|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||

|

Delaware

|

13-3861628

|

|

|

(State of Incorporation)

|

(I.R.S. Employer

Identification Number)

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, par value $0.001 per share

|

The NASDAQ Stock Market LLC

|

|

|

Large accelerated filer

o

|

Accelerated filer

ý

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

PART II

|

||

|

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Consolidated Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Consolidated Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

Item 16.

|

Form 10-K Summary

|

|

|

•

|

increase consumer satisfaction, improve the overall digital experience, and enhance retention and loyalty, while reducing customer service costs;

|

|

•

|

lower operating costs in the contact center by deflecting costly phone and email interactions and improving agent efficiency;

|

|

•

|

increase mobile app retention and engagement by providing a connected messaging experience and turning an app into an engaging support app;

|

|

•

|

maintain a valued connection with consumers via mobile devices, either through native applications, websites, text messages, or third-party messaging platforms.

|

|

•

|

accelerate sales cycles, increase conversion rates, increase average order value and reduce abandonment by intelligently engaging website visitors;

|

|

•

|

leverage spending that drives visitor traffic by increasing visitor conversions;

|

|

•

|

refine and improve performance by understanding which initiatives deliver the highest rate of return; and

|

|

•

|

increase lead generation by providing a single messaging platform that engages consumers through advertisements and listings on branded and third-party websites.

|

|

•

|

technology or service providers offering or powering competing digital engagement, contact center, communications or customer relationship management solutions such as, eGain, Genesys, Oracle, Salesforce.com, TouchCommerce (now part of Nuance) and Twilio;

|

|

•

|

service providers that offer basic messaging products or services with limited functionality free of charge or at significantly reduced entry level prices;

|

|

•

|

social media, social listening, messaging, artificial intelligence, bots, e-commerce, and/or data and data analytics companies, such as Facebook, Google, and WeChat, which may leverage their existing or future capabilities and consumer relationships to offer competing B2B solutions;

|

|

•

|

customers that develop and manage their messaging solutions in-house; and

|

|

•

|

companies that provide cross-category and vertical-specific advice, such as About.com, UpWork and Yahoo Answers.

|

|

•

|

We support our customers through a secure, scalable server infrastructure. In North America, our primary servers are hosted in a fully-secured, top-tier, third-party server center located in the Mid-Atlantic United States, and are supported by a top-tier backup server facility located in the Western United States. In Europe, our primary servers are hosted in a fully-secured, top-tier, third-party server center located in the United Kingdom and are supported by a top-tier backup server facility located in The Netherlands. In the Asia Pacific region, our primary and backup servers are hosted in fully-secured, top-tier, third-party server centers located in Australia. Nearly all of our larger customers outside of the United States are hosted within our UK- and Australia-based facilities. By managing our servers directly, we maintain greater flexibility and control over the production environment allowing us to be responsive to customer needs and to continue to provide a superior level of service. Utilizing advanced network infrastructure and protocols, our network, hardware and software are designed to accommodate our customers’ demand for secure, high-quality 24/7 service, including during peak times such as the holiday shopping season.

|

|

•

|

As a hosted service, we are able to add additional capacity and new features quickly and efficiently. This has enabled us to provide these benefits simultaneously to our entire customer base. In addition, it allows us to maintain a relatively short development and implementation cycle.

|

|

•

|

As a SaaS provider, we focus on the development of tightly integrated software design and network architecture. We dedicate significant resources to designing our software and network architecture based on the fundamental principles of security, reliability and scalability.

|

|

•

|

our ability to attract and retain new customers;

|

|

•

|

our ability to retain and increase sales to existing customers;

|

|

•

|

our customers’ demand for our services and business success;

|

|

•

|

consumer demand for our services;

|

|

•

|

the introduction of new services by us or our competitors;

|

|

•

|

changes in our pricing models or policies or the pricing policies of our current and future competitors;

|

|

•

|

continued adoption by companies of mobile and cloud-based messaging solutions;

|

|

•

|

continued adoption by experts and consumers of web-based advice services;

|

|

•

|

our ability to avoid and/or manage service interruptions, disruptions, or security incidents;

|

|

•

|

exposure to foreign currency exchange rate fluctuations; and

|

|

•

|

the amount and timing of capital expenditures and other costs related to operation and expansion of our business, including those related to acquisitions.

|

|

•

|

economic conditions specific to the Internet, electronic commerce and cloud computing; and

|

|

•

|

general, regional and/or global economic and political conditions.

|

|

•

|

technology or service providers offering or powering competing digital engagement, contact center, communications or customer relationship management solutions, such as eGain, Genesys, Oracle, Salesforce.com,TouchCommerce (now part of Nuance) and Twilio;

|

|

•

|

service providers that offer basic messaging products or services with limited functionality free of charge or at significantly reduced entry level prices ;

|

|

•

|

social media, social listening, messaging, artificial intelligence, bots, e-commerce, and/or data and data analytics companies, such as Facebook, Google and WeChat, which may leverage their existing or future capabilities and consumer relationships to offer competing solutions;

|

|

•

|

customers that develop and manage and their messaging solutions in-house; and

|

|

•

|

companies that provide cross-category and vertical-specific advice, such as About.com, UpWork and Yahoo Answers.

|

|

•

|

potential failure to achieve the expected benefits of the combination or acquisition;

|

|

•

|

inability to generate sufficient revenue to offset acquisition or investment cost;

|

|

•

|

difficulties in integrating operations, technologies, products and personnel;

|

|

•

|

diversion of financial and management resources from efforts related to existing operations;

|

|

•

|

risks of entering new markets in which we have little or no experience or where competitors may have stronger market positions;

|

|

•

|

potential loss of our existing key employees or key employees of the company we acquire;

|

|

•

|

inability to maintain relationships with customers and partners of the acquired business

|

|

•

|

use of alternative investment or compensation structures;

|

|

•

|

potential unknown liabilities associated with the acquired businesses; and

|

|

•

|

the tax effects of any such acquisitions.

|

|

•

|

varied, unfamiliar, unclear and changing legal and regulatory restrictions, including different legal and regulatory standards applicable to Internet services, communications, privacy, and data protection;

|

|

•

|

difficulties in staffing and managing foreign operations;

|

|

•

|

differing intellectual property laws that may not provide sufficient protection for our intellectual property;

|

|

•

|

adverse tax consequences or additional tax liabilities;

|

|

•

|

difficulty in addressing country-specific business requirements and regulations;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

strains on financial and other systems to properly administer VAT and other taxes;

|

|

•

|

different consumer preferences and requirements in specific international markets; and

|

|

•

|

international legal, compliance, political, regulatory or systemic restrictions, or other international governmental scrutiny, applicable to United States companies with sales and operations in foreign countries, including, but not limited to, possible compliance issues involving the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and similar laws in other jurisdictions.

|

|

•

|

any issued patent or patents issued in the future may not be broad enough to protect our intellectual property rights;

|

|

•

|

any issued patent or any patents issued in the future could be successfully challenged by one or more third parties, which could result in our loss of the right to prevent others from exploiting the inventions claimed in the patents;

|

|

•

|

current and future competitors may independently develop similar technologies, duplicate our services or design around any patents we may have; and

|

|

•

|

effective intellectual property protection may not be available in every country in which we do business, where our services are sold or used, where the laws may not protect proprietary rights as fully as do the laws of the United States or where enforcement of laws protecting proprietary rights is not common or effective.

|

|

•

|

damage to our reputation;

|

|

•

|

lost sales;

|

|

•

|

delays in or loss of market acceptance of our products; and

|

|

•

|

unexpected expenses and diversion of resources to remedy errors.

|

|

•

|

enhance the features and performance of our services;

|

|

•

|

develop and offer new services that are valuable to companies doing business online as well as Internet users; and

|

|

•

|

respond to technological advances and emerging industry and regulatory standards and practices in a cost-effective and timely manner.

|

|

•

|

concerns about transaction security or security problems such as “viruses” and “worms” or hackers;

|

|

•

|

concerns about cybersecurity attacks or the security of confidential information online;

|

|

•

|

continued growth in the number of users;

|

|

•

|

continued development of the necessary technological infrastructure;

|

|

•

|

development of enabling technologies;

|

|

•

|

uncertain and increasing government regulation; and

|

|

•

|

the development of complementary services and products.

|

|

•

|

quarterly variations in our operating results or those of our competitors;

|

|

•

|

earnings announcements that are not in line with analyst expectations;

|

|

•

|

changes in recommendations or financial estimates by securities analysts;

|

|

•

|

announcements or rumors about mergers or strategic acquisitions by us or by our competitors;

|

|

•

|

announcements about customer additions and cancellations or failure to complete significant sales;

|

|

•

|

changes in market valuations of companies that investors believe are comparable to us;

|

|

•

|

additions or departures of key personnel; and

|

|

•

|

general economic, political and market conditions, such as recessions, political unrest or terrorist attacks, or in the specific locations where we operate, such as the United States, Israel and the United Kingdom.

|

|

•

|

Our board of directors is divided into three classes, with each class serving three-year staggered terms, which prevents stockholders from electing an entirely new board of directors at any annual meeting.

|

|

•

|

Vacancies on our board of directors may only be filled by a vote of a majority of directors then in office, even if less than a quorum.

|

|

•

|

Our amended and restated certificate of incorporation prohibits cumulative voting in the election of directors or any other matters. This limits the ability of minority stockholders to elect director candidates.

|

|

•

|

Our stockholders may only act at a duly called annual or special meeting and may not act by written consent.

|

|

•

|

Stockholders must provide advance notice to nominate individuals for election to our board of directors or to propose other matters that can be acted upon at a stockholders’ meeting.

|

|

•

|

We require super-majority voting by stockholders to amend certain provisions in our amended and restated certificate of incorporation and to amend our amended and restated bylaws.

|

|

•

|

Our amended and restated bylaws expressly authorize a super-majority of the board of directors to amend our amended and restated bylaws.

|

|

High

|

Low

|

||||||

|

Year ended December 31, 2016:

|

|||||||

|

First Quarter

|

$

|

6.82

|

|

$

|

4.10

|

|

|

|

Second Quarter

|

$

|

7.20

|

|

$

|

5.69

|

|

|

|

Third Quarter

|

$

|

8.50

|

|

$

|

6.26

|

|

|

|

Fourth Quarter

|

$

|

8.65

|

|

$

|

7.45

|

|

|

|

Year ended December 31, 2015:

|

|

|

|

|

|||

|

First Quarter

|

$

|

13.66

|

|

$

|

10.24

|

|

|

|

Second Quarter

|

$

|

10.49

|

|

$

|

8.53

|

|

|

|

Third Quarter

|

$

|

10.16

|

|

$

|

7.56

|

|

|

|

Fourth Quarter

|

$

|

8.24

|

|

$

|

6.75

|

|

|

|

Period

|

Total Number of Shares Purchased

(1) (2)

|

Average Price Paid per Share

(1) (2)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

(1) (2)

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

(1) (2) (3)

|

||||||||||

|

$

|

14,329,958

|

|

||||||||||||

|

10/1/2016 - 10/31/2016

|

—

|

|

$

|

—

|

|

—

|

|

14,329,958

|

|

|||||

|

11/1/2016 - 11/30/2016

|

—

|

|

—

|

|

—

|

|

14,329,958

|

|

||||||

|

12/1/2016 - 12/31/2016

|

491,000

|

|

8.53

|

|

491,000

|

|

20,136,441

|

|

||||||

|

Total

|

491,000

|

|

$

|

8.53

|

|

491,000

|

|

$

|

20,136,441

|

|

||||

|

(1)

|

On December 10, 2012, the Company announced that its Board of Directors approved a stock repurchase program through June 30, 2014. Under the stock repurchase program, the Company was authorized to repurchase shares of the Company's common stock, in the open market or privately negotiated transactions, at times and prices considered appropriate by the Board of Directors depending upon prevailing market conditions and other corporate considerations.

|

|

(2)

|

As of June 30, 2014, approximately $1.1 million remained available for purchases under the program as in effect at that time. On July 23, 2014, the Company's Board of Directors extended the expiration date of the program out to December 31, 2014 and also increased the aggregate purchase price of the stock repurchase program from

$40.0 million

to

$50.0 million

. On March 5, 2015, the Company's Board of Directors extended the expiration date of the program out to December 31, 2016. As of December 31, 2015, approximately $6.1 million remained available for purchases under the program. On February 16, 2016, the Company's Board of Directors increased the aggregate purchase price of the stock repurchase program by an additional $14.0 million. On November 21, 2016, the Company's Board of Directors increased the aggregate purchase price of the stock repurchase program from

$64.0 million

to

$74.0 million

and extended the expiration date of the program out to December 31, 2017.

|

|

(3)

|

Transaction fees related to the share purchases are deducted from the total remaining allowable expenditure amount.

|

|

(1)

|

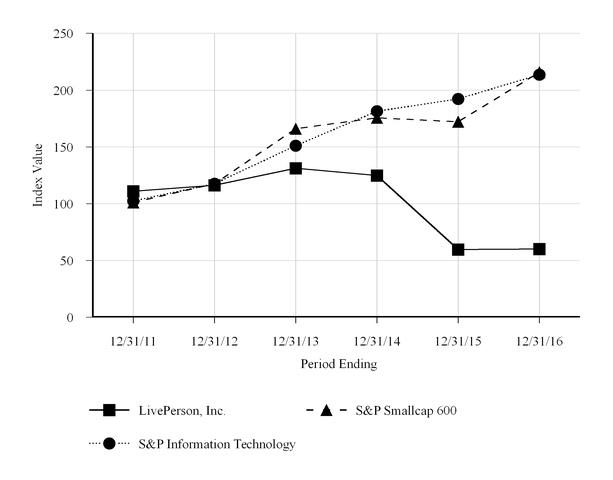

The graph covers the period from December 31, 2011 to December 31, 2016.

|

|

(2)

|

The graph assumes that $100 was invested at the market close on December 31, 2011 in LivePerson’s Common Stock, in the Standard & Poor’s SmallCap 600 Index and in the Standard & Poor’s Information Technology Index, and that all dividends were reinvested. No cash dividends have been declared on LivePerson’s Common Stock.

|

|

(3)

|

Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

(In Thousands, Except Share and per Share Data)

|

|||||||||||||||||||

|

Consolidated Statement of Operations Data:

|

|||||||||||||||||||

|

Revenue

|

$

|

222,779

|

|

$

|

239,012

|

|

$

|

209,931

|

|

$

|

177,805

|

|

$

|

157,409

|

|

||||

|

Costs and expenses:

|

|||||||||||||||||||

|

Cost of revenue

|

63,161

|

|

70,310

|

|

52,703

|

|

42,555

|

|

35,579

|

|

|||||||||

|

Sales and marketing

|

89,529

|

|

94,728

|

|

83,253

|

|

62,488

|

|

49,614

|

|

|||||||||

|

General and administrative

|

43,046

|

|

37,171

|

|

40,192

|

|

39,968

|

|

31,606

|

|

|||||||||

|

Product development

|

40,198

|

|

38,974

|

|

37,329

|

|

36,397

|

|

30,051

|

|

|||||||||

|

Restructuring costs

|

2,369

|

|

3,384

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Amortization of purchased intangibles

|

3,885

|

|

4,873

|

|

1,621

|

|

871

|

|

218

|

|

|||||||||

|

Total costs and expenses

|

242,188

|

|

249,440

|

|

215,098

|

|

182,279

|

|

147,068

|

|

|||||||||

|

(Loss) income from operations

|

(19,409

|

)

|

(10,428

|

)

|

(5,167

|

)

|

(4,474

|

)

|

10,341

|

|

|||||||||

|

Other (expense) income

|

(530

|

)

|

(202

|

)

|

(322

|

)

|

337

|

|

376

|

|

|||||||||

|

(Loss) income before provision for (benefit from) income taxes

|

(19,939

|

)

|

(10,630

|

)

|

(5,489

|

)

|

(4,137

|

)

|

10,717

|

|

|||||||||

|

Provision for (benefit from) income taxes

|

5,934

|

|

15,814

|

|

1,859

|

|

(638

|

)

|

4,362

|

|

|||||||||

|

Net (loss) income

|

$

|

(25,873

|

)

|

$

|

(26,444

|

)

|

$

|

(7,348

|

)

|

$

|

(3,499

|

)

|

$

|

6,355

|

|

||||

|

Net (loss) income per share of common stock:

|

|||||||||||||||||||

|

Basic

|

$

|

(0.46

|

)

|

$

|

(0.47

|

)

|

$

|

(0.13

|

)

|

$

|

(0.06

|

)

|

$

|

0.11

|

|

||||

|

Diluted

|

$

|

(0.46

|

)

|

$

|

(0.47

|

)

|

$

|

(0.13

|

)

|

$

|

(0.06

|

)

|

$

|

0.11

|

|

||||

|

Weighted-average shares used to compute net (loss) income per share:

|

|||||||||||||||||||

|

Basic

|

56,063,777

|

|

56,452,408

|

|

54,478,754

|

|

54,725,236

|

|

55,292,597

|

|

|||||||||

|

Diluted

|

56,063,777

|

|

56,452,408

|

|

54,478,754

|

|

54,725,236

|

|

57,131,041

|

|

|||||||||

|

Other Financial and Operational Data:

|

|||||||||||||||||||

|

Adjusted EBITDA

(1)

|

$

|

19,198

|

|

$

|

21,244

|

|

$

|

22,672

|

|

$

|

18,767

|

|

$

|

29,999

|

|

||||

|

Adjusted net (loss) income

(2)

|

$

|

(7,688

|

)

|

$

|

8,927

|

|

$

|

5,068

|

|

$

|

9,278

|

|

$

|

14,084

|

|

||||

|

Year Ended December 31,

|

|||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Cost of revenue

|

$

|

429

|

|

$

|

1,396

|

|

$

|

1,492

|

|

$

|

1,954

|

|

$

|

1,579

|

|

||||

|

Sales and marketing

|

2,515

|

|

3,088

|

|

3,399

|

|

2,851

|

|

2,878

|

|

|||||||||

|

General and administrative

|

3,304

|

|

3,692

|

|

3,809

|

|

4,148

|

|

3,294

|

|

|||||||||

|

Product development

|

3,488

|

|

3,638

|

|

3,606

|

|

3,555

|

|

2,964

|

|

|||||||||

|

Total stock-based compensation

|

$

|

9,736

|

|

$

|

11,814

|

|

$

|

12,306

|

|

$

|

12,508

|

|

$

|

10,715

|

|

||||

|

As of December 31,

|

|||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

(In Thousands)

|

|||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

50,889

|

|

$

|

48,803

|

|

$

|

49,372

|

|

$

|

91,906

|

|

$

|

103,339

|

|

||||

|

Working capital

|

17,468

|

|

39,122

|

|

34,954

|

|

88,877

|

|

100,593

|

|

|||||||||

|

Total assets

|

219,638

|

|

226,194

|

|

239,817

|

|

205,090

|

|

208,576

|

|

|||||||||

|

Total stockholders’ equity

|

138,476

|

|

165,305

|

|

180,337

|

|

159,053

|

|

170,243

|

|

|||||||||

|

•

|

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

|

|

•

|

adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

|

|

•

|

adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation;

|

|

•

|

adjusted EBITDA does not consider the impact of acquisition costs;

|

|

•

|

adjusted EBITDA does not consider the impact of restructuring costs;

|

|

•

|

adjusted EBITDA does not consider the impact of other non-recurring costs;

|

|

•

|

adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and

|

|

•

|

other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Reconciliation of Adjusted EBITDA:

|

|||||||||||||||||||

|

Net (loss) income

|

$

|

(25,873

|

)

|

$

|

(26,444

|

)

|

$

|

(7,348

|

)

|

$

|

(3,499

|

)

|

$

|

6,355

|

|

||||

|

Amortization of purchased intangibles

|

6,673

|

|

8,040

|

|

5,090

|

|

2,643

|

|

580

|

|

|||||||||

|

Stock-based compensation

|

9,736

|

|

11,814

|

|

12,306

|

|

12,508

|

|

10,715

|

|

|||||||||

|

Contingent earn-out adjustments

|

—

|

|

(3,680

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Restructuring costs

|

2,369

|

|

(1)

|

3,384

|

|

(2)

|

—

|

|

—

|

|

—

|

|

|||||||

|

Depreciation

|

12,011

|

|

12,114

|

|

9,071

|

|

8,090

|

|

7,329

|

|

|||||||||

|

Other non-recurring costs

|

7,818

|

|

(3)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||

|

Provision for (benefit from) income taxes

|

5,934

|

|

15,814

|

|

1,859

|

|

(638

|

)

|

4,362

|

|

|||||||||

|

Acquisition costs

|

—

|

|

—

|

|

1,372

|

|

—

|

|

1,034

|

|

|||||||||

|

Other expense (income), net

|

530

|

|

202

|

|

322

|

|

(337

|

)

|

(376

|

)

|

|||||||||

|

Adjusted EBITDA

|

$

|

19,198

|

|

$

|

21,244

|

|

$

|

22,672

|

|

$

|

18,767

|

|

$

|

29,999

|

|

||||

|

•

|

although amortization are non-cash charges, the assets being amortized may have to be replaced in the future, and adjusted net income does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

|

|

•

|

adjusted net income does not consider the potentially dilutive impact of equity-based compensation;

|

|

•

|

adjusted net income does not consider the impact of acquisition costs;

|

|

•

|

adjusted net income does not consider the impact of restructuring costs;

|

|

•

|

adjusted net income does not consider the impact of other non-recurring costs;

|

|

•

|

adjusted net income does not consider the potentially dilutive impact of deferred tax asset valuation allowance; and

|

|

•

|

other companies, including companies in our industry, may calculate adjusted net income differently, which reduces its usefulness as a comparative measure.

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

Reconciliation of Adjusted Net (Loss) Income

|

||||||||||||||||||||

|

Net (loss) income

|

$

|

(25,873

|

)

|

$

|

(26,444

|

)

|

$

|

(7,348

|

)

|

$

|

(3,499

|

)

|

$

|

6,355

|

|

|||||

|

Amortization of purchased intangibles

|

6,673

|

|

8,040

|

|

5,090

|

|

2,643

|

|

580

|

|

||||||||||

|

Stock-based compensation

|

9,736

|

|

11,814

|

|

12,306

|

|

12,508

|

|

10,715

|

|

||||||||||

|

Contingent earn-out adjustments

|

—

|

|

(3,680

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Deferred tax asset valuation allowance

|

692

|

|

15,820

|

|

||||||||||||||||

|

Restructuring costs

|

2,369

|

|

(1)

|

3,384

|

|

(2)

|

—

|

|

—

|

|

—

|

|

||||||||

|

Other non-recurring costs

|

8,134

|

|

(4)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Acquisition costs

|

—

|

|

—

|

|

1,372

|

|

—

|

|

1,034

|

|

||||||||||

|

Income tax effect of non-GAAP items

|

(9,419

|

)

|

(5)

|

(7

|

)

|

(6)

|

(6,352

|

)

|

(6)

|

(2,374

|

)

|

(6)

|

(4,600

|

)

|

(6)

|

|||||

|

Adjusted net (loss) income

|

$

|

(7,688

|

)

|

$

|

8,927

|

|

$

|

5,068

|

|

$

|

9,278

|

|

$

|

14,084

|

|

|||||

|

•

|

Strengthening Our Position in both Existing and New Markets and Growing Our Recurring Revenue Base.

LivePerson plans to continue to develop its market position by increasing its customer base, and expanding within its installed base. We will continue to focus primarily on key target markets: automotive, financial services, retail, technology, telecommunications, and travel/hospitality within both our enterprise and midmarket sectors, as well as the small business (SMB) sector. Healthcare, insurance, real estate and energy utilities are new target industries and natural extensions of our primary target markets. We plan to leverage our new LiveEngage platform to replace a portion of calls traditionally made to 1-800 numbers with text and mobile messaging, and to increase adoption of intelligent business campaigns across our customer's online properties that target consumers with real-time messaging. We intend to collaborate with our large installed customer base to optimize the value and effectiveness that brands derive from our services. We are also focused on strengthening our recurring revenue stream by signing larger, long-term, and more strategic deals which empower brands to run business campaigns on their websites that engage consumers via messaging

|

|

•

|

Fuel Increased Usage by Expanding our Engagement Tools and Offering Platform Pricing.

In 2011, we began expanding on our market leading real-time chat messaging product by adding new technologies that augment digital consumer engagement, including targeted content delivery and transcript analytics. In 2014, we introduced LiveEngage, whereby we seamlessly integrated into a single platform an expanded suite of mobile and online business messaging technologies, including traditional desktop chat messaging, mobile chat messaging, content delivery, analytics, cobrowse, PCI, customer sentiment, and mobile messaging via in-app, SMS, browser-based search and Facebook Messenger. LiveEngage delivers rich, contextually aware targeting and personalized experiences across mobile and desktop devices. We also began offering a new platform pricing model, which provides brands access to our entire suite of messaging technologies across their entire agent pool for a pre-negotiated cost per interaction. We believe this model is more attractive and will lead to increased usage versus our historic approach of requiring brands to negotiate each agent seat and product license separately. In late 2016, we began launching product programs designed to promote usage of our broader suite of capabilities for targeted customers.

|

|

•

|

Leverage Partners to Enhance our Offering.

In addition to developing our own applications, we continue to cultivate a partner eco-system capable of offering additional applications and services to our customers. For example, in 2015 we integrated LiveEngage with one of the leading consumer messaging platforms and in 2016 we integrated LiveEngage with one of the leading mobile search ad extensions. We have also integrated LiveEngage with several artificial intelligence/bots vendors. In addition, we have opened up access to our platform and our products with application programming interfaces (APIs) that allow third parties to develop on top of our platform. Customers and partners can utilize these APIs to build our capabilities into their own applications and to enhance our applications with their services.

|

|

•

|

Maintaining Market Leadership in Technology and Security Expertise.

As described above, we are devoting significant resources to creating new products and enabling technologies designed to accelerate innovation and delivery of new products and technologies to our customer base. We evaluate emerging technologies and industry standards and continually update our technology in order to retain our leadership position in each market we serve. We monitor legal and technological developments in the area of information security and confidentiality to ensure our policies and procedures meet or exceed the demands of the world’s largest and most demanding corporations. We believe that these efforts will allow us to effectively anticipate changing customer and consumer requirements in our rapidly evolving industry.

|

|

•

|

International Presence.

LivePerson is focused on expanding its international revenue contribution, which increased to 34% of total revenue in 2016, from 33% in 2015, despite approximately $3.5 million of adverse foreign currency exchange impact. LivePerson generated positive results from previous investments in direct sales and services personnel in the United Kingdom and Western Europe. We also continued to focus on expanding our presence in the Asia Pacific region, leveraging our relationships with partners such as NTT Solco, a subsidiary of telecom firm NTT Docomo and Information Services International-Dentsu, Ltd. (ISID).

|

|

•

|

Continuing to Build Brand Recognition.

As a pioneer of brand-to-consumer digital messaging, LivePerson enjoys strong brand recognition and credibility. Our focus on creating meaningful connections among employees, with our customers, and between brands and their consumers, is a key component of our culture and our market strategy. We strategically target decision makers and influencers within key vertical markets, leveraging customer successes to generate increased awareness and demand for brand-to-consumer messaging. In addition, we continue to develop relationships with the media, industry analysts and relevant business associations to enhance awareness of our leadership within the industry. Our brand name is also visible to both business users and consumers. When a consumer messages a customer care professional on a brand’s website, our brand name is usually displayed on the dialog messaging window. We believe that this high-visibility placement will continue to create brand awareness for our solutions.

|

|

•

|

Increasing the Value of Our Service to Our Customers.

We believe the introduction of LiveEngage marks the most important product launch in our history, as it empowers brands to deploy messaging at scale for customer care and sales, instead of demanding that consumers use email or call a 1-800 number. Furthermore, our platform strategy makes available the full suite of LivePerson’s capabilities through a single solution. In addition, the open architecture of LiveEngage will enable LivePerson to rapidly add new capabilities either directly or through partners. For example, we see opportunities for additional efficiencies in the contact center through the integration of artificial intelligence and bots. Because we directly manage the server infrastructure, we can make new features available to our customers immediately upon release, without customer or end-user installation of software or hardware. Our strategy is to continue to enhance the LiveEngage messaging platform and to leverage the substantial amount of mobile and online consumer data we collect, with the aim of increasing agent efficiency, decreasing customer care costs, improving the customer experience and increasing customer lifetime value.

|

|

•

|

Evaluating Strategic Alliances and Acquisitions When Appropriate.

We have successfully integrated several acquisitions over the past decade. While we have in the past, and may from time to time in the future, engage in discussions regarding acquisitions or strategic transactions or to acquire other companies that can accelerate our growth or broaden our product offerings, we currently have no binding commitments with respect to any future acquisitions or strategic transactions.

|

|

•

|

Revenue decreased

5%

and

7%

to

$56.1 million

and

$222.8 million

in the three and twelve months ended

December 31, 2016

, respectively, from

$59.2 million

and $

239.0 million

in the comparable periods in

2015

.

|

|

•

|

Revenue from our Business segment decreased

6%

and

8%

to $

51.9 million

and $

206.5 million

in the three and twelve months ended

December 31, 2016

, respectively, from $

55.2 million

and $

223.8 million

in the comparable periods in

2015

.

|

|

•

|

Gross profit margin increased to

73%

and

72%

in the three and twelve months ended

December 31, 2016

from

70%

and

71%

in the comparable periods in

2015

.

|

|

•

|

Cost and expenses increased

4%

and decreased

3%

to $

64.4 million

and $

242.2 million

in the three and twelve months ended

December 31, 2016

, respectively, from $

61.6 million

and $

249.4 million

in the comparable periods in

2015

.

|

|

•

|

Net loss decreased to $

9.6 million

and $

25.9 million

in the three and twelve months ended

December 31, 2016

, respectively, from net loss of

$20.9 million

and

$26.4 million

for the three and twelve months ended

December 31, 2015

, respectively.

|

|

•

|

Trailing-twelve-month average revenue per enterprise and mid-market customer was greater than $200,000 in 2016, as compared to $197,000 in 2015. The trailing-twelve-month revenue figures are pro forma to exclude contributions from a previously disclosed customer contract that ended in the second quarter of 2015.

|

|

•

|

Customer renewal rate for enterprise and mid-market customers was 83% and 84% over the trailing twelve months ended

December 31, 2016

and

2015

, respectively.

|

|

•

|

compensation costs relating to employees who provide customer support and implementation services to our customers;

|

|

•

|

outside labor provider costs;

|

|

•

|

compensation costs relating to our network support staff;

|

|

•

|

depreciation of certain hardware and software;

|

|

•

|

allocated occupancy costs and related overhead;

|

|

•

|

the cost of supporting our infrastructure, including expenses related to server leases, infrastructure support costs and Internet connectivity;

|

|

•

|

the credit card fees and related payment processing costs associated with the consumer and SMB services; and

|

|

•

|

amortization of certain intangibles.

|

|

|

2016

|

2015

|

2014

|

|||||||||

|

Stock-based compensation expense

|

$

|

9,736

|

|

$

|

11,814

|

|

$

|

12,306

|

|

|||

|

Year Ended December 31,

|

||||||||

|

2016

|

2015

|

2014

|

||||||

|

(as a percentage of revenue)

|

||||||||

|

Consolidated Statements of Operations Data:

(1)

|

||||||||

|

Revenue

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

Costs and expenses:

|

|

|

|

|

|

|||

|

Cost of revenue

|

28

|

%

|

29

|

%

|

25

|

%

|

||

|

Sales and marketing

|

40

|

%

|

40

|

%

|

40

|

%

|

||

|

General and administrative

|

19

|

%

|

16

|

%

|

19

|

%

|

||

|

Product development

|

18

|

%

|

16

|

%

|

18

|

%

|

||

|

Restructuring costs

|

1

|

%

|

1

|

%

|

—

|

%

|

||

|

Amortization of purchased intangibles

|

2

|

%

|

2

|

%

|

1

|

%

|

||

|

Total costs and expenses

|

109

|

%

|

104

|

%

|

102

|

%

|

||

|

Loss from operations

|

(9

|

)%

|

(4

|

)%

|

(2

|

)%

|

||

|

Other (expense) income, net

|

—

|

%

|

—

|

%

|

—

|

%

|

||

|

Loss before provision for income taxes

|

(9

|

)%

|

(4

|

)%

|

(3

|

)%

|

||

|

Provision for income taxes

|

3

|

%

|

7

|

%

|

1

|

%

|

||

|

Net loss

|

(12

|

)%

|

(11

|

)%

|

(4

|

)%

|

||

|

(1)

Certain items may not total due to rounding.

|

||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

(in thousands)

|

(in thousands)

|

||||||||||||||||||||

|

Revenue by Segment:

|

|||||||||||||||||||||

|

Business

|

$

|

206,521

|

|

$

|

223,803

|

|

(8

|

)%

|

$

|

223,803

|

|

$

|

193,302

|

|

16

|

%

|

|||||

|

Consumer

|

16,258

|

|

15,209

|

|

7

|

%

|

15,209

|

|

16,629

|

|

(9

|

)%

|

|||||||||

|

Total

|

$

|

222,779

|

|

$

|

239,012

|

|

(7

|

)%

|

$

|

239,012

|

|

$

|

209,931

|

|

14

|

%

|

|||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Cost of revenue - Business

|

$

|

60,352

|

|

$

|

67,901

|

|

(11

|

)%

|

$

|

67,901

|

|

$

|

50,192

|

|

35

|

%

|

|||||

|

Percentage of total revenue

|

27

|

%

|

28

|

%

|

28

|

%

|

24

|

%

|

|||||||||||||

|

Headcount (at period end)

|

236

|

|

286

|

|

(17

|

)%

|

286

|

|

301

|

|

(5

|

)%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Cost of revenue - Consumer

|

$

|

2,809

|

|

$

|

2,409

|

|

17

|

%

|

$

|

2,409

|

|

$

|

2,511

|

|

(4

|

)%

|

|||||

|

Percentage of total revenue

|

1

|

%

|

1

|

%

|

1

|

%

|

1

|

%

|

|||||||||||||

|

Headcount (at period end)

|

16

|

|

17

|

|

(6

|

)%

|

17

|

|

16

|

|

6

|

%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Sales and Marketing - Business

|

$

|

82,063

|

|

$

|

87,975

|

|

(7

|

)%

|

$

|

87,975

|

|

$

|

77,118

|

|

14

|

%

|

|||||

|

Percentage of total revenue

|

37

|

%

|

37

|

%

|

37

|

%

|

37

|

%

|

|||||||||||||

|

Headcount (at period end)

|

310

|

|

324

|

|

(4

|

)%

|

324

|

|

355

|

|

(9

|

)%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Sales and Marketing - Consumer

|

$

|

7,466

|

|

$

|

6,753

|

|

11

|

%

|

$

|

6,753

|

|

$

|

6,135

|

|

10

|

%

|

|||||

|

Percentage of total revenue

|

3

|

%

|

3

|

%

|

3

|

%

|

3

|

%

|

|||||||||||||

|

Headcount (at period end)

|

11

|

|

9

|

|

22

|

%

|

9

|

|

8

|

|

13

|

%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

General and administrative

|

$

|

43,046

|

|

$

|

37,171

|

|

16

|

%

|

$

|

37,171

|

|

$

|

40,192

|

|

(8

|

)%

|

|||||

|

Percentage of total revenue

|

19

|

%

|

16

|

%

|

16

|

%

|

19

|

%

|

|||||||||||||

|

Headcount (at period end)

|

112

|

|

115

|

|

(3

|

)%

|

115

|

|

125

|

|

(8

|

)%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Product development

|

$

|

40,198

|

|

$

|

38,974

|

|

3

|

%

|

$

|

38,974

|

|

$

|

37,329

|

|

4

|

%

|

|||||

|

Percentage of total revenue

|

18

|

%

|

16

|

%

|

16

|

%

|

18

|

%

|

|||||||||||||

|

Headcount (at period end)

|

300

|

|

253

|

|

19

|

%

|

253

|

|

253

|

|

—

|

%

|

|||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Restructuring Costs

|

$

|

2,369

|

|

$

|

3,384

|

|

(30

|

)%

|

$

|

3,384

|

|

$

|

—

|

|

100

|

%

|

|||||

|

Percentage of total revenue

|

1

|

%

|

1

|

%

|

1

|

%

|

—

|

%

|

|||||||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Amortization of purchased intangibles

|

$

|

3,885

|

|

$

|

4,873

|

|

(20

|

)%

|

$

|

4,873

|

|

$

|

1,621

|

|

201

|

%

|

|||||

|

Percentage of total revenue

|

2

|

%

|

2

|

%

|

2

|

%

|

1

|

%

|

|||||||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Other (expense) income, net

|

$

|

(530

|

)

|

$

|

(202

|

)

|

162

|

%

|

$

|

(202

|

)

|

$

|

(322

|

)

|

(37

|

)%

|

|||||

|

Year Ended December 31,

|

Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

% Change

|

2015

|

2014

|

% Change

|

||||||||||||||||

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||||||||

|

Provision for income taxes

|

$

|

5,934

|

|

$

|

15,814

|

|

(62

|

)%

|

$

|

15,814

|

|

$

|

1,859

|

|

751

|

%

|

|||||

|

For the Three Months Ended

|

|||||||||||||||||||||||||||||||

|

Dec. 31, 2016

|

Sept. 30,

2016 |

June 30,

2016 |

March 31,

2016 |

Dec. 31, 2015

|

Sept. 30,

2015 |

June 30,

2015 |

March 31,

2015 |

||||||||||||||||||||||||

|

(in thousands, except share and per share data)

|

|||||||||||||||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

|||||||||||||||||||||||||||||||

|

Revenue

|

$

|

56,118

|

|

$

|

54,518

|

|

$

|

56,679

|

|

$

|

55,464

|

|

$

|

59,151

|

|

$

|

60,757

|

|

$

|

59,334

|

|

$

|

59,770

|

|

|||||||

|

Costs and Expenses:

|

|||||||||||||||||||||||||||||||

|

Cost of revenue

|

14,952

|

|

14,837

|

|

17,508

|

|

15,864

|

|

17,779

|

|

18,225

|

|

(1)

|

18,052

|

|

(1)

|

16,254

|

|

|||||||||||||

|

Sales and marketing

|

21,698

|

|

22,067

|

|

23,088

|

|

22,676

|

|

22,766

|

|

23,286

|

|

24,382

|

|

24,294

|

|

|||||||||||||||

|

General and administrative

|

13,287

|

|

10,069

|

|

10,161

|

|

9,529

|

|

10,014

|

|

6,587

|

|

(1)

|

10,306

|

|

(1)

|

10,164

|

|

|||||||||||||

|

Product development

|

10,770

|

|

9,495

|

|

10,719

|

|

9,214

|

|

9,498

|

|

9,567

|

|

10,109

|

|

9,800

|

|

|||||||||||||||

|

Restructuring costs

|

2,753

|

|

(384

|

)

|

—

|

|

—

|

|

396

|

|

—

|

|

2,988

|

|

—

|

|

|||||||||||||||

|

Amortization of purchased intangibles

|

931

|

|

1,013

|

|

1,017

|

|

924

|

|

1,189

|

|

1,193

|

|

1,178

|

|

1,313

|

|

|||||||||||||||

|

Total costs and expenses

|

64,391

|

|

57,097

|

|

62,493

|

|

58,207

|

|

61,642

|

|

58,858

|

|

67,015

|

|

61,825

|

|

|||||||||||||||

|

(Loss) income from operations

|

(8,273

|

)

|

(2,579

|

)

|

(5,814

|

)

|

(2,743

|

)

|

(2,491

|

)

|

1,899

|

|

(7,681

|

)

|

(2,055

|

)

|

|||||||||||||||

|

Other income (expense) income

|

(395

|

)

|

(123

|

)

|

(646

|

)

|

634

|

|

169

|

|

(369

|

)

|

229

|

|

(231

|

)

|

|||||||||||||||

|

(Loss) income before provision for (benefit from) income taxes

|

(8,668

|

)

|

(2,702

|

)

|

(6,460

|

)

|

(2,109

|

)

|

(2,322

|

)

|

1,530

|

|

(7,452

|

)

|

(2,286

|

)

|

|||||||||||||||

|

Provision for (benefit from) income taxes

|

897

|

|

3,177

|

|

1,306

|

|

554

|

|

18,535

|

|

(395

|

)

|

(2,098

|

)

|

(228

|

)

|

|||||||||||||||

|

Net (loss) income

|

$

|

(9,565

|

)

|

$

|

(5,879

|

)

|

$

|

(7,766

|

)

|

$

|

(2,663

|

)

|

$

|

(20,857

|

)

|

$

|

1,925

|

|

$

|

(5,354

|

)

|

$

|

(2,058

|

)

|

|||||||

|

Net (loss) income per share of common stock:

|

|||||||||||||||||||||||||||||||

|

Basic

|

(0.17

|

)

|

(0.10

|

)

|

(0.14

|

)

|

(0.05

|

)

|

(0.37

|

)

|

0.03

|

|

(0.09

|

)

|

(0.04

|

)

|

|||||||||||||||

|

Diluted

|

(0.17

|

)

|

(0.10

|

)

|

(0.14

|

)

|

(0.05

|

)

|

(0.37

|

)

|

0.03

|

|

(0.09

|

)

|

(0.04

|

)

|

|||||||||||||||

|

Weighted-average shares used to compute net (loss) income per share

|

|||||||||||||||||||||||||||||||

|

Basic

|

55,861,872

|

|

56,047,645

|

|

55,965,525

|

|

56,386,003

|

|

56,497,544

|

|

56,525,647

|

|

56,491,989

|

|

56,291,383

|

|

|||||||||||||||

|

Diluted

|

55,861,872

|

|

56,047,645

|

|

55,965,525

|

|

56,386,003

|

|

56,497,544

|

|

57,084,437

|

|

56,491,989

|

|

56,291,383

|

|

|||||||||||||||

|

December 31,

|

|||||||

|

2016

|

2015

|

||||||

|

(in thousands)

|

|||||||

|

Consolidated Statements of Cash Flows Data:

|

|||||||

|

Cash flows provided by operating activities

|

$

|

24,560

|

|

$

|

21,831

|

|

|

|

Cash flows used in investing activities

|

(11,452

|

)

|

(18,539

|

)

|

|||

|

Cash flows used in financing activities

|

(7,068

|

)

|

(1,887

|

)

|

|||

|

Payments Due by Period

|

|||||||||||||||||||

|

Contractual Obligations

|

Total

|

Less Than

1 Year

|

1 – 3 Years

|

3 – 5 Years

|

More Than

5 Years

|

||||||||||||||

|

Operating leases

|

$

|

28,574

|

|

$

|

8,889

|

|

$

|

13,953

|

|

$

|

2,914

|

|

$

|

2,818

|

|

||||

|

Total

|

$

|

28,574

|

|

$

|

8,889

|

|

$

|

13,953

|

|

$

|

2,914

|

|

$

|

2,818

|

|

||||

|

Page

|

|

|

Report of BDO USA, LLP, Independent Registered Public Accounting Firm

|

|

|

Consolidated Balance Sheets as of December 31, 2016 and 2015

|

|

|

Consolidated Statements of Operations for each of the years ended December 31, 2016, 2015 and 2014

|

|

|

Consolidated Statements of Comprehensive Loss for each of the years ended December 31, 2016, 2015 and 2014

|

|

|

Consolidated Statements of Stockholders’ Equity for each of the years ended December 31, 2016, 2015 and 2014

|

|

|

Consolidated Statements of Cash Flows for each of the years ended December 31, 2016, 2015 and 2014

|

|

|

Notes to Consolidated Financial Statements

|

|

|

December 31,

|

|||||||

|

2016

|

2015

|

||||||

|

ASSETS

|

|||||||

|

CURRENT ASSETS:

|

|||||||

|

Cash and cash equivalents

|

$

|

50,889

|

|

$

|

48,803

|

|

|

|

Cash held as collateral

|

3,962

|

|

5,409

|

|

|||

|

Accounts receivable, net of allowance for doubtful accounts of $1,732 and $1,184, in 2016 and 2015, respectively

|

31,823

|

|

30,388

|

|

|||

|

Prepaid expenses and other current assets

|

5,477

|

|

9,327

|

|

|||

|

Deferred tax assets, net

|

—

|

|

455

|

|

|||

|

Total current assets

|

92,151

|

|

94,382

|

|

|||

|

Property and equipment, net

|

28,397

|

|

24,129

|

|

|||

|

Intangibles, net

|

16,510

|

|

24,619

|

|

|||

|

Goodwill

|

80,245

|

|

80,322

|

|

|||

|

Deferred tax assets, net

|

773

|

|

785

|

|

|||

|

Other assets

|

1,562

|

|

1,957

|

|

|||

|

Total assets

|

$

|

219,638

|

|

$

|

226,194

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

CURRENT LIABILITIES:

|

|||||||

|

Accounts payable

|

$

|

7,288

|

|

$

|

7,102

|

|

|

|

Accrued expenses and other current liabilities

|

40,250

|

|

34,296

|

|

|||

|

Deferred revenue

|

27,145

|

|

13,862

|

|

|||

|

Total current liabilities

|

74,683

|

|

55,260

|

|

|||

|

Other liabilities

|

3,147

|

|

3,270

|

|

|||

|

Deferred tax liability

|

3,332

|

|

2,359

|

|

|||

|

Total liabilities

|

81,162

|

|

60,889

|

|

|||

|

Commitments and contingencies (See Note 10)

|

|

|

|

|

|||

|

STOCKHOLDERS' EQUITY:

|

|||||||

|

Common stock

|

58

|

|

57

|

|

|||

|

Additional paid-in capital

|

289,524

|

|

286,856

|

|

|||

|

Treasury stock

|

(2

|

)

|

(1

|

)

|

|||

|

Accumulated deficit

|

(144,944

|

)

|

(119,071

|

)

|

|||

|

Accumulated other comprehensive loss

|

(6,160

|

)

|

(2,536

|

)

|

|||

|

Total stockholders’ equity

|

138,476

|

|

165,305

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

219,638

|

|

$

|

226,194

|

|

|

|

Year Ended December 31,

|

|||||||||||

|

2016

|

2015

|

2014

|

|||||||||

|

Revenue

|

$

|

222,779

|

|

$

|

239,012

|

|

$

|

209,931

|

|

||

|

Costs and expenses: