|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Virginia

|

13-3260245

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

6601 West Broad Street, Richmond, Virginia

|

23230

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.33

1

/

3

par value

|

New York Stock Exchange

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

þ

Yes

¨

No

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨

Yes

þ

No

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

þ

Yes

¨

No

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

þ

Yes

¨

No

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K

þ

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

þ

Accelerated filer

¨

|

|

Non-accelerated filer

¨

(Do not check if smaller reporting company) Smaller operating company

¨

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨

Yes

þ

No

|

|

Class

|

Outstanding at February 12, 2016

|

|

Common Stock, $0.33

1

/

3

par value

|

1,957,931,815 shares

|

|

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of shareholders to be held on May 19, 2016, to be filed with the Securities and Exchange Commission on or about April 7, 2016, are incorporated by reference into Part III hereof.

|

|

TABLE OF CONTENTS

|

||

|

|

|

Page

|

|

PART I

|

|

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

|

|

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

|

|

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

|

|

|

Item 15.

|

||

|

|

||

|

2015

|

2014

|

2013

|

||||

|

Smokeable products

|

87.4

|

%

|

87.2

|

%

|

84.5

|

%

|

|

Smokeless products

|

12.8

|

|

13.4

|

|

12.2

|

|

|

Wine

|

1.8

|

|

1.7

|

|

1.4

|

|

|

All other

|

(2.0

|

)

|

(2.3

|

)

|

1.9

|

|

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

▪

|

promote brand equity successfully;

|

|

▪

|

anticipate and respond to new and evolving adult consumer preferences;

|

|

▪

|

develop, manufacture, market and distribute products that appeal to adult consumers (including, where appropriate, through arrangements with, or investments in, third parties);

|

|

▪

|

improve productivity; and

|

|

▪

|

protect or enhance margins through cost savings and price increases.

|

|

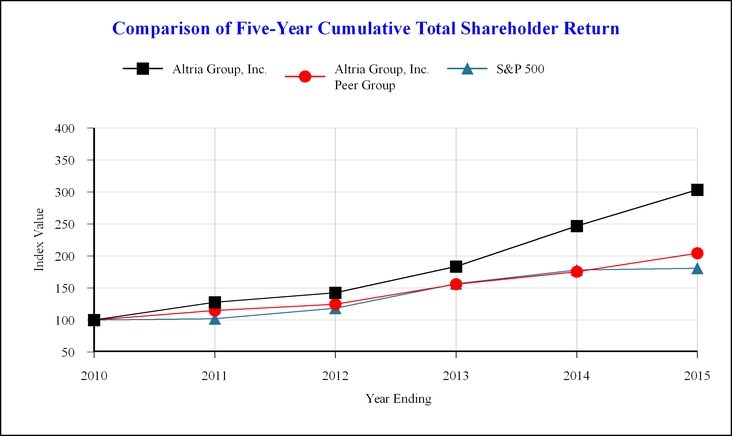

Date

|

Altria Group, Inc.

|

Altria Group, Inc. Peer Group

|

S&P 500

|

|||||||||

|

December 2010

|

$

|

100.00

|

|

$

|

100.00

|

|

$

|

100.00

|

|

|||

|

December 2011

|

$

|

127.66

|

|

$

|

114.65

|

|

$

|

102.11

|

|

|||

|

December 2012

|

$

|

142.68

|

|

$

|

124.68

|

|

$

|

118.44

|

|

|||

|

December 2013

|

$

|

183.42

|

|

$

|

155.86

|

|

$

|

156.79

|

|

|||

|

December 2014

|

$

|

246.72

|

|

$

|

175.31

|

|

$

|

178.24

|

|

|||

|

December 2015

|

$

|

303.71

|

|

$

|

204.47

|

|

$

|

180.68

|

|

|||

|

Price Per Share

|

Cash Dividends Declared Per Share

|

||||||||||

|

High

|

Low

|

||||||||||

|

2015:

|

|||||||||||

|

Fourth Quarter

|

$

|

61.74

|

|

$

|

53.68

|

|

$

|

0.565

|

|

||

|

Third Quarter

|

$

|

56.39

|

|

$

|

47.41

|

|

$

|

0.565

|

|

||

|

Second Quarter

|

$

|

52.99

|

|

$

|

47.31

|

|

$

|

0.52

|

|

||

|

First Quarter

|

$

|

56.70

|

|

$

|

48.52

|

|

$

|

0.52

|

|

||

|

2014:

|

|||||||||||

|

Fourth Quarter

|

$

|

51.67

|

|

$

|

44.59

|

|

$

|

0.52

|

|

||

|

Third Quarter

|

$

|

46.20

|

|

$

|

40.26

|

|

$

|

0.52

|

|

||

|

Second Quarter

|

$

|

43.38

|

|

$

|

37.13

|

|

$

|

0.48

|

|

||

|

First Quarter

|

$

|

38.38

|

|

$

|

33.80

|

|

$

|

0.48

|

|

||

|

Period

|

Total Number of Shares Purchased

(1)

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet be Purchased Under the Plans or Programs

|

||||||||||

|

October 1- October 31, 2015

|

1,811

|

|

$

|

61.14

|

|

—

|

|

$

|

1,000,000,000

|

|

||||

|

November 1- November 30, 2015

|

1,977

|

|

$

|

54.03

|

|

—

|

|

$

|

1,000,000,000

|

|

||||

|

December 1- December 31, 2015

|

613,973

|

|

$

|

57.65

|

|

612,000

|

|

$

|

964,710,531

|

|

||||

|

For the Quarter Ended December 31, 2015

|

617,761

|

|

$

|

57.65

|

|

|||||||||

|

(1)

|

The total number of shares purchased include (a) shares purchased under the July 2015 share repurchase program (which totaled 612,000 shares in December) and (b) shares withheld by Altria Group, Inc. in an amount equal to the statutory withholding taxes for holders who vested in restricted stock and restricted stock units, and forfeitures of restricted stock for which consideration was paid in connection with termination of employment of certain employees (which totaled 1,811 shares in October, 1,977 shares in November and 1,973 shares in December).

|

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||

|

Summary of Operations:

|

|||||||||||||||||||

|

Net revenues

|

$

|

25,434

|

|

$

|

24,522

|

|

$

|

24,466

|

|

$

|

24,618

|

|

$

|

23,800

|

|

||||

|

Cost of sales

|

7,740

|

|

7,785

|

|

7,206

|

|

7,937

|

|

7,680

|

|

|||||||||

|

Excise taxes on products

|

6,580

|

|

6,577

|

|

6,803

|

|

7,118

|

|

7,181

|

|

|||||||||

|

Operating income

|

8,361

|

|

7,620

|

|

8,084

|

|

7,253

|

|

6,068

|

|

|||||||||

|

Interest and other debt expense, net

|

817

|

|

808

|

|

1,049

|

|

1,126

|

|

1,216

|

|

|||||||||

|

Earnings from equity investment in SABMiller

|

757

|

|

1,006

|

|

991

|

|

1,224

|

|

730

|

|

|||||||||

|

Earnings before income taxes

|

8,078

|

|

7,774

|

|

6,942

|

|

6,477

|

|

5,582

|

|

|||||||||

|

Pre-tax profit margin

|

31.8

|

%

|

31.7

|

%

|

28.4

|

%

|

26.3

|

%

|

23.5

|

%

|

|||||||||

|

Provision for income taxes

|

2,835

|

|

2,704

|

|

2,407

|

|

2,294

|

|

2,189

|

|

|||||||||

|

Net earnings

|

5,243

|

|

5,070

|

|

4,535

|

|

4,183

|

|

3,393

|

|

|||||||||

|

Net earnings attributable to Altria Group, Inc.

|

5,241

|

|

5,070

|

|

4,535

|

|

4,180

|

|

3,390

|

|

|||||||||

|

Basic and Diluted EPS — net earnings attributable to Altria Group, Inc.

|

2.67

|

|

2.56

|

|

2.26

|

|

2.06

|

|

1.64

|

|

|||||||||

|

Dividends declared per share

|

2.17

|

|

2.00

|

|

1.84

|

|

1.70

|

|

1.58

|

|

|||||||||

|

Weighted average shares (millions) — Basic and Diluted

|

1,961

|

|

1,978

|

|

1,999

|

|

2,024

|

|

2,064

|

|

|||||||||

|

Capital expenditures

|

229

|

|

163

|

|

131

|

|

124

|

|

105

|

|

|||||||||

|

Depreciation

|

204

|

|

188

|

|

192

|

|

205

|

|

233

|

|

|||||||||

|

Property, plant and equipment, net

|

1,982

|

|

1,983

|

|

2,028

|

|

2,102

|

|

2,216

|

|

|||||||||

|

Inventories

|

2,031

|

|

2,040

|

|

1,879

|

|

1,746

|

|

1,779

|

|

|||||||||

|

Total assets

|

32,535

|

|

34,475

|

|

34,859

|

|

35,329

|

|

36,751

|

|

|||||||||

|

Long-term debt

|

12,915

|

|

13,693

|

|

13,992

|

|

12,419

|

|

13,089

|

|

|||||||||

|

Total debt

|

12,919

|

|

14,693

|

|

14,517

|

|

13,878

|

|

13,689

|

|

|||||||||

|

Total stockholders’ equity

|

2,873

|

|

3,010

|

|

4,118

|

|

3,170

|

|

3,683

|

|

|||||||||

|

Common dividends declared as a % of Basic and Diluted EPS

|

81.3

|

%

|

78.1

|

%

|

81.4

|

%

|

82.5

|

%

|

96.3

|

%

|

|||||||||

|

Book value per common share outstanding

|

1.47

|

|

1.53

|

|

2.07

|

|

1.58

|

|

1.80

|

|

|||||||||

|

Market price per common share — high/low

|

61.74-47.31

|

|

51.67-33.80

|

|

38.58-31.85

|

|

36.29-28.00

|

|

30.40-23.20

|

|

|||||||||

|

Closing price per common share at year end

|

58.21

|

|

49.27

|

|

38.39

|

|

31.44

|

|

29.65

|

|

|||||||||

|

Price/earnings ratio at year end — Basic and Diluted

|

22

|

|

19

|

|

17

|

|

15

|

|

18

|

|

|||||||||

|

Number of common shares outstanding at year end (millions)

|

1,960

|

|

1,971

|

|

1,993

|

|

2,010

|

|

2,044

|

|

|||||||||

|

Approximate number of employees

|

8,800

|

|

9,000

|

|

9,000

|

|

9,100

|

|

9,900

|

|

|||||||||

|

(in millions, except per share data)

|

Net

Earnings

|

|

Diluted

EPS

|

|

|||

|

For the year ended December 31, 2014

|

$

|

5,070

|

|

$

|

2.56

|

|

|

|

2014 NPM Adjustment Items

|

(56

|

)

|

(0.03

|

)

|

|||

|

2014 Asset impairment, exit, integration and acquisition-related costs

|

14

|

|

0.01

|

|

|||

|

2014 Tobacco and health litigation items

|

28

|

|

0.01

|

|

|||

|

2014 SABMiller special items

|

17

|

|

0.01

|

|

|||

|

2014 Loss on early extinguishment of debt

|

28

|

|

0.02

|

|

|||

|

2014 Tax items

|

(14

|

)

|

(0.01

|

)

|

|||

|

Subtotal 2014 special items

|

17

|

|

0.01

|

|

|||

|

2015 NPM Adjustment Items

|

51

|

|

0.03

|

|

|||

|

2015 Asset impairment, exit and integration costs

|

(9

|

)

|

—

|

|

|||

|

2015 Tobacco and health litigation items

|

(94

|

)

|

(0.05

|

)

|

|||

|

2015 SABMiller special items

|

(82

|

)

|

(0.04

|

)

|

|||

|

2015 Loss on early extinguishment of debt

|

(143

|

)

|

(0.07

|

)

|

|||

|

2015 Other income, net

|

3

|

|

—

|

|

|||

|

2015 Tax items

|

11

|

|

—

|

|

|||

|

Subtotal 2015 special items

|

(263

|

)

|

(0.13

|

)

|

|||

|

Fewer shares outstanding

|

—

|

|

0.02

|

|

|||

|

Change in tax rate

|

(53

|

)

|

(0.03

|

)

|

|||

|

Operations

|

470

|

|

0.24

|

|

|||

|

For the year ended December 31, 2015

|

$

|

5,241

|

|

$

|

2.67

|

|

|

|

▪

|

Fewer Shares Outstanding:

Fewer shares outstanding during 2015 compared with 2014 were due primarily to shares repurchased by Altria Group, Inc. under its share repurchase programs.

|

|

▪

|

Change in Tax Rate:

The change in tax rate was due primarily to decreased recognition of foreign tax credits associated with SABMiller dividends.

|

|

▪

|

Operations:

The increase of

$470 million

in operations shown in the table above was due primarily to the following:

|

|

▪

|

higher income from the smokeable products and smokeless products segments; and

|

|

▪

|

lower interest and other debt expense, net;

|

|

▪

|

lower earnings from Altria’s equity investment in SABMiller.

|

|

2016

|

|

2015

|

|

||||

|

NPM Adjustment Items

|

$

|

—

|

|

$

|

(0.03

|

)

|

|

|

Asset impairment, exit and implementation costs

1

|

0.05

|

|

—

|

|

|||

|

Tobacco and health litigation items

|

—

|

|

0.05

|

|

|||

|

SABMiller special items

|

—

|

|

0.04

|

|

|||

|

Loss on early extinguishment of debt

|

—

|

|

0.07

|

|

|||

|

$

|

0.05

|

|

$

|

0.13

|

|

||

|

(in millions)

|

Goodwill

|

|

Indefinite-Lived

Intangible Assets

|

|

|||

|

Cigarettes

|

$

|

—

|

|

$

|

2

|

|

|

|

Smokeless products

|

5,023

|

|

8,801

|

|

|||

|

Cigars

|

77

|

|

2,640

|

|

|||

|

Wine

|

74

|

|

258

|

|

|||

|

E-vapor

|

111

|

|

10

|

|

|||

|

Total

|

$

|

5,285

|

|

$

|

11,711

|

|

|

|

▪

|

the estimated fair values of all reporting units substantially exceeded their carrying values;

|

|

▪

|

the estimated fair values of the indefinite-lived intangible assets within the cigars and wine reporting units substantially exceeded their carrying values; and

|

|

▪

|

in the smokeless products reporting unit, the estimated fair value of the

Copenhagen

trademark

substantially exceeded its carrying value, while the estimated fair values of the

Skoal

trademark

and certain other smokeless products trademarks (primarily

Red Seal

and

Husky

) did not substantially exceed their carrying values.

|

|

|

For the Years Ended December 31,

|

||||||||||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Net Revenues:

|

|||||||||||

|

Smokeable products

|

$

|

22,792

|

|

$

|

21,939

|

|

$

|

21,868

|

|

||

|

Smokeless products

|

1,879

|

|

1,809

|

|

1,778

|

|

|||||

|

Wine

|

692

|

|

643

|

|

609

|

|

|||||

|

All other

|

71

|

|

131

|

|

211

|

|

|||||

|

Net revenues

|

$

|

25,434

|

|

$

|

24,522

|

|

$

|

24,466

|

|

||

|

Excise Taxes on Products:

|

|||||||||||

|

Smokeable products

|

$

|

6,423

|

|

$

|

6,416

|

|

$

|

6,651

|

|

||

|

Smokeless products

|

133

|

|

138

|

|

130

|

|

|||||

|

Wine

|

24

|

|

23

|

|

22

|

|

|||||

|

Excise taxes on products

|

$

|

6,580

|

|

$

|

6,577

|

|

$

|

6,803

|

|

||

|

Operating Income:

|

|||||||||||

|

Operating companies income (loss):

|

|||||||||||

|

Smokeable products

|

$

|

7,569

|

|

$

|

6,873

|

|

$

|

7,063

|

|

||

|

Smokeless products

|

1,108

|

|

1,061

|

|

1,023

|

|

|||||

|

Wine

|

152

|

|

134

|

|

118

|

|

|||||

|

All other

|

(169

|

)

|

(185

|

)

|

157

|

|

|||||

|

Amortization of intangibles

|

(21

|

)

|

(20

|

)

|

(20

|

)

|

|||||

|

General corporate expenses

|

(237

|

)

|

(241

|

)

|

(235

|

)

|

|||||

|

Changes to Mondelēz and PMI

tax-related receivables/payables

|

(41

|

)

|

(2

|

)

|

(22

|

)

|

|||||

|

Operating income

|

$

|

8,361

|

|

$

|

7,620

|

|

$

|

8,084

|

|

||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Smokeable products segment

|

$

|

97

|

|

$

|

43

|

|

$

|

664

|

|

||

|

Interest and other debt expense, net

|

(13

|

)

|

47

|

|

—

|

|

|||||

|

Total

|

$

|

84

|

|

$

|

90

|

|

$

|

664

|

|

||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Smokeable products segment

|

$

|

127

|

|

$

|

27

|

|

$

|

18

|

|

||

|

General corporate

|

—

|

|

15

|

|

—

|

|

|||||

|

Interest and other debt expense, net

|

23

|

|

2

|

|

4

|

|

|||||

|

Total

|

$

|

150

|

|

$

|

44

|

|

$

|

22

|

|

||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Premiums and fees

|

$

|

226

|

|

$

|

44

|

|

$

|

1,054

|

|

||

|

Write-off of unamortized debt discounts and debt issuance costs

|

2

|

|

—

|

|

30

|

|

|||||

|

Total

|

$

|

228

|

|

$

|

44

|

|

$

|

1,084

|

|

||

|

▪

|

pending and threatened litigation and bonding requirements;

|

|

▪

|

the requirement to issue “corrective statements” in various media in connection with the federal government’s lawsuit;

|

|

▪

|

restrictions and requirements imposed by the FSPTCA, and restrictions and requirements that have been, and in the future will be, imposed by the FDA;

|

|

▪

|

actual and proposed excise tax increases, as well as changes in tax structures and tax stamping requirements;

|

|

▪

|

bans and restrictions on tobacco use imposed by governmental entities and private establishments and employers;

|

|

▪

|

other federal, state and local government actions, including:

|

|

▪

|

increases in the minimum age to purchase tobacco products above the current federal minimum age of 18;

|

|

▪

|

restrictions on the sale of tobacco products by certain retail establishments, the sale of certain tobacco products with certain characterizing flavors and the sale of tobacco products in certain package sizes;

|

|

▪

|

additional restrictions on the advertising and promotion of tobacco products;

|

|

▪

|

other actual and proposed tobacco product legislation and regulation; and

|

|

▪

|

governmental investigations;

|

|

▪

|

the diminishing prevalence of cigarette smoking and increased efforts by tobacco control advocates and others (including employers and retail establishments) to further restrict tobacco use;

|

|

▪

|

changes in adult tobacco consumer purchase behavior, which is influenced by various factors such as economic conditions, excise taxes and price gap relationships, may result in adult tobacco consumers switching to discount products or other lower priced tobacco products;

|

|

▪

|

the highly competitive nature of the tobacco categories in which our tobacco subsidiaries operate, including competitive disadvantages related to cigarette price increases attributable to the settlement of certain litigation;

|

|

▪

|

illicit trade in tobacco products; and

|

|

▪

|

potential adverse changes in tobacco leaf price, availability and quality.

|

|

▪

|

FSPTCA and FDA Regulation;

|

|

▪

|

Excise Taxes;

|

|

▪

|

International Treaty on Tobacco Control;

|

|

▪

|

State Settlement Agreements;

|

|

▪

|

Other Federal, State and Local Regulation and Activity;

|

|

▪

|

Illicit Trade in Tobacco Products;

|

|

▪

|

Price, Availability and Quality of Agricultural Products; and

|

|

▪

|

Timing of Sales.

|

|

▪

|

imposes restrictions on the advertising, promotion, sale and distribution of tobacco products, including at retail;

|

|

▪

|

bans descriptors such as “light,” “mild” or “low” or similar descriptors when used as descriptors of modified risk unless expressly authorized by the FDA;

|

|

▪

|

requires extensive product disclosures to the FDA and may require public disclosures;

|

|

▪

|

prohibits any express or implied claims that a tobacco product is or may be less harmful than other tobacco products without FDA authorization;

|

|

▪

|

imposes reporting obligations relating to contraband activity and grants the FDA authority to impose recordkeeping and other obligations to address illicit trade in tobacco products;

|

|

▪

|

changes the language of the cigarette and smokeless tobacco product health warnings, enlarges their size and requires the development by the FDA of graphic warnings for cigarettes, and gives the FDA the authority to require new warnings;

|

|

▪

|

authorizes the FDA to adopt product regulations and related actions, including imposing tobacco product standards that are appropriate for the protection of the public health (

e.g.

, related to the use of menthol in cigarettes, nicotine yields and other constituents or ingredients) and imposing manufacturing standards for tobacco products;

|

|

▪

|

establishes pre-market review pathways for new and modified tobacco products, including:

|

|

▪

|

authorizing the FDA to subject tobacco products that would be modified or first introduced into the market after March 22, 2011 to application and pre-market review and authorization requirements (the “New Product Application Process”) if the FDA does not find them, as a manufacturer may contend, to be “substantially equivalent” to products commercially marketed as of February 15, 2007, and possibly to deny any such new product application, thereby preventing the distribution and sale of any product affected by such denial; and

|

|

▪

|

authorizing the FDA to determine that certain existing tobacco products modified or introduced into the market for the first time between February 15, 2007 and March 22, 2011 are not “substantially equivalent” to products commercially marketed as of February 15, 2007, in which case the FDA could require the removal of such products from the marketplace or subject them to the New Product Application Process and, if any such applications are denied, prevent the continued distribution and sale of such products (see

FDA Regulatory Actions

-

Substantial Equivalence and Other New Product Processes/Pathways

below); and

|

|

▪

|

equips the FDA with a variety of investigatory and enforcement tools, including the authority to inspect tobacco product manufacturing and other facilities.

|

|

▪

|

impact the consumer acceptability of tobacco products;

|

|

▪

|

delay, discontinue or prevent the sale or distribution of existing, new or modified tobacco products;

|

|

▪

|

limit adult tobacco consumer choices;

|

|

▪

|

impose restrictions on communications with adult tobacco consumers;

|

|

▪

|

create a competitive advantage or disadvantage for certain tobacco companies;

|

|

▪

|

impose additional manufacturing, labeling or packaging requirements;

|

|

▪

|

impose additional restrictions at retail;

|

|

▪

|

result in increased illicit trade in tobacco products; or

|

|

▪

|

otherwise significantly increase the cost of doing business.

|

|

▪

|

TPSAC

|

|

▪

|

The

Role of the TPSAC

: As required by the FSPTCA, the FDA has established a tobacco product scientific advisory committee (the “TPSAC”), which consists of voting and non-voting members, to provide advice, reports, information and recommendations to the FDA on scientific and health issues relating to tobacco products.

|

|

▪

|

Challenge to TPSAC Membership

: In February 2011, Lorillard Tobacco Company (“Lorillard”) and R.J. Reynolds filed suit in the U.S. District Court for the District of Columbia against the United States Department of Health and Human Services and individual defendants (sued in their official capacities) asserting that the composition of the TPSAC and the composition of the Constituents Subcommittee of the TPSAC violates several federal laws, including the Federal Advisory Committee Act, because four

|

|

▪

|

TPSAC Action on Menthol

: As mandated by the FSPTCA, in March 2011, the TPSAC submitted to the FDA a report on the impact of the use of menthol in cigarettes on the public health and related recommendations. The TPSAC report recommended, among other things, that the “[r]emoval of menthol cigarettes from the marketplace would benefit public health in the United States.” The TPSAC report noted the potential that any ban on menthol cigarettes could lead to an increase in contraband cigarettes and other potential unintended consequences and suggested that the FDA consult with appropriate experts on this matter.

|

|

▪

|

bans the use of color and graphics in tobacco product labeling and advertising;

|

|

▪

|

prohibits the sale of cigarettes and smokeless tobacco to underage persons;

|

|

▪

|

restricts the use of non-tobacco trade and brand names on cigarettes and smokeless tobacco products;

|

|

▪

|

requires the sale of cigarettes and smokeless tobacco in direct, face-to-face transactions;

|

|

▪

|

prohibits sampling of cigarettes and prohibits sampling of smokeless tobacco products except in qualified adult-only facilities;

|

|

▪

|

prohibits gifts or other items in exchange for buying cigarettes or smokeless tobacco products;

|

|

▪

|

prohibits the sale or distribution of items such as hats and tee shirts with tobacco brands or logos; and

|

|

▪

|

prohibits brand name sponsorship of any athletic, musical, artistic or other social or cultural event, or any entry or team in any event.

|

|

▪

|

FDA Regulatory Actions

|

|

▪

|

Graphic Warnings

: In June 2011, as required by the FSPTCA, the FDA issued its final rule to modify the required warnings that appear on cigarette packages and in cigarette advertisements. The FSPTCA requires the warnings to consist of nine new textual warning statements accompanied by color graphics depicting the negative health consequences of smoking. The graphic health warnings will (i) be located beneath the cellophane, and comprise the top 50% of the front and rear panels of cigarette packages and (ii) occupy 20% of a cigarette advertisement and be located at the top of the advertisement. After a legal challenge to the rule initiated by R.J. Reynolds, Lorillard and several other plaintiffs, in which plaintiffs prevailed both at the federal trial and appellate levels, the FDA decided not to seek further review of the U.S. Court of Appeals’ decision and announced its plans to propose a new graphic warnings rule in the future.

|

|

▪

|

Substantial Equivalence and Other New Product Processes/Pathways

: In January 2011, the FDA issued guidance concerning reports that manufacturers must submit for certain FDA-regulated tobacco products that the manufacturer modified or introduced for the first time into the market after February 15, 2007. These reports must be reviewed by the FDA to determine if such tobacco products are “substantially equivalent” to products commercially available as of February 15, 2007. In general, in order to continue marketing the products commercially available before March 22, 2011, manufacturers of FDA-regulated tobacco products were required to send to the FDA a report demonstrating substantial equivalence by March 22, 2011. PM USA and USSTC submitted timely reports. PM USA and USSTC can continue marketing these products unless the FDA makes a determination that a specific product is not substantially equivalent. If the FDA ultimately makes such a determination, it could require the removal of such products from the marketplace or subject them to the New Product Application Process and, if any such applications are denied, prevent the continued distribution and sale of such products. While PM USA and USSTC believe that all of their current products meet the statutory requirements of the FSPTCA, they cannot predict whether, when or how the FDA ultimately will apply its guidance to their various respective substantial equivalence reports or seek to enforce the law and regulations consistent with its guidance.

|

|

▪

|

Good Manufacturing Practices

: The FSPTCA requires that the FDA promulgate good manufacturing practice regulations (referred to by the FDA as “Requirements for Tobacco Product Manufacturing Practice”) for tobacco product manufacturers, but does not specify a timeframe for such regulations.

|

|

▪

|

Proposed Deeming Regulations

: As noted above in

FSPTCA and FDA Regulation - The Regulatory Framework

, the FDA

|

|

|

For the Years Ended December 31,

|

||||||||||||||||||||||

|

|

Net Revenues

|

Operating Companies Income

|

|||||||||||||||||||||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

2015

|

|

2014

|

|

2013

|

|

|||||||||||

|

Smokeable products

|

$

|

22,792

|

|

$

|

21,939

|

|

$

|

21,868

|

|

$

|

7,569

|

|

$

|

6,873

|

|

$

|

7,063

|

|

|||||

|

Smokeless products

|

1,879

|

|

1,809

|

|

1,778

|

|

1,108

|

|

1,061

|

|

1,023

|

|

|||||||||||

|

Total smokeable and smokeless products

|

$

|

24,671

|

|

$

|

23,748

|

|

$

|

23,646

|

|

$

|

8,677

|

|

$

|

7,934

|

|

$

|

8,086

|

|

|||||

|

Shipment Volume

|

||||||||

|

For the Years Ended December 31,

|

||||||||

|

(sticks in millions)

|

2015

|

|

2014

|

|

2013

|

|

||

|

Cigarettes:

|

||||||||

|

Marlboro

|

108,113

|

|

108,023

|

|

111,421

|

|

||

|

Other premium

|

6,753

|

|

7,047

|

|

7,721

|

|

||

|

Discount

|

11,152

|

|

10,320

|

|

10,170

|

|

||

|

Total cigarettes

|

126,018

|

|

125,390

|

|

129,312

|

|

||

|

Cigars:

|

||||||||

|

Black & Mild

|

1,295

|

|

1,246

|

|

1,177

|

|

||

|

Other

|

30

|

|

25

|

|

21

|

|

||

|

Total cigars

|

1,325

|

|

1,271

|

|

1,198

|

|

||

|

Total smokeable products

|

127,343

|

|

126,661

|

|

130,510

|

|

||

|

Retail Share

|

||||||||

|

For the Years Ended December 31,

|

||||||||

|

2015

|

|

2014

|

|

2013

|

|

|||

|

Cigarettes:

|

||||||||

|

Marlboro

|

44.0

|

%

|

43.8

|

%

|

43.7

|

%

|

||

|

Other premium

|

2.8

|

|

2.9

|

|

3.1

|

|

||

|

Discount

|

4.5

|

|

4.2

|

|

3.9

|

|

||

|

Total cigarettes

|

51.3

|

%

|

50.9

|

%

|

50.7

|

%

|

||

|

Cigars:

|

||||||||

|

Black & Mild

|

27.3

|

%

|

28.3

|

%

|

28.8

|

%

|

||

|

Other

|

0.4

|

|

0.4

|

|

0.2

|

|

||

|

Total cigars

|

27.7

|

%

|

28.7

|

%

|

29.0

|

%

|

||

|

|

Shipment Volume

For the Years Ended December 31,

|

|||||||

|

(cans and packs in millions)

|

2015

|

|

2014

|

|

2013

|

|

||

|

Copenhagen

|

474.7

|

|

448.6

|

|

426.1

|

|

||

|

Skoal

|

267.9

|

|

269.6

|

|

283.8

|

|

||

|

Copenhagen

and

Skoal

|

742.6

|

|

718.2

|

|

709.9

|

|

||

|

Other

|

70.9

|

|

75.1

|

|

77.6

|

|

||

|

Total smokeless products

|

813.5

|

|

793.3

|

|

787.5

|

|

||

|

|

Retail Share

For the Years Ended December 31,

|

|||||||

|

2015

|

|

2014

|

|

2013

|

|

|||

|

Copenhagen

|

31.6

|

%

|

30.7

|

%

|

29.4

|

%

|

||

|

Skoal

|

19.7

|

|

20.3

|

|

21.3

|

|

||

|

Copenhagen

and

Skoal

|

51.3

|

|

51.0

|

|

50.7

|

|

||

|

Other

|

3.6

|

|

4.0

|

|

4.2

|

|

||

|

Total smokeless products

|

54.9

|

%

|

55.0

|

%

|

54.9

|

%

|

||

|

|

For the Years Ended December 31,

|

||||||||||

|

(in millions)

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Net revenues

|

$

|

692

|

|

$

|

643

|

|

$

|

609

|

|

||

|

Operating companies income

|

$

|

152

|

|

$

|

134

|

|

$

|

118

|

|

||

|

|

Shipment Volume

For the Years Ended December 31,

|

|||||||

|

(cases in thousands)

|

2015

|

|

2014

|

|

2013

|

|

||

|

Chateau Ste. Michelle

|

3,253

|

|

3,035

|

|

2,753

|

|

||

|

Columbia Crest

|

1,062

|

|

1,032

|

|

1,031

|

|

||

|

14 Hands

|

1,848

|

|

1,662

|

|

1,374

|

|

||

|

Other

|

2,703

|

|

2,622

|

|

2,814

|

|

||

|

Total wine

|

8,866

|

|

8,351

|

|

7,972

|

|

||

|

▪

|

higher net revenues in the smokeable products segment in 2015; and

|

|

▪

|

the end of the federal tobacco quota buy-out payments after the third quarter of 2014;

|

|

▪

|

higher settlement payments during 2015, driven by the impact of NPM Adjustment Items in 2014.

|

|

▪

|

a voluntary $350 million contribution to Altria Group, Inc.’s pension plans during 2013;

|

|

▪

|

lower interest payments in 2014, resulting from debt maturities in 2013 and 2014, as well as debt refinancing activities in 2013; and

|

|

▪

|

higher earnings in 2014;

|

|

▪

|

higher income tax payments in 2014, resulting primarily from the loss on early extinguishment of debt in 2013; and

|

|

▪

|

higher settlement payments during 2014, driven primarily by the impact of higher NPM Adjustment Items in 2013.

|

|

▪

|

$132 million payment for a derivative financial instrument during 2015;

|

|

▪

|

the sale of PM USA’s Cabarrus, North Carolina manufacturing facility during 2014; and

|

|

▪

|

higher capital expenditures during 2015, due primarily to a new USSTC manufacturing facility in Hopkinsville, Kentucky that is expected to be completed in 2016;

|

|

▪

|

Nu Mark’s acquisition of the e-vapor business of Green Smoke during 2014.

|

|

▪

|

lower proceeds from asset sales in the financial services business during 2014; and

|

|

▪

|

Nu Mark’s acquisition of the e-vapor business of Green Smoke during 2014.

|

|

▪

|

debt tender offer completed during 2015, which resulted in the repurchase of $793 million of senior unsecured long-term notes and a $226 million payment of premiums and fees, as more fully described in Note 9;

|

|

▪

|

$1.0 billion repayment of Altria Group, Inc. senior unsecured notes at scheduled maturity in 2015;

|

|

▪

|

debt issuance of $1.0 billion in 2014; and

|

|

▪

|

higher dividends paid during 2015;

|

|

▪

|

$525 million repayment of Altria Group, Inc. senior unsecured notes at scheduled maturity in 2014;

|

|

▪

|

lower share repurchases during 2015; and

|

|

▪

|

full redemption of UST senior notes of $300 million in 2014.

|

|

▪

|

higher repayments of debt in 2013 driven primarily by the repurchase of senior unsecured notes in connection with the 2013 debt tender offer; and

|

|

▪

|

higher premiums and fees in 2013 in connection with the 2013 debt tender offer;

|

|

▪

|

debt issuances of $3.2 billion in 2013 used to repurchase senior unsecured notes in connection with the 2013 debt tender offer;

|

|

|

Short-term

Debt

|

Long-term

Debt

|

Outlook

|

||

|

Moody’s

|

P-2

|

Baa1

|

Stable

|

||

|

Standard & Poor’s

|

A-2

|

BBB+

|

Stable

|

||

|

Fitch Ratings Ltd.

|

F2

|

BBB+

|

Stable

|

||

|

Payments Due

|

|||||||||||||||||||

|

(in millions)

|

Total

|

|

2016

|

|

2017 - 2018

|

|

2019 - 2020

|

|

2021 and Thereafter

|

|

|||||||||

|

Long-term debt

(1)

|

$

|

12,965

|

|

$

|

4

|

|

$

|

871

|

|

$

|

2,148

|

|

$

|

9,942

|

|

||||

|

Interest on borrowings

(2)

|

10,031

|

|

716

|

|

1,432

|

|

1,146

|

|

6,737

|

|

|||||||||

|

Operating leases

(3)

|

309

|

|

58

|

|

97

|

|

60

|

|

94

|

|

|||||||||

|

Purchase obligations:

(4)

|

|

|

|

|

|

||||||||||||||

|

Inventory and production costs

|

3,218

|

|

989

|

|

1,336

|

|

565

|

|

328

|

|

|||||||||

|

Other

|

729

|

|

555

|

|

142

|

|

32

|

|

—

|

|

|||||||||

|

3,947

|

|

1,544

|

|

1,478

|

|

597

|

|

328

|

|

||||||||||

|

Other long-term liabilities

(5)

|

2,443

|

|

152

|

|

325

|

|

311

|

|

1,655

|

|

|||||||||

|

$

|

29,695

|

|

$

|

2,474

|

|

$

|

4,203

|

|

$

|

4,262

|

|

$

|

18,756

|

|

|||||

|

at December 31,

|

2015

|

|

2014

|

|

|||

|

Assets

|

|||||||

|

Cash and cash equivalents

|

$

|

2,369

|

|

$

|

3,321

|

|

|

|

Receivables

|

124

|

|

124

|

|

|||

|

Inventories:

|

|||||||

|

Leaf tobacco

|

957

|

|

991

|

|

|||

|

Other raw materials

|

181

|

|

200

|

|

|||

|

Work in process

|

444

|

|

429

|

|

|||

|

Finished product

|

449

|

|

420

|

|

|||

|

2,031

|

|

2,040

|

|

||||

|

Deferred income taxes

|

1,175

|

|

1,143

|

|

|||

|

Other current assets

|

387

|

|

250

|

|

|||

|

Total current assets

|

6,086

|

|

6,878

|

|

|||

|

Property, plant and equipment, at cost:

|

|||||||

|

Land and land improvements

|

295

|

|

293

|

|

|||

|

Buildings and building equipment

|

1,406

|

|

1,323

|

|

|||

|

Machinery and equipment

|

2,969

|

|

2,986

|

|

|||

|

Construction in progress

|

207

|

|

153

|

|

|||

|

4,877

|

|

4,755

|

|

||||

|

Less accumulated depreciation

|

2,895

|

|

2,772

|

|

|||

|

1,982

|

|

1,983

|

|

||||

|

Goodwill

|

5,285

|

|

5,285

|

|

|||

|

Other intangible assets, net

|

12,028

|

|

12,049

|

|

|||

|

Investment in SABMiller

|

5,483

|

|

6,183

|

|

|||

|

Finance assets, net

|

1,239

|

|

1,614

|

|

|||

|

Other assets

|

432

|

|

483

|

|

|||

|

Total Assets

|

$

|

32,535

|

|

$

|

34,475

|

|

|

|

at December 31,

|

2015

|

|

2014

|

|

|||

|

Liabilities

|

|||||||

|

Current portion of long-term debt

|

$

|

4

|

|

$

|

1,000

|

|

|

|

Accounts payable

|

400

|

|

416

|

|

|||

|

Accrued liabilities:

|

|||||||

|

Marketing

|

695

|

|

618

|

|

|||

|

Employment costs

|

198

|

|

186

|

|

|||

|

Settlement charges

|

3,590

|

|

3,500

|

|

|||

|

Other

|

1,081

|

|

925

|

|

|||

|

Dividends payable

|

1,110

|

|

1,028

|

|

|||

|

Total current liabilities

|

7,078

|

|

7,673

|

|

|||

|

Long-term debt

|

12,915

|

|

13,693

|

|

|||

|

Deferred income taxes

|

5,663

|

|

6,088

|

|

|||

|

Accrued pension costs

|

1,277

|

|

1,012

|

|

|||

|

Accrued postretirement health care costs

|

2,245

|

|

2,461

|

|

|||

|

Other liabilities

|

447

|

|

503

|

|

|||

|

Total liabilities

|

29,625

|

|

31,430

|

|

|||

|

Contingencies (Note 18)

|

|

|

|||||

|

Redeemable noncontrolling interest

|

37

|

|

35

|

|

|||

|

Stockholders’ Equity

|

|||||||

|

Common stock, par value $0.33 1/3 per share

(2,805,961,317 shares issued)

|

935

|

|

935

|

|

|||

|

Additional paid-in capital

|

5,813

|

|

5,735

|

|

|||

|

Earnings reinvested in the business

|

27,257

|

|

26,277

|

|

|||

|

Accumulated other comprehensive losses

|

(3,280

|

)

|

(2,682

|

)

|

|||

|

Cost of repurchased stock

(845,901,836 shares at December 31, 2015 and

834,486,794 shares at December 31, 2014)

|

(27,845

|

)

|

(27,251

|

)

|

|||

|

Total stockholders’ equity attributable to Altria Group, Inc.

|

2,880

|

|

3,014

|

|

|||

|

Noncontrolling interests

|

(7

|

)

|

(4

|

)

|

|||

|

Total stockholders’ equity

|

2,873

|

|

3,010

|

|

|||

|

Total Liabilities and Stockholders’ Equity

|

$

|

32,535

|

|

$

|

34,475

|

|

|

|

for the years ended December 31,

|

2015

|

|

2014

|

|

2013

|

|

|||||

|

Net revenues

|

$

|

25,434

|

|

$

|

24,522

|

|

$

|

24,466

|

|

||

|

Cost of sales

|

7,740

|

|

7,785

|

|

7,206

|

|

|||||

|

Excise taxes on products

|

6,580

|

|

6,577

|

|

6,803

|

|

|||||

|

Gross profit

|

11,114

|

|

10,160

|

|

10,457

|

|

|||||

|

Marketing, administration and research costs

|

2,708

|

|

2,539

|

|

2,340

|

|

|||||

|

Changes to Mondelēz and PMI tax-related receivables/payables

|

41

|

|

2

|

|

22

|

|

|||||

|

Asset impairment and exit costs

|

4

|

|

(1

|

)

|

11

|

|

|||||

|

Operating income

|

8,361

|

|

7,620

|

|

8,084

|

|

|||||

|

Interest and other debt expense, net

|

817

|

|

808

|

|

1,049

|

|

|||||

|

Loss on early extinguishment of debt

|

228

|

|

44

|

|

1,084

|

|

|||||

|

Earnings from equity investment in SABMiller

|

(757

|

)

|

(1,006

|

)

|

(991

|

)

|

|||||

|

Other income, net

|

(5

|

)

|

—

|

|

—

|

|

|||||

|

Earnings before income taxes

|

8,078

|

|

7,774

|

|

6,942

|

|

|||||

|

Provision for income taxes

|

2,835

|

|

2,704

|

|

2,407

|

|

|||||

|

Net earnings

|

5,243

|

|

5,070

|

|

4,535

|

|

|||||

|

Net earnings attributable to noncontrolling interests

|

(2

|

)

|

—

|

|

—

|

|

|||||

|

Net earnings attributable to Altria Group, Inc.

|

$

|

5,241

|

|

$

|

5,070

|

|

$

|

4,535

|

|

||

|

Per share data:

|

|||||||||||

|

Basic and diluted earnings per share attributable to Altria Group, Inc.

|

$

|

2.67

|

|

$

|

2.56

|

|

$

|

2.26

|

|

||

|

for the years ended December 31,

|

2015

|

|

2014

|

|

2013

|

|

||||||

|

Net earnings

|

$

|

5,243

|

|

$

|

5,070

|

|

$

|

4,535

|

|

|||

|

Other comprehensive earnings (losses), net of deferred income taxes:

|

||||||||||||

|

Currency translation adjustments

|

(3

|

)

|

(2

|

)

|

(2

|

)

|

||||||

|

Benefit plans

|

30

|

|

(767

|

)

|

1,141

|

|

||||||

|

SABMiller

|

(625

|

)

|

(535

|

)

|

(477

|

)

|

||||||

|

Other comprehensive (losses) earnings, net of deferred income taxes

|

(598

|

)

|

(1,304

|

)

|

662

|

|

||||||

|

Comprehensive earnings

|

4,645

|

|

3,766

|

|

5,197

|

|

||||||

|

Comprehensive earnings attributable to noncontrolling interests

|

(2

|

)

|

—

|

|

—

|

|

||||||

|

Comprehensive earnings attributable to Altria Group, Inc.

|

$

|

4,643

|

|

$

|

3,766

|

|

$

|

5,197

|

|

|||

|

for the years ended December 31,

|

2015

|

|

2014

|

|

2013

|

|

|||||||

|

Cash Provided by (Used in) Operating Activities

|

|||||||||||||

|

Net earnings

|

$

|

5,243

|

|

$

|

5,070

|

|

$

|

4,535

|

|

||||

|

Adjustments to reconcile net earnings to operating cash flows:

|

|||||||||||||

|

Depreciation and amortization

|

225

|

|

208

|

|

212

|

|

|||||||

|

Deferred income tax benefit

|

(132

|

)

|

(129

|

)

|

(86

|

)

|

|||||||

|

Earnings from equity investment in SABMiller

|

(757

|

)

|

(1,006

|

)

|

(991

|

)

|

|||||||

|

Dividends from SABMiller

|

495

|

|

456

|

|

439

|

|

|||||||

|

Loss on early extinguishment of debt

|

228

|

|

44

|

|

1,084

|

|

|||||||

|

Cash effects of changes, net of the effects from acquisition of Green Smoke:

|

|||||||||||||

|

Receivables, net

|

3

|

|

(8

|

)

|

78

|

|

|||||||

|

Inventories

|

(33

|

)

|

(184

|

)

|

(133

|

)

|

|||||||

|

Accounts payable

|

(7

|

)

|

(5

|

)

|

(76

|

)

|

|||||||

|

Income taxes

|

(12

|

)

|

1

|

|

(95

|

)

|

|||||||

|

Accrued liabilities and other current assets

|

199

|

|

(107

|

)

|

(107

|

)

|

|||||||

|

Accrued settlement charges

|

90

|

|

109

|

|

(225

|

)

|

|||||||

|

Pension plan contributions

|

(28

|

)

|

(15

|

)

|

(393

|

)

|

|||||||

|

Pension provisions and postretirement, net

|

114

|

|

21

|

|

177

|

|

|||||||

|

Other

|

182

|

|

208

|

|

(44

|

)

|

|||||||

|

Net cash provided by operating activities

|

5,810

|

|

4,663

|

|

4,375

|

|

|||||||

|

Cash Provided by (Used in) Investing Activities

|

|||||||||||||

|

Capital expenditures

|

(229

|

)

|

(163

|

)

|

(131

|

)

|

|||||||

|

Acquisition of Green Smoke, net of acquired cash

|

—

|

|

(102

|

)

|

—

|

|

|||||||

|

Proceeds from finance assets

|

354

|

|

369

|

|

716

|

|

|||||||

|

Payment for derivative financial instrument

|

(132

|

)

|

—

|

|

—

|

|

|||||||

|

Other

|

(8

|

)

|

73

|

|

17

|

|

|||||||

|

Net cash (used in) provided by investing activities

|

(15

|

)

|

177

|

|

602

|

|

|||||||

|

Cash Provided by (Used in) Financing Activities

|

|||||||||||||

|

Long-term debt issued

|

—

|

|

999

|

|

4,179

|

|

|||||||

|

Long-term debt repaid

|

(1,793

|

)

|

(825

|

)

|

(3,559

|

)

|

|||||||

|

Repurchases of common stock

|

(554

|

)

|

(939

|

)

|

(634

|

)

|

|||||||

|

Dividends paid on common stock

|

(4,179

|

)

|

(3,892

|

)

|

(3,612

|

)

|

|||||||

|

Premiums and fees related to early extinguishment of debt

|

(226

|

)

|

(44

|

)

|

(1,054

|

)

|

|||||||

|

Other

|

5

|

|

7

|

|

(22

|

)

|

|||||||

|

Net cash used in financing activities

|

(6,747

|

)

|

(4,694

|

)

|

(4,702

|

)

|

|||||||

|

Cash and cash equivalents:

|

|||||||||||||

|

(Decrease) increase

|

(952

|

)

|

146

|

|

275

|

|

|||||||

|

Balance at beginning of year

|

3,321

|

|

3,175

|

|

2,900

|

|

|||||||

|

Balance at end of year

|

$

|

2,369

|

|

$

|

3,321

|

|

$

|

3,175

|

|

||||

|

Cash paid: Interest

|

|

$

|

776

|

|

$

|

820

|

|

$

|

1,099

|

|

|||

|

Income taxes

|

|

$

|

3,029

|

|

$

|

2,765

|

|

$

|

2,448

|

|

|||

|

|

Attributable to Altria Group, Inc.

|

|

|

||||||||||||||||||||||||

|

|

Common

Stock

|

|

Additional

Paid-in

Capital

|

|

Earnings

Reinvested in

the Business

|

|

Accumulated

Other

Comprehensive

Losses

|

|

Cost of

Repurchased

Stock

|

|

Non-

controlling

Interests

|

|

Total

Stockholders’

Equity

|

|

|||||||||||||

|

Balances, December 31, 2012

|

$

|

935

|

|

$

|

5,688

|

|

$

|

24,316

|

|

$

|

(2,040

|

)

|

$

|

(25,731

|

)

|

$

|

2

|

|

$

|

3,170

|

|

||||||

|

Net earnings (losses)

(1)

|

—

|

|

—

|

|

4,535

|

|

—

|

|

—

|

|

(3

|

)

|

4,532

|

|

|||||||||||||

|

Other comprehensive earnings, net

of deferred income taxes

|

—

|

|

—

|

|

—

|

|

662

|

|

—

|

|

—

|

|

662

|

|

|||||||||||||

|

Stock award activity

|

—

|

|

26

|

|

—

|

|

—

|

|

11

|

|

—

|

|

37

|

|

|||||||||||||

|

Cash dividends declared ($1.84 per share)

|

—

|

|

—

|

|

(3,683

|

)

|

—

|

|

—

|

|

—

|

|

(3,683

|

)

|

|||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(600

|

)

|

—

|

|

(600

|

)

|

|||||||||||||

|

Balances, December 31, 2013

|

935

|

|

5,714

|

|

25,168

|

|

(1,378

|

)

|

(26,320

|

)

|

(1

|

)

|

4,118

|

|

|||||||||||||

|

Net earnings (losses)

(1)

|

—

|

|

—

|

|

5,070

|

|

—

|

|

—

|

|

(3

|

)

|

5,067

|

|

|||||||||||||

|

Other comprehensive losses, net

of deferred income taxes

|

—

|

|

—

|

|

—

|

|

(1,304

|

)

|

—

|

|

—

|

|

(1,304

|

)

|

|||||||||||||

|

Stock award activity

|

—

|

|

21

|

|

—

|

|

—

|

|

8

|

|

—

|

|

29

|

|

|||||||||||||

|

Cash dividends declared ($2.00 per share)

|

—

|

|

—

|

|

(3,961

|

)

|

—

|

|

—

|

|

—

|

|

(3,961

|

)

|

|||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(939

|

)

|

—

|

|

(939

|

)

|

|||||||||||||

|

Balances, December 31, 2014

|

935

|

|

5,735

|

|

26,277

|

|

(2,682

|

)

|

(27,251

|

)

|

(4

|

)

|

3,010

|

|

|||||||||||||

|

Net earnings (losses)

(1)

|

—

|

|

—

|