|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each class

|

Trading Symbols

|

Name of each exchange on which registered

|

||

|

|

|

|

||

|

|

|

|

|

☒

|

Accelerated filer

☐

|

Non-accelerated filer

☐

|

Emerging growth company

|

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

|

☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board

☐

|

Other

☐

|

|

*

|

Not for trading, but only in connection with the registration and listing of the ADSs.

|

|

|

|

Page

|

|

|||||||

|

3

|

||||||||||

|

3

|

||||||||||

|

ITEM 1.

|

5

|

|||||||||

|

ITEM 2.

|

5

|

|||||||||

|

ITEM 3.

|

6

|

|||||||||

|

|

3.A.

|

6

|

||||||||

|

|

3.B.

|

10

|

||||||||

|

|

3.C.

|

10

|

||||||||

|

|

3.D.

|

10

|

||||||||

|

ITEM 4.

|

24

|

|||||||||

|

|

4.A.

|

24

|

||||||||

|

|

4.B.

|

26

|

||||||||

|

|

4.C.

|

55

|

||||||||

|

|

4.D.

|

57

|

||||||||

|

ITEM 4A.

|

57

|

|||||||||

|

ITEM 5.

|

58

|

|||||||||

|

ITEM 6.

|

105

|

|||||||||

|

|

6.A.

|

105

|

||||||||

|

|

6.B.

|

109

|

||||||||

|

|

6.C.

|

114

|

||||||||

|

|

6.D.

|

119

|

||||||||

|

|

6.E.

|

121

|

||||||||

|

ITEM 7.

|

123

|

|||||||||

|

|

7.A.

|

123

|

||||||||

|

|

7.B.

|

123

|

||||||||

|

|

7.C.

|

123

|

||||||||

|

ITEM 8.

|

124

|

|||||||||

|

|

8.A.

|

124

|

||||||||

|

|

8.B.

|

124

|

||||||||

|

ITEM 9.

|

125

|

|||||||||

|

|

9.A.

|

125

|

||||||||

|

|

9.B.

|

125

|

||||||||

|

|

9.C.

|

125

|

||||||||

|

|

9.D.

|

125

|

||||||||

|

|

9.E.

|

125

|

||||||||

|

|

9.F.

|

125

|

||||||||

|

ITEM 10.

|

125

|

|||||||||

|

|

10.A.

|

125

|

||||||||

|

|

10.B.

|

125

|

||||||||

|

|

10.C.

|

138

|

||||||||

|

|

10.D.

|

138

|

||||||||

|

|

10.E.

|

142

|

||||||||

|

|

10.F.

|

148

|

||||||||

|

|

10.G.

|

148

|

||||||||

|

|

10.H.

|

148

|

||||||||

|

|

10.I.

|

149

|

||||||||

|

|

|

Page

|

|

|||||||

|

ITEM 11.

|

150

|

|||||||||

|

ITEM 12.

|

169

|

|||||||||

|

|

12.A.

|

169

|

||||||||

|

|

12.B.

|

169

|

||||||||

|

|

12.C.

|

169

|

||||||||

|

|

12.D.

|

169

|

||||||||

|

ITEM 13.

|

170

|

|||||||||

|

ITEM 14.

|

170

|

|||||||||

|

ITEM 15.

|

170

|

|||||||||

|

ITEM 16A.

|

171

|

|||||||||

|

ITEM 16B.

|

171

|

|||||||||

|

ITEM 16C.

|

171

|

|||||||||

|

ITEM 16D.

|

172

|

|||||||||

|

ITEM 16E.

|

173

|

|||||||||

|

ITEM 16F.

|

173

|

|||||||||

|

ITEM 16G.

|

173

|

|||||||||

|

ITEM 16H.

|

175

|

|||||||||

|

ITEM 17.

|

176

|

|||||||||

|

ITEM 18.

|

176

|

|||||||||

|

ITEM 19.

|

176

|

|||||||||

|

A-

1

|

||||||||||

|

F-

1

|

||||||||||

| • | the recent outbreak of the novel coronavirus; |

| • | increase in allowance for loan losses and incurrence of significant credit-related costs; |

| • | declines in the value of our securities portfolio, including as a result of the declines in stock markets and the impact of the dislocation in the global financial markets; |

| • | changes in interest rates; |

| • | foreign exchange rate fluctuations; |

| • | decrease in the market liquidity of our assets; |

| • | revised assumptions or other changes related to our pension plans; |

| • | a decline in our deferred tax assets; |

| • | the effect of financial transactions entered into for hedging and other similar purposes; |

| • | failure to maintain required capital adequacy ratio levels; |

| • | downgrades in our credit ratings; |

| • | our ability to avoid reputational harm; |

| • | our ability to implement our Five-Year Business Plan and other strategic initiatives and measures effectively; |

| • | the effectiveness of our operation, legal and other risk management policies; |

| • | the effect of changes in general economic conditions in Japan and elsewhere; |

| • | problems related to our information technology systems and cyber attacks; and |

| • | amendments and other changes to the laws and regulations that are applicable to us. |

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

|

ITEM 3.

|

KEY INFORMATION

|

|

|

As of and for the fiscal years ended March 31,

|

|||||||||||||||||||

|

|

2016

|

|

2017

|

|

2018

|

|

2019

|

|

2020

|

|

||||||||||

|

|

(in millions of yen, except per share data, share number information and percentages)

|

|||||||||||||||||||

|

Statement of income data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Interest and dividend income

|

¥ |

1,500,171

|

¥ |

1,509,030

|

¥ |

1,761,886

|

¥ |

2,207,443

|

¥ |

2,151,172

|

||||||||||

|

Interest expense

|

495,407

|

601,712

|

889,936

|

1,313,476

|

1,271,381

|

|||||||||||||||

|

Net interest income

|

1,004,764

|

907,318

|

871,950

|

893,967

|

879,791

|

|||||||||||||||

|

Provision (credit) for loan losses

|

34,560

|

37,668

|

(126,362

|

) |

32,459

|

156,200

|

||||||||||||||

|

Net interest income after provision (credit) for loan losses

|

970,204

|

869,650

|

998,312

|

861,508

|

723,591

|

|||||||||||||||

|

Noninterest income

|

1,883,894

|

1,368,032

|

1,604,663

|

1,222,371

|

1,307,740

|

|||||||||||||||

|

Noninterest expenses

|

1,657,493

|

1,757,307

|

1,763,677

|

1,998,819

|

1,877,841

|

|||||||||||||||

|

Income before income tax expense

|

1,196,605

|

480,375

|

839,298

|

85,060

|

153,490

|

|||||||||||||||

|

Income tax expense

|

346,542

|

91,244

|

237,604

|

9,335

|

47,175

|

|||||||||||||||

|

Net income

|

850,063

|

389,131

|

601,694

|

75,725

|

106,315

|

|||||||||||||||

|

Less: Net income (loss) attributable to noncontrolling interests

|

(429

|

) |

26,691

|

24,086

|

(8,746

|

) |

(43,880

|

) | ||||||||||||

|

Net income attributable to MHFG shareholders

|

¥ |

850,492

|

¥ |

362,440

|

¥ |

577,608

|

¥ |

84,471

|

¥ |

150,195

|

||||||||||

|

Net income attributable to common shareholders

|

¥ |

848,062

|

¥ |

362,440

|

¥ |

577,608

|

¥ |

84,471

|

¥ |

150,195

|

||||||||||

|

Amounts per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Basic earnings per common share—net income attributable to common shareholders

|

¥ |

34.19

|

¥ |

14.33

|

¥ |

22.77

|

¥ |

3.33

|

¥ |

5.92

|

||||||||||

|

Diluted earnings per common share—net income attributable to common shareholders

|

¥ |

33.50

|

¥ |

14.28

|

¥ |

22.76

|

¥ |

3.33

|

¥ |

5.92

|

||||||||||

|

Number of shares used to calculate basic earnings per common share (in thousands)

|

24,806,161

|

25,285,899

|

25,366,345

|

25,362,376

|

25,373,681

|

|||||||||||||||

|

Number of shares used to calculate diluted earnings per common share (in thousands)

|

25,387,033

|

25,380,302

|

25,373,931

|

25,366,898

|

25,375,264

|

|||||||||||||||

|

Cash dividends per share

(1)(2)

:

|

|

|

|

|

|

|||||||||||||||

|

Common stock

|

¥ |

7.50

|

¥ |

7.50

|

¥ |

7.50

|

¥ |

7.50

|

¥ |

7.50

|

||||||||||

|

|

$ |

0.07

|

$ |

0.07

|

$ |

0.07

|

$ |

0.07

|

$ |

0.07

|

||||||||||

|

Eleventh series class XI preferred stock

(3)

|

¥ |

20.00

|

¥ |

—

|

¥ |

—

|

¥ |

—

|

¥ |

—

|

||||||||||

|

|

$ |

0.18

|

$ |

—

|

$ |

—

|

$ |

—

|

$ |

—

|

||||||||||

|

|

As of and for the fiscal years ended March 31,

|

|||||||||||||||||||

|

|

2016

|

|

2017

|

|

2018

|

|

2019

|

|

2020

|

|

||||||||||

|

|

(in millions of yen, except per share data, share number information and percentages)

|

|||||||||||||||||||

|

Balance sheet data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Total assets

|

¥ |

193,810,151

|

(4)

|

¥

|

200,456,304

|

¥ |

204,255,642

|

¥ |

197,611,195

|

¥ |

211,218,760

|

|||||||||

|

Loans, net of allowance

|

77,104,122

|

81,804,233

|

83,204,742

|

82,492,742

|

87,087,233

|

|||||||||||||||

|

Total liabilities

|

185,626,960

|

(4)

|

191,684,247

|

194,751,942

|

188,109,702

|

202,043,136

|

||||||||||||||

|

Deposits

|

117,937,722

|

131,184,953

|

136,884,006

|

138,296,916

|

144,948,667

|

|||||||||||||||

|

Long-term debt

|

14,765,527

|

(4)

|

14,529,414

|

12,955,230

|

11,529,400

|

10,346,152

|

||||||||||||||

|

Common stock

|

5,703,144

|

5,826,149

|

5,826,383

|

5,829,657

|

5,827,500

|

|||||||||||||||

|

Total MHFG shareholders’ equity

|

8,014,551

|

8,261,357

|

8,868,421

|

8,726,519

|

8,512,365

|

|||||||||||||||

|

Other financial data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Return on equity and assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net income attributable to common shareholders as a percentage of total average assets

|

0.43

|

% |

0.18

|

% |

0.28

|

% |

0.04

|

% |

0.07

|

% | ||||||||||

|

Net income attributable to common shareholders as a percentage of average MHFG shareholders’ equity

|

13.33

|

% |

5.25

|

% |

8.26

|

% |

1.11

|

% |

1.90

|

% | ||||||||||

|

Dividends per common share as a percentage of basic earnings per common share

|

21.94

|

% |

52.34

|

% |

32.94

|

% |

225.23

|

% |

126.69

|

% | ||||||||||

|

Average MHFG shareholders’ equity as a percentage of total average assets

|

3.23

|

% |

3.38

|

% |

3.35

|

% |

3.71

|

% |

3.91

|

% | ||||||||||

|

Net interest income as a percentage of total average interest-earning assets

|

0.58

|

% |

0.51

|

% |

0.47

|

% |

0.48

|

% |

0.48

|

% | ||||||||||

| (1) |

Yen amounts are expressed in U.S. dollars at the rate of ¥112.42 = $1.00, ¥111.41 = $1.00, ¥106.20= $1.00, ¥110.68= $1.00 and ¥107.53= $1.00 for the fiscal years ended March 31, 2016, 2017, 2018, 2019 and 2020, respectively. These rates are the noon buying rates on the respective fiscal

year-end

dates in New York City for cable transfers in yen as certified for customs purposes by the Federal Reserve Bank of New York.

|

| (2) |

Figures represent cash dividends per share with respect to the applicable fiscal year. Dividends with respect to a fiscal year include

year-end

dividends and interim dividends. Declaration and payment of dividends are conducted during the immediately following fiscal year, in the case of

year-end

dividends, or immediately following interim period, in the case of interim dividends.

|

| (3) | On July 1, 2016, we acquired ¥75.1 billion of eleventh series class XI preferred stock, in respect of which a request for acquisition was not made by June 30, 2016, and delivered shares of our common stock, pursuant to Article 20, Paragraph 1 of our articles of incorporation and a provision in the terms and conditions of the preferred stock concerning mandatory acquisition in exchange for common stock. On July 13, 2016, we cancelled all of our treasury shares of eleventh series class XI preferred stock. |

| (4) |

Total assets, total liabilities and long-term debt have been recalculated to reflect the retrospective adoption of ASU

No.2015-03.

|

|

|

As of and for the fiscal years ended March 31,

|

|||||||||||||||||||

|

|

2016

|

|

2017

|

|

2018

|

|

2019

|

|

2020

|

|

||||||||||

|

|

(in millions of yen, except per share data and percentages)

|

|||||||||||||||||||

|

Statement of income data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Interest income

|

¥ |

1,426,256

|

¥ |

1,445,555

|

¥ |

1,622,354

|

¥ |

2,056,327

|

¥ |

2,014,440

|

||||||||||

|

Interest expense

|

422,574

|

577,737

|

814,988

|

1,293,846

|

1,280,897

|

|||||||||||||||

|

Net interest income

|

1,003,682

|

867,818

|

807,366

|

762,480

|

733,542

|

|||||||||||||||

|

Fiduciary income

|

53,458

|

50,627

|

55,400

|

55,153

|

58,565

|

|||||||||||||||

|

Net fee and commission income

|

607,551

|

603,542

|

614,349

|

610,427

|

619,243

|

|||||||||||||||

|

Net trading income

|

310,507

|

325,332

|

275,786

|

297,367

|

391,299

|

|||||||||||||||

|

Net other operating income

|

246,415

|

245,419

|

162,454

|

87,306

|

259,567

|

|||||||||||||||

|

General and administrative expenses

|

1,349,593

|

1,467,221

|

1,488,973

|

1,430,850

|

1,378,398

|

|||||||||||||||

|

Other income

|

365,036

|

438,042

|

565,683

|

447,300

|

318,438

|

|||||||||||||||

|

Other expenses

|

228,807

|

279,368

|

192,113

|

712,927

|

383,542

|

|||||||||||||||

|

Income before income taxes

|

1,008,252

|

784,193

|

799,953

|

116,259

|

618,717

|

|||||||||||||||

|

Income taxes:

|

|

|

|

|

|

|||||||||||||||

|

Current

(1)

|

213,289

|

196,535

|

190,158

|

161,376

|

150,088

|

|||||||||||||||

|

Deferred

|

69,260

|

(58,800

|

) |

1,469

|

(163,879

|

) |

11,408

|

|||||||||||||

|

Profit

|

725,702

|

646,457

|

608,326

|

118,762

|

457,221

|

|||||||||||||||

|

Profit attributable to non- controlling interests

|

54,759

|

42,913

|

31,778

|

22,196

|

8,652

|

|||||||||||||||

|

Profit attributable to owners of parent

|

¥ |

670,943

|

¥ |

603,544

|

¥ |

576,547

|

¥ |

96,566

|

¥ |

448,568

|

||||||||||

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Basic

|

¥ |

26.94

|

¥ |

23.86

|

¥ |

22.72

|

¥ |

3.80

|

¥ |

17.68

|

||||||||||

|

Diluted

|

26.42

|

23.78

|

22.72

|

3.80

|

17.68

|

|||||||||||||||

|

Balance sheet data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Total assets

|

¥ |

193,458,580

|

¥ |

200,508,610

|

¥ |

205,028,300

|

¥ |

200,792,226

|

¥ |

214,659,077

|

||||||||||

|

Loans and bills discounted

(2)

|

73,708,884

|

78,337,793

|

79,421,473

|

78,456,935

|

83,468,185

|

|||||||||||||||

|

Securities

|

39,505,971

|

32,353,158

|

34,183,033

|

29,774,489

|

34,907,234

|

|||||||||||||||

|

Deposits

(3)

|

117,456,604

|

130,676,494

|

136,463,824

|

137,649,596

|

144,472,235

|

|||||||||||||||

|

Net assets

|

9,353,244

|

9,273,361

|

9,821,246

|

9,194,038

|

8,663,847

|

|||||||||||||||

|

Risk-adjusted capital data (Basel III)

(4)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Common Equity Tier 1 capital

|

¥ |

6,566,488

|

¥ |

7,001,664

|

¥ |

7,437,048

|

¥ |

7,390,058

|

¥ |

7,244,776

|

||||||||||

|

Tier 1 capital

|

7,905,093

|

8,211,522

|

9,192,244

|

9,232,160

|

9,024,404

|

|||||||||||||||

|

Total capital

|

9,638,641

|

10,050,953

|

10,860,440

|

10,917,507

|

10,722,278

|

|||||||||||||||

|

Risk-weighted assets

|

62,531,174

|

61,717,158

|

59,528,983

|

57,899,567

|

62,141,217

|

|||||||||||||||

|

Common Equity Tier 1 capital ratio

|

10.50

|

% |

11.34

|

% |

12.49

|

% |

12.76

|

% |

11.65

|

% | ||||||||||

|

Tier 1 capital ratio

|

12.64

|

13.30

|

15.44

|

15.94

|

14.52

|

|||||||||||||||

|

Total capital ratio

|

15.41

|

16.28

|

18.24

|

18.85

|

17.25

|

|||||||||||||||

| (1) | Includes refund of income taxes. |

| (2) | Bills discounted refer to a form of financing in Japan under which promissory notes obtained by corporations through their regular business activities are purchased by banks prior to their payment dates at a discount based on prevailing interest rates. |

| (3) | Includes negotiable certificates of deposit. |

| (4) | Risk-adjusted capital data are calculated on a Basel III basis. We utilize the advanced internal ratings-based approach (the “AIRB approach”) for the calculation of risk-weighted assets associated with credit risk and the advanced measurement approach (the “AMA”) for the calculation of operational risk. For more details on capital adequacy requirements set by the Bank for International Settlements (“BIS”), and the guideline implemented by the Financial Services Agency in compliance thereto, see “Item 5. Operating and Financial Review and Prospects—Capital Adequacy.” |

| • | a reduction in the size and liquidity of the debt markets due for example to the decline in the domestic and global economy, concerns regarding the financial system or turmoil in financial markets and other factors; |

| • | adverse developments with respect to our financial condition and results of operations; or |

| • | downgrading of our credit ratings or damage to our reputation. |

| • | increased funding costs and other difficulties in raising funds; |

| • | the need to provide additional collateral in connection with financial market transactions; and |

| • | the termination or cancellation of existing agreements. |

|

ITEM 4.

|

INFORMATION OF THE COMPANY

|

| • | Be a partner that helps customers design their lives in a changing society. |

| • | Assist customers with asset building to support their life design in an era of lengthening lifespans, and develop professionals capable of providing this assistance. |

| • | Provide sophisticated solutions for business succession needs and assist clients with needs regarding identifying candidates for senior management roles. |

| • | Create next-generation branches focused on consulting that combine physical locations and digital channels. |

| • | Appeal to new customer demographics and create new demand through the application of technology and open collaboration. |

| • | Be a strategic partner for business development under a changing industrial structure. |

| • | Open collaboration for growth acceleration, including financing the growth of startups and forming industry-government-academia partnerships. |

| • | Utilize our industry knowledge and other insights to build new forms of partnerships that share business risks. |

| • | Leveraging our Asian client base and networks in order to support the business development of global clients. |

| • | Be a partner with expert knowledge of market mechanisms and the ability to draw on a range of intermediary functions. |

| • | By strengthening our global network and products framework, draw on a broad range of intermediary functions to connect investors with other investors and connect issuers with investors. |

| • | Enhance the sophistication of our ALM and portfolio management through flexible asset allocation while maintaining a focus on achieving a balance between realized gains and unrealized gains/losses. |

| • | Identify business/earnings structure issues in each business domain, focusing on the following four perspectives: |

| • | Risk and return (gross profits ROE) |

| • | Cost and return (expense ratio) |

| • | Growth potential |

| • | Stability |

| • |

Based on the above factors, streamline certain areas and

concentrate/re-allocate

corporate resources to growth areas.

|

| • | After establishing a stable profit base, transition to an earnings structure centered on proactively pursuing earnings streams with upside potential. |

| • | Transform our approach to new business and our working style. |

| • | Focus on the areas of personnel/workplace, IT systems/digital, sales channels and group companies. |

| • | Revise our human resources management in line with an approach that prioritizes employees’ professional growth and career preferences and promote a new human resources management strategy focused on maximizing our workforce value in a manner that is universally recognizable. |

| • | Strengthen group governance. |

| • |

Expand the use of

“dual-hat”

appointments of executive officers between our holding company and group companies and other methods of strengthening unified management of the group, including group companies other than banking, trust banking and securities subsidiaries. This will enhance our ability to implement key strategies and structural reforms.

|

| • | Cultivate a new corporate culture centered on communication. |

| • | Regarding the economy, industry, society and the environment, we will endeavor to increase our positive impacts and reduce our negative impacts, both direct and indirect. |

| • | We, as a financial group, will especially focus on the indirect impacts generated by our provision of financial and other services and through dialogue with clients (engagement). We will provide our clients with multifaceted support for initiatives addressing the Sustainable Development Goals (SDGs) and environmental, social and governance (ESG) concerns. |

| • | In the event of a conflict of interest or differences in opinion among stakeholders regarding the impacts and timeframe for implementation, we will make a comprehensive decision by taking into account the circumstances and situations as well as international frameworks, agreements or consensus, with a long-term perspective towards harmony with the economy, industry, society and the environment. |

| • | In the mergers and acquisitions business, with an aim to increase the corporate value of our customers, we offer sophisticated solutions in response to our customers’ needs, mainly in the areas of cross-border mergers and acquisitions, business succession and management buyouts. |

| • | In the real estate business, by taking full advantage of our extensive knowledge and skills developed through the collaboration of our group companies, we offer various real estate-backed financing methods and real estate-related investment strategy support. |

| • | In the asset finance business, by strengthening the collaboration between banking, trust banking and securities functions and by arranging customers’ asset securitization, we satisfy their demands such as diversification of fund-raising sources and improvement of financial indices achieved by removing assets from their balance sheet. |

| • | In the project finance business, we provide various financial products and services internationally, including long-term loan facilities for large-scale mining and public infrastructure development, and |

| domestically, including loans for renewable energy-related projects and arrangement of PFI/PPP deals. In addition, we offer investment opportunities to institutional investors through our managed infrastructure debt funds. |

| • | In the corporate finance business, we proactively provide a wide variety of fund raising solutions in the syndicated loan and debt and equity capital markets. |

| • | For our corporate customers in the transaction business, we offer various financial services and products such as online banking, cash management solutions, Renminbi-denominated services and trade finance on a global basis. |

| • | For financial institutions and institutional investors, we promote custody, global custody and yen correspondence settlement, asset management and stock transfer agent services. |

| • | In addition, we are further expanding our range of services in collaboration with our group companies and leveraging the latest technological innovations. |

| • | Japan’s other major banking groups: Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group. |

| • | Other banking institutions: These include city banks, trust banks, regional banks, shinkin banks (or credit associations), credit cooperatives, agricultural cooperatives, foreign banks and retail-oriented banks. |

| • | Securities companies and investment banks: These include both domestic securities companies and the Japanese affiliates of global investment banks. |

| • | Government financial institutions: These include Japan Finance Corporation, Japan Post Bank, Development Bank of Japan and Japan Bank for International Cooperation. |

| • |

Non-bank

finance companies: These include credit card issuers, installment shopping credit companies, leasing companies and other

non-bank

finance companies.

|

| • | Asset management companies. |

| • | Other financial services providers: We also compete with financial services providers that utilize “FinTech.” |

| • | a revised standardized approach for credit risk, which is designed to improve the robustness and risk sensitivity of the existing approach; |

| • |

revisions to the internal ratings-based approach for credit risk, where the use of the most advanced internally modelled approaches for

low-default

portfolios will be limited;

|

| • | revisions to the credit valuation adjustment (CVA) framework, including the removal of the internally modelled approach and the introduction of a revised standardized approach; |

| • | a revised standardized approach for operational risk, which will replace the existing standardized approaches and the advanced measurement approaches; |

| • | revisions to the capital floor, under which banks’ risk-weighted assets generated by internal models must be no lower than 72.5% of the total risk-weighted assets as calculated using only the standardized approaches under the revised Basel III framework; and |

| • | requirements to disclose their risk-weighted assets based on the standardized approaches. |

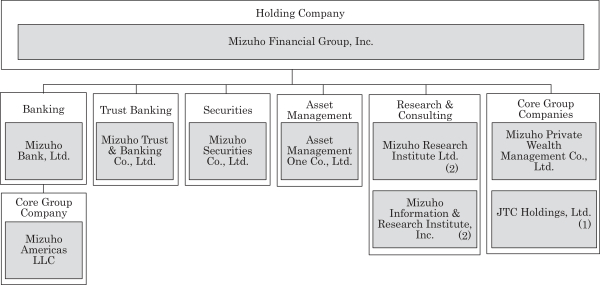

| (1) |

JTC Holdings, in which we have a 27.0% equity interest, is an equity-method affiliate of ours. JTC Holdings, Japan Trustee Services Bank, Ltd. and Trust & Custody Services Bank, Ltd., which are

equity-method

affiliates of ours, plan to merge as of July 27, 2020 and to change the trade name of the merged entity to “Custody Bank of Japan, Ltd.”

|

| (2) | Mizuho Information & Research Institute, Inc., Mizuho Research Institute Ltd. and Mizuho Trust Systems Company, Limited are scheduled to merge in April 2021. |

| (3) | Mizuho Financial Group has a 35.0% equity interest in Mizuho Operation Service, Ltd. and has added it to the core group companies as an equity-method affiliate as of June 30, 2020. |

|

Name

|

Country of

organization

|

Main business

|

Proportion of

ownership

interest

(%)

|

Proportion of

voting

interest

(%)

|

||||

|

Domestic

|

|

|

|

|

||||

|

Mizuho Bank, Ltd

|

Japan

|

Banking

|

100.0%

|

100.0%

|

||||

|

Mizuho Trust & Banking Co., Ltd.

|

Japan

|

Trust and banking

|

100.0%

|

100.0%

|

||||

|

Mizuho Securities Co., Ltd.

|

Japan

|

Securities

|

95.8%

|

95.8%

|

||||

|

Mizuho Research Institute Ltd

|

Japan

|

Research and consulting

|

100.0%

|

100.0%

|

||||

|

Mizuho Information & Research Institute, Inc

|

Japan

|

Information technology

|

100.0%

|

100.0%

|

||||

|

Asset Management One Co., Ltd.

|

Japan

|

Investment management

|

70.0%

|

51.0%

|

||||

|

Mizuho Private Wealth Management Co., Ltd

|

Japan

|

Consulting

|

100.0%

|

100.0%

|

||||

|

Mizuho Credit Guarantee Co., Ltd.

|

Japan

|

Credit guarantee

|

100.0%

|

100.0%

|

||||

|

Mizuho Realty Co., Ltd.

|

Japan

|

Real estate agency

|

100.0%

|

100.0%

|

||||

|

Mizuho Factors, Limited

|

Japan

|

Factoring

|

100.0%

|

100.0%

|

||||

|

UC Card Co., Ltd.

|

Japan

|

Credit card

|

100.0%

|

100.0%

|

||||

|

Mizuho Realty One Co., Ltd.

|

Japan

|

Holding company

|

100.0%

|

100.0%

|

||||

|

Mizuho Business Service Co., Ltd.

|

Japan

|

Subcontracted operations

|

100.0%

|

100.0%

|

||||

|

Defined Contribution Plan Services Co., Ltd

|

Japan

|

Pension plan-related business

|

60.0%

|

60.0%

|

||||

|

Mizuho-DL

Financial Technology Co., Ltd

|

Japan

|

Application and Sophistication of Financial Technology

|

60.0%

|

60.0%

|

||||

|

J.Score Co., Ltd.

|

Japan

|

Lending

|

50.0%

|

50.0%

|

||||

|

Mizuho Trust Systems Company, Limited

|

Japan

|

Subcontracted calculation services, software development

|

50.0%

|

50.0%

|

||||

|

Mizuho Capital Co., Ltd.

|

Japan

|

Venture capital

|

50.0%

|

50.0%

|

||||

|

Overseas

|

|

|

|

|

||||

|

Mizuho Americas LLC

|

USA

|

Holding company

|

100.0%

|

100.0%

|

||||

|

Mizuho Bank (China), Ltd

|

China

|

Banking

|

100.0%

|

100.0%

|

||||

|

Mizuho International plc

|

UK

|

Securities and banking

|

100.0%

|

100.0%

|

||||

|

Mizuho Securities Asia Limited

|

China

|

Securities

|

100.0%

|

100.0%

|

||||

|

Mizuho Securities USA LLC

|

USA

|

Securities

|

100.0%

|

100.0%

|

||||

|

Mizuho Capital Markets LLC

|

USA

|

Derivatives

|

100.0%

|

100.0%

|

||||

|

Mizuho Bank Europe N.V.

|

Netherlands

|

Banking and securities

|

100.0%

|

100.0%

|

||||

|

Banco Mizuho do Brasil S.A.

|

Brazil

|

Banking

|

100.0%

|

100.0%

|

||||

|

Mizuho Trust & Banking (Luxembourg) S.A.

|

Luxembourg

|

Trust and banking

|

100.0%

|

100.0%

|

||||

|

Mizuho Bank (USA)

|

USA

|

Banking and trust

|

100.0%

|

100.0%

|

||||

|

Mizuho Securities Europe GmbH

|

Germany

|

Securities

|

100.0%

|

100.0%

|

||||

|

PT. Bank Mizuho Indonesia

|

Indonesia

|

Banking

|

99.0%

|

99.0%

|

|

|

As of March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in millions of yen)

|

|||||||

|

Land

|

¥ |

563,032

|

¥ |

557,943

|

||||

|

Buildings

|

826,781

|

657,774

|

||||||

|

Equipment and furniture

|

472,186

|

442,302

|

||||||

|

Leasehold improvements

|

97,508

|

228,383

|

||||||

|

Construction in progress

|

37,174

|

73,164

|

||||||

|

Software

|

1,366,481

|

1,359,120

|

||||||

|

Total

|

3,363,162

|

3,318,686

|

||||||

|

Less: Accumulated depreciation and amortization

|

1,462,210

|

1,462,438

|

||||||

|

Premises and equipment—net

|

¥ |

1,900,952

|

¥ |

1,856,248

|

||||

|

ITEM 4A.

|

UNRESOLVED STAFF COMMENTS

|

|

|

Page

|

|

||

|

58

|

||||

|

65

|

||||

|

69

|

||||

|

75

|

||||

|

79

|

||||

|

81

|

||||

|

92

|

||||

|

93

|

||||

|

98

|

||||

|

100

|

||||

|

100

|

||||

|

101

|

||||

| • |

Mizuho Bank provides a wide range of financial products and services mainly in relation to deposits, lending and exchange settlement to individuals, small and

medium-sized

enterprises (“SMEs”), large corporations, financial institutions, public sector entities and foreign corporations, including foreign subsidiaries of Japanese corporations;

|

| • | Mizuho Trust & Banking provides products and services related to trust, real estate, securitization and structured finance, pension and asset management and stock transfer agency; and |

| • | Mizuho Securities provides full-line securities services to individuals, corporations, financial institutions and public sector entities. |

| • | the amount of interest-earning assets and interest-bearing liabilities; |

| • | the average interest rate spread (the difference between the average yield of interest earned on interest-earning assets and the average rate of interest paid on interest-bearing liabilities); and |

| • | the general level of interest rates. |

| • | fee and commission from securities-related business, including brokerage fee and commission related to the execution of customer transactions and sales commission of investment trusts and asset-based revenue, which mainly include fees received from investment trust management companies in return for administration services, such as record keeping services, of investment trusts; |

| • | fee and commission from deposits, including fees related to deposits such as account transfer charges; |

| • |

fee and commission from lending business, including fees related to the arrangement of syndicated loans and other financing transactions such as arrangement fees related to management

buy-out

transactions;

|

| • | fee and commission from remittance business, including service charges for domestic and international funds transfers and collections; |

| • | fee and commission from asset management business, including investment trust management fees and investment advisory fees for investment trusts; |

| • | fee and commission from trust-related business, including trust fees earned primarily through fiduciary asset management and administration service for corporate pension plans and investment funds and other trust-related fees such as brokerage commissions of real estate property, sales commissions of beneficial interest in real estate trust and charges for stock transfer agent services; |

| • | fee and commission from agency business, including administration service fees related to our agency business such as Japan’s principal public lottery program and revenue from standing proxy services; and |

| • | fees for other customer services, including various revenues such as guarantee fees, sales commissions of life insurance, service charges for electronic banking, financial advisory fees and service charges for software development. |

| • |

Japan’s real gross domestic product on a

year-on-year

basis increased by 0.3% in the fiscal year ended March 31, 2019 and almost unchanged in the fiscal year ended March 31, 2020. During the fiscal year ended March 31, 2020, the

year-on-year

growth rates were 0.9%, 1.7%, minus 0.7%, and minus 1.7%, for the quarters ended June 30, September 30, December 31 and March 31, respectively. Japan’s core nationwide consumer price index increased by 0.7%, 0.8% and 0.6% in the fiscal years ended March 31, 2018, 2019 and 2020, respectively.

|

| • |

In September 2016, the Bank of Japan decided to introduce “quantitative and qualitative monetary easing with yield curve control” by strengthening its two previous policy frameworks, namely “quantitative and qualitative monetary easing (“QQE”)” and “QQE with a negative interest rate.” The new policy framework consists of two major components: (1) “yield curve control” in which the Bank of Japan will control short-term and long-term interest rates; and (2) an “inflation-overshooting commitment” in which the Bank of Japan commits itself to expand the monetary base until the

year-on-year

rate of increase in the observed consumer price index exceeds the price stability target of 2% and stays above the target in a stable manner. Under the new policy framework, the Bank of Japan decided to set the guideline for market operations under which, regarding short-term interest rates, the Bank of Japan will apply a negative interest rate of minus 0.1% to certain excess balances in current accounts held by financial institutions at the Bank of Japan, while for long-term interest rates, it would purchase Japanese government bonds to control long-term interest rates so that the yield of

10-year

Japanese government bonds will remain at around 0%. In addition, the Bank of Japan decided to introduce the following new tools of market operations so as to control the yield curve smoothly: (i) outright purchases of Japanese government bonds with yields designated by the Bank of Japan; and (ii) fixed-rate funds-supplying operations for a period of up to ten years (thereby extending the longest maturity of the operation of one year).

|

| • | According to Teikoku Databank, a Japanese research institution, there were 8,285 corporate bankruptcies in the fiscal year ended March 31, 2018, involving approximately ¥2.6 trillion in total liabilities, 8,057 corporate bankruptcies in the fiscal year ended March 31, 2019, involving approximately ¥1.6 trillion in total liabilities, and 8,480 corporate bankruptcies in the fiscal year ended March 31, 2020, involving approximately ¥1.2 trillion in total liabilities. The number of corporate bankruptcies showed an increase from the previous fiscal year for the first time in two years. The amount of total liabilities decreased by approximately ¥0.3 trillion from the previous fiscal year. |

| • | The Nikkei Stock Average, which is an average of the price of 225 stocks listed on the Tokyo Stock Exchange, increased by 13.5% to ¥21,454.30 during the fiscal year ended March 31, 2018, followed by a 1.2% decrease to ¥21,205.81 during the fiscal year ended March 31, 2019 and a 10.8% decrease to ¥18,917.01 during the fiscal year ended March 31, 2020. Thereafter, the Nikkei Stock Average increased to ¥21,877.89 as of May 29, 2020. |

| • | The yen to U.S. dollar spot exchange rate, according to the Bank of Japan, was ¥106.19 to $1.00 as of March 30, 2018, ¥110.75 to $1.00 as of March 29, 2019 and ¥108.42 to $1.00 as of March 31, 2020. The rate fluctuated between ¥102.24 and ¥112.02 to $1.00 during the fiscal year ended March 31, 2020. Thereafter, the yen strengthened to ¥107.21 to $1.00 as of May 29, 2020. |

| • | According to the Ministry of Land, Infrastructure, Transport and Tourism of Japan, housing starts in Japan decreased by 2.8% in the fiscal year ended March 31, 2018, increased by 0.7% in the fiscal year ended March 31, 2019 and decreased by 7.3% in the fiscal year ended March 31, 2020. |

| • | According to the Ministry of Land, Infrastructure, Transport and Tourism of Japan, the average published housing land prices in Japan increased by 0.3%, 0.6% and 0.8% in calendar years 2017, 2018 and 2019, respectively. |

| • |

Allowance based on ASC 310.

re-evaluations

at least once a year. As to collateral of loans that are collateral dependent, in the case of real estate, valuation is generally performed by an appraising subsidiary that is independent from our loan origination sections by using generally accepted valuation techniques such as (i) the replacement cost approach, or (ii) the sales comparison approach, or (iii) the income approach, although in the case of large real estate collateral, we generally engage third-party appraisers to perform the valuation. Management identifies impaired loans through the credit quality review process, in which the ability of borrowers to service their debt is assessed. The difference between our evaluation of the value of the impaired loan and its principal amount is the amount of the impairment which is recorded in the allowance for loan losses. Estimation of future cash flows is based on a comprehensive analysis of the borrower’s ability to service the debt, any progress made on the borrower’s rehabilitation program and the assumptions used therein.

|

| • |

Allowance based on ASC 450.

|

| • |

Adjustment of allowance based on ASC 450.

|

|

Level 1

|

Quoted prices in active markets for identical assets or liabilities. Level 1 assets and liabilities include debt and equity securities and derivative contracts that are traded in an active exchange market.

|

|

|

Level 2

|

Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 2 assets and liabilities include debt securities with quoted prices that are traded less frequently than exchange-traded instruments. If no quoted market prices are available, the fair values of debt securities and

over-the-counter

derivative contracts in this category are determined using pricing models with inputs that are observable in the market or can be derived principally from or corroborated by observable market data.

|

|

|

Level 3

|

Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose values are determined using pricing models, discounted cash flow methodologies, or similar techniques.

|

|

|

Fiscal years ended March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in billions of yen)

|

|||||||

|

Interest and dividend income

|

¥ |

2,207

|

¥ |

2,150

|

||||

|

Interest expense

|

1,313

|

1,271

|

||||||

|

Net interest income

|

894

|

879

|

||||||

|

Provision (credit) for loan losses

|

32

|

156

|

||||||

|

Net interest income after provision (credit) for loan losses

|

862

|

723

|

||||||

|

Noninterest income

|

1,222

|

1,308

|

||||||

|

Noninterest expenses

|

1,999

|

1,878

|

||||||

|

Income before income tax expense

|

85

|

153

|

||||||

|

Income tax expense

|

9

|

47

|

||||||

|

Net income

|

76

|

106

|

||||||

|

Less: Net income (loss) attributable to noncontrolling interests

|

(9

|

) |

(44

|

) | ||||

|

Net income attributable to MHFG shareholders

|

¥ |

85

|

¥ |

150

|

||||

|

|

Fiscal years ended March 31,

|

|||||||||||||||||||||||

|

|

2019

|

2020

|

||||||||||||||||||||||

|

|

Average

balance |

|

Interest

amount |

|

Interest

rate |

|

Average

balance |

|

Interest

amount |

|

Interest

rate |

|

||||||||||||

|

|

(in billions of yen, except percentages)

|

|||||||||||||||||||||||

|

Domestic:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Interest-bearing deposits in other banks

|

¥ |

38,914

|

¥ |

26

|

0.07

|

% | ¥ |

34,333

|

¥ |

26

|

0.08

|

% | ||||||||||||

|

Call loans and funds sold, and receivables under resale agreements and securities borrowing transactions

|

6,201

|

32

|

0.51

|

9,322

|

27

|

0.30

|

||||||||||||||||||

|

Trading account assets

|

5,930

|

71

|

1.19

|

7,753

|

72

|

0.93

|

||||||||||||||||||

|

Investments

|

20,109

|

137

|

0.68

|

16,532

|

85

|

0.51

|

||||||||||||||||||

|

Loans

|

55,897

|

531

|

0.95

|

54,777

|

535

|

0.98

|

||||||||||||||||||

|

Total interest-earning assets

|

127,051

|

797

|

0.63

|

122,717

|

745

|

0.61

|

||||||||||||||||||

|

Deposits

|

87,168

|

94

|

0.11

|

87,143

|

90

|

0.10

|

||||||||||||||||||

|

Short-term borrowings

(1)

|

14,011

|

69

|

0.49

|

10,918

|

63

|

0.58

|

||||||||||||||||||

|

Trading account liabilities

|

1,735

|

34

|

1.93

|

1,591

|

41

|

2.59

|

||||||||||||||||||

|

Long-term debt

|

12,285

|

217

|

1.77

|

9,631

|

198

|

2.05

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

115,199

|

414

|

0.36

|

109,283

|

392

|

0.36

|

||||||||||||||||||

|

Net

|

11,852

|

383

|

0.27

|

13,434

|

353

|

0.25

|

||||||||||||||||||

|

Foreign:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Interest-bearing deposits in other banks

|

5,951

|

95

|

1.59

|

5,716

|

79

|

1.39

|

||||||||||||||||||

|

Call loans and funds sold, and receivables under resale agreements and securities borrowing transactions

|

9,924

|

228

|

2.30

|

11,301

|

249

|

2.21

|

||||||||||||||||||

|

Trading account assets

|

9,197

|

141

|

1.53

|

8,859

|

150

|

1.69

|

||||||||||||||||||

|

Investments

|

4,471

|

95

|

2.13

|

4,096

|

81

|

1.98

|

||||||||||||||||||

|

Loans

|

28,037

|

851

|

3.03

|

28,827

|

846

|

2.94

|

||||||||||||||||||

|

Total interest-earning assets

|

57,580

|

1,410

|

2.45

|

58,799

|

1,405

|

2.39

|

||||||||||||||||||

|

Deposits

|

26,693

|

519

|

1.95

|

27,507

|

526

|

1.91

|

||||||||||||||||||

|

Short-term borrowings

(1)

|

15,094

|

357

|

2.37

|

15,112

|

334

|

2.21

|

||||||||||||||||||

|

Trading account liabilities

|

1,249

|

16

|

1.29

|

1,009

|

12

|

1.16

|

||||||||||||||||||

|

Long-term debt

|

701

|

7

|

0.95

|

678

|

7

|

1.13

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

43,737

|

899

|

2.06

|

44,306

|

879

|

1.98

|

||||||||||||||||||

|

Net

|

13,843

|

511

|

0.39

|

14,493

|

526

|

0.41

|

||||||||||||||||||

|

Total:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Total interest-earning assets

|

184,631

|

2,207

|

1.20

|

181,516

|

2,150

|

1.19

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

158,936

|

1,313

|

0.83

|

153,589

|

1,271

|

0.83

|

||||||||||||||||||

|

Net

|

¥ |

25,695

|

¥ |

894

|

0.37

|

¥ |

27,927

|

¥ |

879

|

0.36

|

||||||||||||||

| (1) | Short-term borrowings consist of due to trust accounts, call money and funds purchased, payables under repurchase agreements and securities lending transactions and other short-term borrowings. |

|

|

Fiscal years ended March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in billions of yen)

|

|||||||

|

Fee and commission

|

¥ |

853

|

¥ |

868

|

||||

|

Fee and commission from deposits and lending business

|

152

|

158

|

||||||

|

Fee and commission from securities-related business

|

145

|

139

|

||||||

|

Fee and commission from trust related business

|

125

|

129

|

||||||

|

Fee and commission from remittance business

|

110

|

112

|

||||||

|

Fee and commission from asset management business

|

98

|

99

|

||||||

|

Fee and commission from agency business

|

36

|

32

|

||||||

|

Fee and commission from guarantee related business

|

29

|

29

|

||||||

|

Fees for other customer services

|

158

|

170

|

||||||

|

Foreign exchange gains (losses)—net

|

94

|

44

|

||||||

|

Trading account gains (losses)—net

|

329

|

746

|

||||||

|

Investment gains (losses)—net

|

(160

|

) |

(526

|

) | ||||

|

Debt securities

|

(4

|

) |

31

|

|||||

|

Equity securities

|

(156

|

) |

(557

|

) | ||||

|

Equity in earnings (losses) of equity method investees—net

|

29

|

34

|

||||||

|

Gains on disposal of premises and equipment

|

5

|

3

|

||||||

|

Other noninterest income

|

72

|

139

|

||||||

|

Total noninterest income

|

¥ |

1,222

|

¥ |

1,308

|

||||

|

|

Fiscal years ended March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in billions of yen)

|

|||||||

|

Salaries and employee benefits

|

¥ |

683

|

¥ |

677

|

||||

|

General and administrative expenses

|

762

|

649

|

||||||

|

Occupancy expenses

|

208

|

215

|

||||||

|

Fee and commission expenses

|

190

|

194

|

||||||

|

Provision (credit) for losses on

off-balance-sheet

instruments

|

(9

|

) |

19

|

|||||

|

Other noninterest expenses

|

165

|

124

|

||||||

|

Total noninterest expenses

|

¥ |

1,999

|

¥ |

1,878

|

||||

|

|

Fiscal years ended March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in billions of yen)

|

|||||||

|

Current:

|

|

|

|

|

|

|

||

|

Domestic

|

¥ |

116

|

¥ |

96

|

||||

|

Foreign

|

50

|

53

|

||||||

|

Total current tax expense

|

166

|

149

|

||||||

|

Deferred:

|

|

|

|

|

|

|

||

|

Domestic

|

(162

|

) |

(111

|

) | ||||

|

Foreign

|

5

|

9

|

||||||

|

Total deferred tax expense (benefit)

|

(157

|

) |

(102

|

) | ||||

|

Total income tax expense

|

¥ |

9

|

¥ |

47

|

||||

|

|

As of March 31,

|

|||||||

|

|

2019

|

|

2020

|

|

||||

|

|

(in billions of yen)

|

|||||||

|

Deferred tax assets:

|

|

|

||||||

|

Lease liabilities

|

¥ |

—

|

¥ |

192

|

||||

|

Allowance for loan losses

|

123

|

166

|

||||||

|

Premises and equipment

|

74

|

78

|

||||||

|

Available-for-sale

securities

|

—

|

6

|

||||||

|

Derivative financial instruments

|

48

|

5

|

||||||

|

Investments

|

—

|

4

|

||||||

|

Net operating loss carryforwards

|

168

|

163

|

||||||

|

Other

|

216

|

201

|

||||||

|

Gross deferred tax assets

|

629

|

815

|

||||||

|

Valuation allowance

|

(158

|

) |

(165

|

) | ||||

|

Deferred tax assets, net of valuation allowance

|

471

|

650

|

||||||

|

Deferred tax liabilities:

|

|

|

||||||

|

Prepaid pension cost and accrued pension liabilities

|

248

|

203

|

||||||

|

ROU assets

|

—

|

189

|

||||||

|

Trading securities

|

9

|

58

|

||||||

|

Investments

|

198

|

—

|

||||||

|

Available-for-sale

securities

|

12

|

—

|

||||||

|

Other

|

62

|

89

|

||||||

|

Gross deferred tax liabilities

|

529

|

539

|

||||||

|

Net deferred tax assets (liabilities)

|

¥ |

(58

|

) | ¥ |

111

|

|||

|

|

Mizuho Financial Group (Consolidated)

|

|||||||||||||||||||||||||||

|

Fiscal year ended March 31, 2019

(5)

:

|

Retail &

Business Banking Company |

|

Corporate &

Institutional Company |

|

Global

Corporate Company |

|

Global

Markets Company |

|

Asset

Management Company |

|

Others

(4)

|

|

Total

|

|

||||||||||||||

|

|

(in billions of yen)

|

|||||||||||||||||||||||||||

|

Gross profits + Net gains (losses) related to ETFs and others

(1)

|

¥ |

705.9

|

¥ |

473.4

|

¥ |

400.3

|

¥ |

192.4

|

¥ |

49.6

|

¥ |

6.1

|

¥ |

1,827.7

|

||||||||||||||

|

General and administrative expenses

(2)

|

713.5

|

205.7

|

237.9

|

207.5

|

27.3

|

48.7

|

1,440.6

|

|||||||||||||||||||||

|

Equity in earnings (losses) of equity method investees—net

|

18.1

|

0.9

|

7.2

|

—

|

1.3

|

23.7

|

51.2

|

|||||||||||||||||||||

|

Amortization of goodwill and others

|

0.4

|

0.4

|

0.4

|

2.3

|

8.0

|

2.1

|

13.6

|

|||||||||||||||||||||

|

Others

|

—

|

—

|

—

|

—

|

—

|

(16.3

|

) |

(16.3

|

) | |||||||||||||||||||

|

Net business profits (losses)

(3)

+ Net gains (losses) related to ETFs and others

|

¥ |

10.1

|

¥ |

268.2

|

¥ |

169.2

|

¥ |

(17.4

|

) | ¥ |

15.6

|

¥ |

(37.3

|

) | ¥ |

408.4

|

||||||||||||

|

Fixed assets

(6)

|

¥ |

499.3

|

¥ |

225.8

|

¥ |

176.9

|

¥ |

92.6

|

¥ |

0.1

|

¥ |

662.5

|

¥ |

1,657.2

|

||||||||||||||

|

|

Mizuho Financial Group (Consolidated)

|

|||||||||||||||||||||||||||

|

Fiscal year ended March 31, 2020:

|

Retail &

Business Banking Company |

|

Corporate &

Institutional Company |

|

Global

Corporate Company |

|

Global

Markets Company |

|

Asset

Management Company |

|

Others

(4)

|

|

Total

|

|

||||||||||||||

|

|

(in billions of yen)

|

|||||||||||||||||||||||||||

|

Gross profits + Net gains (losses) related to ETFs and others

(1)

|

¥ |

673.6

|

¥ |

462.4

|

¥ |

417.8

|

¥ |

410.1

|

¥ |

48.4

|

¥ |

60.5

|

¥ |

2,072.8

|

||||||||||||||

|

General and administrative expenses

(2)

|

668.5

|

215.1

|

249.0

|

208.9

|

29.0

|

41.0

|

1,411.5

|

|||||||||||||||||||||

|

Equity in earnings (losses) of equity method investees—net

|

11.8

|

2.0

|

10.3

|

—

|

1.3

|

5.0

|

30.4

|

|||||||||||||||||||||

|

Amortization of goodwill and others

|

0.4

|

0.4

|

0.4

|

2.3

|

7.8

|

1.9

|

13.2

|

|||||||||||||||||||||

|

Others

|

—

|

—

|

—

|

—

|

—

|

(5.9

|

) |

(5.9

|

) | |||||||||||||||||||

|

Net business profits (losses)

(3)

+ Net gains (losses) related to ETFs and others

|

¥ |

16.5

|

¥ |

248.9

|

¥ |

178.7

|

¥ |

198.9

|

¥ |

12.9

|

¥ |

16.7

|

¥ |

672.6

|

||||||||||||||

|

Fixed assets

(6)

|

¥ |

503.7

|

¥ |

204.1

|

¥ |

173.0

|

¥ |

91.5

|

¥ |

0.1

|

¥ |

767.4

|

¥ |

1,739.8

|

||||||||||||||

| (1) |

“Gross profits + Net gains (losses) related to ETFs and others” is reported instead of sales reported by general corporations. Gross profits is defined as the sum of net interest income, fiduciary income, net fee and commission income, net trading income and net other operating income. Net gains (losses) related to ETFs and others consist of net gains (losses) on ETFs held by Mizuho Bank and Mizuho Trust & Banking on their

non-consolidated

basis and net gains (losses) on operating investment securities of Mizuho Securities on its consolidated basis. For the fiscal years ended March 31, 2019 and 2020, net gains (losses) related to ETFs and others amounted to ¥15.0 billion and ¥10.6 billion, respectively, of which ¥7.3 billion and ¥7.3 billion are included in “Global Markets Company,” respectively.

|

| (2) |

“General and administrative expenses” excludes

non-allocated

gains (losses), net.

|

| (3) | Net business profits (losses) is used in Japan as a measure of the profitability of core banking operations, and is defined as gross profits (as defined above) less general and administrative expenses plus equity in earnings (losses) of equity method investees—net and others. Measurement of net business profits (losses) is required for regulatory reporting to the Financial Services Agency of Japan. |

| (4) | “Others” includes the following items: |

| • | profits and expenses pertaining to consolidated subsidiaries that are not subject to allocation; |

| • | consolidating adjustments, including eliminating internal transaction between each segment; |

| • |

equity in earnings (losses) of equity method

investees-net

that are not subject to allocation; and

|

| • | profits and losses pertaining to derivative transactions that reflect the counterparty risk of the individual parties and other factors in determining fair market value. |

| (5) | Income and expenses of foreign branches of Mizuho Bank and foreign subsidiaries with functional currencies other than Japanese Yen have been translated for purposes of segment reporting using the budgeted foreign currency rates. Prior period comparative amounts for such foreign currency income and expenses have been translated using current period budgeted foreign currency rates. |

| (6) |

“Fixed assets” is presented based on Japanese GAAP and corresponds to the total amount of the following U.S. GAAP accounts: Premises and

equipment-net;

Goodwill; Intangible assets; and

right-of-use

assets related to operating leases included in Other assets. The above table does not include other asset amounts because “Fixed assets” is the only balance sheet metric that management uses when evaluating and making decisions pertaining to the operating segments. “Fixed assets” has been allocated to each segment starting in the fiscal year ended March 31, 2019 to enhance management’s analysis of the Group’s operations. “Others” in “Fixed assets” includes assets of headquarters that have not been allocated to each segment, “Fixed assets” pertaining to consolidated subsidiaries that are not subject to allocation, consolidating adjustments,

|

| and others. Certain “Fixed assets” expenses have been allocated to each segment using reasonable allocation criteria. |

|

|

|

|

Americas

|

|

|

Asia/Oceania

excluding

Japan,

and others

|

|

|

|

|||||||||||||||

|

|

Japan

|

|

United

States

|

|

Others

|

|

Europe

|

|

Total

|

|

||||||||||||||

|

|

(in billions of yen)

|

|||||||||||||||||||||||

|

Fiscal year ended March 31, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Total revenue

(1)

|

¥ |

1,705

|

¥ |

792

|

¥ |

66

|

¥ |

250

|

¥ |

616

|

¥ |

3,429

|

||||||||||||

|

Total expenses

(2)

|

2,082

|

697

|

46

|

203

|

316

|

3,344

|

||||||||||||||||||

|

Income (loss) before income tax expense

|

(377

|

) |

95

|

20

|

47