|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 10-K

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

95-3797580

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

¨

|

|

Accelerated filer

x

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

|

(Do not check if a smaller reporting company)

|

|

|

|

•

|

delays or difficulties in implementing, or the failure to complete, the Topgolf Repurchase Program on the anticipated terms;

|

|

•

|

certain risks and uncertainties, including changes in capital market or economic conditions;

|

|

•

|

delays, difficulties, changed strategies, or increased costs in implementing the Company’s turnaround plans;

|

|

•

|

consumer acceptance of and demand for the Company’s products;

|

|

•

|

future retailer purchasing activity, which can be significantly affected by adverse industry conditions and overall retail inventory levels;

|

|

•

|

the level of promotional activity in the marketplace;

|

|

•

|

future consumer discretionary purchasing activity, which can be significantly adversely affected by unfavorable economic or market conditions;

|

|

•

|

the ability of the Company to manage international business risks;

|

|

•

|

future changes in foreign currency exchange rates and the degree of effectiveness of the Company’s hedging programs;

|

|

•

|

adverse changes in the credit markets or continued compliance with the terms of the Company’s credit facilities;

|

|

•

|

delays, difficulties or increased costs in the supply of components needed to manufacture the Company’s products or in manufacturing the Company’s products, including the Company's dependence on a limited number of suppliers for some of its products;

|

|

•

|

adverse weather conditions and seasonality;

|

|

•

|

any rule changes or other actions taken by the USGA or other golf association that could have an adverse impact upon demand or supply of the Company’s products;

|

|

•

|

the ability of the Company to protect its intellectual property rights;

|

|

•

|

a decrease in participation levels in golf;

|

|

•

|

the effect of terrorist activity, armed conflict, natural disasters or pandemic diseases on the economy generally, on the level of demand for the Company’s products or on the Company’s ability to manage its supply and delivery logistics in such an environment; and

|

|

•

|

the general risks and uncertainties applicable to the Company and its business.

|

|

Years Ended December 31,

|

||||||||||||||||||||

|

2015

|

2014

|

2013

|

||||||||||||||||||

|

(Dollars in millions)

|

||||||||||||||||||||

|

Woods

|

$

|

222.2

|

|

27

|

%

|

$

|

269.5

|

|

31

|

%

|

$

|

249.8

|

|

30

|

%

|

|||||

|

Irons

|

205.5

|

|

24

|

%

|

200.2

|

|

23

|

%

|

178.8

|

|

21

|

%

|

||||||||

|

Putters

|

86.3

|

|

10

|

%

|

81.1

|

|

9

|

%

|

87.8

|

|

10

|

%

|

||||||||

|

Golf balls

|

143.1

|

|

17

|

%

|

137.0

|

|

15

|

%

|

131.1

|

|

16

|

%

|

||||||||

|

Accessories and other

|

186.7

|

|

22

|

%

|

199.1

|

|

22

|

%

|

195.3

|

|

23

|

%

|

||||||||

|

Net sales

|

$

|

843.8

|

|

100

|

%

|

$

|

886.9

|

|

100

|

%

|

$

|

842.8

|

|

100

|

%

|

|||||

|

•

|

Facilities through the partnership with local utilities to implement energy reduction initiatives such as energy efficient lighting, demand response energy management and heating, ventilation and air conditioning optimization;

|

|

•

|

Manufacturing through lean initiatives and waste minimization;

|

|

•

|

Product development through specification of environmentally preferred substances;

|

|

•

|

Logistics improvements and packaging minimization; and

|

|

•

|

Supply chain management through Social, Safety and Environmental Responsibility audits of suppliers.

|

|

Name

|

Age

|

Position(s) Held

|

|

|

Oliver G. Brewer III

|

52

|

President and Chief Executive Officer, Director

|

|

|

Robert K Julian

|

53

|

Senior Vice President and Chief Financial Officer

|

|

|

Alan Hocknell

|

44

|

Senior Vice President, Research and Development

|

|

|

Brian P. Lynch

|

54

|

Senior Vice President, General Counsel & Corporate Secretary

|

|

|

Mark F. Leposky

|

51

|

Senior Vice President, Global Operations

|

|

|

Alex M. Boezeman

|

56

|

President, Asia

|

|

|

Neil Howie

|

53

|

Managing Director, Europe, Middle East and Africa

|

|

|

•

|

Increased difficulty in protecting the Company’s intellectual property rights and trade secrets;

|

|

•

|

Unexpected government action or changes in legal or regulatory requirements;

|

|

•

|

Social, economic or political instability;

|

|

•

|

The effects of any anti-American sentiments on the Company’s brands or sales of the Company’s products;

|

|

•

|

Increased difficulty in ensuring compliance by employees, agents and contractors with the Company’s policies as well as with the laws of multiple jurisdictions, including but not limited to the U.S. Foreign Corrupt Practices Act, local international environmental, health and safety laws, and increasingly complex regulations relating to the conduct of international commerce;

|

|

•

|

Increased difficulty in controlling and monitoring foreign operations from the United States, including increased difficulty in identifying and recruiting qualified personnel for its foreign operations; and

|

|

•

|

Increased exposure to interruptions in air carrier or ship services.

|

|

•

|

Earthquake, fire, flood, hurricane and other natural disasters;

|

|

•

|

Power loss, computer systems failure, Internet and telecommunications or data network failure; and

|

|

•

|

Hackers, computer viruses, software bugs or glitches.

|

|

Year Ended December 31,

|

|||||||||||||||||||||||

|

2015

|

2014

|

||||||||||||||||||||||

|

Period:

|

High

|

Low

|

Dividend

|

High

|

Low

|

Dividend

|

|||||||||||||||||

|

First Quarter

|

$

|

9.78

|

|

$

|

7.52

|

|

$

|

0.01

|

|

$

|

10.25

|

|

$

|

7.97

|

|

$

|

0.01

|

|

|||||

|

Second Quarter

|

$

|

10.20

|

|

$

|

8.84

|

|

$

|

0.01

|

|

$

|

10.35

|

|

$

|

7.51

|

|

$

|

0.01

|

|

|||||

|

Third Quarter

|

$

|

9.46

|

|

$

|

7.97

|

|

$

|

0.01

|

|

$

|

9.12

|

|

$

|

7.24

|

|

$

|

0.01

|

|

|||||

|

Fourth Quarter

|

$

|

10.30

|

|

$

|

8.13

|

|

$

|

0.01

|

|

$

|

8.14

|

|

$

|

6.79

|

|

$

|

0.01

|

|

|||||

|

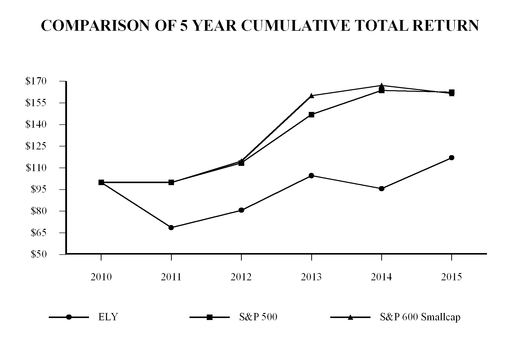

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||||

|

Callaway Golf (NYSE: ELY)

|

$

|

100.00

|

|

$

|

68.56

|

|

$

|

80.63

|

|

$

|

104.62

|

|

$

|

95.60

|

|

$

|

116.99

|

|

|||||

|

S&P 500

|

$

|

100.00

|

|

$

|

100.00

|

|

$

|

113.40

|

|

$

|

146.97

|

|

$

|

163.71

|

|

$

|

162.52

|

|

|||||

|

S&P 600 Smallcap

|

$

|

100.00

|

|

$

|

99.84

|

|

$

|

114.68

|

|

$

|

160.09

|

|

$

|

167.20

|

|

$

|

161.58

|

|

|||||

|

Three Months Ended December 31, 2015

|

|||||||||||||

|

Total Number

of Shares

Purchased

|

Weighted

Average Price

Paid per Share

|

Total Number

of Shares

Purchased as

Publicly

Announced

Programs

|

Maximum

Dollar

Value that

May Yet Be

Purchased

Under the

Programs

|

||||||||||

|

October 1, 2015—October 31, 2015

|

—

|

|

$

|

—

|

|

—

|

|

$

|

47,046,326

|

|

|||

|

November 1, 2015—November 30, 2015

|

1,967

|

|

$

|

9.73

|

|

1,967

|

|

$

|

47,027,187

|

|

|||

|

December 1, 2015—December 31, 2015

|

—

|

|

$

|

—

|

|

—

|

|

$

|

47,027,187

|

|

|||

|

Total

|

1,967

|

|

$

|

9.73

|

|

1,967

|

|

$

|

47,027,187

|

|

|||

|

Years Ended December 31,

|

|||||||||||||||||||

|

2015

(1)

|

2014

(1)

|

2013

(1)(2)

|

2012

(1)(2)(3)(4)

|

2011

(4)(5)(6)(7)(8)

|

|||||||||||||||

|

(In thousands, except per share data)

|

|||||||||||||||||||

|

Statement of Operations Data:

|

|||||||||||||||||||

|

Net sales

|

$

|

843,794

|

|

$

|

886,945

|

|

$

|

842,801

|

|

$

|

834,065

|

|

$

|

886,528

|

|

||||

|

Cost of sales

|

486,161

|

|

529,019

|

|

528,043

|

|

585,897

|

|

575,226

|

|

|||||||||

|

Gross profit

|

357,633

|

|

357,926

|

|

314,758

|

|

248,168

|

|

311,302

|

|

|||||||||

|

Selling, general and administrative expenses

|

297,477

|

|

295,893

|

|

294,583

|

|

334,861

|

|

358,081

|

|

|||||||||

|

Research and development expenses

|

33,213

|

|

31,285

|

|

30,937

|

|

29,542

|

|

34,309

|

|

|||||||||

|

Income (loss) from operations

|

26,943

|

|

30,748

|

|

(10,762

|

)

|

(116,235

|

)

|

(81,088

|

)

|

|||||||||

|

Interest income

|

388

|

|

438

|

|

558

|

|

550

|

|

546

|

|

|||||||||

|

Interest expense

|

(8,733

|

)

|

(9,499

|

)

|

(9,123

|

)

|

(5,513

|

)

|

(1,618

|

)

|

|||||||||

|

Other income (expense), net

|

1,465

|

|

(48

|

)

|

6,005

|

|

3,152

|

|

(8,101

|

)

|

|||||||||

|

Income (loss) before income taxes

|

20,063

|

|

21,639

|

|

(13,322

|

)

|

(118,046

|

)

|

(90,261

|

)

|

|||||||||

|

Income tax provision

|

5,495

|

|

5,631

|

|

5,599

|

|

4,900

|

|

81,559

|

|

|||||||||

|

Net income (loss)

|

14,568

|

|

16,008

|

|

(18,921

|

)

|

(122,946

|

)

|

(171,820

|

)

|

|||||||||

|

Dividends on convertible preferred stock

|

—

|

|

—

|

|

3,332

|

|

8,447

|

|

10,500

|

|

|||||||||

|

Net income (loss) allocable to common shareholders

|

$

|

14,568

|

|

$

|

16,008

|

|

$

|

(22,253

|

)

|

$

|

(131,393

|

)

|

$

|

(182,320

|

)

|

||||

|

Income (loss) per common share:

|

|||||||||||||||||||

|

Basic

|

$

|

0.18

|

|

$

|

0.21

|

|

$

|

(0.31

|

)

|

$

|

(1.96

|

)

|

$

|

(2.82

|

)

|

||||

|

Diluted

|

$

|

0.17

|

|

$

|

0.20

|

|

$

|

(0.31

|

)

|

$

|

(1.96

|

)

|

$

|

(2.82

|

)

|

||||

|

Dividends paid per common share

|

$

|

0.04

|

|

$

|

0.04

|

|

$

|

0.04

|

|

$

|

0.04

|

|

$

|

0.04

|

|

||||

|

December 31,

|

|||||||||||||||||||

|

2015

(1)(9)

|

2014

(1)

|

2013

(1)(2)

|

2012

(1)(2)(3)

|

2011

(5)(7)(8)

|

|||||||||||||||

|

(In thousands)

|

|||||||||||||||||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

49,801

|

|

$

|

37,635

|

|

$

|

36,793

|

|

$

|

52,003

|

|

$

|

43,023

|

|

||||

|

Working capital

|

$

|

212,851

|

|

$

|

199,905

|

|

$

|

195,407

|

|

$

|

225,430

|

|

$

|

251,545

|

|

||||

|

Total assets

|

$

|

631,224

|

|

$

|

624,811

|

|

$

|

663,863

|

|

$

|

637,636

|

|

$

|

727,112

|

|

||||

|

Long-term liabilities

|

$

|

39,643

|

|

$

|

149,149

|

|

$

|

153,048

|

|

$

|

154,362

|

|

$

|

46,514

|

|

||||

|

Total Callaway Golf Company shareholders’ equity

|

$

|

412,945

|

|

$

|

291,534

|

|

$

|

284,619

|

|

$

|

318,990

|

|

$

|

509,956

|

|

||||

|

|

|

(1)

|

On August 29, 2012, the Company issued $112.5 million of 3.75% Convertible Senior Notes (the “convertible notes”) in exchange for cash and 0.6 million shares of the Company’s then-outstanding 7.50% Series B Cumulative Perpetual Convertible Preferred Stock in separate, privately negotiated exchange transactions. During the second half of 2015, the convertible notes were eliminated pursuant to certain exchange transactions and shareholder conversions, which resulted, among other things, in the issuance of approximately 15.0 million shares of common stock to the note holders (see

Note 3

“

Financing Arrangements

” in the Notes to Consolidated Financial Statements in this Form 10-K). In connection with the elimination of the convertible notes and the issuance of the 15.0 million shares of common stock, the Company recorded $109.0 million in shareholders' equity as of December 31, 2015, net of the outstanding discount of $3.4 million. The Company recognized interest expense of

$3.2 million

, $5.0 million and $4.9 million for the years ended

December 31, 2015

,

2014

and 2013, respectively.

|

|

(2)

|

The Company’s operating statements for the years ended December 31, 2013 and 2012 include pre-tax charges of

$16.6 million

and $54.1 million, respectively, in connection with the Company's cost-reduction initiatives that were announced in July 2012 (the "Cost Reduction Initiatives"). As a result of these initiatives, in 2012, the Company recorded related decreases in working capital and total assets from the impairment of certain intangible assets including goodwill, as well as the write-off of certain long-lived assets and inventory. See

Note 17

“

Restructuring Initiatives

" in the Notes to Consolidated Financial Statements in this Form 10-K.

|

|

(3)

|

During the first quarter of 2012, in an effort to simplify the Company’s operations and increase focus on the Company’s core Callaway and Odyssey business, the Company sold its Top-Flite and Ben Hogan brands, including trademarks, service marks and certain other intellectual property for net cash proceeds of $26.9 million. The sale of these two brands resulted in a pre-tax net gain of $6.6 million.

|

|

(4)

|

The Company’s operating statements for the years ended December 31, 2012 and 2011 include pre-tax charges of $1.0 million and $16.3 million, respectively, in connection with workforce reductions related to the reorganization and reinvestment initiatives announced in June 2011.

|

|

(5)

|

The Company’s provision for income taxes for the year ended December 31, 2011 includes $52.5 million of tax expense in order to establish a valuation allowance against its U.S. deferred tax assets and $21.6 million related to the recognition of certain prepaid tax expenses on intercompany profits. The reduction of deferred tax assets had a corresponding decrease in working capital and total assets, as well as an increase in long-term liabilities. See

Note 9

“

Income Taxes

” in the Notes to Consolidated Financial Statements in this Form 10-K.

|

|

(6)

|

In connection with the global operations strategy initiatives that were announced in 2010, the Company’s operating statements for the years ended December 31, 2011 include a pre-tax charge of $24.7 million related to these initiatives.

|

|

(7)

|

In 2011, the Company recognized a pre-tax impairment charge of $5.4 million in connection with the write-down of certain trademarks and trade names. Additionally, in 2011, the Company recognized a pre-tax impairment charge of $1.1 million in connection with the write-off of goodwill.

|

|

(8)

|

In March 2011, the Company completed the sale of three of its buildings located in Carlsbad, California. In connection with this sale, the Company recognized a pre-tax gain of $6.2 million.

|

|

(9)

|

In December 2015, the Company early adopted Accounting Standards Update No 2015-17, "Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes." This update eliminates the current requirement for organizations to present deferred tax liabilities and assets as current and noncurrent in a classified balance sheet, and instead classify all deferred tax assets and liabilities as noncurrent. The adoption of this update was made on a prospective basis as of December 31, 2015, therefore working capital and long-term liabilities in 2015 are not comparable to prior periods presented.

|

|

Years Ended

December 31,

|

Growth/(Decline)

|

Constant Currency Growth/(Decline) vs. 2014

|

||||||||||||||

|

2015

|

2014

|

Dollars

|

Percent

|

Percent

|

||||||||||||

|

Net sales:

|

||||||||||||||||

|

Golf clubs

|

$

|

700.7

|

|

$

|

749.9

|

|

$

|

(49.2

|

)

|

(7

|

)%

|

—%

|

||||

|

Golf balls

|

143.1

|

|

137.0

|

|

6.1

|

|

4

|

%

|

10%

|

|||||||

|

$

|

843.8

|

|

$

|

886.9

|

|

$

|

(43.1

|

)

|

(5

|

)%

|

1%

|

|||||

|

Years Ended

December 31,

|

Growth / (Decline)

|

Constant Currency Growth/(Decline) vs. 2014

|

||||||||||||||

|

2015

|

2014

|

Dollars

|

Percent

|

Percent

|

||||||||||||

|

Net sales:

|

||||||||||||||||

|

United States

|

$

|

446.5

|

|

$

|

421.8

|

|

$

|

24.7

|

|

6

|

%

|

6%

|

||||

|

Europe

|

125.1

|

|

134.4

|

|

(9.3

|

)

|

(7

|

)%

|

7%

|

|||||||

|

Japan

|

138.0

|

|

166.1

|

|

(28.1

|

)

|

(17

|

)%

|

(5)%

|

|||||||

|

Rest of Asia

|

70.3

|

|

89.6

|

|

(19.3

|

)

|

(22

|

)%

|

(17)%

|

|||||||

|

Other foreign countries

|

63.9

|

|

75.0

|

|

(11.1

|

)

|

(15

|

)%

|

(2)%

|

|||||||

|

$

|

843.8

|

|

$

|

886.9

|

|

$

|

(43.1

|

)

|

(5

|

)%

|

1%

|

|||||

|

Years Ended

December 31,

|

Growth/(Decline)

|

Constant Currency Growth (Decline) vs. 2014

|

||||||||||||||

|

2015

|

2014

|

Dollars

|

Percent

|

Percent

|

||||||||||||

|

Net sales:

|

||||||||||||||||

|

Woods

|

$

|

222.2

|

|

$

|

269.5

|

|

$

|

(47.3

|

)

|

(18

|

)%

|

(12)%

|

||||

|

Irons

|

205.5

|

|

200.2

|

|

5.3

|

|

3

|

%

|

9%

|

|||||||

|

Putters

|

86.3

|

|

81.1

|

|

5.2

|

|

6

|

%

|

14%

|

|||||||

|

Accessories and other

|

186.7

|

|

199.1

|

|

(12.4

|

)

|

(6

|

)%

|

—%

|

|||||||

|

$

|

700.7

|

|

$

|

749.9

|

|

$

|

(49.2

|

)

|

(7

|

)%

|

—%

|

|||||

|

Years Ended

December 31,

|

Growth

|

Constant Currency Growth vs. 2014

|

||||||||||||||

|

2015

|

2014

|

Dollars

|

Percent

|

Percent

|

||||||||||||

|

Net sales:

|

||||||||||||||||

|

Golf balls

|

$

|

143.1

|

|

$

|

137.0

|

|

$

|

6.1

|

|

4

|

%

|

10%

|

||||

|

Years Ended

December 31,

|

Growth/(Decline)

|

|||||||||||||

|

2015

|

2014

|

Dollars

|

Percent

|

|||||||||||

|

Income before income taxes:

|

||||||||||||||

|

Golf clubs

|

$

|

53.0

|

|

$

|

50.9

|

|

$

|

2.1

|

|

4

|

%

|

|||

|

Golf balls

|

17.7

|

|

15.2

|

|

2.5

|

|

16

|

%

|

||||||

|

Reconciling items

(1)

|

(50.6

|

)

|

(44.5

|

)

|

(6.1

|

)

|

14

|

%

|

||||||

|

$

|

20.1

|

|

$

|

21.6

|

|

$

|

(1.5

|

)

|

(7

|

)%

|

||||

|

(1)

|

Reconciling items represent corporate general and administrative expenses and other income (expense) not included by management in determining segment profitability. The $6.1 million increase in reconciling items in 2015 compared to 2014 includes increases in stock compensation expense and professional fees, partially offset by a decrease in legal expenses combined with an increase in net foreign currency gains.

|

|

Years Ended

December 31,

|

Growth

|

|||||||||||||

|

2014

|

2013

|

Dollars

|

Percent

|

|||||||||||

|

Net sales:

|

||||||||||||||

|

Golf clubs

|

$

|

749.9

|

|

$

|

711.7

|

|

$

|

38.2

|

|

5

|

%

|

|||

|

Golf balls

|

137.0

|

|

131.1

|

|

5.9

|

|

5

|

%

|

||||||

|

$

|

886.9

|

|

$

|

842.8

|

|

$

|

44.1

|

|

5

|

%

|

||||

|

Years Ended

December 31,

|

Growth

|

|||||||||||||

|

2014

|

2013

|

Dollars

|

Percent

|

|||||||||||

|

Net sales:

|

||||||||||||||

|

United States

|

$

|

421.8

|

|

$

|

401.5

|

|

$

|

20.3

|

|

5

|

%

|

|||

|

Europe

|

134.4

|

|

121.5

|

|

12.9

|

|

11

|

%

|

||||||

|

Japan

|

166.1

|

|

161.6

|

|

4.5

|

|

3

|

%

|

||||||

|

Rest of Asia

|

89.6

|

|

84.1

|

|

5.5

|

|

7

|

%

|

||||||

|

Other foreign countries

|

75.0

|

|

74.1

|

|

0.9

|

|

1

|

%

|

||||||

|

$

|

886.9

|

|

$

|

842.8

|

|

$

|

44.1

|

|

5

|

%

|

||||

|

Years Ended

December 31,

|

Growth/(Decline)

|

|||||||||||||

|

2014

|

2013

|

Dollars

|

Percent

|

|||||||||||

|

Net sales:

|

||||||||||||||

|

Woods

|

$

|

269.5

|

|

$

|

249.8

|

|

$

|

19.7

|

|

8

|

%

|

|||

|

Irons

|

200.2

|

|

178.8

|

|

21.4

|

|

12

|

%

|

||||||

|

Putters

|

81.1

|

|

87.8

|

|

(6.7

|

)

|

(8

|

)%

|

||||||

|

Accessories and other

|

199.1

|

|

195.3

|

|

3.8

|

|

2

|

%

|

||||||

|

$

|

749.9

|

|

$

|

711.7

|

|

$

|

38.2

|

|

5

|

%

|

||||

|

Years Ended

December 31,

|

Growth

|

|||||||||||||

|

2014

|

2013

|

Dollars

|

Percent

|

|||||||||||

|

Net sales:

|

||||||||||||||

|

Golf balls

|

$

|

137.0

|

|

$

|

131.1

|

|

$

|

5.9

|

|

5

|

%

|

|||

|

Years Ended

December 31,

|

Growth/(Decline)

|

|||||||||||||

|

2014

|

2013

|

Dollars

|

Percent

|

|||||||||||

|

Income (loss) before income taxes:

|

||||||||||||||

|

Golf clubs

(1)

|

$

|

50.9

|

|

$

|

32.7

|

|

$

|

18.2

|

|

56

|

%

|

|||

|

Golf balls

(1)

|

15.2

|

|

(3.4

|

)

|

18.6

|

|

N/M

|

|

||||||

|

Reconciling items

(2)

|

(44.5

|

)

|

(42.6

|

)

|

(1.9

|

)

|

4

|

%

|

||||||

|

$

|

21.6

|

|

$

|

(13.3

|

)

|

$

|

34.9

|

|

N/M

|

|

||||

|

(1)

|

Included in the Company’s golf clubs and golf balls segments are pre-tax charges of $6.4 million and $7.0 million, respectively, for the year ended December 31, 2013, in connection with the Company's Cost Reduction Initiatives (see

Note 17

“

Restructuring Initiatives

” in the Notes to Consolidated Financial Statements in this Form 10-K for details regarding this initiative).

|

|

(2)

|

Reconciling items represent corporate general and administrative expenses and other income (expense) not included by management in determining segment profitability. The reconciling items include:

|

|

•

|

Pre-tax charges of $3.2 million in connection with the Cost Reduction Initiatives for the year ended December 31, 2013; and

|

|

•

|

Net gains of $5.9 million for the year ended December 31, 2013 related to foreign currency hedging contracts offset by foreign currency transaction losses. Net gains related to foreign currency were nominal for the year ended December 31, 2014.

|

|

Payments Due By Period

|

|||||||||||||||||||

|

Total

|

Less than

1 Year

|

1-3 Years

|

4-5 Years

|

More than

5 Years

|

|||||||||||||||

|

Japan ABL Facility

|

15.0

|

|

15.0

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Capital Leases

(1)

|

0.6

|

|

0.2

|

|

0.4

|

|

—

|

|

—

|

|

|||||||||

|

Operating leases

(2)

|

22.2

|

|

7.6

|

|

8.9

|

|

3.8

|

|

1.9

|

|

|||||||||

|

Unconditional purchase obligations

(3)

|

43.3

|

|

40.2

|

|

2.7

|

|

0.4

|

|

—

|

|

|||||||||

|

Uncertain tax contingencies

(4)

|

3.5

|

|

0.4

|

|

0.5

|

|

0.4

|

|

2.2

|

|

|||||||||

|

Employee incentive compensation

(5)

|

17.2

|

|

17.2

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Other long-term liabilities

|

0.1

|

|

0.1

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total

|

$

|

101.9

|

|

$

|

80.7

|

|

$

|

12.5

|

|

$

|

4.6

|

|

$

|

4.1

|

|

||||

|

(1)

|

Amounts represent future minimum lease payments. Capital lease obligations are included in accounts payable and accrued expenses and other long-term liabilities in the accompanying consolidated balance sheets.

|

|

(2)

|

The Company leases certain warehouse, distribution and office facilities, vehicles and office equipment under operating leases. The amounts presented in this line item represent commitments for minimum lease payments under non-cancelable operating leases.

|

|

(3)

|

During the normal course of its business, the Company enters into agreements to purchase goods and services, including purchase commitments for production materials, endorsement agreements with professional golfers and other endorsers, employment and consulting agreements, and intellectual property licensing agreements pursuant to which the Company is required to pay royalty fees. It is not possible to determine the amounts the Company will ultimately be required to pay under these agreements as they are subject to many variables including performance-based bonuses, severance arrangements, the Company’s sales levels, and reductions in payment obligations if designated minimum performance criteria are not achieved. The amounts listed approximate minimum purchase obligations, base compensation and guaranteed minimum royalty payments the Company is obligated to pay under these agreements. The actual amounts paid under some of these agreements may be higher or lower than the amounts included. In the aggregate, the actual amount paid under these obligations is likely to be higher than the amounts listed as a result of the variable nature of these obligations. In addition, the Company also enters into unconditional purchase obligations with various vendors and suppliers of goods and services in the normal course of operations through purchase orders or other documentation or that are undocumented except for an invoice. Such unconditional purchase obligations are generally outstanding for periods less than a year and are settled by cash payments upon delivery of goods and services and are not reflected in this line item.

|

|

(4)

|

Amount represents the current and non-current portions of uncertain income tax positions as recorded on the Company's consolidated balance sheet as of

December 31, 2015

. Amount excludes uncertain income tax positions that the Company would be able to offset against deferred taxes. For further discussion see

Note 9

“

Income Taxes

” in the Notes to Consolidated Financial Statements in this Form 10-K.

|

|

(5)

|

Amount represents accrued employee incentive compensation expense earned in 2015, and paid in February 2016.

|

|

Plan Category

|

Number of Shares to be

Issued Upon Exercise of

Outstanding Options

and Vesting of Restricted Stock Units

and Performance Share

Units

(3)

|

Weighted Average

Exercise Price of

Outstanding Options

(4)

|

Number of Shares

Remaining

Available for

Future Issuance

|

|||||||||||

|

(In thousands, except dollar amounts)

|

||||||||||||||

|

Equity Compensation Plans Approved by Shareholders

(1)

|

4,881

(2)

|

$

|

8.55

|

|

7,767

|

|

||||||||

|

(1)

|

Consists of the following plans: Callaway Golf Company Amended and Restated 2004 Incentive Plan ("2004 Incentive Plan") and 2013 Non-Employee Directors Stock Incentive Plan ("2013 Directors Plan"). The 2004 Incentive Plan permits the award of stock options, restricted stock awards, restricted stock units, performance share units and various other stock-based awards. The 2013 Directors Plan permits the award of stock options, restricted stock and restricted stock units.

|

|

(2)

|

Includes 99,249 shares underlying restricted stock units issuable under the 2013 Directors Plan, and 2,425,385 shares underlying stock options, 1,179,425 shares underlying restricted stock units and 1,177,308 shares underlying performance share units issuable under the 2004 Incentive Plan.

|

|

(3)

|

Outstanding shares underlying restricted stock units granted under the 2004 Incentive Plan and 2013 Directors Plan include 10,022 shares of accrued incremental stock dividend equivalent rights.

|

|

(4)

|

Does not include shares underlying restricted stock units and performance share units, which do not have an exercise price.

|

|

3.1

|

|

Certificate of Incorporation, incorporated herein by this reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, as filed with the Commission on July 1, 1999 (file no. 1-10962).

|

|

|

3.2

|

|

Fifth Amended and Restated Bylaws, as amended and restated as of November 18, 2008, incorporated herein by this reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, as filed with the Commission on November 21, 2008 (file no. 1-10962).

|

|

|

4.1

|

|

Form of Specimen Stock Certificate for Common Stock, incorporated herein by this reference to Exhibit 4.1 to the Company's Current Report on Form 8-K, as filed with the Commission on June 15, 2009 (file no. 1-10962).

|

|

|

Executive Compensation Contracts/Plans

|

|||

|

10.1

|

|

Amended and Restated Officer Employment Agreement, effective as of March 24, 2014, by and between Callaway Golf and Oliver G. Brewer, III, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on March 28, 2014 (file no. 1-10962).

|

|

|

10.2

|

|

First Amendment to Amended and Restated Officer Employment Agreement, effective as of March 6, 2015, by and between Callaway Golf and Oliver G. Brewer, III, incorporated herein by this reference to Exhibit 10.2 to the Company's Current Report on Form 8-K, as filed with the Commission on March 10, 2015 (file no. 1-10962).

|

|

|

10.3

|

|

Officer Employment Agreement, effective as of May 1, 2012, by and between Callaway Golf Company and Bradley J. Holiday, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on May 7, 2012 (file no. 1-10962).

|

|

|

10.4

|

|

First Amendment to Officer Employment Agreement, effective as of March 5, 2015, by and between Callaway Golf Company and Bradley J. Holiday, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on March 10, 2015 (file no. 1-10962).

|

|

|

10.5

|

|

Officer Employment Agreement, effective as of May 11, 2015, by and between Callaway Golf Company and Robert K. Julian, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on April 16, 2015 (file no. 1-10962).

|

|

|

10.6

|

|

Officer Employment Agreement, effective as of April 25, 2012, by and between Callaway Golf Company and Mark Leposky, incorporated herein by this reference to Exhibit 10.5 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, as filed with the Commission on August 2, 2012 (file no. 1-10962).

|

|

|

10.7

|

|

Officer Employment Agreement, effective as of June 1, 2012, by and between Callaway Golf Company and Brian Lynch, incorporated herein by this reference to Exhibit 10.6 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, as filed with the Commission on August 2, 2012 (file no. 1-10962).

|

|

|

10.8

|

|

First Amendment to Officer Employment Agreement, effective March 24, 2014, by and between Callaway Golf Company and Brian Lynch, incorporated herein by this reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, as filed with the Commission on April 25, 2014 (file no. 1-10962).

|

|

|

10.9

|

|

Officer Employment Agreement, effective as of February 12, 2014, by and between Callaway Golf Company, and Alan Hocknell, Ph.D., incorporated herein by this reference to Exhibit 10.5 to the Company's Annual Report on Form 10-K for the year ended December 31, 2013, as filed with the Commission on February 27, 2014 (file no. 1-10962).

|

|

|

10.10

|

|

Director’s Service Agreement, effective as of December 1, 2002, as amended, by and between Callaway Golf Company and Neil Howie, incorporated herein by this reference to Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2011, as filed with the Commission on November 2, 2011 (file no. 1-10962).

|

|

|

10.11

|

|

Director's Service Agreement, effective as of December 1, 2002, as amended, by and between Callaway Golf Company and Neil Howie, incorporated herein by this reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, as filed with the Commission on August 2, 2012 (file no. 1-10962).

|

|

|

10.12

|

|

Amended and Restated Executive Entrustment Agreement, effective as of March 24, 2014, by and between Callaway Golf Company and Alex Boezeman, incorporated herein by this reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, as filed with the Commission on April 25, 2014 (file no. 1-10962).

|

|

|

10.13

|

|

First Amendment to Amended and Restated Executive Entrustment Agreement, effective as of March 24, 2015, by and between Callaway Golf Company and Alex Boezeman, incorporated herein by this reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, as filed with the Commission on April 29, 2015 (file no. 1-10962).

|

|

|

10.14

|

|

Callaway Golf Company Amended and Restated 2004 Incentive Plan (effective May 19, 2009), incorporated herein by this reference to Appendix A to the Company's Definitive Proxy Statement on Schedule 14A, as filed with the Commission on April 5, 2013 (file no. 1-10962).

|

|

|

10.15

|

|

Callaway Golf Company 2013 Non-Employee Directors Stock Incentive Plan (effective May 15, 2013), incorporated herein by this reference to Appendix B to the Company's Definitive Proxy Statement on Schedule 14A, as filed with the Commission on April 5, 2013 (file no. 1-10962).

|

|

|

10.16

|

|

Form of Performance Share Unit Grant, incorporated herein by this reference to Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, as filed with the Commission on April 25, 2014 (file no. 1-10962).

|

|

|

10.17

|

|

Form of Notice of Grant of Restricted Stock Agreement for Non-Employee Directors, incorporated herein by this reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2013, as filed with the Commission on July 29, 2013 (file no. 1-10962).

|

|

|

10.18

|

|

Form of Non-Employee Director Phantom Stock Unit Grant Agreement, incorporated herein by this reference to Exhibit 10.7 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, as filed with the Commission on August 2, 2012 (file no. 1-10962).

|

|

|

10.19

|

|

Form of Notice of Grant and Agreement for Stock Appreciation Right, incorporated herein by this reference to Exhibit 10.35 to the Company's Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the Commission on March 2, 2012 (file no. 1-10962).

|

|

|

10.20

|

|

Form of Restricted Stock Grant, incorporated herein by this reference to Exhibit 10.21 to the Company's Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the Commission on February 26, 2010 (file no. 1-10962).

|

|

|

10.21

|

|

Form of Phantom Stock Units Agreement, incorporated herein by this reference to Exhibit 10.57 to the Company's Current Report on Form 8-K, as filed with the Commission on December 30, 2009 (file no. 1-10962).

|

|

|

10.22

|

|

Form of Notice of Grant of Stock Option and Option Agreement, incorporated herein by this reference to Exhibit 10.61 to the Company's Current Report on Form 8-K, as filed with the Commission on January 22, 2007 (file no. 1-10962).

|

|

|

10.23

|

|

Annual Incentive Plan Guidelines, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on March 28, 2012 (file no. 1-10962).

|

|

|

10.24

|

|

Indemnification Agreement, dated January 25, 2010, between Callaway Golf and Adebayo O. Ogunlesi incorporated herein by reference to Exhibit 10.35 to the Company's Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the Commission on February 26, 2010 (file no. 1-10962).

|

|

|

10.25

|

|

Indemnification Agreement, dated March 4, 2009, between Callaway Golf and John F. Lundgren, incorporated herein by this reference to Exhibit 10.51 to the Company's Current Report on Form 8-K, as filed with the Commission on March 10, 2009 (file no. 1-10962).

|

|

|

10.26

|

|

Indemnification Agreement, dated April 7, 2004, between Callaway Golf and Anthony S. Thornley, incorporated herein by this reference to Exhibit 10.34 to the Company's Annual Report on Form 10-K for the year ended December 31, 2004, as filed with the Commission on March 10, 2005 (file no. 1-10962).

|

|

|

10.27

|

|

Indemnification Agreement, dated as of April 21, 2003, between Callaway Golf and Samuel H. Armacost, incorporated herein by this reference to Exhibit 10.57 the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2003, as filed with the Commission on August 7, 2003 (file no. 1-10962).

|

|

|

10.28

|

|

Indemnification Agreement, dated as of April 21, 2003, between Callaway Golf and John C. Cushman, III, incorporated herein by this reference to Exhibit 10.58 the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2003, as filed with the Commission on August 7, 2003 (file no. 1-10962).

|

|

|

10.29

|

|

Indemnification Agreement, effective June 7, 2001, between Callaway Golf and Ronald S. Beard, incorporated herein by this reference to Exhibit 10.28 to the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2001, as filed with the Commission on November 14, 2001 (file no. 1-10962).

|

|

|

10.30

|

|

Indemnification Agreement, dated July 1, 1999, between Callaway Golf and Richard L. Rosenfield, incorporated herein by this reference to Exhibit 10.32 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 1999, as filed with the Commission on August 16, 1999 (file no. 1-10962).

|

|

|

10.31

|

|

Indemnification Agreement, dated August 4, 2015, between Callaway Golf Company and Linda B. Segre, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K as filed with the Commission on August 6, 2015 (file no. 1-10962).

|

|

|

Other Contracts

|

|||

|

10.32

|

|

Loan and Security Agreement, dated as of June 30, 2011, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Interactive, Inc., Callaway Golf International Sales Company, Bank of America, N.A., as administrative agent and collateral agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole lead arranger and sole bookrunner and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on July 6, 2011 (file no. 1-10962).

|

|

|

10.33

|

|

Amended and Restated Loan and Security Agreement, dated as of July 22, 2011, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Interactive, Inc., Callaway Golf International Sales Company, Bank of America, N.A., as administrative agent and collateral agent, UBS Securities LLC, as syndication agent, Wells Fargo Capital Finance, LLC, as documentation agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole lead arranger and sole bookrunner and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on July 27, 2011 (file no. 1-10962).

|

|

|

10.34

|

|

Second Amended and Restated Loan and Security Agreement, dated as of December 22, 2011, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Callaway Golf Interactive, Inc., Callaway Golf International Sales Company, Callaway Golf European Holding Company Limited, Bank of America, N.A., as administrative agent and collateral agent, UBS Securities LLC, as syndication agent, Wells Fargo Capital Finance, LLC, as documentation agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole lead arranger and sole bookrunner and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on December 28, 2011 (file no. 1-10962).

|

|

|

10.35

|

|

First Amendment to Second Amended and Restated Loan and Security Agreement, dated as of December 22, 2011, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Callaway Golf Interactive, Inc., Callaway Golf International Sales Company, Callaway Golf European Holding Company Limited, Bank of America, N.A., as administrative agent and collateral agent, UBS Securities LLC, as syndication agent, Wells Fargo Capital Finance, LLC, as documentation agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole lead arranger and sole bookrunner and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.8 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, as filed with the Commission on August 2, 2012 (file no. 1-10962).

|

|

|

10.36

|

|

Second Amendment to Second Amended and Restated Loan and Security Agreement, dated as of September 5, 2013, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Bank of America, N.A., as administrative agent and collateral agent, UBS Securities LLC, as syndication agent, Wells Fargo Capital Finance, LLC, as documentation agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole lead arranger and sole bookrunner and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2013, as filed with the Commission on October 28, 2013 (file no. 1-10962).

|

|

|

10.37

|

|

Third Amendment to the Second Amended and Restated Loan and Security Agreement, dated as of June 23, 2014, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Callaway Golf Interactive, Inc. and Callaway Golf International Sales Company and Callaway Golf European Holding Company Limited, Bank of America, N.A., as administrative agent and security trustee and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on June 26, 2014 (file no. 1-10962).

|

|

|

10.38

|

|

Fourth Amendment to the Second Amended and Restated Loan and Security Agreement, dated as of May 27, 2015, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Bank of America, N.A., as administrative agent and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on May 27, 2015 (file no. 1-10962).

|

|

|

10.39

|

|

Fifth Amendment to the Second Amended and Restated Loan and Security Agreement, dated as of August 25, 2015, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Bank of America, N.A., as administrative agent and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on August 27, 2015 (file no. 1-10962).

|

|

|

10.40

|

|

Sixth Amendment to the Second Amended and Restated Loan and Security Agreement, dated as of February 8, 2016, among Callaway Golf Company, Callaway Golf Sales Company, Callaway Golf Ball Operations, Inc., Callaway Golf Canada Ltd., Callaway Golf Europe Ltd., Bank of America, N.A., as administrative agent and certain financial institutions as lenders, incorporated herein by this reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, as filed with the Commission on February 10, 2016 (file no. 1-10962).

|

|

|

21.1

|

|

List of Subsidiaries.†

|

|

|

23.1

|

|

Consent of Deloitte & Touche LLP.†

|

|

|

24.1

|

|

Form of Limited Power of Attorney.†

|

|

|

31.1

|

|

Certification of Oliver G. Brewer III pursuant to Rule 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.†

|

|

|

31.2

|

|

Certification of Robert K. Julian pursuant to Rule 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.†

|

|

|

32.1

|

|

Certification of Oliver G. Brewer III and Robert K. Julian pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.†

|

|

|

101.1

|

|

XBRL Instance Document †

|

|

|

101.2

|

|

XBRL Taxonomy Extension Schema Document †

|

|

|

101.3

|

|

XBRL Taxonomy Extension Calculation Linkbase Document †

|

|

|

101.4

|

|

XBRL Taxonomy Extension Definition Linkbase Document †

|

|

|

101.5

|

|

XBRL Taxonomy Extension Label Linkbase Document †

|

|

|

101.6

|

|

XBRL Taxonomy Extension Presentation Linkbase Document †

|

|

|

CALLAWAY GOLF COMPANY

|

|||

|

By:

|

/S/ OLIVER G. BREWER III

|

||

|

Oliver G. Brewer III

|

|||

|

President and Chief Executive Officer

|

|||

|

Signature

|

Title

|

Dated as of

|

|

|

Principal Executive Officer:

|

|||

|

/S/ OLIVER G. BREWER III

|

President and Chief Executive Officer, Director

|

March 3, 2016

|

|

|

Oliver G. Brewer III

|

|||

|

Principal Financial Officer:

|

|||

|

/S/ ROBERT K. JULIAN

|

Senior Vice President and Chief Financial Officer

|

March 3, 2016

|

|

|

Robert K. Julian

|

|||

|

Principal Accounting Officer:

|

|||

|

/S/ JENNIFER THOMAS

|

Vice President and Chief Accounting Officer

|

March 3, 2016

|

|

|

Jennifer Thomas

|

|||

|

Non-Management Directors:

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

Samuel H. Armacost

|

|||

|

*

|

Chairman of the Board

|

March 3, 2016

|

|

|

Ronald S. Beard

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

John C. Cushman, III

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

John F. Lundgren

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

Adebayo O. Ogunlesi

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

Richard L. Rosenfield

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

Linda B. Segre

|

|||

|

*

|

Director

|

March 3, 2016

|

|

|

Anthony S. Thornley

|

|||

|

*By:

|

/S/ ROBERT K. JULIAN

|

|

|

Robert K. Julian

|

||

|

Attorney-in-fact

|

||

|

December 31,

|

|||||||

|

2015

|

2014

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

49,801

|

|

$

|

37,635

|

|

|

|

Accounts receivable, net

|

115,607

|

|

109,848

|

|

|||

|

Inventories

|

208,883

|

|

207,229

|

|

|||

|

Deferred taxes, net

|

—

|

|

5,081

|

|

|||

|

Income taxes receivable

|

487

|

|

928

|

|

|||

|

Other current assets

|

16,709

|

|

23,312

|

|

|||

|

Total current assets

|

391,487

|

|

384,033

|

|

|||

|

Property, plant and equipment, net

|

55,808

|

|

58,093

|

|

|||

|

Intangible assets, net

|

88,782

|

|

88,833

|

|

|||

|

Goodwill

|

26,500

|

|

27,821

|

|

|||

|

Deferred taxes, net

|

6,962

|

|

2,346

|

|

|||

|

Investment in golf-related ventures (Note 7)

|

53,315

|

|

50,677

|

|

|||

|

Other assets

|

8,370

|

|

13,008

|

|

|||

|

Total assets

|

$

|

631,224

|

|

$

|

624,811

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable and accrued expenses

|

$

|

122,620

|

|

$

|

123,251

|

|

|

|

Accrued employee compensation and benefits

|

33,518

|

|

37,386

|

|

|||

|

Asset-based credit facility

|

14,969

|

|

15,235

|

|

|||

|

Accrued warranty expense

|

5,706

|

|

5,607

|

|

|||

|

Income taxes payable

|

1,823

|

|

2,623

|

|

|||

|

Deferred taxes, net

|

—

|

|

26

|

|

|||

|

Total current liabilities

|

178,636

|

|

184,128

|

|

|||

|

Long-term liabilities:

|

|||||||

|

Income tax liability

|

3,476

|

|

3,867

|

|

|||

|

Deferred taxes, net

|

35,093

|

|

35,043

|

|

|||

|

Convertible notes, net (Note 3)

|

—

|

|

108,574

|

|

|||

|

Long-term other

|

1,074

|

|

1,665

|

|

|||

|

Commitments & contingencies (Note 10)

|

|

|

|||||

|

Shareholders’ equity:

|

|||||||

|

Preferred stock, $.01 par value, 3,000,000 shares authorized, 0 shares issued and outstanding at both December 31, 2015 and 2014.

|

—

|

|

—

|

|

|||

|

Common stock, $.01 par value, 240,000,000 shares authorized, 93,769,199 shares and 78,373,598 shares issued at December 31, 2015 and 2014, respectively

|

938

|

|

784

|

|

|||

|

Additional paid-in capital

|

322,793

|

|

210,057

|

|

|||

|

Retained earnings

|

101,047

|

|

89,932

|

|

|||

|

Accumulated other comprehensive income (loss)

|

(11,813

|

)

|

(796

|

)

|

|||

|

Less: Common stock held in treasury, at cost, 2,075 shares and 779,681 shares at December 31, 2015 and 2014, respectively

|

(20

|

)

|

(8,443

|

)

|

|||

|

Total Callaway Golf Company shareholders’ equity

|

412,945

|

|

291,534

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

631,224

|

|

$

|

624,811

|

|

|

|

Year Ended December 31,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net sales

|

$

|

843,794

|

|

$

|

886,945

|

|

$

|

842,801

|

|

||

|

Cost of sales

|

486,161

|

|

529,019

|

|

528,043

|

|

|||||

|

Gross profit

|

357,633

|

|

357,926

|

|

314,758

|

|

|||||

|

Selling expenses

|

228,910

|

|

234,231

|

|

226,496

|

|

|||||

|

General and administrative expenses

|

68,567

|

|

61,662

|

|

68,087

|

|

|||||

|

Research and development expenses

|

33,213

|

|

31,285

|

|

30,937

|

|

|||||

|

Total operating expenses

|

330,690

|

|

327,178

|

|

325,520

|

|

|||||

|

Income (loss) from operations

|

26,943

|

|

30,748

|

|

(10,762

|

)

|

|||||

|

Interest income

|

388

|

|

438

|

|

558

|

|

|||||

|

Interest expense

|

(8,733

|

)

|

(9,499

|

)

|

(9,123

|

)

|

|||||

|

Other income (expense), net

|

1,465

|

|

(48

|

)

|

6,005

|

|

|||||

|

Income (loss) before income taxes

|

20,063

|

|

21,639

|

|

(13,322

|

)

|

|||||

|

Income tax provision

|

5,495

|

|

5,631

|

|

5,599

|

|

|||||

|

Net income (loss)

|

14,568

|

|

16,008

|

|

(18,921

|

)

|

|||||

|

Dividends on convertible preferred stock

|

—

|

|

—

|

|

3,332

|

|

|||||

|

Net income (loss) allocable to common shareholders

|

$

|

14,568

|

|

$

|

16,008

|

|

$

|

(22,253

|

)

|

||

|

Earnings (loss) per common share:

|

|||||||||||

|

Basic

|

$

|

0.18

|

|

$

|

0.21

|

|

$

|

(0.31

|

)

|

||

|

Diluted

|

$

|

0.17

|

|

$

|

0.20

|

|

$

|

(0.31

|

)

|

||

|

Weighted-average common shares outstanding:

|

|||||||||||

|

Basic

|

83,116

|

|

77,559

|

|

72,809

|

|

|||||

|

Diluted

|

84,611

|

|

78,385

|

|

72,809

|

|

|||||

|

Dividends paid per common share

|

$

|

0.04

|

|

$

|

0.04

|

|

$

|

0.04

|

|

||

|

Year Ended December 31,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net income (loss)

|

$

|

14,568

|

|

$

|

16,008

|

|

$

|

(18,921

|

)

|

||

|

Other comprehensive income (loss):

|

|||||||||||

|

Change in fair value of derivative instruments

|

525

|

|

—

|

|

—

|

|

|||||

|

Foreign currency translation adjustments

|

(11,542

|

)

|

(12,973

|

)

|

(2,593

|

)

|

|||||

|

Comprehensive income (loss)

|

$

|

3,551

|

|

$

|

3,035

|

|

$

|

(21,514

|

)

|

||

|

Year Ended December 31,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Cash flows from operating activities:

|

|||||||||||

|

Net income (loss)

|

$

|

14,568

|

|

$

|

16,008

|

|

$

|

(18,921

|

)

|

||

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|||||||||||

|

Depreciation and amortization

|

17,379

|

|

21,236

|

|

25,543

|

|

|||||

|

Deferred taxes

|

128

|

|

604

|

|

(2,309

|

)

|

|||||

|

Share-based compensation

|

7,542

|

|

5,740

|

|

3,533

|

|

|||||

|

(Gain) loss on disposal of long-lived assets and deferred gain amortization

|

(1,006

|

)

|

(1,331

|

)

|

2,242

|

|

|||||

|

Discount amortization on convertible notes

|

531

|

|

739

|

|

702

|

|

|||||

|

Changes in assets and liabilities:

|

|||||||||||

|

Accounts receivable, net

|

(11,591

|

)

|

(23,314

|

)

|

(6,690

|

)

|

|||||

|

Inventories

|

(5,347

|

)

|

47,334

|

|

(60,966

|

)

|

|||||

|

Other assets

|

7,060

|

|

2,884

|

|

(190

|

)

|

|||||

|

Accounts payable and accrued expenses

|

5,382

|

|

(30,578

|

)

|

34,663

|

|

|||||

|

Accrued employee compensation and benefits

|

(3,395

|

)

|

6,328

|

|

11,523

|

|

|||||

|

Income taxes receivable and payable

|

(370

|

)

|