|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WISCONSIN

|

39-1672779

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

100 MANPOWER PLACE, MILWAUKEE, WISCONSIN

|

53212

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Name of Exchange on which registered

|

|

Common Stock, $.01 par value

|

New York Stock Exchange

|

|

Large accelerated filer

x

|

Accelerated filer

□

|

Non-accelerated filer

□

|

|

Smaller reporting company

□

|

Emerging growth company

□

|

|

|

Page Number

|

||

|

•

|

Recruitment and Assessment

– By leveraging our trusted brands, industry knowledge and expertise, we identify the right talent in the right place to help our clients quickly access the people they need when they need them. Through our industry-leading assessments, we help people and organizations understand their strengths and potential, resulting in better job matches, higher retention and a stronger workforce.

|

|

•

|

Training and Development

– Our unique insights into evolving employer needs and our expertise in training and development help us prepare candidates and associates to succeed in today’s competitive marketplace. We offer an extensive portfolio of training courses and leadership development solutions that help clients maximize talent and optimize performance.

|

|

•

|

Career Management

– We help individuals manage their career journey through outplacement services and targeted skills development. By helping individuals and organizations manage workforce transitions and career changes we unleash human potential.

|

|

•

|

Outsourcing

– We provide clients with outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives that are outcome-based, thereby sharing in the risk and reward with our clients.

|

|

•

|

Workforce Consulting

– We help clients create and align their workforce strategy to achieve their business strategy, increase business agility and flexibility, and accelerate personal and business success.

|

|

•

|

Manpower

– We are a global leader in contingent staffing and permanent recruitment. We provide businesses with rapid access to a highly qualified and productive pool of candidates to give them the flexibility and agility they need to respond to changing business needs.

|

|

•

|

Experis

– We are a global leader in professional resourcing and project-based solutions. With operations in over

50

countries and territories, we delivered

71 million

hours of professional talent in

2018

specializing in Information Technology (IT), Engineering, and Finance.

|

|

•

|

Right Management

– We are global career experts dedicated to helping organizations and individuals become more agile and market-ready. By leveraging our expertise in assessment, development and coaching, we provide tailored solutions that deliver organizational efficiency, individual development, and career mobility, to increase productivity and optimize business performance.

|

|

•

|

ManpowerGroup Solutions

– We are a global leader in outsourcing services for large-scale recruiting. We are the world’s largest Recruitment Process Outsourcing (RPO) and our TAPFIN - Managed Service Provider (MSP) business is continually ranked as a top global MSP alongside our Talent Based Outsourcing (TBO). Our Proservia brand is a recognized leader within the Digital Services market and IT Infrastructure sector throughout Europe, specializing in infrastructure management and end-user support.

|

|

•

|

the charters of the Audit, Executive Compensation and Human Resources and Nominating and Governance Committees of the Board of Directors;

|

|

•

|

volatile or uncertain economic conditions;

|

|

•

|

any economic recovery may be short-lived and uneven, and may not result in increased demand for our services;

|

|

•

|

inability to timely respond to the needs of our clients;

|

|

•

|

competition in the worldwide employment services industry limiting our ability to maintain or increase market share or profitability;

|

|

•

|

inability to effectively implement our business strategy or achieve our objectives;

|

|

•

|

cyberattack or improper disclosure or loss of sensitive or confidential company, employee, associate or client data, including personal data;

|

|

•

|

disruption and increased costs from outsourcing various aspects of our business;

|

|

•

|

foreign currency fluctuations;

|

|

•

|

a loss or reduction in revenues from one or more large clients;

|

|

•

|

inability to meet our working capital needs;

|

|

•

|

challenges meeting contractual obligations if we or third parties fail to deliver on performance commitments;

|

|

•

|

failure to keep pace with technological change and marketplace demand in the development and implementation of our services and solutions;

|

|

•

|

failure to implement strategic technology investments;

|

|

•

|

loss of key personnel;

|

|

•

|

competition in labor markets limiting our ability to attract, train and retain the personnel necessary to meet our clients’ staffing needs;

|

|

•

|

political unrest, natural disasters, health crises, infrastructure disruptions, and other risks beyond our control;

|

|

•

|

failure to comply with the legal regulations in places we do business or the regulatory prohibition or restriction of employment services or the imposition of additional licensing or tax requirements;

|

|

•

|

failure to comply with anti-corruption and bribery laws;

|

|

•

|

employment-related legal claims from clients or third parties;

|

|

•

|

liability resulting from competition law;

|

|

•

|

our ability to preserve our reputation in the marketplace;

|

|

•

|

changes in client attitudes toward the use of our services;

|

|

•

|

inability to maintain effective internal controls;

|

|

•

|

costs or disruptions resulting from acquisitions we complete;

|

|

•

|

limited ability to protect our thought leadership and other intellectual property;

|

|

•

|

material adverse effects on our operating flexibility resulting from our debt levels;

|

|

•

|

failure to comply with restrictive covenants under our revolving credit facilities and other debt instruments;

|

|

•

|

inability to obtain credit on terms acceptable to us or at all;

|

|

•

|

the performance of our subsidiaries and their ability to distribute cash to our parent company, ManpowerGroup, may vary;

|

|

•

|

inability to secure guarantees or letters of credit on acceptable terms;

|

|

•

|

changes in tax legislation;

|

|

•

|

fluctuation of our stock price;

|

|

•

|

provisions under Wisconsin law and our articles of incorporation and bylaws could make the takeover of our Company more difficult;

|

|

•

|

the risk factors disclosed below; and

|

|

•

|

other factors that may be disclosed from time to time in our SEC filings or otherwise.

|

|

•

|

create additional regulations that prohibit or restrict the types of employment services that we currently provide;

|

|

•

|

require new or additional benefits be paid to our associates;

|

|

•

|

require us to obtain additional licensing to provide employment services; or

|

|

•

|

increase taxes, such as sales or value-added taxes.

|

|

•

|

claims by our associates of discrimination or harassment directed at them, including claims relating to actions of our clients;

|

|

•

|

claims by our associates of wrongful termination or retaliation;

|

|

•

|

claims arising out of the actions or inactions of our associates, including matters for which we may have indemnified a client;

|

|

•

|

claims arising from violations of employment rights related to employment screening or privacy issues;

|

|

•

|

claims related to classification of workers as employees or independent contractors;

|

|

•

|

claims related to the employment of undocumented or illegal workers;

|

|

•

|

payment of workers’ compensation claims and other similar claims;

|

|

•

|

violations of employee pay and benefits requirements such as violations of wage and hour requirements;

|

|

•

|

entitlement to employee benefits, including healthcare coverage;

|

|

•

|

errors and omissions of our associates and other individuals working on our behalf in performing their jobs, such as accountants, IT professionals, engineers and other technical workers; and

|

|

•

|

claims by our clients relating to our associates’ misuse of clients’ proprietary information, misappropriation of funds, other criminal activity or torts or other similar claims.

|

|

•

|

difficulties in the assimilation of the operations, financial reporting, services and corporate culture of acquired companies;

|

|

•

|

failure of any companies or assets that we acquire, or joint ventures that we form, to meet performance expectations, which could trigger payment obligations;

|

|

•

|

over-valuation by us of any companies or assets that we acquire, or joint ventures that we form;

|

|

•

|

disputes that arise with sellers;

|

|

•

|

failure to effectively monitor compliance with corporate policies as well as regulatory requirements;

|

|

•

|

insufficient indemnification from the selling parties for liabilities incurred by the acquired companies prior to the acquisitions; and

|

|

•

|

diversion of management’s attention from other business concerns.

|

|

•

|

we may not be able to obtain additional debt financing for future working capital, capital expenditures, significant acquisition opportunities, or other corporate purposes or may have to pay more for such financing;

|

|

•

|

borrowings under our revolving credit facilities are at a variable interest rate, making us more vulnerable to increases in interest rates; and

|

|

•

|

we could be less able to take advantage of significant business opportunities and to react to changes in market or industry conditions.

|

|

•

|

changes in general economic conditions; and

|

|

•

|

actual or anticipated variations in our quarterly operating results;

|

|

•

|

announcement of new services by us or our competitors;

|

|

•

|

announcements relating to strategic relationships or acquisitions;

|

|

•

|

changes in financial estimates or other statements by securities analysts; and

|

|

•

|

changes in investor sentiment regarding the company arising from these or other events, or the economy in general.

|

|

•

|

permitting removal of directors only for cause;

|

|

•

|

providing that vacancies on the board of directors will be filled by the remaining directors then in office; and

|

|

•

|

requiring advance notice for shareholder proposals and director nominees.

|

|

Name of Officer

|

Office

|

|

|

|

|

Jonas Prising

Age 54

|

Chairman of ManpowerGroup as of December 31, 2015. Chief Executive Officer of ManpowerGroup since May 2014. ManpowerGroup President from November 2012 to May 2014. Executive Vice President, President of ManpowerGroup - the Americas from January 2009 to October 2012. Executive Vice President, President – United States and Canadian Operations from January 2006 to December 2008. A director of ManpowerGroup since May 2014. An employee of ManpowerGroup since May 1999. A director of Kohl's Corporation since August 2015.

|

|

|

|

|

John T. McGinnis

Age 52

|

Executive Vice President, Chief Financial Officer of ManpowerGroup since February 2016. Global Controller of Morgan Stanley from January 2014 to February 2016. Chief Financial Officer, HSBC North America from July 2012 to January 2014. Chief Financial Officer, HSBC Bank USA from July 2010 to January 2014. An employee of ManpowerGroup since February 2016.

|

|

Mara E. Swan

Age 59

|

Executive Vice President - Global Strategy and Talent since January 2009. Senior Vice President of Global Human Resources from August 2005 to December 2008. An employee of ManpowerGroup since August 2005. A director of GOJO Industries since November 2012.

|

|

|

|

|

Sriram “Ram” Chandrashekar

Age 52

|

Executive Vice President, Operational Excellence, Technology and Transformation since December 2018. Executive Vice President, Operational Excellence & IT, and President of Asia Pacific Middle East Region from February 2014 to December 2018. Senior Vice President of Operational Excellence and IT from October 2012 to February 2014. Chief Operating Officer of Asia Pacific Middle East Region from April 2008 to October 2012. An employee of ManpowerGroup since April 2008.

|

|

|

|

|

Richard D. Buchband

Age 55

|

Senior Vice President, General Counsel and Secretary of ManpowerGroup since January 2013. Prior to joining ManpowerGroup, a partner and Associate General Counsel for Accenture plc from 2006 to 2011. An employee of ManpowerGroup since January 2013.

|

|

|

|

|

(a)

|

preparation and/or review of tax returns, including sales and use tax, excise tax, income tax, local tax, property tax, and value-added tax;

|

|

(b)

|

advice and assistance with respect to transfer pricing matters, as well as communicating with various taxing authorities regarding the requirements associated with royalties and inter-company pricing, and tax audits; and

|

|

(c)

|

audit services with respect to certain procedures and certifications where required.

|

|

|

Total number of

shares purchased

|

Average

price paid

per share

|

Total number of

shares purchased

as part of publicly

announced plan or programs

|

Maximum

number of shares

that may yet be

purchased under the plan or programs

|

|||||||||

|

October 1 - 31, 2018

|

946,376

|

|

$

|

77.56

|

|

946,376

|

|

4,769,198

|

|

||||

|

November 1 - 30, 2018

|

1,621,209

|

|

(1)

|

78.99

|

|

1,620,405

|

|

3,148,793

|

|

||||

|

December 1 - 31, 2018

|

—

|

|

—

|

|

—

|

|

3,148,793

|

|

|||||

|

Total

|

2,567,585

|

|

$

|

78.47

|

|

2,566,781

|

|

3,148,793

|

|

||||

|

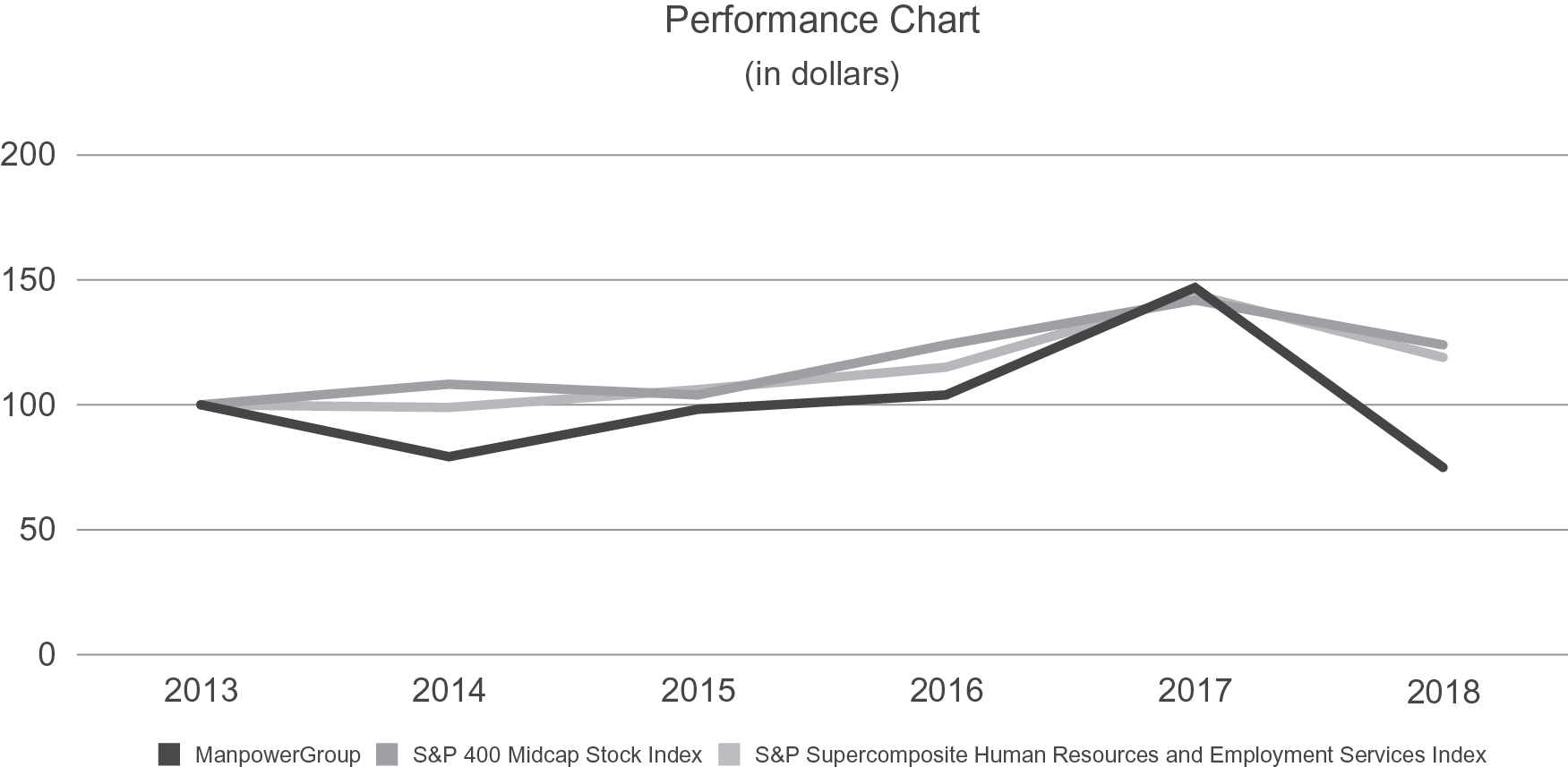

December 31

|

2013

|

|

2014

|

|

2015

|

|

2016

|

|

2017

|

|

2018

|

|

||||||

|

ManpowerGroup

|

$

|

100

|

|

$

|

79

|

|

$

|

98

|

|

$

|

104

|

|

$

|

147

|

|

$

|

75

|

|

|

S&P 400 Midcap Stock Index

|

100

|

|

108

|

|

104

|

|

124

|

|

142

|

|

124

|

|

||||||

|

S&P Supercomposite Human Resources and Employment Services Index

|

100

|

|

99

|

|

106

|

|

115

|

|

144

|

|

119

|

|

||||||

|

As of and for the Year Ended December 31

|

|||||||||||||||

|

(in millions, except per share data)

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Operations Data

|

|||||||||||||||

|

Revenues from services

|

$

|

21,991.2

|

|

$

|

21,034.3

|

|

$

|

19,654.1

|

|

$

|

19,329.9

|

|

$

|

20,762.8

|

|

|

Gross profit

|

3,579.0

|

|

3,484.6

|

|

3,333.8

|

|

3,295.8

|

|

3,488.2

|

|

|||||

|

Operating profit

(1)

|

796.7

|

|

789.2

|

|

745.5

|

|

693.1

|

|

724.3

|

|

|||||

|

Net earnings

|

556.7

|

|

545.4

|

|

443.7

|

|

419.2

|

|

427.6

|

|

|||||

|

Per Share Data

|

|||||||||||||||

|

Net earnings — basic

|

$

|

8.62

|

|

$

|

8.13

|

|

$

|

6.33

|

|

$

|

5.46

|

|

$

|

5.38

|

|

|

Net earnings — diluted

|

8.56

|

|

8.04

|

|

6.27

|

|

5.40

|

|

5.30

|

|

|||||

|

Dividends

|

2.02

|

|

1.86

|

|

1.72

|

|

1.60

|

|

0.98

|

|

|||||

|

Balance Sheet Data

|

|||||||||||||||

|

Total assets

|

$

|

8,519.8

|

|

$

|

8,883.6

|

|

$

|

7,574.2

|

|

$

|

7,517.5

|

|

$

|

7,181.2

|

|

|

Long-term debt

|

1,075.4

|

|

478.1

|

|

785.6

|

|

810.9

|

|

422.6

|

|

|||||

|

(in millions, except per share data)

|

2018

|

|

2017

|

|

Reported

Variance

|

|

Variance in

Constant

Currency

|

|

Variance in

Organic Constant

Currency

|

|

||

|

Revenues from services

|

$

|

21,991.2

|

|

$

|

21,034.3

|

|

4.5

|

%

|

2.5

|

%

|

2.2

|

%

|

|

Cost of services

|

18,412.2

|

|

17,549.7

|

|

4.9

|

|

2.8

|

|

||||

|

Gross profit

|

3,579.0

|

|

3,484.6

|

|

2.7

|

|

0.9

|

|

0.5

|

|

||

|

Gross profit margin

|

16.3

|

%

|

16.6

|

%

|

||||||||

|

Selling and administrative expenses

|

2,782.3

|

|

2,695.4

|

|

3.2

|

|

1.3

|

|

1.0

|

|

||

|

Selling and administrative expenses as a % of revenues

|

12.7

|

%

|

12.8

|

%

|

||||||||

|

Operating profit

|

796.7

|

|

789.2

|

|

0.9

|

|

(0.4

|

)

|

(1.2

|

)

|

||

|

Operating profit margin

|

3.6

|

%

|

3.8

|

%

|

||||||||

|

Net interest expense

|

41.0

|

|

44.6

|

|

||||||||

|

Other expenses

|

1.0

|

|

7.3

|

|

||||||||

|

Earnings before income taxes

|

754.7

|

|

737.3

|

|

2.4

|

|

1.1

|

|

||||

|

Provision for income taxes

|

198.0

|

|

191.9

|

|

3.2

|

|

||||||

|

Effective income tax rate

|

26.2

|

%

|

26.0

|

%

|

||||||||

|

Net earnings

|

$

|

556.7

|

|

$

|

545.4

|

|

2.1

|

|

1.1

|

|

|

|

|

Net earnings per share — diluted

|

$

|

8.56

|

|

$

|

8.04

|

|

6.5

|

|

5.5

|

|

|

|

|

Weighted average shares — diluted

|

65.1

|

|

67.9

|

|

(4.1

|

)%

|

||||||

|

•

|

increased demand for services in several of our markets within Southern Europe and Northern Europe, where revenues increased

8.3%

(

4.0%

in constant currency) and

1.2%

(

-2.0%

in constant currency), respectively. This included a revenue increase in France of

6.4%

(

1.9%

in constant currency), primarily due to strong growth in our large client accounts within the staffing market and a

14.5%

increase (

9.1%

in constant currency) in the permanent recruitment business. The Southern Europe increase also included an increase in Italy of

13.2%

(

8.3%

in constant currency) due to increased demand for our Manpower staffing services and a

15.9%

increase (

10.6%

in constant currency) in the permanent recruitment business. We also experienced revenue growth in the Nordics, Spain and Belgium of

0.3%

,

9.0%

and

6.5%

, respectively (

0.1%

,

4.4%

, and

2.0%

, respectively, in constant currency;

2.5%

, in organic constant currency in Spain). Lastly, we experienced revenue growth in the United Kingdom and the Netherlands of

3.2%

and

0.4%

, respectively, while revenues decreased

0.4%

and

4.2%

, respectively, in constant currency;

|

|

•

|

a revenue increase in APME of

9.6%

(

9.4%

in constant currency and

8.7%

in organic constant currency) primarily due to an increase in our staffing/interim revenues and a

9.9%

increase (

10.2%

in constant currency) in our permanent recruitment business;

|

|

•

|

our acquisitions in the Americas, Southern Europe, and APME, which added approximately

0.3%

revenue growth to our consolidated results;

|

|

•

|

a 2.0% increase due to the impact of changes in currency exchange rates; and

|

|

•

|

the favorable impact of approximately 0.4% as reported and in constant currency due to one additional billing day in the year; partially offset by

|

|

•

|

a revenue decrease in the United States of

5.1%

primarily driven by a decline in our Experis interim services, specifically within the IT sector because of decreased demand from larger clients, a decline in our Manpower staffing services due to reduced demand from certain clients, and a

3.2%

decrease in the permanent recruitment business; and

|

|

•

|

decreased demand for services at Right Management, where revenues decreased

8.5%

(

-9.4%

in constant currency), including a

10.3%

decrease (

-11.3%

in constant currency) in our outplacement services as well as a

2.9%

decrease (

-3.3%

in constant currency) in our talent management business.

|

|

•

|

a 30 basis point (-0.30%) unfavorable impact from the decline in our staffing/interim margin due to the decrease

in the CICE payroll tax credit rate in France and the loss of the December 2018 CICE subsidy as a result of the transition from the CICE program to a new subsidy program in January 2019

and business mix changes in various countries, partially offset by favorable direct costs adjustments in 2018, primarily in France and Japan.; and

|

|

•

|

a 10 basis point (-0.10%)

unfavorable impact from decreased demand in our outplacement business at Right Management; partially offset by

|

|

•

|

a 10 basis point (0.10%) favorable impact from the

8.4%

(

6.9%

in constant currency) increase in our permanent recruitment business.

|

|

•

|

a 15.5% increase (13.3% in constant currency and 13.1% in organic constant currency) in consulting costs primarily related to certain technology projects,

delivery model and other front-office centralization and back-office optimization activities

;

|

|

•

|

restructuring costs of $39.3 million incurred in 2018, comprised of $0.3 million in the Americas, $5.4 million in Southern Europe, $33.3 million in Northern Europe and $0.3 million in Right Management, compared to $34.5 million incurred in 2017, comprised of $6.3 million the Americas, $23.8 million Northern Europe, $1.4 million in APME, $2.0 million in Right Management and $1.0 million in corporate expenses;

|

|

•

|

a 1.9% increase due to the impact of changes in the currency exchange rates; and

|

|

•

|

the additional recurring selling and administrative costs of $10.0 million incurred as a result of acquisitions in the Americas, Southern Europe and APME; partially offset by

|

|

•

|

an $8.4 million decrease related to a gain from the sale of a non-core language translation business in the Netherlands; and

|

|

•

|

a 3.1% decrease (-4.9% in constant currency and -5.2% in organic constant currency) in variable incentive costs due to a decline in profitability in certain markets

.

|

|

•

|

a 10 basis point (-0.10%) favorable impact from better expense leverage as a result of our strong focus on productivity and efficiency; and

|

|

•

|

a 10 basis point (-0.10%) favorable impact due to the decrease in variable incentive costs; partially offset by

|

|

•

|

a 10 basis point (0.10%)

unfavorable impact due to the consulting costs incurred in 2018.

|

|

(in millions, except per share data)

|

2017

|

|

2016

|

|

Reported

Variance

|

|

Variance in

Constant

Currency

|

|

Variance in

Organic

Constant

Currency

|

|

||

|

Revenues from services

|

$

|

21,034.3

|

|

$

|

19,654.1

|

|

7.0

|

%

|

6.0

|

%

|

5.5

|

%

|

|

Cost of services

|

17,549.7

|

|

16,320.3

|

|

7.5

|

|

6.4

|

|

||||

|

Gross profit

|

3,484.6

|

|

3,333.8

|

|

4.5

|

|

3.6

|

|

3.1

|

|

||

|

Gross profit margin

|

16.6

|

%

|

17.0

|

%

|

||||||||

|

Selling and administrative expenses

|

2,695.4

|

|

2,588.3

|

|

4.1

|

|

3.5

|

|

2.9

|

|

||

|

Selling and administrative expenses as a % of revenues

|

12.8

|

%

|

13.2

|

%

|

||||||||

|

Operating profit

|

789.2

|

|

745.5

|

|

5.9

|

|

4.0

|

|

4.2

|

|

||

|

Operating profit margin

|

3.8

|

%

|

3.8

|

%

|

||||||||

|

Net interest expense

|

44.6

|

|

45.9

|

|

|

|

||||||

|

Other expense (income)

|

7.3

|

|

(1.7

|

)

|

|

|

||||||

|

Earnings before income taxes

|

737.3

|

|

701.3

|

|

5.1

|

|

3.5

|

|

||||

|

Provision for income taxes

|

191.9

|

|

257.6

|

|

(25.5

|

)

|

||||||

|

Effective income tax rate

|

26.0

|

%

|

36.7

|

%

|

||||||||

|

Net earnings

|

$

|

545.4

|

|

$

|

443.7

|

|

22.9

|

|

21.3

|

|

||

|

Net earnings per share — diluted

|

$

|

8.04

|

|

$

|

6.27

|

|

28.2

|

|

26.6

|

|

||

|

Weighted average shares — diluted

|

67.9

|

|

70.8

|

|

(4.2

|

)%

|

||||||

|

•

|

increased demand for services in several of our markets within Southern Europe and Northern Europe, where in constant currency revenues increased

12.7%

(

15.5%

as reported) and

3.4%

(

3.5%

as reported;

2.6%

in organic constant currency), respectively. This included a constant currency revenue increase in France of

10.6%

(

13.2%

as reported), primarily due to strong growth in our large client accounts within the staffing market and growth in our Proservia business, and an

8.3%

constant currency increase (

10.5%

as reported) in the permanent recruitment business. This increase also included a constant currency revenue increase in Italy of

23.3%

(

26.4%

as reported) due to increased demand for our Manpower staffing services and a

23.7%

constant currency increase (

26.0%

as reported) in the permanent recruitment business. We also experienced constant currency revenue growth in Germany, the Netherlands, the Nordics, Spain and Belgium of

10.1%

,

12.6%

,

6.6%

,

12.3%

, and

4.5%

, respectively (

12.5%

,

15.2%

,

7.6%

,

15.1%

and

6.8%

, respectively, as reported;

8.4%

,

5.1%

and

5.2%

, in organic constant currency in the Netherlands, the Nordics and Spain, respectively);

|

|

•

|

a revenue increase in APME of

6.4%

in constant currency (

6.7%

as reported;

6.1%

in organic constant currency) primarily due to an increase in our staffing/interim revenues, an increase in our ManpowerGroup Solutions business and a

10.8%

constant currency increase (

12.1%

as reported) in our permanent recruitment business; and

|

|

•

|

our acquisitions in Southern Europe, Northern Europe and APME, which added approximately

0.5%

revenue growth to our consolidated results on a constant currency basis; partially offset by

|

|

•

|

a revenue decrease in the United States of

6.3%

primarily driven by a decline in demand for our Manpower staffing services, mainly due to the prolonged weakness in the manufacturing sector of the economy, a decrease in our Experis interim services, specifically within the IT sector due to decreased demand at several large clients, and a decrease in our ManpowerGroup Solutions business, due to a specific client loss and roll off of certain project work;

|

|

•

|

decreased demand for services at Right Management, where revenues decreased

15.6%

in constant currency (

-15.8%

as reported), including a

14.9%

constant currency decrease (

-15.3%

as reported) in our outplacement services as well as an

18.0%

constant currency decline (

-17.6%

as reported) in our talent management business;

|

|

•

|

a 1.0% decrease due to the impact of changes in currency exchange rates; and

|

|

•

|

the unfavorable impact of approximately 0.4% in constant currency due to one fewer billing day in the year.

|

|

•

|

a 30 basis point (-0.30%) unfavorable impact from the decline in our Manpower staffing margin, particularly in France, Italy, Germany, and the Nordics, due primarily to changes in business mix; and

|

|

•

|

a 10 basis point (-0.10%) unfavorable impact from decreased demand in our outplacement business at Right Management.

|

|

•

|

restructuring costs of $34.5 million incurred in 2017, comprised of $6.3 million in the Americas, $23.8 million in Northern Europe, $1.4 million in APME, $2.0 million in Right Management and $1.0 million in corporate expenses;

|

|

•

|

a 15.8% increase in constant currency (16.8% as reported; 14.6% in organic constant currency) in consulting costs primarily related to certain technology projects and back-office and delivery-model optimization activities;

|

|

•

|

a 0.8% increase in constant currency (1.5% as reported) in organic salary-related costs, primarily because of additional headcount to support the increased demand for our services specifically in Southern Europe, Northern Europe and APME;

|

|

•

|

the additional recurring selling and administrative costs of $16.6 million incurred as a result of acquisitions in Southern Europe, Northern Europe and APME; and

|

|

•

|

a 0.6% increase due to the impact of changes in the currency exchange rates; partially offset by

|

|

•

|

a 1.1% constant currency decrease (-0.4% as reported) in other organic non-personnel related costs as a result of our strong focus on productivity and efficiency.

|

|

•

|

a 50 basis point (-0.50%) favorable impact from better expense leverage as a result of our strong focus on productivity and efficiency; and

|

|

•

|

a 10 basis point (-0.10%) decrease due to the impact on business mix of changes in currency exchange rates; partially offset by

|

|

•

|

a 20 basis point (0.20%)

unfavorable impact due to the restructuring costs noted above.

|

|

Amounts represent 2018

Percentages represent 2018 compared to 2017

|

Reported

Amount

(in millions)

|

|

Reported

Variance

|

|

Impact of

Currency

|

|

Variance in

Constant

Currency

|

|

Impact of

Acquisitions and Dispositions

(in Constant

Currency)

|

|

Organic

Constant

Currency

Variance

|

|

|

|

Revenues from Services

|

|||||||||||||

|

Americas:

|

|||||||||||||

|

United States

|

$

|

2,522.3

|

|

(5.1

|

)%

|

—

|

%

|

(5.1

|

)%

|

—

|

%

|

(5.1

|

)%

|

|

Other Americas

|

1,637.0

|

|

5.1

|

|

(7.3

|

)

|

12.4

|

|

2.5

|

|

9.9

|

|

|

|

4,159.3

|

|

(1.4

|

)

|

(2.7

|

)

|

1.3

|

|

0.9

|

|

0.4

|

|

||

|

Southern Europe:

|

|||||||||||||

|

France

|

5,827.7

|

|

6.4

|

|

4.5

|

|

1.9

|

|

—

|

|

1.9

|

|

|

|

Italy

|

1,670.6

|

|

13.2

|

|

4.9

|

|

8.3

|

|

—

|

|

8.3

|

|

|

|

Other Southern Europe

|

1,873.3

|

|

9.9

|

|

3.1

|

|

6.8

|

|

0.7

|

|

6.1

|

|

|

|

9,371.6

|

|

8.3

|

|

4.3

|

|

4.0

|

|

0.2

|

|

3.8

|

|

||

|

Northern Europe

|

5,370.5

|

|

1.2

|

|

3.2

|

|

(2.0

|

)

|

—

|

|

(2.0

|

)

|

|

|

APME

|

2,890.3

|

|

9.6

|

|

0.2

|

|

9.4

|

|

0.7

|

|

8.7

|

|

|

|

Right Management

|

199.5

|

|

(8.5

|

)

|

0.9

|

|

(9.4

|

)

|

—

|

|

(9.4

|

)

|

|

|

ManpowerGroup

|

$

|

21,991.2

|

|

4.5

|

%

|

2.0

|

%

|

2.5

|

%

|

0.3

|

%

|

2.2

|

%

|

|

Gross Profit - ManpowerGroup

|

$

|

3,579.0

|

|

2.7

|

%

|

1.8

|

%

|

0.9

|

%

|

0.4

|

%

|

0.5

|

%

|

|

Operating Unit Profit

|

|||||||||||||

|

Americas:

|

|||||||||||||

|

United States

|

$

|

130.8

|

|

(14.0

|

)%

|

—

|

%

|

(14.0

|

)%

|

—

|

%

|

(14.0

|

)%

|

|

Other Americas

|

73.1

|

|

19.6

|

|

(8.3

|

)

|

27.9

|

|

3.3

|

|

24.6

|

|

|

|

203.9

|

|

(4.4

|

)

|

(2.4

|

)

|

(2.0

|

)

|

0.9

|

|

(2.9

|

)

|

||

|

Southern Europe:

|

|||||||||||||

|

France

|

290.4

|

|

3.7

|

|

3.5

|

|

0.2

|

|

—

|

|

0.2

|

|

|

|

Italy

|

111.1

|

|

6.3

|

|

4.4

|

|

1.9

|

|

—

|

|

1.9

|

|

|

|

Other Southern Europe

|

66.1

|

|

11.1

|

|

1.2

|

|

9.9

|

|

2.1

|

|

7.8

|

|

|

|

467.6

|

|

5.3

|

|

3.4

|

|

1.9

|

|

0.3

|

|

1.6

|

|

||

|

Northern Europe

|

122.7

|

|

(12.4

|

)

|

0.4

|

|

(12.8

|

)

|

—

|

|

(12.8

|

)

|

|

|

APME

|

114.8

|

|

16.0

|

|

0.4

|

|

15.6

|

|

3.3

|

|

12.3

|

|

|

|

Right Management

|

32.8

|

|

(9.1

|

)

|

0.1

|

|

(9.2

|

)

|

—

|

|

(9.2

|

)

|

|

|

Operating Profit — ManpowerGroup

|

$

|

796.7

|

|

0.9

|

%

|

1.3

|

%

|

(0.4

|

%)

|

0.8

|

%

|

(1.2

|

%)

|

|

Amounts represent 2017

Percentages represent 2017 compared to 2016

|

Reported

Amount (in millions) |

|

Reported

Variance |

|

Impact of

Currency |

|

Variance in

Constant Currency |

|

Impact of Acquisitions and Dispositions

(in Constant Currency) |

|

Organic

Constant Currency Variance |

|

|

|

Revenues from Services

|

|||||||||||||

|

Americas:

|

|||||||||||||

|

United States

|

$

|

2,659.0

|

|

(6.3

|

)%

|

—

|

%

|

(6.3

|

)%

|

—

|

%

|

(6.3

|

)%

|

|

Other Americas

|

1,557.4

|

|

6.6

|

|

(0.5

|

)

|

7.1

|

|

—

|

|

7.1

|

|

|

|

4,216.4

|

|

(1.9

|

)

|

(0.2

|

)

|

(1.7

|

)

|

—

|

|

(1.7

|

)

|

||

|

Southern Europe:

|

|||||||||||||

|

France

|

5,477.2

|

|

13.2

|

|

2.6

|

|

10.6

|

|

—

|

|

10.6

|

|

|

|

Italy

|

1,475.9

|

|

26.4

|

|

3.1

|

|

23.3

|

|

—

|

|

23.3

|

|

|

|

Other Southern Europe

|

1,703.9

|

|

14.2

|

|

3.4

|

|

10.8

|

|

2.6

|

|

8.2

|

|

|

|

8,657.0

|

|

15.5

|

|

2.8

|

|

12.7

|

|

0.6

|

|

12.1

|

|

||

|

Northern Europe

|

5,306.4

|

|

3.5

|

|

0.1

|

|

3.4

|

|

0.8

|

|

2.6

|

|

|

|

APME

|

2,636.4

|

|

6.7

|

|

0.3

|

|

6.4

|

|

0.3

|

|

6.1

|

|

|

|

Right Management

|

218.1

|

|

(15.8

|

)

|

(0.2

|

)

|

(15.6

|

)

|

—

|

|

(15.6

|

)

|

|

|

ManpowerGroup

|

$

|

21,034.3

|

|

7.0

|

%

|

1.0

|

%

|

6.0

|

%

|

0.5

|

%

|

5.5

|

%

|

|

Gross Profit — ManpowerGroup

|

$

|

3,484.6

|

|

4.5

|

%

|

0.9

|

%

|

3.6

|

%

|

0.5

|

%

|

3.1

|

%

|

|

Operating Unit Profit

|

|||||||||||||

|

Americas:

|

|||||||||||||

|

United States

|

$

|

152.1

|

|

6.9

|

%

|

—

|

%

|

6.9

|

%

|

—

|

%

|

6.9

|

%

|

|

Other Americas

|

61.2

|

|

14.1

|

|

(0.6

|

)

|

14.7

|

|

—

|

|

14.7

|

|

|

|

213.3

|

|

8.9

|

|

(0.1

|

)

|

9.0

|

|

—

|

|

9.0

|

|

||

|

Southern Europe:

|

|||||||||||||

|

France

|

280.0

|

|

10.9

|

|

2.9

|

|

8.0

|

|

—

|

|

8.0

|

|

|

|

Italy

|

104.5

|

|

32.1

|

|

3.5

|

|

28.6

|

|

—

|

|

28.6

|

|

|

|

Other Southern Europe

|

59.4

|

|

26.0

|

|

3.1

|

|

22.9

|

|

5.2

|

|

17.7

|

|

|

|

443.9

|

|

17.2

|

|

3.0

|

|

14.2

|

|

0.7

|

|

13.5

|

|

||

|

Northern Europe

|

140.1

|

|

(15.8

|

)

|

1.9

|

|

(17.7

|

)

|

(1.9

|

)

|

(15.8

|

)

|

|

|

APME

|

98.9

|

|

11.8

|

|

(0.1

|

)

|

11.9

|

|

1.2

|

|

10.7

|

|

|

|

Right Management

|

36.0

|

|

(19.4

|

)

|

0.3

|

|

(19.7

|

)

|

—

|

|

(19.7

|

)

|

|

|

Operating Profit — ManpowerGroup

|

$

|

789.2

|

|

5.9

|

%

|

1.9

|

%

|

4.0

|

%

|

(0.2

|

)%

|

4.2

|

%

|

|

(in millions)

|

Total

|

|

2019

|

|

2020–2021

|

|

2022–2023

|

|

Thereafter

|

|

|||||

|

Long-term debt including interest

|

|

$1,140.2

|

|

|

$18.8

|

|

|

$37.5

|

|

|

$486.0

|

|

|

$597.9

|

|

|

Short-term borrowings

|

49.9

|

|

49.9

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Operating leases

|

566.8

|

|

151.4

|

|

200.7

|

|

109.1

|

|

105.6

|

|

|||||

|

Severances and other office closure costs

|

15.5

|

|

13.8

|

|

1.2

|

|

0.5

|

|

—

|

|

|||||

|

Transition tax resulting from the Tax Act

|

128.6

|

|

0.3

|

|

24.3

|

|

34.9

|

|

69.1

|

|

|||||

|

Other

|

301.2

|

|

112.8

|

|

117.2

|

|

36.8

|

|

34.4

|

|

|||||

|

|

$2,202.2

|

|

|

$347.0

|

|

|

$380.9

|

|

|

$667.3

|

|

|

$807.0

|

|

|

|

(in millions)

|

France

|

|

United States

|

|

United Kingdom

|

|

Germany

|

|

Right Management

|

|

Netherlands

|

|

||||||

|

Estimated fair values

|

|

$2,513.8

|

|

|

$1,307.2

|

|

|

$446.9

|

|

|

$431.1

|

|

|

$354.7

|

|

|

$227.6

|

|

|

Carrying values

|

1,186.7

|

808.1

|

|

372.7

|

|

363.3

|

|

143.5

|

|

138.6

|

|

|||||||

|

(in millions)

|

Amount

|

Weighted-

Average

Interest Rate

(1)

|

|||

|

Variable-rate borrowings

|

|

$49.9

|

|

8.4

|

%

|

|

Fixed-rate borrowings

|

1,025.5

|

|

1.8

|

|

|

|

Total debt

|

|

$1,075.4

|

|

2.1

|

%

|

|

Movements in Exchange Rates

|

||||||||

|

2018

(in millions)

Market Sensitive Instrument

|

10% Depreciation

|

10% Appreciation

|

||||||

|

Euro Notes:

|

||||||||

|

€500.0, 1.81% Notes due June 2026

|

|

$57.3

|

|

(1)

|

|

($57.3

|

)

|

(1)

|

|

€400.0, 1.91% Notes due September 2022

|

45.9

|

|

(1)

|

(45.9

|

)

|

(1)

|

||

|

Forward contracts:

|

||||||||

|

£3.5 to $4.5

|

(0.4

|

)

|

0.4

|

|

||||

|

€1.6 to $1.8

|

(0.2

|

)

|

0.2

|

|

||||

|

¥172.8 to $1.5

|

(0.2

|

)

|

0.2

|

|

||||

|

Movements in Exchange Rates

|

||||||||

|

2017

(in millions)

Market Sensitive Instrument |

10% Depreciation

|

10% Appreciation

|

||||||

|

Euro Notes:

|

||||||||

|

€400.0, 1.91% Notes due September 2022

|

|

$48.0

|

|

(1)

|

|

($48.0

|

)

|

(1)

|

|

€350.0, 4.51% Notes due June 2018

|

42.0

|

|

(1)

|

(42.0

|

)

|

(1)

|

||

|

Forward contracts:

|

||||||||

|

£2.9 to $3.9

|

(0.4

|

)

|

0.4

|

|

||||

|

As of December 31, 2018

Market Sensitive Instrument

(in millions)

|

10% Decrease

|

10% Increase

|

||||||

|

Euro Notes:

|

||||||||

|

€500.0, 1.81% Notes due June 2026

|

|

$57.5

|

|

(1)

|

|

($57.5

|

)

|

(1)

|

|

€400.0, 1.91% Notes due September 2022

|

47.8

|

|

(1)

|

(47.8

|

)

|

(1)

|

||

|

Forward contracts:

|

||||||||

|

£3.5 to $4.5

|

(0.4

|

)

|

0.4

|

|

||||

|

€ 1.6 to $1.8

|

(0.2

|

)

|

0.2

|

|

||||

|

¥172.8 to $1.5

|

(0.2

|

)

|

0.2

|

|

||||

|

As of December 31, 2017

Market Sensitive Instrument (in millions) |

10% Decrease

|

10% Increase

|

||||||

|

Euro Notes:

|

||||||||

|

€400.0, 1.91% Notes due September 2022

|

|

$51.0

|

|

(1)

|

|

($51.0

|

)

|

(1)

|

|

€350.0, 4.51% Notes due June 2018

|

43.0

|

|

(1)

|

(43.0

|

)

|

(1)

|

||

|

Forward contracts:

|

||||||||

|

£2.9 to $3.9

|

(0.4

|

)

|

0.4

|

|

||||

|

|

|

Page Number

|

|

Index to Consolidated Financial Statements:

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

Consolidated Statements of Operations for the years ended December 31, 2018, 2017 and 2016

|

|

|

|

Consolidated Statements of Comprehensive Income for the years ended December 31, 2018, 2017 and 2016

|

|

|

|

Consolidated Balance Sheets as of December 31, 2018 and 2017

|

|

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2018, 2017 and 2016

|

|

|

|

Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2018, 2017 and 2016

|

|

|

|

Notes to Consolidated Financial Statements

|

|

|

|

Year Ended December 31

|

2018

|

|

2017

|

|

2016

|

|

|||

|

Revenues from services

|

$

|

21,991.2

|

|

$

|

21,034.3

|

|

$

|

19,654.1

|

|

|

Cost of services

|

18,412.2

|

|

17,549.7

|

|

16,320.3

|

|

|||

|

Gross profit

|

3,579.0

|

|

3,484.6

|

|

3,333.8

|

|

|||

|

Selling and administrative expenses

|

2,782.3

|

|

2,695.4

|

|

2,588.3

|

|

|||

|

Operating profit

|

796.7

|

|

789.2

|

|

745.5

|

|

|||

|

Interest and other expenses

|

42.0

|

|

51.9

|

|

44.2

|

|

|||

|

Earnings before income taxes

|

754.7

|

|

737.3

|

|

701.3

|

|

|||

|

Provision for income taxes

|

198.0

|

|

191.9

|

|

257.6

|

|

|||

|

Net earnings

|

$

|

556.7

|

|

$

|

545.4

|

|

$

|

443.7

|

|

|

Net earnings per share — basic

|

$

|

8.62

|

|

$

|

8.13

|

|

$

|

6.33

|

|

|

Net earnings per share — diluted

|

$

|

8.56

|

|

$

|

8.04

|

|

$

|

6.27

|

|

|

Weighted average shares — basic

|

64.6

|

|

67.1

|

|

70.1

|

|

|||

|

Weighted average shares — diluted

|

65.1

|

|

67.9

|

|

70.8

|

|

|||

|

Year Ended December 31

|

2018

|

|

2017

|

|

2016

|

|

|||

|

Net earnings

|

$

|

556.7

|

|

$

|

545.4

|

|

$

|

443.7

|

|

|

Other comprehensive (loss) income:

|

|||||||||

|

Foreign currency translation

|

(135.5

|

)

|

201.4

|

|

(79.9

|

)

|

|||

|

Translation adjustments on net investment hedge, net of income taxes of $10.2, $(34.3) and $8.4, respectively

|

35.2

|

|

(64.7

|

)

|

14.8

|

|

|||

|

Translation adjustments on long-term intercompany loans

|

(8.4

|

)

|

4.9

|

|

(58.2

|

)

|

|||

|

Unrealized (loss) gain on investments, net of income taxes of $0.0, $(0.8) and $0.4, respectively

|

—

|

|

(3.3

|

)

|

1.6

|

|

|||

|

Defined benefit pension plans and retiree health care plan, net of income taxes of $4.6, $(0.1) and $(5.8), respectively

|

12.4

|

|

(0.4

|

)

|

(18.4

|

)

|

|||

|

Total other comprehensive (loss) income

|

$

|

(96.3

|

)

|

$

|

137.9

|

|

$

|

(140.1

|

)

|

|

Comprehensive income

|

$

|

460.4

|

|

$

|

683.3

|

|

$

|

303.6

|

|

|

December 31

|

2018

|

|

2017

|

|

||

|

ASSETS

|

||||||

|

Current Assets

|

||||||

|

Cash and cash equivalents

|

$

|

591.9

|

|

$

|

689.0

|

|

|

Accounts receivable, less allowance for doubtful accounts of $115.7 and $110.8, respectively

|

5,276.1

|

|

5,370.5

|

|

||

|

Prepaid expenses and other assets

|

129.1

|

|

111.7

|

|

||

|

Total current assets

|

5,997.1

|

|

6,171.2

|

|

||

|

Other Assets

|

||||||

|

Goodwill

|

1,297.1

|

|

1,343.0

|

|

||

|

Intangible assets, less accumulated amortization of $367.7 and $339.9, respectively

|

246.3

|

|

284.0

|

|

||

|

Other assets

|

826.7

|

|

927.7

|

|

||

|

Total other assets

|

2,370.1

|

|

2,554.7

|

|

||

|

Property and Equipment

|

||||||

|

Land, buildings, leasehold improvements and equipment

|

613.6

|

|

633.4

|

|

||

|

Less: accumulated depreciation and amortization

|

461.0

|

|

475.7

|

|

||

|

Net property and equipment

|

152.6

|

|

157.7

|

|

||

|

Total assets

|

$

|

8,519.8

|

|

$

|

8,883.6

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||

|

Current Liabilities

|

||||||

|

Accounts payable

|

$

|

2,266.7

|

|

$

|

2,279.4

|

|

|

Employee compensation payable

|

209.7

|

|

230.6

|

|

||

|

Accrued liabilities

|

411.0

|

|

490.9

|

|

||

|

Accrued payroll taxes and insurance

|

729.8

|

|

794.7

|

|

||

|

Value added taxes payable

|

508.6

|

|

545.4

|

|

||

|

Short-term borrowings and current maturities of long-term debt

|

50.1

|

|

469.4

|

|

||

|

Total current liabilities

|

4,175.9

|

|

4,810.4

|

|

||

|

Other liabilities

|

||||||

|

Long-term debt

|

1,025.3

|

|

478.1

|

|

||

|

Other long-term liabilities

|

620.1

|

|

737.5

|

|

||

|

Total other liabilities

|

1,645.4

|

|

1,215.6

|

|

||

|

Shareholders’ Equity

|

||||||

|

Preferred stock, $.01 par value, authorized 25,000,000 shares, none issued

|

—

|

|

—

|

|

||

|

Common stock, $.01 par value, authorized 125,000,000 shares, issued 116,795,899 and 116,303,729 shares, respectively

|

1.2

|

|

1.2

|

|

||

|

Capital in excess of par value

|

3,337.5

|

|

3,302.6

|

|

||

|

Retained earnings

|

3,157.7

|

|

2,713.0

|

|

||

|

Accumulated other comprehensive loss

|

(399.8

|

)

|

(288.2

|

)

|

||

|

Treasury stock at cost, 56,044,485 and 50,226,525 shares, respectively

|

(3,471.7

|

)

|

(2,953.7

|

)

|

||

|

Total ManpowerGroup shareholders' equity

|

2,624.9

|

|

2,774.9

|

|

||

|

Noncontrolling interests

|

73.6

|

|

82.7

|

|

||

|

Total shareholders’ equity

|

2,698.5

|

|

2,857.6

|

|

||

|

Total liabilities and shareholders’ equity

|

$

|

8,519.8

|

|

$

|

8,883.6

|

|

|

Year Ended December 31

|

2018

|

|

2017

|

|

2016

|

|

|||

|

Cash Flows from Operating Activities

|

|||||||||

|

Net earnings

|

$

|

556.7

|

|

$

|

545.4

|

|

$

|

443.7

|

|

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

|||||||||

|

Depreciation and amortization

|

85.8

|

|

84.4

|

|

85.3

|

|

|||

|

Deferred income taxes

|

(11.9

|

)

|

(196.8

|

)

|

74.0

|

|

|||

|

Provision for doubtful accounts

|

23.0

|

|

18.1

|

|

20.4

|

|

|||

|

Share-based compensation

|

27.8

|

|

28.7

|

|

27.1

|

|

|||

|

Excess tax benefit on exercise of share-based awards

|

—

|

|

—

|

|

(0.8

|

)

|

|||

|

Change in operating assets and liabilities, excluding the impact of acquisitions:

|

|||||||||

|

Accounts receivable

|

(146.4

|

)

|

(544.9

|

)

|

(317.2

|

)

|

|||

|

Other assets

|

58.7

|

|

(68.6

|

)

|

(75.3

|

)

|

|||

|

Other liabilities

|

(110.6

|

)

|

534.6

|

|

342.8

|

|

|||

|

Cash provided by operating activities

|

483.1

|

|

400.9

|

|

600.0

|

|

|||

|

Cash Flows from Investing Activities

|

|||||||||

|

Capital expenditures

|

(64.7

|

)

|

(54.7

|

)

|

(56.9

|

)

|

|||

|

Acquisitions of businesses, net of cash acquired

|

(9.1

|

)

|

(32.7

|

)

|

(57.6

|

)

|

|||

|

Proceeds from the sale of investments, property and equipment

|

18.9

|

|

12.9

|

|

4.1

|

|

|||

|

Cash used in investing activities

|

(54.9

|

)

|

(74.5

|

)

|

(110.4

|

)

|

|||

|

Cash Flows from Financing Activities

|

|||||||||

|

Net change in short-term borrowings

|

3.5

|

|

5.5

|

|

(0.3

|

)

|

|||

|

Proceeds from long-term debt

|

583.3

|

|

0.1

|

|

—

|

|

|||

|

Repayments of long-term debt

|

(408.6

|

)

|

(0.4

|

)

|

(6.4

|

)

|

|||

|

Payments for debt issuance costs

|

(2.5

|

)

|

—

|

|

—

|

|

|||

|

Payments of contingent consideration for acquisitions

|

(18.6

|

)

|

(13.0

|

)

|

(2.9

|

)

|

|||

|

Proceeds from share-based awards and other equity transactions

|

5.2

|

|

44.2

|

|

18.0

|

|

|||

|

Payments to noncontrolling interests

|

(1.9

|

)

|

(10.0

|

)

|

—

|

|

|||

|

Other share-based award transactions

|

(17.3

|

)

|

(18.1

|

)

|

(5.4

|

)

|

|||

|

Repurchases of common stock

|

(500.7

|

)

|

(203.9

|

)

|

(482.2

|

)

|

|||

|

Dividends paid

|

(127.3

|

)

|

(123.7

|

)

|

(118.4

|

)

|

|||

|

Cash used in financing activities

|

(484.9

|

)

|

(319.3

|

)

|

(597.6

|

)

|

|||

|

Effect of exchange rate changes on cash

|

(40.4

|

)

|

83.4

|

|

(24.0

|

)

|

|||

|

Net (decrease) increase in cash and cash equivalents

|

(97.1

|

)

|

90.5

|

|

(132.0

|

)

|

|||

|

Cash and cash equivalents, beginning of year

|

689.0

|

|

598.5

|

|

730.5

|

|

|||

|

Cash and cash equivalents, end of year

|

$

|

591.9

|

|

$

|

689.0

|

|

$

|

598.5

|

|

|

Supplemental Cash Flow Information

|

|||||||||

|

Interest paid

|

$

|

49.9

|

|

$

|

37.0

|

|

$

|

36.6

|

|

|

Income taxes paid, net

|

$

|

184.6

|

|

$

|

127.1

|

|

$

|

163.9

|

|

|

ManpowerGroup Shareholders

|

Non-

controlling

Interests

|

|

|||||||||||||||||||||||

|

Common Stock

|

Capital in

Excess of

Par Value

|

|

Retained

Earnings

|

|

Accumulated

Other

Comprehensive

(Loss) Income

|

|

Treasury

Stock

|

|

Total

|

|

|||||||||||||||

|

Shares Issued

|

|

Par Value

|

|

||||||||||||||||||||||

|

Balance, January 1, 2016

|

114,504,928

|

|

$

|

1.2

|

|

$

|

3,186.7

|

|

$

|

1,966.0

|

|

$

|

(286.0

|

)

|

$

|

(2,243.2

|

)

|

$

|

67.8

|

|

$

|

2,692.5

|

|

||

|

Net earnings

|

443.7

|

|

443.7

|

|

|||||||||||||||||||||

|

Other comprehensive loss

|

(140.1

|

)

|

(140.1

|

)

|

|||||||||||||||||||||

|

Issuances under equity plans, including tax benefits

|

610,820

|

|

|

|

20.5

|

|

(6.3

|

)

|

14.2

|

|

|||||||||||||||

|

Share-based compensation expense

|

27.1

|

|

27.1

|

|

|||||||||||||||||||||

|

Dividends ($1.72 per share)

|

(118.4

|

)

|

(118.4

|

)

|

|||||||||||||||||||||

|

Repurchases of common stock

|

(482.2

|

)

|

(482.2

|

)

|

|||||||||||||||||||||

|

Noncontrolling interest transactions

|

(7.1

|

)

|

16.7

|

|

9.6

|

|

|||||||||||||||||||

|

Balance, December 31, 2016

|

115,115,748

|

|

1.2

|

|

3,227.2

|

|

2,291.3

|

|

(426.1

|

)

|

(2,731.7

|

)

|

84.5

|

|

2,446.4

|

|

|||||||||

|

Net earnings

|

545.4

|

|

545.4

|

|

|||||||||||||||||||||

|

Other comprehensive income

|

137.9

|

|

137.9

|

|

|||||||||||||||||||||

|

Issuances under equity plans

|

1,187,981

|

|

44.2

|

|

(18.1

|

)

|

26.1

|

|

|||||||||||||||||

|

Share-based compensation expense

|

28.7

|

|

28.7

|

|

|||||||||||||||||||||

|

Dividends ($1.86 per share)

|

(123.7

|

)

|

(123.7

|

)

|

|||||||||||||||||||||

|

Repurchases of common stock

|

(203.9

|

)

|

(203.9

|

)

|

|||||||||||||||||||||

|

Noncontrolling interest transactions

|

2.5

|

|

(1.8

|

)

|

0.7

|

|

|||||||||||||||||||

|

Balance, December 31, 2017

|

116,303,729

|

|

1.2

|

|

3,302.6

|

|

2,713.0

|

|

(288.2

|

)

|

(2,953.7

|

)

|

82.7

|

|

2,857.6

|

|

|||||||||

|

Unrealized gain reclassified due to new accounting guidance on investments (See Note 10)

|

15.3

|

|

(15.3

|

)

|

—

|

|

|||||||||||||||||||

|

Net earnings

|

556.7

|

|

556.7

|

|

|||||||||||||||||||||

|