non-deductible loss on disposal

|

|

(d)

|

During 2010, the Company recorded net restructuring charges of $5.8 primarily related to work force reductions and the closing of redundant and underutilized facilities. In addition, the Company recorded a special charge of $6.2 related to the write-off of development costs incurred on systems abandoned during the year.

|

|

(e)

|

During 2009, the Company recorded net restructuring charges of $13.5 primarily related to the closing of redundant and underutilized facilities.

|

|

(f)

|

During 2008, the Company recorded net restructuring charges of $32.4 primarily related to work force reductions and the closing of redundant and underutilized facilities. During the third quarter of 2008, the Company also recorded a special charge of $5.5 related to estimated uncollectible amounts primarily owed by patients in the areas of the Gulf Coast severely impacted by hurricanes similar to losses incurred during the 2005 hurricane season.

|

|

(g)

|

Long-term obligations primarily include the Company’s zero-coupon convertible subordinated notes, 5 1/2% senior notes due 2013, 5 5/8% senior notes due 2015, 3 1/8% senior notes due 2016, 2 1/5% senior notes due 2017, 4 5/8% senior notes due 2020, 3 3/4% senior notes due 2022, term loan, revolving credit facility and other long-term obligations. The accreted balance of the zero-coupon convertible subordinated notes was $130.0, $135.5, $286.7, $292.2 and $573.5 at December 31, 2012, 2011, 2010, 2009 and 2008, respectively. The balance of the 5

1/2% senior notes, including principal and unamortized portion of a deferred gain on an interest rate swap agreement, was $350.0, $350.5, $350.9, $351.3 and $351.7 at December 31, 2012, 2011, 2010, 2009 and 2008, respectively. The principal balance of the 5 5/8% senior notes was $250.0 at December 31, 2012, 2011, 2010, 2009 and 2008. The principal balance of the 3 1/8% senior notes was $325.0 at December 31, 2012, 2011 and 2010, and $0 for 2009 and 2008. The principal balance of the 4 5/8% senior notes was $600.0 at December 31, 2012, 2011 and 2010

|

|

Item 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (in millions)

|

|

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

Net sales

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Routine Testing

|

$

|

3,246.6

|

|

$

|

3,143.9

|

|

$

|

2,995.4

|

|

3.3

|

%

|

5.0

|

%

|

||||

|

Genomic and Esoteric Testing

|

2,089.8

|

|

2,089.0

|

|

1,728.5

|

|

0.0

|

%

|

20.9

|

%

|

|||||||

|

Ontario, Canada

|

335.0

|

|

309.4

|

|

280.0

|

|

8.3

|

%

|

10.5

|

%

|

|||||||

|

Total

|

$

|

5,671.4

|

|

$

|

5,542.3

|

|

$

|

5,003.9

|

|

2.3

|

%

|

10.8

|

%

|

||||

|

|

Years Ended December 31,

|

% Change

|

||||||||||||

|

Volume

|

2012

|

2011

|

2010

|

2012

|

2011

|

|||||||||

|

Routine Testing

|

86.2

|

|

85.2

|

|

83.3

|

|

1.2

|

%

|

2.3

|

%

|

||||

|

Genomic and Esoteric Testing

|

29.9

|

|

29.3

|

|

27.2

|

|

1.8

|

%

|

7.8

|

%

|

||||

|

Ontario, Canada

|

9.8

|

|

9.3

|

|

9.1

|

|

6.2

|

%

|

1.8

|

%

|

||||

|

Total

|

125.9

|

|

123.8

|

|

119.6

|

|

1.7

|

%

|

3.5

|

%

|

||||

|

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

Revenue Per Requisition

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Routine Testing

|

$

|

37.68

|

|

$

|

36.91

|

|

$

|

35.96

|

|

2.1

|

%

|

2.6

|

%

|

||||

|

Genomic and Esoteric Testing

|

$

|

69.94

|

|

$

|

71.19

|

|

$

|

63.48

|

|

(1.8

|

)%

|

12.1

|

%

|

||||

|

Ontario, Canada

|

$

|

33.94

|

|

$

|

33.29

|

|

$

|

30.68

|

|

2.0

|

%

|

8.5

|

%

|

||||

|

Total

|

$

|

45.04

|

|

$

|

44.76

|

|

$

|

41.82

|

|

0.6

|

%

|

7.0

|

%

|

||||

|

Cost of Sales

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Cost of sales

|

$

|

3,421.7

|

|

$

|

3,267.6

|

|

$

|

2,906.1

|

|

4.7

|

%

|

12.4

|

%

|

||||

|

Cost of sales as a % of sales

|

60.3

|

%

|

59.0

|

%

|

58.1

|

%

|

|

|

|

|

|||||||

|

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Selling, general and administrative expenses

|

$

|

1,114.6

|

|

$

|

1,159.6

|

|

$

|

1,034.3

|

|

(3.9

|

)%

|

12.1

|

%

|

||||

|

SG&A as a % of sales

|

19.7

|

%

|

20.9

|

%

|

20.7

|

%

|

|

|

|

|

|||||||

|

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Amortization of intangibles and other assets

|

$

|

86.3

|

|

$

|

85.8

|

|

$

|

72.7

|

|

0.6

|

%

|

18.0

|

%

|

||||

|

|

Years Ended December 31,

|

||||||||||

|

|

2012

|

2011

|

2010

|

||||||||

|

Restructuring and other special charges

|

$

|

25.3

|

|

$

|

80.9

|

|

$

|

12.0

|

|

||

|

Interest Expense

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Interest expense

|

$

|

94.5

|

|

$

|

87.5

|

|

$

|

70.0

|

|

8.0

|

%

|

25.0

|

%

|

||||

|

|

Years Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2012

|

2011

|

2010

|

2012

|

2011

|

||||||||||||

|

Equity method income

|

$

|

21.4

|

|

$

|

9.5

|

|

$

|

10.6

|

|

125.3

|

%

|

(10.4

|

)%

|

||||

|

Income Tax Expense

|

Years Ended December 31,

|

||||||||||

|

|

2012

|

2011

|

2010

|

||||||||

|

Income tax expense

|

$

|

359.4

|

|

$

|

333.0

|

|

$

|

344.0

|

|

||

|

Income tax expense as a % of income before tax

|

38.1

|

%

|

38.4

|

%

|

37.6

|

%

|

|||||

|

Contractual Cash Obligations

|

Payments Due by Period

|

||||||||||||||||||

|

|

|

|

2014-

|

2016-

|

2018 and

|

||||||||||||||

|

|

Total

|

2013

|

2015

|

2017

|

thereafter

|

||||||||||||||

|

Operating lease obligations

|

$

|

583.8

|

|

$

|

166.9

|

|

$

|

228.4

|

|

$

|

100.8

|

|

$

|

87.7

|

|

||||

|

Contingent future licensing payments (a)

|

21.9

|

|

5.1

|

|

9.1

|

|

6.1

|

|

1.6

|

|

|||||||||

|

Minimum royalty payments

|

10.3

|

|

2.0

|

|

3.5

|

|

3.2

|

|

1.6

|

|

|||||||||

|

Zero-coupon subordinated notes (b)

|

130.0

|

|

130.0

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Scheduled interest payments on Senior Notes

|

530.7

|

|

83.3

|

|

163.4

|

|

115.6

|

|

168.4

|

|

|||||||||

|

Revolving credit facility

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Long-term debt, other than revolving credit facility

|

2,525.0

|

|

350.0

|

|

250.0

|

|

825.0

|

|

1,100.0

|

|

|||||||||

|

Total contractual cash obligations (c) and (d)

|

$

|

3,801.7

|

|

$

|

737.3

|

|

$

|

654.4

|

|

$

|

1,050.7

|

|

$

|

1,359.3

|

|

||||

|

(a)

|

Contingent future licensing payments will be made if certain events take place, such as the launch of a specific test, the transfer of certain technology, and when specified revenue milestones are met.

|

|

(b)

|

As announced by the Company on January 2, 2013, holders of the zero-coupon subordinated notes may choose to convert their notes during the first quarter of 2013 subject to terms as defined in the note agreement. See “Note 11 to Consolidated Financial Statements” and "Credit Ratings" above for further information regarding the Company’s zero-coupon subordinated notes.

|

|

(c)

|

The table does not include obligations under the Company’s pension and postretirement benefit plans, which are included in "Note 16 to Consolidated Financial Statements." Benefits under the Company's postretirement medical plan are made when claims are submitted for payment, the timing of which is not practicable to estimate.

|

|

(d)

|

The table does not include the Company’s reserves for unrecognized tax benefits. The Company had a $46.2 and $63.5 reserve for unrecognized tax benefits, including interest and penalties, at December 31, 2012 and 2011, respectively, which is included in “Note 13 to Consolidated Financial Statements.” Substantially all of these tax reserves are classified in other long-term liabilities in the Company’s Consolidated Balance Sheets at December 31, 2012 and 2011.

|

|

•

|

Revenue recognition and allowance for doubtful accounts;

|

|

•

|

Pension expense;

|

|

•

|

Accruals for self insurance reserves;

|

|

•

|

Income taxes; and

|

|

•

|

Goodwill and Indefinite-Lived Assets

|

|

Days Outstanding

|

2012

|

2011

|

|

|

0 – 30

|

48.9%

|

51.2%

|

|

|

31 – 60

|

18.6%

|

17.2%

|

|

|

61 – 90

|

11.7%

|

10.2%

|

|

|

91 – 120

|

6.5%

|

7.7%

|

|

|

121 – 150

|

3.9%

|

4.2%

|

|

|

151 – 180

|

3.3%

|

3.1%

|

|

|

181 – 270

|

6.1%

|

5.3%

|

|

|

271 – 360

|

0.8%

|

0.8%

|

|

|

Over 360

|

0.2%

|

0.2%

|

|

|

1.

|

changes in federal, state, local and third party payer regulations or policies or other future reforms in the health care system (or in the interpretation of current regulations), new insurance or payment systems, including state or regional insurance cooperatives (Health Insurance Exchanges), new public insurance programs or a single-payer system, affecting governmental and third-party coverage or reimbursement for clinical laboratory testing;

|

|

2.

|

adverse results from investigations or audits of clinical laboratories by the government, which may include significant monetary damages, refunds and/or exclusion from the Medicare and Medicaid programs;

|

|

3.

|

loss or suspension of a license or imposition of a fine or penalties under, or future changes in, or interpretations of, the law or regulations of the Clinical Laboratory Improvement Act of 1967, and the Clinical Laboratory Improvement Amendments of 1988, or those of Medicare, Medicaid, the False Claims Act or other federal, state or local agencies;

|

|

4.

|

failure to comply with the Federal Occupational Safety and Health Administration requirements and the Needlestick Safety and Prevention Act, which may result in penalties and loss of licensure;

|

|

5.

|

failure to comply with HIPAA, including changes to federal and state privacy and security obligations and changes to HIPAA, including those changes included within HITECH and any subsequent amendments, which could result in increased costs, denial of claims and/or significant penalties;

|

|

6.

|

failure to maintain the security of business information or systems could damage the Company's reputation, cause it to incur substantial additional costs and to become subject to litigation;

|

|

7.

|

failure of the Company, third party payers or physicians to comply with the ICD-10-CM Code Set by the compliance date of October 1, 2014, could negatively impact the Company's reimbursement, cash collections, DSO and profitability;

|

|

8.

|

increased competition, including competition from companies that do not comply with existing laws or regulations or otherwise disregard compliance standards in the industry;

|

|

9.

|

increased price competition, competitive bidding for laboratory tests and/or changes or reductions to fee schedules;

|

|

10.

|

changes in payer mix, including an increase in capitated reimbursement mechanisms or the impact of a shift to consumer-driven health plans;

|

|

11.

|

failure to obtain and retain new customers or a reduction in tests ordered or specimens submitted by existing customers;

|

|

12.

|

failure to retain or attract managed care business as a result of changes in business models, including new risk based or network approaches, or other changes in strategy or business models by managed care companies;

|

|

13.

|

failure to effectively integrate and/or manage newly acquired businesses and the cost related to such integrations;

|

|

14.

|

adverse results in litigation matters;

|

|

15.

|

inability to attract and retain experienced and qualified personnel;

|

|

16.

|

business interruption, increased costs, and other adverse effects on the Company's operations due to the unionization of employees, union strikes, work stoppages, or general labor unrest;

|

|

17.

|

failure to maintain the Company's days sales outstanding and/or bad debt expense levels;

|

|

18.

|

decrease in the Company's credit ratings by Standard & Poor's and/or Moody's;

|

|

19.

|

discontinuation or recalls of existing testing products;

|

|

20.

|

failure to develop or acquire licenses for new or improved technologies, or if customers use new technologies to perform their own tests;

|

|

21.

|

inability to commercialize newly licensed tests or technologies or to obtain appropriate coverage or reimbursement for such tests, which could result in impairment in the value of certain capitalized licensing costs;

|

|

22.

|

failure to identify and successfully close and integrate strategic acquisition targets;

|

|

23.

|

changes in government regulations or policies, including regulations and policies of the Food and Drug Administration, affecting the approval, availability of, and the selling and marketing of diagnostic tests;

|

|

24.

|

inability to obtain and maintain adequate patent and other proprietary rights for protection of the Company's products and services and successfully enforce the Company's proprietary rights;

|

|

25.

|

the scope, validity and enforceability of patents and other proprietary rights held by third parties which might have an impact on the Company's ability to develop, perform, or market the Company's tests or operate its business;

|

|

26.

|

failure in the Company's information technology systems resulting in an increase in testing turnaround time or billing processes or the failure to meet future regulatory or customer information technology, data security and connectivity requirements;

|

|

27.

|

failure of the Company's financial information systems resulting in failure to meet required financial reporting deadlines;

|

|

28.

|

failure of the Company's disaster recovery plans to provide adequate protection against the interruption of business and/or to permit the recovery of business operations;

|

|

29.

|

business interruption or other impact on the business due to adverse weather (including hurricanes), fires and/or other natural disasters, terrorism or other criminal acts, and/or widespread outbreak of influenza or other pandemic illness;

|

|

30.

|

liabilities that result from the inability to comply with corporate governance requirements;

|

|

31.

|

significant deterioration in the economy or financial markets which could negatively impact the Company's testing volumes, cash collections and the availability of credit for general liquidity or other financing needs;

|

|

32.

|

changes in reimbursement by foreign governments and foreign currency fluctuations; and

|

|

33.

|

expenses and risks associated with international operations, including but not limited to compliance with the Foreign Corrupt Practices Act, the U.K. Bribery Act, as well as laws and regulations that differ from those of the United States, and economic, political, legal and other operational risks associated with foreign markets.

|

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

|

|

1)

|

The Company will pay contingent cash interest on the zero-coupon subordinated notes after September 11, 2006, if the average market price of the notes equals 120% or more of the sum of the issue price, accrued original issue discount and contingent additional principal, if any, for a specified measurement period.

|

|

2)

|

Holders may surrender zero-coupon subordinated notes for conversion during any period in which the rating assigned to the zero-coupon subordinated notes by Standard & Poor’s Ratings Services is BB- or lower.

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

Item 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

|

Item 9A.

|

CONTROLS AND PROCEDURES

|

|

•

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

|

|

•

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America;

|

|

•

|

provide reasonable assurance that receipts and expenditures of the Company are being made only in accordance with authorization of management and directors of the Company; and

|

|

•

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of assets that could have a material effect on the consolidated financial statements.

|

|

Item 9B.

|

OTHER INFORMATION

|

|

Item 10.

|

DIRECTORS, EXECUTIVE OFFICERS and CORPORATE GOVERNANCE

|

|

Item 11.

|

EXECUTIVE COMPENSATION

|

|

Item 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

Item 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

|

(1)

|

Consolidated Financial Statements and Report of Independent Registered Public Accounting Firm included herein:

|

|

See Index on page F-1

|

|

|

(2)

|

Financial Statement Schedules:

|

|

See Index on page F-1

|

|

|

All other schedules are omitted as they are inapplicable or the required information is furnished in the Consolidated Financial Statements or notes thereto.

|

|

|

(3)

|

Index to and List of Exhibits

|

|

2.1

|

Asset Purchase Agreement by and among Genzyme Corporation and Laboratory Corporation of America Holdings dated as of September 13, 2010 (incorporated herein by reference to Exhibit 2.1 to the Company's Current Report on Form 8-K filed on September 16, 2010).

|

|

3.1

|

Amended and Restated Certificate of Incorporation of the Company dated May 24, 2001 (incorporated herein by reference to the Company's Registration Statement on Form S-3, filed with the Commission on October 19, 2001, File No. 333-71896).

|

|

3.2

|

Amended and Restated By-Laws of the Company dated March 25, 2008 (incorporated herein by reference to the Company's current report on Form 8-K, filed with the Commission on March 31, 2008).

|

|

4.1

|

Specimen of the Company's Common Stock Certificate (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001).

|

|

4.2

|

Indenture dated as of January 31, 2003 between the Company and Wachovia Bank, National Association, as trustee (incorporated herein by reference to the January 31, 2003 Form 8-K, filed with the Commission on February 3, 2003).

|

|

4.3

|

Registration Rights Agreement, dated as of January 28, 2003 between the Company and the Initial Purchasers (incorporated herein by reference to the January 31, 2003 Form 8-K, filed with the Commission on February 3, 2003).

|

|

4.4

|

Indenture dated as of December 5, 2005, between the Company and The Bank of New York, as trustee (Senior Debt Securities) (incorporated herein by reference to Exhibit 4.1 to the Company's Current Report on Form 8-K dated December 14, 2005).

|

|

4.5

|

Indenture, dated as of October 23, 2006, between the Company and The Bank of New York, as trustee, including the Form of Global Note attached as Exhibit A thereto (incorporated herein by reference to Exhibit 4.1 to the Company's Current Report on Form 8-K filed on October 24, 2006).

|

|

4.6

|

Indenture, dated as of November 19, 2010, between the Company and U.S. Bank National Association, as trustee (incorporated herein by reference to Exhibit 4.1 to the Company's Current Report on Form 8-K filed on November 19, 2010).

|

|

4.7

|

First Supplemental Indenture, dated as of November 19, 2010, between the Company and U.S. Bank National Association, as trustee, including the form of the 2016 Notes (incorporated herein by reference to Exhibit 4.2 to the Company's Current Report on Form 8-K filed on November 19, 2010).

|

|

4.8

|

Second Supplemental Indenture, dated as of November 19, 2010, between the Company and U.S. Bank National Association, as trustee, including the form of the 2020 Notes (incorporated herein by reference to Exhibit 4.3 to the Company's Current Report on Form 8-K filed on November 19, 2010).

|

|

4.9

|

Third Supplemental Indenture, dated as of August 23, 2012, between the Company and U.S. Bank National Association, as trustee, including the form of the 2017 Notes (incorporated herein by reference to Exhibit 4.2 to the Company's Current Report on Form 8-K filed on August 23, 2012).

|

|

4.10

|

Third Supplemental Indenture, dated as of August 23, 2012, between the Company and U.S. Bank National Association, as trustee, including the form of the 2017 Notes (incorporated herein by reference to Exhibit 4.2 to the Company's Current Report on Form 8-K filed on August 23, 2012).

|

|

10.1

|

National Health Laboratories Incorporated Pension Equalization Plan (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 1992).

|

|

10.2

|

Laboratory Corporation of America Holdings amended and restated new Pension Equalization Plan (incorporated herein by reference to the Company's Quarterly Report for the period ended September 30, 2004).

|

|

10.3

|

First Amendment to the Laboratory Corporation of America Holdings amended and restated new Pension Equalization Plan (incorporated herein by reference to the Company's Quarterly Report for the period ended September 30, 2004).

|

|

10.4

|

Second Amendment to the Laboratory Corporation of America Holdings amended and restated new Pension Equalization Plan. (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004).

|

|

10.5

|

National Health Laboratories 1988 Stock Option Plan, as amended (incorporated herein by reference to the Company's Registration Statement on Form S-1, filed with the Commission on July 9, 1990, File No. 33-35782).

|

|

10.6

|

National Health Laboratories 1994 Stock Option Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on August 12, 1994, File No. 33-55065).

|

|

10.7

|

Laboratory Corporation of America Holdings Senior Executive Transition Policy (incorporated herein by reference to the Company's Quarterly Report for the period ended June 30, 2004).

|

|

10.8

|

Laboratory Corporation of America Holdings 1995 Stock Plan for Non-Employee Directors dated September 26, 1995 (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on September 26, 1995, File No. 33-62913).

|

|

10.9

|

Amendment to the 1995 Stock Plan for Non-Employee Directors (incorporated herein by reference to the Company's 1997 Annual Proxy Statement, filed with the Commission on June 6, 1997).

|

|

10.10

|

Amendment to the 1995 Stock Plan for Non-Employee Directors (incorporated herein by reference to Annex I of the Company's 2001 Annual Proxy Statement, filed with the Commission on April 25, 2001).

|

|

10.11

|

Laboratory Corporation of America Holdings 1997 Employee Stock Purchase Plan (incorporated herein by reference to Annex I of the Company's Registration Statement on Form S-8 filed with the Commission on December 13, 1996, File No. 333-17793).

|

|

10.12

|

Amendments to the Laboratory Corporation of America Holdings 1997 Employee Stock Purchase Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on January 10, 2000, File No. 333-94331).

|

|

10.13

|

Amendments to the Laboratory Corporation of America Holdings 1997 Employee Stock Purchase Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on May 26, 2004, File No. 333-115905).

|

|

10.14

|

Laboratory Corporation of America Holdings Amended and Restated 1999 Stock Incentive Plan (incorporated herein by reference to Annex I of the Company's 1999 Annual Proxy Statement filed with the Commission of May 3, 1999).

|

|

10.15

|

Laboratory Corporation of America Holdings 2000 Stock Incentive Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on June 5, 2000, File No. 333-38608).

|

|

10.16

|

Amendments to the 2000 Stock Incentive Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on June 19, 2002, File No. 333-90764).

|

|

10.17

|

Dynacare Inc., Amended and Restated Employee Stock Option Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on August 7, 2002, File No. 333-97745).

|

|

10.18

|

DIANON Systems, Inc. 1996 Stock Incentive Plan, DIANON Systems, Inc. 1999 Stock Incentive Plan, DIANON Systems, Inc. 2000 Stock Incentive Plan, DIANON Systems, Inc. 2001 Stock Incentive Plan, and UroCor, Inc. Second Amended and Restated 1992 Stock Option Plan (incorporated herein by reference to the Company's Registration Statement on Form S-8, filed with the Commission on January 21, 2003, File No. 333-102602).

|

|

10.19

|

Laboratory Corporation of America Holdings Deferred Compensation Plan (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004).

|

|

10.20

|

First Amendment to the Laboratory Corporation of America Holdings Deferred Compensation Plan (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004).

|

|

10.21

|

Third Amendment to the Laboratory Corporation of America Amended and Restated New Pension Equalization Plan (incorporated herein by reference to the Company's Quarterly Report for the period ended June 30, 2005).

|

|

10.22

|

Second Amendment to the Laboratory Corporation of America Holdings Deferred Compensation Plan (incorporated herein by reference to the Company's Quarterly Report for the period ended June 30, 2005).

|

|

10.23

|

Third Amendment to the Laboratory Corporation of America Holdings Deferred Compensation Plan (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2006).

|

|

10.24

|

Consulting Agreement between Thomas P. Mac Mahon and the Company dated July 20, 2006 (incorporated herein by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed on July 21, 2006).

|

|

10.25

|

Fourth Amendment to the Laboratory Corporation of America Holdings Deferred Compensation Plan (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2007).

|

|

10.26

|

Laboratory Corporation of America Holdings 2008 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K filed on May 7, 2008).

|

|

10.27

|

Laboratory Corporation of America Holdings Amended and Restated Master Senior Executive Severance Plan (incorporated herein by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2009).

|

|

10.28

|

Laboratory Corporation of America Holdings Master Senior Executive Change in Control Severance Plan (incorporated herein by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2009).

|

|

10.29

|

First Amendment to the Laboratory Corporation of America Holdings Master Senior Executive Change in Control Severance Plan (incorporated herein by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2010).

|

|

10.30

|

Second Amendment to the Laboratory Corporation of America Holdings Master Senior Executive Change in Control Severance Plan (incorporated herein by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2010).

|

|

10.31

|

$1 Billion Credit Agreement dated as of December 21, 2011, among the Company, Bank of America, N.A. as Administrative Agent, Swing Line Lender and L/C Issuer, Wells Fargo Bank, National Association and Credit Suisse AG, Cayman Islands Branch as Documentation Agents, Barclays Capital as Syndication Agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Barclays Capital, Wells Fargo Securities, LLC and Credit Suisse Securities (USA) LLC as Joint Lead Arrangers and Joint Book Managers, and the lenders named therein (incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2011).

|

|

10.32

|

Laboratory Corporation of America Holdings 2012 Omnibus Incentive Plan (incorporated herein by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed on May 2, 2012).

|

|

10.33

|

Fourth Amendment to the Laboratory Corporation of America Holdings 1997 Employee Stock Purchase Plan (incorporated herein by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K filed on May 2, 2012).

|

|

12.1*

|

Ratio of earnings to fixed charges

|

|

21*

|

List of Subsidiaries of the Company

|

|

23.1*

|

Consent of PricewaterhouseCoopers LLP, an independent registered public accounting firm

|

|

24.1*

|

Power of Attorney of Thomas P. Mac Mahon

|

|

24.2*

|

Power of Attorney of Kerrii B. Anderson

|

|

24.3*

|

Power of Attorney of Jean-Luc Bélingard

|

|

24.4*

|

Power of Attorney of N. Anthony Coles, M.D.

|

|

24.5*

|

Power of Attorney of Wendy E. Lane

|

|

24.6*

|

Power of Attorney of Robert E. Mittelstaedt, Jr.

|

|

24.7*

|

Power of Attorney of Peter M. Neupert

|

|

24.8*

|

Power of Attorney of Arthur H. Rubenstein, MBBCh

|

|

24.9*

|

Power of Attorney of M. Keith Weikel, Ph.D.

|

|

24.10*

|

Power of Attorney of R. Sanders Williams, M.D.

|

|

31.1*

|

Certification by the Chief Executive Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a)

|

|

31.2*

|

Certification by the Chief Financial Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a)

|

|

32*

|

Written Statement of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. Section 1350)

|

|

101.INS*

|

XBRL Instance Document

|

|

101.SCH*

|

XBRL Taxonomy Extension Schema

|

|

101.CAL*

|

XBRL Taxonomy Extension Calculation Linkbase

|

|

101.DEF*

|

XBRL Taxonomy Extension Definition Linkbase

|

|

101.LAB*

|

XBRL Taxonomy Extension Label Linkbase

|

|

101.PRE*

|

XBRL Taxonomy Extension Presentation Linkbase

|

|

*

|

Filed herewith

|

|

|

By:

|

/s/ DAVID P. KING

|

|

|

|

|

David P. King

|

|

|

|

|

Chairman of the Board, President

|

|

|

|

|

and Chief Executive Officer

|

|

|

Dated:

|

February 26, 2013

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ DAVID P. KING

|

|

Chairman of the Board, President and Chief

|

|

David P. King

|

|

Executive Officer (Principal Executive Officer)

|

|

|

|

|

|

/s/ WILLIAM B. HAYES

|

|

Executive Vice President, Chief Financial

|

|

William B. Hayes

|

|

Officer and Treasurer (Principal Financial

|

|

|

|

Officer and Principal Accounting Officer)

|

|

|

|

|

|

/s/ THOMAS P. MAC MAHON*

|

|

Director

|

|

Thomas P. Mac Mahon

|

|

|

|

|

|

|

|

/s/ KERRII B. ANDERSON*

|

|

Director

|

|

Kerrii B. Anderson

|

|

|

|

|

|

|

|

/s/ JEAN-LUC BÉLINGARD*

|

|

Director

|

|

Jean-Luc Bélingard

|

|

|

|

|

|

|

|

/s/ N. ANTHONY COLES, M.D.*

|

|

Director

|

|

N. Anthony Coles, M.D.

|

|

|

|

|

|

|

|

/s/ WENDY E. LANE*

|

|

Director

|

|

Wendy E. Lane

|

|

|

|

|

|

|

|

/s/ ROBERT E. MITTELSTAEDT, JR.*

|

|

Director

|

|

Robert E. Mittelstaedt, Jr.

|

|

|

|

/s/ PETER M. NEUPERT*

|

|

Director

|

|

Peter M.Neupert

|

|

|

|

|

|

|

|

/s/ ARTHUR H. RUBENSTEIN, MBBCH*

|

|

Director

|

|

Arthur H. Rubenstein, MBBCh

|

|

|

|

|

|

|

|

/s/ M. KEITH WEIKEL, PH.D.*

|

|

Director

|

|

M. Keith Weikel, Ph.D.

|

|

|

|

|

|

|

|

/s/ R. SANDERS WILLIAMS, M.D.*

|

|

Director

|

|

R. Sanders Williams, M.D.

|

|

|

|

By:

|

/s/ F. SAMUEL EBERTS III

|

|

|

|

F. Samuel Eberts III

|

|

|

|

Attorney-in-fact

|

|

|

|

Page

|

|

|

|

|

|

|

|

Consolidated Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Statement Schedule:

|

|

|

|

|

|

December 31,

2012 |

December 31,

2011 |

||||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

466.8

|

|

$

|

159.3

|

|

|

|

Accounts receivable, net of allowance for doubtful accounts of $191.5 and $197.6 at December 31, 2012 and 2011, respectively

|

718.5

|

|

699.8

|

|

|||

|

Supplies inventories

|

121.0

|

|

110.8

|

|

|||

|

Prepaid expenses and other

|

74.6

|

|

79.6

|

|

|||

|

Deferred income taxes

|

10.9

|

|

10.5

|

|

|||

|

Total current assets

|

1,391.8

|

|

1,060.0

|

|

|||

|

Property, plant and equipment, net

|

630.8

|

|

578.3

|

|

|||

|

Goodwill, net

|

2,901.7

|

|

2,681.8

|

|

|||

|

Intangible assets, net

|

1,667.7

|

|

1,620.7

|

|

|||

|

Joint venture partnerships and equity method investments

|

78.1

|

|

76.8

|

|

|||

|

Other assets, net

|

124.9

|

|

94.2

|

|

|||

|

Total assets

|

$

|

6,795.0

|

|

$

|

6,111.8

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|||

|

Current liabilities:

|

|

|

|

|

|||

|

Accounts payable

|

$

|

236.9

|

|

$

|

257.8

|

|

|

|

Accrued expenses and other

|

311.6

|

|

339.3

|

|

|||

|

Short-term borrowings and current portion of long-term debt

|

480.0

|

|

135.5

|

|

|||

|

Total current liabilities

|

1,028.5

|

|

732.6

|

|

|||

|

Long-term debt, less current portion

|

2,175.0

|

|

2,085.5

|

|

|||

|

Deferred income taxes and other tax liabilities

|

546.0

|

|

477.9

|

|

|||

|

Other liabilities

|

307.4

|

|

292.1

|

|

|||

|

Total liabilities

|

4,056.9

|

|

3,588.1

|

|

|||

|

Commitments and contingent liabilities

|

|

|

|

|

|||

|

Noncontrolling interest

|

20.7

|

|

20.2

|

|

|||

|

Shareholders’ equity

|

|

|

|

|

|||

|

Common stock, 93.5 and 97.8 shares outstanding at December 31, 2012 and 2011, respectively

|

11.3

|

|

11.7

|

|

|||

|

Additional paid-in capital

|

—

|

|

—

|

|

|||

|

Retained earnings

|

3,588.5

|

|

3,387.2

|

|

|||

|

Less common stock held in treasury

|

(951.8

|

)

|

(940.9

|

)

|

|||

|

Accumulated other comprehensive income

|

69.4

|

|

45.5

|

|

|||

|

Total shareholders’ equity

|

2,717.4

|

|

2,503.5

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

6,795.0

|

|

$

|

6,111.8

|

|

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2012

|

2011

|

2010

|

||||||||

|

Net sales

|

$

|

5,671.4

|

|

$

|

5,542.3

|

|

$

|

5,003.9

|

|

||

|

Cost of sales

|

3,421.7

|

|

3,267.6

|

|

2,906.1

|

|

|||||

|

Gross profit

|

2,249.7

|

|

2,274.7

|

|

2,097.8

|

|

|||||

|

Selling, general and administrative expenses

|

1,114.6

|

|

1,159.6

|

|

1,034.3

|

|

|||||

|

Amortization of intangibles and other assets

|

86.3

|

|

85.8

|

|

72.7

|

|

|||||

|

Restructuring and other special charges

|

25.3

|

|

80.9

|

|

12.0

|

|

|||||

|

Operating income

|

1,023.5

|

|

948.4

|

|

978.8

|

|

|||||

|

Other income (expenses):

|

|

|

|

|

|

|

|||||

|

Interest expense

|

(94.5

|

)

|

(87.5

|

)

|

(70.0

|

)

|

|||||

|

Equity method income, net

|

21.4

|

|

9.5

|

|

10.6

|

|

|||||

|

Investment income

|

1.0

|

|

1.3

|

|

1.1

|

|

|||||

|

Other, net

|

(7.2

|

)

|

(5.6

|

)

|

(4.9

|

)

|

|||||

|

Earnings before income taxes

|

944.2

|

|

866.1

|

|

915.6

|

|

|||||

|

Provision for income taxes

|

359.4

|

|

333.0

|

|

344.0

|

|

|||||

|

Net earnings

|

584.8

|

|

533.1

|

|

571.6

|

|

|||||

|

Less: Net earnings attributable to the noncontrolling interest

|

(1.7

|

)

|

(13.4

|

)

|

(13.4

|

)

|

|||||

|

Net earnings attributable to Laboratory Corporation of America Holdings

|

$

|

583.1

|

|

$

|

519.7

|

|

$

|

558.2

|

|

||

|

Basic earnings per common share

|

$

|

6.09

|

|

$

|

5.20

|

|

$

|

5.42

|

|

||

|

Diluted earnings per common share

|

$

|

5.99

|

|

$

|

5.11

|

|

$

|

5.29

|

|

||

|

|

Years Ended December 31,

|

||||||||||

|

|

2012

|

2011

|

2010

|

||||||||

|

Net earnings

|

$

|

584.8

|

|

$

|

533.1

|

|

$

|

571.6

|

|

||

|

Foreign currency translation adjustments

|

31.3

|

|

(13.2

|

)

|

41.3

|

|

|||||

|

Interest rate swap adjustments

|

—

|

|

2.4

|

|

8.2

|

|

|||||

|

Net benefit plan adjustments

|

7.3

|

|

(57.5

|

)

|

(8.3

|

)

|

|||||

|

Other comprehensive earnings (loss) before tax

|

38.6

|

|

(68.3

|

)

|

41.2

|

|

|||||

|

Provision for income tax related to items of comprehensive earnings

|

(14.7

|

)

|

25.3

|

|

(14.2

|

)

|

|||||

|

Other comprehensive earnings (loss), net of tax

|

23.9

|

|

(43.0

|

)

|

27.0

|

|

|||||

|

Comprehensive earnings

|

608.7

|

|

490.1

|

|

598.6

|

|

|||||

|

Less: Net earnings attributable to the noncontrolling interest

|

(1.7

|

)

|

(13.4

|

)

|

(13.4

|

)

|

|||||

|

Net earnings attributable to Laboratory Corporation of America Holdings

|

$

|

607.0

|

|

$

|

476.7

|

|

$

|

585.2

|

|

||

|

Common

Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Treasury

Stock

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Total

Shareholders’

Equity

|

||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2009

|

$

|

12.5

|

|

$

|

36.7

|

|

$

|

2,927.9

|

|

$

|

(932.5

|

)

|

$

|

61.5

|

|

$

|

2,106.1

|

|

|||||

|

Net earnings attributable to Laboratory Corporation of America Holdings

|

—

|

|

—

|

|

558.2

|

|

—

|

|

—

|

|

558.2

|

|

|||||||||||

|

Other comprehensive earnings, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

27.0

|

|

27.0

|

|

|||||||||||

|