|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Form |

|

||||

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||||

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

|

|

|

||||||||||

| (State of Incorporation) | (I.R.S. Employer Identification No.) | ||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

|

|

|

|

||||||||||||

|

|

|

|

||||||||||||

|

|

|

|

||||||||||||

|

|

☑ |

Accelerated filer

|

☐ | |||||||||||

| Non-accelerated filer | ☐ |

Smaller reporting company

|

|

|||||||||||

|

Emerging growth company

|

|

|||||||||||||

| Shares Outstanding at September 30, 2023 | ||

|

|

||

|

MOODY’S CORPORATION

INDEX TO FORM 10-Q |

||||||||

| Page(s) | ||||||||

|

3

-6

|

||||||||

|

Consolidated Statements of Operations (Unaudited) for the Three Months Ended and

Nine

Months Ended

September 30, 2023

and

2022

|

||||||||

|

Consolidated Statements of Cash Flows (Unaudited) for the

Nine

Months Ended

September 30, 2023

and

2022

|

||||||||

|

43

-44

|

||||||||

|

|

||||||||

|

TERM

|

DEFINITION

|

||||

|

Acquisition-Related Intangible Amortization Expense

|

Amortization of definite-lived intangible assets acquired by the Company from all business combination transactions

|

||||

|

Adjusted Diluted EPS

|

Diluted EPS excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures”

|

||||

|

Adjusted Net Income

|

Net Income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures”

|

||||

|

Adjusted Operating Income

|

Operating income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures”

|

||||

|

Adjusted Operating Margin

|

Adjusted Operating Income divided by revenue

|

||||

|

Americas

|

Represents countries within North and South America, excluding the U.S.

|

||||

|

AOCI(L)

|

Accumulated other comprehensive income/loss; a separate component of shareholders’ equity

|

||||

|

ARR

|

Annualized Recurring Revenue; a supplemental performance metric to provide additional insight on the estimated value of MA's recurring revenue contracts at a given point in time, excluding the impact of FX and contracts related to acquisitions

|

||||

|

ASC

|

The FASB Accounting Standards Codification; the sole source of authoritative GAAP as of July 1, 2009 except for rules and interpretive releases of the SEC, which are also sources of authoritative GAAP for SEC registrants

|

||||

|

Asia-Pacific

|

Represents Australia and countries in Asia including but not limited to: China, India, Indonesia, Japan, Republic of South Korea, Malaysia, Singapore, Sri Lanka and Thailand

|

||||

|

ASR

|

Accelerated Share Repurchase

|

||||

|

ASU

|

The FASB Accounting Standards Update to the ASC. Provides background information for accounting guidance and the bases for conclusions on the changes in the ASC. ASUs are not considered authoritative until codified into the ASC

|

||||

| BitSight | A provider that helps global market participants understand cyber risk through ratings, analytics, and performance management tools | ||||

|

Board

|

The board of directors of the Company

|

||||

|

BPS

|

Basis points

|

||||

| CCXI | China Cheng Xin International Credit Rating Co. Ltd.; China’s first and largest domestic credit rating agency approved by the People’s Bank of China; currently Moody’s owns 30% of CCXI | ||||

| CDP |

Carbon Disclosure Project; an international nonprofit organization that helps companies, cities, states and regions manage their environmental impact through a global disclosure system

|

||||

|

CFG

|

Corporate finance group; an LOB of MIS

|

||||

|

CMBS

|

Commercial mortgage-backed securities; an asset class within SFG

|

||||

| COLI | Corporate-Owned Life Insurance | ||||

|

Common Stock

|

The Company’s common stock

|

||||

|

Company

|

Moody’s Corporation and its subsidiaries; MCO; Moody’s

|

||||

| COVID-19 | An outbreak of a novel strain of coronavirus resulting in an international public health crisis and a global pandemic | ||||

|

CP

|

Commercial Paper

|

||||

|

CP Program

|

A program entered into on August 3, 2016 allowing the Company to privately place CP up to a maximum of $1 billion for which the maturity may not exceed 397 days from the date of issue, and which is backstopped by the 2021 Facility

|

||||

|

D&A

|

Depreciation and amortization

|

||||

| Data and Information (D&I) |

LOB within MA which provides vast data sets on companies and securities via data feeds and data applications products

|

||||

| Decision Solutions (DS) |

LOB within MA that provides SaaS solutions supporting banking, insurance, and KYC workflows. This LOB utilizes components from the Data & Information and Research & Insights LOBs to provide risk assessment solutions

|

||||

|

EMEA

|

Represents countries within Europe, the Middle East and Africa

|

||||

|

EPS

|

Earnings per share

|

||||

|

TERM

|

DEFINITION

|

||||

|

ESG

|

Environmental, Social, and Governance

|

||||

| ESTR | Euro Short-Term Rate | ||||

|

ETR

|

Effective tax rate

|

||||

|

EU

|

European Union

|

||||

|

EURIBOR

|

The Euro Interbank Offered Rate

|

||||

|

Excess Tax Benefits

|

The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the tax benefit recorded at the time the option or restricted share is expensed under GAAP

|

||||

|

Exchange Act

|

The Securities Exchange Act of 1934, as amended

|

||||

|

External Revenue

|

Revenue excluding any intersegment amounts

|

||||

|

FASB

|

Financial Accounting Standards Board

|

||||

|

FIG

|

Financial institutions group; an LOB of MIS

|

||||

|

Free Cash Flow

|

Net cash provided by operating activities less cash paid for capital additions

|

||||

|

FX

|

Foreign exchange

|

||||

|

GAAP

|

U.S. Generally Accepted Accounting Principles

|

||||

|

GBP

|

British pounds

|

||||

| GCR | Global Credit Rating Company Limited; a credit rating agency in Africa with operations spanning the continent, including in South Africa, Nigeria, Senegal, Kenya, and Mauritius | ||||

| GDP | Gross domestic product | ||||

| GRI | Global Reporting Initiative; an international independent standards organization that helps organizations understand and disclose their impact on climate change, human rights and corruption | ||||

|

ICRA

|

ICRA Limited; a provider of credit ratings and research in India | ||||

| kompany | 360kompany AG (kompany); a Vienna, Austria-based platform for business verification and Know Your Customer (KYC) technology solutions, acquired by the Company in February 2022 | ||||

| KYC | Know-your-customer | ||||

|

LIBOR

|

London Interbank Offered Rate

|

||||

|

LOB

|

Line of business

|

||||

|

MA

|

Moody’s Analytics - a reportable segment of MCO which provides a wide range of products and services that support financial analysis and risk management activities of institutional participants in global financial markets; consists of three LOBs - Decision Solutions; Research and Insights; and Data and Information

|

||||

|

MAKS

|

Moody’s Analytics Knowledge Services; formerly known as Copal Amba; provided offshore research and analytic services to the global financial and corporate sectors; business was divested in the fourth quarter of 2019 and was formerly a reporting unit within the MA reportable segment | ||||

|

MCO

|

Moody’s Corporation and its subsidiaries; the Company; Moody’s

|

||||

|

MD&A

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

||||

|

MIS

|

Moody’s Investors Service - a reportable segment of MCO; consists of five LOBs - SFG; CFG; FIG; PPIF; and MIS Other

|

||||

|

MIS Other

|

Consists of financial instruments pricing services in the Asia-Pacific region, ICRA non-ratings revenue, and revenue from professional services. These businesses are components of MIS; MIS Other is an LOB of MIS

|

||||

|

Moody’s

|

Moody’s Corporation and its subsidiaries; MCO; the Company

|

||||

| MSS | Moody's Shared Services; primarily consists of information technology and support staff such as finance, human resources and legal that support both MA and MIS | ||||

|

Net Income

|

Net income attributable to Moody’s Corporation, which excludes net income from consolidated noncontrolling interests belonging to the minority interest holder

|

||||

|

NM

|

Percentage change is not meaningful

|

||||

|

TERM

|

DEFINITION

|

||||

|

Non-GAAP

|

A financial measure not in accordance with GAAP; these measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s performance, facilitate comparisons to competitors’ operating results and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision making

|

||||

|

NRSRO

|

Nationally Recognized Statistical Rating Organization, which is a credit rating agency registered with the SEC

|

||||

|

Operating segment

|

Term defined in the ASC relating to segment reporting; the ASC defines an operating segment as a component of a business entity that has each of the three following characteristics: i) the component engages in business activities from which it may recognize revenue and incur expenses; ii) the operating results of the component are regularly reviewed by the entity’s chief operating decision maker; and iii) discrete financial information about the component is available

|

||||

|

PPIF

|

Public, project and infrastructure finance; an LOB of MIS

|

||||

|

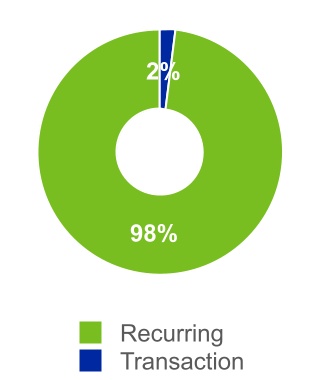

Recurring Revenue

|

For MA, represents subscription-based revenue and software maintenance revenue. For MIS, represents recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. For MIS Other, represents subscription-based revenue

|

||||

|

Reporting unit

|

The level at which Moody’s evaluates its goodwill for impairment under GAAP; defined as an operating segment or one level below an operating segment

|

||||

| Research and Insights (R&I) |

LOB within MA that

provides models, scores, expert insights and commentary. This LOB includes credit research; credit models and analytics; economics data and models; and structured finance solutions

|

||||

|

RMBS

|

Residential mortgage-backed securities; an asset class within SFG

|

||||

| RMS |

Risk Management Solutions, Inc., a global provider of climate and natural disaster risk modeling and analytics; acquired by the Company in September 2021

|

||||

| SaaS |

Software-as-a-Service

|

||||

| SASB |

Sustainability Accounting Standards Board

|

||||

|

SEC

|

U.S. Securities and Exchange Commission

|

||||

|

SFG

|

Structured finance group; an LOB of MIS

|

||||

|

SG&A

|

Selling, general and administrative expenses

|

||||

| SOFR | Secured Overnight Financing Rate | ||||

|

Tax Act

|

The “Tax Cuts and Jobs Act” enacted into U.S. law on December 22, 2017 which significantly amends the tax code in the U.S.

|

||||

| TCFD | Task Force on Climate-Related Financial Disclosures | ||||

|

Total Debt

|

All indebtedness of the Company as reflected on the consolidated balance sheets

|

||||

|

Transaction Revenue

|

For MA, represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, and training and certification services. For MIS (excluding MIS Other), represents the initial rating of a new debt issuance as well as other one-time fees. For MIS Other, represents revenue from professional services.

|

||||

|

U.K.

|

United Kingdom

|

||||

|

U.S.

|

United States

|

||||

|

USD

|

U.S. dollar

|

||||

|

UTPs

|

Uncertain tax positions

|

||||

| 2001 Plan | 2001 Moody's Corporation Key Employees' Stock Incentive Plan, as amended and restated December 20, 2022 | ||||

| 2022 - 2023 Geolocation Restructuring Program |

Restructuring program approved by the chief executive officer of Moody’s on June 30, 2022 relating to the Company's post-COVID-19 geolocation strategy

|

||||

|

2013 Senior Notes due 2024

|

Principal amount of $500 million, 4.875% senior unsecured notes due in February 2024

|

||||

|

2014 Senior Notes due 2044

|

Principal amount of $600 million, 5.25% senior unsecured notes due in July 2044

|

||||

|

2015 Senior Notes due 2027

|

Principal amount of €500 million, 1.75% senior unsecured notes due in March 2027

|

||||

|

2017 Senior Notes due 2028

|

Principal amount of $500 million, 3.250% senior unsecured notes due January 15, 2028

|

||||

|

2018 Senior Notes due 2029

|

Principal amount of $400 million, 4.25% senior unsecured notes due February 1, 2029

|

||||

|

TERM

|

DEFINITION

|

||||

|

2018 Senior Notes due 2048

|

Principal amount of $400 million, 4.875% senior unsecured notes due December 17, 2048

|

||||

| 2019 Senior Notes due 2030 | Principal amount of €750 million, 0.950% senior unsecured notes due February 25, 2030 | ||||

| 2020 Senior Notes due 2025 | Principal amount of $700 million, 3.75% senior unsecured notes due March 24, 2025 | ||||

| 2020 Senior Notes due 2050 | Principal amount of $300 million, 3.25% senior unsecured notes due May 20, 2050 | ||||

| 2020 Senior Notes due 2060 | Principal amount of $500 million, 2.55% senior unsecured notes due August 18, 2060 | ||||

| 2021 Facility | Five-year unsecured revolving credit facility, with capacity to borrow up to $1.25 billion; backstops CP issued under the CP Program | ||||

| 2021 Senior Notes due 2031 | Principal amount of $600 million, 2.00% senior unsecured notes due August 19, 2031 | ||||

| 2021 Senior Notes due 2041 | Principal amount of $600 million, 2.75% senior unsecured notes due August 19, 2041 | ||||

| 2021 Senior Notes due 2061 | Principal amount of $500 million, 3.10% senior unsecured notes due November 15, 2061 | ||||

| 2022 Senior Notes due 2052 | Principal amount of $500 million, 3.75% senior unsecured notes due February 25, 2052 | ||||

| 2022 Senior Notes due 2032 | Principal amount of $500 million, 4.25% senior unsecured notes due January 15, 2032 | ||||

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenue | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Expenses | |||||||||||||||||||||||

| Operating |

|

|

|

|

|||||||||||||||||||

| Selling, general, and administrative |

|

|

|

|

|||||||||||||||||||

| Depreciation and amortization |

|

|

|

|

|||||||||||||||||||

| Restructuring |

|

|

|

|

|||||||||||||||||||

| Total expenses |

|

|

|

|

|||||||||||||||||||

| Operating income |

|

|

|

|

|||||||||||||||||||

| Non-operating (expense) income, net | |||||||||||||||||||||||

| Interest expense, net |

(

|

(

|

(

|

(

|

|||||||||||||||||||

| Other non-operating income, net |

|

|

|

|

|||||||||||||||||||

| Total non-operating (expense) income, net |

(

|

(

|

(

|

(

|

|||||||||||||||||||

| Income before provision for income taxes |

|

|

|

|

|||||||||||||||||||

| Provision for income taxes |

|

|

|

|

|||||||||||||||||||

| Net income |

|

|

|

|

|||||||||||||||||||

|

Less: Net income attributable to noncontrolling interests

|

|

|

|

|

|||||||||||||||||||

| Net income attributable to Moody's | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Earnings per share attributable to Moody's common shareholders | |||||||||||||||||||||||

| Basic | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Diluted | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Weighted average number of shares outstanding | |||||||||||||||||||||||

| Basic |

|

|

|

|

|

||||||||||||||||||

| Diluted |

|

|

|

|

|

||||||||||||||||||

|

Three Months Ended

September 30, 2023

|

Three Months Ended

September 30, 2022

|

||||||||||||||||||||||||||||||||||

|

Pre-tax

amounts |

Tax

amounts |

After-tax

amounts |

Pre-tax

amounts |

Tax

amounts |

After-tax

amounts |

||||||||||||||||||||||||||||||

| Net Income | $ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Other Comprehensive Income (Loss): | |||||||||||||||||||||||||||||||||||

| Foreign Currency Adjustments: | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments, net | $ |

(

|

$ |

(

|

(

|

$ |

(

|

$ |

|

(

|

|||||||||||||||||||||||||

|

Net gains on net investment hedges

|

|

(

|

|

|

(

|

|

|||||||||||||||||||||||||||||

| Cash Flow Hedges: | |||||||||||||||||||||||||||||||||||

| Reclassification of losses included in net income |

|

|

|

|

(

|

|

|||||||||||||||||||||||||||||

| Pension and Other Retirement Benefits: | |||||||||||||||||||||||||||||||||||

|

Amortization of actuarial gains/prior service credits and settlement credit included in net income

|

(

|

|

(

|

|

|

|

|||||||||||||||||||||||||||||

| Net actuarial gains and prior service costs |

|

(

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Total other comprehensive loss

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

|||||||||||||||||||||||

| Comprehensive income |

|

|

|||||||||||||||||||||||||||||||||

| Less: comprehensive income (loss) attributable to noncontrolling interests |

|

(

|

|||||||||||||||||||||||||||||||||

| Comprehensive Income Attributable to Moody's | $ |

|

$ |

|

|||||||||||||||||||||||||||||||

|

Nine Months Ended

September 30, 2023 |

Nine Months Ended

September 30, 2022 |

||||||||||||||||||||||||||||||||||

|

Pre-tax

amounts |

Tax

amounts |

After-tax

amounts |

Pre-tax

amounts |

Tax

amounts |

After-tax

amounts |

||||||||||||||||||||||||||||||

| Net Income | $ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Other Comprehensive Income (Loss): | |||||||||||||||||||||||||||||||||||

| Foreign Currency Adjustments: | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments, net | $ |

(

|

$ |

(

|

(

|

$ |

(

|

$ |

|

(

|

|||||||||||||||||||||||||

| Foreign currency translation adjustments - reclassification of losses included in net income |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Net gains on net investment hedges

|

|

(

|

|

|

(

|

|

|||||||||||||||||||||||||||||

| Cash Flow Hedges: | |||||||||||||||||||||||||||||||||||

| Reclassification of losses included in net income |

|

(

|

|

|

(

|

|

|||||||||||||||||||||||||||||

| Pension and Other Retirement Benefits: | |||||||||||||||||||||||||||||||||||

|

Amortization of actuarial gains/prior service credits and settlement credit included in net income

|

(

|

|

(

|

|

|

|

|||||||||||||||||||||||||||||

| Net actuarial gains and prior service costs |

|

(

|

|

|

(

|

|

|||||||||||||||||||||||||||||

|

Total other comprehensive loss

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

|||||||||||||||||||||||

| Comprehensive income |

|

|

|||||||||||||||||||||||||||||||||

| Less: comprehensive loss attributable to noncontrolling interests |

(

|

(

|

|||||||||||||||||||||||||||||||||

| Comprehensive Income Attributable to Moody's | $ |

|

$ |

|

|||||||||||||||||||||||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ |

|

$ |

|

|||||||

| Short-term investments |

|

|

|||||||||

|

Accounts receivable, net of allowance for credit losses of $

|

|

|

|||||||||

| Other current assets |

|

|

|||||||||

| Total current assets |

|

|

|||||||||

|

Property and equipment, net of accumulated depreciation of $

|

|

|

|||||||||

| Operating lease right-of-use assets |

|

|

|||||||||

| Goodwill |

|

|

|||||||||

| Intangible assets, net |

|

|

|||||||||

| Deferred tax assets, net |

|

|

|||||||||

| Other assets |

|

|

|||||||||

| Total assets | $ |

|

$ |

|

|||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ |

|

$ |

|

|||||||

| Current portion of operating lease liabilities |

|

|

|||||||||

| Deferred revenue |

|

|

|||||||||

| Total current liabilities |

|

|

|||||||||

| Non-current portion of deferred revenue |

|

|

|||||||||

| Long-term debt |

|

|

|||||||||

| Deferred tax liabilities, net |

|

|

|||||||||

| Uncertain tax positions |

|

|

|||||||||

| Operating lease liabilities |

|

|

|||||||||

| Other liabilities |

|

|

|||||||||

| Total liabilities |

|

|

|||||||||

|

Contingencies (Note 16)

|

|

|

|||||||||

| Shareholders' equity: | |||||||||||

|

Preferred stock, par value $

|

|

|

|||||||||

|

Series common stock, par value $

|

|

|

|||||||||

|

Common stock, par value $

|

|

|

|||||||||

| Capital surplus |

|

|

|||||||||

| Retained earnings |

|

|

|||||||||

|

Treasury stock, at cost;

|

(

|

(

|

|||||||||

| Accumulated other comprehensive loss |

(

|

(

|

|||||||||

| Total Moody's shareholders' equity |

|

|

|||||||||

| Noncontrolling interests |

|

|

|||||||||

| Total shareholders' equity |

|

|

|||||||||

| Total liabilities, noncontrolling interests, and shareholders' equity | $ |

|

$ |

|

|||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income | $ |

|

$ |

|

|||||||

| Reconciliation of net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization |

|

|

|||||||||

| Stock-based compensation |

|

|

|||||||||

| Deferred income taxes |

(

|

|

|||||||||

| ROU Asset impairment & other non-cash restructuring/impairment charges |

|

|

|||||||||

| FX translation losses reclassified to net income |

|

|

|||||||||

| Changes in assets and liabilities: | |||||||||||

| Accounts receivable |

|

|

|||||||||

| Other current assets |

|

(

|

|||||||||

| Other assets |

(

|

|

|||||||||

| Lease obligations |

(

|

(

|

|||||||||

| Accounts payable and accrued liabilities |

(

|

(

|

|||||||||

| Deferred revenue |

(

|

(

|

|||||||||

| Uncertain tax positions |

(

|

(

|

|||||||||

| Other liabilities |

(

|

(

|

|||||||||

| Net cash provided by operating activities |

|

|

|||||||||

| Cash flows from investing activities | |||||||||||

| Capital additions |

(

|

(

|

|||||||||

| Purchases of investments |

(

|

(

|

|||||||||

| Sales and maturities of investments |

|

|

|||||||||

| Receipts from settlements of net investment hedges |

|

|

|||||||||

| Cash paid for acquisitions, net of cash acquired |

(

|

(

|

|||||||||

| Net cash used in investing activities |

(

|

(

|

|||||||||

| Cash flows from financing activities | |||||||||||

| Repayment of notes |

(

|

(

|

|||||||||

| Issuance of notes |

|

|

|||||||||

| Proceeds from stock-based compensation plans |

|

|

|||||||||

| Treasury shares |

(

|

(

|

|||||||||

| Repurchase of shares related to stock-based compensation |

(

|

(

|

|||||||||

| Dividends |

(

|

(

|

|||||||||

| Dividends to noncontrolling interest |

(

|

(

|

|||||||||

| Debt issuance costs and related fees |

|

(

|

|||||||||

| Net cash used in financing activities |

(

|

(

|

|||||||||

| Effect of exchange rate changes on cash and cash equivalents |

(

|

(

|

|||||||||

| Increase (decrease) in cash and cash equivalents |

|

(

|

|||||||||

| Cash and cash equivalents, beginning of period |

|

|

|||||||||

| Cash and cash equivalents, end of period | $ |

|

$ |

|

|||||||

|

Shareholders of Moody's Corporation

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Capital Surplus | Retained Earnings | Treasury Stock |

Accumulated

Other Comprehensive Loss |

Total Moody's

Shareholders' Equity |

Non- Controlling

Interests |

Total

Shareholders' Equity |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Balance at June 30, 2022

|

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

| Net income |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Dividends ($

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued for stock-based compensation plans at average cost, net |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased |

|

(

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Currency translation adjustment, net of net investment hedge activity (net of tax of $

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of prior service costs and actuarial losses |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Balance at September 30, 2022

|

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

|

Shareholders of Moody's Corporation

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock |

Capital

Surplus |

Retained

Earnings |

Treasury Stock |

Accumulated

Other Comprehensive Loss |

Total Moody's

Shareholders' Equity |

Non- Controlling

Interests |

Total

Shareholders' Equity |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Balance at December 31, 2021

|

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

| Net income |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Dividends ($

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued for stock-based compensation plans at average cost, net |

(

|

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Shares issued as consideration to acquire kompany

(1)

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased |

(

|

(

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Currency translation adjustment, net of net investment hedge activity (net of tax of $

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net actuarial gains and prior service costs (net of tax of $

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of prior service costs and actuarial losses |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain on cash flow hedges |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 |

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

|

Shareholders of Moody's Corporation

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock |

Capital

Surplus |

Retained

Earnings |

Treasury Stock |

Accumulated

Other Comprehensive Loss |

Total Moody's

Shareholders' Equity |

Non- Controlling

Interests |

Total

Shareholders' Equity |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Balance at June 30, 2023

|

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

| Net income |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Dividends ($

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued for stock-based compensation plans at average cost, net |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased |

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Currency translation adjustment, net of net investment hedge activity (net of tax of $

|

(

|

(

|

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net actuarial gains and prior service costs (net of tax of $

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amortization of prior service credits/ actuarial gains and settlement credit

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net realized and unrealized gain on cash flow hedges

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Balance at September 30, 2023

|

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

|

Shareholders of Moody's Corporation

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock |

Capital

Surplus |

Retained

Earnings |

Treasury Stock |

Accumulated

Other Comprehensive Loss |

Total Moody's

Shareholders' Equity |

Non- Controlling

Interests |

Total

Shareholders' Equity |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 |

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

| Net income |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Dividends ($

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued for stock-based compensation plans at average cost, net |

(

|

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased |

|

(

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Currency translation adjustment, net of net investment hedge activity (net of tax of $

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net actuarial gains and prior service costs (net of tax of $

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amortization of prior service credits/ actuarial gains and settlement credit (net of tax of $

|

(

|

(

|

(

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net realized and unrealized gain on cash flow hedges (net of tax of $

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2023 |

|

$ |

|

$ |

|

$ |

|

(

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| MA: | |||||||||||||||||||||||

| Decision Solutions (DS) | |||||||||||||||||||||||

| Banking | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Insurance |

|

|

|

|

|||||||||||||||||||

| KYC |

|

|

|

|

|||||||||||||||||||

| Total DS |

|

|

|

|

|||||||||||||||||||

| Research and Insights (R&I) |

|

|

|

|

|||||||||||||||||||

| Data and Information (D&I) |

|

|

|

|

|||||||||||||||||||

| Total external revenue |

|

|

|

|

|||||||||||||||||||

| Intersegment revenue |

|

|

|

|

|||||||||||||||||||

| Total MA |

|

|

|

|

|||||||||||||||||||

| MIS: | |||||||||||||||||||||||

| Corporate Finance (CFG) | |||||||||||||||||||||||

| Investment-grade |

|

|

|

|

|||||||||||||||||||

| High-yield |

|

|

|

|

|||||||||||||||||||

| Bank loans |

|

|

|

|

|||||||||||||||||||

|

Other accounts

(1)

|

|

|

|

|

|||||||||||||||||||

| Total CFG |

|

|

|

|

|||||||||||||||||||

| Structured Finance (SFG) | |||||||||||||||||||||||

| Asset-backed securities |

|

|

|

|

|||||||||||||||||||

| RMBS |

|

|

|

|

|||||||||||||||||||

| CMBS |

|

|

|

|

|||||||||||||||||||

| Structured credit |

|

|

|

|

|||||||||||||||||||

| Other accounts |

|

|

|

|

|||||||||||||||||||

| Total SFG |

|

|

|

|

|||||||||||||||||||

| Financial Institutions (FIG) | |||||||||||||||||||||||

| Banking |

|

|

|

|

|||||||||||||||||||

| Insurance |

|

|

|

|

|||||||||||||||||||

| Managed investments |

|

|

|

|

|||||||||||||||||||

| Other accounts |

|

|

|

|

|||||||||||||||||||

| Total FIG |

|

|

|

|

|||||||||||||||||||

| Public, Project and Infrastructure Finance (PPIF) | |||||||||||||||||||||||

| Public finance / sovereign |

|

|

|

|

|||||||||||||||||||

| Project and infrastructure |

|

|

|

|

|||||||||||||||||||

| Total PPIF |

|

|

|

|

|||||||||||||||||||

| Total ratings revenue |

|

|

|

|

|||||||||||||||||||

| MIS Other |

|

|

|

|

|||||||||||||||||||

| Total external revenue |

|

|

|

|

|||||||||||||||||||

| Intersegment revenue |

|

|

|

|

|||||||||||||||||||

| Total MIS |

|

|

|

|

|||||||||||||||||||

| Eliminations |

(

|

(

|

(

|

(

|

|||||||||||||||||||

| Total MCO | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Three Months Ended September 30, 2023 | Three Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||

| U.S. | Non-U.S | Total | U.S. | Non-U.S | Total | ||||||||||||||||||||||||||||||

| MA: | |||||||||||||||||||||||||||||||||||

| Decision Solutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Research and Insights |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Data and Information |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MA |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| MIS: | |||||||||||||||||||||||||||||||||||

| Corporate Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Structured Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Financial Institutions |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Public, Project and Infrastructure Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total ratings revenue |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| MIS Other |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MIS |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MCO | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Nine Months Ended September 30, 2023 | Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||

| U.S. | Non-U.S | Total | U.S. | Non-U.S | Total | ||||||||||||||||||||||||||||||

| MA: | |||||||||||||||||||||||||||||||||||

| Decision Solutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Research and Insights |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Data and Information |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MA |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| MIS: | |||||||||||||||||||||||||||||||||||

| Corporate Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Structured Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Financial Institutions |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Public, Project and Infrastructure Finance |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total ratings revenue |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| MIS Other |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MIS |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total MCO | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| MA: | |||||||||||||||||||||||

| U.S. | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Non-U.S.: | |||||||||||||||||||||||

| EMEA |

|

|

|

|

|||||||||||||||||||

| Asia-Pacific |

|

|

|

|

|||||||||||||||||||

| Americas |

|

|

|

|

|||||||||||||||||||

| Total Non-U.S. |

|

|

|

|

|||||||||||||||||||

| Total MA |

|

|

|

|

|||||||||||||||||||

| MIS: | |||||||||||||||||||||||

| U.S. |

|

|

|

|

|||||||||||||||||||

| Non-U.S.: | |||||||||||||||||||||||

| EMEA |

|

|

|

|

|||||||||||||||||||

| Asia-Pacific |

|

|

|

|

|||||||||||||||||||

| Americas |

|

|

|

|

|||||||||||||||||||

| Total Non-U.S. |

|

|

|

|

|||||||||||||||||||

| Total MIS |

|

|

|

|

|||||||||||||||||||

| Total MCO | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

|

Three Months Ended September 30,

|

|||||||||||||||||||||||||||||||||||

| 2023 | 2022 | ||||||||||||||||||||||||||||||||||

| Transaction | Recurring | Total | Transaction | Recurring | Total | ||||||||||||||||||||||||||||||

| Decision Solutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Research and Insights | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Data and Information | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total MA | $ |

|

(1)

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Corporate Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Structured Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Financial Institutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Public, Project and Infrastructure Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| MIS Other | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total MIS | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total Moody's Corporation | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||

| 2023 | 2022 | ||||||||||||||||||||||||||||||||||

| Transaction | Recurring | Total | Transaction | Recurring | Total | ||||||||||||||||||||||||||||||

| Decision Solutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Research and Insights | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Data and Information | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total MA | $ |

|

(1)

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Corporate Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Structured Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Financial Institutions | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Public, Project and Infrastructure Finance | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| MIS Other | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total MIS | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

| Total Moody's Corporation | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

|

% |

|

% |

|

% |

|

% |

|

% |

|

% | ||||||||||||||||||||||||

|

Three Months Ended September 30, 2023

|

Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||

| MA | MIS | Total | MA | MIS | Total | ||||||||||||||||||||||||||||||

| Revenue recognized at a point in time | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Revenue recognized over time |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Three Months Ended September 30, 2022 | Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||

| MA | MIS | Total | MA | MIS | Total | ||||||||||||||||||||||||||||||

| Revenue recognized at a point in time | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Revenue recognized over time |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

As of September 30, 2023

|

As of December 31, 2022

|

||||||||||||||||||||||

| MA | MIS | MA | MIS | ||||||||||||||||||||

| Unbilled Receivables | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

|

Three Months Ended September 30, 2023

|

Three Months Ended September 30, 2022

|

||||||||||||||||||||||||||||||||||

| MA | MIS | Total | MA | MIS | Total | ||||||||||||||||||||||||||||||

|

Balance at June 30,

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Changes in deferred revenue | |||||||||||||||||||||||||||||||||||

| Revenue recognized that was included in the deferred revenue balance at the beginning of the period |

(

|

(

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||

| Increases due to amounts billable excluding amounts recognized as revenue during the period |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Effect of exchange rate changes |

(

|

(

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||

| Total changes in deferred revenue |

(

|

(

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||

|

Balance at September 30,

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Nine Months Ended September 30, 2023 | Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||

| MA | MIS | Total | MA | MIS | Total | ||||||||||||||||||||||||||||||

| Balance at December 31, | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Changes in deferred revenue | |||||||||||||||||||||||||||||||||||

| Revenue recognized that was included in the deferred revenue balance at the beginning of the period |

(

|

(

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||

| Increases due to amounts billable excluding amounts recognized as revenue during the period |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Increases due to acquisitions during the period |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Effect of exchange rate changes |

(

|

(

|

(

|

(

|

(

|

(

|

|||||||||||||||||||||||||||||

| Total changes in deferred revenue |

(

|

|

(

|

(

|

|

(

|

|||||||||||||||||||||||||||||

|

Balance at September 30,

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Deferred revenue - current | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Deferred revenue - non-current | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

Three Months Ended September 30,

|

Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Stock-based compensation cost | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Tax benefit | $ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||

| Expected dividend yield |

|

% | |||

| Expected stock volatility |

|

% | |||

| Risk-free interest rate |

|

% | |||

| Expected holding period |

|

||||

|

Nine Months Ended

September 30, |

|||||||||||

| 2023 |

2022

|

||||||||||

| Exercise of stock options: | |||||||||||

| Proceeds from stock option exercises | $ |

|

$ |

|

|||||||

| Aggregate intrinsic value | $ |

|

$ |

|

|||||||

| Tax benefit realized upon exercise | $ |

|

$ |

|

|||||||

|

Number of shares exercised

(1)

|

|

|

|||||||||

| Vesting of restricted stock: | |||||||||||

| Fair value of shares vested | $ |

|

$ |

|

|||||||

| Tax benefit realized upon vesting | $ |

|

$ |

|

|||||||

| Number of shares vested |

|

|

|||||||||

| Vesting of performance-based restricted stock: | |||||||||||

| Fair value of shares vested | $ |

|

$ |

|

|||||||

| Tax benefit realized upon vesting | $ |

|

$ |

|

|||||||

| Number of shares vested |

|

|

|||||||||

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Income taxes paid | $ |

|

$ |

|

|||||||

|

Three Months Ended September 30,

|

Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Basic |

|

|

|

|

|||||||||||||||||||

| Dilutive effect of shares issuable under stock-based compensation plans |

|

|

|

|

|||||||||||||||||||

| Diluted |

|

|

|

|

|||||||||||||||||||

| Anti-dilutive options to purchase common shares and restricted stock as well as contingently issuable restricted stock which are excluded from the table above |

|

|

|

|

|||||||||||||||||||

| As of September 30, 2023 | |||||||||||||||||||||||||||||||||||

|

Balance sheet location

|

|||||||||||||||||||||||||||||||||||

| Cost | Gains/(Losses) | Fair Value | Cash and cash equivalents |

Short-term

investments |

Other

assets |

||||||||||||||||||||||||||||||

|

Certificates of deposit and money market deposit accounts/funds

(1)

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Mutual funds | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| As of December 31, 2022 | |||||||||||||||||||||||||||||||||||

|

Balance sheet location

|

|||||||||||||||||||||||||||||||||||

|

Cost |

Gains/(Losses) |

Fair Value |

Cash and cash

equivalents |

Short-term

investments |

Other

assets |

||||||||||||||||||||||||||||||

|

Certificates of deposit and money market deposit accounts

(1)

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

| Mutual funds | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||||||||||||||

|

As of September 30, 2023

|

As of December 31, 2022

|

|||||||||||||||||||||||||||||||

| Hedged Item | Nature of Swap | Notional Amount |

Floating Interest Rate

(1)

|

Notional Amount | Floating Interest Rate | |||||||||||||||||||||||||||

| 2017 Senior Notes due 2028 | Pay Floating/Receive Fixed | $ |

|

|

$ |

|

|

|||||||||||||||||||||||||

| 2020 Senior Notes due 2025 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| 2014 Senior Notes due 2044 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| 2018 Senior Notes due 2048 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| 2018 Senior Notes due 2029 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| 2022 Senior Notes due 2052 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| 2022 Senior Notes due 2032 | Pay Floating/Receive Fixed |

|

|

|

|

|||||||||||||||||||||||||||

| Total | $ |

|

$ |

|

||||||||||||||||||||||||||||

| Total amounts of financial statement line item presented in the statements of operations in which the effects of fair value hedges are recorded | Amount of income/(loss) recognized in the consolidated statements of operations | ||||||||||||||||||||||||||||||||||

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||||||||||

| Interest expense, net | $ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

|||||||||||||||||||||||||||

|

Descriptions |

Location on Consolidated Statements of Operations | ||||||||||||||||||||||||||||||||||

| Net interest settlements and accruals on interest rate swaps |

Interest expense, net

|

$ |

(

|

$ |

(

|

$ |

(

|

$ |

|

||||||||||||||||||||||||||

| Fair value changes on interest rate swaps | Interest expense, net | $ |

(

|

$ |

(

|

$ |

(

|

$ |

(

|

||||||||||||||||||||||||||

| Fair value changes on hedged debt | Interest expense, net | $ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| September 30, 2023 | ||||||||||||||||||||||||||

| Pay | Receive | |||||||||||||||||||||||||

| Nature of Swap | Notional Amount | Weighted Average Interest Rate | Notional Amount | Weighted Average Interest Rate | ||||||||||||||||||||||

| Pay Fixed/Receive Fixed | € |

|

|

$ |

|

|

||||||||||||||||||||

| Pay Floating/Receive Floating |

|

|

|

|

||||||||||||||||||||||

| Total | € |

|

$ |

|

||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||

| Pay | Receive | |||||||||||||||||||||||||

| Nature of Swap | Notional Amount | Weighted Average Interest Rate | Notional Amount | Weighted Average Interest Rate | ||||||||||||||||||||||

| Pay Fixed/Receive Fixed | € |

|

|

$ |

|

|

||||||||||||||||||||

| Pay Floating/Receive Floating |

|

|

|

|

||||||||||||||||||||||

| Pay Floating/Receive Floating |

|

|

|

|

||||||||||||||||||||||

| Total | € |

|

$ |

|

||||||||||||||||||||||

| Years Ending December 31, | ||||||||

| 2026 | € |

|

||||||

| 2027 | € |

|

||||||

| 2028 | € |

|

||||||

| 2029 | € |

|

||||||

| 2031 | € |

|

||||||

| 2032 | € |

|

||||||

| Total | € |

|

||||||

| Derivative and Non-Derivative Instruments in Net Investment Hedging Relationships | Amount of Gain/(Loss) Recognized in AOCL on Derivative, net of Tax | Amount of Loss Reclassified from AOCL into Income, net of Tax | Gain Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing) | |||||||||||||||||||||||||||||||||||

|

Three Months Ended

September 30,

|

Three Months Ended

September 30,

|

Three Months Ended

September 30,

|

||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Cross currency swaps | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Long-term debt |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

| Total net investment hedges | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Derivatives in Cash Flow Hedging Relationships | ||||||||||||||||||||||||||||||||||||||

| Interest rate contracts | $ |

|

$ |

|

$ |

(

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Total cash flow hedges | $ |

|

$ |

|

$ |

(

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Total | $ |

|

$ |

|

$ |

(

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Derivative and Non-Derivative Instruments in Net Investment Hedging Relationships | Amount of Gain/(Loss) Recognized in AOCL on Derivative, net of Tax | Amount of Loss Reclassified from AOCL into Income, net of Tax | Gain Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing) | |||||||||||||||||||||||||||||||||||

|

Nine Months Ended

September 30,

|

Nine Months Ended

September 30,

|

Nine Months Ended

September 30,

|

||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Cross currency swaps | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Long-term debt |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

| Total net investment hedges | $ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Derivatives in Cash Flow Hedging Relationships | ||||||||||||||||||||||||||||||||||||||

|

Cross currency swaps

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Interest rate contracts |

|

|

(

|

(

|

|

|

||||||||||||||||||||||||||||||||

| Total cash flow hedges | $ |

|

$ |

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Total | $ |

|

$ |

|

$ |

(

|

$ |

(

|

$ |

|

$ |

|

||||||||||||||||||||||||||

| Cumulative Gains/(Losses), net of tax | |||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

|

Net investment hedges

|

|||||||||||

| Cross currency swaps | $ |

|

$ |

|

|||||||

| FX forwards |

|

|

|||||||||

| Long-term debt |

|

|

|||||||||

| Total net investment hedges | $ |

|

$ |

|

|||||||

| Cash flow hedges | |||||||||||

| Interest rate contracts | $ |

(

|

$ |

(

|

|||||||

| Cross currency swaps |

|

|

|||||||||

| Total cash flow hedges |

(

|

(

|

|||||||||

| Total net gain in AOCL | $ |

|

$ |

|

|||||||

| September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||

| Notional amount of currency pair: | Sell | Buy | Sell | Buy | |||||||||||||||||||||||||

| Contracts to sell USD for GBP | $ |

|

£ |

|

$ |

|

£ |

|

|||||||||||||||||||||

| Contracts to sell USD for Japanese yen | $ |

|

¥ |

|

$ |

|

¥ |

|

|||||||||||||||||||||

| Contracts to sell USD for Canadian dollars | $ |

|

C$ |

|

$ |

|

C$ |

|

|||||||||||||||||||||

| Contracts to sell USD for Singapore dollars | $ |

|

S$ |

|

$ |

|

S$ |

|

|||||||||||||||||||||

| Contracts to sell USD for euros | $ |

|

€ |

|

$ |

|

€ |

|

|||||||||||||||||||||

| Contracts to sell USD for Indian rupee | $ |

|

₹ |

|

$ |

|

₹ |

|

|||||||||||||||||||||

| Contracts to sell euros for USD | € |

|

$ |

|

€ |

|

$ |

|

|||||||||||||||||||||

| Contracts to sell AUD for USD | A$ |

|

$ |

|

A$ |

|

$ |

|

|||||||||||||||||||||

|

NOTE: € = euro, £ = British pound, S$ = Singapore dollar, $ = U.S. dollar, ¥ = Japanese yen, C$ = Canadian dollar, ₹= Indian Rupee, A$ = Australian dollar

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Derivatives not designated as accounting hedges | Location on Consolidated Statements of Operations |

Three Months Ended

September 30,

|

Nine Months Ended

September 30,

|

|||||||||||||||||||||||||||||