|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| WISCONSIN |

39-0482000

|

|

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

1500 DeKoven Avenue, Racine, Wisconsin

|

53403

|

|

| (Address of principal executive offices) | (Zip Code) |

|

Title of each class

|

Name of each exchange on which registered

|

|

| Common Stock, $0.625 par value | New York Stock Exchange |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Large Accelerated Filer

o

|

Accelerated Filer

þ

|

|

Non-accelerated Filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

| Incorporated Document | Location in Form 10-K | |

|

Proxy Statement for the 2013 Annual

|

Part III of Form 10-K

|

|

|

Meeting of Shareholders

|

(Items 10, 11, 12, 13, 14)

|

|

Fiscal 2013

|

Fiscal 2012

|

|||||||

|

Operating (loss) income

|

$ | (0.6 | ) | $ | 67.5 | |||

|

Impairment charges

|

25.9 | 2.5 | ||||||

|

Restructuring expenses

|

17.0 | - | ||||||

|

Subtotal

|

42.3 | 70.0 | ||||||

|

Tax applied at 30% rate

|

(12.7 | ) | (21.0 | ) | ||||

|

Minority interest

|

(1.4 | ) | (0.3 | ) | ||||

|

Operating income - adjusted

|

$ | 28.2 | $ | 48.7 | ||||

|

Divided by:

Average capital (debt + Modine shareholders' equity for the last two year-ends / divided by 2)

|

$ | 459.3 | $ | 494.6 | ||||

|

ROACE

|

6.1 | % | 9.8 | % | ||||

|

Fiscal 2013

|

Fiscal 2012

|

|||||||

|

Modules/Packages*

|

26 | % | 26 | % | ||||

|

Oil Coolers

|

14 | % | 16 | % | ||||

|

Charge-Air Coolers

|

12 | % | 11 | % | ||||

|

Building HVAC

|

11 | % | 10 | % | ||||

|

Radiators

|

10 | % | 12 | % | ||||

|

Exhaust Gas Recirculation ("EGR") Coolers

|

10 | % | 10 | % | ||||

|

Condensers

|

9 | % | 6 | % | ||||

|

Miscellaneous

|

8 | % | 9 | % | ||||

|

North America

|

Europe

|

South America

|

Asia/Pacific

|

Africa

|

||||

|

Canada

|

Austria

|

Brazil

|

China

|

South Africa

|

||||

|

Mexico

|

Germany

|

India

|

||||||

|

United States

|

Hungary

|

Japan

|

||||||

|

Italy

|

South Korea

|

|||||||

|

The Netherlands

|

||||||||

|

Russia

|

||||||||

|

United Kingdom

|

Environmental, Health and Safety Matters

|

-

|

Code of Ethics and Business Conduct, which is applicable to all Modine employees, including the principal executive officer, the principal financial officer, the principal accounting officer and directors;

|

|

-

|

Corporate Governance Guidelines;

|

|

-

|

Audit Committee Charter;

|

|

-

|

Officer Nomination and Compensation Committee Charter;

|

|

-

|

Corporate Governance and Nominating Committee Charter; and

|

|

-

|

Technology Committee Charter.

|

|

ITEM 1A

.

|

|

A.

|

OPERATIONAL RISKS

|

|

B.

|

MARKET RISKS

|

|

C.

|

FINANCIAL RISKS

|

|

ITEM 1B

.

|

|

ITEM 2

.

|

|

Location of Facility

|

Building Space and Primary Use

|

Owned or

Leased

|

|

North America Segment

|

||

|

Lawrenceburg, TN

|

353,800 sq. ft./manufacturing

|

143,800 Owned;

|

|

210,000 Leased

|

||

|

Nuevo Laredo, Mexico

|

288,500 sq. ft./manufacturing

|

Owned

|

|

Harrodsburg, KY

|

253,000 sq. ft./manufacturing

|

Owned

|

|

Jefferson City, MO

|

220,000 sq. ft./manufacturing

|

162,000 Owned;

|

|

58,000 Leased

|

||

|

Washington, IA

|

165,400 sq. ft./manufacturing

|

148,800 Owned;

|

|

16,600 Leased

|

||

|

McHenry, IL

|

164,700 sq. ft./manufacturing

|

Owned

|

|

Trenton, MO

|

159,900 sq. ft./manufacturing

|

Owned

|

|

Logansport, IN

|

141,600 sq. ft./manufacturing

|

Owned

|

|

Joplin, MO

|

139,500 sq. ft./manufacturing

|

Owned

|

|

Laredo, TX

|

45,000 sq. ft./warehouse

|

Leased

|

|

Europe Segment

|

||

|

Bonlanden, Germany

|

262,200 sq. ft./administrative & technology center

|

Owned

|

|

Kottingbrunn, Austria

|

220,600 sq. ft./manufacturing

|

Owned

|

|

Pontevico, Italy

|

150,700 sq. ft./manufacturing

|

Owned

|

|

Mezökövesd, Hungary

|

146,500 sq. ft./manufacturing

|

Owned

|

|

Pliezhausen, Germany

|

125,900 sq. ft./manufacturing

|

48,400 Owned;

|

| 77,500 Leased | ||

|

Wackersdorf, Germany

|

109,800 sq. ft./assembly

|

Owned

|

|

Kirchentellinsfurt, Germany

|

107,600 sq. ft./manufacturing

|

Owned

|

|

Uden, Netherlands

|

93,300 sq. ft./manufacturing

|

61,900 Owned;

|

| 31,400 Leased | ||

|

Neuenkirchen, Germany

|

76,400 sq. ft./manufacturing

|

Owned

|

|

Gyöngyös, Hungary

|

58,300 sq. ft./ manufacturing

|

Leased

|

|

South America Segment

|

||

|

Sao Paulo, Brazil

|

342,900 sq. ft./manufacturing

|

Owned

|

|

Asia Segment

|

||

|

Chennai, India

|

118,100 sq. ft./manufacturing

|

Owned

|

|

Changzhou, China

|

107,600 sq. ft./manufacturing

|

Owned

|

|

Shanghai, China

|

80,298 sq. ft./manufacturing

|

Leased

|

|

Cheonam, South Korea

|

46,284 sq. ft./manufacturing (Joint Venture)

|

Leased

|

|

Commercial Products Segment

|

||

|

Leeds, United Kingdom

|

269,100 sq. ft./administrative & manufacturing

|

Leased

|

|

Buena Vista, VA

|

197,000 sq. ft./manufacturing

|

Owned

|

|

Lexington, VA

|

104,000 sq. ft./warehouse

|

Owned

|

|

West Kingston, RI

|

92,800 sq. ft./manufacturing

|

Owned

|

|

Corporate Headquarters

|

||

|

Racine, WI

|

458,000 sq. ft./headquarters & technology center

|

Owned

|

|

ITEM 3

.

|

|

ITEM 4

.

|

|

Name

|

Age as of

March 31,

2013

|

Position

|

||

|

Scott L. Bowser

|

48

|

Regional Vice President – Asia (July 2012 – Present); Regional Vice President – Americas (March 2009 – July 2012); Managing Director – Modine Brazil (April 2006 – March 2009); General Sales Manager – Truck Division (January 2002 – March 2006); Plant Manager at the Company’s Pemberville, OH plant (1998 – 2001). Prior to joining Modine, Mr. Bowser held positions at The Pierce Company.

|

||

|

Thomas A. Burke

|

55

|

President and Chief Executive Officer (April 2008 – Present); Executive Vice President and Chief Operating Officer (July 2006 – March 2008); and Executive Vice President (May 2005 – July 2006). Prior to joining Modine in May 2005, Mr. Burke held positions at Visteon Corporation and Ford Motor Company.

|

||

|

Margaret C. Kelsey

|

48

|

Vice President, General Counsel and Secretary (November 2008 – Present); Vice President Corporate Strategy and Business Development (May 2008 – October 2008); Vice President - Finance, Corporate Treasury and Business Development (January 2007 – April 2008); Corporate Treasurer & Assistant Secretary (January 2006 – December 2006); Senior Counsel & Assistant Secretary (April 2002 - December 2005); Senior Counsel (April 2001 – March 2002). Prior to joining the Company in 2001, Ms. Kelsey was a partner with the law firm of Quarles & Brady LLP.

|

||

|

Michael B. Lucareli

|

44

|

Vice President, Finance and Chief Financial Officer (October 2011 – present); Vice President, Finance, Chief Financial Officer and Treasurer (July 2010 – October 2011); Vice President, Finance and Corporate Treasurer (May 2008 – July 2010); Managing Director Financial Operations (November 2006 – May 2008); Director, Financial Operations and Analysis (May 2004 – October 2006); Director, Business Development and Strategic Planning (November 2002 – May 2004); and Business Development and Investor Relations Manager (1999 – October 2002). Prior to joining Modine, Mr. Lucareli held positions at Associated Bank, Alpha Investment Group and SEI Corporation.

|

||

|

Thomas F. Marry

|

52

|

Executive Vice President and Chief Operating Officer (February 2012 – Present); Executive Vice President – Europe, Asia and Commercial Products Group (May 2011 – February 2012); Regional Vice President – Asia and Commercial Products Group (November 2007 – May 2011); Managing Director – Powertrain Cooling Products (October 2006 - October 2007); General Manager – Truck Division (2003 – 2006); Director – Engine Products Group (2001 – 2003); Manager – Sales, Marketing and Product Development (1999 – 2001); Marketing Manager (1998 – 1999). Prior to joining Modine, Mr. Marry held positions at General Motors, Robert Bosch and Milwaukee Electric Tool.

|

||

|

Holger Schwab

|

45

|

Regional Vice President – Europe (July 2012 – Present). Prior to joining Modine, Mr. Schwab held various leadership positions at Valeo in North America and Europe and at Thermal Werke.

|

||

|

Scott D. Wollenberg

|

44

|

Regional Vice President – North America (July 2012 – Present); Chief Technology Officer (July 2011 – May 2013); Vice President – Global Research and Engineering (May 2010 – June 2011). In addition, from 1992 through 2010, Mr. Wollenberg held various engineering and product management positions at the Company. Prior to joining the Company in 1992, Mr. Wollenberg was in the co-operative engineering program at Harrison Radiator, a division of General Motors.

|

|

2013

|

2012

|

|||||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First

|

$ | 9.10 | $ | 5.50 | $ | 17.94 | $ | 13.90 | ||||||||

|

Second

|

8.23 | 5.80 | 16.02 | 8.85 | ||||||||||||

|

Third

|

8.31 | 6.14 | 11.65 | 8.09 | ||||||||||||

|

Fourth

|

9.63 | 8.02 | 11.36 | 8.25 | ||||||||||||

|

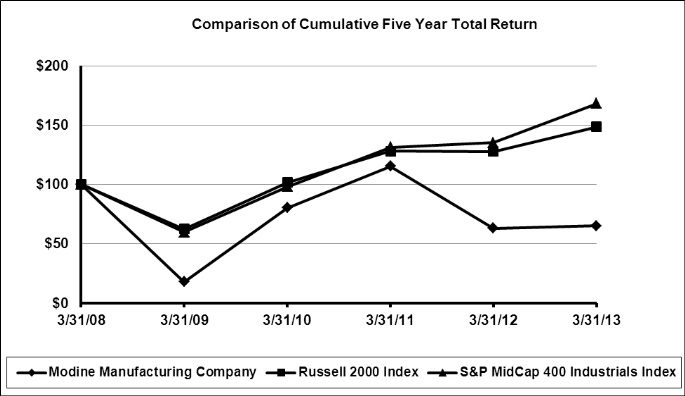

March 31,

|

Initial Investment

|

Indexed Returns

|

||||||||||||||||||||||

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

|||||||||||||||||||

|

Company / Index

|

||||||||||||||||||||||||

|

Modine Manufacturing Company

|

$ | 100 | $ | 17.87 | $ | 80.33 | $ | 115.35 | $ | 63.10 | $ | 65.03 | ||||||||||||

|

Russell 2000 Index

|

100 | 62.50 | 101.72 | 127.96 | 127.73 | 148.55 | ||||||||||||||||||

|

S&P MidCap 400 Industrials Index

|

100 | 59.59 | 98.00 | 131.44 | 135.08 | 168.15 | ||||||||||||||||||

|

ITEM 6

.

|

|

(in millions, except per share amounts)

|

Fiscal Year ended March 31

|

|||||||||||||||||||

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||

|

Net sales

|

$ | 1,376.0 | $ | 1,577.2 | $ | 1,448.2 | $ | 1,162.6 | $ | 1,406.9 | ||||||||||

|

(Loss) earnings from continuing operations

|

(22.8 | ) | 38.0 | 8.3 | (22.8 | ) | (107.3 | ) | ||||||||||||

|

Total assets

|

818.8 | 893.5 | 917.7 | 841.6 | 852.8 | |||||||||||||||

|

Long-term debt - excluding current portion

|

132.5 | 141.9 | 138.6 | 136.0 | 244.0 | |||||||||||||||

|

Dividends per share

|

- | - | - | - | 0.30 | |||||||||||||||

|

(Loss) earnings per share from continuing

operations - basic:

|

(0.52 | ) | 0.81 | 0.18 | (0.58 | ) | (3.35 | ) | ||||||||||||

|

(Loss) earnings per share from continuing

operations - diluted:

|

(0.52 | ) | 0.80 | 0.18 | (0.58 | ) | (3.35 | ) | ||||||||||||

|

·

|

During fiscal 2013, 2012, 2011, 2010 and 2009, the Company recorded long-lived asset impairment charges of $25.9 million, $2.5 million, $3.5 million, $6.5 million and $26.8 million, respectively. Refer to Note 5 of the Notes to Consolidated Financial Statements for additional discussion.

|

|

·

|

During fiscal 2013, 2010 and 2009, the Company incurred $17.0 million, $6.0 million and $39.5 million, respectively, of restructuring and other repositioning costs. Refer to Note 5 of the Notes to Consolidated Financial Statements for additional discussion.

|

|

·

|

During fiscal 2011, the Company recognized total costs of $19.9 million for the early extinguishment of debt and the write-off of unamortized debt issuance costs. During fiscal 2010, the Company recognized a prepayment penalty of $3.5 million related to a partial pay down of debt.

|

|

·

|

During fiscal 2009, the Company recorded impairment charges of $9.0 million related to goodwill in the Europe segment and $7.6 million related to an equity investment.

|

|

·

|

Selected financial data has been presented on a continuing operations basis, and excludes the discontinued operating results of the South Korean HVAC business, which the Company sold during fiscal 2010, and the Electronics Cooling business, which the Company sold during fiscal 2009.

|

|

●

|

Development of new products and technologies for diverse geographic and end markets;

|

|

●

|

A rigorous strategic planning and corporate development process; and

|

|

●

|

Operational and financial discipline to ensure improved profitability and long-term stability.

|

|

·

|

Manufacturing realignment.

We are focused on exiting certain products based on our global product strategy, transferring product lines and reducing headcount, with the goal of reducing manufacturing costs and improving gross margin.

|

|

·

|

SG&A expense reduction.

Our Europe segment is committed to controlling their overall SG&A expenses and has implemented headcount reductions at the segment headquarters. Through this process we are targeting annual expense savings of $7 million to $9 million over the next couple of years.

|

|

·

|

Improve segment earnings and lower assets employed.

During fiscal 2013, our Europe segment decided to exit several facilities. We are currently marketing these facilities for sale.

|

|

·

|

Reducing lead times to bring new or updated products to market and offering a wider product breadth, while at the same time evolving or rationalizing the existing product lines to meet targeted financial metrics that fit within our overall strategy.

|

|

·

|

Balancing our customer and program portfolio and pursuing new business opportunities that meet our minimum targeted rates of return, thus enabling profitable growth for the Company. This includes a focus on both organic and inorganic growth opportunities.

|

|

·

|

Growing revenue with an adjacent market focus in order to leverage the competitive cost structure and to improve asset utilization.

|

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 1,376 | 100.0 | % | $ | 1,577 | 100.0 | % | $ | 1,448 | 100.0 | % | ||||||||||||

|

Cost of sales

|

1,167 | 84.8 | % | 1,321 | 83.7 | % | 1,216 | 84.0 | % | |||||||||||||||

|

Gross profit

|

209 | 15.2 | % | 257 | 16.3 | % | 232 | 16.0 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

166 | 12.1 | % | 187 | 11.8 | % | 186 | 12.8 | % | |||||||||||||||

|

Impairment charges

|

26 | 1.9 | % | 2 | 0.1 | % | 3 | 0.2 | % | |||||||||||||||

|

Restructuring expenses

|

17 | 1.2 | % | - | - | - | - | |||||||||||||||||

|

Operating (loss) income

|

(1 | ) | 0.0 | % | 68 | 4.3 | % | 43 | 2.9 | % | ||||||||||||||

|

Interest expense

|

(13 | ) | -0.9 | % | (12 | ) | -0.8 | % | (34 | ) | -2.3 | % | ||||||||||||

|

Other income (expense) – net

|

- | - | (7 | ) | -0.5 | % | 4 | 0.3 | % | |||||||||||||||

|

(Loss) earnings from continuing operations

before income taxes

|

(13 | ) | -0.9 | % | 48 | 3.1 | % | 13 | 0.9 | % | ||||||||||||||

|

Provision for income taxes

|

(10 | ) | -0.7 | % | (10 | ) | -0.6 | % | (5 | ) | -0.3 | % | ||||||||||||

|

(Loss) earnings from continuing operations

|

$ | (23 | ) | -1.7 | % | $ | 38 | 2.4 | % | $ | 8 | 0.6 | % | |||||||||||

|

North America

|

||||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 565 | 100.0 | % | $ | 602 | 100.0 | % | $ | 573 | 100.0 | % | ||||||||||||

|

Cost of sales

|

484 | 85.6 | % | 512 | 85.1 | % | 494 | 86.2 | % | |||||||||||||||

|

Gross profit

|

81 | 14.4 | % | 90 | 14.9 | % | 79 | 13.8 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

40 | 7.2 | % | 42 | 6.9 | % | 46 | 8.0 | % | |||||||||||||||

|

Impairment charges

|

2 | 0.3 | % | - | - | 1 | 0.2 | % | ||||||||||||||||

|

Operating income

|

$ | 39 | 6.9 | % | $ | 48 | 8.0 | % | $ | 32 | 5.6 | % | ||||||||||||

SG&A expenses decreased $4 million from fiscal 2011 to fiscal 2012, and decreased $2 million in fiscal 2013. Fiscal 2012 SG&A expenses were favorably impacted by a $2 million reversal of a trade compliance liability that was no longer required, a reduction in pension costs and lower management compensation expenses. The decrease in SG&A expenses in fiscal 2013 was primarily due to the favorable impact of cost reduction initiatives and lower pension expenses, partially offset by the $2 million reduction of a trade compliance liability in fiscal 2012.

|

Europe

|

||||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 498 | 100.0 | % | $ | 603 | 100.0 | % | $ | 547 | 100.0 | % | ||||||||||||

|

Cost of sales

|

437 | 87.7 | % | 518 | 85.8 | % | 471 | 86.2 | % | |||||||||||||||

|

Gross profit

|

61 | 12.3 | % | 85 | 14.1 | % | 76 | 13.8 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

36 | 7.2 | % | 46 | 7.6 | % | 46 | 8.4 | % | |||||||||||||||

|

Impairment charges

|

24 | 4.8 | % | 2 | 0.4 | % | 2 | 0.4 | % | |||||||||||||||

|

Restructuring expenses

|

17 | 3.4 | % | - | - | - | - | |||||||||||||||||

|

Operating (loss) income

|

$ | (16 | ) | -3.2 | % | $ | 37 | 6.1 | % | $ | 28 | 5.1 | % | |||||||||||

|

South America

|

||||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 134 | 100.0 | % | $ | 176 | 100.0 | % | $ | 159 | 100.0 | % | ||||||||||||

|

Cost of sales

|

111 | 83.2 | % | 145 | 82.4 | % | 128 | 80.3 | % | |||||||||||||||

|

Gross profit

|

23 | 16.8 | % | 31 | 17.6 | % | 31 | 19.7 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

12 | 8.4 | % | 21 | 11.7 | % | 18 | 11.5 | % | |||||||||||||||

|

Operating income

|

$ | 11 | 8.4 | % | $ | 10 | 5.9 | % | $ | 13 | 8.2 | % | ||||||||||||

|

Asia

|

||||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 60 | 100.0 | % | $ | 84 | 100.0 | % | $ | 64 | 100.0 | % | ||||||||||||

|

Cost of sales

|

58 | 97.2 | % | 76 | 90.6 | % | 59 | 91.8 | % | |||||||||||||||

|

Gross profit

|

2 | 2.8 | % | 8 | 9.4 | % | 5 | 8.2 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

11 | 17.6 | % | 10 | 12.3 | % | 8 | 13.0 | % | |||||||||||||||

|

Operating loss

|

$ | (9 | ) | -14.8 | % | $ | (2 | ) | -2.9 | % | $ | (3 | ) | -4.8 | % | |||||||||

|

Commercial Products

|

||||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||||||||||||||

|

(dollars in millions)

|

$'s

|

% of sales

|

$'s

|

% of sales

|

$'s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$ | 139 | 100.0 | % | $ | 142 | 100.0 | % | $ | 126 | 100.0 | % | ||||||||||||

|

Cost of sales

|

98 | 70.7 | % | 100 | 70.1 | % | 87 | 68.9 | % | |||||||||||||||

|

Gross profit

|

41 | 29.3 | % | 42 | 29.9 | % | 39 | 31.1 | % | |||||||||||||||

|

Selling, general and administrative expenses

|

31 | 22.1 | % | 28 | 19.9 | % | 26 | 21.0 | % | |||||||||||||||

|

Operating income

|

$ | 10 | 7.2 | % | $ | 14 | 10.0 | % | $ | 13 | 10.1 | % | ||||||||||||

Dividends

|

Interest Expense Coverage

|

Leverage Ratio

|

||

|

Ratio Covenant (Not

|

Covenant (Not Permitted

|

||

|

Permitted to Be Less Than)

|

to Be Greater Than)

|

||

|

Fiscal quarter ending on or before August 12, 2014

|

3.00 to 1.0

|

3.25 to 1.0

|

|

|

All fiscal quarters ending thereafter

|

3.00 to 1.0

|

3.00 to 1.0

|

|

Quarter Ended June 30, 2012

|

Quarter Ended

September 30, 2012

|

Quarter Ended

December 31, 2012

|

Quarter Ended

March 31, 2013

|

Total

|

||||||||||||||||

|

Loss from continuing operations

|

$ | (1.0 | ) | $ | (11.8 | ) | $ | (8.4 | ) | $ | (1.6 | ) | $ | (22.8 | ) | |||||

|

Net earnings attributable to noncontrolling interest

|

(0.3 | ) | (0.3 | ) | (0.3 | ) | (0.5 | ) | (1.4 | ) | ||||||||||

|

Consolidated interest expense

|

3.0 | 3.4 | 2.8 | 3.4 | 12.6 | |||||||||||||||

|

Provision for income taxes

|

2.0 | 1.8 | 1.5 | 4.5 | 9.8 | |||||||||||||||

|

Depreciation and amortization expense

|

14.1 | 14.1 | 13.6 | 14.0 | 55.8 | |||||||||||||||

|

Non-cash items

|

0.3 | 16.8 | 8.3 | 1.8 | 27.2 | |||||||||||||||

|

Restructuring expenses

|

4.8 | 1.5 | 1.4 | 9.3 | 17.0 | |||||||||||||||

|

Adjusted EBITDA

|

$ | 22.9 | $ | 25.5 | $ | 18.9 | $ | 30.9 | $ | 98.2 | ||||||||||

|

Four Quarters Ended

March 31, 2013

|

||||

|

Consolidated interest expense

|

$ | 12.6 | ||

|

Plus: Costs to sell receivables

|

0.4 | |||

|

Total consolidated interest expense

|

$ | 13.0 | ||

|

Adjusted EBITDA

|

$ | 98.2 | ||

|

Interest expense coverage ratio

|

7.55 | |||

|

Four Quarters Ended

March 31, 2013

|

||||

|

Debt per balance sheet

|

$ | 163.6 | ||

|

Plus: Derivative financial instruments

|

1.4 | |||

|

Letters of credit as defined by the debt agreement

|

1.4 | |||

|

Indebtedness attributed to sales of receivables

|

15.5 | |||

|

Total debt

|

$ | 181.9 | ||

|

Adjusted EBITDA

|

$ | 98.2 | ||

|

Leverage ratio

|

1.85 | |||

|

(in millions) March 31, 2013

|

||||||||||||||||||||

|

Total

|

Less than 1 year

|

1 - 3 years

|

4 - 5 years

|

More than 5 years

|

||||||||||||||||

|

Long-term debt

|

$ | 126.9 | $ | 0.3 | $ | 1.6 | $ | 24.0 | $ | 101.0 | ||||||||||

|

Interest associated with long-term debt

|

56.0 | 8.6 | 17.1 | 16.1 | 14.2 | |||||||||||||||

|

Capital lease obligations

|

6.1 | 0.2 | 0.6 | 0.6 | 4.7 | |||||||||||||||

|

Operating lease obligations

|

22.3 | 6.5 | 7.5 | 4.0 | 4.3 | |||||||||||||||

|

Capital expenditure commitments

|

11.9 | 7.8 | 4.1 | - | - | |||||||||||||||

|

Other long-term obligations

|

12.7 | 2.4 | 3.1 | 2.3 | 4.9 | |||||||||||||||

|

Total contractual obligations

|

$ | 235.9 | $ | 25.8 | $ | 34.0 | $ | 47.0 | $ | 129.1 | ||||||||||

|

Operational Risks:

|

|

·

|

Our ability to successfully implement our Europe restructuring plans and drive cost reductions and increased profitability and return on assets as a result;

|

|

·

|

The overall health of our customers in light of broad economic and specific market challenges and the potential impact on us from any deterioration in the stability or performance of any of our customers;

|

|

·

|

The impact of operational inefficiencies as a result of program launches and product transfers;

|

|

·

|

Our ability to maintain current programs and compete effectively for new business, including our ability to offset or otherwise address increasing pricing pressures from competitors and price reduction pressures from customers;

|

|

·

|

Costs and other effects of the remediation of environmental contamination;

|

|

·

|

Our ability to obtain and retain profitable business at facilities in our Asia segment, and in particular, in China;

|

|

·

|

Unanticipated delays or modifications initiated by major customers with respect to product launches, product applications or requirements;

|

|

·

|

Unanticipated product or manufacturing difficulties, including unanticipated launch challenges and warranty claims;

|

|

·

|

Increasingly complex and restrictive laws and regulations in various jurisdictions in which we operate and the costs associated with compliance therewith;

|

|

·

|

Unanticipated problems with suppliers meeting our time, quantity, quality and price demands;

|

|

·

|

Work stoppages or interference at our facilities or those of our major customers and/or suppliers; and

|

|

·

|

Costs and other effects of unanticipated litigation or claims, and the increasing pressures associated with rising healthcare and insurance costs.

|

|

·

|

Economic, social and political conditions, changes and challenges in the markets where we and our customers operate and compete, including foreign currency exchange rate fluctuations (particularly the value of the euro and Brazilian real relative to the U.S. dollar), tariffs, inflation, changes in interest rates, recession, restrictions associated with importing and exporting and foreign ownership, and, in particular, the continuing slow recovery of certain markets in China and Brazil and the economic uncertainties in the European Union;

|

|

·

|

The impact of increases in commodity prices, particularly our exposure to the changing prices of aluminum, copper, steel and stainless steel (nickel);

|

|

·

|

Our ability or inability to successfully hedge commodity risk and/or pass increasing commodity prices on to customers as well as the inherent lag in timing of such pass-through pricing; and

|

|

·

|

The impact of environmental laws and regulations on our business and the business of our customers, including our ability to take advantage of opportunities to supply alternative new technologies to meet environmental emissions standards.

|

|

Financial Risks:

|

|

·

|

Our ability to fund our liquidity requirements and meet our long-term commitments in the event of any renewed disruption in the credit markets or extended recessionary conditions in the global economy; and

|

|

·

|

Our ability to realize future tax benefits.

|

|

Strategic Risks:

|

|

·

|

Our ability to identify and implement appropriate growth and diversification strategies that position us for long-term success.

|

|

|

·

|

Cash and investments – Cash deposits and short-term investments are reviewed to ensure banks have acceptable credit ratings and that short-term investments are maintained in secured or guaranteed instruments. Our holdings in cash and investments were considered stable and secure at March 31, 2013;

|

|

|

·

|

Trade accounts receivable – Prior to granting credit, we evaluate each customer, taking into consideration the customer's financial condition, payment experience and credit information. After credit is granted, we actively monitor the customer's financial condition and applicable business news;

|

|

|

·

|

Pension assets – We have retained outside advisors to assist in the management of the assets in the defined benefit plans. In making investment decisions, we have been guided by an established risk management protocol that focuses on protection of the plan assets against downside risk. We ensure that investments within these plans provide appropriate diversification, are subject to monitoring by investment teams and ensure that portfolio managers adhere to the established investment policies. We believe the plan assets are subject to appropriate investment policies and controls; and

|

|

|

·

|

Insurance – We monitor our insurance providers to ensure that they have acceptable financial ratings. We have not identified any concerns in this regard based on our reviews.

|

Foreign currency forward contracts: Our foreign exchange risk management strategy uses derivative financial instruments in a limited way to mitigate foreign currency exchange risk. We periodically enter into foreign currency exchange contracts to hedge specific foreign currency-denominated assets and liabilities. We have not designated these forward contracts as hedges. Accordingly, unrealized gains and losses related to the change in the fair value of the contracts are recorded in other income and expense. Gains and losses on these foreign currency forward contracts are offset by foreign currency gains and losses associated with the related assets and liabilities.

|

2013

|

2012

|

2011

|

||||||||||

|

Net sales

|

$ | 1,376.0 | $ | 1,577.2 | $ | 1,448.2 | ||||||

|

Cost of sales

|

1,167.4 | 1,320.6 | 1,215.9 | |||||||||

|

Gross profit

|

208.6 | 256.6 | 232.3 | |||||||||

|

Selling, general and administrative expenses

|

166.3 | 186.6 | 185.9 | |||||||||

|

Impairment charges

|

25.9 | 2.5 | 3.5 | |||||||||

|

Restructuring expenses

|

17.0 | - | - | |||||||||

|

Operating (loss) income

|

(0.6 | ) | 67.5 | 42.9 | ||||||||

|

Interest expense

|

(12.6 | ) | (12.5 | ) | (33.7 | ) | ||||||

|

Other income (expense) – net

|

0.2 | (7.1 | ) | 3.6 | ||||||||

|

(Loss) earnings from continuing operations before income taxes

|

(13.0 | ) | 47.9 | 12.8 | ||||||||

|

Provision for income taxes

|

(9.8 | ) | (9.9 | ) | (4.5 | ) | ||||||

|

(Loss) earnings from continuing operations

|

(22.8 | ) | 38.0 | 8.3 | ||||||||

|

Earnings (loss) from discontinued operations, net of income taxes

|

- | 0.8 | (3.1 | ) | ||||||||

|

Net (loss) earnings

|

(22.8 | ) | 38.8 | 5.2 | ||||||||

|

Net earnings attributable to noncontrolling interest

|

(1.4 | ) | (0.3 | ) | - | |||||||

|

Net (loss) earnings attributable to Modine

|

$ | (24.2 | ) | $ | 38.5 | $ | 5.2 | |||||

|

(Loss) earnings per share from continuing operations attributable to Modine shareholders:

|

||||||||||||

|

Basic

|

$ | (0.52 | ) | $ | 0.81 | $ | 0.18 | |||||

|

Diluted

|

$ | (0.52 | ) | $ | 0.80 | $ | 0.18 | |||||

|

Net (loss) earnings per share attributable to Modine shareholders:

|

||||||||||||

|

Basic

|

$ | (0.52 | ) | $ | 0.83 | $ | 0.11 | |||||

|

Diluted

|

$ | (0.52 | ) | $ | 0.82 | $ | 0.11 | |||||

|

Weighted average shares outstanding:

|

||||||||||||

|

Basic

|

46.6 | 46.5 | 46.2 | |||||||||

|

Diluted

|

46.6 | 46.9 | 46.7 | |||||||||

|

2013

|

2012

|

2011

|

||||||||||

|

Net (loss) earnings

|

$ | (22.8 | ) | $ | 38.8 | $ | 5.2 | |||||

|

Other comprehensive (loss) income:

|

||||||||||||

|

Foreign currency translation

|

(17.1 | ) | (22.6 | ) | 16.5 | |||||||

|

Cash flow hedges, net of income taxes of $0, $0.1 million and $1.0

million

|

2.6 | (3.4 | ) | 2.3 | ||||||||

|

Defined benefit plans, net of income taxes of $0, $0 and $2.8 million

|

(23.6 | ) | (41.4 | ) | 8.6 | |||||||

|

Total other comprehensive (loss) income

|

(38.1 | ) | (67.4 | ) | 27.4 | |||||||

|

Comprehensive (loss) income

|

(60.9 | ) | (28.6 | ) | 32.6 | |||||||

|

Comprehensive income attributable to noncontrolling interest

|

(1.4 | ) | (0.3 | ) | - | |||||||

|

Comprehensive (loss) income attributable to Modine

|

$ | (62.3 | ) | $ | (28.9 | ) | $ | 32.6 | ||||

|

2013

|

2012

|

|||||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 23.8 | $ | 31.4 | ||||

|

Trade accounts receivable – net

|

194.5 | 216.1 | ||||||

|

Inventories

|

118.8 | 120.8 | ||||||

|

Other current assets

|

61.9 | 59.2 | ||||||

|

Total current assets

|

399.0 | 427.5 | ||||||

|

Property, plant and equipment – net

|

355.9 | 412.1 | ||||||

|

Investment in affiliate

|

3.3 | 3.7 | ||||||

|

Intangible assets – net

|

8.3 | 5.8 | ||||||

|

Goodwill

|

28.7 | 29.9 | ||||||

|

Other noncurrent assets

|

23.6 | 14.5 | ||||||

|

Total assets

|

$ | 818.8 | $ | 893.5 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Short-term debt

|

$ | 30.6 | $ | 21.3 | ||||

|

Long-term debt – current portion

|

0.5 | 1.1 | ||||||

|

Accounts payable

|

150.7 | 156.9 | ||||||

|

Accrued compensation and employee benefits

|

51.2 | 50.6 | ||||||

|

Other current liabilities

|

47.1 | 67.7 | ||||||

|

Total current liabilities

|

280.1 | 297.6 | ||||||

|

Long-term debt

|

132.5 | 141.9 | ||||||

|

Deferred income taxes

|

8.6 | 12.3 | ||||||

|

Pensions

|

108.0 | 94.1 | ||||||

|

Postretirement benefits

|

6.7 | 6.4 | ||||||

|

Other noncurrent liabilities

|

14.6 | 15.1 | ||||||

|

Total liabilities

|

550.5 | 567.4 | ||||||

|

Commitments and contingencies (see Note 18)

|

||||||||

|

Shareholders' equity:

|

||||||||

|

Preferred stock, $0.025 par value, authorized 16.0 million shares, issued - none

|

- | - | ||||||

|

Common stock, $0.625 par value, authorized 80.0 million shares, issued 47.8 million and 47.4 million shares

|

29.9 | 29.6 | ||||||

|

Additional paid-in capital

|

171.2 | 168.3 | ||||||

|

Retained earnings

|

207.6 | 231.8 | ||||||

|

Accumulated other comprehensive loss

|

(128.4 | ) | (90.3 | ) | ||||

|

Treasury stock at cost: 0.6 million shares

|

(14.6 | ) | (14.5 | ) | ||||

|

Total Modine shareholders' equity

|

265.7 | 324.9 | ||||||

|

Noncontrolling interest

|

2.6 | 1.2 | ||||||

|

Total equity

|

268.3 | 326.1 | ||||||

|

Total liabilities and equity

|

$ | 818.8 | $ | 893.5 | ||||

|

2013

|

2012

|

2011

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net (loss) earnings

|

$ | (22.8 | ) | $ | 38.8 | $ | 5.2 | |||||

|

Adjustments to reconcile net (loss) earnings with net cash provided

by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

55.8 | 57.7 | 56.5 | |||||||||

|

Pension and postretirement expense

|

1.9 | 5.0 | 6.5 | |||||||||

|

Loss (gain) from disposition of property, plant and equipment

|

2.5 | 0.6 | (3.4 | ) | ||||||||

|

Impairment charges

|

25.9 | 2.5 | 3.5 | |||||||||

|

Deferred income taxes

|

0.6 | 1.9 | (7.0 | ) | ||||||||

|

Stock-based compensation expense

|

3.1 | 1.6 | 4.0 | |||||||||

|

Other – net

|

4.1 | 2.7 | 2.2 | |||||||||

|

Changes in operating assets and liabilities, excluding acquisitions and dispositions:

|

||||||||||||

|

Trade accounts receivable

|

15.1 | (7.5 | ) | (43.0 | ) | |||||||

|

Inventories

|

(0.8 | ) | (3.1 | ) | (19.4 | ) | ||||||

|

Other current assets

|

(6.8 | ) | (10.5 | ) | (2.6 | ) | ||||||

|

Accounts payable

|

(3.2 | ) | (14.6 | ) | 30.0 | |||||||

|

Accrued compensation and employee benefits

|

1.9 | (10.5 | ) | 7.3 | ||||||||

|

Income taxes

|

(1.3 | ) | 0.5 | (2.6 | ) | |||||||

|

Other current liabilities

|

(16.7 | ) | (6.5 | ) | 7.4 | |||||||

|

Other noncurrent assets and liabilities

|

(10.5 | ) | (12.8 | ) | (23.8 | ) | ||||||

|

Net cash provided by operating activities

|

48.8 | 45.8 | 20.8 | |||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Expenditures for property, plant and equipment

|

(49.8 | ) | (64.4 | ) | (55.1 | ) | ||||||

|

Acquisition – net of cash acquired

|

(4.9 | ) | - | - | ||||||||

|

Proceeds from dispositions of assets

|

0.4 | 1.3 | 12.5 | |||||||||

|

Other – net

|

(1.6 | ) | (1.9 | ) | 1.4 | |||||||

|

Net cash used for investing activities

|

(55.9 | ) | (65.0 | ) | (41.2 | ) | ||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Borrowings of debt

|

166.7 | 134.4 | 260.2 | |||||||||

|

Repayments of debt

|

(167.1 | ) | (116.2 | ) | (252.4 | ) | ||||||

|

Other – net

|

0.7 | 0.6 | 0.8 | |||||||||

|

Net cash provided by financing activities

|

0.3 | 18.8 | 8.6 | |||||||||

|

Effect of exchange rate changes on cash

|

(0.8 | ) | (1.1 | ) | 1.0 | |||||||

|

Net decrease in cash and cash equivalents

|

(7.6 | ) | (1.5 | ) | (10.8 | ) | ||||||

|

Cash and cash equivalents at beginning of year

|

31.4 | 32.9 | 43.7 | |||||||||

|

Cash and cash equivalents at end of year

|

$ | 23.8 | $ | 31.4 | $ | 32.9 | ||||||

|

Cash paid during the year for:

|

||||||||||||

|

Interest

|

$ | 11.6 | $ | 12.8 | $ | 28.1 | ||||||

|

Income taxes

|

$ | 12.4 | $ | 13.0 | $ | 15.6 | ||||||

|

Common stock

|

Additional paid-in capital

|

Retained earnings

|

Accumulated other comprehensive loss

|

Treasury stock

|

Non-controlling interest

|

Deferred compensation trust

|

Total

|

|||||||||||||||||||||||||

|

Balance, March 31, 2010

|

$ | 29.2 | $ | 159.9 | $ | 188.1 | $ | (50.3 | ) | $ | (13.9 | ) | $ | - | $ | (0.3 | ) | $ | 312.7 | |||||||||||||

|

Net earnings

|

- | - | 5.2 | - | - | - | - | 5.2 | ||||||||||||||||||||||||

|

Other comprehensive income

|

- | - | - | 27.4 | - | - | - | 27.4 | ||||||||||||||||||||||||

|

Stock options and awards including related tax benefits

|

0.2 | 1.3 | - | - | - | - | - | 1.5 | ||||||||||||||||||||||||

|

Purchase of treasury stock

|

- | - | - | - | (0.1 | ) | - | - | (0.1 | ) | ||||||||||||||||||||||

|

Stock-based compensation expense

|

- | 4.0 | - | - | - | - | - | 4.0 | ||||||||||||||||||||||||

|

Investment in deferred compensation trust

|

- | 1.2 | - | - | - | - | 0.3 | 1.5 | ||||||||||||||||||||||||

|

Balance, March 31, 2011

|

29.4 | 166.4 | 193.3 | (22.9 | ) | (14.0 | ) | - | - | 352.2 | ||||||||||||||||||||||

|

Net earnings attributable to Modine

|

- | - | 38.5 | - | - | - | - | 38.5 | ||||||||||||||||||||||||

|

Other comprehensive loss

|

- | - | - | (67.4 | ) | - | - | - | (67.4 | ) | ||||||||||||||||||||||

|

Stock options and awards including related tax benefits

|

0.2 | 0.3 | - | - | - | - | - | 0.5 | ||||||||||||||||||||||||

|

Purchase of treasury stock

|

- | - | - | - | (0.5 | ) | - | - | (0.5 | ) | ||||||||||||||||||||||

|

Stock-based compensation expense

|

- | 1.6 | - | - | - | - | - | 1.6 | ||||||||||||||||||||||||

|

Contribution by noncontrolling interest

|

- | - | - | - | - | 0.9 | - | 0.9 | ||||||||||||||||||||||||

|

Net earnings attributable to noncontrolling interest

|

- | - | - | - | - | 0.3 | - | 0.3 | ||||||||||||||||||||||||

|

Balance, March 31, 2012

|

29.6 | 168.3 | 231.8 | (90.3 | ) | (14.5 | ) | 1.2 | - | 326.1 | ||||||||||||||||||||||

|

Net loss attributable to Modine

|

- | - | (24.2 | ) | - | - | - | - | (24.2 | ) | ||||||||||||||||||||||

|

Other comprehensive loss

|

- | - | - | (38.1 | ) | - | - | - | (38.1 | ) | ||||||||||||||||||||||

|

Stock options and awards including related tax benefits

|

0.3 | (0.2 | ) | - | - | - | - | - | 0.1 | |||||||||||||||||||||||

|

Purchase of treasury stock

|

- | - | - | - | (0.1 | ) | - | - | (0.1 | ) | ||||||||||||||||||||||

|

Stock-based compensation expense

|

- | 3.1 | - | - | - | - | - | 3.1 | ||||||||||||||||||||||||

|

Net earnings attributable to noncontrolling interest

|

- | - | - | - | - | 1.4 | - | 1.4 | ||||||||||||||||||||||||

|

Balance, March 31, 2013

|

$ | 29.9 | $ | 171.2 | $ | 207.6 | $ | (128.4 | ) | $ | (14.6 | ) | $ | 2.6 | $ | - | $ | 268.3 | ||||||||||||||

|

Note 1:

|

Significant Accounting Policies

|

Shipping and handling costs: Shipping and handling costs incurred upon the shipment of products to our OEM customers are recorded in cost of sales, and related amounts billed to these customers are recorded in net sales. Shipping and handling costs incurred upon the shipment of products to our HVAC customers are recorded in selling, general and administrative (“SG&A”) expenses. For the years ended March 31, 2013, 2012 and 2011, these shipping and handling costs recorded in SG&A expenses were $4.3 million, $5.4 million and $4.8 million, respectively.

Inventories: Inventories are valued at the lower of cost, on a first-in, first-out basis or weighted average basis, or market value.

|

Note 2

|

Acquisitions

|

|

Note 3:

|

Fair Value Measurements

|

|

·

|

Level 1 – Quoted prices for identical instruments in active markets.

|

|

·

|

Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable in active markets.

|

|

·

|

Level 3 – Model-derived valuations in which one or more significant inputs or significant value-drivers are unobservable.

|

At March 31, 2013, assets and liabilities recorded at fair value on a recurring basis were as follows:

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Assets:

|

||||||||||||||||

|

Trading securities

|

$ | 2.3 | $ | - | $ | - | $ | 2.3 | ||||||||

|

Total assets

|

$ | 2.3 | $ | - | $ | - | $ | 2.3 | ||||||||

|

Liabilities:

|

||||||||||||||||

|

Derivative financial instruments

|

$ | - | $ | 1.4 | $ | - | $ | 1.4 | ||||||||

|

Deferred compensation obligations

|

2.3 | - | - | 2.3 | ||||||||||||

|

Total liabilities

|

$ | 2.3 | $ | 1.4 | $ | - | $ | 3.7 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Assets:

|

||||||||||||||||

|

Trading securities

|

$ | 1.8 | $ | - | $ | - | $ | 1.8 | ||||||||

|

Derivative financial instruments

|

- | 0.4 | - | 0.4 | ||||||||||||

|

Total assets

|

$ | 1.8 | $ | 0.4 | $ | - | $ | 2.2 | ||||||||

|

Liabilities:

|

||||||||||||||||

|

Derivative financial instruments

|

$ | - | $ | 3.5 | $ | - | $ | 3.5 | ||||||||

|

Deferred compensation obligations

|

1.8 | - | - | 1.8 | ||||||||||||

|

Total liabilities

|

$ | 1.8 | $ | 3.5 | $ | - | $ | 5.3 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Money market investments

|

$ | - | $ | 7.3 | $ | - | $ | 7.3 | ||||||||

|

Common stocks

|

35.9 | 0.1 | - | 36.0 | ||||||||||||

|

Corporate bonds

|

- | 19.1 | - | 19.1 | ||||||||||||

|

Pooled equity funds

|

68.8 | 14.1 | - | 82.9 | ||||||||||||

|

Pooled fixed income funds

|

17.6 | - | - | 17.6 | ||||||||||||

|

U.S. government and agency securities

|

- | 32.1 | - | 32.1 | ||||||||||||

|

Other

|

1.0 | 4.6 | - | 5.6 | ||||||||||||

|

Total

|

$ | 123.3 | $ | 77.3 | $ | - | $ | 200.6 | ||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Money market investments

|

$ | - | $ | 11.7 | $ | - | $ | 11.7 | ||||||||

|

Common stocks

|

26.7 | 0.1 | - | 26.8 | ||||||||||||

|

Corporate bonds

|

- | 18.2 | - | 18.2 | ||||||||||||

|

Pooled equity funds

|

67.5 | 12.1 | - | 79.6 | ||||||||||||

|

Pooled fixed income funds

|

16.2 | - | - | 16.2 | ||||||||||||

|

U.S. government and agency securities

|

- | 29.3 | - | 29.3 | ||||||||||||

|

Other

|

1.2 | 3.6 | - | 4.8 | ||||||||||||

|

Total

|

$ | 111.6 | $ | 75.0 | $ | - | $ | 186.6 | ||||||||

|

Note 4:

|

Stock-Based Compensation

|

The Company’s stock-based incentive plans for employees consist of the following: (1) a discretionary equity program for management and other key employees, and (2) a long-term incentive compensation program for officers and key executives that consists of a stock option component and restricted stock components granted for retention and performance.

|

2013

|

2012

|

2011

|

||||||||||

|

Weighted average fair value of options

|

$ | 4.26 | $ | 10.45 | $ | 6.43 | ||||||

|

Expected life of awards in years

|

6.3 | 6.3 | 6.3 | |||||||||

|

Risk-free interest rate

|

0.9 | % | 1.9 | % | 2.4 | % | ||||||

|

Expected volatility of the Company's stock

|

87.4 | % | 79.6 | % | 78.0 | % | ||||||

|

Expected dividend yield on the Company's stock

|

0.0 | % | 0.0 | % | 0.0 | % | ||||||

|

Weighted average

|

||||||||||||||||

|

Weighted average

|

remaining contractual

|

Aggregate

|

||||||||||||||

|

Shares

|

exercise price

|

term (years)

|

intrinsic value

|

|||||||||||||

|

Outstanding, April 1, 2012

|

1.8 | $ | 16.37 | |||||||||||||

|

Granted

|

0.2 | 5.79 | ||||||||||||||

|

Exercised

|

- | 5.01 | ||||||||||||||

|

Forfeited or expired

|

(0.3 | ) | 21.78 | |||||||||||||

|

Outstanding, March 31, 2013

|

1.7 | $ | 14.03 | 5.6 | $ | 2.6 | ||||||||||

|

Exercisable, March 31, 2013

|

1.5 | $ | 15.15 | 5.0 | $ | 2.0 | ||||||||||

|

2013

|

2012

|

2011

|

||||||||||

|

Intrinsic value of stock options exercised

|

$ | 0.1 | $ | 0.2 | $ | 0.7 | ||||||

|

Proceeds from stock options exercised

|

$ | 0.1 | $ | 0.5 | $ | 1.5 | ||||||

|

Weighted

|

||||||||

|

average

|

||||||||

|

Shares

|

price

|

|||||||

|

Non-vested balance, April 1, 2012

|

0.2 | $ | 8.49 | |||||

|

Granted

|

0.5 | 6.07 | ||||||

|

Vested

|

(0.2 | ) | 6.77 | |||||

|

Non-vested balance, March 31, 2013

|

0.5 | $ | 6.91 | |||||

|

Note 5:

|

Impairment and Restructuring Charges

|

|

Year ended March 31

|

2013

|

|||

|

Beginning balance

|

$ | - | ||

|

Additions

|

14.9 | |||

|

Payments

|

(3.3 | ) | ||

|

Balance, March 31, 2013

|

$ | 11.6 | ||

|

Note 6:

|

Other Income and Expense

|

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||

|

Equity in earnings (loss) of non-consolidated affiliates

|

$ | 0.3 | $ | (0.1 | ) | $ | 0.5 | |||||

|

Interest income

|

0.9 | 0.8 | 0.7 | |||||||||

|

Foreign currency transactions

|

(1.1 | ) | (7.8 | ) | 2.3 | |||||||

|

Other non-operating income

|

0.1 | - | 0.1 | |||||||||

|

Total other income (expense) - net

|

$ | 0.2 | $ | (7.1 | ) | $ | 3.6 | |||||

|

Note 7:

|

Income Taxes

|

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||

|

Components of (loss) earnings from continuing operations

before income taxes:

|

||||||||||||

|

United States

|

$ | 10.2 | $ | 17.2 | $ | (27.5 | ) | |||||

|

Foreign

|

(23.2 | ) | 30.7 | 40.3 | ||||||||

|

Total (loss) earnings from continuing operations before income taxes

|

$ | (13.0 | ) | $ | 47.9 | $ | 12.8 | |||||

|

Income tax expense (benefit):

|

||||||||||||

|

Federal:

|

||||||||||||

|

Current

|

$ | 2.6 | $ | - | $ | (3.7 | ) | |||||

|

Deferred

|

(2.6 | ) | 0.3 | 2.7 | ||||||||

|

State:

|

||||||||||||

|

Current

|

0.2 | 0.3 | 0.2 | |||||||||

|

Deferred

|

(0.2 | ) | (0.2 | ) | (2.6 | ) | ||||||

|

Foreign:

|

||||||||||||

|

Current

|

6.4 | 8.3 | 12.2 | |||||||||

|

Deferred

|

3.4 | 1.2 | (4.3 | ) | ||||||||

|

Total income tax expense

|

$ | 9.8 | $ | 9.9 | $ | 4.5 | ||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

|||||||||

|

Statutory federal tax

|

35.0 | % | 35.0 | % | 35.0 | % | ||||||

|

State taxes, net of federal benefit

|

(1.3 | ) | (0.1 | ) | (19.0 | ) | ||||||

|

Taxes on non-U.S. earnings and losses

|

(23.8 | ) | (5.7 | ) | (5.7 | ) | ||||||

|

Valuation allowance

|

(59.3 | ) | 2.1 | 84.6 | ||||||||

|

Tax credits

|

37.0 | (19.2 | ) | (84.3 | ) | |||||||

|

Compensation

|

(13.0 | ) | 3.4 | 11.1 | ||||||||

|

Foreign tax rate changes

|

0.9 | 0.6 | (4.5 | ) | ||||||||

|

Reserves for uncertain tax positions

|

(41.9 | ) | 1.9 | 4.2 | ||||||||

|

Brazilian interest on equity

|

3.2 | (1.0 | ) | (7.4 | ) | |||||||

|

Dividend repatriation

|

(11.4 | ) | 4.4 | 23.0 | ||||||||

|

Other

|

(0.8 | ) | (0.7 | ) | (1.8 | ) | ||||||

|

Effective tax rate

|

(75.4 | %) | 20.7 | % | 35.2 | % | ||||||

During fiscal 2012, the Company satisfied requirements under Hungarian regulations necessary to obtain an additional development tax credit in Hungary and, as a result, recorded a $4.4 million tax benefit, which significantly impacted its effective tax rate for the year.

|

March 31

|

2013

|

2012

|

||||||

|

Deferred tax assets:

|

||||||||

|

Accounts receivable

|

$ | 0.6 | $ | 0.5 | ||||

|

Inventories

|

4.1 | 4.9 | ||||||

|

Plant and equipment

|

13.3 | 19.0 | ||||||

|

Pension and employee benefits

|

85.7 | 77.4 | ||||||

|

Net operating loss, capital loss and credit carry forwards

|

114.6 | 96.9 | ||||||

|

Other, principally accrued liabilities

|

14.2 | 15.3 | ||||||

|

Total gross deferred tax assets

|

232.5 | 214.0 | ||||||

|

Less: valuation allowance

|

(172.8 | ) | (146.8 | ) | ||||

|

Net deferred tax assets

|

59.7 | 67.2 | ||||||

|

Deferred tax liabilities:

|

||||||||

|

Pension

|

34.3 | 31.2 | ||||||

|

Goodwill

|

5.0 | 5.4 | ||||||

|

Plant and equipment

|

11.7 | 24.2 | ||||||

|

Other

|

10.5 | 7.4 | ||||||

|

Total gross deferred tax liabilities

|

61.5 | 68.2 | ||||||

|

Net deferred tax liability

|

$ | (1.8 | ) | $ | (1.0 | ) | ||

|

2013

|

2012

|

|||||||

|

Balance, April 1

|

$ | 3.3 | $ | 5.3 | ||||

|

Gross increases - tax positions in prior period

|

5.6 | 3.6 | ||||||

|

Gross decreases - tax positions in prior period

|

(0.1 | ) | (3.8 | ) | ||||

|

Gross increases - tax positions in current period

|

0.6 | 0.5 | ||||||

|

Gross decreases - tax positions in current period

|

(0.4 | ) | (0.4 | ) | ||||

|

Settlements

|

- | (1.7 | ) | |||||

|

Foreign currency impact

|

- | (0.2 | ) | |||||

|

Balance, March 31

|

$ | 9.0 | $ | 3.3 | ||||

|

Austria

|

Fiscal 2008 - 2012

|

|

Brazil

|

Fiscal 2007 - 2012

|

|

Germany

|

Fiscal 2006 - 2012

|

|

United States

|

Fiscal 2010 - 2012

|

|

Note 8:

|

Earnings Per Share

|

|

Years Ended March 31

|

2013

|

2012

|

2011

|

|||||||||

|

(Loss) earnings from continuing operations

|

$ | (22.8 | ) | $ | 38.0 | $ | 8.3 | |||||

|

Less: Net earnings attributable to noncontrolling interest

|

(1.4 | ) | (0.3 | ) | - | |||||||

|

(Loss) earnings from continuing operations attributable to

Modine

|

(24.2 | ) | 37.7 | 8.3 | ||||||||

|

Less: Undistributed earnings attributable to unvested shares

|

- | (0.2 | ) | - | ||||||||

|

(Loss) earnings from continuing operations available to

Modine shareholders

|

(24.2 | ) | 37.5 | 8.3 | ||||||||

|

Earnings (loss) from discontinued operations

|

- | 0.8 | (3.1 | ) | ||||||||

|

Net (loss) earnings available to Modine shareholders

|

$ | (24.2 | ) | $ | 38.3 | $ | 5.2 | |||||

|

Weighted average shares outstanding - basic

|

46.6 | 46.5 | 46.2 | |||||||||

|

Effect of dilutive securities

|

- | 0.4 | 0.5 | |||||||||

|

Weighted average shares outstanding - diluted

|

46.6 | 46.9 | 46.7 | |||||||||

|

Basic Earnings Per Share:

|

||||||||||||

|

(Loss) earnings per share - continuing operations

|

$ | (0.52 | ) | $ | 0.81 | $ | 0.18 | |||||

|

Earnings (loss) per share - discontinued operations

|

- | 0.02 | (0.07 | ) | ||||||||

|

Net (loss) earnings per share - basic

|

$ | (0.52 | ) | $ | 0.83 | $ | 0.11 | |||||

|

Diluted Earnings Per Share:

|

||||||||||||

|

(Loss) earnings per share - continuing operations

|

$ | (0.52 | ) | $ | 0.80 | $ | 0.18 | |||||

|

Earnings (loss) per share - discontinued operations

|

- | 0.02 | (0.07 | ) | ||||||||

|

Net (loss) earnings per share - diluted

|

$ | (0.52 | ) | $ | 0.82 | $ | 0.11 | |||||

|

Note 9:

|

Inventories

|

|

March 31

|

2013

|

2012

|

||||||

|

Raw materials and work in process

|

$ | 88.1 | $ | 88.6 | ||||

|

Finished goods

|

30.7 | 32.2 | ||||||

|

Total inventories

|

$ | 118.8 | $ | 120.8 | ||||

|

Note 10:

|

Property, Plant and Equipment

|

|

March 31

|

2013

|

2012

|

||||||

|

Land

|

$ | 10.0 | $ | 11.8 | ||||

|

Buildings and improvements (10-40 years)

|

216.7 | 249.7 | ||||||

|

Machinery and equipment (3-12 years)

|

679.1 | 686.1 | ||||||

|

Office equipment (3-10 years)

|

95.7 | 96.0 | ||||||

|

Construction in progress

|

31.6 | 49.1 | ||||||

| 1,033.1 | 1,092.7 | |||||||

|

Less: accumulated depreciation

|

(677.2 | ) | (680.6 | ) | ||||

|

Net property, plant and equipment

|

$ | 355.9 | $ | 412.1 | ||||

|

Note 11:

|

Investment in Affiliate

|

|

Note 12:

|

Intangible Assets

|

|

March 31, 2013

|

March 31, 2012

|

|||||||||||||||||||||||

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||||||||||

|

Carrying

|

Accumulated

|

Intangible

|

Carrying

|

Accumulated

|

Intangible

|

|||||||||||||||||||

|

Value

|

Amortization

|

Assets

|

Value

|

Amortization

|

Assets

|

|||||||||||||||||||

|

Tradenames

|

$ | 9.6 | $ | (4.7 | ) | $ | 4.9 | $ | 10.4 | $ | (4.6 | ) | $ | 5.8 | ||||||||||

|

Acquired technology

|

3.5 | (0.1 | ) | 3.4 | - | - | - | |||||||||||||||||

|

Total intangible assets

|

$ | 13.1 | $ | (4.8 | ) | $ | 8.3 | $ | 10.4 | $ | (4.6 | ) | $ | 5.8 | ||||||||||

|

Estimated

|

||||

|

Fiscal

|

Amortization

|

|||

|

Year

|

Expense

|

|||

|

2014

|

$ | 0.8 | ||

|

2015

|

1.1 | |||

|

2016

|

1.2 | |||

|

2017

|

1.2 | |||

|

2018

|

1.2 | |||

|

2019 & Beyond

|

2.8 | |||

|

Note 13:

|

Goodwill

|

|

March 31, 2011

|

Fluctuations in

foreign currency

|

March 31, 2012

|

Acquisition

|

Fluctuations in

foreign currency

|

March 31, 2013

|

|||||||||||||||||||

|

Asia

|

||||||||||||||||||||||||

|

Gross goodwill

|

$ | 0.5 | $ | - | $ | 0.5 | $ | - | $ | - | $ | 0.5 | ||||||||||||

|

Accumulated impairments

|

- | - | - | - | - | - | ||||||||||||||||||

|

Net goodwill balance

|

0.5 | - | 0.5 | - | - | 0.5 | ||||||||||||||||||

|

Europe

|

||||||||||||||||||||||||

|

Gross goodwill

|

9.6 | (0.6 | ) | 9.0 | - | (0.3 | ) | 8.7 | ||||||||||||||||

|

Accumulated impairments

|

(9.6 | ) | 0.6 | (9.0 | ) | - | 0.3 | (8.7 | ) | |||||||||||||||

|

Net goodwill balance

|

- | - | - | - | - | - | ||||||||||||||||||

|

North America

|

||||||||||||||||||||||||

|

Gross goodwill

|

23.8 | - | 23.8 | - | - | 23.8 | ||||||||||||||||||

|

Accumulated impairments

|

(23.8 | ) | - | (23.8 | ) | - | - | (23.8 | ) | |||||||||||||||

|

Net goodwill balance

|

- | - | - | - | - | - | ||||||||||||||||||

|

South America

|

||||||||||||||||||||||||

|

Gross goodwill

|

15.1 | (1.6 | ) | 13.5 | - | (1.3 | ) | 12.2 | ||||||||||||||||

|

Accumulated impairments

|

- | - | - | - | - | - | ||||||||||||||||||

|

Net goodwill balance

|

15.1 | (1.6 | ) | 13.5 | - | (1.3 | ) | 12.2 | ||||||||||||||||

|

Commercial Products

|

||||||||||||||||||||||||

|

Gross goodwill

|

15.9 | - | 15.9 | 0.8 | (0.7 | ) | 16.0 | |||||||||||||||||

|

Accumulated impairments

|

- | - | - | - | - | - | ||||||||||||||||||

|

Net goodwill balance

|

15.9 | - | 15.9 | 0.8 | (0.7 | ) | 16.0 | |||||||||||||||||

|

Total Company

|

||||||||||||||||||||||||

|

Gross goodwill

|

64.9 | (2.2 | ) | 62.7 | 0.8 | (2.3 | ) | 61.2 | ||||||||||||||||

|

Accumulated impairments

|

(33.4 | ) | 0.6 | (32.8 | ) | - | 0.3 | (32.5 | ) | |||||||||||||||

|

Net goodwill balance

|

$ | 31.5 | $ | (1.6 | ) | $ | 29.9 | $ | 0.8 | $ | (2.0 | ) | $ | 28.7 | ||||||||||

|

Note 14:

|

Product Warranties, Operating Leases and Other Commitments

|

|

Years ended March 31

|

2013

|

2012

|

||||||

|

Balance, April 1

|

$ | 11.4 | $ | 14.7 | ||||

|

Accruals for warranties issued

|

4.9 | 6.6 | ||||||

|

Accruals (reversals) related to pre-existing warranties

|

2.7 | (1.1 | ) | |||||

|

Settlements

|

(6.1 | ) | (8.4 | ) | ||||

|

Effect of exchange rate changes

|

(0.3 | ) | (0.4 | ) | ||||

|

Balance, March 31

|

$ | 12.6 | $ | 11.4 | ||||

|

Years ending March 31

|

||||

|

2014

|

$ | 6.5 | ||

|

2015

|

4.5 | |||

|

2016

|

3.0 | |||

|

2017

|

2.2 | |||

|

2018

|

1.8 | |||

|

2019 and beyond

|

4.3 | |||

|

Total future minimum rental commitments

|

$ | 22.3 | ||

|

Note 15:

|

Indebtedness

|

|

Interest rate at

March 31, 2013

|

Fiscal

year of

maturity

|

March 31, 2013

|

March 31, 2012

|

|||||||||||||

|

Various foreign denominated borrowings

|

3.8 | % | 2016 | $ | 1.9 | $ | 2.3 | |||||||||

|

Denominated in U.S. dollars:

|

||||||||||||||||

|

Fixed rate -

|

||||||||||||||||

|

2020 Notes

|

6.8 | % | 2021 | 125.0 | 125.0 | |||||||||||

|

Variable rate -

|

||||||||||||||||

|

Revolving credit facility

|

2.2 | % | 2015 | - | 9.0 | |||||||||||

| 126.9 | 136.3 | |||||||||||||||

|

Capital lease obligations

|

2014-2029 | 6.1 | 6.7 | |||||||||||||

| 133.0 | 143.0 | |||||||||||||||

|

Less: current portion

|

(0.5 | ) | (1.1 | ) | ||||||||||||

|

Total long-term debt

|

$ | 132.5 | $ | 141.9 | ||||||||||||

|

Interest Expense Coverage

|

Leverage Ratio

|

||

|

Ratio Covenant (Not

|

Covenant (Not Permitted

|

||

|

Permitted to Be Less Than)

|

to Be Greater Than)

|

||

|

Fiscal quarter ending on or before August 12, 2014

|

3.00 to 1.0

|

3.25 to 1.0

|

|

|

All fiscal quarters ending thereafter

|

3.00 to 1.0

|

3.00 to 1.0

|

|

Years ending March 31

|

||||

|

2014

|

$ | 0.5 | ||

|

2015

|

1.7 | |||

|

2016

|

0.5 | |||

|

2017

|

8.3 | |||

|

2018

|

16.3 | |||

|

2019 & beyond

|

105.7 | |||

|

Total

|

$ | 133.0 | ||

|

Note 16:

|

Pension and Employee Benefit Plans

|

|

Pensions Plans

|

Postretirement Plans

|

|||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

Change in benefit obligation:

|

||||||||||||||||

|

Benefit obligation at beginning of year

|

$ | 281.8 | $ | 246.0 | $ | 7.2 | $ | 6.6 | ||||||||

|

Service cost

|

0.6 | 1.4 | 0.1 | - | ||||||||||||

|

Interest cost

|

13.5 | 13.9 | 0.3 | 0.4 | ||||||||||||

|

Actuarial loss

|

27.1 | 35.6 | 0.1 | 0.5 | ||||||||||||

|

Benefits paid

|

(12.6 | ) | (13.8 | ) | (0.2 | ) | (0.5 | ) | ||||||||

|

Settlement/curtailment adjustment

|

- | - | - | 0.2 | ||||||||||||

|

Currency translation adjustment

|

(0.8 | ) | (1.3 | ) | - | - | ||||||||||

|

Benefit obligation at end of year

|

$ | 309.6 | $ | 281.8 | $ | 7.5 | $ | 7.2 | ||||||||

|

Change in plan assets:

|

||||||||||||||||

|

Fair value of plan assets at beginning of year

|

$ | 186.6 | $ | 182.1 | $ | - | $ | - | ||||||||

|

Actual return on plan assets

|

16.2 | 5.5 | - | - | ||||||||||||

|

Benefits paid

|

(12.6 | ) | (13.8 | ) | (0.2 | ) | (0.5 | ) | ||||||||

|

Employer contributions

|

10.4 | 12.8 | 0.2 | 0.5 | ||||||||||||

|

Fair value of plan assets at end of year

|

$ | 200.6 | $ | 186.6 | $ | - | $ | - | ||||||||

|

Funded status at end of year

|

$ | (109.0 | ) | $ | (95.2 | ) | $ | (7.5 | ) | $ | (7.2 | ) | ||||

|

Amounts recognized in the consolidated balance sheets

consist of:

|

||||||||||||||||

|

Current liability

|

$ | (1.0 | ) | $ | (1.1 | ) | $ | (0.8 | ) | $ | (0.8 | ) | ||||

|

Noncurrent liability

|

(108.0 | ) | (94.1 | ) | (6.7 | ) | (6.4 | ) | ||||||||

| $ | (109.0 | ) | $ | (95.2 | ) | $ | (7.5 | ) | $ | (7.2 | ) | |||||

|

Amounts recognized in accumulated other comprehensive loss consist of:

|

||||||||||||||||

|

Net actuarial loss (gain)

|

$ | 176.4 | $ | 154.4 | $ | (0.3 | ) | $ | (0.4 | ) | ||||||

|

Prior service credit

|

- | - | (1.5 | ) | (3.0 | ) | ||||||||||

| $ | 176.4 | $ | 154.4 | $ | (1.8 | ) | $ | (3.4 | ) | |||||||

|

March 31

|

2013

|

2012

|

||||||

|

Projected benefit obligation

|

$ | 309.6 | $ | 281.8 | ||||

|

Accumulated benefit obligation

|

307.2 | 280.3 | ||||||

|

Fair value of the plan assets

|

200.6 | 186.6 | ||||||

|

Pension Plans

|

Postretirement Plans

|

|||||||||||||||||||||||

|

Years ended March 31

|

2013

|

2012

|

2011

|

2013

|

2012

|

2011

|

||||||||||||||||||

|

Components of net periodic benefit costs:

|

||||||||||||||||||||||||

|

Service cost

|

$ | 0.6 | $ | 1.4 | $ | 1.9 | $ | 0.1 | $ | - | $ | - | ||||||||||||

|

Interest cost

|

13.5 | 13.9 | 13.7 | 0.3 | 0.4 | 0.4 | ||||||||||||||||||

|

Expected return on plan assets

|

(16.1 | ) | (15.7 | ) | (15.2 | ) | - | - | - | |||||||||||||||

|

Amortization of:

|

||||||||||||||||||||||||

|

Unrecognized net loss (gain)

|

5.0 | 7.0 | 7.7 | - | - | (0.1 | ) | |||||||||||||||||

|

Unrecognized prior service cost (credit)

|

- | - | 0.4 | (1.5 | ) | (1.7 | ) | (1.8 | ) | |||||||||||||||

|

Adjustment for settlement/curtailment

|

- | - | 1.6 | - | (0.3 | ) | (2.1 | ) | ||||||||||||||||

|